El Salvador Adopts Bitcoin As Legal Tender

El Salvador’s Nayib Bukele, Latin America’s youngest president who’s known to break from the norms, said he plans to send legislation that would make Bitcoin legal tender in the country. El Salvador Adopts Bitcoin As Legal Tender

“In the short term, this will generate jobs and help provide financial inclusion to thousands outside the formal economy,” Bukele said in a video broadcast at the Bitcoin 2021 conference in Miami.

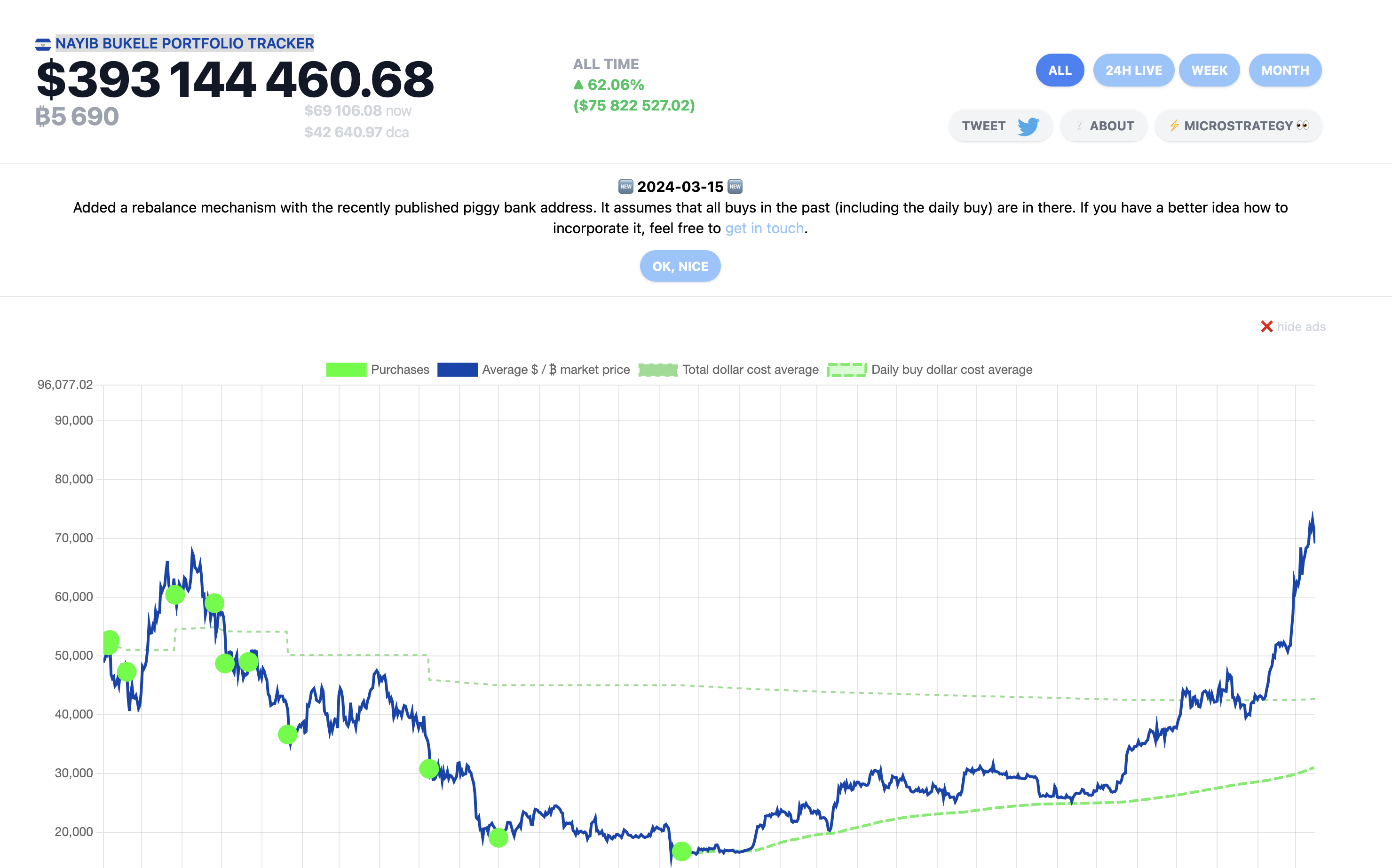

Buying the dip ?

150 new coins added.#BitcoinDay #BTC??

— Nayib Bukele ?? (@nayibbukele) September 7, 2021

He said he would submit the legislature a bill next week.

Related:

Things Utilities Can Do To Strengthen The Grid Includes Deploying MicroGrids

Bitcoin Embassy Bar Mexico

Bitcoin Embassy Atlanta

Bitcoin Embassy Tel Aviv

Bitcoin Embassy Ukraine

Bitcoin Embassy Stockholm

Bitcoin Embassy Helsinki

“Financial inclusion is not only a moral imperative, but also a way to grow the country’s economy, providing access to credit, savings, investment and secure transactions,” he said. “We hope that this decision will be just the beginning in providing a space where some of the leading innovators can reimagine the future of finance.”

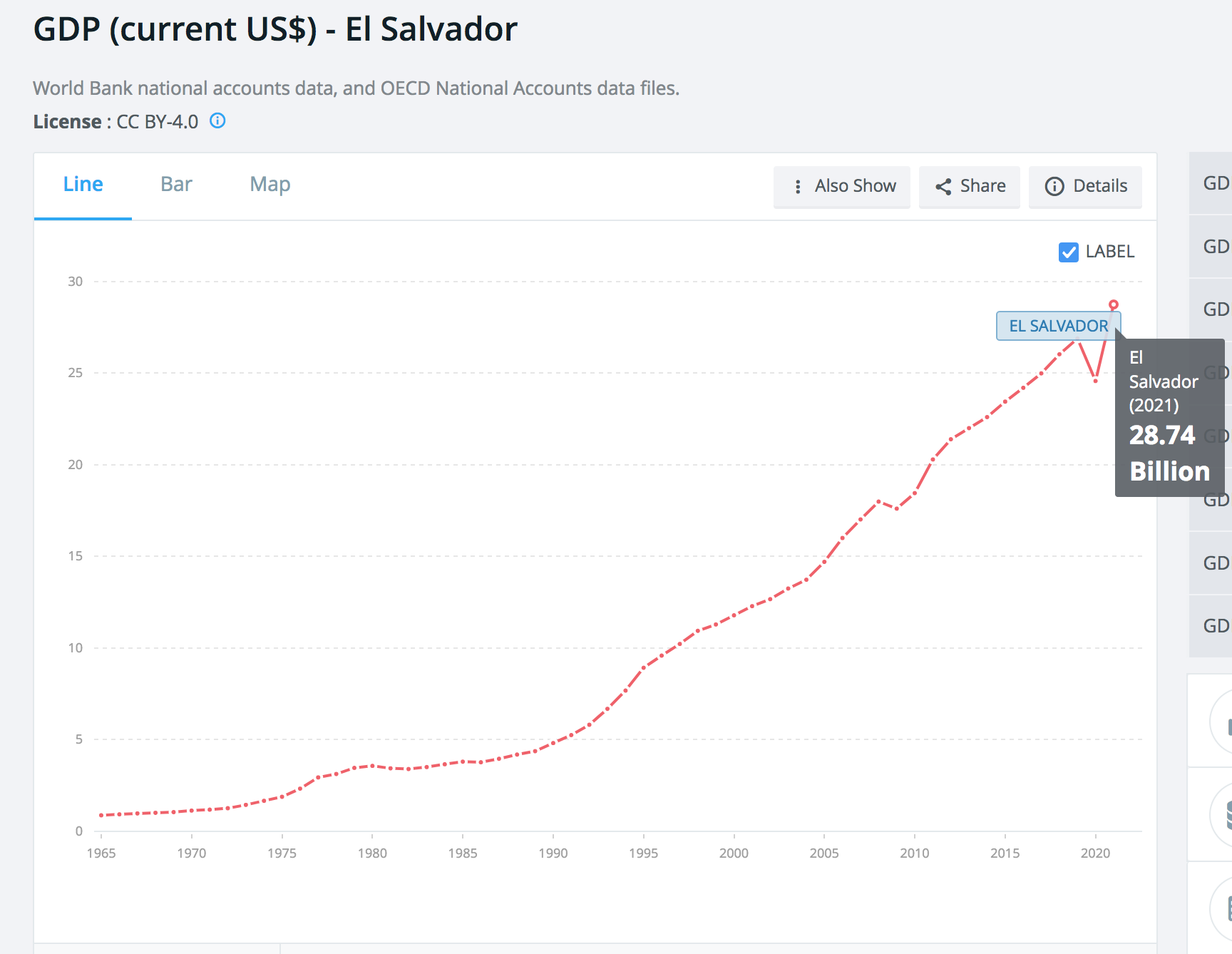

#Bitcoin has a market cap of $680 billion dollars.

If 1% of it is invested in El Salvador, that would increase our GDP by 25%.

On the other side, #Bitcoin will have 10 million potential new users and the fastest growing way to transfer 6 billion dollars a year in remittances.

— Nayib Bukele (@nayibbukele) June 6, 2021

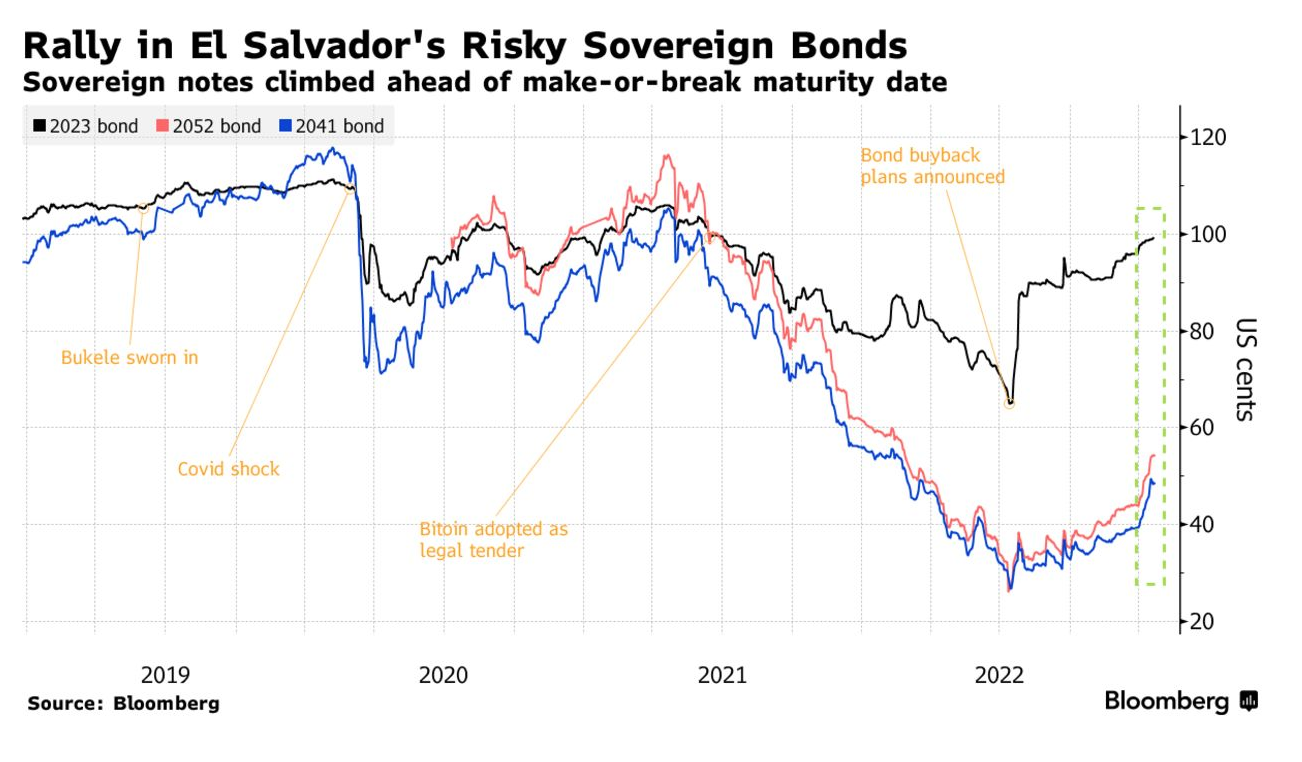

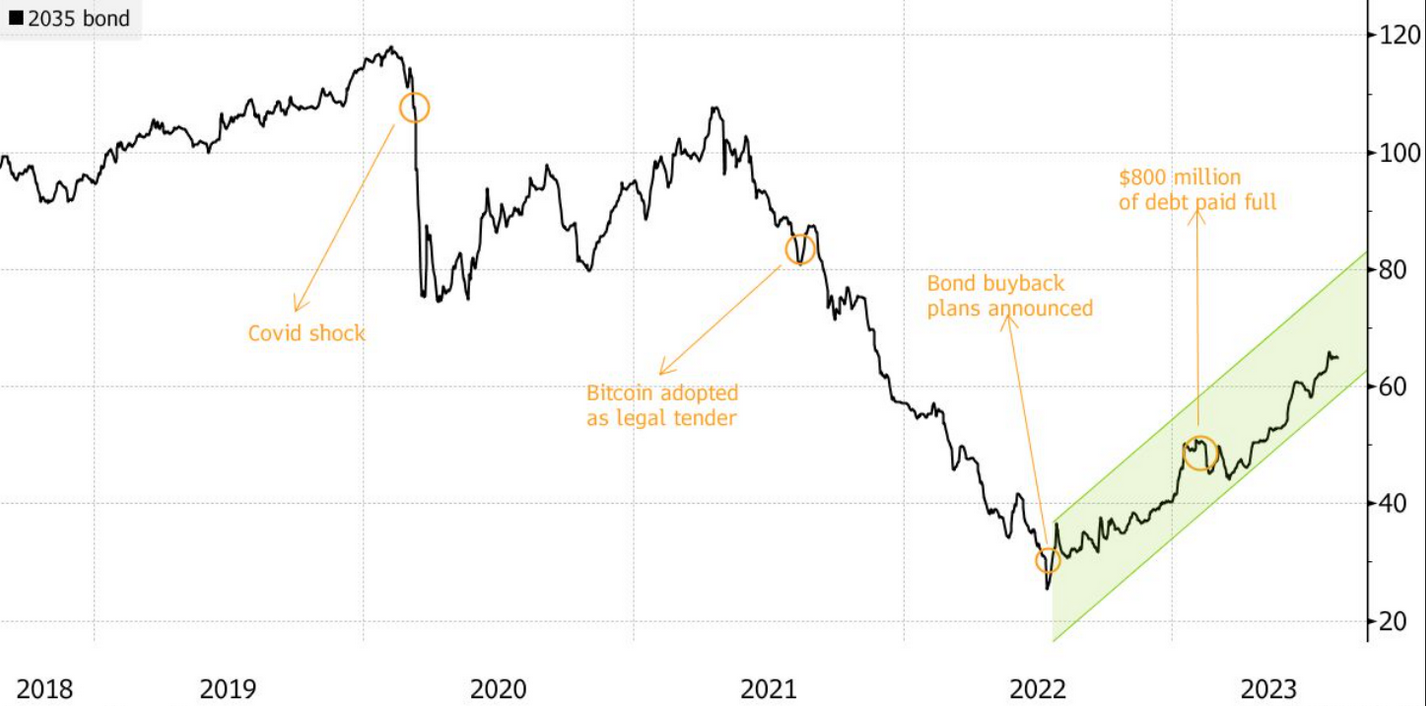

El Salvador’s bonds tumbled last month after Bukele’s party used the supermajority it won in February congressional elections to fire five top judges and the attorney general, drawing condemnation for what critics saw as a blatant power grab. Wall Street reacted swiftly, with Oppenheimer & Co., Amherst Pierpont Securities and Allianz SE among half-a-dozen firms that sold the notes or told clients to pare their holdings.

The move also fueled concern that the U.S. will urge the International Monetary Fund to closely review a much-needed loan for El Salvador, potentially upending government finances.

Bukele is among the region’s most popular leaders, according to public-opinion polls that show him with an approval rating of more than 85%. He has a strong social media following and charted an unconventional route to politics, working at his father’s marketing agency before serving terms as mayor of San Salvador and a suburb.

He ran for president in 2018 pledging to curb corruption and rampant gang-fueled crime, and became the first president in almost 30 years to win without the support of one of the major parties.

Jack Mallers, founder and CEO of the payments platform Strike, presented Bukele’s video during the meeting Saturday. He said the El Salvadoran government asked him to help develop a plan for the use of Bitcoin, according to the Bitcoin 2021 conference’s Twitter account.

Bitcoin Users Will Get Help Relocating And Working In El Salvador: President

Nayib Bukele says he wants to help entrepreneurs embrace El Salvador as a base, with Bitcoin free from capital gains tax.

Bitcoin (BTC) hodlers who want to earn BTC tax-free will get help to stay in El Salvador, the country’s president has said.

In a tweet on Monday, President Nayib Bukele said that his government would “help” settle foreign workers.

El Salvador: “We’ll help with this”

The announcement is one of many that continue to come informally from Bukele, now famous for attempting to put El Salvador on a form of “Bitcoin standard.”

At last week’s Bitcoin 2021 conferwnce in Miami, he told the audience in a prerecorded video message that he would send a bill to lawmakers demanding that Bitcoin be made legal tender.

Welcome to the future #Bitcoin pic.twitter.com/j30vcZVXvJ

— Nayib Bukele (@nayibbukele) June 5, 2021

Now, as part of social media engagement with well-known cryptocurrency figures, Bukele suggested that those wishing to travel to work in El Salvador would get official support. Once made legal tender, Bitcoin income would not face capital gains tax.

“We’ll help with this,” he replied while debating the topic with podcast host Stephan Livera.

Tu tienes Bitcoin? tu tienes residencia en el Salvador yo en cualquier momento caigo … https://t.co/drpnIQ1lAj

— MARCIANOTECH (@MARCIANOPHONE) June 6, 2021

In a separate tweet came promises of “immediate permanent residence for crypto entrepreneurs,” a move that spurred interest from figures such as Tron CEO Justin Sun and Binance CEO Changpeng Zhao, among others.

Latin America embraces Bitcoin

As Cointelegraph reported, meanwhile, El Salvador’s plan has already seen Paraguay make a similar move.

Likewise using Twitter as a venue for publicizing still unofficial government plans, one congressperson hinted that a deal involving PayPal would shortly be announced by Asuncion.

This likewise received a warm reception.

“Now Paraguay? The sovereign level game theory starting to take shape just like many have been talking about for years,” podcast host Preston Pysh responded.

Criticism has nonetheless come mixed with concern for El Salvador. The political structure of the country has worried some, while others believe that there would be international backlash over a Bitcoin standard.

Bukele, however, has already pledged to rise above external pressure.

“Some powerful interests will try to make this historical #Bitcoin move fail,” he wrote.

“They know what it means if it succeeds. It will.”

Plan B Passport, a dedicated service helping Bitcoin owners move to more appealing jurisdictions such as Portugal, has yet to add El Salvador to its list of destinations.

Latin Lawmakers Don Lazer Eyes On Twitter In Support Of Bitcoin

An increasing number of Latin American lawmakers are donning Lazer eyes on their Twitter avatars to express their support for Bitcoin and digital assets.

Gabriel Silva, a Panamanian congressman, is moving to follow in El Salvador’s footsteps by proposing legislation to adopt Bitcoin and other cryptocurrencies on a national scale.

El Salvador’s president, Nayib Bukele announced during the Miami Bitcoin conference on June 6, that he will submit a bill to lawmakers demanding that Bitcoin be made legal tender.

In a June 8 tweet, Silva emphasized the significance of Panama not being left behind by Bukele’s progressive crypto plans, which also includes removing capital gains tax on Bitcoin in El Salvador. According to a rough translation, Silva asserted:

“This is important. And Panama cannot be left behind. If we want to be a true technology and entrepreneurship hub, we have to support cryptocurrencies.”

“We will be preparing a proposal to present at the Assembly. If you are interested in building it, you can contact me,” he added.

Bukele’s announcement has prompted similar moves from other politicians across Latin America, however, few concrete policy proposals have been announced.

On June 7, Paraguayan congressman, Carlitos Rejala, tweeted “El Salvador to the Moon” and uploaded a picture of himself with laser eyes — a popular crypto meme used to express Bitcoin maximalism on crypto Twitter.

Earlier today, the crypto community had turned their attention to Brazilian politician, Fábio Ostermann, who similarly posted a picture of himself with laser eyes accompanied by the hashtag “#lasereyestill100k.”

Despite positive sentiment on social media regarding the apparent bullishness of Latin American lawmakers, the price of Bitcoin has continued to decline.

The price of Bitcoin has slumped roughly 10% since Bukele’s June 6 announcement from $36,000 to roughly $32,500 at the time of writing.

El Salvador Commerce Secretary: Bitcoin Won’t Replace Dollar

Miguel Kattán, a member of President Nayib Bukele’s cabinet, sought to reassure Salvadorans fearful of a full pivot to a bitcoin standard.

El Salvador’s proposed embrace of bitcoin would not end dollarization in the Central American economy, top government officials said, addressing concerns raised by citizens confused about the plan.

“The dollar will continue to be the legal tender in El Salvador. Operations can be done with bitcoin – obviously related to its value in dollars.” Miguel Kattán, El Salvador’s secretary of Commerce and Investment, said in remarks covered by local newspaper El Mundo on Monday.

Providing the most in-depth look yet at President Nayib Bukele’s plan to grant bitcoin legal tender status, Kattan said the still-under-wraps bill would create an opt-in bitcoin economy where the dollar, El Salvador’s official fiat since 2001, remains supreme.

Kattán explained during a Central Bank press conference, the first to address Bukele’s surprise Saturday announcement televised at the Bitcoin 2021 conference in Miami, that goods will remain dollar-denominated in El Salvador. A tomato that costs 20 cents, for example, will still cost 20 cents, even among sellers that accept bitcoin.

He sought to reassure Salvadorans fearful of a full pivot to a bitcoin standard. Radical social media prognostications of an economy where goods are priced in satoshis will never come to pass, he said.

The possibility of such a future had sparked pockets of confusion on social media, according to local journalist José A. Barrera.

“Until Saturday very few people knew about cryptocurrencies” in El Salvador, he said in Spanish over a series of Twitter direct messages with CoinDesk. “Let’s say it is not a popular topic.” But it began consuming Salvadorans’ online discourse almost at once.

“In social networks and discussions, people associate or think that they [would] have to have bitcoins” once the bill becomes the law.

The discrepancy between the bitcoin price (over $30,000) and their country’s sub-$300 a month minimum wage has only deepened the confusion, he said. (Bitcoin is divisible to the eighth decimal, making it possible to buy a fraction of a coin, but this is not always obvious to people unfamiliar with the cryptocurrency.)

For this reason, Barrera said, “it’s no coincidence” the government’s first official word on Bukele’s surprise announcement includes a promise “that bitcoin will not replace the dollar.”

“What the Law will say, at the end of the day, is that you can pay – if the person charging accepts Bitcoin and if the person paying wants to pay – using Bitcoin,” Kattán said during the press conference.

Even so, Kattán said the bill would recognize bitcoin as legal tender in El Salvador. The bill would also come with protections against money laundering, he said.

Kattán said bitcoin presents El Salvador with a growth opportunity. He pointed to the success of a community known as “Bitcoin Beach” where hotels, shops, restaurants and even the water utility accept bitcoin over the low-cost Lightning network.

“There is no difference from what we have today,” Kattan said. For consumers and merchants, “their relationship will always be with the dollar.”

Barrera said bitcoin is “probably” viable in El Salvador as many residents are already plugged into the digital economy.

“But we will have to wait to know what conditions the bill will have, which will surely pass as proposed by Nayib Bukele,” he said.

El Salvador, Paraguay Fail To Flip Bitcoin Bullis

Within Bitcoin, the word on everyone’s lips is “El Salvador.”

After payments gateway Strike began making serious inroads in the country, President Nayib Bukele formally announced that he would send a bill to parliament to make Bitcoin legal tender.

Should it succeed, El Salvador would be the first nation on Earth to do so, effectively adopting something akin to a “Bitcoin standard.”

Bukele confirmed his plans during a video address at last week’s Bitcoin Conference 2021 event in Miami, at which Strike CEO Jack Mallers outlined the plans.

Markets, however, were practically unmoved by the revelation — something that continued as a congress member from Paraguay took to social media to hint at plans for Bitcoin integration in a second world economy.

“As I was saying a long time ago, our country needs to advance hand in hand with the new generation. The moment has come — our moment,” Carlitos Rejala tweeted on Monday.

“This week we start with an important project to innovate Paraguay in front of the world! The real one to the moon.”

Rejala additionally thanked Bukele for his “example.”

As Cointelegraph reported, however, El Salvador’s embrace of Bitcoin may come at a price. Reacting, commentators touched on Bukele’s authoritarian leadership, along with potential teething troubles resulting from an economy that uses the U.S. dollar doing so.

For Caitlin Long, founder and CEO of Avanti Bank, there may be bigger forces at play.

“Bitcoin is hacking dictatorships, just like it’s hacking big tech,” she wrote in one of many tweets about the move.

“Bitcoin doesn’t care WHY El Salvador’s president wants to make BTC legal tender—it doesn’t matter.”

Bitcoin’s ‘Authoritarian Hipster’

El Salvador’s Nayib Bukele has built a career by courting the vulnerable while attacking the establishment. Now he wants Bitcoin as legal tender.

On Sunday, Salvadoran President Nayib Bukele tweeted out his new profile picture. It featured the popular, young upstart standing at a podium with a bitcoiner’s blood red laser eyes (instead of the usual statesman’s stare). In the background stand a few national guardsmen.

The day before, in a pre-recorded video screened to the 12,000 attendees of Bitcoin Miami, the 39-year-old president announced he had drafted a bill to present to the nation’s legislature to make bitcoin an official currency in El Salvador. It would be a monumental step for the nation, known less for its technological prowess than its significant underbanked population.

Details during the announcement were scant – a version of the bill wasn’t immediately made available – though Bukele sold this move as a way to “provide financial inclusion” for his citizens and “push humanity at least a tiny bit into the right direction.”

Changing his Twitter profile to reflect the hodler’s creed might be considered a formal statement on how serious Bukele is about making this happen.

“At this point I don’t think this is anything more than a symbolic gesture,” George Selgin, a Senior Fellow and Director of the Cato Institute’s Center for Monetary and Financial Alternatives, said about the plans in a phone interview. “Obviously he’s a clever politician that knows how to play up to a younger constituency and build popularity.”

Bukele has been lauded as a populist reformer as well as branded an “authoritarian hipster.” He took the presidency in the nation’s most recent election with 53% of the vote, after less than a decade holding various mayorships, running on an anti-corruption platform as part of a newly founded third party, Nuevas Ideas (New Ideas).

He describes his politics as neither left nor right, but instead reflective of what everyday Salvadorians want. In most public appearances, Bukele, the son of a rich Palestinian merchant, is seen wearing a backwards hat, aviators and closely trimmed beard.

His preferred method of communication? Going direct through social media, where he counts millions of followers, often using a tone “more appropriate for tweets about bitcoin or sports,” the Washington Post noted.

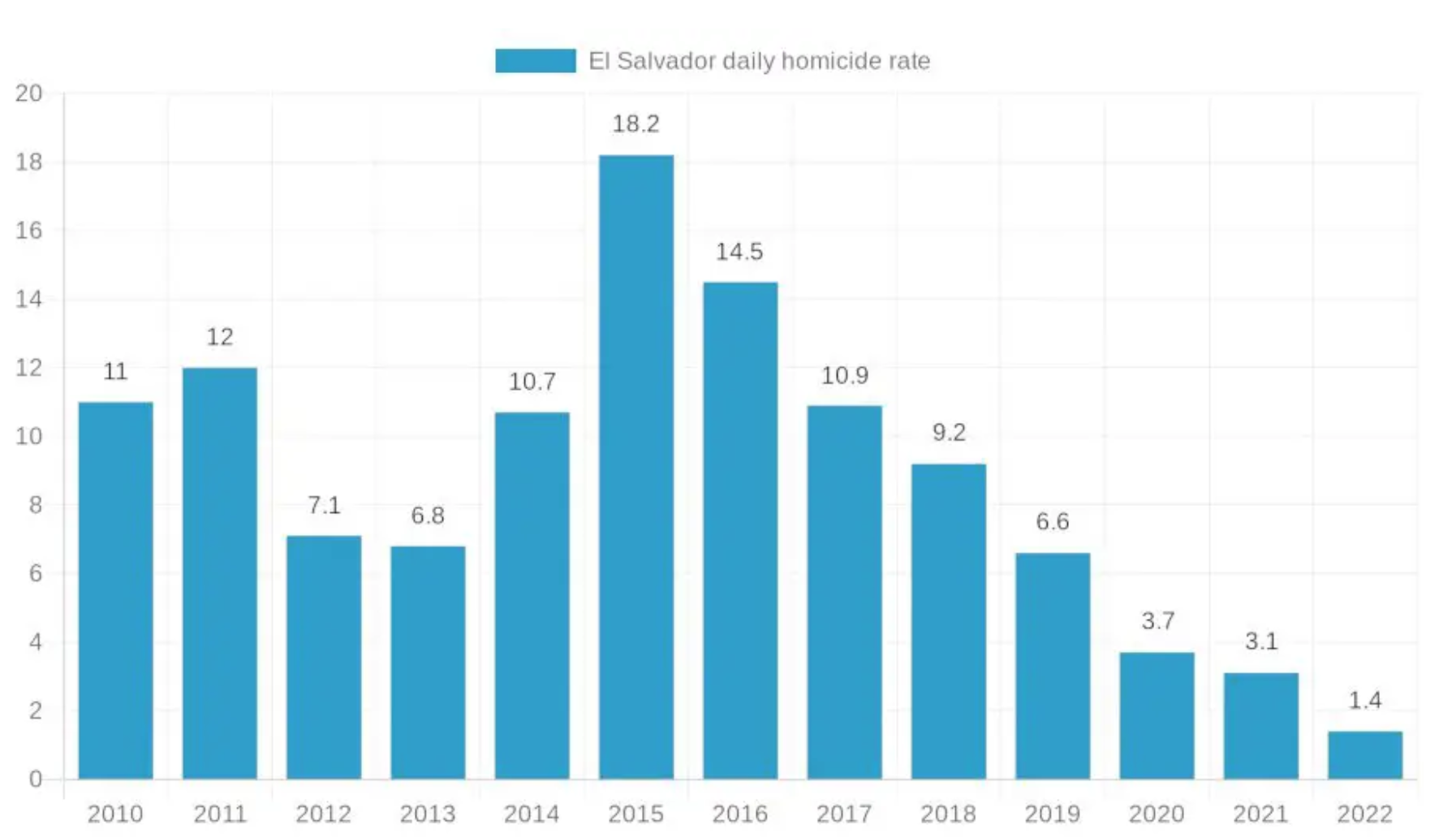

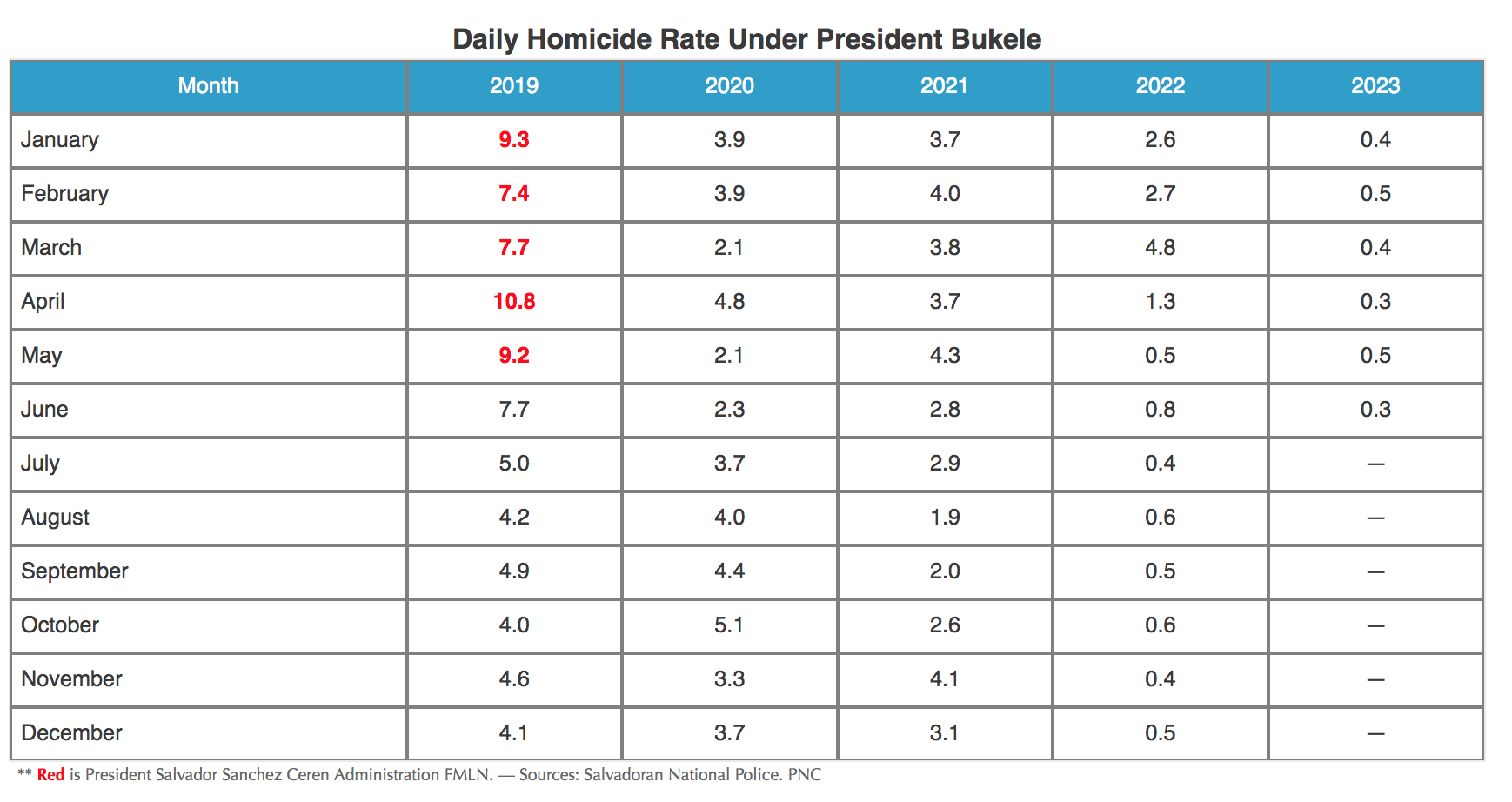

More than a year after his inauguration, Bukele’s popularity ratings hover between 80%-90%. During the coronavirus crisis he provided food assistance and $300 direct cash payments, winning him the admiration of his constituents. He’s also made an effort to build community centers, expand internet access and put a dent in gang-related crime.

But his governing tactics have, indeed, bent authoritarian at times. In February 2020, he sent armed soldiers into the legislature to demand they approve a loan for security equipment. In April 2020, he released official photos of hundreds of alleged gang members stripped nearly nude crowded together on a prison floor.

On May 1, he led efforts for the legislature to remove five magistrates from the Supreme Court who had opposed his policies. The next day it removed the country’s attorney general.

He ignored Supreme Court rulings challenging his COVID-19 lockdowns and has allegedly harassed political opponents, shunned the media and has vilified human rights groups. The Catholic Church, among other leaders in the country, denounced his “persistent efforts…to erode our democratic order.”

The Washington Post called him a “millennial autocrat” and compared the outsider politician to “political bomb-throwers” like former Italian prime minister Silvio Berlusconi and “blustery despots” including the Philippines’ Rodrigo Duterte and Brazil’s Jair Bolsonaro.

His latest turn to bitcoin continues these two trends of courting the most vulnerable while attacking the establishment. In his recorded message, Bukele claimed more than 70% of El Salvador’s 6.5 million people were left out of the banking system. A further 2 million or so live in the U.S. where they send home $6 billion in remittances – which make up about 23% of the nation’s economy – often getting gouged by middlemen.

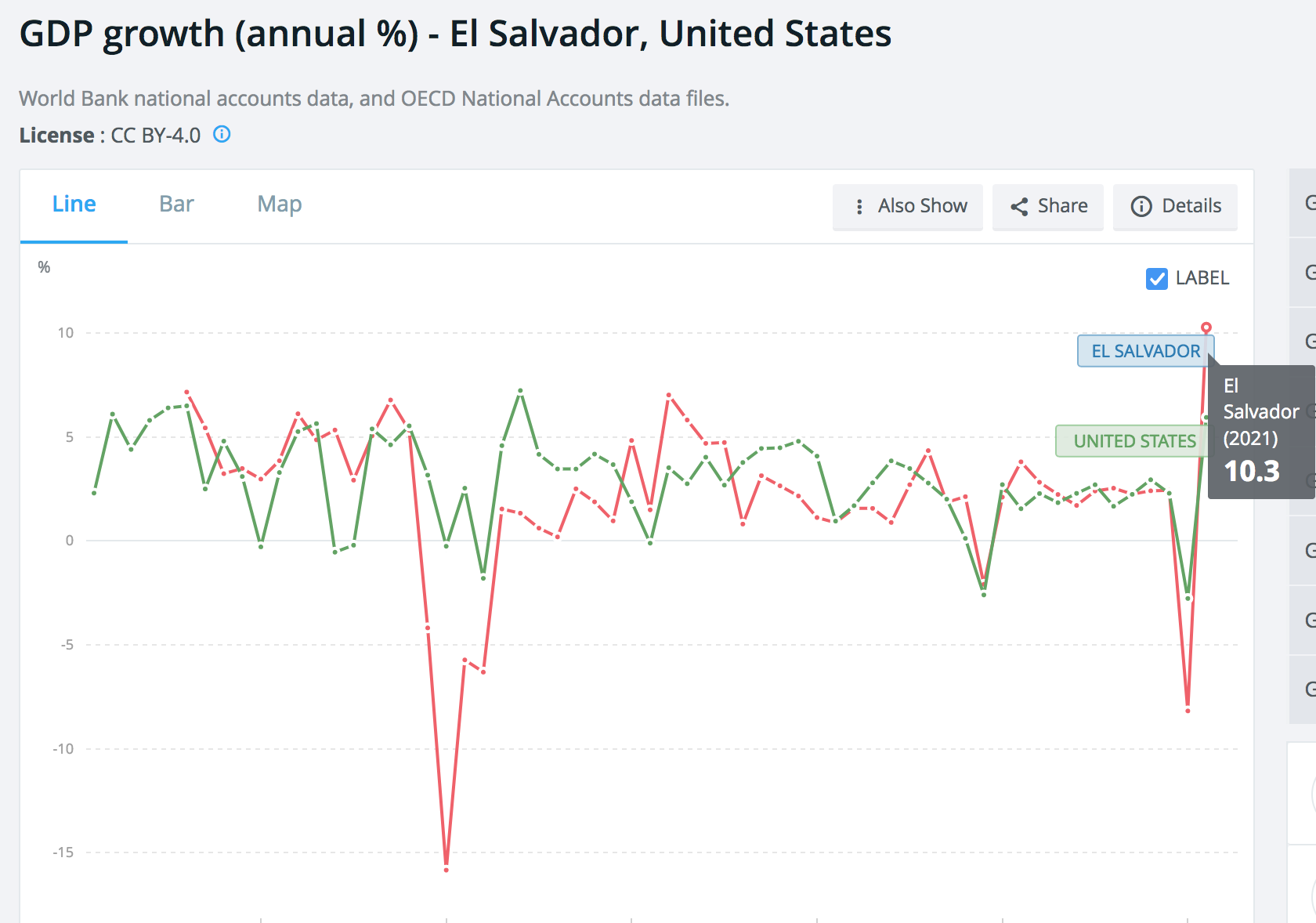

Further, in his announcement, Bukele took aim at central banks like the Federal Reserve that are “increasingly taking actions that may cause harm to the economic stability of El Salvador” by printing money to prop up their own economies. Over the COVID year, Salvadorian exports sank 17%, foreign direct investment dropped $500 million while the country’s debt rose, according to Francisco De Sole, a guest speaker at the Wilson Center.

Making bitcoin a legal tender, Bukele said, fixes this. Not only would it provide a means for people to access an alternative, low-cost financial system, it would also attract investments in the nation.

If just 1% of the total BTC supply moved to El Salvador that would grow the nation’s economic output by nearly 25%, Bukele said. To that end, Bukele is working to make the nation’s tax and regulatory frameworks favorable for crypto businesses, and provide “immediate permanent residence for crypto entrepreneurs.”

“We hope that this decision will be just the beginning in providing a space where some of the leading innovators can reimagine the future of finance, potentially helping billions around the world,” he said.

Cato’s Selgin thinks mostly this is political theater and that there wouldn’t be a functional change in how El Salvador operates.

“Usually the designation of a currency as legal tender doesn’t mean very much. People are already free to ask for bitcoin as payment, if they want.” He noted the Bitcoin Beach community, on the coast of El Salvador, has been piloting a circular Bitcoin economy since 2019.

Rohan Grey, one of the authors of the proposed U.S. STABLE Act and Assistant Professor at Willamette Law, agreed that the move would likely have little effect. Bitcoin is an inherently flawed currency, Grey said, because of its volatility and deflationary aspects – few would choose it as their primary method of payment.

“Bitcoin as a private currency creates far more problems than it solves by trying to bring it into the legal system,” Grey said. For one, in handing over monetary control to a decentralized network, the Salvadoran government would be giving up some of its ability to set policy. Then there’s the matter of finding a peg for foreign exchange.

“If El Salvador does and demands that its citizens have the right to make those kinds of transactions, that’s going to run headlong into the domestic sovereignty of other countries’ legal tender laws,” he said.

Selgin and Grey argue El Salvador would have little meaningful impact for bitcoin itself, as has existed this far without the imprimatur of a government.

“Bitcoin is a phenomenon that has gotten this far on not being a government-based currency,” Selgin said. “It shouldn’t matter what Bukele says.”

Mexico Lawmakers Aim To Follow The Example Of Neighboring Countries With Proposed Bitcoin Legislation

“We are going to lead the shift to crypto and fintech in Mexico,” said one senator.

Eduardo Murat Hinojosa, a senator of the federal government of Mexico, has said he will be submitting a proposal to lawmakers seemingly aimed at crypto adoption in the country.

In a tweet today, Hinojosa changed his profile picture to feature the senator speaking into a microphone with the iconic “laser eyes,” indicating support for crypto. The lawmaker said he would be “promoting and proposing a legal framework for crypto coins in Mexico’s lower house,” specifically mentioning Bitcoin (BTC).

Voy a promover y proponer ante la Cámara de Diputados un marco legal para las criptomonedas en México #btc

I will be promoting and proposing a legal framework for crypto coins in Mexico’s lower house #btc pic.twitter.com/zwhYOZ7KAg

— Eduardo Murat Hinojosa (@eduardomurat) June 8, 2021

Hinojosa was not the only Mexico lawmaker indicating their support for crypto. Indira Kempis Martinez, a senator representing the state of Nuevo León, has also switched her profile to show laser eyes, with Hinojosa referring to her as a friend to the cause.

“We are going to lead the shift to crypto and fintech in Mexico,” said Hinojosa.

The social media activity comes as countries in Latin America have seemingly been taking steps towards greater adoption of crypto. In a video announcement to attendees of the Bitcoin 2021 conference last week, El Salvador President Nayib Bukele said he would send a bill to the country’s legislature demanding that Bitcoin be made legal tender.

On Sunday, Paraguayan congressperson Carlitos Rejala hinted that crypto would be connected to “an important project to innovate Paraguay in front of the world” starting this week. Yesterday he added that he was working with local crypto figures “in order for Paraguay to become a hub for the crypto investors of the world.”

A politician from Paraguay (@carlitosrejala) has posted a laser eyes photo and promised a bitcoin announcement this week.

Just as we saw MicroStrategy start the domino effect for public companies, El Salvador will likely be a catalyst for other countries.

(h/t @WClementeIII) https://t.co/V5bxdbeRWq

— Pomp (@APompliano) June 7, 2021

Though Mexico has many individual investors who back Bitcoin, authorities in the country reported last year that cartels had been increasing their use of crypto to launder funds. At the time, the head of the Mexican attorney general’s Cyber Investigations Unit said the country’s law enforcement lacked the resources needed to tackle money laundering when crypto was involved

Paraguay May Be Next To Court Crypto Businesses With July Bill

Paraguay Congressman Carlos Rejala hopes to draw crypto businesses to the South American nation with a new bill next month.

Next month, Paraguayan congressman Carlos Rejala plans to present a bill to attract international mining companies and other crypto businesses.

The project allows cryptocurrency companies — whether in mining or another segment, such as exchanges — to finance their Paraguayan operations with cryptocurrencies, remit dividends abroad and capitalize their cryptocurrency profits in local banks, Rejala told CoinDesk.

Rejala, a 36-year-old entrepreneur, discovered bitcoin (BTC, -2.36%) in 2017 and began trading in 2019, a year after taking a deputy seat for the independent Hagamos party, he said.

On Monday, following the announcement that El Salvador would introduce a bill to allow bitcoin to be treated as legal tender, Rejala tweeted a photo of himself with laser eyes and a sentence about the project.

“The announcement prompted me not to be afraid and to think that this can be real in my country,” he said.

By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy.

The project seeks to position Paraguay as the crypto hub for Latin America and a model for other countries in the region, he said, adding that if the bill is approved, he will seek to present a second one promoting the use of bitcoin as legal tender.

It’s been a longtime goal for local business leaders, who touted Paraguay’s cheap energy as far back as 2018.

“However, first we want to give Paraguay a blockchain-friendly status,” he said.

According to Rejala, one of the most attractive conditions for mining companies is the cost of electricity in Paraguay, which is around $0.05 per kilowatt-hour and is the lowest in the region. Almost 100% of production comes from hydroelectric sources.

“It is renewable energy, non-polluting, which is extremely important for the mining companies,” he said.

In a dialogue with First Mover on CoinDesk TV, Juanjo Benitez Rickmann, CEO of local mining company Bitcoin.com.py, said that mining in Paraguay only requires registration and payment of taxes, which he classified as lower than in the rest of the region. At present, the country has a system known as triple 10, which consists of 10% income tax, 10% VAT, and 10% personal income tax, Rejala added.

The country offers no restrictions on foreign capital flows and the payment of dividends abroad, Rejala added. “That also makes it an attractive country to crypto investors,” he said.

Paraguay does not use all the energy it produces, Rejala said. At the Itati hydroelectric plant, which Paraguay shares with Brazil, the country only takes 26% of the 6,067 megawatts it is entitled to monthly, submitting the rest to the neighboring country, he added.

“We have a lot of energy that we sell to Argentina and Brazil almost for free because we can only sell to our neighbors,” Benitez Rickmann said.

Next Steps

A draft bill, supported by different players in the crypto sector, was presented to several Paraguayan government offices, such as the anti-money laundering office, Benitez Rickmann said.

Rejala is currently seeking to attract support to achieve the required majority of 41 votes in the chamber of deputies and pass the bill to the Senate chamber, he said. If approved in both chambers, it will then have to be enacted by the country’s President, who has the power to issue a veto.

During the Bitcoin 2021 conference held in Miami, Benitez Rickmann said he spoke to a number of mining pool operators from China who asked for 100 megawatts of space.

“Maybe it is an opportunity for us to get involved with them and develop,” he said.

Updated: 6-9-2021

Bitcoin Miner Poolin Immortalizes El Salvador’s BTC Adoption On The Blockchain

El Salvador accepting Bitcoin as legal tender is now forever etched on the blockchain as mining pool Poolin adds a newspaper headline to block 686,938.

As is par for the course for Bitcoin (BTC), El Salvador becoming the first nation-state to adopt the cryptocurrency as legal tender is now immortalized on the blockchain.

Data from blockchain explorer service Blockchair shows block 686,938 bearing the message “asamblea aprueba la ley bitcoin” — meaning “assembly approves Bitcoin law” — which is the front-page headline carried by El Salvadoran daily Diario El Salvador on Wednesday.

Poolin, the third-largest Bitcoin mining pool by hash rate, was responsible for mining the transaction block that contained the message.

This El Salvador headline announcing #Bitcoin has become legal tender, was just embedded into the blockchain. It will now remain there for all of eternity. pic.twitter.com/DtHiFDB4XM

— Documenting Bitcoin (@DocumentingBTC) June 9, 2021

As previously reported by Cointelegraph, El Salvador’s legislature passed a bill to make Bitcoin legal tender in the country. Meanwhile, a wave of support for BTC among key government figures in Latin America continues to emerge to the excitement of several Bitcoin proponents.

Reacting to the growing trend, Chris Burniske, partner at blockchain-focused venture capital fund Placeholder VC, tweeted that move could be a means for Latin American nations to “strike back at dollars and debt.”

Earlier this week, former United States President Donald Trump doubled down on his Bitcoin stance, stating that BTC was competing with the U.S. dollar.

Poolin’s commemoration of El Salvador’s historic Bitcoin legalization move comes over a decade after BTC creator Satoshi Nakamoto etched The Times’ front-page headline from Jan. 3, 2009, on the blockchain’s genesis block:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

A few blocks in the Bitcoin blockchain also contain messages and other references meant to memorialize certain occasions.

When block height 666,666 came around back in January, the “winning miner” included a verse from the Bible: “Do not be overcome by evil, but overcome evil with good – Romans 12:21.”

In April, Coinbase had Bitcoin mining pool F2Pool embed a New York Times article in block 679,187.

El Salvador’s President Wants To Build Volcano-Powered Crypto Miners

Bitcoin is heating up — some may say erupting — as the Latin American country plans to tap energy from volcanoes for mining the cryptocurrency.

Nayib Bukele’s plans for crypto in El Salvador are still in motion, with the president now calling for a geothermal power company to make certain facilities available to Bitcoin miners.

In a Wednesday tweet from Bukele, the president said he would be instructing Mynor Gil, the president of the state-owned electrical company LaGeo, to facilitate Bitcoin (BTC) mining “with very cheap, 100% clean, 100% renewable, 0 emissions energy” from the country’s volcanoes. The firm operates the only two geothermal power plants in El Salvador based in the regions of Ahuachapán and Berlín, with announced plans to construct new facilities in San Vicente and Chinameca.

I’ve just instructed the president of @LaGeoSV (our state-owned geothermal electric company), to put up a plan to offer facilities for #Bitcoin mining with very cheap, 100% clean, 100% renewable, 0 emissions energy from our volcanos

This is going to evolve fast! pic.twitter.com/1316DV4YwT

— Nayib Bukele (@nayibbukele) June 9, 2021

More than half of the country’s energy comes from renewable energy, with a geothermal power installed capacity — El Salvador is home to 23 active volcanoes — of more than 200 Megawatts. However, reports suggest that El Salvador’s geothermal power potential is closer to 644 MW, meaning LaGeo is currently tapping roughly 31% of the power generation available. According to data from the Cambridge Bitcoin Electricity Consumption Index, Bitcoin uses more than 116.7 terawatt-hours of electricity per year.

The mining solution comes in the middle of a long list of pro-crypto actions Bukele has taken over the last several days. At the Bitcoin 2021 conference in Miami last weekend, the El Salvador president told attendees via recorded message that he would be introducing a bill to make Bitcoin legal tender in the country — a proposal that passed with a supermajority in the nation’s Legislative Assembly earlier today.

At the time of publication, the price of Bitcoin is $36,021, having risen more than 10% in the last 24 hours.

Small Countries Are Punching Above Their Weight In Terms Of Bitcoin Gains

Chainalysis tracked total U.S. dollar gains made by Bitcoin investors in 2020. The country comparison was drawn from an analysis of web traffic on various cryptocurrency exchanges.

Emerging markets appear to be punching above their weight when it comes to Bitcoin (BTC) investment, offering further evidence of growing worldwide adoption, according to a new report from cryptocurrency analytics firm Chainalysis.

A geographic analysis of realized Bitcoin gains revealed that investors in the United States generated $4.1 billion in returns last year, which is more than three times higher than second-ranked China, Chainalysis said.

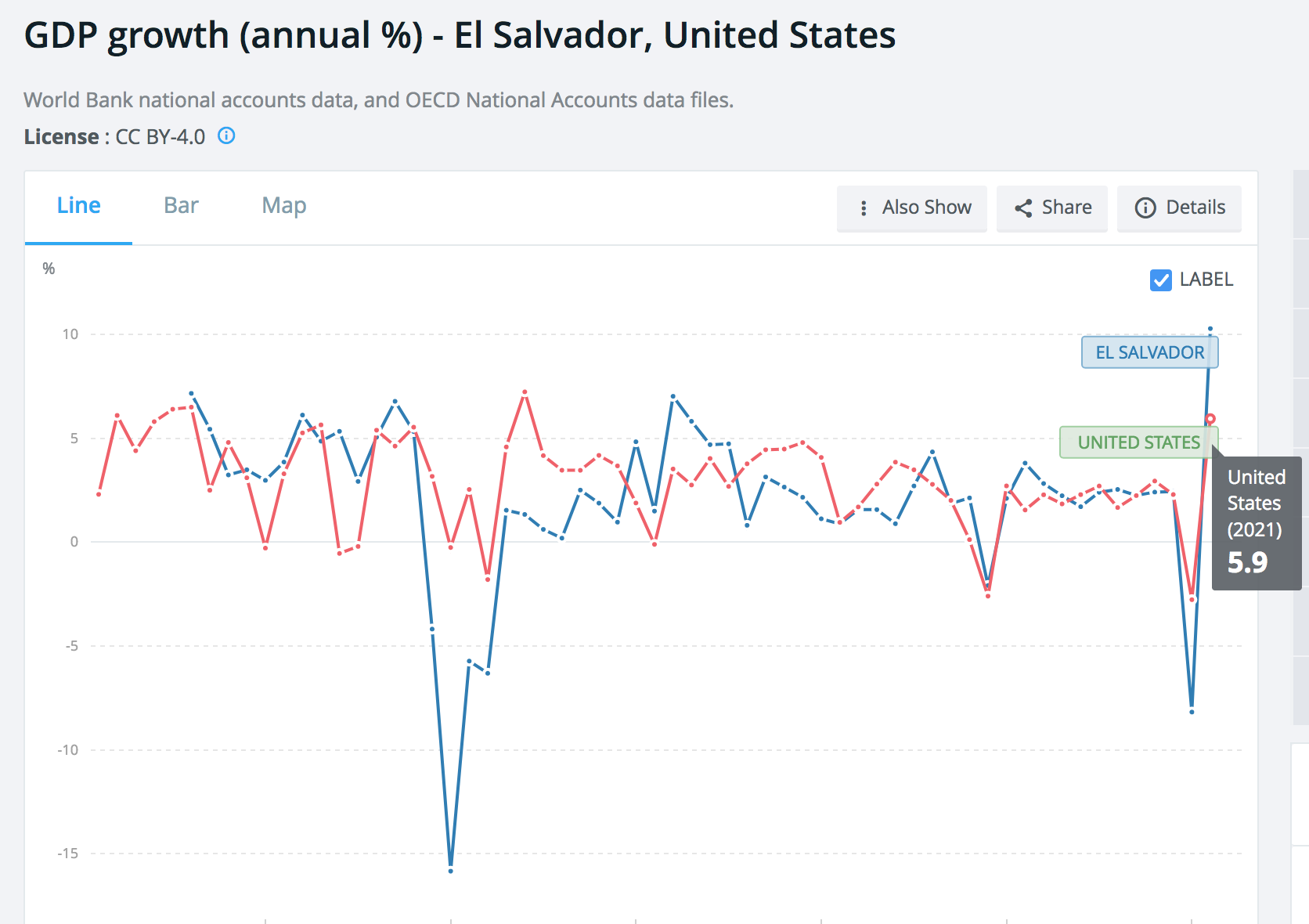

Although economic stalwarts such as Japan, the United Kingdom and Germany were near the top of the list, several countries are investing a lot more in Bitcoin relative to traditional economic metrics like gross domestic product.

In other words, GDP doesn’t seem to be a strong indicator of who is generating higher return on investment in Bitcoin.

A standout case is Vietnam, a country that ranks 53rd in GDP but 13th when it comes to realized Bitcoin gains. The East Asian country’s sharp pivot from a centrally planned economy to one embracing market reforms has allowed it to slash its poverty rate from over 70% to below 6% since 2002, according to the World Bank.

Chainalysis also drew attention to the Czech Republic, Turkey and Spain, which rank 54th, 25th and 19th in GDP, respectively, but all fall within the top 20 in terms of realized Bitcoin gains.

The 2020–2021 Bitcoin bull market began in October of last year, as the price had increased from around $11,000 to over $29,000 by Dec. 31. Bitcoin’s price would eventually peak near $65,000 in April before undergoing a sharp correction.

Chainalysis was able to extrapolate country-specific data by analyzing location-based web traffic on various cryptocurrency exchanges. Cointelegraph asked the analytics firm how it was able to account for the potential presence of VPN usage by exchange users. While Chainalysis acknowledged the limitations, the company stood by its rigorous analysis of transaction data, stating:

“We acknowledge that there are clear limitations to using web traffic data, including the usage of VPNs and other products that can mask the geographic origin of web activity. However, the data that forms the trends we explore comprises millions of transactions, so this activity would need to be extremely widespread for it to meaningfully affect our data.”

The report echoes what many crypto enthusiasts have been saying all along — Bitcoin gives investors in emerging markets unfettered access to a high-performing asset. This is especially important in regions that are facing high inflation and stricter government controls over bank deposits and withdrawals.

Updated: 6-10-2021

IMF Plans To Meet With El Salvador’s President, Potentially Discussing Move To Adopt Bitcoin

The International Monetary Fund has previously spoken out against smaller nations like the Marshall Islands recognizing a digital currency as legal tender.

The International Monetary Fund has said El Salvador’s recent decision to make Bitcoin legal tender in the country may raise legal and financial concerns.

In a Thursday press briefing from the International Monetary Fund, or IMF, spokesperson Gerry Rice said the group was already in discussions with lawmakers in El Salvador over a loan to support the country’s economy, having approved emergency funds related to the pandemic last year. However, Rice said an IMF team would be meeting with President Nayib Bukele today and implied crypto would be a likely topic for discussion.

“Adoption of Bitcoin as legal tender raises a number of macroeconomic, financial and legal issues that require very careful analysis,” said Rice. “We are following developments closely, and we’ll continue our consultations with the authorities.”

Spokespeople for the IMF have often voiced concerns about countries adopting digital currency. In March, the group issued a similar warning against the Marshall Islands’ recognizing its digital sovereign currency, called SOV, as legal tender, as it may pose similar legal and financial risks. In that case, a spokesman said the islands’ local economy had been strained by the economic fallout of the pandemic and likely wouldn’t be corrected with the SOV.

In the case of El Salvador, the time between the introduction of ideas and action is seemingly short. President Bukele first announced he would propose a bill making Bitcoin (BTC) legal tender in El Salvador at a pre-recorded video message at the Bitcoin 2021 conference this weekend. The legislation passed with a supermajority in the nation’s Legislative Assembly yesterday.

Though the country is still seeking support from the IMF related to the pandemic this year, it has already begun to consider the energy needs of Bitcoin miners. Bukele said he would be instructing state-owned electrical company LaGeo, to make certain facilities available to miners to utilize geothermal power from the country’s volcanoes — El Salvador currently operates the two geothermal plants in Ahuachapán and Berlín.

“Crypto assets can pose significant risks,” said Rice. “Effective regulatory measures are very important when dealing with them.”

IMF Sees Risks After El Salvador Makes Bitcoin Legal Tender

El Salvador’s adoption of Bitcoin as legal tender may imply a series of risks and regulatory challenges, International Monetary Fund spokesman Gerry Rice said Thursday.

“Adoption of Bitcoin as legal tender raises a number of macroeconomic, financial and legal issues that require very careful analysis so we are following developments closely and will continue our consultation with authorities,” Rice said, speaking in Washington. “Crypto assets can pose significant risks and effective regulatory measures are very important when dealing with them.”

An IMF team is conducting virtual meetings with El Salvador on its Article IV review of the country and a potential credit program “including policies to strengthen economic governance” Rice said. The team will meet with Bukele Thursday.

El Salvador’s congress approved a law this week requiring businesses to accept Bitcoin in exchange for goods and services. President Nayib Bukele said the digital currency will help counter El Salvador’s low banking penetration and cut the cost of sending remittances.

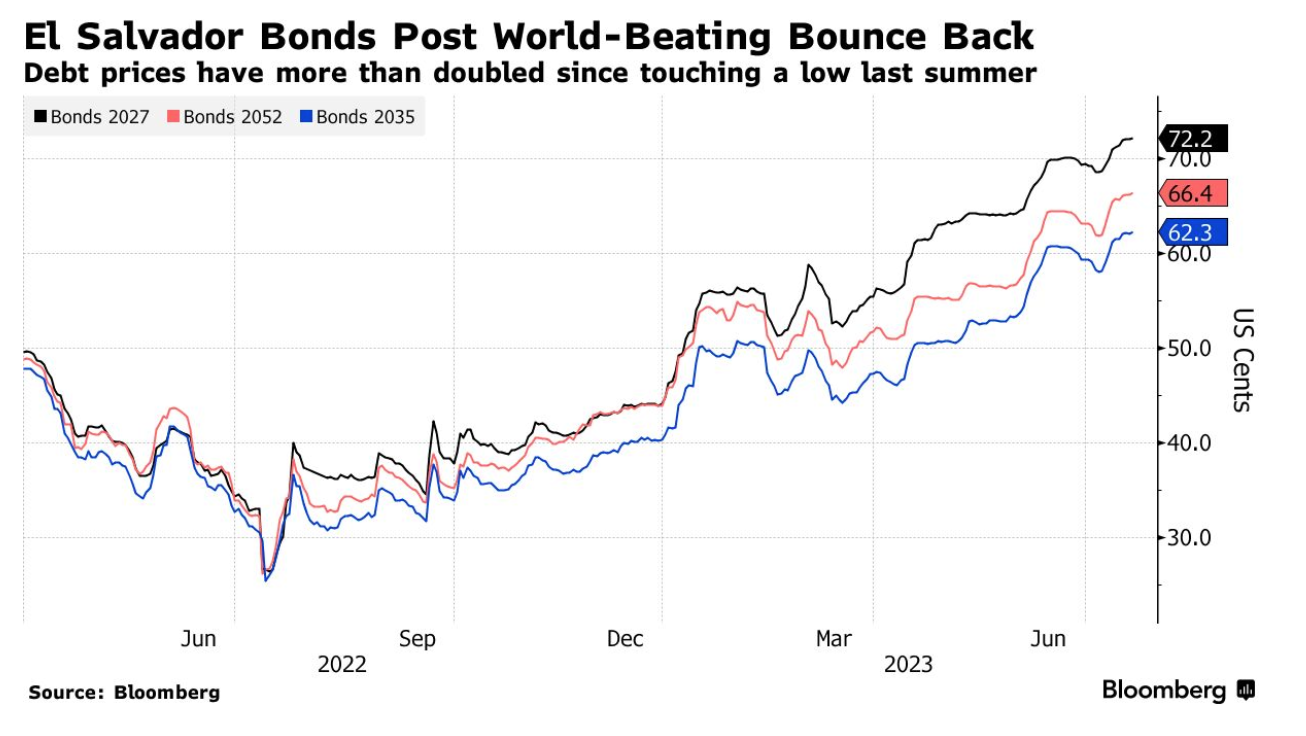

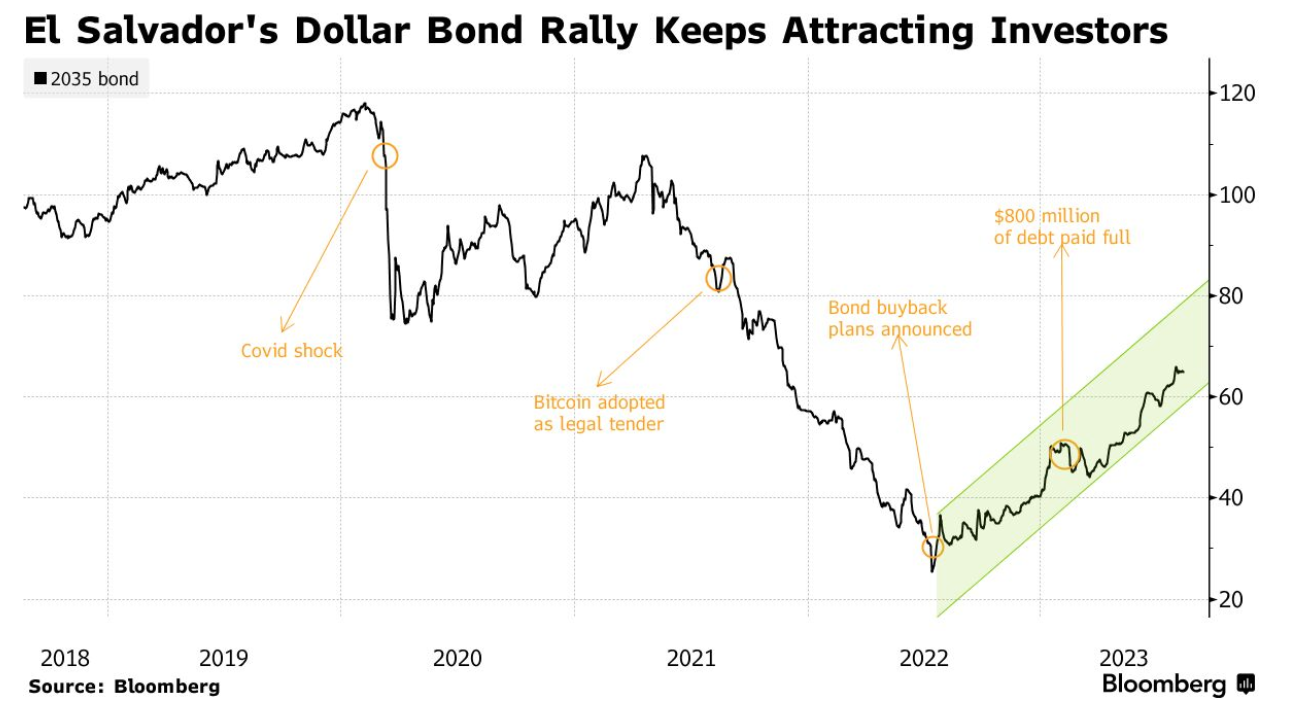

The nation’s bonds dropped, sending the yield on its bonds coming due in 2025 up 71 basis points to 7.8% at 10:40 a.m. in New York. El Salvador’s bonds are the worst performers in emerging markets this week, according to a Bloomberg Barclays index.

“The plans for Bitcoin under an increasingly autocratic regime will likely only compound concerns about corruption, money laundering and the independence of regulatory agencies,” Siobhan Morden, head of Latin America Fixed Income Strategy at Amherst Pierpont, wrote in a note.

Updated: 6-11-2021

El Salvador’s Bitcoin Adoption An ‘Interesting Experiment,’ Says Bank of International Settlements Exec

El Salvador’s move to make Bitcoin legal tender in the country continues to elicit reactions from legacy finance gatekeepers — this time, from the Bank for International Settlements.

Benoît Cœuré, Bitcoin (BTC) critic and the head of the innovation hub at the Bank of International Settlements, called El Salvador’s historic move to make BTC legal tender in the country an “interesting experiment.”

According to Reuters, Cœuré made this assertion during the launch of the BIS’s fourth innovation hub in England on Friday, stating:

“We have been clear at the BIS that we don’t see bitcoin as having passed the test of being a means of payments. Bitcoin is a speculative asset and should be regulated at such.”

As previously reported by Cointelegraph, El Salvador’s parliament passed a bill to make Bitcoin legal tender in the country. The legislative vote on president Nayib Bukele’s “Bitcoin Law” passed by an overwhelming supermajority of 62 out of 84 votes.

Back in November 2018, Cœuré called Bitcoin the “evil spawn of the [2008] financial crisis.” Cœuré’s comments about the need for strict crypto regulations are a common theme within the BIS, with general manager Agustín Carstens also routinely calling for more stringent cryptocurrency laws.

Cœuré’s comments are coming on the heels of similarly stark warnings from the International Monetary Fund (IMF) in the wake of El Salvador’s decision. Reacting to the news, the IMF stated that the decision could pose significant legal and financial ramifications.

Indeed, reports indicate that Bitcoin could be a topic of discussion between the IMF and El Salvador’s president on a planned $1-billion program.

On Thursday, the Basel Committee on Banking Supervision published a consultation paper that placed Bitcoin in its highest risk category. As part of its recommendations, the global banking regulator called for banks keen on crypto exposure to hold $1 capital for every $1 worth of BTC held in custody.

El Salvador’s Bitcoin Adoption May Jeopardize IMF Negotiations: JPMorgan

JP Morgan says that El Salvador’s decision to adopt Bitcoin as legal tender is of little economic benefit.

JPMorgan is the latest source to respond to El Salvador’s decision to adopt Bitcoin (BTC) as legal currency within the country.

In a client note tweeted by @DocumentingBTC, the United States banking giant stated that there was little economic benefit to El Salvador adopting BTC as a parallel legal tender to the U.S. dollar.

JP Morgan on El Salvador adopting #Bitcoin

Notice the last line… pic.twitter.com/5hl0kR9WB0

— Documenting Bitcoin (@DocumentingBTC) June 11, 2021

On Thursday, El Salvador’s parliament passed a historic bill to recognize Bitcoin as legal tender. The “Bitcoin Law” bill passed by an overwhelming majority of 62 out of 84 votes.

Commenting On The Move, The JPMorgan Client Note Stated:

“As with the dollarization in the early-2000s, this move does not seem motivated by stability concerns, but rather is growth-oriented […] But it is difficult to see any tangible economic benefits associated with adopting Bitcoin as a second form of legal tender, and it may imperil negotiations with the IMF.”

Facing a potential $3.2 billion budget deficit in 2021, El Salvador is reportedly in talks with the International Monetary Fund for a $1 billion funding program.

Given the IMF’s role in providing access to external credit for nations like El Salvador, JPMorgan’s comments echo similar sentiments espoused by other market commentators as to the potential implications of the BTC adoption move.

Indeed, the IMF itself has raised issues the development by stating that El Salvador adopting Bitcoin as legal tender poses significant legal and financial ramifications.

Earlier on Friday, Benoît Cœuré, the head of the innovation hub at the Bank for International Settlements called El Salvador’s actions an “interesting experiment.” Cœuré, a noted Bitcoin critic once called BTC the “evil spawn” of the 2008 global financial crisis.

Meanwhile, on Thursday, the Basel Committee on Banking Supervision classified Bitcoin in its highest risk category advising banks to hold $1 capital for every $1 worth of Bitcoin held in custody.

El Salvador’s Bitcoin Beach Is The Crypto Economy

El Zonte, El Salvador (AP) — After El Salvador’s congress made the bitcoin legal tender this week, eyes turned to this rural fishing village on the Pacific coast. Known to surfers for its pounding waves, El Zonte has had the cryptocurrency in its economy for the past year.

Some 500 fishing and farming families use bitcoin to buy groceries and pay utilities, something the government envisions for the country at large. Bitcoin already was legal to use in El Salvador but its acceptance was voluntary, so the legislation passed late Tuesday now requires all businesses — except those without the technology — to accept payment in bitcoin.

El Zonte’s mini bitcoin economy 26 miles (43 kilometers) from the capital came about through an anonymous donor who started working through a local nonprofit group in 2019. Supporters of the financial change point to it as a demonstration case for how digital currency could help in a country where 70% of the people don’t have bank accounts.

President Nayib Bukele, who pushed through the bitcoin law, touts it both as a way to help those many Salvadorans without access to traditional banking services and as a path to attract foreigners with bitcoin holdings to invest in El Salvador, which is the first nation to make the cryptocurrency legal tender.

Experts are trying to figure out why Bukele is pushing bitcoin. They say it is unclear how the highly volatile cryptocurrency will be a good option for the unbanked and only time will tell if the new system translates into real investment in El Salvador.

Bitcoin, intended as an alternative to government-backed money, is based largely on complex math, data-scrambling cryptography — thus the term “cryptocurrency” — lots of processing power and a distributed global ledger called the blockchain, which records all transactions. No central bank or other institution has any say in its value, which is set entirely by people trading bitcoin and its value has moved wildly over time.

In El Zonte this week, construction worker Hilario Gálvez walked into Tienda María to buy a soda and snacks to share with his friends. Instead of reaching for his wallet, he paid through an app on his phone.

The store’s namesake, María del Carmen Avilés, said she is now expert in bitcoin transactions.

“When a customer comes I ask him if he’s going to pay with the application or in cash. The majority pay with the application Bitcoin Beach. I look for it on my cell to charge them.”

It doesn’t take more than two minutes.

“It’s easier than paying with bills,” Gálvez said. “I can buy from my house, do the transaction with the application Bitcoin Beach, and I just come to pick up what I need.”

Avilés notes that the volatility of the bitcoin can be a problem.

“People ask me if I recommend bitcoin, I tell them I’ve won, but I’ve also lost,” Avilés said. “When bitcoin hit $60,000, I won and I bought this refrigerated room for the store, but then it went down and I lost.”

Román Martínez was a pioneer in using bitcoin in El Zonte. He said the anonymous U.S. donor heard about community projects through the nonprofit Hope House where he works and began working through another American who lives in El Zonte. Hope House shares a building with Strike, a Chicago-based start-up that has been working with Bukele’s government on the nationwide bitcoin launch.

A request by The Associated Press to interview Strike CEO Jack Mallers was not granted. In an email, the company said, “Strike’s app is meant to empower people in all countries, broaden the financial system to include those who have been excluded, and increase economic opportunity around the world, and that is at the heart of this effort.”

El Salvador has used the U.S. dollar as its official currency since 2001, and Strike said that adopting bitcoin “as legal tender will help reduce its dependence on the decisions of a foreign central bank.”

Martinez said El Zonte residents did not have bank accounts, had no access to credit and were forced to handle all transactions in cash. “Now they are small investors whose lives have been changed by bitcoin,” he said.

Some question just how much can be learned from the Bitcoin Beach experiment.

David Gerard, author of “Attack of the 50 Foot Blockchain,” said El Zonte is an artificial demonstration.

At Bitcoin Beach, he said, “the bitcoins are traded inside Strike. They don’t actually move on the bitcoin blockchain or anything.”

Gerard said it appears to work because the bitcoin donor keeps pumping bitcoin into the village’s system. “That’s not a proof of concept that works. That shows that you can trade this stuff if you’re not trading actual bitcoins and someone massively subsidizes it.”

Adoption had been slow in El Zonte, but took off during the coronavirus pandemic when strict lockdown measures kept most people from leaving home.

“Our donor made three deliveries of $40, converted to bitcoin, for each of the community’s 500 families, and they were trained to use the application and now it’s normal to buy with bitcoin,” Martínez said.

El Zonte even has a Bitcoin ATM, which gives dollars in exchange for bitcoin or takes dollars and gives credit in bitcoin.

Edgar Magaña was in town from San Salvador to convert $50 to bitcoin. He inserted the dollars into the machine and was surprised to see only $47 in bitcoin fractions credited to his account on his phone.

“They took three dollars commission,” Magaña said, adding that he had understood there was no commission. “This is like in the banks.”

To spur national adoption, Bukele said the government would create a $150 million fund to allow people receiving payments in bitcoin to immediately convert them to dollars, reducing the risk of holding the fluctuating digital currency.

Jessica Velis, who runs the El Zonte business where the ATM is located, said some people here are already receiving remittances from abroad in bitcoin.

Salvadorans received some $6 billion in remittances last year from relatives living abroad, mostly in the United States. Bukele has said adopting bitcoin could save on the costs of sending that money home.

Not everyone in El Zonte is sold on the idea.

At Olas Permanentes, one of the town’s most popular restaurants, customers have been able to pay using bitcoin. But when the waitstaff was asked if they use it, they all said no. Some said they didn’t have higher-end cellphones needed to download the app, while others said they had doubts about how it worked.

“They pay me in dollars and in cash,” said one waitress, who declined to give her name.

Walking through town, a woman who only gave her name as Teresita, was asked if she used bitcoin. “Not me, I prefer to have the bills,” she said.

Updated: 6-12-2021

Adopting The Bitcoin Standard? El Salvador Writes Itself Into History Books

El Salvador has become the first country to make Bitcoin legal tender, but what are the complexities and potential short-term effects?

The cryptocurrency space and wider economic community continue to laud a historic move by El Salvador to recognize Bitcoin as legal tender. The Central American country has become the first in the world to do so, and the move has also spurred a handful of other Central and South American countries to begin taking steps toward that same eventuality.

Unsurprisingly, the move has made waves in the cryptocurrency community, with Bitcoin (BTC) proponents, in particular, highlighting the significance of the legislative change in driving cryptocurrency adoption. There have been some critics who have highlighted potential coercive undertones of the law, which has added intrigue to the situation, but the overarching response has been positive.

Things have moved quickly in El Salvador following the announcement from the country’s president, Nayib Bukele — which took place during the Bitcoin 2021 conference in Miami — that the country’s congress would be voting on the new legislation. In the space of a few days, Bukele’s plans to make Bitcoin legal tender became reality as the Salvadoran Legislative Assembly voted in favor of the new law on June 9.

The country’s president took things one step further when he tasked state-owned electricity producer LaGeo to begin exploring the possibility of powering Bitcoin mining using the country’s rich geothermal energy. No less than a day later, a new geothermal well had been drilled that Bukele said would power a Bitcoin mining facility in the near future.

Our engineers just informed me that they dug a new well, that will provide approximately 95MW of 100% clean, 0 emissions geothermal energy from our volcanos

Starting to design a full #Bitcoin mining hub around it.

What you see coming out of the well is pure water vapor pic.twitter.com/SVph4BEW1L

— Nayib Bukele (@nayibbukele) June 9, 2021

The move was even immortalized on the Bitcoin blockchain by mining firm Poolin, which included a Salvadoran newspaper headline reading “asamblea aprueba la ley bitcoin,” translating to “assembly approves the Bitcoin law,” into block 686,938 mined earlier this week.

This is reminiscent of Bitcoin’s pseudonymous founder Satoshi Nakamoto including a Times newspaper headline reading “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” in the Bitcoin genesis block over a decade ago.

Bukele has also pledged to help Bitcoin users emigrate to El Salvador while touting the benefits of BTC no longer being subject to capital gains tax. As things move at breakneck speed in El Salvador, it’s worth taking a look at the wider reactions from the cryptocurrency community and the reverberations of the newly passed legislation.

An Overview Of El Salvador’s Bitcoin Law

El Salvador’s congress voted to pass President Bukele’s “Bitcoin Law,” which recognizes Bitcoin as legal tender alongside the U.S. dollar, with 62 of a total 84 votes in agreement with the new legislation.

The law will allow citizens to pay for goods and services in Bitcoin, and Bukele also stated that the Salvadoran government will guarantee the convertibility of Bitcoin into dollars at the time of any given transaction.

This is made possible by a $150-million trust established by El Salvador’s Bandesal development bank. In essence, the government will buy BTC from locals if they wish to receive dollars instead of BTC.

A point of contention is Article 7 of the legislation, which requires vendors or businesses to accept Bitcoin as a means of payment from customers, as it is now legal tender. Monetary economist and historian George Selgin raised important concerns over Articles 7 and 13 in a thread on Twitter, suggesting that they are coercive, in that they will force all Salvadoran merchants and companies to accept BTC as a means of payment.

Article 7 Reads: “Every economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service.” Article 13 states: “All obligations in money expressed in USD, existing before the effective date of this law, may be paid in bitcoin.”

The renowned economist stated that the move was a “win for Bitcoin,” but he questioned whether it was a “win for freedom,” given that these articles will force Salvadoran businesses and vendors to accept BTC whether they want to or not. Selgin argued that Articles 7 and 13, which “qualify as ‘legal tender’ provisions,” essentially “undermine free choice in currency instead of promoting it.”

“This is a (relatively) rare instance of something being made compulsory tender not just in settling outstanding debts but in spot exchanges. As such it is even more contrary to the principle of choice in currency. Instead of merely allowing merchants to accept BTC in payment, article 7 compels them to do so even if they’d prefer to be paid in USD (or something else). Very few countries have such Draconian legal tender laws, which in the past were a last-resort of desperate governments.”

The economist called for cryptocurrency and Bitcoin proponents to rally against and condemn these specific clauses in the law. His critique was widely shared and provides a healthy dose of perspective to a situation that has received a lot of positive press.

Wider Community Lauds El Salvador’s Move

While Selgin’s arguments raise some poignant questions around El Salvador’s new currency law, there seems to have been widespread positive sentiment toward the country’s swift move to accept Bitcoin as legal tender.

Many prominent cryptocurrency and Bitcoin advocates have heralded the move as an important step toward more widespread adoption and acceptance of the preeminent cryptocurrency as a store of value and a means of payment. Paolo Ardoino, chief technology officer of Bitfinex, told Cointelegraph that he believes the move will serve as a major step in providing financial freedom:

“Bitcoin being accepted as a legal tender by El Salvador represents what we have said all along: Bitcoin has utility and is a viable alternative to fiat currencies. As we witness the implementation of digital currencies, I believe we will be seeing big steps for Bitcoin. This is a huge step for the financial freedom of humanity and a monumental moment for Bitcoin.”

Humayun Sheikh, CEO of Fetch.ai — a company building artificial intelligence for blockchain — highlighted the significance of first-mover advantage and suggested that countries like El Salvador will attract companies and individuals working in the cryptocurrency space, adding: “A handful of countries adopting Bitcoin or even buying Bitcoin to use as wealth reserves will increase their wealth and lend positive momentum to cryptocurrency adoption.”

Jeffrey Wang, head of Americas at Amber Group, echoed Sheikh’s sentiments in his correspondence with Cointelegraph, highlighting favorable regulatory moves as a key way to attract cryptocurrency- and blockchain-focused businesses: “The biggest cloud that hangs over the crypto industry is the uncertainty of regulation, so moving quickly now to embrace it as a country can be a significant advantage to attract capital and talent to your country.”

Wang also said that swift changes being made in the country could serve as a real-life test case for Bitcoin being adopted as legal tender, and there is the potential for it to be the catalyst for the country to become a hub for cryptocurrency businesses to thrive:

“By embracing it early, countries like El Salvador can help boost their domestic economies by welcoming the industry starting with miners where they can use ‘clean’ energy which also addresses the environmental impact of the miners’ use of electricity. It will also be a great early test case to see it [Bitcoin] used as a medium of exchange.”

Ardoino also highlighted the role that cryptocurrencies could play in helping Central and South American countries grapple with long-term economic problems that have plagued their currencies and people: “Bitcoin has resonated for the benefits that it may bring to the tragedy we’ve witnessed in South American economies. The potential it has to bring financial freedom to the region shouldn’t be understated.”

What Can We Expect In The Short Term?

With the new Bitcoin Law passed in El Salvador, there is now keen interest in the short-term changes that will be felt in the country and beyond. Sebastian Ramirez, head of business operations at bitFlyer USA, told Cointelegraph that a large number of everyday individuals could become less skeptical about Bitcoin and start looking at it as a viable alternative to their existing solutions and see it as a better store of value.

Ramirez also noted that the law change in El Salvador may remove some barriers to entry, like having to pay tax when using Bitcoin. He also conceded that the law change might not lead to an immediate shift in perception in the country and beyond:

“A significant majority of the population may still not feel savvy/comfortable enough to use Bitcoin and bear its risks. I don’t expect most locals will benefit from this change in the short-term, but as the space grows and Bitcoin becomes more stable, it will become a tremendous alternative.”

Wang conceded that there might be some teething problems, as vendors and businesses in the country still need to set up the necessary infrastructure to begin accepting BTC. Furthermore, people may be reluctant to spend their BTC on everyday purchases, given the cryptocurrency’s increased use as a store of value first and foremost: “I imagine for the majority, they hold BTC for the longer term potential price appreciation so spending it to buy bread today when it can double in a week will be too high an opportunity cost.”

IMF Raises Red Flags

The speed at which El Salvador passed its historic Bitcoin Law has made it difficult for major financial and economic regulatory bodies to react or intervene. Nevertheless, the International Monetary Fund raised some concerns around the move in a press conference on June 10.

IMF spokesperson Gerry Rice stated that consultations will take place with the Salvadoran government. The IMF has been in talks with the country to provide over $1 billion in financing: “Adoption of Bitcoin as legal tender raises a number of macroeconomic, financial and legal issues that require very careful analysis. So, we are following developments closely, and we’ll continue our consultations with the authorities.”

Some in the global community have also posed questions around the timing of Bukele’s move to swiftly adopt Bitcoin as legal tender alongside the U.S. dollar, which has served as the Central American country’s reserve currency since 2001.

Ramirez gave his opinion on the timing of the move: “The main reason here is the race to become a Bitcoin hub in Latin America.” He added, “This announcement is putting El Salvador on the map and attracting a lot of foreign interest, which applies pressure on other Latin American countries who don’t want to be left behind.”

Sheikh believes that “As a PR move, the timing was probably set to accommodate the Bitcoin Miami conference.” He further suggested that timing could also factor in ongoing developments in China, where the government is beginning to take a harder line toward Bitcoin mining operators:

“The news comes at a time of a clampdown of coal-based mining operations in China and a surplus of mining hardware that needs to be relocated. With its abundance of renewable geothermal energy, El Salvador stands to benefit from these developments and improve the image of Bitcoin mining as a ‘dirty’ process.”

Nevertheless, all eyes are now on El Salvador and Central America. The country is laying the foundation for the adoption and widespread use of Bitcoin as means of payment and has promised to build essential infrastructure to facilitate large Bitcoin mining operations powered by clean geothermal energy.

Updated: 6-13-2021

Is El Salvador Bitcoin’s Green Savior?

El Salvador’s move to make bitcoin legal tender offers an opportunity to prove that cryptocurrency can power renewable energy development, says CoinDesk’s chief content officer.

Well, the giant Bitcoin Miami love fest conference turned out to be more than just late-night beach parties. It actually delivered some news – a bombshell announcement big enough to quell concerns about the event being a COVID-19 superspreader event.

All week, the crypto world has been alight with the news that the Central American country of El Salvador will become the first nation to treat bitcoin as legal tender.

The implications of that announcement dominate this week’s newsletter. In particular, the main column focuses on the prospect of also spurring renewable energy development across the country via a system of bitcoin-funded community microgrids.

Bitcoin And Green Energy: El Salvador’s Leapfrog Chance

Possibly the only thing this week that got bitcoiners more excited than El Salvador President Nayib Bukele’s move to make bitcoin legal tender was his followup that bitcoin miners will get access to geothermal power from volcanoes.

The bitcoin community is not only celebrating a new Central American haven but pointing to El Salvador as a proving ground for “green” bitcoin. Because geothermal plants draw their energy from an existing, naturally occurring heat, their carbon footprint is minimal.

But I think El Salvador (population 6.4 million), one of the poorest countries in the Western Hemisphere, has an opportunity to make a far more groundbreaking energy play than the buzz generated by linking a volcano to a bitcoin mine.

A Humble Proposal: The government should work with miners, local community leaders and foreign investors to strategically fund the expansion of the country’s electricity coverage, specifically via a decentralized network of cheap, clean, cyber-secure, and community-empowering solar or wind-power microgrids.

The best way to overturn the flawed narrative – most recently furthered by U.S. Sen. Elizabeth Warren – that bitcoin will destroy the planet if we don’t curtail it is to demonstrate the opposite: that miners prefer low-cost green sources of power and that they can be a force multiplier for green energy infrastructure at large.

If executed properly, El Salvador’s bitcoin project could achieve a host of the United Nations’ Sustainable Development Goals (SDGs) in one shot. That’s a story I’d love to tell.

Underwriting Green Economic Development

While Warren, Elon Musk and others have been beating the drum about Bitcoin’s energy usage exceeding Sweden’s, bitcoin mines are being deployed in multiple locations across the world, not only to tap existing renewable or stranded energy sources such as wasted natural gas destined for flaring, but to underwrite the development of green electricity infrastructure to serve wider communities.

In a recent episode of our “Money Reimagined” podcast, Harry Sudock, vice president of strategy at mining infrastructure provider GRIID, told us his company is seeing relentless demand from wind, hydro and solar developers for bitcoin mining; co-locating facilities offers revenue guarantees that allow communities to expand renewables to serve local people.

Without those guarantees, these enterprises tend to stall because they depend on bureaucratically administered and sparsely distributed government subsidies to fund their rollout.

In other words, bitcoin mining can serve as that missing piece of risk capital needed to kick-start infrastructure projects, not only to shift the world toward renewable energy but also to foster economic development. There are deep-pocketed companies ready to do this – payments provider Square, for example, which is investing $5 million into a new bitcoin-driven solar facility run by Blockstream.

To maximize the social impact of this effort, we need to look beyond large-scale, state-run, centralized energy projects such as El Salvador’s geothermal plants and seek ways to fund community-based green power projects run as regional microgrids.

A decentralized network of such grids would provide what power experts call “redundancy,” creating multiple backups to offset the vulnerability of the centralized national grid to outages caused by weather or other disruptions. (For a sense of why centralized systems are more vulnerable, think of the tens of millions of people along the U.S. Eastern Seaboard who were impacted by a single ransomware attack on the Colonial Pipeline. A decentralized structure gives hackers a smaller payoff in terms of disruption.)

Most importantly, if bitcoin miners source their power from local, community-based grids, their payments for it – transferred in newly legal tender bitcoin – will go to those communities, providing a steady long-term source of income. (Ideally, microgrids would be governed as cooperatives, or even as distributed autonomous organizations, or DAOs, to ensure wide distribution of proceeds and that there is accountable reinvestment in sustainable development.)

With those funds in hand and new, more widely distributed, reliable, low-cost sources of electricity available, local entrepreneurs could, for example, build out a network of charging stations, creating the foundation for local businessmen to spin up electric vehicle transport services. There’d be power to pump water into farmers’ irrigation systems.

They could expand cell phone services, which are vital for bitcoin payment apps such as Lightning-based Zap, whose CEO, Jack Mallers, was instrumental in President Bukele’s bitcoin awakening.

The geothermal mining proposal is not antithetical to this idea. Bitcoin payments to the national geothermal energy company, LaGeo, would go to upgrading and maintaining the national system into which the microgrids are integrated to provide greater security and reliability. Or, in a direct application of the so-called “money battery” concept, energy tariff payments to the government by bitcoin miners could fund the development and maintenance of the microgrids in other places.

“The history of El Salvador shows that the concentration of power leads to the country’s elites controlling the government, and that leads to human rights abuses,” Geoff Thale, president of the Washington Office on Latin America, a think tank in Washington, D.C., said in an interview. “That’s why El Salvador had a civil war, that’s why most Salvadorans who have been here for years came to the US in the first place.”

For Her First Major Task As VP, Kamala Harris Is Handed A Thorny Diplomatic Mission

Indeed, the ousting of the top prosecutor and judges sends a defiant and troubling message. Bukele’s party alleges the five judges had blocked the government’s public health response to the coronavirus pandemic and that the president and his cohort are “cleaning our house,” as Bukele tweeted.

A nuestros amigos de la Comunidad Internacional:

Queremos trabajar con ustedes, comerciar, viajar, conocernos y ayudar en lo que podamos.

Nuestras puertas están más abiertas que nunca.

Pero con todo respeto:

Estamos limpiando nuestra casa.

…y eso no es de su incumbencia.

— Nayib Bukele ?? (@nayibbukele) May 2, 2021

Flip The Debate

For those who believe bitcoin’s offer of a censorship-resistant, programmable, universally accessible source of digital currency is a positive force for the world, projects like this provide an opportunity to sway public opinion and get people to recognize that it can drive sustainable growth opportunities if managed properly.

We need to table the dysfunctional debate about bitcoin’s environmental impact. Critics focus on bitcoin’s energy consumption, but it’s the wrong lens. El Salvador and so many other poor countries need to consume more, not less, energy if they are to prosper. And excessive consumption is only a problem if the resource is finite, which is not the case with solar, wind or geothermal energy.

The problem is bitcoin’s mining’s source of energy. And the reality, one that too many crypto advocates ignore, is that bitcoin does access a massive amount of fossil fuel energy.

Its carbon footprint is by no means small and will grow bigger as usage expands unless deliberate actions are taken to reduce it.

We need policy actions that can put both sides of this debate into a more reasonable context. El Salvador can lead the way – especially given the interest among other Latin American leaders to follow its example.

Still, to ensure the spoils of development are spread among host communities and to keep miners and grid operators in a symbiotic contractual relationship that serves the interests of both, regulation is needed. Rules can be set for minimizing mining activity during peak hours to manage the “duck curve” problem caused by unused solar capacity and for ensuring there is constant reinvestment in capacity for the community at large.

The question is, will Bukele’s government, which has been accused of authoritarianism and has resisted efforts by U.S. President Joseph Biden to expand regional anti-corruption efforts, seize the initiative to spread the wealth? Or will corrupt officials and wasteful state companies monopolize the bitcoin windfall?

Well, here’s an opportunity for the Biden Administration to strike a deal.

Deeply poor El Salvador is one of the biggest sources of undocumented immigrants crossing through Mexico into the United States. If the U.S. sees the big picture here, it should take a more positive stance towards El Salvador’s Bitcoin policy than we’re currently hearing from Washington – the U.S.-dominated International Monetary Fund expressed concerns Thursday about it.

It can help the country leverage the opportunity to develop prosperity among the very communities that are sending their people on those treacherous journeys to the U.S.

Remittance Firms Hesitant To Support BTC Despite Legal Tender Law In El Salvador

Remittance firms operating in El Salvador appear reluctant to support Bitcoin despite the country’s new law mandating the crypto asset as legal tender.

Despite El Salvador’s recently passed law mandating Bitcoin as legal tender, local remittance firms are reportedly hesitant to adopt Bitcoin (BTC).

Speaking to Reuters, Autonomous Research fintech analyst Kenneth Suchoski argued that remittance firms are unlikely to launch support for Bitcoin and other crypto assets until prompted to do so by customer demand, likely creating a stalemate for the local payments industry.

“For Western Union and some of the other remittance providers, keep in mind that most of the volume in the remittance industry is going from developed markets to emerging markets primarily to people — families and friends — that operate in cash,” he said.

Suchoski Estimates That Less Than 1% Of Global Cross-Border Remittances Are Conducted Using Crypto Assets, Adding:

“To the extent that bitcoin isn’t adopted and there’s not widespread acceptance, these remittance providers are still going to be relevant for the years to come.”

Global payments firm MoneyGram International also emphasized the challenge of navigating undeveloped infrastructure enabling ramps between crypto assets and local fiat currencies in emerging economies.

“We’ve built a bridge to connect bitcoin and other digital currencies to local fiat currency,” a MoneyGram representative told Reuters, adding:

“As crypto and digital currencies rise in prominence, a core barrier to further growth is the on/off ramps to local fiat currencies.”

Last month, MoneyGram revealed a partnership with Coinme to enable users to buy and sell crypto assets using U.S. dollars at 12,000 retail locations across the United States.

Suchoski also emphasized the compliance burden of supporting crypto assets for payments firms, noting that Western Union’s annual compliance costs had nearly doubled from around $100 million to $200 million over roughly the past decade.

Can Bitcoin Ever Replace Fiat Currencies?

El Salvador’s bold move to accept Bitcoin as legal tender has Wall Street once again wondering whether a cryptocurrency could really ever replace the old-school dollar.

It’s a question that appeared, at least to some, to already be nearly answered after a handful of trailblazing companies — including Tesla Inc., MicroStrategy Inc. and Square Inc. — incorporated Bitcoin into their balance sheets without igniting a broader corporate revolution. Now, the focus is turning to governments.

El Salvador, which started using the U.S. dollar as its currency more than 20 years ago, last week became the first country in the world to pass legislation allowing use of Bitcoin in any transaction. President Nayib Bukele says the point is to counter the fact that relatively few citizens have bank accounts and to cut the cost of sending remittances, or money that workers ship back to their families in El Salvador from other countries.

Some observers wonder whether a bigger movement is afoot: replacing a conventional currency — the dollar, the titan of global commerce and finance — on a national scale and then beyond.

The answer, at least for Julian Sawyer, chief executive officer of Bitstamp, one of the world’s longest-running crypto exchanges, is not quite yet.

“There’s been a lot of people who have sat in the crypto world who’ve said, ‘Oh, crypto is going to take over the world and traditional banks and central banks will go away,’” he said in a telephone interview from London. “That’s not going to happen.”

While the technology itself may be used increasingly in the behind-the-scenes plumbing of financial services, such as money being sent across borders, Sawyer said Bitcoin is still too volatile to fully replace the dollar, though it may become part of the mix.

“Will there still be the dollar? Yes,” he said. “Will there still be Visa and Mastercard? Absolutely. It will just be we’ll have alternatives for using plastic, or paper, or coins or checks.”

El Salvador’s central bank president also said on state television that Bitcoin would not replace the greenback in the nation.

The dollar is stable, especially when compared with Bitcoin’s explosive price moves. And whereas the dollar usually fluctuates for mundane reasons, crypto can be swayed by tweets, memes and Elon Musk — not a great fit for a national or global currency.

Bitcoin quadrupled last year, while the Bloomberg Dollar Spot Index slipped 5.5% — a fairly big number for the greenback. Since mid-April, Bitcoin has lost nearly half of its value.

Bank of America Corp. research shows Bitcoin is about four times as volatile as the Brazilian real and Turkish lira — and neither of those is anyone’s model of stability.

“Bitcoin injects extra volatility,” which is counterproductive for countries looking for stability, said Marc Chandler, chief market strategist at Bannockburn Global Forex. “Why do countries peg their currency to another currency or have a currency board or have a dollarized economy? It’s because their currency has become too volatile or lost credence in the market and become out of control, very inflationary.”

Test Case

That doesn’t mean other countries won’t look to El Salvador as a test case for what can happen, especially those that benefit from remittance flows or have central banks already researching or piloting cryptocurrencies of their own.

“Countries can’t just look away from this option now,” said Valkyrie Investments CEO Leah Wald, who previously worked for the World Bank. “For the longevity and health and well-being of Bitcoin, and the Bitcoin network, this is the dawn of a new day.”

Nations from Haiti to Guatemala, South Sudan and Liberia could be next to adopt Bitcoin given their dependence on remittance inflows, high poverty and low financial inclusion, according to Rahul Shah, Tellimer Ltd.’s head of financials equity research.

Other dollarized economies — those, like El Salvador, that are based on the greenback — are also candidates to officially adopt Bitcoin and become less dependent on the Federal Reserve and U.S. policies.

“It potentially gives the ability to not be as beholden to the dollar over the long term, and be more independent of the existing financial system,” said Brad Bechtel, global head of currencies at Jefferies. “Once you see one country go that way, it wouldn’t surprise me to see more.”

Ecuador, which has been dollarized for two decades, could also consider Bitcoin, said Emily Weis, a global macro strategist at State Street Corp. Colombia and Mexico, meanwhile, would risk disrupting their local currencies, even if they have large remittances and crypto interest among the local populations, she said.