Dramatic Stock Rise Over-shadows Record 55 Million Rise In Jobless Claims (#GotBitcoin)

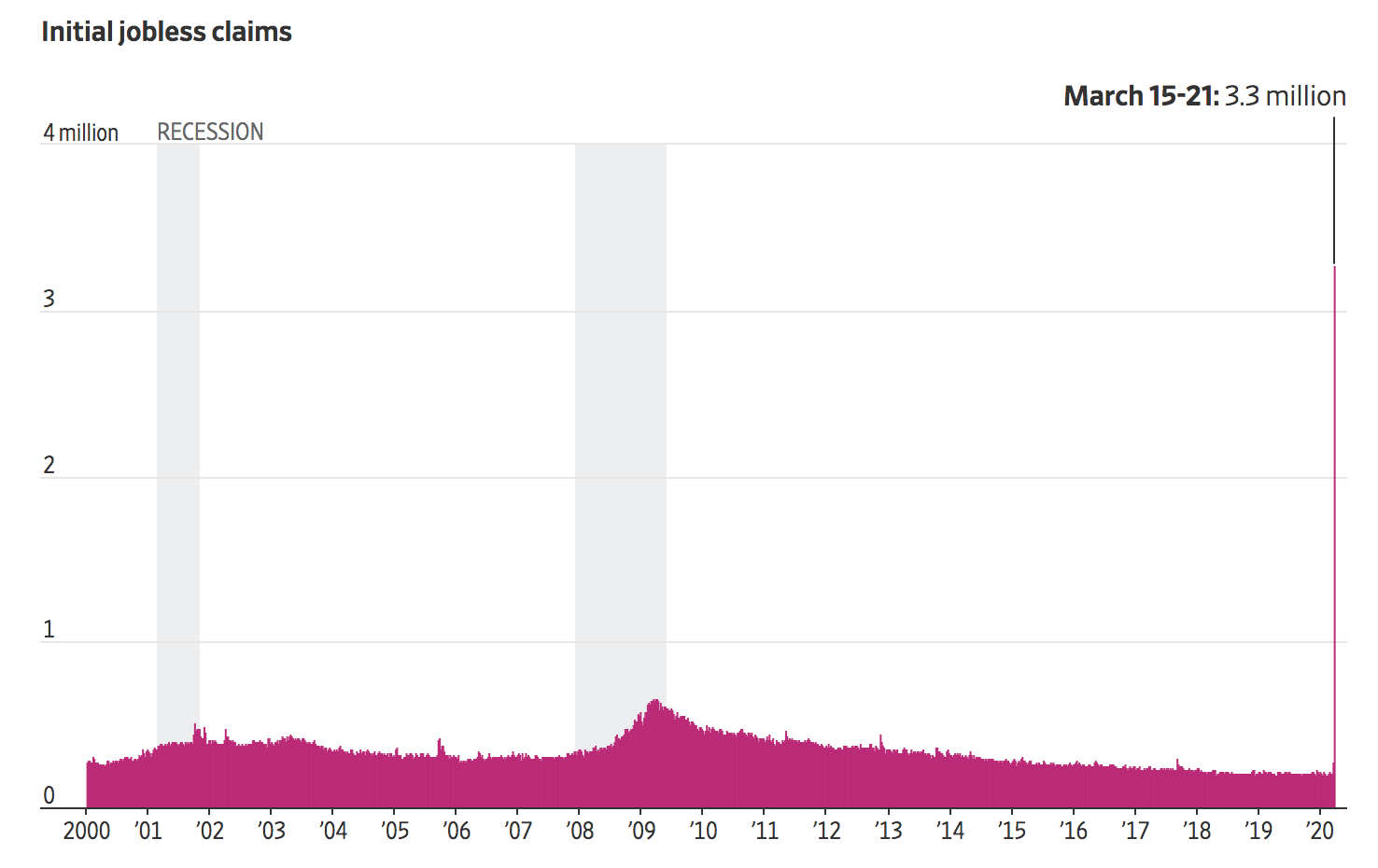

More than 3 million workers file for jobless benefits as coronavirus hits the economy. Dramatic Stock Rise Over-shadows Record 55 Million Rise In Jobless Claims (#GotBitcoin)

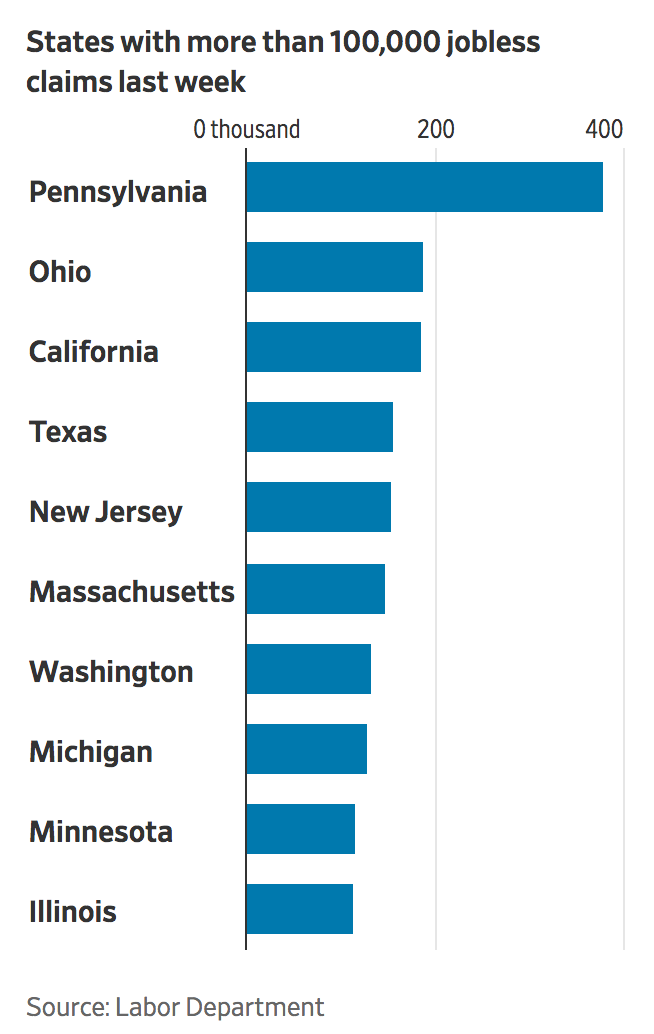

The number of Americans filing for claims was nearly five times the previous record high. The surge was for the week ended March 21 and could rise further. Pennsylvania, Ohio and California were among 10 states reporting more than 100,000 claims, leaving unemployment systems overloaded.

Millions of U.S. businesses have announced layoffs or furloughs as their cash flows dry up. Several state and local authorities have ordered nonessential businesses to close in response to the coronavirus pandemic, bringing the great American job machine to a sudden halt.

Until March, U.S. employers added jobs for a record 113 straight months, causing payrolls to grow by 22 million. In the process, millions of people—including low-wage hourly laborers, disabled people, minorities, former inmates and others—found work.

The unemployment rate, which was 3.5% in February, had been at levels not seen since the 1960s. Wages started to accelerate in the last two years after lagging during the early stages of the expansion that followed the 2007-09 recession.

The strong labor market kept the U.S. economy humming for a decade—straight through a European debt crisis, Japan’s tsunami, a Chinese economic slowdown, a domestic manufacturing slump, volatile energy prices and a global trade war.

Millions of Americans, already fearful the new coronavirus could infect them or their families, now have two new worries: When will the job machine start again? And can they hold out until it does?

Much will depend on how long the virus crisis lasts and whether federal and state unemployment insurance programs can adapt quickly to fill the immense gaps building in household cash flows until the virus recedes.

“We haven’t seen this big of a free fall before,” said Keith Hall, former director of the Congressional Budget Office and adviser to President George W. Bush. “Not even during the Depression…It’s really like an instant Great Recession.”

Mr. Hall said the jobless rate in the coming months could approach the 20% that some economists estimate occurred during the Depression. Northern Trust Chief Economist Carl Tannenbaum said if half the workers in hard-hit industries, such as restaurants, retail and personal services, are laid off the unemployment rate could rise 10 percentage points, to more than 13%. That is well above the post World War II record high of 10.8% at the end of the 1981-82 recession.

The number of jobless claims filed last week in Pennsylvania increased by 363,469 to 378,908 with 5.8% of the labor force seeking assistance.

Those figures didn’t capture everyone seeking assistance. Denzel Buie said he was stymied by crashing websites and unending phone-call waits when attempting to file a claim.

The 25-year-old was laid off from his union construction job Friday when local authorities shut down projects, including the welding and wall building he was doing at Swarthmore College in Pennsylvania. At the start of last week, the state ordered restaurants and bars to shut down.

The increase in claims last week was 17 times higher than the previous record one-week jump. In recessions claims gradually rise, allowing states to shift resources. Now, more claims were filed last week than for all of April 2009, the peak month for job loss during the 2007-2009 recession.

Mr. Buie said his layoff was a serious blow to his family, which includes a 3-year-old daughter. His wife, a secretary, was laid off a week earlier when the allergist’s office where she worked suspended operations.

“It’s not like I can go get another job,” Mr. Buie said. “It was a massive layoff—the entire construction industry in Philadelphia shut down. All I can do is stay home and pray I don’t get sick, because if I go to the hospital, that’s another bill.”

Ohio Gov. Mike DeWine mandated bars and restaurants to close dine-in services on Sunday, March 15. The state had 187,784 new jobless claims last week.

Job losses swept across the nation hitting states with varying mandates for social distancing. California, with tough restrictions, had 186,809, Texas, with less, had 155,657 and New Jersey, had 155,454.

In Rhode Island, 6.4% of the state’s labor force—nearly 1 in 15 workers—sought benefits, the highest share in the country. The state’s governor announced that, effective Tuesday, March 17, there would be “no on-premise food consumption” at restaurants, bars and coffee shops.

In Nevada nearly 6% filed claims. The initial wave of layoffs hit the hospitality, restaurant and tourism industries, the lifeblood of Las Vegas, the hardest. Casinos closed March 17.

The claims data likely don’t fully capture the severity of the layoffs. Workers aren’t required to file for claims the week they are let go. If a person is ill or busy caring for children or family members, they may put off filing for benefits, especially if the process requires a lengthy wait.

New York state, one of the areas hardest hit, had a relatively small level of claims for its population, less than 1% of its labor force.

In addition, more companies laid off workers this week as additional states ordered nonessential businesses to close.

Economists are divided on whether the downturn is short-term disruption or the start of a prolonged recession.

If the nation can get back to business quickly, restaurants, airlines, hotels, and others might quickly hire back the workers they have let go or furloughed in the shock.

With support from government-support programs, including the $2 trillion rescue program being considered in Congress, the jobless rate could theoretically surge and then recede. That is what happened in the 1980s, unlike the long periods of high unemployment in the 1930s and after the 2007-09 financial crisis.

But there are other scenarios. If infection and death rates associated with the coronavirus grow untamed, social distancing—steps to stem the spread of the virus such as keeping 6 feet apart, avoiding nonessential travel and gatherings of more than 10 people—could prolong the economic pain.

Even if the federal government moves away from its push for social distancing—as President Trump has suggested he is considering—states, cities, businesses and individuals could still decide they have no other choice.

The cash crunch now hitting businesses and households also could induce them to pull back further, starting a downward cycle that feeds on itself. All of that could dent business and household confidence, leaving long-lasting economic scars.

Getting back to work thus hangs on how quickly the virus itself is tamed.

“This is happening with dizzying speed, and therein lies my concern,” Northern Trust’s Mr. Tannenbaum said. “The shock and awe from the forthcoming employment numbers could be damaging to the nation’s psyche.”

Large corporations were initially reluctant to lay off workers aggressively, in part because they expected the virus to pass quickly and didn’t want to part with employees. Finding and keeping good workers in what was a tight labor market had been hard.

Now, pressures to fire people are building beyond the industries most directly exposed. General Electric Co. ’s jet-engine business said Monday it would lay off about 10% of its U.S. workforce, or about 2,500 employees. Medical offices not tied to treating the virus, including dentists and physical therapists, are shutting and letting workers go. Those providing in-person services, such as barbers, massage therapists and housecleaners, are seeing business evaporate.

The job market isn’t uniformly dark, in part because the repercussions of the crisis are spreading unevenly. Walmart Inc., Amazon.com Inc., and CVS Health Corp. are among about a dozen large companies that have said they are seeking to hire nearly 500,000 workers in coming weeks. The companies are managing a surge in demand for food and other household products that have taxed their stores and warehouses.

“We are hiring,” says Jeff Stevenson, who runs a wine marketing business that focuses on remote sales called VinoPRO Inc. “We literally had our single largest sales day of the year last Wednesday.”

Though those mini-booms are encouraging, economists don’t expect them to fully counter the pressures millions of other employers face to lay off workers as sales and cash flows dry up.

Joe Olivo is president of Perfect Communications, a small New Jersey commercial printing company that produces direct mailings for universities and nonprofits and promotional material for retail businesses. In February, business was booming. Revenue was up 28% from a year earlier and he was looking to add five more people to his payroll. Under pressure to retain workers and respond to rising minimum wages in the state, he pushed up pay between 2.5% and 11% for his workforce in 2019.

Then, in a matter of days, orders dropped 70%. He thought he would draw in $10 million in revenue this year; now he sees around $5.8 million, much of it already made. That won’t be enough to cover his costs. He has already let five part-time workers go and cut shifts to about 30 hours a week for the other 50. He told his banks he won’t be able to make payments this month.

“Right now the lenders are saying, ‘We get it,’ ” he said. But without cash flow, difficult decisions loom about whether to let more people go. “I am working hard not to do that.”

Jacqueline Martin, a massage therapist based in Albuquerque, N.M., typically gives up to 16 massages a week, charging at least $50 for a one-hour session. She hasn’t worked for much of this month and isn’t eligible for unemployment insurance under existing programs.

“Massage is touch, and that’s how this is spreading,” Ms. Martin said. “I can’t Skype my massages.”

Among many other measures, Congress is considering expanding coverage to include self-employed people like Ms. Martin.

Mr. Hall, the former CBO director, is among the economists who expect the economy to recover at a slower pace than it contracts. But he pointed to a reason for hope: The labor market has defied expectations in the recent past, drawing a larger share of Americans into the workforce than many expected and reaching low unemployment levels few thought possible.

“We kept getting fooled,” he said. “We kept thinking the labor market couldn’t keep improving, but it did. Let’s hope that the surge in labor-force participation is a permanent one and once we get through this those people will be back to work.”

Updated: 4-16-2020

U.S. Jobless Claims Top 20 Million Since Start of Shutdowns

Another 5.2 million Americans filed for unemployment benefits in latest week.

More than 22 million workers have sought unemployment benefits during a month of coronavirus-related shutdowns, a record-shattering total that reflects a broad shock for the U.S. labor market.

Another 5.2 million Americans filed for unemployment benefits last week, the Labor Department said on Thursday, adding to three prior weeks in which millions of people filed for jobless claims. Since mid-March, about 13% of the labor force has sought jobless assistance, far outpacing any prior four-week stretch on record. Last week’s total decreased from figures that approached 7 million in the prior two weeks, suggesting the wave of workers filing for benefits has passed its peak.

“Claims are now falling, having peaked…two weeks ago,” said Ian Shepherdson, economist at Pantheon Macroeconomics. “But the weekly level is still almost unfathomably high.” He said Google search data for “file for unemployment” suggests claims will fall again this week.

Jobless claims are applications by laid-off workers for unemployment-insurance payments—not all of which are approved. Each claim is made by an individual person and that person can’t file another claim until their previous request was either rejected or their benefits expire.

Before the pandemic, the largest number of Americans to ask for unemployment benefits in a four-week stretch was 2.7 million, or 2.4% of the labor force, in the fall of 1982.

U.S. stock markets wavered between gains and losses on Thursday, with the Dow Jones Industrial Average recently down 0.8%. The S&P 500 was 0.2% lower and the Nasdaq Composite up by 0.6%.

Thursday’s report also showed 12 million Americans received unemployment payments in the week ended April 4, a record. That is up from 7.4 million the prior week, which exceeded the highest level set in the 2007-09 recession.

Many Americans are receiving enhanced larger jobless-benefit payments and additional workers are eligible to receive unemployment insurance under the federal stimulus package signed into law in March. The expansion of benefits could make it more attractive for workers to apply, keeping claims at very high levels.

Laid-off workers in 29 states should be receiving the extra $600 in weekly benefits on top of state payments, Labor Secretary Eugene Scalia said Wednesday. Other states will take longer to deliver the larger payments because they are relying on decades-old computer equipment. States will owe catch-up payments to workers backdating to the first week of April.

Mr. Scalia established new criteria to ensure that certain gig-economy workers who can’t find work would be eligible for expanded unemployment benefits under the stimulus bill, according to a Labor Department spokesperson, making many ride-share workers eligible for assistance. Before the benefits expansion, 88% of workers were covered by unemployment insurance.

Economists estimate the bulk of job losses occurred in industries that were ordered by government officials to close, including restaurants, hotels and mall retailers. States including Georgia, Michigan and Texas indicated in Thursday’s report that recent layoffs were occurring in accommodation, food service and retail sectors, but also noted job loss in manufacturing, health care, administrative support and waste-management jobs. Thursday’s report doesn’t give specific figures by industry.

Gregory Daco, chief U.S. economist of Oxford Economics, projects that in the April jobs report, 8 million to 10 million jobs could be lost in other sectors—including lawyers, architects, consultants and other business-service providers, among outpatient health-care employees and in information sectors, such as media and telecommunications.

The level of job destruction among just those mainly white-collar industries could be on par with the total jobs lost in the 2007-09 recession, he said.

Google’s parent company, Alphabet Inc., said it would slow hiring as a result of the coronavirus pandemic.

In a memo to employees on Wednesday, Alphabet CEO Sundar Pichai said the company would “significantly slow down the pace of hiring, while maintaining momentum in a small number of strategic areas. He added, “Just like the 2008 financial crisis, the entire global economy is hurting, and Google and Alphabet are not immune.”

The government’s claims report doesn’t specify if layoffs were temporary or permanent, but other data suggests many workers expect to return to their jobs when allowed to do so.

Nearly half of workers who reported themselves as newly unemployed in March said they were on a temporary layoff, up from 29% in February.

In the states of Colorado and Washington, which require large employers to specify whether layoffs are temporary or permanent, 70% this year have been temporary. In the prior recession, less than 1% were.

More than one in five workers in Hawaii, Michigan and Rhode Island have filed for jobless benefits in the past four weeks, the highest rates of filing in the country.

The most claims were filed in California, 2.8 million, representing 14.5% of the state’s labor force. The next-highest totals were in Pennsylvania at 1.3 million, or 19.8% of workers, and New York at 1.2 million, or 12.4% of the labor force.

The relatively low share filing in New York could suggest more claims are coming from one of the hardest-hit states.

Rhode Island may provide an early glimpse of the effect of the stimulus package on claims. The state received about 37,000 applications for unemployment benefits from April 7 through last Saturday, 22,000 of which were from workers applying for expanded assistance under the emergency federal relief.

As claims have increased, many Americans say they are unable to navigate overwhelmed systems.

Sonya Stalnaker, of Winter Garden, Fla., lost her job as a painter at a resort on March 16 and said she has been trying to apply for unemployment benefits without success.

After filling out an online application, Ms. Stalnaker received a message directing her to call to verify her identity. Despite multiple attempts, she hasn’t been able to reach a state Labor Department representative.

Ms. Stalnaker, 48 years old, said she depleted her savings while waiting to get through the system. She is seeking relief on her cellphone bills and hoping to keep her utilities running.

“I’m just trying to keep my head above water and not drown,” she said, adding that she has turned to her church for financial support. “It’s just pinching pennies right now.”

How long weekly jobless claims remain in the multimillions will give some insight into the degree to which job loss is spilling beyond initial, hard-hit industries to other sectors of the economy.

“It might take until mid-May or longer before we see claims declining” to much lower levels because additional workers are eligible for benefits and others are still waiting for help, University of Michigan labor economist Daniil Manaenkov said. “It could take until we see the economy partially reopen.”

Persistently high claims would indicate layoffs spreading across industries and the economy will need a prolonged period, perhaps years, to regain lost jobs. However, the high level of people seeking claims doesn’t mean monthly employment data will change by the same magnitude.

That is because some of those seeking benefits in recent weeks may have been jobless before the pandemic and are only now seeking aid. Others filing claims might not be counted as unemployed under a statistical definition that requires a survey respondent to be actively seeking work.

Laid-off workers may instead be counted as out of the labor force, perhaps because they aren’t looking for work because of fear of illness or because of family-care responsibilities.

Typically, payrolls don’t drop as much as claims rise, because often people who lose a job will make a claim and find a new position within a few weeks, Mr. Sheperdson said.

But this month, he expects most of the people who have made claims to hit the payroll number, because any hiring occurring now is trivial compared with the scale of the losses.

Navy Federal Credit Union economist Robert Frick said the claims figures suggest the unemployment rate in April will be in the 18%-to-20% range. That would easily be the highest level on records back to the 1940s, but would mean the jobless rate stays below estimates of peak unemployment during the Great Depression, before comparable data was kept.

David Smith, a graphic designer in Wilmington, Del., is among those who expect to return to work but are facing hardship in the interim. He has tried unsuccessfully to apply for unemployment benefits online over the past two weeks.

“It’s all online and there’s nobody there to answer the phone, and I just got automated emails back,” the 42-year-old said. Mr. Smith also has yet to receive a federal stimulus check.

The uncertainty caused him to be more careful with spending. “I have to say no a little more,” he said, for instance if his children ask him to buy a new videogame. “I’m getting a little concerned because unemployment’s not working. It’s also out of my hands. We have to do what’s safe.”

Updated: 4-23-2020

Millions of U.S. Workers Filed for Unemployment Benefits Last Week

Workers have filed more than 26 million claims since start of coronavirus shutdowns, but pace of new applications tapered in most states last week.

About 4.4 million Americans sought unemployment benefits last week as the coronavirus pandemic continued to hurt the labor market, though the rapid pace of layoffs appeared to be easing.

The millions of Americans who sought unemployment benefits last week continued a historic labor-market decline, bringing the total claims for the past five weeks to more than 26 million, the Labor Department said Thursday.

Jobless claims, which are laid-off workers’ applications for unemployment insurance payments, had reached nearly seven million at the end of March as the coronavirus led to widespread business closures.

“There was an immediate wave of layoffs as a result of the crisis,” said Daniel Zhao, senior economist at Glassdoor. “Even though people may have been laid off weeks ago, we might only be seeing the impact now in the numbers.”

Forty-three states reported claims declined from a week earlier, though they remained at high levels. While California continued to see the most claims, with 530,000, that marked a 19% decline from the previous week. New claims in New York and Missouri fell 50% versus the week earlier.

A few states that had previously reported smaller filing rates noted sharp rises last week. Initial claims in West Virginia and Connecticut more than tripled. Florida’s volume increased 180% as more than 500,000 workers filed for unemployment.

U.S. stocks wavered Thursday after the data showed weekly unemployment claims had eased slightly. The Dow Jones Industrial Average added 39 points, or less than 0.2%, paring gains of more than 400 points earlier in the session. The S&P 500 and Nasdaq Composite ended little changed.

The U.S. unemployment data came as surveys of purchasing managers showed business activity in the U.S., Europe and Japan collapsed in April during global restrictions on movement and social interaction aimed at limiting the spread of the virus.

The surveys showed drops in services activity that were unprecedented in the history of the reports, even in the wake of the global financial crisis. Manufacturing activity is also contracting, though not quite as severely.

Some economists expect a fresh surge of claims in future weeks as workers who were previously unable to file because of backlogged state systems are counted, and as states begin to accept applications from people who are newly eligible under a $2 trillion stimulus package, such as independent contractors and self-employed individuals.

“These unbelievable numbers are masking a lot of the true demand, and that’s what we’re going to continue to see play out over the next month,” said Maria Flynn, president of Jobs for the Future, a workforce development nonprofit.

Washington state’s claims decreased sharply last week, according to Thursday’s report. But the state said it saw more unemployment-benefits applications on Saturday night through Sunday than during its biggest week on record, as it launched a “massive update” to its computer systems to start processing expanded unemployment benefits.

Gig-economy workers, self-employed people and those seeking part-time work were among those newly eligible to apply as the state began implementing a key provision of the law.

Rhode Island also experienced a sharp increase in claims when it began accepting applications included in the expanded unemployment assistance, offering a glimpse at the potential impact of the stimulus bill on claims.

The number of workers receiving unemployment insurance continues to rise as states process applications. In the week that ended April 11, a record 16 million Americans received unemployment payments, up from 12 million the previous week. The data date back to 1967. So-called continuing claims are reported with a one-week lag.

Dennis Fithian, 49 years old, of Detroit, was able to register for unemployment insurance benefits relatively quickly after he was laid off from his job at sports radio station 97.1 The Ticket in early April.

Despite high claims volume in Michigan, Mr. Fithian said his wife was persistent in helping him apply online. “She would get up at 2 or 3 in the morning and keep hitting ‘refresh’ until she was able to get in,” he said.

View From The States

Most states reported fewer new applications for unemployment benefits last week, with a few states noting sharp increases that had previously seen smaller rates.

The couple’s biggest immediate concern is losing his health insurance at the end of April—a worry made even more acute by the fact that his 14-year-old daughter suffers from a rare, incurable disease.

“I mostly worked for the love of the job. It wasn’t for the great money, so we’ve always budgeted. But just looking at the summer ahead, the health insurance—that’s going to get really pricey,” he said.

The steepest employment losses appeared to occur between mid- and late March, when the economy shed about 13 million jobs, largely in leisure and hospitality, according to Federal Reserve research. By comparison, about 9 million jobs were lost over the course of the 2007-9 recession.

Oxford Economics estimates that the pandemic will result in 27.9 million lost jobs, including between 8 million and 10 million in industries such as manufacturing and construction that most states haven’t ordered to close.

The federal stimulus package was designed to blunt the economic damage from the coronavirus. Labor Secretary Eugene Scalia said Thursday 44 states were paying recipients an additional $600 a week in enhanced unemployment benefits on top of usual state payments.

The extra $600, which is paid in addition to regular unemployment benefits, could lead to a larger weekly paycheck than many lower-wage workers would typically earn. For others, like Joshua Price, of Syracuse, N.Y., it amounts to much less than they were previously making.

Mr. Price, 46, began receiving unemployment benefits in late March after he lost his homebound math teaching job due to government-mandated public school closures.

He gets a total of $1,104 in weekly benefits, including the extra $600 a week, which works out to 56% of his previous income.

Mr. Price normally tries to save $750 a week, but with tax bills and insurance bills, he is now saving very little.

“I don’t believe I should have to go into my savings to pay bills when it’s a government-mandated work stoppage,” Mr. Price said.

Updated: 5-2-2020

Over 3.8 Million Americans Filed For Jobless Benefits Last Week As States Struggle With Coronavirus Claims Surge

Archaic technology hamstrings systems for processing benefits; ‘not really acceptable now’.

Nearly four million people filed for unemployment benefits last week, bringing total claims to more than 30 million as states struggle to process an unprecedented wave triggered by the coronavirus pandemic.

The latest weekly report on U.S. jobless claims showed that 12.4% of the U.S. workforce was covered by unemployment benefits in the April 18 week, a record dating back to the early 1970s. The surge in unemployment-insurance claims started six weeks ago when shutdowns to contain the virus became widespread.

Americans also cut back on spending by 7.5% in March, the biggest monthly decline on record back to 1959, and saw personal income fall by 2%, the largest decrease since 2013. Stock markets slipped on the data’s accounting of economic damage from the virus.

A day after pledging to maintain aid for the U.S. economy, the Federal Reserve said it would expand a $600 billion lending effort aimed at small and mid-sized businesses.

State and local governments also continued work to reopen economies, with Los Angeles saying it would offer free virus testing to all residents and Florida detailing its plan to relax stay-at-home orders and let businesses reopen.

As shutdowns to contain the pandemic hit in March, Connecticut was more than halfway through a multiyear modernization of its unemployment insurance system when a sudden surge in unemployment claims caused the state website that accepts applications to freeze.

Labor department personnel worked all night trying to figure out what had gone wrong and realized the website could only handle up to 8,300 applications in a single day, a fraction of what residents were now trying to submit. After fixing that problem, they tried to figure out what might break next, said Danté Bartolomeo, deputy commissioner of Connecticut’s labor department.

“You can’t look ahead to see what will fail and what won’t fail,” she said.

The onslaught of claims would have been a challenge under any circumstance for states to manage.

In this case, the challenge is proving even greater because many states’ unemployment benefit systems are hamstrung by archaic, decades-old technology.

Coping with relief legislation that provides an additional $600 a week in benefits and making independent contractors such as Uber drivers eligible has created additional strains.

In the years before the pandemic, computers that process claims were functioning, so upgrading technology wasn’t a priority, state labor department officials say. That has changed, though.

“All that old-school technology just completely doesn’t work anymore,” said Scott Jensen, director of the Rhode Island labor department. “This current crisis is making the weaknesses of these systems very concrete.”

The consequences are now materializing. Hundreds of thousands of Americans are still waiting to receive unemployment payments at a time when many are falling behind on bills and can’t quickly find new jobs due to widespread business shutdowns.

The administrative problems mean the official tally of claims is almost certainly an undercount. About 600,000 people tried to apply for benefits in the week ended April 23 but were unable to file due to long waits or other reasons, according to Alexander Bick, an economics professor at Arizona State University, and Adam Blandin, an economics professor at Virginia Commonwealth University, based on a survey they conducted with about 3,000 individuals.

In the same week nearly five million people had applied but were awaiting a decision on their eligibility and about 2.6 million successful claimants were still waiting for their first payment, they estimated.

There are signs that the volume of initial claims is starting to ease. Last week’s national level of claims was down 44% from the peak of 6.9 million touched in the week ended March 28. Claims in 46 states have declined since the last full week of March.

Two exceptions are Georgia and Florida, where initial claims have been elevated in recent weeks. In Florida, 939,000 claims have been filed in the past two weeks, the most in the nation.

The Walt Disney World theme park in Orlando, Fla., furloughed workers who were previously being paid last week. In Georgia, more than 5% of the state’s labor force sought unemployment benefits last week, the highest share in the country.

For now, front-line administrators in state labor departments, who have become a lifeline to millions of furloughed workers, are working to keep up with the demand for benefits as phone lines are jammed up and websites are inundated.

New Jersey’s labor department has distributed hundreds of laptops so more claims specialists can process applications from home. It has also upgraded its processing systems and expanded its website’s capacity.

The state put out a request for volunteers who know how to work with the decades-old Cobol computer coding used by legacy systems in New Jersey and elsewhere.

“Literally, we have systems that are 40-plus years old,” Gov. Phil Murphy, a Democrat, said in April. “There will be lots of postmortems, and one of them on our list will be, ‘How the heck did we get here where we literally needed Cobol programmers?’”

New Jersey resident Amber Monserrate said she has a past-due electricity bill and rent to pay but still doesn’t know when she will receive unemployment benefits.

Ms. Monserrate, a mother of four boys and her family’s main breadwinner, started applying for unemployment in mid-March, when she was laid off from her job as a waitress due to the pandemic and her hours—and paycheck—for her other job driving a school bus were greatly reduced.

She now works one day a week delivering meals to families from the school district. She calls the New Jersey Department of Labor and Workforce Development every day to find out what the holdup is, but hasn’t been able to get through.

“I’m reading that the system is over 40 years old. It’s pen-and-pencil type stuff,” she said. “That’s not really acceptable now, when you have people that are relying on these services.”

Florida’s technology has been particularly challenged. The state in April started accepting paper applications to help deal with the claims volume.

Between March 15 and April 25, Florida had confirmed more than 800,000 unique jobless claims through its regular online platform, its mobile site and paper applications. But just 200,000 of those had received unemployment payments, according to the state’s Department of Economic Opportunity website.

The poor state of many states’ unemployment insurance systems is in part a legacy of the last recession, which strained their finances, including the trust funds that collect unemployment insurance payroll taxes to finance benefits.

States faced tax increases and spending cuts aimed at shoring up budgets. Upgrading computer systems wasn’t a spending priority, according to state officials.

Michele Evermore, a senior policy analyst at the left-leaning National Employment Law Project, said the federal government could have provided more funding to states for technology upgrades, but at least some of the responsibility falls to the states.

“More states should have applied for and modernized their systems by now,” Ms. Evermore said.

Eugene Scalia, the U.S. Labor Secretary, said each state made its own decisions about its specific computer system and that the federal government was doing as much as it could during the pandemic to support the states.

Connecticut, plagued by sluggish economic growth in recent years, has grappled with multibillion-dollar budget deficits that left little money available for technology investments.

The state did, however, dedicate significant resources to a modernization of its unemployment-benefits system, which started a few years ago and was scheduled to wrap up in May 2021.

“It’s not as if we weren’t aware that we had a problem in the making,” said the state labor commissioner, Kurt Westby. “We’ve been diligently scurrying to get this new system in place.”

The May 2021 completion date may be pushed back, Mr. Westby said, because workers assigned to that project are now helping process claims.

There are signs states are working through their backlogs. In Connecticut, technological improvements that automated a key part of the claims sorting process have helped reduce the backlog, Ms. Bartolomeo said.

Rhode Island used some of the federal funds awarded early in the pandemic to fix old technology, unlike many other states, which used the money to hire staff to field calls and audit claims.

This month, it launched a cloud-based application to process claims in conjunction with Amazon Web Services and a nonprofit called Research Improving People’s Lives.

When Rhode Island began accepting applications from independent contractors under the federal stimulus bill, it received more than 11,000 initial claims on the first day from such workers all at once. That would have crashed the old system, a labor department spokeswoman said.

For the bulk of states, though, it has proven a technological challenge to implement the expanded assistance included in the Cares Act, signed into law in late March. Such changes include revamping their online systems to process benefits applications from gig-economy workers and other individuals newly eligible for unemployment insurance.

The U.S. Labor Department said as of April 23, 10 states had set up their systems to begin accepting applications from gig-economy and other workers.

In the week after the federal government made funds available to states for an extra $600 a week in unemployment benefits, only 29 had the capacity to start making payments. All 50 states now do, according to the Labor Department.

Connecticut started sending out the extra $600 in the past week, after confronting the challenge of altering its computer system, which was set up to process unemployment benefits that max out at $649 a week.

The extra $600 pushes the highest eligible payout to $1,249, but Connecticut’s computer system was designed to handle only up to three-digit payments. Pushing up the maximum to four-digits would require reviewing and modifying well over 100 mainframes, Ms. Bartolomeo said.

Jobless Americans across the U.S. are feeling the impact of payment delays.

Ms. Monserrate, who lives in Edgewater Park, N.J., stopped paying her car insurance to save money since she isn’t driving, and her family is receiving food-stamp aid through the Supplemental Nutrition Assistance Program. But not knowing when she will receive unemployment benefits is causing stress.

“How are we going to pay these bills that are racking up?” she said. “I can’t catch up on everything, it’s just not possible.”

A spokeswoman for the New Jersey Department of Labor and Workforce Development said all payouts are backdated to when an individual first became unemployed.

“Workers who are having trouble filing or claiming benefits will receive every penny they deserve,” she said. “We recognize it may not be as quickly as they—or we—would like.”

Updated: 5-8-2020

April Unemployment Rate Rose To A Record 14.7%

Unprecedented 20.5 million jobs shed as coronavirus pandemic hit the economy.

The April unemployment rate surged to a record 14.7% and payrolls dropped by a historic 20.5 million workers as the coronavirus pandemic hit the economy, wiping out a decade of job gains in a single month.

Employment fell sharply in all broad business sectors last month and across all groups of workers, with particularly large increases in unemployment among women, college dropouts and Hispanics.

The U.S. jobless rate eclipsed the previous record rate of 10.8% for data tracing back to 1948, though it was well below the 25% rate economists estimate was reached during the Great Depression.

The job losses due to business closures triggered by the pandemic produced by far the steepest monthly decline on records back to 1939. By comparison, nearly 2 million jobs were lost in one month in 1945, at the end of World War II.

“It’s absolutely striking—and sobering,” said Adam Blandin, economist at Virginia Commonwealth University. “This puts even more emphasis on the economic damage caused by this virus.”

Many economists project April will be the worst single month of job loss during the pandemic, and the pace of layoffs has already shown signs of easing this month.

But they say it could still be many months before the labor market returns to a point when U.S. employers consistently add jobs, and it probably will take years for the economy to fully replace the jobs lost in April.

The Labor Department survey of households showed a large number of workers who said they were “employed but absent from work.” Many of those should have been counted as a temporary layoff, which would have caused the unemployment rate to be almost 5 percentage points higher, the department said.

U.S. stocks rose, gaining after the jobs numbers weren’t quite as bad as feared and signs of an easing in trade tensions between Washington and Beijing.

The job losses and high unemployment mark a sharp pivot from just a few months ago, when the economy was pumping out hundreds of thousands of new jobs and joblessness was hovering near 50-year lows. The jobs bust has been widespread.

Leisure and hospitality businesses, among the first to be affected by coronavirus-related shutdowns, saw particularly heavy losses, cutting 7.65 million jobs. The health-care, education, retail and professional services industries all experienced major losses.

Among mostly white-collar jobs, consultants, accountants and lawyers all saw job losses.

Average hourly earnings increased by 7.9% in April from a year earlier, likely reflecting that many low-wage workers lost their jobs, while more white-collar employees worked from home.

Numerous companies in several business sectors have recently announced expected layoffs or possible cuts, including technology companies such as Airbnb Inc., which said it would lay off 1,900 people, and ride-sharing company Uber Technologies Inc., which said it was laying off 3,700.

The longer-term severity of the employment crisis depends on factors such as the path of the coronavirus and how fast consumers start to visit businesses and open up their wallets, as the economy reopens.

Such reopenings are already materializing in South Carolina, Georgia, Texas and elsewhere, though often with restrictions.

Further, the sharp rise in unemployment last month mainly reflected temporary, as opposed to permanent, layoffs. Of Americans who newly lost their jobs in April, 88% reported being on temporary layoff, meaning they are more likely to quickly return to their jobs when the crisis ends. In March, 47% of the newly unemployed were on temporary layoff, while 29% were in February.

Rebecca Smith, 47 years old, was temporarily laid off from her New Jersey bus-driving job in mid-March and hopes to be back behind the wheel by June. After surviving Covid-19, the disease caused by the new coronavirus, she is looking forward to returning to work and seeing colleagues.

“I’m eager to see my extended family,” she said.

General merchandise stores, including warehouse clubs and super centers, were one of the very few bright spots in Friday’s jobs report, with employment increasing by 4.7% in April from a month earlier.

It will likely take a while for industries directly affected by the coronavirus, including restaurants, hotels and transportation, to recover.

Colby Hill Inn, in Henniker, N.H., is normally fully booked on weekends, but guests canceled all room reservations because of the pandemic. “Without that income coming in, it is really hurting us,” said Jefferson Brechbühl, a co-owner of the inn.

The inn would typically operate with about 20 employees during its busy season, which starts this month. But after furloughs, the inn is instead offering restaurant takeout services with six workers, including some who have seen their hours cut.

Mr. Brechbühl said reopening guest rooms would be critical to bringing back employees such as a sous-chef who is making more money on expanded unemployment benefits than he would at his job. So far, the lodge is mainly funneling these food-service revenues toward guest-room refunds, he said.

The April unemployment rate masked the current degree of joblessness. Some Americans whose jobs were cut aren’t actively looking for work because many companies have implemented hiring freezes, or they worry a return to work would raise their exposure to the coronavirus.

Although the regular unemployment rate excludes these so-called discouraged workers, another unemployment measure, called the U-6, captures them. That rate hit 22.8% in April, well above the 17.2% peak right after the 2007-09 recession.

Unemployment jumped most for Americans with lower levels of education. The rate for high school dropouts rose to 21.2% in April from 6.8% in March. For those with a college degree, the rate increased to 8.4% in April from 2.5% in March.

Lower-income Americans are most vulnerable to the effects of job losses, said Steve Preston, chief executive at Goodwill Industries International.

“They have no resources. It takes time to get unemployment, if they qualify,” Mr. Preston said, referring to financial benefits that states offer to those out of work. He added most people coming to Goodwill’s job centers for help are seeking support filing for unemployment benefits.

Lynne Reback of Sanford, Fla., filed for unemployment benefits on March 15 after she was laid off from her bartender job at the Orlando International Airport.

But she didn’t receive her first payment of $275 until April 16. The following two weeks she received a $600 payment, less than the $875 she was expecting.

She said she is worried about making her mortgage payments and the possibility of a housing foreclosure. “We don’t want to lose it, but at the same time, we don’t know how long this will take,” she said.

The widespread nature of the job losses extended to health care, as those not working to fight the pandemic are seeing fewer patients for routine checkups and, in some cases, only offering emergency procedures.

Steep job losses in industries such as health care where women are represented in high numbers likely contributed to a sharper rise in unemployment among women than men. The jobless rate for women climbed to 16.2% in April, compared with a rise to 13.5% for men.

Friday’s report showed the number reporting themselves as employed fell by 22.4 million. The share of the population working fell to a record low of 51.3% in April after steadily rising from about 58% since the last recession to just above 61% in February.

Many companies and Americans are now drawing on federal and state aid.

Valori Wells, owner of Stitchin’ Post, a quilting-supplies store, said small-business loans through the federal government’s Paycheck Protection Program allowed her to bring back three employees who were laid off as a result of the pandemic.

The business, based in Sisters, Ore., is operating with eight employees—down from 13—who are filling shipping orders and handling social media, among other tasks.

Ms. Wells said she hopes to bring back all of her workers, but is unsure when she will be able to.

“I can’t predict what’s going to happen,” she said. “All I can do is hope that at some point I can get back to some sense of normalcy within our business—or new normalcy.”

Updated: 5-21-2020

Workers File 2.4 Million Unemployment Claims

Pace of weekly claims continues to ease from late March peak; self-employed receiving coronavirus-related benefits aren’t counted in wave of filings.

Workers filed another 2.4 million unemployment claims last week, a slight drop-off in the wave of historically high weekly filings since the economic fallout from the coronavirus pandemic began.

Weekly claims continued to log in at high levels, though they are down since an initial surge in layoffs drove claims to a peak of nearly 7 million at the end of March, according to Thursday’s Labor Department report.

Meanwhile, the ranks of workers receiving benefits swelled in early May. In the week ended May 9, the number of so-called continuing claims—a proxy for overall levels of unemployment—increased to 25.1 million from 22.5 million a week earlier. Continuing claims figures lag by a week from initial claims filings.

The claims totals exclude hundreds of thousands of self-employed and gig-economy workers receiving unemployment benefits for the first time through a temporary coronavirus-related program.

The omission of self-employed workers means the actual number of workers seeking claims has been higher since the federal program called pandemic unemployment assistance, included in a stimulus package approved in late March, got under way.

“The pandemic unemployment assistance program is giving us a view into a segment of the workforce that’s harmed during a recession that we don’t typically get,” said Dante DeAntonio, an economist at Moody’s Analytics. “It gives us a better handle on the scope of what’s happening.”

While layoffs appear to have subsided in recent weeks, the number of people without work continues to remain at record-high levels. As of the beginning of this month, a large share of workers eligible for unemployment benefits were drawing on them in states across the nation, with particularly big parts of the workforces in Nevada, Michigan and Washington claiming benefits.

Still, the bulk of states saw fewer new applications for unemployment benefits last week, with particularly steep declines occurring in Georgia, New Jersey and Kentucky.

Many states reported fewer layoffs in early May at restaurants and health-care companies, the report said.

States have been paying out unemployment benefits to newly eligible workers such as independent contractors and self-employed individuals in recent weeks. As of Tuesday, 43 states were making such payments, a U.S. Labor Department spokeswoman said.

Arizona mailed out unemployment checks to 165,000 individuals early last week who were eligible for unemployment under the self-employed program.

New Jersey processed 135,000 such applications between April 26 and May 9. Officials expect that number to increase significantly over the next two weeks as they fine-tune their processing of these claims.

“I think we’re starting to hit our stride,” said Robert Asaro-Angelo, New Jersey’s Labor Department commissioner. “People are starting to receive their payments.”

It isn’t clear how many self-employed Americans and people seeking part-time jobs, who also were previously ineligible for unemployment benefits, were applying for benefits as of early May. Many states aren’t yet reporting these claims to the U.S. Labor Department.

The rollout of the program is helping put money into the hands of Americans like Kathy Faber, 59 years old, of Bristol, Conn., who owns a bridal and evening-wear shop that was forced to temporarily close in late March due to the pandemic.

Unemployment Rolls

In some states more than a fifth of the eligible workforce was out of work and receiving unemployment benefits in the week ended May 9.

Ms. Faber said she spent weeks trying to apply for pandemic unemployment assistance in Connecticut. After the state began accepting applications on April 30, Ms. Faber was approved and her benefits, which she said total a couple hundred dollars a week after taxes.

“Obviously it’s not the income you get when you’re working,” she said. “But it takes care of the electric bill, the phone bill. I’m happy that I got anything because usually for the self-employed, you’re on your own.”

Some states recorded large initial surges in claims under the self-employed program that have since subsided. Rhode Island, for instance, began accepting applications earlier than most other states and saw more than 11,000 people apply for the pandemic claims in a single day in April. As of last week, the state reported only hundreds of these claims were filed daily.

States vary in the level of demand they are likely to see based on the composition of their labor force. In California, about 8% of workers get income from self-employment and are likely eligible for pandemic unemployment assistance—nearly double the share in Utah—according to economists Andrew Garin and Dmitri Koustas in a University of Chicago report.

A bill passed by the Democratic-controlled House last week would extend enhanced unemployment benefits into early next year. Republicans, who control the Senate, have been cool to the idea, though some have offered support for modifying the aid.

In a conference call with House Republicans on Wednesday, Senate Majority Leader Mitch McConnell (R., Ky.) indicated he wouldn’t support an extension of the $600 a week boost in unemployment insurance.

“This will not be in the next bill,” Mr. McConnell said, according to a person briefed on the call. Mr. McConnell said one issue with the current level of benefits is that it pays people more to remain unemployed than they would earn if they went back to work, according to the person.

Sen. John Thune (R., S..D), the No. 2 Senate Republican who is responsible for counting votes, said there is no consensus in his caucus on this issue. “We have some who, you know, think obviously that is going to have to be extended in some way, because we’re going to run through the 13 weeks”

States are still confronting snags in implementing the self-employed benefits. Illinois, for instance, experienced a data breach last week at its website used to apply for the federally funded claims, which made public the personal information of some applicants.

The Illinois Department of Labor said in a statement it was working with Deloitte to “run a full-scale investigation into the matter.”

Arkansas’s website to apply for such claims also experienced a data breach. A spokeswoman for the state’s Labor Department said it “took the system offline” upon discovery of the incident last Friday.

More broadly, state labor departments have struggled to process the surge in claims due to the volume and faulty computer systems.

Although many states are working with outdated technology to process the onslaught of claims, Mr. Asaro-Angelo of New Jersey said his state’s biggest challenge is actually the high demand for experienced claims specialists.

“The real bottleneck is when humans need to be involved,” he said. “As much as we’re trying to supplement and augment all of our staff and capabilities, the actual process of going into someone’s unemployment-insurance claim and fixing it requires someone who’s gone through a background check, who’s had weeks or months of training.”

In New York, more than 560,000 previously ineligible workers have received unemployment payments under the expanded benefits.

Updated: 5-22-2020

Unemployment Rate Rose In All 50 States In April, Labor Department Says

Nevada had the highest rate at 28.2%, and Connecticut was lowest at 7.9%

Nevada registered the highest unemployment rate in the U.S. last month at 28.2%, the Labor Department said Friday in a report detailing the impact of the new coronavirus and related lockdowns on the job market in all 50 states.

The jobless rate rose in all 50 states and the District of Columbia last month, and 43 states recorded the highest level on record since 1976. The rate in three states exceeded 20% in April, well above the national rate of 14.7%, which was the highest on record since 1948.

Friday’s report offers the first state-by-state look at how the coronavirus pandemic had a differing, but widely devastating impact, across the country last month. In total, U.S. employers cut more than 20 million jobs in April, but the employment loss wasn’t evenly distributed.

After Nevada, the two states with the highest rates of joblessness were Michigan, at 22.7% and Hawaii, at 22.3%. Rates rose by at least 10 percentage points in 20 states.

Nevada’s heavy dependence on hospitality and tourism is the main reason for the state’s high unemployment rate, said Jeremy Aguero, a principal analyst with Las Vegas-based economic research firm Applied Analysis.

Nearly a quarter of the state’s labor force was employed in the hospitality and leisure industry before the pandemic began, according to the Labor Department. That industry, which normally employs about 350,000 in the state, lost roughly 40% of its workforce in March and April.

Nevada Gov. Steve Sisolak ordered casinos to close March 17, effectively shutting down the tourism industry.

“Nevada remains among the least diversified economies of its size in the country,” Mr. Aguero said. He said the downturn in tourism has also rippled out to affect hotel and restaurant suppliers and other businesses that depend on hospitality workers spending their earnings locally.

Hawaii faced similar challenges. Employment in leisure and hospitality, which accounted for about one in five Hawaiian jobs last year, declined by 56% in April, according to the Labor Department.

States that are heavily dependent on manufacturing also saw big job losses. General Motors Co., Ford Motor Co. and Fiat Chrysler Automobiles NV all closed plants in Michigan mid-March, causing a ripple effect of layoffs at suppliers in the state and elsewhere. Michigan’s employment in manufacturing industries fell 57% in April, according to Labor Department data.

Auto makers on Monday began restarting their U.S. factories, though two later were halted, one as a result of a worker’s illness and the other as a result of a parts shortage.

In Washington state, the unemployment rate rose to 15.4% in April from 5.1% in March. Boeing Co. closed its largest Seattle-area factory temporarily in late March after about two dozen workers in the region tested positive for the new coronavirus and one person died.

The plant reopened last month with additional safety precautions, but the company warned of future layoffs because declining air travel has lowered demand for jetliners.

Connecticut had the lowest unemployment rate last month at 7.9%. The next lowest rates were in Minnesota, 8.1%, and Nebraska, 8.3%.

The unemployment rate represents the people without jobs but actively seeking employment as a share of a state’s overall labor force. Separate Labor Department data show that many people who recently lost jobs dropped out of the labor force because they were either not seeking work or were unable to report to a job in mid-April, the period the survey determining the jobless rate asked about.

Nonfarm payrolls fell in every state in April, according to the Labor Department.

The largest declines occurred in populous states: California lost 2.3 million jobs, New York 1.8 million, and Texas 1.3 million. The states with the largest percentage declines were Michigan at 22.8%, Vermont at 19.6% and New York at 18.8%.

New York has the highest number of Covid-19 cases and related deaths among U.S. states, according to the Centers for Disease Control and Prevention. Covid-19 is the illness caused by the coronavirus.

Updated: 5-28-2020

Easing Unemployment Claims Show Slower Pace of Layoffs

U.S. workers seeking assistance remain historically high, but number receiving benefits fell for the first time since February.

The number of workers receiving unemployment benefits fell for the first time since February and new weekly claims continued to ease, offering evidence that layoffs related to the coronavirus pandemic are slowing.

Initial claims for unemployment benefits declined to a seasonally adjusted 2.1 million last week from 2.4 million the prior week, the Labor Department said. The level of claims is still 10 times prepandemic levels but has fallen for eight straight weeks.

Meanwhile, the number of workers receiving jobless payments for the week ended May 16 was 21.1 million, down 3.9 million from the prior week.

The level remains well above the record before this year—6.5 million in 2009—and underscores that tens of millions remain jobless.

Commerce Department data on Thursday showed gross domestic product—the value of all goods and services produced across the economy—fell at a downwardly revised 5.0% annual rate during the first quarter, overlapping in March with when the pandemic hit the economy.

Corporate profits declined sharply to start the year, the Commerce Department also said, and orders for long-lasting durable goods, such as machinery and trucks, fell 17.2% in April from a month earlier.

Fewer workers on unemployment rolls adds to evidence that while layoffs have been steep and are continuing, some Americans are getting back to work. That suggests the U.S. labor market is at an inflection point where new layoffs are largely offset by hiring and workers are being recalled to their old jobs.

Crystal Hollings, of Pascagoula, Miss., is among those returning to work.

She was laid off from the Goodwill Ocean Springs Mega Store for several weeks this spring, but recently returned to prepare the thrift shop for a June 1 reopening.

Unemployment benefits allowed Ms. Hollings to pay bills, but she was relieved to return to a job she said lifted her and her family out of homelessness in 2016.

“I love what I do and I love being around people,” she said. “I’m just trying to make it safe and clean for all our customers to come back.”

The store will require employees to wear masks and gloves and stay 6 feet from customers. When Ms. Hollings reapplied for employment she sought, and received, a promotion to assistant manager. Not all of her former co-workers returned, she said.

“Some didn’t want to come back because they’re still iffy on the pandemic,” said Ms. Hollings. “I wanted to come back the next day [after her layoff]. I’m not one to sit at home.”

As states allow businesses to reopen and citizens to move more freely, many companies are recalling workers, though often fewer than they laid off in March or April. Restaurants, hit hard by the crisis, face months of adjustment as the virus upends the industry’s business model.

Employees reported for 17% more shifts for the seven days ended May 24 than they did six weeks earlier, when job activity bottomed out, according to Kronos, a Massachusetts workforce management software company.

And some firms have begun hiring. Job search site Indeed.com said job postings have increased during the past three weeks, though the total is still down 35% from a year earlier.

Companies are also bringing back workers to qualify for government loan forgiveness, though some have warned they may need to lay off employees again when that support runs out.

Still, companies are continuing to announce layoffs. Boeing Co. said this week that it will shed more than 13,000 employees and American Airlines Inc. said it would cut its management and administrative staff by 30%, amounting to more than 5,000 workers.

Others are planning to increase staffing levels. Amazon.com Inc. plans to keep most of the U.S. jobs it added to meet demand in March and April as housebound Americans turned to online deliveries. Walt Disney Co. said it plans to begin reopening its Florida theme park at reduced capacity in mid-July.

“I think we’ve hit the bottom, as far as layoffs,” said Marianne Wanamaker, a labor economist at the University of Tennessee.

“Auto factories and suppliers have called back workers and you’re seeing states that shut down construction allowing those projects to restart,” she added.

Many economists say it will take many months, if not years, to replace all the jobs lost this spring. Forecasters at the University of Michigan project the pandemic-related shock will result in about 30 million total jobs lost, with about a third of those returning this summer.

The expected long recovery underscores the depth of the economic contraction the virus caused. Most economists expect a bigger contraction in the second quarter, when lockdowns continued for weeks before states started slowly reopening their economies in May.

Some businesses are starting to see increased, though still halting, demand for their products.

Tents Unlimited, an event rental company in Torrington, Conn., recently recalled three laid-off workers after it qualified for a federal loan and the state allowed restaurants to start serving patrons outside last week. That caused a rush in orders for tents and tables, said Brittany Sherwood, who owns the business.

The company still has one employee on layoff and has forgone hiring about six temporary workers it would have needed to staff the usual crush of spring weddings and corporate events.

“It’s going better—it was pretty bleak before,” Ms. Sherwood said. The restaurant orders don’t replace all the lost work “but it helps pay the bills.”

The company’s sales are still down 80% from last year, but she is hopeful it can survive until 2021, which she expects to be a spring busy with rebooked weddings.

The primary claims totals from the Labor Department exclude self-employed and gig-economy workers receiving unemployment benefits for the first time through a temporary coronavirus-related program.

New claims to that program fell slightly in the week ended May 23 to 1.19 million from 1.25 million. Unlike the regular claims program, pandemic assistance data isn’t seasonally adjusted.

Many states have only started paying benefits through the new program in recent weeks, suggesting recent claims likely reflect a backlog built since March. It is also likely some applying for the relief program earlier sought assistance through state programs and had applications rejected.

Updated: 6-5-2020

U.S. Unemployment Rate Fell To 13.3% In May

Payrolls rose by 2.5 million, suggesting jobs are returning.

The U.S. labor market snapped back to life in May, restoring a chunk of the jobs it lost in the first two months of the coronavirus pandemic while facing big obstacles in the months ahead.

After two months of carnage, employers added 2.5 million jobs last month, the most jobs added in a single month on records dating from 1948. The jobless rate fell to 13.3% from April’s 14.7%, a post-World War II high.

Employment remained down by nearly 20 million jobs, or 13%, since February, the month before the pandemic prompted states to shut down huge segments of their economies.

By comparison, the U.S. shed about 9 million jobs between December 2007 and February 2010, a period that covered the recession caused by the financial crisis.

Hurdles remain, including the prospect of a second virus outbreak, pandemic-related safety regulations and social unrest from the May 25 killing of George Floyd.

But the jobs report boosted hopes that the economy has moved beyond the worst fallout from the pandemic and may recover more quickly than expected. Stocks surged on the news, with the Dow Jones Industrial Average climbing more than 3%, the S&P 500 up nearly 3% and the Nasdaq heading toward a closing high.

“This is definitely in the right direction and suggests the U.S. economy may be faring better than some of those worst-case scenarios,” said economist Lindsey M. Piegza of financial firm Stifel Nicolaus & Co. “But it remains to be seen if this is indicative of an ongoing positive trend or if this reflects the bare minimum of the labor force needed to reopen the economy.”

Economists still expect a slow and choppy recovery. Government aid programs for households and businesses—which have pumped trillions of dollars into the economy—will start to run out this summer and fall. Many consumers and workers remain fearful of the virus and are staying at home.

And protests and looting following the killing of Mr. Floyd, a black man who died in police custody in Minneapolis, led many businesses to board up and close.

Still, a significant number of Americans appear ready to come back to the marketplace, and businesses are eager to reopen to accommodate them. Restaurants and bars added 1.4 million workers last month—more than half the overall job gain—as new virus infections eased and many states began lifting shutdown orders.

Other industries adding workers included construction, health care and retailers—among the industries that had been quickest to let go of workers in March and April.

“The No. 1 customer call that comes in is not, ‘Can I place an order?’ It’s, ‘Do you have dining?’” said Matt Friedman, chief executive of Wing Zone, an Atlanta-based restaurant chain. In recent weeks the company added five to 10 workers to each of its two taverns in Georgia that recently reopened after being shut down since March.

Mr. Friedman cautioned, however, that the two restaurants are operating at far below capacity to comply with rules to prevent further spread of the virus, including increased the space between tables.

That will limit, for now, how fast he can rehire. “It’s almost like if you took a football team and put half the players on the team on the field,” he said.

Sung Won Sohn, an economist at Loyola Marymount University, said the aid that Congress approved to help households is stoking demand. While 21 million workers remained employed last month, research suggests that more than half of those laid off during the pandemic are earning more than they did at their jobs, thanks in part to stimulus checks and extra $600 a week in unemployment pay approved by Congress.

“People have been cooped up in houses and apartments for weeks and they’re anxious to get back,” Mr. Sohn said. “They have money to spend—disposable income.”

Despite last month’s gains, the jobless rate is still historically high—nearly four times the rate in February. Jobs remain down by 19.6 million from February.

In May, a broader measure of unemployment—including jobless workers, those working part time and those who have given up the job search because they are too discouraged—stood at 21.2% in May.

Many other workers have taken pay cuts. Gregory Daco, chief U.S. economist at Oxford Economics, estimates that at least half of the workforce has lost a job, lost hours or took a pay cut.

The jobless rate for Latinos was 17.6% and for African-Americans 16.8%, far higher than for Asians at 15% and whites at 12.4%. Women were more likely to be unemployed than men.

In Portland, Ore., Kate Rafter had spent five weeks on a furlough when she returned to work the first week of May at a nonprofit that takes children on field trips around the Pacific Northwest. Two days after she returned, her boss told her she was being laid off.

Many parents had canceled plans to send their children on trips given the risk of catching the virus. The nonprofit said it could no longer afford to keep Ms. Rafter on as a business-systems analyst.

Now, she is living off unemployment benefits and the stimulus check Congress provided to many households. She is hopeful, though, because she has seen a number of job postings in her field.

“I think I’ll be able to find something,” she said. She has spent recent weeks knitting hundreds of masks which she has donated and decluttering her parents home.

There is at least one big sign that much of the economic damage from the pandemic will be temporary: More than 80% of the people who lost jobs during the pandemic expect the loss to be temporary.

Those permanently separated from their jobs totaled 3 million in May, a low level compared with prior downturns. In October 2009, when unemployment peaked after the financial crisis, there were 8.3 million such workers.

Manufacturers also are adding jobs. Tuff Shed Inc., a Denver-based manufacturer of backyard storage sheds, has called back the 500 employees it furloughed in late March, one-third of its total workforce.

The privately held company is now trying to hire about 300 more employees for its 52 production sites as demand surges for its prefabricated wooden buildings.

Tuff Shed’s buildings are being used as makeshift offices and home-school classrooms by families marooned in their homes by the pandemic, said Phil Worth, the company’s vice president of marketing. The most popular office shed measures 10 feet by 12 feet, about the size of a bedroom, with prices starting at about $4,300.

Tuff Shed’s May sales were up 26% from a year earlier and soared 90% from April, Mr. Worth said. Home Depot accounts for about half of its sales.

“The amount of demand is shocking,” he said. “We definitely want to add production capacity. People don’t want to wait a long time once they’ve made a decision to buy a building.”

Nearly 90% of Fiat Chrysler Automobiles NV’s hourly factory workforce in North America has returned to work, the company said in a statement. Fiat Chrysler and its U.S. competitors General Motors Co. and Ford Motor Co. restarted factory work in North America on May 18 and have since been ramping up production.

Job postings rose in the past week by 10%, according to an analysis of internal data by ManpowerGroup North America, a job-placement company.

Some of the highest demand is for workers in information technology, including for software developers, said Becky Frankiewicz, the group’s president.

She suspects that is because many businesses are now using apps for delivery services, or software such as Zoom to hold virtual meetings. “As states start to reopen we’re seeing an increase in demand,” she said. “When will we be back? We got here overnight. We won’t return overnight.”

Friday’s report, based on a survey of households and businesses in mid-May, offered a snapshot of the labor market before protests and looting after the death of Mr. Floyd.

Penn Quarter Sports Tavern in Washington, D.C., laid off all 28 employees in early March after city leaders ordered nonessential businesses to close during the pandemic.

When the city began the first phase of reopening last month, the restaurant rehired about half of its employees in the hopes of reopening the bar this week, said owner Mike Brand.

But protests and looting prompted him to board up his business and delay the opening by at least a week.

“We had every intention to be operating right now but now we’re back stuck in the mud,” Mr. Brand said. “This extra week, maybe two with the riots, it’s taking a huge financial chunk.”

He said he has been trying to rehire more of his former employers but he has run into a hurdle: Many of his servers and bartenders have declined offers to come back to work, he said. Some are fearful of catching the virus; others don’t want to give up their unemployment benefits, which currently pay them more than they would earn at the restaurant.

He believes that as enhanced unemployment benefits—the federal payments of $600 a week—expire, he will have an easier time finding workers.

Updated: 6-8-2020

The May Jobs Report ‘Misclassification Error’ Explained

New numbers from the U.S. Labor Department Friday surprised economists when the jobless rate dropped from 14.7 percent in April to 13.3 percent in May. But there was a note on the official report called a “misclassification error” that makes last month’s unemployment rate up to three points higher. The Wall Street Journal’s chief economics commentator Greg Ip joins Hari Sreenivasan to explain.

Hari Sreenivasan:

“New numbers from the Labor department yesterday surprised economists when the jobless rate dropped from 14.7% in April to 13.3% in May.

Stocks rose and President Trump called reporters to the Rose Garden to announce the unexpected good news even though tens of millions of Americans are still out of work.

But there was a note on the official report—pointing out a “misclassification error” — an error that makes last month’s unemployment rate as much as three points higher.

The Wall Street Journal’s Chief Economics Commentator Greg Ip explained what was wrong with the numbers.”

Greg Ip:

“So the numbers are a little bit distorted because of the unusual circumstances of the pandemic.

People who are on temporary layoff are supposed to be classified as unemployed. For reasons that we’re not really sure a lot of those people were, in fact, classified as employed.

Now, the Bureau of Labor Statistics is aware of that problem. They told us that if you adjust for that error, then the unemployment rate is actually higher.

How much higher? Well, the month of May, it would have been three percentage points higher but in the month of April it would’ve been five percentage points higher.

So what do we take from that? Well, unemployment rose a lot more in April than we thought. But it also fell more in May than we thought.”

Hari Sreenivasan:

“When we talk about numbers like 13 or 16 percent, compare that to where we were just six months ago.

I know around, you know, January, February, we were down in the three percent area. Now we’re dealing with unemployment rates that are the highest since the Great Depression.

However, let’s put that in context. We had 20 percent unemployment rates for years back in the 1930s. We’ve only had these double digit unemployment rates for a few months.

I have to emphasize, we do not have good models for understanding where the economy is going at a time like this. It’s just too soon to say how long we’ll be dealing with this historic level of unemployment.“

Updated: 6-18-2020

U.S. Unemployment Claims At 1.5 Million Edge Lower But Remain Historically High

At 1.5 million, fewest weekly applications since mid-March, but shows pace of layoffs is no longer significantly easing.

The number of workers applying for and receiving unemployment benefits has stabilized at historically high levels, signs that while the labor market is healing hundreds of thousands of workers are still losing their jobs each week.

New applications for benefits edged lower by 58,000 to a seasonally adjusted 1.5 million in the week ended June 13, the Labor Department said Thursday. While it is the fewest weekly applications since mid-March, it also showed the pace of layoffs is no longer significantly easing.

The number of Americans receiving benefits payments fell by 62,000 to 20.5 million in the week ended June 6. Those continuing claims are reported with a one-week lag. A stable level of people on benefit rolls suggested that new layoffs are being offset by employers hiring or recalling workers as states have allowed more businesses to reopen in recent weeks.

Other signs of economic growth have emerged, including a May rebound in retail spending that followed record declines. But with the economy having slipped into recession this year, many firms have remained cautious about rehiring, leaving millions of people out of work since the pandemic hit.

Employers added to payrolls in May but only offset about one in 10 jobs lost in April and March. Recent data indicate a higher volume of workers are moving in and out of jobs, said Roiana Reid, an economist at Berenberg Capital Markets.

“You’re going to see elevated levels of layoffs because some businesses will permanently close,” she said. “But hiring and rehiring will outweigh that this summer, especially as you see big cities, such as New York, reopen.”