Inheritance Planning For Cryptocurrencies (#GotBitcoin?)

Inheritance Planning For Cryptocurrencies: 3 Steps In 3 Minutes. Inheritance Planning For Cryptocurrencies (#GotBitcoin?)

I’ll be expanding these ideas in a forthcoming article and book but with prices skyrocketing, and so many new people owning tokens for the first time, I want to provide a quick reference guide that you can complete in less than 10 minutes to help protect your new assets. My book Cryptoasset Inheritance Planning: a simple guide for owners is now available at Amazon.com (and at amazon sites throughout the world).

@woodlegalgroup

Protecting You, Your Family And Your Legacy Through Personalized Estate Planning. Ask Us How!

How to use this guide: The fastest, most secure way to use guide this is to print two copies of it as-is, don’t fill in the blanks on your computer. Next, get two sheets of paper and use a pen to write down the important information your heirs will need on both sheets of paper.

Related:

How To Securely Transfer Crypto To Your Heirs

Attach one sheet to each copy of this guide and store it securely. Alternatively, you could print on one side of the page and write your instructions on the other side of the paper.

There are three things that your heirs MUST know about in order to access these tokens and keep them safe:

exchanges, wallets, and devices. We’ll explore each in order.

Exchanges

Most exchanges are centralized and hold funds for you in an account to allow you to trade between local currency and cryptocurrency. Many people purchase their first bitcoin or ether, using their local currency, through exchanges like Coinbase, Xapo, Bitfinex, Kraken, or Poloniex. Often, but not always, people link their traditional bank accounts to these services.

What do your heirs need to know? If your loved ones don’t know the exchange account exists they cannot access it, so at minimum, they need to know what exchanges you’re currently using and the ones that you no longer use but are still open. You do not need to list the password or login credentials; in fact, in a simple inventory you shouldn’t include them. Do not count on your family figuring out what exchanges you use based upon your bank statements. Do not count on the exchange to contact your family; they will not know you’ve passed.

An example of what you’ll write on your sheet of paper:

“I have accounts at __________, _____________, and _________________ exchanges to trade cryptocurrencies. There may be a balance in USD / EUR and/or a balance in any or all cryptocurrencies listed on the exchanges.”

Note: If you’re using a decentralized exchange like Bisq, first, kudos to you, and second, you’ll need to follow the procedures for wallets listed below.

Wallets

Wallets can be a bit trickier because often it’s difficult for people to know if they are using a “hosted wallet,” like an exchange where you don’t actually own your keys, or a non-hosted wallet, where you do. Many exchanges have their own wallets, most of these are “hosted wallets.” If you’re using a hardware wallet, you own your own keys. If you’re using a software wallet that constantly reminds you to “backup your wallet,” you probably own your own keys. If you’re not sure, try opening your wallet’s settings and look for a “wallet backup” or similarly named feature.

If you haven’t backed up your wallet yet, do it now. Seriously. Stop reading this article, take out a another sheet of paper, hand-write the name of the software and the wallet backup information. Be sure there are no cameras or prying eyes around. Put the backup in an opaque envelope and store it in a safe, secure place. Then come back to this article.

What do your heirs need to know? If you’re using a hosted wallet, follow the instructions for exchanges above and mention that you also use the associated wallet. If you’re holding your own keys (which you should be for the majority of your holdings), then your heirs will need to know at least two things:

(1) The name of the wallets you use, and

(2) Where your wallet backups are located.

The name of the wallet software is particularly important if you are using a single wallet to access more than one type of token.

If you use advanced features, like an encryption password for paper wallets (BIP38) or passphrase for seeds (BIP39), they will also need to know where those are stored (which should be separately from the seeds themselves). You do not have to list all of the tokens you hold, particularly if you’re actively trading. Whoever is helping your heirs access the tokens should understand wallet software and be able to search for all tokens available using the software.

An example of what you’ll write on your sheet of paper:

“I use Trezor, Ledger, Samourai, Jaxx, and Green Addresswallets to access my cryptocurrencies. I use my Ledger and Jaxx wallets to access multiple currencies. The rest are bitcoin only.

You can find the wallet backups among my other important documents stored in a vault at XYX bank branch. Or contact my cousin Ray and my sister Lisel to locate my wallet backups. Or I’ve left instructions on how to find my wallet backups at ____________________.

Warning, anyone who has access to these backups can steal the funds and you or your heirs won’t be able to get them back. Watch ‘helpers’ carefully.”

Devices

What do your heirs need to know? They will need to know what devices you use to access your wallet accounts. Why? Because these devices probably have copies of your keys stored on them and it’s important that your heirs know not to throw away, donate, gift, or destroy these devices until the funds have been successfully moved to the estate or moved to your heirs. You don’t need to give them your access codes and passwords, unless you’re relying on them to use these devices to access your cryptocurrency which is a bad idea for many reasons — too many to discuss here. If you use a hardware wallet, print a picture of the device (a stock photo is fine) to attach to this document so that your heirs will be able to identify it.

An example of what you’ll write on your sheet of paper:

“It’s very important that you keep my phone, laptop, and any devices that look like the photo included on the following page until the estate is fully settled. Don’t let anyone access these devices without watching them carefully.”

Bonus

Your heirs will probably need someone to help them access your cryptocurrencies and asset tokens. If you can easily think of people you trust to help, then list them. I prefer having at least two ‘helpers’ designated, from different organizations or different sides of the family. The idea is that you want people who probably won’t collude to steal the assets. My clients often list Third Key Solutions LLC, thirdkey.solutions, as one of the helpers, but of course that’s not required. Remember this is just a bonus; if you’re not ready to commit to helpers now, just omit that section. Don’t let that stop you from writing out your inventory now.

An example of what you’ll write on your sheet of paper:

“My best friend Jessie Leverski can work with Third Key Solutions, at thirdkey.solutions, to help you access these funds.”

While doing these few things won’t guarantee your cryptocurrencies and tokens will go to the people you want them to (that requires a will, testament, or legal trust), not doing them will almost certainly guarantee your heirs won’t be able to benefit from your cryptocurrency holdings. This is the first step in what, for most people, should become a more comprehensive plan, especially if you’re holding a large amount of cryptocurrency. But that sort of planning takes time.

Using this guide, you can start protecting your loved ones in just a few minutes. Select “print”, write down a few things on paper, store the guide securely, and sleep better tonight knowing you’ve started planning for their future.

Sign up to the Third Key Solutions Inheritance for Cryptocurrencies & Asset Tokens Mailing List to receive our latest guides and newsletters: http://eepurl.com/den60f

About the author: Pamela Morgan, @pamelawjd, is an attorney, educator, and entrepreneur who has been working exclusively in the bitcoin and blockchain industry since early 2014. She is a widely respected authority on multi-signature governance and legal innovation using digital currencies. Pamela is one of the few attorneys whose knowledge and understanding goes beyond legal theory; she actually uses these technologies everyday. She’s authored numerous “how-to” articles and is known for delivering engaging, practical presentations about her work to audiences around the world.

In addition to her law practice, Pamela is the CEO of Third Key Solutions LLC.

Third Key works with clients to design and test asset protection plans, including high-value estate planning, internal corporate governance plans, and disaster recovery plans. Pamela is also a board member of the CryptoCurrency Certification Consortium (C4) a non-profit industry standards organization, where she serves as the Director of Education.

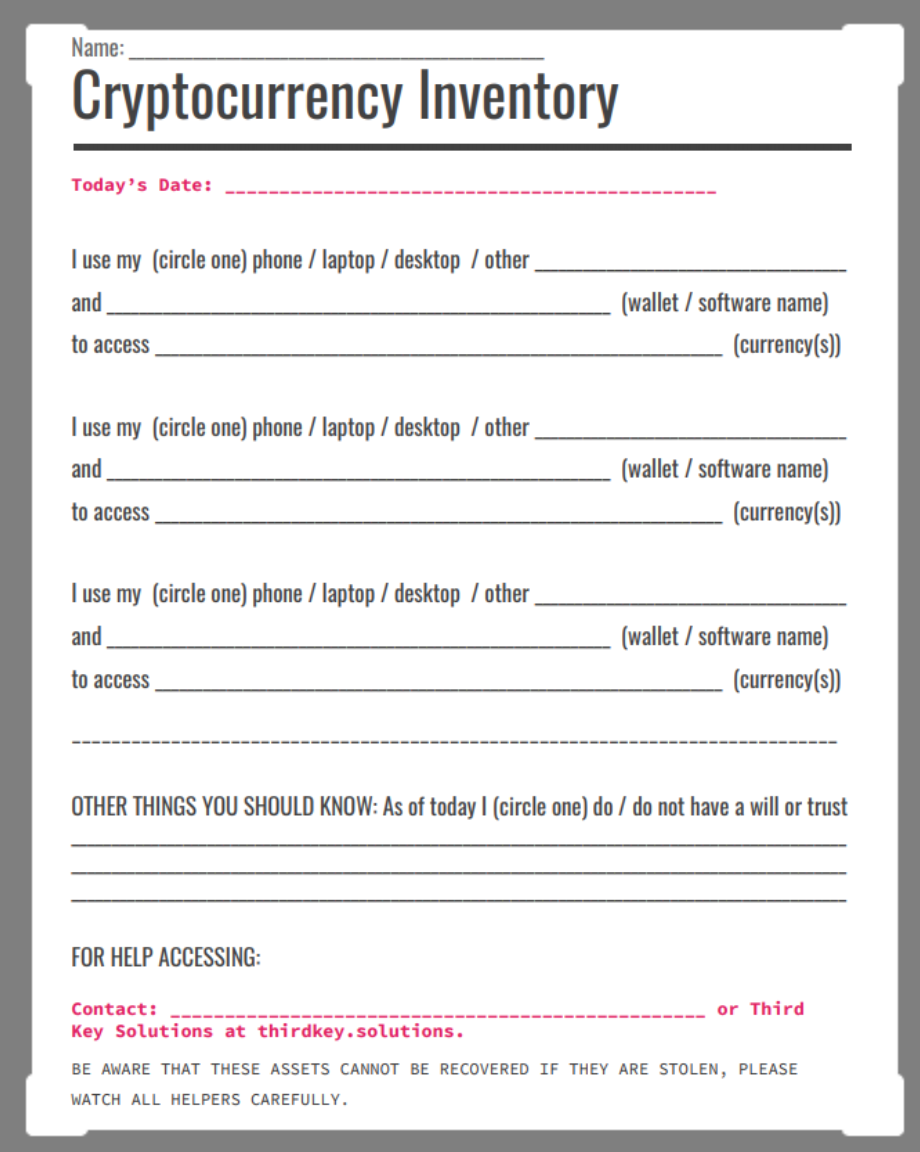

Cryptocurrency Inventory: Start Here for Inheritance Planning

You know you need to do estate planning for your cryptocurrencies, because if you don’t your family likely won’t be able inherit them. You’ve probably been thinking about it for awhile, but it hasn’t made it to the top of your “to-do” list yet (it probably never will). Instead of waiting until you’ve got the time/resources/energy to devote to building an entire estate plan, here’s a simple template that you can complete in less than 5 minutes; it might be the difference between your family inheriting your crypto and them losing out.

Basic Cryptocurrency Inventory Template

Basic Cryptocurrency Inventory TemplateHow To Use The Template:

(1). Customize it for your situation. Add, delete, change whatever you like, it’s your document, designed for your family, and your holdings; we’ve just provided a starting point.

(2). If you’ve told your sister/cousin/friend about your bitcoin, ether, or other cryptoassets and they’re your inheritance plan, consider having them complete the document (with your help) as a way to help them understand what you have.

(3). While nothing in the inventory is security critical, protect it from fire and water damage, and untrustworthy people. Consider storing it with your other important documents.

(4). Keep more than one copy of the inventory and update them regularly. Given the current ICO craze, we’re recommending at least quarterly updates; monthly if you’re actively buying new types of tokens.

This inventory alone is not enough to guarantee your family will be able to inherit your bitcoin, ether, or any other cryptoassets but it’s a great start and it’s far better than doing nothing. To be sure they’ll have access and things will happen as you want them to, you’ll need a more through technical and legal plan.

If you’re not ready for a whole technical and legal plan but want to do a bit more, consider using our more detailed Letter to Your Loved Ones Template (only after your inventories are complete though).

WHO WE ARE

Organizational History and Philosophy

Third Key Solutions (TKS) is a boutique key consulting and management firm that began as a response to market requests. Clients of our CEO, Pamela Morgan, were continually asking her to provide key consulting services in conjunction with legal services. Understanding the importance of good key security, TKS was formed to meet those needs.

TKS is highly selective when it comes to clients and projects. We will only work with clients who demonstrate a committment to community and are working on socially responsible projects. As with many other firms in the blockchain space, we receive far more requests than we can currently serve and we will not accept new clients at the expense of our current ones. We are highly sensitive to conflicts of interest and pride ourselves in delivering exceptional service and building long-lasting relationships through integrity and fair dealing.

Executive Team:

Pamela Morgan, Chief Executive Officer (CEO)

Pamela has recently published her first book Cryptoasset Inheritance Planning: A Simple Guide for Owners, based in large part upon the work she’s done at TKS.

Find out more about Pamela by visiting empoweredlaw.com or follow her on twitter @pamelawjd

Andreas M. Antonopoulos, Chief Technology Officer (CTO)

Find out more about Andreas by visiting antonopoulos.com or follow him on twitter @aantonop

Richard Kagan, Strategic Advisor

Richard has been a tech entrepreneur for over 30 years. As a senior marketing executive he has launched and helped to build several successful companies, including Echelon (NASDAQ:ELON), VPNet (acquired by Avaya), Fortinet (NASDAQ:FTNT), and Infoblox (NYSE:BLOX). He is an active investor and advisor to emerging companies in networking, security, business intelligence and payments.

Only 23% of Hodlers Have a Crypto Estate Plan: Survey

If deceased QuadrigaCX CEO Gerald Cotten’s untimely exit was meant to teach some twisted cosmic lesson in cryptocurrency estate planning, then the vast majority of crypto investors never showed up to class, according to a new study by the Cremation Institute.

A mere 23% of the 1,150 crypto holders who responded to the Cremation Institute’s online survey, conducted between October 2019 and June 2020, reported having a documented plan for passing on their crypto assets in case of their death. That’s despite the vast majority – 89% – of participants who worry on some level about whether their crypto assets will be passed on to their loved ones.

Unsurprisingly, the lack of planning is strongest among younger generations. Millennials and Gen Zers are 10 times more likely to lack a crypto inheritance plan than their elders, the survey found. Of the 18% of those 18-34 years old who reported having a will, just 3% said will provides for what happens to their crypto.

Wills appear to be an unpopular means for documenting crypto plans across all age groups, baby boomers included. Far more prevalent were “instructions,” according to the survey, which found 65% of those planners hid their crypto instructions in the house, 17% stored them on a computer or USB device and 2% kept them in a safe deposit box.

The problem is compounded by a general lack of crypto estate law around the world, the Institute said.

Updated: 8-26-2020

Make Sure To Include Digital Assets In Your Estate Plans

Among other things, beneficiaries can be blocked from accessing accounts and credit-card points and frequent-flier miles may be lost.

The internet opens a world of possibilities to store personal data, to manage assets, and to gather and create digital content.

But too often that data gets forgotten when it comes to estate planning—and that can cause problems for family members and heirs.

“We often forget the fact that we are usually the only ones that can access these accounts,” says Tamara Telesko, director of wealth planning strategies at TIAA and a specialist in estate planning and income-tax issues.

The result is that when an online-account holder becomes incapacitated or dies, beneficiaries can be blocked from financial documents and accounts related to banking, brokerages or cryptocurrency.

Frequent-flier or credit-card points can go to waste. Many kinds of nonfinancial assets, such as photos, social-media accounts, family trees and blog posts may never be seen again.

Here’s some advice for creating an estate plan for digital assets.

Re-Examine Your Estate Plan

For those who crafted an estate plan more than a few years ago, it is worth looking at it again. It is likely that digital assets aren’t mentioned. State laws regarding digital assets also might have changed.

Most states have made it easier for court-appointed fiduciaries to gain access to a decedent’s digital accounts, similar to how they would access tangible property. Even so, lawyers say it is advisable to include provisions in your estate plan that authorize your representatives to access your digital assets, including email and social media.

Create A List

People should keep a list of their digital accounts and online assets to make it easier for their heirs to administer the estate.

Providing a list and instructions for accessing accounts will help authorized people gain access as quickly as possible, which can help prevent theft, among other problems. Hackers and thieves comb public records for information that will help them access the deceased’s accounts.

Chicago lawyer Jennifer Guimond-Quigley offers the cautionary tale of a client whose father died without granting online access to any of his personal or financial accounts. As a result, the daughter, his named executor, didn’t have the ability to monitor his bank account until receiving legal authorization from the probate court, and someone made an unauthorized ATM withdrawal for $1,000 just after the father’s death. In theory, the account could have been drained before the daughter gained access to it.

Another risk is that heirs might be unaware of accounts, says Michael Roberts, president of Arden Trust Co., in Wilmington, Del. This can lead not only to loss of assets, but to mounting debts from unpaid bills. If a bill—for instance, for property taxes or insurance—arrives only by email, and the executor doesn’t have access to the email, the bill could be missed, causing late payments or, worse, default.

Any list of digital assets also should include things like cloud accounts with stored family photographs, videos or genealogy information, Dropbox accounts, email and social-media accounts.

Other possible digital assets with financial value include cryptocurrencies, domain names and copyrighted works that exist in digital form. With cryptocurrencies, account holders should detail the amount and where to find the private keys that will be required to carry out any transaction. Without the private keys, heirs won’t be able to access the account.

Ms. Telesko of TIAA recommends account-holders split up such keys, which are usually a series of letters and numbers, among different trusted people and tell the executor that these three people have the number and what part of the private key each one has. Then the executor can put it together.

Keep The List Safe

Lists of accounts should either be printed out and kept with the estate plan in a safe place, like a vault or safe-deposit box, or stored within a password manager online.

For those using an online password manager as a way to list their digital accounts, it’s important to leave instructions for a trusted individual, such as an attorney, custodian, agent or executor, to gain access to the master password, taking care not to leave the actual password in the will or trust, says Christopher Paul, partner and chair of the Trust & Estates Department at McLane Middleton in Manchester, N.H.

Armed with the account information and necessary documentation, the authorized representative can then contact each account provider and should be able to access each account, he says.

For instance, a person might leave the master password in an envelope with instructions to his or her attorney to provide it to the digital executor upon death, or leave it in a safe-deposit box, says Mr. Roberts of Arden Trust. “You want it secure, but you also want it to be accessible,” he says.

A word of caution about using the deceased person’s passwords. Having a master password and accessing the list of accounts as a starting point for going through official channels is different from using a person’s passwords to log into each individual account.

There’s a concern that logging into someone else’s account using his or her password, without appropriate authority, could violate the provider’s user agreement or state or federal law, and could subject that person to liability.

Although gaining access to the deceased person’s accounts is certainly easier if you know their passwords, lawyers recommend erring on the side of caution and going through the proper channels to inform each online provider of the person’s death and take the necessary next steps.

For example, some social-media providers in particular may take a hard line if people try to use the password for a deceased person’s account; such access may be in violation of the provider’s terms and conditions.

The provider might immediately close the account, leaving the family no way to preserve the information, says Karin Prangley, senior vice president and wealth planner in the private-banking division at Brown Brothers. Ms. Prangley is a former practicing trusts-and-estates attorney.

Choose The Right Settings

On some online platforms users can appoint someone to receive a password and control the account upon the user’s disability or death. It is a good idea to ensure the designated representative doesn’t conflict with the executor or other responsible person named in the estate plan. Otherwise conflicts can arise between your representatives after your death, adding unintended administrative complications.

Each site has its own policy, so it is important to check with each provider.

Google, for example, has something called “inactive account manager,” which allows users to determine who can control the account and what access this authorized representative has once the owner passes away.

Facebook, for its part, has “memorialization settings,” to allow users to decide what happens to their account after they pass away.

While digital estate planning can be somewhat time consuming, lawyers say it is a necessary process.

Says Mr. Paul of McLane Middleton, “The consequences of failing to plan, at best, leaves your heirs or assigns a mess to address at your death, and at worst, causes serious financial harm to your estate.”

Updated: 11-27-2020

What Happens To Your Bitcoin When You Die?

Pass on your crypto to the next generation.

As cryptocurrency investment becomes more and more popular, long-term investors are increasingly concerned with the uncomfortable question: What happens to your Bitcoin (BTC) when you die?

According to a 2020 study by the Cremation Institute, nearly 90% of crypto owners are worried about what will happen to their crypto after they pass away. Furthermore, despite a high level of concern, crypto holders are reportedly four times less likely to use wills for inheritances than non-crypto investors.

As explained in its white paper, Bitcoin is a purely peer-to-peer version of electronic cash, allowing online payments to be sent directly from one party to another without going through a financial institution.

As a distributed network, Bitcoin has no central authority to control user funds, so no one but the owners themselves can control their assets.

Consequently, millions of dollars in crypto is being lost each year through the deaths of its owners. Crypto insurance firm Coincover estimates that around 4 million Bitcoin, or $68 billion at publishing time, is out of circulation after access was lost, with a large portion likely caused by death.

But this doesn’t mean that cryptocurrencies like Bitcoin can’t be bequeathed and will inevitably be buried forever with the deceased owner.

In fact, there are a number of ways for investors to bequeath their crypto to the next generation, but each method requires some decision-making and planning, as well as some general knowledge about how crypto works.

Sharing Keys With Trusted Family Members

Sharing keys with trusted family members is probably one of the most straightforward methods to passing on your crypto. Some of the most prominent people in the crypto industry have publicly claimed to use this method to ensure their crypto fortune gets passed on.

Hal Finney, an early supporter of Bitcoin and recipient of the first Bitcoin transaction from BTC creator Satoshi Nakamoto, willed his crypto holdings to his children by simply providing his keys. About a year before his death in 2014, Finney wrote:

“Those discussions about inheriting your bitcoins are of more than academic interest. My bitcoins are stored in our safe deposit box, and my son and daughter are tech savvy. I think they’re safe enough. I’m comfortable with my legacy.”

This crypto inheritance practice is straightforward but may not be suitable for everyone in the crypto community. This way of bequeathing Bitcoin could be also considered risky, as shared keys come with the responsibility of keeping those assets secure.

If you choose this method, be sure that your heirs are aware of the plan and some best practices for crypto security.

Some exchanges can unlock access to crypto with a death certificate

Despite the Bitcoin network itself not caring about things like inheritance, some crypto services allow family members of a deceased client to access their crypto assets.

Major United States-based cryptocurrency exchange and wallet service Coinbase, for example, allows the bereaved to gain access to a family member’s assets after providing a number of documents including a death certificate and a last will.

Coinbase users can also name a beneficiary on their Coinbase account. However, the procedure is not supported directly through Coinbase but rather using the services of an estate planning attorney.

A spokesperson for Binance — the world’s largest crypto exchange — told Cointelegraph that the company has similar policies for providing access to crypto beneficiaries but did not elaborate on the process. “The beneficiary should contact customer support directly where one of our agents can guide them through the process,” the representative said.

Crypto Inheritance Services: Is It Worth It?

There are also some projects that are dedicated to ensuring the inheritance of digital assets. For example, companies such as Safe Haven, Casa and TrustVerse are working on their own solutions that allow people to bequeath their crypto assets using blockchain technology and cryptography.

Officially launched in September, Safe Haven’s digital inheritance platform Inheriti allows users to bequeath access not only to cryptocurrencies like Bitcoin but also to social media profiles like Facebook and Google+.

Safe Haven’s CEO, Dujardin Logino, said that neither Safe Haven nor Inheriti will ever store any digital assets themselves but rather provide a service to store encrypted information to the assets in question. “It is 100% your decision who gets a Safe Key since Safe Haven or the platform Inheriti has no idea what you are encrypting,” said Logino.

Logino told Cointelegraph that Inheritance has been gaining more traction amid the ongoing COVID-19 pandemic:

“In the last few weeks we have seen our platform grow to more than 1,000 unique users in the space. With the COVID-19 situation we are experiencing a huge demand from crypto and non-crypto people for our solution.”

While specialized services may offer a tailor-made solution to the crypto inheritance problem, they are generally in their early stages of development and also charge a fee. According to Logino, each backup share by Safe Haven costs about $20 to $40 in the firm’s native token, SHA. A standard edition solution also charges a $5 monthly subscription.

Updated: 7-30-2021

Bitcoin Inheritance Tool To Use Cloud Service By Russian Sberbank

A new project in Russia aims to enable secure storage of inherited digital possessions like Bitcoin using a cloud-based service of state-owned Sberbank.

A group of Russian experts is working on a new blockchain-based service to allow users to bequeath their cryptocurrency holdings and digital rights to the next generation.

The National Technological Initiative (NTI), a global technical leadership program in Russia, announced a new digital inheritance tool based on blockchain technology, local news agency RIA Novosti reported Tuesday.

The initiative brings together experts from three local universities, including Lomonosov Moscow State University, the National Research Nuclear University and the Moscow State Institute of International Relations.

Dubbed “Time Capsule,” the service would allow users to store digital data and assets like social media passwords and Bitcoin wallet keys, according to the NTI. The service would also allow the transfer of other digital possessions like images, texts, videos, or location coordinates, NTI representatives reportedly noted.

Project manager Dmitry Izvekov said that the working group is now building a website that would allow users to store their digital possessions in encrypted form before the data is ready to be transferred to specified persons only on the specified date. The transfer of this information is only available if certain conditions are met, effective not earlier than six months after the data was uploaded on the website, Izvekov added.

According to the report, the expert group plans to store the encrypted digital inheritance data on SberCloud, a cloud-based service run by state-owned Sber (formerly known as Sberbank), the largest bank in Russia.

Users would be able to duplicate the data over cloud services like DropBox, the report notes. The project creators reportedly intend to raise up to 3 million rubles ($40,000) to finance the initiative, expecting to monetize the platform as soon as it grows more popular and to offer additional services.

Despite Sber’s cloud-based platform reportedly being expected to be involved in storing digital assets like Bitcoin (BTC) as part of the project, Russia’s largest bank is not a big fan of the cryptocurrency, at least within the country. Last month, Sberbank CEO Herman Gref argued that cryptocurrencies like Bitcoin are probably the riskiest type of investment alongside the equity market. As reported, Sber previously planned to set up a cryptocurrency exchange through its Swiss subsidiary in January 2018.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

The Assets That Matter Most In Crypto (#GotBitcoin?)

Ultimate Resource On Non-Fungible Tokens

Bitcoin Community Highlights Double-Standard Applied Deutsche Bank Epstein Scandal

Blockchain Makes Strides In Diversity. However, Traditional Tech Industry Not-S0-Much (#GotBitcoin?)

An Israeli Blockchain Startup Claims It’s Invented An ‘Undo’ Button For BTC Transactions

After Years of Resistance, BitPay Adopts SegWit For Cheaper Bitcoin Transactions

US Appeals Court Allows Warrantless Search of Blockchain, Exchange Data

Central Bank Rate Cuts Mean ‘World Has Gone Zimbabwe’

This Researcher Says Bitcoin’s Elliptic Curve Could Have A Secret Backdoor

China Discovers 4% Of Its Reserves Or 83 Tons Of It’s Gold Bars Are Fake (#GotBitcoin?)

Former Legg Mason Star Bill Miller And Bloomberg Are Optimistic About Bitcoin’s Future

Yield Chasers Are Yield Farming In Crypto-Currencies (#GotBitcoin?)

Australia Post Office Now Lets Customers Buy Bitcoin At Over 3,500 Outlets

Anomaly On Bitcoin Sidechain Results In Brief Security Lapse

SEC And DOJ Charges Lobbying Kingpin Jack Abramoff And Associate For Money Laundering

Veteran Commodities Trader Chris Hehmeyer Goes All In On Crypto (#GotBitcoin?)

Activists Document Police Misconduct Using Decentralized Protocol (#GotBitcoin?)

Supposedly, PayPal, Venmo To Roll Out Crypto Buying And Selling (#GotBitcoin?)

Industry Leaders Launch PayID, The Universal ID For Payments (#GotBitcoin?)

Crypto Quant Fund Debuts With $23M In Assets, $2.3B In Trades (#GotBitcoin?)

The Queens Politician Who Wants To Give New Yorkers Their Own Crypto

Why Does The SEC Want To Run Bitcoin And Ethereum Nodes?

US Drug Agency Failed To Properly Supervise Agent Who Stole $700,000 In Bitcoin In 2015

Layer 2 Will Make Bitcoin As Easy To Use As The Dollar, Says Kraken CEO

Bootstrapping Mobile Mesh Networks With Bitcoin Lightning

Nevermind Coinbase — Big Brother Is Already Watching Your Coins (#GotBitcoin?)

BitPay’s Prepaid Mastercard Launches In US to Make Crypto Accessible (#GotBitcoin?)

Germany’s Deutsche Borse Exchange To List New Bitcoin Exchange-Traded Product

‘Bitcoin Billionaires’ Movie To Tell Winklevoss Bros’ Crypto Story

US Pentagon Created A War Game To Fight The Establishment With BTC (#GotBitcoin?)

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.