Trump And Republicans Will Have Zero Chance of Re-election During Coming Recession

Lawrence H. Summers, a former treasury secretary and National Economic Council director who helped lead the Obama administration’s efforts to end the Great Recession a decade ago, said no president is immune to a recession and the government ought always to be planning for and guarding against one. Trump And Republicans Will Have Zero Chance of Re-election During Coming Recession

“When the economy turns down, one of the important resources we have is policymakers’ credibility,” Summers said. “Ludicrous forecasts and economically illiterate statements have dissipated the credibility of the president’s economic team.”

Referring specifically to Trump’s actions, Summers added, “It’s banana republic standard to deny the statistics, bash the central bank, try to push the currency down and lash out at foreign countries.”

“I actually hope Trump’s supporters are stupid enough to put him back into office during a Trump-initiated recession” They’ll be some angry SOB’s!

Monty

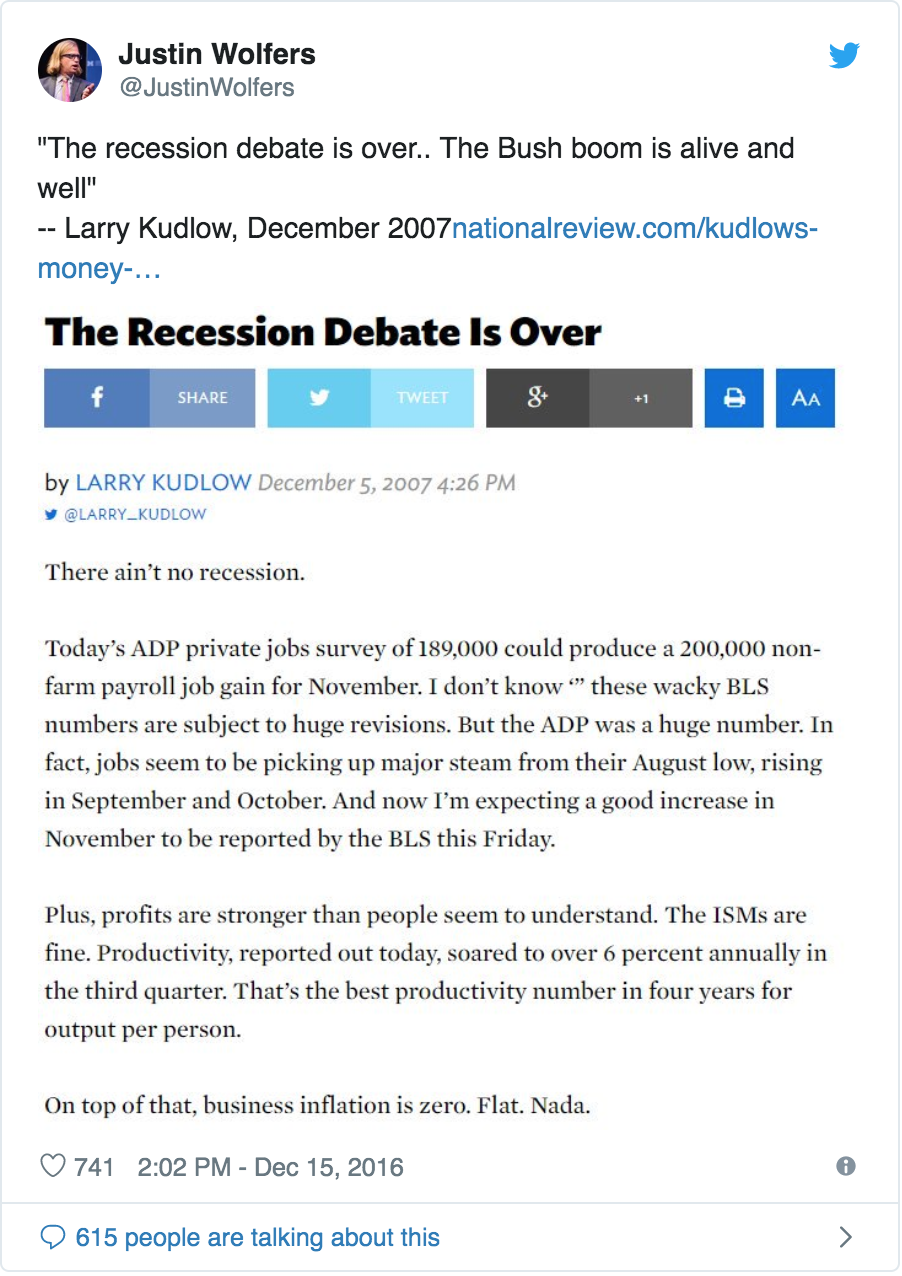

Larry Kudlow, Who Assured Us All Was Well in 2007, says,

Then, of course, the recession comes, the worst economic crisis since the Great Depression of 1929.

To be fair, Mr. Kudlow and Mr. Laffer eventually admitted that they had been wrong. Neither has, however, given any indication of reconsidering his views.

So what does it say about the current state of the G.O.P. that discussion of economic policy is now monopolized by people who have been wrong about everything, have learned nothing from the experience, and can’t even get their numbers straight?

Still, the whole idea of Larry Kudlow chairing the White House Council of Economic Advisors is an intriguing prospect. And it could work, provided the scenario involves periodically releasing Kudlow from a box, getting his advice, stuffing him back inside, and then doing exactly the opposite of his suggestions.

Mounting signs of global economic distress this week have alarmed President Trump, who is worried that a downturn could imperil his reelection, even as administration officials acknowledge that they have not planned for a possible recession.

Trump is banking on a strong economy to win a second term in 2020, and in recent weeks he has impulsively lashed out at the Federal Reserve, pressured Treasury Secretary Steven Mnuchin to label China a “currency manipulator,” and unexpectedly delayed tariffs on Chinese imports out of fear they could depress holiday retail sales.

Yet despite gyrations in the U.S. stock market and economic slowdowns in other countries, officials in the White House, at the Treasury Department and throughout the administration are planning no new steps to attempt to stave off a recession. Rather, Trump’s economic advisers have been delivering the president upbeat assessments in which they argue that the domestic economy is stronger than many forecasters are making it out to be.

In turn, Trump has sought to use his Twitter pulpit to drown out negative indicators. On Thursday, he promoted the U.S. economy as “the Biggest, Strongest and Most Powerful Economy in the World,” and, citing growth in the retail sector, predicted that it would only get stronger. He also accused the news media of “doing everything they can to crash the economy because they think that will be bad for me and my re-election.”

Privately, however, the president has sounded anxious and apprehensive. From his golf club in New Jersey, where he is vacationing this week, Trump has called a number of business leaders and financial executives to sound them out — and they have provided him a decidedly mixed analysis, according to two people familiar with the discussions who spoke on the condition of anonymity because the conversations were confidential.

Trump has a somewhat conspiratorial view, telling some confidants that he distrusts statistics he sees reported in the news media and that he suspects many economists and other forecasters are presenting biased data to thwart his reelection, according to one Republican close to the administration who was briefed on some of the conversations.

“He’s rattled,” this Republican said. “He thinks that all the people that do this economic forecasting are a bunch of establishment weenies — elites who don’t know anything about the real economy and they’re against Trump.”

Trump has relentlessly bludgeoned Fed Chair Jerome H. Powell over interest rates and has told aides and allies that he would be a scapegoat if the economy goes south.

The stock market has slumped in recent weeks because of a number of factors. The U.S.-China trade war has become increasingly acrimonious and is affecting both economies. Germany and the United Kingdom appear to be nearing a recession. Argentina’s stock market has crashed. Meanwhile, a key predictor of future recessions in the bond market — an inverted “yield curve” — was triggered this week, which spooked investors even more.

White House officials said the fundamentals of the U.S. economy remain very strong, citing low unemployment, high productivity, low inflation and strong retail sales. They said the recent turbulence may be connected to problems in other countries, and that there is no reason to recalibrate the administration’s approach, which has relied on low taxes, deregulation and low energy costs.

“I think it’s right to look at what is actually happening,” National Economic Council Director Larry Kudlow said in an interview. “To me, it’s a pretty good story. Nobody likes to see market volatility. I get that. You get bears coming out of the woodwork. I get that. But we’ve been through that before.”

The administration’s economic message has been muddled, however, causing more uncertainty. While Kudlow has been expressing public optimism that a deal could be reached with China, senior trade adviser Peter Navarro has been vigorously defending Trump’s tough tactics and promising a huge economic rebound later this year. Mnuchin, meanwhile, has been largely absent from public view since the trade discussions with China worsened several weeks ago.

In the past, world leaders have come together to try to assure the public about a unified approach to confronting global economic turmoil. But Trump has threatened to slap tariffs on Japanese and German cars and on French wine, and has encouraged newly minted British Prime Minister Boris Johnson’s call to withdraw the United Kingdom from the European Union, even if it means a violent breakup that threatens the economic standing of multiple countries.

Trump has been closely managing his administration’s moves. Two weeks ago, he exerted immense pressure on Mnuchin to label China as a “currency manipulator,” a move the treasury secretary had repeatedly resisted because China’s currency moves did not meet the Treasury’s established criteria, three people with direct knowledge of the push said.

Administration officials are not actively planning for a recession because they do not believe one will occur, and they worry that making such plans would validate a negative narrative about the economy and precipitate a crash, according to people involved in internal discussions.

Despite recent declines in the industrial and agricultural segments caused by the trade war, business leaders are not yet predicting doomsday, said Kathryn Wylde, who leads the Partnership for New York City, which includes CEOs of many of the country’s biggest companies. “People aren’t seeing a dramatic downturn coming unless something really dramatic happens with China,” Wylde said.

Still, some of Trump’s Democratic challengers have focused on the possibility of a recession. Sen. Elizabeth Warren of Massachusetts issued a policy statement last month titled, “The Coming Economic Crash and How to Stop It.”

In it, she diagnoses problems in what she calls “our precarious economy” — including record auto loan debt and rising living costs — and writes, “warning lights are flashing.” She also lays out ideas to strengthen manufacturing, reduce household debt and use existing oversight authority to more closely monitor risks from corporate debt.

“She got to the point where she was saying, ‘There’s enough troubling signs that I want to put my case out there,’ ” Warren campaign policy adviser Bharat Ramamurti said.

Former vice president Joe Biden also has had a sharp focus on the economic anxieties of middle-class Americans and has touted his partnership with President Barack Obama to steer the country out of the economic collapse with a stimulus package and other measures.

Trump has been thinking about the economy through the prism of his reelection campaign. He is cognizant of public and private polling that consistently has registered his approval rating on handling the economy higher than it is overall or on any other issue. To that end, Trump’s political advisers believe the key to his reelection is a strong economy.

“President Trump gets to run on jobs have come back, wages are up, unemployment at record lows for Hispanic, African American, Asian, women,” Republican National Committee Chairwoman Ronna McDaniel said Thursday on Fox News Channel. “He has pushed our economy into full gear and he’s doing things that are making lives better for the American people.”

Some conservatives who have previously praised Trump’s economic policy have soured on his approach to trade, however.

“The president doesn’t understand the basics of international economics, and his erratic behavior is likely slowing business investment, working against his signature corporate tax cuts, and hurting his own reelection chances,” said Michael Strain, an economist at the right-leaning American Enterprise Institute.

Josh Holmes, a longtime adviser to Senate Majority Leader Mitch McConnell (R-Ky.), said, “This president is in a much stronger position for reelection than it is commonly believed if the economy holds. And if it doesn’t, the inverse is true.”

Public support for incumbent presidents and their party historically has collapsed during recessions, as occurred in 2008, when John McCain failed to persuade voters to keep the White House in Republican hands.

Democratic pollster Peter Hart said Trump could be at heightened risk because survey data show some voters overlook opposition to Trump’s leadership style and support him largely because of the strong economy.

“This president is so polarizing and off-putting to so many voters that he is dependent upon the good economic numbers to sustain his style,” Hart said. “When you start to hit an economic downturn, there’s no personal element that sustains him.”

But analysts explained that it is difficult to make any predictions, considering Trump has defied the laws of political gravity before.

“A strong economy helps a president running for reelection; a weak economy hurts him,” Republican pollster Whit Ayres said. “That’s a standard truth in the history of polling. But because so much of his support comes from his cultural messaging, a weaker economy may not hurt him as much as it would hurt a more traditional president.”

Updated: 8-27-22019

On Tuesday, yields on U.S. 30-year bonds dipped below those for three-month notes, providing another red flag for the global economy.

Updated: 9-22-2019

Sheldon Adelson Warned Trump About Impact of U.S.-China Trade War

During the call, the billionaire casino magnate expressed concerns about how conflict would affect U.S. economy, Trump’s re-election prospects.

Sheldon Adelson, Chairman Of Casino Operator Las Vegas Sands, Called President Trump To Warn Him About The Risks The U.S.-China Trade War Pose To The U.S. Economy And To Mr. Trump’s Re-Election Prospects, According To People Familiar With The Call.

President Trump’s sudden escalation of the trade war with China last month triggered a telephone call from billionaire casino owner Sheldon Adelson, who warned the president about the conflict’s impact on the U.S. economy and Mr. Trump’s re-election prospects, according to people familiar with the call.

During his call with Mr. Trump, Mr. Adelson focused on the broader implications of the U.S.-China trade war and their potential political consequences for Mr. Trump, according to one of the people, and not on his own company’s situation.

Mr. Adelson is chairman and chief executive of Las Vegas Sands Corp. The casino company has been operating in the Chinese territory of Macau since 2002 and now derives most of its income from there. In 2018, Macau accounted for nearly $9 billion, or roughly 63%, of Las Vegas Sands’ revenue.

Chinese state media have warned that American companies could pay a price in an unfettered conflict, and some companies, including FedEx Corp. , have already faced setbacks linked to the standoff.

Representatives for Mr. Adelson, a major donor to the Republican Party, have also spoken with members of Mr. Trump’s re-election campaign, according to this person.

The White House couldn’t be reached for comment.

Mr. Trump has said that the tariffs on Chinese imports are needed to pressure China to create a level playing field for U.S. companies and that the tariffs are hurting China more than the U.S.

Besides Mr. Adelson, many U.S. business leaders believe the trade war poses increasing risks for the U.S. economy and together with the U.S. Chamber of Commerce have urged the president to resolve the conflict.

“Sheldon Adelson and President Trump have met and spoken about the broad concerns the business community has with the escalation of trade tensions between the two nations,” said Myron Brilliant, head of international affairs at the Chamber of Commerce, who has known Mr. Adelson for years.

Mr. Adelson is a powerful business voice and influence on Republican politics. During the 2018 midterm elections alone he and his wife donated $123 million—more than anyone else—to candidates and conservative causes.

His company’s license to operate in the Chinese territory of Macau, along with those of U.S. casino operators Wynn Resorts Ltd. and MGM Resorts International , is set to expire in 2022, unless the Macau government grants them renewals.

Before the phone call with Mr. Trump, Mr. Adelson met Mr. Trump in person at the White House on Aug. 20, in part to reinforce a message from the business community that the tariff and business clash with China has economic repercussions in the U.S., according to two people familiar with the meeting.

After that meeting, U.S.-China trade tensions escalated after Beijing said it would retaliate against U.S. tariffs on its imports set for Sept. 1. Mr. Trump lashed out on Aug. 23 in a series of tweets, and his administration the same day announced a plan to raise all tariffs on China by 5 percentage points as of Oct. 1.

Mr. Trump said that day in a tweet that firms operating in China are “hereby ordered” to look for an exit from the market, including by bringing investment back to the U.S. The outburst triggered a market decline, and that evening Mr. Trump touted an emergency-powers law that gives him wide authority to limit business activities overseas.

Several days after the tweets, Mr. Adelson called Mr. Trump with a more urgent message to reinforce what Mr. Adelson said at the prior meeting, according to one of the people familiar with the call.

On Sept. 4, a spokesman for U.S. trade representative Robert Lighthizer said in a statement that U.S. and Chinese officials had spoken by telephone and were planning a high-level meeting in coming weeks. On Sept. 11, Mr. Trump said he would delay the tariff increase to Oct. 15.

It couldn’t be determined whether Mr. Adelson’s call had any influence on Mr. Trump’s decision to postpone the tariff increase.

The latest de-escalation, even if temporary, is a relief for businesses that use products traded between the two countries and for U.S. firms worried Beijing will crack down on their Chinese operations.

Trump And Republicans Will, Trump And Republicans Will,Trump And Republicans Will,Trump And Republicans Will,Trump And Republicans Will,Trump And Republicans Will,Trump And Republicans Will,Trump And Republicans Will,Trump And Republicans Will,Trump And Republicans Will

Related Articles:

Majority Of Americans Stressed Over Being In A Mass Shooting – Trump To Blame?

As Global Order Crumbles, Risks Of Recession Grows (#GotBitcoin?)

U.S. Mortgage Debt Hits Record, Eclipsing 2008 Peak

U.S. Stocks & Treasuries Flash Recession/Depression #GotBitcoin?

Investors Ponder Negative Bond Yields In The U.S. (#GotBitcoin?)

Lower Mortgage Rates Aren’t Likely To Reverse Sagging Home Sales (#GotBitcoin?)

Financial Crisis Yields A Generation Of Renters (#GotBitcoin?)

Global Manufacturing Recession Weighs On US Economy (#GotBitcoin?)

Falling Real Yields (0.241% ) Signal Worry Over U.S. Economy (#GotBitcoin?)

Donald Trump’s WH Projects $1 Trillion Deficit For 2019 (#GotBitcoin?)

U.S. Home Sales Stumble, As Pricey West Coast Markets Suffer Declines (#DumpTrump)

Lower Rates Have A Downside For Bank’s Mortgage-Servicing Rights (#GotBitcoin?)

Central Banks Are In Sync On Need For Fresh Stimulus (#GotBitcoin?)

Weak Corporate Earnings Signal A Weak Economy (#GotBitcoin?)

Price of Gold, Indicator Of Inflation And Recession Surges (#GotBitcoin?)

Recession Set To Materialize In Approximately In (9) Months (#GotBitcoin?)

A Whiff Of U.S. Recession Is In The Air Again. Credit Trumponomics

Trump Calls On Fed To Cut Interest Rates, Resume Bond-Buying To Stimulate Growth (#GotBitcoin?)

Fake News: A Perfectly Good Retail Sales Report (#GotBitcoin?)

Anticipating A Recession, Trump Points Fingers At Fed Chairman Powell (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Los Angeles And Other Cities Stash Money To Prepare For A Recession (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.