Corporate Debt Is Reaching Record Levels (#GotBitcoin?)

Highly leveraged companies could pose a threat to the global economy if rates rise or profits slump. Corporate Debt Is Reaching Record Levels

In the aftermath of the financial crisis, a swath of individuals and families began a long and painful deleveraging process.

Businesses, meanwhile, quickly moved in the opposite direction—loading up on cheap debt to the point where many observers now worry that highly leveraged companies pose a threat to the global economy.

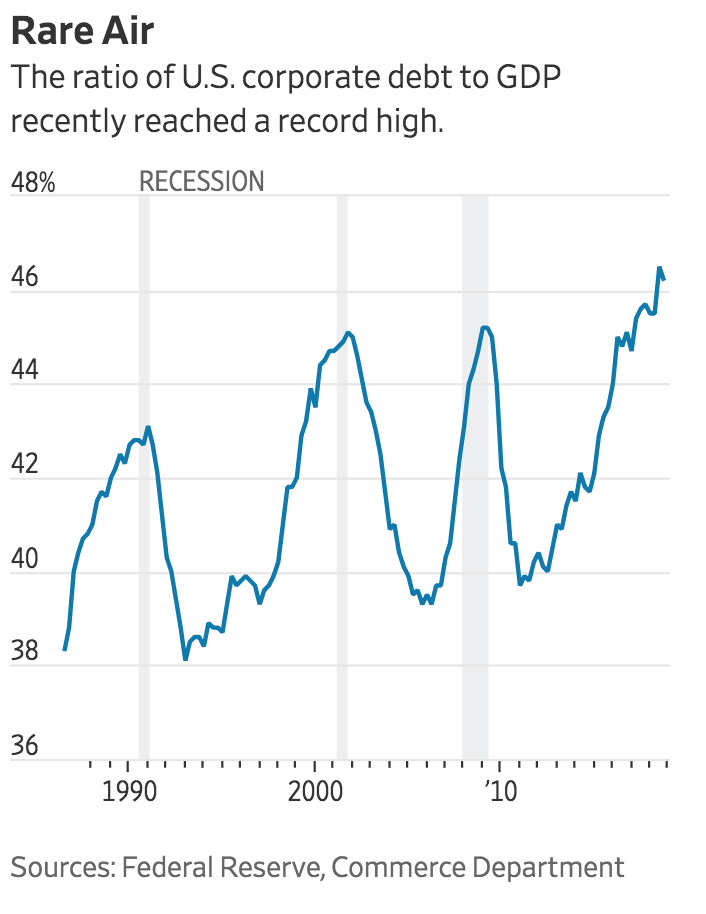

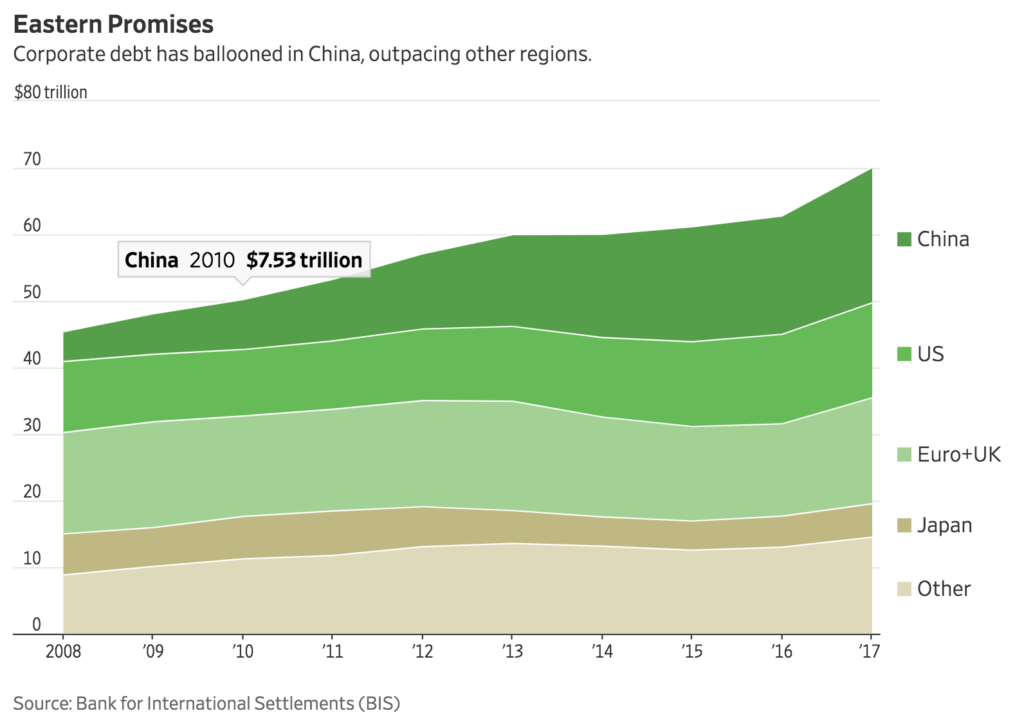

U.S. corporate debt has climbed to roughly 46% of gross domestic product, the highest on record, according to data from the Federal Reserve and Commerce Department. Businesses in emerging markets, such as China, have gone on an even bigger borrowing binge, taking advantage of ultra-low interest rates and, in some cases, state-driven policies designed to propel economies forward.

So far, businesses have been able to service their debt without too much difficulty. The concern is that could change if interest rates continue to rise, making debt more costly, or if the economy slows, crimping profits.

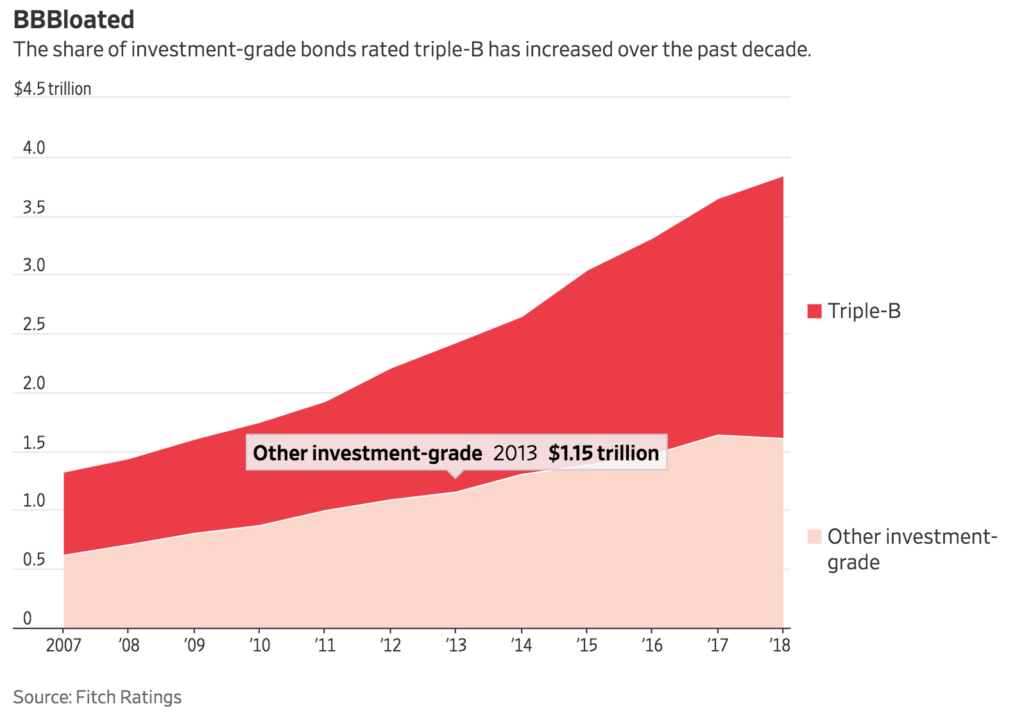

In the U.S., leverage levels have climbed for both larger and smaller businesses. With the economy apparently on solid footing, ratings firms have often allowed larger companies, such as CVS Health Corp. and Campbell Soup Co. , to load up on debt to fund acquisitions without taking away their investment-grade ratings. That has contributed to a large expansion in the amount of corporate bonds rated in the bottom tier of the investment-grade spectrum, a trend some analysts worry could be giving investors a false sense of security about the safety of their holdings.

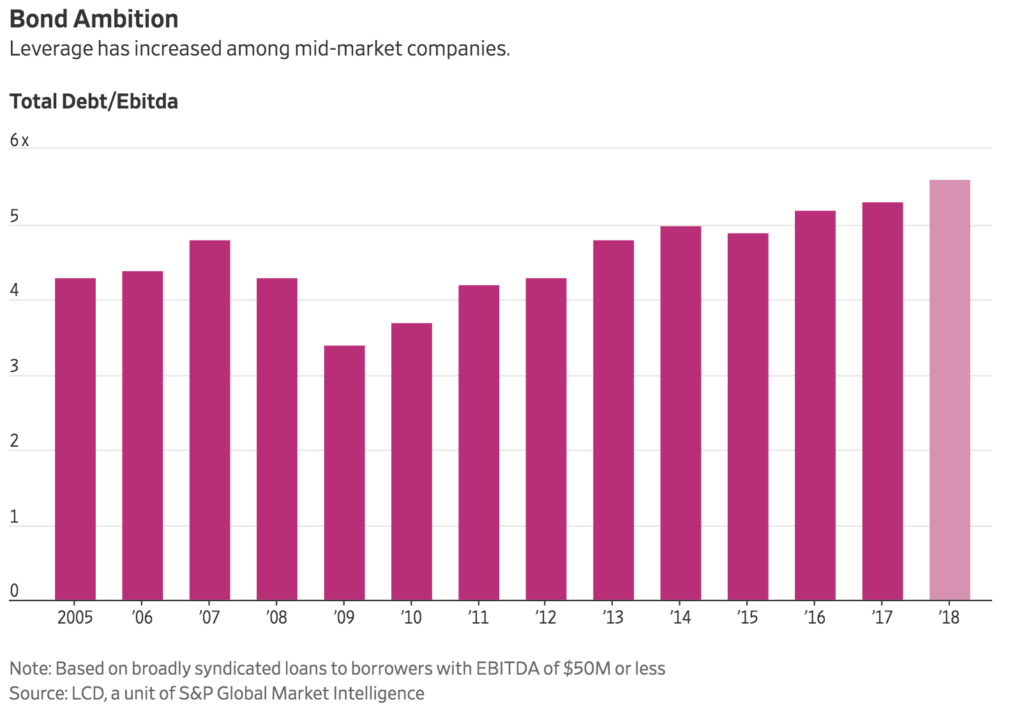

Among midsize businesses, there is has been an uptick in so-called direct lending in which business obtain loans from nonbanks, many of them private-equity firms, with traditional banks playing little part in the process. Nonbanks held more than half a trillion dollars worth of loans to midsize companies at the end of 2017, up from roughly $300 billion in 2012, according to estimates by private-equity firm Ares Management LP.

Not surprisingly, some banks that have long relied on commercial lending have concerns about the growing role of nonbank lenders. Some have warned that their experience will be missed in the next downturn when businesses will be more at the mercy of “distant credit investors,” as the chief executive of Buffalo, N.Y.-based M&T Bank Corp. , René Jones, recently wrote in a letter to shareholders.

Whether or not the banks have a case, it is certainly true that high corporate debt levels pose risks to investors, as well as businesses. Making the threat more severe, most recently issued bonds and loans to even the lowest-rated businesses carry minimal protections for investors, known as covenants.

While that could help businesses forestall bankruptcy in the short term by giving them greater leverage over investors, it also could cause their debt to be worth less in the long run, as businesses find it easier to do things like strip assets from lenders.

Updated: 10-20-2019

Soaring Corporate Debt Levels Threaten Financial Stability, IMF Warns

The global financial system is at risk from ballooning levels of corporate and emerging market debt caused by ultra-low interest rates, the International Monetary Fund (IMF) has warned.

The IMF cautioned that in a downturn half as severe as 2008, $19 trillion (£14.9 trillion) of companies’ debt – “above crisis levels” – is at risk of default and poses the threat of global contagion.

The US-China trade war and a global slowdown mean already very low interest rates are set to stay “lower for longer,” the international lender of last resort said today in its biannual financial stability report.

Low rates have held down government bond prices and sent investors towards riskier assets such as non-financial firms’ bonds and shares and the debt of emerging market countries. The amount of money owed by companies and developing countries has rocketed.

The IMF, which is in the middle of its first annual meeting under new chief Kristalina Georgieva, today cautioned that an economic downturn could severely limit the ability of these firms and countries to pay their debts as earnings fall and lenders demand higher interest.

This “could have significant macroeconomic implications,” the Fund said. A failure by firms to pay up would rock institutional investors such as pension funds that hold their bonds and the damage could spread through economies.

“Similarities in investment funds’ portfolios could magnify a market sell-off, pension funds’ illiquid investments could constrain their ability to play a role in stabilising markets as they have done in the past, and cross-border investments by life insurers could facilitate spillovers across markets,” the IMF said.

Investors have also snapped up the bonds of emerging market countries such as Brazil, India and Mesico which offer bigger returns, leading to high levels of sovereign debt.

“In the event of a sharp tightening in global financial conditions, increased borrowing could raise rollover and debt sustainability risks,” the Fund said.

It said the main focus of governments should be bringing an end to the trade tensions which are the primary “downside risk” to the economy.

n its economic outlook report yesterday, the IMF predicted that the US-China trade war would push global economic growth down to just three per cent this year, its lowest rate since the financial crisis.

The Fund also called on governments to tackle high corporate debt burdens. “Efforts should be made to increase disclosure and transparency in non-bank finance markets to enable a more comprehensive assessment of risks,” it said.

Updated: 1-6-2020

Tense Time For Buyers of Riskier Corporate Loans

Investors are backing away from companies whose finances appear strained.

The market for low-rated corporate loans has suffered sharp declines in recent months, a sign of growing aversion to earnings shortfalls or other strains at indebted companies.

In the U.S. at the start of December, some 2.5% of leveraged loans were trading at less than 70% of face value, the most since September 2016, according to S&P Global Market Intelligence’s LCD, the loan market research service.

Analysts and investors blame the loose credit standards that characterized the market in recent years, encouraged by strong demand from yield-hungry investors. The hunt for yield also fed a boom in new issuance of structured loan funds known as collateralized loan obligations, or CLOs, which have been the biggest group of lenders in recent years.

But investors are shying away from such loans at any sign of trouble, including those deemed “covenant lite” for their scant investor protections, which is sparking steep falls in the prices of loans to firms—particularly when they fail to hit earnings targets.

“In the absence of covenants, loans should trade down quicker,” says Alexander Ohl, head of structured credit at Union Investment in Germany. In Europe, especially, where loan markets are smaller, less transparent and less liquid than in the U.S., loan values can drop very rapidly once they go below the equivalent of 80 cents on the dollar, Mr. Ohl says.

In the U.S., some of the companies whose loans fell below 70 cents on the dollar in recent months included Deluxe Entertainment, a media group whose loans fell to around 40 cents on the dollar in August, according to S&P’s LCD, before the company’s credit rating was downgraded. It later negotiated a debt restructuring, announced in October. Murray Energy Corp., a coal company, and 4L Technologies, a technology recycling group, are two others whose loan values tumbled. Both have since entered restructuring programs.

Another factor driving the selloff: many borrowers have been understating their leverage, or the amount of debt they have relative to earnings. They have done so by regularly inflating earnings before interest, taxes, depreciation and amortization, or Ebitda, by including forecasts for cost cuts or additional sales, according to investors, analysts and ratings firms.

Credit ratings firms say they take into account these so-called Ebitda add-backs and look at more-realistic measures of leverage when assessing companies. But others, such as Matthew Mish, credit strategist at UBS, say credit-rating firms account for only part of the add-backs when trying to work out a more reliable measure of leverage.

According to UBS data, average total debt on new deals is about 5.4 times Ebitda as presented by borrowers, but 6.7 times Ebitda once the add-backs are stripped out. “About 25% to 30% of outstanding leveraged loans are associated with deals done since 2017 that have add-backs worth about 25% of Ebitda,” Mr. Mish says.

S&P recently reviewed U.S. leveraged loans it rated in 2015 and 2016 to determine whether companies had fulfilled their projected earnings add-backs—and if leverage levels had fallen as expected. The finding was resoundingly negative.

Of new borrowers in 2016, more than 90% failed to hit earnings targets by the end of the second year of operation after they took out the loan. That meant debt remained a much higher multiple of earnings. Leverage at the median company was projected to fall to 3.1 times Ebitda by the end of the second year in S&P’s models based on management forecasts. In fact, it ended up at 5.9 times, the S&P study found.

Olen Honeyman, one of the analysts at S&P who wrote the review, says its initial ratings would have been higher if it had bought into the borrowers’ projections. “We’ve always been critical in our approach to add-backs,” he says.

The problem with higher leverage is that debt becomes much harder to repay, or refinance, if earnings start to decline. In the past, when debt was too high or earnings didn’t improve, covenants could push companies and lenders to renegotiate terms, which would protect the value of the loan and give the company room to fix its problems. Today, a lack of protection is both encouraging some investors to sell sooner and reducing the price that distressed investors are willing to pay.

Holland & Barrett, a U.K.-retailer of vitamins and health supplements, saw its loans plunge to less than 50% of face value early in December after a rating downgrade from Moody’s Investors Service—even though a person close to the company says it has adequate liquidity and five years before it must repay its debt. Its loans recovered to above 60% of face value in late December, according to S&P’s LCD, but that is still very low for a company rated single-B.

CLOs, which have become the dominant investor type in the loans markets for the past few years, have very strict limits on the amount of CCC loans that they can hold. Many CLOs try to sell loans before downgrades arrive so they aren’t left as forced sellers. That practice is likely to put more pressure on the market if the outlook for corporate earnings doesn’t improve.

And there are fewer buyers for these loans because of another borrower-friendly condition that became a popular part of loan documents, particularly in Europe: transfer restrictions. Borrowers use these restrictions to draw up blacklists blocking distressed or activist investors, for example, from buying the loans.

“Demand and supply dynamics mean that lenders have had to accept bad docs if they like the credit,” says Jane Gray, head of European research at Covenant Review, a specialist research firm. “More docs don’t allow transfers to certain investors. That makes it harder for lenders to sell out of a loan.”

Related Articles:

Trump Outstripping Obama On Pace Of Executive Orders

White House Condemns Anti-Media Video Shown At Pro-Trump Conference

If E-Commerce Doesn’t Kill Your Store, Sky-High Rents Will (#GotBitcoin?)

$381 Billion Annual Gap Between Taxes Owed And Taxes Collected (#GotRecession?)

When Sales At Struggling Chains Fall Faster Then Commercial Rents (#GotRecession?)

Parts of America Are Already In Recession (#GotBitcoin?)

A Manufacturing Recession Is Here. Now What? (#GotBitcoin?)

Trump Blames Business Setbacks On Incompetency vs Recession He’s Causing (#GotBitcoin?)

What Are YOU Doing NOW To Prepare For The Incoming Recession? (#GotBitcoin?)

Trump And Republicans Will Have Zero Chance of Re-election During Coming Recession

Investors Ponder Negative Bond Yields In The U.S. (#GotBitcoin?)

As Global Order Crumbles, Risks of Recession Grows (#GotBitcoin?)

Lower Mortgage Rates Aren’t Likely To Reverse Sagging Home Sales (#GotBitcoin?)

Financial Crisis Yields A Generation Of Renters (#GotBitcoin?)

Global Manufacturing Recession Weighs On US Economy (#GotBitcoin?)

Falling Real Yields (0.241% ) Signal Worry Over U.S. Economy (#GotBitcoin?)

Donald Trump’s WH Projects $1 Trillion Deficit For 2019 (#GotBitcoin?)

U.S. Home Sales Stumble, As Pricey West Coast Markets Suffer Declines (#DumpTrump)

Lower Rates Have A Downside For Bank’s Mortgage-Servicing Rights (#GotBitcoin?)

Central Banks Are In Sync On Need For Fresh Stimulus (#GotBitcoin?)

Weak Corporate Earnings Signal A Weak Economy (#GotBitcoin?)

Price of Gold, Indicator Of Inflation And Recession Surges (#GotBitcoin?)

Recession Set To Materialize In Approximately In (9) Months (#GotBitcoin?)

A Whiff Of U.S. Recession Is In The Air Again. Credit Trumponomics

Trump Calls On Fed To Cut Interest Rates, Resume Bond-Buying To Stimulate Growth (#GotBitcoin?)

Fake News: A Perfectly Good Retail Sales Report (#GotBitcoin?)

Anticipating A Recession, Trump Points Fingers At Fed Chairman Powell (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Los Angeles And Other Cities Stash Money To Prepare For A Recession (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.