Investors Are Buying More of The U.S. Housing Market Than Ever Before (#GotBitcoin)

Their interest poses a challenge for millennials and other first-time buyers. Investors Are Buying More of The U.S. Housing Market Than Ever Before (#GotBitcoin)

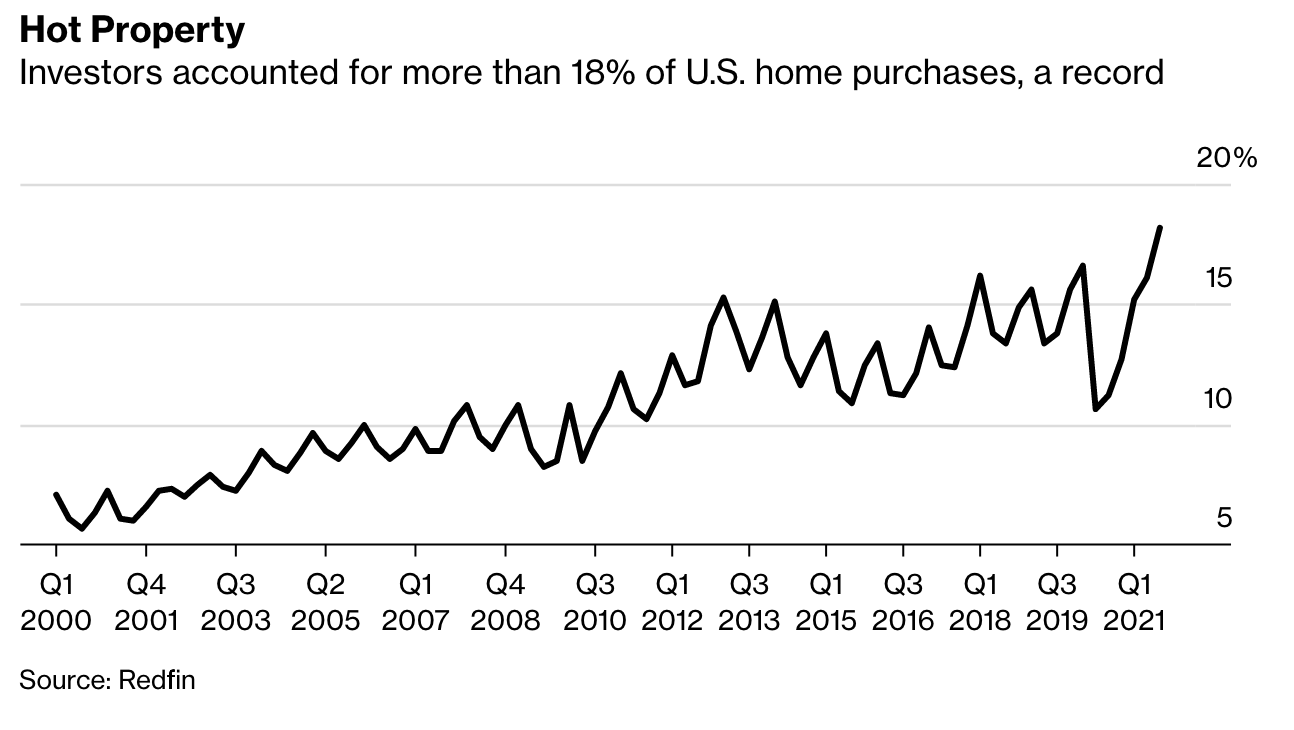

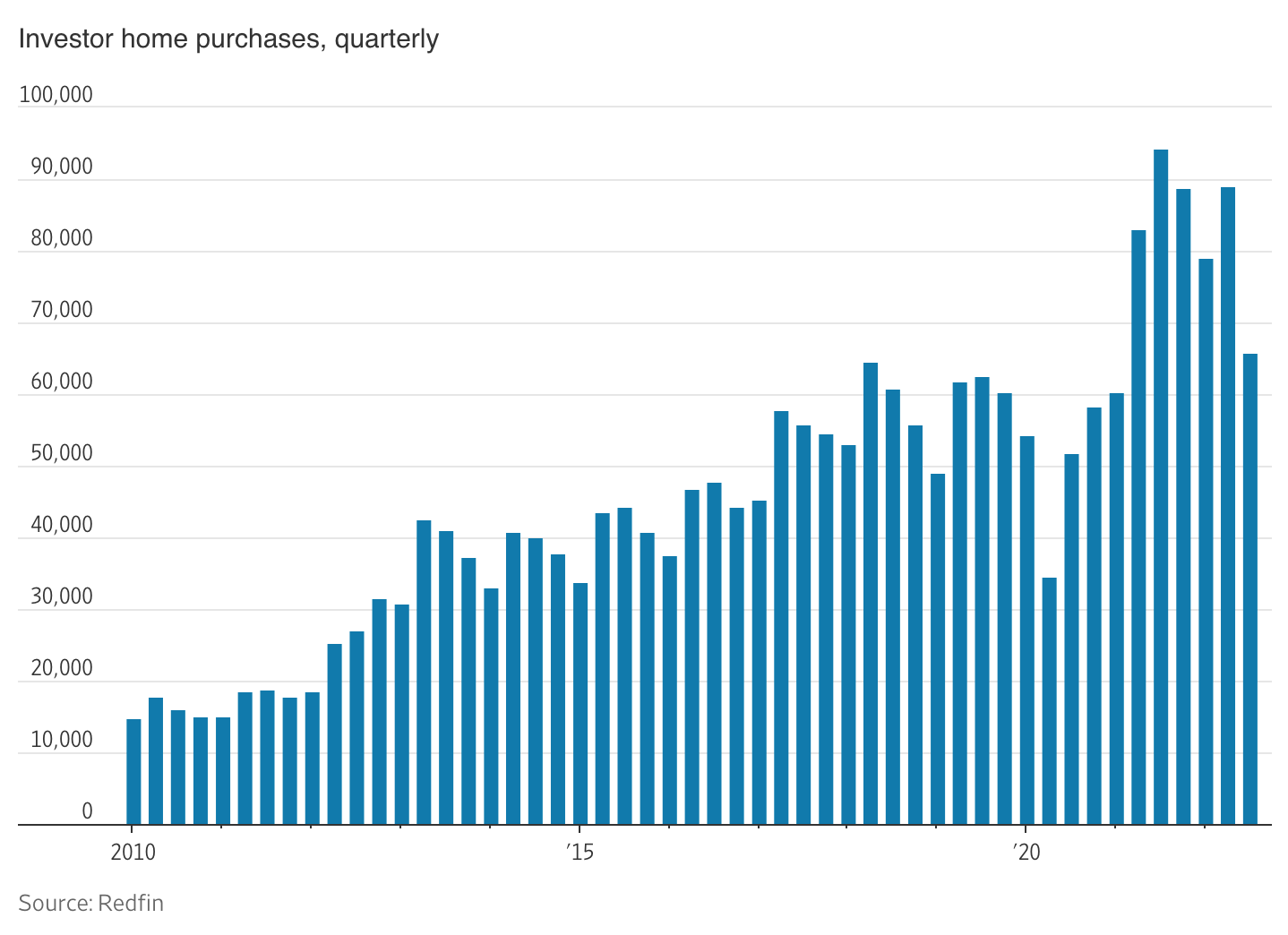

Investor purchases of U.S. homes have climbed to an all-time high, a sign that rising home prices have done little to dampen demand for flipping homes or turning them into single-family rentals.

Big private-equity firms, real-estate speculators and others that buy properties comprised more than 11% of U.S. home purchasers in 2018, according to data released on Thursday by CoreLogic Inc.

Related:

Emergency Rental Assistance Program

Home Flippers Pulled Out of U.S. Housing Market As Prices Surged

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Smart Wall Street Money Builds Homes Only To Rent Them Out (#GotBitcoin)

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Cracks In The Housing Market Are Starting To Show

Biden Lays Out His Blueprint For Fair Housing

Housing Boom Brings A Shortage Of Land To Build New Homes

Wave of Hispanic Buyers Boosts U.S. Housing Market (#GotBitcoin?)

Phoenix Provides Us A Glimpse Into Future Of Housing (#GotBitcoin?)

OK, Computer: How Much Is My House Worth? (#GotBitcoin?)

Sell Your Home With A Realtor Or An Algorithm? (#GotBitcoin?)

The investor purchases are the highest on record and nearly twice the levels before the 2008 housing crash. The investor interest poses a challenge for millennials and other first-time buyers who are increasingly looking to buy starter homes and are forced to compete with deep-pocketed cash buyers.

Big commercial property owners like Blackstone Group LP and Starwood Capital Group began buying thousands of homes out of foreclosure during the housing bust. Many economists credit investors with helping to stabilize the housing market in 2011 and 2012 by buying with cash when prices were low and mortgage credit froze.

But analysts expected those purchases to slow, as the market rebounded and properties could no longer be had for fire-sale prices.

Instead, demand for properties has intensified. While these purchases dipped slightly when the market started to recover in 2015 and 2016, they have rebounded to surpass the previous peak of six years ago.

Strong rental demand, technology that facilitates buying homes online and low interest rates that make other investments less appealing have fueled investor appetite.

Investors are an especially powerful force at the bottom of the market, where they often pay all cash. Investors purchased one in five homes in the bottom third price range in 2018, according to the CoreLogic analysis, up 5 percentage points from the 20-year average of less than 15%.

“These are the homes that first-time home buyers would logically be buying,” said Ralph McLaughlin, deputy chief economist at CoreLogic.

Shane Parker, a real-estate agent in metropolitan Detroit, said first-time buyers he works with are struggling to win bidding wars against out-of-state buyers. The locals he works with are becoming more aggressive, putting in escalation clauses and agreeing to pay the difference if properties don’t appraise.

One of his clients, Michael Burnett, a tech writer in Detroit, and his wife are looking for their first home so they can have a treehouse for their young girls. They have visited 25 properties and bid on half a dozen but keep losing out to cash buyers.

The couple recently fell in love with a property they thought had great potential. “It’s ugly on the outside, ugly on the inside, but it can be made beautiful,” said Mr. Burnett, 43 years old.

The house ended up getting a dozen offers, more than half of which were cash, and selling for $40,000 over the asking price of $150,000. “We write letters. You think you’ve composed this great heartfelt, ‘I have a family, see my family,’” he said. “Oh, please…Cash is king.”

Real-estate entrepreneur Gregor Watson’s business has helped boost investor participation. Following the housing bust, he and partners bought more than 6,000 homes across the country and turned them into single-family rentals.

Then he founded Roofstock, a company that enables investors to purchase properties online. The internet has made it easier for smaller investors and foreign buyers to purchase properties they may never have visited. Demand is also shifting toward former industrial cities in the Northeast and Midwest where prices remain low.

Mr. Watson said that many people in San Francisco and New York are priced out of buying homes where they live but are able to purchase an investment property in less expensive cities.

Michael Pickens, 31, who works in tech sales in the Bay Area, and his wife kept losing out in bidding wars to all-cash offers. “It was all cash, no contingency, seven-day close,” he said.

He and his wife decided instead to rent a small apartment in Santa Clara County and buy investment homes on Roofstock in less expensive locales.

They now own homes in Georgia and Tennessee despite never having visited either state.

So-called iBuyers, such as Opendoor, Zillow Offers and RedfinNow, which snap up homes in cash for a fee to help sellers avoid the hassle of putting their homes on the market, comprised less than 2% of investor purchases last year, according to CoreLogic.

The biggest markets for investor purchases in 2018 were Detroit, followed by Philadelphia and Memphis, Tenn., where home prices are still low enough for investors to profit by renting them out. Investors bought nearly half the starter homes in Philadelphia last year and about 40% of lower-priced homes in Detroit, according to CoreLogic.

When Tawan Davis launched a business renting out single-family homes three years ago, he focused on Philadelphia because of the city’s slow foreclosure process and history of disinvestment, he said.

Mr. Davis typically purchases homes for about $75,000 to $90,000, puts an additional $50,000 to $80,000 into renovation and rents them out for around $1,300 a month.

He said he is often welcomed in these neighborhoods because his modestly priced rental properties help act as a bulwark against gentrification. Many of his renters are single and work as nurses or adjunct professors, he said.

“They’d much rather see us than a lawyer from New York,” he said.

Updated: 9-1-2020

Demand For Houses Boosts Home Construction

Strength in home building highlights uneven nature of the recession; outlook is a sharp turnaround from early spring.

A surge in home-buying demand and limited inventory for existing homes is spurring construction to help fill the gap.

Home builders attribute their robust sales to low interest rates, a shortage of existing homes for sale and consumer willingness to move farther from city centers in exchange for more space.

New single-family-home sales rose 13.9% in July from June to a seasonally adjusted annual rate of 901,000, the highest level since December 2006, according to the Commerce Department. Single-family housing starts, a measure of U.S. home building, rose 8.2% in July from June to the highest seasonally adjusted annual rate since February.

“The demand feels really good right now,” said Martin Connor, chief financial officer of Toll Brothers Inc. “The longer it goes, the more comfortable we are that it’s got longer legs.”

The strength in the home-building sector underscores the uneven nature of the economic recession, which has hit low-wage workers especially hard. While millions of workers have lost their jobs in recent months, those who are still employed have saved more money due to the pandemic and can take advantage of record-low mortgage interest rates.

Home builders’ positive outlook is a sharp turnaround from early spring, when coronavirus lockdowns forced construction sites to halt in some parts of the country and builders swiftly cut spending on land acquisitions and new projects. U.S. home-builder confidence rose in August to match the record high last reached in 1998, up from an eight-year low in April, according to the National Association of Home Builders.

The S&P Homebuilders Select Industry Index is up 15.3% this year as of Monday, exceeding the 8.3% rise in the S&P 500 over the same period, according to FactSet.

Home builders also are benefiting from demographic changes, as younger millennials are entering their early 30s and accounting for a growing portion of home sales. Booming demand also has pushed sales of previously owned homes to multiyear highs.

Housing demand has outpaced supply for years, but the housing shortage has become even more acute in the existing-home market in recent months as the pandemic has made some sellers reluctant to list their homes.

At the current sales pace, there were 3.1 months of existing homes available for sale at the end of July, according to the National Association of Realtors. In comparison, the new-home market had 4.0 months’ supply available at the end of July, according to the Commerce Department.

When Stephanie and Sven Christensen moved to Grand Haven, Mich., this year for Mr. Christensen’s job, they couldn’t find anything on the market that fit their needs. They decided to build a new house instead.

“We’re super, super excited,” Ms. Christensen said. But “we would have much preferred to find a house that would work for us that we could just buy and move into.”

In response to the strong demand, home builders are raising prices. The median sales price of a new house sold in July was $330,600, up 7.2% from a year earlier.

Home builders are limited in how quickly they can grow due to shortages of skilled labor, delays in obtaining some appliances and rising land costs, said Ali Wolf, chief economist at Meyers Research.

Lumber futures also have climbed to a record high, pushing the cost of building a single-family home up by more than $16,000 since mid-April, according to the NAHB.

Eighty percent of builders in August said challenges on the supply side are going to affect their sales plan this year, up from 30% in June, according to a Meyers Research survey.

“You can’t just build 25% more houses,” said Sheryl Palmer, chief executive of Scottsdale, Ariz.-based Taylor Morrison Home Corp. “We just won’t be able to meet the demand overnight.”

Housing economists say high unemployment could also limit home sales in the coming months, especially if job losses spread to affect more high-paid workers.

Ty Andersen paid a deposit on a townhome under construction in Bluffdale, Utah, in April, before being laid off from his digital-marketing job in May. He hopes to find a new job before he applies for a mortgage loan in the fall.

“I’m beginning to worry more” about the home purchase falling through, he said. “I just keep pushing forward with the hope that I will find a job and that it will work out.”

Updated: 5-23-2021

Mega Landlords Are Snapping Up Zillow Homes Before The Public Can See Them

Hot housing market drives alliance with real estate tech firms as landlords flush with cash tap iBuyers to find properties.

Wall Street firms scouring the frenzied U.S. housing market are tapping a new source of properties that regular buyers can’t reach.

Cerberus Capital Management and related entities bought more than 200 houses in the first quarter through next-generation home flippers called iBuyers, including 138 from Opendoor Technologies Inc. The pipeline to Wall Street from Silicon Valley often means the homes never hit the open market.

Other single-family landlords, flush with cash to bet on the demand for suburban rentals, are applying the same strategy. Their purchases come as many Americans can’t afford to buy houses — a side effect of the pandemic-driven real estate rush that’s sparked bidding wars for a shortage of available properties.

“At a moment when we have once-in-a-generation low inventory, we have for-profit companies making the decision to withhold houses from the market,” said Mike DelPrete, a real estate tech strategist who follows the iBuyers. “As a society, are we cool with that?”

Cerberus, which manages $53 billion in assets, operates more than 24,000 rentals through a portfolio company called FirstKey Homes. The firm recently borrowed $2.5 billion against a portion of the property portfolio at a fixed rate of 1.99%, according to Kroll Bond Rating Agency.

In addition to the homes it bought from Opendoor in the first quarter, Cerberus purchased 52 from Zillow Group Inc., the listing site that started flipping homes in 2018, and 28 from Offerpad, according to analytics firm PropertyRadar. The data, which was compiled from public records, may not be complete.

“Homes purchased through iBuyers are a minimal 1% of our entire portfolio of homes,” a representative for FirstKey said in a statement.

IBuyers have sprung up in recent years seeking to profit by streamlining the notoriously complex process of selling a home.

They use software to estimate values and make rapid offers to homeowners who express interest in selling their properties.

When an owner accepts, the iBuyers make light repairs and put the home back on the market, seeking to profit by charging convenience fees.

Cerberus isn’t the only large landlord turning to the tech companies. Invitation Homes Inc., the largest single-family landlord, tapped iBuyers for more than 5% of the 700 homes it purchased in the first quarter, Chief Executive Officer Dallas Tanner said on a recent conference call. Tricon Residential Inc. and Donald Mullen’s Pretium also bought homes through this emerging channel.

For the iBuyers, selling to Wall Street can offer better economics and a leg up in the race to get bigger. It limits expenses, cutting out commissions to real estate agents, and lets the tech firms move homes quickly and benefit from economies of scale.

But in a tight housing market, there’s increasing competition for the entry-level properties sought by first-time buyers and landlords alike.

“We’re in housing shortage, and whatever inventory institutional landlords are gobbling up means there’s less available to first-time homebuyers,” said Lawrence Yun, chief economist at the National Association of Realtors. “In that sense, the investors are an obstacle to the everyday buyer.”

Overall, the homes landlords bought through iBuyers were a tiny fraction of U.S. home sales during the first quarter. But for the tech companies, they add up. At Opendoor, which went public last year through a merger with one of Chamath Palihapitiya’s blank-check companies, entities that bought multiple homes accounted for 21% of the company’s first-quarter sales. For Offerpad, the number was 16%, according to PropertyRadar. For Zillow, it was 9%.

Representatives for Opendoor and Offerpad declined to comment. A representative for Zillow said that the company adjusts its strategies for selling homes to move inventory quickly and reduce the fees it charges sellers.

“These strategies include selling homes to all types of buyers, including individual families, non-profit organizations and investors,” Zillow said in a statement.

Institutional landlords are rushing to buy homes now, as the work-from-anywhere era accelerates the millennial generation’s shift to the suburbs. With backyards and extra space in high demand, investors have been betting that Americans who lack the cash for down payments will gravitate to single-family rentals.

A parade of investors, including JPMorgan Chase & Co.’s asset-management arm, Nuveen Real Estate and Brookfield Asset Management Inc. have committed billions in new capital to single-family rentals since the pandemic began.

But raising money to buy homes is proving easier than finding houses to acquire. In some cases, investors are partnering with homebuilders to develop houses that won’t be ready for tenants for months — or even years.

“The supply of single-family homes remains well short of growing demand,” said Tanner, the Invitation Homes CEO, on the recent conference call. “There is so much capital coming into the space that everything is pretty competitive.”

Updated: 5-27-2021

In Tight Housing Market, Thousands of Homes Are Reserved For Certain Buyers

‘Whisper listings,’ made directly to select customers, are growing at a time when housing inventory is near record lows.

Real-estate agents are selling more homes to select customers while bypassing the public market, a move that squeezes supply tighter for many buyers when inventory is already near record lows.

In the vast majority of transactions, an agent lists a home for sale on a local database and markets the property widely to drum up interest and get the best price. But in certain cases, a broker will show an unlisted property to a small circle of potential buyers more exclusively, often in hope of getting a deal done quickly.

These private sales are known as pocket listings, or whisper listings. They have been around for many years. But they are on the rise now even though the National Association of Realtors adopted a rule last year aimed at discouraging their use following complaints from some of its members.

The new NAR policy requires agents to add listings to their local database within a business day of publicly advertising the listing. But there is a notable exemption: Listings can still be kept off the database if they are only shared within one brokerage, called an “office exclusive.”

Pocket listings accounted for 3% of sales on average in the year ended in March, up from 2.6% of sales in the year ended in March 2020 and 2.5% in the year ended in March 2019, according to an analysis by brokerage Redfin Corp. That 3% represents roughly 169,000 homes a year sold through this sometimes controversial practice.

Proponents say pocket listings offer a preferred option for sellers who want more privacy, or worry about letting strangers or other individuals into their homes.

“A property listing is as unique as the home seller, who should have choice in how they position, price and market their home,” said Ryan Schneider, chief executive of real-estate brokerage giant Realogy Holdings Corp.

In today’s housing market, buyers are furiously competing for a limited number of houses for sale. With the mortgage-finance company Freddie Mac estimating that the housing market is nearly four million homes short of what is needed to meet buyer demand, some brokers say that pocket listings are making a bad situation worse.

Critics say they exclude buyers from viewing all available properties and can keep sellers from getting the highest price for their home.

“There’s no rationale for, ‘I’m going to show it to one group of buyers but not another group of buyers,’” said Glenn Kelman, Redfin’s CEO, who told his agents to stop using pocket listings in 2018.

Mr. Kelman said he was influenced by research from sociologist Elizabeth Korver-Glenn that connects the practice to racial exclusion. Dr. Korver-Glenn’s research in Houston showed that white agents were more likely to use pocket listings and to share the pocket-listing information with predominantly white networks, excluding buyers of other races, she said.

Pocket listings traditionally have been more widely used in high-end markets, where celebrity sellers might not want their homes advertised because of privacy concerns. But Redfin’s analysis showed an increase in pocket listings in many markets around the country.

In Des Moines, Iowa, for example, Redfin estimated that 5.4% of sales were likely done without being publicly listed in the year ended in March, up from 3.1% two years earlier. In Tampa, Fla., the proportion of estimated pocket listings rose to 6.1%, from 4.4% two years earlier, Redfin said.

Pocket listings persist in part because they benefit big brokerages, which can shop listings in-house and advertise to potential clients that they have properties that aren’t available anywhere else.

On brokerage Compass Inc.’s website, a search for active listings or those coming soon in San Francisco pulled up 1,320 online listings as of midday Tuesday. The website also said 105 listings in the city weren’t publicly available but were available through a Compass agent.

A Compass spokesman declined to comment.

Pocket listings are difficult to track. Redfin’s analysis considered pocket listings to be properties that were marked as being sold or under contract the same day they were added to a local listings database.

Real-estate executives and consultants said that is a good proxy for measuring the trend, but it isn’t perfect. In today’s super-competitive market, some properties really might sell within a day. Other property sales are never added to the database, such as some that are sold directly by an owner.

Real-estate listings websites such as Redfin and Zillow Group Inc. benefit when all listings are publicly advertised, making their sites a one-stop shop for home buyers. Zillow opposes pocket listings, said Errol Samuelson, the company’s chief industry development officer.

Bright MLS, a database that covers parts of six Eastern states and Washington, D.C., said its research in 2019 and 2020 showed that in its region, properties that weren’t listed on the database sold for 6% to 20% less than properties that were listed.

“I’m sure there are people out there with privacy concerns,” said Bright MLS CEO Brian Donnellan. “The point is, they should know ahead of time that they’re actually probably going to get less money for their house.”

Updated: 9-7-2021

Wall Street Can’t Get Enough Fixer-Upper Houses

High-interest loans to house flippers are a hot commodity on Wall Street, but inventory is scarce.

Wall Street has made a mountain of money available to house flippers, and selling move-in-ready rehabs has rarely been easier. The challenge is finding beat-up and out-of-date properties that can be renovated and resold for a profit.

“Investors like me, we’re like ants on a sugar hill all fighting for the same projects,” said Ed Stock, who started fixing and flipping houses on New York’s Long Island after the 2008 mortgage meltdown. “It’s the greatest time to be in this market; it’s just hard to find the inventory.”

Foreclosure moratoriums have shut off a big source of fixer-uppers since last spring’s lockdown. Meanwhile, competition is stiff from regular home buyers armed with superlow mortgage rates and inspired by cable-TV renovators. Rising costs and limited availability of labor and building materials, such as lumber, cut into profits and stretch out jobs.

Just 2.7% of home sales were flips—sales within a year of a prior sale—during the first quarter, according to property data firm Attom. That is the lowest portion of sales since at least 2000, when Attom started counting flips. The number of flipped houses and condos were the fewest in a quarter since 2003.

That was two housing booms back and long before measured-in-months loans to house flippers became some of the hottest properties on Wall Street. Mortgage trusts, pensions, hedge funds, private-equity firms, investment banks and insurance companies all want so-called flip loans, drawn by yields in the range of 8% to 12% at a time when one-year Treasurys pay less than 0.1%.

Mr. Stock’s lender, Roc360, last week received a $2 billion infusion from insurer Athene Holding Ltd. to make more loans to house flippers as well as landlords, who buy a lot of rehabbed houses. Arvind Raghunathan, Roc360’s chief executive, said his firm would have little trouble raising several billion more given the hunt for yield that has sent investors into less-familiar pockets of fixed income.

“These notes have done extraordinarily well the last eight years,” Mr. Raghunathan said. “There have been hardly any losses, and 8% for one-year paper is extraordinary.”

Many flip loans are repaid even sooner, allowing investors to recycle their capital by lending anew or buying additional loans to boost returns.

New York Mortgage Trust Inc. said it ramped up its investment in flip loans last fall and ended June with $622 million worth, carrying an average coupon of 9.33%. The firm bundled $167 million worth of loans into two-year securities, sold them to other investors and expects that replacing repaid loans with new notes before the securities mature will produce returns in the high teens or low 20s.

“There’s not many markets where you could achieve that type of return,” the firm’s president, Jason Serrano, told investors last month.

Toorak Capital Partners, which has been buying flip loans and pooling them into securities since 2018, in June sold a $339.5 million security, its first deal since before the pandemic. To supplement the scarcer house flips, CEO John Beacham said Toorak has been buying loans that fund renovations of small apartment buildings.

There is much less competition for these than houses. Additionally, the firm is bundling longer-term notes to rental-house investors, who have accounted for more than 1 in 5 home sales in some of the country’s hottest markets.

“We’ve seen a lot of competition come into the space,” Mr. Beacham said. “It’s hard for investors to find deals in a lot of places.”

On Long Island, Mr. Stock works his real-estate connections and estate-sale scouts to find deals before they hit the market. He looks for houses that need so much work that they won’t qualify for typical government-backed mortgages. Such homes have become hard to come by in the working-class neighborhoods where he used to do most of his flipping. So he has moved up market and into new areas, such as the Hamptons, where more people are living year-round, and even Florida.

Mr. Stock expects to do about 15 flips this year, well below the 53 he undertook in 2014 when foreclosures flooded the market. Most houses he buys are gutted to the studs, windows and roofs replaced, plumbing and electrical systems brought to code, mold remediated. Walls are knocked down and floor plans opened. Marble countertops, stainless steel appliances and other modern trappings are installed.

Roc360 finds flippers such as Mr. Stock with a team of data scientists who sift through public property records for houses that have been bought and quickly resold for gains. Once the people behind profitable flips are pinpointed, Roc360 targets them with advertisements and on social media, offering cheaper financing and deals on property and casualty insurance, appraisals and at home-improvement retailers.

“These are highly entrepreneurial crews,” Mr. Raghunathan said. “People who have really learned to keep their costs down and keep churning.”

Mr. Raghunathan, who has a doctorate in computer science, and others started the firm in 2013. It seeks to adapt the sort of technology his team at quantitative-trading hedge fund Roc Capital Management used to pick stocks and bonds to find the best borrowers in the realms of flip and rental houses.

Since it began, Roc360 has funded about 15,000 loans, which average roughly $350,000. This year, the firm expects to lend $3 billion and with the Athene investment plans to boost its output to more than $4 billion in 2022, he said.

Students Are Going Back to Class, And Property Investors Want To House Them

Companies are pumping billions of dollars into buying and developing off-campus housing.

With millions of students heading back to college campuses this month, some of the world’s largest property investors are pumping billions of dollars into buying and developing off-campus housing.

Blackstone Inc., Brookfield Asset Management Inc. and other investors are offering student housing facilities that feature game and video rooms, fully loaded gyms, speedy Wi-Fi, and even swimming pools in some cases.

These companies are raising their bets on the sector as more universities plan to offer in-class learning again this fall. Yet even last year, demand for student housing only fell slightly when most colleges were closed for in-person learning because of Covid-19.

“Now that we’ve seen the asset class through a global pandemic, it really shows the resilience,” said Christopher Merrill, co-founder and chief executive of Harrison Street, the investment firm that is the largest private owner of student housing.

In August, Blackstone Real Estate Income Trust agreed to pay $784 million for a majority stake in a portfolio of eight student housing properties with 5,416 beds developed and managed by Landmark Properties, of Athens, Ga.

Preleasing of the amenity-rich portfolio, near such schools as Florida State University and Georgia Institute of Technology, is back to 2019 levels, according to Jacob Werner, a senior managing director of Blackstone Real Estate.

Meanwhile, Brookfield is in talks to form a joint venture with Chicago-based student housing developer Scion Group LLC that would acquire at least $1 billion in student-housing properties, according to people familiar with the matter. The deal would be Brookfield’s first move into the property type in the U.S., these people said.

Smaller investors also are getting into the action. In the first half of the year, student housing deal volume was $2.52 billion, up from $1.68 billion in the first half of 2020 and close to the $2.96 billion in deals in the first half of 2019, according to JLL.

When Covid-19 first hit the U.S., investors worried that student housing values and profits would sink because of the large number of schools moving to remote learning. But rent collections remained surprisingly high even at schools that eliminated most in-person classes. Many students opted to live in their campus housing even while doing remote learning.

“Students showed up,” said Al Rabil, chief executive of Kayne Anderson Real Estate, which has developed 50 properties with 34,000 beds in 23 states. “They said, ‘Who cares if it’s remote learning? The last thing I want to do is stay in the room I lived in since eighth grade.’”

Kayne Anderson Real Estate is scheduled to close this month on sales of new properties it completed in 2020 near the University of Florida’s Gainesville campus and Rutgers University. Both were more than 90% occupied last fall, even though Rutgers was completely remote learning, Mr. Rabil said.

Major investors say they tend to invest in complexes near the largest schools in the U.S. where enrollment has been high. Student housing properties near smaller and less popular colleges have struggled more during the pandemic partly because their tenants tend to be less affluent.

Last fall, overall enrollment at public two-year colleges fell 9.5%, according to the National Student Clearinghouse Research Center, a trend some expect to continue. “I don’t think you would find a lot of people who think the U.S. needs 5,500 universities,” Mr. Rabil said.

But student housing at bigger schools saw some benefit from the pandemic because it put a damper on new supply, which was becoming a concern in the sector. An average of more than 40,000 beds a year were added between 2012 and 2019, close to double the rate earlier in the decade, according to Moody’s Investors Service.

Enrollment trends also have been more positive at many larger schools, which aren’t seeing a major impact from the highly contagious Delta variant. According to the Chronicle of Higher Education, more than 1,000 colleges and universities are mandating student vaccinations to put them and their parents at ease.

Such mandates also have helped demand for student housing, investors say. Occupancy is up about 3% to 4% over last year and is only down about 2% to 3% from 2019, according to Alexander Goldfarb, an analyst with Piper Sandler.

“That’s pretty darn good given everyone’s fears when you remember back,” he said.

Updated: 9-9-2021

Homebuying Startup Orchard Reaches $1 Billion Unicorn Valuation

Orchard, which offers cash to homebuyers upfront so they can purchase a new residence before selling their old one, raised $100 million to fuel growth in an ultra-competitive housing market that’s pushing shoppers to find new ways to stand out.

The fundraising round values the startup at more than $1 billion, making it the latest unicorn company to tackle the challenge of simplifying the process of buying or selling a home. Boston-based Accomplice led the round, with existing investors FirstMark, Revolution, First American and Juxtapose also participating.

“We can say we’re a unicorn, which feels good for about five seconds, and then it’s back to the real world of building a business,” Chief Executive Officer Court Cunningham said in an interview. “We’re trying to create a modern way to buy and sell homes, and that’s capital intensive.”

Cunningham, previously CEO of online marketing company Yodle, started Orchard in 2017 to take on what he viewed as a ripe opportunity: Consumers were frustrated with the traditional way of buying and selling homes, and the $1.7 trillion U.S. housing market was big enough to make tackling the problem worthwhile.

Orchard focuses on people who are trying to buy their next home while selling an existing one, a nerve-wracking process that can cause a transaction to collapse or result in households carrying two mortgages.

In addition to offering cash to help clients buy their next home, the New York-based company provides funds to make light repairs before listing the existing home on the market. Orchard seeks to profit by operating as a brokerage and earning commissions.

The startup’s gross transaction volume is approaching an annual run rate of $1.5 billion, Cunningham said. At that level, the startup remains a tiny part of the housing market, but investors see Orchard and companies like it soon having a bigger piece of the pie.

Publicly traded companies known as iBuyers are pioneering a high-tech approach to home-flipping intended to make selling properties easier. Those firms include Opendoor Technologies Inc., Redfin Corp., and Offerpad Solutions Inc. A fourth, Zillow Group Inc., recently raised $450 million by issuing bonds backed by the homes it buys and sells.

Orchard’s business model places it in a group of companies that real estate tech strategist Mike DelPrete calls “power buyers.” Others include Knock, which has explored going public, and Flyhomes, which raised $150 million in June.

Updated: 9-15-2021

Golf Real Estate Roars Back As Vacation Homes Boom In Pandemic

Wayne Swadron wasn’t looking to be near a golf course when he bought a plot of land at South Carolina’s Palmetto Bluff in 2018.

Sure it had an 18-hole, par-72 course designed by the great Jack Nicklaus. But the 55-year-old architect in Toronto was more impressed by the area’s natural beauty and the breadth of other amenities. “We were principally looking for an escape from cold winters,” he says.

He wasn’t in a hurry to erect a home on the property either—that is, until March 2020. Once the reality of Covid-19 set in, however, he hurried to start and now considers it the family’s principal winter residence.

As recently as 2016, developers of golf communities were doing so poorly that they were donating courses to national parks to take a tax break. Hundreds of them closed during the last decade after the building boom of the 1990s and early 2000s.

But like so much of life since the pandemic, everything around the game has changed: A new spate of beginners has taken it up—the National Golf Foundation estimates that a record 3 million people in 2020 tried golf for the first time. Existing fans have been playing more rounds, too, while sheltering in place and working remotely.

That rebound has extended to real estate as interest in vacation homes of all kinds has skyrocketed. “Demand for private golf club community amenities and real estate is at all-time highs,” says Jason Becker, co-founder and chief executive officer of Golf Life Navigators, which matches homebuyers with golf course communities.

Surveys conducted by GLN found that, since March 2020, 64% of those seeking both a club membership and a home were choosing to buy real estate inside a golf community—a stark contrast from 2019, when only 51% intended to live on such properties. “Before Covid hit,” Becker says, “the demand was to buy outside the gates of a golf community. But you need people to live inside to support the amenities.”

Dan O’Callaghan, director of sales for Discovery Land Co., estimates that the residential-community developer was doing $60 million in sales annually at its Silo Ridge property before Covid-19, but that number jumped to $130 million after. “In general, our numbers doubled during the pandemic,” he says.

Following a trend across the country and internationally, buyers in search of turnkey homes and cushy services discovered its development 90 minutes from Manhattan in New York’s Hudson Valley. “If they’d had more homes that were completed,” O’Callaghan says, “we could have sold more.”

Developer Ben Cowan-Dewar reports that the properties in his latest project, Cabot St. Lucia in the Caribbean, also sold well ahead of schedule. “The demand exceeded our wildest expectations” he says. “Product releases that we expected to take months sold in days.”

Sales figures for the Kiawah Island Club community near Charleston, S.C., meanwhile, totaled $152 million in the first quarter of 2021, with a 237% increase in the number of sales from the same period last year and a 337% increase from the first quarter of 2019. August 2020 was the highest-grossing month in the club’s history, with sales approaching $100 million. (The following month was its second-highest.)

What’s pushing this market segment isn’t really the golf, however. GLN’s survey found that the pandemic has increased the importance of safety and security for buyers, a perception that many of these communities invite with gates out front.

The evolution of remote work has also been critical. Both O’Callaghan and Chuck Cary, vice president for sales at Kohanaiki Realty LLC on the Big Island in Hawaii, say the biggest change they’ve seen on the property side is the home office build-out. “It’s no longer a closet tucked off the kitchen,” Cary says.

Instead, the office is a prominent feature of the home, allowing for expansive views, such as the ocean and mountains, as is the case with Kohanaiki. Two Apple Inc. executives have even moved their families there, committing to running their divisions away from the mother ship.

Broker Kevin Sneddon of Compass real estate calls it “the great reshuffle,” which is all determined by the lifestyle buyers desire.

“People want to be in a tony market. It’s a controlled environment, and it’s safe and luxurious.”

At Sand Valley Golf Resort in Wisconsin, where a private course, the Lido, is being built for homeowners, developers projected it would take seven years to sell its 17 lots, some as large as 22 acres. But they’re already sold out after a year.

“I don’t want to speak to the whole market,” says owner Michael Keiser Jr., who runs the property with his brother, Chris. “But in Wisconsin, I feel like Americans have had an existential reckoning over the last year and a half of their lives. For a lot of people, the answer is spending time with my family and spending time in nature and working on my terms and working where I want to work.”

Location, as usual, remains a big catalyst for the growth at the properties run by Chris Randolph of South Street Partners, including Kiawah Island Club, Palmetto Bluff, and the Cliffs, a development that encompasses several properties along the North and South Carolina border. “They’re all in irreplaceable, beautiful settings,” he says.

But Randolph says the seeds of this uptick were planted before the pandemic. In the mid-2000s, “golf communities essentially just got overbuilt, and a lot of bad golf courses were constructed, which were used as a means to sell real estate without any focus on what that external experience or club experience would be like,” he says.

“The segment took a major hit over the last 10 years, and candidly, I think it should have, because it wasn’t a thoughtful plan.”

Families, not retirees, are spurring sales now. Existing programs and facilities have seen a boost—Kiawah Island Club’s summer camps and swim teams for children, for example, had many more attendees this summer than in past years.

At Silo Ridge, the hockey rink was the most popular spot last winter. Food trucks were brought in for those who were tired of cooking, and tutoring arrangements were set up to help with remote learning. The community is looking to expand on that program with the help of nearby elite secondary schools, as well as add sports camps using the coaching staffs of those same institutions.

At each of Randolph’s properties, the buyers—parents or grandparents who wanted their extended families nearby—have been the ones pushing for both housing and new ways of living. Club use by legacy members at a Cliffs community in Asheville, N.C., is up more than 110% since 2019.

At Palmetto Bluff, where the architect Swadron bought a plot in 2018, 45 families are now living there full time with school-age children.

Swadron’s four sons are not school-age anymore, but the plot was a pandemic boon for them nonetheless. “Initially we expected to be there sporadically,” he says. But as a result of the lockdowns and closures last year, each of them was there during the winter for anywhere between four weeks and four months.

“This was an unexpected pleasure to spend large amounts of quality time together in our new home as a family,” Swadron says. “The house was designed with this possibility in mind, but we never really expected it to happen.”

Updated: 9-16-2021

Prefab, But Make It Luxury: Modular Homes Can Be High End Too

Manufactured homes are getting a luxe update, as more homeowners embrace prefabricated properties for their quick turnaround.

Ty Sharp, a 26-year-old software consultant from Aspen, Colo., is building a 2,876-square-foot vacation home in Ventura, Calif. The four-bedroom, four-bathroom custom home, for which he’s paying $1.695 million, will have an open-concept floor plan, a chef’s kitchen, engineered hardwood floors and a master bedroom with a private patio and soaking tub.

But if you visit the quarter-acre site, which has views of the Pacific Ocean, you’ll find only a foundation despite the fact that the home is slated for completion within two months. That is because Mr. Sharp’s new house, a prefabricated modular home, is being manufactured in a factory two hours away.

The term “prefab home” may conjure up images of a double-wide mobile home. But that is a misconception, experts say.

“A mobile home is a manufactured home, but built to a lower standard. Modular homes are also manufactured in a factory environment, so that confuses people,” said Kurt Goodjohn, co-founder and chief executive officer of Dvele, a San Diego-based luxury prefab-home manufacturer that is building Mr. Sharp’s home.

Joseph Tanney, a founder of Resolution 4 Architecture in New York City, who has been designing modular homes since 2002, said today’s modular homes can be very high end. A seven-bedroom, nine-bathroom modular home that Mr. Tanney designed in Bridgehampton, N.Y., and which was completed in 2018, has a pool, pool house, decking, geothermal- and solar-power systems and a green roof. It sold in September 2020 for its full asking price: $4.695 million.

The modules for modular homes are created in a factory, then delivered to the homesite via truck. There, they are placed on the foundation by a crane and assembled like Lego blocks. The foundation and site-preparation work takes place concurrently with the factory’s fabrication of the modular blocks.

That speeds up the construction process, especially because some modular manufacturers ship the modules with all cabinets in place, appliances installed, lighting complete and toilets hanging off the walls.

“Houses still need to get finished when they arrive on-site, so even though we’re doing 50% to 80% of the work off-site, you still have to connect everything,” said Brian Abramson, co-founder and chief executive officer of Method Homes, a Seattle-based manufacturer of prefab homes.

Mr. Abramson said that a high-end custom 4,000- to 6,000-square-foot, traditional stick-built home takes 16 to 18 months to complete, but a modular home of similar size would take less than a year. A typical 4,000-square-foot house would be composed of eight modules, Mr. Abramson said.

Demand for luxury modular homes, which was already strong, has increased due to the pandemic, developers say. Mr. Abramson, for example, who declined to provide specific sales data, said that Method’s sales for 2020 were up 50% from 2019 sales. He’s built a new factory to accommodate the increased demand.

An advantage of modular construction over traditional construction is that modular manufacturers control the entire fabrication process. Speed is another.

Mr. Sharp, who is purchasing the vacation home with his 28-year-old brother, Ian Sharp, said, “It’s a lot quicker than the normal construction process because they can separate the building from the site work and do both at the same time.”

Mr. Sharp, who is a software consultant for home builders, said that his own experience in the industry has shown that while his home will take only about six months to complete, a comparable custom-built home would take 12 to 18 months.

By automating much of the fabrication process, Mr. Goodjohn said that modular construction is more insulated from labor challenges than stick-built construction.

“Modular is a manufacturing process, not a product per se,” said Mr. Goodjohn. “You can train people to do a specific role in the process without the need for skilled labor to make decisions on the fly.”

Here Is What To Consider If You’re Interested In Purchasing A Modular Home:

Your site might not be suitable. Mr. Tanney, of Resolution 4 Architecture, says modules must comply with size and weight regulations for transport on highways and roads. This could affect the ability of the modules to reach your site.

You may not be able to make design changes once fabrication starts. All design decisions are made by a buyer before production, according to Mr. Abramson, of Method Homes. Once the factory starts to build your modules, you can’t make changes. That helps keep production on schedule.

Build in the cost of the build. Mr. Abramson said the cost of a module ranges from $250 to $350 a square foot, including all interior finishes such as cabinets, counters, appliances, tile, hardwood flooring and fixtures.

That price doesn’t include siding, roofing, decks, on-site connections, HVAC, transportation of the modules and installation. These additional costs are about 60%-120% of the modular cost, he said. You’ll also need to pay for the land, and the foundation and site work needed before construction.

Updated: 9-21-2021

Startup Firms Help Home Buyers Win Bidding Wars With All-Cash Offers

Some companies front buyers the cash to buy homes outright; others buy houses directly on a buyer’s behalf and then sell them to the buyer.

When Nestor and Tracy Eugenio decided to move to northern California, they worried about landing a home in such a competitive market. The Eugenios planned to take out a mortgage, which is often a disadvantage when pitted against all-cash buyers who can close quickly.

So they turned to Flyhomes Inc., which helps buyers with less cash on hand make all-cash offers. The Seattle-based startup bought a three-bedroom house in San Ramon, Calif., for $1.525 million in May on the Eugenios’ behalf, then sold it to them at the same price a few weeks later when their mortgage closed.

“We weren’t the highest, but we had the best terms, because we had a cash offer,” said Mr. Eugenio, who competed against five other bidders for the house.

In today’s frenetic housing market, buyers who take out mortgages are struggling to compete with those putting up all cash. Cash offers are more attractive because there is less chance the deal will fall through or be delayed due to financing issues.

Now, a number of startups are offering programs to help level the playing field. Some of these companies front buyers the cash to buy their homes outright, while others buy houses directly on a buyer’s behalf and then sell them to the buyer. The programs often target homeowners who need to buy a house before selling their current one.

“It’s really taken off this year,” said Mike DelPrete, scholar-in-residence on real estate technology at the University of Colorado at Boulder. “In a seller’s market—high demand, low supply—you need to empower buyers.”

Home sellers routinely receive multiple offers and can choose the most attractive one. Homes sold in July received an average of 4.5 offers each, according to the National Association of Realtors, up from 2.9 offers a year earlier. About 23% of existing homes sold in July were purchased in cash, according to NAR, up from 16% a year earlier.

Startups with cash-offer programs are expanding quickly. Companies like Ribbon, HomeLight Inc. and Orchard announced new funding rounds this month. Knock said this spring it is exploring plans to go public.

Opendoor Technologies Inc., a house-flipping company that went public in late 2020, launched a cash-offer program in March. Real-estate brokerage Redfin Corp. is piloting a cash-offer program in some markets, a spokeswoman said.

Cash-offer companies are paid through commissions, fees or both. In some cases, the companies act as the buyer’s real-estate agent or mortgage lender and are paid through sales commissions or origination fees. Other companies charge a flat fee, often between 1% and 3% of the purchase price.

One advantage for companies offering these programs is it helps them connect with consumers early in the home-buying process, said Guy Cecala, chief executive of industry-research firm Inside Mortgage Finance.

“The reality of the situation is it is very, very hard to shop for a house now unless you can put in an all-cash offer,” Mr. Cecala said. “The question is, what kind of strings and everything else do they have attached to it?”

Cash-offer companies are taking a risk. If a home buyer’s financing falls through, the company could end up owning the house and needing to resell it. There also might be limited demand for these programs in a less frenzied market.

Andrew Bouery, who is 24 years old and in the Army National Guard, made more than 10 unsuccessful offers on homes in the Atlanta area. His agent, Edgar Gonzalez, said it is more difficult for his clients to get offers accepted when using loans backed by the Department of Veterans Affairs, as Mr. Bouery was, because those loans can take longer to close.

Mr. Bouery worked with Ribbon, which bought a two-story house in Snellville, Ga., for $276,000 in May and sold it to Mr. Bouery in June after his loan closed.

“Once we started submitting offers as an all-cash offer, rather than a VA loan, I think we ended up going from the bottom of the stack of offers to the top three,” Mr. Gonzalez said.

Sean Black, chief executive of Knock, thinks this business can continue to attract home buyers even after the current housing mania subsidies. “In our case, it’s all about the convenience” offered to homeowners who are simultaneously buying and selling houses, he said.

Dave Ness, a real-estate agent in Denver, said he often suggests cash-offer programs to his frustrated clients. However, while sellers like the convenience of a cash offer, they will still pick a financed offer if it is significantly higher, he added.

Updated: 9-20-2021

Real-Estate Agents Gear Up For Fight to Save Their Commissions

Justice Department probe, civil lawsuits pose challenge to real-estate industry practices.

The residential real-estate industry is bracing for a challenge to the commissions charged by its sales agents, one that could put downward pressure on the fees paid by home buyers and sellers.

The Justice Department is investigating home sale commissions, and in a wide-ranging executive order President Biden asked the Federal Trade Commission to adopt rules to address unfair or exclusionary practices in the real-estate industry.

Several civil lawsuits challenging industry rules and practices around commissions have survived initial procedural challenges and drawn support from the Justice Department, putting added pressure on traditional broker fees.

The politically powerful real-estate industry has survived past challenges to its commission structure, but consumer advocates say rising home prices have exacerbated concerns about excessive fees.

“The litigation and the government attention that the industry is getting now is unprecedented,” said Stephen Brobeck, a senior fellow at the Consumer Federation of America and a longtime critic of the industry.

At issue are the commissions real-estate agents earn for the sale of a home, typically around 5% to 6% of the sale price. For a home sale at the recent national median price of about $375,000, a 5% commission would be $18,750—or for a $1 million home, it would be $50,000.

Very high-end properties tend to have somewhat lower commission rates.

Home buyers end up contributing to these commissions as part of the purchase price, but often have little room to negotiate since it is the home sellers who generally set the commissions for agents on both sides of the deal.

Consumer advocates say this contributes to excessive commissions and point to the National Association of Realtors’ rules as the biggest roadblock to change. Those rules require sellers to offer commissions to would-be buyers’ brokers, which consumer groups say encourages sellers to offer high rates for buyer agents as a way to attract more potential buyers.

Industry critics also say that the fees are opaque to most buyers, and say the advent of online home search engines has diminished the traditional role buyers’ agents play in connecting buyers and sellers.

The National Association of Realtors says a tight sales market and rising prices have made real-estate agents more important than ever, and it says that commissions are fully negotiable and declining.

The average national commission rate is currently in the range of 4.9% to 4.94%, according to industry news and research site RealTrends, down from 5.40% in 2012.

The NAR says that the current commission structure also encourages more competition by giving all participants in local multiple-listing services equal access to information on available properties. It also helps make homes more affordable to first-time and lower-income buyers, the trade group says, because they don’t have to pay their own agents up front.

“NAR remains committed to advancing and defending independent, local broker organizations that provide for greater economic opportunity and equity for small businesses and consumers, including first-time, low- and middle-income home buyers,” said NAR general counsel Katie Johnson.

News Corp, owner of The Wall Street Journal, operates Realtor.com under license from the National Association of Realtors.

Under the Trump administration, the Justice Department and the National Association of Realtors reached a deal to provide more disclosure on broker fees and make them more competitive. But this summer, the Justice Department under President Biden said it was withdrawing from the settlement so that it could pursue a broader investigation into broker commissions.

The Justice Department said that Americans paid more than $85 billion in home sale commissions last year, and that industry practices “may harm home sellers and home buyers.” Last week, the NAR challenged the department’s withdrawal, saying it would fight a Justice Department civil subpoena.

The civil subpoena issued by the Justice Department in July largely focuses on NAR and industry policies that could be shaping the commission structure, according to court records. For example, the subpoena requires NAR to “submit all documents relating to any policy, guideline, rule, or practice: a. requiring listing brokers to make an offer of compensation to buyer brokers to list a home” on a multiple-listing service.

The subpoena also probes practices that could restrict marketing of non-MLS listings—another subject of recent private lawsuits.

In a further sign of the mounting risks to the industry, the Justice Department has taken sides against NAR and other industry defendants, filing statements in several civil lawsuits. The Justice Department statements generally dispute the NAR’s contention that a 2008 settlement with the department gave the government’s blessing to the current commission structure.

Mr. Biden also has pushed the Federal Trade Commission to launch its own review. The president said in a recent executive order targeting competition problems that the FTC should consider rules to curb “unfair tying practices or exclusionary practices in the brokerage or listing of real estate.”

The FTC didn’t respond to a request for comment.

The Justice Department investigation could lead to an antitrust suit and eventual sanctions on the industry. The prospect of FTC action is more distant, given the procedural hurdles that the agency faces in adopting new rules.

The current Justice Department investigation began earlier this year. After the change in administrations, the department was eager to pursue a broader look at the industry and unilaterally withdrew from the settlement pact with NAR.

The department is concerned that an array of practices creates a closed marketplace for the buying and selling of homes, locking in higher fees and preventing maverick firms and agents from successfully offering lower-cost models.

These concerns are especially true at a time of potentially disruptive change in the industry, accelerated by the Covid-19 pandemic, which for example saw a boom in virtual models for touring homes and navigating the real-estate market.

Several civil suits against the industry seeking class-action status have been filed by private law firms, including one by Cohen Milstein and Susman Godfrey filed in U.S. District Court in Chicago that survived initial procedural challenges but hasn’t yet been granted class-action status.

The lawsuit contends NAR rules stifle competition, which Ms. Johnson disputes. Realtors “already are competing on commission, from offering varied commission models to flat fees,” she said.

U.S. District Judge Andrea Wood in Illinois sided with the plaintiff home sellers in denying the defendants’ motion to dismiss the case.

“Plaintiffs’ allegations plausibly show that the Buyer-Broker Commission Rules prevent effective negotiation over commission rates and cause an artificial inflation of buyer-broker commission rates,” the judge wrote last year. “But-for Defendants’ conspiracy, each Plaintiff would have paid ‘substantially lower commissions.’”

Updated: 9-24-2021

Zillow Caught Up In TikTok Drama Over Big-Money Role In Housing

A video posted by a real estate agent in Las Vegas — claiming a company was pulling off a convoluted scheme to manipulate housing prices — has gone viral.

Runaway home prices are fueling angst on social media over the role of big corporations in the U.S. housing market.

Zillow Group Inc. became the latest company to get enmeshed in internet drama when Sean Gotcher — a real estate agent in Las Vegas — posted a TikTok video that said an unnamed company was pulling off a convoluted scheme to manipulate housing prices in his home market.

To understand why the video went viral on social media, it helps to think about the state of the U.S. housing market, where the pandemic unleashed demand that has swamped available inventory in both the for-sale and rental markets.

And to understand why Zillow is facing backlash in the wake of the video, it helps to know a bit about its business. The company, best known as a place to search real estate listings, has spent the past three years building out a home-flipping operation in a bid to simplify the buying process and, eventually, make money.

The company doesn’t like to be called a home flipper, but that’s what the business boils down to. The company invites owners to seek an offer for their property, then uses its software to calculate a bid.

If the owner accepts, Zillow buys the house, makes light repairs and puts it back on the market. The big idea is that selling a home is stressful, and that some consumers will pay Zillow to make the process less nerve-wracking.

Gotcher has a different take. In the hypothetical he lays out in the video, the company uses its cash to amass an inventory of 30 homes in a given neighborhood, all for one price: $300,000. Then the company buys an additional home for $340,000 in a bid to drive up the value of the first 30 homes.

This is a devious and possibly brilliant idea, but probably not what Zillow is up to.

A much more likely explanation is that Zillow sometimes overpays for homes, because the market has been really hot, and at times prices in certain markets have been moving so fast that it’s hard to know what a property is worth.

Zillow said in a statement that it pays market value for every home it buys.

Unlike traditional home-flippers, who aim to buy low and sell high, Zillow aims to run a low-margin business and profit by doing it at scale. Chief Executive Officer Rich Barton recently reiterated that the company is on pace to buy 5,000 homes a month by 2024. The rush to get big fast is another reason the company might sometimes overpay for homes.

This isn’t the first time social media has inflamed angst over the role that big companies are playing in a housing market that’s increasingly difficult for regular people to navigate. In June, “Hillbilly Elegy” author J.D. Vance complained on Twitter that the investing titan BlackRock Inc. was buying up single-family homes for the sake of its rental business, pricing young people of the market.

Vance had likely mistaken BlackRock, which hasn’t been a major player in the single-family rental business, with Blackstone Inc. — which helped create the industry — and had probably exaggerated the role the Wall Street institutions were playing.

Every home that a private equity firm buys is one that a family can’t, but the companies own a tiny share of U.S. houses. That didn’t stop Vance from continuing to go after them in launching his campaign for U.S. Senate.

Private equity landlords, tech unicorns and others are getting involved in the housing market at the same time as a severe inventory shortage is driving up prices and making it harder and harder for regular people to buy or even rent a home. The corporations all say they’re making things better for the consumer, and they may be.

It’s also possible that for all their sophistication, the Wall Street and Silicon Valley players are getting swept up in a speculative craze and could wind up losing money. But that doesn’t really matter to the family who keeps getting outbid for homes.

Updated: 9-27-2021

Zillow’s Home-Flipping Bonds Draw Wall Street Deeper Into Housing

The company’s iBuying program is part of a boom in programs that make it faster for customers to sell.

Zillow Group Inc. is best known for the addictive real estate listings that keep people browsing the internet all night, checking out interior shots of homes for sale or the estimated prices of their own houses or the ones down the street. But Chief Executive Officer Rich Barton has staked his company’s future on a bet that its software can also ease a critical pain point for U.S. homeowners: the time it takes to sell.

In recent years, Zillow has essentially dived into the house-flipping business, offering to quickly take properties off sellers’ hands. And in the process it’s helping pull Wall Street even deeper into the $2 trillion U.S. housing market.

In August, Zillow raised $450 million from a bond backed by homes it’s bought but not yet sold. The offering, led by Credit Suisse Group AG, was modeled on the loan facilities that car dealerships use to finance floor models.

The novelty of using that structure for houses didn’t scare off investors hungry for a new way to bet on the hottest housing market on record. The offering was over subscribed and Zillow, which declined to comment on its bond market activities, is now in the process of selling another $700 million in bonds.

More such offerings are almost certainly coming. Zillow is one of a growing field of tech companies, often known as iBuyers, who are taking advantage of the surge in investor demand to fund purchases of houses. They’re still a small part of the overall market, but as the mortgage meltdown of 2007-2010 showed in the extreme, the mix of housing, easy money, and new forms of financing can be combustible.

“We could very quickly be talking about more than $100 billion in debt,” says Tomasz Piskorski, a professor of real estate finance at Columbia Business School, speaking of the companies as a group. “What happens to the iBuyers when home prices drop? You could imagine a situation where they have a big inventory of homes, and they aren’t able to repay their debt.”

Zillow’s websites and apps get billions of page views a quarter, fueling a high-margin business in charging real estate agents a fee to connect with house hunters. But Barton, who founded Expedia Group Inc. before launching Zillow in 2004, decided the company risked falling behind new entrants into the real estate business if it didn’t get into the buying-and-selling game, too.

IBuyers such as Zillow and its competitors say they’re trying to solve a timing problem for their customers, particularly buyers who are trading up from an existing property. Until they sell their old house, it can be tricky or stressful to pay up for the new one. Or if they sell their current property more quickly than expected, they could find themselves in a rush to find a new place to live.

In 2014 a startup called Opendoor introduced a potential solution. It invited homeowners to request an offer on their house, then used algorithms to come up with a price. If the owner accepted, Opendoor purchased the property, made light repairs, and put it back on the market. Sellers generally accepted a small discount compared with what they would have gotten on the open market.

In return, they could schedule the closing to line up with their purchase of a new property. Zillow joined the iBuying fray in 2018. In some markets, its web and app users are even given the option to “sell to Zillow for your Zestimate,” the company’s marquee instant estimate of a home’s price.

The iBuyer model depends on software that predicts short-term changes in local home prices, since it usually takes three to six months to flip a home. It also requires a network of home renovation contractors and debt facilities for funding home purchases. All of those are complicated in their own right. Still, the four largest iBuyers acquired about 15,000 homes in the second quarter of 2021, accounting for 1% of all purchases nationwide.

Now those volumes are set to explode. Zillow expects to acquire homes at a pace of 5,000 a month by 2024. Another competitor, Offerpad Solutions Inc. could eventually buy 70,000 homes a year, based on its view of the future opportunity.

Opendoor, still the largest iBuyer, has said its playbook calls for the company to capture 4% of all home sales in 100 markets. Together the three companies could soon be buying close to $100 billion worth of homes a year, requiring more than $20 billion in revolving credit facilities.

In the early days, iBuyers funded purchases with credit facilities that charged about 7% interest on committed capital, similar to what a traditional home flipper might have paid. As lenders got more comfortable, the rates came down.

Zillow currently carries separate $500 million facilities with Credit Suisse, Goldman Sachs Group, and Citigroup, all with rates below 3%. Going to the bond market is a way to reach an even larger pool of capital beyond the banks. “It’s kind of a fuel for the ship,” Barton said on a recent call with investors.

Of course, Wall Street has long played a major role in the U.S. real estate market. The massive mortgage-backed securities market is the key source of financing for loans and the backbone of many fixed-income portfolios. But the iBuyers are offering investors a new kind of short-duration exposure to U.S. housing that isn’t directly tied to consumer credit.

And while Americans are used to financial players having a big role in mortgage debt, the ownership of single-family housing has long been a mom and pop affair. That’s changing.

Private equity firms and asset managers have been buying houses to convert to rentals. And now iBuyers backed by Wall Street cash and vast troves of data are becoming a noticeable and sometimes controversial presence in some hot real estate markets.

In September, a TikTok video by Las Vegas real estate agent Sean Gotcher accusing unnamed iBuyers of manipulating prices went viral with more than 2.4 million views. That prompted a six-post Twitter response by Redfin Corp. CEO Glenn Kelman, whose web-based real estate brokerage is also an iBuyer. “We’d never intentionally underpay or overpay for a home,” he wrote.

Zillow said in a statement that it pays market value for every home it buys, and that the prices it pays and sells for are shown on its site. It said it expects to earn thin margins by providing a convenience to sellers.

To date, most of Zillow’s purchases have been median-priced homes in Sun Belt metros, where its price-estimating algorithms operate with the highest confidence. Zillow pledged 1,416 homes as collateral in its initial bond deal, according to documents seen by Bloomberg News, half of which were already under contract to the next buyer.

When those sales close, the homes will fall out of the bond, and Zillow will have to replace them with other real estate. At the end of a two-year term, the company has the option of paying down the loan, or the more likely option of refinancing into a new facility.

The houses pledged in its initial bond deal have an average price of about $320,000. But as much as 20% of the collateral could eventually consist of homes that cost $950,000 or more, the loan documents show.

The main risk for Zillow is that it overpays for houses. If the market slows, the company could take a loss on the homes, or struggle to sell them as quickly as anticipated. The societywide lockdowns at the beginning of the pandemic were an early test.

As the housing market froze in the spring of 2020, the iBuyers scrambled to reduce exposure for a time. But things quickly gave way to a suburban buying boom that boosted their businesses.

A true shock to home prices could be a different story, says Karan Kaul, a researcher at the Urban Institute’s Housing Finance Policy Center. “The last five or so years have been the best time to be in the housing market in a very long time,” he says. “The iBuyers haven’t been exposed to an adverse economic cycle. It’s too early to tell what their long-term future looks like.”

Updated: 9-28-2021

For iBuyers, The Price Is Right

Some frustrated home buyers blame automated home flippers for the tough market, but those iBuyers also play a helpful role.

Capitalism can be a bummer, but it isn’t a crime.

In a soaring and ultracompetitive housing market, U.S. consumers are finding it difficult to buy a home. Zillow Research shows the typical U.S. home was worth over $300,000 in August—up over 23% from the same time two years ago—pricing out many single families.

IBuyers including Zillow Group, Opendoor Technologies and Offerpad, that buy and flip homes with the help of algorithms, may have had a hand in that.

An analysis of property data from Attom published last month by Mike DelPrete, scholar in residence at the University of Colorado Boulder, shows that while leading iBuyers were paying a median purchase price of less than 99% of what an automated market model showed a home was worth back in 2019, several were paying well over 100% as of the second quarter of this year, with Opendoor paying nearly 108%.

Mr. DelPrete offers several possible explanations for this premium, including the fact that houses are generally getting more expensive and, especially in rapidly appreciating markets, pricing may now be more difficult to predict with an algorithm.

Whatever the reason, he concludes there appears to be a shift from tight pricing discipline and to “a free-for-all, acquire at any cost strategy.”

Their strategy is stoking conspiracy theories among frustrated home buyers. A viral TikTok video posted by a Las Vegas real-estate agent earlier this month took aim at automated home flippers. It painted them as deliberate market manipulators, alleging they overpay for select homes to unload the remainder of their inventory for higher gains.

While data show iBuyers have paid well over market value for homes this year, that likely has little to do with them being insidious profiteers and a lot to do with the reality that they are highly funded public companies that need to show their shareholders growth.

It is perhaps an unsavory, but above board, motive furthered by the fact that the iBuying business ground to a temporary halt last spring, costing iBuyers time and money.

IBuyers aren’t the only cash-rich companies helping to fuel the recent market frenzy. Earlier this year, private-equity firm Blackstone Group said it was paying $6 billion to acquire Home Partners of America, a company that buys and rents single family homes.

J.P. Morgan Asset Management and Rockpoint Group LLC also have made big investments in single-family rental operators. Lately entire neighborhoods have sold to investors. In one instance, a Texas community reportedly sold for roughly twice what the builder said it typically makes selling homes one by one to the middle class.

Big tech has certainly been in the news recently for harmful practices behind the scenes, but its actions in housing aren’t so mysterious. IBuyers have been clear that their businesses are built to mostly make money off of ancillary services like mortgage, title insurance and escrow, rather than on home transactions themselves.

Zillow Chief Executive Rich Barton even said on his company’s first-quarter conference call that the margins it was earning “are not what our goal is,” noting iBuying can only be a big business when pricing is perceived to be fair to consumers.

Fair or not, the greater hand iBuyers have in local market transactions, the more consumers are likely to feel their effects.

IBuyers say they represent just 1% of U.S. home transactions today, but that share isn’t evenly dispersed. Among 33 markets analyzed by Zillow, four showed iBuyers commanding market share of 5% or more in the second quarter. And in those cities, iBuyers’ share had risen by nearly two-thirds year over year.

While they may not help lower prices, iBuying can be beneficial to housing-market turnover. It spares time and energy required to host open houses. IBuyers handle small renovations and provide sellers with choice and a guarantee on a closing date. They may also bring inventory into a market that right now needs more of it.

Zillow Research reports 84% of homes sold to one of the four largest iBuyers last quarter weren’t listed for sale beforehand. Unlike private-equity landlords, iBuyers are also sellers.

Much like food-delivery platforms can drive up the cost of a restaurant’s food, higher home prices may be merely a consequence of the addition of large, for-profit companies as middlemen to the equation. One day you might benefit from such a service; another day you might pay some of the tab for your neighbor’s convenience.

Similarly, while it may become more difficult to buy in markets where investment firms purchase single-family homes to rent, they are useful for families that can’t, don’t want to or aren’t yet ready to take the ownership plunge. Gilles Duranton, professor at the University of Pennsylvania’s Wharton School, thinks of it as a kind of arbitrage—it won’t make everyone happy, but some will benefit.

No one said a free market would be free of cost.

Updated: 10-1-2021

Billionaire Charlie Munger’s Timely Apartment Bet Began With Hebrew Bible

Munger couldn’t read it. But the encounter led to an improbable friendship and, more than a decade later, an investment in California apartment complexes before the pandemic sent values soaring.

The young man’s business, Afton Properties, has become a force in the market in the past few years. It bought more apartments in California than anyone else in 2020, on its way to building a real estate portfolio with an estimated value of $1.2 billion, according to Real Capital Analytics.

Munger and Afton declined to comment on how much of that growth was funded by the 97-year-old investor, who’s best known as Warren Buffett’s longtime business partner. Still, Munger’s public remarks and other data provide a glimpse into a little-known chapter in his storied investment career.

Afton, run by Avi Mayer and Reuven Gradon, has focused on an unglamorous corner of the real estate market: Garden-style apartment buildings in the vast sprawl of Southern California.

They spent $423 million last year on more than 1,700 units, and the purchases have continued in 2021, according to RCA data. They’re still on the hunt and prepared to make all-cash offers for apartment complexes.

“Avi and Reuven, they were one of the first to see the secondary markets” had potential, said Otto Ozen, executive vice president at the Mogharebi Group, a multifamily investment banking firm in California that has closed deals with Afton. “They’re buying with a long-term hold strategy.”