In Arkansas, Montana, Boise And Grand Rapids, The Housing Market Looks Red Hot (#GotBitcoin)

Many Midwestern markets have heated up so quickly they are now experiencing shortages of inventory and rising prices. In Montana,Boise And Grand Rapids, The Housing Market Looks Red Hot (#GotBitcoin)

The housing market is booming. Just not in the places you might expect.

Homes for sale in small to midsize cities like Boise, Idaho; South Bend, Ind.; Columbia, Mo.; and Youngstown, Ohio, are enjoying a sustained upswing.

Related:

Smart Wall Street Money Builds Homes Only To Rent Them Out (#GotBitcoin)

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Investors Are Buying More of The U.S. Housing Market Than Ever Before (#GotBitcoin)

Cracks In The Housing Market Are Starting To Show

Biden Lays Out His Blueprint For Fair Housing

Housing Boom Brings A Shortage Of Land To Build New Homes

Wave of Hispanic Buyers Boosts U.S. Housing Market (#GotBitcoin)

Phoenix Provides Us A Glimpse Into Future Of Housing (#GotBitcoin)

OK, Computer: How Much Is My House Worth? (#GotBitcoin)

Sell Your Home With A Realtor Or An Algorithm? (#GotBitcoin)

During the crucial spring selling season, only 10 of 178 metropolitan areas had double-digit annual price increases, down from two dozen in the second quarter of 2018, according to the National Association of Realtors. Nearly all of those high-growth areas were in less-expensive, smaller markets, where home prices are now rising faster than incomes, inventory levels are shrinking, and bidding wars are breaking out, especially for starter homes.

“We’ve seen this shift to the center of the country,” said Glenn Kelman, chief executive of Redfin, a Seattle-based real-estate brokerage. “It used to be flyover country, and now it’s saving our bacon.”

The national housing market and the economy have been on separate paths for most of the past year. Jobs have been plentiful and wage growth is picking up, while mortgage rates are at their lowest level in nearly three years. But existing-home sales are down 4% this year compared with last, according to an analysis of National Association of Realtors data by Ted Jones, chief economist at Stewart Title Guaranty Co.

That divergence has stumped economists. But the growing strength of housing markets in the heartland suggests that strong economic fundamentals are helping, just not where prices have already grown faster than incomes for seven years.

“Some of those [smaller] markets never saw a big boom coming out of the recession,” said Ralph McLaughlin, deputy chief economist at CoreLogic Inc. “This may be a rising tide finally reaching some of these secondary markets.”

Danielle Parent, a Redfin agent in Cleveland, said she is seeing an influx of buyers from expensive coastal cities. Home prices in Cleveland rose nearly 12% in June compared with a year earlier, according to Redfin. That was driven by a shortage of inventory, as the number of homes for sale declined nearly 7%.

“Every time I think my buyers have just a minute to think about buying a house, if you get the price right, it immediately sells,” Ms. Parent said. “It’s still very, very competitive.”

Julia Tiersky and Brian Tiersky spent about a decade in Seattle before deciding last month to move back to Cleveland, where Ms. Tiersky is from. The couple said lower housing and child-care costs sold them on the move.

In Hudson, a suburb of Cleveland where the couple decided to settle, they were surprised at how competitive the market was. “We’d find something we like and think we’ll go out in a couple of weeks. By the time we did that, things would be off the market,” Mr. Tiersky said.

When the couple found the right home, with a treehouse and proximity to Hudson’s downtown, Ms. Tiersky took a redeye flight from Seattle and went straight from the airport to see it. They made an offer a few hours later.

A long rally in hot spots like the Bay Area and Seattle has run out of gas. These markets are experiencing their first price declines in years, as homes linger on the market for weeks and would-be buyers balk at the still-expensive price tags.

It is unclear whether the sales growth in smaller U.S. cities will be enough to prop up the overall housing market, since slower growth or price declines in the biggest metro areas have weighed heavily on national home sales figures.

Many Midwestern markets have heated up so quickly they are now experiencing some of the downsides of a hot market: shortages of inventory and rising prices that are blocking first-time buyers from entering the market.

Anthony West, a Realtor in Kansas City, Mo., said the rise in competition and lack of inventory have prolonged the buying process for millennials and increased prices of lower-cost homes.

He said younger buyers are having to make compromises, such as choosing an inconvenient location, forgoing the inspection period, or stretching themselves financially to pay for homes.

“That’s got me concerned for them down the road as to will they recoup those extra funds that they purchased this property for?” Mr. West said.

Michelle Gordon, a Realtor in Grand Rapids, Mich., said there is strong demand for entry-level homes, especially with lower mortgage rates. “We have some buyers coming out of the woodwork,” she said.

Nathan Thornton, a 34-year-old general manager at a manufacturing company, and his wife, Clare Thornton, recently bought their third home in Grand Rapids since 2012.

The couple, who have three boys under 7 years old, were desperate for a second bathroom. They looked for a year-and-a-half but kept losing out in bidding wars. “There were a lot of over-ask cash offers that were gobbling everything up,” Mr. Thornton said.

Eventually, the couple found the perfect four-bedroom house with an attached garage and two bathrooms. Then they sold their own home in 24 hours.

“We had multiple offers coming in, but the first one was so good, we locked in right away,” he said.

Updated: 9-10-2019

U.S. Housing Supply Declines For First Time In A Year

But inventory of homes priced over $750,000 rose, according to realtor.com.

U.S. housing supply declined for the first time this year in August, largely due to a lack of available properties in lower price brackets, according to a realtor.com report released Tuesday.

The number of homes on the market last month dropped 1.8% year-over-year, the first drop within the last 12 months.

The report didn’t break out luxury data nor specify the exact number of homes available on the market.

The drop in housing inventory is more acute in the affordable housing market—defined as properties valued at $200,000 and under, which shrank 10% in August. A low mortgage interest rate in the U.S. has prompted buyers at this price level to snap up homes available for sale very quickly, said George Ratiu, senior economist for realtor.com.

“Lower interest rates have given buyers more purchasing power, which is contributing to August’s decline in national inventory,” he said.

On the other hand, the inventory of homes priced at $750,000 and above increased 7% last month.

The U.S. region with the highest inventory decline is the Northeast, which saw a 9.4% drop in August. Next was the Midwest, down 3.8%, followed by the South, down 1.3%.

Although declining inventory generally pushes up sales prices, demand is subdued due to economic uncertainty, Mr. Ratiu said.

“Concerns over trade wars and cutbacks in corporate spending are causing some buyers to postpone their search,” he said. “This is contributing to both the slowdown in prices, as well as the inventory decline, as buyers stay put in their current homes.”

The median listing price declined 1.8% from July to $309,000, the largest percentage of decline from July to August since 2012. Typically, home prices increase from June until September as many families spend the summer house-hunting, Mr. Ratiu said.

Updated: 5-12-2021

Housing-Market Surge Is Making The Cheapest Homes The Hottest

Properties in long-neglected neighborhoods are attracting more interest, boosting revival efforts.

The red-hot U.S. housing market is giving an extra boost to the cheapest houses, including many in historically stagnant neighborhoods that have suffered from a lack of investment.

It is pushing forward efforts to revive the local economies of Detroit, Cleveland, Youngstown, Ohio, and other areas where homes can sell for as little as a few thousand dollars but typically require a lot of work to fix up and can’t be financed with a mortgage.

U.S. ZIP Codes where the median home cost less than $100,000 in early 2018 have had a 42% rise in prices in the three years since then, according to a CoreLogic Inc. analysis for The Wall Street Journal. That is about double the rise for ZIP Codes where the median was between $150,000 and $200,000, and triple the rise in locales with $300,000-plus price tags.

The pandemic has prompted wealthy buyers to splurge on vacation homes and families to trade in city living for the suburbs. It has also fueled demand among first-time home buyers and investors, lifting the bottom end of the housing market in particular.

While prices in many low-cost areas remain far below national averages, some worry that the price appreciation either won’t last or won’t reach the residents who stand to benefit most. The rising prices could also lock some families out of homeownership, especially young people and first-time buyers.

It is unclear if the recent rise “is a sign of upward and sustainable wealth accumulation for low-income and minority households,” said Karen Petrou, author of “Engine of Inequality: The Fed and the Future of Wealth in America.” “I think the data is at best equivocal on that point.”

Still, community advocates see signs that neighborhood revitalization is spreading from more established neighborhoods to those previously lacking signs of economic life.

James Jordan Jr., a general contractor, browsed Zillow Group Inc. listings last year across his hometown of Youngstown, Ohio. He was looking for a fixer-upper that he could rehab and flip but scoffed at listing prices of between $30,000 and $40,000 for homes in bad shape. (Zillow pegged the typical home value in Youngstown at just over $38,000 in April, a 26% rise from a year earlier.)

Instead, he turned to the Mahoning County Land Bank, which manages and sells vacant properties in town to those willing to fix them up. He spent $3,000 in September for a house in a rundown neighborhood east of downtown, where the other properties on the block were largely vacant. The only neighbor died soon after he bought the house.

But it was a four-bedroom house on a corner lot. He redid the plumbing and got rid of the mold. He pulled out the old carpets and painted the walls, all of which he estimates cost him about $5,000. With the house in better shape, he changed his mind about flipping it and decided to move in. He is selling his other house on the city’s north side, which is more centrally located, reasoning that he can get more money for it. “My decision was more economic,” he said.

Buyers in Youngstown tend to be a mix of locals looking to upsize and downsize, as well as investors, including those from out of state, according to Debora Flora, the Mahoning County Land Bank’s executive director.

Because the homes still go for prices that are considered low by national standards, mortgages and construction loans typically are tough to get. Homes that require tens of thousands of dollars in rehab costs typically end up in the hands of investors who have the cash for renovations, Ms. Flora said.

Often, an investment in this price range means sinking more money into buying and fixing up a property than it can ultimately fetch upon sale. At Youngstown Neighborhood Development Corp., a nonprofit that rehabs properties and focuses on neighborhood revitalization, the price increases lessen the risk of this pitfall.

“We’re seeing an opportunity for homes to get investment because they actually have real value,” said Tiffany Sokol, the organization’s housing director.

The cheapest third of homes increased in value faster than the rest of the market in the past few years, according to data from Zillow. Growth in these home values kept increasing in 2020, in contrast with the housing boom from the mid-2000s, when they lagged behind the market.

In Detroit’s cheapest ZIP Code, where the median sales price was $45,500 in early 2018, prices have since risen 113%, according to CoreLogic. That is far more than any other ZIP Code in the city.

That is leading to shifts across Detroit, which has thousands of vacant properties in poor condition. The Detroit Land Bank Authority, which manages these homes, sold 1,091 of them in the first three months of the year, more than double that of a year earlier. Increased demand has prompted the land bank to scrap plans to demolish about 300 houses, according to Rob Linn, director of inventory.

Home values across Detroit rose 24% in the 12 months through April, according to Zillow. That has made it tougher for some potential buyers to find affordable homes.

Tekeela Daniels, a specialist at a Stellantis NV manufacturing plant, started working with a real-estate agent in November to find a house. But all of the houses were either in undesirable neighborhoods or were too small for her, her two teenagers and dog and cat.

“The good houses are instantly gone,” she said. “It’s hard out here getting a house.”

She has been outbid on land-bank properties a handful of times in recent months. Homes on auction typically start at $1,000, but Ms. Daniels has lost out to bidders offering tens of thousands of dollars, she said.

In some cases, rising prices might also squeeze investors looking to fix up properties to sell. Lisa N. Evans and Jason Young, business partners in Cleveland, have fixed up and sold more than a dozen houses in Ohio, according to Ms. Evans.

The prices that buyers are paying have gone up, and so have material costs. That is eating into their profit margins. Recently, they lost out on purchases in Cleveland, so they have shifted their focus to Youngstown, which is cheaper, she said.

“The challenge has been competing with people who if we can buy it for $40,000, they can buy it for $60,000,” Ms. Evans said.

Updated: 7-20-2021

Montana Boomtown Is Hottest U.S. Housing Market

Rankings show how the housing boom has ignited homebuying in smaller to midsize cities around the U.S.

Billings, Mont., is the new No. 1 on The Wall Street Journal/Realtor.com Emerging Housing Markets Index, boosted by its affordability and appeal to remote workers.

The index reflects how the housing boom has ignited homebuying activity in smaller to midsize cities around the U.S. The top 20 cities in the ranking have an average population size of just over 300,000.

In the latest index rankings published on Tuesday, smaller cities dominate. The No. 2 metro area is Coeur d’Alene, the lakeside Idaho city that held the top position when the index premiered in April. Fort Wayne, Ind., Rapid City, S.D., and Raleigh, N.C., round out the top 5.

The index identifies the top metro areas for home buyers seeking an appreciating housing market and appealing lifestyle amenities. This quarter’s version added the new criteria of real-estate taxes, which caused some areas in the Northeast, Midwest and Texas with higher property taxes to fall in the rankings.

The strengthening U.S. economy also played a role, rewarding cities where employment and wages grew the most. Rapid City and Raleigh each jumped by about 100 spots from the previous quarter.

Billings, the biggest city in Montana, rose from the fourth spot to the first due to its low unemployment, affordability and booming housing market. With a metro-area population of about 184,000, Billings had a 3% unemployment rate in May, or about half the national rate.

Much of the strength in the Billings housing market has been driven by out-of-state buyers—from coastal states like California and Washington to Kentucky and Texas, said Deb Parker, broker owner of Parker & Co. Real Estate Services in Billings. Many move to the area because they have the flexibility to work remotely, she said.

“I believe Montana’s truly been discovered,” Ms. Parker said. “I’ve never seen so much cash in our market.”

About 65% of page views on Billings property listings came from outside the metro area in the second quarter, up from about 57% a year earlier, according to Realtor.com.

Billings, surrounded by multiple mountain ranges, was founded as a 19th-century railroad town. Today, new residents are drawn to the area’s hiking trails and other outdoor activities. Yet unlike some smaller U.S. cities, where second-home buyers have played a notable role moving in and boosting housing prices, about 3% of Billings homes are vacation properties, according to Realtor.com.

Like much of the West, Billings is currently experiencing extreme heat. The National Weather Service has issued a red-flag warning in the area, which indicates weather conditions that could accelerate the spread of wildfires.

Emily and Travis Elwood decided during the pandemic that they wanted to move out of Portland, Ore., where they were renting a two-bedroom apartment. They visited Billings last summer and were attracted to its size and affordability. “Frankly, [we] were never going to be able to buy a home in the Portland area,” Ms. Elwood said. “We just wanted something a little bit smaller, a little bit tighter knit.”

Ms. Elwood continued working at her Oregon job from Montana, and Mr. Elwood found a new job in Billings at a dental company. They moved in October and bought a three-bedroom house in June for $316,000. Their monthly mortgage payment is lower than their monthly rent was in Portland, Ms. Elwood said.

Smaller markets in Montana, including Bozeman, also saw an influx of buyers during the pandemic. Some of the top reasons out-of-state buyers chose Montana were safety and security, concerns about Covid-19 and the state’s smaller population, according to a survey of Montana real-estate agents by Montana State University Billings last summer.

The average single-family home-sale price in Billings and the surrounding area was $376,248 in June, up 32% from a year earlier, according to the Billings Association of Realtors.

As in many markets around the country, the number of homes for sale is very low. There were 392 single-family listings in the Billings area in June, down from 433 a year earlier, the association said.

“There was not a lot out there,” said Claire Alden, who started house shopping in Billings with her husband, Deaver Alden, this spring. “There was only one or two on the market at a time that we would consider at all.”

After the Aldens put in their first offer on a house, they found out the seller had already accepted a cash offer the same day the house went on the market. They ended up buying a four-bedroom house in June with a shed in the back that they are considering converting into a rental property.

The Wall Street Journal/Realtor.com Emerging Housing Markets Index ranks the 300 biggest metro areas in the U.S. In addition to housing-market indicators, the index incorporates economic and lifestyle data, including unemployment rate, wages, commute time and small-business loans.

Home prices in the top 20 markets in the index have risen 13.7% on average in the past year, outpacing an 8% rise for all 300 areas, but the top 20 areas still had a lower median listing price than the market overall, said Danielle Hale, chief economist at Realtor.com.

Updated: 8-24-2021

Texas Cities Dominate List Of Best Places To Buy A Home

Five of the top six cities in a new analysis are in the Lone Star State. Few in the Northeast even make the ranking.

Five of the six top best places to buy a home in the U.S. are in Texas, according to a new ranking.

The city of Frisco, part of the fast-growing Dallas-Fort Worth metro area, tops the list released Tuesday by personal-finance website WalletHub. Austin takes second, while three more Dallas-Fort Worth suburbs — McKinney, Denton and Allen — hold down the Nos. 4, 5 and 6 spots. (Gilbert, Arizona, in the Phoenix metro area, is third.)

The ranking measures cities on two scores: the local real estate market, which includes data such as median home-price appreciation, along with affordability and the economic environment, which includes job growth and other factors. Frisco leads on both measures, while Austin ranks 56th of the total 300 cities when it comes to affordability and economic environment.

“The low foreclosure rate, the large share of newer homes and the intense building-permit activity in these cities were some of the factors that contributed,” WalletHub analyst Jill Gonzalez said. “These cities all have high population and job-growth rates, as well as low unemployment.”

California and Texas, two of the largest U.S. states, are well-represented. More than 80 of the ranked cities are in the Golden State, with Roseville — in the Sacramento metro area — at No. 9. Texas has 21 cities on the list, while Florida has 17, including Orlando (No. 44), Tampa (No. 57) and Port St. Lucie (No. 66).

Relatively few places in the Northeast made the cut. Cambridge, Massachusetts, was the highest ranked city in that region at No. 78, while Jersey City, New Jersey, came in 165th. New York’s top-ranked home-buying market was Buffalo, at No. 180. New York City came in at No. 282.

Updated: 11-30-2021

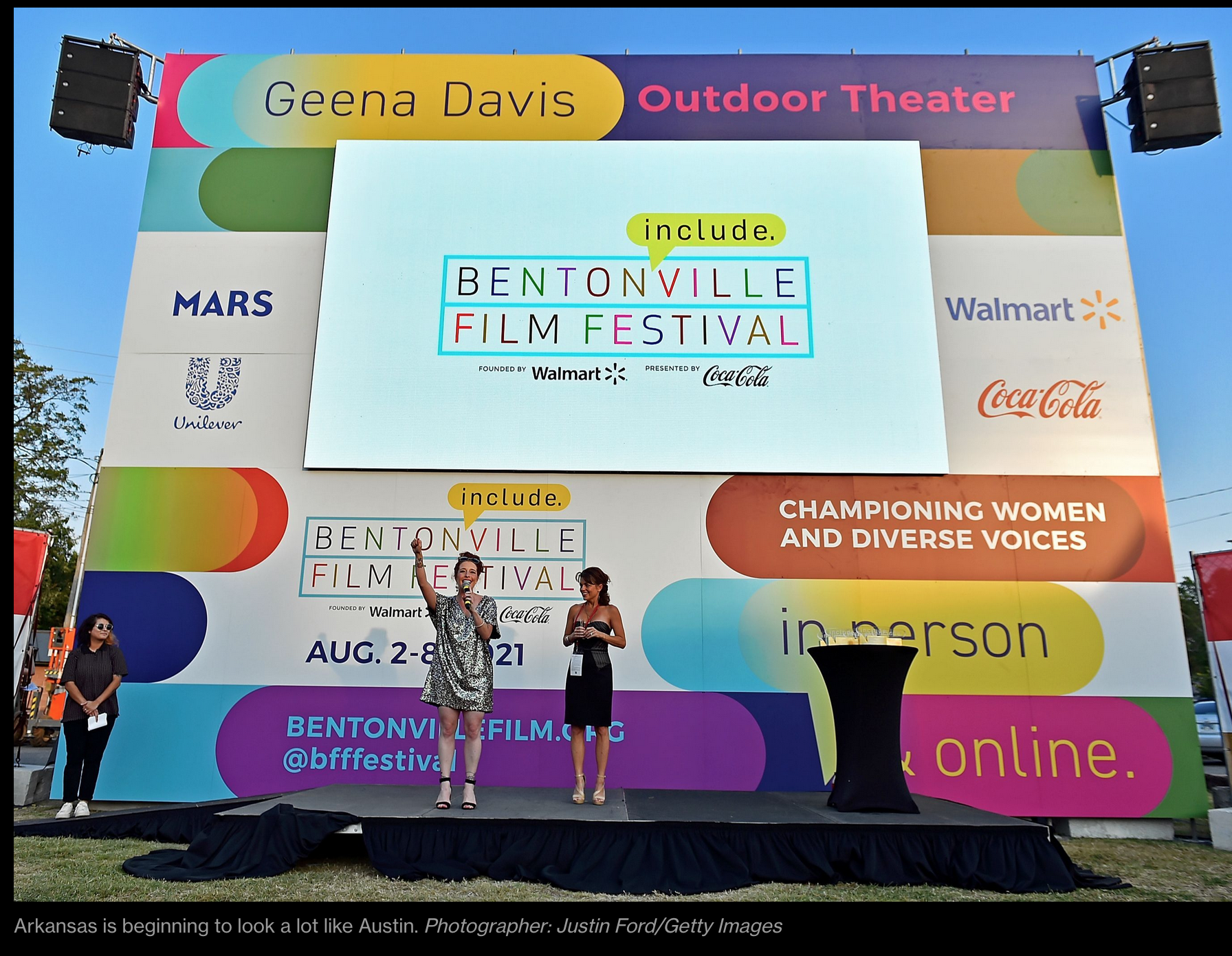

The Next Austin? How About Arkansas. Seriously

Home to corporate behemoth Walmart, a rising state university, and awash in philanthropy money, this Texas neighbor is home to a new crop of urban hotspots.

Ambitious young college graduates are looking for an affordable home base where they can build their families and careers.

Here’s A Place That May Not (Yet) Be On Their List: Arkansas.

For the past decade, coastal metros like New York and San Francisco dominated the landscape for the upwardly mobile, but the main story became how to cope with the high cost of living in those cities. One solution was to move into lower-cost neighborhoods, further pushing up rents and home prices.

Others moved to lower-cost metros that shared some of the characteristics of those high-cost places; Austin, Texas, was one of the biggest beneficiaries of that trend.

Thanks to the accumulated impact of all that migration — accelerated by lifestyle changes during the pandemic — Austin is no longer affordable, and arguably overpriced for what it offers. That begs the question: Where should someone who’s been priced out of Austin look? I would argue the best candidate to be the next Austin is the up-and-coming region known as Northwest Arkansas.

This isn’t just throwing a dart at the map and arbitrarily calling something the next Austin. Northwest Arkansas has both idiosyncratic and macro factors that make it a logical heir to the role played by Austin for so long.

First, we should define what we’re talking about. Northwest Arkansas includes 4 of the 10 largest cities in the state: Fayetteville, home to the University of Arkansas; Bentonville, home to Walmart Inc.; and Springdale and Rogers.

The two key counties in the region are Benton and Washington, which comprise just 17.6% of the state’s population but accounted for more than 100% of the state’s net population growth in the 2010’s.

That’s not a misprint — Arkansas expanded by 95,600 people during the decade thanks to 105,800 residents added by Benton and Washington County. Of the 110 U.S. metro areas that have more than 500,000 people, the Fayetteville-Springdale-Rogers metro area was the fifth-fastest growing during that period.

The metro area, anchored by the state’s flagship public university and the largest corporation in the U.S. by revenues, is growing as fast as recent urban juggernauts such as Boise, Idaho, Raleigh, North Carolina and Orlando, Florida.

Northwestern Arkansas also benefits from the continued growth of Texas in the same way that Austin benefited from the growth of the economy in California. There’s intense competition from universities in neighboring states to raise their profile and fill seats by recruiting students from Texas, and more than 25% of the student body of the University of Arkansas hails from Texas.

Fayetteville is an 8-hour drive from Austin and a 5.5-hour drive from Dallas, so to the extent the Texas metros get too crowded or expensive for locals, northwest Arkansas already has a diaspora of Lone Star expats that should make it a sensible place to consider while remaining less than a day’s drive away from “home.”

If you’re asking, “What’s there to do in Northwest Arkansas?” you should know the region is being transformed by the wealth of the Waltons, Walmart’s founding family. The Crystal Bridges Museum of American Art opened a decade ago, funded by over $1 billion from Walmart heiress Alice Walton, and has become one of the country’s top museums.

It’s where the copy of the U.S. Constitution won at auction by Citadel founder Kenneth Griffin will be lent for public viewing.

Walmart, cognizant of the need to recruit more young talent to Arkansas, is transforming downtown Bentonville into a walkable, amenity-filled campus. The Razorback Regional Greenway — also funded in part with Walton family money — is a 37-mile hiking and biking trail dedicated in 2015 that connects to many community attractions.

The underlying driver in all this is that a lot of second-tier metro areas got a lot more expensive over the past two years and aren’t the bargains they used to be. New places will gain traction as metros like Austin and Boise struggle with their own affordability problems.

At the same time, the continued growth in Texas will slowly but surely create its own spillover dynamics to other metro areas, just as growth on the West Coast spilled over to Austin.

Northwest Arkansas might not be on the radar of many coastal people. but it’s the most likely candidate to be the prime beneficiary of these trends.

In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,In Arkansas, Montana, Boise,

Related Articles:

Wave of Hispanic Buyers Boosts U.S. Housing Market (#GotBitcoin?)

Smart-Home Tech As A Selling Point, Not A Cost Cutter

Condo Conversions Near The End, A Casualty Of Rent Reform (#GotBitcoin?)

This Startup Wants To Sell You A Slice of A Rental Home (#GotBitcoin?)

Realtors And Developers Are Selling Wellness, Whether It Works or Not (#GotBitcoin?)

Uber Drivers Seek Extra Cash Working For House Flippers (#GotBitcoin?)

What’s Rent To Own & How Does It Work? A Guide To Renting Vs Buying

San Francisco’s Housing Market Braces For An IPO Millionaire Wave (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Home Prices Continue To Lose Momentum (#GotBitcoin?)

Freddie Mac Joins Rental-Home Boom (#GotBitcoin?)

Retreat of Smaller Lenders Adds to Pressure on Housing (#GotBitcoin?)

OK, Computer: How Much Is My House Worth? (#GotBitcoin?)

Borrowers Are Tapping Their Homes for Cash, Even As Rates Rise (#GotBitcoin?)

‘I Can Be the Bank’: Individual Investors Buy Busted Mortgages (#GotBitcoin?)

Why The Home May Be The Assisted-Living Facility of The Future (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.