‘Playing Catch-Up In the Game of Life.’ Millennials Approach Middle Age In Crisis (#GotBitcoin?)

New data show they’re in worse financial shape than every preceding living generation and may never recover. ‘Playing Catch-Up In the Game of Life.’ Millennials Approach Middle Age In Crisis (#GotBitcoin?)

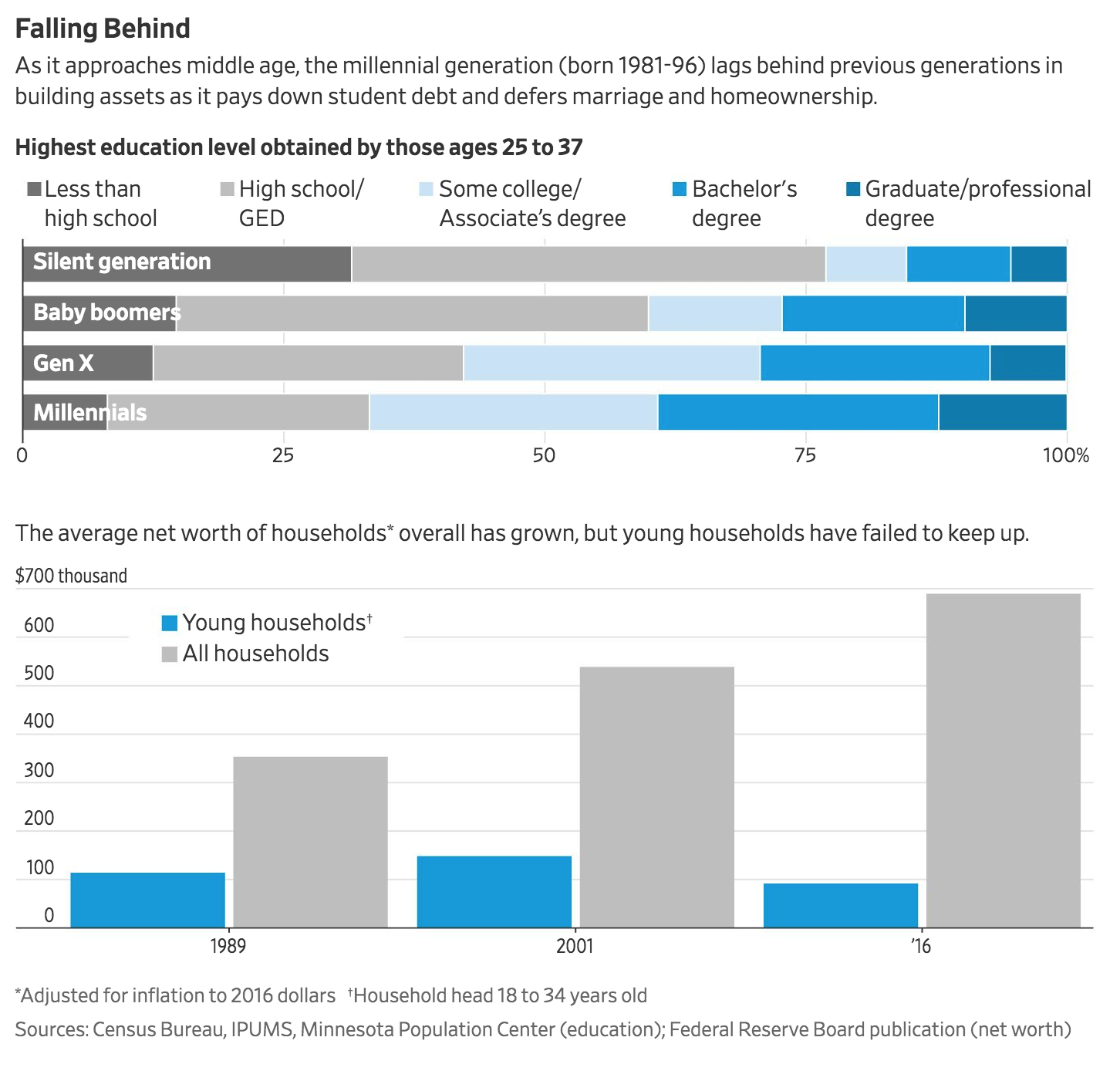

American millennials are approaching middle age in worse financial shape than every living generation ahead of them, lagging behind baby boomers and Generation X despite a decade of economic growth and falling unemployment.

Hobbled by the financial crisis and recession that struck as they began their working life, Americans born between 1981 and 1996 have failed to match every other generation of young adults born since the Great Depression. They have less wealth, less property, lower marriage rates and fewer children, according to new data that compare generations at similar ages.

Even with record levels of education, the troubles of millennials have delayed traditional adult milestones in ways expected to alter the nation’s demographic and economic contours through the end of the century.

Millennials helped drive the number of U.S. births to their lowest levels in 32 years. That means fewer workers in the future to support Social Security and other public programs for the ballooning population of retirees.

Falling Behind

As it approaches middle age, the millennial generation (born 1981-96) lags behind previous generations in building assets as it pays down student debt and defers marriage and homeownership.

Social Security last month estimated that in 2035, after nearly all baby boomers retire, there will be 2.2 workers per beneficiary. Last year, there were 2.8. The current birthrate of around 1.8 children per woman is expected to create a Social Security deficit of nearly $2 trillion over the next 75 years.

Prospects for a quick turnaround aren’t good. Men and women in their 30s are marrying at rates below every other generation on record.

“We’ll have to rethink a lot of things about taxation and how social programs are funded if fertility is really on a more permanent decline,” said Anqi Chen, assistant director of savings research at the Center for Retirement Research at Boston College.

Growth in property values and the stock market this past decade helped older households regain ground since the recession. Millennials, though, have made little headway.

“If I can’t afford a home, I definitely can’t afford kids,” said Joy Brown, 32 years old. She is a renter who is single and earns $75,000 a year. She also owes $102,000 in student loans and $10,000 in credit-card debt.

“Myself and a lot of my peers still feel like we’re playing catch-up in the game of life,” said Ms. Brown, a compliance officer for the city of Chicago

More than half the 72 million American millennials are now in their 30s. The oldest will turn 38 this year, when their generation is expected to surpass the number of baby boomers.

Their slow start has been well-documented in the first years after the recession. New data show that millennials may never catch up with the generations of Americans that preceded them.

A Generation Apart

“Their economic fundamentals are fundamentally different,” said Christopher Kurz, an economist at the Federal Reserve.

Mr. Kurz and his colleagues last year analyzed income, debt, asset and consumption data to figure out how millennials compared at similar ages with Generation X, people born between 1965 and 1980, as well as baby boomers, those born from 1946 to 1964.

They found that millennial households had an average net worth of about $92,000 in 2016, nearly 40% less than Gen X households in 2001, adjusted for inflation, and about 20% less than baby boomer households in 1989.

Wages didn’t look much better. At the same ages, Gen X men working full time and who were heads of households earned 18% more than their millennial counterparts, and baby boomer men earned 27% more, when adjusting for inflation, age and other socioeconomic variables.

Among women, incomes were 12% higher for Gen Xers and 24% higher for baby boomers than for millennials, using the same measures.

One explanation for their slow progress is bad luck. Economists have found that entering the workforce during a downturn yields lower earnings for life.

Till von Wachter, an economics professor at the University of California, Los Angeles, found that Americans who entered the labor market when unemployment rates rose by five points—about the same as in the 2007-09 recession—saw their cumulative earnings fall by 10% over the first decade of a career.

“The effects have health and lifestyle consequences well into middle-age,” said Prof. von Wachter. He reviewed four decades of earning data in his study, which was conducted with Hannes Schwandt of Northwestern University.

Different Priorities

Fewer millennials are reaching many of life’s milestones than those in previous generations.

The disappearance of manufacturing jobs, which in postwar years paid middle-class wages to high-school graduates, is another misfortune. Those who lack a college degree are at the biggest risk of falling behind.

Median household income last year was about $105,300 for millennials with a bachelor’s degree or higher, more than twice that of households headed by high-school graduates, according to the Pew Research Center.

Many millennials couldn’t afford to buy houses or invest in the stock market early enough to profit from the sharp escalation of prices over the past decade, said William Emmons, an economist at the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis.

About one third of millennials owned homes in 2016, compared with half of Gen Xers at similar ages in 2001, and just under half of baby boomers in 1989, according to Mr. Kurz’s findings. Even if millennials close the gap as they age, “asset prices are so high,” Mr. Emmons said, that their expected return on real estate is lower.

Losing out on a decade of gains in the stock and housing markets hurt the financial standing of millennial households. Between 2010 and 2016, Gen Xers, baby boomers and the older silent generation all recouped some of their recession losses, while the average family headed by someone born in the 1980s fell further behind the older groups, in relative terms.

The St. Louis Fed found the median wealth of a family headed by someone born in the 1980s was a third below the level that they would expect, compared with earlier generations at the same age and adjusted for inflation.

The regional Fed bank concluded that people born in the 1980s are at risk of becoming America’s lost generation, Mr. Emmons said, men and women who feel an almost insurmountable burden to catch up financially.

For Richer, For Poorer

Millennials, as a group, are better educated than any generation before them. About four in 10 ages 25 to 37 hold at least a bachelor’s degree compared with about a quarter of baby boomers, and three in 10 Gen Xers when they were the same age.

Those college diplomas have come at a high price. The average student-loan balance for millennials in 2017 was $10,600, more than twice the average owed by Gen X in 2004, according to Mr. Kurz and his Fed colleagues.

Tasha And Joseph Cochran, At Home In Maryland With Their Children. The Couple Put Off Getting Married When They Realized Combining Their Salaries Could Drive Up Their Income-Based Student Loan Payments.

For the Cochrans, the price was personal. Joseph Cochran, a real-estate manager, proposed to Tasha Brown in 2012. She said yes. Then Ms. Brown, a consumer finance attorney, realized that combining their salaries as a married couple could drive up their income-based student-loan payments.

They ditched their wedding plans but forged a life together. Each wear wedding rings. Ms. Brown, 36, legally changed her name and became Ms. Cochran. The couple run a financial-advice website, whittling away at their combined student debt of $377,000.

“If we had zero student loans we’d be married,” Ms. Cochran said. “We have to be far more strategic and creative in order to try to fit everything in around our student loans.”

Their strategy included moving from Philadelphia to Maryland four years ago. Ms. Cochran struggled to get pregnant, and the couple chose a state that mandated insurance coverage of in vitro fertilization, she said. The Cochrans now have a 3-year-old son.

Ms. Cochran also has a 17-year-old daughter from a previous relationship and has promised to pay for college as long as the teenager studies at an in-state school. Last fall, the young woman enrolled in community college to get a head start.

Her teenager “likes the idea of being able to graduate without having any student loans,” Ms. Cochran said.

Tasha And Joseph Cochran With Children Alexis, 17, And Reeves, 3. The Couple Delayed Marriage To Avoid Driving Up Their Income-Based Student-Loan Payments.

The family takes a more practical view of higher education, based, in part, on hard-won experience with jobs and school loans. “We tell her to think a lot about how much is a given major going to pay,” Ms. Cochran said.

The financial strain faced by many American millennials is driving shifts in their political views, reflecting a “feeling that as a citizen the system is not really operating as you expect it to,” said Mohamed Younis, editor in chief of Gallup.

A Gallup poll last summer found that millennials were the only generation that favored socialism over capitalism by a slight margin. The survey didn’t include Generation Z, people born in 1997 or later, and who are mostly too young to vote.

Tough times for millennials struggling to reach a more comfortable middle-class life have triggered support for populist candidates and promises of universal health care and free college education.

Tony Mancilla, a 31-year-old hospital maintenance technician in American Falls, Idaho, voted for Hillary Clinton, a Democrat, in 2016. Now, he is interested in Sen. Bernie Sanders, of Vermont, a self-described democratic socialist.

Mr. Mancilla, who earns about $35,000 a year, said he can’t afford the more than $600 a month it costs to insure his wife and two children on his employer plan. His children rely on a publicly subsidized plan. His wife is uninsured.

These health-care worries pointed Mr. Mancilla to Mr. Sanders’s Democratic Party primary campaign and “his way of looking at health care, trying to get that for everybody, taxing the rich,” he said. “He might have the best interest for the American people rather than just one class.”

As millennials approach middle age, more are asking for help from their employers. Ford Motor Co. two years ago expanded its financial-planning services after internal surveys found that the top monetary concern of millennials was saving for retirement. Ford’s planning services include one-on-one reviews of employee investments. All 80,000 U.S. workers are eligible.

“A good number of them are in their 30s and are thinking about longer-term planning,” said Julie Lodge-Jarrett, chief talent officer at the Dearborn, Mich., auto maker. “While they want to save, and they inherently get the importance of saving and planning, they don’t know how to do it.”

Zillow Group Inc., the Seattle real-estate company, earlier this year began offering a student-loan repayment program, contributing $25 a month toward the employee’s balance. The benefit was initiated after workers asked for help tackling college debts, said Dan Spaulding, the company’s chief people officer.

About 580 workers have signed up, the company said, and they carry an average loan balance of about $28,000.

Mike Maughan, head of global insights at Qualtrics in Provo, Utah, which researches millennials, said the financial picture of the generation is rosier than it appears: “Millennials are much scrappier than we give them credit for.”

Employers have told Mr. Maughan that the desire of millennials for on-the-job feedback shows they are eager to improve their skills.

One other bright spot: Millennials are entering their prime earning years just as baby boomers retire. That should fuel demand for their skills and lift their earnings. “The job market is so much better, so much stronger than it was 10 years ago,” said Mr. Emmons, of the St. Louis Fed. “That’s a huge benefit.”

Updated: 6-2-2020

Crypto Could Save Millennials From The Economy That Failed Them

The Millennial generation will lead humanity to an era of new financial technology as they drive Bitcoin adoption through the next decade.

In a seminal blog post by Blockchain Capital, Bitcoin (BTC) was described as a “demographic mega-trend.” And while new technology tends to follow a path of diffusion from younger to older generations, there is another thing driving crypto adoption among Millennials: The fiat-based economy has failed them.

The Demographic Megatrend

An online Harris poll conducted in April 2019 found that people aged 18–34 were three times as likely to be familiar with Bitcoin as those over 65, and twice as likely as those aged 50–64. They outgunned all age groups in terms of familiarity.

Even more striking, 59% of millennials had a positive view of Bitcoin as a fintech innovation. The demographic surged ahead of the second-most enthusiastic group (aged 35–44), almost twice as enthusiastic about the technology as older working generations and three times as positive as retirees.

It is not necessarily surprising that younger generations are more enthusiastic about cryptocurrency. Everett Rogers’ diffusion of innovations theory depicts how new innovations are adopted.

According to Rogers, innovators and early adopters are typically urban, educated, socially active and young.

But there is something else driving crypto into the arms of Millennials: the economy.

The Toughest Uphill Climb In History

The Millennials are a generation that has been shaped by recessionary forces. With employment levels since the COVID-19 pandemic now falling back to levels of the year 2000, Millennials, having already been through a post-9/11 recession and yet another following the 2008 global financial crisis, now face yet another episode of what the Washington Post has identified as “slower economic growth since entering the workforce than any other generation in U.S. history.”

Among the older group in the Millennial generation, sluggish growth and a jobless recovery defined their earlier working life post-GFC. The recession that will result from the pandemic this year will now define the entrance into the labor market of the younger set of Millennials. According to the Washington Post:

“Millennial employment plunged by 16 percent in March and April this year. […] That’s faster than either Gen X (12 percent) or the baby boomers (13 percent).”

Bleak employment prospects and sluggish wage growth will have defined the working lives of an entire generation.

Even before COVID-19 hit the American economy, a study last year found that:

“All the major life milestones — marriage, children, homeownership — have arrived measurably later for millennials than for the three previous generations for which we have comparable data.”

The Federal Reserve of St. Louis found that since the beginning of the Great Recession, older Millennials were the “only generation to have fallen further behind between 2010 and 2016.”

With the effects of COVID-19 about to pound them again, the generation least prepared for yet another crushing recession already have zero housing net-worth.

Crypto Adoption Highest Among The Generation Abandoned By The System

Millennial enthusiasm for crypto is a function of more risk aversion and tech savviness among younger people. But it is more than that. The Millennial generation could see crypto as an alternative to a volatile economic structure that has repeatedly failed them.

Statistics recently released by BlockFi had the open finance player conclude that “outsized Millennial and Gen Z ownership of crypto will create generational wealth for Millennial and Gen Z families.”

Citing Charles Schwab’s Q4 2019 data, BlockFi found that the publicly listed Grayscale Bitcoin Investment Trust was among the largest stock holdings for Millennials, behind only Amazon, Apple, Tesla and Facebook. It wasn’t among the top 10 for Baby Boomers.

Buffeted by recessions and jobless recoveries, the Millennial generation has borne the brunt of the hardship that economic slowdowns cause. That hardship includes the inability to recover during periods of expansion.

It is no coincidence, then, that the demographic most likely to be early adopters of new innovations is also the one most in need of an escape route to the economic freedoms crypto can bestow.

‘Playing Catch-Up In the,‘Playing Catch-Up In the,‘Playing Catch-Up In the,‘Playing Catch-Up In the,‘Playing Catch-Up In the,

Related Articles:

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing (#GotBitcoin?)

Three Steps To Take If You’re Behind In Retirement Savings (#GotBitcoin?)

A Retirement Wealth Gap Adds A New Indignity To Old Age (#GotBitcoin?)

401(k) or ATM? Automated Retirement Savings Prove Easy to Pluck Prematurely

San Francisco’s Housing Market Braces For An IPO Millionaire Wave (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Home Prices Continue To Lose Momentum (#GotBitcoin?)

Freddie Mac Joins Rental-Home Boom (#GotBitcoin?)

Retreat of Smaller Lenders Adds to Pressure on Housing (#GotBitcoin?)

Borrowers Are Tapping Their Homes for Cash, Even As Rates Rise (#GotBitcoin?)

‘I Can Be the Bank’: Individual Investors Buy Busted Mortgages (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

‘Playing Catch-Up In the, ‘Playing Catch-Up In the, ‘Playing Catch-Up In the, ‘Playing Catch-Up In the, ‘Playing Catch-Up In the, ‘Playing Catch-Up In the, ‘Playing Catch-Up In the

Go back

Leave a Reply

You must be logged in to post a comment.