Real Estate Brokerages And Retailers Worldwide Now Accepting Bitcoin (#GotBitcoin)

The rise of Bitcoin, a form of cryptocurrency, has piqued the interest of real estate brokerages. Real Estate Brokerages And Retailers Worldwide Now Accepting Bitcoin (#GotBitcoin)

Related:

Ultimate Resource On Bitcoin-Friendly Travel Companies That Allow You To Earn Bitcoin Rewards

Ultimate Resource For Bitcoin Debit (Cashback) Cards of 2023 (#GotBitcoin)

Bitcoin is an experiment for real estate brokerages looking for a competitive edge for their listings. Take a look at the brokerages who are paving the way to a cryptocurrency-ready real estate market.

Who Is Using Bitcoin In Real Estate?

Bitcoin usage is still in its initial phases and cryptocurrencies make up only a fraction of real estate sales in the United States. In 2017, Redfin reported about 75 listings nationwide accepting Bitcoin. This year, Realtor.com® has listed 37 single-family homes across the country accepting Bitcoin. The properties range from $114,000 or the equivalent in Bitcoin for a home in Kansas, all the way up to a Hawaiian mansion listed at $7,920,000.

Although real estate Bitcoin deals currently make up a small percentage of the market, brokerages who offer the option of Bitcoin operate in some of the country’s largest real estate markets. New York, Florida, and Texas have all seen cryptocurrency transactions.

So who is currently accepting Bitcoin in the industry? Good question. Though the acceptance of cryptocurrency within the market is still rare, the number of players is growing every day. Here are just a few of the trailblazers.

Florida:

Brown Harris Steven Residential Sales/One Sotheby’s International Realty

Listing agent Stephan Burke, of Brown Harris Stevens, reported that the seller of a 9,500-square-foot Miami mansion is accepting Bitcoin. The home is worth approximately $6.5 million. The seller has also reportedly said he will accept either Bitcoin or Zcash, another type of cryptocurrency. Burke had this to say about the transaction:

Industries, businesses, and careers are being affected by this dramatic globalization and modernization, and real estate is no different. It seems clear to me that banks and title companies will be doing everything in a crypto-recorded fashion within the next decade, and our transactions will eventually become faster — and safer — under this system.

A Clearwater, FL mansion, designed by a student of Frank Lloyd Wright, is also available to be purchased with Bitcoin. Nehad Alhassan is marketing the sale of the 4,000-square-foot home. Alhassan noted that since there are so few agents working with Bitcoin, a close relationship between buyer and agent is vital. He went on to say:

I think the seller has to grasp and understand it, and be comfortable in doing the transaction with me. You have to have that trust.

New York:

Magnum Real Estate Group believes the use of Bitcoin in real estate is linked to a younger group of home buyers — those who have invested in cryptocurrencies and are searching for alternative forms of payment. Ben Shaoul, President of Magnum, spoke to CNBC about his company’s use of Bitcoin and the relationship of cryptocurrency to the overall global market:

I think the demographic of the crypto user is a younger millennial, but, that being said, you have a lot of people coming over from other countries, who are buyers from different places, who like to trade in different types of currency. Not everyone wants to trade in dollars or yen or euros.

According to Blooming Sky, a New York City brokerage also dealing in Bitcoin, the majority of transactions require cryptocurrency to be exchanged for USD. Blooming Sky works with a team of real estate lawyers to help their prospects navigate the Bitcoin exchange process. Bernard Klein, Co-Founder of Blooming Sky, explained the practice this way:

We will help clients facilitate transactions with [cryptocurrency]. Underwriters who review the sources of a down payment tell me they increasingly see transferring Bitcoins into cash as similar to transferring stocks into cash.

Blooming sky has also published a guide on how to buy a NYC apartment with Bitcoin.

Texas:

Kuper Sotheby’s International Realty

The first real estate transaction involving Bitcoin in Texas was brokered by Kuper Sotheby’s International Realty, a real estate brokerage firm operating in Central and South Texas. The broker associate, Sheryl Lowe, who represented the buyer remarked on the seamlessness of the Bitcoin process:

I honestly couldn’t have expected something so unique to go so smoothly. In a matter of 10 minutes, the Bitcoin was changed to US Dollars and the deal was done!

What Else To Know About Bitcoin In Real Estate:

- The U.S. government may recognize cryptocurrency as property in 2018. This leaves some interesting loopholes involving taxes on real estate transactions.

- Not all Bitcoin transactions go as smoothly as planned. A Bitcoin investor made an offer on a luxury home in California that was contingent on the sale of his cryptocurrency. Although the offer was accepted, the buyer had to back out of the deal when he couldn’t sell his cryptocurrency.

- Redfin recently published an infographic showing the dramatic change in the number of bitcoins needed to buy the typical American home.

What Is The Future Of Cryptocurrency In Real Estate?

At this point in time, brokerages are still learning a lot about the role of Bitcoin in real estate transactions. The real estate brokerages dealing in cryptocurrency today are pioneers in the market and are paving the way for the future use of digital currency. The real estate industry has been heavily influenced by the use of technology over the past decade, and cryptocurrency will be no exception. Brokerages who leverage information on technology trends like Bitcoin will help determine its impact going forward.

Educating the public has been part of the job for Michel Triana, founder and CEO of Intelerit, a Fort Lauderdale-based predictive real estate analytics platform for U.S. investors. The vast majority of sellers still want payment in dollars, he said. For some portions of a deal, that may not change soon, Triana acknowledged.

That includes the title and escrow process, said Marlen Rodriguez, president of the HomePartners Title Services, an affiliate of the Keyes Company real estate firm. Major insurance underwriters only accept dollars, she said.

As long as buyers convert their Bitcoin or Ethereum to cash for the title and escrow process, there would be no problem.

Once the seller converts the digital currency to dollars to pay the title company, “there’s nothing unique about that transaction moving forward,” said Andrew Hinkes, a partner at the law firm Berger Singerman.

Pay The Necessary Parties In Dollars

Some attorneys, real estate agents, title and escrow agents will require you pay them in dollars. For that, you would need to convert your Bitcoin to dollars. Services like Bitpay or Changelly can convert the digital currency to cash.

What About Title?

The seller may have liens on the property or an unpaid mortgage. If a seller has $500,000 left on his or her mortgage, they would convert that portion of cryptocurrency into dollars and pay the mortgage. “The title work is exactly the same,” Kakon said. But, he added, “you need somebody who really understands cryptocurrency.” Because most title and escrow companies aren’t set up to accept Bitcoin, “They just might not be sure,” added Lifthrasir.

Recording The Deed

In the future, cryptocurrency supporters hope that recording deeds will be done with blockchain. The startup Propy recently launched a pilot program in Vermont to use blockchain technology to record real estate deals. Velox.RE created a similar program in Chicago’s Cook County.

Propy CEO Natalia Karayaneva said the technology could be replicated in South Florida. For now, deeds are recorded with each county’s property appraiser.

Fascinated By Cryptocurrency And Real Estate? Here Are A Few Resources You Can Leverage:

- Bitcoin Magazine offers a collection of articles from some of the top minds in the cryptocurrency space. We recommend starting with their article on how the blockchain will transform the real estate market. Subscribe to their email alerts to stay on top of the latest Bitcoin news.

- Inman’s technology section stays current on the latest Bitcoin trends in the real estate market. We recommend the article: 2018 real estate: Bitcoin bets, mega brokerages and VR.

Retailers Around The World That Accept Crypto, From Pizza To Travel

Earlier on, when Bitcoin (BTC) arrived on the scene, most cryptocurrency enthusiasts held on to their coins, as there were only so many places they could be spent. Nowadays, the list of marketplaces and retailers accepting Bitcoin and other cryptocurrencies is significantly larger, providing crypto enthusiasts with more options for making real-world purchases.

After all, with recognizable organizations like Microsoft and Wikipedia now accepting Bitcoin as payment, conversations about Bitcoin and the power of cryptocurrencies are becoming more prominent.

Currently, several fast-food restaurants and coffee shops have started accepting Bitcoin as payment.

This will likely provide traction for mass adoption as cryptocurrency payments become increasingly commonplace in day-to-day purchases.

Granted, there are some jurisdictions that do not consider Bitcoin or any other cryptocurrency as legal tender. Despite this set back, even big tech companies like Facebook are coming up with payment systems that mimic cryptocurrencies.

Here are some of the leading retailers, merchants and companies that will let you book flights and hotels, buy coffee or pizza, or even go to space with crypto.

Pay For A Burger In Germany With Crypto

The German branch of fast-food restaurant chain Burger King now claims to accept Bitcoin as payment for its online orders and deliveries, but this is not the first time Burger King has warmed up to Bitcoin as a form of payment.

The company, headquartered in Florida in the United States, had its Russian branch announce in 2017 that it would start accepting Bitcoin payments, but it ultimately did not take off. The global fast-food retailer reports an annual revenue of about $20 billion and serves about 11 million customers around the world. If all its outlets move to accept Bitcoin as payment, cryptocurrency adoption would inevitably spread.

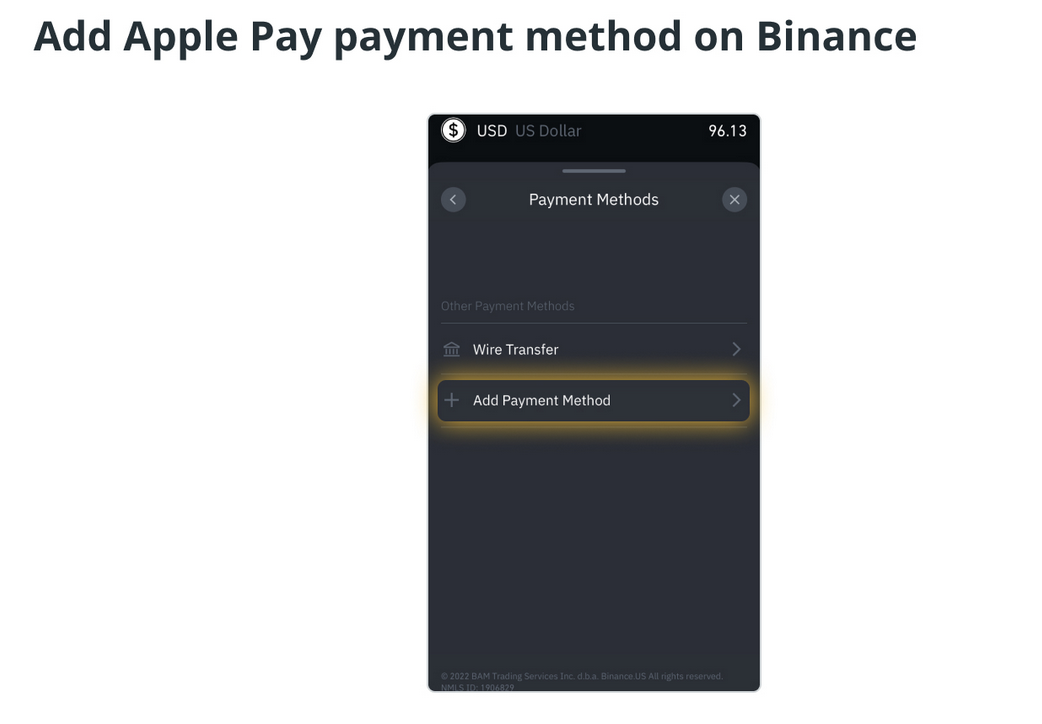

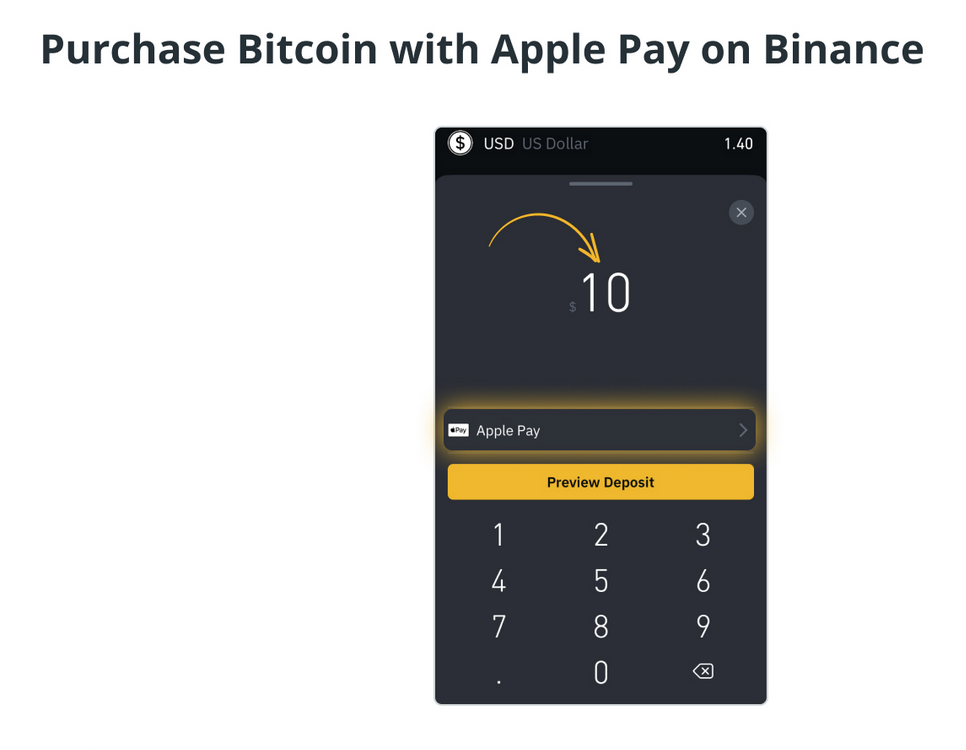

Spend Crypto At Starbucks And Other Places

For crypto payments to gain traction, merchants need to implement systems that enable swift and easy cryptocurrency spending. Starbucks is one of the companies taking advantage of this concept through Flexa, a U.S.-based payment startup that is helping the cafe giant, as well as dozens of other companies, accept cryptocurrency payments.

The company developed an app called Spedn that enables crypto holders to make purchases with merchants like Starbucks. The company’s CEO believes that by making cryptocurrencies spendable in the mainstream, commerce will realize the full benefit of blockchain technology all over the world.

Crypto enthusiasts in Silicon Valley’s Palo Alto might already be familiar with Coupa Cafe for other reasons apart from its coffee and food. Through its partnership with a Facebook software developer, Coupa Cafe has been accepting Bitcoin as payment since 2013.

Reports show that the cafe received a steady stream of Bitcoin revenue as soon as they started implementing crypto payments — a clear sign of how eager its customers were to pay in Bitcoin. Coupa Cafe is among the few physical businesses in Palo Alto that accept Bitcoin at the moment. The cafe owners believe that their collaboration with the Facebook software engineer will create more traction in terms of Bitcoin adoption.

Buy Food With Crypto

With over 50,000 takeaway restaurants listed on its United Kingdom-based site, OrderTakeaways is one of the surest ways to get a pizza paid for with crypto delivered to your doorstep. The company has been accepting Bitcoin payments for online takeout orders since 2018. And other similar services include the Korean platform Shuttledelivery as well as German-based service Lieferando and its subsidiaries in several other countries.

Related: Blockchain for Food, How the Industry Makes Use of the Technology

Apart from online orders, crypto can also be spent at a regular Subway restaurants. As early as 2013, several Subway branches started accepting Bitcoin as payment. Now, for a fraction of a Bitcoin, a Subway sandwich can be purchased at select restaurants.

Pay With Bitcoin To Tour Space

Besides buying food and inexpensive, day-to-day items with crypto, a trip to space can now be bought with Bitcoin. That’s right. Richard Branson’s space tourism company, Virgin Galactic, started accepting Bitcoin as payment as far back as 2013. Although Branson’s predicted date for the first commercial flight has been pushed back several times, the company achieved its first suborbital space flight last year. Perhaps soon, people will be able to tour the moon on crypto’s dime.

Buy Jewelry With Bitcoin

A brick-and-mortar American jewelry company called Reeds Jewelers accepts Bitcoin for both its physical and online stores. What’s more, if a purchase is worth more than $25,000, the company provides free armored delivery for safety. Other jewelry companies accepting Bitcoin include Blue Nile Jewelry, Stephen Silver Fine Jewelry and Coaex Jewelry, to name a few.

A big advantage of purchasing large ticket items — like a diamond — with crypto is that it makes moving around large amounts of money cheap and effortless. Reports show that more Silicon Valley investors are buying jewelry with Bitcoin. Last year, Stephen Silver Fine Jewelry reported a 20% growth in crypto transactions, leading to a boost in the company’s sales. The company has been accepting Bitcoin since 2014.

Send And Redeem Gift Cards With Bitcoin

Gyft, a digital platform that allows users to buy, send and redeem gift cards, was one of the first merchants enabling cryptocurrency adoption to gain traction in the real world. The mobile gift card app allows Bitcoin to be used to purchase gift cards from several retailers, some of which include Burger King, Subway, Amazon and Starbucks. The company has also partnered with popular crypto exchange Coinbase to enable users to buy gift cards from their Coinbase wallets.

Travel And Pay In Bitcoin

If a traveler only has Bitcoin at their disposal, the following merchants will gladly offer services in exchange for it. TravelbyBit, a flight and hotel booking service, accepts cryptocurrencies like Bitcoin, Binance Coin and Litecoin (LTC) as payment. Also, major travel company Hotels.com allows you to book vacation stays using Bitcoin.

With a network of over 300 crypto-friendly merchants, the platform is one of the biggest supporters of crypto adoption.

TravelbyBit can also alert you to upcoming blockchain events in order to interact with other crypto enthusiasts from around the globe. Other platforms to book flights with crypto include Destinia, CheapBizClass, CheapAir, AirBaltic, Bitcoin.Travel and ABitSky, among others.

Use Crypto To Book A Five-Star Hotel In Zurich

If ever one finds themselves traveling to Zurich Switzerland, either BTC or Ether (ETH) can be used to pay for a stay in a five-star hotel in Zurich. In May 2019, five-star hotel and spa Dodler Grand announced that it will start accepting Bitcoin and Ether as payment.

The hotel has partnered with a fintech firm Inacta as well as Bity (a Swiss-based crypto exchange) to facilitate the payment and conversion of crypto to fiat money. The hotel boasts an amazing view of the Swiss landscape among other enticing amenities that come with a five-star hotel.

Norwegian Air May Allow Customers To Pay With Crypto As Soon As Spring

Travelers on Norwegian Air, one of the largest airlines in Europe, will soon be able to pay for flights using cryptocurrency.

In an interview with a local business newspaper, Norwegian Block Exchange (NBX) CEO Stig Kjos-Mathisen said his crypto trading platform had successfully developed payment infrastructure that will allow customers on Norwegian Air to purchase tickets with digital assets.

“Everything is ready to go from our side”, Kjos-Mathisen said in the interview. NBX aims to roll out the new feature to Norwegian customers sometime later this year, possibly as early as the spring.

Kjos-Mathisen is the son-in-law of Bjørn Kjos, the founder and CEO of Norwegian Air, who has been involved in NBX since it launched in 2019. The plan has always been to use the exchange to offer cryptocurrency support for airline ticket purchases.

In September, one of the oldest banks in Norway acquired a 16.3 percent in NBX for a reported $1.6 million. The exchange opened for beta users last September and is now accepting general customers.

Founded in 1993, Norwegian Air Shuttle is the largest airline in Scandinavia and the third-largest low-cost airline in Europe. It flies to destinations all across Europe and North Africa, as well as selected cities in the Americas.

Following extensive cost cuts, the company reported its best-ever quarterly result last October, with a pre-tax profit of 2.2 billion Norwegian kroner (roughly US$215 million). The airline carried over 37 million passengers in 2018, its highest ever figure within a single year.

It is unclear so far which digital assets will be supported on NBX or for ticket payments. The founder’s son, Lars Ola Kjors, is believed to have bought 3.5 million NOK ($404,000) worth of bitcoin (BTC) in 2017 before the cryptocurrency hit its all-time high of around $20,000.

Updated: 2-27-2020

Cryptocurrency Adoption: How Can Crypto Change The Travel Industry?

If government corruption affects the stability of the national currency, it’s only natural that citizens will turn to gold or other assets like Bitcoin (BTC) to invest their savings. It offers them a sense of financial control in an otherwise unstable market.

And it’s not just investing that is feeling the impact of crypto. This technology has the capacity to change the way we live. The freedom to travel and transact is a fundamental right everyone should have, and cryptocurrency adoption is all about providing freedom.

The world is becoming easier to navigate, and people are increasingly traveling to parts that are not equipped to deal with tourism. Often travelers can be caught out in less developed countries with no access to ATMs and a shortage of reliable ways to pay for goods. The use of digital currencies and smartphones could become the best solution.

Imagine not having to search for the best exchange rates or having to carry the local fiat currency around in a wallet. This is freedom. Paying for goods and services on a mobile phone — and even a watch — has been an increasing phenomenon with services like Apple Pay and Google Pay on Android.

According to research, the amount of people who own mobile phones around the world is on the rise. Ownership levels in developing economies are highest in Vietnam, where 97% of adults own a mobile device, although about 90% or more also own one in Jordan, Tunisia, Colombia, Kenya, Lebanon and South Africa.

Ownership is lowest in Venezuela, India and the Philippines, but even in these countries, about 70% of adults own a mobile device.

In the future, more hotels, restaurants and shops will be set up with crypto wallets on a smartphone or similar device to accept global payments in seconds — and this may happen in the developing world faster than the developed world.

Growing Sector

The travel industry is one of the biggest industries in the world with around $1.7 trillion expected to be spent this year alone, making it the world’s second-fastest-growing industry. Now, crypto travel companies are making global crypto travel a reality.

As with all technology development, government and community help are paramount. The state government of Queensland in Australia is committed to technological innovation within the travel industry.

They have helped to make the Brisbane airport the first in the world to have 30 merchants accept cryptocurrency. In fact, Queensland is trailblazing crypto tourism with the regional town of Agnes Water, located at the southern end of Australia’s Great Barrier Reef.

Here, travelers can find more than 40 businesses that accept crypto, allowing them to pay with Bitcoin for their accommodations, meals and even a day tour to the reef.

Additionally, travel giant Expedia is now back in the crypto game, having stepped out of it in 2018 when they stopped accepting Bitcoin payments directly through their platform. Now, they are offering cryptocurrency holders the ability to book their travels and holidays through the site and giving them access to thousands of hotels around the world.

Helping The Unbanked

The figures speak for themselves. Globally, there are around 1.7 billion adults who are unbanked, mostly in developing countries like India, Egypt and parts of Africa. Without a fiat bank account, people from these countries can struggle to participate in the global economy. This affects many of the developing countries and their ability to trade in the world market. Crypto adoption can help change that.

It is important to understand that while it is still in the very early stages of adoption, crypto is much more than just a speculative asset, but it also has the ability to be used in the same way as any currency.

However, problems do exist. For example, many businesses that accept crypto for their services will charge users a high premium, which poses a barrier to adoption. This must be addressed and changed. Crypto must be usable, which is why it is important to provide incentives for early adopters.

Visa debit cards that convert crypto into fiat are becoming more common and are helping to grow the ecosystem. Allowing users to use cryptocurrency anywhere that accepts credit card payments will broaden adoption and take off.

Enticing users into the space with incentives will also help drive adoption, and as with credit card payments, more competition in the marketplace will help drive down fees. As crypto becomes more widely used, it will become more attractive to those who have never experimented with it and will lead more individuals to “give it a try.” This can only be a good thing for the wider crypto travel industry.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Caleb Yeoh is the CEO of TravelbyBit, an Australia-based company that has been instrumental in driving crypto adoption in Australia. Its travel booking platform was launched with the help of Binance, and lets travelers book their flights and hotels with cryptocurrency and earn rewards by doing so.

Pay For Electronics And More With Crypto

For all the gadget lovers, there are a bunch of platforms that allow electronic purchases with cryptocurrency. Newegg, for instance, is an electronic retail giant that uses BitPay to process payments made with digital currencies. Even though one cannot get refunds for Bitcoin purchases, Newegg has a good reputation for quality items.

Plus, the company boasts its being among the first merchants to support cryptocurrency adoption. Other platforms for gadget junkies include Eyeboot (a platform that sells crypto mining rigs in exchange for crypto), Microsoft, FastTech and Alza (a U.K.-based online store that sells phones and beauty products).

An Ever-Expanding List

It seems clear that more retailers are warming up to the idea of accepting cryptocurrencies. There is still a long way to go before full adoption can be achieved, but many companies have nevertheless benefited from being early adopters. Despite the volatile price movements of cryptocurrencies, all evidence points to a future cashless society that uses digital currencies, and crypto is leading the way.

France: 25,000 Major Retail Stores To Accept Bitcoin In 2020

By early 2020, support for Bitcoin payments will be launched at over 25,000 sales points for 30 French retailers, including sportswear giant Decathlon and cosmetics store Sephora.

French crypto news outlet Cryptoglobe reported the development, announced during Paris Retail Week, on Sept. 24.

25,000 Retailers To Enter Economy 3.0 Via Bitcoin

The new cryptocurrency payments system is launching via a partnership between point-of-sale technology provider Global POS, the EasyWallet application and payments platform Easy2Play.

While payments will be made in Bitcoin (BTC), funds will be automatically converted into euros at the moment of sale.

Conversion services are to be provided by two partners, Deskoin and Savitar, both of whom are currently applying for Digital Asset Service Provider accreditations under France’s PACTE Act.

Alongside Decathlon and Sephora, well-known retailers signing on to the initiative include Boulanger, Foot Locker, World House, Intersport, Cultura, Maisons du Monde and Norauto.

Stéphane Djiane, CEO And Founder Of Global Pos, Has Given A Statement Proposing That:

“This is an important symbolic step in the evolution of payment methods in France. However, more than a symbol, what we bring to 25,000 outlets is the ability to safely enter the world of Economy 3.0.”

After Bitcoin, Altcoins Could Be Next

By enabling consumers to use their cryptocurrency holdings at physical retail locations within a legalized and regulated framework, the initiative aims to broaden adoption beyond the currently estimated 4 million French crypto owners.

While Bitcoin remains the sole cryptocurrency on the cards for now, Dijane has indicated the platform intends to roll out support for altcoins in the future.

In January of this year, a handful of tobaccos shops in Paris started to sell Bitcoin, notwithstanding mixed messages from local regulators and the central bank.

5,200 Tobacco Shops In France Now Selling Bitcoin

French crypto startup Keplerk has relaunched its service to accept Bitcoin (BTC) payments in over 5,200 tobacco shops in France starting from Oct. 10.

Service First Launched In January

After suspending the service in less than two months after launch in January, Keplerk says that its customers will be able to buy Bitcoin from tobacconists in coupons of 50, 100 or 250 euros, France’s top news channel BFM TV reports Oct. 10.

According to the report, Bitcoin payments in all 5,200 locations will be feasible through Keplerk’s partner Bimedia, which will provide payment terminals.

As previously reported, Keplerk’s initial launch in January 2019 of the service reportedly involved just six tobacco shops, while other publications reported there were as many as 24 shops participating in the program. At the time, Keplerk co-founder Adil Zakhar stated that the firm was planning to expand the project to 6,500 tobacco shops by February despite the reports that France’s central bank did not endorse the initiative.

Bitcoin Adoption Surges In France

Meanwhile, France is apparently seeing a surge in cryptocurrency adoption. In late September, Cointelegraph reported that over 25,000 points-of-sale of 30 French retailers including sportswear giant Decathlon and cosmetics store Sephora will start accepting BTC payments by early 2020. As reported earlier in September, the French unit of Domino’s Pizza launched an ordering competition with a prize of $110,000 in Bitcoin or cash.

On Sept. 12, French Economy Minister Bruno Le Maire claimed that French authorities do not plan to tax crypto-to-crypto trades, but rather will consider taxation when crypto is sold for fiat money.

Updated: 2-14-2020

Millions of Online Retailers Can Now Accept DAI On Coinbase Commerce

Coinbase Commerce, a platform that supports cryptocurrency payments for internet retailers, has added MakerDAO’s DAI stablecoin as a supported payment method this week.

This integration will let merchants around the world accept the USD-pegged stablecoin as payment for goods and services without Coinbase Commerce taking any extra fees.

Merchants can add a “pay with crypto” button to their checkout process, or choose to accept DAI only. Shop owners can also currently earn a DAI savings rate of 7.5%.

This could open doors to over 800,000 stores and 3 million web shops on Shopify and WooCommerce, as well as anyone else seeking a way to accept decentralized stablecoins as payment. It also introduces merchants to a growing segment of the cryptocurrency market, letting them bridge the gap between DeFi app developers and their own businesses.

DeFi (decentralized finance) is a popular movement sparked by cryptocurrency and blockchain technologies, bringing conventional financial services to the crypto sector.

Rune Christensen, CEO of the Maker Foundation, told Cointelegraph a few months ago that:

“DeFi is a new generation of products that are entirely transparent, where users can see exact cash flows while achieving greater levels of trust and security that can be audited in real time. DeFi also incorporates the global nature of blockchain and its advantages, making these more efficient systems with lower fees and higher yields.”

Updated: 12-30-2020

Las Vegas Luxury Auto Dealership Rakes In Bitcoin Payments

Vegas Auto Gallery has seen an influx of Bitcoin payments amid the bull market.

A luxury auto dealership in Nevada has reported a steady increase in Bitcoin (BTC) payments, a testament to the bull market currently underway as more investors convert their holdings into high-end sports cars.

Vegas Auto Gallery, whose inventory includes makes and models from Aston Martin, Bentley, Ferrari and Lamborghini, recently sold two high-end sports cars to customers who paid more than $6 million in BTC. As the Wall Street Journal reports, owner Nick Dossa says that roughly 3% to 5% of the dealership’s revenue comes from Bitcoin transactions.

The dealership isn’t accepting Bitcoin payments outright, but through BitPay, a third-party payment provider. BitPay transactions settle BTC payments in U.S. dollars upon receipt. In the case of Vegas Auto Gallery, a 1% fee is applied to all Bitcoin purchases, which is equivalent to BitPay’s transaction fee.

Dossa told the Journal that his dealership isn’t exposed to any additional risk by accepting Bitcoin payments. “It’s a very easy transaction,” he said.

Although Bitcoin has been criticized for lacking payment channels, BitPay has onboarded hundreds of thousands of merchants worldwide, giving Bitcoin buyers plenty of ways to spend their BTC.

The Lamborghini became the ultimate status symbol during the 2017 Bitcoin bull market. The recent foot traffic into Vegas Auto Gallery suggests that wealthy Bitcoiners are already splurging following the latest surge in price.

Bitcoin returned to record highs on Wednesday after clearing the $28,500 hurdle. The cryptocurrency’s market capitalization passed $500 billion last week for the first time in history.

Updated: 3-1-2021

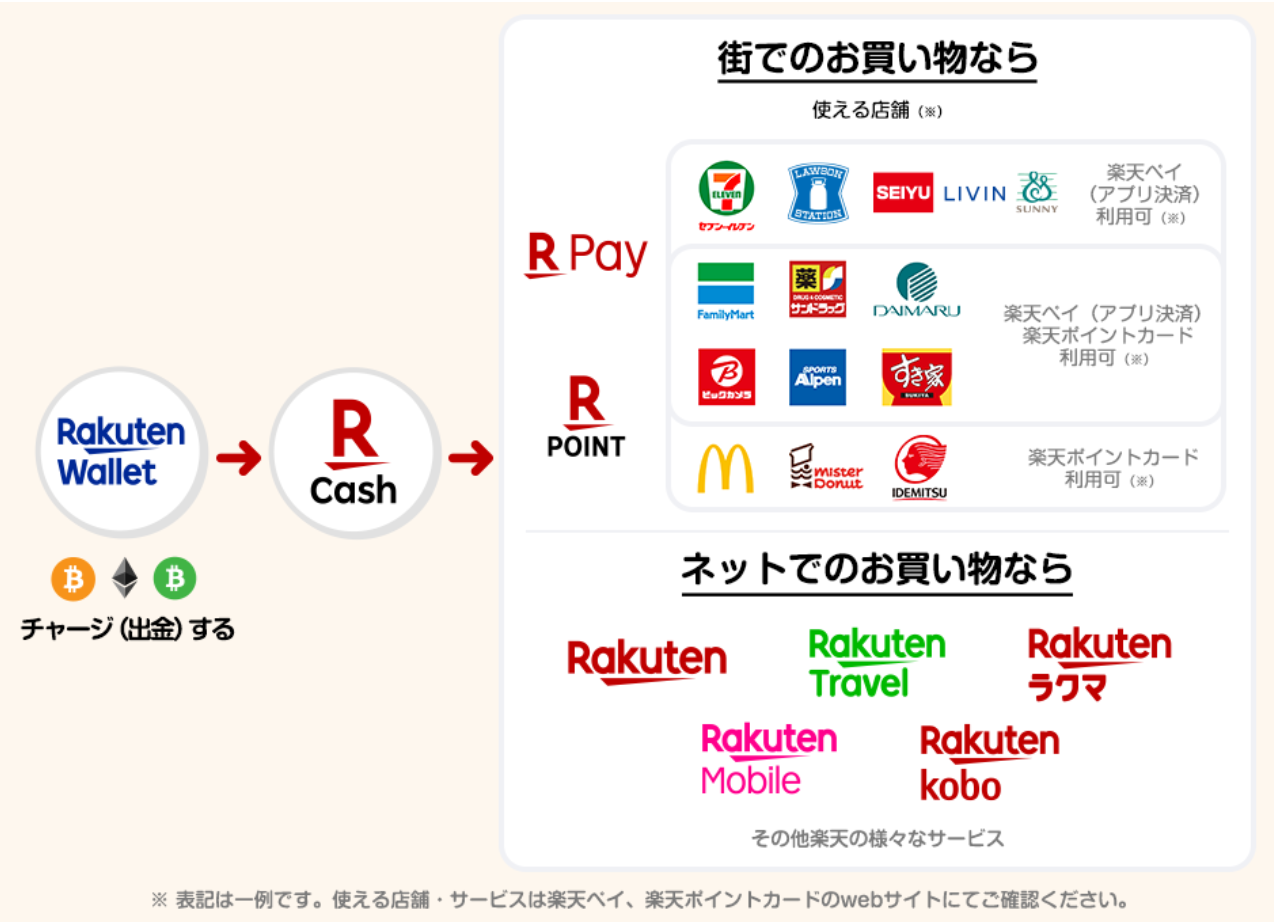

Rakuten’s Customers Can Now Use Bitcoin For Shopping

Japanese retail giant Rakuten has integrated its crypto wallet with its payment app, enabling consumers to directly load and convert their Bitcoin holdings for use in everyday spending.

Crypto-friendly Japanese retailer Rakuten is now enabling users of Rakuten Wallet, its crypto exchange subsidiary, to easily spend their cryptocurrency holdings in everyday transactions.

According to an announcement published on Feb. 24, users are now able to load up their Rakuten Pay accounts seamlessly with their wallet holdings of Bitcoin (BTC), Bitcoin Cash (BCH) and Ether (ETH). Rakuten Pay is a mobile payment app that is operative nationwide and supported at a wide range of large and medium-scale retailers.

Back in 2019, Rakuten had already enabled consumers to convert their Rakuten Group loyalty points to cryptocurrencies like Bitcoin. Now, a deeper integration is being implemented, tying together Rakuten Wallet, Rakuten Cash (Rakuten’s e-money service) and Rakuten Pay together to support cryptocurrency spending at retailers such as McDonald’s, Seiyu and FamilyMart.

There will be no conversion fees between fiat, e-money and crypto holdings, although there is a minimum spend amount of 1,000 yen (roughly $9.40) and a monthly upper limit of around 100,000 yen (roughly $940).

To make use of the integration, users will need to be a Rakuten member and have a trading account set up for Rakuten Wallet. The company is also offering a small bonus of Rakuten points to incentivize the new service.

Updated: 3-2-2021

You Can Now Buy A Used Hyundai, Not Just A Lambo, With Bitcoin

Practical use cases for cryptocurrency payments are popping up all the time. Now, crypto holders in North America will be able to purchase their next vehicle with BTC.

HGreg, a Quebec-based vehicle superstore with 30 North American locations, will begin accepting cryptocurrency payments for new or preowned vehicles this month.

The auto dealer, which has locations in Quebec and Florida, is becoming one of the first large automotive groups to accept digital asset payments in its day-to-day operations. The company claims to have sold 500,000 vehicles over the past 25 years and maintains a warehouse in Miami that’s stocked with over 1,000 cars.

“A portion of the revenue from sales made in cryptocurrency will be kept in this format by the company,” HGreg said, indicating that it plans to hold digital assets like Bitcoin (BTC) on its balance sheet.

In Terms Of Accepting Crypto Payments, The Dealership Said:

“We’re pleased today to be at the forefront of technology, giving our customers another payment option. We also believe it will be advantageous to keep some of our assets in cryptocurrency.”

The dealership sells a wide variety of used cars, from Hyundais to Lamborghinis. Crypto users can therefore use their funds to buy practical cars in addition to luxury vehicles. HGreg claims to have the largest inventory of vehicles in Canada.

HGreg’s decision to accept cryptocurrency payments comes on the heels of Tesla’s entry into the Bitcoin market. As Cointelegraph reported last month, the electric vehicle maker allocated 7.7% of its gross cash position to Bitcoin. In the process, the company announced it will begin accepting BTC for payment.

While cryptocurrencies remain largely within the domain of investments, payment infrastructure is increasingly integrating digital assets. OLB Group recently enabled crypto payments for thousands of United States merchants, allowing businesses to accept Bitcoin, Ether (ETH), USD Coin (USDC) and Dai.

A car enthusiast who spent 37 BTC on two used Hondas in 2017 might wish he had waited…

Updated: 3-5-2021

Thailand’s Largest Movie Theater Chain Accepts Bitcoin

Major Cineplex Group is starting to accept Bitcoin as part of a crypto pilot project.

Major Cineplex Group, the largest operator of movie theaters in Thailand, has reportedly enabled some of its customers to buy tickets with cryptocurrencies like Bitcoin (BTC).

According to a Thursday report by local news agency Siam Rath, Major Cineplex has announced the launch of its cryptocurrency payment pilot project in a move to support innovation and new technologies.

In order to unlock the new payment option, the company has partnered with local crypto exchange Zipmex and lo digital payment startup RapidZ.

Major Cineplex debuted the new feature at Bangkok’s Major Cineplex Ratchayothin movie theater on March 4, allowing customers to buy tickets with Bitcoin via RapidZ by scanning a QR code. Major Cineplex expects to extend the pilot to 39 more of its movie theaters across Bangkok by the end of 2021.

The news apparently marks the first time in history that Thai movie theater has accepted crypto as payment.

Narut Jiansanong, a spokesperson for Major Cineplex, said that the new initiative intends to attract more customers that invest in crypto. He said that Thailand is now estimated to have up to 1 million Bitcoin holders, accounting for 2% of the country’s total adult population.

In mid-February, the Securities and Exchange Commission of Thailand proposed to adopt specific requirements for people willing to invest in crypto, reportedly planning to require investors to have an annual income of at least $33,250. The authority subsequently appeared to back off some of its proposed requirements, stating that its initial proposals intended to gauge investor sentiment.

Updated: 3-12-2021

US Luxury Hotel Brand To Begin Accepting Bitcoin Payments

Bitcoin penetration in the hospitality industry is set for another expansion as a U.S. luxury hotel chain adopts cryptocurrency as a payment option.

The Kessler Collection, an American luxury hotel brand, has begun accepting Bitcoin (BTC) and cryptocurrencies as a payment option.

According to a press release issued on Tuesday, the hotel chain has partnered with crypto payment gateway service BitPay to begin accepting Bitcoin.

Other cryptos adopted include Ether (ETH), Dogecoin (DOGE) as well as four stablecoins — USD Coin (USDC), Paxos Standard (PAX), Binance USD (BUSD), and Gemini dollar (GUSD).

The Kessler Collection now becomes the latest luxury brand to partner with BitPay to enable crypto payments for their products and services.

For Fravy Collazo, the company’s chief financial officer, adopting crypto payments will also help to reduce the forex burden on international guests. Commenting on the move, the firm’s CEO Richard Kessler stated:

“This is one of the most innovative concepts in the hospitality industry right now. I believe cryptocurrency is only going to gain acceptance, and partnering with BitPay allows us to offer more choices in the payment process.”

Indeed, from airlines to travel agencies, several facets of the tourism and hospital industries have been quick to adopt cryptocurrency payments.

The onset of the coronavirus and its impact on global travel has also likely accelerated the pivot towards virtual currency payment channels amid the emerging digitization of the industry and the prioritization of contactless protocols.

In its February 2020 report, crypto travel agency Travala revealed that 68% of all bookings for the month were with virtual currencies as the company recorded its largest monthly revenue figures.

Apart from utilizing crypto payments, airlines and other stakeholders are also exploring blockchain in fighting the spread of COVID-19.

Back in February, Air France announced that it would be testing a blockchain-based system to verify COVID-19 test results for passengers.

Updated: 4-7-2021

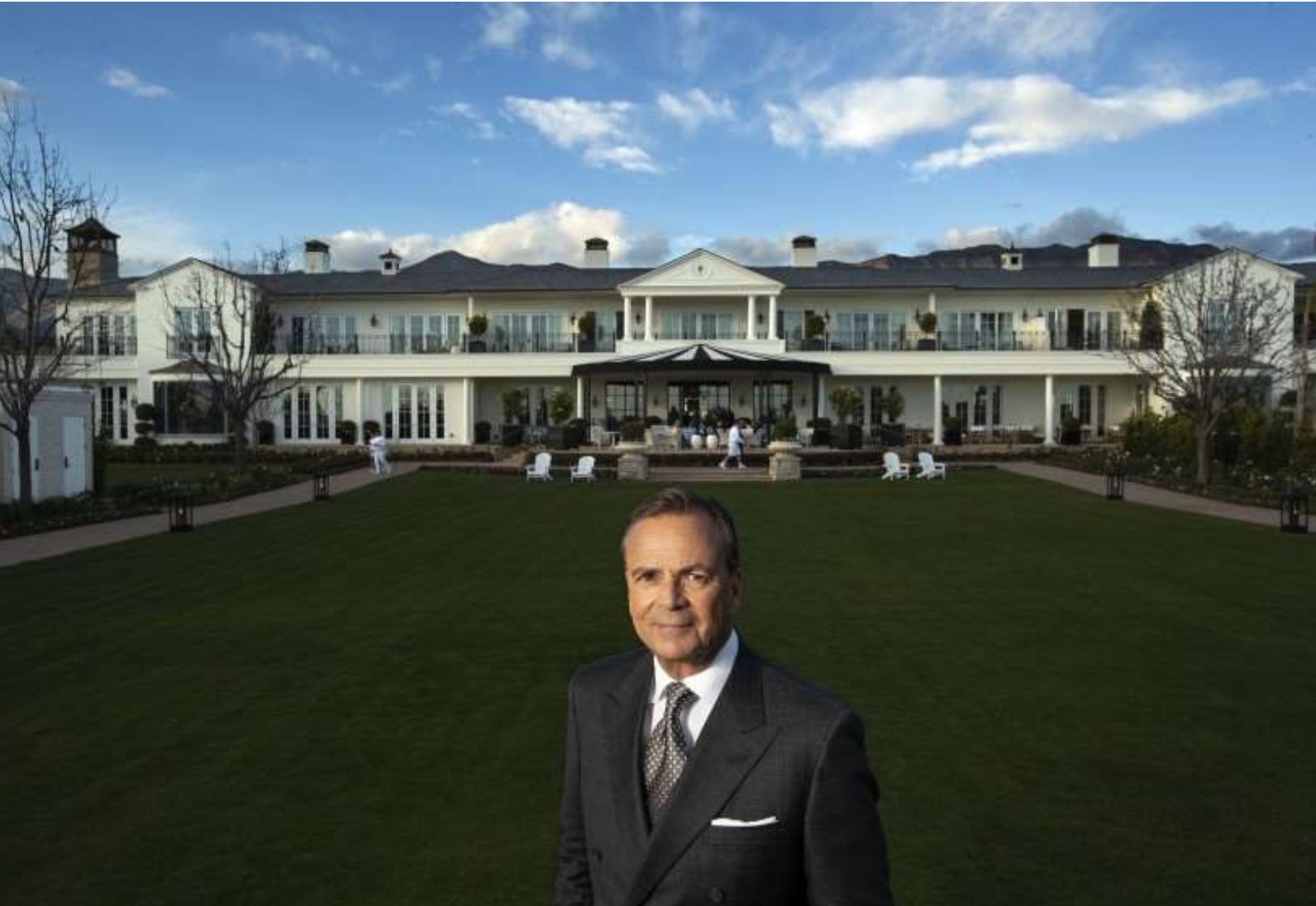

Caruso Properties To Accept Bitcoin For Rent, Allocates 1% of Treasury To Asset

The move makes Caruso the largest real estate manager to accept bitcoin for payment.

California real estate stalwart Caruso properties will now accept bitcoin for rent on all its properties.

In a partnership with Gemini Exchange, Caruso will now let tenants of its retail and commercial properties pay their rent in bitcoin. This makes Caruso the largest real estate manager in the United States to accept the digital asset as a form of payment.

Additionally, Caruso has allocated roughly 1% of its treasury into bitcoin, according to the LA Times.

Caruso’s crypto ambitions may not end at bitcoin, though. A press release shared with CoinDesk signals interest in other aspects of the crypto economy as well, like the hottest segment of the market right now – NFTs.

“This partnership marks the beginning of a holistic, long-term relationship intended to bring cryptocurrency, non-fungible tokens (NFTs), and blockchain applications to Caruso properties as a way to engage the millions of visitors throughout their ecosystem,” the release reads.

Bitcoin continues to make its way onto the balance sheets of prominent firms in the U.S., a trend that MicroStrategy kicked off last year when it converted most of its cash holdings into bitcoin.Since then, Square, Tesla and other publicly traded companies have added bitcoin to their balance sheets, as well.

Developer Rick Caruso is known for his lavish outdoor malls, luxe seaside resort near Santa Barbara and stewardship of USC as chair of the board of trustees. Next up: He’s planning to make a splash in cryptocurrency.

In what may be a real estate industry first, bitcoin will now be accepted for retail and apartment rent at the Grove shopping center and other properties owned by Caruso. The Los Angeles real estate magnate is planning other digital efforts such as using blockchain technology to support a new rewards program for shoppers.

One of his first tenants to pay in bitcoin may be Elon Musk, chief executive of Tesla Inc., who operates a store selling Tesla electric cars at Caruso’s the Americana at Brand center in Glendale.

Caruso announced Wednesday that his company had invested in bitcoin as part of a partnership with Gemini, a cryptocurrency exchange founded by Tyler and Cameron Winklevoss. The twins gained fame for suing former Harvard classmate Mark Zuckerberg for allegedly stealing their idea for a social network that became Facebook.

As a result of the deal, about 1% of Caruso Properties’ treasury is in bitcoin, Caruso said, although he declined to reveal the dollar value.

“I believe it’s a good hedge” to diversify the company’s finances, Caruso said, “and has already proven to be a good investment for us.”

The operator of nine outdoor malls acknowledged that there hadn’t been a clamor from tenants to pay rent in bitcoin, but Caruso said he wanted to be prepared as cryptocurrency grew more widely accepted.

The volatile digital asset has appreciated at a furious rate and has reached a point — trading roughly between $50,000 and $60,000 apiece in the last month — where it’s seen more as an investment, albeit speculative, than something to spend on everyday expenses such as rent.

Federal Reserve Chairman Jerome Powell last month described bitcoin and its crypto cousins as “not really useful stores of value. And they’re not backed by anything.” Still, several big banking names, including Goldman Sachs and Mastercard International, have been making cryptocurrency moves.

Caruso compared bitcoin to credit cards, which started in the 1950s as odd rarities before becoming mainstream.

“I believe bitcoin and blockchain are going to be doing the same in the future,” Caruso said. “We want to be ahead of the curve.”

Blockchains are used for recording transactions made with cryptocurrencies, such as bitcoin, and have other applications Caruso may use in his planned rewards program.

Tesla announced in February that it had purchased $1.5 billion worth of bitcoin and would start accepting it as payment for its products, which include cars, solar panels and batteries.

Tesla said in a filing with the Securities and Exchange Commission that bitcoin would provide “more flexibility to further diversify and maximize returns on our cash.”

Musk has been a strong proponent of bitcoin on Twitter and elsewhere. But would he use the currency, which quadrupled in value in 2020, to pay the rent on a Tesla store?

“I haven’t talked to Elon about it,” Caruso said. “He may be the first, as a pioneer, to pay his rent in bitcoin.”

Shoppers have returned to his malls as officials have eased coronavirus restrictions, and some retailers are seeing sales revenue at pre-pandemic levels or above, Caruso said.

“There has been so much forced savings in the economy,” he said, “people are out spending money and doing it gladly because they have been cooped up for so long.”

In addition to accepting bitcoin from retailers for rent, Caruso will now take bitcoin rent payments for his apartments. He has a combined 350 units for lease at the Americana, at Palisades Village in Pacific Palisades, and at 8500 Burton Way, a luxury complex near the Grove.

Gemini, which is based in New York, will administer Caruso’s cryptocurrency operations.

“We are thrilled to partner with Caruso as they continue to push the real estate sector to new heights by embracing cryptocurrency for the benefit of both their customer experience and their own business operations,” Gemini Chief Executive Tyler Winklevoss said in a statement. “We are excited to help them execute their digital asset treasury strategy and advise them more broadly throughout their cryptocurrency journey.”

Caruso’s new loyalty rewards program is still being developed but may become a widely used element of his cryptocurrency program and is intended to hold particular appeal for younger customers, he said.

Shoppers may accumulate points on a blockchain-based credit card that could be redeemed in fairly conventional ways, such as paying for visits to Caruso’s Rosewood Miramar Beach resort in Montecito, where rooms go for more than $1,000 a night, or for more unusual rewards such as non-fungible tokens.

NFTs, as they are known, are a type of cryptocurrency that represents a unique digital asset, like a piece of art. An NFT version of Twitter cofounder Jack Dorsey’s first tweet sold for $2.9 million in March.

A blockchain-based system gives customers flexibility to redeem rewards in ways they find most appealing, Caruso said.

“There are billions of dollars worth of unredeemed rewards programs around the country because they are not engaging,” he said. “People are quite engaged when it comes to cryptocurrency.”

Updated: 5-6-2021

Nasdaq-Listed Insurer Metromile Plans $10M Bitcoin Purchase

The company will soon accept BTC payments for insurance premiums as part of a broader embrace of digital assets.

Metromile Inc., a digital insurer headquartered in San Francisco, is making Bitcoin (BTC) a core part of its business operations, offering further evidence of the growing mainstream adoption of digital assets.

The company announced Thursday that it will soon give policyholders the option to pay for insurance and receive payment on eligible insurance claims in BTC or dollars. That makes Metromile the first insurance company to both accept premiums and pay insurance claims in cryptocurrency.

Equally as notable, the company said it will allocate $10 million toward Bitcoin in the second quarter. Although it didn’t specify an exact date, a $10 million purchase equates to roughly 175.4 BTC at current price levels.

The company said it believes that accepting crypto payments “will support its commitment to fairer insurance and promote financial resilience for policyholders as cryptocurrency becomes mainstream and a more significant portion of consumers’ assets.”

Dan Preston, Metromile’s CEO, Further Explained His Company’s Rationale:

“Supporting decentralized finance and adding bitcoin as a new payment option is the next logical step for our digital insurance platform and end-to-end AI claims automation. The result is fairer insurance for all.”

Metromile is a pay-per-mile auto insurer that calculates premium payments and coverage based on miles driven as opposed to approximations. The company claims that its insurance coverage produces an average savings of 47% per year.

The company held its fourth-quarter earnings call on March 30, during which it reported a sizable increase in policies in force. Insurance revenue was down slightly compared with 2019, which was a big year in terms of growth.

Metromile shares, which trade under the Nasdaq ticker symbol MILE, closed 2.1% down at $8.81 on Wednesday. At current values, the company has a total market capitalization of $1.11 billion.

Updated: 5-12-2021

MoneyGram To Allow Retail Bitcoin Buying In The US

MoneyGram customers in the United States will soon be able to buy Bitcoin in the country’s retail outlets across the country.

Crypto adoption among mainstream payment service companies continues to grow, with MoneyGram set to join the list.

In a release issued on Wednesday, the global payment service announced a partnership with crypto exchange and Bitcoin (BTC) ATM operator Coinme Inc., to allow United States customers to withdraw their cryptocurrency holdings for cash across its point-of-sale outlets in the country.

As part of the announcement, MoneyGram also revealed that customers will be able to buy BTC and crypto in an expansion of the existing crypto-to-cash model pioneered by the almost 20,000 cryptocurrency ATMs around the world.

Commenting On The Development, MoneyGram CEO Alex Holmes Remarked:

“This innovative partnership opens our business to an entirely new customer segment as we are the first to pioneer a crypto-to-cash model by building a bridge with Coinme to connect bitcoin to local fiat currency.”

For MoneyGram, the ability to buy Bitcoin across its brick-and-mortar retail outlets might be a significant development for would-be first-time crypto users daunted by interacting with online cryptocurrency exchanges.

MoneyGram’s announcement also likely offers another indication of the potential for a unified money transmission licensing regime, especially for cryptocurrencies.

Back in September 2020, 48 U.S. states agreed to establish a single regulatory framework for money transmitters — a move with significant implications for 78 fintech businesses like MoneyGram, with an annual turnover above $1 trillion.

MoneyGram debuting physical Bitcoin-buying across its locations in the U.S. is also another example of fintech and payment service firms warming up to cryptocurrencies. From stables like PayPal to Visa and Mastercard, debuting some form of crypto-related feature is becoming a norm across the industry.

Back in March, PayPal began allowing U.S. customers to pay with Bitcoin across millions of online merchants on the platform. In April, PayPal CEO Dan Schulman said the company’s crypto commerce was on course to reach $200 million in volume within a few months.

Updated: 5-18-2021

Luxury Yacht Club Accepts Bitcoin

The company said it expects to see 40% growth from Bitcoin payments in the first year.

A luxury yacht firm has announced it will begin accepting cryptocurrency for its services and expects to see an immediate 40% growth increase from Bitcoin (BTC) payments in the first year.

In addition to accepting Bitcoin payments, the firm also announced that it would base its web and mobile services on blockchain technology as it provided more transactional security than any other system.

The firm stated that it expects to see $6.5 million in revenue in the coming year, primarily from its yacht charter service and the bespoke experiences it hosts for clients.

Co-founded by two Colombians and operational in North America, Prime Experiences has apparently ear-marked Miami as a possible future source of collaboration. The company’s president, José David Tobón, said the firm was already in talks with Miami’s crypto-friendly mayor, Francis Suarez, who has previously pushed for progressive cryptocurrency laws, and recently suggested Miami’s citizens should be able to receive salaries in Bitcoin.

“With this type of currency many doors have opened, we are currently in talks with the Miami Mayor, who is interested in expanding bitcoin and other cryptocurrencies in the city. Miami could be the next Silicon Valley as most of the large companies such as Tesla, Facebook and Google are looking to enter the city,” said Tobón.

The range of services opting to accept cryptocurrency as a means of payment has grown more varied in recent years. Once largely the currency of choice for mostly web-based services, more and more physical establishments have started to accept crypto of late, including real-estate firms, auction houses, music schools, and baseball teams.

Updated: 5-30-2021

American Convenience Store Chain Now Accepts Bitcoin Payments

Mid-Atlantic convenience store giant Sheetz is set to accept Bitcoin and crypto payments across its outlets.

Retail crypto payment acceptance in the United States continues to grow as Sheetz announces plans to allow the use of digital currencies in its outlets across the country.

In a release issued on Thursday, the convenience store chain announced its partnership with digital payments provider Flexa to enable customers to pay for products and services with cryptocurrencies.

As part of the announcement, Sheetz revealed that the crypto payment option was for both in-store items and gas pumps at their over 600 outlets across Pennsylvania, Ohio, Maryland, Virginia, North Carolina and West Virginia.

Cryptocurrencies that will be accepted by the convenience store chain include Bitcoin (BTC), Ether (ETH), Litecoin (LTC) and Dogecoin (DOGE), among others.

The company’s crypto payment adoption move is also an extension of its business relationship with point-of-sale payment provider NCR.

Apart from enabling Bitcoin and crypto payment, Sheetz also plans to allow customers to link their Flexa-enabled payment apps with the company’s loyalty reward program.

Indeed, crypto is seeing significant adoption in the rebates and loyalty rewards arena, with digital currencies being seen as viable for rewarding patrons.

The Sheetz announcement now adds convenience stores to the growing list of businesses accepting crypto payments in the United States. Back in March, luxury hotel brand The Kessler Collection debuted crypto and stablecoin payment options for guests.

As previously reported by Cointelegraph, a Mastercard survey from earlier in May revealed that up to 40% of respondents across the globe expressed interest to use crypto for payments in 2022.

Indeed, retail crypto payment adoption has been on the rise in recent times, with payment giant PayPal entering the fray back in 2020. In March, the company began allowing U.S. customers to pay with Bitcoin for online shopping.

By April, PayPal was forecasting its crypto commerce revenue exceeding $200 million in only a few months of deploying cryptocurrency payment solutions.

Updated: 6-15-2021

Miami Real Estate Firm Accepts Crypto Deposits For Condos After Conference

Driven by momentum from the Miami Bitcoin event, luxury condo development E11EVEN Hotel and Residences has already secured its first crypto deposit.

Miami-based E11EVEN Hotel and Residences is claiming to be the first real estate company to allow deposits for property purchases in the form of cryptocurrency.

Speaking to Fox Business, company and condominium project co-founder, Marc Roberts, stated the enthusiasm for crypto has been “really astounding”.

Roberts noted that local interest in crypto assets had piqued amid the recent Bitcoin Miami conference — which took place earlier this month and drew crowds of approximately 50,000 according to its organizers.

He noted there has been a “tremendous response” to E11EVEN’s announced support for crypto, adding it had already collected its first deposit in crypto before officially announcing it would accept digital assets.

Roberts added that E11EVEN is now roughly one month away from collecting its second crypto deposit, predicting the down payment will be worth between 10% and 15% of the property’s sale price.

The company offers plush high-rise residences in Miami’s Park West district. Prices for the lavish units start at $377,400, according to real estate agent Miami Residential. The 65 story condominium has 375 units, with the penthouse expecting to fetch as much as $10 million.

Roberts described supporting crypto as one the firm’s “greatest decisions,” warning: “those that don’t embrace [crypto] will be left behind:”

“I think the whole movement is trending towards more buyers paying in crypto and we are very excited to be the first people to take cryptocurrency for deposits on real estate.”

The real estate mogul acknowledged the volatile nature of digital assets, but was confident that the younger generation is unperturbed by price fluctuations and have already embraced digital assets.

When asked if he immediately liquidates crypto deposits to eliminate the volatility, Roberts offered little clarity, stating: “It’s all so new and we’re studying and we’re trying to embrace the movement.”

In mid-May, Cointelegraph reported that investors could buy luxury apartments in Portugal using Dogecoin among other digital assets.

Also in May, it was reported that Miami’s Arte Surfside luxury apartments, home to Ivanka Trump, were accepting payment for real estate in multiple cryptocurrencies including Bitcoin and Ethereum.

Canadian Property Firm Buys Bitcoin In Hopes Of Eventually Scrapping Condo Fees

The firm bought 0.4 bitcoin and plans to buy more every month. Canadian Property Firm Buys Bitcoin In Hopes Of Eventually Scrapping Condo Fees

Saskatchewan-based Thornton Place Condominium Corp is hoping to eventually do away with condo fees by investing in bitcoin.

* In an announcement, Thornton Place in Regina said it has purchased 0.4 bitcoin with CAD$25,000 (US$20,050) through the exchange Kraken at an average price of CAD$62,500 (US$52,104) per bitcoin including fees and expenses.

* The buy is the first of an ongoing series of planned purchases, the company said, with Thornton Place having allocated an added CAD$700.00 per month to the purchase of bitcoin going forward.

* The company said it has taken direct physical custody of the bitcoin purchased instead of using a custodial service or exchange-traded fund with a management fee.

* Thornton Place Condominium said it sees a 10-year time horizon for the investment and it has “taken the first steps” which it hopes will lead to the elimination of fees for residents.

* “Our board determined that a small investment of approximately 5% of the overall reserve fund and 6% of the monthly operating fund contributions into bitcoin will permit Thornton Place to gain a limited exposure to a high-performing asset class without jeopardizing any of the long-term goals of the corporation and its owners,” said the firm.

Updated: 3-28-2021

Tokenized Real Estate Inches Forward Despite Legal, Technical Hurdles

A rowdy virtual panel showcased the hurdles and promise of real estate on chain.

An unusually rowdy (and informative) virtual panel at the Security Token Summit yesterday reveals the fractious difficulties of bringing regulated assets on-chain — as well as the promise and progress of the tokenized real estate use case despite those hurdles.

Michael Flight of the Liberty Fund, Jude Regev of Jointer.io, and Mohsin Masud of AKRU spoke for 30 minutes on the state of securitized real estate in a free-flowing and often-contentious discussion that highlighted the complexities that arise when decentralized finance and stringent governmental oversight meet. Host Kiran Arif of AKRU seldom spoke.

When asked why tokenized real estate is so exciting, Flight pointed to the size of the market and to how few investors can gain exposure to it.

“You’ve got 280 trillion dollars of real estate assets, and tokenized real estate is gonna let all investors into that asset class,” he said.

Mohsin concurred, noting that high prices and regulations have traditionally kept average investors out of the real estate market, aside from purchases like homes.

“We want to offer these securities, these asset-backed securities, to people who traditionally haven’t had access.”

Regulatory Shackles

While the promise of the use case is significant and has been pondered over for close to a decade, aside from a handful of experiments there has been little significant traction.

Part of the reason, according to Regev, is the friction from bringing a regulated asset to a decentralized system.

“It can’t work,” he said.

He compared current digital real estate to “digital paper,” saying that all of the legal requirements and barriers surrounding real estate remain functionally identical regardless of whether its a digital or physical format, and as a result unaccredited investors still can’t have access.

Likewise, he expressed doubt that such tokens would ever be listed on exchanges or achieve any significant liquidity, rendering the use case useless.

“You remember the days of timesharing, it sounds so good? And when you’re into it, you can’t get out? That’s pretty much what it is,” he said, comparing tokenization to a “magic word” with little substance.

Something Is Better Than Nothing

Mohsin rejected many of these points, pointing out that REITs and other real estate-backed products have managed to achieve significant liquidity. Moreover, he noted that there are 12.5 million accredited investor households in the US who could benefit (more recent data suggests there are 13.6 million), even if tokenized real estate doesn’t fully “democratize” the market.

Flight also pointed out the significant advanced in utility that can be made with tokenized real estate. He said that Liberty is working with centralized crypto lender Blockfi to allow real estate-backed security tokens to be used as collateral, and even to earn interest as a yield-bearing asset.

While he remained suspicious regardless of these points, Regev also made a stirring call for platforms and issuers taking responsibility for users if the use case is ever to gain significant traction.

“We need to protect the simple person who is busy, busy to survive, and wants their money to work for them.”

Updated: 3-30-2021

Nasdaq-Listed Canadian Firm Mogo Launches Bitcoin Cashback Mortgage Program

Canada’s residential mortgage market is estimated at C$1.7 trillion.

Mogo Finance Technology Inc., a Canadian fintech firm listed on Nasdaq (NASDAQ:MOGO) and Toronto Stock Exchange (TSX:MOGO), is now giving its members who take out a new mortgage or refinance an existing one the chance to earn cash to buy bitcoin using its bitcoin (BTC, +2.35%) rewards account.

In an announcement on Monday, Vancouver-based Mogo said the cashback rewards program now includes “MogoMortgage” and will give users up to C$3,100 (US$2,461) in cashback rewards. The rewards are distributed in dollars into clients’ accounts which, in turn, allows clients to buy bitcoin through the MogoCrypto program within the Mogo app.

Canada’s residential mortgage market is estimated at C$1.7 trillion (US$1.35 trillion). According to the company, this new scheme allows Canadians to get a mortgage while earning a cash reward to purchase bitcoin.

“Given the volatility and speculative nature of bitcoin, there’s an increasing number of Canadians who are looking for ways to participate without risking their own money, and our bitcoin rewards program meets this demand,” said David Feller, CEO of Mogo.

MogoMortgage is currently available to Mogo Members in a number of selected provinces including Alberta, British Columbia, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador.

The rewards program already applies to the Mogo Visa Platinum prepaid cardholders, allowing users to earn 1% cashback on purchases in Canada and 2% for foreign transactions, which can then be exchanged for bitcoin within the app.

In February, Mogo announced it would acquire a 19.99% stake in the Canadian cryptocurrency exchange Coinsquare with the rights to increase ownership up to 40%.

Mogo was founded in 2003 and had an initial public offering on the TSX in June 2015 and has a market cap capitalization of over CA$500 million.

In December, the company announced its plan to make a corporate investment of up to CA$1.5 million (US$1.19 million) in bitcoin and said it will consider additional purchases throughout 2021.

At the time of publication, Mogo shares listed on the Nasdaq were trading up 4% at US$8.82 and up 2.63% at CA$10.91 on the TSX.

Updated: 7-18-2021

Beauty And The Bitcoin: Female-Focused Brands Accept Crypto Payments Driving Adoption

Will beauty brands drive female adoption by accepting cryptocurrency payments and is there even a demand to pay with crypto besides stacking stats?

While Bitcoin (BTC) may be considered as a store of value for many, some consumers across the globe may be thinking otherwise. Recent data has revealed that 46 million people in the United States plan to use cryptocurrency to pay for things such as groceries or real estate.

Payments giant Visa further revealed in July that its crypto-enabled cards processed over $1 billion in total spending during the first half of this year.

As such, it shouldn’t come as a surprise that major brands like Starbucks, Home Depot and Target have started putting Bitcoin on their balance sheets. Yet, as crypto payments gain popularity and become easier to incorporate, smaller brands — specifically those geared toward women — are starting to accept crypto to help drive female adoption.

Beauty Industry Bets On Bitcoin

For example, the billion-dollar beauty industry has taken a recent interest in Bitcoin. Ann McFerran, CEO and founder of Glamnetic — a magnetic eyelash beauty brand — told Cointelegraph that the company now accepts Bitcoin, Ethereum (ETH) and Dogecoin (DOGE) through a recent partnership with Bitcoin payment provider BitPay. According to McFerran, Glamentic is one of the very first female-founded beauty brands to support crypto payments.

McFerran shared that she started investing in cryptocurrencies in 2017, yet noticed that the space was heavily male-dominated.

To McFerran’s point, research firm BDC Consulting found that only 8% of all crypto users were women in 2019. After launching Glamentic in July 2019, McFerran was determined to incorporate crypto payments into the brand to encourage women to use cryptocurrency:

“The beauty industry is a sector where crypto payments aren’t widely accepted. I wanted Glamnetic to be one of the first brands to support crypto payments since I’m a huge believer in cryptocurrency and because I want to bring more women into the space.”

McFerran further mentioned that she believes there is still a lot of stigma associated with how crypto is being used today. “It was certainly not a secure payment method to begin with,” she remarked. McFerran noted that events such as Silk Road and Mt. Gox have further resulted in women’s disinterest in crypto: “Even to this day, women are not fully educated when it comes to crypto. I want to educate others so they can understand the risks and what they are potentially missing out on.”

Although transacting with Bitcoin and other cryptocurrencies for beauty products may encourage women to become interested in cryptocurrencies, this is just one part of the equation. Sanja Kon, CEO of Utrust — a banking system for crypto payments — told Cointelegraph that educating women around crypto depends heavily on a brand’s ability to reach their consumer base with the correct educational tools:

“More beauty brands adopting cryptocurrency payments can increase awareness, but not necessarily usage. Women need to feel comfortable using cryptocurrency as a payment method. In order for that to happen, brands should provide support and educational content to advocate adoption.”

According to Kon, Utrust is facilitating this movement by investing resources into educational plans with the company’s merchants. McFerran also noted that Glamnetic has started creating TikTok videos to educate consumers on cryptocurrency, which can make a big impact given the notion that younger consumers are more likely to own crypto. PYMNTS.com found that 27% of all millennials either own or have owned one type of cryptocurrency.

McFerran further remarked that Glamnetic will be releasing a magnetic eyelash collection inspired by Dogecoin to help drive adoption: “I think people will be more open to the idea of crypto if you turn that concept into an entire beauty product.”

While Glamnetic may be one of the first female-founded beauty companies to accept crypto payments, a handful of larger cosmetic brands have also started incorporating crypto in other ways to drive female participation.

Aubrey Strobel, head of communications at Lolli — an online Bitcoin rewards platform — told Cointelegraph that the company works with leading retailers including Sephora, Ulta, EM Cosmetics and Glossier. According to Strobel, women make up 30% of Lolli’s user base. “Historically, women have lagged behind men in the space, but lead a vast majority of many households’ purchasing decisions,” Strobel said.

Strobel explained that companies offering Bitcoin rewards to consumers are attractive to many shoppers, especially women who want to “stack sats” when making purchases online.

This notion is highlighted in a recent report from The Defiant, titled “Global Report on Women, Cryptocurrency and Financial Independence.” In this document, a woman named Christine noted that she occasionally learns how to manage cryptocurrency by practicing with small transactions.

She stated that she has been stacking sats to accumulate small amounts of Bitcoin over a long period of time. “When I travel, I like to buy coffee and other things with it,” Christine further remarked.

Will Bitcoin Catch On In The Beauty Industry?

While it’s too soon to tell if crypto payments for beauty products will drive female participation within crypto, a small impact is already being exhibited. McFerran shared that Glamnetic has already processed a handful of crypto transactions from women consumers.

Yuvi Alpert, founder and CEO of Noémie — a jewelry company that also recently incorporated crypto payments — also told Cointelegraph that the brand has currently only seen crypto sales with their female customers.

Although this may be the case, findings show that the top products females are likely to spend cryptocurrency on are travel and leisure, real estate and furniture or appliances. Yet, while crypto payments may be slow to catch on in the beauty industry, brands incorporating cryptocurrency transactions will likely gain a competitive advantage.

According to Kon, more brands, in general, are starting to understand the advantage of accepting cryptocurrencies as a payment method:

“They will be able to drastically reduce their payment processing fees, as blockchain allows to cut all the traditional intermediaries, such as banks, payment processors and credit card schemes. Additionally, these brands will be able to eliminate chargebacks and fraud, as well as increase their revenue by reaching out to new customers.”

Updated: 7-25-2021

Bitcoin Payments For Real Estate Gain Traction As Crypto Holders Seek Monetization

Could crypto payments for real estate become another notable way for people to invest their BTC, or is the learning curve too steep for wider adoption?

Crypto investors are betting big on real estate this year as the cryptocurrency market continues to grow. New York Digital Investment Group (NYDIG) recently conducted a survey that found that 46 million Americans own Bitcoin, equating to 22% of all adults. While optimistic, some cryptocurrency investors have expressed concerns regarding the security, custody and volatility of digital assets.

For example, Nickel Digital Asset Management, a regulated European investment manager dedicated to the crypto market, surveyed institutional investors and wealth managers from the United States and Europe who collectively have $275 billion in assets under management. Findings show that 76% of these individuals are concerned about the security of their digital assets. The same percentage said this about the size of the market and liquidity, followed by 71% who see the regulatory environment for the crypto market as a major issue.

This in mind, many crypto holders have started investing Bitcoin (BTC) and other cryptocurrencies into less risky assets such as real estate. Ben Shaoul, managing partner of Magnum Real Estate Group, told Cointelegraph that the company has recently been receiving more requests to sell real estate to cryptocurrency holders. According to Shaoul, Magnum began conducting crypto for real estate transactions about three years ago:

“We hadn’t tackled this before since most real estate developers didn’t understand crypto paymements. But we understood what it meant and how we could structure a sale for cryptocurrency. With the help of our legal team, we figured out how to conduct crypto transactions with the consent of regulators. We first sold a few residential units and then we sold a retail condominium in New York about three years ago for cryptocurrency.”

Eric Hedvat, chief operating officer of Jet Real Estate and a special consultant for Magnum, further told Cointelegraph that given the fast-paced growth of today’s crypto market, BTC payments for real estate is more important than ever before since it offers crypto investors an opportunity to grow with cash flow: “The cryptocurrency market has created a vast network of new wealth that wants to find traditional assets to invest in like real estate. There also aren’t many commercial properties for sale to buy with Bitcoin.”

Specifically speaking, Shaoul noted that the income generated from the retail condominium building that Magnum sold for $15.3 million in BTC during 2019 is all credit. “M&T bank has been a tenant in this building since it was built. They are a multi-billion-dollar bank.” This is an important detail, as Shaoul further commented that individuals who have created new wealth with cryptocurrency don’t have a way to monetize it or create a steady income stream:

“This property has over a million dollars a year of free cash flow. This is a very attractive offering for someone sitting on wealth they’ve created in cryptocurrency. This gives them an opportunity to monetize and effectively collect a bond moving forward.”

This has especially become the case due to interest rates in the United States. To put this in perspective, a recent survey conducted by the Financial Times and the University of Chicago’s Booth School of Business found that elevated inflation may make the Federal Reserve raise U.S. interest rates at least twice by the end of 2023.

“In an environment where interest rates are where they are now, you can’t monetize into cash and leave your money in the bank and convert,” Shaoul said, adding that as a result, Magnum has been seeing a lot of cash move out of both the crypto and equities markets into hard assets such as real estate.

Piper Moretti, CEO and founder of The Crypto Realty Group, told Cointelegraph that crypto for real estate transactions is indeed becoming more common. Moretti shared that her firm currently has real estate listings available for Bitcoin in Tulum, Uruguay, Puerto Rico and Costa Rica.

Although this is the case, Moretti mentioned that many buyers purchasing real estate with crypto are taking loans out against their cryptocurrency.

“Because of capital gain issues and the belief that Bitcoin’s price will reach $100,000 by the end of this year, people are taking loans out against their crypto. This way, they can keep their crypto and still monetize,” she remarked.

Joseph Kelly, CEO of Unchained Capital — a Bitcoin financial services company — confirmed this, noting that the firm has seen about 30%–40% of its loan originations go toward real estate.

But Cash Is Still King For Sellers

While Bitcoin and other cryptocurrencies are being used to purchase real estate, it’s important to note that, oftentimes, sellers prefer cash to crypto when dealing with these transactions. Moretti explained, “If a seller receives multiple offers, 99% of the time they’re going to push the cash offers to the top of the pile, even if it’s a crypto conversion because more likely than not they will be receiving the cash at closing.”

To put this into perspective, Sonny Singh, chief commercial officer of BitPay — a Bitcoin payments processor — told Cointelegraph that BitPay has facilitated $100 million in real estate transactions in the past five years. Singh mentioned that crypto transactions can easily be converted to U.S. dollars:

“The first thing that needs to happen is for the title or escrow company to be on board with this process. Sellers can also use the companies BitPay already works with. Buyers can then pay in Bitcoin, and we exchange that to cash. The escrow company now gets the Bitcoin at a cash-pay spot rate immediately. The entire process takes one day, and there is a 1% fee to initiate the transaction.”

Although this is typically the case, Shaoul shared that Magnum keeps a percentage of cryptocurrency obtained through real estate transactions in the company’s treasury. “We keep a portion of this to maintain the same percentage of crypto we’ve been balancing for the last six to seven months.” In order to do this, Shaoul shared that the firm is working with the crypto investment company Galaxy Digital to help manage cryptocurrency gained from real estate transactions.

Are Bitcoin Payments For Real Estate Just Hype?

While it’s certainly notable that crypto holders have been seeing more opportunities to purchase real estate with digital assets, some industry experts believe that this recent trend has become overhyped.

For instance, Natalia Karayaneva, CEO of Propy — a real estate transaction platform powered by blockchain technology — told Cointelegraph that many of the stories in the media today focus on crypto payments for real estate as if this is a new development. But to Karayaneva’s point, accepting crypto payments dates back to 2014, when BitPay helped facilitate the sale of a Lake Tahoe property that sold for $1.6 million in BTC. In 2014 , a tech entrepreneur also listed his Tiburon, California home for sale for $3.6 million, which was payable in Bitcoin.

Karayaneva believes that blockchain technology being leveraged to facilitate crypto-to-crypto transactions will be the real game-changer for the real estate industry. It is possible to close a real estate transaction entirely in Bitcoin, without any cash conversion involved. Karayaneva explained that conducting transactions this way saves time for both the buyer and seller: