JPMorgan Chase With It’s JPM ShitCoin Wants To Take On Bitcoin (#GotBitcoin)

Payments is an extremely buzzy corner of the financial sector right now, and JPMorgan Chase wants to dominate it, Credit Suisse analyst Susan Roth Katzke told clients Friday following a meeting with the bank’s management. JPMorgan Chase With It’s JPM ShitCoin Wants To Take On Bitcoin (#GotBitcoin)

The back story. JPMorgan stock (ticker: JPM) is up almost 14% so far this year, just behind the S&P 500 index’s gain of 14.4%. The bank is the largest is the U.S. by assets and is looking to use that position to build a bigger, more profitable payments unit.

Related:

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End of 2019: Report

JPMorgan Chase Settles Crypto Credit Card Lawsuit For $2.5M

JPMorgan Provides Banking Services To Crypto Exchanges Coinbase And Gemini

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years

JPMorgan’s New App Service For Young People Fails

JPMorgan Scams Investors With Phantom Yields In EMBI Indexes

Citigroup, JPMorgan Chase And Others Fined $1.2 Billion Over FX Trading

In January, it combined the formerly separate business units that handled consumer-to-merchant payments and corporate transactions into a new wholesale-payments operation.

In February, the bank rolled out a prototype of a digital coin that will be tested out in transactions with institutional clients.

What’s new. Roth Katzke met with Takis Georgakopoulos, the global head of that new wholesale-payments group, and concluded that the bank’s “management has made it a strategic priority to dominate all aspects, both consumer and corporate.”

Payments, she said, is a business where scale is very important, noting that JPMorgan is making progress on that front with its integration of internal platforms—a process that is now more than halfway done. Additionally, she points out that business lines like Treasury Services are a fragmented market and that the bank can gain from consolidation.

Looking ahead. With revenue growth of between 4% and 5% and a high return on equity, Roth Katze says, JPMorgan’s wholesale payments business is “both strategically important and financially sound.”

Updated: 10-27-2020

JPMorgan’s Stablecoin Finally Sees Commercial Light Of Day

JPMorgan Chase now recognizes blockchain’s profitability and has created a new business dedicated to digital currency and blockchain work.

A year and a half after it was first announced, JPM Coin — JPMorgan Chase’s in-house stablecoin — is now live and in use by a major transnational tech firm for around-the-clock cross-border payments.

According to a report on Tuesday, this real-world proof that the technology is increasing efficiency and reducing costs has bolstered the megabank’s confidence in the technology’s promise and profitability. With the expectation that further commercial clients will sign up to use the stablecoin, JPMorgan Chase has created a dedicated business devoted to digital currency and blockchain work.

The new business unit, dubbed “Onyx,” has over 100 staffers and is being led by Umar Farooq as CEO. Takis Georgakopoulos, JPMorgan Chase’s global head of wholesale payments, told reporters:

“We are shifting to a period of commercialization […] moving from research and development to something that can become a real business.”

On the heels of PayPal’s recent embrace of crypto, incumbents’ confidence that blockchain can actually make them money appears to be on the rise. JPMorgan Chase’s experimentation and development with the technology thus far can be broken up into several key areas.

First, the megabank has been piloting a blockchain-based Interbank Information Network since 2017, involving over 400 participant banks and corporations. JPMorgan Chase believes that the network, now being rebranded as Liink, can bring significant efficiency savings for the complex interactions of corresponding banks in cross-border wholesale payments. JPMorgan Chase itself accounts for cross-border wholesale payment flows of over $6 trillion per day across over 100 different countries.

The bank has also identified blockchain’s usefulness to innovate the existing outdated system for processing “hundreds of millions” of paper checks. Blockchain and digitization can, securely, banish the physical aspects of this exchange altogether. Georgakopoulos said that a new blockchain system is months from commercial launch:

“Using a version of blockchain with the participants being the main issuers of checks and the main operators of lockboxes, it’s possible we can save 75% of the total cost for the industry today, and make checks available in a matter of minutes as opposed to days.”

Lastly, JPMorgan Chase has confidence in blockchain for the creation of new payment rails for global central banks and their evolving central bank digital currencies. Pointing to China and Singapore, Georgakopoulos expressed his confidence that the probability of CBDC adoption is “very high.”

Farooq, the new CEO of Onyx, gave his insights as to why developments have appeared “slow,” or at least equivocal, on the blockchain front at JPMorgan Chase until now:

“If you think about blockchain, we are either somewhere in the trough of disillusionment or just beyond that on the hype curve. That’s why at JPMorgan we’ve been relatively quiet about it until we were ready to scale it and commercialize it.”

Updated: 5-25-2021

JPMorgan Compares The Recent Crypto Plunge To 2017

I wrote on Sunday that the violent action in crypto bore some resemblance to the market peak in December 2017-January 2018. Since then we’ve seen a bit of a rebound, although the big coins are still well off their recent highs.

In a fresh note out last night, JPMorgan Chase’s head of interest-rate derivatives strategy Josh Younger (who has been writing a lot about crypto lately!) published a note getting at the same idea, that this market bears a resemblance to that peak.

Here are two charts showing that nicely. The second one, the seemingly parabolic rise of the non-blue chip cryptos, is particularly powerful in that it offers a very clear indication of the animal-spirits cycle. As the boom goes on, traders make bets on riskier and riskier stuff.

However, Younger notes differences as well. For one thing, the market volatility seems primarily to be a North America phenomenon this time around, with prices much more stable in Europe and Asia. He also notes that while market depth has fallen in the recent liquidations, the markets remain healthy overall.

His Conclusion:

We continue to see evidence of resilient microstructure in cryptocurrency markets: the volatility spike appears somewhat regionally localized, market depth is down but has not cratered despite these moves, and derivatives pricing has managed to adjust quickly enough to retain a decent fraction of the levered long base. This all argues against the view that we are in the midst self-reinforcing vicious cycle of price declines—a classic run scenario.

This is really the key question right here. As many people have pointed out, the crypto market is highly reflexive. Historically when prices go up, they go up fast because everyone wants in. And when prices then go down, they go down fast and stay down because people don’t want to hold the stuff or buy the stuff if the line isn’t going up.

It seems plausible that, with greater institutional ownership and perhaps a greater number of true believers, this bout of selling won’t beget selling the same way it did in the past. Plus we’ve seen crypto continue to not die, despite a million obituaries having been written.

Updated: 3-22-2021

Jamie Dimon May Soon Turn Away Deposits In Order To Comply With Simple Leverage Regulation, And He’s Not Happy

It’s a strange problem: JPMorgan Chase and other big banks are getting more assets than they even want.

You don’t need to feel too sorry for Jamie Dimon, the chief executive officer of JPMorgan Chase & Co., the largest bank in the U.S. by assets and the largest in the world by trading and fee revenue. But it’s easy to see why he might be miffed at the Federal Reserve at the moment.

On March 19, the Fed announced that a temporary regulatory break for banks will expire as scheduled on March 31. Dimon had told investment analysts in January that if the break went away, his bank would have a financial incentive to turn away deposits, as it has done in the past (for large institutional deposits, that is; the bank still likes retail deposits, which tend to be sticky and produce other banking business).

Here’s a snippet from the Jan. 15 earnings call as I transcribed it from Bloomberg’s recording:

Dimon:

Remember, we were able to reduce deposits $200 billion within like months last time.

Jennifer Piepszak, Chief Financial Officer:

Yeah.

Dimon:

But we don’t want to do it. It’s very customer unfriendly to say, “Please take your deposits elsewhere … .”

It’s common for Jamie Dimon to complain about “gold-plated” banking regulation, but in this case he seems to have a point. A Fed regulation that makes it unprofitable for banks to take in deposits—when taking in deposits has always been a key function of banks—is a bit hard to justify.

How we got to this point is complicated but interesting. The old style of bank regulation was to limit the leverage of banks. It was analogous to how banks themselves require homebuyers to have some skin in the game. Homebuyers have to put in some of their own money so the mortgage loan they get is smaller than the value of the house they’re purchasing.

That way, if the homeowner stops making payments, the bank can seize the house, sell it, and get back what it lent. Similarly, under simple leverage regulation, banks had to show that the value of their assets (such as the loans they make and cash in the vault) was substantially greater than their liabilities (such as the deposits they take in, which is money they owe to the depositors). Roughly speaking, the excess of assets over liabilities was called capital.

But that simple system failed. Banks can make more money by going big on risky assets like high-interest loans than by investing in safe, low-yielding stuff like Treasury securities.

And as long as regulators treated all assets alike, it made sense to load up on risky ones.

But risky assets are more likely to go bust, so regulators wisely started taking the safety of different assets into account.

It was a big improvement, but not perfect: Some banks understated the riskiness of their assets, which became a problem in the global financial crisis of 2008-09. For instance, some loaded up on the debt of their national governments because it was given a zero risk-weighting, when in fact it was highly risky.

The new system is belt and suspenders. The belt is risk-weighted capital regulation, under which riskier assets require a bank to have more capital against them, while very safe assets require little or none. There’s also a backup system—the suspenders—where all assets are treated alike, just as in the old days.

This is called the supplementary leverage ratio. It was agreed to by a wide range of nations under the auspices of the Bank for International Settlements and took effect in 2018. The SLR is meant to deal with situations where a bank has loads of assets that aren’t as safe as they’re said to be.

The suspenders are supposed to hang loose most of the time while the belt does the real work of holding up the pants, so to speak. In last year’s Covid-19 recession, though, banks suddenly got flooded with more assets than they could handle.

The Fed bought Treasuries to drive down interest rates and paid for them by creating reserves, which show up as assets on banks’ balance sheets. Businesses drew down lines of credit and deposited the proceeds in banks. Consumers’ bank accounts were swollen by government relief checks.

Demand for consumer and business loans was weak, so banks stashed most of the incoming money in Treasury securities or left it in cash. (Funds from customers are both an asset to the bank, because they can invest the money, and a liability, because they have to return it someday.)

Suddenly the suspenders weren’t so loose anymore. Without even trying, banks had acquired a lot more assets on their balance sheets. Most were supersafe, but the SLR applied equally to every dollar of them, regardless of their safety.

Realizing there was a problem, the Federal Reserve and other federal bank regulators in May 2020 exempted Treasuries and reserves at the Fed from the calculation of the supplementary leverage ratio.

Not permanently, but through March 31, 2021. It said the exemption “will provide flexibility to certain depository institutions to expand their balance sheets in order to provide credit to households and businesses in light of the challenges arising from the coronavirus response.”

This year banks lobbied vigorously for the exemption to be extended or even made permanent, but, as mentioned above, on March 19 the Fed said without explanation that the exemption would end at the end of the month.

What happens now? Nothing right away. Banks have more capital than they need, so they won’t have to shed assets starting April 1. Zoltan Pozsar, an analyst at Credit Suisse Group AG, wrote in a note to clients on March 16, ahead of the Fed announcement, that “Neither the Fed nor the market should fear mayhem if the exemption expires.”

One key reason, he said, is that the major banks won’t be affected by the expiring exemption because they never opted into it in the first place for their operating subsidiaries. And, he wrote, 90% of the currently exempt Treasuries and Fed reserves are being held at the operating subsidiary level.

In the longer run, though, there could be problems. Pozsar wasn’t quite as blithe when he discussed the SLR on the Odd Lots podcast aired by Bloomberg on March 3. If banks such as JPMorgan Chase push away institutional deposits by charging fees or putting on negative interest rates, the money will spill into money-market funds, he predicted. But these funds won’t have any good place to put the money either, he said.

If they pour into Treasury bills, they could push the bill yields negative. But money-market funds can’t afford to earn negative returns because they promise to pay back investors 100 cents on the dollar.

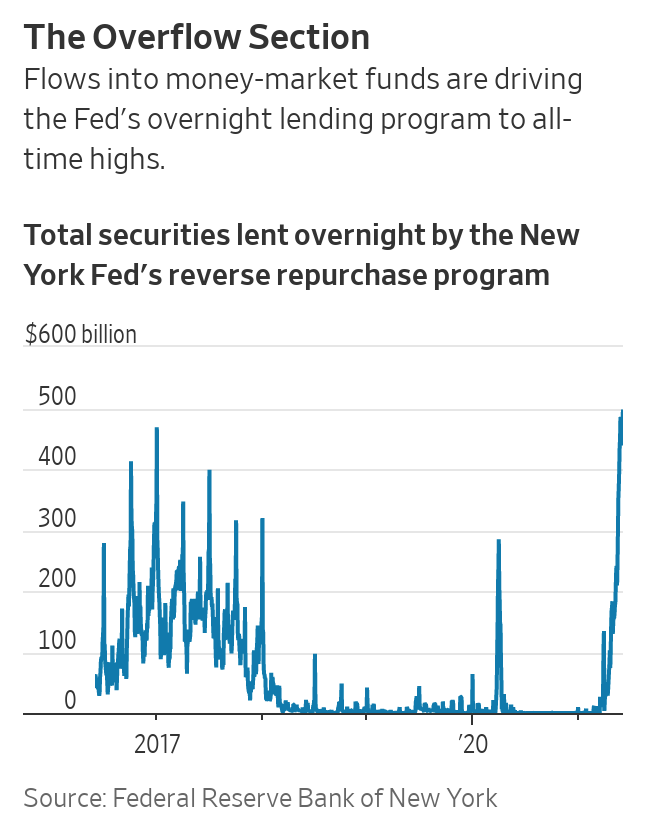

Pozsar said the Fed system could assist by allowing money-market funds to stash more money with it through overnight reverse repurchase agreements. The Federal Reserve Bank of New York did just that two weeks later, announcing on March 17 that it would allow each of its counterparties to do overnight reverse repos of $80 billion a day, up from $30 billion previously.

Pozsar, who used to work for the New York Fed, called that “foaming the runway” for the March 31 expiration of the SLR exemption.

In 2014, when the supplementary leverage ratio was under discussion, Fed staff predicted [PDF] that the impact of the enhanced version of the ratio on the biggest banks would be modest because, after all, the Fed was about to start shrinking its balance sheet. In reality, the balance sheet is bigger than ever now and still growing.

As the Fed continues to buy Treasuries and mortgage bonds and pays for them with reserves, banks’ assets will continue to swell, and eventually the supplementary leverage ratio could become the “binding constraint” on the banks’ behavior; the suspenders will become tight. That would be a return to the bad old days.

Some of the resistance to keeping the leverage exemption in place past March 31 is based on concerns that banks need bigger safety buffers. That’s a legitimate concern. But the question of how much capital banks need is separate from the question of how those capital levels should be determined.

There area actually four ways of setting capital: risk-weighted capital, supplementary leverage ratio, post-stress estimate of risk-weighted capital, and post-stress estimate of supplementary leverage ratio. That ends up causing confusion and treating banks differently when they’re engaged in the same activities.

It’s “not clear you can fix the gaming of one rule by adding more rules,” says a 2017 presentation [PDF] by Robin Greenwood, Sam Hanson, Jeremy Stein, and Adi Sunderam of Harvard University and the National Bureau of Economic Research for a Brookings Papers on Economic Activity conference.

Their preference: a single standard that takes into account stressful scenarios and is “generally more sensitive to the kinds of data that you wouldn’t want to bake into a hard rule.”

The Fed may end up having more to say about this.

Updated: 6-9-2021

Banks To Customers: No More Deposits, Please #GotBitcoin

Some banks have warned the growing deposits could force them to raise more capital, or say no to deposits.

“Raising capital against deposits and/or turning away deposits are unnatural actions for banks and cannot be good for the system in the long run,” Jennifer Piepszak, then-CFO of JPMorgan Chase & Co., said on a call with analysts in April.

Flows into U.S. money-market funds have surged in recent months, pushing the total assets held in such funds to $4.61 trillion, just shy of the record set in May 2020, according to the Investment Company Institute.

Top of mind for many big banks is a rule requiring them to hold capital equivalent to at least 3% of all assets. Worried about the rule’s impact during the pandemic, the Fed changed the calculation in 2020 to ignore deposits the banks held at the central bank, but ended that break this March.

Banks have several options for unloading client deposits, though they try not to offend their customers in the process.

One strategy is reverse tiering, giving clients lower yields for additional deposits. Asking customers to move some funds to another, smaller bank also is an option, said Pete Gilchrist, an executive vice president at Novantas Inc., which advises banks.

In recent months, banks including BNY Mellon have focused on moving clients from deposits into money-market funds, which are common cash-like investments. Assets in money-market accounts, even ones run by the same bank, are treated differently under bank capital rules, alleviating some of the regulatory pressure.

Some banks, awash in deposits, are encouraging corporate clients to spend the cash on their businesses or move it elsewhere.

U.S. companies are holding on to billions of dollars in cash. Their banks aren’t sure what to do with it.

When the coronavirus pandemic hit last year, corporate executives rushed to raise money. Banks have been holding that cash ever since, and because companies are reluctant to borrow from them, they can’t turn it into income-generating loans.

That has weighed on banks’ profit margins, and some have started pushing corporate customers to spend the cash on their businesses or move it elsewhere.

Bankers say they thought the improving economy would reduce companies’ desire for holding cash, but deposit inflows have continued in recent weeks.

Chief financial officers and treasurers, many still wary of the pandemic’s impact, say they aren’t ready for big changes, even if they earn little or nothing on their deposits.

“We have been operating with a higher cash balance for about 12 months now,” said Matthew Ellis, the chief financial officer of telecommunications company Verizon Communications Inc. “There’s been no decision yet if and when to bring it down.”

Verizon held $10.2 billion in cash and cash equivalents at the end of the first quarter, up 45% from a year earlier.

Pascal Desroches, who manages the finances of rival AT&T Inc., said the company doesn’t plan to move its cash holdings into other investments to generate a higher return. “We are not looking to optimize the yield,” he said.

Companies flooded U.S. banks with deposits at the start of the pandemic. In March 2020, the Federal Reserve lowered interest rates to near zero and launched bond-buying programs, which enabled many companies to raise funds at low costs. The Treasury Department also made loans, including to airlines.

Bank deposits have continued to surge this year. Between late March and May 26, they rose by $411 billion to $17.09 trillion, according to the latest available data from the Federal Reserve.

That is slower than the pace last spring, but still nearly four times the average of the past 20 years, according to the Fed data.

High deposits usually aren’t a bad thing for banks, as long as they can use the money to make loans. But bank lending has been slow as many companies prefer to borrow money from investors. For banks, total loans equaled 61% of all deposits as of May 26, down from 75% in February 2020, according to the Fed data.

The industry net-interest margin, a key measure of lending profitability, fell to a record low in the first quarter, according to the Federal Deposit Insurance Corp.

Some banks are encouraging corporate customers to consider alternatives. “Banks would certainly like to do different things, obviously,” said Peter Mariani, CFO of Axogen Inc., a company specializing in nerve-repair research. “But we’re going to maintain our…conservative investment strategy with our cash.”

“We’ve been very successfully working with our clients to basically explore and move some of those nonoperational deposits,” said Emily Portney, CFO at Bank of New York Mellon Corp.

The money-market funds, in turn, need new places to park all that new cash and earn some interest. But rock-bottom interest rates have pushed them into storing it back at the Federal Reserve overnight, in a facility that pays them zero return and had been largely ignored for the past three years.

Funds stored overnight with the Federal Reserve Bank of New York surged in May and hit a record of $497.4 billion on Tuesday.

Finance chiefs say holding on to cash is sensible, for now.

“Having a bit more cash than you normally would still makes good business sense now as we aren’t really out of the pandemic yet,” said Jeff Shepherd, the CFO of Advance Auto Parts Inc., which is based in Raleigh, N.C.

Updated: 3-14-2024

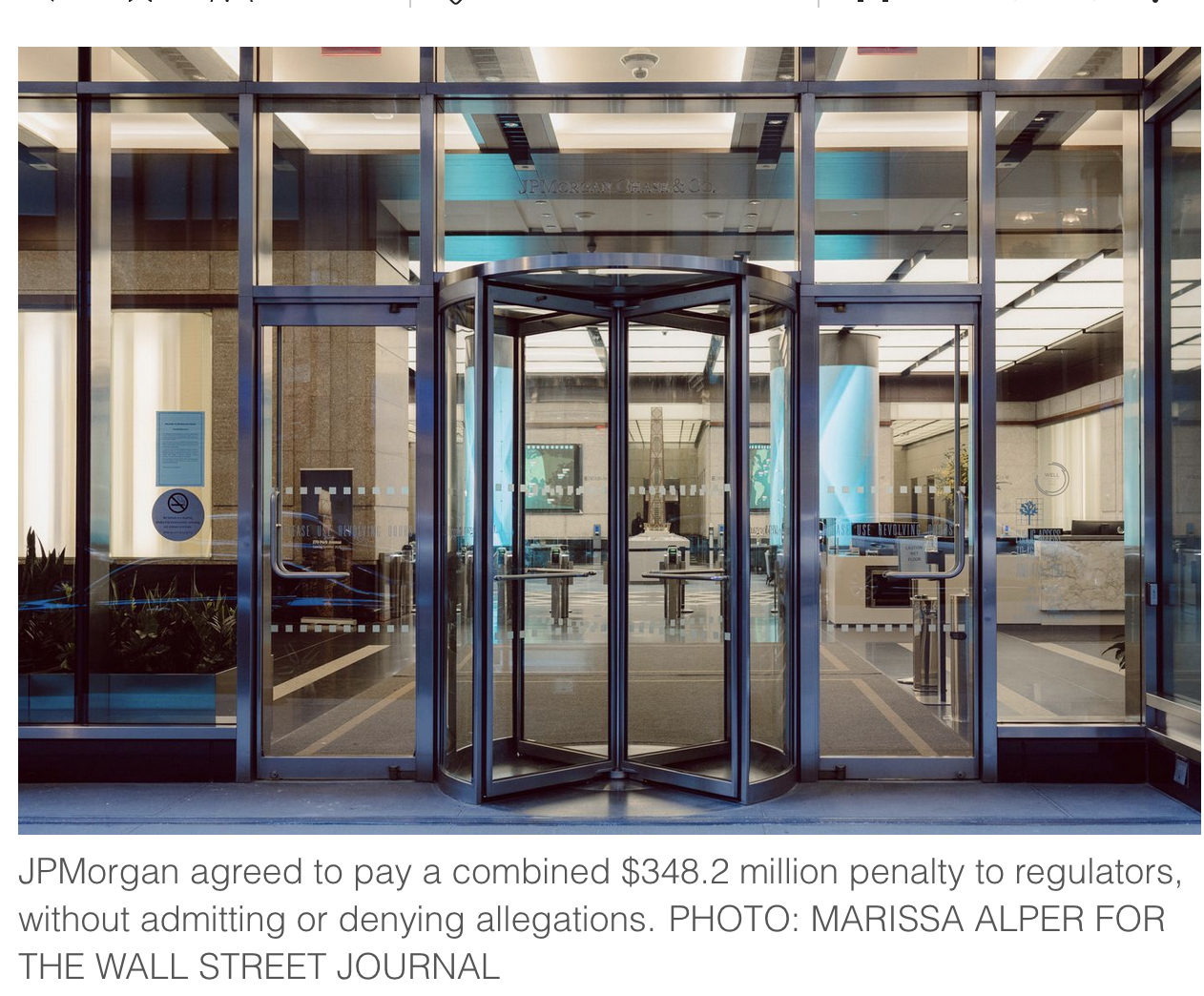

JPMorgan Hit With Nearly $350 Million Fine For Compliance Failures In Trading

Federal regulators allege that JPMorgan didn’t properly oversee and monitor trades that the bank and clients carried out through its systems.

Federal regulators fined JPMorgan Chase roughly $350 million on Thursday for failing to properly monitor billions of trades that the bank has executed since 2019.

The Federal Reserve said JPMorgan didn’t adequately surveil trading and order activity through the firm’s corporate and investment bank across 30 exchanges and other trading venues. The trades were for the firm and for clients.

Regulators and law enforcement require banks to watch and record clients and trades as a front line in market policing and to ensure their own risks are under control. Banks are required to flag suspicious activity and hand over documents to investigators when asked.

JPMorgan agreed to pay a combined $348.2 million penalty to its regulators at the Fed and the Office of the Comptroller of the Currency, without admitting or denying the allegations.

“Certain remedial actions are complete and others are under way, and we have not found any employee misconduct or harm to clients or the market in our review,” a spokesman for JPMorgan said.

JPMorgan also said that it is in discussions to resolve claims with a third regulator over its collection of client data related to trading.

In the settlements, JPMorgan agreed to review the old trading data to ensure that no market misconduct had taken place and to take appropriate action if needed.

The bank isn’t allowed to trade on new exchanges or trading venues without permission from the Federal Reserve.

Additionally, JPMorgan agreed to appoint a compliance committee that would ensure the bank is better overseeing its trading business.

In February, JPMorgan disclosed that the bank had received inquiries from the U.S. government regarding the surveillance of trades that the bank executed. It said then that the bank had subsequently identified some failures in JPMorgan’s commercial and investment bank.

Updated: 4-23-2024

JPMorgan’s ‘Bloody Friday’: Why Several Top Financial Advisors Jumped Ship The Same Day

Six teams managing nearly $15 billion in total assets quit JPMorgan’s brokerage unit to join competitors. Recruiters say it was among the largest set of departures from a single firm in a single day.

“That’s the worst I’ve ever seen,” says Roger Gershman, a recruiter and CEO of the Gershman Group. He called it a “bloody Friday” for JPMorgan.

In addition to lost assets, there is also lost talent. The departing teams were composed of more than four dozen employees, including several top-ranked advisors. They left to join Merrill Lynch, Morgan Stanley, Wells Fargo, regional bank Citizens, and independent firm Cresset.

The company’s losses on Friday represent a setback for its plans to expand J.P. Morgan Advisors.

In the high stakes world of financial advisor recruiting, hiring or losing advisors with large assets under management can make a brokerage executive’s day—or spoil it. How then to classify JPMorgan Chase’s losses on Friday, April 19.

But while they took jobs at different companies, the departing advisors share a common history: They all previously worked at First Republic Bank, which collapsed during last year’s regional banking crisis and was acquired by JPMorgan Chase.

That common thread is the starting point for explaining why JPMorgan was left with a slew of empty desks on Friday.

Regional bank fallout. First Republic was known for offering private banking and wealth management services to wealthy customers.

In the years prior to the 2023’s regional banking crisis, First Republic recruited advisor teams with billions of assets under management from large banks and brokerage firms such as Merrill Lynch and JPMorgan.

Advisors were attracted to First Republic because it offered attractive recruiting bonuses and because of its reputation as a boutique wealth manager that provided clients white glove service.

But when the San Francisco-based lender was engulfed in last year’s regional banking crisis, it hemorrhaged tens of billions of dollars of deposits. Dozens of advisors jumped ship as the bank teetered.

When JPMorgan acquired First Republic in May, it got the company’s private banking business and approximately 200 financial advisors and $200 billion in client assets. First Republic had lost perhaps a third of its advisors in the weeks prior.

Attrition ground to a halt after JPMorgan’s acquisition. Many former First Republic advisors were grateful for the rescue, but continued to evaluate their options, according to wealth management recruiters.

And they had time to do so. That’s because JPMorgan didn’t immediately move all the former First Republic assets to its platform; instead it has been migrating advisors and clients in groups over time.

Moving client assets from one firm’s platform to another is a tedious and time consuming process known in the industry as repapering accounts.

“You don’t want to put your clients through that twice,” says Danny Sarch, a recruiter and president of Leitner Sarch Consultants in White Plains, N.Y.

The six teams that jumped Friday were scheduled to begin to move to JPMorgan’s platform next month, according to people familiar with the matter. That meant they had a deadline to make a decision as to whether to stay or to go. Apparently, that deadline was last Friday, or very close to it.

“They had a chance to taste what JPMorgan is like,” Sarch says. And when it came time to repaper client accounts, it seems they decided to move.

Looking for a fit. With regard to one team that left to join Merrill Lynch in Florida, the departure may not have come as a surprise to JPMorgan leaders; it was the second time in four years that those advisors had tendered their resignations at JPMorgan.

In 2020, the team, which includes top-ranked financial advisor Salvatore Tiano, quit JPMorgan to join First Republic. Tiano’s team managed $3.5 billion and last week quit JPMorgan again to join Merrill Lynch in Palm Beach Gardens, Fla., according to Merrill.

For other departing advisors, there may have been something of a culture clash at JPMorgan, according to recruiters. After all, many former First Republic advisors had joined the regional lender because it offered a smaller, more boutique feel compared to the big banks and brokerage firms that the advisors had left.

“Most of the people who went to First Republic went there because they came from a wirehouse and didn’t want to work at another wirehouse,” says recruiter Bill Willis, referring to the national brokerage firms. Willis is the owner of Willis Consulting in Los Angeles.

JPMorgan is the nation’s largest consumer bank. Its wealth management business, which has more than $3.3 trillion in client assets, is dominated by its private bank.

It also has thousands of bank branch-based advisors who operate in Chase branches and who cater mostly to mass-affluent and affluent customers.

Former First Republic advisors joined the company’s J.P. Morgan Advisors unit, which contains a couple hundred advisors serving high-net-worth and ultrahigh-net-worth clients.

JPMorgan, which doesn’t disclose assets and headcount for the unit, has said that it wants to grow its wealth management business, including J.P. Morgan Advisors and its bank branch-based advisors.

Advisors keep tabs on recruiting moves for a sense of which brokerage firms are becoming go-to destinations. They can get paid big bonuses to switch firms.

But there are other factors that go into their decision-making process, including the strength of a prospective employers’ technology and investment platform as well as the degree of autonomy advisors will enjoy.

Advisors generally want more control over their practices, Gershman says.

Friday’s departures highlight the tricky nature of M&A deals in wealth management. Advisors are one of the only real assets in an acquisition and they can leave at any time, taking clients and money with them.

“An acquisition is really recruiting en masse,” Sarch says. “It’s about figuring out and doing the due diligence about whether it is a good fit. It’s hard to know that [beforehand].”

Other wealth management acquisitions in recent years have seen high attrition rates. For example, when Stifel Financial bought the U.S. wealth management business of Barclays in 2015, about half the advisors left for competitors.

A spokeswoman for JPMorgan declined to comment on specific departures. In December, a JPMorgan executive said the company retained 90% of client assets after its takeover of First Republic.

The JPMorgan spokeswoman said that advisor attrition had been close to zero since the acquisition.

Of course, JPMorgan could lose more teams before it completes its planned migration of former First Republic advisors and clients to its platform. But the recent exodus included advisors that were in the last group to make the transition.

Many advisors and their clients and assets have already made the move. That suggests that even including JPMorgan’s losses on Friday, that its attrition has been low—so far.

During last year’s crisis, JPMorgan’s so-called fortress balance sheet offered former First Republic advisors and their clients a safe port in the storm. Soon we’ll know how many advisors want to make that port a permanent home.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin To Be Exposed To Millions With Upcoming “60 Minutes” Segment (#GotBitcoin?)

Grayscale To Investors: Drop Gold (#GotBitcoin?)

Tether Ordered To Freeze Transfers To Bitfinex By New York Supreme Court, Bitcoin Flash Crashes

HTC Smartphone Will Run A Full Bitcoin Node (#GotBitcoin?)

Send Bitcoin Transactions Without Internet Connection

Bitcoin’s Lightning Comes To Apple Smartwatches With New App (#GotBitcoin?)

E-Trade To Offer Crypto Trading (#GotBitcoin)

Bitfinex Used Tether Reserves To Mask Missing $850 Million, Probe Finds (#GotBitcoin?)

21-Year-Old Jailed For 10 Years After Stealing $7.5M In Crypto By Hacking Cell Phones (#GotBitcoin?)

You Can Now Shop With Bitcoin On Amazon Using Lightning (#GotBitcoin?)

Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin, Bright Future Ahead (#GotBitcoin?)

Crypto Faithful Say Blockchain Can Remake Securities Market Machinery (#GotBitcoin?)

Disney In Talks To Acquire The Owner Of Crypto Exchanges Bitstamp And Korbit (#GotBitcoin?)

Crypto Exchange Gemini Rolls Out Native Wallet Support For SegWit Bitcoin Addresses (#GotBitcoin?)

Binance Delists Bitcoin SV, CEO Calls Craig Wright A ‘Fraud’ (#GotBitcoin?)

Bitcoin Outperforms Nasdaq 100, S&P 500, Grows Whopping 37% In 2019 (#GotBitcoin?)

Bitcoin Passes A Milestone 400 Million Transactions (#GotBitcoin?)

Future Returns: Why Investors May Want To Consider Bitcoin Now (#GotBitcoin?)

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes (#GotBitcoin?)

Major Crypto-Currency Exchanges Use Lloyd’s Of London, A Registered Insurance Broker (#GotBitcoin?)

How Bitcoin Can Prevent Fraud And Chargebacks (#GotBitcoin?)

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.