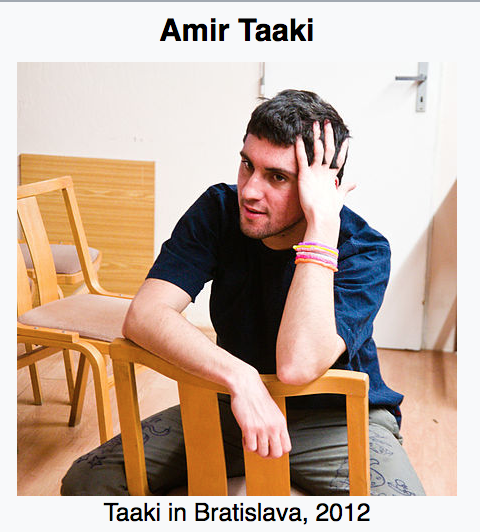

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin)

At Devcon, Bitcoin Developer Amir Taaki Foresees a ‘DarkTech Renaissance’ Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin)

Nobody in the cryptocurrency space is thinking big enough.

That was the message from bitcoin developer and former Kurdish YPG militia member Amir Taaki at Devcon 5, the annual ethereum developer conference hosted this year in Osaka, Japan.

“I hear people talking about decentralized derivatives and mortgages,” Taaki said to an enraptured audience of hundreds on Friday. “Why are we not thinking about how to create dark finance tools we can leverage against government bonds?”

Related:

Bitcoin Has Lost Its Way: Here’s How To Return To Crypto’s Subversive Roots

The Weaponization of Bitcoin And Global Finance (#GotBitcoin)

Weaponizing Blockchain — Vast Potential, But Projects Are Kept Secret

Ultimate Resource On Russia’s Involvement With Bitcoin

Russian Government And Central Bank Agree To Treat Bitcoin As Currency

“We Can Crash National Economies,” He Said, Adding:

“You see the crypto nouveau riche buying yachts and lambos [but] no one is thinking about what we can do on a big scale.”

For Taaki, who spent 2015 to 2018 in war-torn Syria fighting terrorist group ISIS, deploying cryptocurrencies on a national and even international scale has been top of mind.

“[In Syria,] I was in charge of technology projects for a region of about 5 million people. This was a great opportunity to deploy crypto on a massive scale … but most people weren’t interested,” Taaki said.

Taaki recounted approaching both ethereum creator Vitalik Buterin and Parity Technologies founder Gavin Wood for financial support.

Buterin’s response to Taaki’s ask of a $25,000 donation to fund his Syrian initiatives was ambiguous, according to Taaki. Taaki said Wood suggested he apply for funding through an official grants program.

Viewing the grants process as cumbersome and “bureaucratic,” Taaki seemed to take personal offense at the responses and called out the two on the Devcon stage for having “low social intelligence.”

Both Buterin and Wood were contacted to confirm this story though neither has responded as of press time. We will update the piece if we hear back.

“It’s hard to get donations from people to support something that’s strategically important to cryptocurrencies as a whole,” Taaki said, adding:

“It’s a problem that everything now is built off of personality and celebrity culture. … This is going to destroy our effectiveness as a movement.”

Moving Beyond The Tech

Taaki’s words resonated with many at the conference.

“I think he tries to keep the dream real,” said Santiago Siri, founder of Democracy Earth, a Y Combinator-backed nonprofit building digital governance technology. “I’m legitimately inspired by the values he stands for in this industry.”

Echoing that sentiment, Ann Brody, a Ph.D. student studying ethereum at McGill University tweeted:

“We need philosophical education to build a new system to serve the greater good via blockchain. We need to reinvent the hacker image. Thank you Amir.”

To Siri, the biggest takeaway from Taaki’s talk was the need to refocus on “how to become a superpower.” That is, how to advance cryptocurrencies and blockchain technology into becoming a force worth reckoning with.

“It can really be a rival to the internet in our civilization,” Siri told CoinDesk in an interview following Taaki’s talk. “It’s clearly not just a cultural change. It can also be a profound institutional change to our political order.”

New Leaders

But to do this, the industry needs to embrace its political side, according to Siri, and think more globally.

Siri highlighted initiatives such as the recently announced 1 Million Devs project as a welcome step in the right direction.

Announced at Devcon by ethereum co-founder Joseph Lubin (who also heads ethereum venture studio ConsenSys), the 1 Million Devs project seeks to educate traditional web developers about the promise of blockchain technology.

Education, Taaki agrees, is key.

“It can’t just be education about the technology. It also has to also be a philosophical education,” Taaki said, adding:

“There needs to be a change on a big scale for cryptocurrency to realize its big potential. … We have to train not just hackers, but leaders.”

Updated: 12-26-2019

Amir Taaki’s Ongoing Crypto Revolution

Amir Taaki thinks crypto has lost its way. But this isn’t exactly new.

One of the first programmers to work on the bitcoin source code, Taaki split from the group of core developers to build the first independent implementation of bitcoin. Libbitcoin was intended as a springboard for a new community of cryptographers organized around a set of ideals.

He moved to Calafou, an autonomous post-capitalist colony in Catalonia, Spain, and started a hacklab. It’s here that Taaki incubated a number of projects, including Bitcoin Magazine, and upstart coders, like ethereum’s creator Vitalik Buterin.

Taaki has been saying for years that technology can only succeed if guided by ideology. This was the principle behind Darkwallet, an attempt to anonymize bitcoin. Likewise, political revolutions need a technical arm. In 2015, Taaki traveled to Syria as a freedom-fighter with the Rojavan militia, where he spent time on the battlefield and working on civilian projects.

The crypto scene Taaki returned to a year later was flooded with cash. Though the real affront was 2017’s bull-run, which saw billions of dollars come into the industry. Watching this mis-allocation of capital has informed Taaki’s thinking today.

“People say we’re going to change the world, get a million dollars, and have fun while we’re doing it,” Taaki said. “No. Making money, changing the world, and having fun are separate things. You must make a decision about your priorities.”

Alternatively defined as an anarchist or democratic confederalist, Taaki has put politics at the center of his life. In a sense, this word is too large and too small to define his vision. His political aims include the dismantling of nation-states, as well as organizing local, self-sovereign communities.

For CoinDesk’s Year in Review series, we called Taaki in his Barcelona-based bunker, where he’s establishing the Autonomous Polytechnics Academy. The project is envisioned as a training center for revolutionary technologists, where ascetic hackers will learn philosophy alongside python. Announced in 2018, Taaki is still looking for more funding.

How Has The Autonomous Polytechnics Project Progressed?

Slowly, but it’s been going. We’re now nearly finished. I need another $40 thousand. I’m trying to find the right people to put down. We have a whole bunch of projects and events next year to prepare for.

Do You Currently Have Pupils?

Just a few people around in general. But we don’t have the capacity to start on-boarding people onto projects, or have interns. I have a few projects that we’re doing and I need to get them to the prototype stage. But my capacity is limited right now, and I have a lot of pressure because I’m invested in a lot of things.

Your fundraising has been going on for a while.

It’s difficult to make people invest. The problem with crypto is there is no wider level of organization. There are a lot of provincial companies that are short-term focused, so it’s been difficult to get people to invest in things that have a macro advantage. That’s why I have to start businesses to bring in income to fund things that matter.

Having come back from Asia, and seeing the huge amount of capital flowing around, made me realize how insane resources allocation is here. It’s massively inefficient. There are projects with too much money that don’t produce anything of value. And there are people with talent without business acumen, who are getting fucked by the ecosystem.

This touches on something I wanted to ask. You originally wanted to set up Autonomous Polytechnics in Greece, but you had issues with the culture. How can decentralized projects thrive when there are such great differences between communities and countries?

Well, the main reason I moved from Greece, was because I needed to be in Western Europe to be able to do projects and interact with people. Greece is too out of the way, you might as well be in the Middle East. Long term, we want to open up places in Latin America and Asia. And after a while, Russia and the Middle East.

Why Would You Start With Latin America And Asia?

There is a huge amount of opportunity in Asia, so it’s important to be embedded in that market. And Latin America, simply because it’s a political gold mine. We have to be prepared in order to take advantage of that. There’s also a lot of talent there.

There needs to be a systematic organization. It’s no good doing things ad hoc.

What do you make of the recent events in Bolivia.

It was a coup. When news like this happens, I think there is interest by people who say crypto is growing. But a lot of times, I think they are trying to manifest it through news. There are journalists whose schick is to write about these things, and are constantly searching for them, so it becomes a self fulfilling prophecy.

But I think these events were a big missed opportunity, that no one was prepared with analysis beforehand or an organized group to take advantage of the events.

Let’s say you were on the ground in Bolivia when the coup happened, how would you achieve your political aims?

I think before we get on the ground, we need to think about the steps we need to take. An interesting segue into this is to talk about crypto.

I Don’t Buy The Institutional Money Narrative: that big money will come into crypto and that’s when it’ll take off.

Crypto already exists. There is a huge market where huge amounts of money are being moved around. It’s relatively small compared to traditional finance, but it exists. Most of that is grey or black money and is diametrically opposed to traditional financial markets.

“Traditional finance is a giant cartel, where people own different niches of the market, and they all collude.”

Traditional finance is a giant cartel, where people own different niches of the market, and they all collude. These people use offshore havens to hide their wealth. States are putting pressure on the practice and audits are happening, but people are finding smarter ways to hide their money. They’re setting up financial infrastructure, and moving from the realm of finance into politics.

We [in crypto] have to think, not in terms of markets or money, but holistically, in terms of power. What is the nature of power? It has a physical coercive aspect. A financial aspect. An organizational aspect. A technological aspect. Even a philosophical or socio-cultural aspect.

Right now, the political consciousness within blockchain is so low, it’s unable to respond to the challenges or opportunities it faces. Yeah, ok, there are a few crypto rich with yachts and lambos. But it’s limited in its vision. The old money, the old wealth, have the entire systems to protect their wealth. We have to think at that level, how to maintain and secure power.

Before Our Call You Sent A Report By MEMRI About How Terrorists Are Using Cryptocurrencies. Should We Be Worried?

Terrorist groups are making use of bitcoin, ethereum, monero and zcash to raise donations. Any militant group across the world can send money to their hubs. No state can stop that. That’s the reality. It’s a kind of fantasy we’re living in that the crypto market will bring peace. We’re in a period of transition in global humanity that will be incredibly violent. America is losing its hegemonic status. Russia and China are working together in the arctic to lay claim. In between will be proxy wars and new frontiers. Those will be opportunities if we’re prepared. We already have the financial and technological power to leverage.

What Does This Mean For Privacy Coins?

The delisting of Monero off exchanges and the deanonymization of MimbleWimble are another big story this year. I’ve argued for a long time that monero and mimblewimble are not anonymous. On Twitter there’s a whole thread with Fluffypony. These are the first generation of crypto coins. If you’re following the research. At some point there will be a crypto that is purely anonymous, fast and scalable (where you can run a whole node on a mobile). That’s the holy grail of crypto and we’re getting closer every day.

Bitcoin is a legacy system. There is no good alternative at this point, but it will be replaced.

You also wanted to talk about Libra.

People don’t realize how much of a threat Libra actually was. I’ve read their technical specs, and it’s a well designed system. We almost lost the narrative. We’re actually very lucky the U.S. Congress responded with a resounding no. We have to start organizing, our communities are too passive, and think they don’t have to do anything because crypto is an inevitability.

Technologically-speaking we need to develop.

It’s like Linux, the promise of ‘an operating system made by people for the people.’ There was a time when free software as a principle, and everyone knew that Microsoft was shitty. What happened was MacOS came out of left field and took over the market. We missed the opportunity. This happens across history, were idealists have an idea, are unable to organize effectively, and some organized group comes along and takes the initiative from them.

If you look inside the ethereum community: it’s entirely captured. It’s because the Ethereum Foundation has no foresight. The project will probably fail, it’s certainly not going to live up to expectations.

Have You Heard Of The Tyranny Of Structurelessness?

They say it’s decentralized and nobody is in charge, but really there are people in charge. If you don’t create a system for people to acknowledge or challenge power, or a system to onboard people to create new leaders of the future, then what happens is: people invade your open community and seize the narrative. They use their greater resources to attract talent into their silos.

That’s basically happened to ethereum. They don’t know how to respond, except by becoming more authoritarian.

Your Relationship With Vitalik Has Been Widely Reported. Have You Voiced Your Concerns To Him?

To be honest, Vitalik has low social intelligence, so he surrounds himself with sycophants. He hasn’t stepped up to his leadership role.

That’s the consequence of a poorly thought out system of organization. The first generation of blockchain organizations will die off in an extinction event. There was a period that opened and a group quickly grabbed the mic and threw code together. But they’re bumping up against their own limitations, because they didn’t invest any time or energy or resource into developing their thought or vision.

Any technology requires huge amounts of organization between many people to create complex system. It’s not just individuals in a marketplace throwing together random code. It requires planning and strategy. There’s a window opening. Do we want to be minor players? Do we want to be a joke? Or do we want to be a global power?

Right now, the community is a bunch of kids.

Why Do You Suspect That Is?

It’s like an army. You have foot-soldiers, a commander working on the tactical and operational level, and a layer above that, a general, thinking in macroscale movements. When developing a company the CEO is a visionary, he doesn’t need to micromanage, because it doesn’t scale.

That way of thinking is not being nurtured in the crypto industry. Especially not in bitcoin or ethereum. That’s why they’re failing to efficiently allocate resources. It’s easy to work on many things, but if you’re not able to discriminate what’s higher priority, you’ll get sucked into lower hanging fruit.

Like at crypto conferences: it’s unprofessional. You have to hang around for hours and go to parties to talk to one guy. They should just be having meetings where we can directly discuss things we need to do. But there’s this bleeding between public and private life. People say we’re going to change the world, and get a million dollars, and have fun while we’re doing it.

“Making money, changing the world, and having fun are separate things. Make a decision about your priorities.”

No. Making money, changing the world, and having fun are separate things. Make a decision about your priorities. It’s a fantasy.

Are There Any People In The Industry You’re Inspired By?

I don’t know if they want to be named. Outside of crypto, to be honest, politically, all the interesting things are happening in the rightwing. Steve Bannon is really interesting. How he got Trump elected, and then went to Europe to meet with [Nigel] Farage about Brexit. I think Brexit is a good thing. It could lead to the breakup of the United Kingdom. Scotland is saying it wants a referendum. I think that’s a great result: the balkanization of power.

We’re on a precipice, and Bannon knows where to push strategically and tactically to create a change. The biggest problem in Europe is not about redistribution of wealth, or more welfare or benefits. People are sick of benefits and welfare. People want dignity. People want to be a part of a community.

And doing meaningful work and providing for people. There is a deficit of democracy and local power. People don’t have sovereignty or destiny over their lives. That’s not being addressed by the left. The rightwing is coming in with a moralistic message.

I Think There’s A Risk Of You Being Misunderstood Here. Can You Create A System Of Strong Nations Or Support Balkanization While Preventing A Resurgence Of Fascism?

On the one hand, there’s nationalism. Then there’s patriotism, or the right to be culturally different. In my opinion, there’s nothing wrong with culture, or community, or the concept of a nation that’s bonded by a culture, language or a way of life.

That’s what creates social bonds. Someone that doesn’t have a patriotism feels a kind of estrangement from society.

Nationalism is different, chauvinist, like a football team organized around a flag. It’s about domination and exclusion.

Nationalism is a caricature of the nation.

There may be another contraction we should address. You’re supportive of dark markets that remain outside state control, but are fearful of terrorists financing themselves with crypto. How can you have one without the other?

I’m not fearful, I’m saying this is a reality the world has to face. Making an omelette you crack a few eggs. I think the state is one of the most harmful things to human dignity. The western idea of the nation-state has outlived its moment. It’s the construct that’s enforcing order on the world right now. And when it is eroded, you’re taking the lid off a pressure cooker. There are things that will emerge that are unimaginable for us to deal with right now. The longer its out of sight, the worse it gets.

You can kick the football 20 years down the line, but something will happen. Some of this will be forced by upstart geopolitical powers like Russia, Hindu nationalists in India, Islamic terrorists, neo-fascists in the Ukraine, unrest in Chile, financial disorder in Venezuela, coups in Bolivia. We’re living in unstable times.

That’s why I’m talking about crypto-communities.

What Are You Working On?

I’m really interested in anonymous crypto-systems and systems for anonymizing cryptocurrencies. I have a cryptographic scheme for an anonymous cryptocurrency. The thing is, we don’t have the money to hire cryptographers to revue the math, that’s why I’m starting a smaller project on how to anonymize currencies before developing one. Longer term, we’re looking to anonymize cryptosystems in general and creating a platform for apps to apply the tech towards that.

Right now, my main focus is the academies. It’s a two part system. The first is polytechnics to train people in philosophy and technology to solve problems and do research. The second is the business component, focused on dark tech. We’re creating an incubator and trying to find people to onboard and fund the training.

There are so many young people in crypto that understand blockchain’s role in the future, but don’t have space where they can explore ideas or develop. They end up doing slave work for companies. A lot of crypto projects have a startup mentality to get loads of money to pay for the best developers, which is inverted. What you should be doing is developing communities, filtering people from your communities, and developing and nurturing people within.

Amir Taaki Knocks Bitcoin Coinjoin Schemes – Calls Methods ‘Absolute Garbage’

On July 17, the well known Dark Wallet creator and early Bitcoin developer, Amir Taaki, criticized bitcoin privacy methods on Twitter. Taaki claimed that UTXO mixing concepts like Coinjoin were “absolute garbage.” Taaki also knocked other concepts like Mimblewimble and privacy-centric coins like monero as well, claiming that zero-knowledge accumulators will be the “anonymous gold standard” going forward.

Certain methods of privacy-enhancing and transaction obfuscation like Coinjoin were recently criticized by the early Bitcoin (BTC) developer Amir Taaki. The software engineer created the Dark Wallet application with Defense Distributed’s founder Cody Wilson years ago but disappeared for a while.

More recently, Taaki has returned to the crypto community, at least vocally, and he has made a number of critical remarks since then. His statement on Friday was no different, as Taaki tweeted about bitcoin privacy methods and said:

Coinjoin, Coinmix, Coinwhatever – absolute garbage (and I created the first Coinjoin [implementation]). Mimblewimble – interesting but worthless for privacy. Monero – marginally better but not anonymous. Lelantus – decent but still risky. Zero-knowledge accumulators – anonymous gold standard.

In addition to Taaki’s statement, two days later Riccardo Spagni from Monero criticized the Zcash project with a tweet about someone allegedly tracing a z-address to a z-address transaction. An individual was ostensibly able to trace it back to the original t-address. Zcash founder Zooko Wilcox-O’Hearn spoke up about the criticism on Twitter in a series of tweets.

“People think that you should *store* your crypto in a transparent blockchain like BTC, ETH, or Zcash t-addresses, and then “move it through” something like a mixer, Tornado, or Monero when you want to “anonymize” it— That’s backwards,” Zooko said.

“If you want privacy, you have to *store* your crypto in a private cryptosystem. You have to *store* your crypto in a private cryptosystem (such as the Zcash shielded pool) if you want privacy. Then it is safe to *move* it through a transparent system,” the Zcash founder added.

The scheme just below Taaki’s “gold standard” method, called Lelantus is an extension of the Zerocoin protocol. According to the white paper, Lelantus “extends the original Zerocoin functionality to support confidential transactions, while also significantly improving on the protocol performance— Lelantus’ proof sizes are almost 17 times smaller compared to the original Zerocoin proof sizes.”

Similar to Lelantus, zero-knowledge accumulators or crypto accumulators are lesser-known forms of privacy schemes. The security and cryptography expert Aurélien Nicolas explained how zero-knowledge accumulators work in a comprehensive technical blog post about the subject back in January 2018.

“There is a lesser-known technique on the crypto-developer’s tool belt,” Nicolas wrote. “A cryptographic accumulator is a primitive with several exotic properties that can be used to build various zero-knowledge proof systems.” The cryptographer also stated:

We can think of a crypto accumulator as a super-charged hash function that works on sets. A regular hash function, like SHA-3, takes a single message and outputs a fixed-size hash. An accumulator, however, takes a set of values and turns them into a single number, also of constant size. In a sense, accumulators are the asymmetric cryptography cousin of Merkle trees and Bloom filters.

In the Twitter thread with Amir Taaki, the notorious freedom advocate and video streamer Naomi Brockwell asked the engineer about the Bitcoin Cash mixing method Cashfusion. “What about Cashfusion where the outputs are not uniform?” Brockwell tweeted.

Taaki did not respond to Brockwell’s question, but Bitcoin ABC’s Amaury Séchet (deadalnix) answered the question. “By that metric, I’d say garbage. It is clearly better than absolute garbage, but doesn’t quite measure to worthless,” Séchet tweeted in response to Brockwell’s question.

Taaki’s Coinjoin criticism follows the recent Twitter hack fiasco and the blockchain surveillance firm Elliptic claims the Twitter hacker leveraged a Wasabi Wallet. Elliptic noted on July 17, that the company suspected a fraction of BTC from last week’s Twitter scam was transferred to a Wasabi Wallet.

According to the crypto-financial columnist Leigh Cuen, the co-CEO of Zksnacks (Wasabi Wallet’s parent company), Bálint Harmat, told the reporter: “We took a quick look at the addresses. They are not related to Wasabi Coinjoins as of now.”

Updated: 8-1-2021

Meron Estefanos From Eritrea: Bitcoin Can Take Down Dictators

Topics

Meron Estefanos is a Swedish-based Eritrean human rights activist and journalist, who works tirelessly to aid and raise awareness about the plight of Eritrean refugees, who have been kidnapped, tortured, raped and held for ransom in the Sudan and the Sinai.

In her efforts to rise up against the dictatorship in Eritrea she is engaging researchers in Ethiopia, who she has been paying with bitcoin. We’re also discussing the fact that Bitcoin can take down dictators and many human rights activists use bitcoin discreetly.

“Bitcoin helps people on the ground as a money transferring method, as an investment and even to topple a dictatorship. In Eritrea 36% of the population survive because of remittances. Banking is controlled by the government, the Hawala system is controlled by the government.

The people that give out the money in Eritrea are part of the government and they need the hard currency sent from abroad. If we Eritreans and other African regions fighting dictatorships would start using Bitcoin, we’d take away the power of the government, because without money, they are nothing.” – Meron Estefanos, Human rights activist

* Background Of Meron Estefanos

* General Situation In Eritrea

* Human Rights, Living Standards

* Military Service And Women’s Situation

* Journeys And Hardships Of Refugees

* Traffickers Taking Hostages

* How Meron Got Involved

* Using Bitcoin As A Means Of Payment

* Bitcoin Compared To Western Union And Hawala

* Is There A Solution To This Horrible Situation?

* How Meron Copes With The Depressing Stories

* How The Audience Can Support Refugees And Meron’s Work

Donate Bitcoin To Help Eritrean Refugees: bc1qr8v9s5elndezh6r9ff6g20f5kz99pq5hfemfwl

Updated: 11-19-2021

Crypto Could Destabilize Nations, Undermine Dollar’s Reserve Currency Status, Hillary Clinton Says.

Clinton called for a joint effort by nation-states to monitor cryptocurrencies’ rise.

Former U.S. Secretary of State and Democrat presidential candidate Hillary Clinton slammed cryptocurrencies on Friday, calling on nation-states to keep a tab on their rise.

“One more area that I hope nation-states start paying greater attention to is the rise of cryptocurrency because what looks like a very interesting and somewhat exotic effort to literally mine new coins in order to trade with them has the potential for undermining currencies, for undermining the role of the dollar as the reserve currency, for destabilizing nations, perhaps starting with small ones but going much larger,” Clinton said during a panel discussion at the Bloomberg New Economy Forum in Singapore.

While crypto fanboys have long hailed bitcoin as a better alternative to the U.S. dollar, traditional market pundits suggest otherwise. “Bitcoin is unlikely to replace the dollar as a global reserve currency,” Marc Chandler, chief market strategist at Bannockburn Global Forex and author of the book “Making Sense of the Dollar,” told CoinDesk last year. “Backing the dollar is the world’s biggest, deepest and the most transparent government bond market.”

Clinton’s comments come in the wake of controversial crypto tax reporting requirement that was part of the $1 trillion bipartisan infrastructure bill signed into law by U.S. President Joe Biden on Monday.

Per the bill, from 2023 brokers will need to disclose customers’ names, addresses, phone numbers, capital gains, and losses to the Internal Revenue Service. Entities receiving crypto payments worth more than $10,000 will have to reveal the sender’s identity to the government.

Earlier this week, India’s Prime Minister Narendra Modi called for a joint effort by democratic nations to ensure cryptocurrencies do not “end up in the wrong hands, which can spoil our youth.”

Updated: 7-26-2022

Crypto Breaks The Rules. That’s The Point

With cryptocurrencies, as with many other innovations, regulatory arbitrage is a feature, not a bug.

One of the most common criticisms of cryptocurrency is that it is just a way to get around financial rules and regulations. That criticism is not entirely wrong — but with crypto, as with many other innovations, regulatory arbitrage is a feature, not a bug.

Very often, regulatory arbitrage is most successful when the innovation improves on some aspects of the older methods. The arbitrage conveys the message that the old regulations need to change.

Consider a concrete example. Many crypto institutions issue tokens, which to many regulators possess the properties of securities and ought to be regulated as such. But they aren’t, at least not uniformly. So if you issue a crypto token, but don’t have to register it as a security and go through the process of satisfying securities laws, you are engaging in regulatory arbitrage.

It is worth thinking through why some of the regulations ought to change in this new context. In the pre-crypto world, issuing a security involved a host of institutional preparations and investments and legal planning, even apart from whatever regulatory constraints needed to be met.

Issuing crypto tokens is usually easier and quicker, and quite immature institutions have done so. Software and blockchains do much of the work that once required offices, personnel and a lot of hands-on management.

There could be software that automatically issues crypto tokens, based on smart contracts that specify conditions for issuance. This very possibility is a sign of how much things have changed.

Standard US regulatory practice typically focuses on regulating host firms and intermediaries, rather than software. Yet once a blockchain is verifying, storing and communicating information, it is hard for regulators to step in and make a meaningful difference. Thus the old regulatory model no longer applies to a significant part of the crypto experience.

And the lower costs of token issuance mean that the issuing intermediaries can be quite thinly capitalized. Often they are either not able or not incentivized to meet a lot of regulations.

In addition, an institution can participate fully in the crypto space without being based in the US or being tied to any specific nation-state.

You can inveigh against those features of the market. Regardless, they are going to mean a radically different set of regulatory constraints. They also mean that some kinds of securities (if it is appropriate to call them that) can be issued far more cheaply than before.

Given this reality, shouldn’t regulations be changed — and substantially? This may include some areas where regulation is even tighter, though overall regulations will likely become looser.

The regulators will have to learn to live with a more decentralized market structure that has lower costs and is harder to control. It is common sense that when software can substitute for major capital investments, regulations ought to change, even if observers disagree over how.

Unfortunately, the regulatory process is static and typically slow to change. Regulatory agencies often stick with the status quo until it is no longer tenable. One of the benefits of regulatory arbitrage is that it forces their hand and brings about a new equilibrium.

Even if you think the current regulations are appropriate, you should acknowledge that they too are the product of earlier episodes of regulatory arbitrage: In the 1980s, for example, junk bonds helped bypass some regulations on equity. Regulatory arbitrage has long been a means by which regulations are kept at least somewhat up to date.

To get back to the example at hand: It is true that many crypto token schemes are marketed under false pretenses or are part of a “pump and dump” strategy. These negative aspects of the token phenomenon should not blind us to their possible benefits as a new method of raising funds or using markets to value projects. Many valuable innovations — the railroads and the internet come to mind — were also plagued by investor fraud early on.

The argument is not, to be clear, that regulatory arbitrage always is good. It can lead to regulatory overreaction or, conversely, to regulatory holes that remain for too long and allow persistent fraud or systemic risk.

The argument is that, fundamentally, regulatory arbitrage is part of a process that leads to lower costs, greater innovation and better rules.

People often ask me what crypto is good for. It’s good for a lot of things, and I am happy to recite some, but surely one of its more underappreciated benefits is that it is a form of regulatory arbitrage.

Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,Bitcoin Developer Amir Taaki,

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.