With Crypto Jobs Available, US Universities Are Turning To Blockchain Education (#GotBitcoin)

As blockchain-focused jobs increase, universities offer blockchain courses that could help students find job opportunities this year. With Crypto Jobs Available, US Universities Are Turning to Blockchain Education (#GotBitcoin)

Blockchain, a term once only familiar to Bitcoin (BTC) enthusiasts, is becoming one of the most in-demand business skills for 2023.

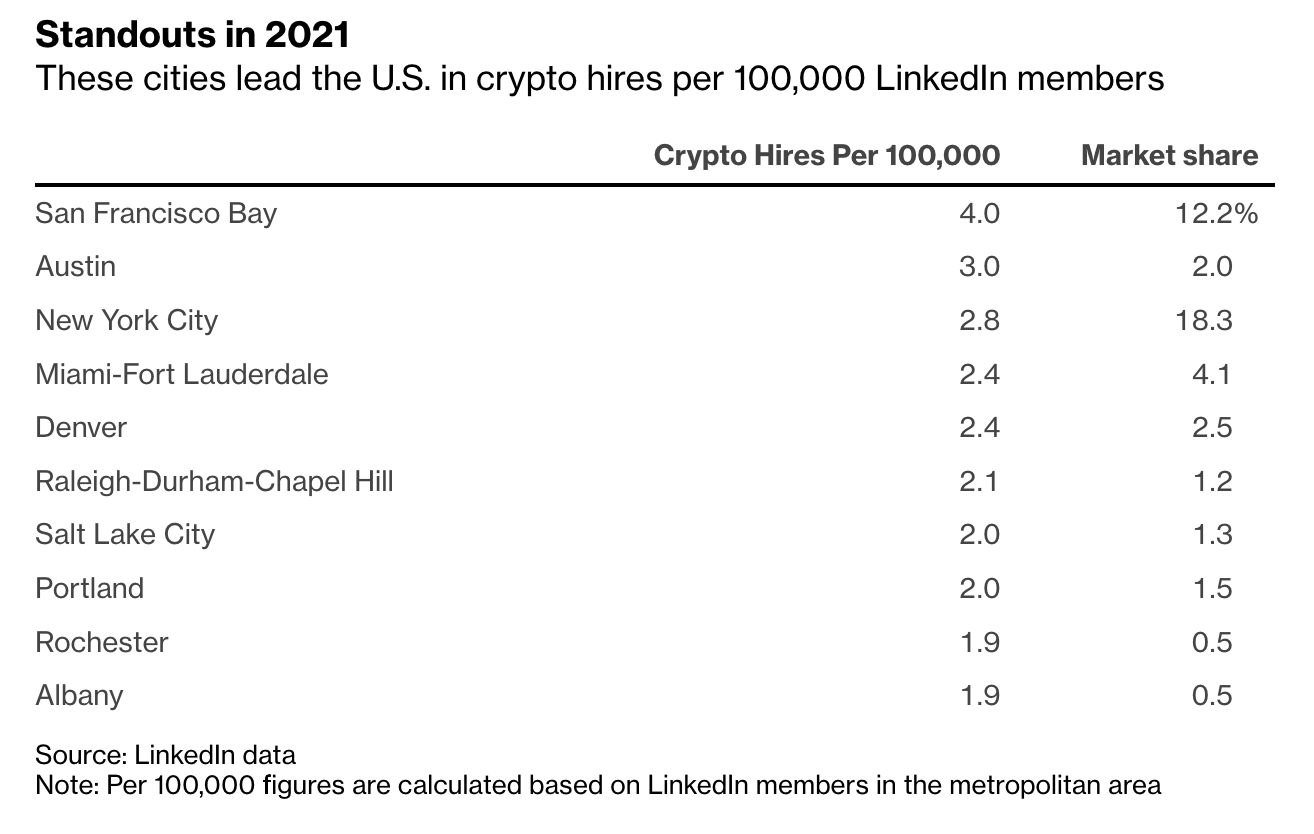

According to a recent LinkedIn blog post, blockchain technology is the most sought-after hard skill this year. The post noted: “The small supply of professionals who have this skill are in high demand.”

Related:

Students In Georgia Set To Be Taught About Crypto At High School

Bitcoin Jobs: Find Great Bitcoin Jobs At Startups That Use Blockchain Technology.

Get A Job At The Black Bitcoin Billionaires Bulletin Board

Instructor: Prof. Gary Gensler, MIT OpenCourseWare. Blockchain And Money (1-23)

We Look At Who’s Hiring vs Who’s Firing (#GotBitcoin)

The Inside Scoop On The Booming Crypto Job Market

Helping 10,000 People Get A Job In Crypto

Moreover, while the coronavirus pandemic continues to impact the United States’ unemployment rate — causing 22 million people to file for unemployment since President Donald Trump declared a national emergency four weeks ago — blockchain-related jobs have been increasing.

In turn, blockchain courses offered at universities are becoming more common, as the need for the skill set rises.

A key finding from Coinbase’s second yearly report on higher education shows that 56% of the world’s top 50 universities offer at least one course on cryptocurrencies or blockchain technology — a 42% increase from 2018.

Kristi Yuthas, an accounting professor at Portland State University, told Cointelegraph that the need for individuals skilled in blockchain technology is a result of traditional companies being impacted by the technology:

“Blockchain companies are innovating at lightning speed. Leaders with the acumen to create business value from these innovations are now in high demand.”

University Blockchain Courses Help Students Find Job Opportunities

American universities such as Portland State, MIT, Stanford, University of California Santa Barbara and many others now offer blockchain-focused courses to meet the increase in job demand, and students who take them have a chance to quickly find job opportunities this year.

For example, Portland State University recently concluded its “Blockchain in Business Lab” courses.

According to Yuthas and her colleague Stanton Heister, the university collaborated with the NULS Foundation, an open-source enterprise blockchain platform, to educate students on the business elements of blockchain development.

Together, the NULS and PSU designed and conducted two hands-on courses that were completed by 21 students under the supervision of Yuthas and Heister.

According to Yuthas, PSU’s blockchain program is meant to provide in-depth analysis of blockchain companies and innovations. She explained that lab-style courses allow students to gain real-world experience in order to build a working blockchain and to execute actual transactions.

PSU’s first Blockchain in Business Lab was conducted in February of this year and offered a step-by-step guide on how to build a blockchain by utilizing NULS Chain Factory, which is a blockchain development kit.

Kathy Norman, a developer of the NULS blockchain and co-organizer of the PSU program, told Cointelegraph that Chain Factory was used by students to drive blockchain education and to test the product as an educational vehicle, adding:

“Our commitment was to provide our technology and our technical expertise, to give the students a hand-on experience of blockchain from the perspective of user/customer, developer, and entrepreneur.”

PSU’s second lab focused on blockchain user and developer activities. Included in this course were guides for practical blockchain applications and instructional sessions on decentralized applications and smart contract development.

America Tirado, a student who completed PSU’s blockchain courses, noted that the classes helped alleviate her fears around blockchain:

“I had heard of Bitcoin before and was asked to invest in it in the early 2000s. I hesitated, though, because I didn’t understand it. Through these courses, I learned about the technology, what it can do, how it functions, and how to properly use it.”

Norman further pointed out that students who have completed PSU’s blockchain courses are invited to join the NULS community to offer their knowledge to help build out the platform:

“All students are invited to join our NULS community, and if they want, offer their skills to NULS. We did not formally invite the PSU students this semester, but can certainly consider this for next time.”

UC Santa Barbara and The University of California Los Angeles also offer blockchain courses. Both universities are part of the Blockchain Acceleration Foundation, a nonprofit organization committed to accelerating blockchain education.

Cryptocurrency analytics firm CipherTrace partners with BAF to train students on how to use the company’s products to investigate cryptocurrency-related scams.

John Jefferies, the chief financial analyst of CipherTrace, told Cointelegraph in a previous article that the company will train and certify students to use its financial investigation software, which is applied to detect money laundering, power-law enforcement investigations and to enable regulatory supervision.

While Jefferies noted that training students is not intended as a recruiting tool for the company, the president of BAF, Cameron Dennis, mentioned that helping students find internships this year is a big focus, telling Cointelegraph that “an internship pipeline is in early-stage development.”

Dennis also explained that BAF’s blockchain courses are offered to both undergraduate and graduate students looking to expand their blockchain knowledge:

“A professor in UCSB’s computer science department and a professor in the economics department agreed to run a cross-disciplinary and graduate-level blockchain seminar for Spring 2019 (this quarter). Also, we are currently running an undergraduate computer science blockchain course at UCLA’s College of Engineering and are preparing for an undergraduate Intro to Blockchain course at University of California Davis for Fall 2020.”

Ben Fisch, a co-founder of Findora, a blockchain company for financial applications, and renowned professor of cryptography, Dan Boneh, both teach a blockchain and cryptocurrencies course at Stanford University.

Fisch told Cointelegraph that engineers who went through a blockchain course are likely to have a great advantage when applying to big companies that are interested in piloting blockchain technology.

He also noted that many early-stage startups with blockchain-related business ideas also need technical team members with an accurate understanding of how blockchains operate.

According to Fisch, the blockchain course at Stanford provides a comprehensive technical overview of blockchain technology, as it focused more on blockchain concepts rather than engineering aspects, adding:

“It covers the core concepts and also a sampling of niche topics within the field. Astute students come out of this course with a holistic understanding of how blockchains work and their fundamental applications, or even with enough knowledge to participate in blockchain research and innovation.

Our guest lectures also give students some exposure to how blockchain is being used in the world today. Our guests this year included Olaf Carlson-Wee of Polychain Capital and Chris Dixon of A16Z.”

As a hiring manager at Findora, Fisch explained that the candidates he looks to bring on board are not much different from engineers who other software development companies would seek out and that they don’t need to be particularly well versed in blockchain technology:

“However, having a background in blockchain concepts, such as the one provided by our Stanford course, does help. It increases the attractiveness of an already strong engineering candidate, and it may reduce the on-boarding time for a new hire.”

Updated: 4-24-2020

Binance Sees 2,000% Employee Increase in Under 3 Years

Binance recently broke the 1,000 employee mark, showing tremendous growth since its ICO.

Major crypto exchange, Binance, now has over 1,000 employees, showing tremendous company growth since its 2017 start.

“When Binance first started in 2017, there were under 50 people,” Binance co-founder, Yi He, told Cointelegraph on April 23. “We have more than 1,000 employees today (currently at 1,002 and counting; we are welcoming new hires almost every day).”

Binance Kicked Things Off Less Than Three Years Ago

Binance conducted its ICO in July 2017, garnering $15 million in capital. The exchange opened one month later.

“Though our team during this time was not very large, we were already an international and decentralized team, collaborating remotely with the executive team,” Yi He said.

The exchange quickly became one of the crypto market’s go-to options for trading, boasting $1.5 billion in volume by June of the following year.

The exchange seeks new workers amid increasing unemployment numbers

Over the past several weeks, coronavirus prevention measures and market downturns have resulted in a mass number of layoffs and company difficulties.

“Many talented people have lost their jobs due to the current climate with a number of companies laying off their employees,” He said, adding

“We believe that this moment is the best time to recruit outstanding talent. This quarter, we will continue to recruit new hires and encourage people to apply at Binance.”

In terms of long-term goals, He explained the company’s mission statement has not changed. Looking at crypto as a method of unlocking money’s caged potential, Binance desires to increase financial accessibility, while enhancing cryptocurrency usability.

In just 2020, Binance has released a number of new products, such as options trading, expanding its product line even further.

Updated: 6-23-2020

University Of Cincinnati Turning Crypto Craze Into Educational Curriculum

The programs, which are funded by a longtime supporter of the university, will teach students about Bitcoin and other digital assets.

Cryptocurrencies are attracting a lot of attention from academic institutions as they become increasingly accepted as an alternative to conventional assets. The University of Cincinnati (UC) in Ohio, United States, has even established courses around cryptocurrency as part of its curriculum.

In fact, UC is working on two new programs that will educate students about cryptocurrencies like Bitcoin (BTC) and emerging financial technologies, according to a Wednesday UC News story.

The reports state that the projects are being funded by Dan Kautz and Woody (Woody) Uible, who will provide them through the UC’s Carl H. Lindner College of Business. The funding also covered the creation of public-private lab space in the new Digital Future headquarters, which is expected to open later in 2022.

[ 1/3 ]

— Haris.ETH (@Haris_ETH) June 22, 2022

Following the launch of this initiative, Dean Marianne Lewis, Ph.D., stated that students will be able to obtain hands-on, practical learning in the new field of financial technology, adding that:

Our students will learn how to manage cryptocurrencies and how such digital assets impact our economy, positioning UC as the regional leader and among the top universities nationally with this kind of program.”

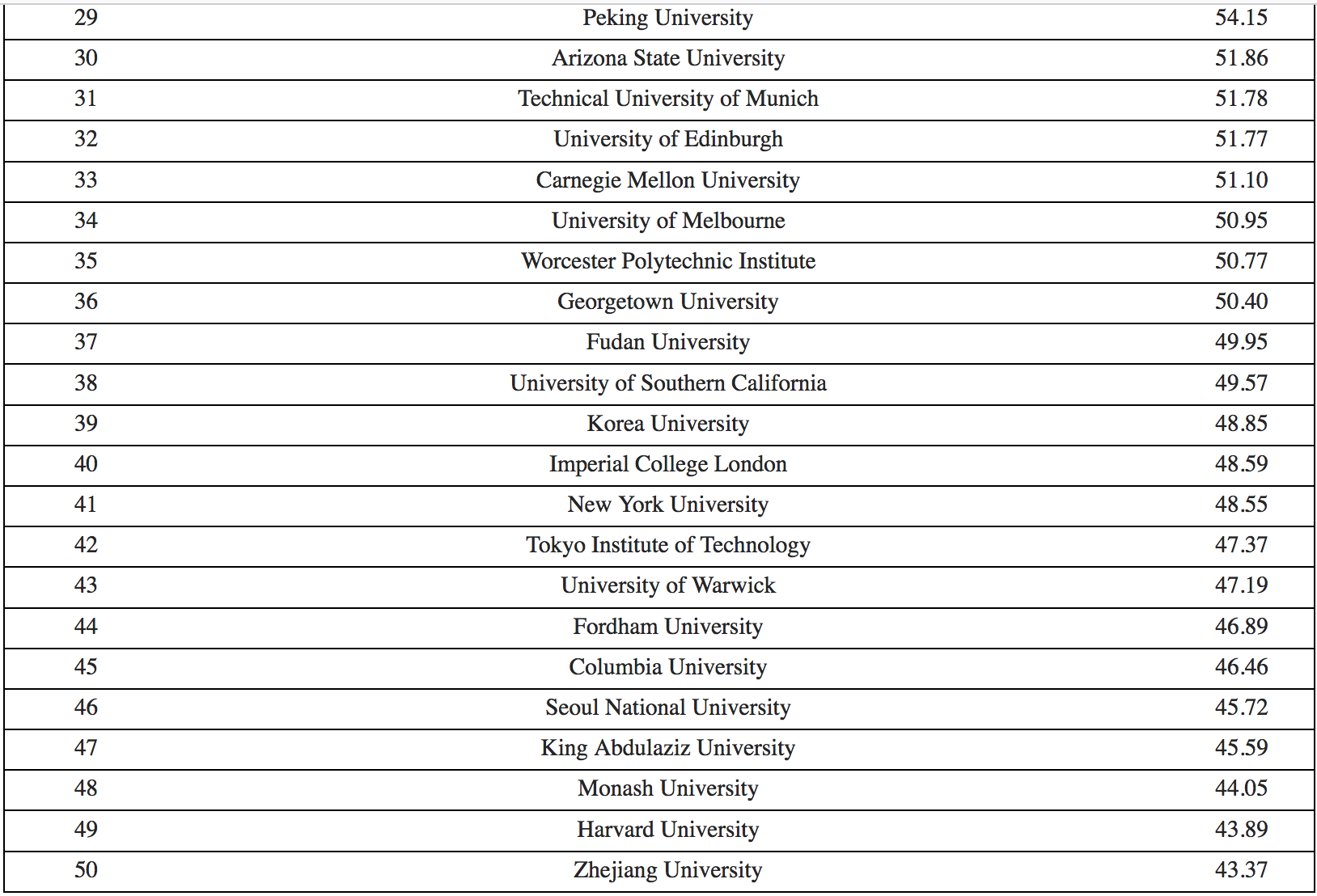

Education about cryptocurrencies has increased in popularity recently, especially among marginalized communities, as the new financial frontier allows people all around the world to create, innovate, generate money and prosper.

To assist such communities to take advantage of these possibilities, Jay-Z and Twitter co-founder Jack Dorsey have partnered to finance The Bitcoin Academy, a program for the residents of Mary Houses in Brooklyn, New York — where Jay-Z grew up — that teaches people about cryptocurrencies.

Other top universities have been getting on board with the blockchain and cryptocurrency craze as well. For example, the Massachusetts Institute of Technology (MIT), widely recognized for its ground-breaking research and demanding academic curriculum, is a leader in terms of blockchain technology, taking a research-first approach to the decentralized ecosystem.

Harvard has a vibrant blockchain student network with over 200 members. Weekly “Crypto 101” discussions are held, and there is an incubator on campus that allows students to develop and scale their cryptocurrency projects.

Updated: 11-5-2020

Fidelity Digital Assets Is Hiring More Crypto Engineers

Fidelity Digital Assets is hiring over 20 engineers in a new push to expand the investing giant’s footprint in the cryptocurrency space.

* Exactly what the new hires will be building was unclear in Fidelity’s Wednesday announcement.

* The post mentioned Fidelity is “improving upon our existing bitcoin custody and execution services” and building new products to “support the ecosystem.”

* Two Digital Asset positions were added to Fidelity’s job board Thursday: a principal data engineer and a senior engineering manager. Eight other digital assets posts were listed on the job board as of press time.

* Hiring will occur over the next several months, Fidelity said.

Updated: 1-27-2021

‘Pomp’ Launches Crypto Jobs Board With Gemini, Coinbase And BlockFi

Anthony Pompliano, the popular crypto evangelist and partner at Morgan Creek Digital, is launching a blockchain-focused jobs board, with backing from Gemini, Coinbase and BlockFi.

Announced Wednesday, PompCryptoJobs went live with over 100 open crypto positions advertised by its three launch partners.

Pompliano – known simply as “Pomp” in the crypto world – is planning to leverage his large audience to bring companies and job candidates together in a talent marketplace.

(Back in August 2020, Pompliano’s Morgan Creek Digital led a $50 million investment round in crypto lender BlockFi.)

“I think that there is an obvious need in the market right now,” Pomp said in an interview. “You’ve got millions of Americans and people around the world that are out of work, and millions more who want to transition from their existing job. Meanwhile, cryptocurrency companies are growing and hiring very fast, but there’s no single place where the job candidates and the employers can meet each other.”

The crypto industry, composed of armies of machine coders and social media scrum-halfs, does indeed seem to be booming.

This month, Digital Currency Group (the owner of CoinDesk and four other firms in the space) posted over 60 new job vacancies.

The revenue model for the new crypto jobs portal involves paying a monthly fee to list positions, Pomp explained.

“My goal is to get 10,000 jobs on the board this year,” he said.

Morgan Creek’s Anthony Pompliano aims to list 10,000 openings by the end of the year.

Updated: 6-7-2021

Help Wanted: Cryptocurrency Experience A Plus

Over the course of January through November of 2017, the number of job postings on LinkedIn with Bitcoin in the headline has boomed by 5,753% to a total of 4,917 listings.

Overall, the number of jobs associated with Bitcoin and blockchain rose 306% on LinkedIn during the 12 month period that ended in mid-November.

Updated: 6-12-2021

Digital Currency Asset Manager Grayscale Investments LLC Hires Its First CMO

Deborah Bussière will promote investment products in a noisy sector of finance.

Grayscale Investments LLC, a digital currency asset manager, has named Deborah Bussière as its first chief marketing officer.

Grayscale, which offers over-the-counter funds focused on bitcoin and other digital currencies, had $53 billion in assets under management as of May 12, according to the company.

Responsibility for marketing was previously shared internally, with external support from Vested LLC, its advertising and public relations agency of record.

Previously, Ms. Bussière was global chief marketing officer at Broadridge Financial Solutions Inc., a financial-technology provider of investing, governance and communications tools.

She had earlier been a marketing consultant to startups including Grayscale and chief marketing officer for the Americas at Ernst & Young.

Ms. Bussière said she intended to help Grayscale educate investors about digital currency as it continues to quickly evolve. “We understand how important it is to navigate the many perceptions and misperceptions that exist,” she said.

She joins the company following the January promotion of Michael Sonnenshein to chief executive officer at Grayscale, where he promised to bolster the leadership team and capitalize on the company’s growth in 2020.

Her appointment to the C-suite at Grayscale comes, too, as digital currencies occupy the spotlight more than ever, most recently as the subject of a “Saturday Night Live” skit starring Elon Musk last month and an enthusiastic conference in Miami earlier this month.

The “laser eyes” social-media meme for bitcoin enthusiasts was adopted this week by the president of El Salvador, which this week approved bitcoin as legal tender.

But the currencies are also volatile, buffeted by forces including tweets by Mr. Musk and the sentiment in Reddit forums such as WallStreetBets. Bitcoin, dogecoin and other cryptocurrencies saw their value decline on Friday, continuing a monthlong drop, after Mr. Musk posted a cryptic tweet implying loss of love for bitcoin, including “#bitcoin” and a broken-heart emoji.

The crosscurrents are a challenge, according to Ms. Bussière. “Perception is reality,” she said. “That’s a fact of life.”

But she said her response to such external factors will be Marketing 101, with a consistent message at its core. “We’re monitoring real-time tweets, news breaks, price fluctuations, market valuations,” Ms. Bussière said. “But it’s like when you’re running a race.

If you want to win you’re not constantly looking back at who’s behind you because if you do that you’re losing valuable milliseconds.”

Marketing cryptocurrency also depends in part on the audience, Ms. Bussière added.

“If you’re in the digital currency and crypto space, it can be Reddit and it can be all the kids that are out there,” she said. “Certainly if you go to talk to your Great Aunt Edna about her perception of digital currencies, that’s a whole different vantage point…Grayscale has a huge opportunity to own that narrative.”

Other players in digital currencies are confronting the same issues.

“We’ve actually surveyed for this—‘Do you find the crypto culture to be off-putting?’” said Andrew Tam, senior vice president of marketing at BlockFi, which offers cryptocurrency versions of traditional financial products and services such as loans. “It scored lower than expected.”

Tweets by Mr. Musk and the laser eyes meme among bitcoin backers help business in the long run, Mr. Tam said.

“It seems kind of silly because if you log onto Twitter you see all these people with laser eyes,” he said. “What that really is is engagement. What that campaign, quote-unquote, has done is really drive awareness in a way that a centralized marketing department could never have done.”

Mati Greenspan, chief executive at research firm Quantum Economics, agreed. “In a lot of ways cryptocurrencies’ value are based on the network effect,” he said. “When you see things like presidents and presidential advisers adding laser eyes, that adds greatly to the network effect, which in turn adds to the value.”

Updated: 6-28-2021

Crypto Businesses Struggling To Fill Job Openings Amid Industry Expansion

Crypto firms pursuing global expansion agendas are having to compete to attract the limited number of top talent to fill job positions.

According to Bloomberg, crypto firms are finding it somewhat difficult to find the right candidates to fill job openings as these firms look to expand their operations across the globe.

The competition for skilled and experienced candidates is not alone among crypto-natives but also with legacy financial institutions that are establishing cryptocurrency-focused departments.

Even the broader fintech and technology services industry are also entering crypto, contributing to even greater competition for the limited workforce available. Back in May, tech giant Apple posted a job opening for a business development manager for alternative payments including cryptocurrency.

Neil Dundon, the founder of cryptocurrency-focused job agency Crypto Recruit, said that companies are experiencing difficulties matching applicants to roles. Despite the increase in interest for employment opportunities in the industry, skill shortage is reportedly a significant problem.

The Apple job, for instance, called for 10 years of experience, with at least a five-year track record with alternative payment services such as cryptocurrency.

According to Dundon, some firms are lowering the expectation in terms of skills and experience, adding:

“In terms of length of experience, one or two years is good enough these days […] The skills shortage is so bad at the moment that companies are casting a wider net.”

Candidates with “strong crypto knowledge” are reportedly a scarce commodity. Universities and colleges are now offering cryptocurrency and blockchain courses to bridge the skills gap in the $1.4-trillion industry.

Companies are also making internal adjustments to their hiring policies to make certain roles available for remote working conditions. With geographical constraints often restricting companies to a limited skills pool, some businesses are now offering roles to more skilled talents based overseas.

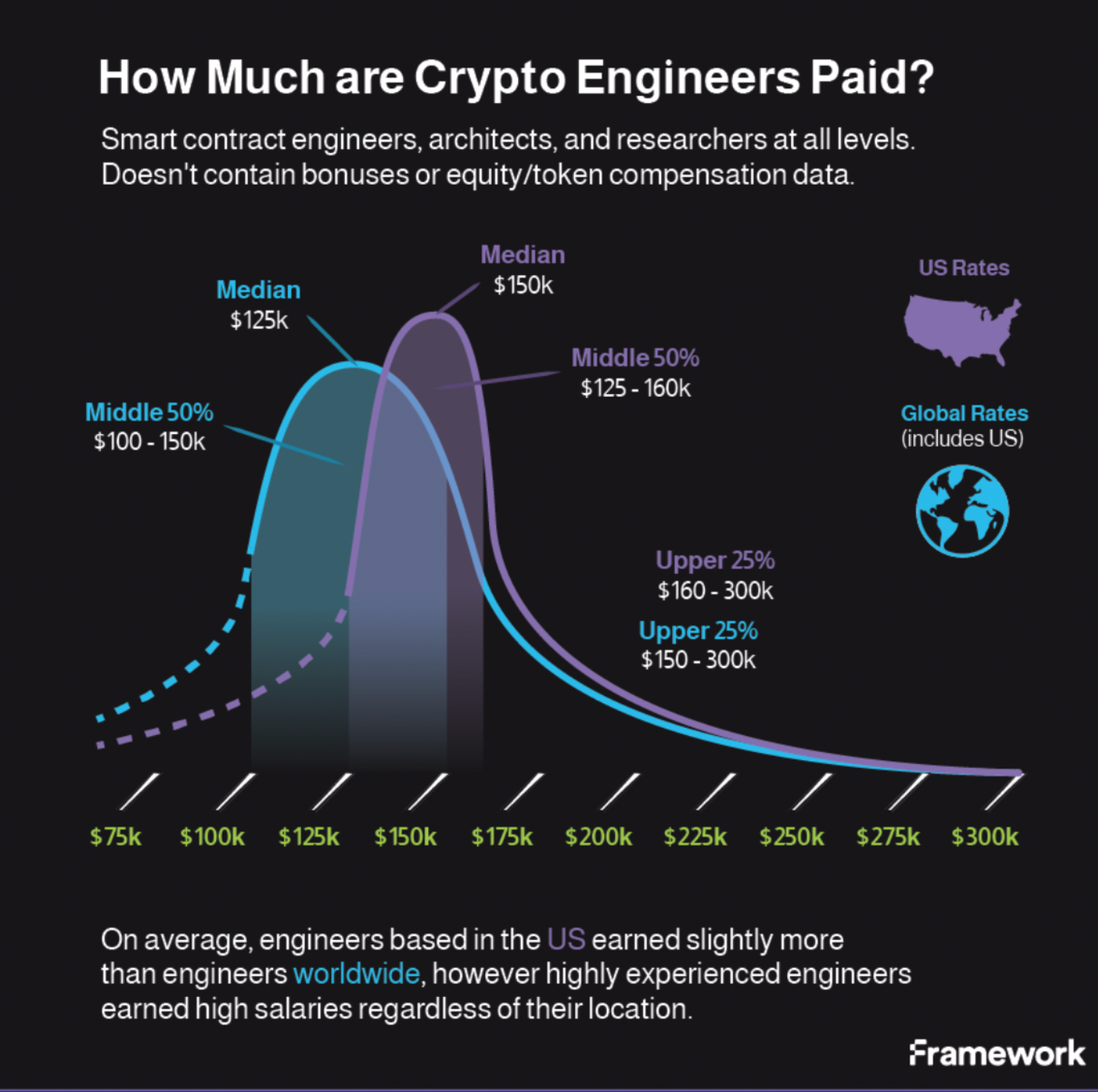

Competing with these established organizations also brings up issues with remuneration, with crypto firms needing to match or offer even greater benefits and incentives to attract skilled workers.

Updated: 8-17-2021

Which Universities Are The Best For Blockchain?

Calling students, academics and industry stakeholders: We need your help to identify the best places to learn about crypto and blockchain technology.

Universities have historically been central to getting new industries off the ground. Stanford was instrumental in the rise of Silicon Valley, and the MIT has helped birth thousands of tech startups, from artificial intelligence to aerospace.

What role will universities play in the development of blockchain technology? Will they be as pivotal as before, or will the cryptocurrency industry, by nature distrustful of institutions and central authorities, develop its own academic methods and learning approaches?

CoinDesk is keen to track how universities are doing when it comes to blockchain education across courses, employment outcomes, student services and research. In October 2020, we published our first ranking of the top 20 U.S. schools for getting an education in blockchain (MIT, Cornell University and the University of California, Berkeley were the top three).

This year, we’re going further, analyzing 200 schools in the U.S. and internationally and adding ranking categories.

To identify the best schools, we need your help. We’re asking students, practicing academics and industry stakeholders to give their opinions in this survey.

Don’t worry, it doesn’t take long. You can choose between a quick one-minute questionnaire and a deeper five-minute one. And you’ll be doing a valuable service: Our goal in tracking and comparing what universities are doing on blockchain education and research is to improve overall standards – and, in turn, the entire industry.

We’ve seen plenty of blockchain startups emerge from universities already, including Ava Labs from Cornell and Algorand from MIT. Most leading schools now offer classes in blockchain subjects. Some have built research centers, hired specialist faculty and sanctioned student clubs.

The big question is whether universities can remain relevant to such a fast-moving industry. Many in crypto are suspicious of institutions and credentialism, favoring self-education, online innovation and community-based approaches. Universities themselves have to come to grips with this decentralization of information. Let’s see how well they’re up to the test.

If you are a faculty or staff member at an accredited university and you are concerned that your school will not be represented in our rankings, please reach out to joe.lautzenhiser [at] coindesk.com. If we are not currently collecting data on your school, you will have the opportunity to provide data and place your school under consideration. Student emails will not be answered.

Updated: 8-20-2021

Work Hard At Playing: How Video Game Job Markets May Develop

Who would have thought that video games could unironically represent a life well spent?

If you thought remote work was game-changing, wait until video game work gains traction. Blockchain-based NFT games such as Axie Infinity and Splinterlands have demonstrated that a play-to-earn business model has the potential to revolutionize the gaming industry.

Pandora’s box has been opened, so to speak, and play-to-earn is here to stay. There are already people logging on to an online video game to spend their days earning a living. In this piece, we will explore what a world where earning income through video games is the norm will look like.

After Venezuela endured cataclysmic hyperinflation, it left individuals working minimum wage jobs and earning an unsustainable $5 dollars a month. However, in the wise words of Jeff Goldblum, “life finds a way.” Individuals had devised a means to earn a living through playing the video game RuneScape (OS).

This was achieved in a form of in-game labor — gold farming — where users would play the game to extract various items to sell to users for United States dollars. This happened despite the RuneScape developers Jagex forbidding any form of transaction of digital items for real-world currency.

It was a controversial practice and some RuneScape players thought farmers were simply exploiting the game without contributing anything to the community. This led to them PK’ing (player-killing) players they thought were farmers. Which in turn, opened up a new earning opportunity to provide security to these player’s farming accounts. This perfectly exemplifies how new job markets can snowball. Venezuelan players were able to provide a living for themselves, and there were even some media reports of players earning more than local doctors.

Economies Emerging

As long as in-game transactions can happen between players, users will attempt to exploit this by buying items with real-world money. For the integrity of the game, it is not in the best interests of developers to allow individuals to pay to win, as it provides an unfair advantage to users with the most disposable income.

However, the fact that digital items are gaining such value and new “jobs” are being created may lead to an all-out gold rush (pun intended). It parallels the emergence of the internet and the avalanche of developer jobs that brought with it.

Blockchain gaming is still very new and if job markets can develop in games that weren’t designed for them, one can only imagine the possibilities found within games designed to allow economies and job markets to function properly.

These new markets will need to be drastically different from what was observed in RuneScape. In-game items that provide an unfair “advantage” should not be on the market for real-world transactions, as this will discourage new players that feel they have to pay their way to a playable standard. But, there is no reason why items that don’t have utility can’t be sold. In-game items that don’t have utility will usually find value from aesthetics.

Aesthetic value is not to be taken lightly. This can be seen in games like Counter-Strike where gun skins are being sold on secondary markets for $4200, and even in League of Legends where the character skin “PAX twisted fate” will set you back $300.

What Sort Of Jobs?

Looking forward, what might jobs that provide real income look like in a blockchain governed game? While it’s difficult to speculate, I will attempt to provide some rough ideas:

Time-Intensive Tasks

One thing that will always be tied to value is time. Video games have long included time-intensive tasks in their games, and as we saw in the Venezuelan RuneScape example, players transacted their time to farm gold. The in-game items that are farmed have value because of the time it takes to gain these items.

Blockchain gaming can take this one step further, where players can offer their time to extract certain in-game items for real financial incentives. This is clearly seen in Axie Infinity where players will grind quests to gain SLP, the native token for Axie Infinity. It is claimed that if Axie Infinity players invest the necessary time they can earn up to 4,500 SLP a month which is currently worth around $935.

Item Generation/Design

As mentioned, aesthetics can represent serious value to some users. Blockchain sandbox MMORPG game Ember Sword has realized this and will open up the design process of items to game users who can spend time designing a new aesthetic skin (an item that represents the same utility but differs by how it looks) and sell this to other users as an NFT.

These NFTs can have coded royalties that will allow both the user who designed the item and the developers to own a percentage of royalty to further receive profits if the item is sold for a higher price on the secondary market. There is then a further scaling possibility for users to brand their items and even create an in-game company by hiring virtual employees to apply their branded design fundamentals to items. This same principle can be applied to virtual architects, interior designers and stylists, and the list goes on and on.

Social/Personality

Personalities can be very valuable and this is most clearly seen in twitch streamers. There are individuals who, although lacking skill or technique in video games, attract millions of viewers. There are opportunities for certain individuals with “attractive” personalities being paid to simply spend time around a certain area of virtual land to bring in more users to the area.

This may be something you would want to pay someone to do if you owned, for example, a virtual casino, so the deal may be mutually beneficial financially. Again, a form of royalty/commission can also be present here for certain users as an incentive to fulfill this role to a high standard.

Playing For Others

One tried and tested in-game value generation task can come from dungeons, raids and boss fighting tasks. This will typically involve users having to battle their way through a large number of enemies to get a final boss who, if users can defeat, will drop the most valuable in-game items/loot.

This kind of in-game work is both skill- and time-intensive. Therefore, it is specifically targeted at those who are more experienced players. However, it also poses opportunities for better players to offer their “services” to help less experienced players accomplish these tasks.

A Note Of Caution

How these technologies, and the jobs they bring with them, will play out is still a mystery. This means we should be proceeding with sensible cautiousness. There is a risk that better and easier financial gains to be made playing video games in less economically developed countries may attract workers away from more important tasks, as we saw with reports that some RuneScape players were outearning emergency services workers.

One caveat to this is that these digital economies draw from a global market, not just a local market, and it seems like it would bring additional money and opportunities into less economically developed areas as we’ve seen with Axie Infinity in the Philippines.

One beautiful thing about cryptocurrency is the freedom that it provides to users to control their own wealth. What we are seeing with blockchain gaming is an evolution of cryptocurrency. To some, it is just a cool new feature where our items are tradeable for profit, independent of the parameters of a single game.

To others, this is a life raft, a means to bring an income that is so desperately needed in a completely new and revolutionary way. Who would have thought that video games could unironically represent a life well spent?

Updated: 8-31-2021

Major Job Postings From The Crypto Space In 2021

Some institutional players, online retailers, and media organizations have called for recruits with experience in crypto or blockchain.

As crypto and blockchain firms grow and need to navigate regulatory and economic challenges for the industry, many have to hire outside to find the best workers. This year, major companies, financial institutions, and even government agencies announced they were searching for fresh blood to help them adapt to the ever-changing crypto space.

In February, major online retailer Amazon posted it was seeking a software development manager in Mexico to help launch “a new payment product.” The Digital and Emerging Payments project was aimed at allowing residents of Mexico to buy cryptocurrencies with cash so they could spend digital currency while shopping on Amazon.

Though there are reports the online retailer intends to accept Bitcoin (BTC) payments by 2022, the company has not officially announced such plans.

In July, Amazon said it was looking for a Digital Currency and Blockchain Product Lead for its Seattle office, hinting at a possible change as to how customers pay on Amazon’s websites.

Apple, the largest company in the world by market capitalization, seems to also be focusing on crypto payments based on a recent job posting. In May, the major tech firm said it was recruiting for a business development manager specializing in alternative payments, specifically preferring someone with experience in “alternative payment providers,” including cryptocurrency.

Reaching Across Industries

Though two of the Big Four may be considering a shift to digital payments, some financial institutions seem to require workers be able to work within regulatory guidelines while still growing the business. In April, the Bank of England announced it was looking for 7 people to fill new positions related to a central bank digital currency, despite the fact it has not officially reached a decision on releasing one.

Japan’s Ministry of Finance was reportedly considering increasing its staff to address growth in the crypto market, including regulations concerning fiat-pegged stablecoins.

It seems as though job seekers with both a knowledge of cryptocurrencies or blockchain and the experience to back it up may have their pick of the litter when it comes to employment, given the industry is barely a decade old and has the potential to make money in a variety of companies. In July, major U.S. investment bank JPMorgan started accepting applications for blockchain-focused software developers, engineers, marketers and auditors.

Other firms simply seem to be responding to a growing industry in job postings. The crypto arm of asset management firm Fidelity Investments reportedly wanted to increase its number of staff by 70% in response to additional interest from institutional investors. Major crypto exchange Coinbase is also attempting to gain greater access to some of the 1.4 billion people of India by hiring locals for its engineering, software development and customer support operations in the country.

Reporting On Crypto

Even media outlets don’t necessarily have the staff to properly report on the crypto space. News organizations like Bloomberg have dedicated journalists on crypto and blockchain, but Time Magazine is still looking for a chief financial officer who has “comfort with Bitcoin and cryptocurrencies.”

According to Neil Dundon, the founder of crypto-focused job agency Crypto Recruit, “one or two years” experience is usually good enough for the industry, given it was only created in 2009. However, just as with the dawn of any new technology like radio, television, or the Internet, interest in and from candidates will likely grow as more institutions offer more options for cryptocurrency and blockchain education to meet demand.

Updated: 9-3-2021

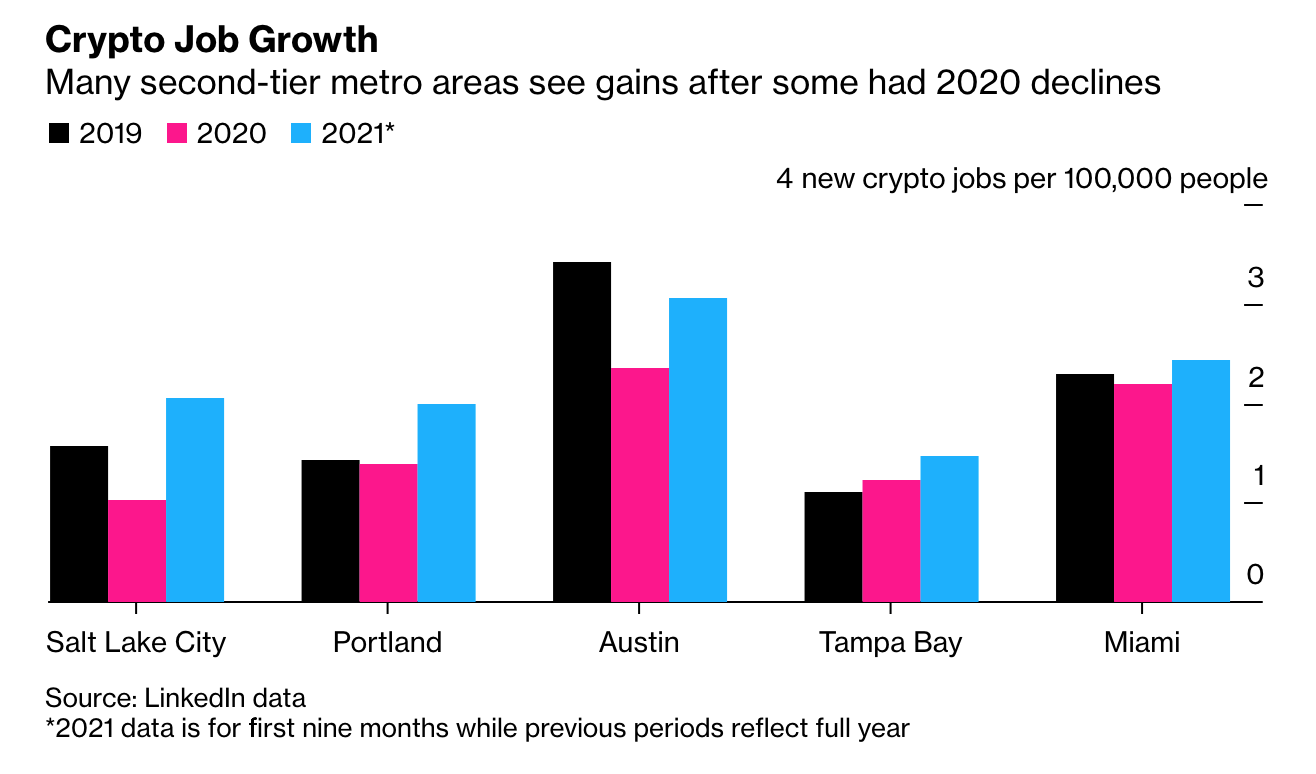

Crypto And Blockchain Jobs’ Share Grew 118% In 10 Months, New Data Shows

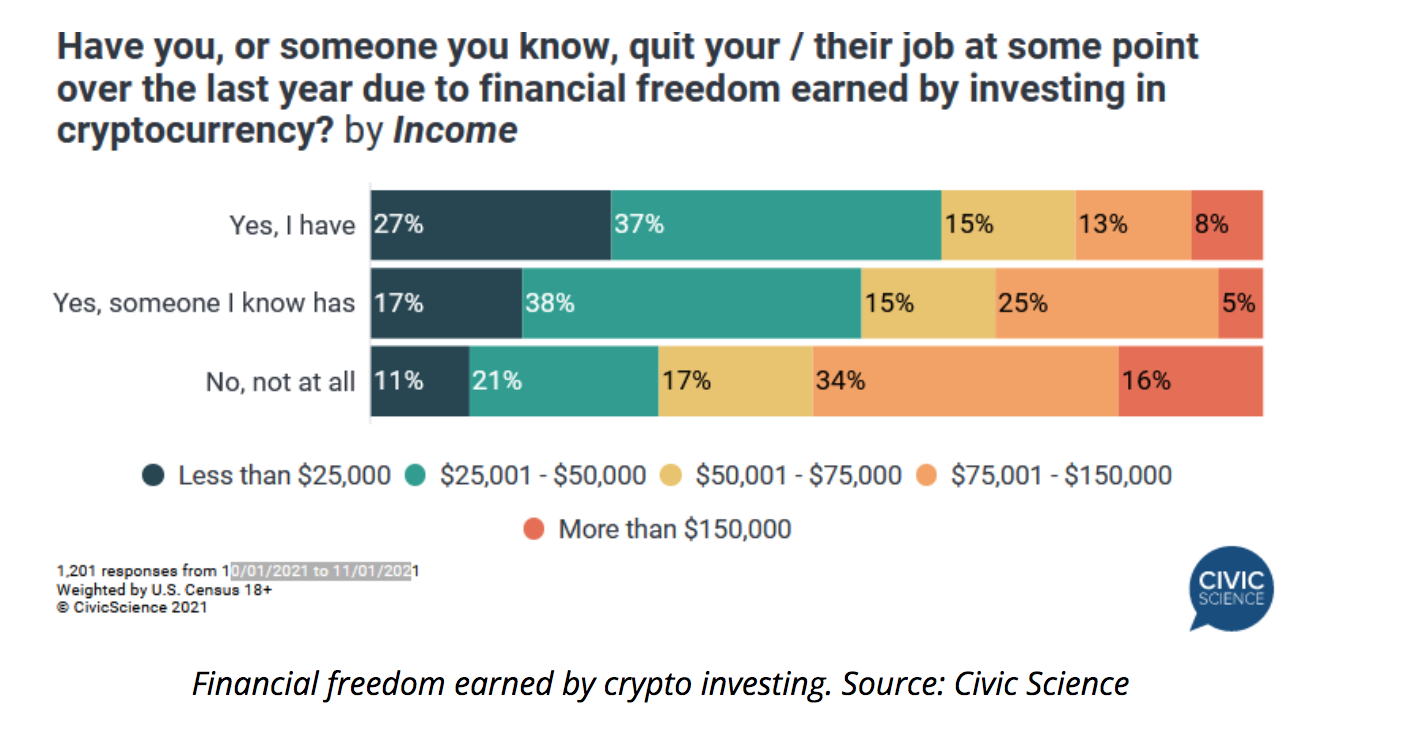

Not only has demand for cryptocurrency- and blockchain-related expertise increased, but new data suggests that the kinds of roles being posted have shifted over time.

Gathering together the most recent data on the cryptocurrency and blockchain job market, a new report suggests that higher levels of institutional adoption have spurred greater demand for expertise in the sector.

According to the employment website Indeed — cited Thursday in Korea IT Times — as of mid-July 2021, the overall share of crypto and blockchain job postings on the platform has grown 118% compared with early September 2020.

This solid growth has also come with a shift in the roles being sought after, with the share of management posts in crypto and blockchain increasing 29.87% year-on-year as of July 16. Human resource accounts have risen 200% over the same time frame, whereas software development jobs have dropped down to 29.7% of all crypto and blockchain posts compared with 34.8% the previous year. All data on the allocation of roles has reportedly been drawn from the crypto trading simulator Crypto Parrot.

As the Korea IT Times observes, blockchain-related roles tend toward a higher salary range than other technology posts as they demand a strong knowledge of cryptography combined with expertise in ledger economics and object-oriented programming, among other areas. While crypto and blockchain — even DeFi— have gained traction in educational institutions steadily, the report alleges that many developers in the sector remain largely autodidact, suggesting that universities and programs are lagging.

The report further claims that reliance upon remote workers during the pandemic may prove to be a good fit for an industry that prizes decentralization, encouraging core developers and researchers to engage with multiple partners and employers on different projects.

While the report does not provide data on the share of public and private sector employers seeking crypto talent, this year has seen everyone from Israeli intelligence agency Mossad to the Bank of England advertise related roles.

In the private sector, the crypto arm of asset management firm Fidelity Investments has reportedly been planning to grow its workforce by 70%, JP Morgan began accepting applications for blockchain-focused software developers, and Amazon has been seeking someone to lead its digital currency and blockchain strategy and product roadmap amid unconfirmed claims that the mega-retailer will accept Bitcoin (BTC) payments by 2022.

Updated: 8-16-2021

Which Universities Are The Best For Blockchain?

Calling students, academics and industry stakeholders: We need your help to identify the best places to learn about crypto and blockchain technology.

Universities have historically been central to getting new industries off the ground. Stanford was instrumental in the rise of Silicon Valley, and the MIT has helped birth thousands of tech startups, from artificial intelligence to aerospace.

What role will universities play in the development of blockchain technology? Will they be as pivotal as before, or will the cryptocurrency industry, by nature distrustful of institutions and central authorities, develop its own academic methods and learning approaches?

CoinDesk is keen to track how universities are doing when it comes to blockchain education across courses, employment outcomes, student services and research. In October 2020, we published our first ranking of the top 20 U.S. schools for getting an education in blockchain (MIT, Cornell University and the University of California, Berkeley were the top three).

This year, we’re going further, analyzing 200 schools in the U.S. and internationally and adding ranking categories.

To identify the best schools, we need your help. We’re asking students, practicing academics and industry stakeholders to give their opinions in the survey below.

Don’t worry, it doesn’t take long. You can choose between a quick one-minute questionnaire and a deeper five-minute one. And you’ll be doing a valuable service: Our goal in tracking and comparing what universities are doing on blockchain education and research is to improve overall standards – and, in turn, the entire industry.

We’ve seen plenty of blockchain startups emerge from universities already, including Ava Labs from Cornell and Algorand from MIT. Most leading schools now offer classes in blockchain subjects. Some have built research centers, hired specialist faculty and sanctioned student clubs.

The big question is whether universities can remain relevant to such a fast-moving industry. Many in crypto are suspicious of institutions and credentialism, favoring self-education, online innovation and community-based approaches. Universities themselves have to come to grips with this decentralization of information. Let’s see how well they’re up to the test.

If you are a faculty or staff member at an accredited university and you are concerned that your school will not be represented in our rankings, please reach out to joe.lautzenhiser [at] coindesk.com. If we are not currently collecting data on your school, you will have the opportunity to provide data and place your school under consideration. Student emails will not be answered.

Updated: 10-4-2021

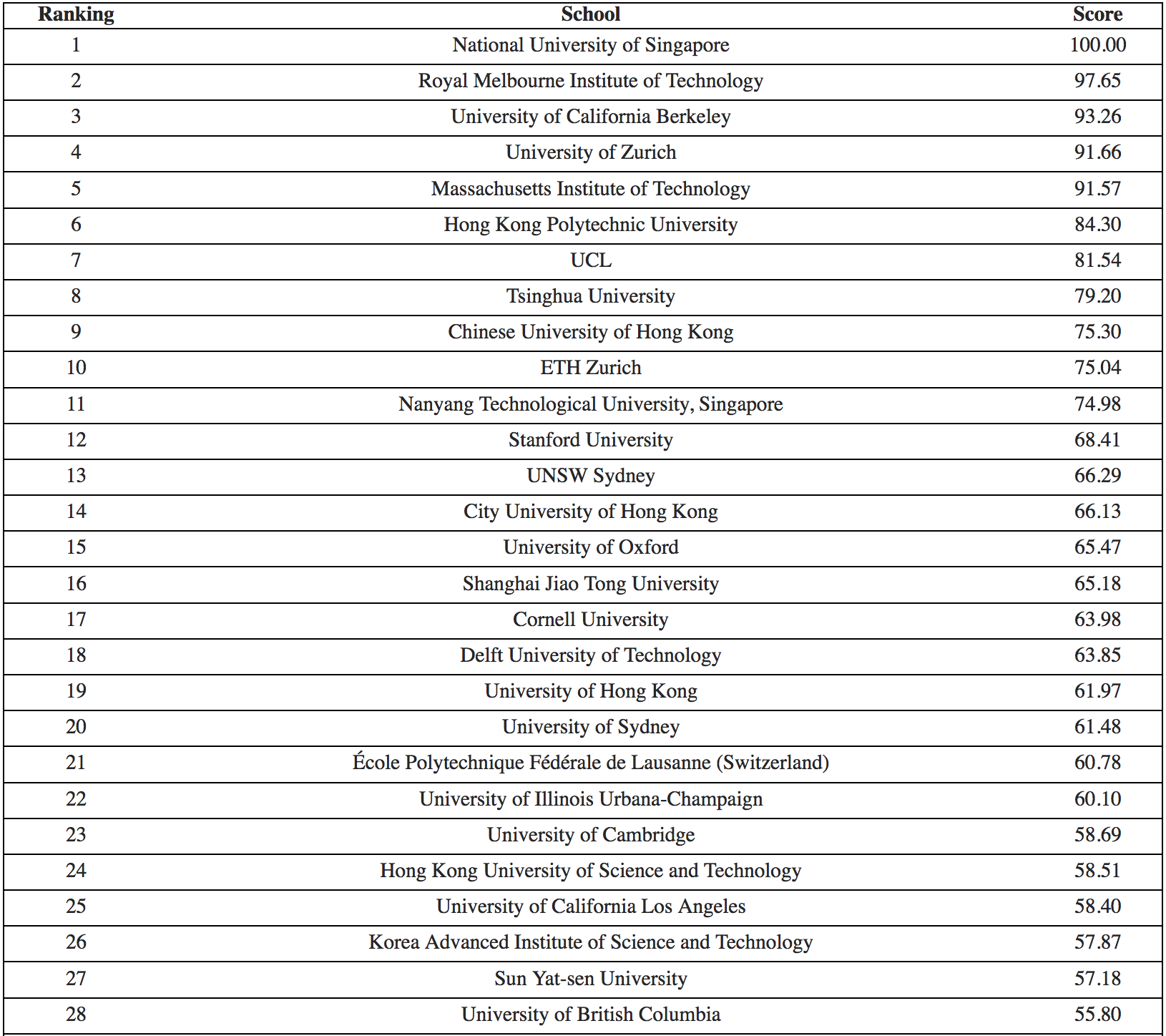

The Top Universities For Blockchain By CoinDesk 2021

This year’s ranking of 230 schools worldwide sees Asian names dominate and European universities rise up the board. Berkeley and MIT are the highest-rated U.S. schools.

CoinDesk’s rankings cover courses, research output, campus blockchain offerings (like student clubs and research centers), employment outcomes, academic reputation and cost.

This year’s ranking rates 230 schools internationally, expanding the sample from just U.S. schools in our first university ranking last year.

Overall, the National University of Singapore is in first place as a result of its multiple blockchain research centers, its frequently hosted blockchain-themed conferences, its many blockchain clubs, its company partnerships and its masters program in digital financial technology.

Also representing Asia in the top 10 are Hong Kong Polytechnic, Tsinghua University and Chinese University of Hong Kong. RMIT in Melbourne comes second while representing Europe are the University of Zurich, UCL and ETH Zurich.

The top U.S schools are Berkeley (third) and MIT (fifth). Cornell, which was second last year, is now in 17th place. Stanford, which placed fourth in 2020, is now in 12th. Harvard, which was fifth last year, is now 49th, reflecting stronger competition this time, and that schools with strong overall reputations aren’t always the best performers when it comes to blockchain.

Below Are The Full Top 50 In Our Ranking:

More About Top Universities For Blockchain

This is the second year CoinDesk has done these rankings. Last year we tracked 46 U.S. schools, and ranked the top 30. This year, we tracked 230 schools internationally.

Data is good. There is an absence of data on this space: Research and teaching can only get better if we track what academic institutions are offering.

We hope these rankings prompts the sharing of best practices in teaching and other campus offerings. We profile the top 30 schools here, and invite those and other schools to share with the world what they are doing. We want to hear from you.

Research was led by Reuben Youngblom, a researcher from Stanford and MIT, along with CoinDesk’s Joe Lautzenhiser. To assess the rankings, they scoured publicly available sources including course catalogues, program prospectuses, social media channels, club web page the Clarivate Web of Science, and devised an online survey where academics, students and stakeholders could rate the offerings at their schools and their competitors.

Mindful that the cost of university education varies wildly, this year we introduced a metric that compares the unsubsidized tuition costs against the average cost of living in the region in which the school is located.

How We Ranked The Top Universities For Blockchain

Our methodology for ranking of 230 institutions worldwide, and how your school can get involved.

To this end, we’ve made two major changes to our methodology this year. First, we included not only more schools, but a wider variety of schools – our field has expanded from 46 U.S.-based universities to more than 200 schools (230, to be exact) from around the globe. Second, we factored in “cost of attendance” to reflect a metric of growing concern for many current and future students.

Above all, we want to ensure that these rankings do what they’re intended to do: offer a holistic snapshot of the intersection between this transformative technology and institutions of higher education. We believe that a transparent, intellectually defensible ranking can help condense what ends up being an incredible amount of difficult-to-find information (with innumerable factors) down into a more manageable format.

In the open-source spirit, we’d also like to reiterate our commitment to integrity and data transparency. We are more than happy to discuss and/or share our data, our methods or anything else about the project upon request.

Sample Size

Our official sample size for these rankings was 230 individual schools, which is not nearly the total number of universities that exist around the world. To determine on which institutions to focus, we added schools to the list according to their ability to meet any one of three criteria.

First, we included any school that was listed in the top 100 of any one of the USNWR Best Global Universities (2021), the QS World University Rankings (2022), the ShanghaiRanking’s Academic Ranking of World Universities (2021), or the World University Rankings (2022).

We also included any school that had been considered last year (2020) that was similarly based on aggregating outside rankings. This gave us a large initial sample.

This setup, however, if limited to just these two criteria, could pose a problem: What if a lower-ranked school (as judged by USNWR, QS, ARWU, or THE) is doing amazing work but fails to be considered simply because a few outside sources happened to overlook them in their global rankings? This is far from a desirable outcome.

On the other hand, we simply don’t have the resources to closely examine every school in existence, especially when relatively few of them are engaged in the kind of impactful blockchain work that is likely to lead to a place on our rankings.

To balance these considerations, our third criteria was a compromise: When we released our qualitative survey, we also included a call for any school, anywhere in the world, to request inclusion/consideration in our rankings.

By opening our criteria but placing the burden of requesting to be included on the schools themselves, we were able to remove any artificial limitations on which schools were considered while simultaneously maintaining a high level of confidence that any school that took the affirmative step of asking to be evaluated would ultimately be worth our time and resources to examine closely.

These final 230 institutions represent some of the best schools in existence today, and our final sample saw a mix of large, traditionally “elite” research institutions and smaller schools, from public to private, from free to expensive, with every continent (with the exception of Antarctica) represented.

Methodology

To Determine Final Scores, We Looked At Five Primary Categories:

(1) An Institution’s Strength In Research And Academic Contributions To Advancing The Field;

(2) The Existing Blockchain Offerings On Campus, Whether In The Form Of Classes, Educational Centers, Clubs, Etc.;

(3) Employment And Industry Outcomes;

(4) Cost Of Attendance; And

(5) Overall Academic Reputation.

Each category comprises multiple sub-categories, offering a holistic picture of a university’s presence in the blockchain space. For a final score, we assigned points to each institution proportional to their performance in each category, and normalized their final point totals on a scale from 0-100.

1) Scholarly Impact: To determine a school’s scholarly impact score, we relied primarily on the Clarivate Web Of Science database.

We took the total number of publications (all subjects) from each school, and narrowed them to include only blockchain- or cryptocurrency-related papers published between 2019-2021 (including forthcoming papers slated for 2022).

From this set, we generated citation reports and created subsets in which the first author of the publication was affiliated with the university in question. The resulting data gave us the key metrics of:

(1) Total Blockchain Research Papers Published By University Affiliates,

(2) How Often These Papers Were Cited, And Rough Numbers On

(3) How Often The Primary Researcher On A Paper Comes From A Given Institution (The “First Author” Convention Being, Of Course, Discipline Dependent).

Raw numbers, however, don’t always tell the full story. A bigger school, with a larger faculty and a hefty endowment, may be putting out more blockchain research overall (while still managing to devote a relatively small percentage of its resources to the field), while a tiny school that dedicates a much more impressive percentage of its overall resources to blockchain research may end up with fewer papers simply due to a smaller overall headcount.

To account for this, we also normalized each data point (where applicable) against the total institutional output. When normalized in this way, a smaller university that is devoting a larger proportion of its research to blockchain will be rewarded relative to a more massive university who is able to pump out a greater quantity of research with less investment.

In recognition of the fact that both raw output and targeted output are valuable metrics, both are factored into our rankings, along with the aggregated H-Index of a school’s blockchain publications. For anyone interested in reproducing our dataset, please ensure that a) you have full access to the Web of Knowledge and all Clarivate subscriptions; and b) use our query to filter the results: “cryptocurrenc* OR blockchai* OR bitcoi* OR ethereum OR stablecoi*”

2) Campus Blockchain Offerings: To arrive at a school’s blockchain offerings score, we examined multiple facets of their existing campus infrastructure. Campus course offerings are the largest single subcategory that we looked at.

The number of available classes (especially when spread over multiple departments, providing an opportunity for a more robust education) shows a deep investment into the space both in the present and for the future.

Faculty must be hired, curricula must be developed and administrative buy-in must be achieved. These are not done on a whim, and are usually quite permanent.

The second-largest factor in our rankings is the presence of a dedicated blockchain research center, although we also separately considered smaller initiatives and student-run clubs.

Research centers and initiatives often offer unique opportunities for students to get involved in academic work or obtain hands-on experience, and can serve as a gravity well for novel ideas and thinkers (especially when these entities take the additional step of organizing conferences, summits or other educational events).

Research centers, initiatives and clubs all allow students, faculty and the larger community to connect with other enthusiasts, and tend to provide a crucial tether between academia and industry.

Lastly, to round out this category, we gathered data on the nascent but ever-growing set of universities that offer blockchain-related degrees, whether at the graduate or undergraduate level and sometimes as a concentration within another degree. As a whole, the Campus Blockchain Offerings category is the most consequential component of our methodology.

3) Employment And Industry Outcomes: A university’s ability to place students into relevant jobs is an important metric for two reasons: one, it says something about an institution’s cache in the industry, either due to name recognition, personal connections, or institutional pipelines; and two, this is of particular importance to current and incoming students.

A student’s primary goal in obtaining a college education is, after all, often to secure a job in industry. To discover which schools are placing the most graduates in the blockchain field, we looked at the LinkedIn footprint of over 200 of the largest and most influential companies in the space, as well as their thousands and thousands of employees.

To mitigate biases, we factored in both raw and normalized numbers. Raw numbers are useful for highlighting schools that are placing a high number of graduates into jobs, but larger schools in larger countries will tend to have an advantage simply because of sheer size.

Normalized numbers paint a more nuanced picture of hiring practices. To shed some light on our data, we tweaked our data in two additional ways. First, because we relied heavily on LinkedIn as a source, we found it prudent to get a sense of how accurate LinkedIn might be for different countries.

To do this, we used each country’s size, higher education levels, and LinkedIn use to generate a multiplier for each university based on the expected number of hires that we may have missed. Countries with lower proportionate levels of LinkedIn use got a boost in terms of raw numbers.

Second, we also recognize that raw numbers can easily be inflated simply due to the size of a population. The University of Buenos Aires, for example, with its ~300,000 students, is much more likely to place 200 alums into blockchain jobs than someplace like Rockefeller University with its ~213 students.

The University of Buenos Aires placing 200 grads into blockchain is expected even with zero investment into the field, whereas Rockefeller placing that same number would be indicative of something closer to a school that is focused entirely on blockchain (highly unlikely, as Rockefeller is well-respected bio/medical sciences university). To account for this, we normalized against school size, as well.

To gather qualitative data, we also surveyed industry stakeholders and other non-students, non-academics to get a sense of how institutions are (subjectively) viewed by those who consider themselves to be outside of academia. This data was quantified numerically, as was information about the number of active industry partnerships (including sponsored research) maintained by each university.

4) Cost of Attendance: To calculate a school’s Cost of Attendance score, we looked at both overall cost and a normalized construction of overall cost of attendance. We assumed here that lower tuition was preferable, and feel that we ought to acknowledge the important caveat that we only considered the base price of a university, while in actual practice, grants, scholarships, opportunity costs, and even residency can completely change an individual’s calculation.

Along similar lines, tuition is a purely student-facing concern, while we hope that these rankings find use by non-students. Because of these concerns, our cost metric is, by weight, the least consequential component of our methodology.

Two pieces of data were factored in to generate this score. The first is tuition, with one note. Whenever possible, we assumed that an attendee would be from within the country but out of state when calculating tuition costs. Of course, some universities just have one flat fee.

Others, however, charge different amounts of tuition for in-state (versus out of state), and have yet another fee schedule for international students. To capture the largest number of likely students, we consistently applied the “out of state but not out of country” tuition rule whenever necessary.

The second piece of data is a normalized cost of attendance. To determine this, we employed both salary data for the country in which the university is located and an external cost-of-living chart as proxy data to build a combined country-specific cost of living index. We then ran raw tuition data against this hybrid index to assign ranked scores to each university.

5) Academic Reputation: In a perfect world, rankings would emphasize merit, and anonymized, quantifiable data would be sufficient to judge a university’s impact in the blockchain space. Realistically, however, the intangibles of a school have an outsized impact on everything from a student’s job prospects, to their ability to get a foot in the door of an internship, to the caliber of speaker that will spend their limited time giving a talk at any given school.

To pretend that reputation doesn’t matter, that history is insignificant, is to do a disservice to our rankings. The effect of a school’s academic reputation on our methodology, however, is dwarfed by every other category except for cost, reflecting both the recent shift away from credentialism and the greater weight that we assign to more tangible, productive metrics.

To determine an institution’s reputation score, we looked at two criteria: (a) existing, overall reputation as calculated by USNWR, THE, ARWU, and QS; and (b) reputation as determined by our own qualitative surveys, which asked both practicing academics and current students to evaluate schools. This data was split according to whether it came from a student or an academic, and quantified numerically.

Similar to last year, there are two common threads in our methodology. First, in keeping with our goal of rigor, defensibility and reproducibility, we used externally verified, quantitative data whenever such data was available, and normalized this data where appropriate to add as much nuance into our rankings as possible.

When we required qualitative data, we sent out open, public, shareable surveys through all available channels and did our best not to limit participation in any way.

Second, we made every attempt to examine each data point from as many angles as possible. As is often the case, any given data point can be seen as a positive in some situations but a negative when seen through a different lens. Normalization is one tool to combat this, but so are things like common sense and a dispassionate analysis of the landscape. Data tells a story, and our goal was to let our data tell as complete a story as we could.

On Rankings In General

As a final note, we’d like to echo a sentiment expressed last year and address the project of creating university rankings in a more general sense. In important ways, ordinal rankings are incredibly useful for showing very specific data or reducing large amounts of information down into a digestible format, but are also both narrow and inherently malleable.

Even small changes to the methodology can have outsized effects on the final result, as can outlier data or even researcher-introduced errors. To state that rankings are vulnerable to criticisms of subjectivity and malleability is not intended to marginalize our data or the larger project at hand; rather, we hope that by highlighting the limitations of our output, these rankings will be more useful to a greater number of individuals.

We are very willing to discuss our methodology, share data, answer questions, and address concerns. Interested readers are encouraged to contact Joe Lautzenshiser (joe.lautzenhiser [at] coindesk.com).

As a final note, it’s worth noting that we hope these rankings serve as the foundation for a living, breathing resource that goes well beyond an ordered list of schools. We have started and will continue to do this research, but we’re not naive enough to believe that we can build this particular monument alone.

But we believe this resource illuminating one small corner of the blockchain universe has tremendous value – for students seeking a more traditional path into the industry, for academics hoping to collaborate with like-minded individuals, for companies wondering where specific research is being done. As a first step, we’ve started filling out profiles for some of the top universities, but we’d eventually like to have every school represented.

Students can contribute to this by checking their school(s) and having an authorized university representative (e.g., a member of the media/communications/etc. team) contact us if any information is outdated or missing, or if their schools do not yet have a profile.

Individuals can help by highlighting important research and projects, or novel approaches to blockchain education. Schools can help by examining these rankings and using them as a signal for how to improve. Ultimately, the answer is simple: devote resources to educating students, faculty, and the community about blockchain technology.

Do You Need To Go To College To Work In Crypto?

College dropouts sometimes become world-changing legends, including in crypto. But the big picture is a lot more complicated.

Against All Authority

“I told my parents, I’m willing to die on this hill. I don’t want to go on with this because it’s just about ticking boxes. My dad happened to agree.

“We went to the school, I think it was on my 16th birthday, and I withdrew.”

You may not know Keonne Rodriguez by name, but you know his story. From the age of nine he compulsively played with the family computer, and was being paid to code web pages for local businesses by the time he was 14. He would go on to major success in the blockchain industry – but despite his obvious talent and focus, he had challenges with formal education.

“I was in advanced programs, honors, advanced placement [but] I was really starting to develop an allergy to bureaucracy and things that didn’t make sense.” The breaking point came when his high school instituted a required computing course – one Rodriguez is certain he could have taught.

The College Conundrum

Some of the most successful people in the tech industry either didn’t attend or didn’t complete college. Famed dropouts include Bill Gates, Steve Jobs and Steve Wozniak – world-changers who made billions of dollars without a diploma.

Those stories have become totemic in the tech world, even as broader skepticism of college spreads. That skepticism is partly driven by financial calculus: As tuition and student debt loads rise dramatically, there’s more reason to ask whether the investment in college is really worth it.

Various startups and reformers have established alternative paths, from coding boot camps to online certification programs to radical new models like Minerva University.

Some organizations, such as Peter Thiel’s Thiel Fellowship, push an even stronger line: not that college is too expensive or inefficient but that, at least for some people, it’s a waste of time at any cost. The Fellowship awards $100,000 to “young people who want to build new things instead of sitting in a classroom.” Recipients must skip or drop out of college to be eligible.

That backdrop makes things particularly challenging and confusing for young people interested in careers in crypto. Spending three or four or five years on a campus could seem like a big sacrifice in an industry that changes so fast.

And perhaps the single most widely admired person in crypto stands as an example of the potential of skipping school: Vitalik Buterin received the Thiel Fellowship in 2014 and, instead of going to college, used the time to build Ethereum.

But the data about college outcomes tells a much different story than the biographies of these few outliers. The average college degree holder will earn $625,483 more than a high school graduate over his or her lifetime.

College graduates also have much higher lifetime employment rates, better lifelong health and even longer-lasting marriages, according to a 2015 study by University of Maine education researcher Philip Trostel.

Moderate critics of higher ed acknowledge this reality. “I’m a pragmatist. At the individual level, you should take the system as it’s constructed,” said investor Marc Andreessen during a 2020 interview that was otherwise quite critical of the status quo in higher ed. “I think it’s actually quite dangerous to give someone as an individual the advice, ‘don’t go to college.’”

The data about college outcomes tells a much different story than the biographies of these few outliers

The reality on the ground in the crypto and blockchain industries, too, seems a bit less freewheeling than the mythos would have it. While reporting this story, I reached out to about a dozen close contacts in the industry, asking if they knew anyone who had found a role building in crypto without going to college.

Rodriguez was the only example I was able to unearth. Unscientifically, it seems the overwhelming majority of people with serious careers in crypto are college graduates.

That makes sense once you remember how many complex ideas are wrapped up in the design and deployment of blockchains. The crypto industry moves fast, but that’s in part because it draws from a many-layered, complex “stack” of intellectual traditions, legal norms and technical breakthroughs stretching back decades, even centuries.

That includes not just extremely advanced computer science, but the far frontiers of securities law, economics, even sociology and art.

The Bitcoin Off-Ramp

Keonne [Key-own-ee] Rodriguez defied those odds and immediately thrived – not just without going to college, but without even finishing high school. Despite his outlier status, his means of ascent holds career lessons even for people who do take the college route.

Most importantly, Rodriguez was able to clearly demonstrate his real-world effectiveness thanks to a portfolio of web design work built up in his early teens. His portfolio was the first step towards a string of full-time positions that grew his skill set further, at the same age he would have normally been attending college.

Eventually he found himself a very well-paid coder and designer at Cleversafe, a security company that’s now part of IBM.

But then things hit a rough patch, thanks to the same thing that was derailing a lot of tech careers circa 2012: Bitcoin.

“I got so obsessed with bitcoin that I couldn’t stop tweeting about it,” Rodriguez told me. “So [Cleversafe] got concerned. We mutually decided it was better for me to focus on my passion.”

Things moved fast after that. Rodriguez, who was based in the U.K., showed up at an early bitcoin conference organized in London by Blockchain.com.

Blockchain “had just gotten some money from Roger Ver and they were building out the initial staff. I just told [them], I’m interested, here’s my portfolio and if you guys need someone let’s talk. I was interviewed by Dan Held and Changpeng Zhao.”

Those names may sound familiar. Nearly a decade later, Held is head of growth at the crypto exchange Kraken. Changpeng Zhao is slightly better known as “CZ,” the CEO of Binance, the world’s largest crypto exchange by a country mile.

Rodriguez became employee number eight at Blockchain, living and working with a small initial crew in York, U.K. He eventually became head of user experience for Blockchain’s wallet, then its main product.

But Can You Write Poetry?

Rodriguez, who evolved from web coding to front-end design, could clearly demonstrate results. But in fields where results are less tangible, that approach doesn’t work as well. “Anyone with hopes of a managerial position needs a college diploma,” for example, according to Steve Mintz, a historian and education researcher at the University of Texas.

That also applies to much of the high-level, back-end system design work involved in blockchain projects. In fact, blockchain encompasses so many deep concepts that it’s an ideal introduction to computer science as a whole.

“I use blockchain as a way to introduce a number of computer science fields in my courses,” says Professor Ron Van Der Meyden at the University of New South Wales in Sydney. “Here we’ve got this brilliant application which, to really understand how it’s working, there’s a lot of pieces of computer science we can introduce – cryptography, consensus. And each of those has a whole lot of [complexity] behind them.”

That sort of deep theoretical knowledge may seem abstract from the outside, but according to Van Der Meyden, it’s extremely practical.

“You can look at a particular thing you need to code, and identify within that problem, [for example,] here’s something that a finite set automata would be good for,” he says. “You learn how to think about, ‘I’m not just going to write a program, I’m going to really care about how efficiently that program performs.’ That requires a conceptual toolset.”

That’s why Van Der Meyden believes there’s little comparison between the strictly functional coding knowledge conveyed in condensed courses, and what students get from a full computer science degree.

“With respect to code camps, I would say that what those are giving you is just the coding skills. It’s kind of like, you can speak English but can you write poetry?”

Van Der Meyden also believes those pushing against college may have a point – but only within their own very narrow sphere. Peter Thiel “is thinking of his experiences in Silicon Valley, Harvard, Yale, that small fragment of the world,” he says of the entrepreneur’s Fellowship program.

By contrast, many of Van Der Meyden’s students come from developing parts of Asia. UNSW considers educating these students something of a social mission because it ultimately helps their home nations advance and grow.

“That’s a very different world than the world Thiel is thinking about.”

College In Context

As Marc Andreessen pointed out, it’s important to separate the broader debate over college from individual decisions. Simple math shows that going to college is still the right choice for those who have the option. And this is crypto – we trust math, right?

Still, it’s important to be tuned in to the broader debate, which breaks down into essentially two camps. On one side are those who focus on declining public spending on higher education, which has pushed costs on to students.

On the other side are those who argue the university model itself is broken, and that new educational approaches and less reliance on credentials are the longer-term solution.

It’s important to keep in mind that critics of traditional colleges are often trying to profit from the alternatives. Andreessen Horowitz has substantial investments in edtech startups trying to disrupt college with new models for financing and delivering education. So does Peter Thiel – making the Thiel Fellowship as much a marketing expense as a philanthropic project.

Broadly, would-be education disruptors “unbundle” the college experience – with its partying, athletics and residence halls – from pure education. For example, it was for a time thought that Massive Open Online Courses, or MOOC, would upend the traditional college model by providing free or very cheap lectures from top-tier professors, available anywhere in the world.

But the promise of edtech has become much hazier. The coronavirus pandemic shutdown of most in-person schooling was a chance for online learning to shine, but it largely wound up demonstrating the limitations of education ripped from its social context and individual feedback.

Endless Zoom lectures and isolation have led to mass burnout for students and educators alike. That shouldn’t have been a surprise – remote alternatives had already proven ineffective for most learners. Fewer than 15% of participants, for instance, complete MOOCs.

“I think it’s much more than creating great content and putting it up on the web,” David Deming, professor of education and economics at Harvard, said on the a16z podcast last year. “I think that’s why MOOCs haven’t revolutionized the market, because that’s not what education is. Education is not just content, it’s also engagement and personalization.”

It’s also worth remembering that even as some members of the American elite voice skepticism of traditional college, others are willing to go to absurd lengths to get their kids on exactly that path.

The 2019 college admissions scandal arguably showed just how valuable college is to the wealthiest Americans, who were willing to spend hundreds of thousands of dollars and commit obvious fraud to fake admissions credentials for their unimpressive spawn.

But that’s just the egregious tip of the double-standard iceberg: One recent study found that 43 % of white Harvard students were either legacy admissions (students attending the same college their parents or other relatives attended), athletes or related to donors. (The rate was under 16% for non-white students). If those kids aren’t going to code camp or getting an education on YouTube, maybe you shouldn’t be either.

On the other hand, it’s true that college isn’t for everyone, and it’s certainly not perfect. I know that firsthand: My initial career goal was to become a professor, and I even earned a PhD and landed a short string of research jobs.

Ultimately, I found myself leaving academia. I had a variety of reasons, but a big one was that I saw the life of the mind dying a slow death in American higher education.

During my career I taught at universities and colleges of various stripes, and found that many of them were havens for mediocrity and stasis, with professors merely pantomiming research – and even more often, pantomiming teaching.

There are still many colleges full of brilliant, engaged people in wonderful, grass-green settings, and I have walked that sort of glorious lawn. But not every college is the intellectual Arcadia of myth – in fact, it sometimes seems that fewer and fewer of them are. And this, too, is borne out by the numbers: For non-technical fields like business and social science, the rank and quality of a school has a major impact on the career prospects of its graduates.

The Quitter’s Dilemma

On both sides of the college debate I heard consensus on at least one good reason not to go to college: if you really, really don’t want to.

“For someone who is convinced that they’re a genius and don’t need a college education,” says Trostel, the education researcher, “they’re not going to put in the effort and they’re not going to get much out of it.”

In other words, it’s not that being brilliant guarantees you’ll succeed without a degree – it’s that without some humility, you’ll never earn one. Unlike most investments, education doesn’t just require time and money, but also mental and emotional focus.

If you can’t or won’t apply those, you might as well not waste resources trying to earn a degree.

Going straight into the workforce might seem like an immediate way to learn practical skills – but it’s hard to say in advance what ‘practical’ really means

This was certainly true for Keonne Rodriguez. As much as his clear passion and portfolio justified skipping college, he was also very self-aware about the challenges he would face with a traditionally structured education. He even tried to attend college, twice, after completing his GED. His second try was at a computer science program at Oxford.

“I figured, it’s such a prestigious program, it must be different,” he says. “But I figured out it’s not the program, it’s me.” He dropped out, and soon after that he joined Blockchain.

Cases like Rodriguez’s, it must be emphasized, are exceedingly rare – particularly because Rodriguez, whose father was a lifeguard, didn’t come into the world with either a thick family bankroll or a built-in professional network.

Many of the world’s celebrated dropouts rely on those advantages: Bill Gates’ father, for instance, was a prominent lawyer, and his mother was a major business figure who helped Microsoft ink a crucial early deal with IBM.

And as much as we celebrate successful dropouts, it’s just as important to remember those who fail. We don’t know most of their names, but you might include Mark Zuckerberg: Facebook has made him fabulously wealthy, but blindness to complex social impacts may earn his creation the same infamy now accorded tobacco and oil companies.

Or take Theranos founder Elizabeth Holmes, who modeled herself after Steve Jobs, in part by dropping out of Stanford. She is now facing criminal fraud charges in large part because of her lack of education in the basic medical science at the core of her failed company. At age 37, her name is tarnished forever.

“There’s also an ethics component” to education, says Matthew D’Amore, a professor and associate dean at Cornell Tech, which offers courses on blockchain and the law. “How does my idea fit into the world? Is my idea just designed to make money or is it designed to improve people’s lives? Those kinds of things don’t necessarily come naturally to folks, and the opportunity to get that perspective exists on a college campus differently than elsewhere.”

It’s a final helpful way to think about the college question for aspiring blockchain innovators. Going straight into the workforce might seem like an immediate way to learn practical skills – but it’s hard to say in advance what “practical” really means.