Fed To Further Overhaul Stress-Testing Regime, Making It Easier For Banks To Pass (#Gotbitcoin)

Regulator aims to make test scenarios more consistent from year to year, Quarles says. Fed To Further Overhaul Stress-Testing Regime, Making It Easier For Banks To Pass (#Gotbitcoin)

The Federal Reserve plans to broaden its proposal to ease stress tests for the nation’s largest banks with changes that could reduce the chance they fail the annual assessments.

Related:

Annual January 3rd “Proof of Keys” Celebration of The Genesis Block!

Bitcoin Is World’s Best Performing Asset Class Over Past 10 Years

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin)

Ultimate Resource For Your Crypto Hardware (And Other) Wallets

Ultimate Resource On Trezor Hardware Wallets (#GotBitcoin)

Ultimate Resource On Ledger Hardware Wallet (#GotBitcoin)

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes (#GotBitcoin)

Apple Announces CryptoKit, Achieve A Level of Security Similar To Hardware Wallets (#GotBitcoin)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin)

Fed Vice Chairman of Supervision Randal Quarles in a Friday speech said the agency was considering revisions that could make the test scenarios more consistent from year to year and give firms their results before they wrap up shareholder-return plans. Big banks must pass the Fed’s stress tests to be able to make shareholder payouts, although the timing of the test results means banks set those plans before knowing how they performed.

“It is prudent to review all our practices,” Mr. Quarles said in prepared remarks for a speech in Washington, “in light of changes in the industry that have been achieved.”

The changes under consideration “are not intended to alter materially the overall level of capital in the system,” he said. Some of the revisions are expected “in the not-too distant future,” he added.

Banks will likely welcome what Mr. Quarles outlined as a sweetening of an April proposal that was already set to ease the stress-testing burden.

“We believe this should permit mega banks to boost distribution levels while reducing the risk of an unexpected” stress-test result, Cowen & Co. analyst Jaret Seiberg said in a note to clients.

Mr. Quarles also recommended that financial institutions with less than $250 billion in assets, which include SunTrust Banks Inc. and Fifth Third Bancorp , should skip the 2019 tests as they are set to enter a two-year evaluation schedule under a different Fed proposal.

Each year, banks’ balance sheets must run through a hypothetical doomsday scenario presented by the Fed that measures whether banks could keep lending during a severe downturn. Some years present tougher challenges than others, and banks have complained it is hard to adjust capital levels to a moving target. The latest round in June was the toughest to date, and Goldman Sachs Group Inc. and Morgan Stanley almost failed.

Mr. Quarles said the Fed was considering addressing a key roadblock for banks in the stress tests: receiving results after making plans for the following year’s shareholder dividends and share buybacks. This puts them at risk of paying less to shareholders than they actually could, or failing the tests if they distribute too much, Mr. Quarles said.

“Firms have told us that they would be able to engage in more thoughtful capital planning” if they got the results before making payout plans, Mr. Quarles said. Such a change could effectively eliminate the possibility that a bank gets publicly shamed by failing the tests.

Mr. Quarles recommended eliminating a capital requirement known as the leverage ratio from the stress tests. That would be a significant change, as some banks have been tripped up by that part of the tests in years past. Mr. Quarles said the leverage ratio, which compares equity to total assets and doesn’t take into account the relative riskiness of different bank loans and investments, might not be consistent with the “risk-sensitive” stress tests.

The Fed official also proposed modifying capital buffers, which force banks to gradually build up capital when they edge close to the Fed’s minimum. Buffers require big banks to sock away additional capital during good times so they have more to fall back on during bad times.

Existing buffers are too tough “in our current world in which a healthy and profitable banking system is seeking to maintain its capital levels rather than continue to increase them,” Mr. Quarles said.

He also said stress tests should be more transparent, suggesting for instance that the Fed seek public input as it crafts doomsday scenarios. He acknowledged giving banks more information up front could create an opportunity for banks to game the tests. But after the speech, he said more disclosure about the test was akin to giving the banks a textbook to prepare for the tests, not the test questions.

Updated: 8-12-2019

Fed Considers New Tool For A Downturn

The countercyclical capital buffer would require banks to hold more capital should the economy show signs of overheating.

Federal Reserve officials are weighing whether to use a tool that could reduce the risk of a credit crunch in a downturn.

The tool is known as the countercyclical capital buffer. It allows the Fed to require banks to hold more loss-absorbing capital should the economy show signs of overheating, or to keep less of it during bad economic times. The buffer applies generally to banks with more than $250 billion in assets, including firms such as JPMorgan Chase & Co., Bank of America Corp. and Citigroup Inc.

The Fed’s board of governors so far hasn’t used the tool, approved in 2016. Its rule on the buffer says it should turn it up when economic risks are “meaningfully above normal” and reduced when they “abate or lessen.”

Now, some Fed officials are debating whether it is time to use the tool, which could provide banks with additional lending firepower in a subsequent downturn. It isn’t clear when they might make a decision.

“The idea of putting it in place so you can cut it, that’s something some other jurisdictions have done, and it’s worth considering,” Fed Chairman Jerome Powell said at a late July press conference.

Deciding whether to use the buffer is somewhat fraught, though. Banks are reluctant to hold even more capital than they do today as this could hamper their profitability. That is already under strain due to low interest rates.

Plus, it isn’t clear how markets would interpret such a move by the Fed, especially since this would be a first. Investors could find the buffer reassuring, believing the Fed is giving itself additional room to fight a downturn. Or they could be unsettled by it, fearing the Fed believed a slowdown is imminent.

Fed officials have been debating about whether to use the tool since last year. Now, they are raising another question: how it should be used.

Some officials have suggested turning it on without increasing capital levels—signaling the Fed is prepared to use the tool, even if not right away. Others think higher capital requirements should be applied now.

Either move would give the central bank the option of lowering the requirement during a downturn.

Fed Gov. Lael Brainard, an Obama appointee, favors turning on the buffer now and raising capital requirements for big banks. She dissented from a March Fed vote to leave the buffer dormant.

“Turning on the [buffer] would build an extra layer of resilience and signal restraint, helping to damp the rising vulnerability of the overall system,” she said in a May speech.

Others say capital levels are already high enough, and that the tool could be used instead as a release valve for bad times.

“We rely on through-the-cycle, always on, high capital and liquidity requirements,” Mr. Powell said. “I view the level of capital requirements and the level of capital in the system as being about right.”

Randal Quarles, the Fed’s vice chairman for bank supervision, at a July Fed conference in Boston said, “The overall risk to financial stability is swamped by the extremely low leverage in the financial sector. ”

Messrs. Quarles and Powell have cited the Bank of England’s approach as a possible model for the U.S. In the U.K., the countercyclical capital buffer is set at 1% of risk-weighted assets when risks are “neither subdued nor elevated,” allowing the central bank to dial it down if the economy is thrown a curveball.

Banks have argued the buffer shouldn’t be turned on now because they are already subject to regulations, including other capital requirements, that ensure they are prepared for bad times. One example is the Fed’s annual stress tests that banks must pass to prove they would continue lending in a recession.

At the same time, they have encouraged the Fed to reduce other capital requirements. The central bank would likely have to do that if it activated the countercyclical capital buffer while maintaining the same amount of capital in the banking system, as suggested by Messrs. Powell and Quarles.

The countercyclical capital buffer was created in 2010 by international regulators through the Basel Committee on Banking Supervision. It is being used in other parts of the world, including Sweden and Hong Kong.

Updated: 7-12-2021

Banks Struggled Last Year, But Now They Are Set For Big Profits

JPMorgan, Goldman Sachs and other big banks are expected to report large second-quarter gains this week.

The economic recovery is looking good for the biggest U.S. banks.

Major players such as JPMorgan Chase & Co. and Citigroup Inc. are expected this week to report second-quarter profit gains, a U-turn from a year ago when they were girding for a wave of Covid-19-related loan defaults.

At the same time, there are obstacles. For example, the trading businesses that thrived in the chaos of the pandemic are slowing down.

JPMorgan and Goldman Sachs Group Inc. report results Tuesday, followed by Citigroup, Bank of America Corp. and Wells Fargo & Co. on Wednesday. Morgan Stanley releases results on Thursday.

A year ago, banks were socking away billions of dollars to prepare for soured loans. But as the economic outlook has brightened, banks have started releasing reserves, boosting their earnings.

Banks could report second-quarter per-share profits that are 40% higher than the same period a year ago, according to analysts at Keefe, Bruyette & Woods.

However, the trading boom that powered banks through the pandemic wasn’t repeated in the second quarter. Citigroup and JPMorgan executives have said trading revenues would be down 30% or more compared with a year ago. That could amount to losing about 10% of total revenue at each bank.

“We believe that this summer represents the acid test for whether normalized trading levels will be higher than pre-pandemic,” Goldman analysts wrote.

Loan demand has been tepid, and low interest rates have dampened the profits that banks can make when they do lend. The industry’s net-interest margin, a key measure of lending profitability, hit a historic low in the first quarter, and analysts expect roughly the same for the second quarter.

Rising interest rates and increased lending, particularly to consumers, would provide a double-barreled lift, but it is still unclear when either will happen. Autonomous Research is predicting 2021 net-interest income declines at the big banks, noting executives “have recently been moderating their expectations (without completely giving up hope).”

Banks have plenty of money to lend—more than enough, in fact. Many companies are still hoarding cash, and there is now $17 trillion in deposits at U.S. commercial banks, according to data from the Federal Reserve. That is up nearly 30% since the start of 2020, or $3.8 trillion, equal to the size of the whole pot in 2001.

The excess cash is dragging down margins because banks aren’t earning much on it. Barclays PLC analysts estimate average pretax profits would be 5% higher if that excess cash could be put to work at better interest rates.

The biggest banks shelled out money during the depths of the pandemic to waive customer fees and get employees set up to work from home. Now they are trying to reel expenses back in.

Bank of America Chief Financial Officer Paul Donofrio said on the first-quarter earnings call with analysts: “We’re sitting here in the middle of a pandemic with a lot of Covid expenses that have been a little bit more sticky than we had all hoped, but they’re going to come out. There’s no question about that.”

The KBW Nasdaq Bank Index has risen 27% in 2021, topping the S&P 500’s 16% increase. Where the bank-stock rally goes from here will depend partly on how much banks lift their dividends and buy back their shares.

The Fed had limited shareholder returns during the pandemic, but removed restrictions at the end of June.

The six biggest banks collectively have already raised their per-share dividends 40% for the third quarter and some announced new buyback programs, but additional details may surface in earnings reports.

Updated: 9-18-2022

Big Regional Banks Might Face New Rules For Dealing With A Crisis

Bailout-prevention proposals could call for firms to raise billions in debt to absorb losses.

WASHINGTON—A group of President Biden-appointed bank regulators are considering new rules to require large regional banks to add to financial cushions that could be called on in times of crisis.

The steps under consideration include requirements that the regional firms raise long-term debt that can help absorb losses in case of their own insolvency, according to three people familiar with the matter, extending a slimmed-down version of requirements that at present apply only to the largest U.S. megabanks.

The most likely path for achieving these new requirements is through a formal rule-making process led by the Federal Reserve, the prospects for which banks and their trade groups are already beginning to fight on the grounds that the measure is unneeded and that their costs outweigh any benefits.

At issue are concerns among the Biden administration and its top regulators that the steady growth of the nation’s largest regional banks, a group that includes firms such as U.S. Bancorp, Truist Financial Corp. and PNC Financial Services Group Inc., has introduced new risks to the financial system.

While these firms may lack the vast trading floors and international operations of megabanks like JPMorgan Chase & Co. and Bank of America Corp., the big regionals’ balance sheets are so large that it could be difficult to wind down such a firm in an orderly manner should one fail, top regulators have warned in recent years.

Michael Barr, the Fed’s new point man on financial regulation, signaled in a Sept. 7 speech that he is eyeing large regional banks “as they grow and as their significance in the financial system increases.”

In his first public comments since taking office in July, he said that he would work with other banking regulators to boost regional banks’ so-called living wills, or plans for lenders to wind themselves down without a government bailout.

Bankers and their trade groups say extending long-term debt rules to regional firms is unwarranted, forcing banks that typically fund their operations through deposits to instead issue public debt that would ultimately increase costs for consumers and business borrowers.

“The agencies have yet to articulate a clear or meaningful benefit that would offset these significant costs for end users and the financial system,” said Lauren Anderson, senior vice president and senior associate general counsel at the Bank Policy Institute.

The work to address perceived risks posed by large regional banks is in its early stages and would have to be approved by the full Fed board.

The Federal Deposit Insurance Corp., which typically oversees bank seizures after regulators have determined that a bank is in a perilous financial situation, has also been involved in the discussions, along with a third banking Though any requirements that regional firms hold more long-term debt could be slimmed down from what megabanks are required to raise, they could still require regional firms to issue billions of debt over several years.

The focus on regional lenders comes on top of work regulators are separately weighing for the biggest U.S. banks, as they broadly review capital and other requirements.

Mr. Barr said banks have emerged from the pandemic in strong financial shape, but signaled he may move to boost overall bank-capital levels. “Is capital in the system strong enough,” Mr. Barr said at the Sept 7 event. “It’s strong. I think the question is, ‘Is it strong enough?’”

After the 2008 financial crisis, regulators imposed tougher rules on firms whose failure could threaten the financial system because of their size, complexity and global reach.

Those measures included stepped-up planning to unwind operations in the face of catastrophic losses and requirements to stockpile additional capital.

Large regional banks were exempt from some of the rules. Their growth in the past decade—often through acquisitions—has given regulators a reason to rethink that decision.

The precise group of large banks in question is unclear. Firms with at least $100 billion in assets, but excluding the biggest “systemically important” U.S. banks, collectively hold roughly $3.7 trillion in deposits, or about a quarter of the deposits in the U.S. banking system, according to FDIC data.U.S.

Bancorp, Truist and PNC, three of the largest regional firms in question, have assets of about $591 billion, $545 billion and $541 billion, respectively, as of June 30, according to the Federal Financial Institutions Examination Council.

While larger than most U.S. commercial banks, that is far smaller than the $3.8 trillion held by JPMorgan, the largest bank.

U.S. Bancorp and PNC declined to comment. A Truist spokesman didn’t respond to a request for comment.

Even as the industry prepares to fight any rules to emerge from the Fed, the process could bring a sense of relief to a small group of regional banks with merger deals awaiting regulatory approval.

Michael Hsu, acting comptroller of the currency, said in April he was concerned that a recent wave of bank mergers risked creating more too-big-to-fail firms. Blocking those deals, though, would also shield the largest banks from competition, he said.

He suggested that pending merger deals could be conditioned upon the merged bank agreeing to hold more “total loss-absorbing capacity” in the form of long-term debt, as well as other commitments.

Banks and their lobbyists resisted those calls, saying it wasn’t fair to apply rules selectively to firms seeking a merger and not to others of similar size and structure.

Officials at the Fed and at other agencies generally agreed, the people familiar with the matter said, viewing the issue as part of a major policy that should be addressed through a transparent rule-making process, albeit one that might take years to complete.

Additional new requirements on regional firms could have the effect of encouraging greater industry consolidation, say banking lawyers. That potentially runs counter to steps that Biden-appointed regulators have taken to impose more stringent reviews of bank mergers.

“More stringent standards often cause firms to think about whether they need to be significantly bigger to absorb the cost of compliance,” said David Portilla, a partner at law firm Cravath, Swaine and Moore LLP, which represents banks.

Updated: 6-5-2023

Big Banks Could Face 20% Boost To Capital Requirements

Those relying on fees might need larger buffers to absorb losses under planned rules.

WASHINGTON—U.S. regulators are preparing to force large banks to shore up their financial footing, moves they say will help boost the resilience of the system after a spate of midsize bank failures this year.

The changes, which regulators are on track to propose as early as this month, could raise overall capital requirements by roughly 20% at larger banks on average, people familiar with the plans said. The precise amount will depend on a firm’s business activities, with the biggest increases expected to be reserved for U.S. megabanks with big trading businesses.

Banks that are heavily dependent on fee income—such as that from investment banking or wealth management—could also face large capital increases. Capital is the buffer banks are required to hold to absorb potential losses.

The plan to ratchet up capital is expected to be the first of several steps to beef up rules for Wall Street, a shift from the lighter regulatory approach taken during the Trump administration.

The industry says more stringent requirements aren’t needed, could force more banks to merge to stay competitive and could make it harder for Americans to get loans from banks.

Tougher rules were already on the way for the biggest lenders before the March failures of Silicon Valley Bank and another bank sent tremors through the industry. Since then, regulators have said they plan to apply new rules to a wider range of banks.

Institutions with at least $100 billion in assets might have to comply, effectively lowering an existing $250 billion threshold for which regulators have reserved their toughest rules.

Three agencies—the Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency—are expected to propose and seek comment on the capital rules. They would have to vote again to complete the changes and would likely implement them over the coming years.

Critics in the banking industry say a relatively large increase in bank-capital requirements could raise costs for consumers and lead banks to stop offering certain services.

“Higher capital requirements are unwarranted,” said Kevin Fromer, the chief executive of the Financial Services Forum, which represents the largest U.S. banks. “Additional requirements would mainly serve to burden businesses and borrowers, hampering the economy at the wrong time.”

They also say the proposal could punish banks for relatively benign services that revolve around fee income. The new rules are expected to treat fee-based activities as an operational risk, a category that includes the potential to lose money from flawed internal processes, people and systems or from external threats such as cyberattacks.

The framework for calculating operational risk charges “would disproportionately and inappropriately” increase capital requirements for firms focused on fee-generating activities, said Katie Collard, senior vice president and associate general counsel at industry group Bank Policy Institute.

That could include banks with large wealth-management businesses, such as Morgan Stanley as well as American Express, which owns a credit-card network that generates swipe-fee income, people familiar with the proposal said.

“The strength and breadth of the U.S. financial system requires a tailored approach to capital standards,” said Andrew Johnson, a spokesman for American Express, adding that regulators should take the size and business models of different banks into account when writing rules.

A spokesman for Morgan Stanley declined to comment.

While the largest U.S. banks emerged from the pandemic in solid financial shape, Fed Vice Chair for Supervision Michael Barr has signaled he believes capital requirements should be higher.

“The banking system might need additional capital to be more resilient precisely because we don’t know the nature of the kinds of ways we might experience shocks to the system, as has happened with these recent bank failures,” he told House lawmakers in May.

The coming proposal is the last piece of capital rules that global policy makers agreed to implement after the 2007-09 financial crisis. The overhaul forced banks around the world to boost their capital cushions in hopes of making them better prepared to weather downturns without taxpayer bailouts.

Banks must have loss-absorbing buffers to account for the risks tied to their activities, but regulators believe the way some firms currently measure these risks varies too widely.

The last step of the global overhaul is aimed at making measures of riskiness more transparent and comparable around the world.

The new framework was completed in 2017, but efforts to implement it in the U.S. were delayed by the pandemic.

Regulators are also expected to propose ending a regulatory reprieve that had allowed some midsize banks to effectively mask losses on securities they hold, a contributing factor in the collapse of SVB.

Supporters of the change say it would have forced SVB to address the issue earlier as interest rates began rising and the value of its holdings declined.

Updated: 1-3-2024

Billionaire Sternlicht Sees $1 Trillion Loss In Office Values

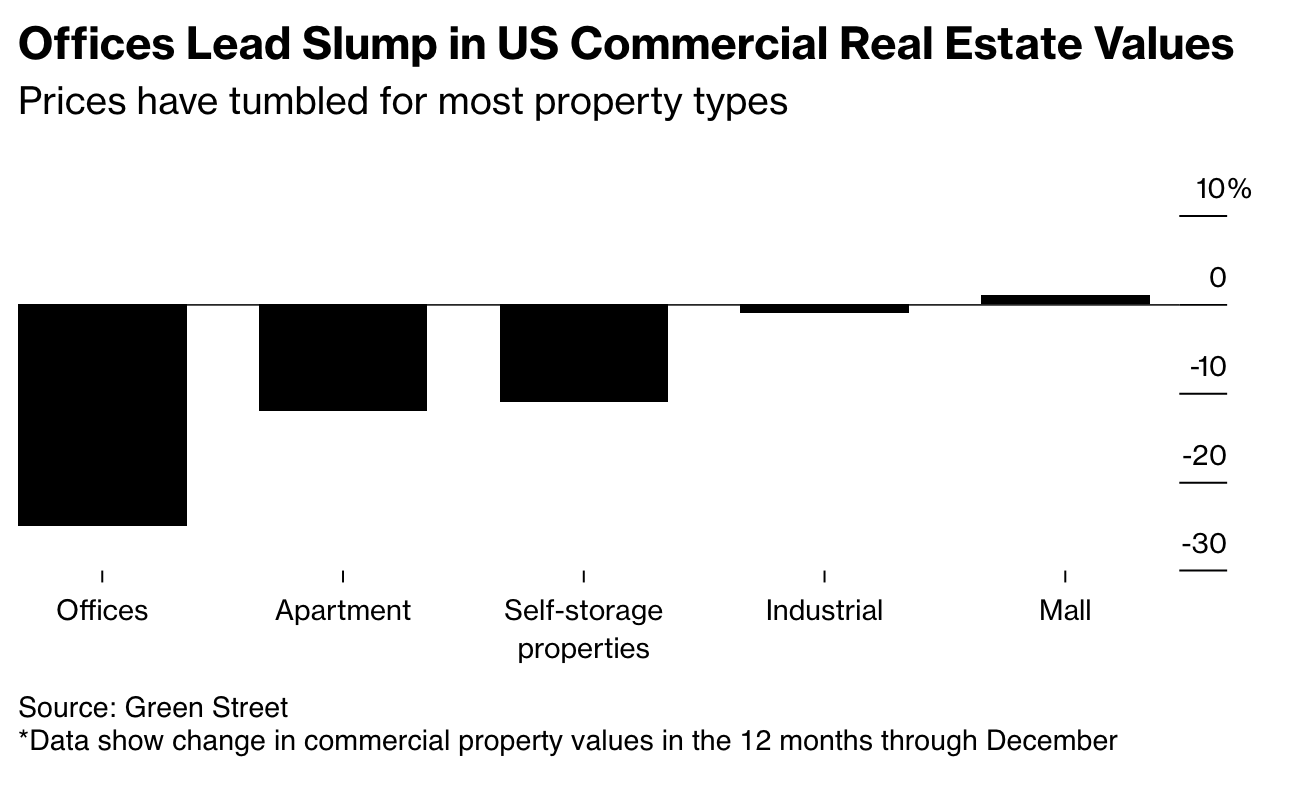

Billionaire Barry Sternlicht sees more than $1 trillion of losses for office real estate, calling the properties “one asset class that never recovered” from the pandemic.

“The office market has an existential crisis right now,” which is largely a US phenomenon because workers haven’t gone back to their desks, Sternlicht said Tuesday at the iConnections Global Alts conference in Miami Beach.

Once a $3 trillion asset class, offices now are “probably worth $1.8 trillion,” said Sternlicht, chief executive officer of Starwood Capital Group. “There’s $1.2 trillion of losses spread somewhere, and nobody knows exactly where it all is.”

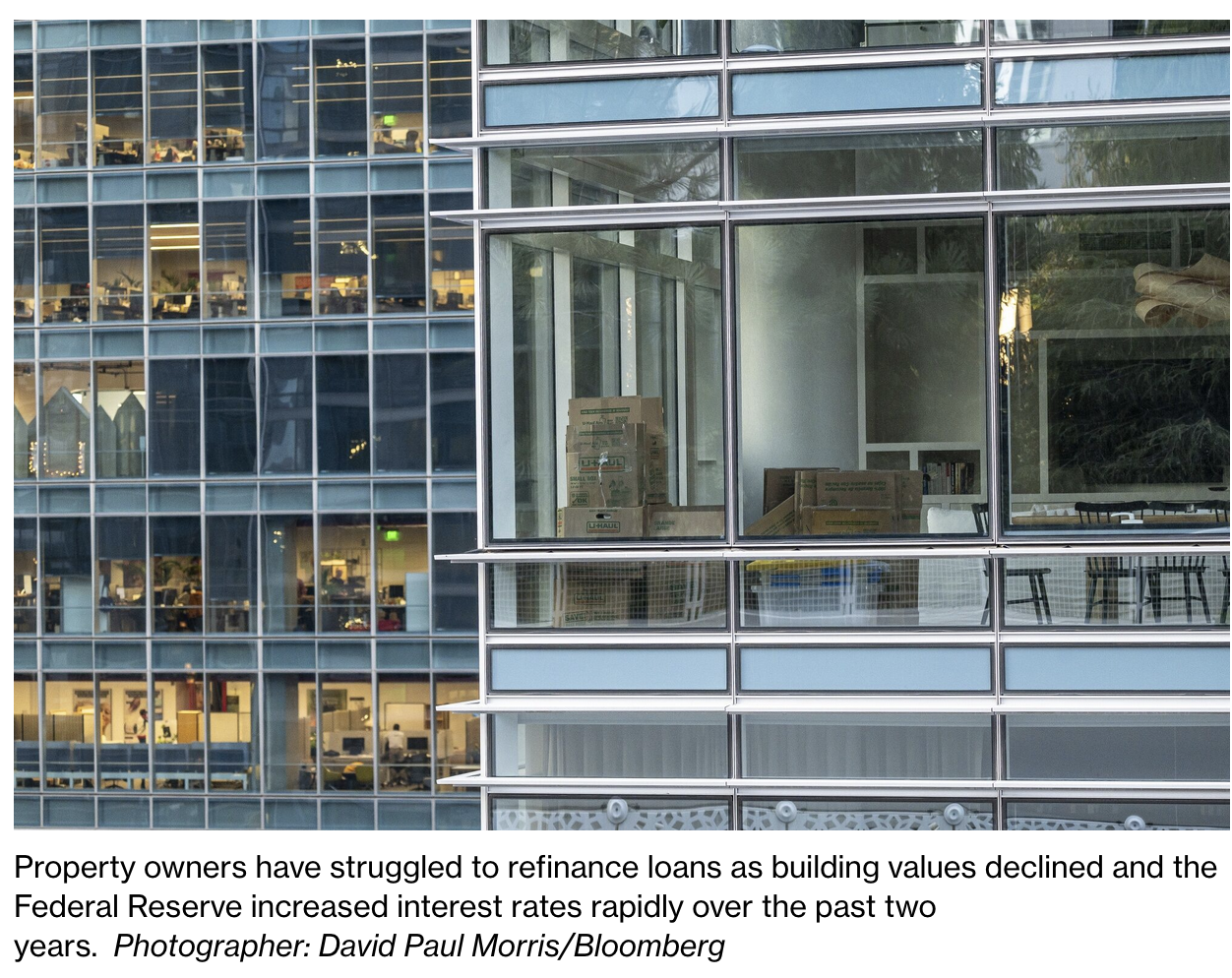

Property owners have struggled to refinance loans as building values declined and the Federal Reserve increased interest rates rapidly over the past two years. Where regional banks have previously been a source of funds for real estate owners, they have disappeared from the market, he said.

“We’re in the business of getting loans,” he said. The banks “don’t show up, they’re not even playing. So the alternatives are the debt funds, which are having a field day.”

The Fed’s policies have left a “serious mess in capital markets and real estate and anything that’s yield related,” said Sternlicht, who expects the first rate cut to come in June.

Updated: 1-31-2024

A $560 Billion Property Warning Hits Banks From NY To Tokyo

* Lenders Face Debt Maturities, Lower Values After Thaw In Deals

* Multifamily Also A Focus Following Change In New York Rent Law

The US commercial real estate market has been in turmoil since the onset of the Covid-19 pandemic. But New York Community Bancorp and Japan’s Aozora Bank Ltd. delivered a reminder that some lenders are only just beginning to feel the pain.

New York Community Bancorp’s decisions to slash its dividend and stockpile reserves sent its stock down a record 38% on Wednesday, with the fallout dragging the shares to a 23-year low on Thursday.

The selling bled overnight into Europe and Asia, where Tokyo-based Aozora plunged more than 20% after warning of US commercial-property losses and Frankfurt’s Deutsche Bank AG more than quadrupled its US real estate loss provisions.

The concern reflects the ongoing slide in commercial property values coupled with the difficulty predicting which loans might unravel. Setting that stage is a pandemic-induced shift to remote work and a rapid run-up in interest rates, which have made it more expensive for strained borrowers to refinance.

Billionaire investor Barry Sternlicht warned this week that the office market is headed for more than $1 trillion in losses.

For lenders, that means the prospect of more defaults as some landlords struggle to pay loans or simply walk away from buildings.

“This is a huge issue that the market has to reckon with,” said Harold Bordwin, a principal at Keen-Summit Capital Partners LLC in New York, which specializes in renegotiating distressed properties. “Banks’ balance sheets aren’t accounting for the fact that there’s lots of real estate on there that’s not going to pay off at maturity.”

Moody’s Investors Service said it’s reviewing whether to lower New York Community Bancorp’s credit rating to junk after Wednesday’s developments.

Banks are facing roughly $560 billion in commercial real estate maturities by the end of 2025, according to commercial real estate data provider Trepp, representing more than half of the total property debt coming due over that period.

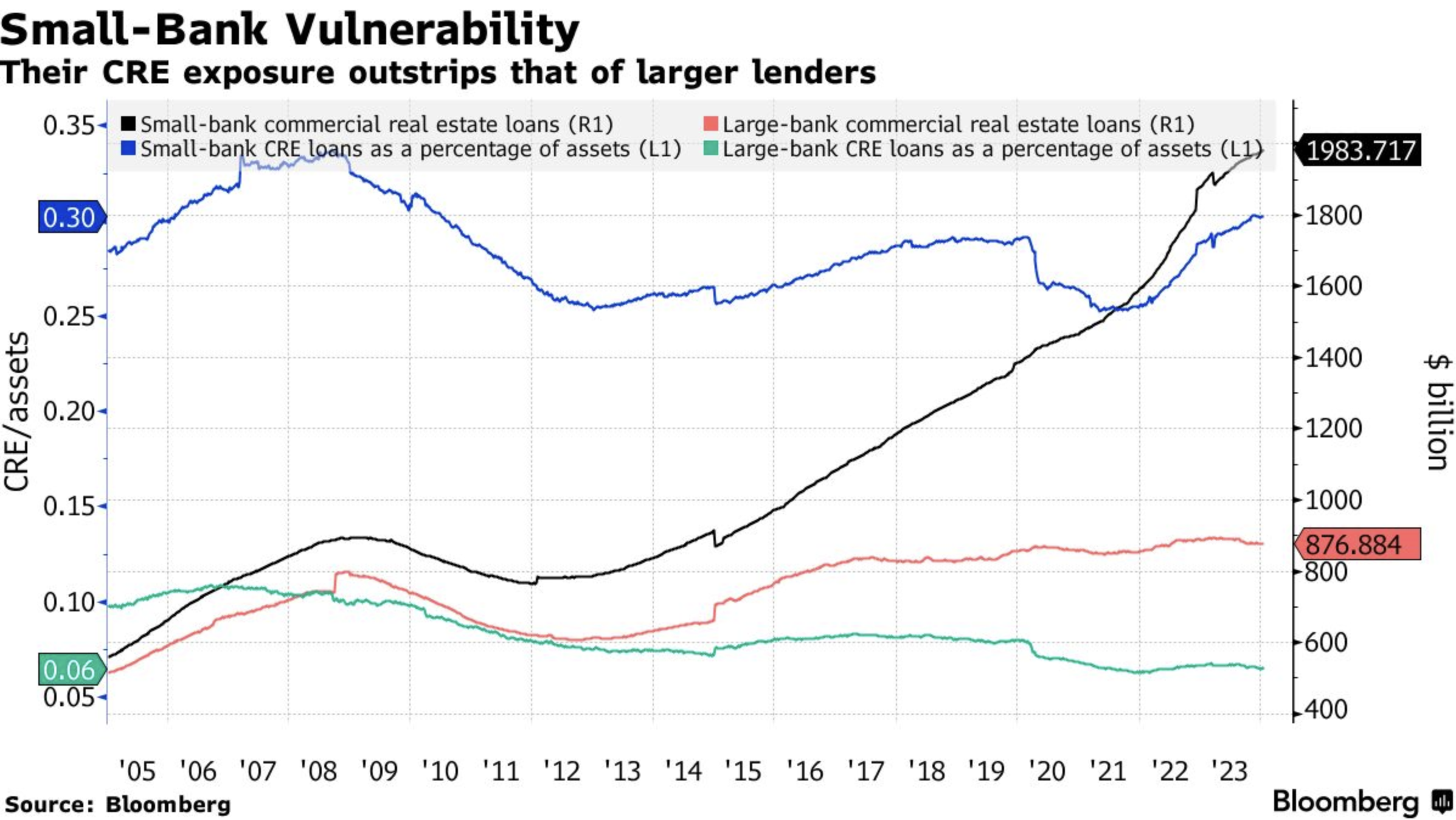

Regional lenders in particular are more exposed to the industry, and stand to be hit harder than their larger peers because they lack the large credit card portfolios or investment-banking businesses that can insulate them.

The KBW Regional Banking Index slumped 6% Wednesday, its worst performance since the collapse of Silicon Valley Bank last March. The gauge dropped an additional 3.2% Thursday.

Commercial real estate loans account for 28.7% of assets at small banks, compared with just 6.5% at bigger lenders, according to a JPMorgan Chase & Co. report published in April. That exposure has prompted additional scrutiny from regulators, already on high alert following last year’s regional banking tumult.

“It’s clear that the link between commercial property and regional banks is a tail risk for 2024, and if any cracks emerge, they could be in the commercial, housing and bank sector,” Justin Onuekwusi, chief investment officer at wealth manager St. James’s Place, said.

While real estate troubles, particularly for offices, have been apparent in the nearly four years since the pandemic, the property market has in some ways been in limbo: Transactions have plunged because of uncertainty among both buyers and sellers over how much buildings are worth.

Now, the need to address looming debt maturities — and the prospect of Federal Reserve interest-rate cuts — are expected to spark more deals that will bring clarity to just how much values have fallen.

Those declines could be stark. The Aon Center, the third-tallest office tower in Los Angeles, recently sold for $147.8 million, about 45% less than its previous purchase price in 2014.

“Banks — community banks, regional banks — have been really slow to mark things to market because they didn’t have to, they were holding them to maturity,” said Bordwin.

“They are playing games with what is the real value of these assets.”

Multifamily Loans

So far this year, earnings at many regional lenders have shown little sign of stress, with Fifth Third Bancorp, for example, noting it experienced zero net charge-offs in commercial real estate in 2023.

But exacerbating the nervousness surrounding smaller lenders is the unpredictability of when and where soured real estate loans can occur, with just a few defaults having the potential to wreak havoc. New York Community Bancorp said its increase in charge-offs were related to a co-op building and an office property.

While offices are a particular area of concern for real estate investors, the company’s largest real estate exposure comes from multifamily buildings, with the bank carrying about $37 billion in apartment loans.

Nearly half of those loans are backed by rent-regulated buildings, making them vulnerable to New York state regulations passed in 2019 that strictly limit landlords’ ability to raise rents.

At the end of last year, the Federal Deposit Insurance Corp. took a 39% discount when it sold about $15 billion in loans backed by rent-regulated buildings.

In another indication of the challenges facing these buildings, roughly 4.9% of New York City rent-stabilized buildings with securitized loans were in delinquency as of December, triple the rate for other apartment buildings, according to a Trepp analysis based on when the properties were built.

‘Conservative Lender’

New York Community Bancorp, which acquired part of Signature Bank last year, said Wednesday that 8.3% of its apartment loans were considered criticized, meaning they have an elevated risk of default.

“NYCB was a much more conservative lender when compared to Signature Bank,” said David Aviram, principal at Maverick Real Estate Partners.

“Yet because loans secured by rent-stabilized multifamily properties makes up a larger percentage of NYCB’s CRE book in comparison to its peers, the change in the 2019 rent laws may have a more significant impact.”

Pressure is growing on banks to reduce their exposure to commercial real estate. While some banks have held off on large loan sales due to uncertainty over the past year, they’re expected to market more debt now as the market thaws.

Canadian Imperial Bank of Commerce recently started marketing loans on struggling US office properties. While US office loans make up just 1% of the bank’s total asset portfolio, CIBC’s earnings were dragged down by higher provisions for credit losses in the segment.

“The percentage of loans that banks have so far been reported as delinquent are a drop in the bucket compared to the defaults that will occur throughout 2024 and 2025,” said Aviram. “Banks remain exposed to these significant risks, and the potential decline in interest rates in the next year won’t solve bank problems.”

Updated: 4-10-2024

Major City’s Return-to-Office Rate Nears 80%, Driven By (Surprise) Banks Depending On Who’s Counting

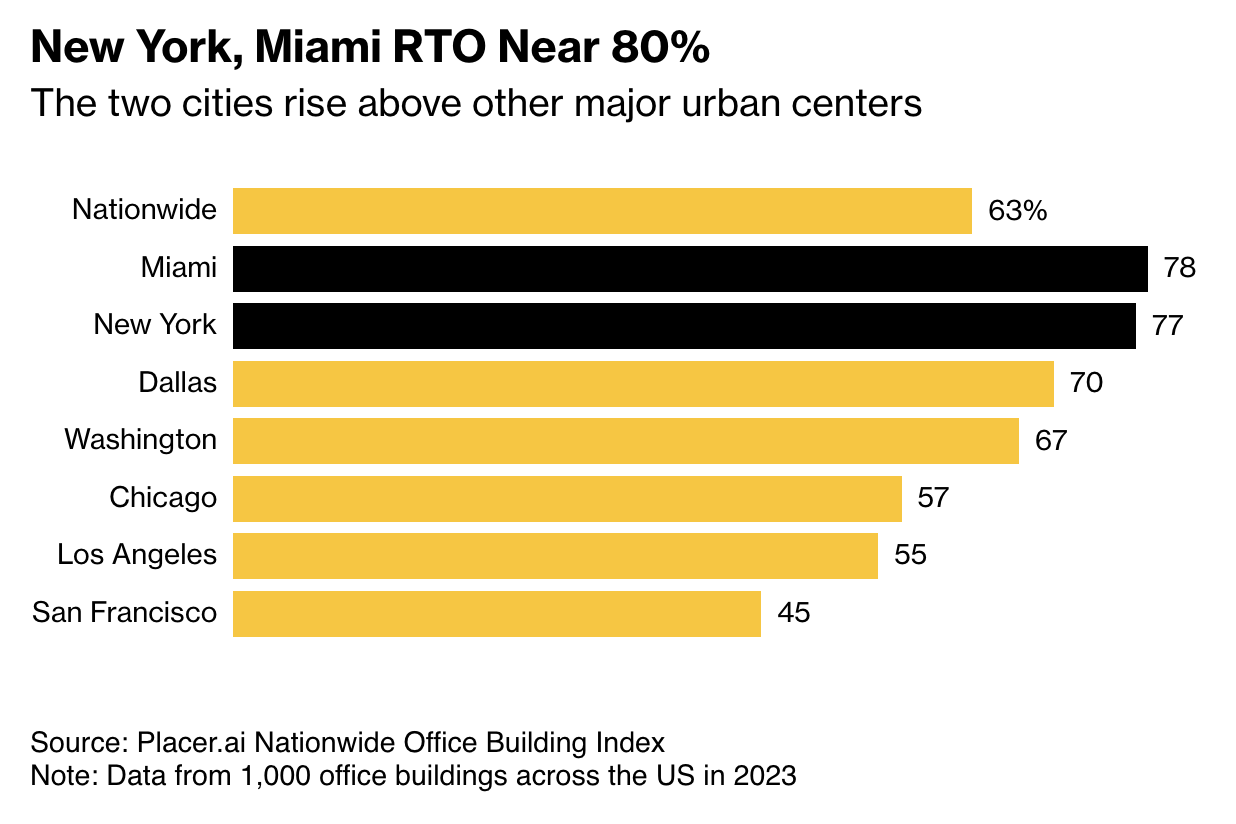

Wall Street firms including Goldman Sachs Group Inc. and JPMorgan Chase & Co. have helped push New York City’s return-to-office rate to almost 80% of its pre-pandemic levels, a rebound also seen in Miami, according to one measure.

RTO rates last year for the two East Coast cities were the highest among seven major US markets and above the national average of about 63%, according to the Placer.ai’s Nationwide Office Building Index. The firm analyzed foot traffic data from about 1,000 office buildings across the country.

Wall Street banks were among the first companies to aggressively encourage — and then require — employees to return to the office, helping drive a rebound in weekday foot traffic in Manhattan.

Miami’s resurgence may have benefited from Florida’s early lifting of Covid restrictions and a steady influx of tech companies, according to Placer.ai.

“The analysis suggests that the finance sector has indeed been an important driver of office recovery,” the company said in a report. “Cities with greater shares of employees from this sector tended to experience greater office recovery than other urban centers.”

Residents and tourists have also come back to the New York subway system. Weekday ridership is about 70% of what it was in 2019, up from roughly 10% during the height of the pandemic, according to Metropolitan Transportation Authority data. Weekend usage is about 85% of 2019 levels.

San Francisco saw the greatest growth in office visitation in 2023, but it still lagged behind other major cities, with foot traffic at about 45% of 2019 levels, according to the report.

Updated: 6-6-2024

Banks Tap Complex Mortgage Product To Fight Deposit Flight Risk

* Floating-Rate CMOS Also Help Banks Mitigate Interest-Rate Risk

* Demand From Banks Pushes CMO Issuance To Years-Long Highs

Banks are ramping up investments in a complex part of the mortgage bond market that offers shorter-term securities, as they cope with the growing risk of their losing deposits amid high rates.

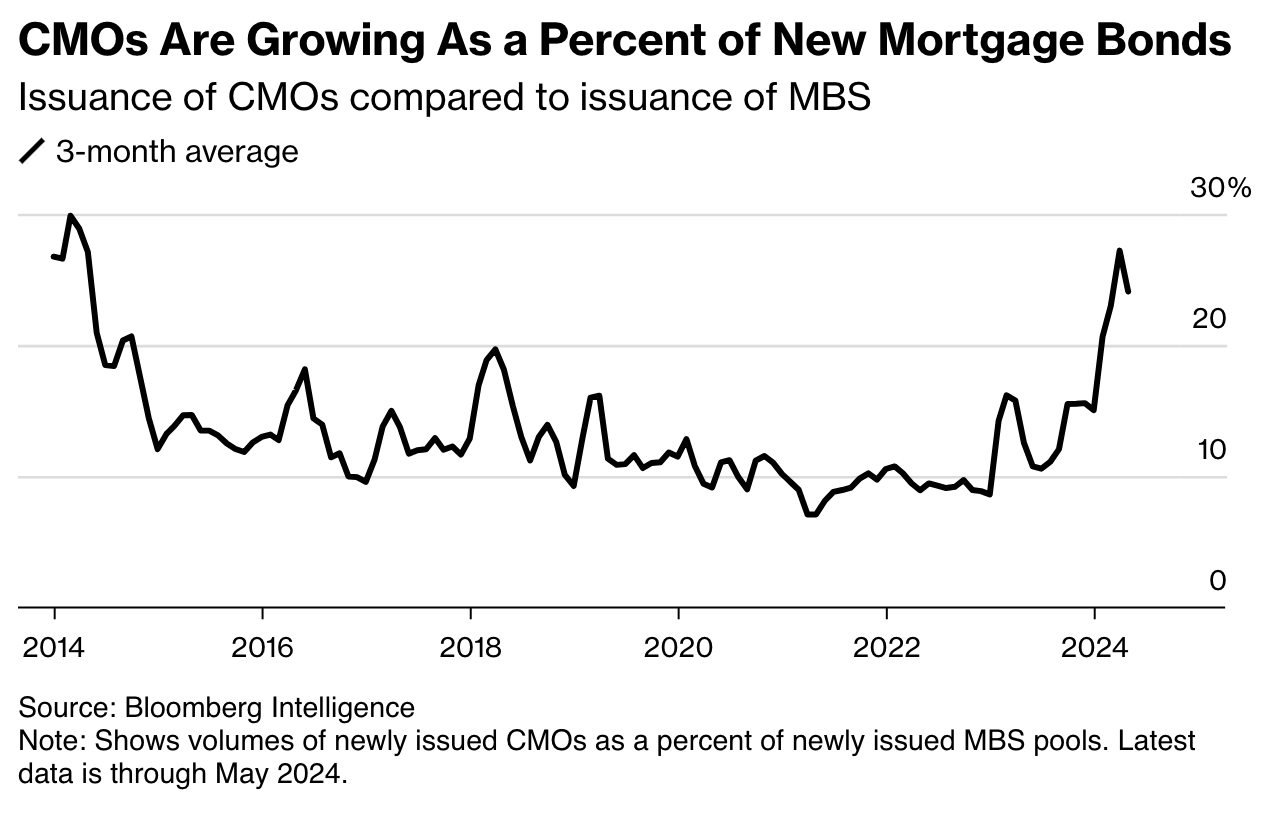

Demand from banks is fueling sales of floating-rate, collateralized mortgage obligations, which are constructed from simpler mortgage securities. Overall, there were $25 billion of new CMO sales in April, the highest monthly figure in nearly three years.

That represented as much as 30% of all MBS that month — the largest slice since 2014, according to Bloomberg Intelligence. Analysts and market participants say banks have been a major driver of the increase.

“The CMO machine is revving up,” said Kirill Krylov, a strategist at Robert W Baird & Co. who focuses on mortgages.

Since the Federal Reserve started raising interest rates in 2022, banks have had a harder time hanging onto deposits. Higher rates translate to stronger returns on competing instruments, such as money market funds, and many depositors pulled money out of banks and plunged it into other higher-returning markets.

While banks have taken steps to retain deposits — primarily by paying higher rates — they are also reworking the asset side of their balance sheets by cutting holdings of longer-term bonds and boosting investments in shorter-term securities.

The implosion of several regional lenders last year has also made banks acutely sensitive to the risks of owning longer-term debt.

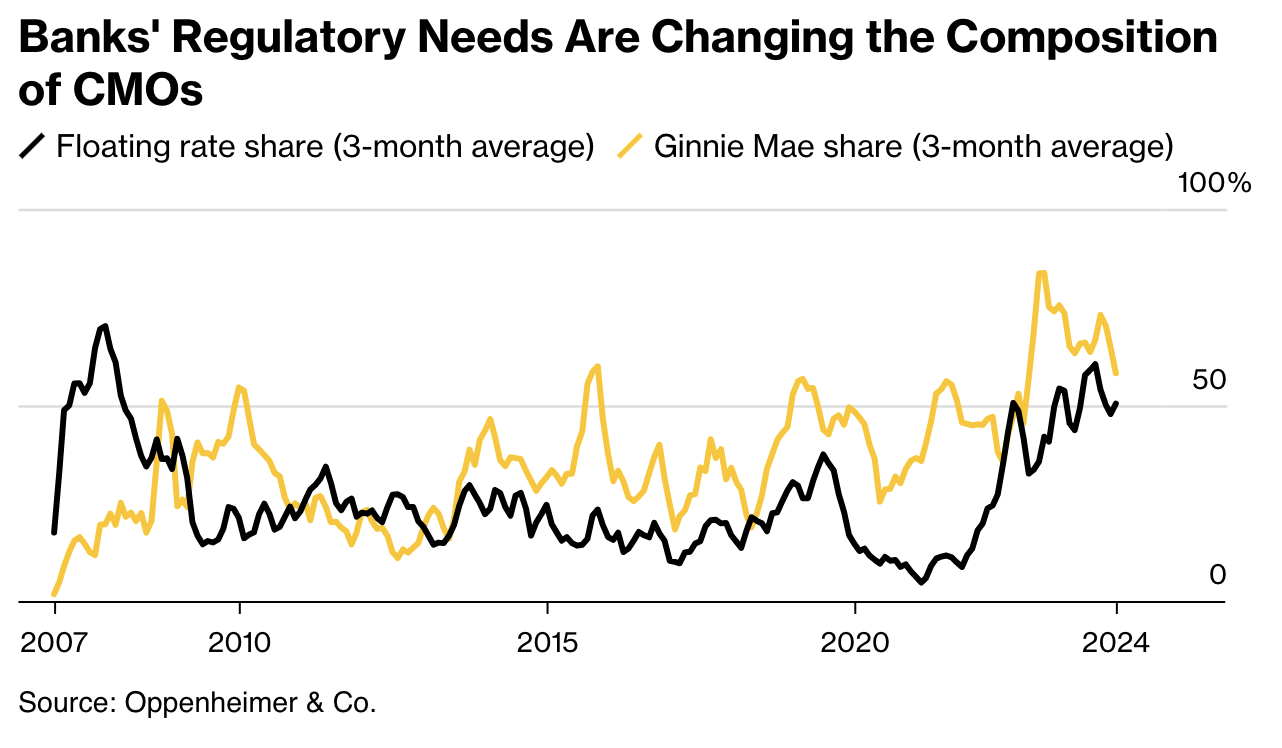

There are around $800 billion of CMOs outstanding, according to Erica Adelberg, a strategist at Bloomberg Intelligence. The share of new CMOs that have floating rates and are backed by Ginnie Mae has been hovering around the highest level in years, according to Oppenheimer & Co. data.

Banks tend to prefer CMOs tied to Ginnie Mae, a guarantor of mortgage bonds that is part of the US government. Bank regulators assign those products risk weights of zero, and that’s not expected to change under upcoming rules known as Basel III Endgame.

Mortgage-backed securities are a staple of bank balance sheets alongside Treasury bonds, and CMOs are just one type.

But they differ from products that simply pass through income to investors, because CMOs can be customized to meet the needs of whoever is buying them.

The securities are complicated, but they are generally designed to lower risk for banks by, for example, cutting the maturities on the securities or carrying floating rates. Because they are built with government-backed mortgage bonds, investors don’t face the risk of losing principal if borrowers default.

In that regard, they are very different from the kinds of securities that blew up bank balance sheets during the financial crisis.

The CMOs that banks have been gobbling up are often structured so that the rates reset each month, although there are limits as to how high or low the coupons can go.

“Banks are trying to retain less sticky deposits, which are liabilities they treat as floating rate,” said Nick Maciunas, a strategist at JPMorgan. “They need to match that on the asset side, and one way to do that is with floating rate CMOs, which have relatively short durations.”

If rates go down significantly and mortgage borrowers start refinancing in large waves, the CMOs banks are investing in would become less attractive. But, for now, they offer an opportunity to minimize interest rate risk while also delivering attractive yields.

“Short-term yields are currently quite high,” said Walt Schmidt, a strategist at FHN Financial. “CMOs are very low duration bonds with wide spreads that live near the front of the yield curve, so they confer both of those benefits.”

The trend coincides with other steps banks have been taking to right their balance sheets since the failure of Silicon Valley Bank in March 2023.

When the market noticed that SVB was heavily invested in longer-term bonds whose market value had dropped, its stock price dropped and the bank began losing deposits, causing ripple effects across the sector.

Regional banks that remain standing have had to raise capital, sell assets, boost deposit rates and become more sophisticated about balance-sheet management.

“For 15 or maybe even 17 years you had very, very low fluctuations in interest rates and you had nothing on the horizon that presented indications of material changes in interest rates,” said Greyson Tuck, president of Gerrish Smith Tuck, which provides legal and consulting services to US community banks.

“Banks got very comfortable in structuring their portfolios around that.”

Now though, “the banks are having to fight deposit flight by meeting depositor and market demands for higher rates.”

US banks have lost about $386 billion in deposits, or 2% of total deposits, since the end of 2021, according to seasonally adjusted Federal Reserve data.

They have recouped some funds by offering better rates and paying special attention to commercial customers that typically have higher average deposits, Tuck said.

Lenders have also been highlighting products that distribute deposits across multiple institutions to benefit from a $250,000 federal insurance maximum on each, and bulking up teams that manage investments, he said.

While all lenders can buy CMOs, regional banks are most focused on them.

For instance, Western Alliance Bancorp — one of the lenders that faced worries last year over possible deposit flight — boosted

its CMO holdings by several-fold during the first quarter of 2024 to roughly $3 billion, according to Bank of America data.

Similarly, East West Bancorp, a California-based lender focused on Asian American communities, quadrupled

holdings of CMOs in the first quarter, the Bank of America data show. CMOs now account for more than two-thirds of its total $6 billion in mortgage bonds backed by government agencies.

Western Alliance and East West Bancorp declined to comment.

Updated: 7-13-2024

Rate Cuts Could Make Things Worse For Banks Before They Help

Lenders could get caught between falling yields and rising deposit costs, especially if loan growth is slow.

With the Federal Reserve poised to begin cutting interest rates, banks stand to benefit. But not right away.

High interest rates have started to wear on the biggest banks, with deposit costs rising and customers like credit-card and commercial-property borrowers feeling the effects of higher debt payments.

Ultimately, lower but still fairly high interest rates can work in banks’ favor. Rate cuts could stimulate more borrowing and encourage Wall Street dealmaking, while also helping banks dial back the rates they are paying on things like high-yield savings accounts or certificates of deposit.

If the Fed ultimately only cuts rates a few times and doesn’t return to the ultra-low rates of previous cycles, that would help keep banks’ overall interest earnings pretty robust.

But the transition to that world could get rocky. The first small decline in rates probably won’t by itself stimulate a huge amount of new lending. Yet it will start to eat into banks’ interest earnings on their cash, and on floating-rate loans tied to benchmark rates, like credit cards or corporate revolvers.

And a lot of depositors are probably still going to be looking for a good return on their cash.

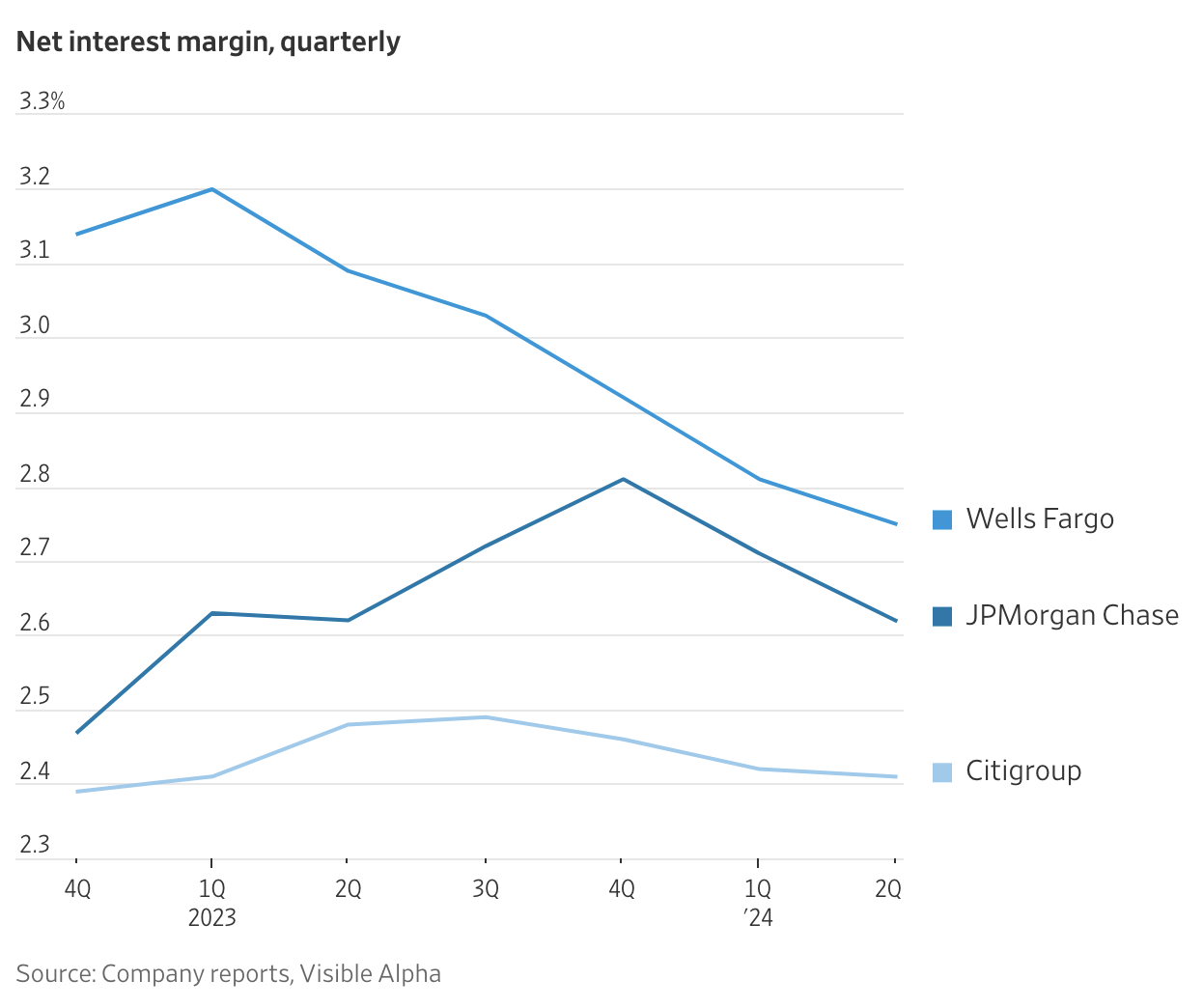

When it reported second-quarter earnings on Friday, Wells Fargo said it currently expects net interest income this year to be down by around 8% to 9%, a bit more pessimistic than its prior range of a roughly 7% to 9% decline.

This is a closely tracked measure of how much banks earn in interest net of what they pay out in interest expense.

Calling which quarter will be the “trough” for net interest income “sometimes can be a little tough,” Wells Fargo Chief Financial Officer Michael Santomassimo told analysts on Friday. But, he said, “we still feel pretty good about being able to see that happen over the coming few quarters.”

Wells, Citigroup and JPMorgan Chase all reported another quarter-over-quarter drop in their reported net interest margin, which is a way to measure the difference between the rates banks earn on assets and what they pay on liabilities.

Banks can escape this squeeze and add more dollars overall to their earnings if they are growing their loan books. But big corporate borrowers are still acting cautiously.

And in the case of commercial real-estate loans, some banks may actually be looking to shrink those books for now, hoping that construction projects find permanent financing elsewhere, or that borrowers will put up a lot more equity and get smaller loans when they refinance.

Consumer lending via credit cards is still growing at a strong clip. Yet worries about consumers mean this might not be the best time to go hog-wild with cards. Banks’ net charge-off rates on card loans rose sharply in the second quarter from a year prior.

Banks argue the jump in losses partly reflects the abnormally good credit performance during the pandemic. And delinquency rates were slowing quarter over quarter. But it might still take a couple quarters to work through that hump of losses, and for the benefits of lower monthly payments to move through borrowers’ budgets.

As for deposits, lower interest rates should eventually take the pressure off banks’ rising deposit costs.

But a lot of customers have been taking their time to move cash out of things like checking accounts, and may still be doing so even if rates are slightly lower, meaning interest costs for banks could keep rising.

Until longer-term bond yields pick up and people want to invest their cash or want to spend more, they might be content to let that cash sit and earn for as long as it can.

For example, Wells Fargo’s Santomassimo told analysts on Friday that the pace of overall increase in deposit costs had slowed in the first half of the year. But he also noted that the bank recently raised pricing on sweep deposits in advisory brokerage accounts, which wasn’t a change anticipated in the bank’s original net interest income guidance.

There are other things working in the background that might help big banks. A further jump in Wall Street dealmaking could add fee income. Falling interest rates also can raise the value of banks’ securities portfolios, building up more capital.

That, combined with regulators revisiting some of their plans to increase banks’ capital requirements, could leave the biggest lenders with a lot of excess resources.

But those resources need better opportunities to be deployed—and that might have to wait for a few more rate cuts to filter through to stronger economic activity. For now, it seems bank stocks are on pause.

Citigroup, JPMorgan and Wells shares were all down on Friday. The KBW Nasdaq Bank index is still up over 13% this year, but that trails the S&P 500’s nearly 18% rise.

Sometimes the waiting really is the hardest part.

Updated: 7-19-2024

State Laws Barring ‘Debanking’ Could Harm National Security, Treasury Says

The Treasury Department, taking aim at a new Florida law, warned against legislation meant to prevent banks from discriminating against customers over their politics.

The U.S. Treasury Department said state laws targeted at stopping banks from dropping customers over their politics could harm national security, singling out Florida legislation recently signed by Gov. Ron DeSantis.

Banks need to be able to probe customers so they can prevent money laundering and counter terrorist financing, Treasury Undersecretary Brian Nelson said in a letter to lawmakers sent Thursday.

“State laws interfering with financial institutions’ ability to comply with national security requirements heighten the risk that international drug traffickers, transnational organized criminals, terrorists and corrupt foreign officials will use the U.S. financial system to launder money, evade sanctions and threaten our national security,” Nelson said.

The Associated Press earlier reported on the letter, which was sent in response to a bipartisan request from several House lawmakers earlier this month.

Florida Gov. Ron DeSantis has been at the center of a political fight that has pitted conservatives against financial institutions seen as too left-leaning, which he has derided as “woke capital.” A law that DeSantis signed in May, House Bill 989, bars institutions from looking outside quantitative factors and into their “affiliations” when deciding whether to do business with customers.

The letter extensively criticized that legislation. A representative for DeSantis declined to comment. DeSantis’s communications director on his personal feed on social-media site X said the Biden administration opposes the law because it threatens the administration’s political agenda.

The law is meant to prevent, for example, a bank from deciding not to do business with a legal firearms dealer. Tennessee has also passed similar legislation.

“We are not going to allow big banks to discriminate based on someone’s political or religious beliefs, and we will continue to fight back against indoctrination in education and the workplace,” DeSantis said when he signed the bill.

But the Treasury Department warned Thursday that banks need to be able to look closely at customers when assessing risks.

Florida’s law against looking into a customer’s affiliations might, for example, stop a bank from considering their connection to a terrorist group, Treasury said.

The law also bars banks from considering factors “related to the person’s business sector,” which some banks might interpret as prohibiting them from taking a close look at high-risk sectors that trade in goods Russia could use for its war effort and the sale of fentanyl precursors, the Treasury Department said.

U.S. officials have increasingly used the financial sector as a tool to pursue geopolitical goals, including through the extensive sanctions imposed on Russia following its invasion of Ukraine, and to fight transnational crime, such as the flow of illicit fentanyl.

Related Articles:

The Federal Minimum Wage Doesn’t Really Matter Anymore (#GotBitcoin?)

Investors Ponder Negative Bond Yields In The U.S. (#GotBitcoin?)

Lower Mortgage Rates Aren’t Likely To Reverse Sagging Home Sales (#GotBitcoin?)

Financial Crisis Yields A Generation Of Renters (#GotBitcoin?)

Global Manufacturing Recession Weighs On US Economy (#GotBitcoin?)

Falling Real Yields (0.241% ) Signal Worry Over U.S. Economy (#GotBitcoin?)

Donald Trump’s WH Projects $1 Trillion Deficit For 2019 (#GotBitcoin?)

U.S. Home Sales Stumble, As Pricey West Coast Markets Suffer Declines (#DumpTrump)

Lower Rates Have A Downside For Bank’s Mortgage-Servicing Rights (#GotBitcoin?)

Central Banks Are In Sync On Need For Fresh Stimulus (#GotBitcoin?)

Weak Corporate Earnings Signal A Weak Economy (#GotBitcoin?)

Price of Gold, Indicator Of Inflation And Recession Surges (#GotBitcoin?)

Recession Set To Materialize In Approximately In (9) Months (#GotBitcoin?)

A Whiff Of U.S. Recession Is In The Air Again. Credit Trumponomics

Trump Calls On Fed To Cut Interest Rates, Resume Bond-Buying To Stimulate Growth (#GotBitcoin?)

Fake News: A Perfectly Good Retail Sales Report (#GotBitcoin?)

Anticipating A Recession, Trump Points Fingers At Fed Chairman Powell (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Los Angeles And Other Cities Stash Money To Prepare For A Recession (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.