Bitcoin Is World’s Best Performing Asset Class Over Past 10 Years (#GotBitcoin)

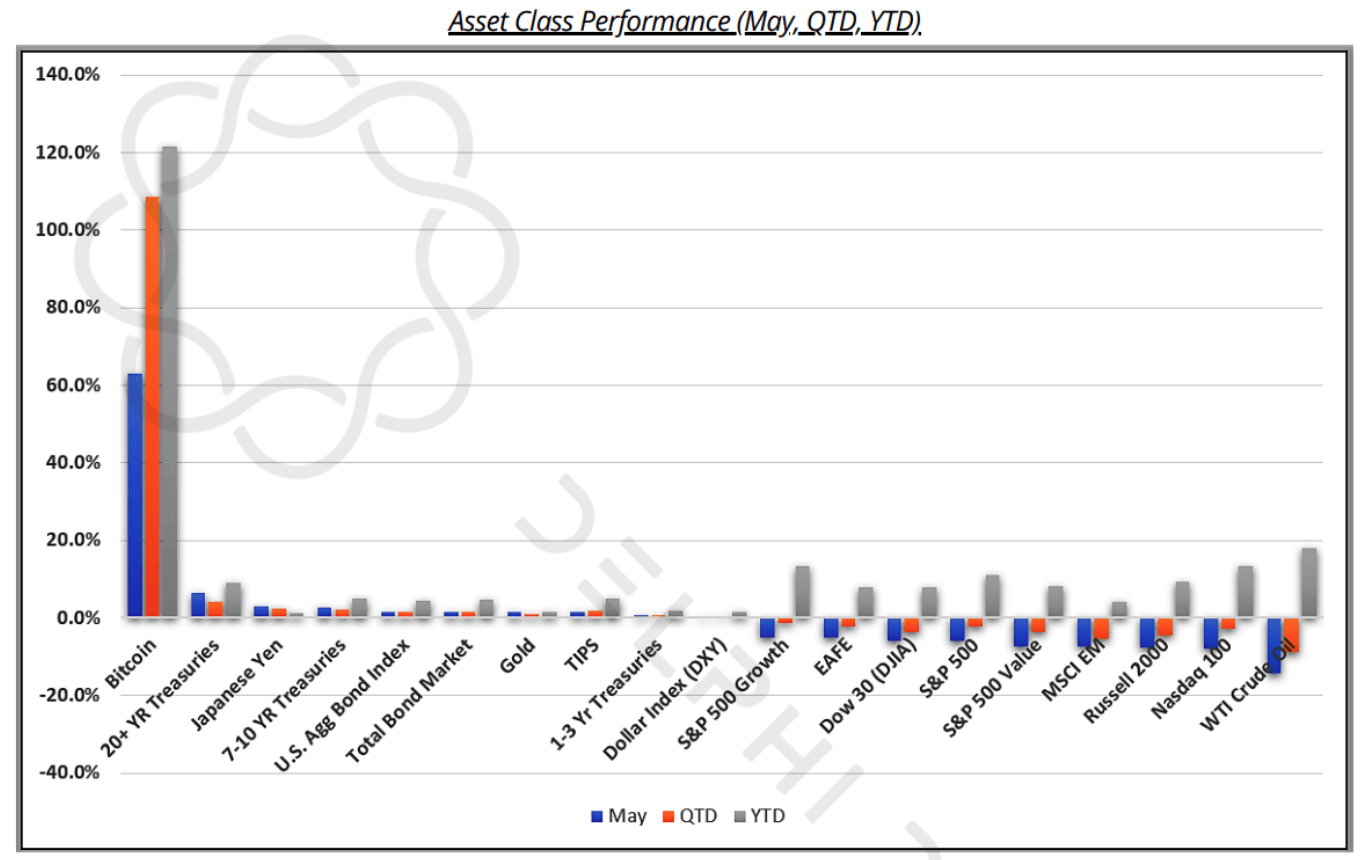

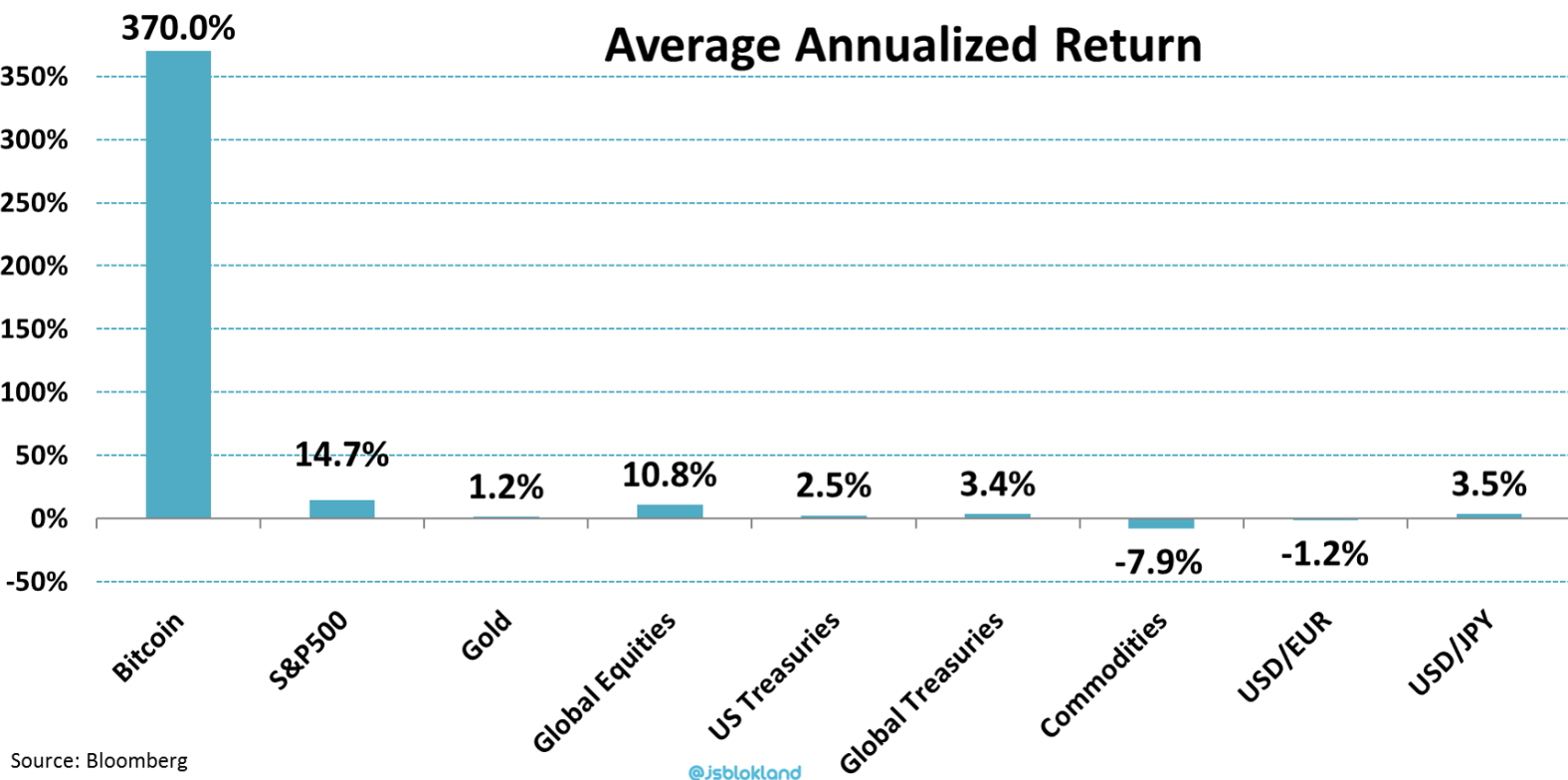

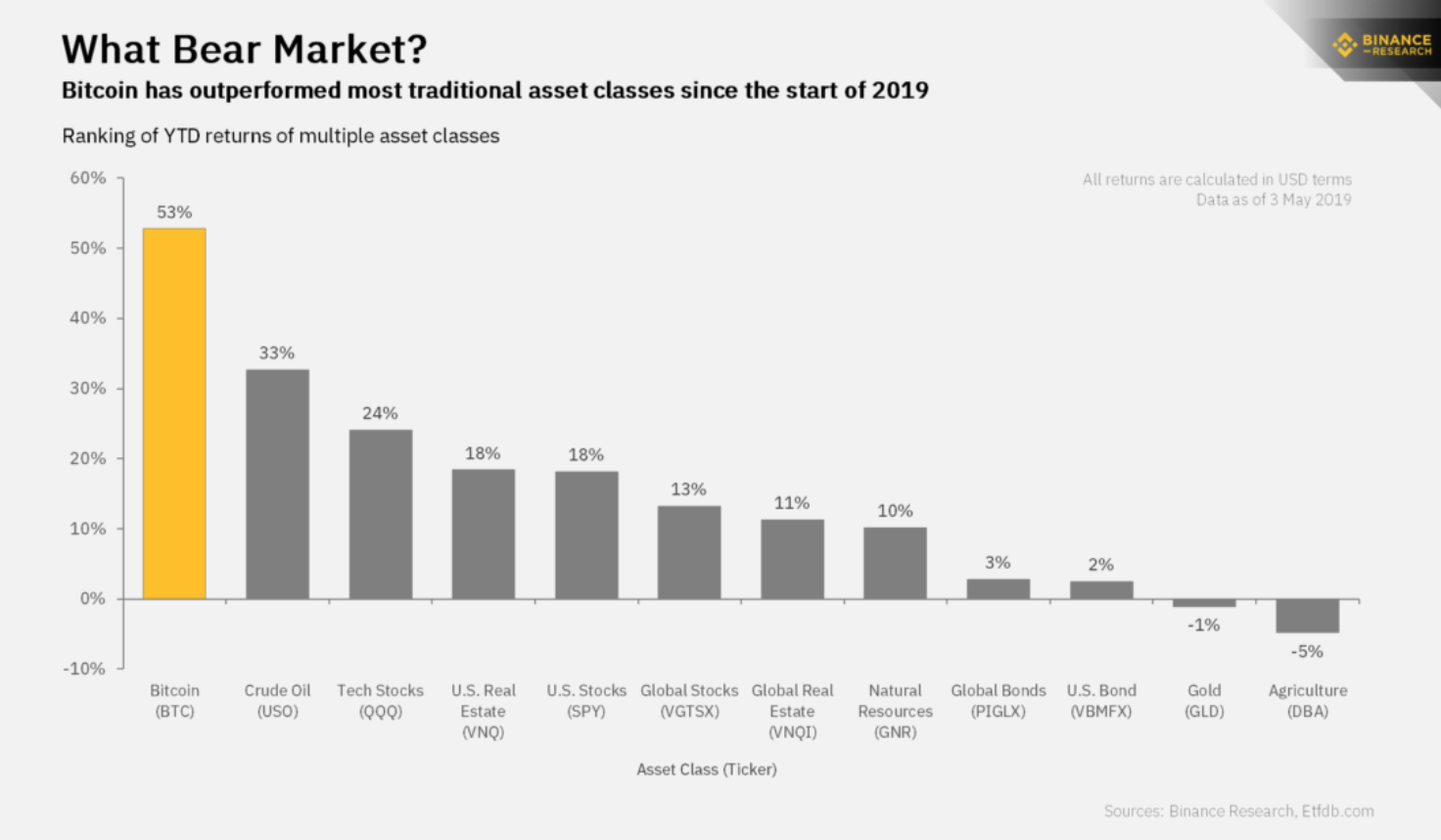

Bitcoin has outperformed other asset classes by a huge margin, demonstrating its uncorrelated nature to stocks and oil. Bitcoin Is World’s Best Performing Asset Class Over Past 10 Years (#GotBitcoin)

In December 2018, the mainstream media proclaimed the death of bitcoin (BTC/USD) for the millionth time. At that point, the first cryptocurrency dropped by as much as 84% from the all-time high of around $20,000 as the price plunged below mining costs. The bearish sentiment was so strong that almost no one dared to long the digital asset. Those who did, however, have been handsomely rewarded because bitcoin is 2019’s best-performing asset globally.

[Bitcoin] is the most secure transaction settlement layer in the world, so it’s got to be worth something […] it’s the best performing asset class over the past ten years – it’s outperformed S&P, DOW, NASDAQ, etc. during the longest bull run. It experienced two 85 percent drops during that time, but [it’s] still up over 400 percent in the last two years.”

Bitcoin Outperforms Other Assets By A Huge Margin

It may come as a shock to you but bitcoin is way ahead of any asset in terms of this year’s returns. As of this writing, it is up by more than 67% on Coinbase year-to-date.

Coming in at No. 2 is oil (USOIL), up by 38.35%. The other investable assets in the green this year are the Nasdaq 100 (through the QQQ ETF), small caps (through the IWM ETF), and S&P 500 (through the SPY ETF).

These investment vehicles are up by 22.25%, 18.17%, and 16.54% percent, respectively. On the other hand, gold (GLD), which is considered as a safe store of value, is down by 0.12%.

Bitcoin’s recovery comes at a time when global markets appear to be in turmoil. The uncertainty is further intensified as China threatens to come up with severe retaliatory measures in response to the significant tariff bump by the White House.

Fundstrat Co-Founder Thomas Lee recently took to Twitter to show how BTC is unaffected by these developments. He applauded the rise of bitcoin in spite of tense global market conditions:

Even more impressive, bitcoin is not just buckling under the sharp declines of global markets. The cryptocurrency also appears to be shrugging off bad developments within the crypto community. Crypto-enthusiast Alex Kruger was able to notice this pattern.

Bitcoin is still rising even after three negative developments. It appears to be in the midst of a massive disbelief rally. An in-depth analysis shows that this digital currency has more gas left in the tank.

Bitcoin Targeting $8,000.00 In The Near Term

Bitcoin looks to mock the shorters and the non-believers as the cryptocurrency continues to push higher despite overheated technical signals. Daily volume and RSI may be flashing bearish divergences yet bitcoin remains strong. It is now threatening to breach heavy resistance of $6,200 on Coinbase.

Nevertheless, bulls have the pending golden cross between the 100-day moving average (MA) and the 200-day MA on their side. A confirmed cross can be the technical catalyst that keeps BTC above $6,200. Above this resistance, the next logical target is $7,800.

Bottom Line

Bitcoin is 2019’s top performing asset, significantly edging traditional assets like oil, the Nasdaq, and the S&P 500. The cryptocurrency’s trend is so strong that it defies negative developments in the legacy markets as well as within the crypto community. Don’t wait for bitcoin to hit $7,800 before you start considering it as an investment. Bitcoin Is World’s Best, Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best

Updated: 11-16-2019

These 4 Facts Show How ‘Boring’ Bitcoin Is Crushing the Stock Market

Analytics company Blockforce Capital published the October edition of its in-depth crypto markets overview on Nov. 11. Packed with information, the report provides a surplus of data on the overall state of the cryptocurrency markets, noting that Bitcoin (BTC) still outpacing traditional markets.

Bitcoin Gets Boring In November But…

November has thus far been rather uneventful if not boring with regards to price action. However, Bitcoin has had an eventful October. Last month started off slow but ended with Bitcoin skyrocketing from $7,300 to $10,500.

Shortly after, the asset quickly fell back down just below $9,000 before the end of the month. Now almost halfway through November, Bitcoin is holding around the $8,500 mark.

But even at current prices, Bitcoin’s gains have still far outpaced traditional markets, which are having a record year. Several data points also reveal increased mainstream Bitcoin trading as well as increased overall transaction activity in the latter part of the month.

Let’s take a closer look at some striking stats demonstrating how Bitcoin is still outperforming the red-hot U.S. stock market despite the bearish sentiment that has been prevalent since June.

1. Bitcoin 150% vs. US Stock Market 23% YTD returns

Before its dramatic rise to $13,800 in June, Bitcoin sat at $3,400 in February of this year.

Currently, in the $8,000 to $9,000 range, Bitcoin has fallen significantly from its yearly high, although crypto’s leading asset has still outperformed traditional financial benchmarks even at current prices — and traditional markets have had an excellent year.

Blockforce CIO David Martin Said The Report:

“Bitcoin returned 11.5% for October, compared to mid-2% returns for gold, the S&P 500, and the MSCI All-World Index. The S&P hit new highs to close the month, returning 23% YTD — a favorable return for traditional assets, but one that is dwarfed by bitcoin’s 150% YTD return.”

As demonstrated by Bitcoin’s volatility this year, buying into the digital asset at the wrong time likely led some traders or investors to buy BTC near its yearly highs of almost $14,000. Bitcoin currently sits almost 40% lower than that yearly high.

The coin’s current price, however, is more than double its 2019 low, outpacing traditional markets by a long shot.

Taking the aforementioned into consideration, one might consider dollar-cost averaging into Bitcoin exposure as a potential opportunity, in addition to traditional market exposure.

Dollar-cost averaging involves buying a predetermined amount of an asset at a recurring set point, regardless of that asset’s price, over a period of time. This strategy has the potential to provide investors with long-term profits while decreasing the risk associated with volatility.

2. Institutional Interest In BTC Gains Steam In October

Throughout most of October, Bitcoin futures posted little volume on the Chicago Mercantile Exchange (CME), Martin said, adding:

“CME Bitcoin futures volume was non-existent for the first three weeks of the month but increased during the last week of October given the dominant news cycle regarding Facebook and China. CME contract volume was under $200M for the month, the lowest since Jan 2018, but open interest remained relatively healthy.”

After Bitcoin’s significant price tumble below $8,000 near the end of September, the asset consolidated with overall rangebound activity and limited action for most of October. Bitcoin dropped to $7,300 on Oct. 23 before bouncing all the way up to $10,500 three days later — a historic rally of more than 40% in one day.

During this time, speculations arose regarding various causes for such a pump, including China’s President Xi Jinping speaking positively on Bitcoin’s underlying blockchain technology. Facebook also headlined numerous articles due to numerous governments’ backlash against its Libra asset concept.

As Martin noted, CME Bitcoin futures volume rose near the end of October. Naturally, this occurred around the same time Bitcoin’s market price rose significantly.

Bitcoin trading activity on the Intercontinental Exchange’s Bakkt platform revealed the same conclusion — that mainstream Bitcoin trading activity increases significantly when Bitcoin’s market price makes major moves.

Martin said:

“Bakkt Bitcoin futures got off to a slow start last month, but both volume and open interest continue to grow. Open interest closed the month at a high of $900k on October 31.”

Additionally, citing a Grayscale report, Martin added that Grayscale’s mainstream cryptocurrency products have seen increased interest, with $255 million invested in its offerings.

“Grayscale has been a dominant force in with their ‘not an ETF’ trust, and saw record quarterly inflows during the third quarter,” Martin noted.

3. Bitcoin Transaction Volume Recovering

Prices for the overall crypto market surged back in May and June 2019, so naturally, the blockchain networks associated with those assets also saw significant traffic.

Daily Ethereum (ETH) transactions hit the seven-figure mark in June, which the market had not seen in more than a year, according to a Cointelegraph report. Since June, however, Bitcoin and Ethereum tallied decreasing transaction numbers until October posted a slight turnaround, Martin reported.

“Network transactions continue to be a healthy barometer of interest in cryptocurrency, and both Bitcoin and Ethereum saw an uptick in October, increasing 1.3% and 2.5%, respectively.”

As Cointelegraph also reported earlier this month, some key on-chain metrics are also suggesting that investors are currently accumulating BTC in anticipation of the halving taking place next May.

4. More Mining Power Is Entering Bitcoin’s Network

October saw a 7.5% rally in Bitcoin’s hash rate. Essentially, this means increasing computing power and security of the Bitcoin network.

Increased network hash rate (net hash) sometimes means more miners are mining Bitcoin, although it more broadly states that Bitcoin’s network is receiving more mining power in general.

This means new miners, as well as existing miners, are directing more computing power toward Bitcoin’s network, crypto trader, miner and Twitter personality Socal Crypto explained to Cointelegraph.

Either way, a higher network hash rate for Bitcoin means more miners are investing capital into the network, which suggests that they anticipate the value of BTC to continue rising in the future.

Over the past year, Bitcoin’s rising network hash rate trend appears to have coincided with its upward price trend, according to data from a recent Cointelegraph article.

In the Blockforce report, Martin adds that Bitcoin has posted rising hash rate figures every month since May 2019, “although the month-over-month change is slowing down after posting double-digit growth over the six months.”

In any case, Bitcoin’s hash rate when the price hit nearly $20,000 in late 2017 was around 14,000,000 TH/s. Today, this figure has climbed to over 100,000,000 TH/s, suggesting that the price is yet to catch up, as some analysts believe.

Updated: 12-12-2019

Cryptocurrency Is Still the World’s Best Performing Asset Class This Year

As the year and decade come to an end, cryptocurrencies once again outperform other major asset classes.

Despite trading significantly down from their record highs of late December 2017, large-cap cryptocurrencies had a phenomenal year and remain one of the greatest investment success stories of the decade.

Cementing themselves as the world’s leading asset class for yearly performance, cryptocurrencies have risen well above annualized returns of the U.S. equities, commodities and bond markets for 2019.

Ryan Alfred, President and co-founder of Digital Assets Data said large-cap crypto assets possess significantly higher returns versus traditional markets for this year.

“Looking back at the performance of the top ten large-caps (Bitwise 10) in comparison to other major asset classes, we can see their special signature,” Alfred said.

As seen in the chart above, research provided by Digital Assets Data shows how this year’s performance of the top 10 cryptos by market capitalization fared against other major asset classes such as gold, oil and equities.

Of course, 2019 didn’t start out that way. Back in February, the top 10 crypto began a fairly dismal run, resting well below all other traditional asset classes when viewing their return on investment figures. However, sentiment began to pick up significantly in March and by mid-year, cryptocurrencies were far out ahead of other the other assets.

That gap has begun to narrow as stocks, bonds and commodities begin to increase their lead. Yet cryptocurrencies remain significantly ahead of all other asset classes as the year comes to a close.

Much of this rally is courtesy of bitcoin (BTC). The world’s first cryptocurrency is currently up 100 percent since the year began.

Meanwhile, Ether, the world’s second-largest crypto is up 35 percent year-to-date, though XRP is down 25 percent from where it traded on Jan. 1.

In the year before the decade began, the world was in the throes of a financial crisis. Since then, stocks have rebounded. From its March 2009 market meltdown lows to now, the S&P 500 has gained a respectable 369 percent. Similarly, the Dow Jones Industrial Average has also had a good run, up 326 percent in that same time period.

However, BTC has blasted those figures, rising well above a staggering 12 million percent (yes, you read that correctly) over a one-year-shorter time frame, beginning March 2010. That’s when the price of 1 BTC was around $0.05, data taken from Messari shows.

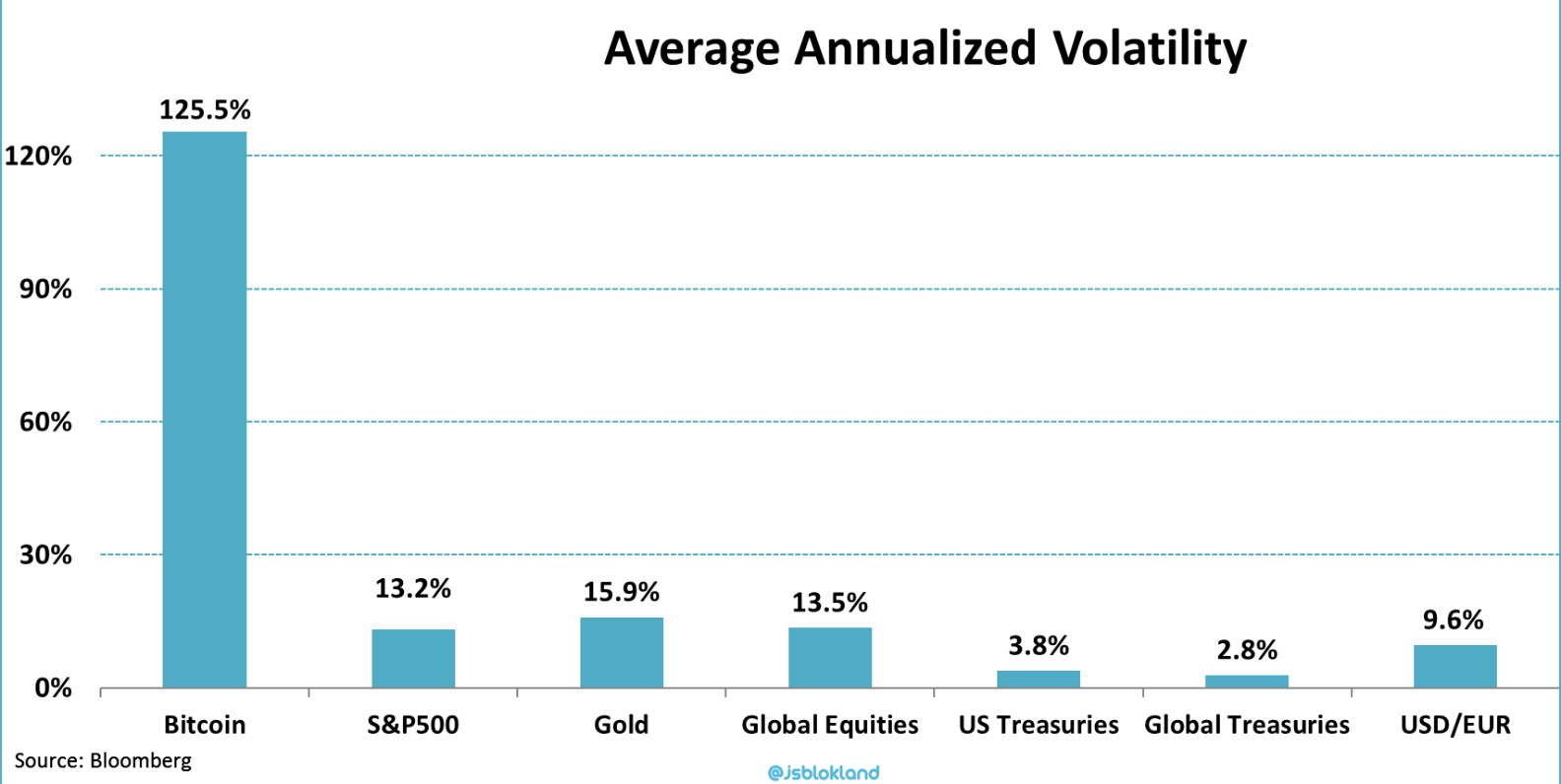

Crypto’s success can likely be attributed to its most defining characteristics: high volatility and liquidity, allowing market participants to quickly and easily trade between digital and fiat currencies.

Lorenzo Pellegrino, CEO of Skrill, a cross-border payments platform utilizing crypto, said digital assets resembled a nascent market. Prices bouncing around in a frantic manner enable the asset class to outperform all others based on irrational sentiment and low barriers to entry.

“As it (crypto) matures we should start to see increased stability and the core fundamentals will become more apparent,” Pellegrino said.

Other cryptocurrencies have performed even better than bitcoin, with ether (ethereum) experiencing gains of more than 60 percent since the start of the year.

Despite their recent gains, bitcoin and ethereum remain a long way off the highs of late 2017 and early 2018, when one bitcoin was worth more than twice its current value.

Updated: 5-8-2020

Bitcoin Overtakes Gold To Become The Best Performing Asset Of 2020

World’s most valuable cryptocurrency has nearly doubled in value since a flash crash in mid March.

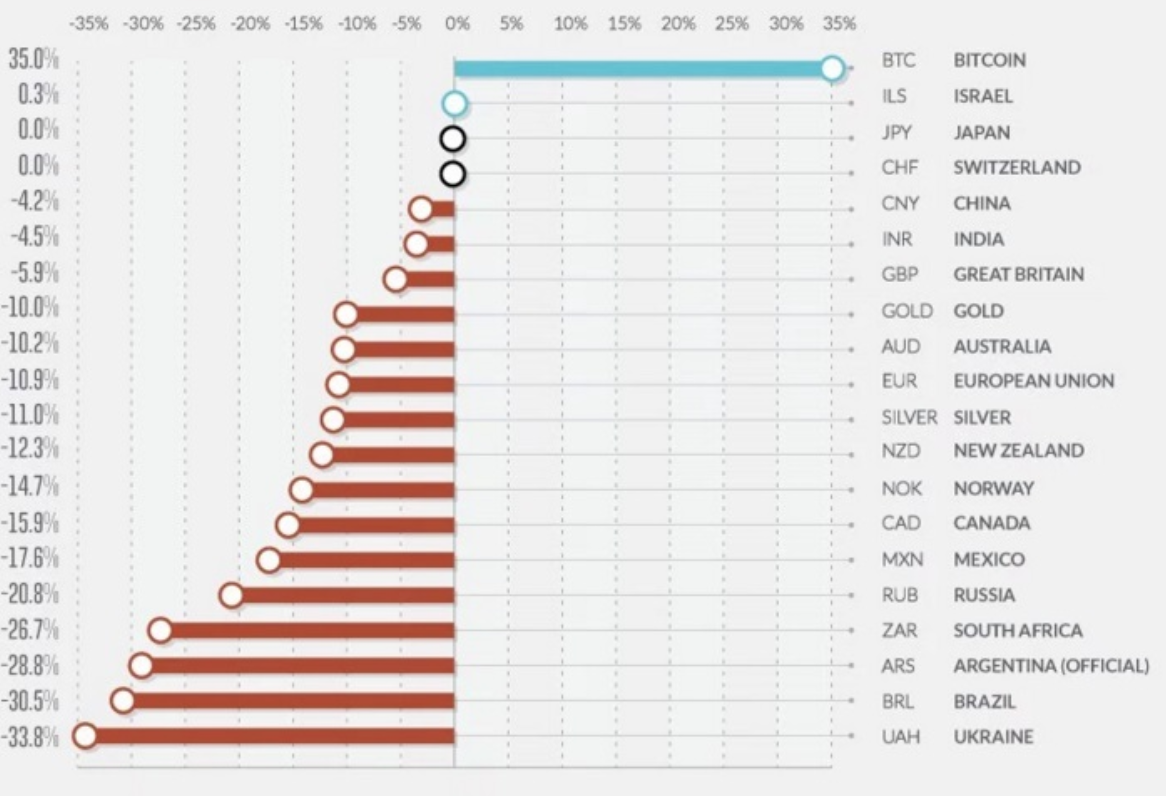

A sudden surge in the price of bitcoin has made the cryptocurrency the top performing asset of 2020, outpacing gold, silver and crude oil.

Over the past four months, the price of bitcoin has risen by almost a third despite a major crash in March that wiped more than $4,000 (£3,200) from its value.

In the same time period, gold has only risen by around 13 per cent, while silver has fallen by 14 per cent and crude oil has dropped by more than 70 per cent in value.

Bitcoin’s recovery comes less than two weeks ahead of a rare event known as a halving, whereby the number of new bitcoins created will fall by 50 per cent.

It is only the third time a halving has happened in bitcoin’s 11-year history and some market analysts believe it could push the cryptocurrency’s price to new all-time highs this year.

Both bitcoin and gold have seen significant gains since around mid March, when countries around the world began to introduce lockdown measures in an effort to slow down the spread of the Covid-19 coronavirus outbreak.

This resulted in a global economic slowdown and caused stock markets to crash, as investors looked to secure their holdings in safe haven assets.

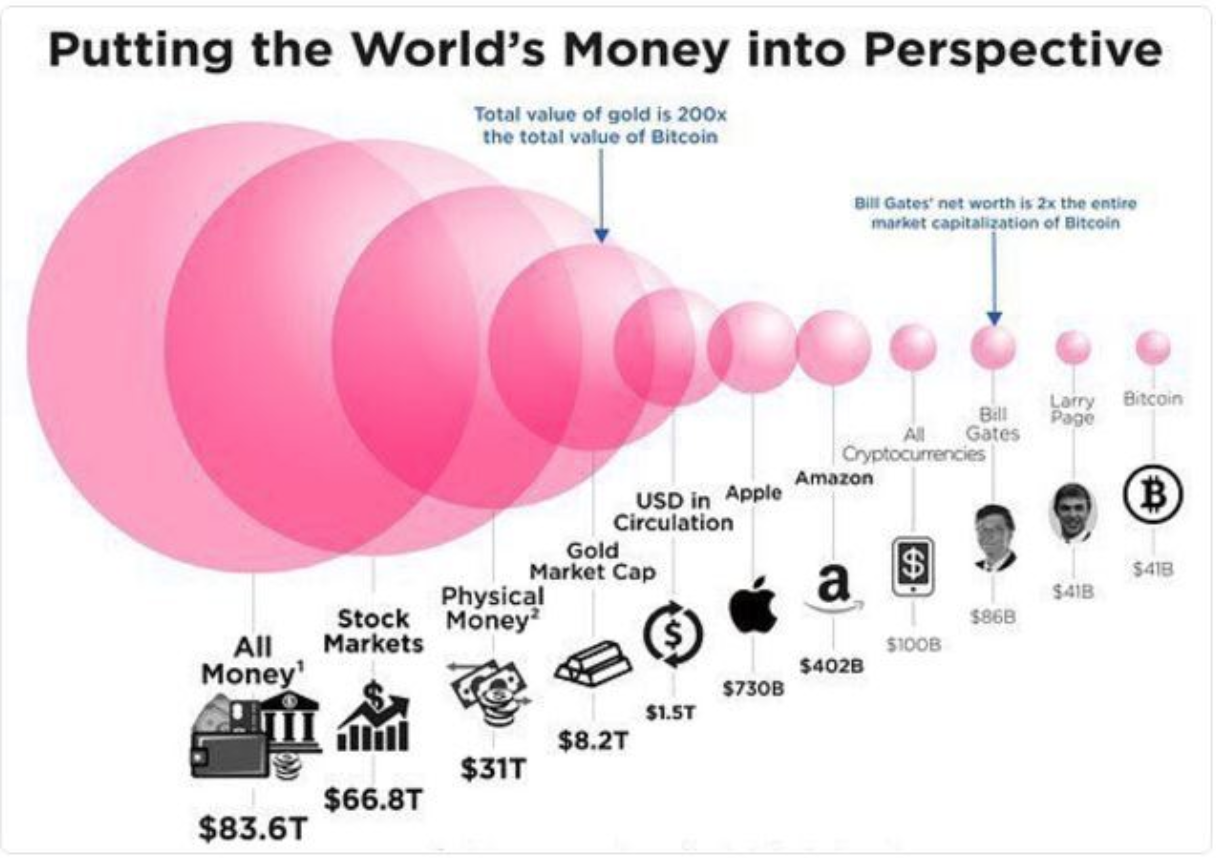

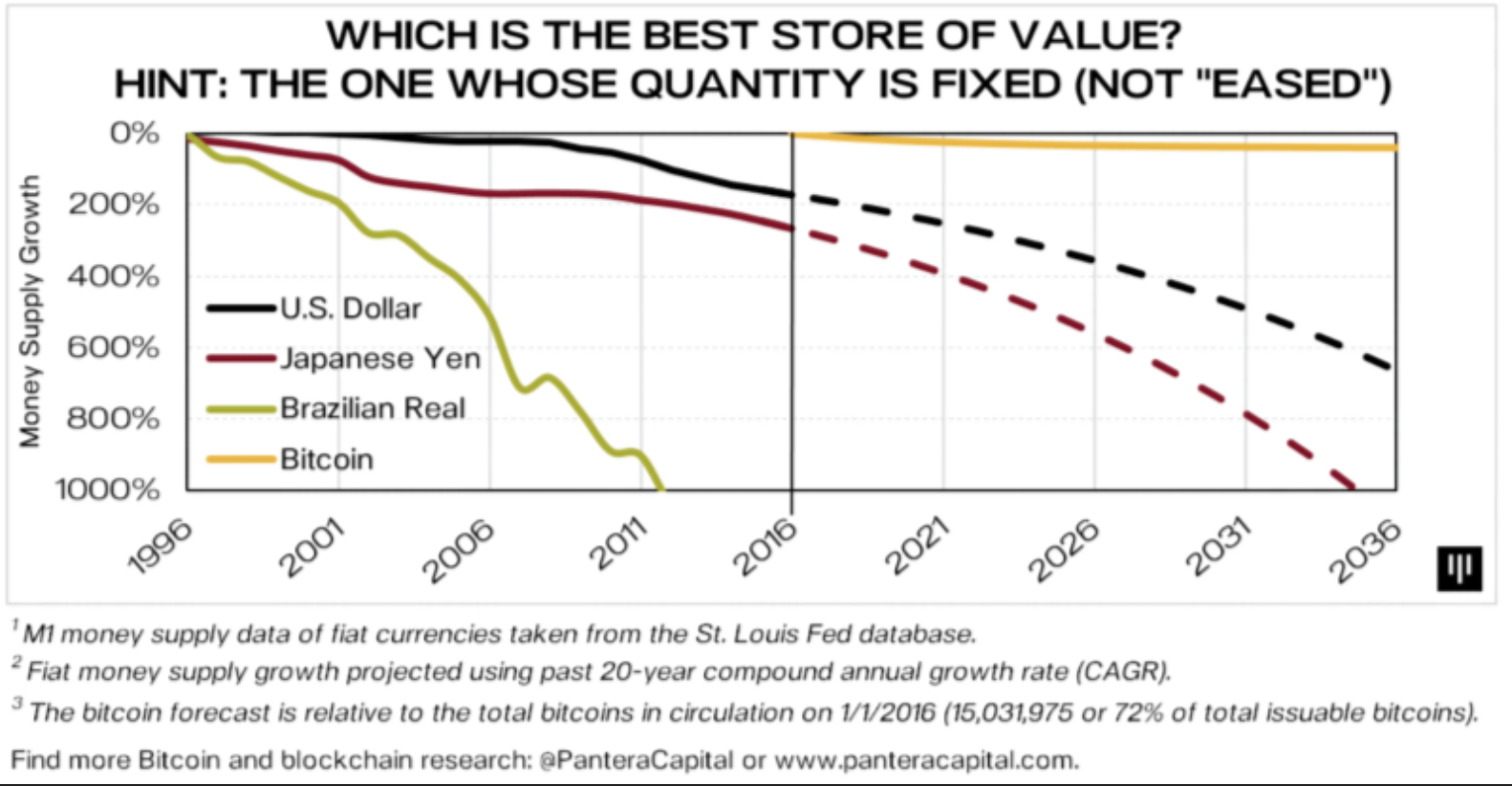

This has been why gold has traditionally performed well during times of economic uncertainty, however market data suggests that the finite supply of bitcoin means it is increasingly being viewed as a safe haven asset.

“Bitcoin has been surging ahead of the May halving event, with investors eagerly anticipating the positive impact of a tightening in supply that comes once every four-years,” Joshua Mahony, a senior market analyst at financial services firm IG, told The Independent.

“As things stand we are in line to post a 182 per cent rise for bitcoin since the lows of December 2018, and the surge we are currently seeing paints a bullish picture for the months following this third halving.

“From a wider perspective, the huge growth in central bank easing and government debt does highlight why many feel the need to store their wealth in alternative assets to avoid the apparent depreciation that could be on the cards.”

Other cryptocurrencies have performed even better than bitcoin, with ether (ethereum) experiencing gains of more than 60 percent since the start of the year.

Despite their recent gains, bitcoin and ethereum remain a long way off the highs of late 2017 and early 2018, when one bitcoin was worth more than twice its current value.

Updated: 5-9-2020

Bitcoin Is Outperforming Every Mainstream Asset Class In 2020

With less than three days left until the halving, Bitcoin is currently outperforming every mainstream asset class for 2020 so far.

Data published by market research firm Fundstrat shows that Bitcoin (BTC) is the top-performing asset class of 2020 so far.

The data, posted to Twitter by Fundstrat’s Thomas Lee, shows Bitcoin to have outperformed every other asset class by at least 19% — with BTC having gained 39% since the start of the year.

20-year U.S. treasures rank as the second-best performing asset with a 21.1% year-to-date (YTD) gain, followed by gold with 12.5%, and U.S. treasuries with 8.9%.

Global government bonds and the Nasdaq increased by 1.8% and 1.7% respectively, while high-grade U.S. credit and cash funds post roughly 0.5%. All other asset classes are currently in the red.

Bitcoin On Track To Outperform For The Second Consecutive Year

The post also details the performance of the top 13 asset classes of 2019, which Bitcoin again tops with a 12-month gain of 92.2%.

The Nasdaq ranked second with 35.2%, followed by the S&P 500 28.9%, and the MSCI World Index with 25.2%.

Bitcoin is also the best performing asset of 2017 with a gain of over 1,550% and would have comprised the top commodity of 2016.

Leading Altcoins Outshine BTC On YTD Charts

As of this writing, Bitcoin appears to have gained 33.5% from $7,205 to $9,620 since the start of the year — ranking BTC as the fifth-strongest performing of the top ten cryptocurrencies by market capitalization YTD.

Bitcoin SV (BSV) currently boasts the largest gains for 2020, having risen 115% from $98 to $210.5. Tezos (XTZ) ranks second, posting a 107.5% increase from $1.35 to $2.80.

Ether (ETH) and Stellar (XLM) follow with gains of roughly 61% each.

Updated: 9-25-2020

China State Media Make Rare Reports Calling Crypto 2020’s Best Performing Asset

Several Chinese state-owned media have made coordinated reports describing cryptocurrencies as the year’s top performing investment.

* China Central Television (CCTV), the country’s top broadcaster, published a three-minute news clip on Friday that highlighted crypto assets have soared by 70% this year so far.

* The report added that “cryptocurrency has undoubtedly become the top performing investment” among various global assets.

* CCTV’s clip followed the state-owned news agency Xinhua, which published an online article Thursday entitled “Cryptocurrency is this year’s ‘No. 1 asset.'”

* The same article first appeared on the Thursday print version of Cankaoxiaoxi and was a summarized translation of an article from Bloomberg on Tuesday.

* Cankaoxiaoxi is one of the longest running state media that selectively translates news reports from foreign sources, including those that are normally blocked by China’s Great Firewall.

* The CCTV clip immediately drew wide attention from the Chinese crypto community.

* Many started sharing the clip on WeChat news feeds as a bullish signal since the unusual neutral-to-positive tone is seemingly at odds with China’s stance that crypto speculation could undermine financial stability.

* Such a rare and coordinated effort also sparked some to wonder what the real intention and nuance might be, since state-owned media in China typically carry political agendas.

* Citing Bloomberg’s index, CCTV said the yield of crypto asset has this year surpassed that of gold, which has risen only 20%.

* The broadcaster said various countries’ economic stimulus plans following the coronavirus pandemic and the recent mania for decentralized finance contributed to the surge of values in cryptocurrencies.

However, it also cautioned that the risks for retail investors still remain high given crypto assets’ volatility.

Updated: 3-15-2021

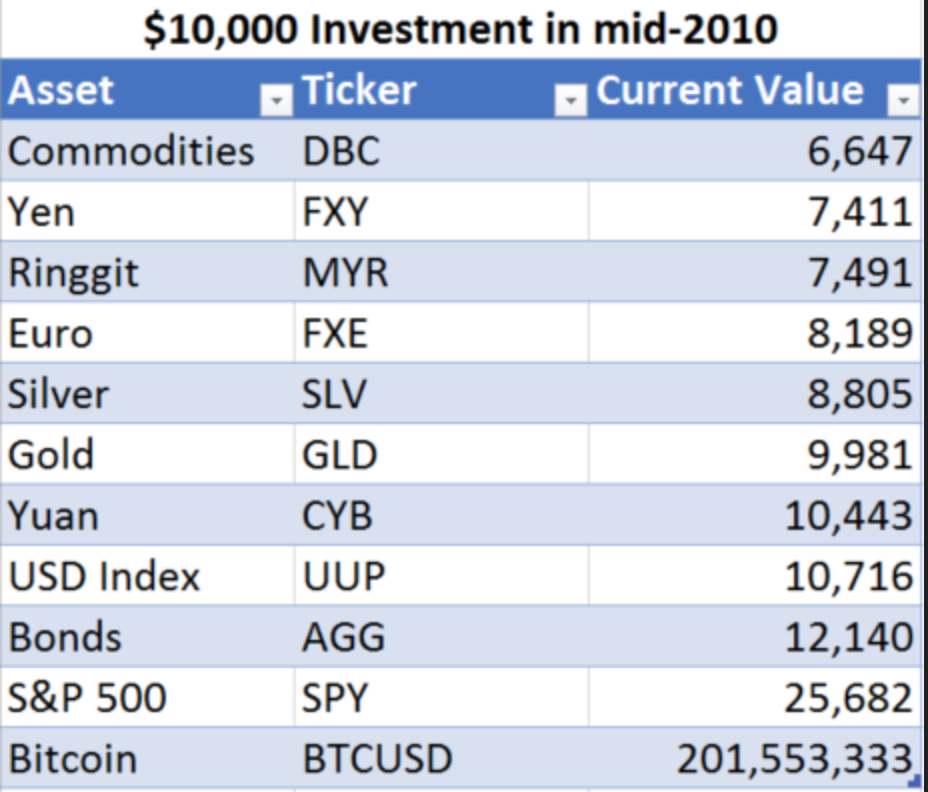

BTC Was Best-Performing Asset Of Past Decade By 900%

Bitcoin’s annualized returns have eclipsed all other asset classes by a big margin.

Over the past ten years, Bitcoin has beaten out all over asset classes by at least a factor of 10.

The milestone was noted by Compound Capital Advisors’ CEO and founder, Charlie Bilello, who compiled the performances of the top asset classes using data from Ycharts.

Responding to the findings, Messari researcher Roberto Talamas highlighted that Bitcoin has produced an annualized return of 230% on average — more than 10 times higher than the second-ranked asset class.

Asset Class Returns over the Last 10 Years…

Data via @ycharts pic.twitter.com/yRvdkIX1BV

— Charlie Bilello (@charliebilello) March 13, 2021

The U.S. Nasdaq 100 Index ranked second with an annualized return of 20%, followed by U.S. Large Caps — shares in U.S.-based companies with market caps exceeding $10 billion — with an average annual performance of 14%. U.S. Small Cap stocks were the only other asset class to post double-digit annualized returns for the past ten years, with 12.9%.

The data also shows that gold made a paltry annualized return of 1.5% since 2011, with five out of the past 11 years producing a loss for the asset. According to Gold Price, the precious metal has fallen by 8.5% since the beginning of 2021, much to the chagrin of Bitcoin detractor and gold investor Peter Schiff.

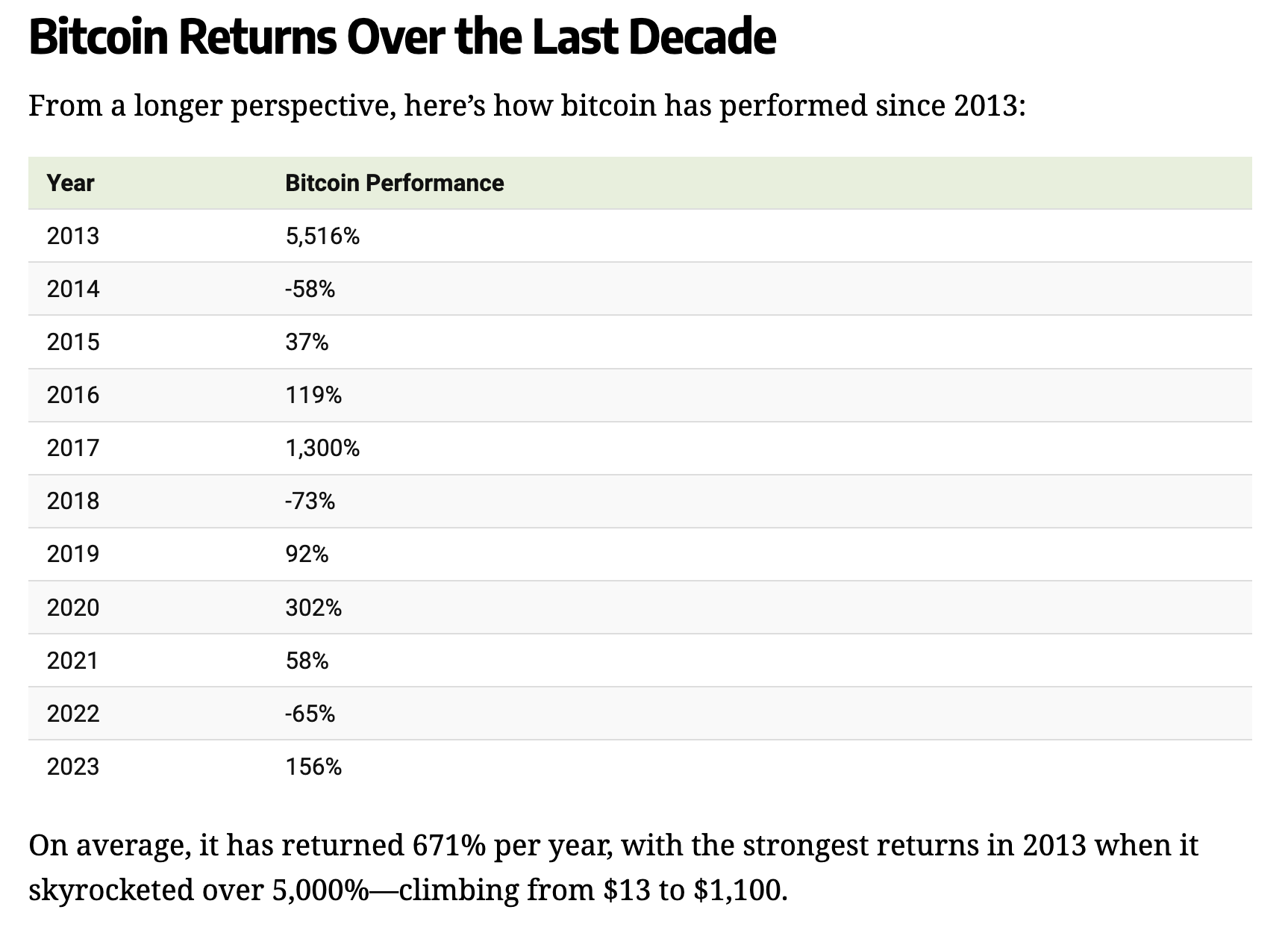

Since 2011, BTC’s cumulative gains for BTC equate to a whopping 20 million percent. 2013 was Bitcoin’s best-performing year, during which it gained 5,507%.

The data also shows that Bitcoin has only posted an annualized loss for two years of its history, with BTC falling by 58% and 73% during 2014 and 2018 respectively.

Since the start of 2021, BTC is up 108%, with the markets hitting an all-time high of just over $61,500 on Sunday, March 14.

Updated: 7-12-2021

By One Measure, Bitcoin Is One Of This Year’s Worst-Performing Asset Classes

The cryptocurrency is up, but it’s been quite a rollercoaster to get there.

Bitcoin is up around 16% so far this year. It’s not incredible, but it’s solid. On the other hand, it’s been quite a rollercoaster getting to that 16% return, with the cryptocurrency having gained over 115% between January and April before plunging more than 50%.

So as with all things crypto, or even Bitcoin itself, you’ve needed some serious stomach to achieve these returns.

Has it been worth it? Eh.

According to a Goldman Sachs list of risk-adjusted returns by asset class, Bitcoin is down near the bottom right now.

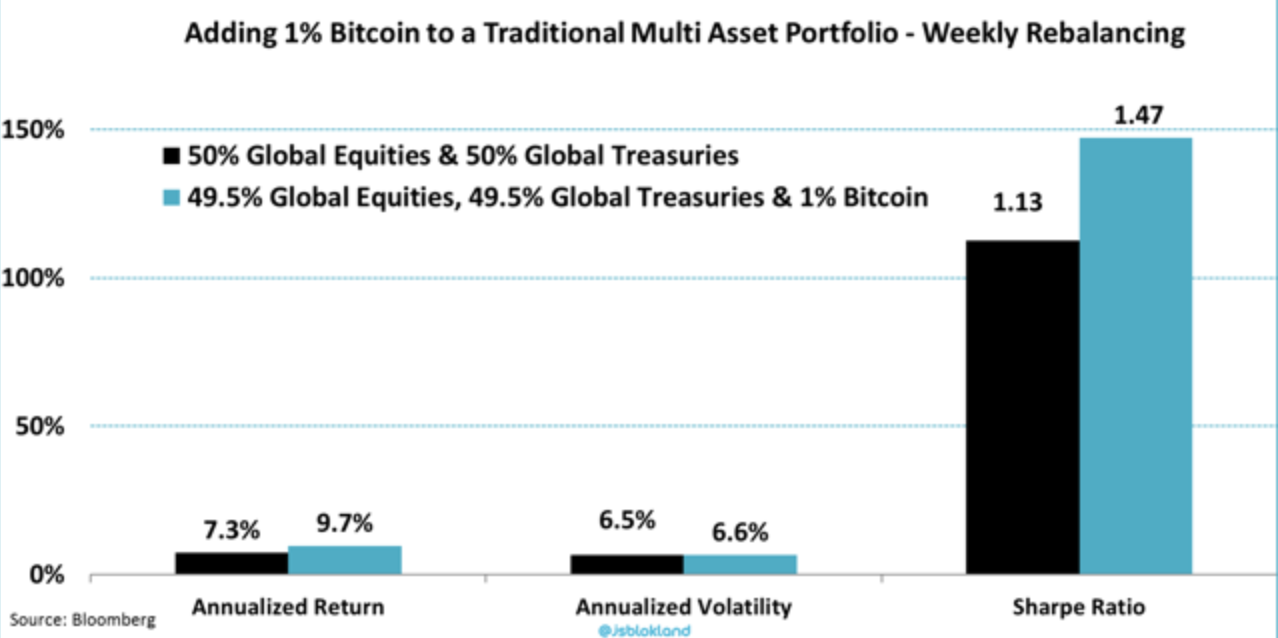

Basically when you adjust the returns for volatility (to get the Sharpe Ratio), Bitcoin has done a bit better than gold or Treasuries, but much worse than basically anything in the equity sphere. And while some defenders of Bitcoin’s “store of value” narrative might take some solace in outperforming Treasuries, the fact of the matter is that typically people aren’t into Treasuries for capital appreciation, whereas with Bitcoin they are.

Of course, some argue that Bitcoin isn’t an asset class, and that the asset class should instead be characterized as “crypto.” In which case Bitcoin is one of the year’s worst-performing cryptocurrencies.

Updated: 2-22-2022

Bitcoin Outperforms U.S. Equities On Ukraine Turmoil

Bitcoin rose as much as 3.4% to $38,319, while the Nasdaq 100 was down as much as 1.2%.

* Bitcoin Took Brunt Of Geopolitical Tensions Over U.S. Holiday

* Market Sentiment Could Change ‘On A Whim,’ McQueen Says

Bitcoin’s notorious weekend volatility is paying dividends Tuesday for investors in the largest cryptocurrency, which is outperforming U.S. equities for a change amid the uncertainty surrounding the turmoil in Ukraine.

The digital token has remained in the green through most of Tuesday after slumping through the three-day U.S. holiday weekend. By comparison, the Nasdaq 100 Index has extended losses from last week after trading resumed following the Presidents Day holiday.

“You tend to see overreactions that happen on weekends and holidays, and for a couple of hours overnight,” said Ed Hindi, chief investment officer and co-founder of Tyr Capital.

Bitcoin’s relationship with global markets had been strengthening despite it being long touted by advocates as an uncorrelated hedge against turmoil. The cryptocurrency has been mimicking movements in equities, most notably the technology benchmark Nasdaq 100 index. The correlation between the two rose was recently at 0.43, with a coefficient of 1 indicates asset classes move in lockstep.

Greg Waisman, co-founder of global payment network Mercuryo, said $40,000 is a key resistance level for Bitcoin in the short-term.

“The old adage of ‘turnaround Tuesday’ looks to be ringing true again as Bitcoin gains today,” said Justin McQueen, a strategist at DailyFX, by email. “Of course, an extension of this move higher is dependent on the situation between Russia and Ukraine and as we have seen, sentiment can change on a whim from one headline to the next.”

Updated: 3-30-2023

Bitcoin’s Stealth Rally Puts It Atop the Quarterly Scoreboard Once Again

Volatile Price Moves Are A Hallmark Of The Digital Currency

Market-Watchers Are At Odds Over Catalysts Behind Big Rally

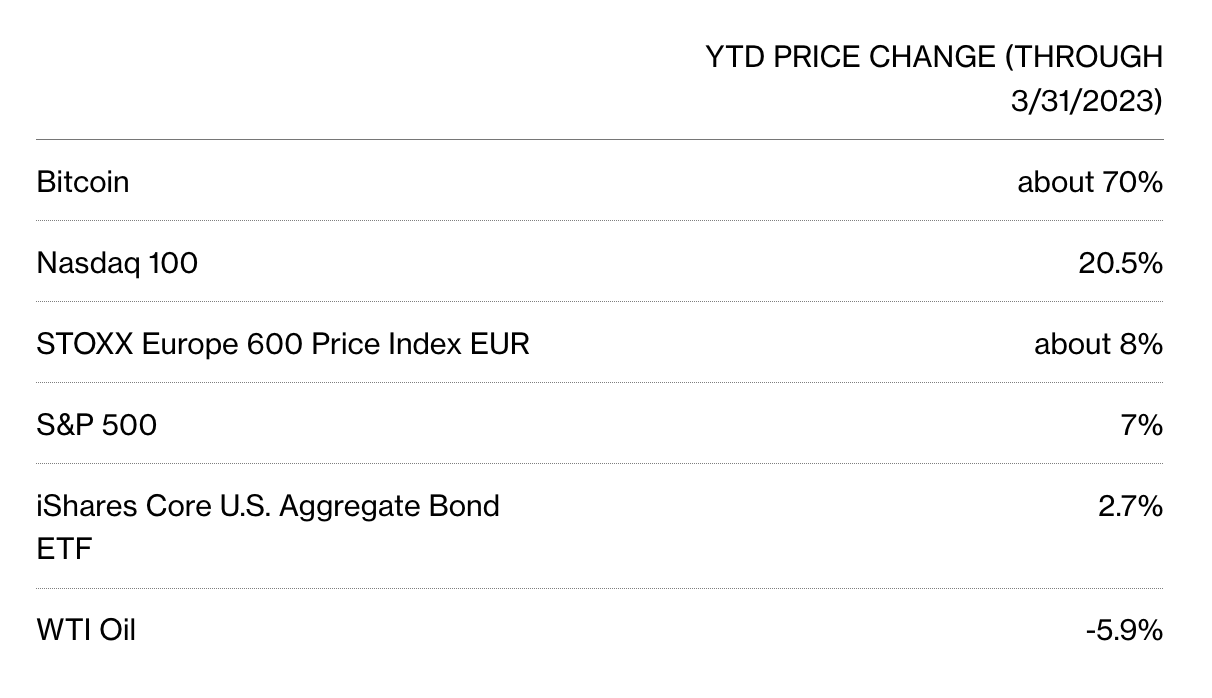

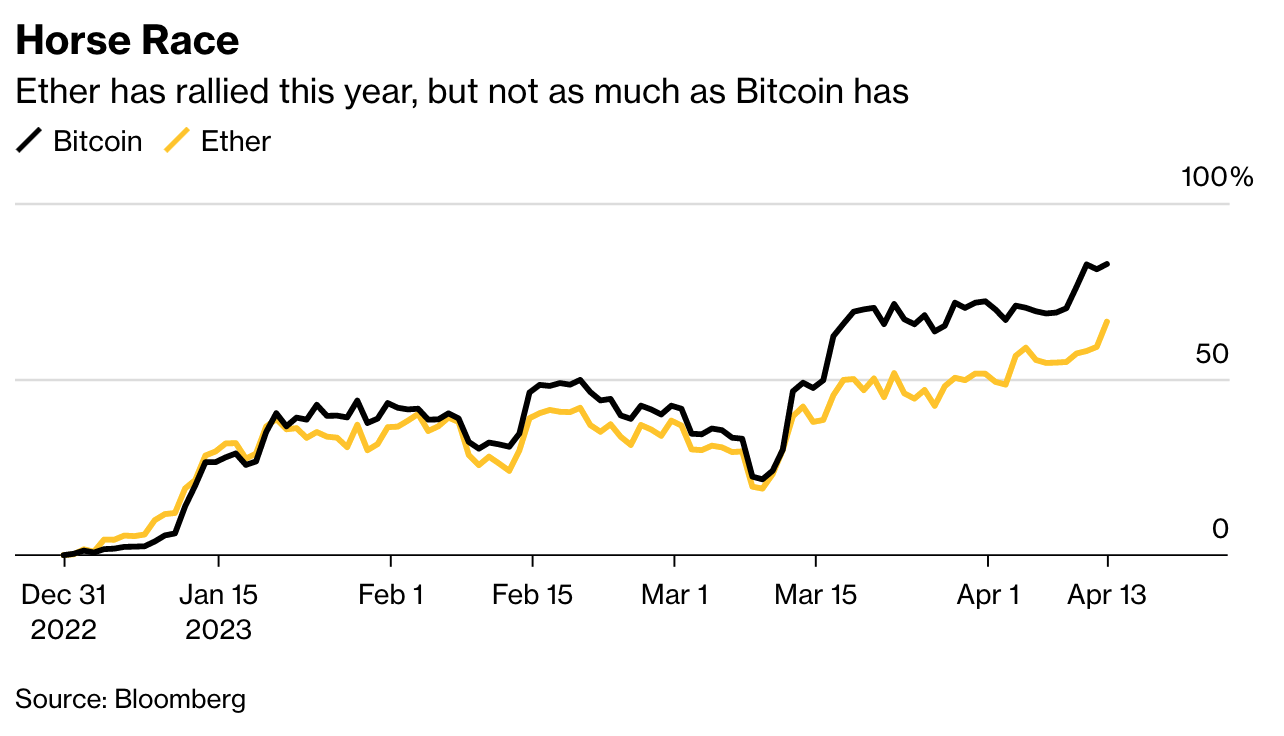

Bitcoin’s surprising fast exit from its “crypto winter” has once again put the notoriously volatile digital currency atop the leader-board in the first quarter for being the best-performing asset class by a wide margin.

With a 72% gain, Bitcoin closed out its best quarter since the three months ended March 2021, when it surged some 103%, Bloomberg data show.

That vastly outstripped the S&P 500’s 7% year-to-date advance, the Nasdaq 100’s 20.5% uptick and the iShares 20+ Year Treasury Bond ETF’s 6.8% jump.

Long-time participants note that volatility is expected — and is even part of the attraction to investors in the relatively embryonic asset class.

Bitcoin burst onto the mainstream consciousness with a more-than 1,000% annual gain in 2017, only to post a 74% drop the following year in what became known as a crypto winter.

Then after three consecutive annual increases, it tumbled 64% last year amid a series of industry scandals and bankruptcies.

“For many crypto market observers, it’s not at all a surprise,” said Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, of this year’s rally.

“All the signs were pointing to a strong price floor starting last November, and it was just a matter of time before either the liquidity narrative changed (which it did in early January) or longer-term investors saw a store-of-value opportunity (which seems to have also happened).”

Market-watchers are at odds over the exact causes behind Bitcoin’s big bounce. The coin started 2023 coming off its second-worst year ever. Partly, some say, it might have been recovering from such a bruising performance.

Yet many more have in recent weeks pointed to its origins as reasons why it’s back in demand: amid tremors in the global banking sector, the token can act as a sanctuary given that it’s independent of central banks, they argue.

“Most people’s knee-jerk would’ve said Bitcoin should do terribly because markets are under pressure or strain,” said Peter van Dooijeweert at Man Solutions. “But actually if you think about the Bitcoin bugs — the people who love Bitcoin — they love the idea of a non-fiat currency — like this is the outside-the-US-dollar, outside-of-the-banking-system-type thing.”

Matthew Sigel, head of digital assets research at VanEck, agrees. “Bitcoin has remained resilient because of legitimate fundamental improvements and its unique role as a bearer asset in a period of skepticism about bank deposits and more central bank bailouts,” he said in an interview.

No matter the catalysts, the coin’s recently been notching rally after rally. Over the last three weeks, which roughly covers the period of when banks in the US started to exhibit stresses, it’s only seen seven sessions out of 22 with losses and has posted a 40% jump in that period.

It’s not just Bitcoin — which is hovering just around $28,000 — that’s risen during the first quarter. Ether gained 52% to trade around $1,800.

To be sure, there are some companies as well as some exchange-traded funds that look to amplify returns that have performed better than Bitcoin has this quarter.

Shares of Nvidia Corp., with a 90% gain, have risen more than Bitcoin has since the start of the year, as have some crypto-specific ETFs, like the Valkyrie Bitcoin Miners ETF (ticker WGMI), which has jumped more than 100%. Levered products are usually also standouts, with 1.5x Nvidia and Meta Platforms Inc. ETFs each surging more than 100% year to date.

But out of a handful of major asset classes, Bitcoin’s still the standout. Bloomberg data show that in the world of commodities, sugar was the best-performing so far this year, with a 23% gain.

In bonds, a global inflation-linked total return index is up 4.5%, while among global stock gauges, the Laos Composite Index is up more than 44% through Friday.

Stephane Ouellette, chief executive of FRNT Financial Inc., points out that “seemingly, BTC rallies have come from ‘darkest before the dawn’ moments.”

“After the SVB failure and subsequent Signature closing, the narrative entering the week was that it would be a difficult period for crypto,” he said. “In fact, those events fueled the narrative for Bitcoin as an alternative to banking solutions and all of crypto inclusive of BTC had some fantastic positive trading days, which was unexpected for many.”

Updated: 4-4-2023

Bitcoin ‘Untouchable’ Amid Regulatory Pressures, Says Analyst

Bitcoin is “untouchable” because it’s more decentralized than other cryptocurrencies in the space, such as Ether, according to senior commodity strategist Mike McGlone.

Bitcoin (BTC) is “untouchable” despite ongoing regulatory pressures in the crypto sector, and those who don’t have some crypto exposure are “seriously silly” according to Bloomberg senior commodity strategist Mike McGlone.

During an April 3 stream with crypto podcaster Scott Melker, McGlone argued that unlike other cryptocurrencies such as Ether, Bitcoin couldn’t be killed by regulators because it’s more decentralized.

Can #Bitcoin replace the banks? And can it remain uncorrelated if markets crash again?

Discussing with weekly guests @mikemcglone11 and @daveweisberger1.

It’s Macro Monday at 9:30 am EST. https://t.co/WDVCbkkWyU

— The Wolf Of All Streets (@scottmelker) April 3, 2023

“There’s so much disdain about regulators pushing back on the whole space, and that’s the key thing where Bitcoin sticks out,” McGlone said.

“You can’t do anything to this, and you can’t kill it and it’s just unprecedented; it is untouchable.”

“You could make a case that Ethereum is a security when you hear about all these upgrades and people doing this and people doing that to make it better, I’m like okay, well that’s kind of scary, can’t do that to Bitcoin, it’s why it’s fine and impressive,” McGlone added.

The crypto sector has faced a wave of crackdowns in the United States recently, with the U.S. Securities and Exchange Commission filing charges against crypto exchange Kraken for its staking services, then suing stablecoin issuer Paxos over Binance USD.

The regulator also proposed rule changes targeted at crypto firms operating as custodians.

McGlone stated he is still bullish on BTC but expects the price to go down again in step with other assets if a recession hits.

Back in January, he warned BTC might not see the surge being predicted just yet, as there are challenging macroeconomic conditions and pressure from interest-rate hikes.

According to McGlone, the April 2 decision by the Organization of the Petroleum Exporting Countries (OPEC) to reduce daily oil output makes a recession more likely, as does interest rate hikes from the Federal Reserve to clamp down on inflation.

“We had our morning call this morning and our economist Anna Wong said, Yeah, their base case is for that recession to kick in Q3,” he said.

“OPEC is helping that. Fed tightening is helping that. So all assets have to go down. That means Bitcoin too. It’s the fastest horse in the race. So I’m overall, certainly relatively bullish.”

In McGlone’s opinion, it’s “seriously silly” to risk not having some exposure to crypto or trying to stand in its way.

“The key thing I look at simplistically for Bitcoin is, if you’re a money manager, why take the risk of not having some of this revolutionary asset, particularly because it’s so controversial you want to have at least some in it because you don’t want to look like an idiot over history,” he said.

“The smart guys get it; we’re not gonna be a Blockbuster or Sears, and we’re going to be part of this technology.”

Updated: 4-15-2023

Bitcoin Surged Past $30,000. Is Another Crypto Boom On The Way?

A rally in the world’s biggest cryptocurrency has some heralding the end of crypto winter, but a true thaw-out may still be a while away.

When Bitcoin plunged from around $30,000 to below $20,000 in little more than a week last year, Three Arrows Capital co-founder Su Zhu described the tailspin as the “nail in the coffin” for his hedge fund.

Fast forward to today, and the largest cryptocurrency has just retraced that path from $20,000 back to $30,000 in the past month — but the industry is a shadow of what it was the last time the token crossed that milestone.

That’s because several more caskets were hammered shut in the domino-like wave of bankruptcies that followed Three Arrows’ collapse: Voyager Digital, Celsius, FTX, Blockfi, Genesis Global, and other formerly high-flying startups.

It’s clear that while the mood has improved compared with last year’s apocalyptic vibe, the promising Bitcoin rebound alone won’t be enough to fix all of the damage from last year’s scandal-filled downturn.

“The sentiment here doesn’t seem like the last few weeks mean that we can pretend that the last 10 months never happened,” said Oliver Linch, the chief executive officer of the trading platform Bittrex Global, speaking on the sidelines of a crypto conference in Paris.

“But there is certainly a feeling that maybe this signals that a line can be drawn under those scandals and we can get back to assessing – and valuing – crypto without all the noise from the rumors and wrongdoing.”

That alleged wrongdoing has drawn a deluge of regulatory scrutiny and high-profile enforcement actions in the US.

Among the most prominent: FTX’s Sam Bankman-Fried is awaiting trial on fraud charges; Do Kwon, co-founder of the Terra blockchain, is facing prosecution for his role in that project’s collapse; Binance and its CEO Changpeng “CZ” Zhao have been sued by the Commodity Futures Trading Commission for a variety of alleged violations; and Coinbase Global Inc. has received notice that the Securities and Exchange Commission intends to sue the company.

Binance and Coinbase have denied any wrongdoing; Bankman-Fried has pleaded not guilty.

Then there is the recent failure of the crypto-friendly banks Silvergate Capital Corp., Signature Bank and Silicon Valley Bank.

While often cited as a bullish catalyst for Bitcoin, since they revived its origin story as an alternative to untrustworthy banks, the downfall of those lenders also severed key links to the US financial system, helping to make the once-promising future of the crypto industry as uncertain as ever.

Many of the retail investors burned by last year’s plunge in prices appear to be licking their wounds, rather than taking on new risk, because the amount of money involved in decentralized finance projects remains subdued.

While the total value of coins locked into DeFi projects is up more than 25% since the beginning of January, at about $50 billion it is still a fraction of the $180 billion peak reached in December 2021, according to the DeFiLlama website.

At the same time, thousands of jobs have been lost in the industry and hiring has not picked back up. In a sign of supply for talent still outstripping demand, blockchain project Concordium received more than than 350 applications for a couple of recent job openings, said its co-founder and chairman Lars Seier Christensen.

“The space is maturing a bit, realizing that the money tree available a couple of years ago has withered a bit,” he said.

Investments from venture-capital firms have slowed dramatically. Private funding for crypto startups globally fell to $2.4 billion in the first quarter, an 80% decline from its all-time high of $12.3 billion during the same period last year, according to PitchBook.

“A lot of the industry is still in wait-and-see mode,” said Matteo Dante Perruccio, international president at crypto wealth manager Wave Digital Assets. “There has been a flight to quality and the beneficiaries are those companies that weren’t hit by the crypto winter.”

Another way this move higher is different: The eye-popping 83% rally in Bitcoin this year has not been matched by newer coins. Ether, which greatly outperformed Bitcoin from 2020 and 2021, is up 71% this year.

The Bloomberg Galaxy DeFi Index that tracks the largest decentralized-finance protocols has recoupled only about one-tenth of last year’s 2,000-point drop.

“We could be seeing a case of seller exhaustion combined with a renewed bullish narrative following the banking crisis, all mixed with generally low liquidity that has helped BTC’s price toward the upside,” said Clara Medalie, director of research at market-data provider Kaiko.

Despite all of the gloom and uncertainty, progress in the evolution of the industry has continued. Ethereum this week completed what appears to be a successful upgrade to its network.

The so-called Shanghai update, which enables investors to withdraw Ether coins that they had locked up in exchange for rewards as part of a “proof-of-stake” system to safeguard the network, could lure billions of dollars into Ether even after SEC Chair Gary Gensler indicated he believes that token ought to be regulated as a security. The price of Ether rose back above $2,000 this week for the first time in six months.

“I don’t think there’s the mania or gusto we saw at $30k or $40k, but there is still, behind the scenes, quiet progress,” said Simon Taylor, head of strategy at Sardine, a fraud prevention startup whose clients include fintech and crypto companies.

The macro picture has also changed, potentially for the better. A year ago, the Federal Reserve and other central banks were only beginning what would become a series of interest-rate hikes that reversed a years-long policy of easy money.

With the end of that tightening cycle now closer at hand, the conditions may once again be ripe for a crypto boost.

One big question is how enthusiastic traditional financial institutions will be going forward, and whether they’ll be willing to step in to fill the roles once played by failed crypto startups like FTX.

There are some indications that could be happening. Nasdaq Inc., for example, expects its custody services for digital assets to launch by the end of the second quarter.

Over the long haul, as much as $5 trillion may transition into new forms of money, such as central bank digital currencies and stablecoins, by 2030, according to a Citigroup research study.

Another $5 trillion worth of traditional financial assets could be tokenized, helping drive mass adoption of blockchain technologies, according to the report.

Even so, for Michael Purves, the chief executive officer of Tallbacken Capital Advisors, the “‘show me’ threshold” will be higher this time around for institutional investors, considering the role crypto is meant to play in a portfolio is a moving target.

Once touted as a hedge against inflation — like an Internet-age gold — it instead tumbled during the worst consumer-price surge since the 1980s.

“Institutions started to take Bitcoin seriously after Bitcoin broke $20,000 in 2020 and played a key role in the subsequent rally to $69,000,” he wrote in a recent note to clients. “However, this time around, its longer-term history of not providing portfolio diversification will weigh heavily on institutions, which probably have bigger headaches to worry about.”

Updated: 6-23-2023

Bitcoin Hits Highest In A Year As Crypto Rebounds From Scandals

* Largest Digital Token Has Rallied Almost 90% This Year

* Price Remains Less Than Half The Record High Of Almost $69,000

Bitcoin hit its highest level in a year amid renewed fervor for digital assets despite a slew of challenges for the industry.

The original digital currency crossed above $31,013, its 2023 peak, to reach its highest level since June 2022, Bloomberg data show. The surge has brought Bitcoin to as high as $31,410 and up by almost 90% since the start of the year. Other cryptocurrencies followed suit, with Ether also rallying.

It’s a remarkable development — and show of resiliency — for a market that many had written off as being on the verge of extinction following a number of high-profile and high-impact scams and company fallouts that left the industry besmirched among investors.

“From the ardent Bitcoiner’s perspective, the token’s most fundamental investment thesis is playing out: inflation, monetary mismanagement, banking crises, sovereign debt anxiety, US-dollar-reserve-status questions are all playing a role in giving Bitcoiners an ‘I told you so’ moment,” said Strahinja Savic, head of data and analytics at FRNT Financial. “I would not describe rallying to new all time highs despite the challenging environment, but rather because of it.”

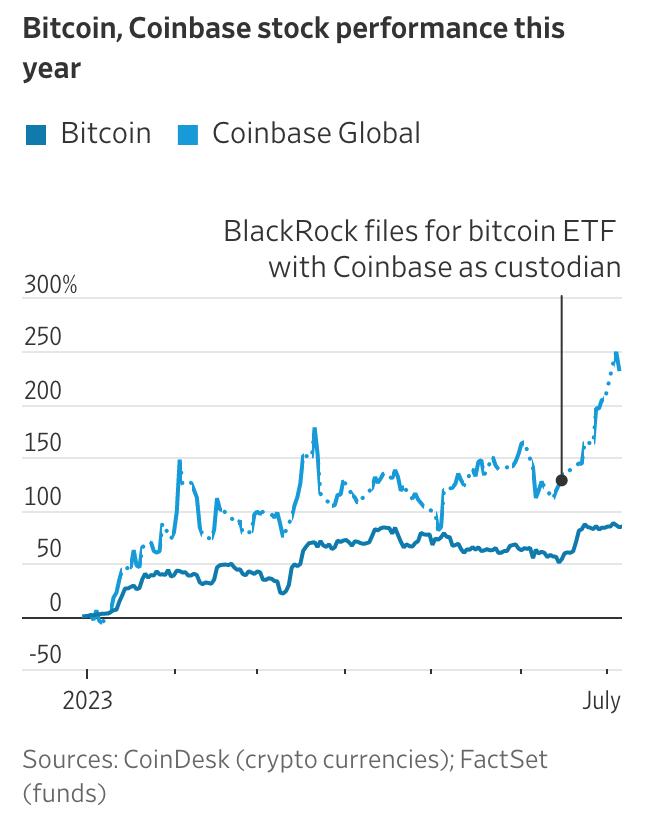

Most recently, it’s been news about BlackRock Inc.’s shock filing for a US spot Bitcoin exchange-traded fund that’s reignited fervor for crypto, with some in the market hoping that such a product — which currently doesn’t exist — gets approval from regulators.

An approval — whatever its odds — would mark a win for fans who have for years longed for such an investment product.

“BlackRock’s filing is big news for Bitcoin due to its close ties with regulators and a very strong ETF-approval track record,” wrote K33’s Bendik Schei and Vetle Lunde. “It’s also worth noting that BlackRock would not dedicate time and resources to this filing if they did not view the probability of long-term strength from BTC, and thus strong inflows, as substantially high.”

They added: “An approval would profoundly impact the market structure of Bitcoin, as it would reduce the barriers for financial advisors to offer exposure to BTC through an accessible investment vehicle with daily creations and redemptions delivered by a trusted issuer.”

Other recent news also reinforced crypto believers’ faith in the rally. A new crypto exchange backed by firms including Citadel Securities, Fidelity Digital Assets and Charles Schwab Corp. — called EDX Markets — said it’s gone live.

And, among other pieces of news, JPMorgan Chase & Co. expanded one of the most high-profile projects to bring blockchain technology to traditional banking, introducing euro-denominated payments for corporate clients using its JPM Coin.

“The effects of the so-called ‘crypto winter’ seem less persistent today than a year ago, as various jurisdictions and institutional players continue to embrace crypto-related initiatives,” David Duong, head of research at Coinbase, said in a recent note.

On Twitter, where a lot of crypto discourse takes place, a number of users cited FOMO — or the fear of missing out — as part of the recent price surge, whereby some investors jump into the market because they are watching others reap the benefits of the rally and want to take part in it.

But the fact that the industry is facing harsh regulatory oversight has not dissipated, despite all the renewed hype over prices surging.

The SEC has set its sights on the crypto space following last year’s numerous instances of scams and fallouts of once-vaunted companies, including FTX and a number of lenders.

It’s led to a mass exodus by retail investors in particular, who have collectively lost billions of dollars in the wake of the revelations and implosions.

Trading volumes have dried up as a result. In May, the combined spot and derivatives trading volumes on centralized exchanges fell more than 15% to $2.4 trillion, according to CCData.

Spot trading volumes alone dropped nearly 22% to $495 billion, notching the lowest monthly reading since March 2019, the researcher said in a report.

“People are speculating BlackRock’s heft in the financial markets will help them get approval. I am not quite there yet,” said Michael O’Rourke, chief market strategist at JonesTrading. “The SEC has been aggressively cracking down on the crypto space, it seems a bit early for such an about-face.”

Updated: 7-10-2023

Bitcoin, Coinbase Are Soaring Despite Obstacles Facing Spot Bitcoin ETFs

Bitcoin and crypto stock Coinbase Global have soared on hopes that an exchange-traded fund that holds the digital currency will soon be approved by U.S. regulators.

Bitcoin has climbed about 20% since June 15, when BlackRock filed paperwork with regulators to launch an ETF that would own bitcoin. Shares of Coinbase Global, which is listed as the custodian for the fund’s bitcoin holdings, leapt more than 40% over the same period.

Approval of such a fund—known as a spot bitcoin ETF—by the Securities and Exchange Commission would mark a milestone for the industry and offer wider access to the cryptocurrency. Investors would be able to buy and sell it through a brokerage account as easily as shares of stock.

Fidelity Investments, Cathie Wood’s Ark Investment Management, Invesco, WisdomTree, Bitwise Asset Management and Valkyrie updated and reactivated their own applications following BlackRock’s move.

Yet the SEC has repeatedly rejected spot bitcoin ETF applications going back to 2017 on the grounds that they are vulnerable to fraud and market manipulation. At least half a dozen ETFs that own bitcoin futures are already on the market.

Analysts say that outcome faces long odds and warn steps to limit market manipulation might not clear SEC’s bar.

In previous denials, the regulator argued that the filings didn’t specify an agreement to share “surveillance” between the stock exchange where the ETF would be listed and a spot bitcoin-trading platform that is “regulated” and “of significant size.”

The crypto platform is meant to share data for orders and trades as well as information about buyers and sellers, with the stock exchange to prevent potential market manipulation.

Some industry watchers say the latest round of applications might not clear the bar either.

Several of the asset managers, including BlackRock, Fidelity and Ark, specified that Coinbase would help monitor trading.

But analysts warn that Coinbase might not tick the box for “regulated market” or “significant size.” The SEC sued the exchange last month saying it violated rules that require it to register as an exchange and be overseen by the federal agency.

Although it is the largest crypto exchange in the U.S., with more than half of the domestic market share, Coinbase accounts for just 7% of global spot market share, according to digital assets data provider Kaiko. In contrast, Binance has 52% of the global market share.

“Given that they are under these SEC charges, it’s an open question that the SEC would allow these ETFs to be approved until there’s an outcome there,” said Stephen Glagola, an analyst at TD Cowen.

Some of the applications, including the one from BlackRock, outline a second surveillance-sharing agreement with CME Group, which lists bitcoin futures and is overseen by the SEC.

That is unlikely to satisfy the agency either, according to John Paul Koning, an independent financial writer. The securities regulator has never accepted previous applicants’ arguments that futures trading on the CME exerts enough influence over the global market to qualify as “significant,” he said.

“As long as Binance and the offshore spot and futures markets are so big, it will probably never be possible to prove to the SEC that the CME exerts more than temporary and intermittent leadership over the global price of bitcoin,” Koning said.

The SEC has also sued Binance, alleging the overseas company operated an illegal trading platform in the U.S. and misused customers’ funds.

Investors and analysts have viewed the bid by BlackRock, the world’s largest money manager, as the best hope yet for a spot bitcoin ETF, partly because of its near-perfect record of seeing applications through.

BlackRock Chief Executive Larry Fink, a longtime critic of bitcoin, called the token “digitizing gold” and “an international asset” last week in an interview with Fox Business.

“When and if these ETFs get introduced, they are going to bring a lot of money in and a lot of action,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. “You cannot overstate how potent and powerful the ETF is as a bridge to a gigantic wad of money, especially from financial advisers.”

Balchunas and his team put the odds of a spot bitcoin ETF approval at 50%, up from just 1% a month ago, before BlackRock filed its application.

The latest leg of the race to launch a spot bitcoin ETF hit a speed bump last week when the SEC said the applications were inadequate. Nasdaq and Cboe Global Markets, which had filed for the ETFs on behalf of the asset managers, quickly updated and refiled their applications to address the regulator’s feedback.

“We work really closely with our regulators and we want to hear from the regulators what are their issues, and how can we fix those issues around that,” Fink said in the Fox Business interview. “So we hope that like in the past, we could be working with our regulators and get the filing approved one day.”

The SEC has up to 240 days to approve or reject the applications.

Although Coinbase is thought to be a potential winner should regulators eventually approve the funds, some analysts are skeptical that there is much meaningful revenue to be earned via providing custody services to the likes of BlackRock.

As the bitcoin custodian of the BlackRock fund, Coinbase would be responsible for safekeeping the bitcoin and would receive a fee based on the total value of those assets. Coinbase is already the custodian of the world’s largest bitcoin fund, the $19 billion Grayscale Bitcoin Trust.

TD Cowen’s Glagola estimates Coinbase would generate just $57 million in additional annual custody revenue, if BlackRock’s fund gathered the $43.6 billion in assets that the Grayscale fund held under management at its peak. That would represent about 2% of Coinbase’s trailing 12-month net revenue.

“The custodial fee business isn’t a high revenue-generating business for Coinbase—I don’t expect that to be a meaningful driver of upside for them,” Glagola said.

Updated: 10-25-2023

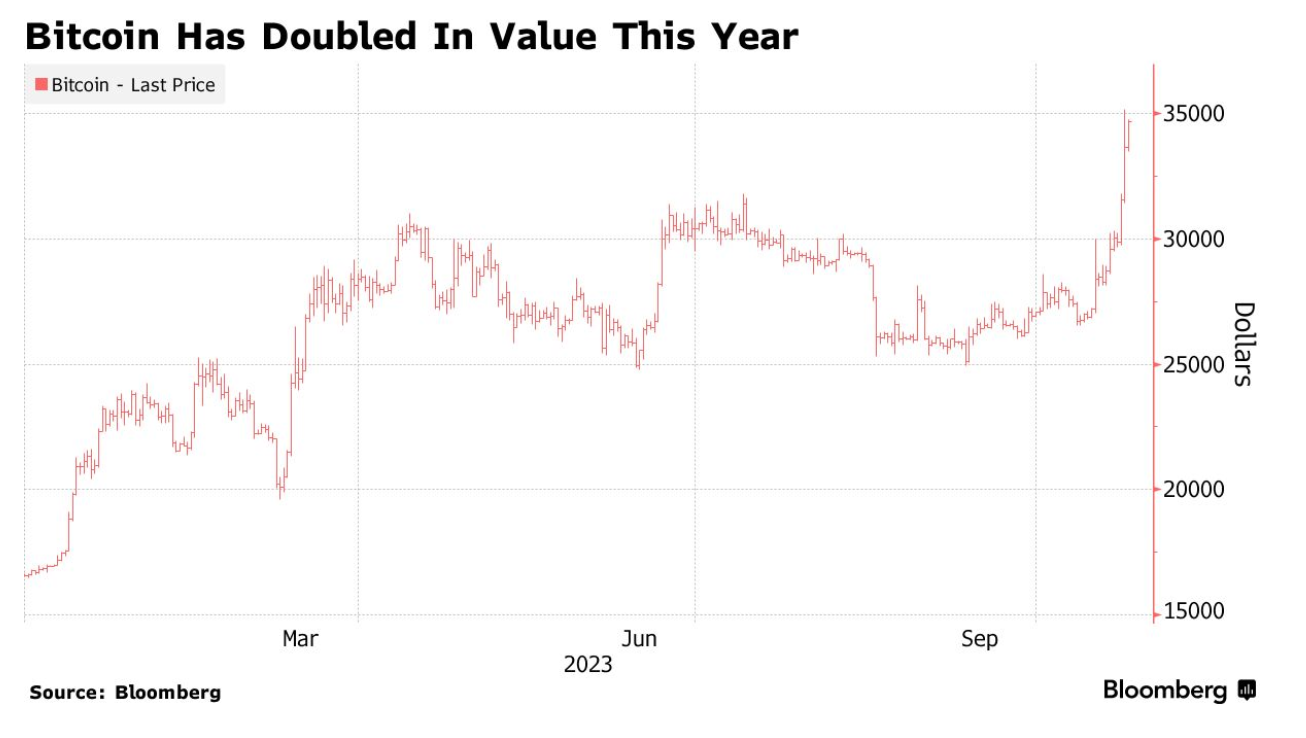

Bitcoin Has More Than Doubled This Year In Unforeseen Resurgence

* Cryptocurrencies Are Rallying On Expectations For Spot ETFs

* Court Formalized A Victory For Grayscale In Fight With SEC

Bitcoin has now more doubled in value this year in a surprising resurgence from a tumultuous 2022 that had some skeptics predicting the demise of digital assets.

The largest cryptocurrency by market value rallied for a third day, pushing the price back to around $35,000, the highest level in about 18 months. Bitcoin tumbled 64% last year amid industry scandals and bankruptcies. It reached a record of almost $69,000 in late 2021.

Growing expectations that the US Securities and Exchange Commission will authorize exchange-traded funds that invest directly in the cryptocurrency after a decade of deliberation has fueled a more than 25% rally over the past two weeks.

“Sentiment is clearly bullish as more and more signs start to reveal what appears to be a likely, imminent listing for a spot Bitcoin ETF in the US,” said Darius Tabatabai, co-founder at decentralized exchange Vertex Protoco.

On Monday, a federal appeals court formalized a victory for Grayscale Investments LLC in its bid to create an ETF based on Bitcoin. Last week, Bitcoin briefly surged 10%, the highest price since August, on an erroneous report that BlackRock Inc. had won SEC approval for an ETF.

Tabatabai added that the exchange saw a new all-time record for shorts being liquidated over the past 24 hours, with one of the highest volume days ever.

“Bulls largely came roaring back and brought some much needed optimism to what has been a fairly bleak market for some time,” Tabatabai said.

Matthew J. Maley, chief market strategist at Miller Tabak + Co., LLC, said that geopolitical strains are also contributing to the rally.

“I think investors are thinking that the increase in geopolitical hotspots in the world is raising the odds crypto will be an important currency quicker than they thought previously,” Maley said.

The three-day rally is the largest since March. When Silicon Valley Bank collapsed on March 10, Bitcoin rallied for four consecutive days, climbing above $26,000 for the first time since June of last year.

While Bitcoin prices might experience a short-term price pullback, the currency is poised to continue rising over the long term, according to James Butterfill, head of research at CoinShares.

“Before the ETF hype, Bitcoin’s price closely mirrored the expected probabilities of a December rate hike,” Butterfill said. “As these probabilities decrease in light of increasing treasury yields, it seems it could further support prices, poising to shape the next bull market for Bitcoin over the longer term.”

Updated: 10-26-2023

Bitcoin Restarting 2023 Uptrend After 26% Uptober BTC Price Gains — Research

Bitcoin has delivered gains that “set the foundation for a resumption of the 2023 uptrend,” says the latest BTC price analysis from Glassnode.

Bitcoin is due to finish 2023 as it started, on-chain analytics firm Glassnode said, as October gains near 30%.

In the latest edition of its weekly newsletter, “The Week On-Chain,” released Oct. 24, researchers argued that the past week “sets the foundation” for a BTC price uptrend.

BTC Price “Convincingly” Beats Out Resistance Levels

As it hit $35,200 this week, Bitcoin eclipsed various key trendlines, which had previously acted as support for months.

These included various moving averages (MA), among them the 200-week simple MA at $28,400 — the classic “bear market” support line.

“A cluster of long-term simple moving averages of price are located around $28k, and have provided market resistance through September and October,” Glassnode noted.

“After a month of the market grinding higher, the bulls found sufficient strength this week to convincingly break through the 111-day, 200-day, and 200-week averages.”

In so doing, the profitability of various investor cohorts improved considerably. The so-called cost basis of speculators and market newcomers also lies near $28,000.

“The Short-Term Holder (STH) cost basis is also now in the rear view mirror at $28k, putting the average recent investor into an average profit of +20%,” “The Week On-Chain” continued.

Researchers uploaded a chart of the short-term holder market-value-to-realized-value (STH-MVRV) ratio, which tracks the profitability of STH coins. They noted that even prior to the October upside, no major capitulatory behavior was visible.

“We can see instances in 2021-22 where STH-MVRV reached relatively deep corrections of -20% or more,” they explained.

“Whilst the August sell-off did reach a low of -10%, it is noteworthy how shallow this MVRV decline is by comparison, suggesting the recent correction found noteworthy support, being a precursor to this week’s rally.”

Bitcoin “Sets The Foundation” For Green Year

As Cointelegraph reported, the presence of STH entities versus their seasoned counterparts, the long-term holders (LTHs), is now historically low.

Despite facing profitability issues of their own, LTHs now own more than three-quarters of the available BTC supply for the first time.

Their cost basis is lower, further toward $20,000 — and while some believe that Bitcoin could still return to that area, Glassnode is optimistic over how the year will end.

“A meaningful proportion of supply and investors now find themselves above the average break-even price, located around $28k,” it concluded.

“This sets the foundation for a resumption of the 2023 uptrend. At the very least, the market has crossed over several key levels where aggregate investor psychology is likely to be anchored, making the weeks that follow important to keep an eye on.”

Per data from on-chain monitoring resource CoinGlass, BTC/USD is currently up 26% this month — by October standards, still relatively modest.

Updated: 10-28-2023

I Need Enough Money To Say ‘No’ To Jobs. How Do I Get That? #BitcoinFixesThis

For me and my peers, it’s important to have more control over our work lives. That means we have to build up a walking-away fund.

When I graduated from college in 2011 into a slow job market, I was happy to take any job. But two years later, I found myself stuck in a role without a career trajectory or opportunities for growth, and I realized I had to walk away.

Related:

Billionaire Investor Tim Draper: If You’re a Millennial, Buy Bitcoin

Millennials Prefer Bitcoin To Alibaba, Netflix Stock

A Guarded Generation: How Millennials View Money And Investing

‘Playing Catch-Up In the Game of Life.’ Millennials Approach Middle Age In Crisis

Millennials Are Still Catching Up From The Last Recession. Now They Face a New One

I got some other gigs lined up, asked for a small raise, and when they said no, I also said no, getting out of that dead-end job.

Ever since then, the power of saying no to jobs—of having options—has stayed with me.

It stayed with me as I survived layoffs and slogged through restructurings, ending up in positions that neither suited my skill sets nor taught me new ones. It stayed with me as I saw friends being laid off at seemingly stable companies.

And it stayed with me as friends made big changes in their careers and their lives—whether it was a breakup-spawned move to another city or a later-in-life career change.

That’s when I realized an emergency fund isn’t enough. In this economy, I needed what others might use an expletive for but I’ll just call my “options fund.”

Whereas an emergency fund is something I dip into when I don’t have a choice, this is the money I’m saving for when I want to make a choice.

“It’s basically like, ‘I want to make a change,’ ” says AJ Ayers, a financial adviser and co-founder of Brooklyn Fi. “If I don’t like my job, I don’t like my living situation, I don’t like my relationship, I have enough financial security to get out of this uncomfortable state I’m in.”

Layoffs And Debt

Having an options fund has felt especially crucial for me and my peers. In a world where layoffs are common, employment stability rarely lasts a decade, let alone a lifetime.

If we survive a layoff, we might end up in restructured roles that no longer fulfill our career goals; the ability to walk away in search of another can be powerful.

If we do get laid off, this cushion helps in the job search after; we don’t want to take just any job that comes along. We want to be able to pause and find the job we’re passionate about, not just one to pay the bills.

One such friend got laid off recently; he’s using his fund to give himself a breather so he can take his time finding the next role to grow his skills and career.

And it isn’t always about a job. This need for extra stability bleeds through into our home life, perhaps explaining why my peers are getting married—and having children—later.

One friend told me she waited to become financially secure before getting hitched, saying, “I didn’t want to get married unless I knew I could afford a divorce.”

Some might see that as a bad omen; I see it as an understanding that some things are out of individual control. There’s also a psychological benefit of having this fund.

Having an extra cushion might not make a divorce or a layoff OK, but it certainly makes tackling a bad situation more manageable, removing at least one worry.

Still, we know it won’t be easy to raise that kind of money. As a generation, we’ve entered the workforce with more student debt than those who came before us, making it harder to suddenly stop working, even if only for a short time. Add on the standard financial advice of saving for emergency funds and retirement, and this third fund seems rather daunting.

How Much Is Enough?

The biggest question as I started building my own options fund is figuring out how much I really need. While some millennials might be part of the FIRE movement (financial independence, retire early), my friends and I aren’t necessarily thinking about early retirement.

We just need a little wiggle room. To that end, a very basic calculation Ayers recommends is simply multiplying a current monthly pay stub by the number of months you may want to take for yourself. That way, you can at least maintain your current quality of life.

That number can also vary based on age, lifestyle choices and location. “[It] means something different at 22 than it does at 40 and at 65,” Ayers says.

In my early 20s, when I had a higher tolerance for life’s inconveniences, my cost of living was lower. In my 30s, that number has gone up; my body can no longer handle cheap pizza dinners, and I tend to take taxis rather than subways after midnight.

The fact that I don’t have children helps, but the fact that I continue to stay in New York City doesn’t.

This is where trade-offs come into play. “What’s the secret of getting to financial independence? There’s really two options: One is to make more money and the other is to spend less money,” Ayers says.

“Do you really enjoy going out to eat every single night? Do you need to move to a cheaper city to have cheaper rent, to continue to live your life?”

I’m not quite ready to leave New York City, so I’ve taken the first option: Make more money. When I can freelance, I’ve said yes to every job, no matter how small.

Most of that money—along with any tax refunds or bonuses—gets socked away into a separate investing account, ignored like it doesn’t exist.

When and if freelancing isn’t available, Ayers says starting with small, incremental goals might feel more achievable, like putting away 10% of every paycheck into a high-yield savings account.

Cutting My Budget

Spending less money has been harder, especially with the inflation of the past couple of years. Instead of limiting my grocery bill, however, I’ve focused on avoiding lifestyle inflation.

I try my best to scroll quickly past consumer-based TikToks to curb any “life-changing” home buys, and still restrict myself to buying secondhand clothes via resale websites.

But the biggest savings adjuster might be housing. While millennials have been behind when it comes to homeownership, those who can save money on rent or live with their parents are subjects of envy within my friend circle.

Other trade-offs can also make a big difference over time; one of my friends stayed for 10 years in a below-market-rent apartment, instead of splurging on a higher-rent option with more amenities.

“Would it have been nice to have a dishwasher or consistent hot water or not have to carry groceries up four flights of stairs? Of course,” she says. “But being able to save $100,000 over that same period was so much nicer.”

The dream is of course to never have to make a big decision that will upend my life. But as I’ve had to book last-minute flights for a family funeral, ended a long-term relationship, and chatted with multiple friends who have been laid off and are struggling to find full-time jobs, I’ve started to give priority to this slush fund more.

There are a lot of things I can’t control, but having financial options is something I can. And even if I never choose to use this options fund, if I’m lucky, it will grow into the type of money I can do whatever I want with.

Updated: 3-21-2024

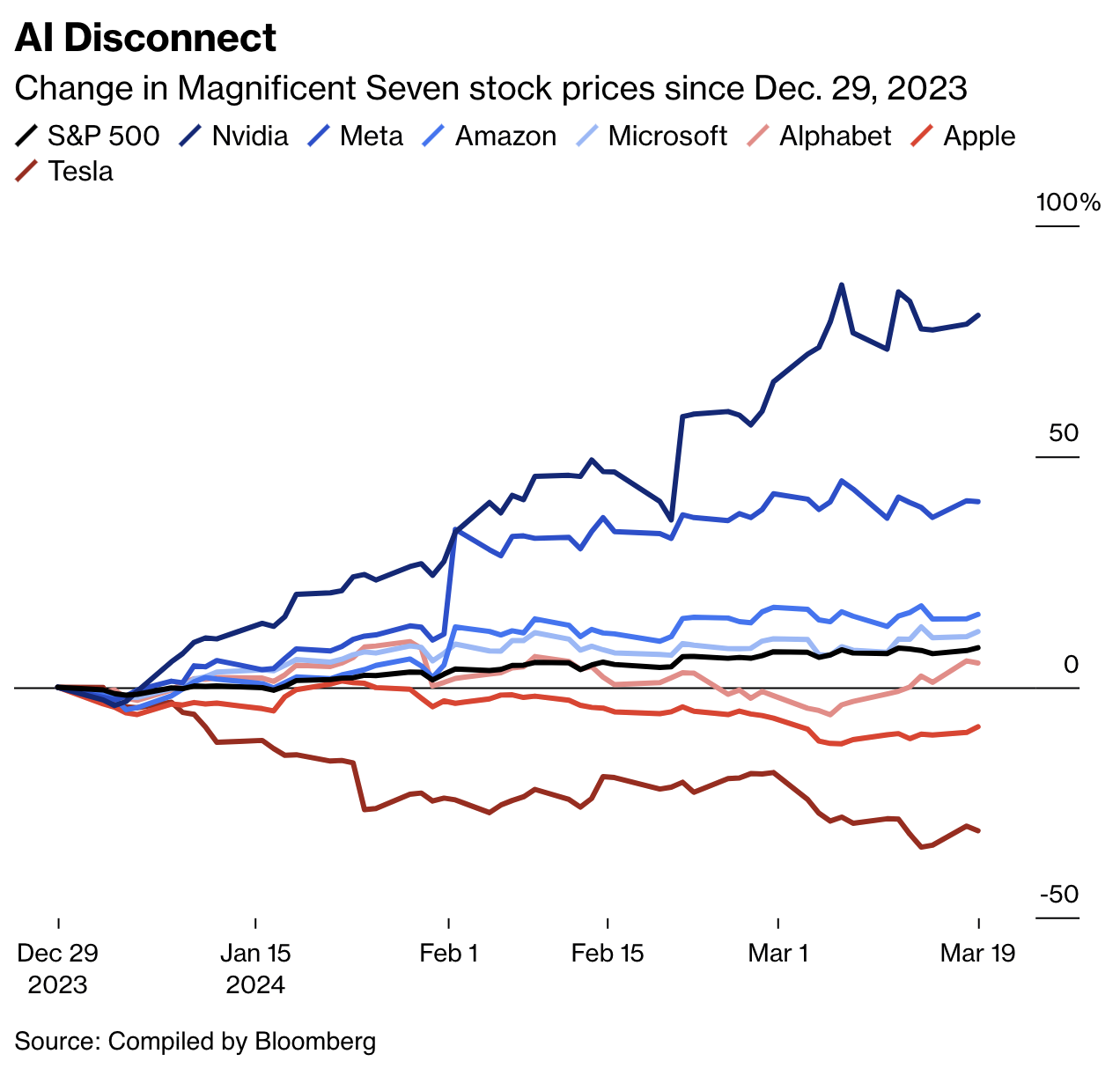

Magnificent Seven? It’s More Like The Blazing Two And Tepid Five

Nvidia and Meta have pulled away from the rest of the once-hot group as investors focus on AI.

For more than a decade, the stock market has been supercharged by a handful of technology behemoths that have offered the promise of hypergrowth.

You Know Them: household names such as Google parent Alphabet, Amazon.com, Apple, Facebook parent Meta, Microsoft and Tesla.

Grouped under various acronyms that played off their corporate monikers—FANG, FAANG, MAMAA—these companies became a staple of just about everyone’s portfolio.

Then last year, a newcomer joined the crowd: Nvidia Corp., the leading chipmaker for artificial intelligence technology.

With its stock up more than sixfold since the start of 2023, portfolio advisers soon began talking about an investment strategy built around a new grouping, the “Magnificent Seven.”

But this year, the Magnificent Seven has looked more like the Magnificent Two, the Middling Two and the Meh Three. As investors have come to focus on the importance of AI, Nvidia and Meta have surged ahead, Microsoft and Amazon have done reasonably well, and the other three have trailed the S&P 500 index.

“No matter how good it is, if it doesn’t have that AI component, you’re not going to drive investors’ attention right now,” says Kim Forrest, chief investment officer at Bokeh Capital Partners.

Tesla Inc., which has struggled to make any realistic claim as an AI player even as it grapples with questions about the EV market and concerns regarding Elon Musk’s leadership, is the worst-performing stock in the S&P 500 this year, sinking almost 30% as of March 20.

Apple Inc. is also down, and Alphabet Inc. has underperformed the broader market. But on March 18 they both took a big jump, with the latter posting its best day since December.

The reason? AI again. Bloomberg News reported that Apple was in talks to license Google’s Gemini AI engine for the iPhone.

Despite Apple’s strong showing on the Google news, some investors suggest that if Apple can’t boost its AI credibility, it will start looking uncomfortably like Coca-Cola Co.—a solid performer with reliable revenue, but lacking the hypergrowth investors demand from tech stars.

Apple has “become more of a value stock,” says Phil Blancato, chief market strategist at Osaic Holdings Inc.

Similarly, Alphabet’s surge doesn’t solve its recent AI difficulties. In February, users discovered that Gemini struggled to provide accurate images of various races in historical contexts, such as requests regarding America’s Founding Fathers.

That sparked conspiracy theories on social media, with some claiming Google harbors a hidden bias against White people. Sundar Pichai, Alphabet’s chief executive officer, called Gemini’s performance “completely unacceptable” and paused its generation of images of people.

Expect AI to continue to reshape the corporate landscape. Microsoft Corp.’s partnership with industry pioneer OpenAI has helped it edge out Apple as the world’s most valuable company.

Microsoft now has a market value of almost $3.2 trillion, while Apple’s is $2.8 trillion—but Nvidia suddenly isn’t far behind, at $2.3 trillion.

This explains why Apple CEO Tim Cook has promised that his company will “break new ground” in AI this year. The plan is crucial to investors desperate for new growth sources.

Bloomberg News has reported that Apple is planning a big announcement at its annual software developer’s conference in June, though many shareholders are losing patience and turning to stocks with a clearer path in AI, including Microsoft and Nvidia.

“If you took AI out of the picture right now, and the sensationalism, would people look at Apple differently?” says Kevin Walkush, portfolio manager at Jensen Investment Management. “I think they would.”

A deal between Apple and Alphabet would build on an existing partnership that has for years seen Google pay billions of dollars annually to be the default search option in the Safari web browser.

Talks between the two companies on AI collaboration remain active, but no formal announcements are expected until this summer. And Apple could still choose to work with other players—it has also held talks with OpenAI—or tap multiple partners. Apple and Google declined to comment.

Both companies could do worse than to look at Microsoft for guidance. It’s currently trading near a record high, but when Satya Nadella took over in 2014, it was considered an outdated software maker with a 20th century mindset and a languishing share price. Now the company that gave Windows to the world is everywhere, from the cloud to AI.

“Microsoft finally got going,” says Mark Lehmann, CEO at Citizens JMP Securities LLC. “But it took them 15 years to figure it out.”

Updated: 7-8-2024

Bitcoin Price Weakness Spurs $441M Investors’ Buying Sprees!! #GotBitcoin

CoinShares revealed a market buying opportunity amounting to $398 million in inflows for Bitcoin in the last week.

The July 8 report also highlighted an inflow into Bitcoin (BTC) amounting to $398 million. According to CoinShares, the weakness of Bitcoin prices, alongside activity from Mt. Gox and selling pressure from the German government, were the likely causes of investors’ buying sprees.

Mt. Gox’s creditors have seen the value of their BTC increase by over 8,500% since the exchange’s demise.

Inflows were primarily seen in the United States with $384 million, followed by Hong Kong ($32 million), Switzerland ($24 million) and Canada ($12 million), whereas Germany saw $23 million in outflows.

What To Know

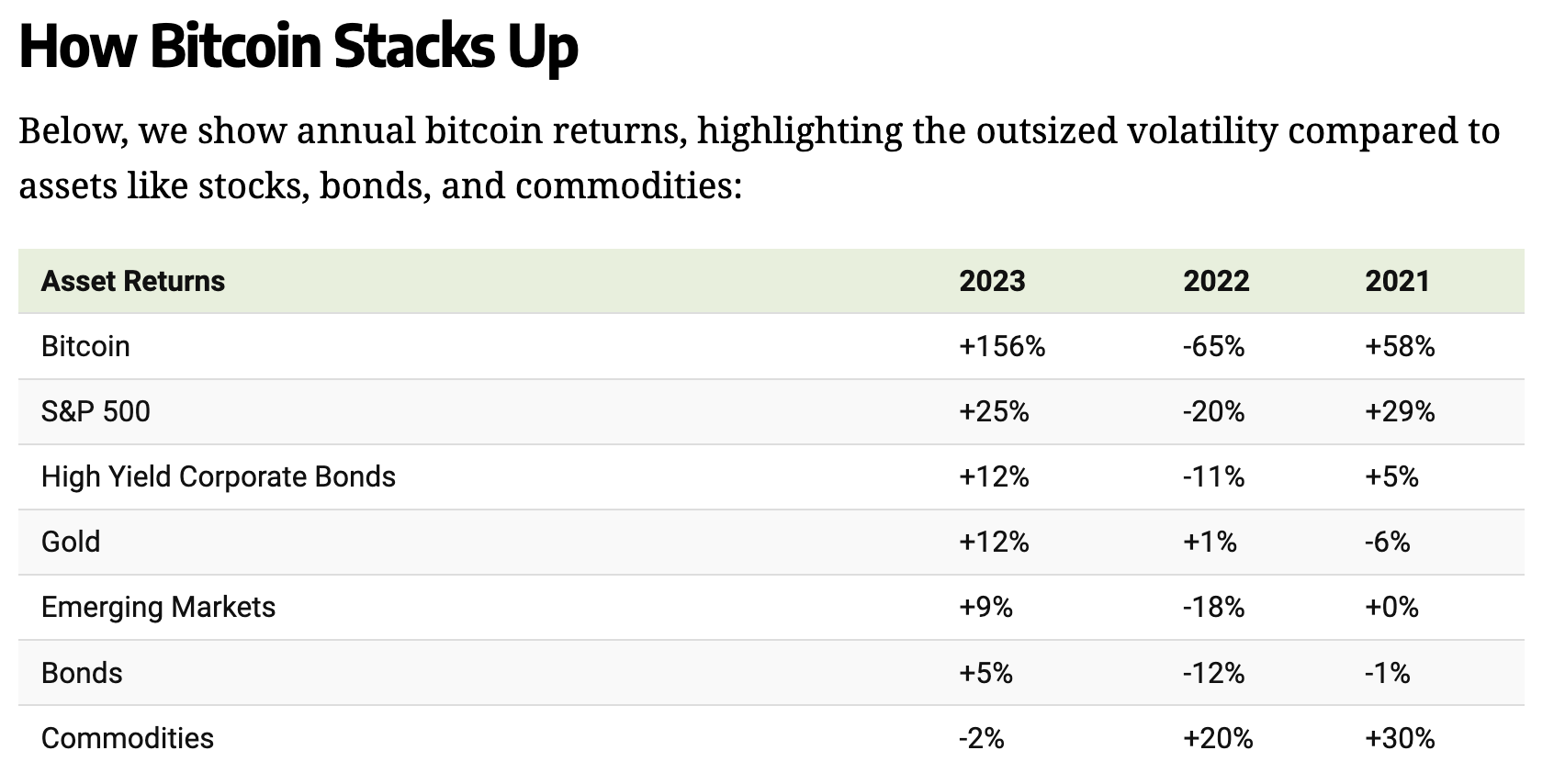

Bitcoin Returns vs. Major Asset Classes

* In The Decade From 2011-2021, Bitcoin Was The Best-Performing Asset In The World

* In 2023, Bitcoin Is Once Again The Top Performing Asset Class

The crypto winter finally came to an end in 2023, as bitcoin soared 156% over the year.

Not only did Bitcoin outperform all major asset classes, it saw its best year since 2020.

By comparison, the S&P 500 posted 25% returns in 2023, rising above its historical average of 11.5% while U.S. bonds saw 5% returns.

Source: Visualized: Bitcoin Returns vs. Major Asset Classes

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,Bitcoin Is World’s Best,

Go back

Leave a Reply

You must be logged in to post a comment.