Ultimate Resource On Chainalysis A Tool That Provides An Inside Look Into Blockchain Transactions

Chainalysis is building a crypto-space risk data clearinghouse for financial institutions. Ultimate Resource On Chainalysis A Tool That Provides An Inside Look Into Blockchain Transactions

Related:

Antonopoulos: Chainalysis Is Helping World’s Worst Dictators & Regimes

Leaked Chainalysis Documents Reveal Company Is Advertising An IP-Scraping System To Law Enforcement

Its new Kryptos platform will help institutions parse regulatory hazards and build risk assessment models.Kryptos “is our step towards financial institutions, so they can have the transparency they need to build risk management programs and integrate into the crypto economy,” Chainalysis co-founder and COO Jonathan Levin said.

It’s the blockchain analysis firm’s first product to specifically target institutional players, joining KYT, the exchange-facing anti money laundering software, and Reactor, which helps investigators trace criminal money flows.

Those products help governments, crypto companies and investigators analyze their sectors of the crypto economy, Levin said. But while those entities grasp the larger crypto ecosystem, crypto-curious investors, including the banks and advisors not already involved, have no clear point of entry.

That could stymie investment. Chainalysis’ solution: build a “trusted and referenced” dataset for new market entrants.

Levin said:

“If you are in a financial institution and trying to understand who the major players are what assets are trading where they are registered, how their activity looks on the blockchain, and how to make sure you’re managing your risk appropriately, you’ll log into Kryptos and see those top counterparties you’ll be wanting to do business with.”

The product, still in beta and set to launch early next year, features a mix of manually-collected data to give them that view. Chainalysis’ employees compile and update reams of regulatory, compliance, and business interest information in one place.

Levin said:

“We find that Kryptos is a good way for someone to get that high level overview, really a good starting point for someone to do a deeper dive investigation.”

That, he claimed, is good for everyone: “All players in the cryptocurrency ecosystem stand to benefit from increased transparency.”

Updated: 11-21-2019

Chainalysis Reportedly Cuts 39 Jobs Aiming to Boost Profit Margins

Blockchain analytics firm Chainalysis is reportedly letting go of 39 of its employees in order to become more profitable.

On Nov. 21, Coindesk reported that Chainalysis is cutting its workforce by nearly 20%, eliminating positions across the board to the tune of 39 employees laid off. According to Maddie Kennedy, Chainalysis’ director of communications, the research and development team had to bear the brunt of it.

Layoffs Might Come As A Surprise

The staff cuts might come as something of a surprise as the New York-based blockchain analytics firm has experienced a number of positive announcements over the years.

In September, the firm announced blockchain trading platform Bittrex’s deployment of its real-time transaction monitoring solution. In 2018, the vast majority of blockchain intelligence government deals were reportedly contracted toChainalysis, which during that time had signed deals with government agencies totaling $5.3 million.

It is also well-known that the IRS used Chainalysis back in 2015 to assist them in its case against Coinbase, in which a United States federal judge ordered the crypto trading platform to report 14,355 users to the IRS.

However, Kennedy explained that the layoffs will further aid the company on its path to profitability and to pivot its resources into product teams and go-to-market strategies. She added:

“Market conditions necessitated early action […] The layoffs are a preemptive measure, meant to stave off the unexpected, including the possibility of an economic downturn […] We think that acting now is best for the long-term health of the business.”

FinCEN Chief Speaks At Chainalysis Conference

In November, the United States Financial Crimes Enforcement Network (FinCEN) Director Kenneth Blanco spoke at a conference hosted by Chainalysis, where he told the audience that Anti-Money Laundering (AML) laws will be strictly enforced in the world of cryptocurrencies. Blanco also said that the so-called travel rule does apply to digital currencies and that the government expects crypto firms to comply.

Updated: 11-28-2019

Chainalysis Chief Economist Wants Crypto to Move Past ‘Buying Drugs on the Silk Road’

CoinDesk sat down with Chainalysis’ chief economist Philip Gladwell to get a macro-view of the crypto market.

Speaking at Invest: NYC 2019, Gladwell said the crypto-sleuthing firm has found that only 30 percent of bitcoin is actually liquid. Of this value exchanged, more and more of it is going towards legitimate merchant services, a departure from crypto’s first use case: “buying drugs on the Silk Road.”

“In recent months there has been a lot of disruption to [dark] markets, law enforcement has taken down a number of those sites. That’s actually reduced their size in the overall crypto economy,” Gladwell said.

One notable example was the investigation and closure of Welcome to Video, the world’s largest child exploitation site, according to Gladwell. Chainalysis participated in the global cooperative effort to shutter the site and arrest the alleged perpetrators, by analyzing crypto transactions used to pay for child pornography.

“We were able to help the [IRS and Homeland Security] understand were the bitcoin came from or where it got cashed out to,” Gladwell said. “You shouldn’t underestimate the amount of non-blockchain investigations,” that contributed to the effort, he added.

Gladwell also addressed how law enforcement might respond to the distribution of privacy-protecting coins, such as Zcash, as well as the open industry debate as to how much personally identifiable information exchanges should keep under Financial Action Task Force’s “Travel Rule.”

“The industry needs to work out what the right solution is,” Gladwell said.

Updated: 12-13-2019

Chainalysis To Provide Bitfinex With ‘Privacy-Safe’ Tools To Combat Crime

New York-based blockchain analytics firm Chainalysis is set to provide crypto exchange Bitfinex with its Anti-Money Laundering compliance solution.

In a press release published on Dec. 12, both firms took pains to stress that the solution will be privacy-safe, but help Bitfinex to crack down on bad actors using its platform.

Enhanced Monitoring

Chainalysis is one of the highest-profile firms in the blockchain intelligence industry, providing solutions — such as its proprietary KYT (Know Your Transaction) tool — that enable firms, governments and law enforcement agencies to monitor blockchain transactions and track suspected illicit activities.

Earlier this year, the firm expanded its monitoring capacities beyond Bitcoin (BTC) to cover 41 further cryptocurrencies including Ether (ETH), Bitcoin Cash (BCH), Litecoin (LTC), ERC-20 tokens such as Maker (MKR) and Dai (DAI), and various stablecoins, including Bitfinex’s affiliated token Tether (USDT).

Bitfinex will ostensibly be able to use the real-time monitoring capabilities of Chainalysis’ technology to identify high-risk outliers amid a high volume of transactions. Automated and granular due diligence tools can help the exchange to better allocate resources, enforce compliance policies and robustly counter financial crime, the press release claims.

Troubled History

Bitfinex’s move to tighten up its compliance and due diligence in partnership with a veteran intelligence firm like Chainalysis comes after months of protracted legal difficulties.

Among these, Bitfinex, Tether and parent firm iFinex have been accused by the New York Attorney General’s office to have lost $850 million of commingled client and corporate funds and then to have attempted to cover-up the purported shortfall.

In October, the U.S. Attorney’s Office for the Southern District of New York indicted the principal of controversial Panama-based shadow payment processor Crypto Capital on three criminal counts. Crypto Capital had, in the exchange’s own words, “processed certain funds for and on behalf of Bitfinex for several years.” Bitfinex has argued that it is itself a victim of the fraud.

Last month, Bitfinex dismissed a separate, fresh lawsuit as “mercenary and baseless”. It has redoubled its denial of persistent controversies, including claims that Tether’s issuance was used to manipulate the cryptocurrency markets and long-standing allegations that the token is not backed 1:1 by the U.S. dollar.

Updated: 1-13-2020

Analytics Firm Training Students To Detect Cryptocurrency Scams

Cryptocurrency analytics firm CipherTrace has launched “Defenders League,” a program designed to provide students with the training and tools necessary to investigate crypto-related scams.

On Jan. 13 CipherTrace announced partnerships with the Middlebury Institute of International Studies at Monterey, Middlesex University London, and the Blockchain Acceleration Foundation (BAF). The Defenders League will initially consist of graduate students from Middlebury and Middlesex, along with BAF students at nine universities located across California.

CipherTrace’s chief financial analyst, John Jeffereies, told Cointelegraph that the Defenders League’s objective is to make the crypto economy safer for consumers and investors.

CipherTrace reported that the cost of thefts, scams and fraud has already reached over $4 billion by the end of Q3 2019, emphasizing the urgent need for proper solutions to be brought to market to combat crypto crime and protect individual investors. Jefferies said:

“Together, the collaborating entities will empower students with training and tools to investigate crypto-related scam and fraud cases, helping to make the crypto economy safer for everyone.”

A Free Training Program For Students

According to Jefferies, CipherTrace will train and certify students to use its financial investigation software. The software is used to detect money laundering, power law enforcement investigations and enable regulatory supervision.

CipherTrace is providing a $4.3 million grant to the Defenders League to help students visualize blockchain interactions, allowing them access to the CipherTrace data visualization tool, which is a standard component of the software.

Jefferies explained that students in the Defenders League will have complete access to the professional version of the company’s software – CipherTrace Investigator Plus – that supports over 800 tokens:

“With access to the full suite of CipherTrace tools, certified students will be able to trace funds lost in cryptocurrency fraud and theft.”

Jefferies mentioned that students in the training program will receive class credit while providing services to help recover “small” losses that are typically too small for law enforcement officials to investigate. CipherTrace’s director of investigations and education, Pam Clegg, said:

“We’ve experienced a significant increase in requests for investigative and analytic support for fraud and theft cases. The CipherTrace Defenders League will be an elite corps of blockchain knowledgeable students who can conduct smaller-scale investigations. Their objective will be to produce actionable intelligence and evidence that can be used to recover stolen funds and ultimately prosecute those criminal actors responsible for the losses.”

Moving forward, Jefferies told Cointelegraph that CipherTrace is working on an initiative to grant software licenses to researchers and instructors at other universities and even to the United Nations. He mentioned that CipherTrace, along with BAF, is actively discussing bringing several more institutions on board to join the Defenders League. BAF’s vice president, Piergiacomo Palmisani, told Cointelegraph:

“This is an incredible opportunity for students, who will have access to the same top notch tools used by CipherTrace employees. The Blockchain Acceleration Foundation will work closely with CipherTrace to ensure the success of this initiative at our partner universities and help expand the Defenders League to other schools in the country.”

In addition, CipherTrace will be offering free “CipherTrace Certified Examiner” (CTCE) one-day training events. Boot camps will take place in Monterey, London, Frankfurt, Singapore, San Francisco, Los Angeles and New York.

According to Jefferies, these courses aim to provide attendees with the skills required to become expert cryptocurrency financial investigators. He also noted that remote training events will be available each month.

Not a recruiting tool

While CipherTrace’s Defenders League may seem like a useful recruiting tool, Jefferies said that this was not a motivating factor for developing the program. Rather, he explained that training students is a way to give back to the blockchain community:

“CipherTrace Cryptocurrency Intelligence has the information, but our team doesn’t have the time to investigate each case. This is an opportunity for CipherTrace to give back to the blockchain community by helping to remove the taint of illicit finance, dark markets and scammers from virtual assets.”

While this may be, senior lecturer in digital forensics at Middlesex University London, Sukhvinder Hara, noted that the training CipherTrace provides will enhance their employment opportunities, stating, “Being the only UK university with commercial crypto investigation software enhances our students’ employability, particularly as they can certify as CipherTrace Certified Examiners.”

Updated: 1-18-2020

Chainalysis Finds Terrorists Are Refining Crypto Financing Operations

A new study by Chainalysis finds that terrorists are refining their financing operations using cryptocurrencies.

Faster and broader funding

Earlier today, Jan. 17, the blockchain analysts identified Izz ad-Din al-Qassam Brigades (AQB), Hamas’s military arm and noted terrorist organization, as the first confirmed case of terrorists using cryptocurrency to aid their activity. AQB used a website to generate a new Bitcoin address for each donor to deposit funds. It included a how-to video on donating with maximal anonymity. Compared to similar earlier campaigns, AQB raised as much money and garnered more donors but in less than half the time.

Cryptocurrency has been linked to crime before, including Ponzi schemes and hate crimes. In other recent research, Chainalysis tracked $2.8 billion in Bitcoin from criminal enterprises to exchanges. Over 50% — $1.4 billion in Bitcoin — moved through major exchanges Binance and Huobi.

Law Enforcement Response

Crypto-enabled crime has caught the attention of regulators and government officials who would like greater oversight of digital currencies. Last year, Treasury Secretary Steve Mnuchin, speaking at a gathering of the Financial Action Task Force (FATF), applauded global regulatory standards that would combat crypto crimes:

“The FATF will make sure that virtual asset service providers do not operate in the dark shadows […] This will enable the emerging FinTech sector to stay one-step ahead of rogue regimes and sympathizers of illicit causes…”

The FATF, whose 200 countries, including the U.S., promote measures to combat financial crime, now demand that exchanges know more about customers and transactions. More data will hopefully help identify money laundering and terrorism financing in exchange institutions that largely lack the oversight needed to combat this growing problem.

In a statement to Chainalysis, Binance CCO Samuel Lin said,

“Binance is committed to cleaning up financial crime in crypto and improving the health of our industry. We will continue to improve on our proprietary KYC and AML technology, as well as the third-party tools […] One of our core values at Binance is to protect our users…”

Binance, one of the largest crypto exchanges, exceeded $1 billion in profits last fall.

Updated: 1-20-2020

Palestinian Militant Group Has Received 3,370 Bitcoins in Donations Since 2015: Report

A Palestinian militant group took millions of dollars-worth of bitcoin donations to finance its operations, according to a new report.

Obtained by the Jerusalem Post and reported Sunday, the report from the Israeli International Institute for Counter-Terrorism (ICT) found the al-Nasser Brigades, the military wing of the Popular Resistance Committees (PRC), used bitcoin sent from overseas as a means to fund operations both in and out of the Gaza Strip.

ICT researchers linked the group to the bitcoin wallet address, “1LaNXgq2ctDEa4fTha6PTo8sucqzieQctq,” which showed “an irregular increase in the scope of activity,” with more than 4,500 transactions over the past four years.

The report claims the group – which the Jerusalem Post says has links to Hamas – used bitcoin to avoid sanctions, offer a degree of anonymity to donors from overseas and enable cross-border money transfers.

The wallet, which had received a total of nearly 3,370 BTC (almost $29 million at current prices) between October 2015 and July 2019, was also linked to financial website “cash4ps.” Digging a little deeper, researchers found cash4ps had a bank account with the Islamic National Bank, designated by the U.S. as a terrorist organization in 2010 for its connection to Hamas.

The Bitcoin Abuse Database linked the wallet to Hamas in February 2019, saying it had been used for “collecting donations to a terrorist organization.”

The PRC is a coalition of various armed groups, affiliated with Hamas, that has fought for the total reclamation of a state of Palestine from Israel since 2000. Through the al-Nasser Brigades, it is generally considered to be one of the strongest factions in Gaza, with close links to Hamas and Hezbollah. It has been designated as a terrorist organisation by both Israel and the U.S.

The al-Nasser Brigades has been active in numerous conflicts with Israel. It was part of a broader group, including Hamas, responsible for the 2006 kidnapping of Israeli soldier Gilad Shalit. Shalit was only released in 2011 following a prisoner exchange deal.

Funding Cut

This isn’t the first time that Palestinian militant groups have been found to be using cryptocurrencies. One Israeli blockchain analytics firm reported in February 2019 that Hamas may be using a Coinbase wallet address to help with fundraising. The New York Times has previously said that bitcoin had been used for “tens of thousands of dollars” worth of illicit transactions.

Iran has historically been one of the primary backers for many armed groups in Palestine. The country reportedly donated as much as $23 million every month to Hamas following the group’s 2006 victory in the Palestinian legislative elections. But much of this funding was cut in 2013 after Hamas continued supporting the revolution against the Iranian-backed Syrian president Bashar al-Assad.

The ICT researchers connected the bitcoin wallet to various Facebook posts from the al-Nasser affiliated al-Baraq media that appealed for support “due to lack of resources and Iran’s rejection to their request for support.”

As opposition efforts in Syria have faded, Iranian relations with Palestinian armed groups have begun to warm over the past year. Just over a month after the last transaction on the identified bitcoin wallet, Iran increased its monthly payments to Hamas to $30 million in return for assistance gathering intelligence on the missile stockpiles of their “common enemy” Israel.

It’s unclear if Palestinian militants are continuing to focus on bitcoin as a fundraising mechanism now that many have re-developed stronger ties with Iran.

Economic isolation has also forced many Palestinian businesses to use cryptocurrency to send and receive international payments. CoinDesk has previously highlighted that there were up to 20 bitcoin dealers operating in Gaza each processing as much as $5 million to $6 million per month for clients that included charities based overseas as well as domestic businesses or entrepreneurs.

One source at the time said that Hamas’ use of bitcoin may very well have helped raise awareness of bitcoin among Palestinians.

Updated: 2-11-2020

Inside Chainalysis’ Multimillion-Dollar Relationship With the US Government

It started with a $9,000 data software contract for the FBI in 2015.

But just five years later, Chainalysis is now the cryptocurrency-tracing equivalent of Palantir, the data analytics company flush with lucrative government software contracts. Chainalysis is, right now, doing millions of dollars worth of business each year with the U.S. government, dwarfing its competitors in the young industry of blockchain surveillance.

The company is by far Uncle Sam’s leading crypto analysis contractor by spending and has become the go-to firm for 10 federal agencies, departments and bureaus.

In short, the feds want to catch up on, and make sense of, the tangled transactional web of bitcoin and other cryptocurrencies to stop all sorts of crimes – and they’ll spend big to do it.

Federal agencies have spent at least $10 million ($10,690,706 to be precise) in American tax dollars on Chainalysis’ tools, services and training since 2015, when Chainalysis was founded, according to 82 records of federal procurement contracts reviewed by CoinDesk. Counting contracts with possible extensions, the company stands to take in more than $14 million.

No competing firm’s federal contracts match Chainalysis’, and none are as prevalent across agencies. CipherTrace, led by CEO David Jevans, has made about $6 million through mostly research and development contracts; Elliptic, a British firm, has had only one contract worth $2,450 with the Internal Revenue Service, according to federal data.

Chainalysis’ contracts open a small but prescient window into the federal government’s nascent relationship with the cryptocurrencies some use to evade detection. Bitcoin is a pseudonymous system with inherent traceability – a network moving billions of dollars in value on a public ledger that anyone can track.

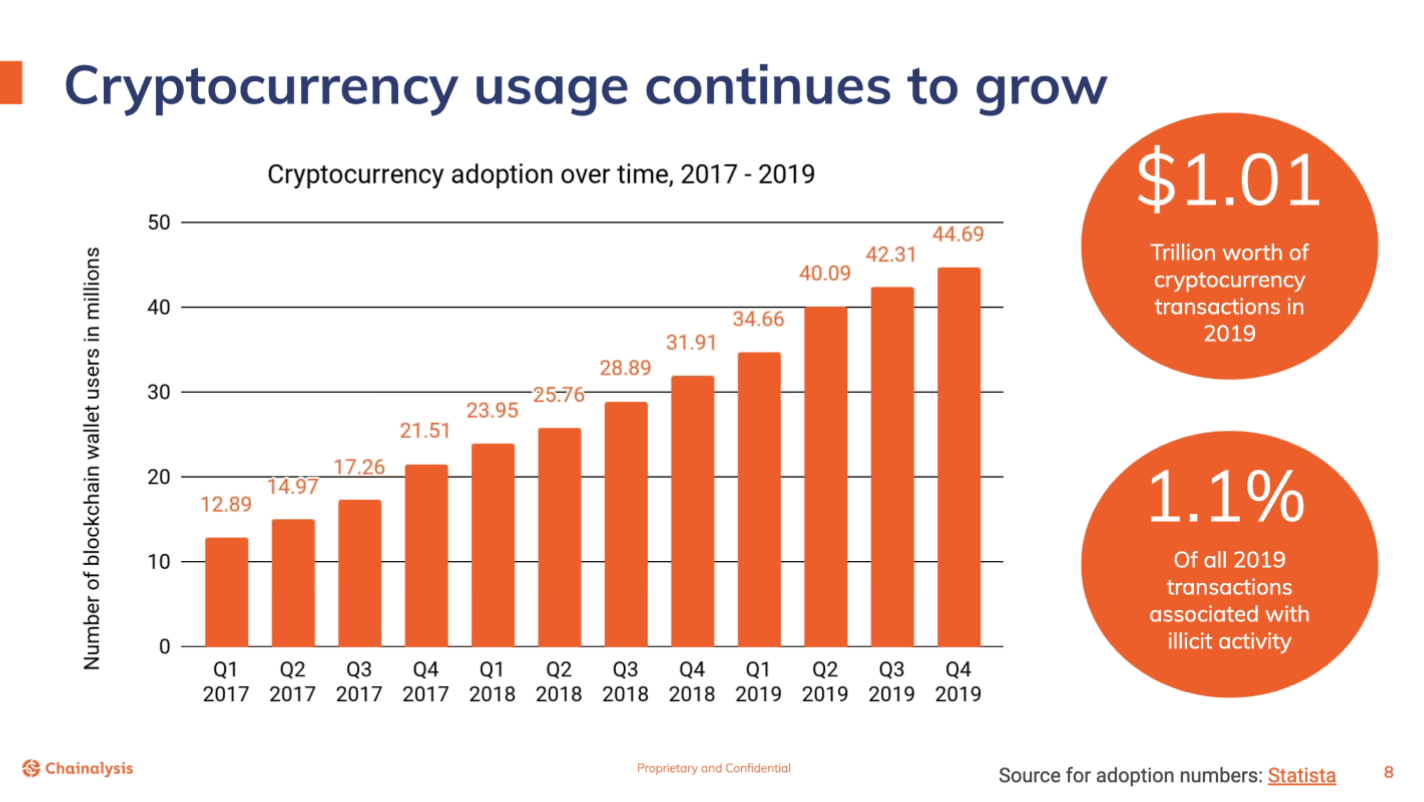

And though Chainalysis data show only 1.1 percent of bitcoin transactions were illicit in 2019, that proportion is growing: up 180 percent over the year before.

The U.S. government has responded in kind, raising its spending on Chainalysis every year, the data show. It paid the company over $5 million in 2019, a 20 percent increase from 2018 and a 22,558 percent increase from 2015, when the FBI and the Internal Revenue Service were Chainalysis’ only federal clients.

Nowadays, Chainalysis’ federal money comes from many corners: the Federal Bureau of Investigation, the Drug Enforcement Agency (DEA) and Immigration and Customs Enforcement (ICE), from financial regulators in the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC) and Financial Crimes Enforcement Network (FinCEN), from the IRS, the Secret Service (USSS), the Transportation Security Administration (TSA) – even from the Department of the Air Force.

Most have signed six-figure deals with Chainalysis, although some agencies spend more than others. For instance, the TSA spent $40,000 on one contract in 2018 while the IRS, Chainalysis’s biggest federal partner spent $4.1 million over five years – $3.6 million of it since 2018, according to the data.

ICE, with $2.6 million in total contracts, holds the number two spot, and the FBI’s $2.4 million is third.

But the FBI plans to spend millions more in the next two years, and will overtake the IRS as the U.S. government’s most prolific Chainalysis partner. On Dec. 18, 2019, it paid Chainalysis $377,500 for “Virtual Currency Tracing Tools,” with an option to spend at least $3,628,775 through 2022.

By contrast, when Vice reported on Chainalysis’s government contracts in 2017, the fledgling New York firm had received $330,000 from the FBI, $88,000 from the IRS and $58,000 from ICE in its history.

What Are They Buying?

It’s tricky to state with certainty what the agencies are buying from Chainalysis. Many of the contracts are short on details, with 29 mentioning various product licenses, five noting “Reactor” software and others a cryptic mix of telling and vague. (The Department of the Air Force has spent over $110,000 on “BitCoin [sic] Cryptocurrency Transactions”).

But the company that raised $30 million in Series B funding a year ago makes only three products: Reactor, KYT and Kryptos. Only Reactor, its flagship transaction visualization software, has been around for more than a year.

“While our private-sector customers also use Reactor, we have also developed two newer products – KYT (Know Your Transaction) and Kryptos – specifically for them,” said Jonathan Levin, co-founder and chief strategy officer at Chainalysis.

Reactor is Chainalysis’ investigatory workhorse. It visualizes cryptocurrency movement across a blockchain and flags addresses associated with illicit activity.

Casey Bohn, a high-tech crime specialist with the Virginia-based National White Collar Crime Center (NW3C), who regularly trains law enforcement officers to use Reactor and other firms’ cryptocurrency tools, said Reactor takes some of the pain out of blockchain crawling.

“It’s a relatively easy tool to use. It’s not a rocket surgeon level of complexity,” Bohn said. “Once you figure the tool out you can really make some good headway in what is truly a tedious task.”

Bohn has taught federal, state and local officers, including some in the 10 agencies that contract with Chainalysis. He explained that blockchain analysis has broad appeal for them.

“All of these investigative agencies kind of have a specialized sub-niche” that intersects with cryptocurrency, he said.

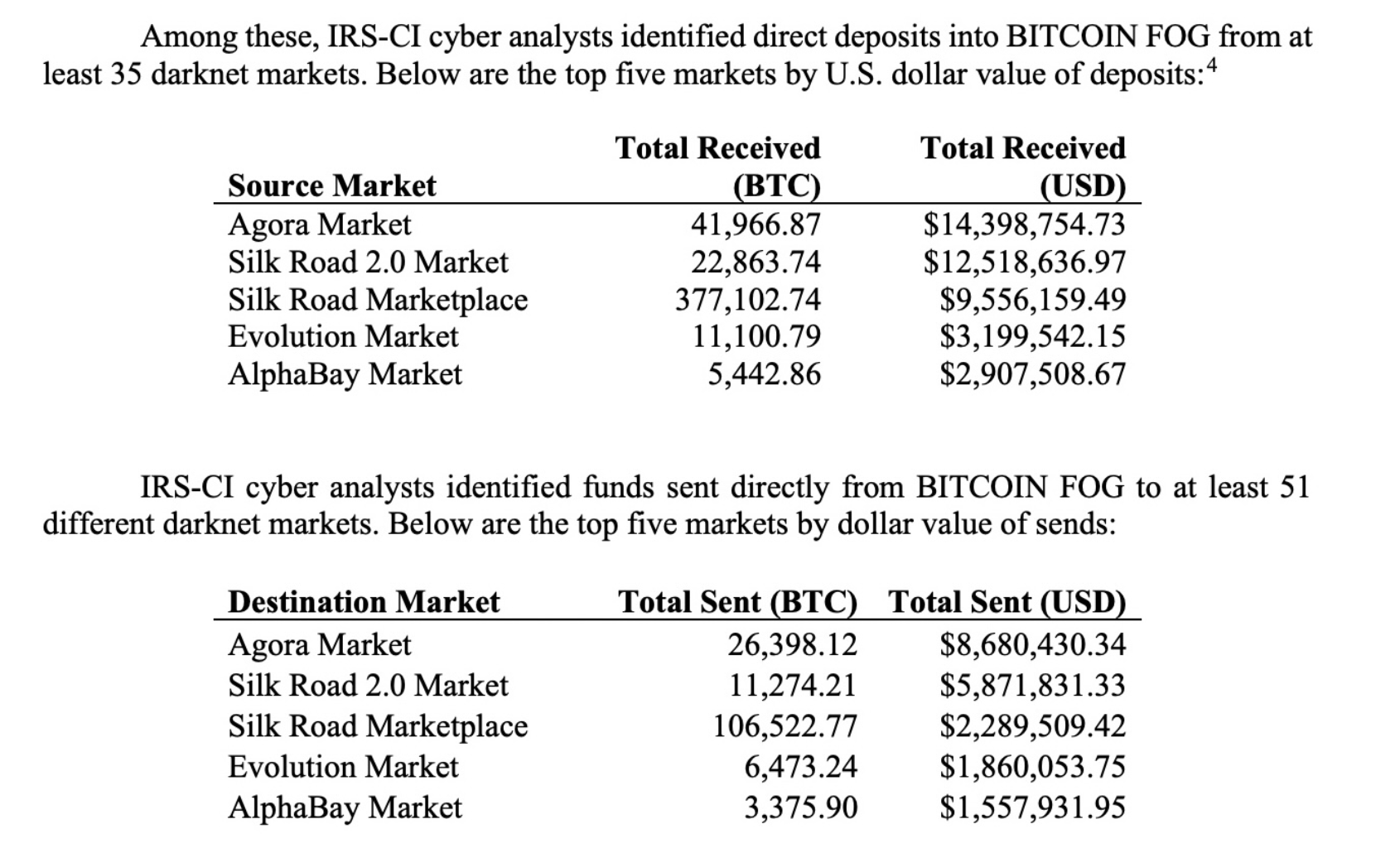

One such niche is the IRS Cyber Crimes Unit (CCU), a five-year-old division of its larger Criminal Investigation (CI) wing and the force behind the tax collector’s cryptocurrency crimes investigations. It’s also a major Chainalysis client: CCU has spent over $3.3 million on four years of “Case Support and Training” from the firm.

The IRS did not respond to requests for comment. But in the 2019 Criminal Investigations annual report, IRS-CI Deputy Chief Jim Lee hinted his agents’ crypto-tracing prowess is “in demand” even outside of the agency.

“U.S. Attorneys want IRS-CI agents in all of their financial crime cases. The fact of the matter is, if a case involves money and it’s a crime that rises to the federal level, IRS-CI almost always has jurisdiction. There is no better example to this than in tracing cryptocurrency transactions,” he said.

IRS-CI Chief Don Fort has been even more explicit about his investigators’ relationship. He has said that Chainalysis helped the IRS and the Department of Justice dismantle a sprawling child pornography ring in South Korea.

But other agencies don’t talk about their cryptocurrency tracing activities. Most did not respond to requests for comment. FinCEN, the FBI and DEA declined to comment.

“DEA does not discuss any investigative techniques,” a spokesperson said.

Agencies may also not want to publicize their private-sector relationships, other now-public documents show.

In 2018, Vice filed a FOIA request with ICE demanding the agency produce documents related to its $13,188 contract for Chainalysis “software.” Five months later, ICE released an at-times poorly redacted document that confirmed its Homeland Security Investigations unit uses Reactor.

“Public disclosure of Chainalysis, Inc.’s cooperation with ICE would also damage ongoing cooperative information sharing arrangements with other companies in the logistics and financial sector,” according to that document.

Starting Small

Chainalysis tailored its earliest product to cryptocurrency investigators. Levin, the co-founder, said his company initially focused on signing specialized agency teams.

“We started off with smaller units within agencies who were focused on being able to deal with cybercrime and money laundering,” Levin said. “What we found is that the different types of crime and illicit activity that these agencies need to be able to prevent means that our appeal has become much broader to those organizations, and our role has expanded.”

The strategy triggered a snowball effect of federal procurement contracts that may well stretch beyond the figures disclosed here. Levin said some contacts do not get reported in the FPDS system.

“Our revenue is roughly a 50-50 split between public and private sectors,” Levin said. The public split includes contracts with state-level agencies and governments overseas.

In many respects $10.6 million is a negligible total, according to Bohn, the cyber crimes educator. He pointed out the U.S. government spends many times more on other private-sector tech solutions, like Cellebrite, which helps investigators crack mobile phone data. Cellebrite has made at least $40,000,000 from government contracts since August 2015, FPDS records show.

But when it comes to tracing cryptocurrency, Chainalysis appears to have the federal market cornered.

Updated: 2-12-2020

Tether To Track Stablecoin Network Activity With Chainalysis Suite

Chainalysis is rolling out a global compliance solution for Tether (USDT), a Feb. 12 press release announced. The stablecoin’s issuer is now able to identify “high risk” transactions occurring on its network.

The tracking is made possible by Chainalysis’ Know Your Transaction (KYT) suite, which allows token issuers to monitor the activity of their assets. The real-time Anti-Money Laundering (AML) solution assists compliance efforts by tracking the entire chain of a token’s life, from issuance to redemption.

KYT provides both an API and a user interface to track suspicious activity, with various filtering tools.

Preparing For Regulators

Tether representatives did not directly reveal to Cointelegraph why the firm chose to enhance its compliance measures now.

However, regulators around the world recently started signaling that stablecoins deserve deeper scrutiny. In October 2019, Financial Crimes Enforcement Network (FinCEN) Director Kenneth Blanco noted that stablecoins are not exempt from complying with AML laws.

For the regulator’s purposes, stablecoin issuers are categorized as money services businesses (MSB), and have to adhere to the regulatory standards reserved for such companies.

Cryptocurrency exchanges are also categorized as MSBs, and have gradually implemented stricter KYC and AML controls. But while compliance for an exchange is relatively straightforward — its scope is only for the money coming in and out — stablecoin issuers are potentially faced with the much harder task of tracking network activity.

Regulating the flow of money in and out of the stablecoin network is relatively simple, yet regulators around the world have often identified severe risk for stablecoin transactions.

Tracking activity within the network itself may alleviate these concerns. While Tether cannot confiscate the “high risk” tokens directly, it can freeze the wallets that contain them.

Updated: 2-13-2020

‘Full Transparency Not Ideal For Cryptocurrency’ Says Chainalysis Exec

A major global company that helps fight illicit cryptocurrency-related activity does not think that privacy in crypto markets is necessarily bad.

Despite representing one of the primary sources of crypto transaction data for federal agencies like the Internal Revenue Service and the FBI, Chainalysis does not exactly oppose the privacy and decentralization of crypto.

“Complete Transparency Is Not Necessarily An Ideal Place”

Jonathan Levin, co-founder and CSO at blockchain and crypto analytics firm Chainalysis, reiterated his stance to privacy in crypto, claiming that full transparency of cryptocurrency transactions might not turn out to be the best situation.

Speaking in an interview with Cointelegraph, Levin noted that there is still a need to support the ability of regulators and businesses to monitor illicit activity related to crypto, stating:

“There will be the invention of privacy-enhancing technology. Complete transparency is not necessarily an ideal place to be either, but ultimately there needs to be the ability for regulators and businesses with the appropriate levels of legal authority and oversight to tackle the illicit activity that abuses the systems.”

Speaking to Cointelegraph in January, Levin previously outlined the issue of privacy and transparency extremes:

“The two extremes of total anonymity and complete transparency are bad. Complete anonymity opens the door to illicit activity that, by definition, cannot be investigated. That’s not a world you want to live in. On the other hand, complete transparency means no privacy at all. That’s also not a world you want to live in.”

Chainalysis “Sometimes Find Ways To Trace Some” Privacy Coins

While Levin appears to support the privacy in crypto in some sense, the Chainalysis co-founder admitted that the company is not yet able to fully trace privacy-focused cryptocurrencies:

“We may not necessarily be able to track all of the funds in privacy coins but we still perform research on what they are used for. We sometimes find ways to be able to trace some of that.”

Levin pointed out that the majority of cryptocurrency transactions are conducted on more publicly traceable blockchains like Bitcoin (BTC) and Ethereum (ETH) so far. However, some crypto security firms like Elliptic believe that privacy coins like Monero (XMR) and Dash (DASH) are still gaining steady traction and usability despite Bitcoin transactions dominating on the dark market.

Originally set up in Denmark in 2013, Chainalysis is a New York-based provider of Know Your Transaction and Anti-Money Laundering solutions for financial institutions and regulators in the crypto industry.

The company has emerged as one of the most trusted sources of analytical data on global illicit activity in crypto such as terrorism financing, money laundering and operations on darknet markets. According to Levin, the firm is working with 250 agencies and firms worldwide to date, with its services coverage spanning across 45 countries.

On Feb. 12, Chainalysis partnered with major U.S. dollar–pegged stablecoin project Tether to identify high-risk transactions occurring on its network.

Updated: 3-5-2020

Chainalysis: Only 1% of $1 Trillion Transacted in Crypto in 2019 Was Illicit

According to Chainalysis’ March 5th webinar, over $1 trillion worth of cryptocurrency transactions took place in 2019 with only 1.1% of them being illicit.

Diminishing Of Darknet Markets

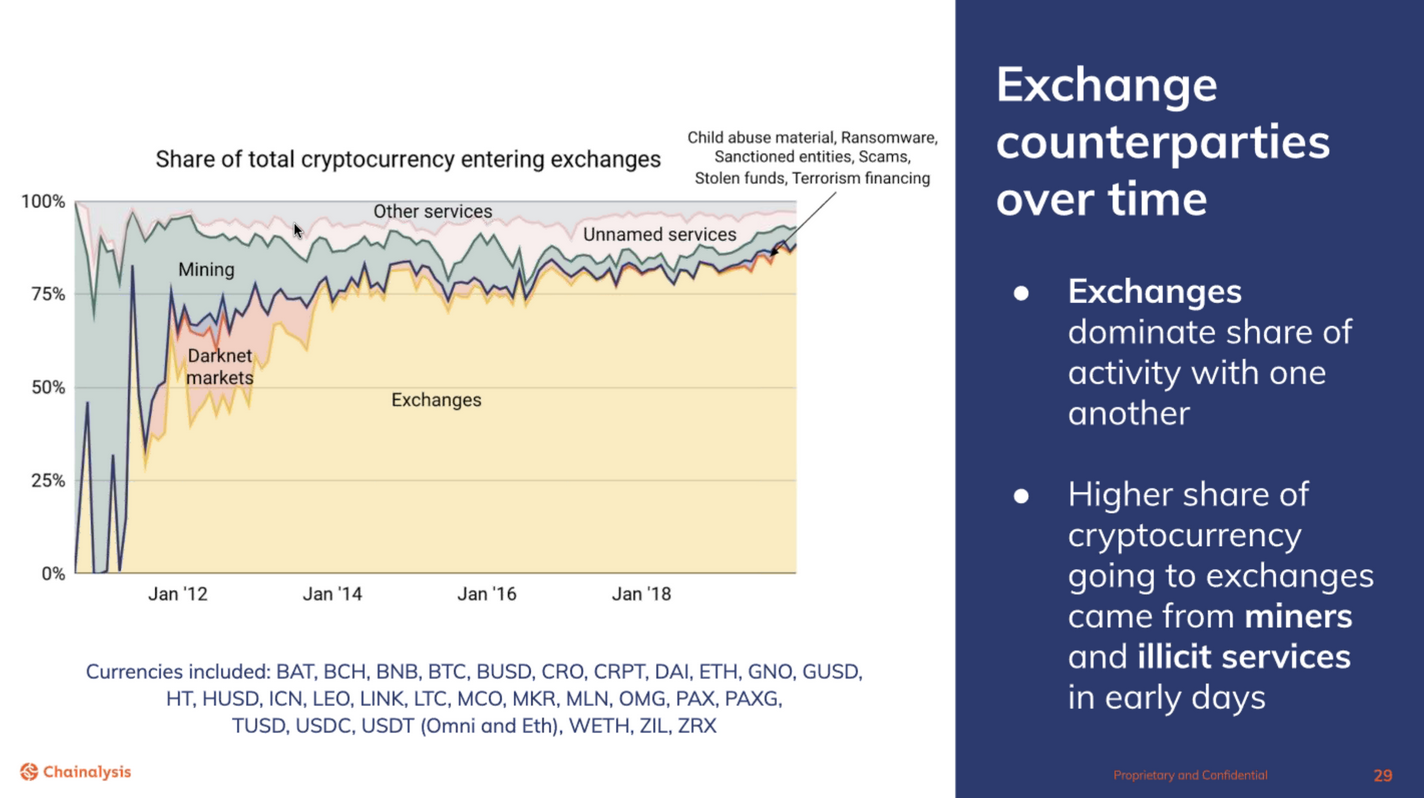

Overall, as crypto adoption keeps on growing and the number of use cases for cryptocurrency expands, illicit transactions on a percentage basis, keep diminishing; implying that the industry today is much healthier than in the early days when much of the volume was driven by darknet markets.

Industry-Wide Cooperation Thwarts Crypto Hackers

As more cryptocurrency enters exchanges, they remain the most coveted targets for crypto hackers. However, the criminals’ success rate has decreased. There was an inflection point after 2018 when the criminals got away with almost 1 billion dollars worth of cryptocurrency. These numbers have been dwindling ever since.

Not only the exchanges have implemented more sophisticated cybersecurity measures, but the industry-wide cooperation and coordination with the various law-enforcement agencies helps secure the entire ecosystem. According to Chainalysis, this wide cooperation has helped client DragonEx recover some stolen funds.

Halving — Newly-Mined Coins Go Straight To Exchanges

The majority of freshly mined coins are going straight to exchanges. This fact is especially significant considering we are only 70 days away from the halving. This implies that after the halving, even if the miners decide to send all of their newly mined coins to the exchanges, this will not make up the shortfall from decreased mining reward.

Now, the ball is in the hackers’ court – they can either evolve or perish.

Updated: 3-10-2020

Bithumb Taps Chainalysis For FATF-Grade Crypto Investigation Tool

Cryptocurrency exchange Bithumb is clamping down on suspicious transactions less than a week after South Korea, its home country, moved to enact tough new laws for the virtual asset space.

Bithumb announced Tuesday it had deployed Chainalysis’ “Reactor” investigations tool to get ahead of illicit activity. Reactor, used in many cryptocurrency law enforcement actions, will help the exchange’s compliance officers police their network, according to a press release.

The announcement follows the South Korean National Assembly’s early March vote to amend the Special Financial Transactions Information Act, which, once signed into law, will force all virtual asset service providers (VASPs) to register with the government and submit to an internet security certification program. Bithumb is one of the few South Korean VASPs to have already completed both aspects.

The National Assembly’s vote brings its money transmission laws more in line with the Financial Action Task Force’s recommendations around VASPs last year, ahead of a June deadline for countries to comply.

But the 12-month deal with Chainalysis also addresses the spate of recent hacks against Bithumb, a historically hack-ridden exchange that has lost tens of millions in crypto – and in a country, South Korea, that has become an exchange raider’s billion-dollar honeypot.

“They had an immediate need for Reactor to manage their hack last year, and wanted to focus on boosting their investigative skills,” said Chainalysis’ Head of Communications Maddie Kennedy.

Many private-sector crypto companies partner with Chainalysis, though not always for Reactor. Tether uses “Know Your Transaction” to build risk profiles, as does Bittrex, Binance and some 150 other VASPs around the world, by Chainalysis’ own count.

Kennedy said Bithumb and Chainalysis are now in talks to provide KYT, too.

Other above-board Korean VASPs are also gearing up for the new regulations. Korbit CEO Caleb Oh said his exchange “is considering making various investments” to comply with the amendment and the Financial Action Task Force’s “travel rule.”

Updated: 3-23-2020

P2P Exchange Paxful Teams Up With Chainalysis For Increased Overwatch

Peer-to-peer exchange Paxful will add security to its operation through a partnership with blockchain analysis outfit Chainalysis.

Through a new partnership, Paxful will harness specific technologies from Chainalysis. “Paxful uses the Chainalysis Reactor to conduct deep investigations and the Chainalysis KYT to monitor transactions for any illicit behavior,” Youssef said, referring to the firm’s Know Your Transaction solution — a similar acronym to Know Your Customer, or KYC, regulations. Youssef added:

“Through working with Paxful, Chainalysis is evolving its policy and will evaluate P2P exchanges on a case-by-case basis before labeling them as risky, just as it does for other cryptocurrency exchanges.”

Prior to working with Paxful, Chainalysis viewed P2P organizations as having questionable safety, due to their lack of required user data, a press statement said.

“Paxful is setting a new standard for compliance at P2P exchanges,” Paxful CEO Ray Youssef told Cointelegraph. “Chainalysis is changing its policy based on the strides P2P exchanges like Paxful have made.”

Don’t Users Go To P2P Exchanges Seeking Anonymity?

At its core, crypto’s pioneer asset Bitcoin came into the world as an anonymous digital asset. Over the past 11 or so years since the industry’s beginning, a movement has pushed forward, touting the importance of data privacy.

Historically, many crypto users have gravitated toward P2P outfits, such as LocalBitcoins, as a way of trading value while controlling their own privacy and data. Such a partnership between Paxful and Chainalysis could thus seem antithetical to the crypto industry’s founding ethos of privacy and anonymity.

“The Paxful Marketplace Is For The Honest Users,” Youssef Said In Response To Questions On The Matter, Adding:

“Like in other industries, there are bad actors who try to scam and steal money anonymously from the honest users. They are the ones who fail to provide appropriate verification and are left with only one option: to flee. KYC and KYT keep the honest users in the platform, and give them more confidence to trade.”

Anonymity and privacy are part of a double-edged sword. Authorities express the desire to protect users from fraudulent players, while some honest traders also prefer to guard their personal data. The topic remains up for debate.

Updated: 3-2-2020

Leading blockchain intelligence firm Chainalysis has found that the COVID-19 pandemic and global economic contraction is affecting Bitcoin (BTC) consumer habits in surprising ways.

In a new report published on March 30, Chainalysis details how Bitcoin spending trends in three areas — merchant services, gambling and darknet marketplaces — have changed, or even reversed.

Weakening Correlation Could Be A Boon For Bitcoin Merchant Services, Says Report

Chainalysis reported that one such change in trend shows resilience among Bitcoin merchant services in the current economic crisis.

For example, the firm’s data for Bitcoin spending using merchant services from July 2019 until March 9, 2020 reveals that there was a strong positive correlation between price and expenditure: the more Bitcoin is worth, the more likely holders are to spend it.

Since the COVID-19 outbreak, this positive correlation has weakened by roughly half, and the total value of expenditure has declined.

While this indicates that Bitcoin holders are indeed spending less during Bitcoin’s recent decline in value, this decrease is less dramatic than might otherwise have been expected. This is because since the outbreak, the strength of the correlation between price and behavior has itself also weakened.

So while Bitcoin’s decline in price does continue to lead to reduced spending — it does not do so as significantly as it would have done in pre-pandemic times. A weakened correlation means that the price does is not dictating consumer behavior as strongly as before.

Darknet Marketplaces Take A Hit

Most conspicuous of all is the change in user behavior on darknet marketplaces, which usually has only a weak negative correlation to Bitcoin’s price. Since the outbreak, however, this correlation has reversed and strengthened — leading to a significant decrease in darknet market revenue.

Chainalysis points to possible external factors to explain this trend, noting that illicit substances such as recreational drugs may be harder to come by due to the impact of disrupted supply chains worldwide:

“Recent reports point out that Mexican drug cartels are having a harder time sourcing fentanyl, as China’s Hubei province — a hub of the global fentanyl trade — has been hit hard as the epicenter of the outbreak. Such disruptions […] could be hampering darknet market vendors’ ability to do business.”

With gambling, its marginally positive correlation to Bitcoin price has corrected to zero since early March 2020 (i.e. no relationship), signaling that there appears to be no discernable impact of the pandemic on gamblers’ behavior.

Chainalysis closes its report noting that with China’s gradual comeback from the domestic COVID-19 crisis, darknet activity now appears to be seeing a gradual recovery there.

In January 2020, a Chainalysis report revealed that the volume of cryptocurrency flows on darknet markets had doubled in 2019 for the first time in four years.

Updated: 4-9-2020

Blockchain Intelligence Firm Chainalysis Seeks New Partners To Extend Its Reach

New York-based blockchain analytics firm Chainalysis is launching a major partnership program to expand its operations and broaden its intelligence capabilities.

As one of the highest-profile analytics firms in the blockchain intelligence industry, Chainalysis develops investigative tools that enable firms, governments and law enforcement agencies to monitor blockchain transactions and track suspected illicit activities.

Speaking to Cointelegraph on April 9, Chainalysis chief revenue officer Jason Bonds explained that the program would be dedicated to collaborations with several categories of partners.

The first, key crypto infrastructure providers, will help Chainalysis and the wider industry to “broaden cryptocurrency transaction monitoring via simpler integrations.” The firm will seek to partner with firms specializing in compliance in order to integrate their offerings for clients.

Second, Chainalysis is seeking new distribution partners in several of its existing markets as well as further afield. Bonds identified two such partners — Carahsoft, an IT provider working with federal and state institutions in the United States, and Singapore-based cybersecurity firm M.Tech in the Asia Pacific (APAC) region.

The partnership program, Bonds said, “is global and we already have partners in the Americas, EMEA, and APAC.”

Third, Chainalysis will look to broaden its own intelligence capabilities by partnering with data providers. These could include specialists in ransomware, bolstering Chainalysis’ labeling of suspect addresses. M.Tech’s chief financial officer Rayson Lim stated:

“In the APAC marketplace, we are noticing increased demand from law enforcement for cryptocurrency investigative software. Our partnership with a top tier company like Chainalysis will help fill this demand.”

Further information on the program, including a partner directory, will be made publicly available in the coming weeks.

Identifying Trends

Alongside its work on blockchain intelligence, Chainalysis conducts regular research into the crypto sector. Most recently, the firm published the results of its analysis of changing Bitcoin (BTC) consumer habits during the COVID-19 pandemic and global economic downturn.

In a webinar last month, Chainalysis shared data revealing that only 1.1% of over $1 trillion in cryptocurrency transactions in 2019 were found to be illicit.

Updated: 4-21-2020

Over $900K In Bitcoin Went To Child Sexual Abuse Material Providers In 2019, Says Chainalysis

Blockchain intelligence firm Chainalysis has published its latest analysis of the use of cryptocurrencies to purchase child sexual abuse material on the darknet.

New York-based blockchain intelligence firm Chainalysis has published its latest analysis of the use of cryptocurrencies to purchase child sexual abuse material (CSAM) on the darknet.

In a report shared with Cointelegraph on April 22, Chainlaysis noted that it had traced just under $930,000 worth of Bitcoin (BTC) payments to addresses associated with CSAM providers in 2019. This represents a 32% increase over 2018, which had in turn presented a 212% increase over the previous year.

Nonetheless, Chainalysis emphasized that this stark year-on-year rise is not necessarily reflective of an absolute rise in CSAM demand, but is likely to reflect a rise in the level of adoption of cryptocurrencies across all sectors.

How To Decode The Warning Signs

$930,000 in Bitcoin represents “a miniscule fraction of all cryptocurrency activity” — and yet the industry should be concerned about such usage of cryptocurrencies in a criminal and deeply exploitative industry, Chainalysis says.

While cryptocurrencies may have become prevalent among criminal content providers due to their perceived pseudonymous properties, Chainalysis notes that the blockchain can in fact provide investigators with actionable data that sheds light on the profiles and activities of those involved.

Among the key patterns identified in the report are frequent low-value payments — typically between $10 and $50 in Bitcoin — sent between 11pm and 5am. While small payments account for the lion’s share of transactions, CSAM providers do draw a significant percentage of their revenue from much larger individual payments.

Other signs of illicit CSAM activity include cryptocurrency transactions that are tied to prepaid credit and debit cards, or those made repeatedly to one address (or group of addresses controlled by the same entity).

Crypto payments to known escort services or other adult services providers or the purchase of crypto tokens that target the adult industry specifically can provide law enforcement with further data points towards an analysis of the CSAM darknet sector.

The Backpage Backstory

As Cointelegraph has reported, listings site Backpage — described as “the world’s largest brothel” — was seized by the United States Department of Justice in 2018.

CEO Carl Ferrer later pleaded guilty to conspiracy and three counts of money-laundering, in part via cryptocurrencies, admitting he had been aware that the “great majority” of the site’s ads were for prostitution services.

Ferrer had laundered $500 million in revenue through multiple bank accounts and sites that included Coinbase, GoCoin, Paxful and Kraken, among others.

Updated: 5-20-2020

Blockchain Sleuthing Firm Elliptic Adds 87 Crypto Assets In Arms Race With Chainalysis

Crypto sleuthing firm Elliptic has expanded its scope to cover some 97% of digital assets by trading volume – the broadest range of any crime-fighting blockchain analytics service, the company said.

Announced Wednesday, Elliptic Navigator adds 87 new crypto assets to the firm’s existing purview.

That said, touting just the number of coins covered can be “fairly irrelevant,” said Elliptic co-founder Tom Robinson, because analytics shops could be including many ERC-20 tokens that nobody really uses.

“More important is the proportion of all trading volume your supported assets cover,” said Robinson. “We now support just over 97% of all assets by trading volume, the broadest of any crypto transaction screening tool.”

That figure beats the competition, Robinson said. Chainalysis has said it covers 90% and Ciphertrace has said it covers 87%.

It’s increasingly becoming a regulatory expectation that crypto businesses have transaction screening capabilities across all the assets they support. Because exchanges have sought out new customers and revenue, the number of assets they support has grown rapidly.

On this occasion, Elliptic added a swathe of new tokens and stablecoins in one go, all of them based on the Ethereum ERC-20 standard. Elliptic also adds some tokens individually, as it recently did with Stellar.

Robinson said stablecoin adoption, in particular, has exploded this year. Elliptic can now track tether (USDT), TrueUSD (TUSD), USD Coin (USDC), Gemini Dollar (GUSD), Paxos Standard (PAX), dai and Binance USD (BUSD).

“Elliptic is the clear leader in crypto transaction screening,” Binance Chief Compliance Officer Samuel Lim said in a statement. “Support for BUSD in their compliance products will help us to increase adoption for our stablecoin and maintain regulatory compliance.”

Crooked Coins

In terms of which cryptocurrencies attract the most nefarious activity, Robinson said darkweb transactions are dominated by bitcoin and monero. With some of the other cryptocurrencies, such as XRP and stellar (XLM), illicit activity is less about trade or purchases, and more about scams or Ponzi schemes.

“We saw a similar type of distribution with a lot of the new tokens we are adding,” said Robinson. “It’s more about fraud than any kind of dark market activity; there are no dark marketplaces accepting payment in an obscure ICO token.”

Stablecoins tend to be involved in relatively little illicit or fraudulent activity, said Robinson, probably because the issuers have the functionality to freeze accounts or reverse payments in a given stablecoin.

On the subject of privacy coins, Robinson said monero, with its belt-and-braces approach to privacy features, would be “extremely challenging” to add to Elliptic’s roster of supported assets. “It’s not something we are targeting at the moment,” he said.

“Something like zcash has dual modes of operating either shielded or non-shielded transactions,” Robinson said. “So, we are going to add support for zcash unshielded transactions to Navigator.”

Updated: 6-9-2020

Crypto Forensics Firm Chainalysis Adds Tracing Support For Zcash, Dash

Blockchain intelligence firm Chainalysis is drawing back the curtain on privacy coins.

Chainalysis announced Monday its Reactor and Know Your Transaction (KYT) products can now trace zcash and dash, two privacy coins whose technical underpinnings theoretically make their transaction flows difficult for investigators to follow. Both have been delisted by global exchanges wary of regulatory scrutiny.

Chainalysis’ support poses a likely challenge to their secretive reputation, however. Chainalysis said that it can partially trace over 99% of zcash transactions and perform “successful investigations” on the handful of dash transactions transferred through “PrivateSend.”

The coins, which together account for $1.5 billion in daily crypto trading volume, broadens the reach of Chainalysis’ two key products: Reactor, an crypto investigations platform whose clients include the U.S government, and KYT, a real-time transaction monitor for exchanges that previously covered 90% of all crypto transactions.

In a blog post that downplayed how private these “privacy coins” actually are, Chainalysis said it can follow dash and zcash transactions without completely co-opting user privacy or leaving investigations at dead ends.

“The two cryptocurrencies’ privacy features – both in how they’re built as well as how they’re used in the real world – leave room for investigators and compliance professionals to investigate suspicious or illicit activity and maintain compliance,” Chainalysis said.

Dash’s PrivateSend mixes multiple fund transfers together as an optional core feature. But dash is technologically similar to bitcoin, and the techniques that Chainalysis said prove successful on CoinJoin bitcoin mixers also work on dash.

Zcash, a privacy coin by design, offers a “shielded pool” service that encrypts wallet addresses, balances and transactions via the zero knowledge proof zk-SNARK. Chainalysis said this encryption is hardly insurmountable; only about 0.9% of zcash transactions are shielded right now.

“So even though the obfuscation on zcash is stronger due to the zk-SNARK encryption, Chainalysis can still provide the transaction value and at least one address for over 99% of ZEC activity,” Chainalysis said.

Additionally, Chainalysis said zcash usage patterns could serve to undermine their party’s anonymity.

Jonathan Levin, chief of strategy at Chainalysis, said the additions may prompt exchanges to consider relisting or adding dash and zcash, both of which have been delisted from global exchanges in the past.

“We seek to provide transaction monitoring software to anyone who wants to be able to transact in different currencies, and I think that we may see businesses become more comfortable with these coins as a result,” he said.

Updated: 6-15-2020

Fireblocks Integrates Chainalysis’ Know Your Transaction Feature

Fireblocks will now utilize Chainalysis’ Know Your Transaction tool to streamline compliance and Anti-Money Laundering measures.

Blockchain analysis company Chainalysis is partnering with institutional digital-asset security specialist Fireblocks to integrate its Know Your Transaction (KYT) system to monitor crypto transactions within the platform.

According to an announcement on June 15, the addition will strengthen Fireblocks’ security standards and Anti-Money Laundering (AML) compliance.

Strengthening AML Compliance

KYT allows users to automatically screen transactions based on risk standards and ensure that non-approved trades aren’t executed without manual review. Speaking with Cointelegraph, Fireblocks CEO Michael Shaulov said:

“Compliance and security are two of the most important pillars of storing and transferring digital assets today.

By integrating with Chainalysis KYT, Fireblocks is removing the regulatory obstacles that exchanges, lending desks, banks, liquidity providers and market makers face when moving crypto — ensuring that these institutions can be as secure and compliant as possible, all from the Fireblocks platform.”

Shaulov claims that in just 2019 alone, more than $4 billion worth of crypto was lost to fraud, misappropriation of funds, exchange hacks and thefts, leading the United States Department of the Treasury to declare digital assets to be one of the most significant illicit finance vulnerabilities.

Furthermore, the ability to more easily comply with AML standards could prove to be a cost-saving measure for companies in the space. A recent study by CipherTrace revealed that banks and traditional financial systems globally paid more than $6.2 billion in AML fines in 2019.

Looking ahead, Shaulov said that there are near-term plans to expand the Fireblocks Network through onboarding new institutions, offering support for new tokens, and integrating with new exchanges.

Recently, Fireblocks launched its Asset Transfer Network. The open network enables institutions to find and connect with peers and transfer assets on-chain while streamlining settlement and post-trade operations.

Updated: 6-23-2020

China’s Blockchain Service Network Integrates Chainlink Oracles

China’s Blockchain Service Network, made up of some of the leading technology companies, is integrating Chainlink’s data oracles.

China’s Blockchain Service Network (BSN) is integrating Chainlink’s (LINK) oracle service into its ecosystem.

BSN was recently formed by China’s State Information Center, China Mobile, China Unionpay, and Red Date Technologies. The goal of this consortium is to build infrastructure that will lower the entrance barriers to blockchain technology.

Blockchain Was Too Expensive

Yifan He, CEO of Red Date Technology and BSN co-founder, told Cointelegraph that when his company first started experimenting with blockchain technology, he was excited about the new capabilities it enabled, but was appalled by how expensive it was:

“We really saw the upgrade from the Internet to the distributed way of transmitting data. So we really liked the technology. But at the same time, we thought it’s just way too expensive to make sense because just to set up the environment, put the framework together and build the nodes, it costs almost half a million yuan to set up the project.”

Chainlink Wasn’t The Number One Choice

Initially, Chianlink was not BSN’s number one choice, it was second on the list of potential oracalized data providers. However, he says that they were swayed by the strength of Chainlink’s community and team:

“We looked at the top four, on the list, Chainlink was not number one. They were the second one. But we saw that Chainlink has the best community, best support. […] Also, we really liked the team.”

He also noted that, unfortunately, there are too many misconceptions about China’s blockchain projects in the West saying, “not everything in China is evil.”

Updated: 7-23-2020

Chainalysis Widens Access To Its Blockchain And Crypto Certification Program

Chainalysis is expanding access to its Chainalysis Cryptocurrency Fundamentals Certification program to the wider community.

New York-based blockchain analytics firm Chainalysis is extending access to its certification program in crypto fundamentals to the wider professional community.

Announced on July 23, the company said that its Chainalysis Cryptocurrency Fundamentals Certification (CCFC) would from now on be open to professionals in the financial services sector, government employees and the wider enterprise community.

Previously, the course had been limited to clients using Chainalysis’ investigations and compliance products.

As one of the higher-profile analytics firms in the blockchain intelligence industry, Chainalysis develops investigative tools that enable firms, governments and law enforcement agencies to monitor blockchain transactions and track suspected illicit activities.

The CCFC program has been designed to provide participants with an industry credential and give them a foundational knowledge of cryptocurrency technology, an understanding of key stakeholders in the field, use cases and the functions of cryptocurrency in relation to the traditional financial system.

A New Cohort Of Crypto Professionals

The CCFC course offers two days of training — web-based for now due to the coronavirus — that are centered on group discussions, practical exercises and case studies. Anyone is eligible to apply, and those who complete the course receive a two-year CCFC credential, provided both as a digital certificate and LinkedIn badge.

Tim Simpson, A Compliance Analyst At Bittrex Crypto Exchange, Said:

“The majority of individuals do not have the time or technical expertise to filter through the endless amount of information about cryptocurrency to focus on what matters. For individuals with a non-technical background or those needing to become quickly up-to-date on how cryptocurrency really works, the CCFC course provides a focused, well-organized and active learning experience.”

Jason Bonds, chief revenue officer at Chainalysis said that as crypto and blockchain enter the mainstream, the course is intended to spread a thorough understanding of the technology that will be “crucial for its safe and successful adoption.”

Blockchain Educational Opportunities Worldwide, Public And Private

As previously reported, many higher education institutions globally have launched their own internal blockchain laboratories, research centers and degree programs and certificates — including MIT in the U.S. and the IT University of Copenhagen.

Last year, the French Ministry of National Education announced plans to integrate an educational module into its high school curriculum covering Bitcoin (BTC) and cryptocurrencies.

Ripple has also continued to add partners in its global University Blockchain Research Initiative, including universities from the United States, China, Singapore and Brazil.

Within the venture capital sector, Andreessen Horowitz (a16z) has offered a free, seven-week crypto startup school to provide guidance in areas such as product and technology design and legal/regulatory best practices.

This year, the Africa Blockchain Institute planned to open Rwanda’s first blockchain school, offering five new courses for local developers, professionals and policymakers.

Updated: 7-28-2020

Cellebrite Launches Crypto Tracer Solution To Track Illicit Transactions

Cellebrite released a new cryptocurrency tracer tool that gives law enforcement and analysts the ability to track illicit crypto transactions.

Digital intelligence firm Cellebrite has launched its “Cellebrite Crypto Tracer” solution.

The new offering is powered by CypherTrace and aims to trace illicit cryptocurrencies involved in money laundering, terrorism, drugs, human trafficking, weapon sales and ransomware schemes.

The suite of tools will be available to investigators, analysts and non-technical agents who want to lawfully obtain evidence and trace criminals who use cryptos like Bitcoin (BTC) through the darknet.

Citing figures from an Oxford University study, Cellebrite states that an estimated $76 billion worth of illegal activities involve Bitcoin.

Curating Millions Of Information References To Trace Transactions

The Cellebrite Crypto Tracer Solution allows investigators to aggregate and curate millions of open-source and private references, deception data, and human intelligence, resulting in a dataset of over 522 million attributable points.

Speaking with Cointelegraph, Leeor Ben-Peretz, chief strategy officer of Cellebrite, states that Cellebrite Crypto Tracer is able to attribute millions of data points, such as account type, account holders, contract types, contract owners and other metadata. It can also pinpoint where the illicit funds were headed, whether that be a wallet or an exchange.

Ben-Peretz said, “Some of the major features of the solution include the ability to conduct risk scoring and profile hundreds of global exchanges, ATMs, mixers, money laundering systems, gambling services, and known criminal addresses and assign risk levels to transactions.”

The Ongoing Fight Against Illicit Crypto Transactions

John Jefferies, chief financial analyst of CypherTrace, predicts that, as cryptocurrencies become more mainstream and accepted by traditional financial institutions, criminals will also adopt them more widely, making for a “continued and escalating game of cat and mouse.”

“As the market capitalization of crypto grows, larger financial crimes and nation-state scale. Regulatory reform, driven by the updated FATF guidelines, will force jurisdiction arbitrage as new laws are enacted, globally on unsynchronized timelines,” he added.

Jefferies addressed to the recent Twitter hack incident, stating that he believes the situation could have been “much worse and shows that the blockchain community is wising up to the scammers.”

“When cryptocurrencies first emerged, law enforcement agencies had very little understanding about how cryptocurrencies work and that the transactions can be traced on the public ledgers. The situation is much different today. We are working closely with law enforcement agencies on the recent Twitter hacking bitcoin scam, for example,” he concluded.

Updated: 7-29-2020

LocalBitcoins Ramps Up Compliance Efforts In New Partnership With Elliptic

LocalBitcoins has partnered with blockchain intelligence firm Elliptic to gain access to new blockchain monitoring tools that can help prevent the illicit use of its services.

LocalBitcoins has partnered with blockchain intelligence firm Elliptic — the latest move in the veteran peer-to-peer exchange’s fight against criminal activities on its platform.

Speaking to Cointelegraph, chief operating officer at LocalBitcoins, Elena Tonoyan, said the partnership was a key step in tackling the complex challenge the platform faces. She explained:

“LocalBitcoins handles only Bitcoins — we don’t touch traditional currencies — hence we don’t have the same visibility to the traditional financial side as for example the banks. Additionally LocalBitcoins is very diverse and operates in 150+ countries, which creates its own challenges when it comes to the practical side.”

Tonoyan said that managing to process and evaluate the legitimacy of documents — in multiple languages — of the site’s global customer base requires “a huge effort.”

LocalBitcoins employs a multinational workforce — from over 20 countries — to help in this. But beyond this diversity, a partnership with Elliptic will bring access to more blockchain monitoring tools that can help prevent the illicit use of LocalBitcoins’ services.

The Straight And Narrow

LocalBitcoins had notably already tightened verification procedures, as part of its efforts to comply with regulations such as the EU’s 5th Money Laundering Directive (5AMLD) and international Know Your Customer (KYC) regulations.

This has sparked some backlash — if one takes the 50% drop in trading volume in the months following the implementation of the measures at face value.

Elliptic’s co-founder and chief scientist Tom Robinson has argued that introducing better controls on sites like LocalBitcoins has — whatever the costs for popularity — secured major gains in reducing criminal activities in the space:

“Like the rest of the crypto industry, peer-to-peer crypto exchanges have made huge strides in adapting to the new regulatory environment by introducing more stringent, technology-enabled anti-money laundering controls. Our data shows this has led to a 50% reduction in the volume of cryptoassets moving from dark markets to peer-to-peer exchanges.”

A Trade-Off Between Compliance And User Privacy?

LocalBitcoins CEO Sebastian Sonntag has definitively left behind the site’s earlier model of operation, pledging this week to “continue to invest heavily in AML and KYC to maintain a secure and trusted platform.”

Data shared with Cointelegraph by LocalBitcoins’s chief marketing officer Jukka Blomberg indicates that roughly 2.8 million trades were successfully completed on the site between April and June 2020. Those completed trades moved an average of 19,800 Bitcoin (BTC) per month, which Blomberg noted represents “a slight increase in comparison with the first months of the year.”

Even as Blomberg contends that these stats are testament to “a healthy level of activity in the platform overall,” a glance at the historical data confirms that LocalBitcoins still has a way to go before recuperating its former peak volumes.

In An Earlier Interview With Cointelegraph, Tonoyan Herself Had Argued:

“In the early days people used LocalBitcoins because it was anonymous. But nowadays they use LocalBitcoins because they want a safe and legit service to buy bitcoins.”

Updated: 9-30-2020

Chainalysis And Texas Firm Win Million-Dollar IRS Contract To Crack Monero

The IRS has named the winners of its bounty program to track transactions on privacy tokens and layer-2 protocols.

On Wednesday, the IRS awarded two $625,000 contracts looking for tracing tools for privacy token Monero and Layer 2 protocols. The winners were blockchain analytics firms Chainalysis and Integra FEC.

The IRS initially publicized its quest for a privacy-busting analytics solution at the beginning of the month. An IRS representative told Cointelegraph that the agency had selected the two winning firms out of a field of 22 proposals received, though the only rationale the representative gave for the agency’s decision was “comparative analysis was used.”

Chainalysis is among the leading firms in crypto analytics and routinely wins such contracts with a range of government agencies. Integra FEC is a relatively unfamiliar name, despite millions of dollars in contracts with, for example, the Securities and Exchange Commission for “Other Scientific and Technical Consulting Services.”

Integra FEC had not responded to Cointelegraph’s request for comment as of press time. Chainalysis declined to comment, as it generally does when questioned about its work on privacy tokens.

As governments ramp up their interest in crypto tracing, the field of firms working on crypto tracing is likely to expand. In mid-September, the U.S. Treasury blundered with sanctions on a Monero wallet that turned out to be a payment ID.

Updated: 1-27-2021

DoJ, Chainalysis Work To Break Up Ransomware Network That Targets Hospitals

The Department of Justice has seized half a million dollars in crypto from NetWalker, in an operation that also involved Bulgarian authorities.

United States authorities have hit a major malware operator, with help from leading blockchain analytics firm Chainalysis.

On Wednesday, the Department of Justice announced the seizure of $454,530.19 in cryptocurrency from NetWalker, a ransomware operator the Federal Bureau of Investigation alleges to have targeted hospitals globally amid the COVID-19 pandemic.

Piggybacking on the DoJ’s announcement was Chainalysis, which took the opportunity to advertise the firm’s involvement in tracking down NetWalker hardware in Bulgaria as well as Sebastien Vachon-Desjardins. The DoJ arrested Vachon-Desjardins, a Canadian national who it alleges to be an affiliate of the NetWalker network who garnered $27.6 million through its malware.

The DoJ has yet to release a criminal complaint against any of those involved in NetWalker, presumably because, if its allegations are true, there is tens of millions of dollars out there yet to be seized. Chainalysis noted NetWalker’s business model of ransomware-as-a-service as particularly difficult to investigate because:

“Attackers known as affiliates ‘rent’ usage of a particular ransomware strain from its creators or administrators, who in exchange get a cut of the money from each successful attack affiliates carry out. RaaS has led to more attacks, making it even more difficult to quantify the full financial impact.”

The FBI initially flagged NetWalker as a threat to hospitals back in July 2020. At the time, the agency said it had first noticed the ransomware in March 2020, when COVID-19 lockdowns had come into place around the world.

Ransomware has been on the rise over the course of the past year, as remote working has opened up new vulnerabilities in business networks or, in this case, in people’s willingness to click on questionable links in emails that offer potential information on COVID-19 conditions.

Law enforcement interest in ransomware has, correspondingly, increased. Alongside other investigative concerns, the rise in ransomware-tracing has been lucrative for firms like Chainalysis, which have seen an inflow of government contracts.

Updated: 1-28-2021

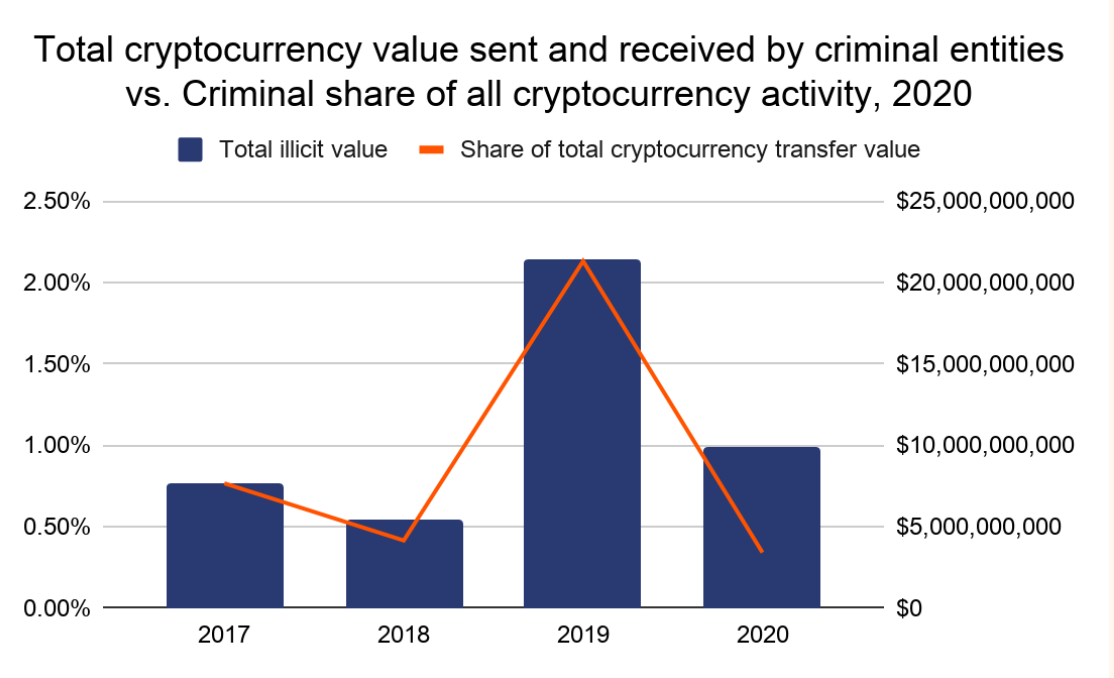

Cryptocurrency-Based Crime Fell To $10 Billion Worth Of Transfers Last Year From $21 Billion In 2019

That means that in 2020, crime represented just 0.34% of all transaction volume!

Consider ransomware for example. Ransomware attackers extorted nearly $350 million from victims last year, an increase of over 300% compared to 2019. While that may sound daunting, we can fight ransomware by stopping attackers from converting their cryptocurrency into cash — and the data suggests it may be easier than you think.

In 2020, a small group of 200 deposit addresses received 80% of all funds sent by ransomware operators. By cracking down on the owners of those addresses, cryptocurrency businesses and law enforcement could prevent more ransomware attackers from cashing out, reducing their monetary incentive and making the cryptocurrency ecosystem safer for all.

Updated: 2-2-2021

Darknet Market Had A Record 2020, Still Paltry Compared To Illicit Activity In Traditional Financial Markets

The darknet market, where cryptocurrency is used to buy and sell illicit goods online, generated record revenue last year, led by the Russian bazaar Hydra, according to a research report by blockchain forensics firm Chainalysis.

Revenue rose 23% to $1.75 billion of cryptocurrency in 2020 even as the number of total darknet purchases fell, the firm said. Revenue at Hydra, which only serves Russian-speaking countries, jumped 33% to $1.37 billion, accounting for more than 75% of sales worldwide.

“Eastern Europe has one of the highest rates of cryptocurrency transaction volume associated with criminal activity and, thanks to Hydra, is the only region with a criminal service as one of the top 10 entities sending cryptocurrency value to the region,” Chainalysis said in the report.

Hydra dominates the market because Ukraine and Russia are the top two adopters of cryptocurrency in the world, Kim Grauer, Chainalysis’s head of research, said in an interview. “A lot of that plugs into this Russian-speaking marketplace,” she said.

Another reason Hydra is so popular with users is how creative it’s become in delivering products to buyers.

“Hydra has developed uniquely sophisticated operations, such as an Uber-like system for assigning drug deliveries to anonymous couriers, who drop off their packages in out-of-the-way, hidden public locations, commonly referred to as ‘drops,’ which are then shared with the buyers,” Chainalysis said in the report. “That way, no physical exchange is made, and unlike with traditional darknet markets, vendors don’t need to risk using the postal system.”

‘Fraud Shops’

Other darknet markets include Wall Street Market, Bypass Shop and Empire Market, according to Chainalysis. After Eastern Europe, the rest of Europe and North America are the second- and third-largest regions for darknet markets, Chainalysis said.

“We see that many of the largest markets are fraud shops, which sell stolen credit-card information and other data that can be used for fraud, including personally identifying information,” the company said in the report.

Hydra said in 2019 that it would sell an initial coin offering, or ICO, to fund its international expansion. The Covid 19 pandemic, not to mention the sheer illegality of such a move, has made that unlikely now, Grauer said.

“This is the biggest year on record for darknet marketplaces,” she said. “Hydra is really the crux of this.”

Updated: 2-16-2021

Crypto Criminals Got Away With $5B Less In 2020 As Scam Revenue Falls

The proceeds of crypto crime fell by more than $5 billion in 2020, due to increasing regulatory compliance by crypto exchanges and declining scams.

Revenue from crypto-related crime dropped by more than half in 2020 according to Chainalysis’ annual report on the subject.

Cybercriminals netted around $5 billion less than the $10 billion plus they got away with in 2019, representing a 53% fall.

Transactions involving illicit funds have decreased even more rapidly than the total volume of those funds, falling from 2.1% of all transactions analyzed in 2019 down to just 0.34% last year.

Among the eight categories of transactions deemed “illicit” by Chainalysis, the dollar amount of crypto taken in by scams decreased the most, by 71% to $2.6B, largely due to the fact that 2019’s multi-billion dollar PlusToken scandal dwarfed anything seen in 2020 so far.

Overall crypto crime volume — including the proceeds of crime and the attempts to launder it — fell from above $20B in 2019 to around $10B last year.

But it’s not all good news and possibly the most alarming part of the report is the finding that ransomware-related theft rose 311% from 2019 to 2020, representing an additional loss of more than $250 million in 2020 compared to 2019.