Consumer Sentiment Slump Hits Online Retailers Too (#GotBitcoin)

An unexpected profit warning in Europe suggests internet stores may be less resilient than expected in consumer downturns. Consumer Slump Hits Online Retailers Too (#GotBitcoin)

Online retailers haven’t so far been properly tested by a consumer-spending downturn. Early signs from Europe suggest they won’t be as resilient as tech bulls might hope.

Roughly $3 billion has been wiped from the value of shares of ASOS and Zalando , two major European online fashion retailers, this week after the former flagged a slowdown on Monday. ASOS was hit by dismal demand in November, just like regular malls and bricks-and-mortar stores. The London-based company, which specializes in cheap but trendy clothes for 20-somethings, blamed weak consumer sentiment and “economic uncertainty.”

This is an eye opener for investors who have few clues how e-commerce will fare in the next consumer recession. During the 2008 financial crisis, most grew rapidly thanks to the shift to internet shopping. But as online markets mature—U.K. online sales are growing at half the rate they were two years ago—e-commerce companies will lose that structural boost.

Thin margins make online retailers particularly vulnerable in a slump. ASOS expects an operating margin of just 2% this year—half what it previously expected and much lower than even the most stressed high-street retailers. One reason is the need for heavy investment in automated warehouses and distribution centres. ASOS has been building a major hub in Atlanta to serve the U.S. market, for example.

Internet retailers don’t pay for prime storefronts, but they do face major logistics costs that bricks-and-mortar players don’t. One third of all clothing ordered online is returned, compared with around 8% for items bought from the shop floor. And processing a return costs $3 when it is handed to a shop, but $6 when it is shipped back to a distribution center, data from consulting firm AlixPartners show. ASOS said it has to foot the bill for free delivery to maintain an edge over traditional shops, even though orders are getting smaller.

Investors have been cooling on European internet retailers. Shares in Britain’s Boohoo.com and Germany’s Zalando were in the red for this year even before this week’s rout. ASOS shares now trade at a 50% premium to those of Zara-owner Inditex on a prospective earnings basis, compared with 180% just eight months ago. Investors still think online-only players are a better bet—but much less so than they once did.

For now, consumer confidence remains strong in the U.S., and shares in online retail giant Amazon are up 26% this year, even as the tech-heavy Nasdaq index has fallen. This week’s lesson from Europe is that e-commerce doesn’t necessarily offer protection from plunging consumer sentiment. Investors should take note before it is the U.S. economy’s turn to cool.

Updated: 11-5-2019

Drop In Consumer-Goods Imports Points To Slower U.S. Growth

U.S. posts largest petroleum products surplus on record on import decline.

U.S. imports of goods such as cellphones, toys and apparel fell sharply in September, the latest sign that slowing global growth may be spilling into the domestic economy.

Imports sank 1.7% from August to a seasonally adjusted $258.44 billion, the Commerce Department said Tuesday. The decline was led by a 4.4% drop in imports of consumer goods, followed by a 3.4% fall in imports of vehicles and auto parts. Imports of petroleum products also fell in the month, creating the largest monthly surplus in records going back to 1978.

“It could be a sign that the U.S. consumer is possibly curtailing spending,” said Pooja Sriram, a U.S. economist at Barclays, of the drop in consumer-goods imports. “We haven’t seen that category fall by this magnitude in a considerable time.”

Another possible factor is the latest round of tariffs by the Trump administration. Starting Sept. 1, the U.S. imposed 15% duties on $111 billion worth of imported tools, apparel items, footwear and electronics from China.

U.S. households have been a main driver for the economy this year as global growth has weakened and business investment has fallen amid trade uncertainties. A sustained drop in consumer spending would leave the economy vulnerable, economists say.

Consumer outlays grew at a 2.9% annual rate in the third quarter from the previous three months, the Commerce Department reported last week, down from a 4.6% increase in the second quarter. The increase helped offset a 3% decline in business investment. U.S. retail sales also fell a seasonally adjusted 0.3% in September from August.

Tuesday’s report showed imports of goods from China fell 4.9% in September from August to a seasonally adjusted $37.05 billion.

Because of month-to-month fluctuations in trade flows, economists said it was difficult to determine the extent to which the latest tariffs hampered imports.

But Hasbro, Inc., maker of Play-Doh, the board game Monopoly, and other toys and games, said tariffs prompted retailers to cancel some imports of its products from China and attempt to replace them with domestic orders, which the manufacturer wasn’t entirely able to fill.

“In the third quarter, the threat of and the implementation of tariffs in certain instances impacted our shipments and our ability to fully meet demand,” Hasbro CEO Brian Goldner said in an earnings call in October, according to a transcript by FactSet.

Xerox Holdings Corp. Chief Executive Bill Osbourn said in a conference call last week he expects the greatest impact from the September tariffs to be felt in the fourth quarter.

U.S. imports of petroleum products fell 4.6% in September from August, contributing to the record $252 million trade surplus in petroleum.

For months, the U.S. has been expected to become a net exporter of oil and petroleum products, a symbolic moment that showed the country is moving closer to the ideal of “energy independence.”

But the figure, which includes crude oil as well as products such as gasoline, doesn’t mean the U.S. is independent from foreign sources of oil.

The U.S. has become far less reliant on foreign crude in recent years, thanks to a fracking boom that has transformed the country into the world’s top oil producer, churning out more than 12 million barrels a day, according to the Energy Information Administration.

Still, America continues to import substantial volumes of foreign oil, primarily heavier varieties that refiners mix with domestic crude, which generally is lighter and less sulfurous. The fuel makers need a mix of light and heavy oils to operate at optimal capacity.

The U.S. was briefly a net exporter of oil and refined fuels last November, according to Energy Information Administration data, and it has achieved the distinction during several weeks since. Tuesday’s report was the first time in decades that trend has shown up in the monthly Commerce Department reports.

In the calculation of gross domestic product, imports are subtracted, so lower imports, arithmetically, will raise GDP. However, if imports fall because of weak domestic demand, the GDP boost is offset by lower business and consumer spending.

Overall, the U.S. trade deficit narrowed 4.7% in September from a month earlier to a seasonally adjusted $52.45 billion, the Commerce Department said. Through the first nine months of the year, the gap stood at $481.33 billion, up 5.4% from the same period of 2018.

Updated: 12-22-2020

U.S. Consumer Confidence Unexpectedly Drops, Hits Four-Month Low

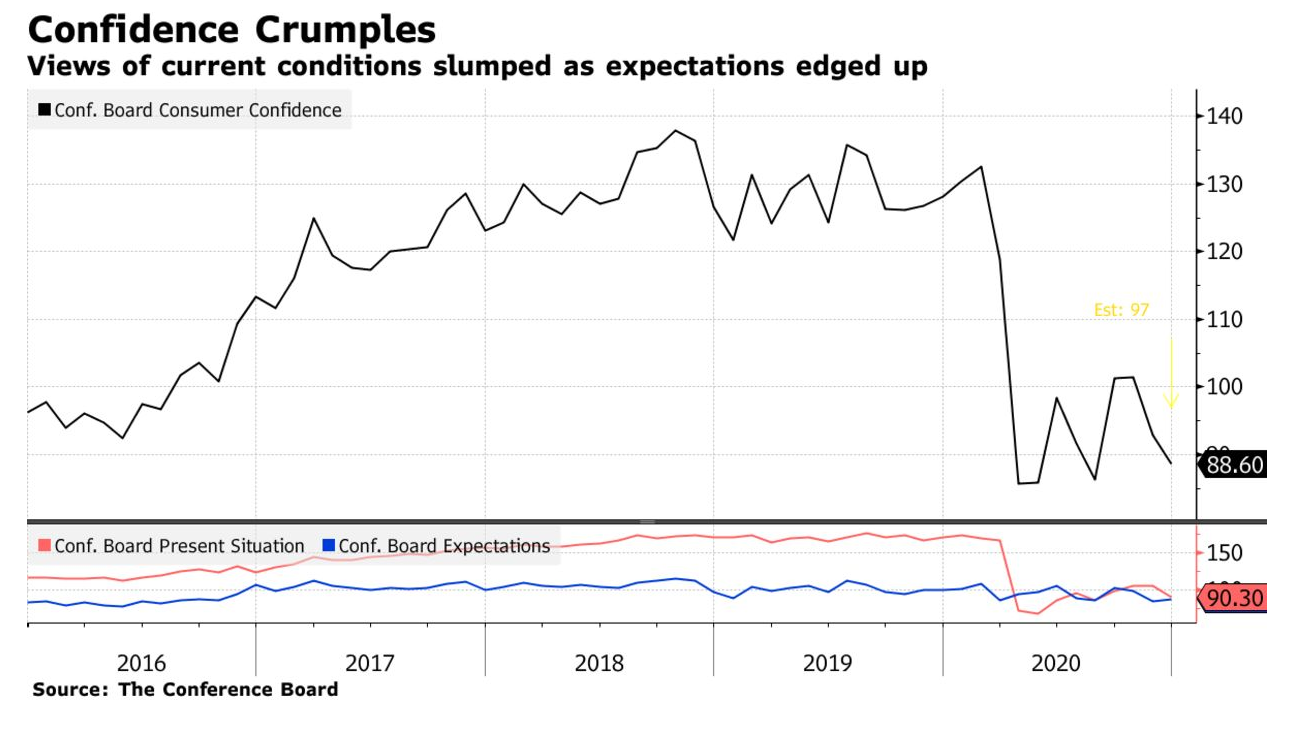

U.S. consumer confidence unexpectedly fell in December to a four-month low amid surging Covid-19 cases that are spurring more states to tighten restrictions on businesses and travel.

The Conference Board index dropped to 88.6 from a downwardly revised 92.9 in November, according to a report from the group Tuesday. That missed all estimates in a Bloomberg survey of economists that had called for 97. The measure of sentiment about current conditions fell the most since April, while the expectations gauge rose from a four-year low.

The unexpectedly downbeat reading amid record virus cases and deaths comes just as new vaccines and federal-aid plans offer more reasons for optimism about the coming months. The latest reading, reflecting responses through Dec. 14, remains well below pre-pandemic levels.

“Consumers’ assessment of current conditions deteriorated sharply in December, as the resurgence of Covid-19 remains a drag on confidence,” Lynn Franco, senior director of economic indicators at the Conference Board, said in the statement.

The report contrasts with another key measure of the country’s outlook. The University of Michigan’s gauge of U.S. consumer sentiment unexpectedly increased in early December to the second-highest level since March. However, the Bloomberg Consumer Comfort Index has fallen for four straight weeks after rebounding since May.

The share of survey respondents who said they expected their incomes to increase edged up to 16.8 from 16, the board said.

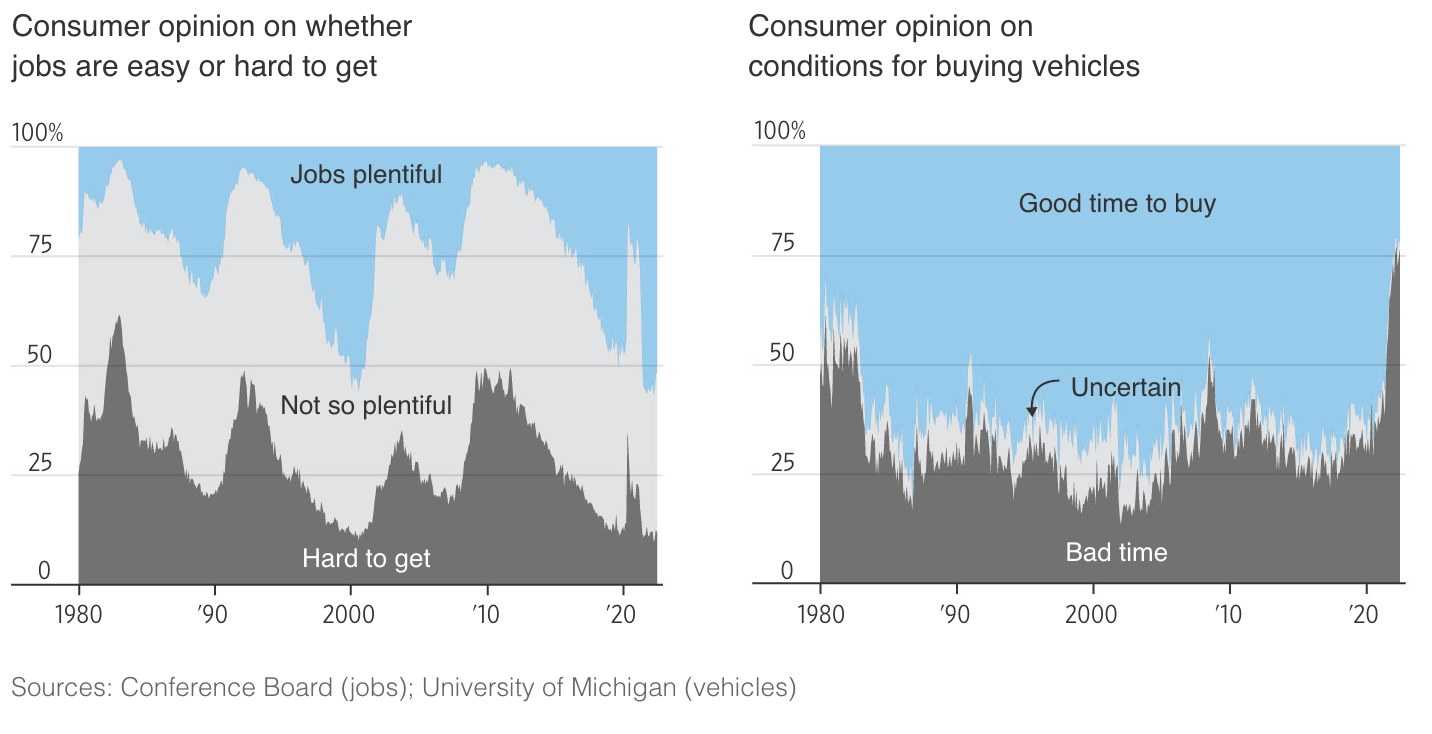

On the labor market, the share of respondents saying jobs are plentiful declined for a second month. For expectations, the share saying that fewer jobs will be available in the next six months rose to a seven-year high of 22.2%.

Updated: 12-31-2020

U.S. Consumer Comfort Gauge Drops To Four-Month Low

A gauge of U.S. consumer sentiment dropped last week to a four-month low as Americans grew more pessimistic about the state of the national economy and the resurgence of Covid-19 cases.

The Bloomberg Consumer Comfort Index fell 2.4 points in the week that included Christmas to 44.6, the lowest since the period ended Aug. 23, data released Thursday showed. The sentiment measure is now only a third of the way back from its pre-pandemic level.

Americans’ assessments of the national economy, buying climate and their personal finances all worsened. The report comes against a backdrop of surging Covid-19 cases and renewed lockdown restrictions.

Americans’ pessimism about the economy and their financial situation continued as lawmakers dragged their feet on another fresh round of stimulus. A $900 billion pandemic-relief bill, passed by Congress on Dec. 21, wasn’t signed into law by President Donald Trump until Dec. 27.

Matching its low since early July, the sentiment index for the national economy fell by 3 points to 34, the third straight weekly decline. The gauge has fallen 6.5 points in the last two weeks, the most since April and reflecting pessimism among Republicans.

The measure of attitudes about personal finances fell to a four-month low of 58.8 from 61.2. Views of the buying climate also deteriorated last week.

Updated: 3-16-2021

Retail Sales, Manufacturing Slip Ahead of Expected Stimulus Checks

U.S. shoppers pulled back and factories produced less in February due to winter weather and supply-chain disruptions.

U.S. retailers and manufacturers slumped in February due to winter storms and supply-chain disruptions, but a broader economic rebound appears poised to accelerate this spring because of the easing pandemic and another round of government stimulus.

Retail sales—a measure of purchases at stores, at restaurants and online—fell by 3% in February compared with the prior month, the Commerce Department said Tuesday. The decline followed robust January sales that were propelled by stimulus payments to households from the December pandemic-relief package. January sales advanced a revised 7.6%, up from the earlier estimate of a 5.3% increase.

Severe winter weather wreaked havoc across a large swath of the U.S., affecting retail shopping and manufacturing output last month. The Federal Reserve separately said industrial production fell a seasonally adjusted 2.2% in February compared with January. Manufacturing, the largest component in the industrial-production index, drove the decline because of the weather disruptions and supply shortages in semiconductors for autos, the Fed said.

Consumers meanwhile spent less on autos, furniture, electronics, home improvement, healthcare and clothing. Sales at food and beverage stores were unchanged, while sales at gas stations were up strongly, by 3.6%, as gas prices have accelerated this year.

Despite the February decline, retail sales were up 6% over the last three months compared with the same period a year earlier, according to the Commerce Department.

February is typically a quiet month for retail sales, as stores gear up for the spring selling season, including Easter. Economists expect spending to accelerate in the coming months as additional government stimulus is distributed and Covid-19 vaccinations lead to a corresponding decline in cases and pickup in employment levels as businesses open up more fully.

The upwardly revised January sales figures “took the sting out of the negative surprise” in the February data, Aneta Markowska and Thomas Simons, economists at Jefferies LLC, said in a research note.

Federal stimulus checks, which many households will receive as part of the $1.9 trillion coronavirus aid plan signed into law last week, create “a massive tailwind for consumer demand this spring,” the economists said.

“The checks will coincide with broadening vaccine distribution and warmer weather, which will accelerate the return of high-contact activity, providing more avenues for consumers to spend their stimulus payments,” they added.

JPMorgan Chase & Co.’s tracker of credit- and debit-card transactions showed consumer spending on a seasonally adjusted basis climbed in early March after dropping off in February.

Other signals of a pickup in the economic recovery have emerged. After cutting workers at the end of 2020, U.S. employers added 379,000 jobs in February, and the unemployment rate ticked down to 6.2%. The U.S. manufacturing industry has shown steady signs of expansion.

Richard Woolley, owner at Weathered Vineyards in New Tripoli, Pa., said he was optimistic about the outlook for business as warmer months approach and federal stimulus efforts permeate the economy.

“You can’t pump trillions of dollars into the U.S. economy and not have some of it land here,” he said. “People will spend it. We’ll see some feedback from that at some point and that will probably lead to an OK 2021.”

He said February was a slow month for sales, with revenue at the winery during Valentine’s Day weekend down 50% compared with last year. Mr. Woolley said the business is currently relying on curbside pickups and outdoor service, because of state coronavirus mandates that restrict its ability to hold wine tastings indoors. Cold weather last month damped the number of customers willing to sit outside, he added.

As part of the federal government’s most recent relief package, many Americans will receive direct $1,400 cash payments. The package also extended enhanced unemployment benefits and expanded the child tax credit.

Meanwhile, new reported coronavirus cases in the U.S. are hovering near their lowest levels since early October, and President Biden has directed states to make all American adults eligible to sign up to receive a vaccine by May 1.

Those factors combined could help propel consumer spending on services, such as in the leisure-and-hospitality sector, where consumer outlays and employment gains have lagged behind.

“The bottom line is all about the pandemic. Once the pandemic is behind us, you’re likely to see a big rebound in consumer services,” said Scott Brown, chief economist at Raymond James Financial. “People are likely to go nuts, we think, in terms of wanting to get out there and do stuff.”

U.S. households broadly are sitting on cash potentially ripe for spending, as they boosted savings during the pandemic. Research has suggested that Americans have spent previous rounds of direct cash payments on bills, food and other goods and to pay down debt, while also stashing away some of the funds.

‘Consumers have the ability to spend, willingness to spend.’

— Jack Kleinhenz, chief economist at the National Retail Federation

Fiscal stimulus “is definitely adding purchasing power to households,” said Jack Kleinhenz, chief economist at the National Retail Federation. “The question is how much will actually be spent” in the coming months, he said.

Data firm IHS Markit on Tuesday lifted its forecast for first-quarter gross domestic product growth to 5.1% from 4.9%, citing the upward revisions to January’s retail sales data. Consumer spending is a key component of GDP, accounting for roughly two-thirds of economic output.

States and municipalities, meanwhile, have continued to relax restrictions on businesses and activity as cases have eased. Still, public health officials have warned of a potential resurgence in infections amid fatigue among Americans with precautions such as mask wearing and social distancing.

“Consumers have the ability to spend, willingness to spend, but on the downside, it’ll get contorted if the virus picks up again or variants put a speed bump in our ability to contain it,” Mr. Kleinhenz said.

Tom Scheiman, owner of b.a. Sweetie Candy Co. in Cleveland, said foot traffic and business at his candy store have picked up in recent months. The company has a 40,000-square-foot facility that is open to the public and it sells candy, old-fashioned sodas and ice cream.

The company is also a wholesale distributor of candy to local grocery and convenience stores. Mr. Scheiman said that portion of the business has too been on an upswing.

“You can tell by the way people are buying and the way they’re shopping, there’s no reluctance,” he said. Shoppers “have more money in their pocket,” he said, adding that the size of his customers’ average purchase had also increased.

The pandemic forced the retail store to close for 10 weeks around Easter last year, causing a loss of about $2 million in sales. This year, things look different.

“We’ve turned a corner substantially,” Mr. Scheiman said.

In turn, he said he had added three full-time employees to his staff and raised wages for his workers by an average of 12% since the start of the year.

Factory Production In U.S. Unexpectedly Declines

Production at U.S. manufacturers unexpectedly declined in February, representing a pause in recent momentum as factories were beset by severe winter weather and supply-chain challenges.

The 3.1% decrease in output was the first since April and followed an upwardly revised 1.2% gain in January, according to Federal Reserve data Tuesday. That was worse than all estimates in a Bloomberg survey of economists. The median forecast called for a 0.2% rise.

Excluding the effects of inclement weather, factory production would have fallen about 0.5% in February, the Fed said in a statement.

Total industrial production, which also includes mines and utilities, dropped 2.2% in February after an upwardly revised 1.1% increase a month earlier.

“We likely will see at least a partial reversal of the February changes in March given expected normalization in the weather and over time we believe industrial production will keep trending higher as the recovery continues,” Daniel Silver, an economist at JPMorgan Chase & Co., said in a note.

Total industrial output reflected a 7.4% surge at utilities. That was the largest advance since March 2017 and driven by increased demand for heating. The bitter cold weather also resulted in blackouts in Texas and disrupted production at refineries.

While manufacturers continue to battle supply shortages and shipping challenges, tailwinds for producers include lean business inventories, steady demand from consumers and solid capital spending.

The Fed’s index of manufacturing output is 4% below where it was a year ago. The March data will offer a clearer read on the progress of American manufacturing, given other gauges of activity have largely been upbeat. The Institute for Supply Management’s measure rose last month to a three-year high.

Auto production slumped 8.3% in February, the largest fall since April and reflecting both a global shortage of semiconductors and the severe weather, reducing overall manufacturing output about 0.5%.

Production in the chemical industry dropped 7.1% last month, reflecting petrochemical plant shutdowns along the Gulf Coast.

A separate report Tuesday from the Commerce Department showed retail sales were also impacted by winter weather in February, falling 3% after a 7.6% gain in January.

Digging Deeper

* Manufacturing capacity utilization dropped 2.3 percentage points to 72.3%, the lowest since September. Total capacity utilization, including factories, mines and utilities, decreased to a four-month low of 73.8%

* Excluding motor vehicle and parts production, manufacturing output decreased 2.6%

* Oil and gas well drilling rose 6.4% but remains almost half of its pre-pandemic level

Updated: 8-13-2021

Consumer Sentiment In US Plunges To Lowest Since 2011

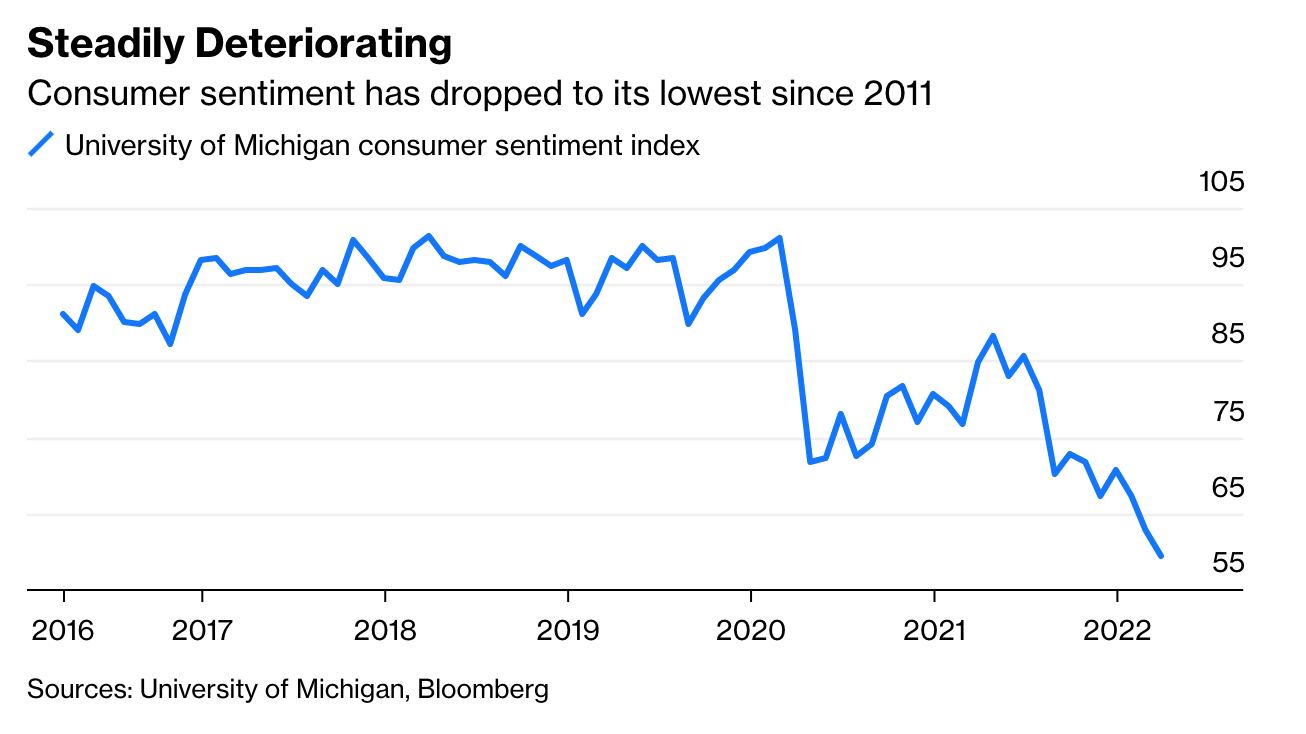

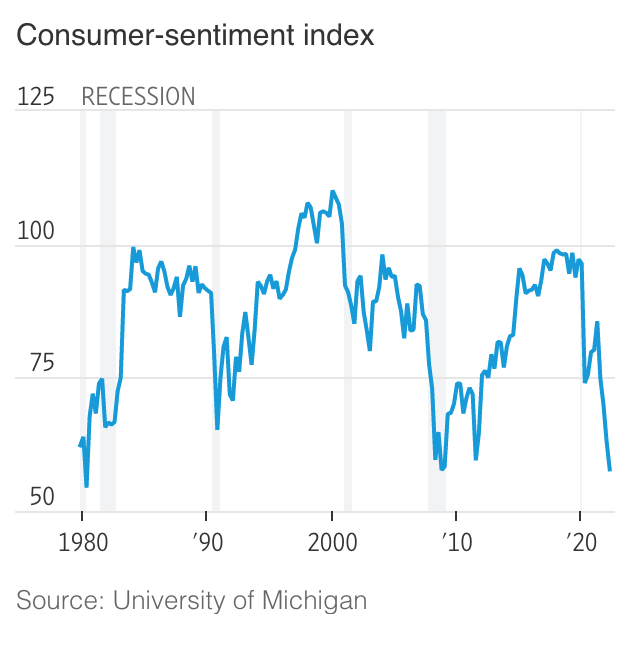

U.S. consumer sentiment fell in early August to the lowest level in nearly a decade as Americans grew more concerned about the economy’s prospects, inflation and the recent surge in coronavirus cases.

The University of Michigan’s preliminary sentiment index fell by 11 points to 70.2, the lowest since December 2011, data released Friday showed. The figure fell well short of all estimates in a Bloomberg survey of economists.

The slump in confidence risks a more pronounced slowing in economic growth in coming months should consumers rein in spending. The recent deterioration in sentiment highlights how rising prices and concerns about the delta variant’s potential impact on the economy are weighing on Americans.

“Consumers have correctly reasoned that the economy’s performance will be diminished over the next several months, but the extraordinary surge in negative economic assessments also reflects an emotional response, mainly from dashed hopes that the pandemic would soon end,” Richard Curtin, director of the survey, said in the report.

The expectations gauge plummeted almost 14 points to 65.2, the lowest since October 2013. A measure of consumers’ outlook for the economy over the coming year soured, falling the most since the onset of the pandemic in March 2020.

Only 36% of respondents expect a decline in the jobless rate, down from 52% the prior month, despite record job openings. Consumers also became decidedly downbeat about their income prospects. The gauge of expected personal finances fell to a seven-year low.

The Michigan sentiment index has largely underperformed the Conference Board’s gauge of consumer sentiment in recent months. While in general the Conference Board’s measure places a greater emphasis on views of the labor market, the Michigan survey tends to reflect respondents’ views about their personal financial situations.

However, it’s yet to be seen how rising concerns about the delta variant will impact the Conference Board’s measure when it’s released at the end of the month.

“The text of the report attributes the fall mainly to an intense reaction (perhaps an overreaction) to the Delta wave, and especially an exasperation that perhaps the pandemic will drag on for years,” said Stephen Stanley, chief economist at Amherst Pierpont Securities. “If that is what’s going on, the pessimism should pass as the current wave fades over the next few months.”

U.S. equities resumed their grind higher to record levels after briefly pausing following the report. The yield on 10-year Treasury notes and the dollar fell.

An index of current conditions dropped to 77.9, the lowest since April of last year, according to the survey conducted July 28 to August 11.

Inflation Worries

Consumers expect inflation to rise 3% over the next five to ten years, an increase from the 2.8% seen last month and matching the highest level since 2013. They expect prices to advance 4.6% over the next year, a slight pullback from the 4.7% in the July survey.

Rising prices are having a clear impact on Americans’ budgets, particularly among those with lower or fixed incomes. Nearly a third of those aged 65 or older complained that inflation had lowered their living standards, as did about a fourth of those with incomes in the bottom third or with a high school education or less.

The Michigan report showed buying conditions deteriorated to the lowest since April of last year.

Concerns about the variant have accelerated in recent weeks. A number of U.S. cities have reintroduced mask requirements, and events such as the upcoming New York International Auto Show have been canceled. Meantime, several companies including Alphabet Inc.’s Google, Amazon.com Inc. and BlackRock Inc. have all recently pushed back plans to return to the office.

Updated: 8-27-2021

U.S. Consumer Sentiment Remains Depressed In Late August

U.S. consumer sentiment remained weak in late August amid ongoing concerns over inflation and the coronavirus pandemic.

The University of Michigan’s final sentiment index fell to a near-decade low of 70.3 during the month from 81.2 in July, data released Friday showed. The figure was in line with the preliminary reading and just below the median estimate of 70.8 in a Bloomberg survey of economists.

“Consumers’ extreme reactions were due to the surging Delta variant, higher inflation, slower wage growth, and smaller declines in unemployment,” Richard Curtin, director of the survey, said in a statement.

“The extraordinary falloff in sentiment also reflects an emotional response, from dashed hopes that the pandemic would soon end and lives could return to normal without the re-imposition of strict Covid regulations,” he said.

If the slide in confidence translates to a pullback in spending, economic growth may decelerate further in the coming months.

The survey period, July 28 to Aug. 23, also coincided with the Taliban’s takeover of Afghanistan and the start of the chaotic evacuation operation of U.S. and Afghan citizens.

Respondents said they expect inflation to rise 2.9% over the next five to ten years, a three-month high. They expect prices to advance 4.6% over the next year – just shy of the 4.7% seen in the July survey, which was the highest in more than a decade.

Severe supply chain disruptions and a broader reopening of the economy have fueled swift price gains for a variety of goods and services. Soaring rents and home prices are further burdening Americans’ finances.

Meantime, the recent surge in Covid-19 cases has disrupted return-to-office and back-to-school plans, forced the cancellation of events and led many cities to reintroduce mask mandates.

A measure of expectations dipped further in the second half of the month, falling to 65.1 from 65.2 in the preliminary reading, still the lowest since 2013. The current conditions gauge improved slightly from the initial reading but remains its weakest since April of last year at 78.5.

An alternative gauge of consumer sentiment — which places greater emphasis on views of the labor market — will be released by the Conference Board Tuesday.

Updated: 9-6-2021

Goldman Cuts U.S. Growth Forecast As Consumer Sees ‘Harder Path’

Goldman Sachs Group Inc. economists revised down their forecast for growth in the U.S. economy this year, pointing to a “harder path” ahead for the American consumer than previously anticipated.

Overall expansion in 2021 is now seen at 5.7%, economist Ronnie Walker wrote in a report to clients on Monday. That compares with an expectation of 6% published at the end of August.

Walker said the weaker growth will follow through into more of a pickup in 2022. Goldman raised its forecast for that year to 4.6%, up from 4.5% previously.

Explaining the downgrade for 2021, Walker wrote that American consumers are likely to spend less amid the Delta variant’s emergence, fading fiscal support and a switch from demand for goods to services. He added that supply-chain disruptions had hit inventory restocking too.

“The hurdle for strong consumption growth going forward appears much higher: the Delta variant is already weighing on Q3 growth, and fading fiscal stimulus and a slower service- sector recovery will both be headwinds in the medium term,” said Walker.

The bank also lifted its projection for the unemployment rate to 4.2% at end of 2021 from a prior estimate of 4.1%.

Updated: 11-7-2021

Canadian Consumer Confidence Slides For Third Straight Week

Canada reported a third weekly decline in consumer confidence amid concerns about a softening economic outlook.

The Bloomberg Nanos Canadian Confidence Index, a measure of sentiment based on household polling, fell 1 point to 61.6 last week, bringing it to the lowest level since March. The index is down 3.5 points over the past three weeks, and almost five points since hitting a record high in July.

Waning optimism over the strength of the economy is driving the sentiment decline, fueled by growing worries about the highly transmissible delta variant and a fourth wave of the Covid-19 pandemic. Weakening confidence is also coinciding with a string of poor economic numbers that suggest the nation is repairing damage from the crisis more slowly than analysts had been anticipating.

Every week, Nanos Research surveys 250 Canadians for their views on personal finances, job security and their outlook for the economy. The confidence index represents a rolling four-week average of about 1,000 responses.

The share of Canadians who see the economy strengthening over the next six months fell to 35% last week, down from 54% at the beginning of July. Questions around personal finances and real estate have also shown a declining trend in recent weeks.

The good news that household sentiment is still at high levels. The confidence index is about 10% above its historical average.

Updated: 9-11-2021

Disappointed Consumers Temper U.S. Economy’s Main Growth Engine

American consumers’ hopes of completely and quickly escaping the clutches of Covid-19 have been dashed by a more contagious variant, renewed mask mandates and uncertainty surrounding in-person returns to schools.

A pickup in inflation, including higher costs for fuel and household energy, has also dimmed prospects for more robust spending and economic growth. By one measure, consumer sentiment slumped in August by the most since the darkest days of the pandemic. Another fell to its lowest since February.

Before the delta variant emerged, vaccines fueled one of the strongest quarters in decades for household spending, a category that accounts for about two-thirds of economic growth. But odds of further outsize spending growth through yearend have been scaled back.

“You think about the engine of growth from this spring through the early summer, it was this re-emergence of leisure activities and services spending and people pulled back spending on goods,” said Michelle Meyer, head of U.S. economics at Bank of America Corp. “And obviously this most recent rise has challenged that.”

Forecasters expect consumer sentiment data out Friday to remain depressed.

Economists at Goldman Sachs Group Inc. cut their estimate for spending in current quarter to a 0.5% annualized decline. They also reduced their fourth-quarter consumption growth projection to 3.5% from 6%.

Adding to the pandemic-related angst about the economy is disapproval of the Biden administration’s handling of the U.S. evacuation from Afghanistan that resulted in the deaths of 13 service members. Weather-related destruction also has the potential of shaking attitudes in some parts of the country.

“If you get a couple more of these weak sentiment indicators, and that coincides with disruptions to back-to-school and then you tack on maybe debt ceiling showdown in Congress that comes on the heels of an Afghanistan debacle, then you could see consumer spending really take a step back,” said Brett Ryan, senior U.S. economist at Deutsche Bank AG.

The University of Michigan’s latest survey of consumers shows a record share of people say it’s a bad time to buy vehicles because of high prices, while home buying conditions are the second-worst in data.

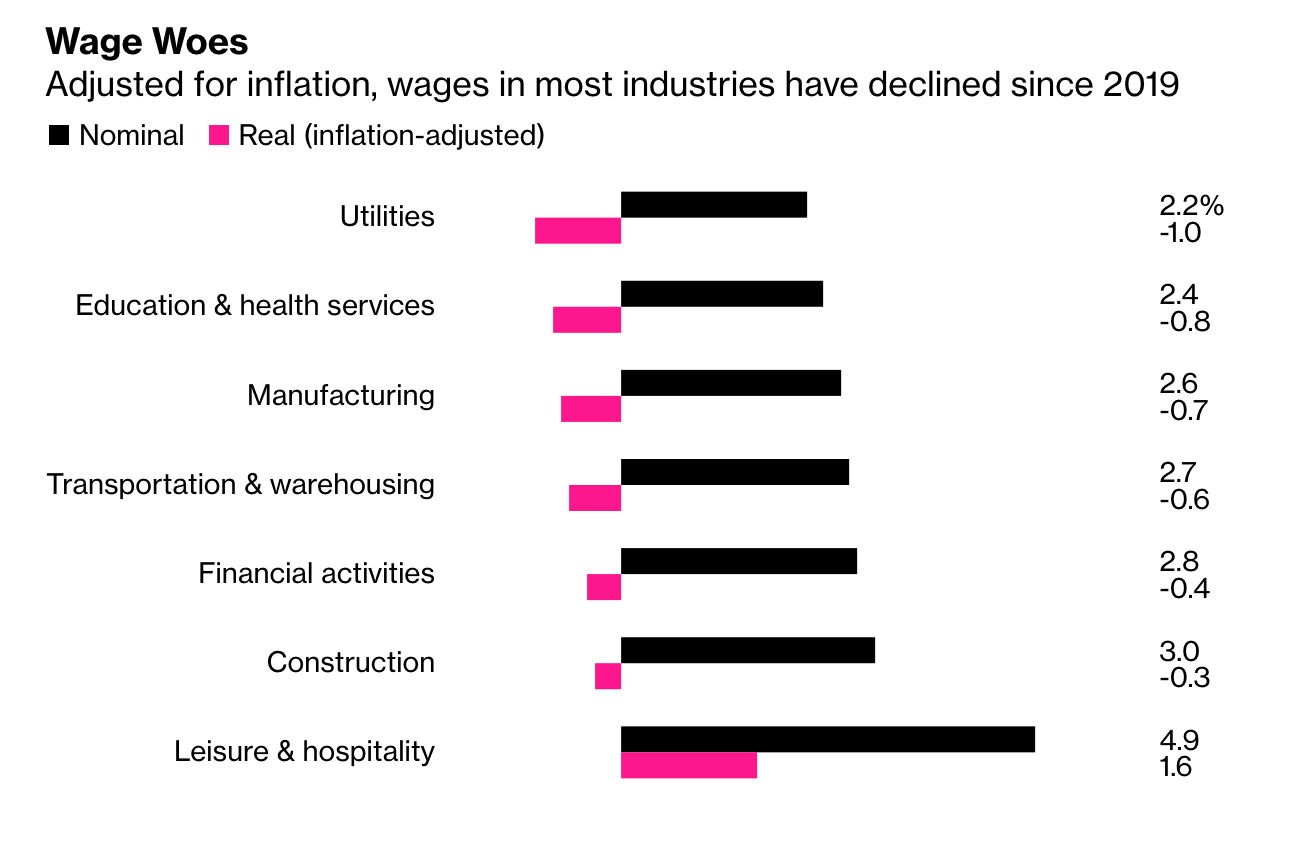

Meantime, prices are rising faster than wages in most industries. More consumers than at any time since 2012 see their financial situation worsening in the coming year.

Even for the consumers that are keen to purchase big-ticket items like cars, supply chain bottlenecks and higher prices are likely to deter spending. Morgan Stanley economists more than halved their estimate for third quarter growth last week, pointing to lack of inventory, inflation and the waning impact of stimulus checks.

To be sure, airports and restaurants are busier than they were a year ago, while entertainment venues are stirring back to life. While that indicates consumers are hankering to get back to their typical spending patterns, the more contagious delta variant is causing some consumers to pull back their activity, according to high-frequency data.

What Bloomberg Economics Says…

“A slew of disappointing consumer spending data points to a weak start to the quarter amid a resurgence of Covid-19, higher prices, and product shortages. Recent negative data surprises underscore how the delta variant remains a key determining factor for the U.S. economic outlook.”

— Bjorn van Roye, Anna Wong And Andrew Husby, Economists

Economists at Bank of America have revised down their estimates for household spending for the current quarter, though they expect spending to rebound once the delta wave of infections subsides. Much like other virus waves of the past 18 months, however, no one is sure how long this wave will last, and when the next will emerge.

Uncertainty about the path of the delta variant has led schools and businesses to rethink plans to be fully in-person this fall. That could make it more difficult for parents to return to the workforce, dampening income prospects at the same time that federal enhanced unemployment benefits have expired.

Political Sentiment

In addition to concerns about the delta variant, government policy is leaving many Americans feeling deflated. President Joe Biden’s approval rating has dropped to an all-time low of 39%, according to the latest Economist/YouGov poll, conducted Sept. 4-7.

That’s the first negative reading since his inauguration and reflected declines among Democrats, Republicans and political independents, as well as his handling of the economy, the coronavirus and the exit from Afghanistan.

At the same time, Congress faces a collision of crucial deadlines this month. Lawmakers will have to pass a stopgap funding bill to avoid a government shutdown, and they’ll have to raise the nation’s debt ceiling over the next several weeks to avoid a default on federal payment obligations.

“A debt ceiling dispute like the one that occurred in 2011 could further erode consumer confidence,” Michael Pugliese, an economist at Wells Fargo & Co. said in a note. “Furthermore, even if the debt ceiling does not cause any major disruptions, a shutdown could still weigh on the economy.”

Updated: 9-28-2021

U.S. Consumer Confidence Unexpectedly Falls To Seven-Month Low

U.S. consumer confidence dropped in September for a third straight month, suggesting concerns over the delta variant and higher prices continue to dampen sentiment.

The Conference Board’s index fell to 109.3 from a revised 115.2 reading in August, according to the group’s report Tuesday. Economists in a Bloomberg survey had called for an increase to 115.0.

The figures suggest the spread of the delta variant continues to dent consumers’ outlook of the economy and thwart spending on services. While new cases have dipped from the latest peak, they’re still rising in some states. At the same time, Americans are paying more for household goods, further weighing on sentiment.

“Consumer confidence dropped in September as the spread of the delta variant continued to dampen optimism,” Lynn Franco, senior director of economic indicators at the Conference Board, said in a statement.

“Concerns about the state of the economy and short-term growth prospects deepened, while spending intentions for homes, autos, and major appliances all retreated again,” she said.

Stocks continued to drop after the report, while the yield on the 10-year Treasury rose and the dollar strengthened.

Falling Expectations

The Conference Board’s gauge of current conditions fell to 143.4, a five-month low, while the group’s expectations index dropped to the lowest since November. Consumers’ views of present and short-term business conditions outlook also faded.

Consumers were less optimistic about their future income and job prospects. The share of consumers who said jobs were “plentiful” rose to a record 55.9%.

The figures follow the University of Michigan’s preliminary consumer sentiment index, which edged up in early September but remained close to a near-decade low. The report said high prices drove the declines in buying conditions for durable goods such as appliances and cars.

Back-to-back declines in confidence may portend a pullback in spending, which could surface in a government report on personal outlays later this week. The University of Michigan’s final September sentiment reading is also out on Friday.

Updated: 11-12-2021

Americans Think the Economy Is Bad Because It Actually Is

Wages and benefits are moving up but living standards aren’t. So it’s reasonable for people to feel pinched at the moment, no matter how positive the statistical indicators may be.

Commentators friendly to the president couldn’t understand it. The economy was expanding. Unemployment was falling. But the public was unhappy about the economy and the president’s popularity kept slipping.

That’s the way things looked in 2006 to a lot of Republicans, and they concluded that the problem was that the “Bush boom” was “the greatest story never told.”

Now the bafflement has switched parties. Paul Krugman wrote in the New York Times that “the economy has been booming this year” but that gloomy news coverage has affected people’s mood about it. Neil Irwin, in the same newspaper, called it a “great contradiction” of today’s economy: “Americans are, by many measures, in a better financial position than they have been in many years.

They also believe the economy is in terrible shape.” Economists may think inflation produces both winners and losers, he continued, but most people aren’t seeing it that way.

If this is really a puzzle, it’s a frequently recurring one. It happened during Barack Obama’s presidency, too. In 2014, a large majority of Americans thought the economy was in recession — a view that reporters pointed out was “flat-out wrong.”

Americans have, in fact, been pessimistic about the economy for most of the last two decades. Gallup’s “Economic Confidence Index” went negative after the dot-com boom went bust in 2000, and did not register sustained positive readings until the pre-pandemic part of President Donald Trump’s administration.

It might, then, be more instructive to examine what our last two periods of widespread happiness about the economy — throughout 1998 to 2000, and from mid-2018 to early 2020 — had in common. Both were times when the standard of living for most people was rising, and had been rising for a while.

Those conditions weren’t present in 2006 or 2014, even though the economy was growing and unemployment falling. Households in the middle of the income-distribution scale made less in 2014 than they did in 2000, after adjusting for inflation.

More of the years in between saw declines than gains. Americans had not seen such a prolonged period of disappointment since this data series began in 1953. The public’s unhappiness was not irrational.

It’s not irrational now, either. Income fell in 2020 as the pandemic hit. Even if living standards were rising again, positive trends would have to continue before people began to register satisfaction. But living standards aren’t yet rising, anyway.

Wages and benefits have been moving up smartly, but only in nominal terms. As the economics researchers Jason Furman and Wilson Powell III pointed out in an analysis for the Petersen Institute, total compensation is 0.6% below its December 2019 level after adjusting for inflation.

Irwin wrote that economists see rising wages and rising prices as “two sides of the same coin.” For most people, though, the net effect in today’s economy is that the coins they are getting don’t go as far.

It stands to reason that changes in the real value of wages would have a bigger effect on public sentiment than changes in the unemployment rate. The number of people paying more at the pump and the grocery store is much larger than the number of people who have gotten new jobs.

One complication in this story is that people’s financial conditions have improved, thanks to the extensive transfer payments that the federal government implemented during the pandemic. It may be, though, that people don’t see those transfers as substitutes for a continuing stream of income that they feel they are earning.

The simplest explanation for why the public thinks it’s a bad economy is that, for most people, it’s a bad economy. We don’t need to come up with a theory about the effects of modern partisanship on views of the business cycle, any more than we needed such a theory in 2006 or 2014. We need only consult the great democratic maxim: The foot knows best where the shoe pinches.

U.S. Consumer Sentiment Drops To 10-Year Low On Inflation Fears

U.S. consumer sentiment unexpectedly collapsed in early November as Americans grew increasingly concerned about rising prices and the inflationary impact on their finances.

The University of Michigan’s preliminary sentiment index decreased to 66.8 from 71.7 in October, data released Friday showed. The November figure trailed all projections in a Bloomberg survey of economists which called for an increase to 72.5.

Waning confidence reflects “ an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation,” Richard Curtin, director of the survey, said in a statement.

Consumers expect inflation to rise 4.9% over the next year, the highest since 2008, the report showed. They expect prices will rise 2.9% over the next five to 10 years, unchanged from the previous month.

“One in four consumers cited inflationary reductions in their living standards in November, with lower income and older consumers voicing the greatest impact,” Curtin said.

Surging costs for food, gas, and housing are eroding consumers’ purchasing power despite stronger wage growth. About half of all families anticipate declines in inflation-adjusted incomes next year, according to the data. The sentiment figures follow government data earlier in the week that showed the highest annual inflation in three decades.

While consumers are growing more distraught over inflation’s impact on buying conditions, household spending showed signs of improving at the end of a soft third quarter.

“Looking ahead, the risk is outsize, persistent price rises feed into the consumer-inflation psyche,” Bloomberg economist Eliza Winger said in a note. “In the near term, shortages and prices should restrain inflation-adjusted spending.”

Political Impact

President Joe Biden said in a statement earlier this week that addressing rising inflation is a “top priority” for him as he faces declining approval ratings. The Michigan figures showed a deep divide along partisan lines.

Sentiment among Republicans plunged 17 points to the lowest on record while for Democrats respondents it slipped 5.3 points.

The Michigan report showed buying conditions for household goods deteriorated sharply, with a gauge falling to a reading of 78 that was the second-lowest in data back to 1978. There were more frequent mentions in the survey of higher costs for vehicles, durable goods and homes.

Twenty-four percent of households expect to be worse off in the coming year, the highest since June 2008, according to Curtin.

The gauge of current conditions dropped to 73.2, the lowest since 2011. A measure of future expectations decreased to 62.8, which was the weakest since 2013, according to the survey.

Americans are also more pessimistic about the economy’s prospects over the coming five years. The university’s gauge fell to the lowest since 2011.

Updated: 11-15-2021

Republican Consumer Sentiment Is Worse Today Than It Was During The Height Of The Financial Crisis

Consumer sentiment has been sliding across the board lately, owing in large part to accelerating inflation.

But one contribution to diminished readings may be extreme political polarization. Check out this chart (which I wrote about this morning) showing consumer sentiment among Republicans crashing to a level that’s even lower than the financial crisis. This is from the University of Michigan survey that came out on Friday.

There are probably a number of factors behind this. The most simple is that in an era of extreme polarization, every question is being answered through a political lens. And so the party out of the White House sees things particularly bleakly.

Surging quit rates may be another factor, hitting small businesses particularly hard (small business owners are a notable Republican constituency). It’s also possible that factors like gasoline prices are hitting Republicans harder (if one surmises that Democrats are more concentrated in cities and rely less on automobile usage).

Regardless, it’s an absolutely stunning chart.

Meanwhile, this morning, Larry Summers warned fellow Democrats that rising inflation could be the thing that ultimately brings Donald Trump back to The White House.

Updated: 12-15-2021

American Consumer Momentum Wanes Just In Time For The Holidays

* Retail Sales Growth Is Starting To Falter As Stimulus Fades

* U.S. Spending Has Boosted Global Growth, Can It Continue?

The American consumer has held strong since last year’s Covid-driven spending pause, as their purchases helped power the global economic recovery. But that momentum may be fading as the holiday season approaches.

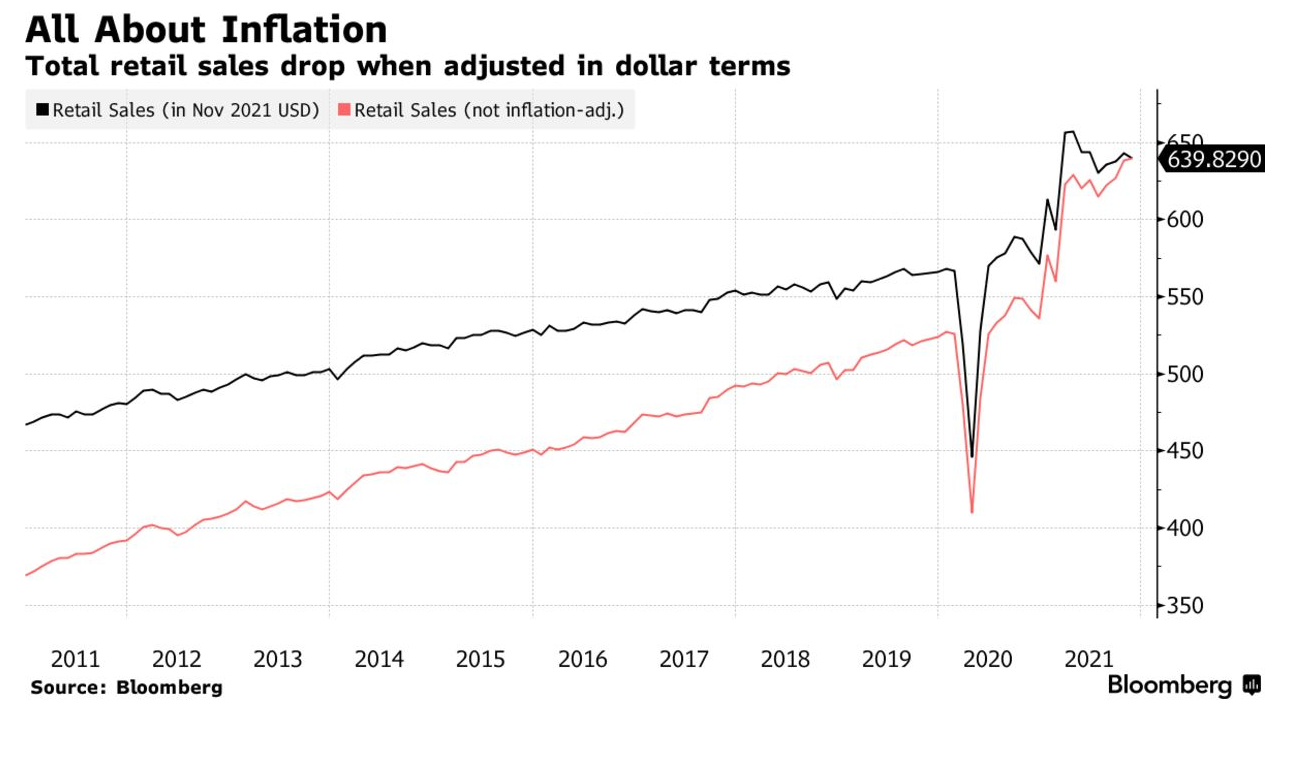

Today’s Chart of the Day looks at the retail sales boom compared to pre-pandemic trends. Spending took an initial Covid-related hit in spring 2020, but since then the trajectory has been mostly upward, eventually hitting a record high.

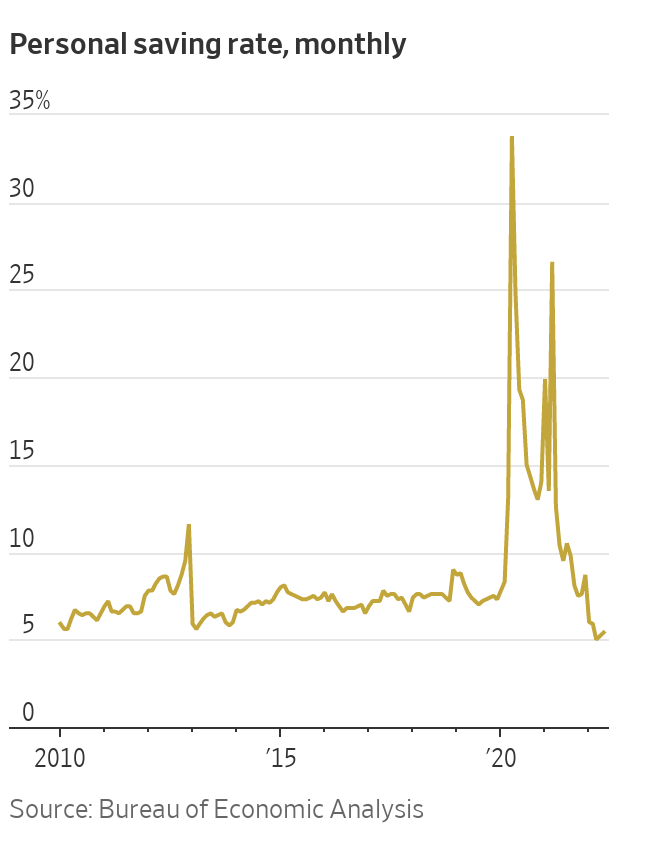

Stimulus clearly played a role, boosting the savings rate to a record — even higher than what was seen during the austerity of the Great Depression.

But now, the effects of that stimulus are wearing off and the savings rate as a percentage of disposable household income has drifted down to 2019 levels. In other words, the tailwinds pushing the spending boom are easing and momentum is waning. The result is a new, relatively flatter year-to-date trend line.

November retail sales increased 0.3% from October, falling short of the expected 0.8% rise. Investors’ knee-jerk reaction was to turn defensive, with Nasdaq futures catching a bid and Treasury yields dipping lower.

This year’s data carries extra significance as demand was largely expected to be pulled forward from December in anticipation of supply-chain snags and shipping delays. Economists are also wondering if some of that demand showed up in October as well.

The data also serves as an indication of how rising inflation and diminishing real wages are weighing on American consumer spending during a typically strong period for retailers powered by holiday gift-buying. The results aren’t encouraging. On an inflation-adjusted basis, taking into account CPI data, retail sales growth is actually negative.

In the pandemic era, the sustained ability to spend was a uniquely American story. In Europe and China, sales data is back to pre-pandemic levels. The momentum there faded a while ago. Europe used job-retention programs instead of stimulus checks, while China was largely affected by lockdown policies.

Overnight Chinese data showed retail sales growth of 3.9% year-over-year, short of the estimated 4.7%, while industrial output rose 3.8% on an annual basis, slightly higher than the 3.7% estimate. Even exports are hitting records.

At the end of the day, the U.S. is a consumer-driven economy, and the nation’s fiscal stimulus efforts helped power activity at home as well was growth globally. But with inflation rising and fiscal support waning, it’s worth wondering the American consumer can continue to lead that charge. Or is this the first sign of a deceleration in global growth?

Updated: 3-28-2022

American Consumers Are Starting To Hit Their Breaking Point

Evidence is mounting that the days of pandemic-era profligate spending may be over in a bad sign for stocks and corporate bonds.

Signs are emerging that the resilience of American consumers is rapidly waning, potentially undermining one of the few remaining pillars supporting the bull market in equities.

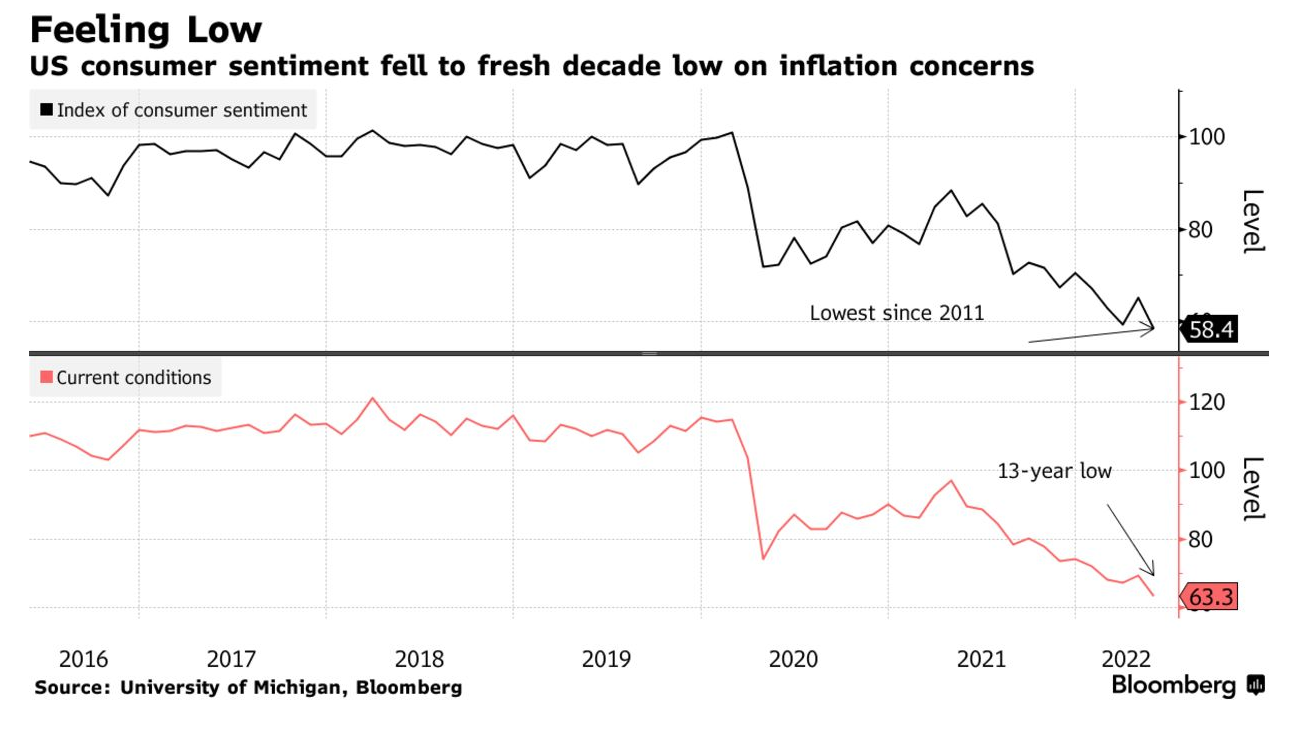

U.S. households have until recently mostly absorbed higher prices on everything from coffee to chicken to clothes, helping companies maintain fat profit margins despite higher input. But that doesn’t mean consumers were happy about paying more for the same goods, which is why the University of Michigan’s sentiment index has steadily deteriorated to the lowest since 2011.

The line from the bulls has been to watch what consumers do, not what they say. And for the most part, the bulls have been right about consumer spending, which is why many investors remain positive on stocks and the riskier parts of the credit markets. Although Americans have griped about higher prices, they have kept buying goods and have increasingly gone out to eat and started traveling as the pandemic waned.

But the latest surge in inflation rates, stemming in part from rising energy prices as a result of Russia’s invasion of Ukraine, has pushed many households to the breaking point. Energy prices have surged about 26% over the past year while food costs have jumped 8% in the largest increase since 1981, according to Joseph Lavorgna, the chief economist at Natixis North America LLC. These two inputs account for more than 20% of household outlays, he wrote in a March 23 research note.

Meanwhile, the big increase in homes prices and the recent increase in 30-year mortgages rates to 4.5% from about 3% last year has pushed home loan payments as a percent of family income to 22.4% on average for new buyers from 18.7%, according to Tom Porcelli, the chief U.S. economist at RBC Capital Markets. Standard Chartered Bank strategist Steven Englander calculates that housing affordability is the lowest since 2007, with costs an estimated 15% higher in March than December.

Retail sales data have been resilient on a nominal basis, supported by inflation that isn’t stripped out of the numbers. But a look at unit sales of general merchandise goods such as apparel, footwear, toys and sports equipment dropped in nine out of 10 weeks between the end of December and early March on a year-over-year basis, according to NPD Group data cited in a recent Wall Street Journal article. The report noted that 43% of consumers recently surveyed said they would delay less-important purchases if prices kept going up.

Analysts expect this trend to show up in Thursday’s personal consumption data, with the pace of increased spending expected to lag behind the inflation rate. It will also be important to watch the saving rate, which has dropped back to pre-pandemic levels. If the rate falls further, it may show that consumers are whittling down cash piles built up during the pandemic. Even if the rate stays the same, it may indicate that the days of profligate, pandemic-era spending are over.

The shift among consumers has been subtle, but one that has consequences amid the monetary and fiscal policy tightening that is currently happening. Consumer spending accounts for almost 70% of the annual economic output, up from around 60% in the early 1980s, the last time consumer price inflation was as high as it is now. The more consumers push back on higher prices, the bigger the ripple effect throughout the economy. Companies will see their profit margins shrink, diminishing their appetite to expand, invest or hire new people who are demanding substantially higher wages.

This isn’t a reason to sell stocks or high-yield bonds outright. Many companies still have high cash balances and they have taken advance of buoyant credit markets in recent years to extend their debt maturities at historically low interest rates. But at the same time, the emerging weakness in consumer spending is enough to suggest that it’s no longer safe to employ a “buy the dip” investing strategy like it was just a couple of months ago.

The longer consumers rein in their spending in response to the highest rates of inflation since the early 1980s, the more difficult it will be to emerge from the recession that seems increasingly inevitable. As we now know, recessions resulting from sudden exogenous shocks, such as the Covid-19 pandemic-induced on in 2020, can be reversed or offset extremely loose monetary policy and extremely generous fiscal policy. We may be about to find out that recessions born out of stagflationary shocks are harder to mitigate.

Updated: 5-27-2022

US Consumer Sentiment Falls To Fresh Decade Low On Inflation

* Final May University Of Michigan Gauge Declined To 58.4

* Views Of Economic Outlook, Buying Conditions Deteriorate

US consumer sentiment deteriorated further in late May to a fresh decade low as escalating concerns over inflation dimmed the outlook for the economy.

The University of Michigan’s final May sentiment index decreased to 58.4 from a preliminary reading of 59.1, data released Friday showed. In April, the gauge stood at 65.2.

Households turned especially pessimistic in their short- and long-term outlooks for the economy. A gauge of current conditions fell to a 13-year low of 63.3, while a measure of future expectations dropped to 55.2.

Consumers expect prices to rise 5.3% over the next year, holding close to a four-decade high. They expect prices will climb at an annual rate of 3% over the next five to 10 years.

“This recent drop was largely driven by continued negative views on current buying conditions for houses and durables, as well as consumers’ future outlook for the economy, primarily due to concerns over inflation,” Joanne Hsu, director of the survey, said in a statement.

The university’s index of buying conditions for durable goods dropped in May to the lowest level on record.

Inflation is outpacing wage gains, stressing Americans’ finances and leaving less discretionary income after covering for higher costs of food and gas. And while workers have enjoyed a strong job market, there are signs that pay increases have peaked.

A separate report earlier Friday showed inflation-adjusted consumer spending rose in April by the most in three months, indicating households were holding up in the face of persistent price pressures by dipping into savings.

President Joe Biden and fellow Democrats are desperate to bring inflation down ahead of midterm elections later this year, and so far Americans are frustrated with their efforts. Opinions on government policies to fight inflation and unemployment are at the lowest since 2014, the university’s report showed.

Updated: 6-28-2022

Consumers’ Outlook On The Economy Hits Lowest Point In Nearly A Decade

Conference Board’s expectations index for June dips to level not seen since 2013 as overall consumer confidence falls.

Consumers’ short-term outlook for the U.S. economy dropped sharply to its lowest point in nearly a decade on concerns about inflation, the Conference Board’s consumer-confidence survey showed.

The consumer-confidence index, which hints at American attitudes toward jobs and the economy, also fell, dropping to 98.7 in June, down 4.5 points from 103.2 in May, the Conference Board said on Tuesday.

The board’s expectations index, which measures consumers’ short-term outlook about the labor market, business and income, reached a low of 66.4 in June from 73.7 the prior month. That was its lowest reading since March 2013.

“Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices,” said Lynn Franco, senior director at the Conference Board. “Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by year-end.”

The survey adds to evidence that inflation is weighing on households. A separate survey of consumer sentiment, which polls consumer attitudes on personal finance, this month dropped to its lowest point on record, according to the latest report from the University of Michigan.

When consumer sentiment and confidence decline in tandem, spending usually decreases with it, said Bernard Baumohl, chief global economist at the Economic Outlook Group. Mr. Baumohl pointed to a decline in spending in May retail sales numbers.

“Consumers are the bedrock of the economy,” he said. “They have been on an emotional roller coaster the last 2½ years, and we’re seeing now that they are pretty much close to the breaking point.”

Diane Swonk, chief economist at Grant Thornton, said the economy has shown signs of losing momentum and that the risk of recession has dramatically increased. “Even with a strong labor market, it’s not enough to make everyone feel good about the economy when their living standards erode,” Ms. Swonk said.

Nearly 30% of those surveyed in June expect business conditions to worsen, according to the Conference Board survey. And 23% of consumers said business conditions were “bad,” up from 21.7% the prior month.

Stephen Stanley, chief economist at Amherst Pierpont, said rising prices are eating into consumer purchasing power, and it is making consumers “more grumpy than fearful.”

“Most of them are confident that they will remain employed,” Mr. Stanley wrote in a note. “In this context, I do not expect the low level of confidence to correlate with a major pullback in consumer spending, the way that it might if households were worried about holding their jobs.”

Updated: 7-5-2022

Americans Tap Pandemic Savings To Cope With Inflation

Households at almost all income levels drew down accumulations in first quarter to cover costs.

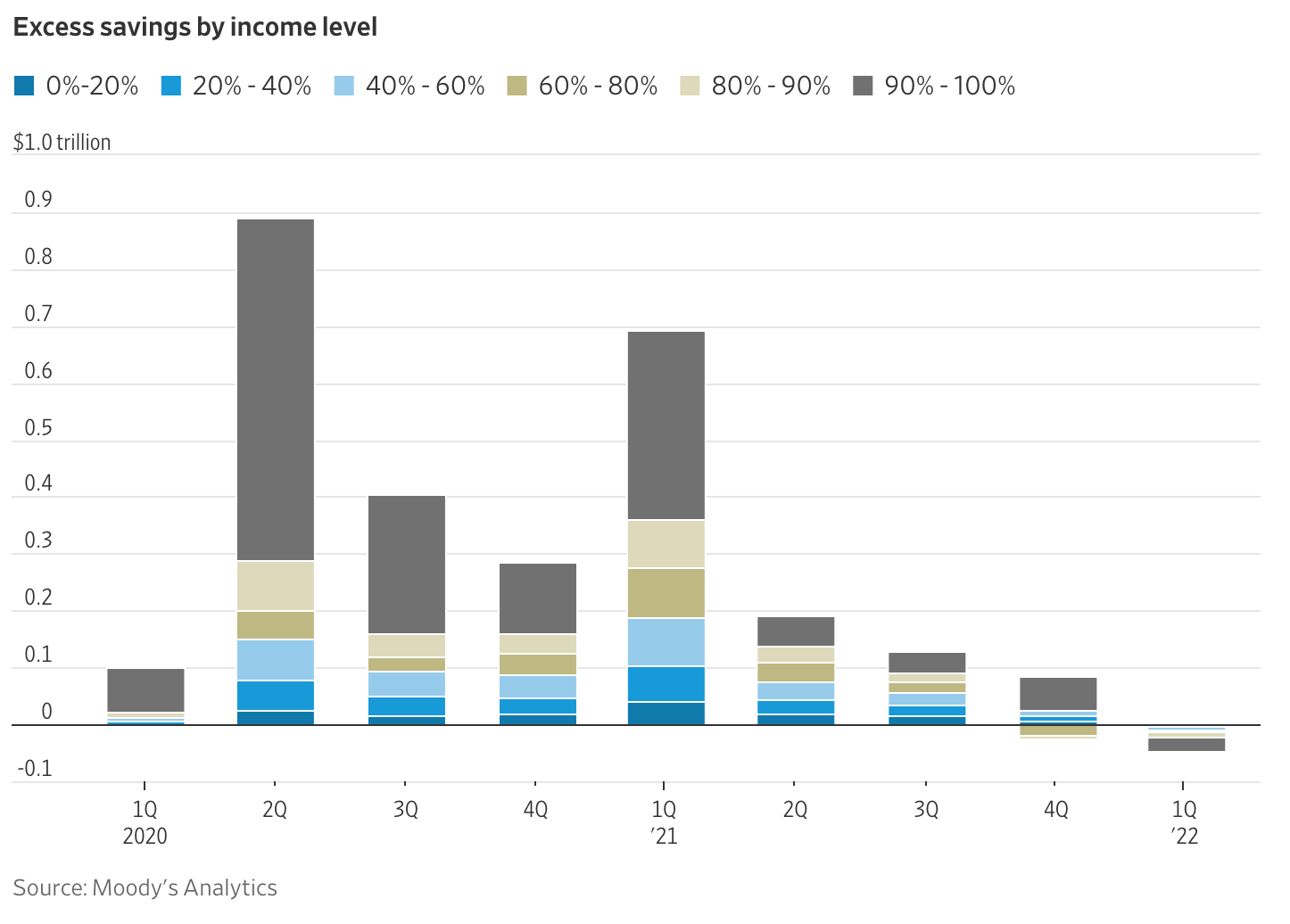

Americans are starting to dip into the huge pile of savings they accumulated over the first two years of the pandemic.

From the start of the pandemic to the end of 2021, U.S. households built up $2.7 trillion in extra savings, according to Moody’s Analytics. Covid-19 lockdowns kept people at home with nowhere to spend money, and three rounds of stimulus payments boosted their incomes.

Now, with inflation at its highest point in decades and wage gains trailing behind, Americans are turning to that stash to cover costs.

The personal saving rate, a measure of how much money people have left over after spending and taxes, reached 5.4% in May. That figure is below the average of the last decade and far below the record of 34% in April 2020, according to the Bureau of Economic Analysis.

Families have tapped about $114 billion of their pandemic savings so far, according to Moody’s Analytics, which analyzed government data.

“Most households have a cash cushion to navigate through the very high inflation,” said Mark Zandi, Moody’s Analytics chief economist. “This is allowing consumers to stay in the game.”

Stimulus checks and expanded child-tax-credit payments helped Shannon Houston and her husband cover major expenses, including daycare. “It was just enough buffer to make things easier month to month,” said Ms. Houston.

The child tax credit gave families up to $300 per child each month in the second half of 2021, but that ended in December. The federal government’s last stimulus checks were sent more than a year ago.

Each month this year, the Connecticut couple has drawn on their savings, which includes money from the child tax credit as well as prepandemic savings. Higher prices are forcing the family to spend more on gas and groceries for their two children, Ms. Houston said.

Ms. Houston, 37 years old, works part time as a freelance communications specialist for nonprofit organizations but is considering returning to work full time when her son starts kindergarten in the fall. “We don’t want to completely squander our savings,” she said.

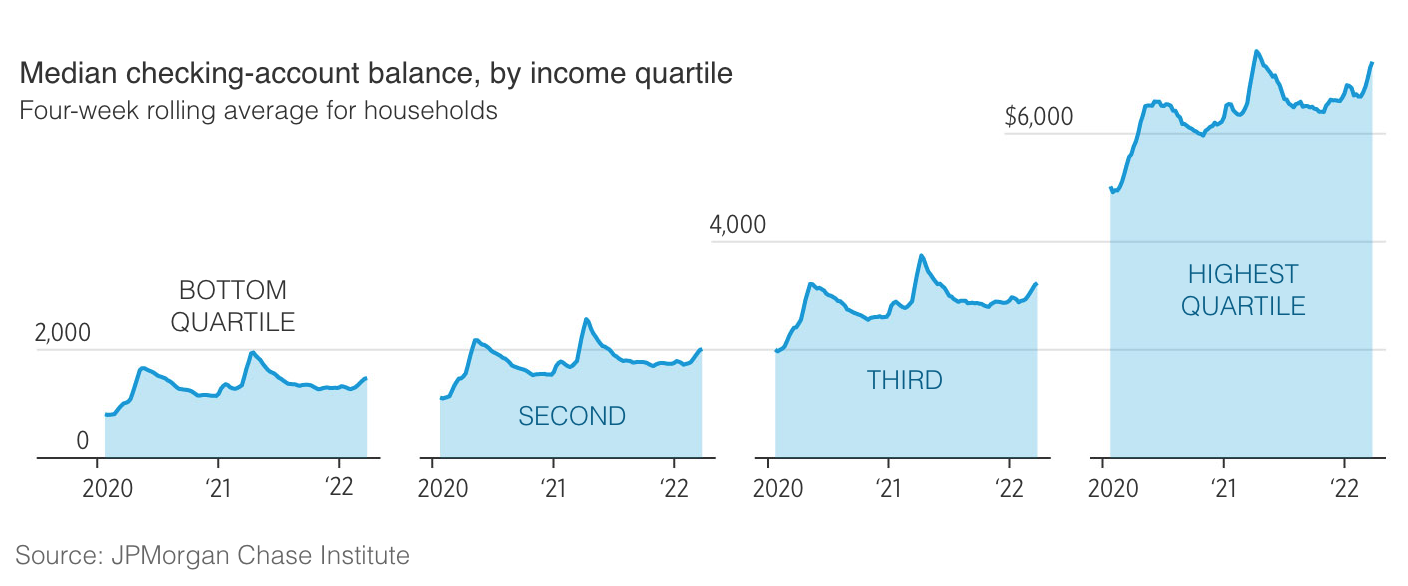

Americans’ checking-account balances jumped after they got their pandemic stimulus payments, bank executives have said.

While customers have spent some of that money, balances still remain markedly above where they were in 2019, said Chris Wheat, co-president of the JPMorgan Chase Institute, the bank’s in-house think tank. At the end of March, balances of families with the lowest incomes were 65% above 2019 levels.

Still, they used to be higher. In March 2021, around the time of the third round of federal stimulus checks, balances for those families were up 126% from 2019 levels.

JPMorgan Chief Executive Jamie Dimon last month said U.S. consumers still had between six and nine months of spending power remaining in their bank accounts.

Darius Palmer built up an investment account of more than $5,000 by stashing away money from his paycheck and some earlier pandemic stimulus payments.

But he turned to his credit card to cover costs for trips this year to Philadelphia and Washington, D.C., when they were more expensive than he anticipated.

The 24-year-old industrial engineer is weighing different options for paying off the $2,000 balance. He plans to cancel a meat-subscription service that costs around $150 a month and buy fewer books.

If the North Carolina resident can’t cover the payment with his income, he plans to dip into his investments.

Mr. Palmer is also concerned about the potential end of the student-loan payment moratorium. The government paused payments on federal student loans in the spring of 2020, though borrowers might have to start making monthly payments again this fall.

“I know what it’s like to have to tighten the belt,” Mr. Palmer said.

The bottom 20% of earners was the only income group that didn’t draw on their pandemic savings in the first quarter of the year, Moody’s Analytics found. “These are folks working in leisure, hospitality, retail, healthcare,” Mr. Zandi said. Strong wage growth has allowed many of these workers to continue to save.

Eric Cullen was laid off from his job at AmeriCorps at the start of the pandemic. Over the following months, he was able to save about half of his federal stimulus checks and unemployment payments.

The 27-year-old continued to increase his savings after he took a job at an upscale New Orleans restaurant in spring 2021, where he initially earned about $500 a week as a busser and food runner.

A staff shortage helped him get promoted to a waiter position, where he sometimes brought home as much as $1,500 weekly.

Mr. Cullen recently moved back to his hometown near Albany, N.Y. He noticed gas prices going up steadily on the drive north from Louisiana. “I was initially taking this summer off,” he said.

Updated: 7-14-2022

People Have Money But Feel Glum—What Does That Mean For The Economy?

Strong job market and savings have shielded consumer spending so far, but it is endangered by inflation that has some households running scared.

Inflation is melting away the value of household paychecks. Even so, household finances are as strong overall as they’ve been in decades, thanks to money saved during the pandemic, debt paid off over the past decade and a strong job market.

The economic outlook now hangs on which of these forces proves greater.

More than two-thirds of U.S. economic activity is tied to household spending. Recessions typically are accompanied by a pullback by consumers. Spending has surged during the pandemic, but it now shows signs of cooling.

Last year, Alexandra Peña, 27, of Brooklyn, N.Y., was thinking, “Wow, we saved so much money.” She estimates she and her husband saved $21,000 between canceled date nights and a postponed honeymoon, federal relief checks and her getting a higher-paying job. They used some of that to buy a Peloton exercise bike for their apartment.

Recently, however, inflation has shifted their perspective. Because of rising costs, she says, she has cut back on luxuries such as new clothes, manicures and haircuts, and she is trying to avoid eating out.

In February, she and her husband started looking for their first home purchase. But in recent weeks, after watching their stock portfolio sink and interest rates rise, they have put the search on hold.

“I look at my bills after going to the grocery store and wonder, ‘Who stole my credit card?’” Ms. Peña said.

A consumer pullback would be a big reversal if it gathers force. Spending jumped in 2021. At the end of last year, household purchases of cars, restaurant meals, clothing and other goods and services were up almost 7% from a year earlier, adjusted for inflation.

This spring, between March and May, that growth rate settled to 2% from a year ago, slightly below average when compared to the previous two decades.

The hit from the pandemic proved short-lived for many. Two years since it began, household finances are remarkably strong.

At the end of March, households had $18.5 trillion socked away in deposit, savings and money-market accounts, more than $5 trillion above what they had heading into the pandemic, according to Federal Reserve data.

Cash reserves rose across income groups. JPMorgan, tracking 7.5 million of its own accounts, found that checking-account balances averaged nearly $1,400 among its lowest-income customers in the first quarter, up from under $900 before the pandemic. Among its highest-income accounts, balances rose to almost $7,000 from less than $5,500.

Many Americans used federal relief checks to pay down debt, according to surveys by the Federal Reserve Bank of New York. Household financial obligations—including monthly rent, mortgage payments, car leases, homeowners’ insurance and other recurring bills—were 14% of their disposable income in the first quarter, according to the Fed.

That was historically low. Heading into the recessions of 1991, 2001 and 2007, that share was 17% to 18%, meaning households had less income after meeting regular payments. As unemployment rose, households cut back on spending to pay their bills.

The three- to four-percentage-point difference between then and now adds up to a lot—roughly $550 billion to $725 billion of yearly income collectively that households can save or spend.

Until stocks fell into a bear market in the second quarter, household wealth also was abundant. Net worth—assets such as homes and stocks minus debts—was eight times disposable income at the end of the first quarter, greater than 6.7 at the height of the 2000s housing boom and 6.2 during the 1990s tech bubble, according to the Fed.

“Consumer demand continues to be strong for us,” John Lawler, chief financial officer for Ford Motor Co., told analysts in June. “Our order bank is still very robust.” At 300,000, he said, the company’s order book still exceeded its ability to produce cars.

Executives at Levi Strauss & Co. said last week they were seeing moderation in demand for lower-end brands, though overall spending looked strong.

“We really have not seen any softening or have heard really any concern about Levi’s [core brands] from our customers,” said Charles Victor Bergh, CEO. Revenue in the second quarter was up 15% from a year earlier; households were shifting from online shopping to shopping in stores, the company said.

Nycole and Brady Walsh have been doing their own calculations lately from their Austin, Texas, home.

The past decade and before weren’t easy. Nycole, 40, emerged from nursing school in 2008 with $40,000 in student loans and a national economy in deep recession. She scaled back wedding plans when her mom, who was helping fund the event, lost her job. She also sold a house at a loss.

A decade of careful budgeting, and some good fortune, left her better off. She and a new husband, 42-year-old Brady, bought another home in Austin, which doubled in value, and she paid off the student loans.

Before 2020, they made it a tradition to visit Disney World in Florida and Disneyland in California once each year. Then Covid put those trips on hold. The family returned to Disney World in May and booked a follow-up trip to Disneyland, where they are vacationing again.

The latest trip, however, includes modest but potentially telling changes in their behavior. With inflation soaring, they’re cutting back on how much they’ll spend on Mickey Mouse souvenirs for their two children to bring home. They’re also ordering fewer cocktails at the pool.

“As a millennial parent, I think we’re just so used to everything being hard at every juncture,” Ms. Walsh said. “If it’s not a plague then it’s a recession. Or it’s another recession. Or it’s a terrorist attack. It feels like I just expect it at this point.”

Consumer psychology is an ingredient in spending decisions, and consumers’ nerves right now look more frayed than their bank accounts.

“People really hate inflation,” said Andrew Haughwout, director of household and public policy research at the New York Fed.

The University of Michigan, which has been surveying households for decades about their beliefs about spending, inflation and the economy, finds consumer sentiment deeply depressed.

It is at levels typically associated with recession, even though the majority of Americans say they are better off than five years ago and expect to be better off five years from now.

Its index of consumer sentiment in the second quarter was about as low as at the depths of the 2007-09 recession, when the unemployment rate hit 10%, compared to June’s 3.6% rate. The sentiment index was much lower than it was at troughs during 1991 and 2001 recessions.

It is a remarkable finding because another survey, by the Conference Board, finds the share of households who believe jobs are easy to get is near the highest in decades, thanks to historically low unemployment.

In this case, inflation, not lack of jobs, is the driving force of household malaise.

The Michigan survey shows that many households believe now is a terrible time to shop, especially for big-ticket items like cars and household appliances—worse even than the recessions of 2001 or 2007-09.

“Consumers signaled strong concerns that inflation will continue to erode their incomes,” Joanne Hsu, who runs the Michigan survey, said of the latest reading. “While consumer spending has remained robust so far, the broad deterioration of sentiment may lead [consumers] to cut back on spending and thereby slow down economic growth.”

How people say they feel doesn’t always align with what they’ll do.

A survey in April by the New York Fed found that nearly a third of 1,300 respondents planned a vacation in the next four months, the highest in the survey’s seven years. Their spending plans for vehicles and furniture were stable.

“The situation is a little bit unique,” said Wilbert van der Klaauw, director of the New York Fed’s Center for Microeconomic Data. “There might be pent up demand for services like vacations.”

Hotel traffic has been climbing, according to STR Global, which tracks travel behavior. Stays at U.S. hotels totaled 117.5 million in June, up 8.2% from a year earlier. The Transportation Security Administration cleared 24.5 million travelers at U.S. airports between July 1 and July 11, up 10.6% from a year earlier, though still below prepandemic levels.

Economists say the outlook for consumer spending depends heavily on whether the nation’s inflation fever recedes. Even though jobs are plentiful and unemployment very low, vast numbers of Americans find their cost of living is rising faster than the income they’re bringing home.

Not only is that discouraging, it is eating into those savings socked away during the pandemic. Adjusted for inflation, weekly worker paychecks in June were down 4.4% from a year earlier—the worst month since the depths of the 2008 recession, when inflation was low but pay was falling.

More people might join the workforce as they run down their savings. The labor force participation rate for adults aged 25 to 54 was 82.3% in June, still modestly below the level of 83% reached at the highest of the last expansion. For older Americans, labor force participation is even further below pre-pandemic levels.

At some point, if inflation doesn’t give, consumers seem bound to crack.

Amy Willson, a New Orleans small-business owner and mother of three boys, said she feels demoralized about her family’s financial prospects—and the country’s.

“There’s definitely that feeling of just like, we’re in the pits and I don’t really see a way out,” Ms. Willson, 38, said.

Her husband, Joel, a musician, lost his wedding and church gigs at the beginning of the pandemic. Ms. Willson’s business, which provides childbirth education classes and doula support to new moms, also took a hit. Relief payments, government unemployment checks and savings helped the family stay afloat.

As the nation reopened in 2021, Mr. Willson went back to work, and business at Ms. Willson’s Louisiana Baby Company boomed. The Willsons contacted a lender to see if they could start the process of getting pre-approved for a loan to buy a home.

“And then as the months went by we were like, ‘Ooh, ooh, oh no, oh no,’” Ms. Willson said of how their expenses began to surge. In addition to gasoline and food, their costs went up for electricity, car insurance and monitoring a security system.

They scrapped plans to sign their boys up for music lessons this summer, and the house search went on hold.

“I’m feeling pretty scared, honestly,” Ms. Willson said. All of the family’s financial padding has gone to cover the higher cost of necessities. She estimates that their baseline expenses have gone up by $1,000 a month since March.

Ms. Willson especially misses being able to visit local businesses. “Even if it’s only $50 here and there, I really like to patronize the little guy. It’s just something we haven’t been able to do recently,” she says.

Updated: 10-25-2022

US Consumer Confidence Falls To Three-Month Low

* Conference Board Index Decreased To 102.5 In October

* Views Of Present Situation Plunged To Lowest Since April 2021

US consumer confidence fell in October by more than expected to a three-month low as widespread inflation and growing concerns about the economic outlook weighed on Americans.

The Conference Board’s index decreased to 102.5 from a 107.8 reading in September, data out Tuesday showed. The median forecast in a Bloomberg survey of economists called for a drop to 105.9.

A measure of expectations — which reflects consumers’ six-month outlook — dropped to 78.1, while the group’s gauge of current conditions plunged to 138.9, the lowest since April 2021.

The pullback in confidence underscores how high prices across the economy and growing concerns that aggressive interest-rate hikes by the Federal Reserve will tip the US into recession are weighing on consumers.

And with just two weeks to go until midterm elections, it’s a worrisome sign for President Joe Biden and Democrats as they try to maintain their thin congressional majorities.

“Concerns about inflation — which had been receding since July — picked up again, with both gas and food prices serving as main drivers,” said Lynn Franco, senior director of economic indicators at the Conference Board.

“Looking ahead, inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers,” she said.

There are already signs consumers are shifting their buying patterns to adapt to high prices. Amazon.com Inc. shoppers largely skipped pricey purchases during the company’s Prime sale sequel, and Coca-Cola Co. said it benefited from bundling different sizes and mixes of its products for price-conscious consumers.

What Bloomberg Economics Says…

“Tighter monetary policy has cooled demand. Home sales and general housing-market activity have deteriorated sharply. Consumers will likely continue to reduce spending on goods, while spending cautiously on services.”

–Eliza Winger, Economist

Despite the pullback in sentiment, buying plans for autos, homes and major appliances like washing machines and TVs all rose. Vacation intentions retreated.

The median inflation rate seen over the next 12 months ticked up in October, the first increase since June. September data on the personal consumption expenditures price index, which the Fed uses for its inflation target, as well as real consumer spending will be released Friday.

Sentiment continued to be supported by the jobs market, though there are signs of cooling. The share of consumers who said jobs were “plentiful” fell to 45.2%, the lowest since April 2021. Those who say jobs are hard to get rose to the highest share since last September, though remained historically low.

Related Articles:

Donald Trump Boards Air Force One With Toilet Paper On Shoe

Stock-Market Trading Volumes Decline As Liquidity Concerns Rise (#GotBitcoin?)

The Downside To Charles Schwab And TD Ameritrade Eliminating Trading Fees (Yes, Really)

Insiders Profiting From Advanced Knowledge Of Donald Trump Tariff Announcements

Trump Outstripping Obama On Pace Of Executive Orders

White House Condemns Anti-Media Video Shown At Pro-Trump Conference

If E-Commerce Doesn’t Kill Your Store, Sky-High Rents Will (#GotBitcoin?)

$381 Billion Annual Gap Between Taxes Owed And Taxes Collected (#GotRecession?)

When Sales At Struggling Chains Fall Faster Then Commercial Rents (#GotRecession?)