Bitcoin Dominance Hits 70% As Keiser Warns Altcoins ‘Not Coming Back’ (#GotBitcoin)

Bitcoin (BTC) now has the highest share of the overall cryptocurrency market since before its record-breaking $20,000 bull run in 2017. Bitcoin Dominance Hits 70% As Keiser Warns Altcoins ‘Not Coming Back’ (#GotBitcoin)

According to data from major monitoring resource CoinMarketCap, Bitcoin now accounts for 70.5% of the total cryptocurrency market cap as of Sept. 3.

Bitcoin Market Cap Hits Pre-$20K High

That figure has not been seen since March 2017, and comes as BTC/USD makes gains at altcoins’ expense.

As Cointelegraph reported, continued underperformance in cryptocurrencies other than Bitcoin has triggered warnings from traders and analysts alike.

Among them are Peter Brandt and RT host Max Keiser, the latter again claiming this week that altcoins would never recover from this downturn.

“Alts never coming back… Sorry,” he tweeted on Sept. 3, also referencing market cap statistics. Brandt reiterated similar warnings.

“When will altcoin junkies understand that $BTC is the crypto with real and lasting value,” wrote Brandt, who added:

“Altcoins are to Bitcoin what lead is to Gold.”

Some sources had reported Bitcoin hitting the 70% mark as early as last week.

Market Cap Readings Set Highs Across The Board

Bitcoin itself delivered a sudden return to form late on Monday, having previously dropped to just $9,350. At press time Tuesday, BTC/USD was circling $10,360, bringing 24-hour gains to 6.2%.

Altcoins in the top twenty, however, mostly failed to achieve more than 4%, meaning they, in fact, lost value in Bitcoin terms.

Some commentators voiced caution about placing faith in Bitcoin’s strength. Market cap, they argued, is a poor measure of performance, as it includes many altcoins which do not even have any trading volume.

Earlier, Cointelegraph reported on the phenomenon of Realized Market Cap, a metric designed to solve those inconsistencies which has also set new records in recent weeks.

Updated: 12-23-2020

Bitcoin Dominance Hits 1-Year Peak Amid XRP Sell-Off As $24K Briefly Returns

Bitcoin sees major volatility and a tussle between bullish and bearish levels while altcoin traders feel the pain of an XRP sell-off.

Bitcoin (BTC) kept the volatility coming on Dec. 23 as a dive to $22,800 sparked a lightning-fast rally to classic $24,000 resistance.

BTC Dominance Hits Highest Since Late 2019

Data from Cointelegraph Markets, Coin360 and TradingView tracked BTC/USD as factors including panic among XRP traders made unstable conditions prevail.

At press time, the pair was circling $23,700 after briefly heading above sell levels at $24,000. All this happened in the same few hours, which saw Bitcoin go from current levels to $22,800 in a matter of minutes and back again.

With volatility firmly evident, attention turned to the prospects for altcoins as problems at Ripple sent BTC dominance soaring to one-year highs.

“Historically, we’ve been making a top structure in December, after which we had a wonderful first quarter for altcoins,” Cointelegraph Markets analyst Michaël van de Poppe commented to Twitter followers on Bitcoin dominance action.

Altcoins Flounder In Another Trying December

Meanwhile, the biggest XRP holder, Ripple, is facing a new lawsuit from U.S. regulators over potential sales of unlicensed securities. Should the Securities and Exchange Commission (SEC) win its case, analysts worry that XRP trading will be effectively destroyed due to the legal ramifications.

As Van de Poppe implied, Bitcoin’s advance came at the expense of altcoins more widely, with various top-ten tokens seeing daily losses. The largest altcoin, Ether (ETH), was flat on the day at $611.

Earlier today, Cointelegraph noted that a major stockpiling effort from institutional giant Grayscale failed to buoy market mood after the company added $285 million in BTC to its assets under management on Tuesday.

Updated: 5-30-2021

Bitcoin Dominance Cycle Suggests The 2017 Crypto Rally Could Repeat

Bitcoin dominance patterns are showing similar lows and an eerie resemblance to 2017. So what does this suggest for BTC price?

For the purposes of historical comparison, it’s also worth noting that the pattern of the dominance chart currently looks much like it did during the earlier part of 2017.

As the markets have gone into meltdown since May 12, Bitcoin (BTC) dominance has fluctuated dramatically, bucking 2021’s prevailing trend. Before the sell-off started in earnest, BTC dominance had been falling pretty steadily from around 70% in January to a low of under 40% by the time the crash was underway. At that point, BTC dominance was at its lowest since the summer of 2018. It has since recovered to above 43%.

If the same pattern is underway this time around, then the market is likely to be at the equivalent of summer 2017 when the alt season was just ramping up, and still some months away from Bitcoin’s price peak of around $20,000 in December 2017.

Of course, while the patterns draw some interesting parallels, BTC dominance doesn’t necessarily tell that much about price.

But it does offer insights into how the flagship asset is performing in relation to the rest of the markets, underpinning certain trends. So, what are the likely scenarios for BTC dominance, and what would it mean for the markets?

Follow The Money Flow

The money flow model is one potential predictor of where the markets could go. The model states that money flows from fiat into Bitcoin, and then down from large caps, through mid-caps to small-cap altcoins before redirecting back to BTC and, ultimately, back to fiat.

This model is interesting because it pretty much sums up what happened in 2017, except that the cycle played out twice as BTC surged toward the end of the year. So, if the 2017 scenario repeats itself, BTC dominance could continue to rise until the flagship asset sees another price peak, then fall as alt season accelerates once again.

Along with the eerie similarities of the dominance charts, the behavior of the alt markets also offers some indication that they could be performing according to historical cycles. In early May, Cointelegraph reported that altcoins had flipped their previous cycle high to support — a move that last happened in 2017.

If the cycle repeats, it could still launch the alt markets to stratospheric new heights in 2021. While the performance observed during May may not offer much reassurance in this regard, there’s also nothing yet to indicate that BTC and the broader markets won’t perform according to long-term trends. Sam Bankman-Fried, CEO of exchange FTX and Alameda Research, told Cointelegraph:

“If we enter a prolonged bear market, I would expect BTC dominance to rise, as it did in 2018–2019; but the correction we’ve seen so far isn’t enough to trigger that.”

But Wait…

For individual investors looking to follow the money flow, there is one big consideration. Speaking to Cointelegraph, Robert W. Wood, managing partner at Wood LLP, warned: “The elephant in the room for diversification is taxes.” He added: “Up until 2018, many investors could claim that a swap of one crypto for another was nontaxable under section 1031 of the tax code. But the law was changed at the end of 2017.”

Indeed, Omri Marian, director of the Graduate Tax Program at University of California, Irvine School of Law, confirmed that crypto-to-crypto transactions are likely to trigger tax obligations, explaining to Cointelegraph:

“Any reading of one crypto asset for another is a taxable event. So whatever the profit motivation is, a cryptoassets investor must account for the fact that rebalancing of the portfolio may have a tax cost.”

Shane Brunette, CEO of CryptoTaxCalculator, put it into practical terms, telling Cointelegraph: “If an investor switches between BTC and altcoins, the capital gain/loss would be realized in this financial year, regardless of whether or not they’ve ‘cashed out’ to fiat.” Furthermore, he clarified that “The activity would reset the length of time the investor has been holding the asset which would impact the eligibility to claim a long-term capital gains discount.”

So, be mindful that following the money flow may come with its own set of costs, and as a result, there are no guarantees that the pattern may repeat, as new variables may have an effect.

The Unknown Quantity

The most critical difference between 2017 and now is the presence of institutions in the markets. At least, that’s true for Bitcoin and, to some extent, large-cap altcoins such as Ether (ETH). Large swathes of the alt markets, including almost all low-cap coins and memecoins like Dogecoin (DOGE), are dominated by retail traders and investors.

Examining the dominance charts, BTC seemed to get a boost at the end of 2020 as institutional interest in cryptocurrencies started to pique. Its dominance continued to rise until around January.

But there’s some evidence that institutions could be behind the recent boost to BTC dominance. On May 21, it emerged that whales had bought $5.5 billion worth of BTC while prices were below $36,000; two days later, crypto hedge funds MVPQ Capital, ByteTree Asset Management and Three Arrows Capital all confirmed they were dip buyers.

So, there’s a chance that Bitcoin’s sudden dominance recovery may not come down to regular market cycles but instead be influenced by institutional whales scooping up discounted BTC.

Risk-Off, But How Far?

The question is: To what extent will the involvement of institutions make a difference to BTC dominance patterns compared with what was seen in 2017? Perhaps the most critical difference between institutions and retail investors is that institutions are far more likely to follow prevailing market conditions and go risk-off accordingly. Therefore, BTC dominance is rising as investors choose to step away from risk-on alts.

However, based on the “buying the dip” reports, it seems there’s no reason to assume that investors are going as far as going risk-off from crypto itself — at least for now. Furthermore, bullish sentiments continue to swirl around, undeterred by the market chaos of recent weeks as seen by the reports that interest in BTC appears to still be on the rise.

Therefore, there’s still every chance that if interest in BTC continues to hold, and no major bad news comes in to destroy the sentiment around crypto, the money flow model may still play out once again. For now, if history holds firm, some further increases in BTC dominance will take place before investors once again start to expand into large-cap altcoins.

Updated: 5-27-2022

3 Reasons Why Bitcoin Is Regaining Its Crypto Market Dominance

Many altcoins—not just LUNA—are down over 80% from their all-time highs in 2022.

Bitcoin is regaining its lost crypto market dominance even as it trades nearly 60% below its record highs.

Bitcoin Dominance At 6-Month Highs

The Bitcoin Market Dominance (BTC.D) index, a metric that weighs BTC’s market capitalization against the rest of the cryptocurrency market, jumped to around 47% on May 27, its highest since October 2021.

The dominance index swelled despite the drop in Bitcoin’s market cap in the last six months from $1.3 trillion in November 2021 to nearly $550 billion in May 2022, suggesting that traders were more comfortable selling altcoins.

Let’s look at three likely reasons why traders have been rotating out of the altcoin market to seek safety in Bitcoin.

Bitcoin isn’t only the oldest blockchain, but stands on its own without any central authority.

No one controls the #bitcoin network.

— CZ Binance (@cz_binance) May 26, 2022

Historically, Bitcoin’s dominance drops during crypto bull markets as waves of new tokens spring up during the mania phase.

For instance, the duration of the infamous initial coin offering (ICO) pump coincided with BTC.D dropping from nearly 96% in January 2017 to 35% in January 2018.

Then the March 2020 crash was the beginning of the DeFi and nonfungible token (NFT) hype, boosted further by the Federal Reserve’s quantitative easing.

Therefore, if Bitcoin’s market dominance has indeed bottomed out, it could once again align with a macro bottom in Bitcoin price, and possibly the beginning of a new bull market phase in the coming months.

Updated: 6-10-2023

Bitcoin Dominance Surges, Accounting For Nearly Half of The $1T Crypto Market, Amid #shitcoin Selloff

Bitcoin’s dominance rate neared the 50% mark early Saturday as altcoin crash triggered a flight to safety.

Bitcoin’s (BTC) dominance rate or share in the total crypto market capitalization rose early Saturday, nearing the 50% mark for the first time since April 2021, according to data tracked by charting platform TradingView.

The uptick came as alternative cryptocurrencies (altcoins) like SOL, MATIC, DOGE, and ADA suffered double-digit losses amid rumors of a $2 billion portfolio dump by a proprietary trading firm.

Meanwhile, bitcoin lost just 3%. The relative outperformance perhaps stemmed from increased haven demand – investors moving money out of altcoins and into bitcoin, the world’s largest and most liquid cryptocurrency.

“Bitcoin’s relative dominance mooning amid altcoin market sell-off. Flight to majors (1st stage before crashes occur),” pseudonymous crypto trader and analyst @52kskew tweeted.

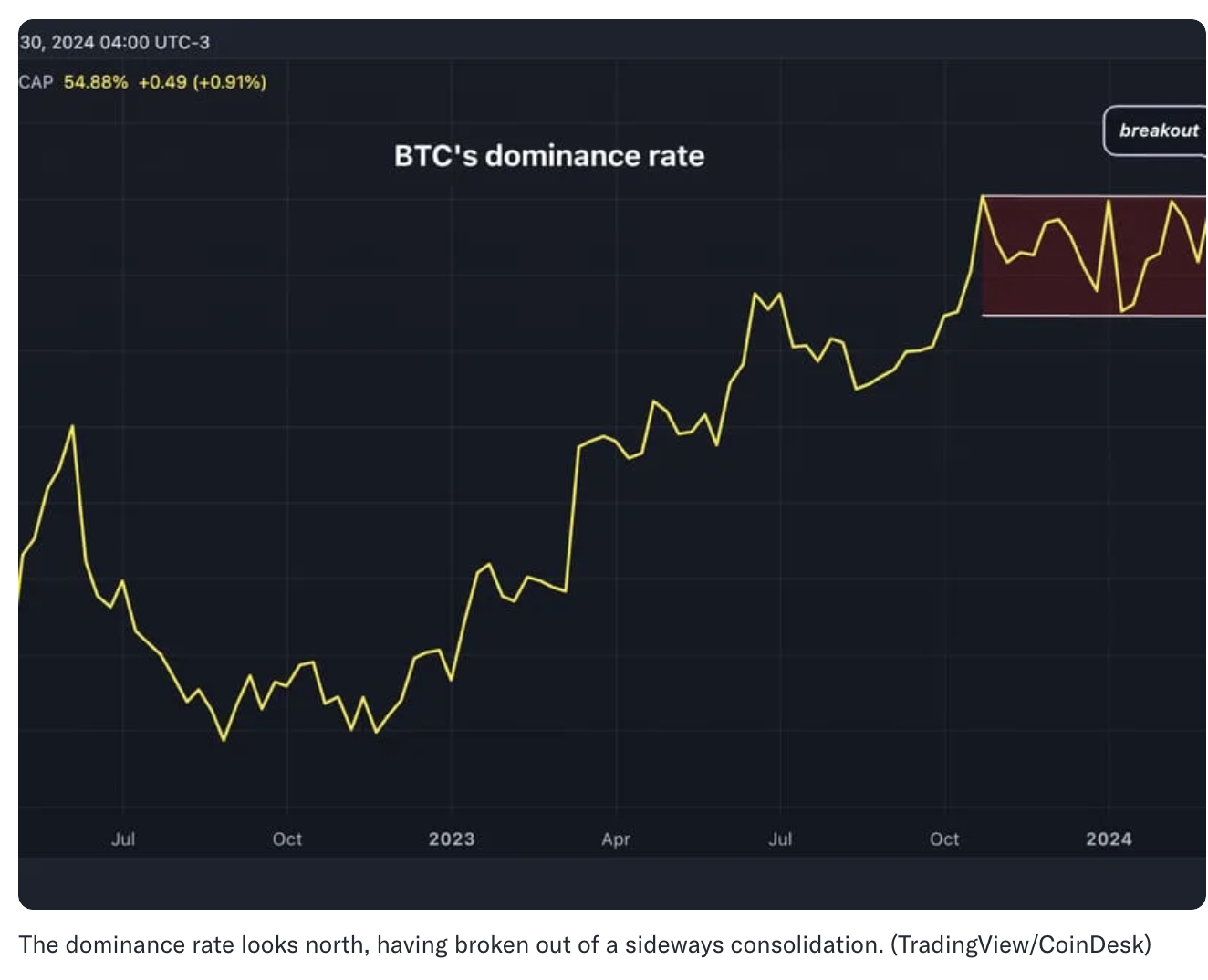

BTC’s dominance rate has been steadily rising since November and surged during the March U.S. banking crisis. The indicator now looks to be breaking out of its three-year oscillation pattern, a sign of continued bitcoin outperformance in months ahead, according to Decentral Park Capital’s Lewis Harland.

Tether, the world’s largest dollar-pegged stablecoin, also likely benefitted from Saturday’s risk aversion. Its dominance rate jumped 5% to 7.82%, the highest since Jan. 8, TradingView data showed.

Updated: 6-13-2023

Bitcoin Gets Closer To ‘51% Attack’ On Altcoin Market

Bitcoin’s market dominance index has failed to sustain above 50% since April 2021, so will this time be any different?

Bitcoin’s percentage share in the crypto market has risen to nearly 50% in the aftermath of last week’s altcoin market rout.

On June 13, the Bitcoin Dominance Index (BTC.D), which tracks BTC’s weight against other cryptocurrencies, reached 49.29%, slightly down from its two-year highs of 49.66% seen earlier this week.

BTC Not An “Unregistered Security”

The surge in Bitcoin dominance comes in the aftermath of the United States Securities and Exchange Commission’s lawsuit against crypto exchanges Binance and Coinbase.

In the court filings, the commission accuses many leading altcoins, including Cardano’s ADA, of being “unregistered securities.”

Bitcoin’s market share typically rises during high market stress, given that traders view it as the least volatile non-stablecoin crypto asset.

For instance, at the height of the banking crisis in March 2023, Bitcoin’s dominance versus altcoins also rebounded to 50%.

There are also other cues suggesting Bitcoin’s dominance could grow further to finally break 50%.

For instance, crypto market maker DWF Labs has reportedly sent millions of dollars worth of non-Bitcoin tokens to exchanges, potentially adding selling pressure for certain altcoins.

Independent market analyst Stack Hodler also suggested that most crypto hedge funds would first and foremost abandon their altcoin exposure.

But not everyone is bullish on BTC dominance. Fellow analyst Moustache, for example, argued that the altcoin market may have bottomed once again, with Bitcoin unable to break the 50% mark.

Is the USDT-Dominance about to fall?

If so, we’re in for a massive Altseason.

-Head and Shoulders pattern forming (W)?

-Stoch RSI heavily overbought.In the last 3 years this has led to an Altseason 4 out of 5 times.

+ Sentiment is in the basement for most = Good. pic.twitter.com/odU5jg8srF

— ⓗ (@el_crypto_prof) June 12, 2023

Bitcoin Dominance Risks Pullback In June

Chart technicals suggest that Bitcoin’s dominance can indeed drop in the coming weeks as altcoins rebound.

Most notably, BTC.D has failed to close decisively above the 50% mark since April 2021, often reversing its gains due to an overbought weekly relative strength index (RSI).

Bitcoin now faces a similar scenario with a retest of the 50% level for the first time since last summer. Meanwhile, its RSI hangs just two points below its overbought level of 70.

Therefore, if history repeats, Bitcoin’s dominance will decline toward 39% by late 2023 or early 2024.

On the other hand, a breakout here will be key for BTC to possibly reach levels not seen in over two years. For example, analyst Crypto Rover sees a classic bullish continuation setup, with 52% being the next major hurdle if such a scenario pans out.

Updated: 7-11-2023

Bitcoin Continues Dominance As 3Rd Week Of Fund Inflows Correct Previous Months’ Outflows

Blockchain equities inflows reached a recent high of $15 million as well. However, total trading volume dropped.

A third straight week of positive digital asset inflows has fully corrected nine previous weeks of outflows for the market, according to a report from CoinShares published on July 10.

This week’s inflows registered $136 million. Bitcoin funds continued their trend of holding the anchor position, with 98% of the inflows coming into BTC. The other 2% mostly came into Ether, multi-asset holdings and a handful of altcoins.

After nine weeks in which digital asset outflows outpaced inflows, this third consecutive week of positive movement brings the current streak’s total to $470 million. According to CoinShares, this total fully corrects for the previous outflow streak.

This brings the last 3 consecutive weeks inflows to US$470m, fully correcting the prior 9 weeks of outflows.

Trading turnover has slowed though, which might be explained by the seasonal effects, where lower volumes are typically seen during July and August.

2/6 pic.twitter.com/4uyvrY0aRP

— CoinShares (@CoinSharesCo) July 10, 2023

Bitcoin inflows showed no signs of slowing down this past week after posting yearlong highs in the previous two. As Cointelegraph previously reported, BTC inflows for last week were $123 million. This week adds $10 million, bringing the two-week inflow haul for BTC alone to $256 million.

This continues Bitcoin’s crypto market dominance by extending its total market cap from last week’s 51.46% to a reported 51.66% share as of July 11.

In other good news for hodlers, blockchain equities inflows reached a yearlong high of $15 million. This more than doubled last week’s $6.8 million, which snapped a nine-week outflow streak of its own, according to CoinShares.

However, there may be some indication of equilibrium on the horizon, as overall liquidity appears to be down. According to the report, trading volume has hit a “seasonal low,” imitating cycles from previous years that saw low liquidity in July and August.

Despite the continuing positive news surrounding inflows, some investors appear to be getting nervous over the lack of a clear trend.

Positive sentiment generated by the expectation that one or more companies would finally receive authorization from the United States government to offer BTC as a spot exchange-traded fund may be tapering off as the process wears on.

There also remains an air of uncertainty, as the U.S. Securities and Exchange Commission’s ongoing litigation against Binance and Coinbase continues with no clear sign as to how the courts will decide.

Updated: 7-14-2023

Bitcoin’s Crypto Market Dominance Slides By Most In 13 Months As XRP Court Ruling Spurs ‘Alt Season’ Talk

Bitcoin’s share of the crypto market tanked on Thursday while altcoins rallied after a U.S. court threw a spanner in the SEC’s plans to regulate digital assets.

Bitcoin’s (BTC) share of the total crypto market, known as its dominance, tanked Thursday after a U.S. court complicated the Securities and Exchange Commission’s (SEC) plan to regulate digital assets and spurred hopes for a sustained outperformance of alternative cryptocurrencies, often called the “alt season.”

In a highly anticipated ruling in the SEC’s case against Ripple Labs for violating securities law through XRP sales, the District Court for the Southern District of New York ruled that XRP is not a security when offered to individuals through centralized exchanges, but is one when sold directly to institutions.

The distinction in the ruling essentially threw a spanner in SEC’s plan to paint all altcoins with the same brush and subject them to stringent oversight by categorizing them as securities.

Bitcoin’s dominance rate fell 2.6% to 50.14% after the court ruling, the biggest one-day decline since June 13, 2022, according to data from charting platform TradingView. Altcoins like XRP, SOL, MATIC and ADA chalked out double-digit gains, outshining bitcoin by a big margin.

Some observers foresee potential for a continue outperformance of altcoins over the near term.

“Alt season may be upon us following the Ripple news as indicators collectively suggest risk appetite is funneling down the risk continuum,” Decentral Park Capital said in a market update published Thursday.

“With the U.S. dollar breaking down and the inflation battle nearing the end, it appears to be game on for investors.”

In contrast, Noelle Acheson, author of the Crypto Is Macro Now newsletter, said the ruling could help Coinbase in its legal tussle with the SEC, but cautioned against predicting an outsized altcoin rally.

Early last month, the SEC charged cryptocurrency exchange Coinbase and its offshore rival Binance for offering unregistered securities, a move that injected uncertainty into the market.

“The ruling should be enough to reawaken greater interest in the shifting market narrative, which itself could be enough to bring in new flows,” Acheson told CoinDesk.

“However, it’s premature to assume that a ‘win’ is in the bag – the SEC will likely appeal the decision, and given some of the inconsistencies, it might win. At best, the uncertainty will drag on for longer.

So, it feels too soon for alt season; that will probably wait until we get greater clarity on the Coinbase case,” Acheson said.

In a note to clients on Friday, analysts at K33 Research voiced a similar opinion, saying, “the ruling will be appealed and might even be reversed, so we expect the ongoing battle to continue.”

The court also found Ripple violated securities law when selling XRP directly to institutions. So institutions that bought XRP can come under the regulatory scanner, injecting further uncertainty into the market.

“It is important to note that institutional investors who purchased directly from Ripple may find themselves subject to class-action litigation as potential underwriters.

This is an area to watch closely, especially if big-name venture capitalists were involved,” CoinShares’ head of product, Townsend Lansing, said. “The legal landscape continues to change, and we urge all parties to stay informed of these important developments.”

Updated: 10-10-2023

Bitcoin Dominance Hits 3-Month High As ‘Hammered’ Altcoins Risk Dive

Bitcoin price action wobbles but recovers without new lower lows, while altcoins suffer, with traders eyeing potential short opportunities.

Bitcoin’s Price Preserves Weekly Support

Data from Cointelegraph Markets Pro and TradingView showed BTC price stability returning ahead of the Wall Street open.

Bitcoin bulls had lost their footing as the week began, with BTC/USD heading to $27,300 before reversing to trade near $27,700 at the time of writing.

“Overall there’s been a lot of market de-risking into $27.4K—$27.3K,” popular trader Skew wrote in part of X analysis at the time.

“Important area now because losing that level would take prices back to 1W demand. More importantly, around here into tomorrow buyers need to establish price control for a move higher.”

Continuing on the day, Skew noted that derivatives traders controlled trajectory for the time being.

“Better to see what spot market wants later,” he advised.

$BTC

as you can see price is very much correlated to perp involvement~ positions chasing the market

Better to see what spot market wants later https://t.co/VH46ZsLRbO pic.twitter.com/S3GScvPDtc

— Skew Δ (@52kskew) October 10, 2023

Some market participants were broadly optimistic, among them Michaël van de Poppe, founder and CEO of trading firm MN Trading.

In his latest X post, van de Poppe described altcoins as being “hammered” by sell pressure, while Bitcoin held support.

“If Bitcoin is able to break back above $28,000, the thesis to $35,000–40,000 might become real,” he argued.

A previous post predicted that “most likely the path towards $30K is going to start from here,” with an accompanying chart showing relevant resistance levels.

Altcoins Bear Brunt of Crypto Cold Feet

Meanwhile, against altcoins, the picture remains in Bitcoin’s favor, data showed.

Bitcoin’s share of the overall crypto market cap hit 51.35% on Oct. 9, marking its highest levels since mid-July.

“A lot of Altcoins looking like they are breaking major support zones and bringing us some juicy short entries,” popular trader Crypto Tony continued on the topic.

On Bitcoin, Crypto Tony flagged $27,200 as the level to hold to avoid going short on BTC.

$BTC / $USD – Update #Bitcoin continues to range as we bounced off the support zone yesterday. I remain long until we lose $27,200, which then i will look to short down pic.twitter.com/rLyokRPqWp

— Crypto Tony (@CryptoTony__) October 10, 2023

Updated: 10-25-2023

Bitcoin Dominance Hits Fresh 30-Month High As Ether, Altcoins Lag In Rally

Bitcoin’s bullish momentum could prove a harbinger of an altcoin rally, one analyst noted.

* Bitcoin’s Crypto Market Share Surged To 54.4%, The Highest Since April 2021.

* BTC Outperforms Altcoins Due To The Spot ETF And Safe Haven Narratives, One Analyst Noted.

Bitcoin’s (BTC) market share of all cryptocurrencies rose to a fresh 30-month high Wednesday as BTC continues to beat most altcoins or alternative cryptocurrencies (altcoins).

The BTC Dominance rate, which measures the largest crypto asset’s market capitalization relative to the overall digital asset market, surged to 54.4%, the highest since the raging bull market of April 2021, according to TradingView data.

Another way of phrasing it is that a ratio over 50% means bitcoin is worth more than all other cryptocurrencies combined.

The index spent almost two years oscillating between 39% and 49% before breaking out from the range in mid-June. The breakout coincided with BTC’s rally above $30,000 on the news about BlackRock filing for a spot BTC ETF in the U.S.

The narrative still prevails in the investing landscape for digital assets, as observers take an eventual approval by the U.S. Securities and Exchange Commission (SEC) as a near certainty, which could unleash a wave of fresh demand for the asset.

The rise of BTC dominance can be explained by the crypto market cycle and bitcoin’s appeal as a less risky asset compared to altcoins, including the second-largest cryptocurrency ether (ETH), according to Noelle Acheson, market analyst and author of the Crypto Is Macro Now newsletter.

“Bitcoin tends to lead crypto markets in the early part of a cycle, only losing dominance when investors get more comfortable moving out on the risk curve and smaller tokens overtake in performance,” Acheson noted Wednesday.

“BTC has the ETF and safe haven narratives as tailwinds,” she added. “ETH has regulatory chill and upgrade uncertainty as headwinds.”

Bitcoin vs. Ethereum

BTC’s price jumped 32% over the past month, CoinDesk data shows. Meanwhile, ETH advanced only 12%, and its relative value against BTC is at the brink of levels not seen since May 2021.

The performance gap is even starker when zooming out: Bitcoin’s price has doubled this year, while ETH is up about 50%.

Bitcoin’s bullish momentum could prove a harbinger of an altcoin rally.

“Historically, when bitcoin’s price rises, that money begins filtering out into altcoins,” John Glover, chief investment officer at crypto lender Ledn, said in an email.

“This means there is a very real possibility that the launch of one or more spot ETFs could lead to the next major bull run in the entire cryptocurrency ecosystem,” he added.

Updated: 10-26-2023

Bitcoin Dominance Hits 54% — Highest In 2.5 Years As BTC Halving Approaches

BTC market dominance hovered around 80% during the 2017 bull market but slumped to the 50%–60% range during the 2021 bull market, at times even dipping below 50%.

Bitcoin’s market dominance has reached 54%, its highest in the last 30 months, indicating the top cryptocurrency is strengthening just before the halving event scheduled for April 2024.

The Bitcoin halving is an event in which the mining reward per block is halved, thus cutting the supply of the asset amid growing demand and leading to bullish price momentum.

The Bitcoin halving occurs every four years, and the next halving in 2024 will reduce the BTC mining reward from the current 6.25 BTC to 3.125 BTC.

As the total supply of Bitcoin is fixed at 21 million, the halving of BTC mining rewards creates a supply-demand gap that lowers the influx of new BTC into the market.

Bitcoin market dominance is a measure of the crypto asset’s market capitalization relative to the overall digital asset market and highlights the asset’s strength. The market dominance of over 50% is considered highly bullish and marks its highest point since the last bull run in April.

|

Bitcoin’s market dominance began reviving at the start of October, when it rose from below 49% to reach this new two-and-a-half-year high. October has been historically considered a bullish crypto month, leading to the nickname “Uptober.”

This was evident from Bitcoin’s double-digit percentage surge over the past few weeks, helping BTC rise from just below $27,000 at the start of October to post a new yearly high of $35,000.

Uptober has been great, but the party may not be over just yet.

November is historically #Bitcoin‘s best performing month. pic.twitter.com/kaMMt7pgZz

— Miles Deutscher (@milesdeutscher) October 25, 2023

In 2017, Bitcoin maintained a market dominance of over 80%, followed by Ether with nearly 10%–17% in market dominance.

Over the years, Bitcoin has seen a steep decline in its market dominance owing to the rise in the number of cryptocurrencies and the growth of several new tokens during the last bull run in 2021.

Updated: 4-30-2024

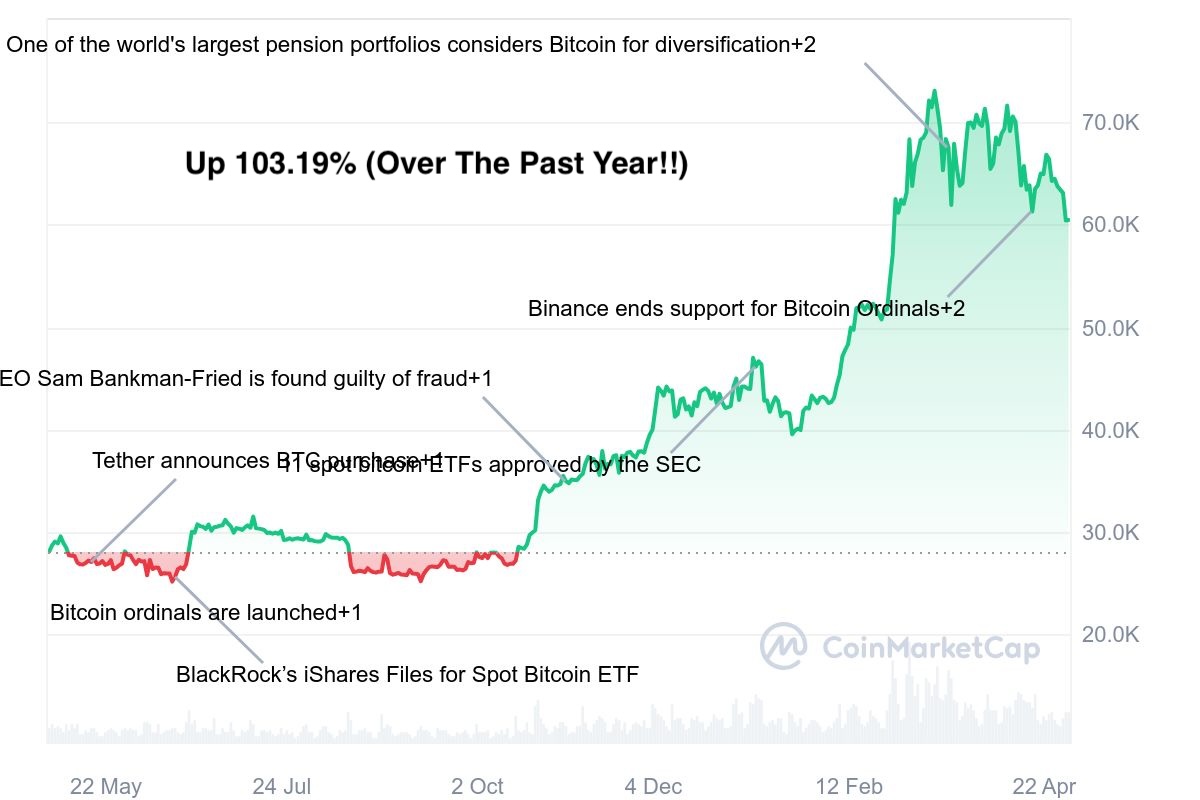

Bitcoin Set To Become More Dominant Even As BTC Stares At First Monthly Loss Since August

* Bitcoin Is About To Snap A Seven-Month Winning Streak.

* According To Fairlead Strategies, Bitcoin’s Dominance Rate Has Risen Past A Critical Level, Signaling Further Upside.

BTC To Become Even More Dominant

Bitcoin’s dominance rate, or the share in the crypto market, recently rose to a three-year high of 57%, breaking higher from a six-month consolidation pattern.

The breakout means bitcoin could continue to outshine alternative cryptocurrencies (altcoins) in the coming months.

“It [the dominance rate] recently had a breakout favoring bitcoin over altcoins in the intermediate-term, which is in line with the weekly RRG [relative rotation graph] where most altcoins point lower,” Fairlead Strategies said in a note to clients Monday.

“The breakout in the index marks a continuation of a long-term turnaround phase, which has reversed much of the altcoin gains made in early 2021,” Fairlead Strategies added.

Bitcoin {{BTC}} appears on track to end a seven-month winning streak. Still, the largest token by market value is likely to become more dominant in the crypto market, according to one analyst.

As of the time of writing, bitcoin changed hands at $63,200, representing an 11% monthly loss, the first since August 2023, according to data source CoinDesk and TradingView. The CoinDesk 20 Index, a measure of the most liquid digital assets, traded nearly 20% lower for the month at 2,185 points.

Analysts are now closely watching Wednesday’s quarterly refunding statement by the U.S. Treasury. According to Singapore-based QCP Capital, a higher issuance of short-term bills could free up liquidity, supporting risk assets.

“The upcoming Quarterly Refunding Announcement (QRA) on May 1 could also see higher issuances of short-term U.S. bills. This will drain the RRP, which currently has USD 400 billion, and also increase liquidity,” QCP said in a market note.

The U.S. Treasury said on Monday it plans to borrow more in the April to June quarter. Higher-than-expected borrowing means more bond supply, higher yields or risk-free rates and less reason to invest in risky assets.

The Treasury also said it expects to maintain a balance of $850 billion in its Treasury General Account by the end of September, slightly higher than the $750 billion expected.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.