Goldman Sach’s Call On Crisis, Bitcoin, And Inflation

Goldman Sachs will soon host a conference call discussing the impacts of the current economic crisis on Bitcoin, gold, and inflation. Goldman Sachs Hosts Conference Call On Crisis, Bitcoin, And Inflation

Goldman Sachs will host a conference call on May 27 titled US Economic Outlook & Implications of Current Policies for Inflation, Gold, and Bitcoin.

On May 23, Mike Dundas, the founder of crypto media outlet The Block, posted a screenshot of the invitation for the call, revealing that the event will be hosted by Sharmin Mossavar-Rahmani, the CIO of Goldman’s Investment Strategy Group, alongside Harvard economics professor Jason Furman, and Goldman Sachs’ chief economist Jan Hatzius.

Goldman Sachs Appears To Be Warming To Bitcoin

The news has been heralded as a milestone for the institutional adoption of crypto assets, appearing to signify a complete u-turn on the part of Goldman’s Mossovar-Rhami — who stated that cryptocurrencies fail as mediums of exchange, stores of value, and units of measurement, in August 2018.

For many years, the crypto community has appeared dedicated to willing cryptocurrency engagement from Goldman Sachs into existence, with false rumors that the financial giant planned to open a Bitcoin (BTC) trading desk circulating at frequently throughout the short history of cryptocurrency.

Institutions Increasingly Embrace Crypto

Goldman Sachs’ conference call comes amid other signs that many top financial institutions may be warming to crypto, with JPMorgan providing banking services to U.S. exchanges Coinbase and Gemini since April.

At the start of May, billionaire and hedge fund founder, Paul Tudor Jones, revealed that he is purchasing Bitcoin as a hedge against money printing-induced inflation.

The 65-year-old revealed that his Tudor BVI hedge fund is hodling “a low single-digit percentage” of its total assets in BTC futures, stating; “The best profit-maximizing strategy is to own the fastest horse […] If I am forced to forecast, my bet is it will be Bitcoin.”

Updated: 5-27-2020

Goldman Sachs Butts Heads With Bloomberg Over Bitcoin

Goldman Sachs starkly disagrees with Mike Bloomberg on cryptocurrency as an asset class worthy of investment interest.

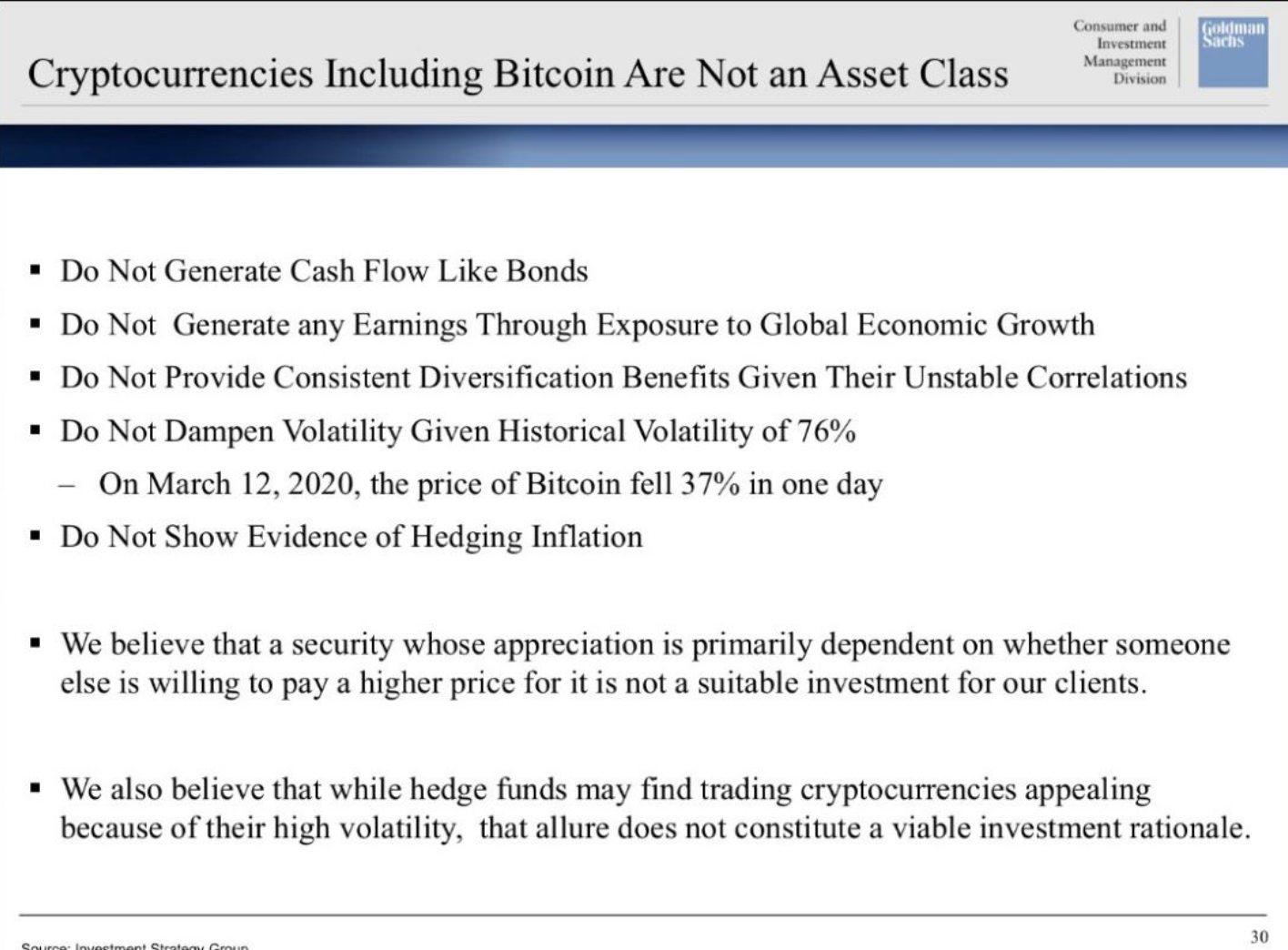

According to a leaked PowerPoint slide, Goldman Sachs, in a May 27 call discussing the U.S. economic outlook, stated that cryptocurrencies are not an asset class. The wording of the slide appears to discourage its clients from investing in the up and coming technology-based asset. This stands in stark contrast to the views of former presidential hopeful, Michael Bloomberg, whose financial reform plan unequivocally called Bitcoin an asset class.

Bloomberg: Better Than Gold

Michael Bloomberg’s Plan Openly Acknowledged Cryptocurrency As A Major Asset Class. It Also Called For A Transparent Regulatory Framework:

“Cryptocurrencies have become an asset class worth hundreds of billions of dollars, yet regulatory oversight remains fragmented and undeveloped. For all the promise of the blockchain, Bitcoin and initial coin offerings, there’s also plenty of hype, fraud and criminal activity.”

It should be noted that most, if not all, of the alleged criticisms of Bitcoin (BTC) by Goldman Sachs could also be levied against other established assets, such as gold. Notably, Bloomberg analyst Mike McGlone, who is frequently bullish on the cryptocurrency, believes Bitcoin to be a better store of value than gold because of the inelastic nature of its supply:

“Unlike quasi currency brethren gold, higher prices won’t be an incentive for more supply.”

Updated: 5-28-2020

‘What Are You Smoking?’ Winklevoss Pans Goldman Sachs Bitcoin Bashing

Tired claims that Bitcoin and cryptocurrencies are not an asset class say more about Goldman Sachs and the banking system itself, proponents argue.

Bitcoin (BTC) supporters have widely panned Goldman Sachs after it emerged that the banking giant does not consider it as a real asset class.

Materials from an investor call on May 27 revealed that the United States’ fifth-largest bank is dismissive of the largest cryptocurrency.

Goldman Wheels Out Legacy Bitcoin Complaints

The main reason for the continued lack of attention, Goldman says, is that Bitcoin does not generate revenue flows for holders, for example, in the same way that stocks and bonds do.

“We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients,” a related PowerPoint presentation states.

Along with other claims including high volatility, the criticism is nothing new, Bitcoin having faced years of identical scorn from the legacy banking sector. Just last week, wealth manager Peter Mallouk told CNBC that despite its recent returns, there was “no need” for any investors to buy Bitcoin.

“Cookiecutter Arguments”

Goldman’s tone meanwhile riled some of the best-known figures in the Bitcoin industry and beyond.

Reacting, D-TAP capital founder Dan Tapeiro argued that the bank was simply concerned about its revenue stream.

“Goldman Sachs does not make fees when a client buys #bitcoin. Buying Btc is an implicit rejection of buying assets that Goldman Sachs sells upon which they make fees,” he wrote on Twitter.

Buying btc is a rejection of the worldview they sell upon which they make fees. Long PTJ/Short GS EVERY TIME.

Gemini exchange co-founder Tyler Winklevoss meanwhile argued that the attention being paid to Bitcoin suggested a longer-term shift was underway.

“Crypto used to be where you ended up when you couldn’t make it on Wall Street,” he tweeted.

The quality of Goldman Sachs’ recent research on #Bitcoin demonstrates that there has been a talent flippening. Today, Wall Street is where you end up when you can’t make it in crypto.

In another post, Winklevoss took issue with Goldman’s understanding.

“Me: What are you smoking? I thought Goldman was the bank on Wall Street for smart bankers,” he wrote.

Others simply reiterated that Bitcoin was immune to naysayers, as evidenced in recent years by high-profile criticism impacting the price less and less.

“In all honesty most of their arguments were cookiecutter,” School of Arms Media CEO, John Bednarski summarized.

Updated: 5-28-2020

What Goldman Gets Wrong About Bitcoin (From Someone Who Used to Work There)

When I worked at Goldman Sachs, one of the running jokes among those around me was that I spent more time trading bitcoin than the bonds I was meant to be covering. Back in 2013, bitcoin was not taken very seriously among my colleagues. Even seven years later, I did not expect much to have changed. So, as I started reading and listening to the Goldman Sachs research piece on bitcoin Wednesday, I was pretty sure I knew where it was going.

The report begins with an overview of the state of the U.S. economy and projections as to what it may look like in a post-COVID-19 world. In particular, the report emphasizes that inflation is unlikely to be something to worry about anytime soon. Dollar demand remains strong and indicators show the pandemic has had effects that are, if anything, deflationary in nature. As I’ve written before, I think this is largely true for the short-to-medium term.

Goldman’s research then goes on to make a largely data-driven argument against investing in gold. Not only do we not have to worry about inflation, it says, but even if we did, gold would not be a great investment. Gold has not consistently outperformed inflation whereas equities have.

Similarly, U.S. Treasury bonds tend to offer a much better return in market downturns than gold. It turns out that gold does not always, or even often, behave as advertised. There are better options. The value of gold as an asset class has largely been driven by historical narrative – and that narrative does not line up with reality.

This is all reasonable. And as I say, I thought at this point that I knew where this was going. I believed the talented team of Goldman research analysts was about to break down bitcoin in a similar way. The story that has been told around bitcoin as an inflation hedge does not line up to the reality of how bitcoin has performed over the course of its albeit brief life as an investable asset.

The noisiness and volatility of its price action has prevented us from being able to draw a meaningful correlation between bitcoin and any major market or economic indicators. I expected Goldman’s report to conclude by summarizing that inflation is not an issue and that even if it was, neither gold nor bitcoin behave as the narratives around them might lead us to believe.

I was wrong. Rather than make a parallel argument to the one that they made against gold – a feat that is eminently possible using the data at hand and would have made for a compelling case – Goldman research launched into a series of non sequiturs about the objectionable traits of and dynamics around bitcoin. They did exactly what I find the smartest people often do when confronted with something as ground-breaking as bitcoin: they abandon all reason.

“They did exactly what I find the smartest people often do when confronted with something as ground-breaking as bitcoin: they abandon all reason.”

The report first poses the question as to whether bitcoin is a currency or an asset class. After only defining the features of a sovereign currency, the report concludes that, due to bitcoin’s failure to meet these criteria, it does not qualify as an asset class. This makes so little sense there is not even a name for this kind of logical fallacy.

“We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients,” the report goes on to state.

I hate to point out that, really, the fact someone else is willing to pay a higher price for a given instrument is probably the only criteria necessary to know something is a suitable investment. The reasons why someone else will be willing to pay that higher price are what is interesting and are what people generally look to the likes of Goldman Sachs research to explain and expound upon.

It’s not worth detailing every misconception or failed bit of logic in the report. But a few are worth mentioning. Goldman’s argument that cryptocurrencies are not a scarce resource due to the ability to fork into “nearly identical clones” represents a shocking failure of research into the immense technical and cultural differentiations between the three examples that they offer (bitcoin, bitcoin cash and bitcoin sv).

Goldman raises the possibility that cryptocurrency can be used for illicit activity to further discredit it – failing to address that the U.S. dollar, which is lauded for its strength earlier in the report, is the number one asset in the world used for illicit activity.

Finally, the report says the infrastructure around bitcoin and cryptocurrencies is relatively immature. There is much that is misrepresented on the slide illustrating this contention, including the omission of the option to self-custody assets uniquely offered by cryptocurrency. For a company that prides itself on being a “technology firm,” this slide in particular demonstrates an unwillingness to break out of traditional ways of thinking and instead look toward the possibilities opened up by bitcoin.

It would be easy to blame Goldman’s poor arguments against bitcoin on intellectual laziness or a certain strain of stuck-in-the-past thinking. If there is one thing I know from having worked there, however, it is that Goldman Sachs is neither lazy nor slow on the uptake. Rather, I would posit, the weakness of Goldman’s thesis around bitcoin is due primarily to the weakness of the industry around bitcoin in articulating the defining attributes and uses of this paradigm-shifting technology. There are exceptions, to be sure. There are voices, for which I am immensely grateful, that ring out loud and clear in articulating why bitcoin is valuable. But they have an arduous task breaking through the din of misinformation and jargon.

One need only look as far as the industry’s recent failed attempts to sell J.K. Rowling on the value proposition of bitcoin to know that we need to start finding better ways of communicating. If we want the likes of Goldman Sachs to buy into bitcoin, or if we even just want it to be able to make coherent arguments as to why not to buy into bitcoin, then we as an industry ought to look at the coherence of our own arguments first, do more to quiet the noise and work harder to lift up the voices that do make an honest and compelling case.

Updated: 5-29-2020

Coinbase Investor and Fundstrat Analyst Explain Why Goldman Sachs Is Incorrectly Assessing Bitcoin

Here’s why Goldman’s approach to Bitcoin is ‘stale’ and ‘hasn’t evolved much.’

A leaked slide from a client meeting shows Goldman Sachs does not believe Bitcoin is an asset class. Coinbase angel investor Seth Ginns and Fundstrat analyst David Grider explain why Goldman continues to hold this antiquated position.

Ginns and Grider joined Cointelegraph’s weekly Crypto Live Show to bring an investor’s perspective to the usual trader-heavy lineup. They also dive deeply into a broad range of topics including how they began investing in crypto, why they’ve stayed, crypto’s macro impact on the world of finance, private and central bank digital currencies, and institutional involvement in the space. Watch the livestream’s full recording in the video above or skip to 23:05 to go directly to the discussion on Goldman Sachs.

Cointelegraph’s Crypto Markets Live broadcasts every week on Thursday afternoons eastern time. The next show will feature crypto traders Big Cheds and Korean Jew Crypto, so subscribe to the Cointelegraph YouTube channel to make sure you don’t miss when we go live!

Goldman Sachs Leaks Its Position On Bitcoin

Cointelegraph reported that in a May 27 call discussing the state of the U.S. economy, Goldman Sachs appeared to discourage clients from investing in Bitcoin. This was discovered after a Powerpoint slide of Goldman’s presentation was leaked to the public.

On the opposite side of the spectrum stands former presidential hopeful Michael Bloomberg, who already acknowledged cryptocurrency as an asset class. When asked whether they supported Bloomberg or Goldman’s perspective, both Ginns and Grider sided against Goldman.

‘Stale’ Arguments Against Bitcoin

Ginns stated that he thought the question of Bitcoin being an asset class was already settled. He went on to point out another flaw in a different part of Goldman’s presentation, suggesting he was privy to the entire report:

“One of the interesting takedowns of crypto that we’ve seen — we saw it yesterday — was the idea that a lot of crypto is used for illicit purposes, and I found it really funny… So I thought that was a really good indicator of how stale that type of argument is as a takedown on crypto.”

Grider Also Noted How Goldman’s Approach To Crypto Hasn’t Changed Much Over The Past Few Years:

“Goldman — they’re obviously smart folks, very, very smart folks, some of the smartest folks on Wall Street. I think that the narrative that they put out on the call and in the deck — it’s very 2017, 2018…I don’t think that the narrative they’ve kind of put out has evolved much.

Grider goes on to explain why he thinks Goldman’s stance is due in part to political motivations. To hear the full explanation, check out Cointelegraph’s May 28 Crypto Markets Live stream in the video above.

If you enjoyed this latest market update, make sure to hit the Like button, and subscribe to Cointelegraph’s YouTube channel for more weekly crypto content!

Updated: 3-1-2021

Goldman Sachs Set To Jump Back Into Cryptocurrency Trading

Goldman Sachs Group Inc. is restarting a trading desk for cryptocurrencies amid a surge in the value of Bitcoin, a person familiar with the effort said.

The Wall Street bank will begin offering Bitcoin futures among other products by mid-March, according to the person, who asked to to be named because the plans haven’t been announced.

Goldman first offered crypto trading in 2018 when prices were cratering, the person said. The value of Bitcoin has surged in recent weeks, hitting a record high of more than $58,000 on Feb. 21. It has risen about 67% this year.

Reuters reported the news earlier.

Updated: 3-7-2021

40% of Goldman Sachs Clients Reported Exposure To Crypto

A Goldman Sachs client survey on digital assets found that 40% of clients have exposure to cryptocurrencies.

A Goldman Sachs’ client survey on digital assets shows positive sentiment toward the future of cryptocurrency investing.

* The survey showed that 40% of the respondents have exposure to cryptocurrencies and 54% predict the price of bitcoin (BTC, +3.37%) will be between $40,000 and $100,000. News of the survey was first reported by The Block.

* Other key takeaways include 61% of respondents expect their digital assets to increase in the next 12 to 24 months and 32% were most interested in prime brokerage for physical or spot to gain exposure to cryptocurrencies.

* Looking ahead, 22% of respondents predict the price of bitcoin will be over $100,000 in 12 months, while 34% believe regulation and mandate permissions are the greatest hurdles to starting to allocate funds to digital assets.

* On March 1, reports emerged that Goldman Sachs is relaunching its cryptocurrency trading desk after a three-year hiatus and plans to once again support bitcoin futures trading, a source familiar with the matter confirmed to CoinDesk.

Updated: 3-8-2021

Goldman Crypto Chief Flags Institutional Demand Driving Boom

Goldman Sachs Group Inc. is seeing substantial demand for digital assets from institutions as it works to restart its cryptocurrency trading desk.

In a survey of nearly 300 clients by the firm, 40% currently have exposure to crypto, according to Matt McDermott, global head of digital assets for Goldman Sachs Global Markets Division, speaking on a podcast. The situation is different now compared with the 2017 Bitcoin bubble due to “huge” institutional demand across different industry types and from private banking clients, he said.

McDermott confirmed plans reported last week for Goldman to restart its crypto trading desk, which he said will be “quite narrow initially,” with a focus on areas such as CME Group Inc. futures. He said that U.S. banks need to cope with regulations that bar them from trading physical cryptocurrencies.

Cryptocurrency enthusiasts argue that digital tokens and the underlying blockchain technology are gaining acceptance among more mainstream institutions and investors. The derivatives market and new investment products have made digital assets more easily accessible. Some strategists posit that the asset class is a potential diversifier for portfolios, while others are more skeptical and blame speculators for inflating a possible bubble in Bitcoin and other cryptos.

Bitcoin rose as much as 3.4% on Monday in Asia, while Ether gained as much as 5.3% to the highest since Feb. 23.

Blockchain technology offers “a real diverse set of opportunities for the financial industry and something that there’s a huge amount of momentum” for in the market, McDermott said. “We know firsthand just given the various different projects we’re working on. And we see this as a hugely exciting time exploring the potential of that technology.”

As for prices, 76% of those surveyed see Bitcoin ending 2021 between $40,000 and $100,000, McDermott said. However, 22% expect it to end the year over $100,000.

Updated: 3-31-2021

Goldman Sachs Readying Bitcoin Product For Clients

Crypto assets will be available to Goldman Sachs investors at some point in quarter two, comments from an incoming senior executive quoted by CNBC suggest.

Bitcoin (BTC) and some altcoins will soon be available to Goldman Sachs clients, according to a new media report.

Released by CNBC on Wednesday, comments from an interview with Mary Rich, global head of digital assets for the bank’s private wealth management division, confirmed the bank’s plans to offer crypto assets to investors.

Goldman Executive: Crypto Access Coming In “Near Term”

The move will make Goldman the second major lender to open up the world of cryptocurrency to its clients, and it comes weeks after a pioneering move by Morgan Stanley.

″We are working closely with teams across the firm to explore ways to offer thoughtful and appropriate access to the ecosystem for private wealth clients, and that is something we expect to offer in the near-term,” CNBC quoted Rich as saying.

Morgan Stanley’s rollout is due to launch in April, with Goldman’s occurring later in the second quarter. Both banks have the potential to bring large amounts of new capital into the Bitcoin ecosystem via participation in crypto-focused funds.

Continuing, Rich highlighted demand as a driving force behind Goldman’s decision.

“There’s a contingent of clients who are looking to this asset as a hedge against inflation, and the macro backdrop over the past year has certainly played into that,” she added.

“There are also a large contingent of clients who feel like we’re sitting at the dawn of a new Internet in some ways and are looking for ways to participate in this space.”

Like many major banks, Goldman has changed its tune on Bitcoin this year, going from a solid skeptic to embracing the phenomenon — noticeably in contrast with central banks including the United States Federal Reserve.

“Eventually they will have to offer bitcoin services to everyone,” Morgan Creek Digital co-founder Anthony Pompliano commented.

BTC/USD Gets Instant Boost After Crash

Bitcoin price action reacted warmly to the news, passing $58,000 once more after Wednesday produced a flash crash of more than $2,000 in mere minutes.

As Cointelegraph reported, analysts remain less concerned about the lack of momentum, pointing to solid fundamentals and the need to shake out overleveraged positions before grinding toward all-time highs.

$68,000 and $73,000 are points of interest for a potential breakout.

Updated: 4-1-2021

Rich Crypto Investors Going Alone Gets Goldman Off Sidelines

After watching Bitcoin’s stratospheric rise from the sidelines, game developer Adam Dart wanted a piece of the action.

The 29-year-old Scot who lives in Singapore reached out to a handful of local and international banks to ask about opening investment accounts to trade crypto with funds from his family’s wealth office. To his surprise, he was told that while bankers could offer their personal opinions on digital currencies, they couldn’t provide investment services.

“We had to eventually deploy the family office investment via Gemini, a U.S.-based digital asset exchange that operates in Singapore,” said Dart, who helps his parents run the firm that mainly invests in stocks, currencies and private equity. “It’s too much risk for banks to put Bitcoin in the portfolio, that’s generally the reason.”

Dart, whose family owns a semiconductor business, is just one of millions of wealthy investors going it alone as banks largely shy away from cryptocurrencies. Thousands of miles away, Christian Armbruester, founder of the London-based Blu Family Office, is exploring setting up a dedicated fund to trade the assets at a potential cost of more than $100,000 after European banks turned him away.

“They said no way — they didn’t want to custody this stuff,” said the one-time investment banker who oversees about $700 million for himself, his family and other wealthy investors. “This is where the rubber meets the road for cryptos. Everybody can get excited, but the implementation is very difficult.”

Warming Up

After dismissing digital currencies for years, some — but not all — Wall Street giants are warming to the idea. Goldman Sachs Group Inc. said this week it’s close to offering investment vehicles for Bitcoin and other digital assets to private wealth clients.

Morgan Stanley plans to give rich clients access to three funds that will enable ownership of crypto and Bank of New York Mellon Corp. is developing a platform for traditional and digital assets. Still, none of the biggest U.S. banks currently provide direct access to Bitcoin and the likes.

In Europe, Julius Baer Group Ltd. has started offering trading and custodian services of major cryptocurrencies within Switzerland, and Swiss private bank Bordier & Cie began to trade the assets via a third-party platform.

In Singapore, DBS Group Holdings Ltd. recently started a digital exchange that allows qualified investors of its private bank to invest in major digital assets while providing custodian services for them.

Volatility Risk

While Bitcoin is now more than 11 years old, there are very few things it can actually buy, and many lenders remain wary of the volatility risk associated with the virtual currency. JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon famously called Bitcoin a “fraud” in 2017 and threatened to fire any employee caught trading it — comments he later said he regretted.

UBS Group AG, one of the world’s largest wealth managers, in January warned new crypto investors that they could lose all their money.

“Lenders also have concerns over compliance and risk management, especially around money laundering and terrorist financing risks,” said Nizam Ismail, founder of Singapore-based Ethikom Consultancy, which advises firms on compliance.

“Still, regulators worldwide are revamping their framework to regulate cryptocurrency intermediaries as conventional financial institutions.”

Once seen as the province of nerds and computer geeks, Bitcoin has been gaining wider acceptance and many investors are speculating it will shake up the financial world. The best-known cryptocurrency has reached a series of records in 2021 — just three years after its price collapsed — after endorsements from the likes of Paul Tudor Jones, Stan Druckenmiller and Elon Musk.

The cost of a single Bitcoin has doubled this year to about $59,000 and the price has surged more than 500% since the start of 2020, according to Bloomberg data.

Some of the wealthiest and most sophisticated investors have become long-term backers after striking out on their own.

Mexican billionaire Ricardo Salinas Pliego revealed in November that he’s put a chunk of his liquid funds in the world’s biggest cryptocurrency and first invested in it five years ago through Grayscale Investments, when the price of one Bitcoin was about $800.

Now, Bitcoin’s rally over the past few months is intriguing wealthy investors in a new way.

“We have seen a surge in demand for investment professionals — particularly those focused on private equity and digital assets,” said Tayyab Mohamed, co-founder of Agreus Group, a London-based recruitment and resourcing company for family offices. In the past year, one single-family office based in the English capital completely shifted its investment portfolio of about $2.8 billion away from real estate to new asset classes including cryptocurrencies, he said.

The boom has also vaulted those helping trade the digital assets into the world’s ultra-rich. Coinbase Global Inc. co-founder Brian Armstrong is now a billionaire, though estimates of his fortune vary, underscoring the wild price swings of cryptocurrencies.

Set up in 2012, Coinbase is the biggest U.S. exchange for the assets and is expected to go public this month, marking another milestone for the transformation of crypto as a mainstream asset class.

“Trading and speculation were the first major use cases to take off in cryptocurrency, just like people rushed to buy domain names in the early days of the internet,” Armstrong, 38, wrote in a letter included in Coinbase’s registration filings with the U.S. Securities and Exchange Commission. “But we’re now seeing cryptocurrency evolve into something much more important.”

Yet for crypto newcomers like Dart, investing hasn’t been easy. Although he’s attended many next-gen courses that teach financial markets and trading via the family’s private banks, not much was explained about dealing with digital assets, he said.

Dart, who was drawn to crypto after his sister successfully invested in Bitcoin in 2014, has now set aside a small percentage of his family’s portfolio for it. He’s hoping that private banks will catch on to the craze and allow clients to include crypto in their accounts, instead of having to use external exchanges.

“It would be safer and much less of a hassle, while allowing us to achieve a more holistic view of our total asset allocation within our portfolios,” he said.

Updated: 4-28-2021

Goldman Sachs Identifies 19 Crypto Stocks That Massively Outperformed The S&P 500

Companies that have made big Bitcoin investments have performed 3x better on average.

Wall Street banking giant Goldman Sachs has identified an emerging cluster of crypto-related stocks that are performing much better than the S&P 500 itself.

In a note to investors on Tuesday, analysts at the investment bank highlighted 19 United States stocks that had a market capitalization of more than $1 billion and close ties to the cryptocurrency and blockchain industry.

Goldman’s investment gurus stated that many of these stocks have “dramatically outperformed” the broader stock market, with the firms averaging a return of 43% this year, which is more than three times the 13% that the S&P 500 has gained over the same period.

The leading two stocks were crypto mining companies Marathon Digital Holdings and Riot Blockchain with gains of 218% and 151% year to date, respectively.

Tesla has also had a solid year, with the stock reaching an all-time high of $883 in January a couple of weeks before its announcement that it had invested $1.5 billion into Bitcoin. Facebook has also been cited as a big dabbler in the space, with plans to launch its own cryptocurrency this year.

Another of Bitcoin’s (BTC) corporate backers is MicroStrategy, which saw its stock price explode in mid-April just before Bitcoin itself hit an all-time high of $65,000. Goldman estimates that the company has BTC holdings valued at around $4.5 billion.

Jack Dorsey’s payments firm, Square, has also poured money into crypto assets with a $220-million Bitcoin buying spree.

Other payments giants leaning heavily toward crypto include PayPal, Mastercard and Visa, which are all offering some forms of digital asset payments and even trading in some instances.

Goldman analysts noted that two big banks, BNY Mellon and JPMorgan Chase, have spearheaded blockchain adoption through crypto custody and interbank transactions.

The list was rounded out with U.S. exchange Coinbase, exchange operator Overstock.com, blockchain pioneer IBM, microchip maker Nvidia, and financial services firms InvestView, Broadridge Financial and Ideanomics.

In A Note To Clients Last Week, Dan Ives, An Analyst At Investment Firm Wedbush Securities Painted The Bigger Picture:

“The story and theme here is much larger than just investing in Bitcoin and predicting its potential price path… It’s about the potential ramifications that crypto, blockchain, and Bitcoin could have across the corporate world for the next decade.”

As reported by Cointelegraph, there have been hundreds of funds making significant investments into the crypto and blockchain industries despite the lack of a U.S. Bitcoin ETF.

Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,Goldman Sachs Hosts Conference,

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

If You Have 10 Bitcoin Then You’re Now In The Top 0.5% of 30 Million Bitcoin Addresses

Master of Puppets: Bitcoin Cuts The Strings

Trump’s Fed Nominee Advocates A Gold-Backed Currency, Even A Crypto One

What’s More Resilient To Global Electric Failure, The Banks or Bitcoin?

5 Key Reasons Bitcoin Price Fell From $9,800 To $9,200 Overnight

New Amazon Prime Documentary Shows How Bitcoin Is Changing Africa

Did Satoshi Just Move His Coins For The First Time In 11 Years? (#GotBitcoin?)

Mainstream Banks Discourage Clients From Crypto Encourages B.Y.O.B Be Your Own Bank (#GotBitcoin?)

Blockchain And Government-As-A-Platform AKA Algorithmic Regulation (#GotBitcoin?)

Newest Episodes of ‘Billions’ To Put More Emphasis On Bitcoin

To Generation X, Y and Z, add C. As in Generation Crypto (#GotBitcoin?)

Less Than 1% of FinCEN’s Suspicious Activity Reports Since 2013 Mentioned Crypto

Bitcoin Doubling Gold’s Yearly Gain So Far (#GotBitcoin?)

No, Donald Trump, Negative Rates Aren’t A ‘Gift,’ Bitcoin Advocates Warn

JPMorgan Provides Banking Services To Crypto Exchanges Coinbase And Gemini (#GotBitcoin?)

Bitcoin Advocates Cry Foul As US Fed Buying ETFs For The First Time

Final Block Mined Before Halving Contained Reminder of BTC’s Origins (#GotBitcoin?)

Meet Brian Klein, Crypto’s Own ‘High-Stakes’ Trial Attorney (#GotBitcoin?)

3 Reasons For The Bitcoin Price ‘Halving Dump’ From $10K To $8.1K

Bitcoin Outlives And Outlasts Naysayers And First Website That Declared It Dead Back In 2010

Hedge Fund Pioneer Turns Bullish On Bitcoin Amid ‘Unprecedented’ Monetary Inflation

Antonopoulos: Chainalysis Is Helping World’s Worst Dictators & Regimes (#GotBitcoin?)

Survey Shows Many BTC Holders Use Hardware Wallet, Have Backup Keys (#GotBitcoin?)

Iran Ditches The Rial Amid Hyperinflation As Localbitcoins Seem To Trade Near $35K

Buffett ‘Killed His Reputation’ by Being Stupid About BTC, Says Max Keiser (#GotBitcoin?)

Blockfolio Quietly Patches Years-Old Security Hole That Exposed Source Code (#GotBitcoin?)

Bitcoin Won As Store of Value In Coronavirus Crisis — Hedge Fund CEO

Decentralized VPN Gaining Steam At 100,000 Users Worldwide (#GotBitcoin?)

Crypto Exchange Offers Credit Lines so Institutions Can Trade Now, Pay Later (#GotBitcoin?)

Zoom Develops A Cryptocurrency Paywall To Reward Creators Video Conferencing Sessions (#GotBitcoin?)

Bitcoin Startup Purse.io And Major Bitcoin Cash Partner To Shut Down After 6-Year Run

Open Interest In CME Bitcoin Futures Rises 70% As Institutions Return To Market

Square’s Users Can Route Stimulus Payments To BTC-Friendly Cash App

$1.1 Billion BTC Transaction For Only $0.68 Demonstrates Bitcoin’s Advantage Over Banks

Bitcoin Could Become Like ‘Prison Cigarettes’ Amid Deepening Financial Crisis

Bitcoin Holds Value As US Debt Reaches An Unfathomable $24 Trillion

How To Get Money (Crypto-currency) To People In An Emergency, Fast

Bitcoin Miner Manufacturers Mark Down Prices Ahead of Halving

Privacy-Oriented Browsers Gain Traction (#GotBitcoin?)

‘Breakthrough’ As Lightning Uses Web’s Forgotten Payment Code (#GotBitcoin?)

Bitcoin Starts Quarter With Price Down Just 10% YTD vs U.S. Stock’s Worst Quarter Since 2008

Bitcoin Enthusiasts, Liberal Lawmakers Cheer A Fed-Backed Digital Dollar

Crypto-Friendly Bank Revolut Launches In The US (#GotBitcoin?)

The CFTC Just Defined What ‘Actual Delivery’ of Crypto Should Look Like (#GotBitcoin?)

Crypto CEO Compares US Dollar To Onecoin Scam As Fed Keeps Printing (#GotBitcoin?)

Stuck In Quarantine? Become A Blockchain Expert With These Online Courses (#GotBitcoin?)

Bitcoin, Not Governments Will Save the World After Crisis, Tim Draper Says

Crypto Analyst Accused of Photoshopping Trade Screenshots (#GotBitcoin?)

QE4 Begins: Fed Cuts Rates, Buys $700B In Bonds; Bitcoin Rallies 7.7%

Mike Novogratz And Andreas Antonopoulos On The Bitcoin Crash

Amid Market Downturn, Number of People Owning 1 BTC Hits New Record (#GotBitcoin?)

Fatburger And Others Feed $30 Million Into Ethereum For New Bond Offering (#GotBitcoin?)

Pornhub Will Integrate PumaPay Recurring Subscription Crypto Payments (#GotBitcoin?)

Intel SGX Vulnerability Discovered, Cryptocurrency Keys Threatened

Bitcoin’s Plunge Due To Manipulation, Traditional Markets Falling or PlusToken Dumping?

Countries That First Outlawed Crypto But Then Embraced It (#GotBitcoin?)

Bitcoin Maintains Gains As Global Equities Slide, US Yield Hits Record Lows

HTC’s New 5G Router Can Host A Full Bitcoin Node

India Supreme Court Lifts RBI Ban On Banks Servicing Crypto Firms (#GotBitcoin?)

Analyst Claims 98% of Mining Rigs Fail to Verify Transactions (#GotBitcoin?)

Blockchain Storage Offers Security, Data Transparency And immutability. Get Over it!

Black Americans & Crypto (#GotBitcoin?)

Coinbase Wallet Now Allows To Send Crypto Through Usernames (#GotBitcoin)

New ‘Simpsons’ Episode Features Jim Parsons Giving A Crypto Explainer For The Masses (#GotBitcoin?)

Crypto-currency Founder Met With Warren Buffett For Charity Lunch (#GotBitcoin?)

Bitcoin’s Potential To Benefit The African And African-American Community

Coinbase Becomes Direct Visa Card Issuer With Principal Membership

Bitcoin Achieves Major Milestone With Half A Billion Transactions Confirmed

Jill Carlson, Meltem Demirors Back $3.3M Round For Non-Custodial Settlement Protocol Arwen

Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin?)

Top Graphics Cards That Will Turn A Crypto Mining Profit (#GotBitcoin?)

Bitcoin Usage Among Merchants Is Up, According To Data From Coinbase And BitPay

Top 10 Books Recommended by Crypto (#Bitcoin) Thought Leaders

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Bitcoin’s Lightning Comes To Apple Smartwatches With New App (#GotBitcoin?)

E-Trade To Offer Crypto Trading (#GotBitcoin)

Bitfinex Used Tether Reserves To Mask Missing $850 Million, Probe Finds (#GotBitcoin?)

21-Year-Old Jailed For 10 Years After Stealing $7.5M In Crypto By Hacking Cell Phones (#GotBitcoin?)

You Can Now Shop With Bitcoin On Amazon Using Lightning (#GotBitcoin?)

Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin, Bright Future Ahead (#GotBitcoin?)

Crypto Faithful Say Blockchain Can Remake Securities Market Machinery (#GotBitcoin?)

Disney In Talks To Acquire The Owner Of Crypto Exchanges Bitstamp And Korbit (#GotBitcoin?)

Crypto Exchange Gemini Rolls Out Native Wallet Support For SegWit Bitcoin Addresses (#GotBitcoin?)

Binance Delists Bitcoin SV, CEO Calls Craig Wright A ‘Fraud’ (#GotBitcoin?)

Bitcoin Outperforms Nasdaq 100, S&P 500, Grows Whopping 37% In 2019 (#GotBitcoin?)

Bitcoin Passes A Milestone 400 Million Transactions (#GotBitcoin?)

Future Returns: Why Investors May Want To Consider Bitcoin Now (#GotBitcoin?)

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes (#GotBitcoin?)

Major Crypto-Currency Exchanges Use Lloyd’s Of London, A Registered Insurance Broker (#GotBitcoin?)

How Bitcoin Can Prevent Fraud And Chargebacks (#GotBitcoin?)

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.