OK House, Exactly How Smart Are You?

Proposed regulations would allow the majority of homes to be bought and sold without being appraised by a human. OK House, Exactly How Smart Are You?

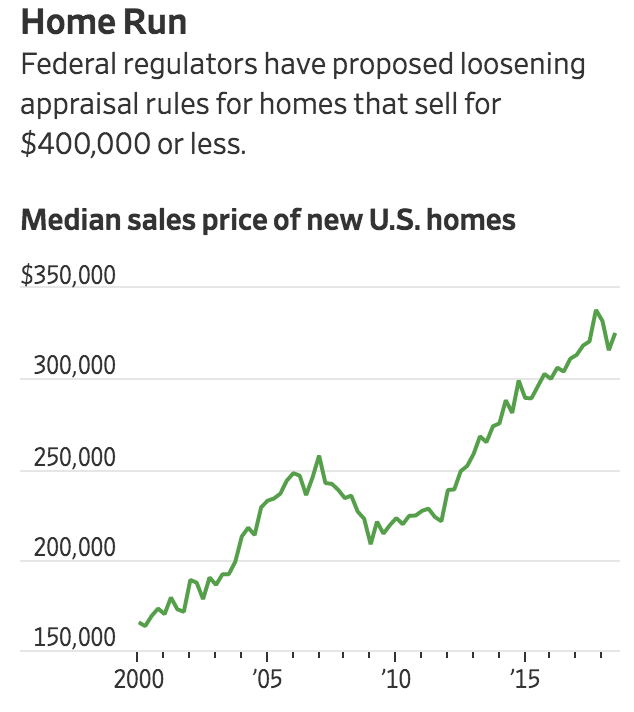

Federal regulators have proposed loosening real-estate appraisal requirements to enable a majority of U.S. homes to be bought and sold without being evaluated by a licensed human appraiser. That potentially opens the door for cheaper, faster, but largely untested property valuations based on computer algorithms.

The proposal was made earlier this month by the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corp. and the Federal Reserve. It would increase to $400,000, from $250,000, the value of homes that can be bought and sold without a tape-measure-toting appraiser visiting a property.

More than two-thirds of U.S. homes sell for $400,000 or less, according to U.S. Census data and the National Association of Realtors. If the regulators’ proposal had been in force last year, about 214,000 additional home sales, or some $68 billion worth, could have been made without an appraisal, regulators said in their 69-page proposal.

Related:

Emergency Rental Assistance Program

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin)

Home Flippers Pulled Out of U.S. Housing Market As Prices Surged

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Smart Wall Street Money Builds Homes Only To Rent Them Out (#GotBitcoin)

New Ways To Profit From Renting Out Single-Family Homes (#GotBitcoin)

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Investors Are Buying More of The U.S. Housing Market Than Ever Before (#GotBitcoin)

Cracks In The Housing Market Are Starting To Show

Biden Lays Out His Blueprint For Fair Housing

Housing Boom Brings A Shortage Of Land To Build New Homes

Wave of Hispanic Buyers Boosts U.S. Housing Market (#GotBitcoin?)

Phoenix Provides Us A Glimpse Into Future Of Housing (#GotBitcoin?)

Sell Your Home With A Realtor Or An Algorithm? (#GotBitcoin?)

“We still would prefer a human being doing the appraisal,” said Lima Ekram, a mortgage-backed securities analyst at Moody’s Investors Service.

One Issue: Automated valuations done by computers are largely unregulated. The 2010 Dodd-Frank financial overhaul required regulators to propose quality control standards for so-called automated valuation models, but they have yet to do so.

“There are a lot of problems with appraisals, but there are voluminous standards,” said Ritesh Bansal, chief executive of Appraisal Inc., a New York-based provider of automated valuations. “On the AVM side, it’s a wild, wild West. And that just invites abuse of all kind.”

Regulators say the immediate effect of dropping appraisal requirements would be limited because a vast majority of home loans in that range are bought these days by mortgage giants Fannie Mae and Freddie Mac , or guaranteed by other federal agencies. Those typically require appraisals regardless of home value.

Appraisals help “ensure that the estimated value of the property supports the purchase price and the mortgage amount,” regulators wrote in their proposal. “However, the agencies also are aware that the cost and time of obtaining an appraisal can, in some cases, result in delays and higher expenses.”

Scrapping the appraisal requirement would open a swath of new turf for upstart property valuation companies, like HouseCanary Inc., which use artificial intelligence, algorithms and sometimes even drones to value homes. Jeremy Sicklick, the company’s chief executive, said that replacing appraisers with computers will speed up home sales by weeks, reduce costs for buyers and eliminate human bias and error from the process of valuing mortgage collateral.

“The technology has reached the level to where this change creates a win-win for the consumer and lender,” Mr. Sicklick said.

Although appraisals are based on criteria such as sales of recent comparable homes, they are sometimes more art than science. And appraisers came under fire following the housing crisis, shouldering much blame for inflating home prices at lenders’ behest.

Their latest turf battle comes months after a defeat at the hands of lawmakers rolling back some financial-crisis-era banking rules. That change eliminated a chunk of appraisers’ business by exempting many rural properties from appraisals.

“The appraisal profession is suffering a death by a thousand cuts,” said Joan Trice, chief executive of Allterra Group, a Maryland firm that tracks the industry.

Since the housing crash, the number of appraiser credentials in the U.S. has declined about 21%, to fewer than 96,000, according to a federal group that governs the profession. Some lenders have complained appraisers in booming and rural markets are in short supply.

Last autumn a rural Tennessee bank asked federal regulators to waive appraisal requirements and allow an employee with some appraisal training to value collateral. The request was denied, but it sparked national debate over whether there are enough appraisers, and how homes might be valued without them.

Appraisals typically cost between $375 and $900 for a single-family home. Valuations produced by the likes of HouseCanary often cost less than $100 a house. So do broker price opinions, which are a sort of perfunctory assessment performed by real-estate agents and even outsourced to office workers in India who use online data.

Banks and Wall Street investors use these alternatives to price portfolios of houses and home loans, since valuations that are too high or low tend to balance out over pools of thousands of properties.

Appraisers argue that approach is unsuitable for home purchases, though. An appraisal that is off by a few percent could leave a homeowner owing more than their house is worth or lenders with insufficient collateral to cover defaulted loans.

“There’s still no computer that can see, hear, taste, smell and touch,” said Pat Turner, an appraiser in Richmond, Va. “Have you ever been in a hoarder’s house?”

Updated: 10-18-2021

Blockchain Brings The Sharing Economy To Real Estate Investing

Crypto adoption in the real estate market could see fractional property ownership becoming more popular.

Fractional ownership of buildings and property developments is becoming one of the adoption areas for blockchain technology in the real estate business. From democratizing access to real estate investment to improving liquidity in the market, there is an argument to be made for tokenization being a net positive for the real estate space.

Tokenization via fractional real estate investment is also another example of the emerging “sharing economy” that seems to be encouraging crowdfunded ownership, a trend that could help to decentralize the global asset market across several sectors.

With Millennials, the maiden generation of digital natives entering their peak spending years, the digitization of the real estate market could see greater interaction in the market from this particular demographic.

However, as is the case with fractional ownership as a whole, tokenized real estate investing does come with its share of drawbacks. Given the novel nature of the enterprise, financing options can often be limited, leading to less liquidity in the market and an overall flexibility deficit.

Initial Fraction Offering

As previously reported by Cointelegraph, Fraction, a subsidiary of Hong Kong fintech firm Fraction Group, received regulatory approval from Thailand’s Securities and Exchange Commission to trade tokens representing fractional ownership of physical and digital assets.

While the approval covers tokenized investments in physical and digital goods, Fraction’s first focus is on fractional real estate investment and will reportedly utilize an initial fraction offering (IFO) vehicle.

According to the company’s announcement back in September, IFOs will provide easier entry into the high-end real estate market for prospective investors. IFO tokens will represent fractional ownership of luxury real estate listings for as low as $150, presumably lowering the barrier for greater participation in the market.

Back in January, Fraction listed its first property on its proprietary exchange platform, a condo unit located in On Nut, Bangkok, Thailand. According to details on the company’s website, the process involved the total digitization of the title deed followed by the fractionalization of the ownership of the property before offering tokenized ownership of these fractions via an IFO.

Speaking to Cointelegraph, Josh Stech, co-founder and CEO of Sundae — a digital residential real estate marketplace platform — highlighted the merits of tokenization and fractional ownership in the market. “Investing in residential real estate is one of the biggest opportunities for wealth creation, and sadly, it’s accessible mainly to the wealthy,” Stech said, adding:

“Tokenizing residential real estate on blockchain has the promise to provide efficient and open access to the largest asset class in the U.S. not just for younger people but for anyone who wants to invest in real estate without having the funds for an entire property transaction.”

By leveraging crypto and blockchain technology, Stech stated that tokenization will serve to lower the entry barrier for investors into fractional real estate investment. “While real estate investment funds and platforms provide fractional investment opportunities, they are hard to find, hard to evaluate, illiquid and accessible to accredited investors only,” the Sundae CEO added.

A Slow Start

Real estate tokenization is still in its infancy and remains a niche aspect of the market. However, industry insiders say there is potential for massive growth with British accounting network Moore Global estimating that the tokenized real estate market could achieve a $1.4-trillion valuation by 2026 on the back of tokenizing only 0.5% of the current global property market.

While the tokenized real estate space does show some promise, there are a few significant issues that need to be addressed. Lack of liquidity especially in the secondary market, institutional hesitancy and absence of regulatory clarity are among some of these major hurdles.

According to Tal Elyashiv, founder and managing director of blockchain-focused venture capital firm SPiCE VC, fractional real estate ownership via tokenization still has a long way to go. Elyashiv told Cointelegraph:

“I believe that to propel the real estate tokenization market, we will need to see some more institutional comfort level with tokenized assets, which is coming. The market is already seeing an influx of institutional-grade projects. The market also needs to experience innovation in the area of dedicated real estate platforms, which allow investing in tokenized real estate assets without investors having to deal with the underlying blockchain complexity.”

The SPiCE VC founder added that these dedicated platforms that deal in tokenized real estate assets are essential for improving liquidity in the market. According to Elyashiv, such platforms will make token-based real estate investing more intuitive.

A Few Notable Examples

For now, tokenized real estate remains fragmented with different projects providing their own somewhat limited platforms while navigating sometimes vague regulatory provisions. However, there have been a few notable developments in the market.

In the summer of 2020, Overstock’s regulated tZERO exchange platform started trading a security token that represented fractional ownership of a luxury resort in Colorado. The launch attracted record trading volume at the time, but the initial enthusiasm was likely dampened by the market slowdown occasioned by the coronavirus pandemic.

In September, RealX, a fintech firm based in Pune, India, launched a blockchain-based registry system to enable fractional property ownership in the country. According to a previous Cointelegraph report, tZERO also partnered with real estate crowdfunding company NYCED Group to tokenize $18 million worth of properties.

Growing demand for fractional ownership could be the trigger that spurs greater adoption of tokenized real estate. With Millennials coming into their own in terms of being the dominant consumer demographic in the world, investment vehicles steeped in the ethos of the sharing economy could become even more popular within the next few years.

The current rise of the sharing economy appears to be at least in part due to the pivot toward access rather than the ownership framework that characterizes the older economic model. This preference for access-based services has in some way contributed to the success of neo-businesses such as ride-hailing, content crowdfunding, streaming service for entertainment, among others.

With cryptocurrencies, service providers and the millennial consumer class probably have a suitable mechanism to drive token-based fractional ownership.

Updated: 12-5-2021

Here’s What Could Change Your U.S. Property Tax Bill In 2022, And Beyond

Soaring residential values, changes to the highly divisive SALT deductions and more could be in store for homeowners.

Rising U.S. property values, potential changes to federal taxes and concerns over Covid-19 related gaps in local budgets may have some homeowners wondering what’s ahead for property taxes in 2022.

Of course, what Americans pay in property tax varies from state to state, but for most people, there’s no reason to panic, not yet.

Rising property values will likely increase property tax liability, but that won’t happen automatically. Many homeowners won’t see a change in the assessed value of their home until their local assessor deems fit. That could be this year, or it could be five years from now, depending on the schedule of the assessor’s office.

Some municipalities are raising rates to cover expenses, but because of federal funding, those increases may not be as steep as in previous years. Other areas are lowering property tax rates to help give residents a break after a trying couple of years.

In addition, well-heeled homeowners may get a break in the form of increased state-and-local-tax deductions. The so-called SALT deductions have caused consternation for many since they were capped to $10,000 in 2017, and lawmakers from high-tax states have been trying to get that limit repealed ever since.

Efforts are underway to raise the SALT deduction cap to $80,000 in the Build Back Better bill, which passed the House last month.

And although the proposed limits to 1031 exchanges—which allow real estate investors to defer capital gains—are off the table for now, the Biden administration may choose to resurrect the initiative in the future.

Up, Up And Away

By the end of the year, median prices in the U.S. are expected to be up 12%, according to a report last week from Realtor.com. Eventually that will lead to higher property appraisals and therefore an increase in property tax bills. But that change may not be immediate.

“It depends on where you live as to when those changes in property values that we are seeing take place,” said Marc Pfeiffer, senior policy fellow and assistant director at the Bloustein Local Government Research Center at Rutgers University in New Brunswick, New Jersey.

For instance, in the Garden State, some municipalities conduct annual reassessments, while others divide their jurisdiction into regions and reassesses one area per year for a few years. So, if a city is broken up by the assessor into three districts, each will be reassessed once every three years.

Still other municipalities in New Jersey may wait five to seven years and have the whole municipality reevaluated at the same time, according to Mr. Pfeiffer.

In that case, it could be years before a homeowner sees the result of rising property values on their tax bill, he noted.

Some areas may also see higher property tax rates as cities look to fund services during the Covid-19 pandemic. However, federal funding has offset that in many communities.

Take Chicago. Mayor Lori Lightfoot’s budget, approved by the Chicago City Council in late October, sets out a $76.5 million increase to the property taxes, less than the $94 million rise in 2021. Homeowners with a property valued at the average price of $250,000 will see a $38 bump in their bills, according to city officials.

Properties in the Windy City were reassessed this year as part of a three-year process in Cook County. “Surprisingly robust real estate trends” have been seen throughout the county, but the average increase in residential tax bills was about 1%, according to Scott Smith, a spokesman from the Cook County Assessor’s office.

Other areas, including several municipalities in Florida and Texas, are lowering rates to give taxpayers a break or to keep revenues under state-mandated levels.

Pass The SALT

Affluent homeowners in New Jersey, as well as other high-tax states such as New York, Illinois and California, may also be keeping an eye on the changes to the state-and-local-tax deductions which is currently part of the Build Back Better bill.

“It is a significant issue in the wealthier parts of New Jersey, in those places where taxes are significantly above the state average of around $9,000,” Mr. Pfeiffer said. “Just because people are wealthy, it doesn’t mean that they don’t wince when they’re writing that check.”

The version passed by the House of Representatives last month will raise the $10,000 cap on the deduction for state and local taxes to $80,000 through 2030, The Wall Street Journal reported.

Democratic leaders have been trying to repeal the $10,000 cap on so-called SALT deduction since it was introduced in the Trump administration’s Tax Cuts and Jobs Act of 2017.

Previously, there was no cap, meaning taxpayers could deduct all their property and state income taxes from their federal income taxes. Currently, the deduction cap is set to expire at the end of 2025.

It remains to be seen if the increased SALT cap will survive as the Senate debates the bill, which Democrats hope to push through by the end of the year.

Not included in the bill is the proposal to limit the 1031 exchanges that allow investors to defer capital gains taxes on the sale of property.

Currently, investors who sell properties at a profit can reinvest the money in another “like-kind” property, thus deferring capital gains taxes. That process, which is subject to certain rules, can be repeated and investors can avoid the fees indefinitely.

Earlier this year, the America’s Families Plan tried to cap the amount investors can defer at $500,000 for individuals and $1 million for couples, according to Jesse Little, senior director of wealth planning at Wells Fargo Private Bank. Although the proposal was scrapped for the current legislation, “it’s not off the table.”

“It’s definitely still important for investors to keep in mind because there’s no real certainty on what might happen over the next couple of years,” Mr. Little said. “It could certainly be a part of a next wave of potential changes.”

Updated: 12-7-2021

California Couple Sues When Their Home Was Appraised For $500,000 More When Appraiser Thought Homeowner Was White

An appraisal firm valued the home at nearly $1 million, but a second firm increased the appraisal by 50% once African artwork and family pictures were replaced with white illustrations.

A Black couple from Northern California are suing an appraisal company for wildly undervaluing their home by nearly half a million dollars.

The North Bay Business Journal reports Paul and Tenisha Tate-Austin bought their home in Marin City in 2016 for $550,000. The lawsuit states that they spent $400,000 over the next two years in home improvements.

During a refinance in 2020, the Austins got a valuation for $995,000 by Janette Miller of Miller & Perotti appraisers. The family thought the appraisal seemed low. According to the Washington Post, the couple enlisted a white friend, Jan, who agreed to pretend to be the homeowner for a different appraiser three weeks later.

The Austins took down family photos and removed African-themed artwork. Jan brought in photos of her own family, the lawsuit states.

After the “whitewashing,” the second company’s estimate came in at $1.48 million, which is in line with the median home value for a single-family home in Marin County.

The Fair Housing Advocates of Northern California filed suit in U.S. District Court in San Francisco on behalf of the Austins. Paul Austin said in a statement, “We believe that Ms. Miller valued our house at a lower rate because of our race and because of the current and historical racial demographics of where our house is located.”

The lawsuit states that the defendants’ actions violated the California Fair Employment and Housing Act, enacted in 1959 to prohibit discrimination in employment and housing based on a person’s race, religion, national origin and ancestry. The plaintiffs, which include the advocacy group, seek unspecified damages.

The Washington Post reports similar situations with other Black homeowners. “The value of a woman’s Indiana home more than doubled between appraisals last year after she stripped it of all evidence that it was owned by a Black person and a White family friend stood in as the homeowner.

Earlier this year, a Black family in Ohio removed family photos, artwork and their 6-year-old daughter’s superhero pictures, replacing them with belongings their White neighbors offered up. The appraised value of their house went from $465,000 to about $560,000.”

Updated: 1-12-2022

There’s Still No Amazon For Housing, But Fintech’s Working On It

Buying and selling a house is a large, complicated transaction, so companies are focusing on making small parts of it easier.

It’s hard to imagine a better scenario for real estate technology than the one that played out in 2021. Low interest rates and pent-up demand ignited the hottest housing market on record, while the pandemic gave buyers and sellers new reasons to conduct business virtually.

And yet the year will be better remembered for the way some of the biggest names in the industry struggled. The highest-profile flop was Zillow Group Inc., the online listings giant that pulled the plug on its nascent instant homebuying operation in the face of mounting losses.

Compass Inc., the tech-driven real estate brokerage, saw its shares plummet 50% as part of a broader selloff in property-related technology stocks. Better, an online mortgage company, fired 9% of its staff.

The bumpy year underscored a problem that’s been holding back the adoption of technology in real estate for the past two decades. Each sale of a home involves hundreds of thousands if not millions of dollars, and no two properties are exactly alike.

Silicon Valley-backed companies have gone a long way in making searching for homes and advertising them simpler and faster.

But it’s a difficult process to move fully online and involves a lot of people such as agents, appraisers, brokers, and contractors, as well as entrenched interests. For example, Zillow’s house buying business—billed as a way for customers to get out of their homes quickly and speed the moving process—faltered in part because the company couldn’t find enough contractors to fix up those homes to resell them.

This isn’t a unique problem: Online retailers quickly convinced shoppers it made sense to order pants online, but many consumers still prefer brick-and-mortar grocery stores, where they can squeeze the avocado and eye the steak.

And of course even in online retail there are still plenty of people working to pack boxes in warehouses.

Real estate just presents a higher level of difficulty. “The real estate transaction won’t be unscathed by the impact of automation,” says Stefan Swanepoel, chief executive officer of T3 Sixty, a consulting company focused on residential real estate.

“But it’s arguably the most complex, fragmented, and localized of all transactions. It’s not a transition that will take place quickly.”

There are rich rewards for companies that get it right. About $2 trillion worth of homes changes hands in a typical year, generating upwards of $90 billion in brokerage commissions, tens of billions of dollars in mortgage origination fees, and smaller yet still substantial sums for things such as appraisals, inspections, and title services.

It’s a big pie, and even the crumbs can amount to a lucrative business. Venture capitalists invested more than $12 billion in U.S. real estate technology companies last year—a record, according to PitchBook.

Another group of companies is trying to tackle similar problems outside the U.S., where the real estate is often more opaque.

“You have peer-to-peer transactions of significant assets with very little transparency and trust,” says Brynne McNulty Rojas, co-founder of Bogotá-based Habi, which is aiming to be something like the Zillow of Latin America.

Nima Wedlake, a principal at Thomvest Ventures, tracks 240 real estate tech companies in five main categories. One group, which includes listing portals and tech-enabled brokerages, wants to help house hunters find a home.

Another, including digital lenders and alternative financing companies, helps them pay for it. Scores of companies are also working on improving various parts of housing market plumbing: processing mortgage applications, appraising properties, and servicing loans.

One emerging theme is that tech companies are finding ways to do the hand-holding that was long left to human advisers.

Wedlake points to Rocket Cos.’ recent acquisition of a personal finance app called Truebill for $1.3 billion as an example. Rent-to-own company Landis Technologies has added a coaching layer to its products to help renters save money for a down payment.

Another trend is companies that gained traction with one product seeking to add more services, says Clelia Warburg Peters, a property tech investor and the former president of a Manhattan real estate brokerage. “Expectations of customers are going to keep growing,” she says.

In this vein, brokerage Redfin Corp. announced a $135 million purchase of a mortgage lender on Jan. 11 as part of its bid to create a one-stop shop for agents, loans, and other services.

The goal for companies is to create a seamless transaction while finding the revenue to pay for the underlying technology.

That last part is crucial—unlike in some corners of fintech, where a snappy new app feature can make all the difference, it may be hard to woo customers with free add-ons that don’t cost a company much to provide.

Updated: 2-10-2022

Zillow’s Next Steps Eyed After $35 Billion Market-Value Wipeout

* Company’s Shares Have Plunged After Hitting Record Last Year

* CEO Will Update Investors As It Winds Down Home-Flipping Unit

Zillow Group Inc. was flying high last February, when the red-hot U.S. housing market helped push its share price north of $200 and a “Saturday Night Live” skit cemented the company’s place in the pandemic zeitgeist.

Housing is still hot a year later, but Zillow isn’t. Chief Executive Officer Rich Barton shocked the real estate world in November when he pulled the plug on his company’s tech-powered home-flipping operation, sending shares plummeting and adding fuel to a selloff that has wiped out more than $35 billion in market value.

Now, Zillow is at a crossroads. Its website and apps draw more than 200 million unique visitors in a typical quarter, driving a profitable business selling ads to real estate agents. But after the home-flipping collapse, investors are eager to hear what’s next for the most high-profile real estate company in the U.S.

Zillow reports results after the close of trading in New York on Thursday, giving Barton a chance to update investors for the first time since November.

Things To Watch

* Zillow had been buying and selling thousands each quarter but decided to exit the iBuying business, known as Zillow Offers, after a bad bet on home-price appreciation. Now, analysts are looking for clues on what Barton has planned to fuel growth. When Zillow last reported earnings, “management had limited opportunity to put a new game plan in place,” Wedbush analysts Ygal Arounian and Chad Larkin wrote in a recent research note. “We look to hear more on the specific details and vision for that model at earnings.”

* The company’s shares dropped 54% last year and have continued slipping in 2022. The stock closed at $48.47 on Wednesday, a 76% plunge from a record high closing price of $203.79 on Feb. 16, 2021.

* Zillow has made steady progress exiting its iBuying operation. It has sold more than 8,900 homes since Sept. 30, according to a Bloomberg analysis of property records compiled by Attom Data Solutions. That number includes some sales that closed in January, but not transactions that are under contract but not yet closed.

Exit Strategy

Zillow has sold thousands of homes as it winds down its iBuying business.

The company is expected to report a loss of roughly $177 million before interest, taxes, depreciation and amortization, according to an average of analyst estimates compiled by Bloomberg. It had posted an adjusted profit for four straight quarters before announcing the Zillow Offers shutdown. Zillow said in November that it would take writedowns of as much as $569 million on the flipping business and reduce its workforce by 25%.

Updated: 2-21-2022

Online Real Estate Isn’t Worth The Chance

Even as the housing market booms in the U.S., dreams of online real-estate riches have faded in the stock market.

You can make a lot of money on physical real estate right now, but recent results from major online real-estate players show 2022 isn’t the year to play Monopoly in the stock market.

The carnage isn’t about any one company. Since Compass’s initial public offering last April, the S&P 500 is up more than 8%, while online real-estate stocks including Redfin, Zillow Group, Opendoor Technologies and Compass are down about 58% on average over that period.

Their similar losses have come despite the fact each platform boasts a different business model—Opendoor is a pure-play iBuyer, Zillow is an iBuyer returning to an agent ad business, Redfin is a hybrid broker that also dabbles in iBuying and Compass is an old-school brokerage firm dressed up as a technology company.

The group’s underperformance seems to have had more to do with the erosion of tech valuations marketwide rather than the fundamentals of each firm, though Zillow’s iBuying implosion didn’t help.

But there is one underlying similarity that could keep online real-estate stocks depressed: Even if the tech sector stages a broader recovery this year, all rely on transaction volume to make money.

Inherent to the iBuying business is an ability to buy and flip homes in a timely manner at prices higher than what the buyer paid for them. Zillow, meanwhile, continues to test what is known as a Flex model for its agent ads business in which it is paid when agents close a deal rather than when an ad is posted.

Brokers typically are paid on commission and Compass says it generates “substantially all” of its revenue from commissions paid by clients at the time a home is transacted.

U.S. for-sale home inventory is at an all-time low. Redfin said Friday that active listings for the week ended Feb. 13 were down 49% from the same period of 2020. Still, demand so far has been so strong that transaction volumes have held up: Redfin’s data also show that pending home sales were up 35% over that period.

How long can transaction volumes remain high despite a shortage of product? In January, Zillow reported a panel of U.S. economists was evenly split on whether home sales will rise or fall in 2022. They worried about increasing affordability challenges and rising mortgage rates.

On the other hand, the 1.6 million homes started in 2021 made last year the biggest for housing starts since 2006. More homes built should bolster inventory, potentially tempering prices, though rising material and labor costs are also a factor. At the same time, mortgage rates are already at their highest level since May 2019.

Redfin’s data shows the median home-sale price was up 30% in mid-February compared with the same period of 2020, while the monthly mortgage payment on the median asking price had risen 31% over that period.

Zillow has long been predicting many homes will go on the market as the pandemic eases with the assumption that homeowners have balked at listing amid uncertainty and potential risk of infection via open houses. As prices appreciate, it is true that these would-be sellers could fetch top dollar—as long as they have somewhere to go. Zillow reported last week there are now 481 U.S. cities in which the typical home value is at least $1 million. That is up from fewer than 300 at the beginning of 2019.

Outside of iBuying, the core businesses of online real-estate players also face challenges. Zillow’s first-quarter guidance for its agent ad business came in 3% below consensus estimates at its midpoint. Redfin was even worse: Guidance for its real-estate services revenue issued on Thursday came in 15% below consensus at the midpoint. Its shares fell 20% Friday in large part based on that outlook.

Compass’s fourth-quarter revenue also slightly missed Wall Street’s forecast, as did first-quarter and full-year revenue guidance. Specifically, Compass said that tight inventory would likely slow the rate of growth in transactions in the first quarter compared with a year earlier.

Online real-estate platforms can make you money this year—it just might not be in the stock market.

Updated: 4-21-2022

Does Smart Home Tech Make You A Better Short-Term Rental Host Or An Evil Puppet Master?

There’s a fine line between making sure everything is running smoothly and spying on your vacation guests.

For my money, the best horror film ever made was the 2012 movie, “The Cabin in the Woods.” A group of teenagers go on vacation to a cabin in the woods, only to find themselves terrorized, and slowly knocked off, by a series of horrible zombie monsters.

Unbeknownst to them, the entire zombie monster operation is being run by a group of engineers who are surveilling their every move from a clandestine lab. The engineers are also technologically manipulating the events that trigger the release of the zombie monsters. It doesn’t end well for anyone.

I think of this film every time I try to decide whether we should install smart-home surveillance and control technology at our short-term rental property.

I waffle back and forth between the advantages of having a remote view into the operation of the home, and the knowledge that I may be stepping onto a slippery slope that inevitably leads to zombie monsters.

Owning a short-term rental is fraught. The revenue is nice, but it’s a lot of work and worry. Landlords are completely at the mercy of a rotating cast of renters. Also, stuff happens in a house you don’t occupy full-time that can wreak holy havoc if left undetected.

Smart-home tech, like smoke, fire and carbon-monoxide detectors that automatically alert responders, water heater monitors, and flood detectors can stop a situation going from bad to worse. This tech is firmly in the “benevolent” category.

Where I get conflicted is with the clandestine lab/evil engineer-type stuff.

Some short-term landlords have installed so much smart-home tech that they can, theoretically, observe their renters almost everywhere in the house, track who comes and goes, control the lights, air conditioning, heat and window shades, monitor their Netflix consumption, view the contents of the refrigerator, and reduce the water pressure to a dribble.

They can lock renters out of the house entirely. Smart-home tech can’t unleash zombie monsters yet, but that’s probably coming in the next generation of the Amazon Echo.

While I love the idea of having a layer of oversight and protection over my rental property, I’m not sure I should possess the power that all that smart-home tech provides. Here’s why:

Obsessiontown. Population, Me: Web-enabled, real-time video surveillance, recorded on a remote server, is a proven way to reduce break-ins at vacation rentals, and, at the very least, gives landlords a chance to identify and prosecute perps.

But How Do I Stop Watching?

If I got 24/7 access to a live feed of the comings and goings at our largest single asset, I’d never get anything else in my life done.

I’d be reduced to a bleary-eyed gamer, staring unblinking at the action on my computer screen, afraid to look away lest I miss something: a criminal with a crowbar trying to break down the front door, a flurry of guests clearly dressed for a rave, someone smuggling in a pet tiger even though we have a very specific “no pets” policy, the progress on the crown of thorns plant by the front door. (It hasn’t been doing well.)

Then, inevitably, I’d start going all evil engineer.

How much would the renters freak out if I lowered the shades in the living room while they’re sitting there? What would happen if I made the pool really cold one day and really warm the next? How would they react to having only basic cable for eight hours?

Hammer-hard water pressure, then just dribbles? I wouldn’t sleep. I wouldn’t eat. I’d just mess with them ALL DAY. Now, I am become Zombie Monster, destroyer of vacations.

Clearly, I couldn’t handle that kind of power.

It’s gross: Home-security systems are nothing new, but it’s a different ballgame when you’re surveilling your short-term rental, because you are, by definition, watching the daily activities of strangers. This is creepy. Clandestine lab creepy.

Short-term renters, like all tenants, have a legal expectation of privacy. Airbnb and other short-term rental companies have policies about what hosts can and cannot surveil at their property. Hosts are also required to disclose to renters the location of any surveillance.

But people forget about such things when night falls and alcohol begins to flow. Do I REALLY want to see what my renters are doing in the pool or on the couch at night? Nope. Don’t watch, you say? Please see the “Obsessiontown” item above.

Ignorance is still bliss: Dumb homes are more vulnerable than smart homes to many things. But I’ll bet the owners of dumb homes have less gray hair. They’re not sitting around, watching the feed, waiting for the big scary thing to happen, second guessing everything they see.

Last winter, some friends of mine learned there was a raging party taking place at their rental property, complete with fire dancers juggling lit torches on the patio, which is covered with wooden furniture and other highly flammable things. It was still happening when they learned about it, but damage had already been done.

If they had seen the fire dancers arrive on a video feed, they might have been able to get their property manager there fast enough to shut it down, but the only way they could have done that was to be glued to a video-surveillance feed at all times. That’s no way to live.

I’ll keep my home dumb. I will let the campers frolic unobserved at my cabin in the woods. That way, if some zombie monsters do show up, I can honestly say I didn’t see them coming. And I know I didn’t send them.

Updated: 5-6-2022

Heat Pumps Are The Ultimate Climate Techno-Fix, But Not A Silver Bullet

To ditch fossil fuels for good, we must combine a range of technologies and approaches.

Russia’s invasion of Ukraine has shown once and for all that we must get off fossil fuels—fast. Heat pumps are a big part of the solution to stopping burning them in our homes. Heat pumps will not stop the war in Ukraine.

These seemingly contradictory statements are both true. And they’re a microcosm of the much broader climate and clean technology debates playing out now from sector to sector and country to country.

Electric heat pumps are indeed a superior solution to heat one’s home. They are a key component in the drive to electrify everything. In fact, they are so efficient at converting power to heat that even if the power grid ran entirely on gas, heat pumps connected to it would use less than directly gas-powered furnaces do.

But the clean energy transition must not stop with electrification. Decarbonizing the grid is a big piece of the equation. So is insulating homes to lower the need for heating and cooling in the first place.

Heat pumps are not the only solution, but they are pretty close to the universal techno-fix for the world’s home and commercial heating needs. The International Energy Agency estimates that they “could satisfy 90% of global heating needs with a lower carbon footprint than gas-fired condensing boilers.”

They are especially prominent in colder climates, embraced by Nordic countries where their emissions-reduction potential is particularly high. But there is a long way to go. Heat pumps now heat less than 10% of buildings globally.

That gap promises massive market opportunities focused on deploying an existing technology at scale. Doing so would help cut carbon emissions as well as dependence on gas, Russian or otherwise.

Saying just that, in about as many words, is likely to raise objections. Environmental activist Bill McKibben called for “Heat Pumps for Peace and Freedom” in the immediate aftermath of Russian President Vladimir Putin’s invasion of Ukraine and was prominently accused of focusing on a silver bullet at the exclusion of other, more systemic, solutions.

Typically, the sparks fly the other way: Environmentalists call for the more systemic approach while business leaders tend to point to the “simple” techno-fix (preferably their own).

It’s not surprising. But it need not—and should not—be framed as an either/or.

There cannot be one “typical” approach. Getting Europe off Russian oil and gas, much like getting the world off all oil, coal and gas, goes well beyond any single solution. And there is no one answer for any given technology.

Rapidly scaling up the commercial production of heat pumps is needed—several U.S. senators introduced a bill on Wednesday to give a tax credit to manufacturers—but it alone is not enough.

It also takes (re)training workers to be able to install them and educating consumers about their benefits to the indoor and outdoor climate, as well as their own pocketbooks.

All that means supportive policies are required at every step along the way, including deployment subsidies to avoid installing a single additional gas furnace anywhere. And yes, that begins by ceasing to subsidize gas furnaces.

Austria, for example, subsidizes heat pumps to the tune of €10,000 each, which is good. Some Austrian provinces, meanwhile, still offer €1,000 for gas furnaces. That should have ended years ago.

It is precisely the interplay between business and policy, between techno-fix and broader societal transformation, that is needed.

Rich Lesser, global chair of Boston Consulting Group, spoke at a Columbia Business School business and climate conference last Friday about how climate leaders gain competitive advantage, and how he personally spends 60% to 70% of his time on climate issues.

Leaders do gain from this, and so he should. One core assumption underlying an analysis BCG undertook with the World Economic Forum to support this point: an explicit or implicit price per ton of CO₂ of roughly €75 by 2030.

Climate policies commensurate with such a price won’t just happen by themselves. That implies business leaders actively pushing for them, or at the very least not standing in their way. Even €75 by 2030, meanwhile, won’t be enough, in any meaningful sense of the term. Perhaps the best indication?

The European Union has just such a price now, covering half of the bloc’s carbon emissions.

Decarbonizing will take meaningful, constructive cooperation among multiple technologies, policies, and interventions. Heat pumps alone are but a small step in this broader puzzle, and no, they alone will not stop this current war anytime soon. But they just might help prevent the next one.

Updated: 5-8-2022

A Virtual Golf Venue, A Metaverse Space: Rooms You’ll Find In Homes Of The Future

A pandemic that left many people sequestered at home gave them a lot of time to think about spaces that would better cater to their future selves. Now developers are starting to integrate more comprehensive plans for working and learning into the rooms they design for new homes, says Andres Miyares, chief operating officer of CC Homes, a builder based in Florida. Some clients have more idiosyncratic ideas.

From high-tech places for getting active to spaces devoted entirely to other dimensions, here are some of the rooms that could become must-haves in homes of the future.

An Indoor Sports Center

Rec rooms are going high-tech, says John Kean, founder of design/build company Kean Development, which designs homes in New York, Palm Beach and the Hamptons.

Indoor golf simulators that were once too expensive for most single-family homes are showing up more often now that prices have fallen, developers say.

While the full immersive experience can cost as much as $100,000, entry-level simulators that use laser or infrared radar tracking to read the speed and spin of a golf ball and translate it to a virtual course projected on a screen are available for $6,000-$10,000.

In most of these systems, players—typically using “soft-feel” golf balls—hit into the hanging screen that the game appears on. Nets can be attached on the sides of the setup to stop balls from flying into different areas of the room.

On some systems, game consoles can be connected to the projector to play your favorite games on a big screen. Many do double duty as entertainment systems for kids. “Every year, they’re getting better and better,” says Mr. Kean, who predicts they could replace TVs in some homes because of their wide screens.

A Space For The Metaverse

Gamers are looking for places to do their thing without stubbing a toe on their coffee tables as virtual reality gains popularity.

Sales of VR headsets rose more than 70% last year from 2020, according to International Data Corp., with demand driven in part by rising hype around the metaverse, a term proponents use to describe a future 3-D version of the internet.

Fine Homes By Hearthstone Corp., a California-based architectural and home construction firm, has recently started building virtual-reality rooms in people’s homes that include padded walls to protect them from hurting themselves as they don headsets and wander digital realms.

Virtual-reality gaming systems are included in many of the fully furnished homes the company sells. Customers haven’t yet inquired about the metaverse, “but I see that being something in the future,” says Robb Daniels, FHB Hearthstone’s owner.

Some of the VR rooms have surround-sound speakers and vibration sensors in the floors to maximize the virtual experience.

Mr. Daniels compares the technology to the vibration pads that some theaters use in seats, triggered by bass tones in movies.

“We’re just trying to make it a little bit more immersive, so they can enjoy it,” says Mr. Daniels of the custom-made rumble rooms for VR enthusiasts.

A Garage Without Grease

A shift to electric vehicles could also mean less grease and more connectivity in your garage. Some owners of EVs are already putting down flooring over the concrete in their garages and adding extra storage space. “It almost becomes an additional room to the home,” says Lisa McClelland, senior vice president of design studios at Toll Brothers Inc., a luxury-home builder.

Electric vehicles could lead more people to think of their garages as an energy source rather than just a spot to store a car. “As you start to transition to the electric vehicle, it starts to really integrate with the home,” says Nora Hennings, senior director of business development at Sunrun, a provider of home batteries that can be charged by solar panels.

Last year, Sunrun announced a partnership with Ford Motor Co. on the F-150 Lightning electric truck. Those who buy the F-150 Lightning can also purchase Sunrun’s “Home Integration System” that, when paired with the charge station, enables the truck to serve as a backup power source for a home during an outage.

The Sound-Proof Room

Sound-damped studios typically associated with music production are in demand–but for new reasons. Customers need them for their internet broadcasts. “They’re using those for [making] podcasts as well,” says Dan Fuller, owner of Haley Custom Homes, a home-builder in Denver, Colo.

The pandemic’s focus on the home as a center for work and recreation has also heightened the appeal of the sound-proof room. “Everything can be done from the house,” Mr. Fuller notes.

One client commissioned a sound-proof room to use for teaching online real-estate classes, says Phil Kean, president of Phil Kean Design Group, a construction firm in Florida. “The doors had to be soundproof,” Mr. Kean says. He used fabric on the walls that absorbed sound and added extra electrical outlets for technical equipment.

The Multi-Tasking Space

One room to do the job of several: Behring Co. real-estate development company calls this the 18-hour space, a room that can be transformed for different uses.

Equipped with flex desk areas and retractable screens, the room is designed to accommodate various people and activities from day into evening. A projector setup that’s used for virtual meetings can also be used for family movie night. “That space works around the clock for them,” says Colin Behring, chief executive officer of the Bay Area company.

Though convertible rooms existed before the pandemic, the need for work-from-home and relaxation areas increased after Covid-19 emerged. Giving underutilized rooms multiple uses has become a smart alternative, Mr. Behring says. “It is a better solution that increases utility, adds value and lowers the cost for everyone all at the same time.”

Updated: 5-19-2022

How To Install Heat Pumps In Millions Of European Apartments

Heat pumps are highly efficient electrical devices that can heat and cool homes. The tech could save Europe an estimated 60 billion euros in annual natural gas import costs.

Heat pumps are emerging as a key technology for securing Europe’s energy independence from Russian natural gas.

The highly efficient electrical devices extract warmth from air, liquids or other sources to heat and cool homes and provide hot water, producing more energy than they consume.

The war in Ukraine is accelerating the European Union’s efforts to replace fossil fuel heating with heat pumps to meet its target of reducing greenhouse gas emissions at least 55% by 2030, compared with 1990 levels.

In March, the European Commission unveiled its REPowerEU initiative that calls for doubling the deployment of heat pumps over the next five years as part of a plan to eliminate dependence on Russian gas. The EU imports 90% of its natural gas, 40% of which comes from Russia.

“Europe sleep-walked into a situation where we were increasingly reliant on Russian gas over the decades and we just have to break the habit,” says Richard Lowes, a heat pump expert and senior associate at the Regulatory Assistance Project, a multinational organization that works on energy decarbonization policy.

Although heat pump installations are rising due to mandates and incentives offered by some countries, they currently supply only 2.5% of the EU’s heating and cooling demand, according to the Regulatory Assistance Project.

“The fact is a lot of people have gas heating, they’re used to it and there’s a whole system built for gas that we have to breach,” says Lowes.

Before the war, the EU projected that heat pumps would cut natural gas consumption in buildings 40% by the end of the decade, according to a March 2022 report. That would save nearly 60 billion euros ($63 billion) in annual natural gas import costs, according to estimates.

“Heating was completely unsexy before,” says Thomas Nowak, secretary general of the European Heat Pump Association, an industry group. “Now people are discussing heat pumps at their cocktail parties.”

Retrofitting existing housing to run on heat pumps, however, can be a complicated and expensive proposition, experts say. That’s particularly the case with apartment buildings that are home to nearly half of the EU’s population.

That’s because heating sources, fuels, financial incentives and policies vary widely across Europe and within countries. Oil, gas and coal supply nearly 83% of heating in EU nations, with gas accounting for 66% of fossil fuel boilers, the report states.

How heat is delivered also differs from country to country. For instance, “district heating” dominates in some urban areas and in Scandinavia, Poland and the Baltic states.

A central source, such as a boiler or industrial facility, heats water that is distributed through an underground network of pipes to radiators in homes and apartment buildings.

In other countries, a large gas boiler is installed in an apartment building to heat the entire structure or small boilers are placed in individual apartments. (U.S-style furnaces are rare in Europe.)

Nowak says that there is no one approach to decarbonizing Europe’s apartment buildings. “Since we’re at the beginning of this type of renovation, there’s a variety of technical solutions today,” he says.

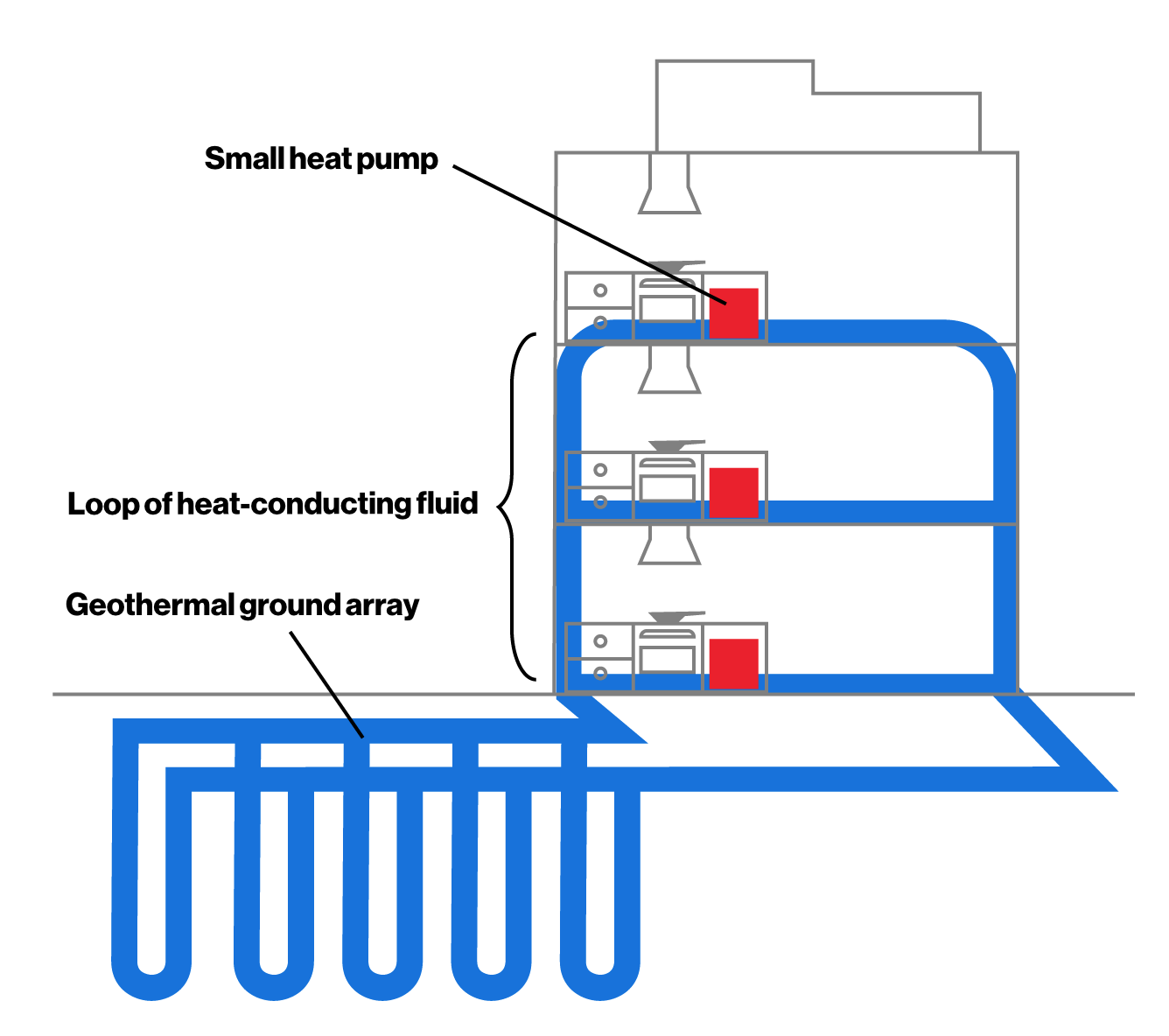

One retrofit option that has become more common taps heat from the Earth. Pipes filled with a heat-conducting fluid are placed in boreholes drilled into the ground outside an apartment building.

If the building has a central fossil fuel boiler, the boiler is replaced with a large heat pump. The device extracts warmth from the ground array to heat water for distribution through pipes to apartment radiators.

If each apartment contains its own boiler, the boiler is replaced with a small heat pump the size of a mini fridge. The ground array is connected to pipes that loop through the building, transporting the geothermally heated fluid past the apartments.

The heat pump in each unit extracts warmth from the loop and increases its temperature for use in space heating and to provide hot water.

Drilling geothermal heat pumps for individual apartment buildings isn’t feasible in densely packed cities. Given the prevalence of district heating in urban areas, Lowes and Nowak say the most effective way to decarbonize housing there is to replace centralized gas and coal-fired boilers with industrial-scale heat pumps.

Such heat pumps can also extract warmth from wastewater treatment plants, lakes and other sources.

The cost of retrofitting apartment buildings, though, can be steep and heat pumps require electricity, which is more costly than natural gas in many regions of Europe.

Heat pump advocates call for an acceleration of natural gas bans in buildings, more government incentives for retrofits and a carbon tax on gas heating to help spur adoption of the technology.

Retrofit costs vary widely depending on the size of an apartment building, its condition, location and the technology used. It cost £9 million ($11 million) for a 2021 renovation of a gas-powered complex of seven residential towers in the north of England. The retrofit installed a geothermal ground array outside the buildings and small heat pumps in each of the 364 apartments.

One particular challenge, Lowes says, is retrofitting large older homes that have been subdivided into apartments that are individually owned and that each contain a gas boiler.

“As a general rule [one] big heating system will cost less than lots of small ones just because it’s more efficient,” he says. “But that’s more complicated to do when you have multiple owners each with their own boiler.”

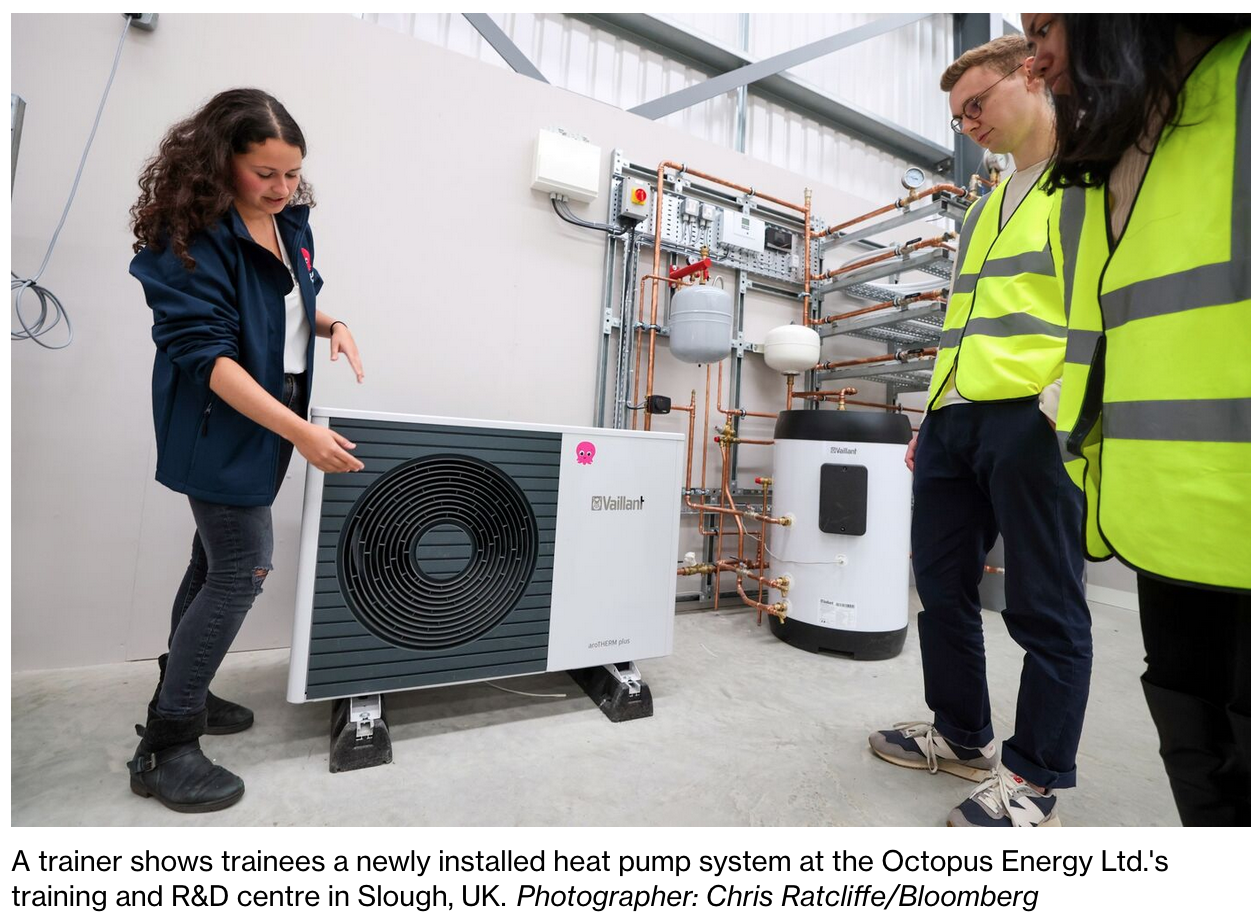

Novak says that supply chain constraints are expected to affect the availability of heat pumps in Europe for another year. A bigger issue as demand rises is a shortage of workers with the expertise to install heat pumps.

“We’re not training plumbers and heating engineers at the rate needed,” says Lowes. “And because it’s such an important part of the energy transition, that will rapidly become a hurdle.”

Updated: 12-27-2022

Five Questions To Ask Before You Buy A Heat Pump

Heat pumps and heat pump water heaters are up to four times as efficient as their conventional gas or electric counterparts.

Heat pumps are one of the most effective ways to shrink your home’s carbon footprint and your utility bills at a time of rising electricity and natural gas costs. The technology can heat and cool homes, and supply hot water.

A high-efficiency electric heat pump that replaces a fossil fuel furnace or boiler resembles an air conditioner unit and is installed outside the house.

To heat the home, a liquid refrigerant in a copper coil extracts heat from the atmosphere as warm air naturally moves toward the cold.

The heat transforms the refrigerant into a cold gas; a compressor then pressurizes the gas, raising its temperature and heating the air inside the house. In the summer, the appliance cools a home by absorbing heat from inside and transferring it outside.

Heat pumps are up to four times as efficient as natural gas furnaces since they merely move heat from one place to another rather than burn fuel.

A heat pump water heater works on the same principle and is up to four times as efficient as conventional gas or electric water heaters.

They can also act as “thermal batteries,” heating water when electricity rates are low for use later in the day when prices rise.

Many models are Wi-Fi-enabled, allowing homeowners or utilities to control when water is heated.

If you’ve been on the fence about getting a heat pump, consider that some countries are offering generous incentives — £5,000 in the UK, for example, and up to $8,000 in the US — that make now a good time for it. But make sure you know or ask for the answers to these five questions first.

How Old Is My Furnace And Water Heater?

The lifespan of a natural gas furnace typically runs 15 to 20 years, though some can last as long as 30 or more: If you’ve recently replaced a natural gas furnace with another one, you probably won’t want to scrap it for a heat pump. Likewise, gas water heaters usually only need to be replaced after 12 to 15 years.

But if you’re planning on installing an air conditioner, it could make sense to go ahead and switch to a heat pump. And if you’re in the US and your home is already powered by solar panels, there’s a stronger case for replacing a furnace before the end of its useful life.

Not only will you avoid paying for increasingly expensive natural gas, you’ll be tapping low-cost electricity to power the heat pump.

Water heaters are prone to sudden failure as they age. Most people don’t want to go long without hot water, so if your gas or conventional electric water heater is getting old, now would be the time to replace it with a heat pump.

Another reason to avoid buying a heat pump under duress is that installing one can be complicated and time consuming and they can be in short supply.

How Well Insulated Is My Home?

If your house is drafty because the doors and windows are leaky and the walls and attic are poorly insulated, then you’ll need a bigger and more expensive heat pump to keep the home warm.

It pays in the long run to hire an energy auditor to identify where heat is escaping the house and plug the leaks. That will let you properly size the heat pump, lowering your electricity bills.

What Type Of Heat Pump System Do I Need?

If you currently have central heating, you’ll most likely want a heat pump that distributes air through the existing ducts. (Be forewarned, though, that the ducts may need to be replaced if they’re old, which can be a pricey proposition.)

Alternatively, you can install what is known as a ductless heat pump, also called a mini-split, that circulates warm or cool air through wall-mounted units. One advantage of the mini-split is that you don’t have to worry about maintaining ductwork, which can become leaky over time.

Will I Need To Upgrade My Home’s Electrical Panel?

Heat pumps are high-voltage appliances and usually require a circuit panel capable of handling multiple 240-volt devices. If you live in an older home and are replacing lower-voltage furnaces and gas water heaters, you may need to upgrade your circuit panel to 200 amps, which can cost several thousand dollars.

If a utility “supply” wire to your home must be replaced, costs can balloon to $10,000 or more.

There are some workarounds. One option is to install a “smart panel” that manages all the circuits in the home, balancing electrical demand so that appliances like heat pumps can be added without overloading the system.

Smart panels made by Span and Schneider Electric can cost $3,000 or more. The Inflation Reduction Act, however, offers Americans a $4,000 rebate for electrical upgrades.

Another alternative to reduce the electrical load is to install a lower-voltage heat pump water heater. Right now, there’s just a couple of 120-volt models available, from Rheem and Ruud, and the Rheem is currently only sold in California.

But other major manufacturers are expected to bring 120-volt versions to market in the next year or so.

One Word of Caution: Some home electrical upgrades can take months to complete, time you won’t have if a water heater just failed. It’s a strong argument for answering this question ASAP, and making any needed improvements well in advance of installing a heat pump.

Do Contractors In My Area Specialize In Heat Pumps?

Almost any plumbing company can install a gas furnace or water heater. But finding one that is knowledgeable about heat pumps and how to replace gas appliances can be a challenge. In the US, your state or utility rebate program may list recommended contractors.

Otherwise, check out plumbing contractors’ websites and gauge how much they promote heat pumps and the depth of their expertise.

Updated: 4-14-2023

Heat Pumps Need Better Branding

In December a survey in the UK asked 2,500 homeowners whether they would consider getting a heat pump at home in the future. Only 2% said they had one, and 18% said they’d likely make the switch. But 39% of respondents weren’t interested, and another third didn’t know enough to answer the question.

By transferring heat from one place to another rather than generating it through the burning of fossil fuels, heat pumps are more versatile, several times more energy-efficient and more affordable over time than a boiler or an electric heater.

Widespread heat pump adoption could nix 500 million tons of greenhouse gas emissions by 2030, according to the International Energy Agency.

But heat pumps also have a problem: Pretty much everything about them is a puzzle to the public. They can’t boast the sleekness of solar panels, the awesome power of wind turbines or the zip of electric cars.

Their power is instead humble, hidden and a little mysterious. And anyway, boosting adoption isn’t as easy as tapping into environmental anxiety; knowing something is better for the planet rarely changes consumer behavior.

So how do you tout the benefits of a critically important but relatively boring technology? How do you make heat pumps sound cool to consumers? We sought out three studios to help us design heat pump advertisements that might appeal to a range of potential buyers: the Early Adopter, the Purist and the Pragmatist.

The Early Adopter

Making new technology desirable often hinges on getting consumers to feel anxious about missing out. Advertisers call this “social proofing”: copying the actions of others to project “correctness.”

Examples of social proofing include looking for reviews before buying a product, copying influencers’ purchases and chuckling along with sitcoms’ canned laughter. In green tech, there’s evidence of this behavior when it comes to solar panels.

“There’s good research showing that solar panels are literally contagious,” says Toby Park, head of energy, environment and sustainability at the UK’s Behavioural Insights Team, a research group focused on techniques for prompting behavior change. “If other houses around you have solar panels, you are more likely to install them yourself.”

Another clear and recent example of social proofing comes from electric cars. EVs’ journey to the mainstream was largely paved by the rise of Tesla as a high-end car for cool people.

“Tesla totally transformed what that car looked like, and the way that that car was framed was, ‘This is super exciting, sexy, the car of the future,’ ” says Clare Hutchinson, chief strategy officer at advertising agency VCCP.

1. Branding Matters. For more than a century, headphone cords were black—until Apple introduced the iPod in 2001, alongside white earbuds and an iconic ad campaign. “It made iPod ownership highly visible, and it created the sense that this was a must-have,” says Josh Bullmore, chief strategy officer at advertising agency Leo Burnett London. Source: Alamy

2. Energy Switches Have Been Here Before. In the 1940s and ’50s, the UK’s Gas Council and the American Gas Association each produced ads positioning gas boilers (then the new technology) as time-saving and sophisticated. It was an “aspirational vision—what a modern, clean, comfortable, quiet heating system might be like,” says Gabriel at Nesta. Source: Alamy

3. There’s Also The “Ikea Effect”: People tend to value an object more if they make or assemble it themselves. Hutchinson says letting consumers customize heat pump designs could spur adoption, adding, “They look like pretty rubbish, boring boxes at the moment.” Source: Creative Solutions.

Heat pumps may not have the same inherent cool factor, but efforts to promote them could highlight the first-mover advantage of installing one now: emissions reductions, cost savings and the possibility of being first.

“There’s definitely something about trying to create a sense of desirability,” says Madeleine Gabriel, director of the sustainable future mission at Nesta, a charity in the UK that runs “heat pump show homes” to let people see the technology in action. It’s “a signal that you have a certain type of lifestyle that represents something aspirational.”

“The design should be sleek and modern, with a focus on functionality and ease of use. By highlighting these features, the visual can help to promote the benefits of cleantech and encourage consumers to consider heat pumps as a viable alternative to traditional heating and cooling systems. I believe that a well-designed product can influence how consumers perceive it. Ultimately, the goal is to promote cleantech while implementing visual codes from a corporate and commercial aesthetic.” —Fournier

The Purist

The simple incentive of being greener does motivate some people—or at least they claim it does. A 2022 survey by the Energy & Climate Intelligence Unit, a think tank in London, found that 1 in 3 Brits would be more likely to get a heat pump if it would free the UK from dependence on Russian gas supplies. Four in 10 said learning about the air pollution that gas boilers produce made them more likely to switch.

The difficulty is in overcoming the “value-action gap,” or the gulf between what people claim to care about and what they actually do in practice. One way to do this: Set out the broader consequences of inaction.

“As humans, when bad things happen we’re more likely to try and make things good,” Hutchinson says, “whereas when good things happen, we don’t really change.” In other words: Loss aversion is powerful.

Denormalization, in which previously acceptable behaviors are made taboo, has also been used to combat behaviors such as drunk driving and indoor smoking, though there is a debate over whether shame is a useful way to get people to adopt more environmentally friendly behaviors.

1. Inconvenience For The Greater Good? One of the best-known UK advertisements Hutchinson created was a harrowing film depicting a boy accidentally killing his mother in a car crash. The goal was to show people that not wearing a seatbelt in the back seat could be fatal to others, and Hutchinson says it improved seat belt adoption rates by 20% to 30% “almost overnight.”

2. Emphasize The Urgency. Roughly a quarter of the world’s carbon emissions currently come from heating and cooling buildings. Although heat pump adoption is picking up, many countries are still behind. In the UK the government has targeted 600,000 installations per year by 2028; the first estimates for 2022 suggest current levels are one-tenth of that.

“Our design aims to promote eco-friendly choices by making the negative effects of traditional heating and cooling systems more visible. By highlighting the positive effects of cleantech, we hope to encourage consumers to switch. Through this, we try to reduce the environmental impact of heating and cooling systems and create a sustainable future.” — Bus.Group

The Pragmatist

The ad industry offers a number of basic principles for capturing consumers, based on decades of trial and error. One model, the “four I’s,” zeros in on the need to introduce, inform, inspire and involve. Another principle is even more straightforward: Emphasize lower prices.

In a number of countries, including the US and the UK, government subsidies are available for consumers interested in making the switch to a heat pump.

Hutchinson says a campaign could use that to reframe some of the common reasons people cite for waiting, including cost, for example, by comparing the lifetime expenditure rather than the upfront price, and highlighting the availability of free money. “If you put [an] air-source heat pump in the context where something else is more expensive, it will suddenly start to feel more reasonable,” she says.

Perspective is important when name recognition doesn’t exist. Ben Mitchell, co-founder of UK marketing agency Red Brick Road, says pushing heat-pump adoption is an unusual challenge because it’s selling a category rather than a brand.

“You’re selling the heat pump ‘thing’ versus ‘Heat Pump Inc.,’ ” he says. Highlighting price is a good way to neutralize the distinction.

1. Heat Pumps Can’t Pull Heartstrings. Among the UK’s most iconic advertisements are the annual Christmas spots from department store John Lewis. They’re beautifully shot and wildly popular, but the campaign explains almost nothing about the store. “If you went out and tried to be the John Lewis of heat pumps, and you had some brilliant personality and some beautiful advertising, everyone would be left going, ‘What is it and how does it relate to my world?’ ” Mitchell says.

2. A Spokesperson Helps.“You might want [them] to be caring and nurturing and nod to nature,” Mitchell says. “Alternatively you might want to be really scientific, like a university lecturer, talking to people’s rational minds.” He suggests TV physicist and professor Brian Cox (not to be confused with Scottish Succession actor Brian Cox) as a potentially suitable figure. “Keeping people warm is a massive responsibility,” Mitchell says, “so you don’t want to be too lightweight about who your personality is.”

“You’ll need to consider using bold typography, clean lines and a minimal color palette to create a modern and sophisticated look. The design should aim for a sense of simplicity and elegance that will make the product visually striking and attention-grabbing.”— Loreng

Related Articles:

The U.S. Housing Boom Is Coming To An End, Starting In Dallas (#GotBitcoin?)

Home Prices Continue To Lose Momentum (#GotBitcoin?)

Freddie Mac Joins Rental-Home Boom (#GotBitcoin?)

Retreat of Smaller Lenders Adds to Pressure on Housing (#GotBitcoin?)

Borrowers Are Tapping Their Homes for Cash, Even As Rates Rise (#GotBitcoin?)

‘I Can Be the Bank’: Individual Investors Buy Busted Mortgages (#GotBitcoin?)

Why The Home May Be The Assisted-Living Facility of The Future (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.