We Look At Who’s Hiring vs Who’s Firing (#GotBitcoin)

A slowdown in hiring in transportation and logistics sector follows strong expansion over previous year. We Look At Who’s Hiring vs Who’s Firing (#GotBitcoin)

Hiring at parcel-delivery firms plummeted in February as job growth slowed sharply across the broader U.S. economy, even as payrolls expanded in other logistics sectors.

Related:

With Crypto Jobs Available, US Universities Are Turning to Blockchain Education (#GotBitcoin?)

This Sector Could Have A Half Million Job Openings And Opportunities For Older Workers

Coronavirus Commercial And Residential Cleaning Services See A 75% Spike In Demand

Workers Are Quitting Hotel And Restaurant Jobs At The Highest Rate On Record

Where The Best Paying Jobs Are (#GotBitcoin?)

Helping 10,000 People Get A Job In Crypto

To Survive The Pandemic, Entrepreneurs Might Try Learning From Nature

Courier and messenger companies, made up mostly of the companies that deliver packages to homes and businesses, cut 9,700 jobs last month, according to preliminary figures the Labor Department released Friday. Warehouse operators and trucking companies added a combined 4,800 jobs from January to February.

The slide in parcel hiring was the steepest drop since January 2017 in a sector that includes United Parcel Service Inc. and FedEx Corp. Package carriers have added 53,100 jobs over the past 12 months, including 14,500 in January, as e-commerce growth led to more delivery demand.

“This was not a great month for couriers and messengers,” said Martha Gimbel, director of economic research at jobs website Indeed.com’s hiring lab.

Delivery-firm wages also have slipped, counter to the broader national trend. The average hourly wage in the courier and messenger sector was about $21 in January, the most recent data available by sector, compared with $22 a year earlier, Ms. Gimbel said.

The 2018 labor agreement between UPS and unionized workers in its main package division “should lower the effective hourly rate of marginal labor,” Bernstein Research analyst David Vernon wrote in a Friday research note.

Ms. Gimbel noted courier and messenger payrolls have grown by 8% in a year and that movements in hiring in specific industry sectors can be volatile from time to time.

“In the long view, growth has been quite strong,” Ms. Gimbel said. “One month should not cause people to panic, particularly when it was a month that was slow all around.”

Overall the U.S. economy added 20,000 jobs in February, far fewer than economists had expected. Goods-producing industries slashed payrolls by 32,000 jobs, potentially a signal of weaker output that would reduce demand for transportation and logistics services.

Construction payrolls shrank by 31,000, and retailers cut 6,100 positions. Manufacturing added 4,000 jobs, down from 21,000 in January, and factory output softened as cold weather in the Midwest caused transportation disruptions and closed factories.

Warehouse operators added 3,900 jobs last month, nearly a third of January’s postholiday hiring surge.

“There’s a real shortage of labor,” Hamid Moghadam, chief executive of industrial real estate giant Prologis Inc., said in an interview this week. The world’s largest owner of warehouses and distribution centers, the company is working with local workforce programs in Southern California and elsewhere to train high-school students for logistics jobs.

Distribution and storage companies are raising pay and other benefits as they compete with Amazon.com Inc. and others for staff while unemployment is hovering around its lowest in decades.

Trucking companies hired 900 workers in February, the 10th straight month of growth as carriers coming off one of the strongest freight markets in years continue adding capacity. Fleets ordered new trucks at a record clip last year, and have been raising pay to boost hiring.

Long-distance truckload employment added about 13,000 workers last year, “nearly double the number added in 2017, helped partly by a 4% increase in average hourly wages,” KeyBanc Capital Markets analyst Todd Fowler wrote in a Thursday research note. “In our view, industry employment trends are contributing to reduced driver attrition, further supporting incremental capacity near term.”

Updated: 8-11-2020

U.S. Employers Shed IT Jobs Amid Faltering Reopening Plans

Job postings in once-hot tech sector cool off as firms assess economic outlook.

U.S. employers shed roughly 134,000 information-technology jobs in July, according to IT trade group CompTIA, a signal that companies might be taking a wait-and-see approach as questions remain over everything from a new stimulus package to the return of in-person schooling amid the coronavirus pandemic.

July marked the first month of tech job declines since March, as employers across industries expanded net IT head count in April, May and June, according to CompTIA. While tech jobs remain among the most in-demand, some firms may be hesitant to fill openings as they assess how the economy develops, said Tim Herbert, CompTIA’s executive vice president for research and market intelligence.

“Perhaps they want to see how the stimulus package is going to play out,” Mr. Herbert said. “They want to see how states navigate school reopenings—a lot of those factors that they probably are hoping to get some clarity on before investing in additional hires.”

The results are based on an analysis of last week’s U.S. Labor Department data, which reported that 1.8 million new jobs were added in July, lowering the unemployment rate to 10.2% from 11.1% in June. The unemployment rate for tech jobs stood at 4.4% in July, up from 4.3% in June.

Roughly half of the nation’s 12 million technology workers are employed in the enterprise-tech sector, with the rest in IT-related jobs at companies spread across the economy. Together they represent roughly 8% of the U.S. workforce, according to CompTIA.

CompTIA’s analysis of tech-sector employment includes positions such as sales, marketing and operations, as well as core technology workers.

Tech-sector job cuts in July were driven in part by losses in the IT-and-software services segment, as well as the tech manufacturing sector, which produces hardware and other components, CompTIA said.

Across all sectors, job postings in IT fell to roughly 235,000 in July, down from nearly 269,000 in June and about 358,000 in March. The sectors with the most tech-job postings in July were professional and technical services with 39,956 postings, finance and insurance at 18,756, and manufacturing at 17,473.

“Professionals across the board are feeling the tightened market,” said Adam Lombardi, senior director of delivery transformation at staffing firm Kforce Inc., speaking about tech workers.

Despite the job losses in July, more than 500,000 IT jobs have been added so far this year, including a net 203,000 jobs from April to July—with tech jobs related to cybersecurity and e-commerce fueling many of the gains, CompTIA analysts said.

Graig Paglieri, the technology and engineering group president at staffing firm Randstad US, said the company’s clients have been beefing up their IT support staff job postings. “As many of us continue to work from home, there’s an increased burden on companies to provide sufficient technical support to their remote employees, which is why we’ve seen an increase in IT support roles by 16% in July.”

Updated: 2-1-2021

The CIA Fine-Tunes Its Hiring Pitch To Millennials And Gen Z

The agency has revamped its recruiting to attract younger workers who might be skeptical of its mission.

Recruitment was a clubby affair in the earliest years of the Central Intelligence Agency. The CIA, founded in 1947, scoured Ivy League campuses and elite East Coast social circles to find promising young men (and a handful of women) to fill out its ranks at home and abroad.

Today, the agency is turning to more public tools in a hiring push to expand and diversify its ranks. It runs video advertisements, has an Instagram account, and posts job openings on LinkedIn. It even launched a splashy new website in January whose content includes an advice column and dog-training tips, plus a bold new black-and-white logo.

The CIA hopes these efforts will convince the millions of millennials and Gen-Zers scrolling through their phones and streaming TV to consider a career in intelligence.

“We had to go where the talent is,” says Sheronda Dorsey, the CIA’s deputy associate director for talent, who is now on LinkedIn herself.

The agency has always relied on a steady influx of young people, especially recent college graduates, but has periodically faced challenges hiring them. Students frequently protested on-campus CIA recruiters in the 1960s, for instance.

Today’s CIA has its own obstacles. Polling shows that some millennials are more critical of past CIA actions and skeptical of the intelligence community’s role than older generations are. The agency faces hiring competition from the private sector. And today’s diffuse foreign policy arena presents no single mission to inspire recruits, like the focus on fighting al Qaeda after the 9/11 attacks.

The Catch-22 of the CIA’s hiring push is that while some of its controversial past actions are now public, its recruiters can’t tell candidates specifically what they do accomplish. CIA employees past and present, including Ms. Dorsey, speak instead with hushed reverence about “the mission,” a unique set of exciting and meaningful security issues that they get to work on.

Hiring today is less an issue of sheer numbers—its number of new hires in 2020 was the third-largest in a decade, Ms. Dorsey says—so much as attracting people of more diverse backgrounds. While there are no specific benchmarks, she says the agency hopes to increase racial, cultural, disability, sexual orientation and gender diversity so that its workforce is “reflective of America.” She adds that there are openings at all levels, including for midcareer professionals.

An internal demographic survey of those employed in the intelligence community, which comprises 17 bodies including the CIA, found that 26.5% of them were minorities in the fiscal year 2019.

Ms. Dorsey says STEM talent is a hiring priority. “We know that we have deep competition for talent in the STEM field, and especially where they can offer higher compensation packages,” she says. The agency uses the government’s standardized General Schedule pay scale.

A majority of Americans, 64%, gave the CIA a favorable rating in a Pew survey from 2018. But another 2018 survey by the University of Texas pointed to a generational divide: 78% of those born between 1928 and 1945 agreed that the intelligence community “plays a vital role in protecting the country,” versus only 47% of millennials.

Richard Solomon, a 24-year-old graduate of Indiana University who majored in international relations, says he once dreamed of becoming a spy and first learned Arabic with that in mind. But he became disillusioned by the post-9/11 War on Terror.

“This sexy image I had as a child, of undercover CIA agents kind of saving the world, slowly eroded and was replaced by knowledge of torture chambers,” he says, encapsulating some of his generation’s skepticism. He is applying to Ph.D. programs to study the political economy of the Middle East, but hopes to focus on agriculture, rather than topics with straightforward intelligence applications.

The CIA operated secret prisons known as black sites to detain and interrogate suspected terrorists after 9/11. The Senate Intelligence Committee said some of the interrogation techniques used there amounted to torture in a 2014 report. A 2014 Pew survey of 1,001 American adults found that 44% of those under 30 believed that the CIA’s post-9/11 interrogation practices were justified, versus 60% of those over 50.

The CIA declined to comment on the prisons. In 2014, then-director John Brennan declined to label any of the techniques as “torture,” but described some unauthorized interrogation methods as “abhorrent.”

Today, the CIA’s digital face-lift coincides with a new presidential administration. Mr. Brennan, whose directorship ended in 2017, says the Biden administration has sent out a “very strong signal on diversity” with its intelligence appointees, including the first-ever female director of national intelligence, Avril Haines.

Douglas London, who retired in 2019 after 34 years in the CIA, questions whether public outreach is the best way to increase diversity. Instead, he says, just as with past generations of elite hires, “You have to go and find them,” with more personalized overtures to, for instance, promising students of specific regions and languages.

Mr. London sat on CIA promotion and hiring panels throughout his career. He says getting hired was one thing, but continuing to work there as a minority could present challenges. He says that in the clandestine Directorate of Operations where he worked, there was resistance to matching nonwhite officers to certain assignments.

“It was not uncommon to hear an assertion like, ‘You can’t send a Black officer to Paris or Riyadh,’ whereas there was no hesitation assigning a white officer to Baghdad,” Mr. London says. But he doesn’t believe these norms to be insurmountable obstacles and maintains that the CIA is a “sensational place to work.”

The CIA declined to respond to Mr. London’s comments.

Whoever decides to take up the CIA’s call for applications should prepare for a rigorous vetting process, which Ms. Dorsey says can take a year or longer. She assures anxious candidates: “We are looking for honest people, not perfect people.”

Some prospective applicants are already prepared for such scrutiny. “I’ve thought about vetting and security clearances my entire life,” says 20-year-old Lauren Wadas, a junior at Brigham Young University-Idaho who is interested in working at the CIA. She keeps separate personal and professional Twitter accounts, and uses Facebook “only for church and my grandparents.”

The CIA has advice for people like Ms. Wadas on its website: “For your security, if you are interested in or have applied for a job at CIA, do not follow us on social media.”

Updated: 3-5-2021

Oilfield Jobs Tank Again In U.S. After Brief Recovery Last Year

The hired hands of America’s oil patch have now lost all the job gains they made during a brief recovery last year, according to a trade group.

The companies that frack wells and make the equipment necessary to produce oil cut an estimated 12,321 jobs over a three-month stretch ending in February, according to an analysis of labor market data by the industry-funded Energy Workforce & Technology Council. That wiped out the 11,282 jobs added between September and November, when shale companies were beginning to climb back from history’s worst crude crash earlier in the year.

Nearly all of the large publicly traded shale explorers are continuing to hold the line and not boost output this year, in an effort to appease investors demanding greater returns. The U.S. rig count is still down by about half compared to the start of last year, according to Baker Hughes Co.

The job estimates are preliminary and subject to revisions by the U.S. Bureau of Labor Statistics in future months.

Updated: 3-26-2021

Spotify Plans Hiring Spree In Bid To Challenge Clubhouse

After agreeing to buy Locker Room app, the streaming giant has big ambitions for Clubhouse-style live audio.

Spotify Technology SA is planning a major push into live audio, hoping to corner the market on what it thinks could be its next big business.

The company aims to hire more than 100 people to work on the effort, and has begun talking to talent about exclusive shows, according to people familiar with the matter. The idea is to capitalize on a new market popularized by Discord and Clubhouse, which let users participate in live audio chats — a 21st century version of call-in radio shows.

Just last month, Spotify announced it was buying Betty Labs, the owner of the Locker Room app, which sports journalists and fans use to discuss major games after they happen. Spotify is already talking to hosts of its in-house podcasts about developing ideas for the new version of the app, according to the people, who asked not to be identified because the plans are still being formulated. Spotify expects to pay some talent several hundred thousand dollars to host shows.

The Swedish company already operates the largest on-demand music service in the world and is trying to dominate all aspects of online audio. It has spent more than $1 billion buying podcasting companies and adding more than 2 million podcasts to its platform, hoping the shows will bring in new customers and fuel its advertising sales. Spotify has also added audiobooks.

Unlike podcasts, services like Locker Room or Clubhouse are participatory and live. Locker Room hosts can invite listeners onto the virtual stage to pose a question or discuss a new idea.

While it’s still not clear how big the business for these live-audio apps will be, Spotify doesn’t want to risk missing out on a potentially major shift in the industry. Clubhouse, which gained an early reputation for hosting conversations about tech and investing, just raised money to fund its social audio app at a valuation of $4 billion.

Spotify’s top podcasting executives, including Courtney Holt, Max Cutler and Bill Simmons, are overseeing the programming for live audio. Cutler founded Parcast, a podcasting studio Spotify acquired in 2019, and he’s now also in charge of audiobooks. Cutler has begun talking about ideas with producers and hosts — both inside and outside the company. In one scenario, hosts of pop-culture podcasts could stage live chats after new episodes of a popular series, the people said.

Another option is for sports podcasters to talk live after a major sporting event. Simmons, host of one of the most popular sports podcasts, used Locker Room after rounds in the Masters golf tournament. Simmons, like Cutler, sold a company he founded to Spotify. Both Cutler and Simmons declined to comment on their plans.

Though Locker Room is devoted to sports, the revamped app will branch out into pop culture and music. The development of the new service is being led by Gustav Soderstrom, Spotify’s head of research and development. Soderstrom suggested musicians might use the app to offer the modern version of liner notes on an album.

“Interactivity and live is something our creators have been asking us for for a long time,” he said in an interview when Spotify announced the Locker Room acquisition. “Were trying to facilitate interactivity between creators and fans.”

The company is racing to get a version of the app that works on Android phones — something Clubhouse has yet to do. The growth of Clubhouse has slowed at a time when many of the largest technology companies, including Facebook and Twitter, are pushing into its market.

But Spotify may have an edge. Unlike Facebook or Twitter, which don’t have much of an audio business at the moment, Spotify is already the top audio service.

Updated: 3-31-2021

Musk Doubles Hiring Goal To 10,000 at Tesla’s Austin Factory

Elon Musk can’t stop tweeting about all the jobs he’s bringing to Texas.

Tesla Inc.’s new factory in Austin will need 10,000 hires through 2022, double the previous pronouncement, Musk said Wednesday on Twitter. The tweet came less than an hour before President Joe Biden is slated to lay out his infrastructure plan, in which clean energy and new jobs will be a big focus.

Musk is rapidly expanding his Texas footprint. The new hiring goal in Austin represents a big step up from June, when Tesla told local officials that the factory would bring 5,000 “middle-skill” jobs to Travis County, with positions that pay solid wages without requiring substantial higher education. And this week, Musk issued a public invitation to engineers interested in working for Space Exploration Technologies Corp., his rocket maker, in South Texas.

Over 10,000 people are needed for Giga Texas just through 2022!

— Elon Musk (@elonmusk) March 31, 2021

– 5 mins from airport

-15 mins from downtown

– Right on Colorado river https://t.co/w454iXedxB

The Austin plant will produce the forthcoming electric Cybertruck and Model Y crossovers for customers on the East Coast. Texas is the third most popular state for Tesla vehicles, after California and Florida.

Drone footage of the Austin plant shows that construction is moving quickly. The challenge for Tesla in 2021 is one of global expansion amid increased competition as legacy automakers play catch-up with regard to electric vehicles.

Updated: 5-9-2021

Summer Jobs For Teens Make A Comeback—But Not All Types

It’s easy to find a gig as a lifeguard. Demand is high for work in child care and food service, too. But teens and young adults are finding more competition for paid internships.

Mayson VanMeter hoped to switch gears from her cashier jobs to find a more career-oriented internship in human resources this summer, after her freshman year in college—but she hit a wall.

“It’s kind of hard to find a paid internship, honestly,” says the 19-year-old University of Southern Indiana student. She has been applying online to numerous posts listed on LinkedIn and Google, but hasn’t heard back from anyone yet. She is vaccinated and open to in-person work. But with her school year ended, she feels like the kind of summer experience she wants may not be in the cards.

“If I can’t find an internship, then I’ll probably stay here at Rural King,” she says of the farm-supply store chain where she’s worked since January. She is paying her way through college and says some income is essential.

This year is shaping up as a boom year for summer jobs for young people, but it’s an uneven spread. Industries that traditionally hire teenagers, like hospitality and retail, are rapidly expanding again. Millions of young adults have been vaccinated against Covid-19, making them more comfortable than they were last year with high-contact, in-person jobs. And many teenagers, who suffered some of the biggest job losses in 2020, really need the money.

But for those interested in more white-collar work like paid internships and research gigs, it can still be competitive. Short-term positions are often not critical to running a business, so there are fewer of them available in many fields than there were before the pandemic, says AnnElizabeth Konkel, a Washington, D.C.-based economist with the Indeed Hiring Lab, a research arm of the jobs website Indeed.

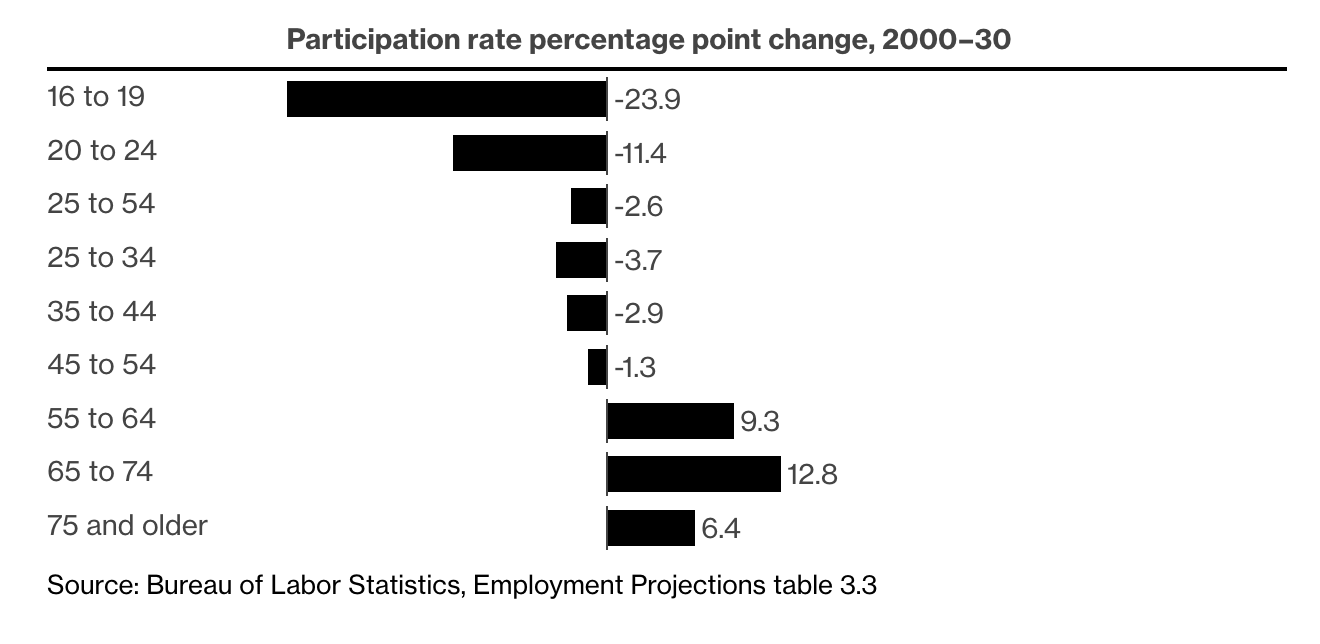

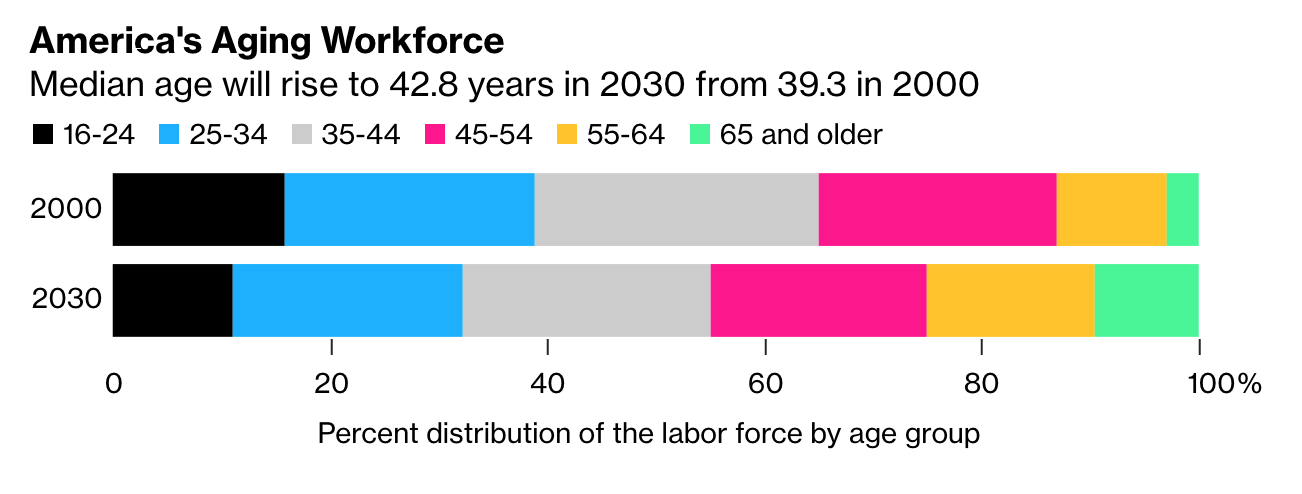

Youth summer employment has been trending downward since the 1970s, according to monthly data collected by the Bureau of Labor Statistics. In July 1978, 71.8% of workers aged 16 to 19 participated in the labor force. In the 2010s, that number never topped 45%.

It’s not just that employer demand for young workers dried up, says Andrew Challenger, a senior vice president at Challenger, Gray & Christmas, an executive coaching firm. Some modern teenagers also have incentives to spend their summers on unpaid activities like volunteering and sports, especially with college admissions in mind.

He believes that this year’s post-lockdown summer may buck that longstanding trend, because more teenagers typically want jobs when the labor market does better. His firm estimates that U.S. teens will add two million new jobs this summer. “All the industries where teens traditionally find jobs, like small retail businesses, restaurants and entertainment, are preparing for a huge surge,” he says.

Many of those old-school, paid summer jobs are finding it tough to hire enough young people. “We’re facing a camp counselor and lifeguard shortage this summer,” says Tom Rosenberg, CEO of the American Camp Association, a nonprofit. The talent pool for hiring camp staff, mainly 18- to 25-year-olds, has been challenged by disrupted school schedules, he says. “U.S. camp workers are less available this year than at any other time in the last 50 years.”

“We are ready to hire just about anybody who walks in the door at this point,” says Bill Bumbernick, owner of the Surfing Pig restaurant in North Wildwood, N.J., on the Jersey Shore. He says that young people ages 18 to 25 comprise most of his front-of-the-house staff, like waiters and busboys.

The demand for babysitting, another summer job mainstay for young people, is picking up fast this spring after a pandemic-induced slowdown last year, says Rachel Charlupski, Miami-based owner of the Babysitting Co. The company has about 2,500 sitters on its payroll this year. “This year is probably 200% more busy than in 2019—it’s unbelievable,” she says.

While there are plenty of openings for teens in these bread-and-butter fields, other kinds of summer work, like professional internships and research positions, can still feel competitive today, according to young people who have applied for them.

There are relatively fewer internship postings this year than last year, according to data posted by Indeed in April. The fraction of internships as a share of overall postings on the website was 39% lower than in 2019 and 15% lower than in 2020. At the same time, applicants’ internship-related searches on the website were 38% higher in April 2021 than in April 2020.

Alexis Hatch, an 18-year-old freshman at the University of Chicago, wrote 72 cover letters last winter in hopes of getting a paid research role this summer. She was chastened by her experience cold-applying for summer jobs last fall on Handshake, the student jobs platform. She never heard back from a single one.

“So I had to go ballistic and nuclear with this cover letter thing,” she says. She eventually got and accepted a paid summer research position at the Ming Xu Laboratory at her university, where she will help test a novel skin stem-cell treatment for cocaine overdoses on mice.

As a prospective medical student, she felt it was crucial to spend her summer on research rather than a less academic job. Based on conversations with older students, she believes it was far more difficult this year than it was before the pandemic to find a paid research position.

Vaccines have opened up new frontiers for many summer jobs: Ms. Hatch, for instance, will be going into her lab in-person. Jamee McAdoo, a 19-year-old in Little Rock, Ark., will start next month as an in-person summer associate at her local library.

“I just got my second shot, so I’m excited to go in,” she says. It will mark a contrast from her classes at Jackson State University in Mississippi, which she has been attending remotely since March 2020. “I think it will be good for me not to be cooped up at home all day,” she says.

There’s still some uncertainty about the logistics of all kinds of summer jobs. Quinn Nelson, an 18-year-old high school senior in Oakland, Calif., hopes to work again as a sailing instructor this summer, but is still not sure when or if it will happen. “Typically, they email staff about the dates for sailing sessions by now, but we’re still waiting on that,” she says.

That being said, she’s in no rush to figure out the specifics.

“The way I see it, it’s just something to fill up my day and keep me busy after graduation,” she says. “All my friends and I are really trying to take a break now. We’re so burned out from this school year.”

Updated: 6-19-2021

Hire Black And Latinx Tech Talent From These Overlooked Cities

Companies recruiting in STEM fields need to look beyond Atlanta and Miami.

After last summer’s racial justice protests, numerous tech companies promised to hire, retain and promote more from the Black community. Now another summer is upon us and not much has changed. The industry has a track record of insufficient action on diversity despite consistent promises.

How can tech CEOs do better? Let’s begin first with a major roadblock: the extreme geographic concentration of the industry and its workforce. Seventy-five percent of venture capital funding — which is mostly in tech — has been captured by New York, California, and Massachusetts, with the focus heavily on the tech superclusters of the San Francisco Bay Area, Boston, New York and Seattle. Ironic, indeed, for the industry that is meant to be the de-concentrator and the killer of distance.

In an industry that experiences fast growth and a perennial war for talent, hiring managers tend to be both risk-averse and expedient: They hire from the same places, often close to these hubs, because it’s harder to spot and recruit talent from a distance.

But a firm based in Boston or Seattle is going to run into the reality that less than 2% of the Black workforce lives in Massachusetts and less than 1% lives in Washington state. Almost 60% of the Black labor force lives in the South.

The pandemic could have made long-distance recruiting easier. Remote work could have opened possibilities for hiring managers to cast a much wider net. It hasn’t so far — but the remote working window is still open.

Many tech companies have extended flexible working policies for the post-pandemic era. Some, such as Facebook, have pledged to let their employees continue remote work indefinitely.

So, where to look? Atlanta, with a majority Black population, has emerged as the go-to city for Black talent, with Google, Microsoft, among others setting up satellite offices there.

It ranked 10th in tech employment nationally, and is a hub of Black tech entrepreneurship, and is home to several excellent academic centers, including Georgia Tech and Emory University, as well as Morehouse and Spelman, two preeminent HBCUs. Then there’s Miami, with its majority Latinx population, which became the top destination for remote workers last year.

But although Atlanta and Miami offer some of the largest and most diverse STEM talent pools of all U.S. cities, both are already well above the median in cost of living. Neither is “under the radar” any longer.

Based on an analysis by my Digital Planet team at the Fletcher School at Tufts, there are several other cities recruiters should be looking in for Black and Latinx graduates with STEM backgrounds. All have relatively high rates of STEM graduates of color as a share of the population.

Five metro areas with deep benches of Black and Latinx STEM talent are Washington, Houston, Chicago, Dallas-Ft. Worth and Philadelphia. For Black talent specifically, recruiters could add Baltimore, Raleigh-Durham, Charlotte, Detroit, and Norfolk. And for Latinx talent, recruiters should add San Antonio, Phoenix, Orlando, Austin and Denver.

It’s not just a matter of which city has the most candidates, though. Recruiters will also care about how easy it is for those new hires to log on to video calls, upload their work, or download new assignments.

Washington, Baltimore, Philadelphia, Atlanta, Chicago and Detroit are already among the top 12 cities in the country in terms of median download speeds. But the cities in the South and Southwest do not have the same strengths in terms of digital infrastructure. In particular, cities such as Miami, Houston and Dallas-Ft. Worth would benefit from upgrading the accessibility of their high-speed internet.

According to a recently released report on the state of work-from-anywhere, internet connectivity problems are the biggest employee concern regarding remote work. Even if one can expect tech workers to have relatively better access or establish their own workarounds, note that the digital divide disproportionately affects households of color; for many companies, worries about reliable internet access for remote employees from such households could be a deterrent or an excuse to simply not recruit.

This factor seems to have escaped several governors and mayors offering incentives for remote workers to relocate. Consider the extreme examples of Shepherdstown, Lewisburg and Morgantown, three cities in West Virginia, where the governor is offering a $12,000 incentive to lure remote workers to the state. According to our analyses, West Virginia ranks 50th out of 50 states in digital infrastructure.

While slow internet is often perceived as a rural problem, 62% of urban West Virginia does not use the internet at broadband speeds. And in fact, across the U.S., urban households are three times less likely to have a broadband subscription than their rural counterparts. This is a serious deterrent to companies that would like to search for talent in a more diverse array of cities.

Hiring managers in tech companies need to become less risk averse and extend beyond the traditional source cities and target schools for recruiting fresh talent. And cities need to upgrade their digital infrastructure so that they can benefit from the boom in remote work.

Many hiring managers may agree with the Wells Fargo CEO’s misguided comment last fall that talent from under-represented populations is hard to find, especially for those with a STEM background. That simply isn’t true — if you know where to look. If tech companies start looking in some different places, we could be having a different conversation next summer.

Updated: 7-4-2021

Hiring And Wage Growth Are The Strongest For Restaurant, Hotel And Retail Jobs, Reflecting Consumers’ Desire To Get Out

A fading pandemic and heating U.S. economy appear to be paying off for lower-wage workers.

New jobs at restaurants, hotels, stores, salons and similar in-person roles accounted for about half of all payroll gains in June, according to the Labor Department. And workers in those industries are seeing larger raises than other employees.

“Americans are becoming more mobile and dining out more,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors. “Retailers and restaurants are having to pay more to hire workers to meet that demand.”

Restaurants and other hospitality businesses added a seasonally adjusted 343,000 jobs in June, the department said Friday. Retailers added 67,000 jobs last month, including strong gains at clothing stores, indicating Americans are getting dressed up to go out and back to offices.

Similarly, personal-services businesses such as salons and dry cleaners added 29,000 jobs. Overall, employers added in 850,000 jobs last month, the best monthly gain since August 2020.

In the first six months of the year, the leisure and hospitality sector alone has accounted for nearly 50% of the 3.3 million jobs added in the U.S.

The rapid hiring reflects a renewed desire from consumers to travel, dine with friends and shop. It also suggests that constraints on the labor supply could be starting to ease.

Wages are rising and employers are offering hiring bonuses, including up to $1,500 to work at a fast-food restaurant, to attract workers. Meanwhile widespread availability of the Covid-19 vaccine is easing fears over contracting the virus.

Nearly half of states have withdrawn enhanced unemployment payments, which many Republicans and some economists said provided a disincentive to return to work, when recipients often received the equivalent of working full time at $15 an hour.

Average hourly wages for retail workers were up 8.6% in June from February 2020, before the pandemic took hold in the U.S. Wages for restaurants and other hospitality workers were up 7.9%.

Both gains are above both overall wage growth, at 6.6% in that period, and inflation. The average hourly wage in the hospitality sector was $18.23 an hour in June, and $21.92 in the retail sector, versus $30.40 for private-sector workers overall, according to Labor Department data.

“The food-service sector is out of control,” said Eugene Lupario, chief executive of SVS Group, a staffing firm based in Oakland, Calif. “Employers are willing to pay almost anything they need to get workers.”

He said starting restaurant wages are nearing $20 an hour in the San Francisco area, from around $15 an hour before the pandemic. Some clients are willing to take workers who have already completed an eight-hour shift at another business, and pay them overtime wages to do so, Mr. Lupario said.

“There is no shortage of opportunities, but we still have a lot of job seekers asking if they can get a customer-service job they can do from home, rather than return to a restaurant,” he said.

Better pay could be drawing workers into the labor market.

About 900,000 fewer Americans reported themselves as being prevented from looking for work due to the pandemic in June, versus May, according to the Labor Department.

And Friday’s report showed the number of people who became unemployed because they either voluntarily quit their jobs or re-entered the workforce rose by 300,000—a sign of confidence in the labor market—while the number who were unemployed due to job loss fell.

Also, the number of workers who said they hold part-time jobs but prefer full-time work declined by more than 600,000 last month.

“We’ve had this sustained run of wage increases particularly in lower-wage sectors,” said Robert Rosener, economist at Morgan Stanley & Co.

While wage gains are beneficial to workers, they have consequences for businesses and consumers. Businesses often attempt to pass along higher labor costs to customers by raising prices, which contributes to higher inflation. If companies can’t pass on all their costs, their profit margins will narrow.

The recent stronger hiring in low-wage fields brings them closer to fully recovering the jobs lost in March and April of last year.

The leisure and hospitality sector, including restaurants, still had 2.2 million fewer jobs in June than in February 2020, according to an analysis of Labor Department data. Retail employment was down more than 300,000 last month from its pre-pandemic level, though some categories, including nonstore retailers, like Amazon.com Inc., general merchandise stores, like Walmart Inc., and building-supply stores, like Home Depot Inc., employ more workers than they did at the start of last year.

Economists, including Mr. Rosener, expect further improvement in hiring.

“We should expect that this quickening pace of job growth will continue over the summer and into the fall,” he said.

At Amusement Parks, Pay Raises And Free Fries Get Teens To Work

Kennywood, like other amusement parks across the country, has increased pay and offered other perks to attract more workers.

Grant McCray was busy preparing trays of chicken fingers and french fries at Kennywood, an amusement park just outside Pittsburgh. It was pushing 90 degrees, but the 19-year-old said he didn’t mind.

Mr. McCray earns $15 an hour cooking for other young people who work at the park’s roller coasters, arcade games and gift shops. Earlier this year, he quit a $10-an-hour job at Chipotle when a friend told him he could earn a lot more at Kennywood, which raised pay for summer employees amid a severe worker shortage. Now he has money left over after splitting $750 a month in rent and utilities with a roommate, he said.

“It’s better than all my other jobs,” Mr. McCray said.

The pandemic dealt amusement parks a severe blow last year, and they have been working to staff up amid the reopening this summer, by increasing pay and handing out other perks—from free french fries to free family passes.

Amusement parks across the country have been forced to increase wages. Universal Studios Orlando increased its minimum pay across a range of positions to $15 an hour, up from $13 an hour for 18,000 employees.

Cedar Point, an amusement park in Sandusky, Ohio, doubled starting pay to $20 an hour, and it had to reduce its operating hours at the start of the season due a shortage of workers. And Splish Splash, a water park on Long Island, bumped pay up to $18 an hour.

It is a boon for teens seeking summer jobs. The share of U.S. teens who were employed stood at 33.2% in May, its highest point since 2008, according to Labor Department data. Meanwhile, the percentage of adults with jobs is still well below pre-pandemic levels.

Isabella Ladisic, 19, who told Mr. McCray about the pay increases at Kennywood, now works alongside him earning $15 an hour, up from $10 a year ago. She said she would use her summer earnings to help pay tuition at St. Vincent College in Latrobe, Pa., where she is studying biology.

Kennywood opened in 1899 along the Monongahela River, and its roller coasters rise above the trees across the river from a rusting U.S. Steel plant that has been puffing steam for almost as long. The amusement park’s black-and-gold Steel Curtain, opened in 2019, boasts the highest inversion in the world.

Officials at Kennywood’s owner, Palace Entertainment, which has 25 attractions in 10 states and in Australia, realized in the first quarter that the flood of people buying passes to Kennywood and a tightening labor market were going to require higher pay to attract enough summer employees, said John Reilly, the company’s chief operating officer.

“It’s a dynamic environment, and you have to be flexible,” said Mr. Reilly, who walked through the park on a recent morning as customers started pouring in. The company analyzed local wages for similar jobs in all of its markets. “We saw what the cost of not reacting quickly was,” he said.

The company increased pay rates at Kennywood, up to $15 an hour in many cases, and offered free french fries and cotton candy to anyone willing to drive out to a job fair and fill out an application. Workers who were hired in May each got four passes to the park for family members.

So far, the company has hired about 2,000 summer employees at Kennywood and two other parks, Sandcastle and Idlewild, more than it had anticipated in March, and it plans to keep hiring workers. For all of 2019, it hired 2,700 workers at the three parks.

The company is now planning to offer a retention bonus at Kennywood and 11 other properties, equal to $1.25 an hour worked, to employees who stay through the date they committed to when they were hired, said Nick Paradise, a spokesman for Palace Entertainment.

The pay increases are a plus for returning summer workers. “It’s the cherry on the top,” said Lamar Hill, 27, back for his seventh year. As a manager in games and retail, he works six days a week and earns $15 an hour, $1 more than the company paid for that position in the past.

On a recent day, Zach Koontz, 16, secured riders in their seats on the Phantom’s Revenge, a roller coaster that hits a dizzying 80 miles an hour. With a promotion to unit supervisor, he earns $14 an hour, a job that paid $9.75 an hour last year.

He also referred his sister Sydney Pivovarnik, 21, to a job interning in group sales. A mathematical economics major at Gettysburg College, she said she was attracted by the resume-building experience and the chance to earn $14 an hour, $3 more than the company paid last year for the position.

“I feel like $14 is a pretty decent wage for a starting office job,” she said. “I save everything I can.”

Updated: 7-7-2021

U.S. Job Openings Rise To Record, Underscore Hiring Difficulties

U.S. job openings rose to a fresh record high in May, underscoring persistent hiring difficulties and reflecting more vacancies in the health care, education and hospitality industries.

The number of available positions climbed to 9.21 million during the month from a downwardly revised 9.19 million in April, the Labor Department’s Job Openings and Labor Turnover Survey, or JOLTS, showed Wednesday.

The availability of vaccines paired with a broader reopening of the economy has spurred a snapback in economic activity in recent months, but consumer demand has largely outpaced businesses’ ability to hire. In a race to increase headcount, many businesses have begun raising wages and offering incentives like hiring bonuses to attract applicants.

The number of people who voluntarily left their jobs decreased to a still-lofty 3.6 million in May, as the quits rate dropped to 2.5%. Quits fell in nearly all industries, though they picked up slightly for restaurants and hotels.

At the same time, the figures highlight an elevated number of Americans quitting their jobs to search out new opportunities. Whether seeking more flexible hours, increased pay or the ability to work remotely, the number of quits suggests workers are confident in their ability to find other employment.

The enigma of a worker shortage at a time when millions of Americans remain out of work likely reflects a myriad of factors including child care challenges, lingering coronavirus concerns and expanded jobless benefits. Those factors will likely abate in the coming months though, supporting additional hiring.

Accommodation and food service job openings increased by 89,000 in May, and by 81,000 in health care. Hiring at restaurants and hotels remained robust.

Total hires decreased to 5.93 million in May from 6.01 million, while the hires rate eased to 4.1%. The decline was concentrated in construction, government and professional services.

The total number of vacancies exceeded hires by 3.28 million in May, the highest in records to 2000.

The latest jobs report showed payrolls increased 850,000 in June, the largest advance in 10 months, suggesting firms were having greater success a month later in recruiting workers to fill open positions. Still, other data underscore ongoing labor constraints.

The employment measures for the Institute for Supply Management’s manufacturing and services surveys both contracted in June. A separate report from the National Federation of Independent Business showed small business job openings eased slightly in June, but the reading was second only to the record seen a month earlier. And on June 25, job search website Indeed had 33.6% more job postings than the pre-pandemic baseline.

Updated: 7-23-2021

London Becomes Jobs Hot Spot As Finance And Consulting Hire

London’s jobs market has sprung back to life, becoming a hot spot for the first time since the pandemic closed vast sections of the economy, two separate surveys showed.

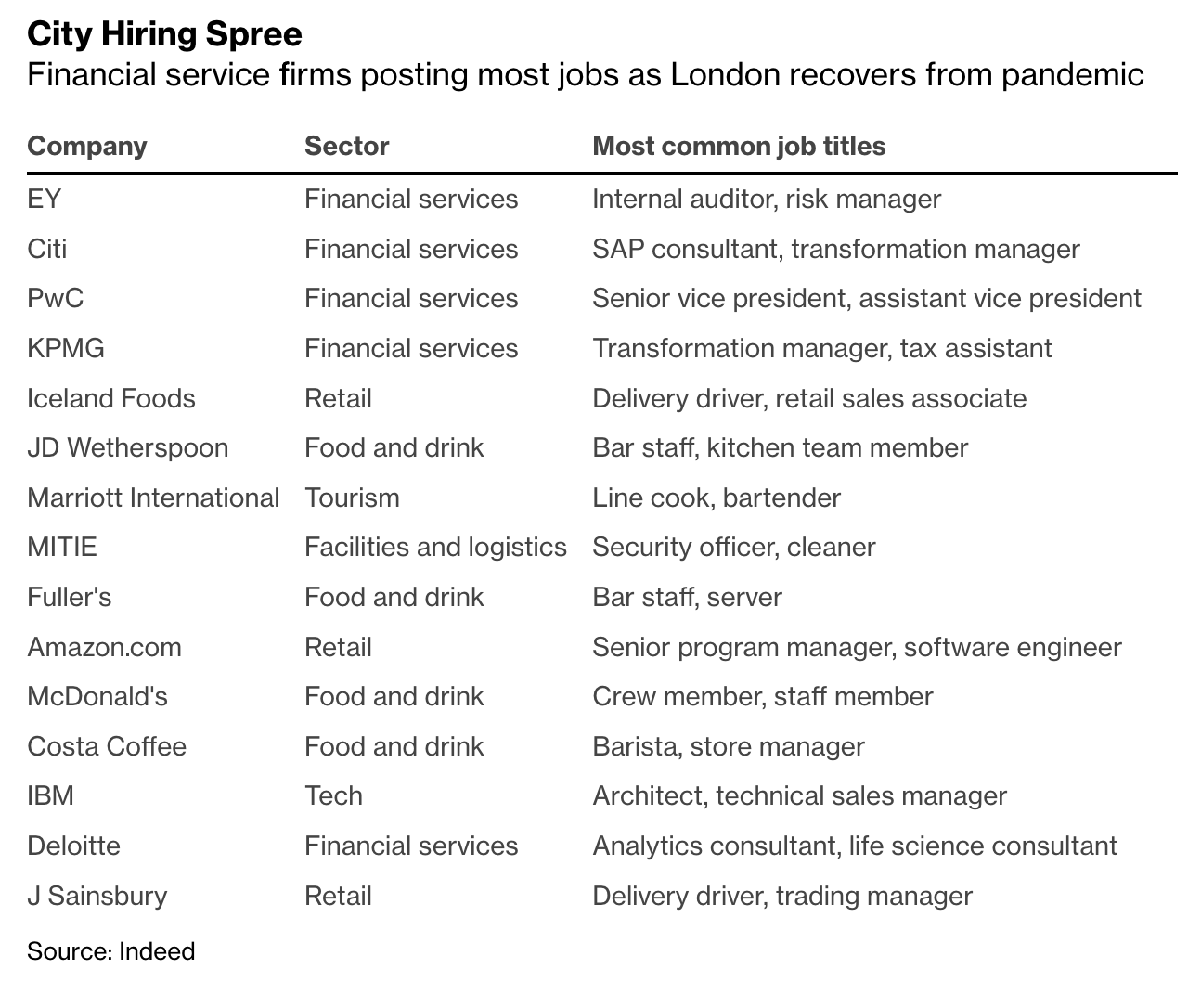

The Recruitment & Employment Confederation said London had six of the top 10 areas in the U.K. for new job postings in the week ending July 18. Consulting and financial firms were among the top companies seeking staff in the city, led by EY, Citigroup Inc., PwC and KPMG, a report by the job search website Indeed showed.

London has lagged the rest of the nation in generating jobs, dragged down by a trend toward remote working that kept people out of the capital and devastated hospitality and retail jobs that depend on footfall. The city’s revival adds to evidence of tightening in the national labor market that’s starting to push up wages, fanning concerns about inflation.

“There’s a real sense of employer confidence has returned,” said Kate Shoesmith, deputy chief executive officer of REC. “London’s jobs market is kicking into gear as the hospitality and retail sectors open and more people return to offices.”

REC counted 1.57 million active job postings across the U.K. About 194,000 were added in the last week, a pace that’s been stable since early June. Childminders, driving instructors, bricklayers and information technology staff saw the biggest jump in demand. Want advertisements dropped for teacher, butchers and vehicle cleaners.

The Bank of England is carefully watching signs of strain in the labor market as it considers whether to pare back stimulus measures it put in place in early 2020. As the government winds down a furlough support for wages of those whose workplaces were closed during the pandemic, unemployment is forecast by the central bank to tick higher.

Indeed said jobs in financial services, consulting and law are driving a hiring spree in London, pushing job postings 2% above their February 2020 levels. Food service, arts and entertainment positions also rose strongly from a year ago.

“It’s not just the hospitality industry hiring,” said Jack Kennedy, U.K. economist for Indeed. “Some of the capital’s biggest and best known professional and financial services institutions are leading the charge.”

Updated: 7-25-2021

New Job Posting Shows Amazon Seeking A Digital Currency And Blockchain Expert

The role signals a shift toward cryptocurrency which Amazon still doesn’t accept as payment.

Amazon is hiring a digital currency and blockchain product lead for its payments team, according to a new job listing. First reported by Insider, the ecommerce giant is looking for an “experienced product leader to develop Amazon’s Digital Currency and Blockchain strategy and product roadmap.” The listing, which Amazon has confirmed is legitimate, continues:

You will leverage your domain expertise in Blockchain, Distributed Ledger, Central Bank Digital Currencies and Cryptocurrency to develop the case for the capabilities which should be developed, drive overall vision and product strategy, and gain leadership buy-in and investment for new capabilities.

Amazon.com doesn’t accept cryptocurrency as payment, but a spokesperson told Insider that the company was “inspired by the innovation happening in the cryptocurrency space and are exploring what this could look like on Amazon.”

Amazon’s cloud division, Amazon Web Services (AWS) already has a managed blockchain service. But CEO Andy Jassy said in 2017 when he was head of the AWS division that the company was “watching” the space but that Amazon didn’t see “a lot of practical use cases for blockchain that are much broader than using a distributed ledger,” ZDNet reported at the time. That would appear to be changing if this new listing is any indication.

Apple posted a similar listing in May for a business development manager for “alternative payments,” and among the key qualifications for the role was five years of experience “working in or with alternative payment providers, such as digital wallets, BNPL, Fast Payments, cryptocurrency and etc.”

Updated: 8-2-2021

More Job Ads Disclose Wages As U.S. Employers Grow Desperate

A rising number of U.S. job listings are including wage ranges as employers compete for cooks, truck operators and other scarce workers.

The lack of transparency on pay has long been a scourge of job seekers, and recent data suggest that the tight labor market may be starting to force companies’ hands.

Around 12% of listings across all occupations offered salary information in the second quarter, up from 8% in the same period in 2019, according to analytics firm Emsi Burning Glass.

The biggest gains were in hard-to-find positions such as restaurant hosts and nurse practitioners, for which almost one in five ads now disclose pay, according to Burning Glass, which analyzes millions of offers for trends.

The number of offers disclosing wages remains a small minority, but the shift could embolden workers. President Joe Biden has called rising wages “a feature” of his economic plan, and in a recent CNN town hall event said the hospitality and tourism industries may be “in a bind for a while” as workers hold out for better wages and working conditions.

Employers historically have been reluctant to show their cards publicly, fearing that they’ll have to pay more than a job seeker is willing to accept, or that current employees will grouse about being underpaid.

However, some state legislators are trying to force the issue, arguing that women and minorities are more hesitant to negotiate with employers and fall behind their White male counterparts in pay.

The day when most employers are transparent about wages can’t come soon enough for Kristen Ware, a 22-year-old in Rock Hill, South Carolina, seeking a marketing job.

“I would like to know how much a company is going to pay me, because I don’t know how much a recent graduate should be getting paid,” said Ware, who complained about the lack of pay disclosures on a Facebook forum. ”We shouldn’t have to guess all the time what’s the best pay for me.”

Colorado Law

A new law in Colorado requires that companies with any presence in the state post wage information in their job ads. That holds even for positions that can be done remotely from outside of Colorado, and the state’s Department of Labor and Employment has been following up on tips about companies that aren’t compliant.

Maryland and California also have laws requiring companies to provide wage ranges to job applicants upon request, and Connecticut will soon require companies to disclose wage ranges for open jobs to both applicants and existing employees.

“Colorado is nudging the country toward having a more informed labor market,” said Scott Moss, director of the division of labor standards and statistics at the Colorado labor department.

Burning Glass compared 2021 with prepandemic 2019 instead of last year to get a clearer picture of changes, and focused on employer-sponsored job sites, filtering out public job boards that sometimes include their own wage estimates.

The Rocky Mountain states, including Colorado, saw more than a 300% increase in job listings that include salaries, but the numbers grew in most other regions, too, the data show. The Great Lakes region rose 29%, the Mid East rose 35% and the Southeast and Southwest rose 54% and 61%, respectively. The Far West and New England were two regions that saw small declines.

Tim Dupree, president of staffing giant Kelly Services’ Professional and Industrial unit, chalks up some of the gains to “leakage” from Colorado.

Forced to disclose pay in that state, some employers are probably including the information in other states as well. Other companies are being very public with their wages to signal they’re no longer a low-paying operation, he said. As he drives around his Michigan base, Dupree sees warehouses and manufacturers touting their $17-an-hour wages out front.

“They’re probably using it as a way to drive messaging as an employer brand,” Dupree said. “Those former employers that were paying $9, $10, $11 an hour are now paying $15 or $16.”

There’s still a long way to go before full pay transparency in offers, and data from other sources provide mixed signals.

Adzuna, an international job board with a U.S. headquarters in Indianapolis, found that only 1.5% of ads across occupations included wage information in June, actually down slightly from two years earlier. However, the company did see big gains in competitive industries, including trade and construction, where the percentage of ads with wages has quadrupled since June 2019.

Unlike Burning Glass, Adzuna included ads from public job boards as well as from companies’ own websites.

Kimberly Harris, who runs career fairs around the country from her base in Charlotte, North Carolina, has been pushing her corporate clients to disclose wages.

“When we include pay ranges or pay rates, the responses would triple,” Harris said. “We want honesty and we want transparency.”

Updated: 8-6-2021

The Jobs Numbers: Who’s Hiring In America—and Who’s Not

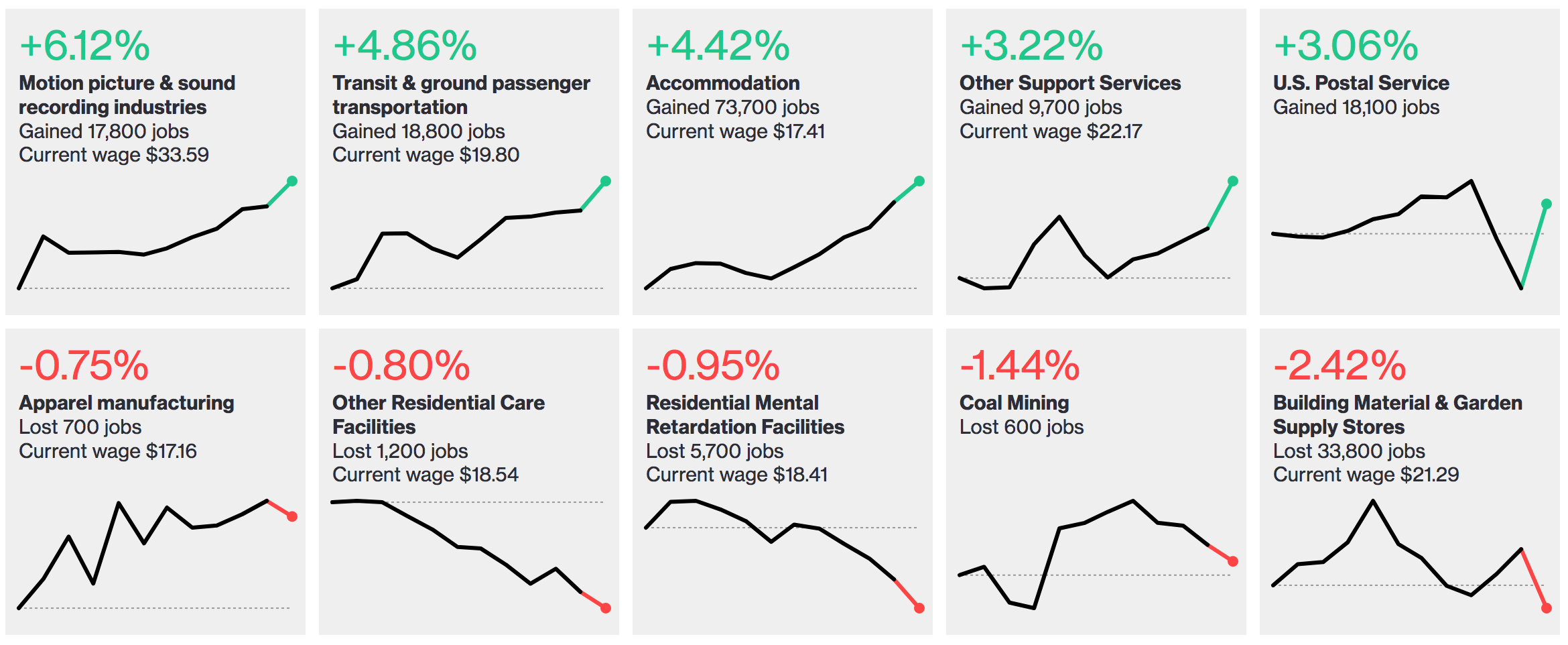

U.S. employers added 943,000 jobs in July, and the nation’s unemployment rate fell to 5.4 percent, according to data released Friday by the Labor Department. Meanwhile, average hourly pay for workers rose 4 percent from a year earlier, to $30.54 from $29.37.

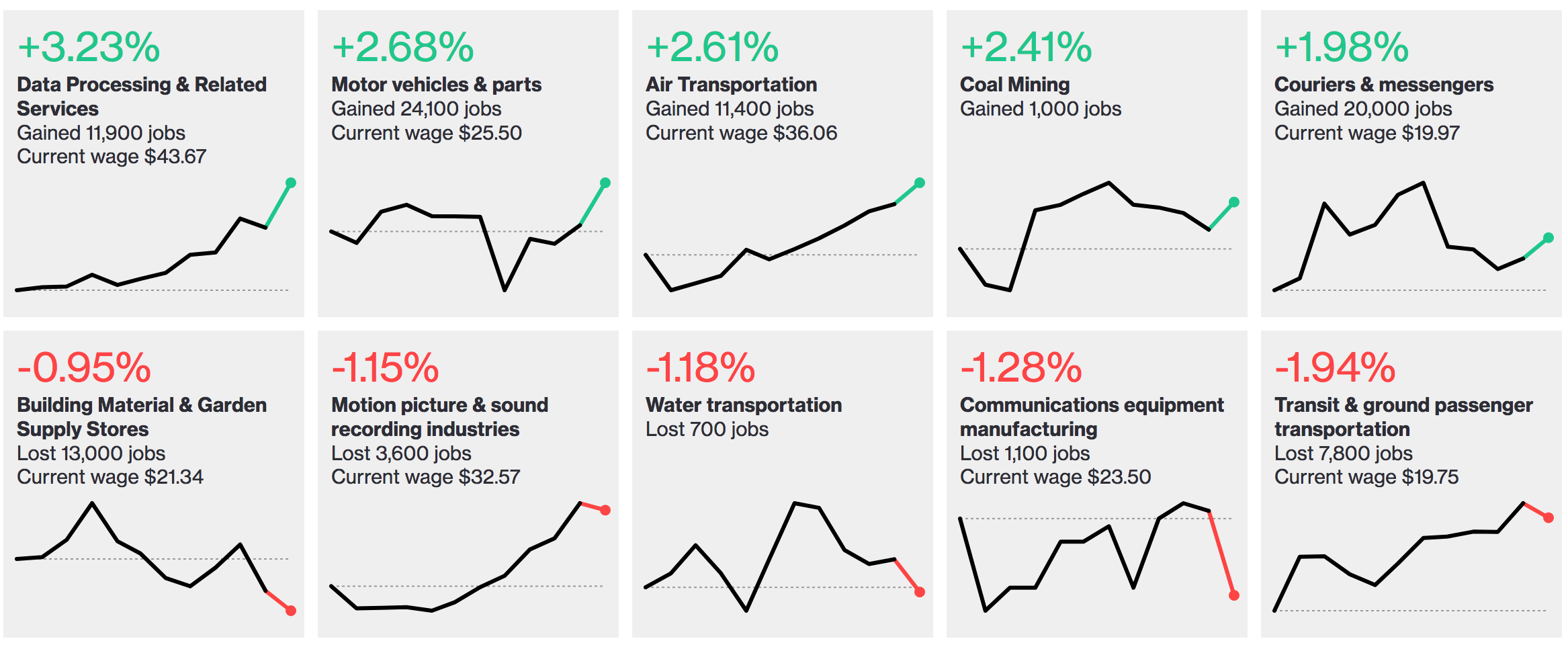

Leaders & Laggards

Below are the industries with the highest and lowest rates of employment growth for the most recent month. Additionally, monthly growth rates are shown for the prior year. The latest month’s figures are highlighted. Wage data are shown when available.

Connecting The Dots

Follow the dots in the chart below to see how shifts in employment have coincided with changes in average hourly pay from one month to the next. The greater the vertical distance between dots, the larger the change in wages; the greater the horizontal distance, the larger the change in total number of jobs.

Updated: 8-8-2021

Black Americans Leave Workforce, Driving Their Jobless Rate Down

Black Americans saw a sizable drop in unemployment in July, but the decrease came as workers left the labor force, an indication that the jobs recovery remains uneven.

The jobless rate for Black Americans fell to 8.2%, the lowest level since March of 2020, and down from 9.2% in June, according to figures released Friday by the Department of Labor. Black men in particular saw a large decline.

Behind the lower rates is a drop in participation for both Black men and women, as well as Latina women aged 20 and over. Most other major groups, including White Americans of both sexes and Hispanic men, saw an increase in the ranks of workers last month.

Monitoring the progress of minorities is key to assessing the economic recovery. The Federal Reserve has said that its maximum employment goal is “broad-based and inclusive,” and policy makers are looking at how different groups of Americans are rebounding from the pandemic crisis in considering future policy moves.

Overall, the unemployment gap between Whites and Blacks narrowed, but rates for both Blacks and Hispanics remain above the national rate, which was 5.4% in July.

The Asian American unemployment rate is below the national level, at 5.3%. However, Asian joblessness was the farthest from pre-pandemic rates among the demographics tracked by the Labor Department. The prime-age participation rate — people age 25 to 54 — reached a 12-year high in July for Asian Americans, the data also show.

Women saw improvements last month. The unemployment rate fell to 5.2% from 5.7% as the number of women in the labor force increased modestly and 649,000 more women became employed. The female labor force is still down nearly 1.7 million workers since the start of the pandemic, compared to a shortfall of 1.4 million men.

Updated: 8-30-2021

These Millennials Are Dumping Their Jobs to Plot New Careers

With several years in the workforce and some savings, some young professionals take an early career break to reassess and chart a different path.

They launched careers in the years after the 2007-09 recession and only recently hit their stride in earning power. Now some young professionals are quitting their jobs with no Plan B.

With several years in the workforce and some savings in the bank, they are taking a breather to learn new skills, network and develop their creative potential before locking into another career path.

These workers, now in their late 20s and early 30s, are both chastened by pandemic-era burnout and optimistic about a rebounding job market. While many of their peers are jumping immediately to better-paying or more well-suited jobs, they are leaning into an early-career break instead.

Tessa Raden, 33, was so burned out by remote work that she quit her dream job as a program director at the Dramatists Guild Foundation in July with no set backup plan. She says she goofed off for a couple of weeks, then picked up a bartending job, about five evening shifts a week, at Brookland’s Finest Bar & Kitchen in her Washington, D.C., neighborhood.

“I was just so tired of pushing, and I had totally lost my passion,” says Ms. Raden, who has a master’s degree in arts management. On paper, her job overseeing programming and supporting writers was everything she had worked toward in her adult life. But the pandemic eliminated live performances, a part of her job she loved, and she found it hard to focus and stay motivated once she traded the office for sitting at home on her computer.

“I love that I don’t have to take my work home with me,” she says of her new lifestyle. “And I love that the majority of my job now is just being friendly, not staring at a computer screen.”

Ms. Raden is using her free hours to complete a graduate certificate in education policy and hopes eventually to transition into public education. She notes she probably wouldn’t have been able to afford such a break in her less-flush 20s. But for now, she has enough savings to cover her rent, and bartending covers her other expenses. “I think I can hang on to this structure for a couple more months,” she says. “I’m trying to plan a little less.”

U.S. workers are quitting their jobs at some of the highest rates in years, a sign of great appetite for change and confidence in better prospects down the line. The share of people leaving jobs reached 2.7% in June, according to the Labor Department, just shy of April’s 2.8% rate, the highest level since the government began tracking quit rates two decades ago.

A Prudential Financial survey of 2,000 American workers this spring found that millennials—those between the ages of 25 and 40—were antsier than other generations to make a change: More than a third of that demographic said they planned to look for a new job post-pandemic, compared with about a quarter of workers overall.

Some of these workers don’t want to jump into another role until they find one more aligned with their long-term career goals.

“Earlier this year I was hoping to switch jobs and scrolling through tons of postings, but I eventually realized the only way I could make a successful career transition was to quit,” says 33-year-old Andrew Hibschman, who was a program lead and assistant professor at La Salle University in Philadelphia until he quit this month. “I didn’t have the time or energy to devote myself to the search the way I wanted to,” he says.

He started out mainly teaching English and, over the course of the decade, became more involved in admissions and other academic-support programs. But his longer-term goal is to work in education technology or learning development. To that end, he spends two-to-three hours a day taking online classes to brush up on topics such as diversity-and-inclusion programming, and at least another hour a day on networking and the job search.

“This is the first time since I was 14 that I don’t have a job, which is somewhat terrifying,” Mr. Hibschman says. “But I do feel optimistic because there are so many jobs out there.”

Getting married in May has eased the transition. In addition to lending emotional support, his husband also is working to get him onto his health insurance plan.

Figuring out health insurance can be one of the thorniest issues for those leaving a full-time job with benefits. Most options leave a lot to be desired, says Laura Briggs, a coach for freelance workers based in Springfield, Ill. Many join a partner’s plan if that’s in the cards, she says, and another option is a high-deductible plan with relatively low premiums that covers worst-case scenarios like surgeries and accidents.

Another short-term option is to use Cobra, a federal law that permits workers who leave their jobs to temporarily continue a former employer’s health benefits, though that can be expensive.

Ms. Briggs also suggests that those planning to leave a job with benefits meet with a financial adviser. “You should be proactive about figuring out how much you can and should set aside every month, especially if you no longer have employer-matching contributions to your retirement plan,” she says.

Evelyn Danciger, 27, says she is relying on several years of savings and looking into Cobra options as she transitions to full-time writing. She resigned in July from the Sid Lee creative agency, where she was a senior manager. She dreamed of becoming a writer since she was in third grade, she says, but fell into marketing after graduating from Loyola Marymount University in Los Angeles, where she majored in screenwriting, in 2016.

As she took on bigger projects at the firm, the time she usually set aside to write slowly disappeared. And the heavier workload left her “stress-crying” and feeling intense burnout.

“I wasn’t doing anything creative, and my job had turned into mostly client management,” she says.

Now that her days are free, she can write more, plus do more in-person networking in Los Angeles, where she lives.

“I’m so excited to call up my industry contacts and go out for lunch and coffee again,” she says. “I don’t have to cram it all into a weekend now.”

Updated: 8-27-2021

FedEx Ground Delivery Becomes A Road To Riches For Contractors

Thanks to the e-commerce boom, prices for the rights to handle packages within designated routes have soared 50% in three years.

The crowd was amped. Some 1,800 strong, they had traveled from across the country amid a raging coronavirus flare-up to assemble in a hotel ballroom in Nashville. The man they were cheering as he took the stage wasn’t a rock star, a preacher, or a politician. It was Spencer Patton, a bespectacled 35-year-old former hedge fund manager in a polo shirt and khakis.

Patton has carved out a niche doling out advice to entrepreneurs looking to make it big as contractors for FedEx Ground, the package-delivery service that’s been booming amid a surge in online shopping during the pandemic.

“This is like buying Apple at $1 a share—that’s what we’re doing here,” Patton told rapt attendees packed into the presidential chamber at the Gaylord Hotel. “We’re at the tip of the spear in an asset class that no one knows about.”

The unusual asset class Patton proselytizes about—contracts that give owners the right to operate FedEx Ground routes in specified areas for as long as three years—is red-hot these days. The owners collect a fee for each package their fleets drop off, but they’re entirely responsible for hiring drivers, buying trucks, and dealing with all the issues that come with running a small business.

Prices for routes have increased 50% from only a few years ago, but they still may bring returns of more than 20% a year. Patton predicts most contractors will see their sales double over the next three years. Meanwhile, the mom and pops that dominated the industry are selling out to a new class of investors looking for growth and higher returns.

Patton’s celebrity status stems from his deep knowledge of the business: He owns 250 routes across the country, and he estimates that his consulting company, Route Consultant, has brokered about 25% of all the FedEx Ground route transactions in the U.S. So the nation’s thousands of would-be delivery czars are eager to get Patton’s advice on everything, including how much to pay for routes, the latest safety standards, and the skills needed to operate in the urban gridlock of Chicago or the rural byways of Chugwater, Wyo.

Patton came to logistics stardom via a circuitous path. Growing up in Nashville, he got his first taste of trading stocks at age 10 at his dad’s urging and was dabbling in options by age 16. After graduating from Vanderbilt University in 2008, he joined a company in Nashville that bought struggling businesses and turned them around. Two years later he persuaded the partners there to kick in $2 million to back a hedge fund he’d started.

In 2013, Patton walked away from managing other people’s money to concentrate on his own business. He’d methodically studied different industries, including self-storage units and liquor stores, before settling on the then-obscure idea of buying FedEx Ground delivery routes.

Patton’s opportunity stemmed from a decision two decades earlier by FedEx Corp. founder Fred Smith to buy a small parcel company, which quickly became a growth engine and is now the crown jewel of his delivery empire.

Annual revenue has tripled over the past decade, to $30.5 billion, while sales at the company’s Express unit, which transports mostly by air and has its own fleet of drivers on the payroll, have increased about 60% during the same period, to $42 billion. Average profit margins at Ground over the last two decades have been more than twice those at the Express business.

Unlike the overnight service, which hires its drivers directly, Ground operates on short-term contracts with 5,600 small companies. That’s given it a lower cost structure than rival United Parcel Service Inc., which has a unionized workforce and pays the industry’s highest wages. A UPS driver with over four years on the job makes about $65,000 a year, not counting overtime, plus pension and health benefits.

Delivery driver pay at FedEx Ground depends on the independent contractor and the location; it can range from about $39,000 a year to $60,000 for a high-performing employee. This doesn’t count benefits, which most contractors don’t offer.

Eight years ago, when e-commerce was shifting into high gear, Patton began to build his own route operations, which now deliver FedEx packages in 10 states. Along the way he began building a consulting business for newbies or others looking for advice. Eventually he added deal brokering, truck leasing, driver training, and even a financing unit to round out his suite of services—comprising 26 entities in all.

Since 2019, FedEx Ground has overhauled operations to account for the boom in at-home shopping. Smith extended deliveries to seven days a week from five, updated routing software, and started accepting more large packages, and FedEx Ground began taking back small packages that previously were passed to the Postal Service for final delivery. Then the pandemic hit, and volume jumped 23%, to 3.1 billion packages last year.

The operational changes and accelerated growth at FedEx Ground have overwhelmed many contractors and spurred an unprecedented frenzy of route buying and selling, Patton says. Longtime FedEx contractors, many of whom started out driving their own truck and have since accumulated wealth along with more delivery routes, are selling as the value of their holdings rises.

“We are seeing a ton of old-school contractors who are … retiring, cashing out, and making great money,” Patton says. “The new people coming in are business savvy and capitalized, and they’re hungry to grow.”

Patton lures potential clients with a weekly webinar that teaches the basics about FedEx routes. Every week he also announces the location of FedEx routes up for grabs and offers his services to support sales or purchases. Patton now has 70 employees at Route Consultant after starting three years ago with only four.

Typically, entrepreneurs can buy 10 FedEx routes for about $1.25 million. Annual operating profit for the small-package-delivery businesses can range from 10% to as much as 25% of sales for a well-run operation, Patton says. Prices for individual routes are based on a multiple of operating cash flow, while the price paid per package depends on a route’s population density, typical number of stops per mile, and the types of packages usually delivered. Valuations have climbed to about 4.5 times operating cash flow, up from about 3 times only a few years ago as package delivery expands.

FedEx signs off on each new owner, but it doesn’t get involved when routes get bought or sold. The courier must take a hands-off approach to the contractors, known as independent service providers, to avoid lawsuits from drivers who otherwise might claim they really work for FedEx. Amazon.com Inc. is also using the contractor model, which wards off union organizers and keeps costs down, as the company builds its own delivery network.

Patton’s expo attracted those 1,800 people this year, with sponsors including vehicle outfits Ryder System Inc. and Isuzu Motors Ltd. That’s up from about 400 at the first expo in 2019 and about 750 in 2020. At such gatherings, Patton always begins his talks with disclaimers that he’s not a FedEx employee and doesn’t speak on behalf of the company and that FedEx doesn’t endorse his consulting business.

At this year’s event, after light banter and a soft sales pitch for Route Consultant, Patton revealed previously unannounced changes to safety training that FedEx Ground plans to roll out. Attendees furiously scribbled notes.

One of those in attendance in Nashville was Larry Murray. A marketing professional who before the pandemic helped organize tours and festivals including Willie Nelson’s Luck Reunion in Texas, he says he binge-watched Patton’s webinars for four days and then signed onto the consulting program in 2020 before buying nine FedEx routes this year in Belton, Texas. Patton’s team helped value the business and get Murray started.

“Every penny was worth it,” Murray says. “We would be in really bad shape if we hadn’t done that.” He aims to buy more routes within the next year. Patton has “laid out a great road map,” he says.

Sean Randall, a career banker who last worked at Citigroup Inc.’s wealth management unit, quit corporate America in 2020 to be his own boss. He’d invested in apartment buildings but said they’ve gotten too expensive to produce a decent return. After watching the webinars and podcasts, Randall hired Patton’s company as a consultant and bought FedEx routes in the Washington metro area in January 2020. “There’s a lot of opportunity,” Randall says. “Because of that growth, a lot of smaller operators are being forced out. It’s too much for them to handle.”

FedEx has contributed to the hot market for buying and selling routes by limiting contractors from handling too much of the volume at one FedEx hub. It typically tries to keep a single contractor at less than 10% of a hub’s total volume, lowering the risk in case an independent operator stumbles and FedEx has to find other contractors to pitch in to get the packages delivered.

Todd Smart, in Mansfield, Ohio, got his first delivery area from FedEx Ground in January 1999 on the condition that he would buy and drive a new vehicle. From that beginning, Smart now has amassed 70 routes and started a repair shop for his vehicles and others. He needs to pare back to comply with FedEx’s hub limits. “The expectation is that if I sell half of my business, I will still grow by double in three years,” Smart says.

The system works most of the time, but it does have its quirks. When an operator fails, FedEx calls on other contractors to pitch in and pays them an extra stipend per package to help get the emergency under control.

Some contractors keep contingency teams on hand to send to areas where help is needed. Jim McCarthy, who formed a business with his sons that’s amassed 120 routes in multiple states, has four teams with five members each that travel all over the U.S. to do contingency work, renting out a large house wherever they’re needed. The groups earn more per package, and if the routes ever become available, McCarthy’s business is likely to be in a good position to vie for them. “Spencer opened my eyes to a bigger picture,” he says. “He brings a big business perspective to a little business.”

Updated: 8-31-2021

Fidelity Wants To Add 9,000 Jobs by Year-End

Move to meet investing demand will boost company’s workforce to more than 60,000.

Fidelity Investments plans to hire another 9,000 employees this year to help its businesses keep pace with the surge in demand for stock-trading and other personal-investing services.

Fidelity’s hiring spree is its third in the past year, when millions of new investors flocked to brokerages like Fidelity, Charles Schwab Corp. and Robinhood Markets Inc. Including the latest push, Fidelity’s total workforce is expected to grow more than 22% this year, to over 60,000 employees.

Drawn to the market’s rally, individual investors have changed the fortunes of the brokerage industry. The no-commission stock trades and low-fee investment funds now offered by many firms have brought in plenty of new clients. They also have thinned money managers’ profit margins and forced them to compete on price. Traditional products, like stock- and bond-picking mutual funds, have been leaking client money.

It is a trade-off Fidelity and some of its peers are willing to make. As more transactions course through their platforms, the costs associated with processing each of them drops. These firms also are betting many of the new account-holders will eventually graduate to more-expensive offerings, including financial advice.

The conditions that captivated many new, younger investors last year have continued in 2021, straining the call centers, websites and trading platforms that respond to customers’ questions and process their transactions. The major U.S. stock indexes touched record highs last week, buoyed by news that regulators had given full approval for one of the Covid-19 vaccines and Congress pressed ahead on a $1 trillion infrastructure bill.

Fidelity ended the second quarter with $11.1 trillion in assets under administration, or what investors held in brokerage and retirement accounts on the firm’s platforms, and in its funds. The firm added 1.7 million new retail accounts in the 12-month period ended in June, including 697,000 opened by clients 35 years old or younger. Fidelity processed 2.6 million trades a day in the second quarter, up from 2.3 million in the same period a year earlier.

“Over the last 18 months we’ve seen unprecedented levels of engagement from our customers,” said Kirsten Kuykendoll, Fidelity’s head of talent acquisition. “That’s been driving the record number of customer-facing roles.”

Those jobs include employees who staff regional call centers, serve as financial advisers and manage relationships with the firm’s institutional clients. The new hires, along with buyout offers Fidelity extended to about 2,000 employees earlier this year, will shift a bigger percentage of the firm’s workforce to the front lines of those customer interactions.

Of the 16,000 hires Fidelity plans to make this year, some 79% will be for client-facing roles.

The Boston-based company opened regional call centers in Smithfield, R.I., and Durham, N.C., during the second quarter, bringing its total to eight.

Fidelity plans to allow employees to continue to work remotely at least part-time for the foreseeable future. The firm hasn’t required staff to get vaccinated before they return to offices, Ms. Kuykendoll said.

Fidelity also is beefing up its technology staff to support its existing businesses as well as new services.

Fidelity Digital Assets, which helps hedge funds and other institutional investors trade and store bitcoin, has nearly doubled its staff over the past 18 months. The firm also has started a private bitcoin investment fund and filed for regulatory approval to launch an exchange-traded fund that tracks the cryptocurrency.