What Crypto Users Need Know About Gary Gensler’s SEC

Acting SEC Enforcement Director Berger to Step Down. What Crypto Users Need Know About Gary Gensler’s SEC

Berger presided over the enforcement division when it launched the Ripple lawsuit.

The U.S. Securities and Exchange Commission’s Acting Enforcement Director Marc Berger will leave the agency this month, the SEC said Tuesday.

* Berger assumed SEC’s top investigative post after former Director Stephanie Avakian’s departure at the end of 2020. He had been moving up the agency ranks since December 2017.

* SEC said Berger presided over the agency’s prosecution of the Telegram initial coin offering and its initiation of the unregistered securities suit against Ripple Labs.

Related:

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

Ultimate Resource On Insider Trading (Congress, Senators, Corporate America)

Ultimate Resource On BlockFi, Celsius And Nexo (Including Regulatory Scrutiny From States And The SEC)

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

* Enforcement staff pursued “meaningful relief” for victims of cryptocurrency fraud during Berger’s tenure, SEC said.

Gensler Said To Be Named SEC Chairman

Gensler has testified before Congress about cryptocurrency and blockchain on multiple occasions.

Gary Gensler, a Washington and Wall Street veteran who has closely studied the cryptocurrency field, is expected to be named chairman of the U.S. Securities and Exchange Commission (SEC) in the next several days by President-elect Joe Biden, two sources familiar with the matter told Reuters on Wednesday.

* A former chairman of the Commodity Futures Trading Commission (CFTC), Gensler served as a key financial regulator for former President Barack Obama, spearheading new derivatives rules after the 2008 financial crisis. He also served in the Treasury Department during the Clinton administration.

* More recently, he has also testified before Congress about cryptocurrency and blockchain on multiple occasions, pushing back against comparisons between cryptocurrencies and Ponzi schemes and declaring that the still-unlaunched libra token met the requirements of being a security under U.S. law.

* At MIT’s Sloan School, Gensler taught a course on cryptocurrencies and blockchains, calling the technology “a catalyst for change in the world of finance and the broader economy.”

Gensler’s SEC Has No Plans to Ban Crypto

Updated: 1-15-2021

Cryptocurrencies Face Greater Oversight Under Gensler-Led SEC

Gary Gensler’s expected nomination to lead the U.S. Securities and Exchange Commission is seen ushering in an era of greater federal oversight of the $1 trillion cryptocurrency market.

Gensler, who most recently taught about cryptocurrencies and their underlying technologies at the Massachusetts Institute of Technology, previously chaired the Commodity Futures Trading Commission and was a partner at Goldman Sachs Group Inc. He is known for pushing back at banks and corporations in search of greater investor protections.

In talks and editorials over the last several years, he’s advocated for a nationwide way to register and monitor cryptocurrency exchanges, instead of leaving oversight to the states.

That could have implications for online exchanges like Coinbase Global Inc., which is planning to go public. The SEC is also likely to continue to go after thousands of initial coin offerings, as Gensler has said he believes that most of these digital tokens are unregistered securities.

“It is good to have an ex-banker in there who is smart enough to recognize the value of Bitcoin and other cryptocurrencies to building wealth and value in society,” said Tim Draper, a billionaire venture capitalist who is a large investor in cryptocurrencies. “He will understand the importance of allowing innovation, while watching over banks who might try to restrain trade by blocking the use of superior currency.”

In a 2018 Bloomberg Television interview, Gensler said that the pure-cash cryptocurrencies like Bitcoin would “need more protection.” The world’s biggest cryptocurrency by market capitalization quadrupled last year, and has continued to surge in volatile trading since the start of 2021.

Gensler has also advocated for greater regulation of cryptocurrency exchanges. He didn’t respond to a request for fresh comment.

“If it gets broad adoption, if we really think the crypto world is going to be part of the future, it needs to come inside of public policy envelope,” Gensler said in the 2018 interview. “That means we need to guard against illicit activity. And yes, we need to protect investors. The crypto exchanges, big exchanges like Coinbase, need to come within the SEC or the CFTC.”

Greater oversight could lead to greater mainstream adoption, he said.

“I would say, you want some form of regulation, you want traffic lights and speed limits, because then the public is confident to drive on the roads,” Gensler said in the 2018 Bloomberg interview.

He has also long railed against illegal offerings of securities, which the SEC has been actively pursuing.

In December, the agency filed a lawsuit against Ripple Labs Inc. for issuing more than $1 billion in unregistered tokens XRP. In a 2019 keynote at Harvard Law School, Gensler said “I don’t think the SEC is going to leave many ICOs off the hook.”

In his 2019 Congressional testimony, Gensler appeared to favor projects like Facebook-led Diem, which used to be called Libra — an effort to create a cryptocurrency for payments. But he did suggest that the effort may need to have banking regulations applied to it.

“Gary is extremely dialed-in on the crypto markets and understands them extremely well,” said Nic Carter, co-founder of researcher Coin Metrics. “If his stated views are any indication of his priorities as commissioner, I would expect the SEC to continue with or even accelerate its agenda of discouraging unregulated securities issuance in the form of tokens.”

Updated: 1-17-2021

An Old Foe of Banks Could Be Wall Street’s New Top Cop

Gary Gensler is expected to be Joe Biden’s pick to take over the Securities and Exchange Commission. ‘He will do things that are controversial.’.

President-elect Joe Biden’s expected pick of Gary Gensler to lead the Securities and Exchange Commission could give Wall Street its most aggressive regulator in two decades.

The finance industry has thrived under the Trump administration’s light regulatory touch. Mr. Gensler, who sources familiar with the transition say is likely to be tapped by Mr. Biden for SEC chairman, has a history of shaking up the status quo. If he gets the assignment, he would be tasked with toughening regulation and enforcement of public companies and the finance industry.

He did that when he ran the Commodity Futures Trading Commission, a smaller regulatory sibling to the SEC, from 2009 to 2013. There, he steamrolled the opposition to write rules from scratch governing the markets for hundreds of trillions of dollars of derivatives. Some of these complex financial instruments were blamed for the 2008-09 financial crisis.

Lawyers, regulators and lobbyists say Mr. Gensler would likely be the most active, pro-regulatory SEC chairman since William Donaldson ran the agency in the wake of the corporate scandals of the early 2000s, or Arthur Levitt’s tenure during the Clinton administration. They also expect a renewed eagerness to pursue enforcement cases against major corporations and Wall Street banks. At the CFTC, Mr. Gensler earned a reputation for an aggressive, sharp-elbow style of management more reminiscent of Wall Street than Washington, at times even clashing with officials in his own party.

“He’s a totally different cup of tea than we’ve had at the SEC,” said Hal Scott, a professor of capital markets law at Harvard Law School. “He will do things that are controversial.”

Mr. Gensler’s nomination hasn’t been formally announced by the Biden transition team. People familiar with the matter say it is no coincidence that his name emerged only after Democrats won control of the Senate following runoffs in Georgia on Jan. 5. The irony is Mr. Gensler is a product of Goldman Sachs Group Inc., a Wall Street giant that attracts criticism from progressives. He made partner at Goldman at 30 and then served in the Treasury Department and led the CFTC after an 18-year stint on Wall Street. Since leaving the CFTC, Mr. Gensler has been teaching at Massachusetts Institute of Technology’s business school.

A spokesman for the Biden transition team declined to comment for this article. Mr. Gensler didn’t respond to requests for comment.

Mr. Gensler’s record at the CFTC fits with the Democratic Party’s progressive wing, which hopes to use the SEC as a lever for driving domestic policy goals. These include combating climate change and racial injustice, forcing more transparency around corporate political spending and tilting the balance of power from executives to workers and small investors.

But the firms the SEC regulates are hopeful Mr. Gensler’s understanding of finance and markets would make him a pragmatist when balancing progressive demands against the implications of causing widespread disruption.

Among Democrats’ top priorities are for the SEC to require more-comprehensive reporting from public companies about the risks they face from climate change or government efforts to curb it. They say financial disclosures should also include more information about companies’ diversity and worker pay. And Mr. Gensler is already facing calls to further tighten a 2019 rule that stopped short of requiring brokers to put their clients’ interests ahead of their own.

“We are really looking for someone to be bold,” said Lisa Gilbert, executive vice president at consumer-advocacy group Public Citizen, adding that Mr. Gensler has shown an ability to challenge entrenched interests.

Critics of the SEC in recent years have said it focused too much on helping companies raise capital and not enough on investor protections. Rick Fleming, the SEC’s in-house investor advocate, said in a Dec. 29 report that the agency “engaged in numerous rule-makings of a deregulatory nature” last year that “often had the effect of diminishing investor protections.”

Some have also called for the SEC to refocus enforcement efforts on large banks and hedge funds. Under recently departed chairman Jay Clayton, the enforcement program emphasized wrongdoing that harms less-sophisticated investors, including cryptocurrency scams, Ponzi schemes and investment advisers who fleeced clients with murky fees.

Mr. Gensler dealt with the big banks at the CFTC when he oversaw enforcement actions against banks accused of manipulating a key interest rate known as Libor.

Another target of Democrats may be private-equity firms and hedge funds, lightly regulated investment firms that are off limits to small investors. The firms captured 69% of the capital raised in 2019, while the regulated public markets accounted for 31%, according to SEC estimates.

At the CFTC, Mr. Gensler faced fierce opposition from Wall Street over his push to make trading of derivatives more transparent as required by the 2010 Dodd-Frank Act. He advanced a series of regulations that required so-called swaps to be traded on public platforms, in an effort to eliminate the unseen buildup of risks that precipitated the 2008-09 financial crisis.

Former colleagues said Mr. Gensler wasn’t afraid to say no to powerful financial firms in meetings at the CFTC and that he was unflappable in sometimes-heated congressional hearings. Mr. Gensler’s nomination could face opposition in Congress from Republicans, Ms. Gilbert of Public Citizen said.

He clashed at times with Republican members of the CFTC, who accused him of leaving them out of key discussions over proposed rule makings. He was accused of implementing rules too fast, exposing the agency to legal challenges. A Republican commissioner in 2013 said in a speech that lawsuits challenging CFTC regulations were evidence of a “flawed rule-making process that prioritized getting the rules done fast over getting them done right.”

But he also demonstrated an unusual ability to navigate the competing interests of industry, lawmakers and other regulators to churn out a prolific volume of work. That track record likely made Mr. Gensler a front-runner for the SEC nomination.

At the SEC, Mr. Gensler would have to manage a much larger staff—4,500 employees to the CFTC’s 700—and a five-member commission that tends to be more partisan. He also has fewer congressionally mandated reforms to tackle than during his tenure at the CFTC, which was dominated by implementation of the Dodd-Frank financial reforms.

“The policy agenda for the SEC is pretty obvious…the question is who can get it done, sequence and prioritize,” said Dennis Kelleher, a Biden transition team adviser who is president of Better Markets, a group that advocates for stricter Wall Street oversight. “Gary proved at the CFTC that he has the ability to operate in multiple arenas at the exact same time.”

Updated: 1-18-2021

Biden Team Announces Pick To Lead SEC

Biden’s pick to run the SEC has some serious crypto and blockchain chops.

President-elect Biden’s team recently unveiled additional folks it plans on nominating for various positions after the inauguration on Wednesday.

One key pick is Gary Gensler as Chairman of the Securities and Exchange Commission, or SEC, according to a statement from Biden’s transition team on Monday. On Jan. 12, Reuters reported on anonymous sourcing forecasting Gensler as Biden’s choice. Today’s statement from the Biden team confirms the President-elect’s expected choice.

“Gary Gensler served as chairman of the U.S. Commodity Futures Trading Commission from 2009 to 2014,” the statement said. Coming immediately after the financial crisis, Gensler’s term at the CFTC saw him enforcing the provisions of the nascent Dodd-Frank Act in commodities markets.

Formal nomination will have to wait until Biden actually takes office, and will further need confirmation from the U.S. Senate. January run-off elections in Georgia, however, secured the Senate for the Democrats.

Gensler also taught classes on blockchain and crypto at MIT. Having someone knowledgeable on the crypto and blockchain industry leading the SEC could pave the way for educated regulation and guidelines. The SEC has been critical for its role in regulating the initial coin offering market, which has quieted down significantly since the commission began treating many ICOs as unregistered public securities offerings.

Biden’s Wall Street Watchdogs Signal New Era of Tough Oversight

President-elect Joe Biden’s team of financial regulators is taking shape, with progressive favorites being chosen for the top jobs at the Securities and Exchange Commission and the Consumer Financial Protection Bureau — moves that mean Wall Street should prepare itself for a new era of tougher oversight and stricter rules.

Biden’s SEC pick, former Commodity Futures Trading Commission Chairman Gary Gensler, 63, is known for sparring with the industry as the nation’s top derivatives watchdog during the Obama administration and for his deep knowledge of finance as an ex-partner at Goldman Sachs Group Inc.

That means he not only knows how to mobilize a bureaucratic federal agency but also understands the often impenetrable ways that Wall Street makes money — and how firms use that complexity to turn regulation in their favor.

His top targets likely will include Chinese companies that list on U.S. stock exchanges while bypassing American regulations, the surge in trading by neophyte investors during the coronavirus pandemic, cryptocurrencies and pushing Corporate America to reveal more about workforce diversity and how climate change impacts bottom lines.

Biden’s pick for the consumer agency, Rohit Chopra, 38, will seek to revive an agency that progressives contend was put to sleep during the Trump administration.

Chopra also is an acolyte of Senator Elizabeth Warren, the Massachusetts Democrat who conceived of the CFPB and is a renowned Wall Street adversary. If he succeeds in turning the agency around, life will almost certainly get less pleasant for student lenders, for-profit colleges, payday lenders and credit-card companies that progressives say prey on consumers.

The pending nominations send a clear signal that the rule-cutting and lax enforcement that Wall Street has grown accustomed to during four years of President Donald Trump are over. Here’s an overview of what the pending appointments mean for the agencies and for the financial industry.

Robinhood and SPACs

Robinhood Markets and special purpose acquisition companies — or SPACs — were among the finance industry’s hottest phenomenons in 2020. Both are sure to draw Gensler’s attention.

Robinhood, with its popular smartphone app, rode a wave of Covid 19-fueled day trading to add millions of customers. But critics say the company represents a disturbing trend of brokerages encouraging less-sophisticated investors to take risks that they don’t understand — and Gensler is likely to face pressure from progressives to erect new guardrails.

Robinhood has disputed claims that its platform promotes a “gamification” of trading as an inaccurate depiction of its business, saying its goal is to “democratize” wealth creation and investing by enabling a new class of consumers to trade shares and other assets.

Critics, including former SEC Chairman Arthur Levitt, say what’s needed is an aggressive examination by the regulator of whether apps use technological nudges to inappropriately stimulate excessive and even addictive trading. Robinhood has also faced repeated calls to improve its customer service, something the firm says it’s doing.

There’s another concern that the Robinhood-led boom in retail trading is inflating a stock bubble that could pop, triggering steep losses for investors — something that also worries progressives.

SPACs, which list on public exchanges to raise money to buy companies, have already been drawing scrutiny from the SEC. The attention is a direct result of how hot they are, with the vehicles used to raise a record $79.2 billion from U.S. investors in 2020.

Jay Clayton, who stepped down as SEC chairman last month, has said he’s concerned that potential investors aren’t receiving appropriate disclosures about conflicts and insiders’ lucrative pay structures. That prompted the agency to launch a review, which would now fall to Gensler.

Volcker Rule and Private Equity

After the 2008 financial crisis, Gensler solidified his status with progressives by insisting on a tough version of the Volcker Rule. The regulation, which banned proprietary trading by Wall Street banks, was eased during the Trump administration. Goldman and other firms will now be watching to see whether Gensler leads an effort among regulators to bolster its restrictions.

Another area in which Gensler is likely to square off with big names in finance is over the SEC’s approach to regulating private-equity firms. During the Trump era, the SEC sought to remove regulatory barriers that prevent private equity from raising money from retail investors. Progressives are hopeful that Gensler will move in the other direction, by bringing more transparency to buyout firms, which Warren and other lawmakers blame for loading companies with unsustainable debt burdens and cutting jobs.

A Crackdown on Chinese Stocks

One area that will demand Gensler’s attention is rising tensions between the U.S. and China — fighting that is now being waged in financial markets.

Congress passed legislation late last year that could lead to Alibaba Group Holding Ltd., Baidu Inc. and other Chinese companies getting kicked off of U.S. stock exchanges if they continue their non-adherence to American auditing rules.

At issue are longstanding American requirements that all publicly traded companies in the U.S. allow their auditors to be inspected by the Public Company Accounting Oversight Board. Gensler will be responsible for writing rules that make Chinese companies comply. Their penalty is possible ejection from U.S. markets.

The crackdown would follow a separate one already initiated by the Trump administration, which issued an executive order in November that requires American investors to sell their stakes in Chinese companies deemed a threat to U.S. national security.

New Rules For Crypto

Bitcoin is on a tear again, having surged roughly four-fold last year. That means it and other cryptocurriencies are likely to get renewed attention from Gensler’s SEC.

He’s quite familiar with the industry, having taught a class about it at the Massachusetts Institute of Technology, and has called for more regulation.

Some in the industry argue that more oversight wouldn’t necessarily be a bad thing because, right now, many institutional investors shy away from the space, as they see it as akin to the Wild West. As a result, stiffer rules might bring more capital flows to digital tokens.

Environment And Diversity

Progressives have long contended that the SEC should have just as strong a role in responding to climate change as more obvious agencies such as the Environmental Protection Agency.

A change at the top of liberals’ wish list is for the SEC to require public companies to boost disclosures of how a warmer planet and less-reliance on fossil fuels could impact profits, a move that could hit oil companies particularly hard.

Gensler could show he’s serious about such concerns by prioritizing whats known as environmental, social and governance investing, or ESG. One way he may do that is by establishing a new SEC office that’s dedicated to ESG issues.

The diversity of C-Suites and public companies’ employees is also a top focus for progressives, who want the SEC to force businesses to disclose more information on race and gender.

Chopra’s Quick Fix

One reason Chopra was picked for the CFPB, progressives say, is that he’s uniquely qualified to get a fast start in reversing some of Trump’s policies on day one.

Since he already holds a Senate-confirmed post as a Democratic member of the Federal Trade Commission, federal law allows him to join the CFPB immediately as its acting chief. In such an arrangement, he would be able to retain his position at the FTC and run the CFPB for about 300 days before the Senate signs off on his nomination.

While an official nod from the Senate is likely with Democrats poised to take control of the chamber, the several weeks or months it might require for confirming a CFPB chief is much longer than progressives are willing to wait.

The regulator’s shift under Trump has been impossible to miss. Since the outgoing president’s appointees took over in late 2017, it has imposed just a single fine against one of the U.S.’s six largest banks — a $500 million penalty against scandal-ridden Wells Fargo & Co. for allegedly overcharging auto lending and mortgage customers.

CFPB’s Targets

Banks from Wall Street to Main Street are expecting the CFPB to review the controversial — and lucrative — practice of lenders penalizing depositors when they spend money that they don’t have in their accounts. Known as overdraft fees, such charges generate some $12 billion annually for U.S. banks.

Consumer advocates also want Biden’s incoming CFPB chief to bring back an Obama-era rule that required payday lenders to assess prospective borrowers’ abilities to repay their loans.

Companies that provide short-term credit such as Enova International Inc., Curo Group Holdings Corp. and Elevate Credit Inc. could come under pressure, Height Capital Markets analyst Edwin Groshans told clients earlier this month.

Updated: 3-3-2021

Bitcoin Dips After Gensler Says SEC Must Root Out Crypto Fraud

Cryptocurrency enthusiasts exhibited a bit of nerves during Tuesday’s Senate confirmation hearing for Gary Gensler, the nominee for chairman of the U.S. Securities and Exchange Commission.

Bitcoin dipped to the lowest levels of the day after Gensler said that insuring that cryptocurrency markets are free of fraud and manipulation is a challenge for the agency. The largest cryptocurrency declined as much as 3% to $47,341 in New York trading. It has jumped about 65% since December.

Gensler, who served as a Commodity Futures Trading Commission chairman during the Obama administration, has been viewed as a strong advocate for digital assets. He serves as a senior advisor to the MIT Media Lab Digital Currency Initiative and teaches about blockchain technology and digital currencies.

State of Crypto: How SEC Chair Gary Gensler Could Differ From Predecessor Jay Clayton

Gary Gensler will testify before the U.S. Senate Banking Committee today for a confirmation hearing on his nomination to lead the SEC.

Gary Gensler ran the Commodity Futures Trading Commission (CFTC) after the 2008 financial crisis. Now, he’ll get a chance to run its securities-regulating counterpart.

Meet Gary

The Narrative

Former Commodity Futures Trading Commission (CFTC) Chairman Gary Gensler has been nominated to run the Securities and Exchange Commission (SEC) by President Joe Biden. Gensler unites a pro-regulation history with a pro-crypto viewpoint, and could finally implement the regulatory clarity many in the industry have desired.

In this, he’s likely to depart from predecessor Jay Clayton, who repeatedly said he believed initial coin offerings are securities but did not provide much guidance on when or how tokens might be classified as something other than a security.

Today, the U.S. Senate Committee on Banking, Housing and Urban Affairs will hold a hearing to consider his nomination for chairman of the SEC.

Why It Matters

Should he be confirmed, Gensler will shape crypto policy over the next several years, though it’s an open question if the industry will love the rules he implements. Under his tenure, the CFTC approved nearly 70 rules or pieces of guidance, and he may just regulate the hell out of crypto. He told the Senate Banking Committee he intends to continue focusing on consumer protection at the SEC.

“We have seen that when the SEC does its job – when there are clear rules of the road and a cop on the beat to enforce them – our economy grows and our nation prospers.,” Gensler said in his prepared remarks.

Companies are already hinting at or have announced plans to file to launch a bitcoin exchange-traded fund (ETF), a retail-accessible product that the industry has been pursuing for years. Some in the industry hope that under Gensler the SEC might finally create “bright-lines” regulatory guidance that clearly defines when a token is a security and when one is not.

He’ll also oversee litigation against companies that SEC staff believe have violated federal securities laws, including the high-profile lawsuit against Ripple Labs.

Breaking It Down

Like many of Biden’s nominees, Gensler was an official in former President Barack Obama’s administration. As CFTC chair, he had a major role in the Dodd-Frank Act, which sought to bring some consumer-focused reforms to Wall Street. Gensler has been a part of Team Biden since the president won the White House last year; Biden announced Gensler would lead his Wall Street reform team just days after news organizations projected his victory.

Many of his views on the digital asset space can be found in the transcripts of his lectures at MIT, some of which my colleague Danny Nelson went through. Gensler gave these lectures in 2018, though he has remained active in the industry as a member of the MIT Digital Currency Initiative.

He’s also spoken out about blockchain over the past several years. Below is a summary of his views on some issues that are important to the crypto industry.

XRP

A day before former SEC Chair Jay Clayton stepped down, the securities regulator filed a lawsuit alleging Ripple Labs, the San Francisco startup closely associated with the XRP cryptocurrency, had violated securities laws for over seven years by selling XRP in unregistered securities transactions.

Other senior SEC staff, including now-former Director of Enforcement Stephanie Avakian, also departed around that time. If approved, Gensler will inherit an agency overseeing one of its highest-profile crypto cases.

In his own words, Gensler believes XRP is “a non-compliant security,” though he said (again, this is from 2018) that it would require the courts to make that determination, “whether it’s appellate courts or the Supreme Court.”

He went on to explain that he believes XRP meets the requirements of the Howey Test, the Supreme Court case often used to determine whether something is a security.

ICOs

The SEC has spent years suing companies that conducted initial coin offerings (ICOs) without registering their tokens as securities, often because they raised money specifically to build a project that could issue a token that investors could re-sell at a profit.

Gensler raised concerns about information asymmetry in one of his lectures, noting that U.S. law is designed to protect investors and consumers. He’s also expressed concern that ICOs, which were numerous in 2018, might violate securities laws, particularly given the projects that launched without having any code or tokens developed.

“Jay Clayton, who runs the SEC, has said in congressional testimony in February that he hadn’t met an ICO that he didn’t think was a security … But it wasn’t quite enough,” Gensler said.

He said early tokens may fail, but as some projects go live they could provide a roadmap for how future projects could succeed, pointing to Telegram (which ended its blockchain ambitions after the SEC sued) and Filecoin (which went live last year).

CBDCs

Central bank digital currencies (CBDCs) are becoming increasingly popular, with multiple central banks now trialing different types of sovereign digital currencies. In Gensler’s view, CBDCs could bring efficiencies to cross-border remittances or local payments.

Central Banks Have To Understand Why They Would Launch A CBDC And What The Benefit Would Be, He Said, Explaining:

“The strategic question for the central banks is, should we allow direct access to digital reserves? We have this intermediated central bank digital reserve called bank deposits, but should we have something direct to us? Like cash is a direct relationship between the central bank and the holder.”

Still, in that same lecture Gensler noted that a CBDC doesn’t necessarily need to rely on a blockchain platform, a view echoed by Boston Fed and MIT Digital Currency Initiative researchers looking into different technology bases that could support a digital dollar.

Digital Yuan

In 2019 Gensler participated in a wargaming exercise that looked at a hypothetical future where the digital yuan, China’s effort at a central bank digital currency, was live and used by the government of North Korea to bypass U.S. sanctions. The premise of the exercise was the U.S. may need to revisit how it enforces its sanctions regime, which basically seeks to lock individuals or entities out of the global financial system.

“I think it’s good to have a healthy debate about where we stand with the U.S. dollar, our reliance on SWIFT – the international messaging system – for a tool in our sanctions regime that we the U.S. have,” Gensler told CoinDesk ahead of the exercise. “We’re using it as a tool in geopolitics, a digital form of blockade that in the 17th and 18th and even in the 19th century, what one would have to do with ships we’re doing digitally.”

Gensler further noted during his MIT lectures that other countries could use CBDCs as part of an effort to bypass U.S. sanctions, citing Venezuela and Iran, both of which had announced efforts to create sovereign digital currencies at the time.

Does Crypto Fund Terrorism?

Last week, the U.S. House Financial Services Committee’s Subcommittee on National Security, International Development and Monetary Policy held its long-awaited hearing on domestic terror financing. You can read my preview and summary but my immediate impression was that it seems good crypto wasn’t being scapegoated as this tool for terror financing, despite multiple statements of concern by Treasury Secretary Janet Yellen and other lawmakers.

The hearing almost went in that direction at the beginning, when Rep. James Himes (D-Conn.), the subcommittee’s chair, asked the witnesses to speak to whether cryptocurrencies were enabling easier terror financing.

Instead, the witnesses compared cryptocurrencies to systems like PayPal or GoFundMe, and called for better moderation efforts by the companies behind these tools.

That said, the proposed FinCEN counterparty rule was raised multiple times, and so it is worth keeping an eye on any next steps here.

Robinhood, GameStop and Whether Blockchain Fixes This™

I wasn’t planning on talking about the Robinhood-GameStop thing again but the Depository Trust and Clearing Corporation (DTCC) published a proposal to shorten settlement times from T+2 to T+1, on the same day GameStop’s stock jumped like 100%. So let’s take a quick look.

First Off: If the bit about T+2 to T+1 didn’t make sense, read this article first, then come back to the newsletter.

Okay, so moving to T+1 requires industry agreement, meaning participants have to get together and say, “We think one-day settlement makes financial and operational sense and that we are all capable of handling it.” Robinhood CEO Vlad Tenev has come out in favor of shortened settlement times, blaming T+2-related margin requirements for why his company had to suspend trading in volatile securities last month.

The DTCC said in a blog post after that incident that it didn’t have the authority to unilaterally make that decision, but now “based on extensive industry engagement conducted throughout 2020,” it seems the industry could be open to faster settlement.

The DTCC has looked into whether blockchain in particular can offer a T+0/1 settlement solution through its Project Ion last year. In short, a distributed ledger-based settlement system can effectively shorten settlement times, though the Project Ion proof-of-concept paper noted that its PoC focused on usability over scalability.

“It’s important to note that NSCC and DTC can support T+1 and even same-day (T+0) settlement today, using existing technology. In fact, NSCC clears T+1 and T+0 trades every day and DTC is already a T+0 settlement platform. However, the current T+2 settlement cycle is a convention of market practice,” last week’s white paper said.

Biden’s Rule

Gary Gensler’s confirmation hearing is today, as is that of CFPB Director-Nominee Rohit Chopra. I’ll be live-tweeting the hearing (shameless plug here). As of press time, there’s still no formal nomination for the next heads of the CFTC or OCC.

What Gary Gensler Thinks About Bitcoin’s Future

Cryptocurrency enthusiasts have been eyeing Joe Biden’s pick to run the US Securities and Exchange Commission for clues about how he might regulate the technology. In his confirmation hearing today, nominee Gary Gensler suggested that more government oversight of cryptocurrencies was in the offing.

He also hinted that the type of oversight will depend on which form of cryptocurrency is under discussion. With crypto prices on a tear in recent months, the frenetic debate about whether the rapidly evolving market constitutes a legitimate new asset class or a bubble ripe for abuse has turned into a regulatory conundrum, as institutional and retail investors race ahead of rules to govern the space.

As head of the SEC, Gensler would be in charge of cryptocurrencies deemed to be securities. During the Senate Banking Committee hearing, Gensler said that while the SEC should promote innovation in blockchain technology, if there are securities involved that trade on exchanges, “we want to ensure that there’s appropriate investor protection.”

This thinking isn’t new. Using the definition of a security to determine how a financial instrument should be regulated, known as the Howey test, dates back to a 1946 Supreme Court ruling, devised to help define which transactions constitute an investment contract. It’s a rule Gensler knows well.

He is known in progressive circles as a tough financial sector reformer from his post-financial crisis days as head of the Commodities Futures Trading Commission, but he is also hailed by the crypto crowd for his understanding of blockchain technologies, as an MIT economics professor who teaches about blockchain, digital currencies, and financial innovation.

Gensler’s comments during the hearing echo his teachings on the Howey test. By this logic, cryptocurrencies are generally either defined as utility tokens, which act like a form of tender, or security tokens, which represent equity or share in a company that would be regulated by the SEC.

If a coin offering is meant to give investors an ownership stake, then the company’s token should be subject to the regulations of a security, he told an audience at a 2018 MIT blockchain conference, even if it doesn’t offer a dividend, or have the typical attributes of an equity or bond.

“The investing public is clearly hoping for possible appreciation,” Gensler said. “When you quack like the duck, when you swim like the duck, when you walk like the duck…I think the bird’s a duck.”

Bitcoin, the most ubiquitous virtual currency, doesn’t qualify as a security, according to Gensler. “Bitcoin came into existence as mining began as an incentive in validating a distributed platform,” he said at the conference. Unlike other cryptocurrencies being offered by companies like Ripple, bitcoin had no initial token offering and no common enterprise.

Ripple, on the other hand, “sure seems like a common enterprise,” he concluded.

The SEC has since followed that logic. In December, it sued Ripple for selling a bitcoin-like digital asset called XRP, a high-profile case Gensler will inherit if he’s confirmed as the agency’s new chair.

Bitcoin’s value dipped on jitters about Gensler’s comments during the confirmation hearing. But according to the Howey test, those investors should be in the clear.

Updated: 3-30-2021

Former SEC Chairman Jay Clayton Joins Crypto Advisory Board

Clayton, who stepped down from the SEC in 2020, joins the regulatory advisory council of One River Asset Management.

Three months after resigning from the United States Securities and Exchange Commission, or SEC, Jay Clayton has joined an advisory board of crypto investment manager One River Asset Management, signaling a changing of the guard for the former securities regulator.

Clayton, along with Kevin Hassett of The Lindsey Group and Jon Orszag of Compass Lexecon, joins One River Asset Management’s newly formed academic and regulatory advisory council, the company announced Monday.

Although Clayton’s exact role within the advisory group wasn’t specified, One RIver CEO Eric Peters said his goal was to bring together distinguished individuals with “varying regulatory and policy experience.”

“We were impressed by Eric’s willingness to hear our varying views on the digitization of our monetary, banking and capital markets ecosystem and One River’s commitment to transparency,” Clayton said.

Clayton served a three-and-a-half-year stint at the SEC before resigning on Dec. 23, 2020. His tenure was defined by a substantial increase in monetary remedies, possibly to the tune of over $14 billion, and returning billions to harmed investors.

He was also present during the last cryptocurrency bull market when Bitcoin (BTC) mania reached mainstream investors. In 2019, Clayton warned investors they would be “sorely mistaken” if they expect that the cryptocurrency would be tradeable on major exchanges without more stringent regulations in place.

One River Asset Management emerged as a pivotal Bitcoin player in late 2020 by scooping up $600 million in crypto assets. At the time, the firm said it expected to own roughly $1 billion worth of BTC and Ether (ETH) by the first half of 2021. Those targets may have already been met, given the rapid appreciation of crypto assets so far this year.

Updated: 4-2-2021

Former SEC Chair Jay Clayton Tips New Bitcoin Regulations Are Coming

The former SEC chairman warns that regulation will come both directly and indirectly.

Former US Securities and Exchange Commission Chair Jay Clayton has stated that Bitcoin has not been classified as a security for a long time.

But speaking on CNBC’s Squawk Box on March 31, Clayton warned that its status as a non-security still does not protect it from the imposition of new regulations which, he warned, could be coming soon.

“Where digital assets land at the end of the day–will be driven in part by regulation both domestic and international, and I expect that regulation will come in this area both directly and indirectly,” says Former SEC Chairman Jay Clayton on #bitcoin. pic.twitter.com/voWcgCFqOH

— Squawk Box (@SquawkCNBC) April 1, 2021

Host Andrew Ross Sorkin pointed out that under Clayton’s watch the SEC did not take a position on Bitcoin regulation. Clayton responded that was because the asset was declared not to be a security before he even took up his position as the head of the regulatory body.

“Bitcoin was decided to be not a security before the time I got to the SEC. Therefore, the SEC’s jurisdiction over Bitcoin was rather indirect.”

Clayton has remained in the industry following his departure from the SEC in December 2020 and currently advises One River Asset Management on cryptocurrencies.

Although he professes not to have any special insights into what new laws are coming from his time heading up the SEC, he believes the regulatory environment is due for a shake up.

“Where digital assets land at the end of the day […] will be driven in part by regulation—both domestic and international—and I expect, and I’m speaking as a citizen now, that regulation will come in this area both directly and indirectly whether it’s through how these are held at banks, security accounts, taxation and the like. We will see this regulatory environment evolve.”

Clayton’s comments come just a week after billionaire hedge fund manager Ray Dalio warned that the U.S. may ban Bitcoin outright just as they did with gold in the 1930s.

His comments about Bitcoin’s status as a non-security are also interesting in light of Ripple’s appeals to the SEC for documents from the agency to determine how exactly it came to the conclusion that Bitcoin and Ethereum were not securities.

The company and its backers have repeatedly argued that XRP is not a security however the SEC believes it is markedly different due to being morcentralized. Former SEC attorney Marc Powers told Cointelegraph that the agency is executing significant overreach in its case against Ripple and its executives.

Updated: 4-14-2021

US Senate Votes To Confirm Gary Gensler As SEC Chair

Gensler’s confirmation comes almost three months after President Joe Biden first announced he was his pick for the SEC.

Voting mostly along party lines, the U.S. Senate confirmed the nomination of Gary Gensler to chair the Securities and Exchange Commission, or SEC.

In a vote of 53-45 today, the Senate members confirmed the former chair of the Commodity Futures Trading Commission, or CFTC, to lead the Securities and Exchange Commission. Gensler, a professor at the MIT Sloan School of Management, volunteered to join then President-elect Joe Biden’s team as a financial expert in November. Biden announced the former CFTC was his pick to chair the SEC shortly before his inauguration in January.

During his confirmation hearings with the Senate Banking Committee last month, Gensler was seemingly evasive about whether he would implement changes to SEC policy regarding crypto. However, he said he supported some of the body’s prior decisions, like the exclusion of Bitcoin (BTC) from the commission’s regulatory purview.

“Bitcoin and other cryptocurrencies have brought new thinking to financial planning and investor inclusion,” said Gensler at the time. “I’d work with fellow commissions both to promote the new innovation but also, at the core, ensure investor protection. If something were a security, for instance, it comes under security regulation, under the SEC.”

Gensler served as chairman for the CFTC under President Barack Obama from 2009 until 2014. He was known as a stringent regulator during his time as CFTC head, overseeing reforms to the $400 trillion financial derivatives market.

Updated: 5-6-2021

SEC Chair Hints At Greater Regulatory Oversight For US Crypto Exchanges

Gary Gensler said a regulatory framework for digital assets from the SEC or CFTC “could instill great confidence” for investors.

Recently confirmed U.S. Securities and Exchange Commission chair Gary Gensler punted to congress on providing more regulatory oversight to the crypto space, but also said the commission would act within its purview.

In a virtual hearing held by the House Financial Services Committee today, North Carolina Representative Patrick McHenry asked Gensler what the regulatory body would be doing to ensure a “vibrant digital asset marketplace with legitimate money and the rule of law.” McHenry highlighted collaborations across regulatory agencies regarding digital assets and cryptocurrencies.

Gensler said the crypto market could benefit from “greater investor protector” within the Securities and Exchange Commission’s, or SEC’s, current authority around securities and other financial products.

He added that he believed only the U.S. Congress had the power to address such regulatory oversight rather than having the commission overreaching its authority under his leadership.

“Right now, the exchanges, trading in these crypto assets, do not have a regulatory framework either at the SEC or our sister agency, the Commodity Futures Trading Commission,” said Gensler. “That could instill great confidence. Right now, there’s not a market regulator around these crypto exchanges, and thus there’s really not protection against fraud or manipulation.”

The hearing today was the third held regarding the controversy over GameStop stock shorts earlier this year. Lawmakers have been exploring allegations of market manipulation from Robinhood and major hedge funds in response to Redditors’ short squeeze of GameStop stock and others. The price of GME has been volatile since peaking at $469.49 on Jan. 28, falling to under $50, and since fluctuating between $100 and $300.

Senate members officially voted on Gensler’s nomination last month, meaning this was his first hearing on the GameStop controversy as SEC chair. During his confirmation hearings with the Senate Banking Committee, Gensler said he supported the SEC excluding Bitcoin (BTC) from its regulatory purview.

Updated: 5-11-2021

Gary Gensler’s Regulatory Clarity Sounds Awfully Familiar

Gary Gensler said Congress should provide clarity around crypto exchange regulation. A 2020 bill sought to do just that.

SEC Chair Gary Gensler’s been on the job for three weeks. He’s just revealed what increased regulatory clarity might look like for crypto.

Regulating crypto?

The Narrative

Securities and Exchange Commission Chairman Gary Gensler, three weeks into the job, said the U.S. Congress could help protect cryptocurrency investors by drafting some laws around crypto exchange regulation, noting the current, limited jurisdiction of the SEC.

“I think that this market, which is close to $2 trillion, [this] crypto asset market is one that could benefit from greater investor protection,” he said.

“I think if [Congress were to take action] – because right now the exchanges trading in these crypto assets do not have a regulatory framework, either at the SEC, or our sister agency, the Commodity Futures Trading Commission – that could instill greater confidence. Right now there’s not a market regulator around these crypto exchanges, and thus there’s really no protection against fraud or manipulation.”

Why It Matters

Okay, some thoughts. First off, a (HUGE!) caveat that this is all speculation on my part.

With that out of the way, the entirety of the crypto industry’s support of Gensler comes from the idea that he understands crypto in a way his predecessor did not, and that this would lead to regulatory clarity. We now have a hint of how Gensler thinks he can provide this clarity.

Any number of issues pertinent to the crypto industry will depend on how the U.S.’ regulatory framework develops, including whether a bitcoin exchange-traded fund (ETF) is approved and how retail investors can tap the crypto market. The question becomes: Will Congress act with Gensler’s backing?

Breaking It Down

What we don’t know are the specifics. There’s no concrete SEC or CFTC framework from Gensler right now. What we do know is that he thinks one of these agencies should have clearer oversight authority to address possible fraud or manipulation around the cryptocurrency markets.

Of course, exchanges are regulated right now at the state level. There are problems with this, though. For one thing, an exchange must secure money transmitter licenses in every state where it wants to operate (except Montana, which doesn’t have a licensing regime), which takes money and time. I’m not sure whether Gensler’s proposed federal framework would supersede the state-by-state approach, but if it did, does that would be massive.

It’s the same problem that former Comptroller of the Currency Brian Brooks (now Binance.US CEO) tried to address with a federal trust charter to crypto companies. (While a few crypto custodians now have trust charters, it remains to be seen whether any exchanges will receive one.)

Both the SEC and CFTC have also demonstrated their oversight of the crypto markets with enforcement actions, but it sounds like Gensler’s going for something bigger. Though the CFTC has also laid claim to a number of crypto spot markets, there’s questions as to whether it actually has the authority to do so. So, in essence, it appears that what Gensler wants is some form of codified confirmation that a federal agency has oversight jurisdiction over the crypto markets in the U.S.

Here’s the next thing: We’ve seen this type of proposal in Congress already. Rep. Michael Conaway (R-Texas) introduced the Digital Commodity Exchange Act in the House of Representatives last year before he retired. That bill outlined how digital currencies could be treated similarly to commodities under federal law and, more importantly, it would create a federal jurisdiction for crypto exchanges.

To the best of my knowledge, there are no immediate plans to reintroduce the DCEA but it does seem like Gensler’s first recommendation has a frame all ready to go if someone in Congress does want to act on it.

It could also, if passed, have a somewhat more immediate impact than the Eliminate Barriers to Innovation Act, sponsored by Rep. Patrick McHenry (R-N.C.), who asked Gensler about digital asset regulation. McHenry’s bill, which has been passed by the entire House, would form a working group that studies the issue sends Congress recommendations after a year, versus the DCEA, which would skip the study aspect.

This extends beyond just the possible impact on exchanges. If Gensler believes the crypto industry in the U.S. needs more oversight, and in particular is concerned about market manipulation on exchanges, that might mean regulated products dependent on trustworthy exchanges won’t be approved before that oversight is in place.

Market manipulation, after all, is an issue the SEC has brought up repeatedly in denying approval of bitcoin exchange-traded fund (ETF) applications. As Bloomberg senior ETF analyst Eric Balchunas tweeted, Gensler may want this oversight to be formalized into law before an ETF is approved.

The possible downside I see here is if a new federal regulatory framework comes on top of the existing state-by-state regime. That would just become an additional burden on exchanges.

There’s also the risk a federal framework would benefit larger, more established exchanges and become too difficult for smaller competitors to match, which would lead to some consolidation. The DCEA, as envisioned last year, would offer exchanges a choice of federal or state regimes to follow, so theoretically it wouldn’t result in a greater burden or consolidation.

I don’t know whether Gensler’s first public comments on crypto as SEC chair are a positive or negative sign for the industry. My view on Gensler’s nomination and confirmation has always been that he is likely to provide regulatory clarity, but it may not necessarily be the type of regulatory clarity the industry wants.

That being said, my impression so far is that if Congress gets together and acts on this recommendation, this will be a long-term positive, both by giving exchanges some of that clarity they want and by giving retail or institutional investors more comfort about how their assets are regulated.

Fed Accounts

Last Wednesday, the Federal Reserve published a proposal to allow financial institutions with novel banking charters access to accounts and services offered by the Fed. In other words, non-traditional financial institutions – like, say, crypto exchanges with certain charters – would be able to tap the Fed directly for an account rather than have to go through an intermediary bank.

If finalized (there’s currently a 60-day comment period on the proposal), the rule would mean entities like Wyoming-licensed Special Purpose Depository Institutions would be one step closer to acting as a full bank native to the crypto industry.

“The payments landscape is evolving rapidly as technological progress and other factors are leading to both the introduction of new financial products and services and to different ways of providing traditional banking services (i.e., payments, deposit-taking, and lending).

Relatedly, there has been a recent uptick in novel charter types being authorized or considered across the country and, as a result, the Reserve Banks are receiving an increasing number of inquiries and requests for access to accounts and services from novel institutions,” according to the 20-page proposal.

David Kinitsky, the CEO of Kraken Bank, one such Wyoming-chartered bank, told CoinDesk his company had already applied for an account with the Fed, meaning this proposal is “of vital importance to us.”

The fact the Fed has taken the step of publishing this proposal is a good sign in and of itself, he said.

“We’re stoked about how they’re approaching it, with a risk-based approach,” he said. “There’s nothing novel in terms of the factors that they’re including here. It’s exactly the type of things that the Federal Reserve is looking at, in terms of risk to the reserve itself, risk to the payment system [and] risk to the economy.”

In other words, fintech or crypto platforms won’t have to jump through extra hoops simply because they’re within the fintech or crypto industries.

Kraken Bank intends to maintain full reserves for the assets it holds rather than operate any fractional lending services or otherwise engage in fractional banking, Kinitsky said.

This means the liquidity and solvency risks that other banks might face aren’t an issue for Kraken Bank, he said. Kraken Bank does not intend to apply for Federal Deposit Insurance Corporation insurance at this time for that reason.

That’s not to say the Fed is comparing these alternate-charter institutions to banks. In Kinitsky’s view, the U.S. central bank is trying to determine how best to evaluate novel financial institutions in their own right.

“I think it’s a really positive acknowledgement of the validity of some of these alternative charters that are eligible,” Kinitsky said. “… We don’t want big banks to be gatekeepers, in effect, for them through banking as a service platform. It’s super, super important. It keeps us up to speed with other kinds of global regions like the U.K. faster payments initiative.”

On Friday, Treasury Secretary Janet Yellen announced Michael Hsu would be taking over as the Acting Comptroller at the Office of the Comptroller of the Currency, effective Monday. Hsu comes from the Federal Reserve, where he was a part of the bank supervision division, so he’s got experience overseeing major financial institutions.

I’m not sure if he has any crypto background or where he’ll take former Comptroller Brian Brooks’ work from the past year. I’m also not sure if Hsu will eventually be nominated to become the full comptroller.

Has anyone heard anything about the CFTC?

Updated: 5-21-2021

Gensler Says SEC Should Be ‘Ready To Bring Cases’ Involving Crypto

The SEC chair continued to highlight investor protection as he previewed the regulator’s cryptocurrency enforcement efforts.

U.S. Securities and Exchange Commission (SEC) chief Gary Gensler said Thursday that federal financial regulators should “be ready to bring cases” against bad actors in crypto and other emerging technologies.

“As we continue to stay abreast of those developments, the SEC and FINRA [the Financial Industry Regulatory Authority] should be ready to bring cases involving issues such as crypto, cyber and fintech,” Gensler told FINRA conference attendees. He highlighted investor protection throughout his brief remarks.

The statements come as federal agencies propose upgrades to their crypto-monitoring efforts, from the Internal Revenue Service asking businesses to disclose high-value transactions to lawmakers calling for reviews of crypto-friendly banking policies.

“We need to do whatever we can to ensure that bad actors aren’t playing with working families’ savings and that the rules are enforced aggressively and consistently,” Gensler said.

He said regulators should be ready to pursue deceptive private funds, accounting fraud, insider trading and a bevy of other potential regulatory pitfalls rippling throughout the capital markets.

While hardly offering a playbook, Gensler’s remarks may bolster the perception that investor protection is a top priority for the Biden Adminstration’s SEC – especially when it comes to crypto.

Perhaps more telling was the SEC’s May 11 warning to investors in mutual funds that trade bitcoin futures. Though it contained no allegations of fraud, the memo highlighted bitcoin’s legendary volatility and instructed SEC staff to consider suspicious activity in the space.

Updated: 5-30-2021

US SEC Wants To Work With Congress To Regulate Crypto Exchanges

SEC head Gary Gensler said that the authority spends only $325 million per year on tech, which is less than some industry players spend in two weeks.

The United States Securities and Exchange Commission is looking to cooperate with Congress and other regulators to increase its oversight of cryptocurrency exchanges.

Gary Gensler, the newly appointed chairman of the SEC, said that the commission is looking forward to working with fellow regulators and Congress to fill gaps in investor protection in crypto markets.

The official announced the plans at a Wednesday hearing before the Financial Services and General Government subcommittee of the House of Representatives.

Gensler said that the SEC needs to provide similar protections for crypto exchanges that an investor would get on the New York Stock Exchange or Nasdaq:

“If you placed an order on an app, and you said, ‘Alright, I want to buy a stock,’ there are rules that protect you that somebody won’t use your order and get ahead of you. […] So, it’s trying to bring the similar protections to the exchanges where you trade crypto assets as you might expect at the New York Stock Exchange or Nasdaq.”

The new SEC head also outlined some of the challenges to regulating the cryptocurrency industry, stating that the SEC is “under-resourced” in financial terms when compared with some of the big players in the industry. “We only spend about 16% or 17% of our budget, about $325 million a year, on technology, which is less than probably some large firms spend in a month. Some of them even spend that much in two weeks,” he noted.

Gensler previously suggested that the SEC should be cooperating with Congress to properly address crypto exchange regulation in a market volatility-related hearing of the House Financial Services Committee in early May.

Last week, Michael Hsu, the new head of the Office of the Comptroller of the Currency, announced that the agency has been in talks with the U.S. Federal Reserve and the Federal Deposit Insurance Corporation about setting up an “interagency policy sprint team” focused exclusively on crypto.

US Regulators Must Collaborate On ‘Regulatory Perimeter’ For Crypto: OCC Head

Acting OCC head Michael Hsu wants greater interagency cooperation in establishing regulatory guidelines for the crypto sector.

The acting comptroller of the currency, Michael Hsu, has stated that regulatory agencies in the United States should establish a “regulatory perimeter” for digital assets and cryptocurrencies.

In an interview with Financial Times, Hsu indicated that U.S. regulators will look to take a more active role in policing the crypto-asset sector with an emphasis on minimizing the associated risks faced by investors and consumers.

“It really comes down to coordinating across the agencies,” Hsu said, adding: “Just in talking to some of my peers, there is interest in coordinating a lot more of these things.”

Hsu noted that the first meeting of the interagency, crypto-focused “sprint” team took place earlier this month. The team comprises representatives from the Federal Reserve, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency.

Hsu described the group as “small” but “senior,” adding that it is tasked with presenting “ideas in front of the agencies to consider” rather than formulating policy. Hsu emphasized the speed of growth and innovation in the crypto sector, asserting that a failure to begin acting now will only make policing the sector harder in the future:

“The idea is that time is of the essence and if it’s too big that gets harder.”

Hsu is not alone in thinking the United States lacks robust regulatory guidelines for crypto assets, with Securities and Exchange Commission Chairman Gary Gensler highlighting “gaps” in the “current system” regarding crypto while speaking to a House committee last month.

Gensler noted the Treasury Department has recently focused on “anti-money laundering and guarding against illicit activity” in the digital asset industry.

Updated: 8-3-2021

SEC Chair Wants Robust Crypto Regulatory Regime For The US

America’s securities chief has crypto regulatory ambitions beyond ETFs and token offerings, which include markets like lending and DeFi.

Gary Gensler, chairman of the United States Securities and Exchange Commission, is reportedly keen on bright-line regulations for the country’s crypto space.

Gensler expressed the SEC’s desire to install safeguards for crypto investors in the U.S. in a Bloomberg interview, stating, “If somebody wants to speculate, that’s their choice, but we have a role as a nation to protect those investors against fraud.”

The SEC chairman identified seven crypto-related policy changes currently being examined by the Commission. These include matters concerning token offerings, decentralized finance (DeFi) and stablecoins. Other focus points for Gensler’s SEC are custody, exchange-traded funds (ETF) and lending platforms.

According to Gensler, crypto exchange regulations might be the most straightforward way to achieve SEC oversight of the crypto trading arena. However, such legal policies may also include decentralized exchanges as well as other DeFi players.

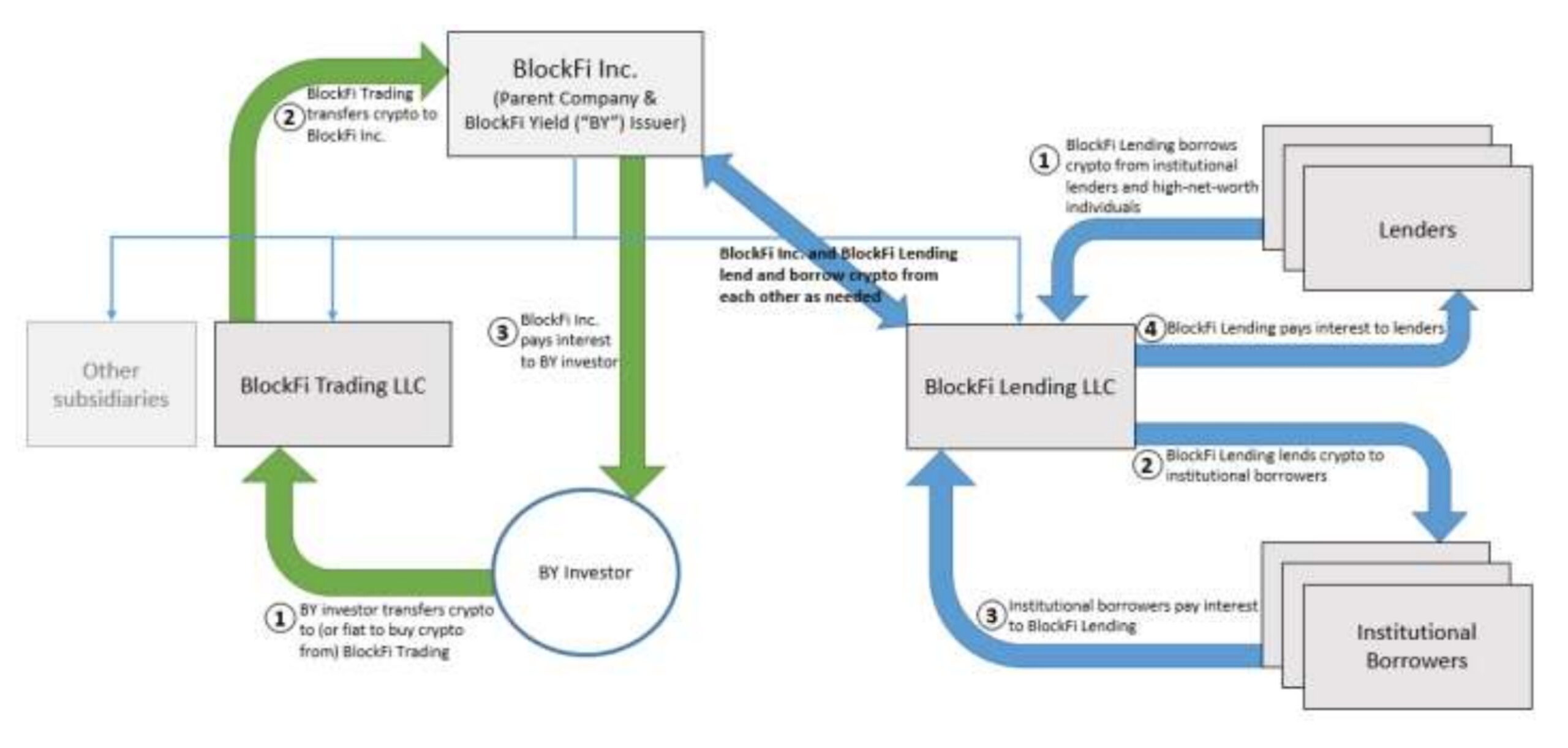

Gensler also identified the crypto lending market as coming under the SEC’s radar. Indeed, as previously reported by Cointelegraph, the flurry of state regulatory actions against crypto lending giant BlockFi might be a bellwether for future SEC action in the market segment.

For Gensler, the interest-rate advertising aspect of these companies and the pooling of digital assets to offer returns serve as entry points for the SEC to impose regulations akin to those enforced on mutual funds.

While Gensler is indeed keen on introducing regulatory clarity to the U.S. crypto market, these measures are reportedly not on the agenda for the SEC at the moment.

With close to 50 non-crypto-related policy matters on the Commission’s plate, crypto regulations might be on the backburner for now. Indeed, with environmental, social and corporate governance and meme stocks issues, some market commentators say a Bitcoin ETF in 2021 is unlikely.

Meanwhile, members of Congress, including Senator Elizabeth Warren, continue to push for stricter cryptocurrency policing.

Updated: 8-5-2021

SEC Chief Gary Gensler Braces For Clash With Crypto Traders

Gensler wants to regulate digital assets to the same extent as stocks, bonds and commodity-related trading instruments.

Securities and Exchange Commission Chairman Gary Gensler this week declared war on what he called the Wild West of crypto trading, promising a vigorous attack on fraud and misconduct. But progress is likely to be more piecemeal and incremental than wholesale and sudden.

Mr. Gensler outlined his desire to regulate digital assets such as bitcoin and other crypto products to the same extent as stocks, bonds and commodity-related trading instruments. He told the Aspen Security Forum on Tuesday that his priorities include newer innovations such as stablecoins and decentralized finance, products that are beginning to draw more mainstream investors.

The impulse to regulate these markets is growing more evident around the globe. Japan’s top financial regulator said Wednesday that plans to combat money laundering would also include digital currencies.

Mr. Gensler’s mission faces several obstacles, including the cryptocurrency industry’s historical resistance to following SEC rules. Because so many crypto developers have bypassed the SEC’s front door, the agency has tried to rein them in through enforcement, a slow process that requires investigating a particular product and either suing the team behind it or convincing them to settle and adopt the SEC’s requirements.

“There is going to be a more aggressive enforcement posture, and I think that is one way to bring order to chaos,” said Lee Schneider, a securities lawyer who has worked at several broker-dealers and cryptocurrency firms. “That is one way, but perhaps not the most effective or the most evenly distributed way.”

One of the biggest problems for Mr. Gensler is bitcoin, a cryptocurrency with a market capitalization of $710 billion and one that Washington has acknowledged is a commodity. Market regulators don’t have authority to write rules for how commodities are bought and sold—only for financial products such as futures whose value is tied to the real-world products.

Mr. Gensler has said Congress should create an investor-protection regime for bitcoin trading. But lawmakers tend to move slowly on financial-regulation overhauls, and typically write laws only after a crisis.

That means Mr. Gensler must use the SEC’s existing powers, which limit him to policing crypto assets that qualify as securities. Many are, but crypto developers insist SEC oversight doesn’t fit their technology and trading protocols.

To date, the SEC’s strategy has centered on suing token sellers on a case-by-case basis. The SEC has prevailed—through settlement or trial verdicts—in every such enforcement action it has filed. As a result, public sales of crypto tokens largely stopped, with startups limiting the deals only to private investors.

Late last year, the SEC sued Ripple Labs Inc. and two of its executives, Chris Larsen and Brad Garlinghouse, accusing them of raising $1.3 billion by selling an unregulated cryptocurrency, XRP, that should have been registered with the SEC.

Larger U.S. crypto exchanges reacted by halting trading in XRP. More crypto exchanges should reckon with whether they are dealing in unlicensed securities, the SEC chairman told CNBC on Wednesday.

“They’ve got to come in and let’s talk to them,” Mr. Gensler said. “Many of them right now are trying to say, ‘you know, well, well, we’re not going to come in.’”

Newer crypto innovations, such as stablecoins and decentralized finance, or DeFi, could form the next wave of enforcement targets, according to securities lawyers. Some stablecoins may meet the definition of mutual funds, while certain DeFi applications could be investments that should be registered with federal regulators, Mr. Gensler said.

Stablecoins, which seek to track the value of national currencies such as the U.S. dollar, are used by traders to shift value between exchanges and move between strategies. Total stablecoin supply is about $113 billion, more than triple the level from the start of the year, according to The Block, a news and data provider.

Forcing stablecoin issuers to register the assets as securities could be painful for some players, said Charles Cascarilla, chief executive of Paxos, a blockchain company that developed Binance USD, a dollar-backed stablecoin. But the industry would ultimately benefit from transparency into the reserves that underpin the coins’ value, he added. “Oversight creates trust, and trust can lead to widespread adoption,” Mr. Cascarilla said.

DeFi encompasses a range of projects that seek to replicate traditional financial activities, such as trading and lending, using cryptocurrencies and the internet. DeFi has boomed during the past year, with many projects avoiding the most basic regulation such as anti-money-laundering controls.

Regulators may have trouble applying securities laws to DeFi, where projects are often set up as automated peer-to-peer networks with no central entity operating them. In contrast, the SEC and other federal agencies largely focus on people and companies. Mr. Gensler suggested that legislation might be needed to impose investor protections on DeFi.

“The problem is that regulation applies to entities,” said Lee Reiners, executive director of the Duke University’s Global Financial Markets Center. “But with a decentralized trading or lending platform, it’s not clear who that entity is.”

The industry could potentially avoid an enforcement blitz by agreeing to follow SEC rules or pursuing exemptions on a case-by-case basis. The SEC has exempted a few digital assets from oversight. In those cases, the token wasn’t sold to raise capital and was used for purposes such as videogames or flights on business jets.

Some still argue Mr. Gensler should stop enforcing old rules and propose an updated code tailored to how crypto works. But Mr. Gensler and other regulators have shown little interest in that.

“Many in the crypto industry are saying that the SEC should come up with new rules,” said Michael Didiuk, a former SEC lawyer and now a partner at Perkins Coie LLP. “The SEC, on the other hand, has repeatedly said that, for the most part, the rules are there.”

Updated: 8-6-2021

‘Nakamoto’s Innovation Is Real,’ Says SEC Chair Gary Gensler

Gary Gensler describes Satoshi Nakamoto as an important innovator in cryptography and that their “innovation spurred the development of crypto assets and the underlying blockchain technology.”

Gary Gensler, chair of the United States Securities and Exchange Commission, or SEC, believes that the blockchain revolution started by Satoshi Nakamoto in 2008 is more than just a fad, but a real value proposition for the future of the internet.

In an interview with the Aspen Security Forum on Tuesday, Gensler talked about his role at the Massachusetts Institute of Technology, where he taught about the intersection of finance and technology:

“[…] in that work I came to believe that though there was a lot of hype masquerading as reality in the crypto field, Nakamoto’s innovation is real.”

SEC Chairman @GaryGensler on #Bitcoin

— Documenting Bitcoin (@DocumentingBTC) August 3, 2021

Gensler noted that, while some within the public sector wish that cryptocurrency would just go away, the technology likely has a big role to play in the future of finance.

“I really do think there’s something real about the distributed ledger technology, moving value on the internet,” he said.

Some within the crypto community took Gensler’s comments to mean that he’s studied the entire field of blockchain and concluded that Bitcoin is the only real innovation. A transcript of Gensler’s address to the Aspen Security Forum appeared to be hyper-focused on the Bitcoin (BTC) white paper published by Satoshi Nakamoto more than a decade ago.

Here’s the clip of Gary Gensler basically saying “I’ve studied the entire field & #Bitcoin is the only real innovation.” pic.twitter.com/AbsGcD7awP

— Rohun vora (@rohunvora) August 3, 2021

“At its core, Nakamoto was trying to create a private form of money with no central intermediary, such as a central bank or commercial banks,” Gensler said in his remarks. Although he acknowledged that no single cryptocurrency broadly fulfills all the functions of public currencies like the dollar, he said assets like Bitcoin provide a different value proposition:

“Primarily, crypto assets provide digital, scarce vehicles for speculative investment. Thus, in that sense, one can say they are highly speculative stores of value.”

After being confirmed by the Senate Banking Committee in April of this year, Gensler assumed the role as SEC chair in June, replacing the outgoing Jay Clayton, whose term expired the same month. Gensler’s five-year term is scheduled to last through 2026. He believes in creating a “robust” regulatory framework for cryptocurrencies in the United States, especially in emerging DeFi markets such as lending.

Updated: 8-19-2021

Crypto’s ‘DeFi’ Projects Aren’t Immune To Regulation, SEC’s Gensler Says

Some peer-to-peer trading and lending projects have features that may trigger the need for regulation, chairman says.

A new breed of digital asset exchanges is potentially the holy grail for cryptocurrencies: online places for people to trade and lend that purportedly involve no middleman setting the rules or taking fees.

But these peer-to-peer networks, so far completely unregulated in the U.S., may not be immune from oversight, said Gary Gensler, chairman of the Securities and Exchange Commission. Some decentralized finance projects, known as DeFi, have features that make them look like the types of entities the SEC oversees, Mr. Gensler said in an interview Wednesday.

DeFi developers write software that automates transactions and say they then step away from the project, allowing it to operate with no central entity in charge. They argue that such decentralization defeats the need for oversight by the SEC, which has said that some cryptocurrencies, such as bitcoin and ether, are sufficiently decentralized to avoid regulation.

But Mr. Gensler, who took over in April, said projects that reward participants with valuable digital tokens or similar incentives could cross a line into activity that should be regulated, no matter how “decentralized” they say they are.

“There’s still a core group of folks that are not only writing the software, like the open source software, but they often have governance and fees,” Mr. Gensler said. “There’s some incentive structure for those promoters and sponsors in the middle of this.”

The SEC under Mr. Gensler has doubled down on an effort, started several years ago, to look for cryptocurrency projects that are offering investments that should be regulated. In the past, that strategy has leaned heavily on enforcement actions that target digital-asset issuers or exchanges on a one-by-one basis.

Mr. Gensler, a longtime policy maker and former banker at Goldman Sachs Group Inc., two weeks ago promised a vigorous attack on fraud and misconduct in the market. He also said he would ask Congress to help legislate a solution to fill regulatory gaps, such as cases in which some digital assets don’t fall neatly into an existing regulatory framework.

A variety of DeFi platforms have popped up, with some rivaling the trading volumes of more established centralized cryptocurrency exchanges.

Unlike conventional crypto exchanges, DeFi apps don’t require users to hand their digital tokens to an exchange to be able to trade. That appeals to traders worried about losing their assets to hackers who steal digital coins from exchanges. There is also no central authority deciding who is allowed to trade, or what tokens can be traded.

DeFi projects generally don’t have safeguards against money laundering, or “know your customer” measures in which an exchange confirms the identity of traders using the platform. That also could raise red flags for authorities.

The SEC earlier this month brought its first enforcement action against a DeFi firm, Blockchain Credit Partners, and two men who ran it.

The project recruited investors to contribute their digital assets in exchange for a slice of income-generating car loans. The business was supposed to be decentralized because a separate “governance” token granted owners the right to make decisions about the business and share in the management company’s profits.

The SEC said the project’s creators misled investors about how the business worked and sold $30 million of digital tokens in violation of investor-protection laws.

The term DeFi is “a bit of a misnomer,” Mr. Gensler said, speaking generally and not about the Blockchain Credit case. ”These platforms facilitate something that might be decentralized in some aspects but highly centralized in other aspects.”