What The HEX: A Look at Richard Heart’s Controversial New Crypto (#CryptoScam)

HEX is a new financial tool and cryptocurrency launching on the Ethereum network via a Bitcoin UTXO snapshot on December 2. Critics are questioning HEX’s legitimacy, calling it a colossal cash grab and privacy compromise. What The HEX: A Look at Richard Heart’s Controversial New Crypto (#CryptoScam)

Devout fans can’t wait to claim their tokens and start staking. So who’s right and who’s wrong?

Heart explained that HEX is the world’s first high-interest blockchain certificate of deposit (CD), letting users stake their tokens in return for interest.

Users can enjoy interest payments ranging from 3.69% if 99% of the total supply is staked, up to an improbable and enormous payout of 369% if only one percent of the total supply is staked — paid out in HEX tokens.

It’s worth noting that the monetary value of such a payout depends entirely on the market value of HEX at the time of maturity.

“It’s the world’s first blockchain CD that attacks the largest market in the banking ecosystem outside of savings accounts,” Heart said.

This is the new and improved Hex (Funny As Hell) Zux Bux The First Provably-Zero-Sum Copy-Cat Meta-Scam Improving The Hex Scam To Make It Even More Scammy.

Maybe not as cool as Blockchain Enhanced Distributed Computational Fluid Dynamics Supercomputing Networks, but close enough!

Designed to go up even faster than HEX…basically the Tron to HEX’s IOTA!

ZUX is the scam to save you from all the other scams. Are you addicted to being scammed? Find yourself sending money to dozens of Nigerian Princes just hoping that this is the one? Then ZUX is for you!

Getting you your fix of crazy promises and stupid-game theory, all without losing (too much) real money! You’ll be wealthier, happier, and your wife won’t leave you (at least not for economic reasons)!

Move Over, Big Banks?

HEX is essentially a crypto version of the traditional fixed deposit. The client-side looks like the popular banking instrument: a user locks up funds, then receives their invested principal plus interest when the term matures.

“Banks use your money as a sort of collateral that’s just an excuse for them to borrow money from the government at extremely low rates,” Heart said.

HEX Fixes This…

Meanwhile, Bitcoin has some serious limitations, Heart explained. “What does Bitcoin do? It lets you enter a number on your screen which changes the number on someone else’s screen. It makes sure nobody does that twice by burning millions of dollars in electricity.”

Of course, the cost to secure a single such transaction is far from millions of dollars, but Heart has a soft spot for hyperbole.

Heart said Bitcoin prices can spiral downward due to miner competition, causing difficulty to spike to all-time highs while the market price dwindles.

Miners have to keep selling more of their newly minted coins, and thus continue to push the price further down. Heart neglected to mention Bitcoin’s difficulty adjustment system, which finds an economic balance between mining costs and monetary rewards.

Rather than losing against inflation, HEX users earn it by locking up coins, Heart said. People are competing against each other for larger and longer stakes, starting as early as possible, in order to get a larger piece of the profits. “If you end your stake early or late,” he said, “you’re penalized.”

Only users who don’t lock their coins suffer from inflation because they’re not letting the rest of the world know when they will sell them. ”It’s a truly unique system. It’s the first of its kind,” Heart beamed.

Meanwhile, (Another Failed) Richard Heart Project:

Blockchain Enhanced Distributed Computational Fluid Dynamics Supercomputing Network

FAQ

What Problem Are You Solving?

Who Would Want To Use This?

Why Did You Write This?

What Does The CFD Code Do?

How Long Have You Been Working On This?

Back To Hex…

Heart complains that Bitcoin’s system still has critical bugs that aren’t solvable by wasting more electricity.

“Bitcoin’s security model burns millions of dollars but starves developers of money, has no security audits, and no bug bounty.” Heart continued by pointing to the decline in wider Bitcoin adoption: “Fewer people accept it, it has fewer addresses, fewer Google searches, only minor upgrades besides SegWit… Lightning only has $6 million in total, and also has critical vulnerabilities from time to time.”

Heart explained that HEX solves these problems. “It does everything Bitcoin does, but better, except liquidity, but that’s because it’s brand new.” First, Heart pointed out that users can profit from referrals.

Secondly, lending BTC in the hopes of making interest requires trust, whereas HEX does not, Heart said: “To earn money on your Bitcoin, you have to lend it out to a counterparty and hope that you ever see it again. With HEX, you lock it in a smart contract. It’s trustless interest.”

This programming is secure, he explained, since the consensus code that controls the inflation and validity of coins is locked in a smart contract.

Developers can’t accidentally generate a bug, he said. “But in Bitcoin, if you try to improve the network anywhere, your changes touch the consensus code. That’s how that last inflation bug got accidentally put in there.” Heart compared such a change to upgrading an airplane’s software while it’s in the air — a dangerous, difficult task.

10% Of The World Will Hate You

Many criticisms aimed at HEX focus on Heart’s potential to make the lion’s share of profits from the scheme. The origin address, an element of the scheme that users are obliged to trust, receives a massive portion of claimant bonuses. “Whoever holds the keys to the origin address is going to be happy,” Heart said with a chuckle.

Meanwhile On Reddit….

Scammer Alert: You Know The Narcissist Guy Who Does Like 5 Hour Long Videos Richard Heart – He Is A Known Scammer And Conman (Truth Revealed)!

I don’t know how this flew under the radar but this is very interesting. Richard Heart was a nobody just a few short months ago. Literally nobody had heard of him until this year.

Then all of a sudden out of nowhere he was someone where he himself claimed he was a “thought leader” and started creating these multi hour long videos where he would do nothing but talk shit about big blockers, talk shit about Bitcoin Cash and pump Core and Blockstream as much as possible.

He was a nobody until one day he caught the eye of Roger Ver and made a public spectacle of himself to get Roger to debate him live about the block size. Roger did it and demolished him all on video –

Up until then nobody paid this guy Richard Heart any mind. After that because Roger is a well known figure with millions of followers all of a sudden this guy got a little following. But what made him think he was this self claimed thought leader that everyone should listen to before this and why did he think he was king shit? It’s almost like he was paid to become someone he wasn’t at some point this year….

As it turns out this guy is a SCAMMER. I’m not sure why this didn’t get more attention but he was revealed in a video in September with Chris Derose and some other guy –

They outed him after discovering his past where he was a HUGE SPAMMER, running scams and hanging with murderers and criminals – I KID YOU NOT. He also has a bunch of fake identities including legit fake passports and fake IDs. This guy is not your run of the mill troll. He is a full on scammer with a shady as fck past!

He literally has a page on a website from 2005 calling him a SPAM KING where he was sued and lost for spamming –

I’m not direct linking to it because it has some personal info of his online that wouldn’t be fair to give out. There are literally hundreds of examples of him spamming back in the early 2000’s if you search for it for example.

You can also see this early video of him on YouTube with a long beard trying to spam for anti aging scams – (a real deal true paid shill).

On top of that he was involved with some sort of robbery not at his fault (or maybe it was because of who he ran with) where he was robbed in Panama. Again I won’t direct link to it because of personal IDs and passports published (even though they are fake) but an excerpt of one Google group post in 2007 wrote- https://i.imgur.com/J47TiAx.png

Get To Know This Criminals Well, So You Don’t Fall Into Their Scam.

Beware of the new breed of young thieves in association with an old U.S. ex convict that escaping United States law and associating with Panamanian citizens and two crooked Criminal panamanian attorneys have moved their operations into Latin America and cheated, blackmailed, Extorted and robbed already countless victims in countries like Argentina, Costa Rica, Panama, Mexico, Colombia, Grand Caiman, Great Britain and more, Helped by small banks in the Republic of Panama and Panamanian petty thieves named Jaime Rosales, Adriano Bellido, Yasmin Iglesias, US Citizen Joshua Petty (with Panamanian ID), Alberto Cheng and their Crooked Attorneys Lanna Bermudez Romero & Gabriel Lawson Blanco.

(Master sick mind) young thief & extortionist Alias James Hart, j, Richard, or charity lover Multiple identities of who we think is called Richard James Schueler:

Obviously this character cannot be trusted and has all of a sudden showed up in the Bitcoin block size debate as some paid insider with thousands of (fake/paid) followers that small blockers should listen to.

It’s all fake and a scam! Now you must wonder who would pay this guy to show up in 2017 to push the small block agenda? Who has that kind of millions of dollars to set up a scam this big and get a scammer to fly under the radar and do this? Hrrmm….

Back To Hex

When asked for his thoughts on HEX, Cryptoconomy podcaster Guy Swann took the question to his listeners. “I started a thread in our Cryptoconomy Telegram group and it got out of control, fast,” Swann said. “I can’t believe how this thing is set up.

Its core design could make it one of the most prolific schemes to funnel money to a single party that I’ve seen in the crypto space.” Swann expressed further concerns, comparing it to OneCoin in its “brazen means of aggregating vast sums (upwards of two-thirds) of all invested ETH and HEX supply under a single entity’s keys.”

Swann explained, “To get HEX after the airdrop, you participate in an ‘Adoption Amplifier,’ which makes a game out of bidding on new HEX tokens by sending ETH into a ‘pool’. That ETH then goes directly to Richard…” Swann concluded, “Everything in this ridiculous token is designed to look like a game and encourage gambling.

But the one universal factor in every game element is that Richard gets wealthier and you get a worthless token that he invented for free…”

Others have fired criticisms at Heart for HEX’s purportedly Ponzi-like structure, as well as for privacy and security concerns regarding its claiming process. Vlad Costea, a writer at Bitcoin Magazine, presented a range of arguments against HEX’s purported legitimacy, calling it a scam back in January 2019 when it was originally branded as “Bitcoin Hex.”

Costea wrote: “Bitcoin Hex resembles a Ponzi scheme…” He criticized the project as a sort of “fool’s gold,” promising to “make everybody richer at the expense of a simple sign-up process.” The writer also pointed to privacy concerns regarding the claiming process.

During the launch phase, anyone holding Bitcoin can claim 10,000 HEX for each Bitcoin stored in a wallet address. Costea wrote,

“People watching the weekly interviews and understanding the process will probably think that they have nothing to lose. But the price to pay is privacy itself, as participants to the Hex scheme willingly reveal to the public how many bitcoins they own (unless they obfuscate their transaction history with a tool like Wasabi wallet, that is).”

Following a barrage of criticisms fired at HEX, Costea concluded that the tokens will have no value, with gullible traders left handing over their valuable crypto gold for worthless stones.

The project uses “tactics a scam might use”

Heart justified the design of HEX’s payment system: “The market sets the price. If no one wants in, the price will be nothing.” He took a lighthearted approach in handling critiques of outright fraud: “So there’s this trustless thing that people can use — or not — and pay what the market says it’s worth — or not. Scam!”

Heart Elaborated:

“I don’t care who you are, 10% of the world will hate you. In crypto, there’s a tribalism that every coin you buy is a world-changing amazing thing. Every coin anyone else buys is a scam by default.”

He also responded to critics bemoaning his financial success and profit-seeking motivations: “They’re closet socialists. They say, ‘I’m poor, so I want you to be poor, too.’”

Heart addressed the issues surrounding privacy and security, saying “every HEX claim is safe and secure.” For extra anonymity, users can claim each “BTC Freeclaim” to a new ETH address over TOR and click “new circuit” after each claim. Heart said, “I don’t know your IP. I don’t know your name. I know the public address that has claimed HEX. It’s like knowing you have a front yard and people can see your front yard.”

Heart Continued:

“I don’t want your data. If I wanted to know your IP address, I could set up a Bitcoin node and just listen, or I could buy a wallet company or make an app. It’s so stupid.”

Heart has extremely ambitious hopes for the project, envisioning HEX “overtaking all other cryptocurrencies… and onboarding people in the real world.” He explained the project uses “tactics a scam might use,” like referral bonuses, in order to attract interest — but offers an honest, real project.

There is no doubt that Heart is a master marketer and salesman. He appears to be genuinely passionate about the project, aiming to recreate the early days of free mining, $1 Bitcoin, and massive profits for the fortunate few.

Exactly how few will benefit from HEX is yet to be determined.

The Truth About Richard Heart AKA Richard J Schueler

Here is a story that really shocked me when i heard about it today,

I had thought previously that Richard Heart (Real name Richard J Schueler ) as one of the most reputable crypto aficionado’s.

He seems to be another well trained scammer sadly the crypto-sphere has no shortage of these and as the potential for cryptocurrencies is realized these numbers will continue to swell.

Luckily there are those experienced in crypto and of an inquisitive nature with a disdain for this kind of behavior which take the fight to those who try and pull the wool over pull one over on the everyday people trying to make it in cryptoland.

One of these is Jonathan Sterling who investigated rumors on Richard Heart and contacted him to discuss which he received threats for doing so.

I have contacted through twitter will give a whatever % of the payout Jonathan would like for posting.

TL;DR

I asked some questions to Richard Heart and mentioned to him that he raised some red flags for me. He revealed his name as Richard James Schueler with this article via Twitter. I still had questions regarding the red flags. He sent a thinly veiled threat to me. I let people know. I went on Bitcoin Uncensored to talk about it. I wrote this article to cover everything in an organised fashion.

This is mostly excerpts copy and pasted from Jonathan’s site imnotdead.co.uk/blog/richard-heart with screenshots of proof added video with Chris Derose on bitcoin uncensored and Video with Richeard Heart under the name Richard J Schueler regarding the Methuselah_Foundation

How I Learned of Richard Heart

I first learned of Richard Heart a few weeks ago when he interviewed Roger Ver. I then went through and watched his interviews with Chris DeRose, and generally liked his content, although I disagreed with some of his points. I got in touch with him to get an outline of his upcoming book, and then joined his Discord community. I learned he was working on a token, and due to my technical background got into his private group of “Certified Geniuses” on his Discord. I liked his content, I liked his book, and his token stuff looked interesting – he had my attention. I read hundreds of pages of his book outline, and took the time out of my day to privately send him feedback, section by section. It’s pretty safe to say that I was becoming a fan. And then shit hit the fan.

The Explosion

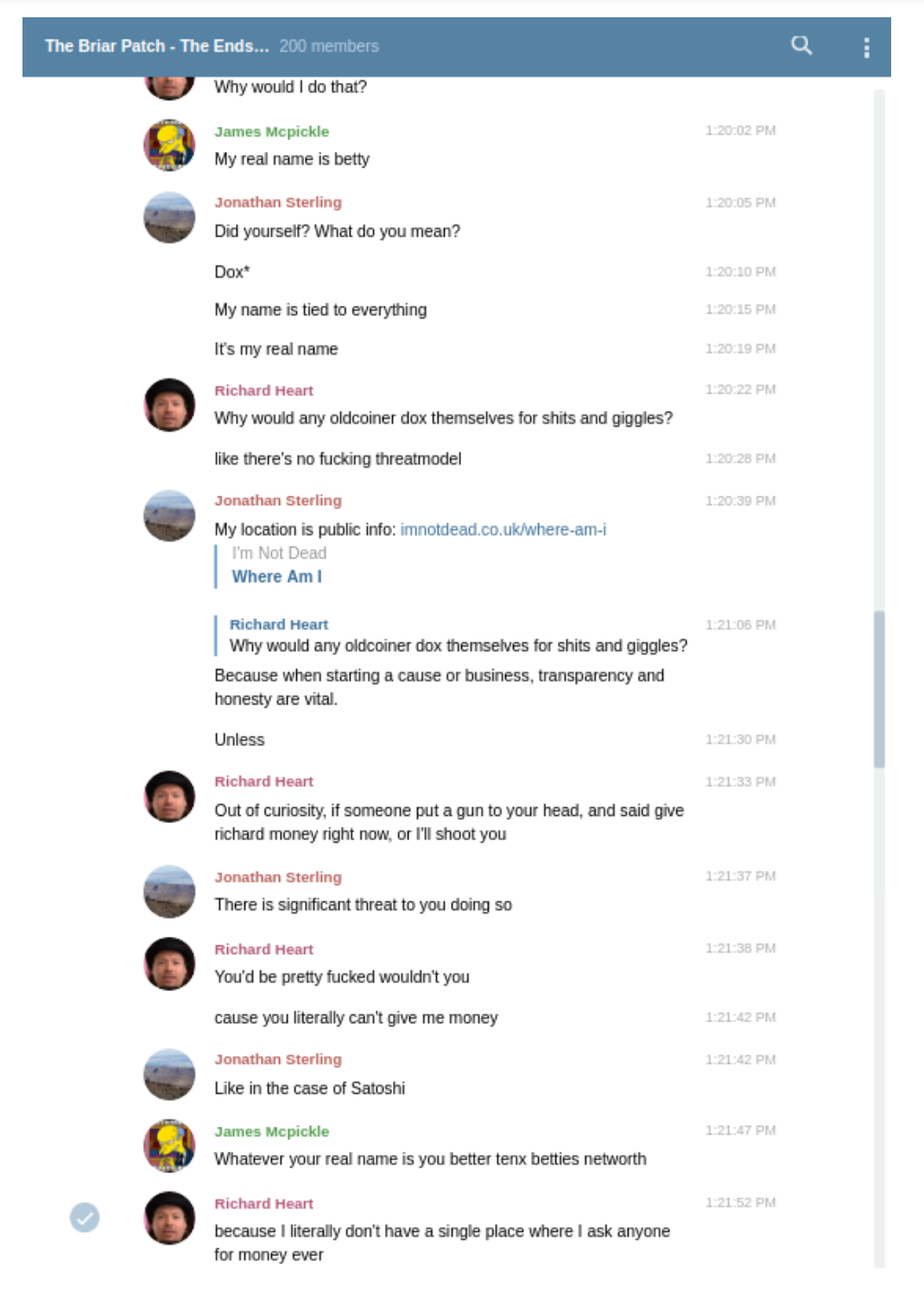

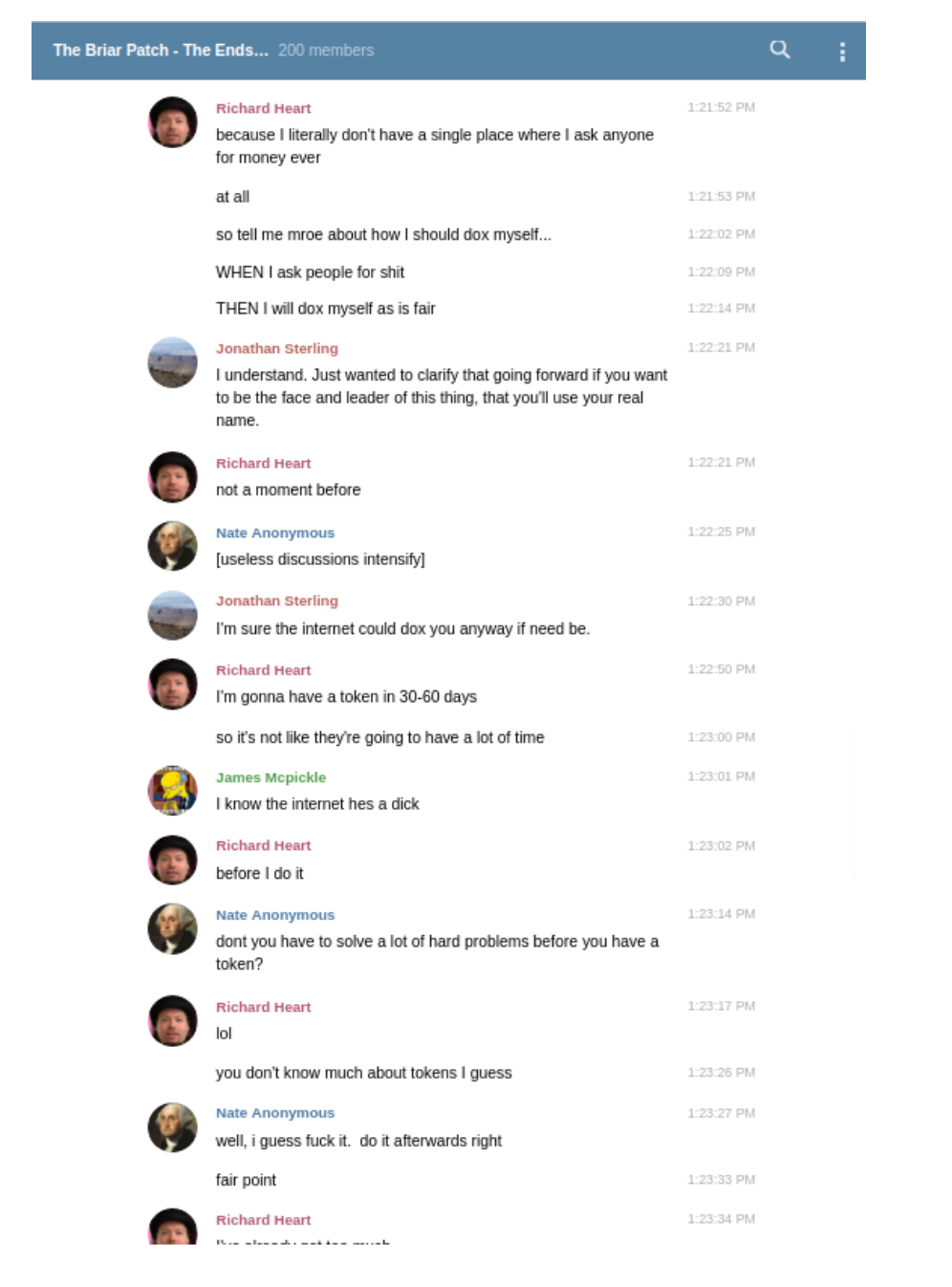

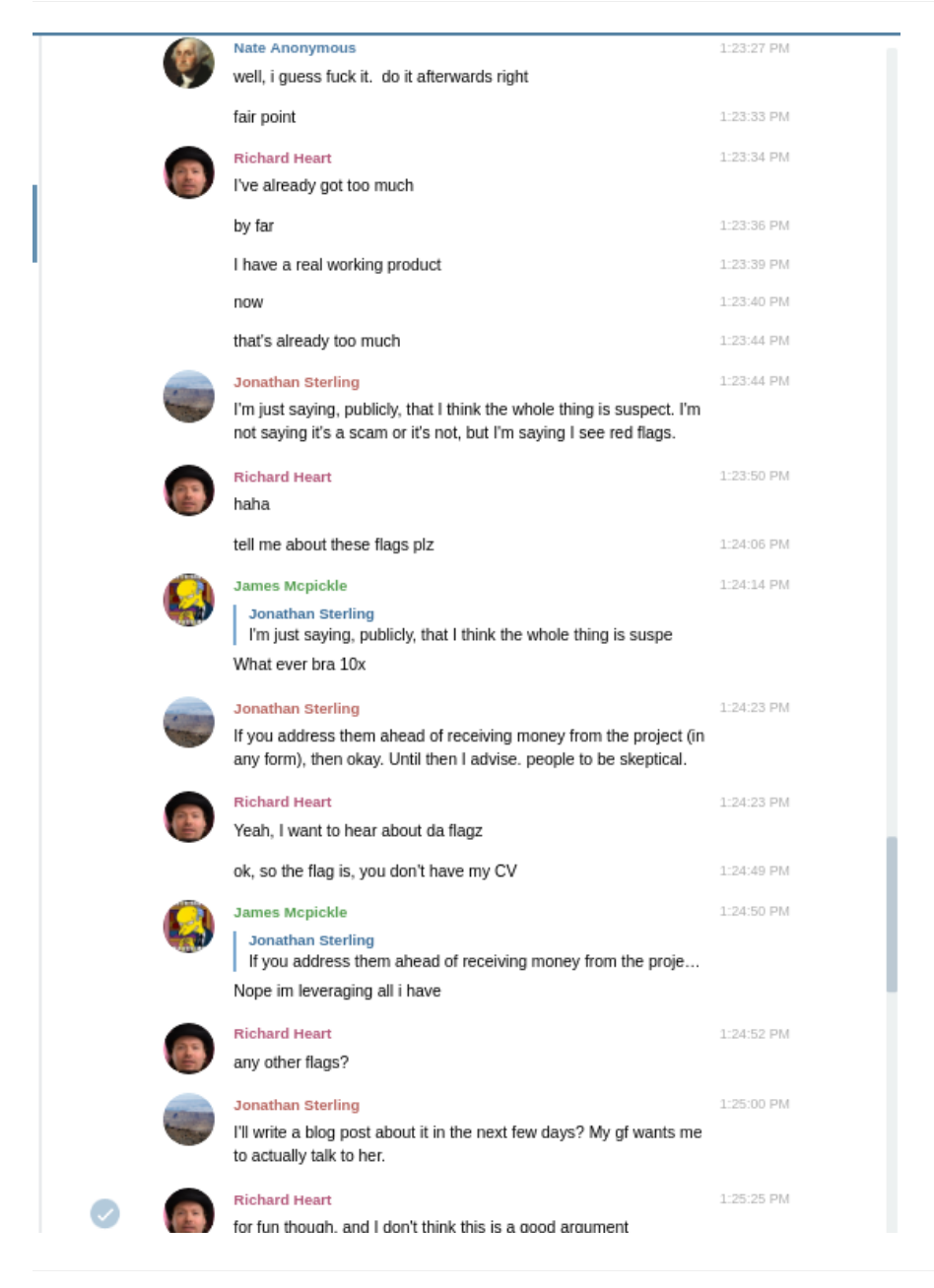

I have screenshots of all of the following messages (public and private) for verification, should they be called into question. All of the private messages were posted by Richard Heart on his own Twitter (he may have deleted them, I dunno, he blocked me). They were also posted in The Briar Patch Telegram group. My lawyer also has a copy. I’ve publicly left a screenshot of the veiled threat on my twitter. In Chris DeRose’s Telegram group, The Briar Patch, which has about 200 members. Richard Heart was discussing the tech behind what he eventually wanted to do an ICO for, and I asked the question:

I’d left when I said I was off and only saw that last part after the fact. It piqued my interest. The red flags I alluded to before weren’t even necessarily to do with his identity, and I’ll discuss them after I finish the saga. After I’d spoken to my girlfriend for a bit, I then sent Richard Heart this private message (all of the following messages are from our private chat until I say otherwise):

Hey dude. I’m gonna write this blog post over the next few days (if/when I find time – I’m finishing a project and moving to Bali in the meantime). I’m gonna release the full post to you privately beforehand. I sincerely don’t want to damage your reputation – consider this an opportunity to further steelman yourself. I generally like what you’re doing, and find your content thought-provoking and entertaining (even the bits I disagree with). If you see from the post that it might be damaging and there’s stuff you want to do ahead of the public release to alleviate that, I’m okay to give you a few days to sort it out. Again, I’m not here to cause harm; I’m here to ask the questions that are in the back of the public’s mind. If everything gets cleared up/explained, I won’t release the post to anyone and will keep this message and further private discussions we have about it 100% private. You have my word. Sound fair?

Updated: 12-16-2019

HEX Dives 60% On Bitcoin.Com As Backlash Builds Over Exchange Listing

Bitcoin.com Exchange, a Bitcoin (BTC)-skeptical trading platform associated with the eponymous website, has sparked fresh controversy after supporting an altcoin widely considered to be a scam.

In an article and Twitter post on Dec. 15, officials confirmed that trading of HEX had gone live two days previously.

Wild Volatility Greets HEX Traders

The move makes Bitcoin.com one of the few recognized trading platforms to forge ties with HEX, which together with founder Richard Heart continues to field widespread accusations of fraud.

Explaining the decision, Bitcoin.com claimed it wished to offer security to those looking to trade the coin, which launched earlier this month.

“We are thrilled to announce that we have just listed #HEX by @RichardHeartWin on our exchange, giving anyone who wants to trade it a secure venue to do so. Check it out!” its Twitter announcement reads.

While little overall trading data is available, Bitcoin.com’s HEX markets have traded the equivalent of 0.81 BTC ($5,700) in the past 24 hours. In that period, the platform’s two HEX trading pairs, HEX/BCH and HEX/ETH, have dropped in price by 64% and 57% respectively.

Warnings Over HEX Founder’s “Perpetual Self-Enrichment”

As Cointelegraph reported, HEX purports to enrich investors by giving away free tokens in return for confirming BTC holdings.

Others purchased tokens using Ether (ETH), with Heart quickly reacting to suspicions that the entire project was being run in a manner that mirrors a pyramid scheme.

Critics point out that Heart, as the alleged owner of HEX’s so-called “origin address,” will potentially control around 45% of the entire HEX supply just one year after the launch.

This will be achieved by claiming a constant stream of HEX tokens from various types of transactions, while Heart will also keep the ETH from purchases.

“Not only will Richard control close to half of all HEX after the first year, but it is the first token I have seen to have its founder’s perpetual self-enrichment baked into the protocol,” a blog post on HEX by the private researcher known as Goldman Sats summarized on Dec. 7.

Goldman Sats added that Heart seeks to downplay the existence of the origin address, despite its likely status as a giant centralized repository capable of crashing the entire HEX market with a single sell-off.

Controversy Continues For Bitcoin.com

Bitcoin.com Exchange, the trading arm of cryptocurrency news outlet Bitcoin.com, already holds a controversial reputation among community participants over its sidelining of Bitcoin, which it calls “Bitcoin Core,” while championing altcoin Bitcoin Cash (BCH).

The company’s owner, Roger Ver, has sought to present BCH as the “real” Bitcoin, arguing the altcoin has better features as a currency.

Rebuttals which have surfaced since BCH’s debut in 2017 include the fact that BCH network participation is overly centralized, and that users would rather hold BTC but spend BCH as soon as possible.

Following the HEX announcement, Twitter users led recriminations against Bitcoin.com, with large numbers of comments voicing disbelief at the decision to launch trading.

“Why would you do this?” the owner of popular cryptocurrency podcast, Colin Talks Crypto, responded.

Updated: 12-20-2019

Here’s What Caused A Little Known Cryptocurrency To Drop By 99% In 12 Days

HEX cryptocurrency, a scam project masquerading as a blockchain certificate of deposit, has seen its price fall by over 99% in less than a fortnight following its launch on Dec. 2.

The project becomes the latest cryptocurrency that has caused millions of dollars in lost investment as unwitting investors poured their life savings to the scam. I the article we discuss the massive drop in HEX’s price and possible factors that may have caused it.

The Shortest Scam Is Crypto History?

HEX cryptocurrency launched its initial offering on December 2nd 2019 with much funfair and “scam like talk”. On its website the project is termed as the “world’s first decentralized high interest blockchain certificate of deposit”.

The project aims at offering users high interest rewards to stake HEX crypto backed by other cryptocurrencies such as Bitcoin.

Did you know that you can lower your entry price on something by buying some lower? For instance if something dropped 90% you could 2x your stack by spending just 10% more than you originally did.

— HEX (@HEXcrypto) December 13, 2019

HEX claims to improve the cryptocurrency space by paying people to take possession of their private keys to enhance storage. For BTC holders the service is free with an open to verify code.

The project team further claims over $1 billion dollars in BTC (~141,000 BTC, as price stands) has been claimed for HEX on over 21,000 BTC wallet addresses. Over $500 million has been set aside for ETH, with only about 35,452 ETH claimed for HEX.

Following a number of critics coming forward prior to the launch condemning the Richard Heart-led project as a cash grabbing scheme and a privacy starved platform, the launch on Dec.2 has seen investors lose over 99% of their initial investment.

Starting off at 3700 sats on December 2, the price has plummeted to just under 3 sats representing a whopping 99% drop. Could this be the shortest ICO failure yet?

What The HEX Happened?

The fall from grace in less than 12 days is comical even for the poorest of ICOs, and Richard’s recent explanations may do little to convince the market to buy into HEX. While the cryptocurrency holds a sensible value proposition for their users (giving it the benefit of doubt), there remains one huge flaw that may have seen the token collapse 99.3% in the past 12 days.

— starbust (@inversebrah) December 14, 2019

— starbust (@inversebrah) December 14, 2019

According to a crypto researcher, Dilemma Beats, the biggest flaw in the crypto project lies in the origin address that “will create terrible distribution by giving Richard a gigantic bag of free HEX.” The fear is shared across the community as users remain skeptical of Richard’s motives.

“The AA benefits Richard more than investors, he gets a bunch of free ETH. ETH that can be used to manipulate the AA directly,” he wrote on Twitter. “The federal bonuses give the origin address an equal bonus reward, further diluting the value, benefiting Richard, hurting the investors.”

While the whole competitive advantage of HEX lies is getting rid of the whales, the origin address is built to deposit massive amounts of ETH and BTC in exchange for needless HEX tokens, all Richard’s plan, Dilemma accuses.

Whatever the resolutions from the HEX team, the event signals a need for thorough checks on projects before investing. Do your own research!

Updated: 1-5-2020

Richard Heart’s HEX Now Trading For Less Than 1 Satoshi After 52% Drop

Bitcoin’s (BTC) smallest denomination is now worth more than an entire unit of altcoin Hex (HEX) after the controversial token lost over 50% in a day.

Data from Coinmarketcap and other sources confirm that HEX/BTC is now below 1 satoshi — or 0.00000001 BTC.

HEX price too small to measure

Put in different terms, the price of a single HEX token has become so small that many price calculators cannot measure its value. On Jan. 5, Hex traded at 7.745e-9 BTC according to Coinmarketcap, the equivalent of 0.000000007745 BTC.

That number, of course, is far below a single U.S. dollar cent, and roughly translates as $0.000058. Data from Bidesk, an exchange offering the HEX/BTC pair, confirmed the price levels.

Hex’s demise over its short lifetime has been precipitous. Those who bought tokens or claimed them using existing Bitcoin holdings since its Dec. 2 launch have seen their value dive by practically 100%.

Throughout, Richard Heart, the coin’s vocal creator, has continued to promise vast returns for those who hold HEX for certain periods via a staking scheme.

Speaking to Cointelegraph in an interview last month, Heart was unrelenting in his promotion of what he claims is a “truly unique system” in the cryptocurrency world.

Investors Would Rather Buy Satoshis

Criticism has nonetheless come from multiple sources, with a popular theory naturally centering around Hex being run similar to a pyramid scheme. A study released shortly after the launch highlighted what its author described as the “perpetual self-enrichment” of Heart at the expense of other investors.

A further gaffe saw HEX/BTC plunge 60% overnight after cryptocurrency exchange Bitcoin.com chose to list it.

The drop below 1 satoshi meanwhile fielded a fresh wave of satisfaction from social media users, many of whom had long warned that investing in Hex was a decision which amounted to little more than plain foolishness.

Domingo Guerra, co-founder of enterprise mobile security company Appthority, noted that on Saturday, there were no buyers for HEX at 1 satoshi, “It’s dead! Essentially at zero,” he summarized.

Updated: 5-15-2020

HEX Still Can’t Shake Scam Label As Token Approaches $1B Market Cap

A market cap surge from April still leaves HEX critics labeling the cryptocurrency a borderline Ponzi scheme.

While widely written off as a scam earlier this year, Richard Heart’s controversial HEX is fast approaching a $1 billion market cap.

According to crypto analytics site CoinMarketCap, the HEX token had a market cap of over $979 million on May 14 with a value of $0.006 at the time of writing. Prior to mid-February, the value of the coin was so small, many sites simply couldn’t measure it.

HEX is an ERC-20 token that pays holders for rewards instead of miners, essentially a crypto version of a traditional fixed deposit account. Users can lock up funds, then receive their investment plus interest when the term matures.

There are currently only nine exchanges that offer trading on HEX. On Uniswap, the Ethereum decentralized exchange, the 24-hour volume for HEX was $2.4 million, while on Hotbit it was close to $900,000. The remaining exchanges have very low liquidity, including Coinsbit, Bidesk, p2b2b and Bitcoin.com.

A Sudden Surge?

The question is: why this surge in value for a token that most of the crypto media has derided as worthless, if not an outright scam?

True believers on crypto Twitter point to the fact that whales have staked a lot in HEX, and the nature of the token’s rewards benefits the stakers, not the miners:

Rewarding stakers instead of miners…encourages holding with amazing interest! Facts: Price drops when people sell. Truth: People will hold if it benefits them even more than selling! Don’t listen to people calling it a scam, DYOR! Ask questions if you need! Dont miss out! #hex pic.twitter.com/WScs1Nnmuh

— Annette BTC ❤ HEX ❤ (@THEAnnette) May 11, 2020

Some users, tribal though they may be when it comes to crypto, ultimately see the token as reliable, pointing to the high returns of early stakers, “Is Hex is a good investment this early? To me, as an investor, yes. I am up 35x.”

Others simply say HEX detractors are too quick to dismiss the token as a scam instead of doing their research and listening to Heart explain himself, essentially accusing them of confirmation bias.

The HEX founder wrote on Twitter that HEX reached an all-time high price on May 14 and is looking at a $1.1 billion market cap by the end of 2020. He said that for those concerned with the current financial crisis, the token has ”basically less than 0% inflation to the staker class on average.”

Few people understand the value of shares in HEX. People will care more and more about them as we get nearer to the estimated $1.1 Billion dollar worth of HEX paid by share on BigPayDay (BPD), Nov 19th. BPD goes up as more people FreeClaim w/ #BTC and share price can only go up. pic.twitter.com/WQ8MIT5uoQ

— HEX.win price did 116x in 129 days!????M⬣⬣N (@HEXcrypto) May 14, 2020

Some are still on the fence. One user thinks the crypto community’s reaction to HEX could determine how future coins and innovations are received:

“I feel the crypto community has been through so many scams… when something good comes along for the holder we are blinded. Time will tell how good hex is…”

Still Labeled A Scam By Many

HEX’s critics are legion. Peter McCormack, the host of the podcast “What Bitcoin Did,” has repeatedly referred to Heart as a fraud and HEX a scam.

As Cointelegraph has reported, others have attacked Heart for HEX’s privacy and security concerns regarding its claiming process. Vlad Costea, a writer at Bitcoin Magazine, presented a range of arguments against HEX’s purported legitimacy in January 2019, saying the cryptocurrency “resembles a Ponzi scheme” and was more like “fool’s gold”.

Heart spoke to Cointelegraph in December, admitting the HEX project uses “tactics a scam might use,” but ultimately believing the stigma was due to people in the crypto community being loyal to certain coins:

“In crypto, there’s a tribalism that every coin you buy is a world-changing amazing thing. Every coin anyone else buys is a scam by default.”

Updated: 11-6-2022

SEC Issues Subpoena To Influencers Promoting HEX, Pulsechain And PulseX

The SEC issued the subpoena as part of the investigation, which demanded the influencers in question produce the required documents by Nov. 15, 2022.

Over several years, social media influencers have earned a bad rep among regulators for shilling risky and unvetted tokens to millions of investors.

Pursuing a crackdown on such scenarios, the U.S. Securities and Exchange Commission (SEC) reportedly issued a subpoena to influencers who were found promoting cryptocurrencies such as HEX, Pulsechain and PulseX.

Swedish researcher Eric Wall shared an official letter from the SEC dated Nov. 1, which was addressed to influencers. It read:

“We believe that you may possess documents and data that are relevant to an ongoing investigation being conducted by the staff of the United States Securities and Exchange Commission.”

The letter was accompanied by a subpoena that was issued as part of the investigation, which demanded the influencers in question to produce the required documents by Nov. 15, 2022.

While the HEX community members retaliated against the finding, calling it “fake news,” Wall quickly pointed out that HEX information channels on Discord and Telegram were filled with information on preserving anonymity on data and discussions.

GUYS. IT’S HAPPENING. Hexicans influencers are getting subpoenad by the SEC over HEX, PulseChain and PulseX. The HEX information channels are filled with information about how to shred your digital evidence pic.twitter.com/PrTYBRT9Wc

— Eric Wall X (@ercwl) November 5, 2022

He further challenged those who claimed that the subpoena was fake, stating:

“Hexicans: time to post the unblurred versions here. If they’re fake—no harm right?”

On Nov. 3, Richard Heart, the founder of HEX, tweeted:

“Do you accept the good advice you’re given? You think you do, but do you really? Are you using secret chats with self-destruct timers? Or are you a slow learner? Is it hard for you to click buttons?”

The above tweet supports Wall’s claims. However, Wall maintains that he has no respect for the SEC and that he’s just sharing the information.

The above tweet supports Wall’s claims. However, Wall maintains that he has no respect for the SEC and that he’s just sharing the information.

According to the SEC chair, the commission’s enforcement staff consisted of “public servants” and “cops on the beat” who were “uniting public zeal with unusual capacity.”

Updated: 5-31-2023

Richard Schueler AKA Richard Heart’s PulseChain Sideshow Tent Is Collapsing

For some crypto projects, actually launching is the worst possible plan.

One of the perverse truisms of crypto is that for a certain kind of founder, the clearest path to success is to never actually build anything.

Token presales incentivize infinite delay because you can cash in so effectively on grandiose promises – and the reality of what you create is always going to fall short of those fantasies.

Backers of Richard Heart (aka Richard James Schueler), longtime crypto raconteur and leader of the Hex and PulseChain projects, have spent the past two weeks learning that the hard way.

PulseChain and PulseX, essentially a clone of the Ethereum smart-contract platform and the Uniswap decentralized exchange (DEX), had been eagerly anticipated by investors – sorry, “sacrificers” – for years by the time they launched this month. And yea, there was much rejoicing.

But in the weeks since PulseChain’s May 13 launch, as laid out by Protos, the system has seized up and failed in a variety of ways. That included high fees, despite the entire rationale for the PulseChain project being essentially “Ethereum, but with lower fees.”

After Protos published its analysis, another devastating bug was discovered which is thought to have robbed liquidity providers on the PulseX DEX of millions of dollars’ worth of fees.

In another index of how busted the economics of the system are, wrapped bitcoin briefly spiked to $70,000 per token on PulseX, more than twice its open market price.

Meanwhile, the price of related assets including HEX, PLS and PLSX have sold off aggressively since launch, dropping on the order of 30% or more in the days since PulseChain launched.

Some version of this comical catastrophe was easily predictable. PulseChain, you see, isn’t just a fork of the Ethereum code, but was pitched as a copy of the Ethereum state.

That is, it includes all wallet balances and assets as they existed on Ethereum, apparently as of the mid-May launch. Numerous critics over the years have pointed out that this ignores the vast number of dependencies behind these Ethereum assets, which would break in a dazzling variety of ways if cloned.

A simple example would be stablecoins like USDC that are backed by reserve assets. Clones of such assets on PulseChain have no backing, and hence no actual value.

PulseChain’s most devoted critic is blockchain researcher Eric Wall, who recently referred to PulseChain as part of “bizarro crypto world.” While it’s difficult to be specific about what makes something Bizarro Crypto, it’s a hugely useful label.

On the one hand, you have the likes of Ethereum and Bitcoin and Uniswap and Filecoin, things that more or less work as intended. Then you have projects that look a lot like the real thing, but are inverted or compromised in crucial ways – the same way DC Comics’ Bizarro represents the inverse shadow-self of Superman.

The differences that mark out Bizarro Crypto can be far more subtle and arcane, though, sometimes only visible to those of us who have, as the saying goes, seen too much.

One thing I’ve definitely seen too much of is Richard Heart’s backside. His specific brand of carnival-barker shtick centers around four things: track suits, gold chains, cars and twerking.

He has made vulgar displays of his poor taste and apparently vast wealth – wealth largely harvested from Hex and Pulse investors – the defining characteristic of his online persona.

Perversely, this is one of the reasons you may not have heard much about Hex or PulseChain. Heart’s absurd persona seems calculated to keep his projects firmly in Bizarro Crypto World, beneath serious attention.

It’s the tactical equivalent of misspellings in deceptive emails, which security experts say are intentionally included to scare off people with good critical thinking skills.

By selecting his own pool of credulous (and possibly vulnerable) investors, Heart has created a parallel universe where he is viewed as some mix of Satoshi Nakamoto, Vitalik Buterin and Tai Lopez. (Because, you know, Lambos prove you’re smart).

That kind of parallel universe can, it seems clear, be very seductive. But eventually, Bizarro Crypto does have to come face to face with the real thing – and that rarely goes well.

Updated: 7-31-2023

SEC Files Complaint Against Hex Founder For Allegedly Offering Unregistered Securities

According to the SEC, Richard Heart allegedly used more than $12 million of investor funds to buy “a 555-carat diamond, expensive watches, and high-end automobiles.”

The United States Securities and Exchange (SEC) has filed a lawsuit against Richard Schueler, better known in the crypto space as Richard Heart, for alleged unregistered offerings of three tokens.

In a July 31 filing in U.S. District Court for the Eastern District of New York, the SEC claimed Heart had raised more than $1 billion through “the unregistered offer and sale of crypto asset securities”, which included HEX, PulseChain (PLS), and PulseX (PSLX).

According to the complaint, Heart touted the tokens “as a pathway to grandiose wealth for investors”, hiring developers to maintain the framework behind the crypto assets.

The SEC alleged Heart violated federal securities laws and defrauded retail investors both in the U.S. and abroad. Many of the allegations focused on the HEX founder promising large returns for investors in exchange for hundreds of millions of dollars in deposits.

For example, he allegedly accepted more than 2.3 million Ether between December 2019 and November 2020 — worth roughly $678 million at the time — in exchange for HEX tokens, $354 million in exchange for the promise of future delivery of PLS tokens, and $676 million in exchange for the promise of future delivery of PLSX tokens.

“Heart and PulseChain defrauded investors by misappropriating at least $12.1 million of PulseChain investor funds,” said the complaint. “Instead of using these investor funds to develop and market the PulseChain network, or even to fulfill Heart’s explicit statement that invested funds supported ‘freedom of speech’ Heart and PulseChain used at least $12.1 million of investor funds for Heart’s personal luxury purchases, including a 555-carat diamond, expensive watches, and high-end automobiles.”

The U.S. regulator said it was seeking permanent injunctive relief, disgorgement, prejudgment interest, and civil penalties against Heart and the projects.

Heart, who resides in Finland, was subject to a civil summons requiring him or his legal team to respond to the SEC complaint within 21 days or risk default judgment.

The civil action by the SEC was the latest in what many critics have called a “regulation by enforcement” approach to crypto in the United States.

The federal regulator has ongoing cases against crypto exchanges Coinbase and Binance, among others, for similar allegations of unregistered securities offerings.

Many in the crypto space viewed HEX with skepticism despite the price of the token often making significant gains, surging in 2021 to reach an all-time high of roughly $0.48. Immediately following news of the SEC lawsuit, the price dropped more than 26% from roughly $0.0084 to $0.0062.

Following scrutiny from the SEC, many reported that Heart seemed to be removing certain references to Hex, PulseChain and PulseX from his social media posts and profiles.

According to his X bio, Heart “doesn’t read messages, email, newspapers, magazines, letters, communication of any form or listen to the radio or nearly anything else”.

“Heart continually touted these investments as a pathway to grandiose wealth for investors, claiming that Hex, for example, ‘was built to be the highest appreciating asset that has ever existed in the history of man,'” the lawsuit said. “… Although Heart claimed these investments were for the vague purpose of supporting free speech, he did not disclose that he used millions of dollars of PulseChain investor funds to buy luxury goods for himself.”

PulseX and PulseChain launched earlier this month, but faced rocky starts in the weeks immediately after going live, seeing high fees, liquidity issues and exploitable bugs. The prices of the HEX, PLS and PLSX tokens fell post-launch.

Heart made frequent references to federal securities laws, the SEC further alleged, citing his YouTube livestreams and other public statements. However, the suit said, Heart had himself admitted that “the success of these endeavors were completely dependent on his efforts.”

“Heart pumped Hex’s capacity for investment gain, claiming at Hex.com (until at least November 1, 2020) that, ‘Hex is designed to surpass ETH, which did 10,000x price in 2.5 years. It’s working! So far, HEX’s USD price went up 115x in 129 days,'” the suit said.

‘On December 2, 2019, during a seven-hour livestream on YouTube hours before the Hex Offering commenced, Heart stated that Hex “was built to outperform Ethereum and Bitcoin and all other cryptocurrencies.'”

The suit charges Heart and the projects with fraud and securities registration violations.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.