People Are Using Stimulus Checks To Buy Bitcoin

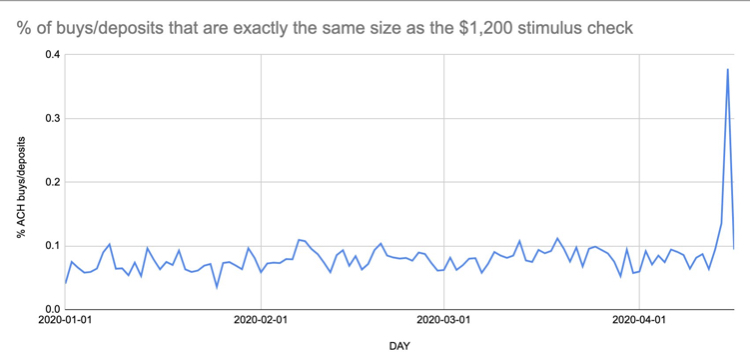

Coinbase CEO Brian Armstrong has published on social media a chart showing a large spike in buys and/or deposits that are of exactly $1,200 on the cryptocurrency exchanges. People Are Using Stimulus Checks To Buy Bitcoin

The chart implies that U.S. citizens are using their stimulus checks, distributed as part of a $2 trillion CARES Act, to buy cryptocurrency. The U.S. Internal Revenue Service (IRS) has started distributing $290 billion in direct cash payments within the past week as part of the stimulus bill.

— Brian Armstrong (@brian_armstrong) April 16, 2020

The IRS determines eligibility and check amounts by looking at a household’s adjusted gross income using its 2019 tax return. If it hasn’t yet been filed, it uses the 2018 tax return to determine the size of a household’s stimulus check.

Single filers who have an adjusted gross income below $75,000 receive a $1,200 payment, while married couples with an income below $150,000 will receive a $2,400 check. The U.S. government is also paying $500 per qualifying child under age 17.

The data is backed by accounts on social media, where users claim they’ll be using their stimulus checks to buy the flagship cryptocurrency. On Twitter, responding to a poll, users showed interest in using the stimulus check in the crypto space.

Will you spend any of your $1,200 check to buy crypto?

— Alex Svanevik (@ASvanevik) April 15, 2020

It’s worth noting that Armstrong’s data points to direct buys and deposits of exactly $1,200, meaning those who used their entire stimulus check to buy bitcoin. As such, it doesn’t reflect the amount of cryptocurrency that may have been bought with a portion of the $1,200.

Moreover, BTC could have been bought with the check elsewhere as well. Square’s Cash App, for example, allows users to route their stimulus check to BTC almost directly, as the funds can be received via the Cash app.

The stimulus checks were sent as a measure to support the economy amid the coronavirus-induced slowdown.

Updated: 4-20-2020

First Mover: Bitcoin Attracting More Buyers, Even With Market Stuck In ‘Extreme Fear’

Bitcoiners are abuzz over new data showing more people might be tiptoeing into the market.

Mass adoption has long been one of the main bullish investment theses for bitcoin. The bet is growing numbers of institutions and individuals will eventually come to understand the cryptocurrency’s virtues, from its potential use as a peer-to-peer payment system to its potential as a hedge against inflation, like a digital version of gold. As the newbies pile in, prices will soar, the theory goes.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

Brian Armstrong, CEO of the major cryptocurrency exchange Coinbase, tweeted last week the frequency of deposits in the amount of $1,200 had jumped – a hint some recipients of coronavirus relief checks from the U.S. government might even be using the funds to buy cryptocurrencies.

The following chart from CoinDesk Research (using data from Coin Metrics) also shows a surge in addresses holding less than a billionth of the total supply of bitcoin, or those holding roughly $130 or less at current price levels.

Any increase in bitcoin’s popularity among retail investors might dovetail with signals that institutional investors are getting into the market, too. Renaissance Technologies, one of the world’s biggest hedge funds with $166 billion under management, said in a regulatory filing that its market-beating Medallion fund can now trade bitcoin futures on CME Group’s Chicago Mercantile Exchange.

And last week, cryptocurrency-focused investment firm Grayscale said it raised $503.7 million in the first quarter, nearly double the previous quarterly high. The firm, which is controlled by Digital Currency Group, CoinDesk’s parent company, said in a public report that “despite the risk asset drawdown this quarter,” investors are “increasing their digital-asset exposure.”

Mike Alfred, CEO of cryptocurrency analytics firm Digital Assets Data, told CoinDesk’s Omkar Godbole last week that the unprecedented money injections by the Federal Reserve and other central banks have “pushed many people toward bitcoin as an alternative monetary system.”

“We are hearing and seeing increased retail interest,” he said.

Zac Prince, founder and CEO of the cryptocurrency lender BlockFi, noted in a tweet last week the industry is “still early in our adoption cycle within just our first addressable market of crypto investors, estimated to be low single digit millions just in the U.S.”

In an April 16 report, Arcane Research, a Norwegian cryptocurrency analysis firm, wrote that the number of addresses holding more than 0.01 bitcoin (about $72 at current prices) has climbed by about 5 percent just since March 1, to a new record of 8.3 million.

Arcane, which cited the data provider Glassnode, wrote that the trend might be due to big bitcoin investors – known as “whales” in crypto-speak – using so-called mixing services to move their digital assets, essentially splitting their holdings into multiple, smaller accounts.

But it might also be a “sign of increased user adoption of bitcoin,” the researchers wrote.

Ki Young Ju, CEO of the Korean cryptocurrency-analytics firm CryptoQuant, noted in a Telegram message the number of unspent transaction outputs recorded on the bitcoin blockchain, known as UTXOs, has also increased.

That could represent a “small-scale wallets including personal wallets (mass adoption) and mixing activities,” he wrote.

What’s interesting is that Alternative.me’s closely tracked “Fear & Greed Index” has been pointing to “extreme fear” since March 9, a five-week period that’s now the longest since the gauge launched in February 2018, according to Arcane.

So if that’s the backdrop for greater mass adoption of cryptocurrencies, bitcoiners are eager to see how cryptocurrency markets react when the gauge turns toward greed – or even extreme greed.

Updated: 4-22-2020

No Stimulus Check? You’ll Buy Bitcoin As A ‘Hard Asset’ — VanEck Exec

U.S. citizens who lost out by getting no helicopter money will look to Bitcoin as an empowering alternative, argues Gabor Gurbacs.

Bitcoin (BTC) will be most attractive to United States citizens whom the government refused to bail with $1,200, one market commentator says.

As it emerged that stimulus checks may be going towards purchasing BTC, Gabor Gurbacs, digital asset director at VanEck, argued that those left out will still look for an exit from fiat.

Gurbacs: Bitcoin Will Appeal To Bail Out Losers

Rather than as a short-term investment, people without stimulus checks will value Bitcoin more for its store-of-value properties and permissionless nature.

“Those that didn’t get stimulus checks or corporate bailouts are the most likely to buy #Bitcoin for what it is: A scarce, non-sovereign-issued, trust-minimized, hard asset,” he summarized in a tweet on April 21.

“The most influential group of new adopters since the early days of Bitcoin is just entering the arena.”

His words come just days after data suggested that U.S. helicopter money was already finding its way into cryptocurrency.

According to exchange Coinbase, deposits for the full $1,200 value of the stimulus checks had increased four times over.

Calls Grow For More Helicopter Dollars

The United States will meanwhile send fresh dollars worth over 69 million BTC to small businesses as its latest stimulus package injects even more money.

On April 21, Congress passed the latest $484 billion instalment of the stimulus program, which lawmakers indicate will have many phases and continue on for months on end. Other voices have called for helicopter money to continue and increase in value to regular payments of $2,000.

The general consensus among Bitcoiners and consumers alike nonetheless points to the idea that $1,200 is poor compensation for the loss of jobs, wealth and other restrictions imposed as a result of the government’s response to coronavirus.

“The Bitcoin Standard” author, Saifedean Ammous, is among the most vocal critics of lockdowns, in particular, arguing that they are ineffective at helping coronavirus abate while actually shortening lifespans in the long term.

Updated: 5-8-2020

Tracking what the US government’s $1200 stimulus check would now be worth if used to buy #bitcoin on April 15, 2020. Created by

Second Stimulus Check Coming, But Will Americans Use It On Crypto?

Americans who invested the entirety of their first $1,200 stimulus checks in Bitcoin have seen more than a 40% return as BTC passes $10,200.

U.S. residents who invested their first stimulus checks in Bitcoin have seen a 45.5% return, from $1,200 in April to roughly $1,746 at the time of writing, when the cryptocurrency is surging past $10,200.

In a July 26 interview with CNN’s Jake Tapper, White House economic advisor Larry Kudlow confirmed Americans will be receiving another $1,200 check as part of a roughly $1 trillion stimulus package first announced on July 23.

However, according to Newsweek, many Americans have reported not receiving the first checks, which the U.S. Treasury started issuing in late March. Treasury Secretary Steven Mnuchin has said the second payments will arrive in August, but that could potentially mean November for some if the process is the same.

Bitcoin Or Rent?

The stimulus checks are intended to ease the economic hardship suffered by many U.S. residents who lost their jobs or are seeing much lower income amid the coronavirus pandemic.

However, Cointelegraph reported in April that many Americans may have chosen to invest their first payment not in delaying eviction or supplementing their income — when necessary — but cryptocurrency. Brian Armstrong of Coinbase showed that the number of deposits and buys on the exchange worth $1,200 increased fourfold that month.

Based on online responses to the news that another check would be forthcoming, coupled with the recent surge of Bitcoin (BTC) to more than $10,200, some crypto traders may be thinking another $1,200 investment isn’t the worst idea.

“Straight to the BTC, straight to the cold storage wallet,” said Reddit user Limited-Visibility.

“What I do get will go straight to Bitcoin, just like last time,” said rapierce0238.

Stimulus News May Be Driving Bitcoin Price

The announcement that $1,200 checks for every U.S. resident would once again be a part of the stimulus package came just hours before Bitcoin experienced another surge, rising 3.1% from $9,941 to $10,249 in the last four hours. When U.S. officials first announced the $1 trillion stimulus package on July 23, the price of BTC rose past $9,500, breaking a particularly long stretch of low volatility between $9,000-$9,500.

Updated: 7-27-2020

Gold, Stimulus And A Futures Gap: 5 Things To Eye In Bitcoin This Week

Gold builds on all-time highs as markets wait for news from the U.S. Federal Reserve and Bitcoin price volatility returns — where will it go?

Bitcoin (BTC) begins a new week above $10,000 and teasing investors with more gains — will it last or is a correction already guaranteed?

Cointelegraph takes a look at the coming week and what it might have in store for the Bitcoin price — five factors that could take BTC/USD to the moon or back down to four figures.

Gold Vs. Bitcoin: “Strong Gains Are Inevitable”

While stocks futures were inching higher on Monday, the focus for macro was more on geopolitical tensions. The United States and China continued to ratchet up the hostile mood, while coronavirus woes likewise stayed in the headlines.

Both issues have had a conspicuous impact on demand for safe havens, and notably gold. As Cointelegraph reported, last week witnessed major appreciation in both gold and silver, while the weekend saw bullion hit record intraday highs.

In line with previous sentiment gauges, plenty of faith lies in Bitcoin following the precious metal’s lead.

Speaking to Bloomberg, one analyst predicted that gold’s run was far from over.

“Strong gains are inevitable as we enter a period much like the post-GFC environment, where gold prices soared to record levels as a result of copious amounts of Fed money being pumped into the financial system,” Gavin Wendt, senior resource analyst at Australia’s MineLife Pty said.

At the same time, Citigroup placed the odds of XAU/USD topping $2,000 by the end of 2020 at 30%.

“The U.S. dollar just hit an all-time record low. You now need over $1,920 to buy a single ounce of #gold,” gold bug Peter Schiff summarized.

“But this record won’t last long as the dollar’s decline is only just getting started. It’s about to plunge to new depths taking the American standard of living down with it.”

Exchanges Inflows Spike Hard

Against a backdrop of a flight to havens, Bitcoin’s rise to $10,300 is hardly surprising. Weeks of price compression were long anticipated to resolve in a break up or down — analysts were just split over which direction the market would go.

The speed of the weekend’s breakout nonetheless was troubling for some. Specifically, trader behavior suggests that the mood is increasingly turning to short-term profit-taking.

“BTC price went up too fast. Seems like other whales think so too,” Ki Young Ju, founder of on-chain analytics resource CryptoQuant, summarized.

Ki uploaded a chart showing exchange inflows for the past three days, which revealed a noticeable spike in the number of coins moving to exchange wallets.

At the start of the surge, a lack of selling from long-term hodlers gave the impression that this time, $10,000 would not disappear in a sell-off as with the two previous spikes.

Updated: 1-5-2021

Got Coronavirus Stimulus? Buying Bitcoin Has Already Offered 12% Returns

The $600 stimulus check invested in BTC last week would have made you $75 better off already, data shows.

Americans who received their second coronavirus stimulus checks on Dec. 29 have already gained 12% — if they invested it in Bitcoin (BTC).

As the United States government rolls out another round of “free” money to eligible residents, attention is fixed on how many will choose to invest their $600 in cryptocurrencies.

April Stimulus Recipients Now Have $5,600

The handouts began last week and are expected to be completed by Jan. 15. According to a dedicated monitoring resource, those who received the money on the first day and who immediately swapped their U.S. dollars for BTC are already up around $75.

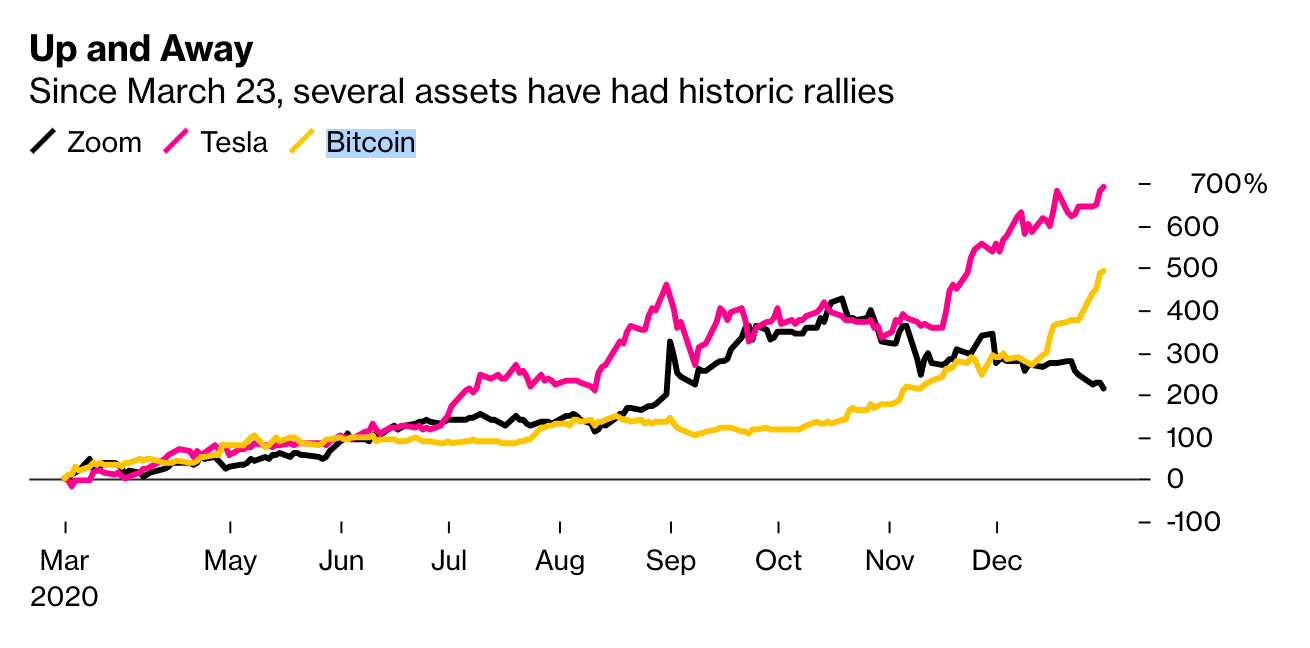

Bitcoin and Ether (ETH), the largest altcoin by market capitalization, have outstripped practically all competition in the first week of 2021 when it comes to returns on investment.

As mainstream media overflows with tales of how stimulus recipients plan to invest in stocks and consumer goods, notionally with the goal of “stimulating the economy,” those who bought Bitcoin with the previous cash gift in April 2020 are now sitting on $5,600.

At the time, the stimulus check was worth $1,200 — twice the amount of the second round — meaning Bitcoin has supplied gains of 370% if you “hodled” until now.

The figures underscore the curious way in which the average taxpayer can benefit from the bizarre financial environment that characterizes 2020 and 2021. By simply buying and holding Bitcoin, anyone can outpace even the most seasoned equities trader.

“Maybe we should be sending out the stimulus money in Bitcoin. The $600 will turn to $2,000 in a week anyways,” fund manager Austin Rief summarized in a tongue-in-cheek tweet over the weekend.

Monthly chart shows Bitcoin is not done at $32,000

While 233% gains in a week have yet to come true, many are already confident of Bitcoin’s prospects to match or even beat last year’s performance in 2021.

The year after a block subsidy halving has historically been the cryptocurrency’s best, and under that logic, a correction will only be due in 2022.

Added to this is data showing longer-term behavior following a price top in each four-year halving cycle. With $20,000 as the previous top, history suggests that BTC/USD will not dip below that level again.

What’s more, between 2017 and 2020, the difference between Bitcoin’s two tops was 1,600%. Between the 2013 and 2017 tops, it gained 3,500%. Since May 2020, Bitcoin is up by a comparatively modest 75%.

Updated: 1-5-2021

Stocks, Bitcoin And More: Unusual Ways Americans Are Planning To Use Their $600 ‘Stimmy’

Some stimulus check recipients are considering investing their money or treating themselves after a tough 2020.

Stimulus checks will provide a financial lifeline to millions of Americans, as they reel from the economic devastation brought on by the Covid-19 pandemic.

But some recipients have kept their jobs and income, and are able to cover critical monthly expenses such as rent, utility bills and debt payments. For them, the $600 checks represent an opportunity to boost their savings, spend on non-essential goods or buy stocks.

On TikTok, where young investors have turned for investment advice, videos on how to turn your “stimmy” into thousands of dollars are making the rounds.

Albert Lewis III, a 19-year-old Iowa State University student who grew up in Chicago, has already decided where the money is going: into his Robinhood investment account.

“The $600 isn’t needed at this moment,” Lewis said. “I’m investing it hopefully to turn it into something more than that by the time I’ll need it. $600 in a year isn’t going to turn into $10,000, but if I invest it now, in 40 years it’s going to be worth way more.”

He says most of his essential expenses are already covered. Most of Lewis’s college tuition is paid for by scholarships. He lives at home with his parents, meaning he doesn’t have to worry about rent at the moment. Small side jobs allow him to cover everyday costs, like those for food and his phone.

He hasn’t decided where he’s investing his $600 yet, but is considering “some company that’s not going anywhere,” like Apple Inc. or Facebook Inc.

Lewis’s plans illustrate how the fallout from the coronavirus crisis is dividing the U.S. economy. Claims for unemployment benefits averaged 1.45 million a week last year, compared with about 220,000 in 2019, with tens of thousands of people struggling for food, shelter and income.

At the same time, the percentage of disposable income that households manage to stash away has jumped, home owners are seeing property prices increase and the stock market is soaring. The annual compensation rate for employees in November neared pre-pandemic levels.

Compensation Rebound

The monthly compensation U.S. employees received reached pre-pandemic levels in November.

To mitigate the hardship caused by the pandemic, U.S. lawmakers have agreed on a relief package that would send $600 to those with an adjusted gross income of less than $75,000, or $150,000 for married couples filing jointly, plus $600 for each dependent child.

That will be cut by $5 for every $100 earned above the income threshold, meaning those earning over $87,000 as an individual or $174,000 as a couple don’t get anything. The legislation also gives unemployed people a $300-a-week federal boost for at least 10 weeks.

“There are going to be a number of people who won’t need it and are still going to get the checks because the issuing of the check is purely based on income, not employment,” said R.A. Farrokhnia, Columbia Business School professor and executive director of the Fintech Initiative.

With social distancing and lockdowns still in place, Farrokhnia added, people have limitations on where they can spend the money. “Those who actually have been lucky to still have jobs end up saving more, because they are not putting money into the economy, they’re not going out to restaurants, and are on Zoom so they won’t be needing a whole lot of new clothes or shoes.”

U.S. Census data shows that the majority of U.S. households used the previous round of stimulus checks — $1,200 per person — in 2020 to cover basic expenses. About 80% of respondents in a Household Pulse survey reported using the funds on food and 77.9% on rent, mortgages or bills.

More than half of respondents said they spent the money on household supplies and personal-care products, and about 20% on clothing. And while 87.6% of adults in households with incomes of $25,000 or less planned to use their payments to simply meet expenses, over a third of adults in households with incomes above $75,000 reported that they would use the money to pay off debt or add to it to their savings.

“We know people earmark money for specific purposes, so this windfall is seen as not part of what they need to get from paycheck to paycheck but as something extra to be put towards something special,” said Neil Fligstein, professor of sociology at the University of California, Berkeley. “That’s why lots of people might try to save or invest it. It’s seen as ‘found money.’”

Disposable Income Rises

The monthly real disposable income per capita was higher in November than before the pandemic hit

Once Hailey Wiggins, a 25-year-old business owner from Houston, receives the $600 check, she’s probably going to keep 10% in cash, invest 60% in stocks and 30% in cryptocurrencies.

“We’re about to get flooded with all of this extra money that’s just going to stimulate the market,” says Wiggins, who entered the stock market in March of last year. “I’ve been investing and had this crazy return because of the pandemic and what it’s done to the stock market. I don’t see $600, I see way more money.”

“Although we can’t speculate directly on the data, the increase in spending on brokerages in June aligns with discount online brokerages like Robinhood reporting a spike in new accounts,” said Bill Parsons, Envestnet Yodlee’s group president of data and analytics. “Our data shows a significant uptick in new users during both the months of March, the month the CARES Act was passed, and June after everyone had received their checks.”

For some people, the latest stimulus money is too little to cover major bills or provide an incentive to save it. Instead, it’s prompting them to consider buying something nice as a way of making themselves feel better after a tough year.

“$600 can’t really cover my rent,” said George Takam Jr., a 22-year-old from Maryland, who is considering buying a PlayStation 5 gaming console. “I may as well use it on something nice and stimulate the economy.”

Takam is a nursing assistant and says his minimum-wage paying job barely covers his rent when he works a standard 40-hour week. He receives some assistance with his bills from his parents, who have also taken a financial hit by the pandemic. The stimulus check will mean he can spend money on something he enjoys.

“In a way, this is extra money — but it’s essential,” Takam said.

Updated: 2-12-2021

What If Artificial Intelligence Decided How To Allocate Stimulus Money?

New Treasury Department software points the way. But research suggests that it’s impossible to show that an artificial “superintelligence” can be contained.

If, like me, you’re worried about how members of Congress are supposed to vote on a stimulus bill so lengthy and complex that nobody can possibly know all the details, fear not — the Treasury Department will soon be riding to the rescue.

But that scares me a little too.

Let me explain. For the past few months, the department’s Bureau of the Fiscal Service has been testing software designed to scan legislation and correctly allocate funds to various agencies and programs in accordance with congressional intent — a process known as issuing Treasury warrants. Right now, human beings must read each bill line by line to work out where the money goes. If the program can be made to work, the savings will be significant.

Alas, there’s a big challenge. Plenty of tools exist for extracting data from HTML files (and, of course, XML files), but Congress initially publishes legislation only in PDF form; XML or HTML versions often arrive only weeks later. As many a business knows, scraping data from PDFs generally requires human intervention, leading to the possibility of copy errors.

The trouble is that PDFs have no standard data format. Even “simple” methods for extraction generally are designed to work only if the data in question is already presented within the PDF in tabular form.

Treasury’s ambitious hope, however, is that its software, when fully operational, will be able to scan new legislation in its natural language form, figure out where the money is supposed to go and issue the appropriate warrants far more swiftly than humans could. The faster the warrants are issued, the sooner the agency that’s supposed to receive the money can start spending.

Pretty cool stuff.

Yet this snapshot of the future inspires a wicked train of thought. Suppose that the Treasury Department software — which you are free to describe as artificial intelligence or not, depending on your taste — is later replaced by a better program, then by a better one and finally by one that can mimic the working general intelligence of the human mind.

What’s to stop this future AI from deciding on its own that Congress was wrong to give another billion to Agency A when, in the judgment of the program, Agency B needs it more? The program makes a tiny adjustment in a gigantic spending bill, and given that nobody’s actually read it, nobody’s the wiser.

Sounds improbable, right? HAL 9000 meets “Person of Interest” meets Skynet?

Not so fast.

For technophiles like me, recent achievements in AI are exciting, even breathtaking. AI is credited with reorganizing supply chains to help overcome disruptions caused by the pandemic. Deep learning systems may be able to discover coronary plaques more accurately than clinicians.

So why worry? After all, most of those in the field, including my professors when I studied artificial intelligence as an undergraduate, are confident that tight programming will keep even the most advanced artificial intelligence from escaping the bounds set by its creators. (Think Isaac Asimov’s Laws of Robotics.)

But there have long been dissenters, even among the experts. The prospect of an out-of-control AI has haunted researchers in the field for almost as long as it’s haunted science fiction writers. One thinks of Joseph Weizenbaum’s “Computer Power and Human Reason,” published back in 1976, or even Norbert Wiener’s classic “God and Golem, Inc.,” based on lectures the author delivered in 1962.

All of which brings us to an unnerving paper published last month by six AI researchers who argue that it is impossible to show that an artificial “superintelligence” can be contained.

The authors are an international group, representing universities in Germany, Spain, and Chile, as well as the U.S. According to their analysis, no matter how tightly an AI may be programmed, if it indeed possesses generalized reasoning skills “far surpassing” those of the most gifted humans, what they call “total containment” turns out to be incapable of formal proof.

Using what is known as computability theory, they hypothesize a superintelligent AI that incorporates a fundamental command never to harm humans. (Asimov again.) The programming will then require a function that decides whether a particular action will harm humans or not.

They proceed to show that even if it’s possible “to articulate in a precise programming language” a perfect set of “control strategies” to implement this function, there’s no way to know for sure whether the strategies will in fact constrain the AI. (The proof, although technical, is rather elegant, and fun to read.)

Don’t get me wrong: I’m not arguing that the Treasury Department should abandon its quest for a system that extracts data from PDFs, any more than I’m suggesting that any of the countless researchers working on various aspects of AI should halt. I continue to find the prospect of true artificial intelligence as exciting as ever.

What concerns me, however, is the way that public critiques of AI tend to pick around the edges rather than go to the heart of the matter. We often charge nascent AI systems with enhancing bias — for example, by exacerbating rather than correcting disparities in the distribution of health care.

Such issues are of undeniable public importance. But as the authors of the paper on computability remind us, you don’t have to be either a technophobe or a fan of apocalyptic steampunk sci-fi to see that the time for public conversation about the containability of AI is now, not later.

Updated: 8-26-2021

11% Of Young Americans Have Invested Their Stimulus Checks Into Crypto

Young Americans are choosing crypto over mutual assets and ETFs to invest their stimulus checks.

A new survey has found that more than one in ten Americans between 18 to 34 have invested part of their COVID-19 stimulus checks into crypto assets.

Conducted by CNBC and research firm Momentive, the survey queried 5,530 adults and found that 11% of the participants had purchased cryptocurrency with their stimulus money.

Roughly half of the respondents were found to have funneled their stimulus money into investments broadly — with 15% seeking exposure to stocks, 9% investing in mutual funds, and 6% backing exchange-traded funds (ETFs).

The majority of young Americans appear bullish on cryptocurrency’s future prospects, with 60% of survey participants indicating they see digital assets as a long-term investment. By contrast, 21% described crypto as a short-term investment, while 26% said they are engaging with the market out of excitement.

The appetite of young Americans for crypto appears to be growing, with a Harris Poll carried out in March indicating that only 7.5% of the respondents had invested their stimulus checks into digital assets.

The Momentive Poll also noted a surge in investment interest among Millennials and Gen Zers during 2020. The survey found that most young Americans used mobile trading apps to invest, while social media is their dominant source of market analysis.

Those who were game enough to invest their first stimulus check into crypto last year are reaping handsome rewards.

According to Bitcoin Stimulus, citizens who invested the entirety of the first $1,200 stimulus checks issued on April 15, 2020 into Bitcoin (BTC) would currently be sitting on more than $8,600 — a 620% gain.

Young crypto investors in Australia are seeing sizable profits from their cryptocurrency investments too.

According to a survey of Australians commissioned by local crypto exchange Swyftx, 20% of the participants identifying as a Millennial or a Gen Xer have reported profiting by tens of thousands of dollars from crypto investments over the past 12 months.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin’s Quantitative Hardening vs Fiats Quantitative Easing (QE)

Bitcoin Startup Purse.io And Major Bitcoin Cash Partner To Shut Down After 6-Year Run

Open Interest In CME Bitcoin Futures Rises 70% As Institutions Return To Market

Square’s Users Can Route Stimulus Payments To BTC-Friendly Cash App

$1.1 Billion BTC Transaction For Only $0.68 Demonstrates Bitcoin’s Advantage Over Banks

Bitcoin Could Become Like ‘Prison Cigarettes’ Amid Deepening Financial Crisis

Bitcoin Holds Value As US Debt Reaches An Unfathomable $24 Trillion

How To Get Money (Crypto-currency) To People In An Emergency, Fast

Bitcoin Miner Manufacturers Mark Down Prices Ahead of Halving

Privacy-Oriented Browsers Gain Traction (#GotBitcoin?)

‘Breakthrough’ As Lightning Uses Web’s Forgotten Payment Code (#GotBitcoin?)

Bitcoin Starts Quarter With Price Down Just 10% YTD vs U.S. Stock’s Worst Quarter Since 2008

Bitcoin Enthusiasts, Liberal Lawmakers Cheer A Fed-Backed Digital Dollar

Crypto-Friendly Bank Revolut Launches In The US (#GotBitcoin?)

The CFTC Just Defined What ‘Actual Delivery’ of Crypto Should Look Like (#GotBitcoin?)

Crypto CEO Compares US Dollar To Onecoin Scam As Fed Keeps Printing (#GotBitcoin?)

Stuck In Quarantine? Become A Blockchain Expert With These Online Courses (#GotBitcoin?)

Bitcoin, Not Governments Will Save the World After Crisis, Tim Draper Says

Crypto Analyst Accused of Photoshopping Trade Screenshots (#GotBitcoin?)

QE4 Begins: Fed Cuts Rates, Buys $700B In Bonds; Bitcoin Rallies 7.7%

Mike Novogratz And Andreas Antonopoulos On The Bitcoin Crash

Amid Market Downturn, Number of People Owning 1 BTC Hits New Record (#GotBitcoin?)

Fatburger And Others Feed $30 Million Into Ethereum For New Bond Offering (#GotBitcoin?)

Pornhub Will Integrate PumaPay Recurring Subscription Crypto Payments (#GotBitcoin?)

Intel SGX Vulnerability Discovered, Cryptocurrency Keys Threatened

Bitcoin’s Plunge Due To Manipulation, Traditional Markets Falling or PlusToken Dumping?

Countries That First Outlawed Crypto But Then Embraced It (#GotBitcoin?)

Bitcoin Maintains Gains As Global Equities Slide, US Yield Hits Record Lows

HTC’s New 5G Router Can Host A Full Bitcoin Node

India Supreme Court Lifts RBI Ban On Banks Servicing Crypto Firms (#GotBitcoin?)

Analyst Claims 98% of Mining Rigs Fail to Verify Transactions (#GotBitcoin?)

Blockchain Storage Offers Security, Data Transparency And immutability. Get Over it!

Black Americans & Crypto (#GotBitcoin?)

Coinbase Wallet Now Allows To Send Crypto Through Usernames (#GotBitcoin)

New ‘Simpsons’ Episode Features Jim Parsons Giving A Crypto Explainer For The Masses (#GotBitcoin?)

Crypto-currency Founder Met With Warren Buffett For Charity Lunch (#GotBitcoin?)

Bitcoin’s Potential To Benefit The African And African-American Community

Coinbase Becomes Direct Visa Card Issuer With Principal Membership

Bitcoin Achieves Major Milestone With Half A Billion Transactions Confirmed

Jill Carlson, Meltem Demirors Back $3.3M Round For Non-Custodial Settlement Protocol Arwen

Crypto Companies Adopt Features Similar To Banks (Only Better) To Drive Growth (#GotBitcoin?)

Top Graphics Cards That Will Turn A Crypto Mining Profit (#GotBitcoin?)

Bitcoin Usage Among Merchants Is Up, According To Data From Coinbase And BitPay

Top 10 Books Recommended by Crypto (#Bitcoin) Thought Leaders

Twitter Adds Bitcoin Emoji, Jack Dorsey Suggests Unicode Does The Same

Bitcoiners Are Now Into Fasting. Read This Article To Find Out Why

You Can Now Donate Bitcoin Or Fiat To Show Your Support For All Of Our Valuable Content

2019’s Top 10 Institutional Actors In Crypto (#GotBitcoin?)

What Does Twitter’s New Decentralized Initiative Mean? (#GotBitcoin?)

Crypto-Friendly Silvergate Bank Goes Public On New York Stock Exchange (#GotBitcoin?)

Bitcoin’s Best Q1 Since 2013 To ‘Escalate’ If $9.5K Is Broken

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin?)

If You Missed Out On Investing In Amazon, Bitcoin Might Be A Second Chance For You (#GotBitcoin?)

2020 And Beyond: Bitcoin’s Potential Protocol (Privacy And Scalability) Upgrades (#GotBitcoin?)

US Deficit Will Be At Least 6 Times Bitcoin Market Cap — Every Year (#GotBitcoin?)

Central Banks Warm To Issuing Digital Currencies (#GotBitcoin?)

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Bitcoin’s Lightning Comes To Apple Smartwatches With New App (#GotBitcoin?)

E-Trade To Offer Crypto Trading (#GotBitcoin)

Bitfinex Used Tether Reserves To Mask Missing $850 Million, Probe Finds (#GotBitcoin?)

21-Year-Old Jailed For 10 Years After Stealing $7.5M In Crypto By Hacking Cell Phones (#GotBitcoin?)

You Can Now Shop With Bitcoin On Amazon Using Lightning (#GotBitcoin?)

Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin, Bright Future Ahead (#GotBitcoin?)

Crypto Faithful Say Blockchain Can Remake Securities Market Machinery (#GotBitcoin?)

Disney In Talks To Acquire The Owner Of Crypto Exchanges Bitstamp And Korbit (#GotBitcoin?)

Crypto Exchange Gemini Rolls Out Native Wallet Support For SegWit Bitcoin Addresses (#GotBitcoin?)

Binance Delists Bitcoin SV, CEO Calls Craig Wright A ‘Fraud’ (#GotBitcoin?)

Bitcoin Outperforms Nasdaq 100, S&P 500, Grows Whopping 37% In 2019 (#GotBitcoin?)

Bitcoin Passes A Milestone 400 Million Transactions (#GotBitcoin?)

Future Returns: Why Investors May Want To Consider Bitcoin Now (#GotBitcoin?)

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes (#GotBitcoin?)

Major Crypto-Currency Exchanges Use Lloyd’s Of London, A Registered Insurance Broker (#GotBitcoin?)

How Bitcoin Can Prevent Fraud And Chargebacks (#GotBitcoin?)

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.