As Crypto Crash Erases Approx. $1 Trillion in Market Value Users Say, “Thanks But No Thanks” To Bailouts

As Crypto Crash Erases Approx. $1 Trillion In Market Value Users Say Thanks But No Thanks To Bailouts, Bail-ins, Executive Orders, Circuit Breakers, Federal Reserve Stimulus Or Even A Need To Panic! As Crypto Crash Erases Approx. $1 Trillion in Market Value User Say Thanks But No Thanks To Bailouts

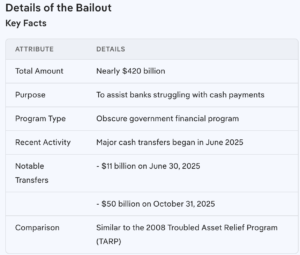

The Federal Reserve’s $420 Billion Bank Bailout

The Federal Reserve has recently provided nearly $420 billion to Wall Street through a government financial program aimed at banks facing cash shortages.

This unprecedented move has raised concerns about the stability of the financial sector.

Implications

These cash infusions suggest that banks may be experiencing liquidity issues, indicating potential instability in the financial system.

The Federal Reserve has lifted the cap on such transactions, allowing banks to borrow without limits to meet their liquidity needs.

Response From The Federal Reserve

The New York Federal Reserve has stated that these large infusions are routine and intended to support effective monetary policy and interest rate control. They emphasize that these are temporary loans to help banks maintain operations.

However, the lack of transparency regarding which banks received the funds has led to speculation about the overall health of the banking sector.

Biden Administration Said To Aim For Crypto Executive Order

Bitcoin Drops To Below $36,000 For First Time Since July

Related:

Four Ways Black Families Can Fight Against Rising Inflation (#GotBitcoin)

Ultimate Resource For Crypto Mergers And Acquisitions (M&A) (#GotBitcoin)

Why Wall Street Is Literally Salivating Over Bitcoin

The Ultimate Resource For The Bitcoin Miner And The Mining Industry (#GotBitcoin)

With Crypto Jobs Available, US Universities Are Turning To Blockchain Education (#GotBitcoin)

The Ultimate Marketplace For Bitcoin-Based (And Other) Games (#GotBitcoin)

Bailout List: Banks, Auto Companies, And More

For Bitcoin, there’s only been one constant recently: decline after decline after decline. And the superlatives have piled up really quickly.

With the Federal Reserve intending to withdraw stimulus from the market, riskier assets the world over have suffered. Bitcoin, the largest digital asset, lost more than 12% Friday and dropped below $36,000 to its lowest level since July.

Since its peak in November, it has lost over 45% of its value. Other digital currencies have suffered just as much, if not more, with Ether and meme coins mired in similar drawdowns.

Bitcoin’s decline since that November high has wiped out more than $600 billion in market value, and over $1 trillion has been lost from the aggregate crypto market. While there have been much larger percentage drawdowns for both Bitcoin and the aggregate market, this marks the second-largest ever decline in dollar terms for both, according to Bespoke Investment Group.

“It gives an idea of the scale of value destruction that percentage declines can mask,” wrote Bespoke analysts in a note. “Crypto is, of course, vulnerable to these sorts of selloffs given its naturally higher volatility historically, but given how large market caps have gotten, the volatility is worth thinking about both in raw dollar terms as well as in percentage terms.”

With the Fed’s intentions rocking both cryptocurrencies and stocks, a dominant theme has emerged in the digital-asset space: cryptos have twisted and turned in nearly exactly the same way as equities have.

“Crypto is reacting to the same kind of dynamics that are weighing on risk-assets globally,” said Stephane Ouellette, chief executive and co-founder of institutional crypto-platform FRNT Financial. “Unfortunately for some of the mature projects like BTC, there is so much cross-correlation within the crypto asset class it’s almost a certainty that it falls, at least temporarily in a broader alt-coin valuation contraction.”

Crypto-centric stocks also dropped on Friday, with Coinbase Global Inc. at one point losing nearly 16% and falling to its lowest level since its public debut in the spring of 2021, Bloomberg data show.

MicroStrategy Inc. tumbled 18% while the Securities and Exchange Commission said the company can’t strip out Bitcoin’s wild swings from the unofficial accounting measures it touts to investors. The enterprise software company’s pile of Bitcoin has effectively made its shares a proxy for the digital asset.

Meanwhile, the Biden administration is preparing to release an initial government-wide strategy for digital assets as soon as next month and task federal agencies with assessing the risks and opportunities that they pose, according to people familiar with the matter.

Antoni Trenchev,, Nexo co-founder and managing partner, cites Bitcoin’s correlation to the tech-heavy Nasdaq 100, which right now is near the highest in a decade.

“Bitcoin is being battered by a wave of risk-off sentiment. For further cues, keep an eye on traditional markets,” he said. “Fear and unease among investors is palpable.”

Take also the correlation between Bitcoin and Cathie Wood’s ARK Innovation ETF (ticker ARKK), a pandemic poster-child of speculative risk-taking. That correlation stands at around 60% year-to-date, versus about 14% for the price of gold, according to Katie Stockton, founder and managing partner of Fairlead Strategies, a research firm focused on technical analysis. It’s “reminding us to categorize Bitcoin and altcoins as risk assets rather than safe havens,” she said.

Meanwhile, more than 239,000 traders had their positions closed over the past 24 hours, with liquidations totaling roughly $874 million, according to data from Coinglass, a cryptocurrency futures trading and information platform.

Though liquidations have spiked, the numbers are relatively muted when compared to previous declines, according to Noelle Acheson, head of market insights at Genesis Global Trading.

Acheson points out that Bitcoin’s one-week skew, which compares the cost of bearish options to bullish ones, spiked to almost 15% on Wednesday compared to an average of about 6% in the past seven days.

“This flagged a jump in bearish sentiment, in line with overall market jitters given the current macro uncertainty,” she said.

Kara Murphy, chief investment officer at Kestra Investment Management, said cryptocurrencies have a life of their own but that the recent slump is rational.

“It makes sense as people start to retrench a little bit, look for something that’s a little bit more solid, they’re gonna move away from crypto,” she said. “On the margin, with folks becoming more risk averse, crypto will suffer from that.”

Crypto Collapse Fails To Sway Faithful’s Infinite Supply of Optimism

* Market Could See Some Capitulation Before Long: Miller Tabak

* Proponents Say Liquidations Often Serve To Cut Out The Froth

With the blink of an eye, more than a trillion dollars in crypto-market value has evaporated.

The jarring downturn that’s been a hallmark of digital assets in recent weeks continued to play out this week and into Saturday, with Bitcoin at one point losing more than 15% during that stretch. The coin, which is the largest digital token, has dropped more than 50% from a recent peak, and many other cryptocurrencies have lost just as much, if not more.

The carnage superlatives have been easy to come by: Friday’s decline led to the liquidation of more than $1.1 billion in crypto futures positions and overall more than $1 trillion in market value has been destroyed since the last peak. In other words, the meltdown is pouring salt on an already-deep wound.

“Digital-currency markets in total have been challenged this month,” said Jonathan Padilla, co-founder of Snickerdoodle Labs, a blockchain company focused on data privacy. “There’s definitely some pain there.”

Even long-time bulls are starting to wonder out loud at what point the battering might end. Famed crypto investor Mike Novogratz mused on Twitter that “this will be a year where people realize being an investor is a difficult job.”

But, crypto fans have an infinite supply of optimism and many are confident that with Bitcoin already spending two-thirds of the year in the red, better times could come soon.

At some point, sellers will become exhausted and the market could see some capitulation soon, said Matt Maley, chief market strategist for Miller Tabak + Co.

“When that happens, the institutions will come back in in a meaningful way,” he said. “Once the asset class becomes more washed-out, they’ll have a lot more confidence to come back in and buy them. They know that cryptos are not going away, so they’ll have to move back into them before long.”

The news cycle has been relentless. Regulators from Russia, the U.K., Singapore and Spain all announced interventions that could undermine crypto companies looking to grow in those regions, while tightening U.S. monetary policy left traders anticipating several interest rate hikes this year.

The Bloomberg Galaxy DeFi Index of digital coins involved in decentralized finance fell 14% in the past week.

Meanwhile, the Biden administration is preparing to release an initial government-wide strategy for digital assets as soon as next month and task federal agencies with assessing the risks and opportunities that they pose, according to people familiar with the matter.

That weighed on Bitcoin enough to send it to within a whisker of $34,000 on Saturday.

Bitcoin’s decline since its November high has wiped out roughly $600 billion and greater than $1 trillion has been lost from the aggregate crypto market.

While there have been much larger percentage drawdowns for both Bitcoin and the aggregate market, this marks the second-largest ever decline in dollar terms for both, according to a Friday note from Bespoke Investment Group. The largest ever occurred last summer, when a decline that peaked at the end of July wiped out $646 billion for Bitcoin.

Roughly 290,000 traders had their positions closed over the 24 hours through Friday evening in New York, with liquidations totaling more than $1.1 billion, according to data from Coinglass.

Crypto Liquidations Leave Their Mark

Bitcoin price fall pushes out traders as crypto seeks a new baseline.

It remains to be seen if Bitcoin’s tumble below the psychological level of $40,000 will serve as an inflection point. Crypto proponents say heavy liquidations often serve to cut out the froth in easy-win asset speculation, helping to solidify new bottoms in the market.

“Fear and unease among investors is palpable,” said Antoni Trenchev, managing partner at Nexo. “If we see a bigger selloff in equities, expect the Fed to verbally intervene to calm nerves and that’s when Bitcoin and other cryptos will bounce.”

As the dust settles, key technical indicators show things could be about to look up for Bitcoin. The fall in the crypto’s price on Friday triggered a drop below the lower band of its trading envelope. Traditionally, this has been a sign that the selloff might be overdone, and a reversion to the mean is in play but Saturday’s nudge lower suggests the bears remain in charge.

“For now, Bitcoin is up against the wall after falling below $40,000. A swift bounce above that key technical and psychological level can’t be ruled out,” added Trenchev. “Failing a quick reversal, I’m not excluding Bitcoin re-tests $30,000 before the Fed changes tack, but that ought to be the bottom, at least in the mid-term. And from there, I think we can have a nice leg up.”

Bitcoin has been trading largely in tandem with the Nasdaq 100, whose members include high-growth tech stocks that have been dinged during this year’s selloff.

That makes sense to Art Hogan, chief market strategist at National Securities, who said that it’s useful to think of cryptocurrencies as living in the same space as other speculative sectors, including special-purpose acquisition companies (SPACs) and electric-vehicle makers.

“When we’re in an environment where all of those riskier assets are selling off, crypto is going to find itself doing the same,” Hogan said. “When the Nasdaq 100 or any of the other more-speculative, rapid-growth, momentum-type asset classes start to gain some traction, so will cryptocurrencies.”

Updated: 1-27-2022

The Crypto Crash Strengthens The Case For Crypto

The plunge shows that prices can fall sharply and suddenly without inducing a more general contagion.

Crypto prices are tumbling. By one account, crypto assets have lost about $1.35 trillion globally since November, with some falling in price by 80% or more. Many investors feel a real pinch.

The good news is that the global economy, or for that matter American society, is not poorer. And thus there need not be much of an economic response to adjust to these new prices. (The flipside is that if crypto prices see another steep increase, there won’t be much cause to celebrate.)

Over time I have moved from crypto-skeptical to what I call crypto-hopeful. So this is a good moment to assess how radically lower crypto prices will affect how socially valuable crypto will prove to be.

One possibility is that crypto prices, even at current levels, are mostly a bubble and that crypto won’t do much that is useful. In that case lower crypto prices mean less purchasing power for crypto holders, but that doesn’t translate into less wealth for the economy as a whole.

People who don’t own much crypto will, over the longer run, have greater command over goods and services. The crypto holders who were bidding against them will, over time, spend less. Purchasing power will shift to the non-crypto holders.

In these scenarios the psychological losses are felt before the psychological gains. Most crypto holders are unhappy right now, but few non-holders are celebrating their (modest) boost in purchasing power.

Over time, however, these non-crypto-holders will be able to buy more at better prices than they had been expecting. What the crypto holders lose will be roughly about what the non-crypto holders gain.

Consider another scenario — one where crypto is poised to provide a lot of useful services. Perhaps crypto assets will underpin useful savings and lending through DeFi, execute online smart contracts at low cost, and provide useful currencies and stores of value for the pending metaverse.

Most of these services are not yet available, at least not in a way that they will be eventually. So if a lower crypto price is a signal that these services won’t be as valuable as expected, that means society will be somewhat less wealthy in the future. This doesn’t much harm living standards today.

That is a worst-case scenario that I think is unlikely, even granted that the crypto revolution succeeds. Instead, it is more likely that the long-term value of crypto is robust and that the current crypto price declines are driven by risk and liquidity issues.

The plunge in crypto prices doesn’t seem to be the result of a newfound understanding that crypto institutions are irrevocably flawed. Instead it is due to an unpleasant mix of persistent inflation, higher real interest rates, lower equity prices for the major technology companies and geopolitical fears.

All of that is bad news — but not necessarily bad news about crypto. The same crypto fundamentals are in place. Higher real interest rates make the future less valuable in present discounted value terms, but crypto has no special place in that misfortune.

The bottom line is that even a large fall in crypto prices won’t create a lot of social worries. The Federal Reserve doesn’t have to panic, and the regulators don’t have to take action. Regardless of whether you are a crypto optimist or a crypto pessimist, at the social level the loss of that $1.35 trillion in value is largely imaginary.

This lack of correlation between major disasters and the decline in crypto prices could prove to be good news for crypto in the longer run. For one thing, it shows crypto prices can fall sharply and suddenly without inducing a more general contagion. And while some blockchains have been slow to process transactions, overall the crypto world has taken this major shock in stride.

Another lesson is not to confuse high prices with high social usefulness. Food prices plummeted during most of the 20th century, for example, even as food continued to provide increasing value to consumers. More vigorous competition in crypto markets could, in similar fashion, bring lower rather than higher prices, even as crypto-enabled services proved increasingly valuable.

It’s a good thing that crypto price volatility is so manageable at the social level — because we’re probably in for a lot more of it.

Updated: 4-27-2022

Hacked Crypto Startups Get Capital Infusions From Investors (No Federal Bailouts Needed)

Venture capitalists aim to protect investments and restore user trust.

Recent high-profile heists targeting cryptocurrency projects haven’t scared away venture capitalists and other investors. In fact, some backers are doubling down, investing more in hack victims.

Crypto platform Wormhole received a $320 million infusion from owner Jump Trading LLC in February, just a day after a hack. Game developer Sky Mavis Ltd. quickly put together $150 million from investors to help reimburse victims of a March hack targeting the online game “Axie Infinity.”

Now, a decentralized financial platform known as Beanstalk aims to raise more than $76 million to fill the hole from a theft this month.

Such infusions can prop up blockchain projects in crisis and protect investors’ equity. Lawyers and security experts warn that such funding in a largely unregulated sector increasingly targeted by criminals carries risks that can be amplified by the fear of missing out on the next bitcoin.

For crypto investors, however, occasional bailouts are seen as the cost of doing business, said Richard Muirhead, chairman of London-based venture-capital firm Fabric Ventures LLP. “If the prospects for growth and everybody’s success were not so great, people would feel that this is good money after bad,” said Mr. Muirhead, whose firm previously helped fund Sky Mavis.

Mr. Muirhead compared such hacks to other setbacks for startups, such as key executives’ departures or missed revenue projections. Investors and users “are attuned to the fact that they have to stomach these situations,” he added.

Software underpinning “Axie Infinity” was hacked in March, allowing attackers to siphon off cryptocurrency valued at roughly $540 million on the date of the theft. Eight days after the hack was discovered, Sky Mavis announced funding from crypto companies and venture-capital firms to help reimburse users who saw funds they can earn in the game evaporate.

Venture-capital firms Andreessen Horowitz and Accel participated in Sky Mavis’s new funding round. Andrei Brasoveanu, a partner at Accel, said the post-hack investment was aimed at restoring “Axie Infinity” users’ trust and protecting his firm’s earlier funding of Sky Mavis.

“If you don’t take care of your early community, it’s hard to inspire trust in new users for onboarding,” said Mr. Brasoveanu, adding that he doesn’t consult with Accel’s limited partners before cutting such checks.

Mr. Muirhead said his firm wasn’t asked to participate in the new funding round. Andreessen Horowitz didn’t respond to requests for comment.

Sky Mavis declined to comment on whether the new funding affected its valuation.

The Federal Bureau of Investigation has attributed the “Axie Infinity” incident to North Korea-linked hackers and U.S. officials later issued an alert about a broader effort by Pyongyang to target crypto projects. The warning said hackers could go after such organizations or their investors—including venture capitalists—through cyberattacks including highly targeted phishing campaigns.

VCs can fund crypto projects through traditional equity investments or by buying digital assets themselves, giving victims multiple ways to get help after incidents.

According to blockchain-analytics firm Elliptic, Beanstalk was the victim of a hacker who borrowed about $1 billion in different stablecoins and then added the money to Beanstalk, gaining an overwhelming percentage of voting power over the decentralized platform’s governance.

The hacker proposed donating money to Ukraine, and voted to approve the idea. The proposal, however, included code that instead sent all the funds to a wallet controlled by the hacker, according to Elliptic. Once the attacker stole the funds, they repaid the loan and pocketed the difference—about $76 million.

After the attack, the Beanstalk protocol’s founding developers told users on their Discord channel, “This project has not had any venture backing, so it is highly unlikely there is any sort of bail out coming.”

Users panicked after seeing losses that reached hundreds of thousands of dollars and watching the price of the platform’s stablecoins, known as Beans, plummet. One user shared a link to the suicide-prevention hotline’s website.

But Beanstalk’s leaders are now more optimistic about another potential solution, a mechanism similar to issuing bonds. Ben Weintraub, a co-founder of the project, said Beanstalk is preparing to sell debt in the form of so-called Pods to make previous lenders whole and restore the value of the platform’s tokens.

Interest rates for lenders will start at 20%, he said, with victims who receive the reimbursements subject to a vesting schedule that allows them to retrieve more of their funds as more of the newly issued Pods are also paid back.

The goal is to keep the platform stable by providing an incentive for users not to take the bailout money and run.

“The real question is about new audience and whether Beanstalk is going to be able to attract new lenders here,” Mr. Weintraub said, adding that several venture-capital firms have expressed interest in participating. He declined to name them.

The Securities and Exchange Commission, which declined to comment, has previously said many crypto offerings could eventually be subject to federal oversight. In a speech in Washington this month, SEC Chairman Gary Gensler said many crypto-based financial platforms “likely are trading securities.”

Mr. Weintraub acknowledged the possibility of SEC scrutiny but said he doesn’t “see it being something that the regulators have the real time for,” adding, “In the grand scheme of things, this isn’t a billion-dollar thing yet.”

Mr. Weintraub, 24 years old, lost more than $1 million of his own money in the heist and faces a potential haircut alongside other lenders if the coming fundraising round doesn’t recoup the full amount stolen.

“This is not a safe space,” he said of the crypto sector. “You’re not investing in the S&P 500.”

Some small investors agree. Albert Millis, a marketing professional in the U.K., said he has mentally written off about $4,000 that he lost in the Beanstalk incident. Still, he is considering investing a small amount in the platform’s coming debt offering.

Part of Mr. Millis’s motivation is that he supports the Beanstalk team and community, he said, while “the other part is definitely the sunk-cost fallacy kicking in.”

Updated: 1-14-2026

The Fed Is Quietly Bailing Out Wall Street

The Federal Reserve has quietly delivered nearly half a trillion dollars to Wall Street with few strings attached over the past few months. These cash infusions could signal instability in the broader financial sector.

The Federal Reserve has quietly delivered nearly half a trillion dollars to Wall Street with few strings attached over the past few months through an obscure government financial program intended for banks struggling to make cash payments.

These cash infusions could signal instability in the broader financial sector — and come as the central bank is besieged by potentially market-rattling turmoil following the Trump administration’s launch of a criminal investigation into Federal Reserve chair Jerome Powell.

The New York Federal Reserve, a regional branch of the larger central bank that works to maintain the country’s financial stability, kicked off the new year by dumping nearly $97 billion into the banking sector since December 31, 2025.

The move is the latest in a series of major cash transfers the New York Federal Reserve has recently delivered to Wall Street.

The infusions began with an $11 billion transfer on June 30. In October, the transfers became much more frequent, culminating in a massive $50 billion infusion on Halloween, as first reported by investigative news outlet DCReport.

In total, after doling out little to no money since July 2020, the New York Federal Reserve has transferred more than $420 billion to Wall Street in the past seven months — a record amount from the program.

For comparison, that lump sum is nearly equivalent to the pot of money that Congress passed to bail out the banks during the 2008 financial crisis under the Troubled Asset Relief Program.

Amid the deluge, the central bank has encouraged Wall Street to make use of the program and lifted its $500 billion cap on such transactions, meaning there is no limit to how much banks can borrow to meet their cash liquidity needs.

All of these cash infusions — issued through an arcane and newly restructured division of the New York Federal Reserve branch — amount to some of the largest cash bailouts since the COVID-19 pandemic sent shock waves through financial markets in 2020.

Experts argue that this uptick in Federal Reserve lending could indicate that banks do not have the liquid cash on hand to make payments and dole out loans.

But the circumstances driving those transactions — and whether they signify broader financial turmoil — remain unknown.

It’s unclear, for example, which banks received the funds, since that information is kept secret for two years to help protect the institutions’ reputations.

“Without more information, it’s impossible to say whether this is a good big deal or a bad big deal [that] regulators are getting banks to use liquidity facilities or . . . if the financial system is under stress,” said Todd Phillips, a former senior attorney at the Financial Deposit Insurance Corporation, a federal agency that oversees the banking sector.

In an email sent to the Lever after publication, the New York Federal Reserve said the large infusions were routine activities and disputed the idea that they might indicate looming market disruptions.

“[These] are temporary short-term loans to assist in funding operations . . . they are a market functioning tool, primarily used to support effective monetary policy implementation and interest rate control,” wrote a bank spokesperson.

“It’s A Moral Hazard”

The cash infusions are intended to provide additional liquidity to banks that are short on cash so they can continue extending lines of credit to the public and businesses.

These infusions, called repurchase agreements, are a form of short-term lending in which the Federal Reserve trades cash in exchange for assets, usually Treasury bills and mortgage-backed securities, as collateral from the banks.

But according to critics, the money has instead frequently ended up in the hands of hedge funds and other financial firms, which often use it to make risky bets on various securities and derivatives that can be more profitable than ordinary loans.

“It’s a problematic signal that markets are using the liquidity for reasons that are not part of the intention of providing liquidity in the first place,” said Phillip Basil, a director at the consumer advocacy group Better Markets.

“That’s the problematic thing about this, [banks] end up using [the funds] for just financial market transactions, instead of allowing it to flow to more productive places.”

If banks are tapping the Federal Reserve’s repurchase agreement operation to cover their losses from poor financial decisions, that could encourage further risky financial behaviors.

“Financial firms have learned and are just kind of expecting that anytime something bad happens, the Fed is going to bail them out . . . it’s a moral hazard,” said Phillips.

Banks usually first turn to the private markets when they need cash to make payments on loans and for lending purposes.

But higher interest rates for private repurchase agreements have led to a recent slump in the industry, so the New York Federal Reserve stepped in and encouraged banks to instead use its in-house repurchase agreement provider, offering more favorable rates than those available in the private market.

While this practice was previously only used for emergency circumstances, the central bank in 2021 turned the operation into a “standing repo facility” to expand its lending even in noncrisis periods and “support smooth market functioning.”

Historically, banks have been reluctant to use the Federal Reserve for short-term lending unless they’re desperate because it can send a signal to the market that the institution is short on cash.

Over the past year, the Federal Reserve has tried to break that stigma by urging banks to utilize the system.

Federal Reserve economists believe the policy acts as a relief valve to keep interest rates within their target margins.

“With the steady decline in the level of reserves, we have observed upward pressure on [repurchase agreement] rates at times in recent months,” New York Federal Reserve president John C. Williams told the New Jersey Bankers Association on December 15.

“When this occurs, the Fed’s standing [repurchase agreement] operations can act as a shock absorber by capping pressures on money market rates resulting from strong liquidity demand or market stress. I fully expect that standing [repurchase agreement] operations will continue to be actively used in this way.”

While the recipients of these infusions aren’t immediately disclosed, the considerable size of the recent repurchase agreements suggests that one or more of the largest banks in the country are likely involved.

Financial analysts writing for DCReport suggest the massive cash infusion could be an effort to shore up the billions of dollars that some major banks have lost from shorting precious metals.

The commodity’s price has soared to historic levels thanks in part to technology- and defense-sector demand, leading to massive losses for those who had bet that prices would drop.

Updated: 1-24-2026

Bank Deposits Finally Get Real Yield!!!

The fight over stablecoin yield isn’t really about stablecoins.

It’s about deposits and who gets paid on them, argues Le.

As Congress debates crypto market structure legislation, one issue has emerged as especially contentious: whether stablecoins should be allowed to pay yield.

On one side, you have banks fighting to protect their traditional hold over consumer deposits that underpin much of the U.S. economy’s credit system.

On the other side, crypto industry players are seeking to pass on yield, or “rewards,” to stablecoin holders.

On its face, this looks like a narrow question about one niche of the crypto economy. In reality, it goes to the heart of the U.S. financial system.

The fight over yield-bearing stablecoins isn’t really about stablecoins. It is about deposits, and about who gets paid on them.

For decades, most consumer balances in the United States have earned little or nothing for their owners, but that doesn’t mean the money sat idle. Banks take deposits and put them to work: lending, investing, and earning returns.

What consumers have received in exchange is safety, liquidity, and convenience (bank runs happen but are rare and are mitigated by the FDIC insurance regime). What banks receive is the bulk of the economic upside generated by those balances.

That model has been stable for a long time. Not because it is inevitable, but because consumers had no realistic alternative. With new technology, that is now changing.

A Shift In Expectations

The current legislative debate over stablecoin yield is more a sign of a deeper shift in how people expect money to behave. We are moving toward a world in which balances are expected to earn by default, not as a special feature reserved for sophisticated investors.

Yield is becoming passive rather than opt-in. And increasingly, consumers expect to capture more of the returns generated by their own capital rather than have them absorbed upstream by intermediaries.

Once that expectation takes hold, it will be hard to confine to crypto. It will extend to any digital representation of value: tokenized cash, tokenized Treasuries, onchain bank deposits, and eventually tokenized securities.

The question stops being “should stablecoins pay yield?” and becomes something more foundational: why should consumer balances earn nothing at all?

This is why the stablecoin debate feels existential to traditional banking. It is not about one new asset competing with deposits.

It is about challenging the premise that deposits should, by default, be low-yield instruments whose economic value accrues primarily to institutions rather than individuals and households.

The Credit Objection And Its Limits

Banks and their allies respond with a serious argument: If consumers earn yield directly on their balances, deposits will leave the banking system, starving the economy of credit.

Mortgages will become more expensive. Small-business lending will shrink. Financial stability will suffer.

This concern deserves to be taken seriously. Historically, banks have been the primary channel through which household savings are transformed into credit for the real economy.

The problem is that the conclusion does not follow the premise. Allowing consumers to capture yield directly does not eliminate the need for credit.

It changes how credit is funded, priced and governed. Instead of relying primarily on opaque balance-sheet transformation, credit increasingly flows through capital markets, securitized instruments, pooled lending vehicles and other explicit funding channels.

We have seen this pattern before. The growth of money-market funds, securitization, and nonbank lending prompted warnings that credit would collapse. It did not; it just reorganized.

What is happening now is another such transition. Credit does not disappear when deposits are no longer silently rehypothecated.

It relocates into systems where risk and return are more clearly surfaced, where participation is more explicit and where those who bear risk capture a commensurate share of the reward.

This new system doesn’t mean less credit; it means a restructuring of credit.

From Institutions To Infrastructure

What makes this shift durable is not any single product, but the emergence of financial infrastructure that changes default behavior. As assets become programmable and balances more portable, new mechanisms allow consumers to retain custody while still earning returns under defined rules.

Vaults are one example of this broader category, alongside automated allocation layers, yield-bearing wrappers and other still-evolving financial primitives.

What these systems share is that they make explicit what has long been opaque: how capital is deployed, under what constraints and for whose benefit.

Intermediation does not disappear in this world. Rather, it moves from institutions to infrastructure, from discretionary balance sheets to rule-based systems and from hidden spreads to transparent allocation.

That is why framing this shift as “deregulation” misses the point. The question is not whether intermediation should exist, but rather who and where should benefit from it.

The Real Policy Question

Seen clearly, the stablecoin yield debate is not a niche dispute. It is a preview of a much larger reckoning about the future of deposits.

We are moving from a financial system in which consumer balances earn little, intermediaries capture most of the upside and credit creation is largely opaque, to one in which balances are expected to earn, yield flows more directly to users, and infrastructure increasingly determines how capital is deployed.

This transition can and should be shaped by regulation. Rules around risk, disclosure, consumer protection, and financial stability remain absolutely essential. But the stablecoin yield debate is best understood not as a decision about crypto, but as a decision about the future of deposits.

Policymakers can try to protect the traditional model by limiting who may offer yield, or they can recognize that consumer expectations are shifting toward direct participation in the value their money generates.

The former may slow change at the margins. It will not reverse it.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

“Better Days Ahead With Crypto Deleveraging Coming To An End” — Joker

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Ultimate Resource For Crypto Mergers And Acquisitions (M&A) (#GotBitcoin)

Why Wall Street Is Literally Salivating Over Bitcoin

Nasdaq-Listed MicroStrategy And Others Wary Of Looming Dollar Inflation, Turns To Bitcoin And Gold

Bitcoin For Corporations | Michael Saylor | Bitcoin Corporate Strategy

Ultimate Resource On Myanmar’s Involvement With Crypto-Currencies

‘I Cry Every Day’: Olympic Athletes Slam Food, COVID Tests And Conditions In Beijing

Does Your Baby’s Food Contain Toxic Metals? Here’s What Our Investigation Found

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

Ultimate Resource On BlockFi, Celsius And Nexo

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

100 Million Americans Can Legally Bet on the Super Bowl. A Spot Bitcoin ETF? Forget About it!

Green Finance Isn’t Going Where It’s Needed

Shedding Some Light On The Murky World Of ESG Metrics

SEC Targets Greenwashers To Bring Law And Order To ESG

BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Canada’s Major Banks Go Offline In Mysterious (Bank Run?) Hours-Long Outage (#GotBitcoin)

On-Chain Data: A Framework To Evaluate Bitcoin

On Its 14th Birthday, Bitcoin’s 1,690,706,971% Gain Looks Kind of… Well Insane

The Most Important Health Metric Is Now At Your Fingertips

American Bargain Hunters Flock To A New Online Platform Forged In China

Why We Should Welcome Another Crypto Winter

Traders Prefer Gold, Fiat Safe Havens Over Bitcoin As Russia Goes To War

Music Distributor DistroKid Raises Money At $1.3 Billion Valuation

Nas Selling Rights To Two Songs Via Crypto Music Startup Royal

Ultimate Resource On Music Catalog Deals

Ultimate Resource On Music And NFTs And The Implications For The Entertainment Industry

Lead And Cadmium Could Be In Your Dark Chocolate

Catawba, Native-American Tribe Approves First Digital Economic Zone In The United States

The Miracle Of Blockchain’s Triple Entry Accounting

How And Why To Stimulate Your Vagus Nerve!

Housing Boom Brings A Shortage Of Land To Build New Homes

Biden Lays Out His Blueprint For Fair Housing

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Cracks In The Housing Market Are Starting To Show

Ever-Growing Needs Strain U.S. Food Bank Operations

Food Pantry Helps Columbia Students Struggling To Pay Bills

Food Insecurity Driven By Climate Change Has Central Americans Fleeing To The U.S.

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Families Face Massive Food Insecurity Levels

US Troops Going Hungry (Food Insecurity) Is A National Disgrace

Everything You Should Know About Community Fridges, From Volunteering To Starting Your Own

Russia’s Independent Journalists Including Those Who Revealed The Pandora Papers Need Your Help

10 Women Who Used Crypto To Make A Difference In 2021

Happy International Women’s Day! Leaders Share Their Experiences In Crypto

Dollar On Course For Worst Performance In Over A Decade (#GotBitcoin)

Juice The Stock Market And Destroy The Dollar!! (#GotBitcoin)

Unusual Side Hustles You May Not Have Thought Of

Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

The Fed Is Setting The Stage For Hyper-Inflation Of The Dollar (#GotBitcoin)

An Antidote To Inflation? ‘Buy Nothing’ Groups Gain Popularity

Why Is Bitcoin Dropping If It’s An ‘Inflation Hedge’?

Lyn Alden Talks Bitcoin, Inflation And The Potential Coming Energy Shock

Ultimate Resource On How Black Families Can Fight Against Rising Inflation (#GotBitcoin)

What The Fed’s Rate Hike Means For Inflation, Housing, Crypto And Stocks

Egyptians Buy Bitcoin Despite Prohibitive New Banking Laws

Archaeologists Uncover Five Tombs In Egypt’s Saqqara Necropolis

History of Alchemy From Ancient Egypt To Modern Times

Former World Bank Chief Didn’t Act On Warnings Of Sexual Harassment

Does Your Hospital or Doctor Have A Financial Relationship With Big Pharma?

Ultimate Resource Covering The Crisis Taking Place In The Nickel Market

Apple Along With Meta And Secret Service Agents Fooled By Law Enforcement Impersonators

Handy Tech That Can Support Your Fitness Goals

How To Naturally Increase Your White Blood Cell Count

Ultimate Source For Russians Oligarchs And The Impact Of Sanctions On Them

Ultimate Source For Bitcoin Price Manipulation By Wall Street

Russia, Sri Lanka And Lebanon’s Defaults Could Be The First Of Many (#GotBitcoin)

Will Community Group Buying Work In The US?

Building And Running Businesses In The ‘Spirit Of Bitcoin’

What Is The Mysterious Liver Disease Hurting (And Killing) Children?

Citigroup Trader Is Scapegoat For Flash Crash In European Stocks (#GotBitcoin)

Bird Flu Outbreak Approaches Worst Ever In U.S. With 37 Million Animals Dead

Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.