Parts of America Are Already In Recession (#GotBitcoin?)

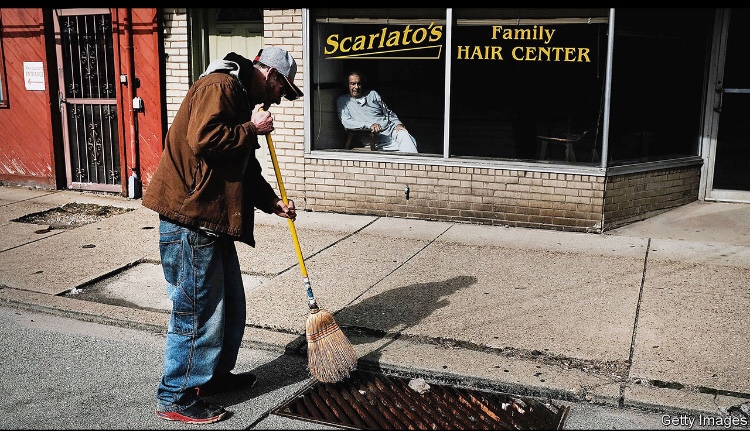

Slowdowns in housing construction and manufacturing are ominous. Parts of America Are Already In Recession (#GotBitcoin?)

IT CAN BE hard to know when isolated announcements become something more. Since last November General Motors has cut several thousand factory jobs at plants across the Midwest. In early August US Steel said it would lay off 200 workers in Michigan. Sales of camper vans dropped by 23% in the 12 months ending in July, threatening the livelihoods of thousands of workers in Indiana, where many are made.

Factory workers are not the only ones on edge. Lowes, a retailer, recently said it would slash thousands of jobs. Halliburton, an oil-services firm, is cutting too.

In any given month, even at the height of a boom, more than 5m Americans leave a job; nearly 2m are laid off. Most of the time, however, overall employment grows. But not all the time. America may or may not be lurching towards a recession now.

For the time being employment and output continue to grow. But in the corners of the economy where trouble often rears its head earliest, there are disconcerting portents.

Recessions are synchronised declines in economic activity; weak demand typically shows up in nearly every sector in an economy.

But some parts of the economic landscape are more cyclical than others—that is, they have bigger booms and deeper slumps. Certain bits tend to crash in the earliest stages of a downturn whereas others weaken later.

Every downturn is different. Those caused by a spike in oil prices, for example, progress through an economy in a different way from those precipitated by financial crises or tax increases.

But most recessions follow a cycle of tightening monetary policy, during which the Federal Reserve raises interest rates in order to prevent inflation from running too high. The first rumblings of downturns usually appear in areas in which growth depends heavily on the availability of affordable credit.

Housing is often among the first sectors to wobble; as rates on mortgages go up, this chokes off new housing demand. In a paper published in 2007 Edward Leamer, an economist at the University of California, Los Angeles, declared simply that “housing is the business cycle”. Recent history agrees.

Residential investment in America began to drop two years before the start of the Great Recession, and employment in the industry peaked in April 2006.

Conditions in housing markets were rather exceptional at the time. But in the downturn before that, typically associated with the implosion of the dotcom boom, housing also sounded an early alarm. Employment in residential construction peaked precisely a year before the start of the downturn.

And now? Residential investment has been shrinking since the beginning of 2018.

Employment in the housing sector has fallen since March.

Things may yet turn around. The Fed reduced its main interest rate in July and could cut again in September. If buyers respond quickly it could give builders and the economy a lift. But housing is not the only warning sign.

Manufacturing activity also tends to falter before other parts of an economy. When interest-rate increases push up the value of the dollar, exporters’ competitiveness in foreign markets suffers. Durable goods like cars or appliances pile up when credit is costlier.

In the previous cycle, employment in durable-goods manufacturing peaked in June 2006, about a year and a half before the onset of recession. This year has been another brutal one for industry. An index of purchasing managers’ activity registered a decline in August.

Since last December manufacturing output has fallen by 1.5%. Rather ominously, hours worked—considered to be a leading economic indicator—are declining. Some of this is linked to President Donald Trump’s trade wars, which have hurt manufacturers worldwide. But not all. Domestic vehicle sales have fallen in recent months, suggesting that Americans are getting more nervous about making big purchases.

In some sectors, technological change makes it difficult to interpret the data. Soaring employment in oil industries used to be a bad sign for the American economy, since hiring in the sector tended to accompany consumer-crushing spikes in oil prices. But America now produces almost as much oil as it consumes, thanks to the shale-oil revolution.

A recent fall in employment and hours in oil extraction may be a bad omen rather than a good one. By contrast, a fall in retail employment was once unambiguously bad news. But retail work in America has been in decline for two and a half years; ongoing shrinkage may not signal recession, but the structural economic shift towards e-commerce.

Other signals are less ambiguous. In recent decades employment in “temporary help services”—mostly staffing agencies—has reliably peaked about a year before the onset of recession. The turnaround in temporary employment in 2009 was among the “green shoots” taken to augur a long-awaited labour-market recovery. Since December it has fallen by 30,000 jobs.

Midwest’s Faltering Economies Will Spread Pain Nationwide

Financial strain is increasing for farmers and manufacturers in the heartland.

With the fortunes of flashy young companies such as We Co. and Peloton stealing headlines, it may be easy to forget about the worsening economic condition of flyover country, USA. That would be a mistake.

Regional economic indicators suggest that the financial health of the Midwest is waning, as trade tariffs start to take their toll on sectors from farming to manufacturing. The implications for the U.S. economy at large are significant.

One heartbeat of the Midwestern economy, farming, has been under serious pressure throughout the spring and summer. Agricultural exports to China have plummeted over the past two years, particularly soybeans. While a wet planting season kept crop yields in check, the lack of crop buyers has kept prices for soybeans and corn under pressure, too, which has been a double whammy for farmers.

As a result, farmers are starting to get into real financial trouble. Loan delinquencies and bankruptcies are rising, according to data aggregated by the American Farm Bureau Federation. For the first quarter of 2019, 2.5% of commercial real-estate loans in agriculture were more than 30 days past due, up from 2.1% in the prior quarter, which is also the historical average. Delinquencies on nonreal-estate loans in agriculture held by commercial lenders are rising, too, and above the historical average.

But it isn’t just farmers that are hurting. The Federal Reserve Bank of Chicago tracks nonfarm business activity in five states—Iowa, Indiana, Illinois, Michigan, and Wisconsin—through its Midwest Economy Index. The index was in negative territory for the fifth straight month in August, the Chicago Fed said Monday. Readings below zero indicate that growth is below the historical average rate. The July reading, at minus-0.37, was the worst since early 2010.

The Chicago Business Barometer, which tracks a broader range of activities and is influenced by swings in orders for Chicago-area businesses such as Boeing , also declined to 47.1 in September from 50.4 in August. A reading below 50 indicates contraction, and the index has rarely dipped below 50 since the latest recession.

Meanwhile, third-quarter business confidence measured in the same report dropped 4.9 points compared with the previous quarter to 47.3, leaving it at the lowest level on a quarterly basis since the third quarter of 2009. “There was anecdotal evidence of tariffs affecting prices and business activity,” said the report, out on Monday.

States in the midsection of the country aren’t as driven by headline-grabbing bubbles in, say, financial services or technology. But this actually makes their degradation all the more worrying, as it indicates strain in “real economy” sectors like manufacturing that drive nationwide consumer spending.

The combined gross domestic product for states in the Great Lakes and Plains regions, as defined by the U.S. Bureau of Economic Analysis, account for almost one-fifth of U.S. GDP. Pain in the Midwest will quickly ripple outward.

Updated: 11-3-2019

Are We In A Recession? Experts Agree

Sahm rule is reassuring to economists looking for new ideas on stimulus when interest rates are already low.

Two of the biggest challenges of fighting a recession are knowing when you’re in one and deciding what to do next. When economic data weaken, it’s impossible to know in real time whether it’s a blip or something more prolonged. The official declaration usually comes a year or more after a recession starts.

Now, a Federal Reserve economist has come up with a simple rule based on movements in unemployment to rapidly determine when a recession is under way. In conjunction with that rule, Claudia Sahm has also proposed policies to immediately soften the downturn without the political hurdles that usually slow stimulus efforts.

For now, the so-called Sahm rule is sending a reassuring signal: The economy may be slowing but no recession has begun. Nonetheless, it is generating excitement among economists and at least one presidential contender looking for new ideas on how to combat future recessions at a time when the Fed lacks its normal ammunition since interest rates are already so low.

Policy makers need to know when a recession has begun before they can act to prop up the economy, said Jay Shambaugh, director of the Hamilton Project, a liberal think tank that included Ms. Sahm’s proposal in a book this year on preparing for the next downturn. “Knowing that in as close to real time as possible is a huge advantage over waiting, say, for Congress to act over a six- to eight-month period,” he said.

In January 2008, Fed officials projected the flagging U.S. economy would avoid a recession. Fed staff believed the probability of recession within the next six months was 45%, according to a policy meeting transcript.

In fact, a recession had begun the previous month, a determination the official arbiter, the National Bureau of Economic Research—a nonpartisan, nonprofit academic network—would take almost a year to make. It took six to 21 months to call previous recessions.

“That’s too long for stabilization policy to wait,” Ms. Sahm said on Twitter earlier this year. “Stimulus early could help reduce the severity of a downturn.”

The unemployment rate has risen sharply in every recession, and thus economists have long looked for recession signals in its behavior. Ms. Sahm spent weekends playing with a massive spreadsheet, testing different rates of increase over varying periods of time, to arrive at the following formula: If the average of unemployment rate over three months rises a half-percentage point or more above its low over the previous year, the economy is in a recession.

Her formula would have accurately called every recession since 1970 within two to four months of when it started, with no false positives, which could trigger unnecessary and costly fiscal stimulus.

Ms. Sahm says her rule is based on historical relationships in the U.S. and thus can’t be applied to other countries or individual states, whose labor markets may behave differently.

Nor should it be used predict recessions, as are some indicators such as an inverted yield curve, when long-term interest rates fall below short-term rates. The Sahm rule only determines when one has started. Yet that is potentially quite valuable.

Ms. Sahm received her Ph.D. at the University of Michigan then joined the Fed in 2007 where she studied the effects of fiscal policy on households. She and others have found that sending lump-sum payments to individuals, as the government did in 2001 and 2008, had a bigger effect on spending than spreading the money out across paychecks by lowering tax withholding, as Congress did in 2009.

By automating such payments, and designing the size, structure and funding ahead of time, policy makers could avoid those difficult decisions in a crisis, Ms. Sahm wrote in “Recession Ready,” the book published by the Hamilton Project and Washington Center for Equitable Growth, a left-leaning think tank where Ms. Sahm will soon move to become director of macroeconomic policy. The book discussed how to improve automatic stabilizers, the safety-net programs that kick in when the economy weakens, such as unemployment insurance and food stamps.

Ms. Sahm proposed that the Treasury begin sending payments to households equal to 0.7% of gross domestic product, or 1% of consumer spending, when the Sahm rule trigger is met, and extend those payments in subsequent years if the unemployment rate increases at least 2 percentage points above the level at the time of the first payment, then gradually scaling them back as the jobless rate declines.

Under her proposal, payments in the last recession would have started in April 2008 and continued into 2013, after the last of the big household stimulus programs expired. The boost to spending in 2008 and 2009 together would have been about 50% larger than under the stimulus actually enacted, she estimated.

Expanding automatic stabilizers this way could have drawbacks, warns Douglas Holtz-Eakin, president of the American Action Forum, a right-of-center think tank, and former Congressional Budget Office director. They would boost mandatory spending, which already weighs on the federal budget, and lawmakers would still face political pressure to respond with additional discretionary stimulus, he said.

Since its release in May, Ms. Sahm’s rule has been flagged in Wall Street research notes and news reports, and added to the Federal Reserve Bank of St. Louis’s free economic database, known as FRED. Lawmakers on Capitol Hill have asked for briefings on the proposal, and Sen. Michael Bennet (D., Colo.), who is running for president, highlighted it along with others in his campaign’s economic platform.

“The reason it’s been getting attention is it is simple, it is understandable, it is something people can observe themselves,” Mr. Shaumbaugh said.

It also helps that Ms. Sahm, unusual for a Fed staffer, is active on Twitter, where she has discussed the Sahm rule—and noted the name wasn’t her idea. “[In my opinion] ‘unemployment change rule’ is a better label,” she tweeted.

Related Articles:

Historic Asset Boom Passes By Half Of Families (#GotBitcoin?)

A Manufacturing Recession Is Here. Now What? (#GotBitcoin?)

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Trump Blames Business Setbacks On Incompetency Vs Recession He’s Causing (#GotBitcoin?)

India’s Spending Spree Slows As Debt Problems Become More Widespread (#GotBitcoin?)

Home-Price Growth Slows To Levels Not Seen Since 2008 (#GotBitcoin?)

Trump Claims “Billions” In Trade Tariffs While Diverting Hurricane Relief Funds For Border Detention

Bond Yields Sink To New Lows, Federal Deficits Skyrocket And Trump Back-Tracks On Tax Cuts

What Are YOU Doing NOW To Prepare For The Incoming Recession? (#GotBitcoin?)

Trump And Publicans Will Have Zero Chance Of Re-Election During Coming Recession

Majority Of Americans Stressed Over Being In A Mass Shooting – Trump To Blame?

As Global Order Crumbles, Risks Of Recession Grows (#GotBitcoin?)

U.S. Mortgage Debt Hits Record, Eclipsing 2008 Peak

U.S. Stocks & Treasuries Flash Recession/Depression #GotBitcoin?

Investors Ponder Negative Bond Yields In The U.S. (#GotBitcoin?)

Lower Mortgage Rates Aren’t Likely To Reverse Sagging Home Sales (#GotBitcoin?)

Financial Crisis Yields A Generation Of Renters (#GotBitcoin?)

Global Manufacturing Recession Weighs On US Economy (#GotBitcoin?)

Falling Real Yields (0.241% ) Signal Worry Over U.S. Economy (#GotBitcoin?)

Donald Trump’s WH Projects $1 Trillion Deficit For 2019 (#GotBitcoin?)

U.S. Home Sales Stumble, As Pricey West Coast Markets Suffer Declines (#DumpTrump)

Lower Rates Have A Downside For Bank’s Mortgage-Servicing Rights (#GotBitcoin?)

Central Banks Are In Sync On Need For Fresh Stimulus (#GotBitcoin?)

Weak Corporate Earnings Signal A Weak Economy (#GotBitcoin?)

Price of Gold, Indicator Of Inflation And Recession Surges (#GotBitcoin?)

Recession Set To Materialize In Approximately In (9) Months (#GotBitcoin?)

A Whiff Of U.S. Recession Is In The Air Again. Credit Trumponomics

Trump Calls On Fed To Cut Interest Rates, Resume Bond-Buying To Stimulate Growth (#GotBitcoin?)

Fake News: A Perfectly Good Retail Sales Report (#GotBitcoin?)

Anticipating A Recession, Trump Points Fingers At Fed Chairman Powell (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Los Angeles And Other Cities Stash Money To Prepare For A Recession (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.