Economic Downturn Could Cost Five Million U.S. Jobs (#GotBitcoin?)

Economic output seen shrinking by as much as $1.5 trillion with recession all but certain. Economic Downturn Could Cost Five Million U.S. Jobs (#GotBitcoin?)

The fallout from the coronavirus outbreak is expected to have a significant negative impact on U.S. economic prospects, with predictions emerging for losses of up to five million jobs this year and a drop in economic output of as much as $1.5 trillion.

A recession is now all but certain, according to a Wall Street Journal survey of 34 economists, which projects a downturn that would last months at least, and would in some ways rival—and possibly even surpass—the severity of the 2007-09 slump triggered by the housing collapse and subprime loan debacle.

“This shock is very big,” said Bruce Kasman, head of economic research at JPMorgan. “You are going to see in the next two months the consequences of the actions taken in terms of economic activity. That set of trade-offs is not really clear in policy makers’ minds right now.”

Economic forecasts, which remained upbeat just two weeks ago, suddenly turned bleak as it became clear that a pandemic, one that started in Asia and spread to Europe, would now affect American life far more than originally understood.

The extent of the coming downturn remains unclear to many economists, given uncertainties stemming from an unknown trajectory of the pandemic, extreme volatility in the financial markets, restrictions on daily economic activity of unknown duration and a government response that is being adjusted every day and is likely to continue to change in the weeks and months ahead.

Mr. Kasman’s current predictions are representative. He expects U.S. gross domestic product will fall by 1.8% this year. Before the outbreak, he had projected output to grow 1.5%. That would translate into $700 billion in lost output. Beyond those losses, “the rise in public-sector debt and destruction of human, and possibly physical, capital is important,” he said.

The economy, Mr. Kasman believes, will lose between 7 million and 8 million jobs this spring, though some of those will likely come back if, as he expects, the economy rebounds in the second half of the year.

Sung Won Sohn, a business economist at Loyola Marymount University, expects the coronavirus to cost $592 billion in output, after inflation, and a loss of nearly 5.2 million jobs in 2020, compared with his pre-virus forecast.

Goldman Sachs projects U.S. output to fall 3.1% this year and unemployment to soar to 9% from the current 3.5%. Unemployment last peaked at 10% in October 2009, after the housing and financial collapse.

Economists at Goldman estimate that U.S. jobless claims—a proxy for layoffs—increased by roughly 2 million just this week.

“A public health emergency is morphing into an economic emergency,” said David Shulman of the UCLA Anderson School of Management. “The basic outlines of the economy will be determined more by biology than by economics.”

Some industries might actually be forced to hire workers as buying patterns shift. Amazon.com Inc., for example, plans to hire an additional 100,000 employees in the U.S. as it boosts online deliveries. Walmart Inc. said it would pay cash bonuses totaling $550 million to its hourly workers and hire 150,000 temporary staffers.

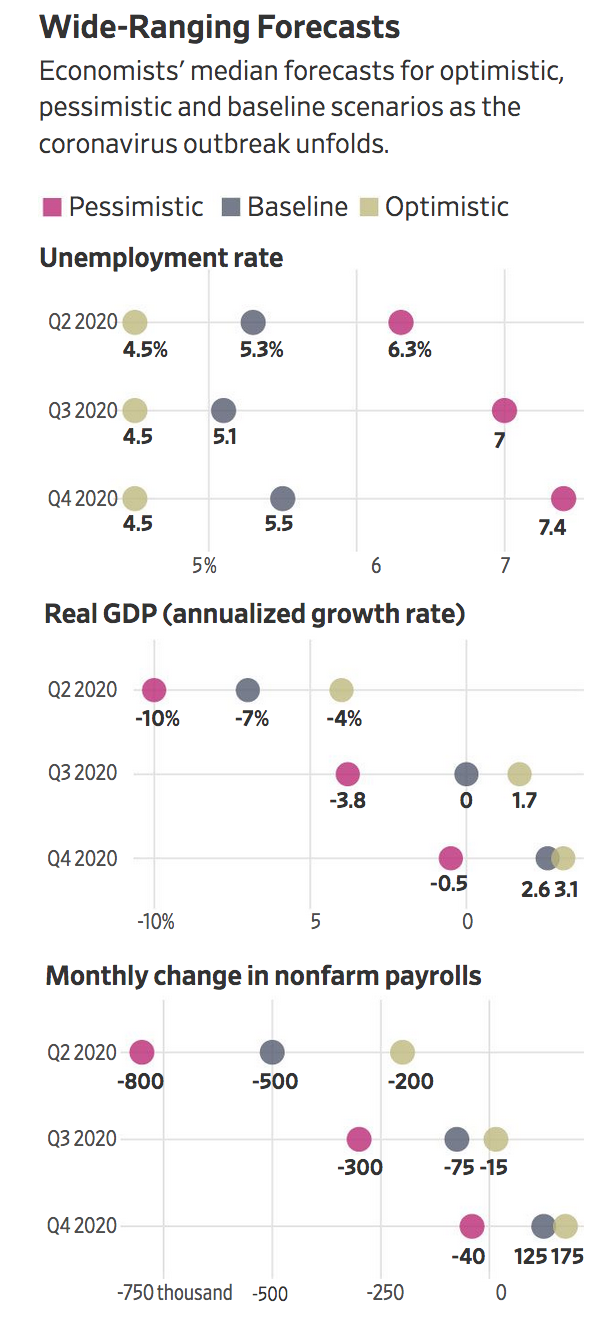

And some believe that an unprecedented government relief effort could still avoid some of the worst-case scenarios. In the median “optimistic” forecast, economists still see an extremely sharp contraction in the second quarter, but a recovery apparent by the third quarter of 2020, with 1.7% growth that quarter and 3.1% growth in the fourth quarter.

Under this scenario, job growth could recover to 15,000 in the third quarter and 175,000 in the fourth quarter. Unemployment, they said, could still be contained at 4.5%. For most economists, their optimistic scenario isn’t a “V-shaped recovery” with a sharp collapse followed by an extremely rapid rebound. But it is a scenario in which the contraction is brief.

Joel Prakken, chief U.S. economist at IHS Markit, issued an updated forecast Friday afternoon for forgone growth in gross domestic product of $1.5 trillion, based on negative growth of 13% in the second quarter, and a rebound in growth unseen until the fourth quarter. But his forecast is for 3.8% growth in 2021.

“Things look so gloomy right now that perhaps we should be grateful if we can get out of this health crisis with a brief recession,” said Bernard Baumohl of the Economic Outlook Group.

“You just cannot rule out the prospect of a longer, more destructive depression,” said Mr. Baumohl. “What is clear is that we are in a race against time.”

The pessimistic scenario, according to the Journal survey, would be a sharp and long-lasting contraction. The median pessimistic forecast sees GDP decreasing by 10% in the second quarter, falling another 3.8% in the third quarter and dropping 0.5% in the fourth quarter. It projects the unemployment rate climbing continuously, reaching about 7.4% by the end of the year.

Job losses, under this scenario, could approach 800,000 a month in the second quarter, followed by 300,000 a month in the third quarter and 40,000 a month in the fourth quarter.

By comparison, in the fourth quarter of 2008, the most severe quarter of the last recession, GDP fell at an annualized rate of 8.8% with job losses reaching around 800,000 for several consecutive months. In total, the economy lost more than 8 million jobs in the recession that began in December 2007. The unemployment rate climbed from 4.4% in 2007 to a peak of 10% in 2009.

One important difference may be whom the downturn hurts this time around. Rajeev Dhawan, director of the Economic Forecasting Center at Georgia State University, said the recession in 2008 killed jobs across all industries, from construction and manufacturing to banking and law.

This time, he expects the job losses to be heavily concentrated in several industries: restaurants, hotels, airlines and real estate. He expects the laid-off workers to be concentrated in jobs with below-average earnings. He believes the economy could lose six million jobs in the coming months and eight million by year-end.

The good news, Mr. Kasman said, is that unlike the 2007-09 downturn, the economy will likely rebound quickly if the government can slow the spread of the disease and lower the death rate. “I don’t think the economy is fundamentally imbalanced or at a fragile position at this point,” Mr. Kasman said. “I don’t think it has to play out like 2008, 2009 where you had most longer-lasting problems unwound.” Economic Downturn Could Cost,Economic Downturn Could Cost,Economic Downturn Could Cost,Economic Downturn Could Cost,Economic Downturn Could Cost,Economic Downturn Could Cost,

Go back

Leave a Reply

You must be logged in to post a comment.