Ultimate Resource On Stablecoins (#GotBitcoin)

Stablecoins are prevalent at all levels of crypto transactions these days, from the largest spot markets on exchanges like Binance to the trading pair of choice by many Hong Kong and mainland China OTC desks. The reason for the demand is simple: stablecoins provide a bridge between the fiat and crypto worlds. Ultimate Resource On Stablecoins (#GotBitcoin)

trusted and trustless stablecoins, with each referring to different levels of counterparty collateral risk.

—————————————————————–

@FranklinNoll In your opinion according to this excellent article (Does a Law From the Civil War Make Stablecoins Illegal?) .. which part definitively points to a clear violation of the law making Stablecoins illegal? The “scrip” part?

— Nanny Camera Rentals (@dplsurve) July 18, 2021

1864 law states: No one “shall utter or pass…any coins…intended for the use and purpose of current money.”

A stablecoin used for everyday retail transactions would be considered current money and be in violation.

— Franklin Noll (@FranklinNoll) July 19, 2021

—————————————————————–

We prefer trustless stablecoins as that model eliminates the counterparty risk of needing to trust a company, auditor, bank and humans in general.

HERE’S A NEW PAPER (Taming Wildcat Stablecoins) out of the Fed (+Yale) that lays out regulatory options for US dollar #stablecoins. Interesting–it was released yesterday (on a Saturday) & its first footnote references tomorrow’s big President’s Working Group meeting on the topic.????https://t.co/gfGWDbjjA4 pic.twitter.com/5VwMlnErHJ

— Caitlin Long ???? (@CaitlinLong_) July 18, 2021

Related:

Ultimate Resource On Central Bank Digital Currencies (#GotBitcoin)

USD Stablecoins: Exporting US Toxic Sludge

Access to digital cash that’s publicly visible and under the ownership of the individual would eliminate these problems and this is what Bitspark has been pioneering with PHP, IDR, VND pegged stablecoins for our remote money exchange agents.

Unique Trading Opportunities

There are interesting trading opportunities here too. Exotic currencies around the world almost always depreciate against the US dollar with recent examples found in Venezuela, Argentina, Turkey, Zimbabwe and Iran.

A good trade here would be to short those currencies via placing a dollar stablecoin as collateral to back the issuance of these currencies and then selling them for dollars. Bitcoin traders, merchants, and individuals need to use these currencies everyday anyway, so there is a market of buyers to which issuers can sell to.

Over time as the issued currency depreciates, the collateral value backing it becomes more valuable relative to the issued currency, enabling the issuer to withdraw or exchange excess collateral. Having already sold their issued coins on Day 1, they have effectively shorted the exotic currency without having to deal with any questionable local custodian – that’s almost impossible to do within traditional financial services

At Bitspark, we are creating trustless stablecoins for every currency in the world having recently launched an exciting product with Stable.PHP, a stablecoin pegged to the Philippine Peso backed by BitUSD (the first and oldest stablecoin in existence) using the Bitshares protocol.

I will be discussing more about some of the trading opportunities in taking short positions on Stable.PHP at this year’s Invest.Asia conference in Singapore. For example, when your collateral is BitUSD and you are issuing an exotic currency like Stable.PHP, you can take a leveraged position long or short.

Our set of exotic stablecoins will only be expanding through the year enabling more people to access a digital financial system in their local currency.

Updated: 10-14-2019

G7 Says ‘Global Stablecoins’ Pose Threat To Financial Stability

The G7 group of nations has reportedly drafted a report which says that “global stablecoins” pose a threat to the global financial system.

According to the BBC on Oct. 13, a draft report from the G7 outlined the various risks associated with digital currencies. It also said that, even if member firms of the governing Libra Association addressed regulatory concerns, it may not get approval from the necessary regulators, stating:

“The G7 believe that no stablecoin project should begin operation until the legal, regulatory and oversight challenges and risks are adequately addressed. […] Addressing such risks is not necessarily a guarantee of regulatory approval for a stablecoin arrangement.”

The G7 also states that global stablecoins with the potential to scale rapidly could stifle competition and threaten financial stability if users lose confidence in the coin.

The report will purportedly be presented to finance ministers at an annual meeting of the International Monetary Fund this week.

Further Problems For Libra?

The BBC states that, while the report does not single out Facebook’s proposed Libra stablecoin project, it could spell further trouble for the already beleaguered proposed payments system.

Global regulators are increasingly leaning on the project, with the Bank of England recently establishing provisions with which it must comply before it can be issued in the United Kingdom.

Facebook CEO Mark Zuckerberg will testify before the United States House of Representatives Financial Services Committee about Libra later this month. The head of the committee, Democratic Representative Maxine Waters, has been a noted critic of the project. Earlier this year, the committee drafted the “Keep Big Tech out of Finance Act.”

Libra has seen several major partner firms of its governing consortium leave the project recently. On Oct. 4, major payments network PayPal withdrew from the organization and was soon followed by Visa, Mastercard, Stripe and eBay.

Furthermore, Finco Services of Delaware initiated a lawsuit against Facebook, alleging trademark infringement, unfair competition, and “false designation of origin” regarding the use of the Libra logo. The plaintiff is also suing its former designer, who did the logo work for Facebook, for reusing the design.

Updated: 10-18-2019

Bitcoin Has Failed But Global Stablecoins A Threat, Say BIS And G7

Bitcoin and other early cryptocurrencies have failed as an “attractive means of payment or store of value,” says a new report from the G7 and Bank of International Settlements (BIS).

However, the October report, argues that widely adopted asset-pegged cryptocurrencies, or stablecoins, such as Libra are a growing threat to monetary policy, financial stability and competition.

Widely adopted stablecoins, dubbed “global stablecoins” in the report, have the potential to reach an international audience and have “significant adverse effects” on the current economic system, it argues.

Meanwhile, “[first generation cryptocurrencies like bitcoin] have suffered from highly volatile prices, limits to scalability, complicated user interfaces and issues in governance and regulation, among other challenges. Thus, cryptoassets have served more as a highly speculative asset class for certain investors and those engaged in illicit activities rather than as a means to make payments.”

Stablecoin taxonomy – defined as a money equivalent, contractual or property claim, or right against an issuer for an asset – will remain a preeminent legal question for the time being, the report continues. The effects of stablecoins on incumbent money systems such as wire transfers have yet to be fully understood as well.

While stablecoins may offer faster, cheaper and more inclusive payments, they can “only be realized if significant risks are addressed.”

In a footnote, the G7 report says the Swiss Financial Market Supervisory Authority’s (FINMA) handling of the Libra Association, which falls under the regulator’s purview in Geneva, agrees with the G7’s stablecoin recommendations.

FINMA recently said Libra highlights the need for international coordination and “appropriate prudential requirements” for all services offered over that of a payment system.

The report on stablecoins was prepared at the request of the G7 in July, soon after the launch of Libra back in June. While obviously directed in part at the project, the report only mentioned Libra in one footnote.

Responding to the G7, the Libra Association sent out a memo Friday saying the stablecoin is “not intended to change the role and influence of central bankers,” adding:

“Wallets and other financial services operating on the Libra Network (including exchanges and other on and off ramps) will have to comply with regulations, such as local capital controls, which can be tailored to prevent large scale flights from local currency to Libra coins in emerging markets.”

Updated: 12-14-2019

Why The ECB Is Getting In On The Stablecoin Game

Welcome to The Breakdown with Nathaniel Whittemore. Starting off this episode we discuss European Central Bank (ECB) President Christine Lagarde’s comments on stablecoins that inflamed Crypto Twitter yesterday. She said projects in the space indicated clear demand even as she gave bitcoin a bit of a backhanded compliment.

Meanwhile, two hugely hyped projects – Orchid and Filecoin – have both resurfaced. What might this mean for the token narrative going into 2020? We’ll explore what the growth of these tokens means for the market in general.

Lastly, in her end-of-year piece for CoinDesk, Jill Carlson triggered an avalanche of commentary by arguing that crypto isn’t supposed to be mainstream because its primary use case is for censored transactions. We’ll go deep on that subject on today’s podcast.

Updated: 1-31-2020

Bitfinex Users Can Now Trade Tether Gold Stablecoin Against Bitcoin

After launching trading of gold-pegged stablecoin Tether Gold (XAU₮) last week, Bitfinex now allows users to trade Tether Gold against Bitcoin (BTC).

On Jan. 30, Bitfinex has rolled out three margin trading pairs for Tether Gold, a digital asset backed by physical gold, which was introduced by Bitfinex’s affiliate firm Tether on Jan. 23.

The crypto exchange exchange now allows traders to trade Tether Gold against Bitcoin as well as the U.S. dollar and dollar-pegged stablecoin Tether (USDT).

Margin trading — a feature that enables traders to borrow funds to increase leverage — will require an initial equity of 20% and provide a maximum leverage of 5x, Bitfinex noted.

Tether Has Been Accused Of Not Backing Its Usdt Token With Enough Dollars

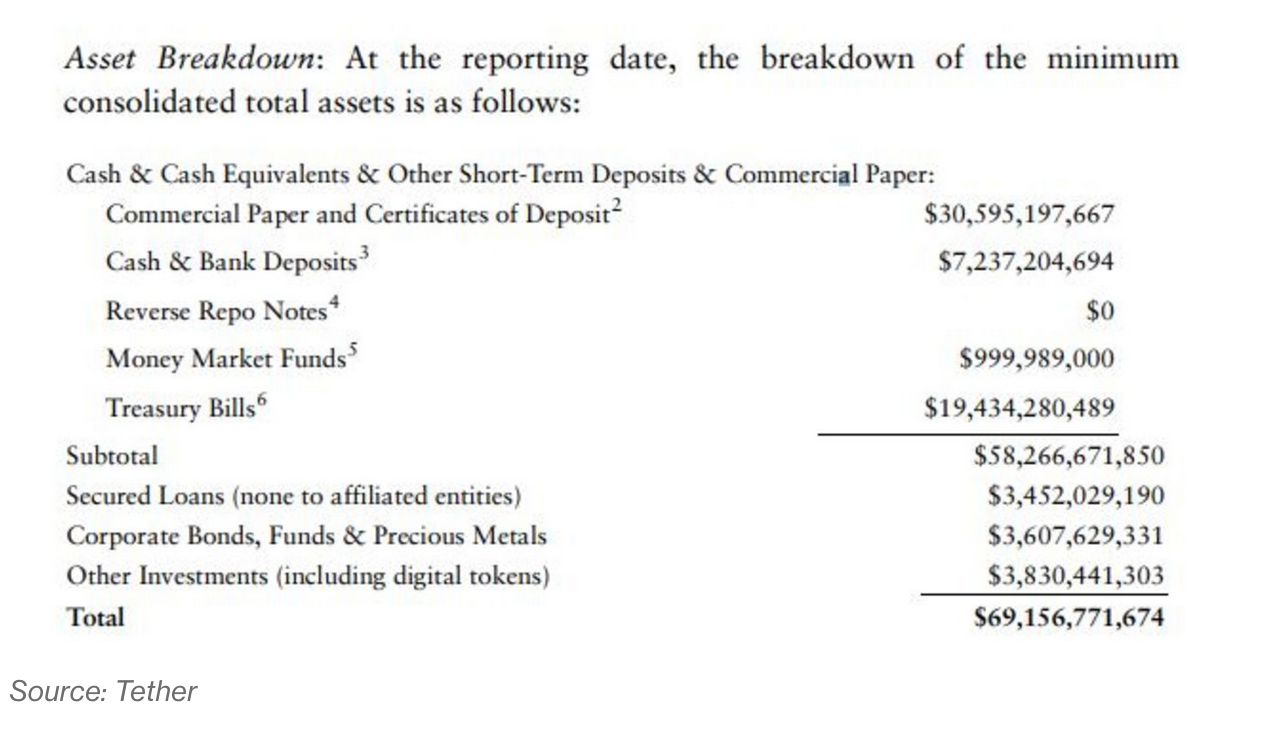

Tether Gold is one of the stablecoins launched by major cryptocurrency firm Tether alongside the controversial stablecoin USDT. Known as the world’s leading stablecoin, USDT has been subject to multiple controversies as some reports suggested that Tether does not have enough dollars to back the token. The company has been struggling to convince the public that USDT is backed by the appropriate amount of dollar holdings.

Meanwhile, Tether Gold is claimed to be the “best way to hold gold” as its physical gold storage backing is purportedly held in a Swiss vault, adopting “best in class security and anti-threat measures.”

Tether And Bitfinex Are Facing A Lawsuit On Crypto Market Manipulation

On top of the controversy around Tether’s USDT, both Tether and Bitfinex have been accused of cryptocurrency market manipulation, with some ongoing lawsuits alleging that the companies caused Bitcoin’s 2017 bull run that lead up to the all-time-high of $20,000 per coin.

As the companies have faced multiple suits on the matter, a court in New York ordered on Jan. 24 to merge four lawsuits against Tether and Bitfinex. As recently reported by Cointelegraph, the consolidation of suits has raised questions regarding the plaintiff’s leadership.

Updated: 3-4-2020

Why Betting On Gold-Backed Stablecoins Is A Losing Game

Gold has been regarded as an eternal value since times immemorial. This shiny metal still acts as a store of value — especially in countries like India. Due to its exclusivity, gold is an essential element of the global financial system, and since this metal is not subject to corrosion, it has many areas of technical application. Unfortunately, the metal is heavy, its transportation is fraught with certain difficulties, and storage costs a lot of money.

The last century, however, has brought more changes within the existing world monetary system than all the previous millenniums. Following the national fiat currency advents, the digital world with electronic money has stepped in over the past 20 years, and we are now close to seeing the establishment of e-money 2.0 with the help of emerging blockchain technology. We are witnessing an asset fusion process taking place, where digital currencies are backed not only by public interest and hype but also by the particular assets or commodities. But the question is, can the past merge with the future to provide better financial solutions?

Choosing The Underlying Asset For Stablecoin

Many stablecoin projects haven’t produced the value and strength anticipated a few years ago when more and more companies concluded that unbacked cryptocurrencies couldn’t lead the future of the digital market. Out of all the projects ever launched, the Stable Report data indicates that more than 150 stablecoins are either inactive or dead. Moreover, more than 40 stablecoin projects that were backed by gold have already closed up shop.

According to Blockdata, it’s vital that fiat-backed stablecoins have some type of centralized entity controlling the security and that gold-backed assets have to be able to prove that the gold reserves exist and are stored somewhere safe. If a stablecoin is backed by gold reserves, it should be solid enough to survive the extreme market movements often experienced by other digital currencies.

However, gold itself is not a stable asset — it’s a public store and a way of accumulating value over the long run. Therefore, how can such an asset be the ultimate measure of value in the future?

The business model of stablecoins is built around the fact that the issuer receives interest income from money market rates, which allows them to engage in business development as well as pay back the audit and board of directors. Aside from issuing a gold-backed stablecoin, the storage of collateral comes at an additional and mandatory cost, and the stablecoin itself is impossible to audit.

Moreover, gold is a metal that can be faked by using tungsten. The main uses for tungsten fake gold bars are to protect wires from corrosion or for soldering to other metals. Tungsten fake gold is sustainable, saving energy and posing no threat of pollution to the environment.

Maintenance of huge amounts of gold results in a negative carry — a condition where investments cost more than they return over the short-term. Even while tokens maintain the price of gold, gold-backed tokens are doomed to a decaying value per unit.

The rotten foundations of gold-backed stablecoins

While companies jumped on the crypto bandwagon in droves following Bitcoin’s (BTC) meteoric price increase in 2017, the logical choice would have been for these projects to follow suit.

The reality of last year’s market suggests that gold is not the best choice for the currency of the future, as many gold-backed stablecoin projects failed. There are specific reasons behind this outcome:

* A Gold-Backed Stablecoin Is Derivative For An Action That Changes In Price And, Therefore, Can Be Classified As A Security.

* Millennials Or The New Generation Do Not And Will Not Rely On Old-World Values Such As Gold, Which Is Nothing But A Relic Of The Past For Them.

* Current Bitcoin Generations Rely On Crypto To Pay For Their Everyday Latte Or Shopping Rather Than Gold Coins.

* Gold Has A Potentially Unlimited Supply, Which Is Not A Feature Of The Bitcoin Or Other Crypto Assets With A Fixed Amount Of Coins That Could Be Mined.

* We Don’t Know The Exact (Or Even Close To Exact) Numbers Of Gold Assets Held By Governments, Which Are Likely Not Audited — Even The U.S. Bullion Depository Was Never Audited.

Choosing Solid Ground For A Stablecoin Project

Thus, we can conclude that by using gold as the underlying layer to a stablecoin, its creators increase the chances of a project failure.

However, it’s unlikely that these statistics are reviewed by many of the industry’s finest. Tether (USDT), a controversial but significant platform issuing stablecoin, has recently announced its plans regarding the launch of a digital asset providing exposure to physical gold (XAU₮).

There have been reports of other crypto-based platforms also working on similar products such as Coin Shares, which has been exploring the possibility of launching a gold-backed cryptocurrency. While Bitcoin has often been regarded as “digital gold,” only the future will tell whether either Tether Gold or another similar project comes out on top.

Despite the fact that the possible benefits of fusing both physical and digital assets may look lucrative, this is not timely innovation in crypto ecosystems. Tether is infamous for having problems with auditing fiat, which can easily be audited in electronic form. Moreover, as gold can be easily replaced with Tungsten, only more auditing issues arise.

Gold represents everything that the new generation stands against. In these circumstances, the new-age global money transfer system can’t be built upon gold since governments across the globe confiscated gold in the 1930s. They still control the majority of this precious metal and are able to influence the market for gold through sales and lending.

We can’t say that gold can be 100% replaced by digital assets, as doing so still represents difficulties. Despite general misconceptions regarding gold, it still offers the most lucrative investment opportunities. Despite some fluctuations, gold constantly increases in price over time.

The world needs a next-generation e-currency designed to provide better options for trading, payments and transfers. In a quickly developing world where digitalization and speed are vital, it is only a matter of time before such an asset can be created.

When a new stablecoin is being designed, not only the particular underlying assets matter but also a careful calculation of the steps before the launch to avoid legal and governmental pressure that projects like Libra are experiencing. Ultimately, gold is not the asset that stablecoin-issuing companies should look up to, but there are possibilities to tie cryptocurrency to other assets — such as the United States dollar or the euro.

In fact, the euro is a solution that is already digital-ready. Fiat-backed stablecoins might just be the efficient solution to shortcut payments flow in low competitive markets, like acquiring in tourist-heavy destinations, where merchants are being charged a high, single-digit percentage fee to process foreign credit cards.

Moreover, it can be used to fix the gap between the classical financial industry and steadily maturing digital assets.

Bicoin may not be the digital currency that can ultimately replace cash. Concerns have recently grown as Elon Musk has recently joined the camp of crypto critics who do not believe in digital money taking over. We cannot be sure whether the day of its dominance over cash payments ever comes, but we can definitely say that gold-backed stablecoins will never have a future.

Updated: 3-30-2020

USD Stablecoins Are Surging, But Zero Interest Rates Complicate Business Model

“There are decades where nothing happens, and there are weeks when decades happen.” Vladimir Lenin – allegedly

The last 30 days have been historic by any meaning of the word. The coronavirus is shaking up life as we know it, and has already caused unprecedented dislocations in both the traditional financial markets and the crypto market.

In the center of this financial turmoil was the U.S. dollar, which saw a “flight to safety” from many different assets, including ones deemed “safe” by traditional investors. As I write this article, the S&P 500 is down 20 percent against the dollar in 2020, crude oil down 62 percent, the British pound down 9 percent, and both the Russian ruble and the Brazilian real are down 25 percent respectively.

While the crypto markets have been insulated from the markets at large for a long time, this is no longer the case now that public blockchains have effectively become rails for the U.S. dollar in the form of dollar-backed stablecoins. Dollars on the blockchain represent the third largest asset in crypto after bitcoin (BTC) and ether (ETH) , ahead of XRP (XRP) and bitcoin cash (BCH). In terms of transactions volume, they are even encroaching on bitcoin itself.

And since they are backed by dollars, they are both affected by global changes in demand for the U.S. currency as well as the monetary policy of the Federal Reserve.

Since bitcoin fell from its $9,000 range all the way below $4,000 before consolidating around $5,000 in mid March, stablecoins as a group have seen net inflows of around $2 billion, a 33 percent increase. This represents the largest surge in demand ever, in line with the dollar’s demand surge in traditional markets.

Most of these inflows went to tether with +1.55 billion since the start of the year, but USDC and BUSD also gained +170m and +150m respectively.

As demand increases, investors bid up the price of a token beyond one dollar. That creates an incentive for arbitrage firms to step up and introduce more supply into the system until the spread closes. To give an example, a firm could deposit $10 million with tether to buy $10 million USDT tokens – for exactly $1 apiece. Then it sells these tokens for slightly more than $1 and pockets the difference as profit.

For the last month, USDT has consistently traded >$1 as a result of this increased demand, explaining the massive 1.55 billion inflows.

Why do investors want USD stablecoins now more than ever? I believe there are three main reasons for this surge in interest.

First, we have seen a flight to safety from risky crypto assets as the markets tumbled. I saw people who are bullish on cryptocurrency in the long-term divest for the short term as previously uncorrelated asset classes started to move down in lockstep.

Second, there is big demand for USD from emerging market currencies that are weakening against the dollar, as described in the intro. Due to its offshore nature, USDT in particular has become one of the best ways to dollarize in places like China, Indonesia, Russia and Brazil.

Finally, the physical reality of coronavirus quarantines and travel restrictions has made moving cash extremely hard for the time being, especially between countries. Dollars on the blockchain have some of the desirable properties of cash, especially in terms of permissionless access and privacy (if used correctly), and can act as a substitute – at least temporarily.

While dollar-backed stablecoins increasingly turn into “eurodollars lite,” they are also subject to the monetary policy of the dollar. On March 15, the Federal Open Market Committee (FOMC) lowered the federal funds rate by 1 percent to 0 percent-0.25 percent to soften the upcoming recession caused by the coronavirus.

This reduction actually has big effects on the business model of these stablecoin issuers. To understand why, we only need to look at how they make money. So far, there are two main ways.

First, by investing their reserves (usually by lending it to commercial banks, or buying AAA-rated fixed income securities like U.S. government bonds). Going into 2020, the largest stablecoins held a collective $5.5 billion of customer funds. At an interest rate of 1.25 percent, these deposits could have generated up to $68.75 million in revenue for them.

“Even with revenue from interest drying up, I see a big future for dollar-backed stablecoins”

Because the fed fund rate affects all commercial interest rates, the issuers of coins like tether or USDC now stand to make significantly less money from interest going forward. If the rates become negative, which is the case in Europe and Japan, then they might even have to pay in order to deposit money, turning their business on its head.

Due to the reduction in revenue, there are concerns that stablecoin operators could be pushed into riskier investments to pay the bills, for example corporate bonds. This dynamic could also explain why euro- or yen-backed stablecoins have never taken off.

As a second revenue stream, some operators (like Tether) already charge a fee, currently 0.1 percent, on deposits and redemptions, while others (like USDC) don’t. We might also see stablecoins explore entirely new business models to meet the new zero-rates reality. USDC seems to push into the direction of becoming a defacto commercial bank by providing APIs for payments (including from fiat credit cards), wallets, marketplaces and business accounts.

For now, it seems more likely that operators will try to build (and charge) adjacent businesses made possible by these stablecoins instead of passing on costs to retail users, e.g. via inflating the token supply relative to deposits as a form of usage tax, or implementing an additional transaction fee (PAX already does this for its gold-backed token.)

The latter brings its own challenges, as users are incentivized to wrap the original tokens in a trustless contract and transact in the receipts instead (similar to WETH/ETH.) Centralized exchanges could once again be the kingmakers in this situation, as they can decide to support the wrapped tokens or not.

Even with revenue from interest drying up, I see a big future for dollar-backed stablecoins, especially now that the opportunity cost for holding stablecoins has effectively gone to zero.

We’ll probably see even larger inflows in the future, both from places with negative rates in their traditional bank accounts as well as emerging markets with currencies that rapidly lose their value against the dollar. As long as users value the service offered by stablecoins, I see good odds that operators can develop new and sustainable business models.

Updated: 4-14-2020

How Zero Interest Rates In The US Will Impact Stablecoin Adoption

We are living through interesting times. At the time of writing, roughly half of the world’s population is on lockdown, with 90 countries in various forms of confinement and the pandemic crashing global stock markets.

Although we’ve seen some relief in certain parts of the world, the pandemic is far from over, and there is a tangible fear of a possible global recession. While several easing measures have been adopted by the world’s banks to contain the worst of the economic damage, the pandemic has created a perfect environment for crypto.

However, the new measures currently being taken by the banks may also create new challenges. There has been increasing concern from both the traditional and crypto markets about the effects that negative interest rates in the United States will have on the economy.

In fact, Bitcoin (BTC) whale numbers have hit a two-year high as fear-selling has created a mirror image of 2016 market conditions. But where does this leave the stablecoin market and its business model?

Stablecoin Adoption

As with all forms of digital currency, popularity and adoption depend on how the currency stores its value and its means of payment. From USD Coin (USDC) to Facebook’s Libra, the rise of stablecoins can be accredited to their attractiveness as payment methods.

They have a global reach, low costs and no delays. They can also be embedded in digital applications or integrated into customer relationship management platforms due to their open architecture. They have also proved to be safe from the very popular data-hog crypto-mining malware.

At the moment, most stablecoin claims get delivered to the issuing institution or its known underlying assets with face value redemption guarantees. For example, a coin bought for one U.S. dollar may be redeemed for an actual U.S. dollar, but there is no government backing involved.

The U.S. government has rushed to the defense of American small businesses, pledging nearly $600 billion in loans as part of its Paycheck Protection Program. But many financial technology lenders have struggled to secure loans through the program.

Some businesses may make it through the application process, but a simple business loan calculation shows they would still be cash strapped in a matter of months. This doesn’t take into account the fact that the dollar would be devalued, lowering the relative value of any cash reserves. Stablecoin investments, on the other hand, should deliver high yields of interest if invested properly.

Trust is created by the issuance of safe assets against any stablecoins, and the settlement technology is usually based on a blockchain model. But its biggest attraction by far is the promise from networks to make transacting an integrated and social experience, as most of the models are designed by companies that have a user-centric approach.

With organizations bracing for cryptojacking and the pandemic currently encroaching on all the financial markets, Coin Metrics’s “State of the Network” report has shown clear indications of spectacular growth in the supply of all stablecoins, growing its market share at the time COVID-19’s impact on global markets started to become visible.

Looking At Interest Rates, Stablecoins And The Dollar

The dollar has always been seen as one of the safer currencies during troublesome times, as the recent market anxiety led by COVID-19 goes to show. Just as businesses want predictable revenue so that they can plan for the future, investors want a safe bet when it comes to their investments.

As panic started to make itself known, the dollar index grew from 94 handles to around 103 at the peak of the sell-off. The same movement can be seen when it comes to stablecoins. As the market started crumbling, U.S. dollar-pegged stablecoins such as USDC and Tether (USDT) were seen as safer crypto assets as compared to other cryptocurrencies.

As of March, the market capitalization of the biggest stablecoins has grown significantly. U.S. dollar-pegged stablecoins are linked to the demand of dollars by nature, and we cannot ignore the market’s view on the greenback or the Federal Reserve’s stance on interest rates when looking at their overall position in the financial sphere.

One of the biggest sources of revenue for stablecoin users has been the interest generated by stablecoin funds deposited into their traditional bank accounts by stablecoin issuers. As the Fed has cut its benchmark rates to 0.25% in light of the pandemic, banks will also lower their percentage yields on saving accounts to match the Fed’s move, leading to less income for stablecoin users.

If the rate goes any lower, like we’ve seen in Europe and Japan, stablecoin users will definitely be affected.

Stablecoins Will Continue To Flourish

The current low interest rates may trigger some stablecoin users to start collecting fees in some way or form or to pursue other crypto avenues, but stablecoin issuers will not be left out to dry. In fact, it may benefit them in new ways. Institutional interest, especially in the security transaction and money movement areas, is flourishing.

Several of the major investment banks are stepping up to take advantage of blockchain technologies, chief among them JPM Coin of JPMorgan Chase. To brighten the light at the end of the tunnel, it is not only the giants in the banking industry that want to take advantage of the technology, but the smaller central banks have also shown growing interest.

The People’s Bank of China is close to finalizing its central bank digital currency, or digital yuan, and according to reports the central bank believes that its digital currency will be “a convenient tool for its zero and negative interest rate.” At the same time, the Fed, the European Central Bank, the Bank of England and the Bank of Japan are also stepping up their efforts in this area.

Even though digital bank currencies and stablecoins do not work the same way, the growing awareness of blockchain and the technology’s disruptive nature could lead to fantastic collaborations. This could also boost trust levels among consumers since many of them still feel that stablecoins, like most cryptocurrencies, could easily serve as an enabler of their online privacy.

The decentralized finance and open finance movements can also be significant in the future growth of stablecoins. With rising national debts, demand for a U.S.-dollar centralized collateral within the DeFi system has been growing.

According to Paolo Ardoino, the Chief Technology Officer of Tether, “You cannot have algorithmic stablecoins relying only on the crypto-assets themselves.” Ardoino continued to state that centralized collateral of the U.S. dollar could provide a “safe set of shoulders” to the DeFi ecosystem. It may be worth our while to keep an eye on these developments.

Conclusion

Our current low interest climate may leave stablecoin users at a loss when it comes to managing their assets, but it should be seen in a positive light. When looking at the bigger picture, the concept of the “stablecoin” has established itself as an essential part of the crypto space, and its importance will continue to expand going forward.

Individual investors may find that stablecoins provide safety when we experience harsher market conditions. Investment options within the stablecoin space can always be reevaluated by traders and investors alike when the market becomes more competitive again.

Updated: 4-22-2020

The Stablecoins Movement — Toward Stability in Crypto Assets

Blockchain technology is becoming more and more common in the traditional finance market with stablecoins and CBDCs — could these bring stability for the crypto industry?

Stablecoins have become widely popular in the digital currency industry because they don’t have the volatility associated with other cryptos like Bitcoin (BTC) for instance. Despite their popularity, the first wave of crypto assets — of which Bitcoin is the most popular — is failing as a reliable means of payment or store of value in several ways. They are susceptible to complicated user interfaces, highly volatile prices, issues in governance and regulation, and limits to scalability, among other challenges. Thus, instead of serving as a means of payment, cryptocurrencies in the past have often served as a highly speculative asset.

In response, the emerging stablecoins offer the features of conventional crypto assets, while linking the coin’s value to a real-world asset or pool of assets, thereby stabilizing its price. This stabilizing mechanism at the core of this initiative determines whether the units issued can effectively maintain a stable value or not. What is a working stablecoins definition? Per the Bank for International Settlements:

“Stablecoins, which have many of the features of earlier cryptocurrencies but seek to stabilize the price of the ‘coin’ by linking its value to that of a pool of assets, have the potential to contribute to the development of more efficient global payment arrangements.”

Needless to say, since the stablecoin price is more or less stable, it has become increasingly important in the digital currency space. Days before the entire world went into full lockdown, stablecoins and CBDCs, their government-backed sibling, were a hot topic that we have discussed at length.

In this article, I outline some of the crucial aspects of this new promise, beginning with a comprehensive list of stablecoins. Also, I look at how the industry’s giants are competing to make the best of the opportunity.

And, as per my new collaboration series of articles, I reached out to some industry leaders to get their thoughts (consensus), which I included below.

A List Of Stablecoins

What are the best stablecoins? The most common ones are fiat or asset-backed where the stablecoins serve as a digital representation for a specific asset — say, one coin equals one United States dollar. A second type is known as crypto collateralized stablecoins. Here, several distinct cryptocurrencies, put together in one group, act as a collateral for an issued stablecoin. Then, there are algorithmic stablecoins that eliminate the need for economic markets — a digital authority is created to stabilize the on-chain currency. To simplify, let’s look at an example from each category.

Tether Stablecoins (Asset-backed)

Endowed with a significant first-mover advantage, stablecoins are among the first crypto assets to surface. Issued by Tether Limited, it operates on the Omni protocol as a token issued on the blockchain. Not only is it backed by the U.S. dollar (USDT) but Tether is also pegged to the euro (EURT) due to the control wielded by the European Union.

Additionally, it has launched a Chinese yuan-backed stablecoin (CHNT).

Tether crypto dominates the stablecoin market in terms of market capitalization and trading volume. In February 2019, it accounted for almost 90% of the entire market capitalization of stablecoins.

While the market has been witnessing stiff competition, Tether’s quasi-monopoly remains unchallenged with its trading volumes hovering around 95% of the overall stablecoins market and the tether crypto price — which is pretty impressive. It also happens to be the largest tokenized stablecoin, with an average daily volume of $40,337,665,581 and a capitalization of $4,633,935,920, according to stablecoin CoinMarketCap.

MakerDAO stablecoins (Crypto-collateralized)

Even if a fully trustworthy audit was realized, any kind of regulatory issue is likely to jeopardize the convertibility of Tether. There are plenty of stable digital currencies available, but only one can claim to be widely used, decentralized and trustless — MakerDAO. The MakerDAO CDP portal is responsible for the generation of Dai (DAI), Maker’s in-house stablecoin. It offers an alternative that does not rely on existing models and, as a system, is largely analogous to a pawn shop loan. What is the MakerDAO price? It is backed by on-chain collateral, Ether (ETH), with a floating peg to one U.S. dollar.

The MakerDAO model leverages a dual token system comprising primarily of the stablecoins Dai and a secondary unit called Maker (MKR). Here, we’re looking at a Decentralized Autonomous Organization — that is, a decentralized organization represented by cryptographically encrypted “rules” controlled by all MKR holders on the network. They are responsible for carrying out various administrative tasks. As they are in charge of defining the risk parameters, they are also responsible for maintaining a stable Dai exchange rate.

NuBits Stablecoins (Algorithmic)

Building on Peercoin’s platform, NuBits (USNBT) has been operational since 2014 and is one of the oldest algorithmic stablecoins, with a peak capitalization of $674,584 and a daily volume of $13,176.59, according to CoinMarketCap. Although it recovered remarkably from a major loss of confidence back in 2016 and was additionally able to withstand temporary price fluctuations, the value of NuBits coins failed to recover after a drop in March 2018.

Its stability mechanism largely relies on a dual token design. Share token holders can initiate the creation of new NuBits. However, the share tokens are not pegged to any specific price; they have a fixed supply; and they can be used to validate transactions. The contraction of the NuBits supply is incentivized through dynamic rewards for locking NuBits.

Coinbase vs. Binance — The Race For Stablecoins

Of all the companies operating in the crypto market, none have grown as significantly in terms of the crypto market cap as these behemoths that have exceeded Morris Katz in painting a new industry. There have also been multiple claims about Binance being the fastest profitable startup to achieve unicorn status — a private company valued over $1 billion. However, Binance is not the undisputed king — Coinbase saw similar explosive growth when the exchange reached a valuation of $8B from $483M in just one year. Coinbase charts are thus looking great.

Binance, though, has a complete monopoly over the market in terms of the trading volume. On Dec. 18, the 24-hour trading volume was $1,448,959,110 (it was approximately $241,458,067 across all trading pairs on the Coinbase Pro exchange although it has significantly increased). Moreover, Binance has a very low fee of just 0.05% per trade for its Binance Coin (BNB). Once you purchase Bitcoin, Litecoin (LTC) or Ether, you can use Binance to convert one of those into nearly any altcoin.

Although Binance has overtaken Coinbase in many ways, it barred American users from its global exchange thanks to regulatory reasons. However, they opened a smaller exchange called Binance.US to continue serving American customers after receiving approval from the New York State Department of Financial Services.

However, days later, Coinbase announced the establishment of the Crypto Rating Council, of which Coinbase and Kraken were two of the founding members, along with other predominantly U.S. firms (Binance was, as you may have guessed, excluded).

Circle’s Entry Into The Stablecoins Movement

Although it had emerged as a behemoth of the industry in 2018, Circle, by the end of 2019, had discontinued its payments app and sold Poloniex to an Asia-based consortium. Thereafter, its footprint continued to shrink. The company’s strategic roadmap for the year 2020 involved the sale of its over-the-counter trading desk to Kraken for global expansion.

Kraken, the cryptocurrency exchange based in San Francisco, has been pursuing its expansion spree for a while with the acquisition of product-specific firms. This vital sale will help Circle not just to focus solely on its stablecoins but also to reorganize resources, improve team agility, achieve a specialized product portfolio and lower complexity in operations.

According to Cryptobriefing, it will perhaps soon assume a leading role in the stablecoin project’s infrastructure.

Blockchain consensus with industry leaders

Here’s What Other Industry Leaders Feel About This Important Topic.

Andy Cheung, The Founder Of Acdx And The Former Coo Of Okex:

“Stablecoins seem to offer the best of both worlds: utilizing blockchain technology and offering stable value. Personally, I see it merely as a branch of cryptocurrency and is developed to cope with regulations. The most successful model is fiat-backed stablecoin, yet it failed to align with the vision of Bitcoin — to liberate money from banks and giants. That said, it plays a crucial role in the mass adoption of cryptocurrency and bridges the gap between crypto and fiat.”

Paul Veradittakit, Partner Of Pantera Capital:

“Pantera is an investor in both Maker and Circle. I believe that stablecoins are important for payments, decentralized finance and other applications, and it will be great to see how they evolve and gain adoption. At the end of the day, one way folks can go out to market is having the right relationships and use cases such as payments, Eco and Luna are both great examples of that.”

Vincent Molinari, the founder, CEO and host of Fintech.TV and Digital Asset Report, and the CEO of Molinari Media:

“As the evolution of finance and technology continue to intersect globally, cryptography will continue to deepen its role in global capital flows. The advent of stablecoins, with underlying pooled assets, will continue to be woven into payment systems. This will perhaps see its most significant near-term adoption in the global securities settlement processes. This will create efficiency and scale between global counterparties and meaningful cost savings will be achieved in the cost of carrying capital between transacting syndicates and consortiums as continuous linked settlement and netting will occur via top tier stable coin usage.”

What Lies Ahead As Far As Stablecoins Are Concerned?

The coming years will possibly witness the advent of the second generation of branded stablecoin projects that would include secondary market liquidity, loyalty program integration and branding opportunities. Moreover, now that we have the much-controversial Facebook’s Libra, we might expect stablecoins from other major brands with a large customer network like Delta and Amazon.

Further, the Bank of Canada governor mentioned stablecoins in his 2020 vision. It’s true that just like any other invention, stablecoins offer as many conundrums as they do potential benefits. Yet, it’ll be wise on the part of policymakers to envision far-sighted regulatory regimes that will serve to meet the challenge and usher in a less fluctuating future for the stablecoin cryptocurrency.

Updated: 4-27-2020

Uphold Announces Expansion Of Its Stablecoin Portfolio

Digital payment platform Uphold launches a new Stablecoin Center to meet increased demand for digital dollar offerings.

Uphold, a digital money platform providing access to investments and payments using blockchain technology, has announced the expansion of its stablecoin offerings alongside the launch of a “Stablecoin Center.”

The Center, according to the announcement, will offer access to six stablecoins in the platform, including four of the most popular in terms of market volume: Tether (USDT), TrueUSD (TUSD), USD Coin (USDC) and DAI.

Uphold has also added coins from the Universal Protocol Alliance, such as UPUSD and UPEUR.

Writing To Cointelegraph, Uphold’s CEO, JP Thieriot, Praised The Recent Addition Of Stablecoins:

“Stablecoins are inherently less volatile than cryptos being pegged 1:1 to safe-haven currencies like USD and are quickly being adopted by central banks around the world.”

According to Thieriot, the goal of the new Stablecoin Center is to allow people to transfer value between stablecoins, traditional banking networks and crypto markets. He said:

“Stablecoins are ostensibly a measure of interest in crypto combined with the shortcomings of the legacy financial system. The units of account are still the Fiat units of account. Nothing changes on that front. Moving from bank USD to digital USD just means better velocity, more options and, perhaps most notably – higher interest yields.”

Thieriot also mentioned that the Stablecoin Center will help users determine which stablecoins are comparatively better than others in terms of transparency, auditability, liquidity, and available interest rates, adding:

“Stablecoins have generally come a long way from their inception, and some of the newer ones are clearly superior, in nearly every regard, to the older ones. Hopefully, users will overcome inertia and start to go with the best constructed alternatives.”

Key Features To Consider

On the key features of the Stablecoin Center, Uphold said that they relied on the principles of accessibility, connectivity, financial stability, and interest earning to expand their new product portfolio.

Thanks to the new “Center,” Uphold now offers users access to funds through debit/credit cards and bank accounts in more than 40 countries, together with wallets on seven crypto networks. Uphold currently supports over 50 different currencies including cryptocurrencies, national currencies and commodities.

Supported stablecoins will also be eligible to earn up to 10% interest via a third-party app, Cred Earn.

CEO of Cred Earn, Dan Schatt, mentioned that Uphold customers are receiving the most competitive interest rates available on stablecoins, commenting, “We’re excited to see this segment of the crypto-asset market maturing.”

Thieriot further noted that Uphold plans to provide support for any new stablecoins that prove to be legitimate and of public interest.

Updated: 4-30-2020

Stablecoins Provide Cover As Global Risks And Uncertainty Quake

As the global economy trembles, investors continue to find sanctuary in stablecoins, which have increased their market cap dramatically.

As the global economy trembles, investors continue to find sanctuary in stablecoins. In the most recent 12-month period (ending April 29, 2020), the three top stablecoins — Tether (USDT), Circle (USDC) and Paxos (PAX) — increased their market capitalization by 161%, 191% and 146%, respectively.

Kim Grauer, head of research at Chainalysis, told Cointelegraph that with the use of a different metric, “We can confirm a 250% increase in the amount of Tether moved on-chain in the past 12-months (ending March 2020),” and the growth isn’t all front-loaded, either.

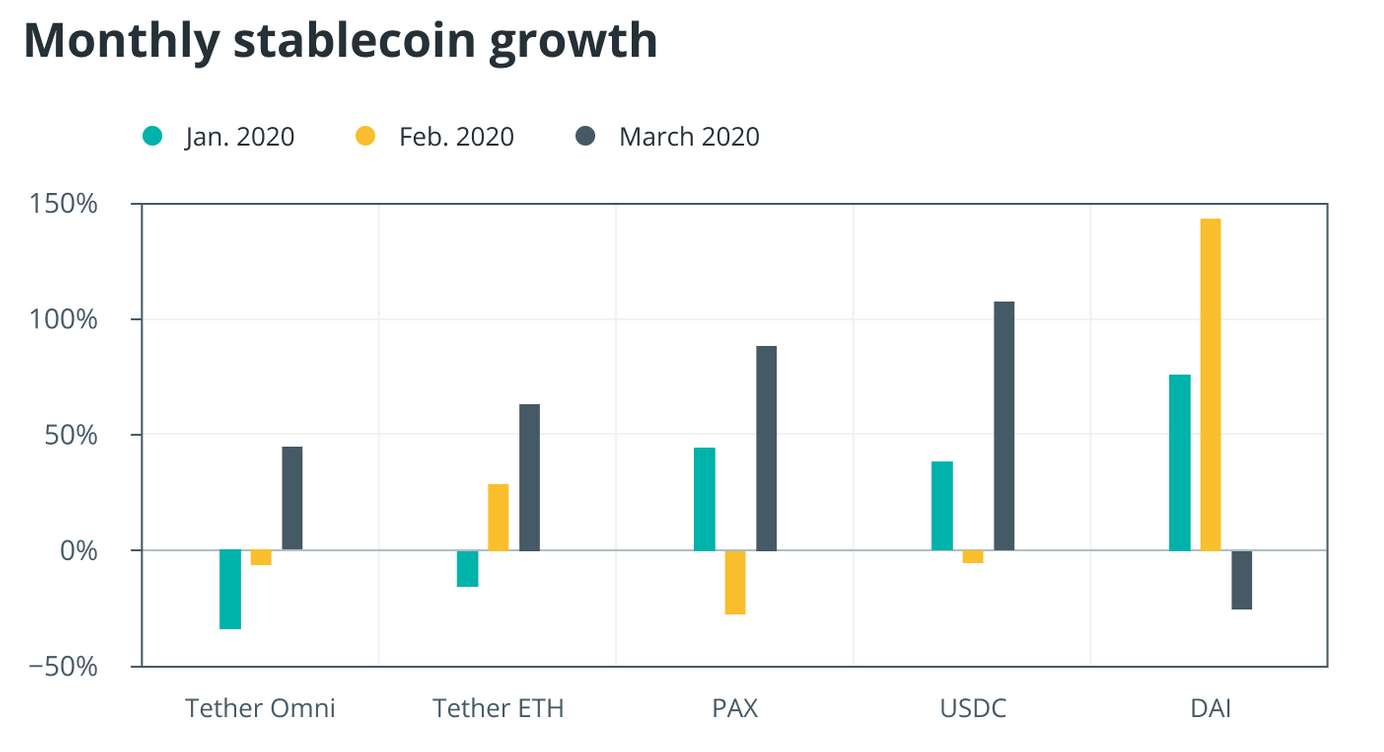

As COVID-19 raged, President Trump declared a national emergency in the United States on March 13, and for that month, the three largest stablecoins each notched month-on-month on-chain growth of 50% or higher.

Elsewhere, on March 10, Binance’s new stablecoin (BUSD), created in partnership with Paxos Trust company, crossed the $100 million market cap threshold for the first time since its September debut. Dramatic growth continued through April. On April 29, BUSD’s market cap stood at $194 million, trailing only USDT ($7.52 billion), USDC ($726 million) and PAX ($244 million).

Talking to Cointelegraph, Binance chief compliance officer Samuel Lim shed some light on the likely causes of such growth. “Stablecoins have been used more frequently in trading due to huge market volatility in the past year,” he said, “but apart from that, we have also seen an increase in its public adoption and usage.” In reference to Tether’s growth in particular, Lim added:

“The issuance of USDT has increased greatly, but its market share is gradually decreasing, which means other stablecoins have been growing phenomenally — not to mention that it [USDT] may face potential competition from CBDCs [central bank digital currencies] or even the likes of Libra.”

Not So Surprising

Are other industry representatives confounded by the continued growth? “It’s not surprising to me,” Cred CEO Dan Schatt told Cointelegraph, “we’ll see more of this, with the current state of the financial markets. There is a strong interest in the dollar, and it’s much easier to acquire dollars through crypto assets.”

COVID-19 has done nothing to disrupt stablecoins’ advance on non-pegged digital coins (i.e., non-stablecoin crypto).

“Compared to the top 5 non-stablecoin assets (BTC, ETH, LTC, BCH, and XRP), the stablecoins we track saw higher month-over-month growth from February to March in terms of on-chain transaction volume,” Grauer told Cointelegraph. She elaborated, “The flight to stablecoins suggests that people may be deliberately looking to store value in traditional fiat assets, namely the USD.” Adding to this sentiment, Gregory Klumov, CEO of Stasis, which issues the EURS stablecoin, told Cointelegraph:

“You can track the outstanding circulating amount of issued stablecoins, and during the first wave of a crypto market correction in early March, there was a significant issuance of stablecoins. That’s exactly the outcome that is expected: people were relocating to stablecoins, reducing the volatility of their crypto portfolio.”

A flight to safety is one common explanation. But there may be other considerations amid the coronavirus pandemic, some even hygienic, as Klumov went on to add, “People may start treating things they touch differently. For example, they will prefer to make digital payments and perform cashless interaction.” This is a significant trend for stablecoins in his view. Users can download crypto wallet apps and “get a checking account in dollars or euros by receiving and sending the same stablecoins.”

Asked to explain the recent stablecoin upsurge, Preston Byrne, partner at law firm Anderson Kill, told Cointelegraph, “It’s because people want dollars, and stablecoins are one form of exposure to dollars in places that don’t have direct access to the U.S. banking system or the means of holding physical cash.” Not all stablecoins are created equally, though, “There are really two different types of stablecoins: audited schemes, like Paxos and Circle, and unaudited ones like Tether,” Byrne said, adding:

“Paxos and Circle have likely seen increased adoption by market participants looking for a crypto-native alternative to ACH [automated clearing house] to make payments and settle debts, or simply a quick and easy way to convert crypto to USD. Tether’s market cap has ballooned to the stratosphere, but until Tether passes an audit conducted by a reputable firm, prudence dictates that I can’t believe their numbers.”

Byrne has been critical of stablecoins in the past, especially crypto-collateralized stablecoins (such as DAI), which he once described as “the perpetual motion machines of modern finance.” He also wrote, “A stablecoin that is collateralized by itself is a complex and fragile ‘Nakamoto Scheme’ doomed to fail.” Asked about this, Byrne said, “Stablecoins that fail to do those things or which cut corners on regulatory compliance are a bad idea,” further sharing with Cointelegraph:

“DAI faces numerous compliance challenges, starting with money services business licensing and continuing to a total lack of investor protections, as seen in recent events where DAI CDP [collateralized debt position] holders got wiped out due to a black swan drop in the price of Ether and network failure. That wouldn’t happen with a Paxos or a Gemini.”

For the record, DAI’s market capitalization increased by 38% over the past 12 months, which would be enviable growth under most circumstances, though it now pales beside the increases exceeding 140% notched by the top three stablecoins over the same period.

Moreover, Alex Melikhov, CEO of Equilibrium — which issues EOSDT, a decentralized stablecoin — told Cointelegraph that centralized stablecoins like Tether, USDC and PAX have their own black swan risks. The banks that hold their currency’s cash reserves could fail. Decentralized stablecoins, by comparison, are transparently backed by cryptocurrency that is sitting in smart contracts.

Melikhov added, “These stablecoins are dependent only on the [underlying] technology and its embedded algorithms. They are free from third-party risk and may be even safer than their centralized analogs.” Tether, of course, remains the gorilla in the room, with a market cap more than eight times that of the number two stablecoin. Regarding Tether, Grauer noted:

“We see interesting technical and economic trends that may be related to this surge. Technically, most of the growth in Tether activity can be attributed to Tether on the Ethereum blockchain. In March 2020, over 90% of Tether transactions were settled on the Ethereum blockchain whereas just under 19% were settled there in April 2019.”

She added that 65% of Tether value was transferred in transactions that were over $100,000 each. “This confirms some speculation that a large source of the demand for Tether likely comes from professionals, probably based in China, where there is no fiat available to onramp into the crypto market.” Approximately 50% of Tether’s activity in March was sourced directly to China-based exchanges Huobi and OKEX, added Grauer, while Binance sourced nearly 30% of the Tether present on the Ethereum blockchain.

Could Regulations Stifle Growth?

What, if anything, could derail stablecoin growth? “Most of the Tether demand is coming from the Asia region,” continued Grauer, “so a future regulatory crackdown could be felt by stablecoin users. But we have seen a resilience to these types of moves in the APAC region.” When the Chinese government banned the use of yuan for crypto purchases, for instance, many users simply shifted to Tether. On the matter, Lim believes that:

“Either way we believe they [i.e., stable and non-stable coins] can coexist, as their target audience might even be different. And needless to say, the crypto market is still very small when compared to the traditional fiat market. All it takes is for a small percentage of the flow of funds from the traditional world to enter this space and we will see a tremendous explosion of growth and adoption in our industry.”

Schatt added that more stablecoins are now emerging with higher standards and that are truly substantiated 1:1 with auditable transparency pages. He went on to say, “Those that cannot obtain a certain level of liquidity, transparency and auditability will be more susceptible to market crashes.”

Speaking hypothetically, Melikhov believes that a failure of Tether could still have a drastic impact on the crypto sphere, “but the stablecoins market is slowly becoming more diversified as existing Tether alternatives become more mature.” In the future, a major stablecoin failure could simply result in the rise of an alternative stablecoin project — that is, one to take its place, he suggested.

Looking Ahead

Should the current run continue, can the stablecoins’ collective market capitalization eventually surpass that of Bitcoin, currently at $165 billion? “It’s possible,” said Schatt, “as we are already seeing more use cases for stablecoins — settlement of M&A and POS transactions. Connecting stablecoins to the several trillion dollar retail commerce market can significantly light up the prospect for stablecoins.” Lim, on the other hand, told Cointelegraph that “It is too early to tell,” adding:

“Stablecoins are a bridge between the traditional fiat world and the crypto world, and we are all aware the fiat world is significantly larger. There is certainly room for growth within the stablecoins space and we strongly believe demand will only grow larger as institutional interest begins to pick up.”

There is only a finite supply of Bitcoin, too — a restriction not imposed on stablecoins. Market cap, of course, has its limitations as a measure of size or success, especially if governments enter the stablecoin arena. “If China or the U.S. create their own stablecoin, you will see how it is easy for them to overcome the market capitalization of Bitcoin,” Paolo Ardoino, chief technical officer at Bitfinex exchange, told Cointelegraph.

“It is probably more meaningful to look at the amount of on-chain activity that we see, and right now stablecoins account for less than half of the activity of Bitcoin,” suggested Grauer. In any event, “the success of stablecoins and the success of other cryptocurrencies are not separate stories; they support each other,”she said.

Updated: 5-25-2020

Stablecoins Could Transfer Value Across Blockchains, Says Vitalik Buterin

Ethereum co-founder Vitalik Buterin suggested that stablecoins could serve as instant cross-blockchain bridges.

Ethereum co-founder Vitalik Buterin thinks that the stablecoin industry is missing a valuable opportunity to improve interoperability between different blockchains.

In a lengthy Twitter thread on May 20, Buterin suggested that stablecoins could enable users to move value across different blockchains:

“In the specific case of issuer-backed stablecoins there’s lots of things that could be done but aren’t, eg. every stablecoin could be an instant cross-chain bridge!”

Bitcoin (BTC) activist and independent developer Udi Wertheimer pointed out that something similar to what Buterin suggested is already possible with cryptocurrency exchanges. He explained that a user can deposit the Ethereum version of Tether’s USDT on crypto exchange Binance and immediately withdraw its Omni protocol or Tron (TRX) version.

Buterin, on the other hand, explained that he would be happy to see a bridge that does not require the user to move funds on an exchange:

“I would of course love it if they and USDC and the others could agree on a standardized API (perhaps a “bridge contract” ERC); so I don’t need to bother dealing with Binance accounts to move coins around!”

Users Do Not Care About Decentralization

Wertheimer admitted that, while industry insiders such as he and Buterin like decentralized solutions, users do not really care about how systems work as long as they are interconnected.

Tether’s chief technical officer Paolo Ardoino, on the other hand, is convinced that the lack of interoperability is a problem that concerns all digital tokens. He also argued that third parties should implement a system solving this issue, not stablecoin issuers:

“Tether is the issuer of the stablecoin. There are plenty of projects that are working on solving this problem already. This is a general problem that applies to all the tokens on all the blockchains. […] Now Tether is advising projects that are trying to solve this problem. […] So we have an active role in the process. We are just not developing the solution ourselves.”

A Tough Solution

Ardoino said that the biggest challenge in developing an interoperability protocol is developing a full understanding of the security implications of each blockchain involved.

Testimony to the difficulty of implementing interblockchain bridges is the incident earlier this month, in which a non-custodial Bitcoin to Ethereum bridge shut down just two days after its launch due to a bug.

Jagdeep Sidhu, a co-founder and lead core developer at Syscoin — which launched a Syscoin-Ethereum bridge at the end of January— commented on the challenges in developing interblockchain bridges:

“It is easier for projects to make sacrifices to fast-track solutions to market, or to base core interoperability on market-driven trading mechanisms or liquidity providers, only to experience multiple discoveries, or find enterprise adoption can hit roadblocks due to regulatory and legal requirements.”

Sidhu told Cointelegraph that Syscoin would be “most definitely” interested in collaborating with stablecoin issuers in implementing its bridge. Ardoino, on the other hand, suggested that third parties interested in bringing USDT onto new blockchains are free to port them independently:

“Tether is on public blockchains and communities can build and use these cross-chain products in order to move Tether from one chain to another. That is the beauty of it.”

Updated: 6-10-2020

Less Than 6 Accounts Control 80% of Wealth On Top Stablecoins

A report by CoinMetrics has found at least 80% of the entire capitalization of five top stablecoin projects is held in less than six accounts on each respective network.

A report published by CoinMetrics has found extreme wealth centralization among many top stablecoins, with at least 80% of the total capitalization for five top stable tokens being held in less than six accounts.

CoinMetrics found that most at least 20% of transfers made using most stablecoins are valued at less than $100, showing significant stable token adoption as a means of payment.

The report also found that more than 40% of transactions made using the Paxos Standard Token (PAX) are directly linked to a single multi-level marketing, or MLM, Ponzi scheme.

Stablecoins Show Extreme Wealth Centralization

The report found many stablecoins to exhibit extreme wealth centralization, with less than six accounts of the Gemini Dollar (GUSD), Binance USD (BUSD), Huobi Dollar (HUSD), Tether (USDT) and USDK networks representing over 80% of each token’s respective capitalization.

USDT issued on Ethereum comprised the most pluralistic stablecoin market by far, with nearly 1,600 accounts representing 80% of wealth. USD Coin (USDC) and TrueUSD (TUSD) followed with nearly 200 accounts each, trailed by Omni-based USDT with over 150.

Looking at the total number of transfers made using stable tokens, USDC comprises the second-most distributed stablecoin, with over 20% of wallets driving 80% of transfers, followed by Omni-based USDT and GUSD in the high teens, and TUSD with nearly 15%.

Paxos Reportedly Comprises Fuel For MLM Ponzi

At first glance, the findings appeared to show significant pluralism on the Paxos network, with nearly 50% of wallets representing 80% of the token’s total capitalization.

However, closer inspection shows that Paxos’ two most active accounts are directly linked to the MMM BSC Ponzi. The scheme has seen exponential growth in user activity over the past year — currently representing nearly 40% of all Paxos network activity.

CoinMetrics also found that the most active Tron-based USDT accounts were associated with “dividend” payouts, representing over 90% of network activity on certain days.

Sub-$100 Transfers Represent At Least 20% Of Stablecoin Activity

At least 20% of transfers made using eight of the 10 stable tokens examined by CoinMetrics are valued at less than $100.

Less than 4% of transfers are valued in excess of $100,000 for all stablecoins except for HUSD and BUSD — with transfers worth over $100,000 comprising more than 35% of HUSD activity and roughly 17% of BUSD transactions.

Updated: 7-1-2020

Tether Crosses $10B, Leaving Competing Stablecoins In The Dust

Tether, USD Coin, and Binance USD have posted triple-figure market cap growth this year.

Crypto market data aggregator Messari reports that the market cap of leading stablecoin Tether (USDT) has surpassed $10 billion for the first time.

Alongside Bitcoin (BTC) and Ethereum (ETH), Tether is now one of three crypto assets with an eleven-figure capitalization.

Tether’s reported $10 billion market cap comes after year-to-date growth of 144% — with Tether representing $4.1 billion at the start of 2020.

However, data aggregators are at odds on Tether’s capitalization, with CoinGecko and CoinMarketCap estimating USDT’s market cap to be just over $9 billion.

USD Coin And Binance USD Post Strong Growth

The second-largest stablecoin by market cap, Circle’s USD Coin (USDC) has also seen triple-digit growth since early January — increasing from less than $450 million to over $930 million today.

USDC has steadily grown since launching in October 2018 to currently comprise the 18th-largest crypto asset overall.

Since launching in September of last year, Binance’s USD stablecoin BUSD has quickly emerged as a major player in the stablecoin sector — currently ranking fourth among stablecoins with a market cap of nearly $166 million.

Binance has grown by more than 875% since representing roughly $17 million at the start of the year, now ranking as the 49th-largest crypto market.

PAX And TUSD Stagnate

After starting the year with a capitalization of $225 million, Paxos Standard (PAX), the third-ranked stablecoin by market cap, has seen its market cap stagnate at $245 million since April, according to CoinMarketCap.

CoinMarketCap ranks Paxos as the 37th-largest crypto asset overall. However, the data may not take into account PAX that have been issued on the Ontology blockchain since April.

TrueUSD (TUSD) has actually posted a drop in market cap since the year — falling from $155 million to $144.5 million as of this writing.

TUSD is the fifth-largest stablecoin and the 55th-ranked crypto asset by capitalization.

Updated: 7-3-2020

Coinbase And Circle-Backed Stablecoin USD Coin Breaks $1B Market Cap

Launched by the Centre Consortium in October 2018, USD Coin reached a $1 billion market cap in 21 months.

USD Coin (USDC), a stablecoin project founded by Coinbase and Circle, has hit a major milestone in market capitalization.

On July 3, 2020, USDC market cap broke the $1 billion threshold for the first time since the stablecoin was launched in October 2018. According to data from Coin360, the coin has seen sharp growth since March 2020.

USDC, the second-largest USD-pegged stablecoin after Tether (USDT), is ranked the 17th largest cryptocurrency by market cap as of press time.

Announcing the news on Thursday, the Centre Consortium — an organization co-founded by Circle and Coinbase — highlighted a number of factors that contributed to USDC’s notable growth. According to Centre, the demand for USDC in 2019 was mainly driven by the progress of the decentralized finance, or DeFi ecosystem.

Three Major Factors Brought Rapid Growth In 2020

Centre identifies three major developments that pushed the sharp growth of USDC: the coronavirus-fueled financial crisis, the increased demand for low-cost transfers among businesses worldwide, and the impact of massive growth in the Compound protocol, a major DeFi project. Centre added that it anticipates more growth in 2020:

“We expect USDC to continue growing rapidly throughout 2020 and help fulfill Centre Consortium’s mission of establishing an open standard for money on the internet.”

Stablecoins Post Massive Growth Over The Course Of 2020

USDC’s progress comes in line with overall growth in the stablecoin market. Tether, the largest USD-pegged stablecoin, crossed a $10 billion market cap on July 1 — a 144% growth from the start of 2020. The news came soon after Tether overtook major altcoin XRP to become the third largest cryptocurrency by market cap in March.

On June 24, the Centre announced a multi-chain USDC Framework, featuring the Algorand blockchain as the first network to power USDC on another blockchain.

Updated: 7-9-2020

Centre Freezes Ethereum Address Holding $100K USDC

Stablecoin issuer Centre has confirmed they froze an Ethereum address holding $100,000 USDC at the request from law enforcement.

Centre, the company that issues the stablecoin USD Coin (USDC) has blacklisted an Ethereum address holding $100,000 in USDC in response to a law enforcement request. In the first of its kind, the address had a “blacklist(address investor)” function called on June 16, 2020.

It’s not yet clear the reason behind the law enforcement request, but Centre Consortium — founded by Circle and Coinbase — did release a statement confirming the blacklisting:

“Centre can confirm it blacklisted an address in response to a request from law enforcement. While we cannot comment on the specifics of law enforcement requests, Centre complies with binding court orders that have appropriate jurisdiction over the organization.”

A Known Thief

Although Circle spokesperson Josh Hawkins, said he could not provide any specifics about the blacklisting, it appears the address could be involved in other cryptocurrency theft.

In the comment section of a different address, a user claims the owner of the blacklisted address stole other tokens from them:

“Hello unknown thief, you are in contact with this eth address 0xEeC84548aAd50A465963bB501e39160c58366692 and you stole 10,000 Loopring Coin (750 euros) from my wallet. I am now giving you a chance to send the 10,000 Loopring Coin back to me. You already know my eth address. If you do not do this, I will report you anywhere with your 2 known addresses.”

They’re All The Same

Last week USDC broke $1 billion market cap, making it the second-largest stablecoin behind Tether (USDT), and Twitter users likening stablecoins to centralized fiat currencies, suggesting what can happen to USDC can happen to any other stablecoin.

Another user stated that Dai (DAI) could fix this issue of centralized control, however they were also rebutted with the fact that DAI is backed by USDC and other centrally controlled digital currencies.

It’s All About Censorship

Normally funds held on the Ethereum blockchain are controlled by the address owner, however, in relation to USDC, an address can be blacklisted which restricts them from executing transactions (sending or receiving) through the USDC smart contract. Although technically reversible, Circle’s website warns that blacklisted addresses may be “wholly and permanently unrecoverable.”

This Has Raised Concerns Among The Community Surrounding Censorship With A User Lamenting On Reddit:

“Central government control and censorship is just going to get worse.”

Another user commented on Twitter saying the “C” in USDC “stands for censorable.”

Updated: 7-10-2020

‘Stablecoins’ Vulnerable To Criminal Abuse, Watchdog Says

The virtual currency, which aims to maintain price stability, could become more vulnerable to money laundering and terrorist finance risks, the FATF said.

A type of digital currency that aims to maintain a stable value relative to that of an underlying asset or benchmark has the potential for mass adoption, but that potential also makes it more vulnerable to criminal abuse, a global standard setter for anti-money-laundering laws said.

The Financial Action Task Force, in a report to the G-20 finance ministers, identified illicit finance vulnerabilities specifically with so-called stablecoins and said risks should be analyzed and mitigated before such digital currencies are launched, particularly if they have the potential for mass adoption.

The value of stablecoins can be pegged to a variety of assets or benchmarks, such as the value of a fiat currency, or a basket of assets that could include investment securities and commodities. Some existing stablecoins include Tether, USD Coin and Paxos. Proposed ones include Facebook-backed Libra and Gram.

Stablecoins so far have only been adopted on a small scale. But their promise of price stability could make them more likely to reach wider adoption than some existing virtual assets, particularly if they are sponsored by large technology, telecom or financial companies, according to the report, which was published this week.

However, stablecoins face some of the same money-laundering and terrorist-financing risks as other virtual assets, such as increased anonymity and quick exchanges of virtual assets to help disguise the origins of illicit funds, the FATF said.

To mitigate risks, the FATF proposed that all jurisdictions implement its standards for virtual assets. It noted that some jurisdictions, including 25 countries or regions among its members, and virtual asset service providers have made progress in implementing its standards.

The FATF also plans to review the implementation and impact of its standards by June 2021 and provide further guidance on stablecoins and virtual assets.

Updated: 8-2-2020

On Solid Ground: Stablecoins Thriving Amid Financial Uncertainty

The state of stablecoins: Demand for stablecoins continues to grow amid financial uncertainty.

As a new COVID-19 stimulus bill is debated in the United States Senate and Bitcoin (BTC) begins to bounce back from its volatility lows, the demand for stablecoins continues to grow. Powered both by the stability that they provide to tokenholders and the demand created by decentralized finance lending and yield farming, stablecoins — Tether (USDT) in particular — continue to hit record figures consistently.

According to a report by cryptocurrency data and research firm Messari, USDT may soon become the cryptocurrency with the greatest daily transaction volume in terms of U.S. dollars transferred across all Tether-enabled blockchains.

According to Ryan Watkins, research analyst at Messari, that may happen sooner rather than later. He told Cointelegraph: “USDT certainly could flip Bitcoin in transaction volume in August, and if not then sometime soon after. Stablecoins as a whole have already flipped Bitcoin in transaction volume.”

While USDT and a few other dollar-pegged tokens such as Binance USD (BUSD) or USD Coin (USDC) have been leading the way in the growth of stablecoins, even commodity-based stablecoins have been gaining traction lately. Tether’s new gold-backed stablecoin, Tether Gold (XAUT), is reportedly seeing high demand as its underlying commodity recently broke above the $1,900 mark — a number that gold has not seen since September 2011 — even coming close to reaching $2,000 for the first time.

Stablecoin Issuance And Volumes Rise

Although stablecoin volumes have, like most of the cryptocurrency market, remained stagnant during most of the summer, the last few days have seen a considerable uptick in volume for USDT and other dollar-based stablecoins, especially Binance’s BUSD.

Although stablecoin volume has picked up recently, it is still far from the all-time highs achieved in March. However, the collective market capitalization for all fiat-based stablecoins has been growing consistently, increasing by $3.8 billion in the second quarter of 2020 and counting for over $13.4 billion at the time of writing.

USDT alone is responsible for $11 billion out of the aforementioned $13.4 billion, having only just reached the $10 billion milestone on July 22. This means that USDT’s market cap has more than doubled from $5 billion since March. In fact, Tether even temporarily surpassed Ripple’s XRP to become the third-largest cryptocurrency in the market.

Following USDT, Circle’s USD Coin is the second-largest stablecoin, having been the first Tether competitor to surpass the $1 billion market cap figure in early July. On the other hand, Binance USD has been the fastest-growing stablecoin in 2020, according to Messari.

Why Is There Demand?

A demand for stable, safe assets like the U.S. dollar may have been the biggest driver for the success of stablecoins in the first half of 2020, according to Ido Sadeh Man, founder of Saga Monetary Technologies, who told Cointelegraph: “The allure of stablecoins is simple: they appear to promise stability — and given the economic tumult of 2020 so far, it is understandable why they are gaining so much attention.”

As Bitcoin surged over the $11,000 mark throughout July 26 and 27, exchange inflows for USDT reached a 2020 high, which suggests buying pressure for BTC and other cryptocurrencies. This is further supported by the decreasing balance of Bitcoin currently being held by major exchanges. In fact, activity for all three of the largest stablecoins — USDT, Dai and USDC — grew tremendously during this time.

On the other hand, the huge growth in activity and value settled in stablecoins does not come from user remittances or transfers but rather interexchange settlements, as noted by Watkins. He told Cointelegraph: “The majority of stablecoin activity is driven by interexchange settlement. Probably somewhere in the realm of 90+%. Though DeFi activity is certainly picking up.”

Challenges And Dangers