The Ultimate Marketplace For Bitcoin-Based (And Other) Games (#GotBitcoin)

Open source blockchain platform Waves and blockchain game distribution platform The Abyss will jointly launch a blockchain-based marketplace of digital goods and in-game items. The Ultimate Marketplace For Bitcoin-Based (And Other) Games (#GotBitcoin)

CinemaDraft

Pitch: A Daily Fantasy Sports (DFS)-style movie game. Instead of picking athletes from teams, you’re picking actors from movies, earning points based off their movies’ performance.

Business Summary: CinemaDraft helps solve the movie industry’s engagement problem which, despite being an $11B a year industry, has seen admissions decline 6% over the past decade.

Related:

SHAmory: The First And Only STEM Certified Bitcoin Card Game!

“Against-All-Odds” is a tower defense game, where you take the role of a cybersecurity expert to fight against hackers and other blockchain threats in this cypherpunk interactive fiction. Combined with squad customization, base/tower building, and simulation. Defend the blockchain!

Satoshis Games: Is a gaming platform that allows you to earn bitcoin by playing games.

Thndr Games: Play Games. Win Bitcoin

Get Bitcoin Playing Light⚡Nite

Accept the challenge of this multiplayer battle-royale game with in-game bitcoin rewards and a minimalistic low-poly & cartoonish design.

MintGox is a brand new style of esports tournament. Games become more engaging and rewarding when virtual currency is added, so we went ahead and did just that! Now you can earn Bitcoin, tip streamers, even powerup your favourite players! Welcome to the future of esports!

The ZEBEDEE wallet is your bridge into virtual economies. It is a Bitcoin Lightning wallet made specifically to connect with games. It comes with a unique gamertag. This is like your ID for payments in virtual worlds. Use it to send and receive transactions.

Bitcoin Card Game Bitopoly Launches: The new card game Bitopoly gives players an entertaining way to learn about the history, technology and culture of Bitcoin.

Chill Club for Plebnet (On Clubhouse) Bitcoin Lightning Node Girth talk. Included Access To The Lightning-Network-Based Poker Game!!!

EA, Other Videogame Companies Target Mobile Gaming As Pandemic Wanes

Crypto Game Surge Lures Australia’s Carnegie On Play-to-Earn

Venture-capital investor Mark Carnegie is backing the nascent play-to-earn cryptocurrency market through Crypto Gaming United, a coalition of more than 1,500 players that he expects will grow to 100,000 over the next 18 months.

Crypto Gaming United raised $5 million in a seed funding round that was oversubscribed, Carnegie said in an interview Wednesday. The majority of the players are based in the Philippines, where many users of the popular Axie Infinity game for tradable tokens currently reside, with some also coming from countries including Indonesia, South Africa and India.

The coalition works across multiple games, providing education to current and aspiring players on financial literacy and the digital economy. Gaming guilds offer “scholarships” to players of NFT games, funding the entry costs for indiviuals and their ongoing training costs. In return, the guild splits the revenue made within the game with its players.

“Everyone knows crypto is a speculative asset class from the money point of view, but I feel unquestionably in a decade’s time for eSports and stuff like that, a huge number of players will have come from these,” Carnegie said. “I bet a lot of these sports stars in a decade are going to have their starts on games like Axie.”

Carnegie and co-founder Sergei Sergienko, who have nearly 40,000 gamers waiting to join after establishing the coalition last month, said they chose Singapore as the headquarters for their non-fungible token gaming company because it is a “forward looking” jurisdiction in terms of cryptocurrency adoption.

“The opportunity for wealth creation in the NFT space is no longer limited to those with the means, such as sports celebrities,” said Carnegie, a former banker who sold his boutique to Lazard Ltd. “At Crypto Gaming United, we are overcoming the cost barrier required for admission to play, thereby allowing players to generate income through their gaming exploits.”

——————————–

The streaming, free-to-play games spur interest and fan engagement through fantasy gaming, much like how daily fantasy sports (DFS) has driven engagement with professional sports leagues.

Management Team: Edwardo Jackson, novelist, screenwriter, and one-time professional poker player combined his varied skill set to create and run the CinemaDraft game. His experience as poker room manager for an online poker site plus being an avid daily fantasy sports player with an extensive background in marketing & social media uniquely positions this lifelong entertainment professional as the one to popularize this game with the public.

Problem: The movie industry needs innovative ways to engage movie fans who have increasing content options vying for their attention instead of going to the theater.

Service: CinemaDraft provides a free-to-play, fantasy sports-style game for people who love the movies, encouraging them to engage more with the industry through gamification, movie discovery, and, ultimately, increased movie theater attendance.

Target Market: 246M North Americans (71% of the population) attended the movies at least once in 2016 (MPAA).

57.4M North Americans are fantasy sports users, with DFS players enjoying 40% more sports content after becoming players (FSTA).

The cross-section of moviegoing fantasy sports players equals a target market of 40.8M, with an underserved market opportunity of at least 13.99M female moviegoing, fantasy sports players. While DFS players are 98% male and 91.6% white (Eilers Research), the frequent moviegoing audience is 52% female & 56% white, offering an opportunity that caters to Mr. Jackson’s career marketing strengths.

Customers: Our primary focus is to provide an entertaining game for our players, creating a sticky gaming environment and community that invites paying for premium services while also being a pool of warm leads for marketing partners.

Marketing Strategy: In promoting cash prizes for our free-to-play game, we will attract gamers, moviegoers, and DFS enthusiasts alike through targeted online marketing campaigns; building a separate community site around the game featuring strategy, podcasts, and other content marketing; robust referral/affiliate marketing rewards & contests; and growing the size of prize pools and variety of contests to generate good old-fashioned word of mouth.

Business Model: Movie ticket brokering, contest sponsorship, player fees for premium mobile features, loyalty club subscription service for additional features & exclusive contests, and revenue share with players from opt-in email marketing from our advertising partners. Additionally, an innovative, decentralized app smart contract, cryptocurrency/token-based model native to the platform is in development.

Competitor: Fantasy Movie League, acquired by National CineMedia (May 2017).

Competitive Advantage: Mr. Jackson’s creative, professional, and gaming skill sets/experience; enhanced, more skillful & fun strategy/game mechanics; cash prizes for playing a free game.

The Problem

Hollywood has a moviegoer engagement problem.

All it takes is one look at Box Office Mojo and some basic math to see that North American movie theater admissions are down 14% in the last 15 years (1.51B to 1.31B tickets), with it being down 8% in the last decade (1.41B tickets to 2019’s estimated 1.29B). As of September 1, 2019, attendance is down 5% from last year.

Attendance can be fickle year-to-year due to what is at the movies (“content is king”). However, this is a general trend that is exacerbated by more entertainment options competing for our attention, rising ticket prices, and a general disconnection from finding compelling enough content to go to the theater. For an $11B yearly industry, theatrical movie distribution losing 8-14% is a lot of money off the table.

CinemaDraft helps solve the movie industry’s engagement problem by streaming our free-to-play games that spur interest and fan engagement through fantasy sports-style gaming, much like how daily fantasy sports (DFS) has driven engagement with professional sports leagues. We are currently pivoting to a streaming content model in the midst of the global pandemic.

Testimonials:

Michael Villante, player: Very cool site for movie buffs and fantasy sports fans. The best of

both worlds.

Nick Ringwald, player: Anyone who considers themselves movie buffs should be playing! It’s

fun and addicting and FREE!! Already won over $100!

Claudette, player: It really makes you want to learn more about the different movies and go see

more movies.

Jay Devlin, “Mostly Sports” podcast personality, player: You’ve created a monster.

Mission

I want to make a very specific point that should guide our focus moving forward. Having been a lifelong lover of words, I respect and appreciate their power. And the most basic level of CinemaDraft is that this is a game to be enjoyed by our players.

In all consumer facing copy and internal communications that do not involve code, I want to address the concept of “user” as “player.”

At the end of the day, it’s all about the game. Games are fun. Players play games to have fun. I want us all, on the most basic of levels, to be guided like the North Star on a player experience that will be FUN. Because if this game is fun, then we all win.

So players over users. Tabs vs. spaces. Here’s to continued good work.

Edwardo Jackson

CEO & Founder

CinemaDraft, LLC

Updated: 1-16-2020

Atari Seeks New Cachet With Crypto — And A Return To Hardware

As Microsoft Corp. and Sony Corp. prepare to launch their new video-game consoles, another legendary player, Atari, is readying its first new hardware in more than 20 years. The Atari VCS will come with a twist — a way for gamers to spend a cryptocurrency while they play.

First teased several years ago and expected to ship in November, the Atari VCS is being called a mini-console or a gaming computer. The product will offer access to more than 100 Atari arcade games and home classics, like Pong, plus new titles. It will have internet connectivity and let consumers buy products using Atari Tokens, which will go on sale in late October.

“We have a brand, we have a following — we think we are going to get some attention in any case,” said Chief Executive Officer Frederic Chesnais, adding that his competition is more the iPhone than an Xbox or PlayStation. “After that the product has to be good.”

On Oct. 29, Bitcoin.com Exchange will start selling $1 million worth of Atari Tokens for 25 cents apiece to retail investors outside of the U.S. The tokens will be used for in-game purchases and for partner games, as well as eventually in the broader gaming ecosystem if Atari’s effort to create a standard currency for the industry bears fruit.

The company is also working on a gaming stablecoin, which won’t be as volatile as most tokens. But it isn’t close to launch, said Chesnais, who led Atari out of its 2013 bankruptcy.

The push is part of Chesnais’s seven-year effort to revitalize Atari SA, making it more modern and relevant. While Atari’s predecessor companies raised a whole generation of gamers with arcade and home titles like Asteroids and Missile Command in the 1970s and 1980s, it has long been sidelined by stronger, bigger rivals.

The company has been split into pieces, merged and emerged from bankruptcy. Today’s Atari is tiny, with only about 20 staffers. Its Paris-traded shares have languished below 50 cents since 2018, when the company announced a cryptocurrency effort.

But Chesnais has great ambitions for Atari, which largely hinge on nostalgia for the brand.

“The consumer going for the retro systems is different than what the new consoles are targeting,” said David Cole, CEO at digital entertainment researcher DFC Intelligence. “And yes, that is an opportunity.”

So far, more than 11,500 people have preordered the new hardware through the crowdfunding site Indiegogo, where Atari ran a campaign for the player and took in more than $3 million.

The company is facing economic headwinds. While Covid-19 has led to a surge in people staying home and playing games, many millions have lost their jobs or fear losing them. That could limit their spending this holiday season and push consumers to opt for major players’ new consoles, instead.

There’s also the pricing. Atari’s all-in bundle, which includes an 8-gigabyte Atari VCS, a wireless controller, a wireless classic joystick, and 100 classic arcade and console games, costs $390. The Xbox Series S starts at $300.

“I am kind of pessimistic, to be honest, because you are going head to head with Xbox and PlayStation 5,” said Lewis Ward, an analyst at researcher IDC. “Obviously if you are a huge fan of Atari games, there’s always a nostalgia basis. But simply on a price-to-value ratio, I don’t see how this becomes more than a niche product.”

Covid-19 had already delayed the VCS — it was previously scheduled to ship in March. What’s more, Atari faces looming competition even in the retro category. Intellivision Entertainment plans to release its Amico player early next year with a starting price of around $249. That player “is looking more impressive,” Cole said.

Atari’s foray into cryptocurrencies could also be hit or miss. Past efforts to marry tokens with video games haven’t panned out. The good news is that cryptocurrency enthusiasts are also gamers. If Atari’s tokens do take off, they could be an “on-ramp for a major increase in crypto use,” according to Aaron Brown, a crypto investor who writes for Bloomberg Opinion.

“We’ll see how it plays up,” Chesnais said. “We don’t need to sell millions in the beginning, it’s a long-term effort.”

————————–

Abyss Reveals Its Collaboration With The Waves Platform

In a blog post published on Sept. 5, The Abyss revealed its collaboration with the Waves Platform, aimed at the development of a blockchain-powered marketplace of tradable goods and in-game items. The marketplace will enable users to purchase items with Abyss Tokens and sell them to other users.

Waves Blockchain-Integrated Tokens

The integration of Abyss Tokens with Waves blockchain will allow game developers to incorporate Abyss Token operations directly into their Waves-based games. Commenting on the development, Sasha Ivanov, founder and CEO of Waves Platform, said:

“We recognize the huge potential of the $100+ billion gaming sector as a major use case for blockchain which perfectly fits with current gameplay mechanics and trading of goods. We strongly believe that the gaming industry will be an enthusiastic adopter of blockchain, and partnership with The Abyss will drive its widespread use.”

Earlier Collaborations

This spring, The Abyss announced a partnership with Epic Games to allow developers on the platform access to the Unreal Developers Network. At the time, a The Abyss spokesperson commented on the partnership in an email sent to Cointelegraph:

“The program is aimed at attracting more gaming studios and titles to The Abyss platform, as well as supporting Unreal Engine developers in cryptocurrency adoption. More specifically, they will be able to accept ABYSS tokens both for game and in-game purchases in legal and easy-to-use way.”

In late June, Waves introduced an upgrade to its blockchain that enables decentralized applications on the platform, which will purportedly enable developers to perform calculations necessary for use cases on the Waves blockchain.

Real-Time Strategy Game For Mining ‘Crypto Gold’ Launches On WAX

The online real-time economic strategy game, Prospectors, will be launching on the Worldwide Asset eXchange (WAX).

Prospectors Blockchain Game Lands On WAX

In a Sept. 17 blog post, WAX announced that one of the largest dApps in the world, The Prospectors, is launching on the WAX blockchain, on which users buy physical and virtual items using WAX tokens.

This blockchain-based decentralized strategy game set during the 19th-century gold rush launched on EOS in late June 2019. Notably, the game’s designers plan for it to become fully autonomous over time.

Arielle Brechisci, Content Manager at WAX said that the game will launch on the WAX blockchain within the next few weeks, so that WAX Token holders and millions of OPSkins Marketplace customers can start playing the game, adding:

“The exciting game of strategy gives players endless opportunities to earn crypto gold by utilizing blockchain technology, where they can start a business and explore a world teeming with resources there for the taking.”

WAX Summoned To California Court Over 2017 ICO

Cointelegraph reported in August that the United States District Court for the Central District of California issued a summons to video game virtual goods company OPSkins Group and WAX in response to a complaint filed by Crypto Asset Fund.

The complaint included 12 charges — including fraud, unlawful business practices and violation of the Securities Acts of 1933 and 1934. In particular, these concerned the accused’s initial coin offering of WAX tokens.

Largest Tencent Shareholder Leads $15M Round In Blockchain Game Developer

Naspers, the largest shareholder of Chinese Internet giant Tencent, participated in a $15 million investment in blockchain game developer Immutable.

Key Investors

Immutable, a Sydney-based blockchain gaming startup, completed a new funding round led by Naspers and Mike Novogratz’s crypto investment bank Galaxy Digital, the company announced in a blog post on Sept. 23.

As reported by the Australian Financial Review (AFR), other investors also included Sydney-based VC firm Reinventure and American private investment firm Apex Capital.

Scaling From 13,000 To 1 Million Gamers Projected

According to the report, Immutable’s flagship game Gods Unchained has made over $4.5 million in revenue in just over a year, despite it is being played by a closed group of 13,000 gamers.

Founded by brothers Robbie and James Ferguson in July 2018, Immutable reportedly expects to grow Gods Unchained from the current 13,000 to 1 million players with the new investment, James stated in an interview with AFR.

Based on the Ethereum blockchain, Gods Unchained is a trading card game that has reportedly overtaken other popular TCGs such as Artifact, Faeria and Kards, Immutable stated. In February 2019, Gods Unchained’s unique digital card Hyperion became the world’s second most expensive card ever sold after selling for137.8 Ether (ETH), or $62,000 at the time of auction.

On Sept. 17, the Worldwide Asset eXchange (WAX) announced that one of the largest decentralized apps in the world, online real-time economic strategy game Prospectors, was launching on the WAX blockchain.

Updated: 11-8-2019

Game Makers Expect to Ring in Holidays With Strong Digital Sales

Makers organizing special events inside blockbusters, adding features to keep players engaged.

Videogame companies are planning to lean further on high-margin digital sales this holiday season, as more consumers ditch discs for downloads and publishers find creative ways to generate revenue from their biggest hits long after release.

Activision Blizzard Inc., Take-Two Interactive Software Inc. and Electronic Arts Inc. all raised their end-of-year guidance for revenue and net bookings in recent weeks, citing stronger-than-expected consumer spending. The December quarter, which is typically the largest revenue-generating period for these companies, is expected to show continued demand for digitally delivered content.

Game makers are organizing special events inside their blockbusters and adding new features to keep players engaged. For example, Electronic Arts late last month brought new factions, maps, weapons and vehicles to “Battlefield V,” the most recent installment of the company’s nearly two-decade-old war franchise.

“The holidays will also be a busy season for players in our live services,” Electronic Arts Chief Executive Officer Andrew Wilson said on last week’s earnings call, referring to spending that occurs after a game has launched. “Our communities will all have new content and new experiences to dive into during the holiday quarter.” The company also forecast the holiday quarter to be one of its biggest for net bookings, an important measurement of industry revenue.

While Take-Two expects revenue to fall year over year due to a lighter release slate, it forecast growth in spending inside its videogames. That is because people can spend money on virtual perks in its existing hits such as “Grand Theft Auto Online” and “NBA 2K20” any time.

“The business as a whole is overperforming,” Take-Two CEO Strauss Zelnick said in an interview Thursday.

In the latest quarter, digital sales made up roughly three-quarters of net bookings for Take-Two and Activision Blizzard, both companies said Thursday. Last week, Electronic Arts said more than 60% of net bookings came from digital purchases.

“This is a trend we’ve seen happening for the last several years,” Stephens analyst Jeff Cohen said. “It’s having a positive impact on margins.”

Investors also want to see these companies boost margins. Share-price growth in all three companies has lagged behind the broader Nasdaq Composite Index this year, in part because analysts have raised concerns about their ability to lift profits.

This year, the major publishers are again serving up just a handful of mostly sequels and spinoffs for the holidays, continuing a decadeslong pattern that analysts attribute to rising development costs. They say publishers are investing in more advanced technology and talent to create beefier and higher-quality games.

With tentpole games now commanding budgets of around $100 million or more, up from single-digit millions in the 1980s, analysts say big publishers view original properties as a major risk, just like in sequel-heavy Hollywood for movies. “Franchises have built-in audiences with proven customer loyalty,” said Jefferies analyst Alexander Giaimo. “They’re a much safer play.”

For those big-budget holiday releases, Take-Two introduced a sequel to its decade-old Borderlands franchise in September while Activision Blizzard put out a new installment of its 16-year-old Call of Duty franchise last month. Next week, Electronic Arts is expected to launch its latest Star Wars-themed game, a franchise that has already been licensed for dozens of games over the last four decades.

The major game publishers are also pursuing opportunities to boost revenue through new channels, such as Stadia, a cloud-gaming platform launching later this month from Alphabet Inc. ’s Google.

Electronic Arts also said last week it is growing its digital subscription business. The company ended the quarter with about 5 million subscribers on EA Access, a service that allows people to play a collection of games through Microsoft Corp. ’s Xbox One and Sony Corp. ’s PlayStation 4, up from 3.5 million in July. The service is also expected to launch on the popular game-download store Steam in the spring, Electronic Arts said.

Updated: 11-20-2019

Online Gaming Platform Lets Gamers Collect BTC In First-Person Shooter Game

Donnerlab, an online gaming platform that builds lightning games and applications, lets gamers hunt for Bitcoin (BTC) and pick-up “Satoshi cubes.”

Shoot Other Players And Collect Satoshis

In a tweet on Nov. 19, Donnerlab announced the launch of its latest project, titled Bitcoin Bounty Hunt, a fully lightning-native multiplayer first-person shooter (FPS) game. The Lightning network is a payment protocol that allows for fast, micropayments between two so-called nodes — in this case, gamers.

Donnerlabs was founded by twenty-five-year-old Konstantin Nick after the 2018 Lightning Hackday in Munich, Germany, as a means to introduce the world’s largest cryptocurrency to more people.

The FPS game features an integrated neutrino wallet, where gamers can store coins in a noncustodial fashion, an ad space for Hodl-auctions, and of course the ability to kill off other players in order to collect bounties.

Bitcoin adoption through games

In October, Bitcoin-enabled games startup Satoshis Games announced the development of a Fortnite-like game with built-in Lightning Network microtransactions, titled Lightnite, where interactions between players trigger a monetary reward or penalty for the user. Satoshis Games said at the time:

“In simple words, players earn Bitcoin by shooting other players and lose Bitcoin when they get shot.”

The game reportedly updates in real-time when the player damages another player, gets damaged or picks up an item with BTC value and allows gamers to instantly withdraw their balance via Lightning Network when they wish to do so.

“Lightning network will drive Bitcoin to $250,000”

In November, the pro-cryptocurrency venture capitalist Tim Draper said that innovations such as the Lightning network would be key in propelling the Bitcoin price higher. Draper believes that Bitcoin could reach $250,000 by 2022 or 2023, in part due to “Bitcoin payment processors”, which “are really going to open the floodgates.” He said:

“It’s because of Lightning Network and OpenNode and maybe others that are allowing us to spend Bitcoin very freely and quickly, so that it’s not just a store of value but it can be used for micropayments; it can be used for retail, it can be used all over.”

Updated: 11-25-2019

Formula 1-Branded Blockchain Game To Auction Digital Race Car Tokens

Blockchain game F1 Delta Time — licensed by the world-renowned racing series Formula 1 — is holding an auction of F1 car-branded non-fungible tokens (NFTs) later this week.

According to an announcement on Nov. 22, the auction will be held on Nov. 28, with fans already able to participate in a live contest to compete for various related prizes.

As previously reported, F1 Delta Time purportedly draws 1.6 billion television viewers across over 180 territories and engage 506 million fans worldwide.

NFTs To Be Functional Within F1 Blockchain Game

Unlike most cryptocurrencies, non-fungible tokens are a form of a digital collectible: non-fungible meaning they are not interchangeable, carrying unique information and varying in their level of rarity.

F1 Delta Time notes that it has set five different rarity levels, while official team cars are not available in the lowest two rarity tiers. Each NFT will be usable in the forthcoming official F1 Delta Time game and will be auctioned simultaneously in a descending Dutch format, with a starting price of 30 Ether (ETH).

All F1 branded team cars will be included in the NFT auction, including Mercedes AMG W10, Ferrari SF90, Red Bull Racing RB15, McLaren MCL34, Renault R.S. 19, Racing Point RP19, Toro Rosso STR14, Alfa Romeo Racing C38, Haas VF-19, and Williams FW42.

According to the announcement, all cars’ performance indices are similar and will be disclosed next week.

F1 Delta Times’ contest is currently inviting fans to predict the order of sale for the F1 team cars, with prizes including 30 Ether and various types of F1 Delta Time Car Gear NFTs.

Popularizing Blockchain

As reported, Formula 1 signed a global licensing agreement with blockchain startup Animoca Brands in March of this year, paving the way for the development of the F1 Delta Time Game.

At the time, both parties underscored the significant brand power of Formula 1 and the new licensing agreement’s potential to broaden consumer exposure to blockchain.

Animoca Brands has also entered into a licensing agreement with Atari — famous for being the developer of iconic video games such as Tetris and Pac Man.

In Feb. 2018, Atari saw its share price skyrocket by over 60% after announcing that it would be investing in cryptocurrency.

Ethereum co-founder Vitalik Buterin has made the argument that non-financial blockchain applications can face more difficulty gaining traction and identified developments such as NFTs and gaming as potential areas that can broaden the technology’s appeal.

Updated: 12-1-2019

Microsoft To Turn 1980s Gamebook Series Into Blockchain Card Game

Microsoft, major game developer Eidos and gamebook firm Fabled Lands are jointly developing a blockchain card game based on a 1980s best-selling gamebook.

According to a press release published on Dec. 1, the new card game will be based on the 1980s best-selling book called “The Way of the Tiger,” written by Jamie Thomson and Mark Smith.

The game’s title will be “Arena of Death” and its players will fight in fantasy-themed card battles with features from the original gamebook series.

Ensuring Card Ownership

Thomson is also Fabled Lands’ chief executive officer and decided to use blockchain technology because he believes it suits what he is trying to achieve better than a traditional videogame. He said:

“We were going to relaunch the series into a computer game format but this new technology (blockchain), just made more sense. Imagine playing Magic the Gathering but knowing if you owned a card, it really does belong to you. Or if we say there are only 100 editions of an item or skill, you know there really are only 100 editions.”

The company plans to use non-fungible tokens (NFT) on the Vechain blockchain — which has been associated with enterprises and supply-chain management — to ensure ownership of in-game assets.

Vechain will allow creating cards and in-game items “without having to deal with all the crypto stuff,” says Thomson.

In-Game Blockchain Tokens Gaining Popularity

The tokenization of in-game assets appears to be a growing trend. As Cointelegraph reported in late November, Blockchain game F1 Delta Time — licensed by the world-renowned racing series Formula 1 — held an auction of F1 car-branded NFTs.

Elsewhere, the Ethereum (ETH) based trading card game Gods Unchained has far outstripped CryptoKitties by volume after a censorship scandal involving game-developer Blizzard, reaching almost half of a million NFT transfers per day.

Updated: 12-5-2019

What Attracts Investors To Blockchain Gaming?

Blockchain is transforming the financial industry right before our eyes, with many market onlookers anticipating a complete replacement of existing payment, trading and banking infrastructures. Blockchain and finance seem like the perfect match, but there are other sectors, for which the technology may play a game-changing role. For one particular industry, the latter adjective isn’t figurative at all, because blockchain can do just that – change the gaming market. This is a unique chance for investors, and it seems like they don’t want to miss it.

During the last few years, the gaming industry has been pampered with several innovations at once – virtual reality (VR), augmented reality and artificial intelligence. But it is blockchain that can have the greatest contribution, bringing more transparency and trust to the gaming space.

Investors don’t want to be simple observers and are jumping on the blockchain gaming bandwagon. For them, the technology has a disruptive potential that can be converted into profitable deals. Thus, they consider this emerging technology to be a breakthrough in the gaming industry.

Transforming gaming at all levels

But how can distributed ledger technology (DLT) help both developers and gamers? Blockchain’s capabilities are limitless in terms of use cases, so there are many ways it can transform the gaming industry:

Blockchain can help developers remove grey market trading of in-game assets — game developers have designed their games to be closed ecosystems, which ensures that any value inputted into the game cannot be extracted. For instance, players were not able to sell their assets for money, use them in other games or trade them for another game’s assets. This led to the creation of grey markets where players could come together to facilitate these types of activities. Blockchain technology enables publishers to embed rules into their tokenized assets that enforce a transaction fee upon each transfer of the asset, regardless of where that asset is being sold. As a result, users are free to trade their assets as they see fit, and publishers can continue to generate revenue beyond the primary market.

Blockchain enables projection of value to intangible assets — everyone realized the close interaction between DLT and gaming when CryptoKitties came out on Ethereum. The game allows players to purchase, breed and trade unique virtual kittens with cryptocurrencies. This collectible game uses so-called non-fungible tokens (NFT) since each digital kitty is unique. So far, players have spent millions of United States dollars for the kitties, with the most expensive one being sold for 600 Ether (ETH) — over $173,000 at the time. Games like CryptoKitties demonstrate the power of DLT through the tokenization of assets. This ensures that each asset can be proved to be unique or rare; it ensures that users have ownership over their digital assets; and it allows these assets to interoperate with other applications outside of their original ecosystem. These features all contribute to a greater perceived value by the user, which increases the propensity to spend real dollars within the app. While CryptoKitties showcased the attributes that DLT could bring to gaming, it failed to create an engaging experience that would entice a wider audience. Next generation blockchain-enabled games, like Epics Digital Collectibles, seamlessly integrate DLT with a consumer-centric, captivating and gamified experience.

Blockchain can help with buying, selling and storing in-gaming assets — with DLT, the issuing and trading of in-game assets reach the next level.

Developers can create games that allow players to buy in-game assets with cryptocurrencies, which makes the process easier, more rapid and secure. Also, cryptocurrencies can address the challenge of microtransactions. However, publishers understand that the average consumer is not ready to make a transaction in cryptocurrencies, and thus, they obfuscate these crypto mechanics behind a familiar fiat payment gateway.

Moreover, developers can create specialized frameworks for digital assets used in games. As mentioned, CryptoKitties was built on Ethereum, but there are already blockchain-based standards focused exclusively on gaming. One such example is dGoods, which is a token framework developed initially for the EOSIO protocol.

Mythical Games is one of the creators and developers that has used dGoods for its in-game assets. The company is set to launch its first game, called Blankos, in 2020. Blankos is projected to be the biggest launch of a blockchain-enabled game to date, accessing the wider gaming communities on PC, console and mobile.

Soon, more developers will begin leveraging digital asset frameworks and will collectively improve the operation of in-game assets.

Blockchain can help developers reach higher engagement rates and improve the Average Revenue Per Paying User (ARPPU) — NFT’s can be used to increase player engagement and improve the ARPPU. Game publishers have been noticing that blockchain-enabled games produce much higher ARPPU metrics due to the greater perceived value by the user. NFT’s are changing the way brands interact with their consumers. This new form of marketing is non-intrusive and offers the end consumer value, which ultimately drives up engagement rates. For instance, Azarus runs a challenge network on the Twitch streaming platform that rewards players for watching their favorite esports streams with AZA tokens that can be redeemed for in-game goods and items. Rewarding users with in-game items related to the game they are watching incentivizes them to continue viewing, which increases the likelihood of them spending more time playing the game. Given the engagement results that these new forms of marketing are producing, it is no surprise that game publishers are starting to invest marketing dollars in this industry.

Contributing To Market Growth

The gaming market is huge, and blockchain has attracted many investors who are now driving the industry’s expansion to new levels.

Today, there are over 2 billion gamers who either play on computer devices or smartphones. Games and esports analytics firm Newzoo estimates that the total number of gamers is 2.5 billion, suggesting that 1 in 3 people play video games. By the end of this year, they will have spent a combined $152.1 billion on games, which is a 9.6% increase compared to 2018.

Gaming is one of the fastest-growing industries in the world right now, and blockchain plays an essential role in polishing its image by bringing a new set of possibilities through a more open and trusting environment. This, in turn, attracts investors, many of whom are looking specifically for gaming firms that adopt DLT.

Some prominent blockchain-oriented investors have been including gaming firms in their portfolios. For instance, venture capital firm SVK Crypto has invested in Mythical Games, Azarus and High Fidelity. The latter is a VR platform co-founded by Philip Rosedale, the founder of the popular game Second Life, that uses blockchain technology to manage the ownership of in-game assets and currency.

SVK Crypto is part of Block.one’s EOS VC syndicate alongside Galaxy Digital and FinLab AG. Interestingly, FinLab AG has also shown interest in gaming firms, as it invested in Upland. Elsewhere, Galaxy Digital recently took part in a funding round held by Immutable, a Sydney-based blockchain gaming startup.

All in all, blockchain-oriented institutional investors don’t want to stay aloof from the rapid growth of the gaming space. Therefore, they might play an essential role in driving the industry’s expansion.

Updated: 12-5-2019

Microsoft Teams Up With Enjin To Offer Crypto Collectible Rewards

Do Good Work, Earn A “Badger.”

That’s the idea behind a new incentives scheme launched by Microsoft in partnership with blockchain gaming project Enjin.

Dubbed Azure Heroes, a new web page for the initiative describes its as a “new and fun way to earn digital collectibles for meaningful impact in the technical community.”

Simply, Azure Heroes rewards Azure community members for positive actions, such as coaching, making demos, providing sample code, making posts about Azure or completing challenges.

Participants with demonstrable contributions will be handed badges, er no, badgers, across various categories. These include community leadership, content, mentorship and innovators.

Issuance and transactions of the badger collectibles will be carried out on the ethereum blockchain, allowing winners to hold them as non-fungible tokens (NFTs).

According To Microsoft:

“Microsoft and Enjin have collaborated in a local pilot to create a blockchain based recognition programme. The Azure Heroes badgers were created in a number of original and unique designs which have been tokenised into a digital asset on the Ethereum public blockchain.

Initially a pilot in “select Western European countries,” badgers will be created in limited numbers verifiable on the public blockchain. Some of the NFTs, which will be issued in “seasons,” will be tougher to win than others, says Microsoft.

Badgers will be issued by sending a QR code to winners, which when scanned will give the recipient the option to install Enjin’s wallet. Once claimed, the NFTs can be sent to any public ethereum address or destroyed if desired.

The news looks to have brought a major boost to the price of Enjin’s token. At press time, enjin coin had risen over 44 percent in 24 hours, as per CoinMarketCap.

In October, Enjin became one of the first portfolio companies of the new venture arm of wallet and data provider Blockchain after receiving an undisclosed investment. The project also became an official partner of Samsung Electronics on its flagship, blockchain-enabled Galaxy S10 smartphone this spring.

Updated: 12-18-2019

Gaming Is Key To The Mass Adoption Of Crypto

A whole new exciting world of value is being coded into life right now by gamers. While it may be a far cry from the lofty ideals of banking the unbanked and taking down the global banking system, gaming is gearing up to be a massive force in the crypto space.

Addictively fun games will draw a whole new base of users into the crypto economy. Gamers are an excellent target market for adoption because many gamers are a touch more tech savvy than the average internet user and tend to be a bit more open to new ideas.

Just imagine this — a gamer beating a monster, picking up a rare item, selling that item for Ether (ETH) on a secondary market, and then using that Ether to buy a new hat online. This creates a whole new network of value that is liquid, fast and global — and most importantly, taps into gamers’ existing behavior: playing games.

But for this exciting future to transpire, games need to be fun… addictively fun. Up until now, most crypto games have been little more than retro 1980s throwbacks — with very simple graphics and limited playability — which is nice for nostalgia but will not add anything significant to the crypto economy.

However, a new class of games is changing this scenario and is set to take crypto games into the leagues of the truly great online games.

NFTs Pave The Way

Before looking at some examples, it is important to note that all of this has been enabled by nonfungible token technology, which allows for the proliferation of in-game digital assets on public blockchains.

Gaming could possibly be one of the major contributors to the crypto economy, with game developers making new token standards and technical developments that benefit the entire ecosystem — as well as the players of these games generating significant on-chain activity that helps to feed the miners. So, let us not make the mistake of thinking that crypto games are not lifting their weight in terms of ecosystem development.

Here Are A Couple Of Examples Of What Is Being Built And Played

Gods Unchained is bringing the wonder and excitement of a collectible card game like Magic: The Gathering to Ethereum. Gods Unchained is graphically enticing and has a great in-game flow of animations that keep the action rolling. The game has already attracted thousands of players to tournaments and continues to find a growing community of enthusiasts. Under the hood, players own the cards that they play with, storing the unique nonfungible tokens in their Ethereum wallet. Rarity is provable on-chain, and swaps on the secondary market are seamless. In February, a card sold for $62,000, which is astonishing for such a new game and really underlines the excitement building around crypto games.

Then, there is the Enjinverse, which is a growing multi-game experience that allows for in-game items to be used and moved seamlessly between dozens of games. Enjin itself is one of the most important cryptocurrencies in the gaming realm. One of the most interesting games in the Enjinverse is Age of Rust, which is a post-apocalyptic sci-fi adventure with stunning graphics and an enticing story. Looking at the popularity of games like Dead Space or Fallout, it becomes clear that Age of Rust stands a good chance of gaining significant popularity.

While the game itself is exciting, it is the underlying tech that really makes Age of Rust stand out: Not only are Enjin assets interoperable between games, but they also have value baked into them. So, regardless of the long-term outcome of the game itself, the items you acquire in the game all are forged with Enjin tokens melted into the in-game asset. These assets can be melted back down at any time, enabling you to claim the tokens underpinning the value of the item — as well as creating increased scarcity for the item class, as once it is melted, that item it gone forever.

Here are some major players to watch. Enjin is working closely with Unity, which accounts for nearly half of all game developers globally. Cocos has 1.4 million game developers using its engine, and the launch of its blockchain is likely to bring many of those developers over. Loom is focused on interchain operability and on enabling fun, user-facing games that will draw more users into crypto — with such titles as Neon District, which is a Blade Runner-esque RPG.

According to the recent research conducted by a gaming and e-sport analytics provider, the gaming industry as a whole is expected to be worth $180 billion by 2021, so the opportunity for crypto gaming is massive.

For players, there will be better experiences; for developers, there will be more tools to attract players to their games; and for investors, there will be the ability to own the cryptos that will be at the forefront of a major trend — but that has not yet taken off.

Updated: 12-19-2019

James Ferguson on Decentralized Gaming’s Next Moves

Growing up, CEO of Immutable James Ferguson’s favorite game was Runescape (a fantasy game). He said he found ways to run arbitration schemes in the MMORPG’s medieval economy and amassed a horde of virtual gold. After spending thousands of hours on game play, however, he realized his new-found wealth couldn’t be traded outside the game ecosystem.

It was this experience of investing time and effort without being able to fully reap the economics rewards that spurred Ferguson to decentralized game development. His studio’s creation, God’s Unchained, uses non-fungible tokens (NFTs) as game pieces appended to the ethereum blockchain to ensure players maintain ownership. Described as Magic: The Gathering meets Hearthstone, the fantasy-themed cards have real-world value.

In 2018, one of these NFT’s sold at auction for 146 ether, worth more than $60,000 at the time. This year, Immutable raised $15 million from investors including Naspers Ventures and Michael Novogratz’s Galaxy Digital EOS VC Fund.

Ferguson emailed his thoughts on what it’s like running a decentralized game studio as well as the crypto industry in 2019.

Why Do You Think Investor Interest Sparked For Crypto Games And NFT This Year?

There’s a compelling argument that gaming will be the first vertical within the crypto industry which achieves mainstream adoption. Gamers have historically been first-adopters, and they are accustomed to interacting and valuing digital assets. We’re reaching a state where blockchain games like Gods Unchained are compelling for their gameplay alone, with expert teams from the games industry and veterans like Chris Clay, taking the games to new heights. Crypto simply allows new mechanics and forms of ownership to exist, such as ownership of the cards in Gods Unchained.

With more of these examples popping up, crypto gaming has begun to separate away from the noise and prove product-market fit.

“There’s a compelling argument that gaming will be the first vertical within the crypto industry.”

What Are The Problems Unique To Developing Decentralized Games?

The stakes for designing and building out in-game economies is greater in decentralized games. Considering these assets have real value and live within an immutable environment, developers need to ensure the underlying economic mechanics and the way in which players can generate assets is done in a sustainable manner and resistant to bots and sybil attacks. We’ve hired some of the best meta designers and economists in the world for this reason, economic impact is something that underpins most of the decisions we make within game design.

What Were Some Of The Things You’ve Learned About The Crypto Community And Gamers While Developing God’s Unchained?

One of the largest differences we’ve found between the crypto-natives and gamers is the requirements in marketing to them. Unlike crypto-natives, gamers have a general aversion to anything blockchain-related given the turbulent past of the industry. At the same time, they love the trading and benefits that blockchain gaming offers and understand the value of it once effectively explained. Getting them to a stage where they understand and believe in what we’re doing before placing judgment is an art, and requires a completely different approach compared with someone who already understands and believes in the fundamentals of the technology.

Do You Envision God’s Unchained Being Brought Back On-Chain?

With a game as complex as Gods Unchained, it doesn’t make sense for the gameplay to be on-chain. Nearly all of the benefits you get from introducing blockchain into games can be accomplished simply by decentralizing the underlying assets. By approaching development this way, we can move faster and build a far better user experience than if the entirety of the game’s logic was developed into a smart-contract. That being said, the best mechanics and features for Gods Unchained have yet to be introduced, so we will continue aggressively investing in the development of the game. We’re also hyper-focused on improving the touchpoints users have with the blockchain, aiming to make the experience of interacting with decentralized assets noob-proof.

What Do You Think Is Next For The Crypto Industry?

While protocol development continues its slow and steady pace, there have been some breakthrough improvements at the application layer this year, with significant milestones taking off in the decentralized finance space. As these building blocks and infrastructure continue to be built out, the possibilities at the frontier continue to expand and I think we’ll see some big developments here as defi liquidity and functionality continues to improve.

Updated: 1-2-2020

Ubisoft Might Be The First Major Games Company To Geek Out Over Blockchain

It’s already well-theorized that it’s not cryptocurrency or decentralized finance apps, but gaming that will actually drive blockchain use cases in the real world.

While this has moved many smaller development companies and hobbyist programmers to release their own blockchain-driven games, distributed ledger technology’s reception among mainstay gaming companies has so far largely been neutral.

A New Partnership Between Old Players

But that’s about to change in the wake of Ubisoft’s partnership with Ultra, a DLT-driven gaming platform that might be fairly described as Steam on the blockchain. Users can earn digital currency, buy games, and resell them.

Ubisoft is the mainstream gaming giant responsible for the Assassin’s Creed franchise, Far Cry, and a whole range of other commercial hits. The company knows how to make and market games that people actually play, and they know how to do it exceptionally well.

The professional, at-scale approach to game development within a blockchain paradigm isn’t exactly common. Most blockchain games nowadays are by passion project developers or small-scale commercial enterprises. Perhaps due to the technology’s association with regulatory uncertainty, game developer heavyweights are mostly keeping blockchain at arm’s length. Except now Ubisoft is going to become a block producer on Ultra’s associated UOS blockchain.

Meaning For The Future

This move is purportedly about lending UOS more trust since Ubisoft is such an established company, and its hardware is now part of the ecosystem that approves transactions in UOS tokens that are confirmed by other block producers. It is also not too great a stretch of the imagination to hypothesize that Ubisoft could begin developing blockchain-dependent games for the Ultra platform.

But that’s raw speculation for now. Until then, Ubisoft is lending its hardware and credibility in support of a new crypto gaming project.

Updated: 2-3-2020

Minecraft Players Can Win Bitcoin On New Treasure Hunt Server

A new Minecraft server allows players in the blocky universe to compete against one another to find hidden treasure and receive a bitcoin reward.

Known as SatoshiQuest, the challenge is to find the hidden loot within “vast Minecraft landscapes.” Users pay $1 in bitcoin for an in-game life. Entry fees are collected and most will go towards a specific treasure wallet address, which is awarded to the player who finds the loot first.

In order to participate, users set up their own in-game wallet they can use to pay for lives and receive their winnings. Should they wish, they can also connect an external wallet to the Minecraft game server.

More than 180 million copies of Minecraft have been sold since late 2019, making it the single best-selling video game in history. It allows users to create their own worlds on their own servers. The game has already featured bitcoin, with the BitQuest and PlayMC servers, from 2014 and 2015 respectively, which both integrated the original cryptocurrency to test and educate users about digital currencies.

The first round of SatoshiQuest began on Jan. 26 and the game resets once treasure has been found. The server checks the bitcoin spot price every 15 minutes, automatically updating the participation fee to keep it at $1.

The project is open source, with the code available on GitHub.

Ninety percent of total game fees go towards the treasury address, with the remaining 10 percent going towards developer costs. After finding the treasure, winners receive 85 percent of the balance, while the remaining 5 percent is kept the wallet until the next round. The reward is only paid out if the treasury wallet balance exceeds the transaction fee.

The Minecraft contest comes after another more real-world bitcoin treasure hunt was launched last April. Called Satoshi’s Treasure, the game’s developers hid the keys to $1 million-worth of bitcoin across the globe.

The keys to the bitcoin wallet containing the prize were divided into 1,000 fragments, requiring a minimum of 400 key fragments to access and transfer the funds. Players are able to collect and unravel clues any way they want, and can even sell leads.

Updated: 2-10-2020

Overview And Market Trends Of Crypto Games In 2020

After CryptoKitties proved to be successful in the mainstream limelight in 2017, a surge of digital collectibles built on blockchain technology ensued. This rising trend made it pretty clear that blockchain and gaming make a perfect match.

While blockchain technology provides a reliable reward system for players to collect digital collectibles making the game worthwhile, the gamification process, on the other hand, creates a friendly environment for learning and mass adoption.

When it comes to crypto games, Japan leads the pack with an estimated net worth of over $40 billion. In addition, expert blockchain researchers have predicted that with increasing smartphone penetration around the globe, the crypto gaming industry could take off even further in 2020 and beyond.

Here is a list of some popular blockchain-based games to watch out for in 2020.

My Crypto Heroes

The Japan-based blockchain game has barely existed for more than a year, yet it ranks first in the world in terms of transactional volume. The game was developed by Double jump.tokyo inc. on Nov. 30, 2018, and is built on Ethereum as a decentralized application.

The game can be played on both mobile and PC’s that are online and features records of historical heroes that can be collected and trained to fight in epic battles. The heroes are all hidden, and their enemies have made them weaker.

The player’s role is to go through the depths of this fantasy world to free and restore the heroes to their former glory. Players can even train their heroes to acquire new characteristics. The game also allows to trade heroes on a social marketplace.

Blockchain Cuties

Blockchain Cuties takes the idea of digital collectibles a bit further by making them available on multiple blockchains. The game is made up of cute fantasy creatures, like cats, puppies, pandas and lizards, that can be traded, sold or turned into traditional digital currencies. Furthermore, these digital collectibles can be trained with multiple skills that are put to the test in battles.

Blockchain Cuties can be played both on PC and mobile devices through a web browser. What makes this game interesting is its growing support team and its intuitive design.

Forgotten Artifacts

Forgotten Artifacts is a crypto game that allows players to go on an endless adventure to find Forgotten Artifacts. The collectibles in this blockchain game are a mix of fungible and non-fungible tokens each with a limited supply thereby making them unique and valuable.

Currently, in its pre-alpha development stage, this crypto game can only be played with an Enjin wallet, as it is the only way to store the ERC-1155 tokens and collectibles. So far, there has been a huge interest in the game from the gaming community with a user base that the Forgotten Artifacts team calls “assiduous.”

Gods Unchained

Gods Unchained is a deck-building card game that lets the players acquire card packs and accumulate unique collections of rare cards. With cards that are built on Ethereum’s blockchain, the game players get true ownership of the cards and can exchange them for other cards or sell them on a market place.

Easily compared to Blizzard’s Hearthstone — with the only difference that GU is built on a blockchain — Gods Unchained gained traction in the past year after Blizzard expelled one of its top players after he voiced support for the Hong Kong protests.

Most importantly, the crypto game has received upwards of $15 million in funding, making it one of the most promising blockchain-based games of 2020. In November of last year, the game’s transactional volumes surpassed that of CryptoKitties during its peak. In just 3 days, this fantasy card game was able to transfer upwards of 6 million cards, which were valued at more than 4.7 million transfers when it achieved its peak in 2017.

Spells of Genesis

This mobile crypto game is designed to be a mix between an arcade-style game and a card trading game. Players of Spells of Genesis can embark on epic adventures while collecting and trading orbs to build strong decks that can be tested in battles. Players get to cast their spells on enemies using the deck of cards with strategy and skill being key elements for victory.

Since the collectibles and cards in the game are built on blockchain technology, players get to keep their items and cards that they win from playing the game. What’s even more interesting is that this is one of the first role-playing Bitcoin (BTC) games that allows to directly store collectibles on the Bitcoin blockchain. Additionally, winnings can be exchanged outside the game, which is exciting for gamers.

Splinterlands

Any Game of Thrones fan will find it easy to fall in love with Splinterlands. This crypto game is set in a fantasy world made up of six kingdoms that battle for control of Splinterland. And just like Games of Thrones, there is a prophecy that predicts the coming of a common enemy that will force the Splinters to unite and fight.

Players get to use in-game collectibles to defeat enemies in battle. Thanks to its use of blockchain technology, each card is unique, and the results of every battle can be verified easily. The game is built with an algorithm that prevents tampering with the results of battles. Even game creators cannot manipulate or change them.

Bitcoin Flip (Trading App)

For novices who are trying to learn how to trade cryptocurrencies, Bitcoin Flip Trading App is the game for you. Designed as a Bitcoin exchange simulator, this game allows players to understand the basics of trading crypto while having fun at the same time.

It is a free Bitcoin simulator that features real pricing, charts and tools. Using Bitcoin Flip, players can test their trading strategies in a safe sandbox. However, unlike most game features on this list, users do not earn crypto while playing.

Altcoin Fantasy

Another simulator that can make trading crypto exciting is Altcoin Fantasy. The game allows players to start trading with virtual U.S. dollars. Therefore, players can pick from over 140 cryptocurrencies and adjust their portfolio accordingly.

What’s even more exciting about this game is that it features contests allowing players to win prizes that have a monetary value. Altcoin Fantasy has partnered with companies like bread, Paxful and OKCoin to sponsor its contests financially and reward players with real Bitcoin, as well as other cryptocurrencies.

Neon District

Developed by Blockade Games, Neon District is an all-time favorite for cyberpunk lovers. This is a role-playing game driven by a story with a mix of elements of sci-fi dystopian movies like The Matrix. What hooks gamers is the fact that, at every stage, players have to acquire skills to fight enemies and solve complex puzzles.

New characters can be collected along the way to build up a personal profile. These characters and in-game items are programmed to the blockchain to secure ownership. In 2020, the creators of the game plan to develop a second season to the story that includes a new co-operative play that allows players to join forces with one another.

0xUniverse

For those who enjoy spaceships and outer space fantasy games, 0xUniverse is a good fit. It comes with an intuitive user interface. Built on Ethereum, this game is all about using strategy while going on a cosmic ride into the universe, much like The Mandalorian.

On each planet, users will be able to find different resources and meet new people. A player can own an entire planet or a part of it since all in-game items are recorded on the blockchain.

MegaCryptoPolis

If Monopoly and everything real estate are of interest, MegaCryptoPolis is a blockchain game to feed this need. The game is designed so that players can acquire a piece of land, construct something and collect Ether (ETH) daily as a profit. Players can even grab the entire district to collect taxes in the form of tokens.

Just like in real life, plots of the land rise in value. Additionally, they are hardcoded as ERC-721 tokens and stored on the blockchain. What’s more, the game comes with a demo version that can be played on any browser, making it easy for beginners to get familiar with the interface.

So far, the game has had a positive reception in the gaming community, amassing over 4 million views on YouTube, — not to mention a total of 10,000 Ethereum wallets being registered.

Mythereum

Launched in February 2018, Mythereum is another blockchain-based card game built on Ethereum’s blockchain. The game features a variety of characters who battle for survival. Players are supposed to keep their characters alive.

Also, these characters can be traded on third-party marketplaces. The in-game currency is Mythex, which is a redeemable ERC-20 token. The gameplay is affected by a strategic deck-stacking process that includes adding powerful characters to the deck to increase the overall performance.

Eos Knights

Built on one of the most prominent blockchain networks, EOS Knights comes with smart contracts that account for every action. Players can collect in-game items that resemble natural elements or even craft new and unique items, using materials found in the game. The game also has the ability to have pets that can be adopted. All the collectibles found in the game can be traded with the EOS token on a native marketplace.

Conclusion

The crypto gaming scene is growing as more games are being invented and more collectible in-game items are being built on blockchain technology. Not only do games make mass adoption of blockchain and cryptocurrencies possible but they also provide an easy way to learn how blockchain technology works.

Cointelegraph spoke to James Ferguson, the CEO of Immutable (the creators of Gods Unchained), about 2020’s outlook in the crypto gaming scene. According to Ferguson, 2020 will feature huge progress in terms of ease of use and quality:

“We’re expecting an influx of mainstream users that far surpasses what was achieved in 2019 as a result.”

However, as in-game items become increasingly popular, it can be difficult to imagine a world, in which cryptocurrencies and in-game collectibles do not collide:

“In-game digital assets will likely be the largest driver of cryptocurrency adoption over the next couple of years, especially considering games will be one of the greatest tools for onboarding users into the ecosystem.”

Updated: 2-13-2020

IRS Does Not Consider Fortnite Money As Virtual Currency After All

The Internal Revenue Service (IRS) removed wording on its website that put game currencies as examples of a convertible virtual currency. This clarification is important as a new tax filing requirement obliges taxpayers to report whether they dealt with virtual currencies.

The move was first reported by Bloomberg Tax on Feb. 13. Official guidelines on the IRS website indicated Fortnite’s V-bucks and Roblox’s Robux as examples of virtual currencies. A screenshot captured by Bloomberg Tax shows a fairly detailed explanation of the concept, even mentioning blockchain alternatives such as the Directed Acyclic Graph (DAG).

Poor Examples Of A Virtual Currency

The IRS definition of a virtual currency hinges on its ability to “operate like ‘real’ currency,” which means that it needs to be freely transferable between users and easy to exchange for fiat currency.

Spokesmen from Epic Games, Fortnite’s publisher, told Bloomberg that none of these apply to the game’s currency:

“V-Bucks cannot ‘be digitally traded between users,’ nor can they be ‘exchanged into, U.S. dollars, Euros, and other real or virtual currencies.’”

Roblox representatives voiced a similar stance, noting however that Robucks can be exchanged for fiat money under specific circumstances. The transaction is automatically submitted to the IRS, the company added.

The revised guidelines only mention Bitcoin (BTC), striking off a previously existing reference to Ether (ETH) — which should fall under the definition.

Aggressive Stance On Crypto

The U.S. tax enforcement agency has recently made a strong move in its efforts to curb perceived tax evasion facilitated by crypto. Form 1040 now features a straightforward question:

“At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

Categorizing game money as a virtual currency would have led to millions of people having to answer “yes” to this question. There are generally few profits to be made from owning game currencies, however.

Given that lying on the form can cost up to $250,000 in fines, this measure was likely introduced to force cryptocurrency users to go through the effort of reporting their gains.

Doing so is likely to be quite complicated. For example, each crypto-to-crypto exchange is considered as a taxable event that has to be reported. Though some hoped that these fall under the definition of a “like-kind exchange,” an IRS official denied this. This definition would have meant that cryptocurrency gains are only taxed when converting to fiat currency.

Cryptocurrency taxation remains an unclear subject, with worldwide regulators having widely diverging approaches. As an example, France does not tax crypto-to-crypto transactions.

A new bill recently proposed in the U.S. Congress could ease the use of crypto for payments by exempting low value transactions from tax returns.

Updated: 2-17-2020

Crypto Games, A Market In The Making Of Its Own Fortune

Since the release of a game called CryptoKitties in November 2017, the concept of nonfungible tokens has been rooted in the minds of developers and crypto investors alike. The year 2019 was groundbreaking, with large, multinational companies beginning to draw attention to the new sector of digital assets and develop their own projects. In 2020, however, new games backed by different technologies are starting to emerge. So, what does 2020 hold for crypto games?

Tokens That Cannot Be Changed

There are a lot of fungible tokens that the crypto community uses every day, like Monero (XMR) and so on. An excellent example of such tokens is the well-known standard, ERC-20, which emerged back in 2015. Their interchangeability is mainly used in cryptocurrencies, but also in initial coin offerings. In addition to fungible currencies, tokens can be used in gaming — for example, to buy equipment or weapons — that is, they can be used for anything that does not require uniqueness and that can be exchanged.

Then comes the need to make tokens unique. Imagine that a gamer has spent 100 hours to get a very rare artifact in a game, but upon receiving the item, realizes there is no way to trade or exchange it. So, the time spent obtaining it is wasted.

To prevent this, special tokens have come to the rescue, which turn a valuable weapon in the game into a unique, one-off asset that can be exchanged or sold. Nonfungible tokens, or NFTs, are not interchangeable, as there is only one of each of them in the world. The most popular standard for such tokens is ERC-721.

The ERC-721 standard has become popular due to its convenience. It defines the minimum interface required by a smart contract to be comparable to the management, ownership and sale of unique tokens. One of the cases of using this sort of token is for game characters.

NFTs gained their popularity thanks to the well-known game CryptoKitties, which assigns tokens to each unique cat, the data of which is written into the tokens’ metadata. This data cannot be changed. The cats can have different coat colors, different eyes and accessories, and other features.

In Gods Unchained, a card game where each card is backed by a smart contract, the developers took it a step further, not only using NFTs to generate cards but also enabling cats from CryptoKitties to be added to the game. The cats are presented in the form of a talisman placed in the corner of the playing field. In this case, the talisman can be converted back into a cat and sold if necessary.

Thus, NFTs make it possible to transfer game items from one game to another. In addition, smart contracts that are based on ERC-721 have implemented a function that fixes the movement of tokens, so they can accumulate value by themselves. This is great for digitizing unique assets such as art objects, paintings, legal documents and assets in other industries. This has great potential for various stores that deal with unique digital goods.

The Rise Of NFTs In Games

2019 was a turning point in crypto being accepted into the gaming community, and there were several reasons for this. First of all, after the success of CryptoKitties and Gods Unchained, other collectible games have gained popularity, such as Decenterland, Spells of Genesis, Rare Pepe, 0xUniverse and others.

In addition to the gaming industry, trading platforms like OpenSea, RareBits and OpenBazaar have also launched NFTs that are trading as collectibles. The infrastructure around NFTs is also in progress and offers work tools for the production and management of NFTs. Another project, Codex Protocol, founded in 2018, has developed a decentralized registry of unique assets such as art, rare liquor and antiques.

There are other factors explaining why NFTs are becoming more popular. The main one is the interest of global companies in blockchain games. Back in September 2018, major videogame publisher Ubisoft sponsored the Blockchain Game Summit and became a Blockchain Game Alliance member.

At the end of 2019, the Microsoft Azure cloud platform released its own program called Azure Heroes, aimed at rewarding its own developer community. The release and transactions of collectible items will be carried out on the Ethereum network, which will allow the winners to keep them as NFTs.

To earn one of these tokens, developers must first be nominated either by themselves or the internal community. The moderators then choose the best nominees and award tokens, which can be transferred to any NFT-compatible address in the Ethereum network.

Another project of Microsoft is a blockchain-based card game in collaboration with large game developer Eidos and game book maker Fabled Lands. It will be called Arena of Death, and its players will fight in battles using fantasy-themed playing cards. The project will use collection tokens as NFTs on the Vechain blockchain to secure ownership of gaming assets.

In spring of last year, it became known that Liberty Media, the owner Formula One, would release a blockchain-based game where tokens will also act as collectible elements. A couple of months later, an anonymous buyer paid more than $100,000 for a unique car in the F1 Delta Time game.

2019 was also quite a successful year for NFT games because many projects — seeing the success of CryptoKitties — took an attractive idea and developed and improved upon it, attracting players. The creators of Gods Unchained, Tyler Perkins and James Ferguson, shared their thoughts with Cointelegraph on how the industry should be developed:

“Crypto games will never succeed if we don’t increase transaction limits. Earlier this year we made some breakthroughs that allowed us to batch hundreds of transfers in single transactions. This allowed us to transfer over 3.7 million ERC-721s in a single day, over 4x more transfers than the previous all-time high, all without clogging Ethereum.”

Kara Miley from Infura, ConsenSys’ dev tooling and infrastructure product, also gave a similar example of Axie Infinity, which came up with its own solution from a project learned from predecessors:

“A team of blockchain engineers and early crypto adopters were able to take a concept CryptoKitties pioneered and take it to the next level with strategic gameplay and great IP. They were able to bootstrap the business on the backs of a number of successful NFT asset sales.”

The More Advanced, The Better

NFTs do have uses outside of gaming. For example, a famous musician can make a new album and sell each copy for a certain price. One million copies of the album can be created and sold through auction. As the copies begin to run out, the price of the remaining ones is likely to rise. In doing so, the goods and the ownership rights will not leave the internet. 0xGames Founder Segey Kopov told Cointelegraph that such examples are likely to become a reality soon:

“This standard provides the ability to work with digital objects as real unique objects. Such items can be owned, transferred and sold. In real life, the uniqueness of items is usually needed only for collectors. Therefore, now NFT is used only for handling collectibles. Outside of games, we see this, for example, in art and celebrity areas. So it’s logical to expect evolution in this direction.”

Developers are also working on ways to make tokens more functional. One such attempt is the relatively new ERC-825 standard, designed to transfer several nonfungible tokens in one transaction. The ERC-1155 standard, developed by the Enjin project, allows to issue and send a large number of tokens at once.

What Will Happen In 2020?

Crypto gaming is a very young sector. The entire ecosystem of developers and users still has a lot of work to do to get this idea to the masses and take root. There is still the problem of lacking convenient interfaces that users often encounter with unique tokens and games.

The second problem is the limited scalability of the blockchain, and consequently, the ensuing problems in the number of supported transactions per second in a particular decentralized application. CMO at Satoshi’s Games, Federico Spitaleri, also pointed out that the competition is likely to grow as NFT-based games come up against those powered by the Lightning Network:

“I believe NFTs based crypto gaming companies will have a hard time considering that now, thanks to the Lightning Network, players can get rewards in Bitcoin. In addition, those companies will have to answer the question ‘How do you plan to solve scalability issues in order to bring your product to the mass market?’ and they’ll figure out that their competitors from the Bitcoin space already found a solution which is called Lightning.”

But the NFT market is beginning to standardize, which will give a big breakthrough in the development of digital goods trading. Kara Miley believes that, given more comfortable interfaces and interesting storylines, NFT games could continue to attract players this year:

“We’ll see a few viral games launch this year that will help onboard hundreds of thousands of new mainstream users to owning their first digital asset. These players may not know at first they’re trading a NFT or spending a stable token, but over time as they start earning crypto and seeing the benefits of more open and transparent ecosystems, they will be incentivized to dig deeper and explore more of the Web3 world.”

Updated: 2-18-2020

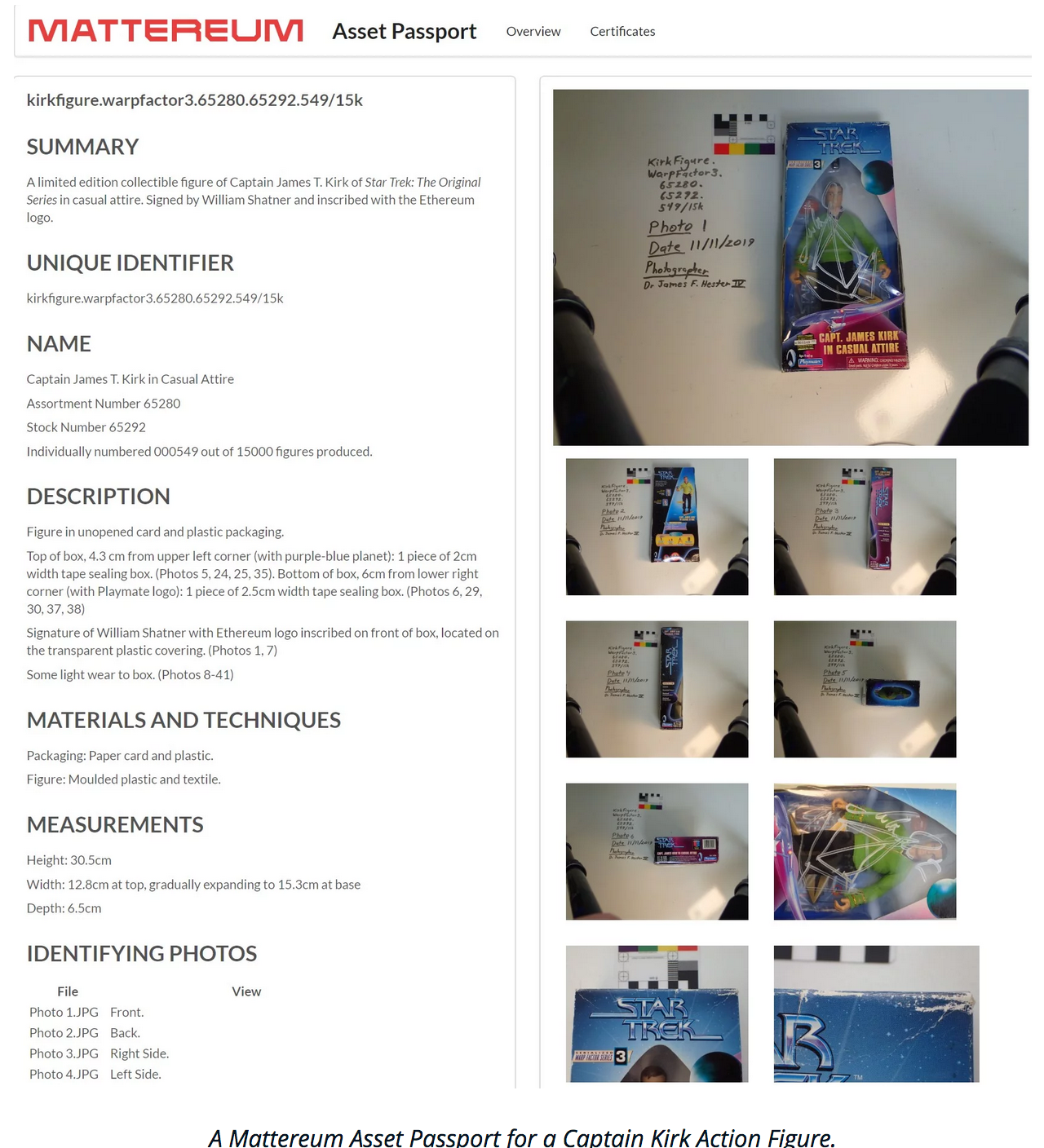

Collectible William Shatner Figurines Have Now Been Authenticated On Ethereum

Matterum’s platform for authenticating collectible items is now live, and it’s already processed several $10,000 William Shatner figurines.

According to its website, Mattereum “has the tools to make physical goods flow around the world as easily as information using Ethereum blockchain smart contracts.”

The company’s first client is Third Millenia Inc. (which works on the authentication of real-world items), co-founded by actor William Shatner of Star Trek fame. Amongst the first digitized objects were several signed Captain Kirk action figures. They’re worth a lot of money!

As you might imagine, this project goes beyond sci-fi collectibles. In its whitepaper, the company claimed that one of its first on-chain objects would be a $9,000,000 Stradivarius violin. It wrote: “The governing committee for the instrument [violin] will have legal decision-making powers over the instrument [violin], protecting and curating it on behalf of the token holders and posterity, in accordance with a written constitution.”