Can You Say “Federal Bailout”? (#GotBitcoin?)

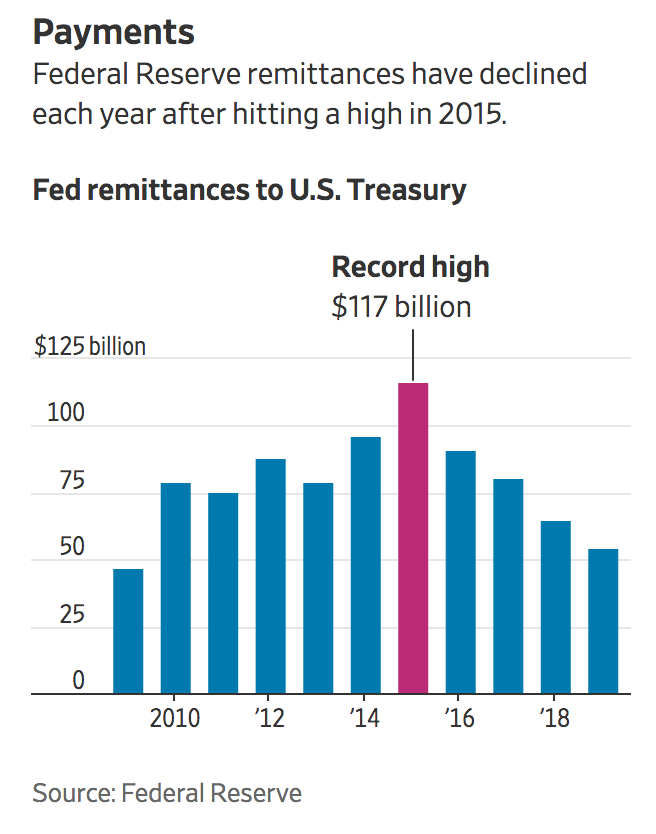

The Fed is required to use its revenue to cover operating expenses and send much of the rest to the Treasury’s general fund, where it is used to help cover the government’s bills.

The Fed said Friday’s figures are preliminary and could be adjusted when its audited financial statements are released in March. Can You Say “Federal Bailout”?,Can You Say “Federal Bailout”?,Can You Say “Federal Bailout”?,Can You Say “Federal Bailout”?

Related Articles:

Trump Attempts To Bribe Ukraine President To Investigate Biden’s Son (#GotBitcoin?)

Service Sector Also Impacted By Negative Affects Of Trumponomics (#GotBitcoin?)

Junk Debt Sends Early Warning Signals (#GotBitcoin?)

Trump: The Best President Russian Money Can Buy

Trump Concedes Economic Defeat Trumponomics Will Result In Negative Interest Rates (#GotBitcoin?)

U.S. Corporate Insiders Selling Shares At Fastest Pace Since 2008 (#GotBitcoin?)

Median U.S. Household Income Slows As U.S. Job Openings Cool

High Debt Levels Are Weighing On Economies (#GotBitcoin?)

Budget Deficit Grow, Stocks, Bond Yields Fall, Negative Interest Rates Spread!

Central Banks Plan For Negative Interest Rates (#GotBitcoin?)

Junk Bond Yields Go Negative As Central Banks Cut Interest Rates And Print Money (#GotBitcoin?)

White House Pushes Fed Towards Negative Interest Rates (#GotBitcoin?)

U.S. Junk Bonds With Negative Yields? Yes, Kind of (#GotBitcoin?)

Investors Ponder Negative Bond Yields In The U.S. (#GotBitcoin?)

European Central Bank Warns World Of Drawbacks of Negative Rates (#GotBitcoin?)

Bond Yields Sink To New Lows, Federal Deficits Skyrocket And Trump Back-Tracks On Tax Cuts

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.