Could Organic Pesticides Be The Next Gold-Rush For Entrepreneurs? (#GotBitcoin)

Hunt for Beneficial Microbes Comes Amid Regulatory Scrutiny of Man-Made Chemical Insecticides. Could Organic Pesticides Be The Next Gold-Rush For Entrepreneurs? (#GotBitcoin)

On his way to a conference in Orlando, Fla., Brian Vande Berg pulled his rental sedan over every 10 minutes to hike along beaches and marshes and occasionally stoop down to pack dirt into small, plastic vials. His target: microscopic, soil-dwelling organisms that agricultural companies consider a new frontier in protecting crops.

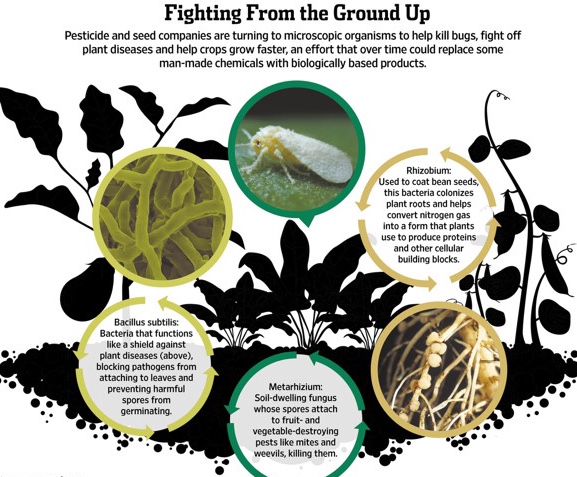

The push into microorganisms reflects an effort by agricultural companies to diversify beyond synthetic chemical pesticides, amid growing regulatory and consumer scrutiny. Pesticides and other products incorporating microbes typically can be rolled out faster than man-made chemical insecticides and weedkillers, which have drawn closer scrutiny from U.S. regulators in recent years following environmental concerns raised by consumers, advocacy groups and organic farmers.

Seed and pesticide makers like BASF SE , DuPont Co. , Bayer AG and Monsanto Co. are investing heavily to develop new products incorporating organisms like bacteria and tiny fungi, which executives say can help corn, soybean and other plants fend off pests and grow faster.

“There are a lot of things [microbe-based products] can do that today we look to synthetic chemistry to do,” said Paul Schickler, president of DuPont’s seed unit, Pioneer.

Microorganisms have been narrowly used for decades in agriculture, mainly in coating soybeans and other legumes to better absorb nutrients and fight fungus. Now, companies say advances in genetic-analysis technology and cultivation practices enable them to find and develop new microorganisms that can perform much broader functions, such as shielding crops from more diseases and pests or mitigating damage from drought.

“The DNA diagnostics today give you a level of understanding you didn’t have five to 10 years ago,” said Robert Fraley, Monsanto’s chief technology officer.

Monsanto and its rivals for nearly 20 years have sold genetically modified seeds for crops like corn and cotton.

They splice in traits from other organisms that enable the seeds to produce bug-killing proteins or withstand the chemical sprays that the companies also sell.

Incorporating microscopic organisms such as bacteria and fungi represents a different approach, encouraging helpful bacteria and fungi to live on the plants’ surfaces, helping plants absorb nutrients and providing defenses against bugs and disease.

Microbe-based products face skepticism from some environmentalists. But because they don’t rely on genetic engineering or man-made chemicals, the products can be used in producing organic and natural foods. USDA rules bar organic products from containing genetically modified organisms, or GMOs, but permit the use of naturally occurring bacteria on organic crops—though the agency reviews such treatments in certifying farms as organic to make sure the products don’t include synthetic substances.

Consumers’ appetite for healthier, more environmentally friendly options has made organics a star in the food industry, driving deals like General Mills Inc. ’s planned $820 million purchase of organic-and-natural foods purveyor Annie’s Inc. A small-but-growing number of food makers also have started culling GMOs from some products.

Biological pesticides, including bacteria-based products, today have annual sales of about $2 billion, or 4% of the $54 billion in global sales of chemical sprays, according to industry estimates.

But consumers and advocacy groups also are raising alarms over the environmental impact of man-made crop chemicals that dominate the market, such as glyphosate, widely sold by Monsanto as Roundup. That could help boost sales of bio-pesticides to $5 billion, or about 10% of the projected market, by the end of the decade, according to Piper Jaffray analyst Michael Cox.

The products also may appeal to agricultural producers who export crops to foreign countries that restrict synthetic-pesticide use, said Sara Olson, agricultural analyst for advisory firm Lux Research Inc.

Finding beneficial microorganisms is like looking for a needle in a field of haystacks.

‘The DNA diagnostics today give you a level of understanding you didn’t have five to 10 years ago.’

—Robert Fraley, Monsanto’s chief technology officer

About 50 billion microbes live in a typical tablespoon of soil. Researchers have discovered effective microbes in samples from a Buddhist temple garden and a Hawaiian beach, and from less exotic locales like dry creek beds and compost piles. At Bayer, one promising microbe that kills caterpillars came from a sample taken in an employee’s backyard in North Carolina.

“It’s serendipity,” said Mr. Vande Berg. He said that he’s not sure whether any of the soil samples he collected on his Florida drive four years ago had yielded a breakthrough microorganism.

Pesticide makers pushed into the business through a string of deals. Germany’s BASF, the world’s largest chemical company by sales, in 2012 paid $1 billion to buy Becker Underwood, an Iowa firm specializing in biologically based pesticides. Bayer paid about $500 million that year for a similar business called AgraQuest Inc.

DuPont is building its microbe platform with technology acquired in its $6.5 billion deal for ingredient maker Danisco A/S in 2011. DuPont said in August it is building two new U.S. research facilities that will help develop such products. Monsanto, the largest seed maker by sales, said in August it plans to nearly triple microbe research efforts in 2015. It struck a partnership last year with Novozymes A/S, agreeing to pay the Danish biotech firm $300 million so Monsanto can use Novozymes’ technology and sell farm-friendly microorganisms they develop together.

Microbe-based products face challenges, too. Analysts said it is unclear the companies will be as successful making scientific advancements with microbes as they have been with GMO seeds and chemical sprays. “It could be a meaningful market, but it’s still years down the road,” said Jeffrey Stafford, an analyst with Morningstar Inc.

And some environmental groups warn that mass deployment of microorganisms across farm fields could yield its own problems, such as by spurring pests to more quickly develop resistance to bacterial attacks, leading to even tougher weeds and bugs.

Margaret Reeves, a senior scientist with the Pesticide Action Network, said that problem could end up requiring even more pesticide use. “The approach is still not one of long-term sustainability,” she said.

Related Article:

Consumer’s Appetite For Organic, Antibiotic / Hormone-Free Food Outstrips Supply (#GotBitcoin?)

Updated: 3-10-2022

Roundup Owner Bayer Divests Pest-Control Unit In $2.6 Billion Deal

Sale marks latest step by the German pharmaceutical company to lower debt as it continues to defend legal claims in the U.S.

Bayer AG agreed to sell its pest-control unit to private-equity firm Cinven for $2.6 billion, as the German chemical and drug giant seeks to focus on its core agricultural portfolio and reduce debt.

Environmental Science Professional, a U.S.-based unit of the company, sells pesticides and rodent control to non-farming customers such as warehouses and golf courses. Bayer announced last year its intention to unload the unit, which is part of Bayer’s environmental science business that had around 1 billion euros, equivalent to $1.1 billion, in sales in 2021.

“This divestment represents a very attractive purchase price and allows us to focus on our core agricultural business,” said Rodrigo Santos, Bayer board member and the head of the company’s Crop Science division.

Bayer shares were up 1.2% on Thursday.

Bayer, the inventor of aspirin, has been seeking to lower debt since its big bet on agriculture with its $63 billion acquisition of Monsanto in 2018 turned sour. The purchase was followed by a costly legal fight over Monsanto’s Roundup weedkiller that led to Bayer’s share price falling and prompted a backlash among investors against management.

Bayer says that the chemical is safe and continues to sell Roundup with glyphosate, the weedkiller’s active ingredient, which some plaintiffs have said causes cancer. Federal regulators have said glyphosate is safe and isn’t carcinogenic.

In a bid to end thousands of Roundup claims, Bayer in August filed a petition with the U.S. Supreme Court to invalidate a jury verdict on one case. In December, the court asked the Biden administration to offer its views on whether it should hear Bayer’s appeal and a decision is expected sometime this year.

On Thursday, Cinven said that it would look to increase innovation and speed up growth of the Environmental Science Professional business. In 2021, the division had around 800 employees and sales in more than 100 countries.

Bayer said it expects the transaction to close in the second half of this year, with the net proceeds used to reduce the company’s net financial debt. BofA Securities acted as financial adviser to Bayer, while law firm Hengeler Mueller acted as legal adviser.

Updated: 6-10-2022

Bayer Wins Roundup Cancer Case Ahead of Supreme Court Move

The court is expected to announce next week whether it would hear Bayer’s bid to dismiss a key Roundup case.

Bayer notched a third consecutive court victory in the U.S. over its Roundup weedkiller after a jury in Missouri rejected a claim that it causes cancer days before an eagerly anticipated Supreme Court announcement on a key case.

The Supreme Court is expected to announce next week whether it would hear Bayer’s bid to dismiss a Roundup case. Should the court take up the case and ultimately find in favor of the German agricultural and pharmaceutical giant, Bayer says it would largely end thousands of claims that have dogged it since taking over Monsanto Co., the product’s original owner, in 2018.

The win in the Missouri court this week comes after Bayer last year won two other cases in California. Previously, three U.S. juries had found in favor of plaintiffs who said that the glyphosate-based weedkiller caused their cancer, awarding them hundreds of millions of dollars in damages. The company said earlier this year it had resolved 107,000 claims out of about 138,000 overall.

“The jury’s verdict in favor of the company brings this trial to a successful conclusion and is consistent with the evidence in this case that Roundup does not cause cancer and was not the cause of Mr. [Allan] Shelton’s cancer,” Bayer said in a statement, referring to the plaintiff in the Missouri case.

Bayer’s share price was down 0.9% on Friday amid a broader decline in European stocks. Bayer has been among Europe’s best-performing large stocks this year as food shortages stoked by Russia’s invasion of Ukraine drive demand for seeds and pesticides to boost global crop production.

The rise in the company’s share price, however, represents only a partial recovery for the company, which was hit by a wave of lawsuits over Roundup following its $63 billion acquisition of Monsanto. The uncertainty over the liability, mounting legal costs, and some failed attempts to settle past and future cases have angered investors and weighed on the share price.

Bayer has earmarked $16 billion in total to deal with Roundup litigation. Bayer says that the chemical is safe and continues to sell Roundup with glyphosate. Federal regulators have said that glyphosate is safe and not carcinogenic.

Bayer last year petitioned the Supreme Court to invalidate a $25 million jury verdict in the case of California resident Edwin Hardeman, who has blamed Roundup for causing his cancer.

Last month, Bayer’s stock fell 6.2% the day after the U.S. Justice Department recommended the court reject that request, which analysts say diminishes the chances of the court hearing the case. The Supreme Court only hears a small percentage of the thousands of cases it is asked to review.

Bayer remains hopeful the Supreme Court will take up the case. “The company continues to believe there are strong legal arguments to support Supreme Court review and reversal in Hardeman, as its petition and the many amicus briefs filed in support of the petition underscore,” it said.

Investors are more skeptical.

“Disappointment is likely. That would mean another attempt to reduce legal risks has failed,” said Ingo Speich, head of corporate governance and sustainability at Bayer shareholder Deka Investment. “It is now important to make rapid progress with the further processing of the open legal cases.”

If the Supreme Court declines to hear the case, or ultimately issues a ruling in favor of the plaintiff, Bayer would activate its own voluntary claims resolution program, for which it set aside $4.5 billion last July.

The Supreme Court petition is one of the pillars of a five-point plan Bayer announced last year to deal with the Roundup litigation, including beginning to remove glyphosate from Roundup that is sold to American retail consumers from 2023 as most of the claims come from such users.

Roundup sold to commercial users, which makes up the bulk of the sales, will still include glyphosate. Bayer has also created a website with studies relevant to Roundup’s safety.

Updated: 6-21-2022

Supreme Court Declines To Hear Bayer Appeal On Roundup

Court’s decision not to hear case leaves Bayer exposed to billions of dollars in potential settlement costs.

The Supreme Court on Tuesday declined to hear a bid by Bayer AG to end thousands of lawsuits alleging its weedkiller Roundup causes cancer, potentially costing the German conglomerate billions of dollars in legal settlements.

Bayer has been mired in Roundup litigation since acquiring Monsanto, the product’s original owner, in 2018.

The German conglomerate, which maintains that Roundup is safe, has earmarked $16 billion to deal with litigation over the herbicide.

Last year, Bayer asked the high court to invalidate a $25 million jury verdict in favor of Ed Hardeman, who says decades of using Roundup on his Northern California property caused his non-Hodgkin lymphoma, a type of cancer.

The 2019 jury verdict in favor of Mr. Hardeman came in the first federal trial over whether Roundup’s active ingredient glyphosate causes cancer. The court’s denial bears not only on that case, but also on thousands of similar ones against the company.

“This has been a long, hard-fought journey to bring justice for Mr. Hardeman, and now thousands of other cancer victims can continue to hold Monsanto accountable for its decades of corporate malfeasance,” Hardeman’s trial lawyers, Jennifer Moore and Aimee Wagstaff, said in a statement.

Bayer has said those Roundup cases should be dismissed because the product was cleared by federal regulators.

The German conglomerate said Tuesday that the court’s decision to turn away the case undermines the ability of companies to rely on official actions taken by expert regulatory agencies. Bayer said there could be future Roundup cases that could lead to the high court revisiting the legal questions raised by the Hardeman case.

“Bayer continues to stand fully behind its Roundup products which are a valuable tool in efficient agricultural production around the world,” the company said.

Matthew Stubbs, a lawyer at the firm Duncan Stubbs who represents Roundup plaintiffs, said: “We’re grateful that SCOTUS has put an end to Bayer’s strategy of deny and delay.”

He added, “Today, SCOTUS has set a clear path for recovery in the courts, and we look forward to having jury trials throughout the country for decades to come.”

The U.S. Environmental Protection Agency has concluded that glyphosate isn’t a carcinogen, and Bayer has argued that Roundup’s warning label was based on these regulatory actions.

The verdict for Mr. Hardeman, which was upheld by an intermediate appeals court, “means that a company can be severely punished for marketing a product without a cancer warning when the near-universal scientific and regulatory consensus is that the product does not cause cancer, and the responsible federal agency has forbidden such a warning,” Bayer said last year.

The Supreme Court petition was one of the pillars of a five-point plan Bayer announced in May 2021 to deal with the Roundup litigation.

The plan also included beginning to remove glyphosate from Roundup sold to American residential consumers. Most of the Roundup cases involve such users.

Under Bayer’s plan, Roundup sold to commercial users will still include glyphosate. Commercial users account for the bulk of Roundup’s sales.

Last month, Bayer’s stock fell 6.2% the day after the Biden administration recommended the Supreme Court decline to hear Bayer’s appeal. That move by the U.S. Justice Department appeared to diminish the chances of the court hearing the case.

A federal appeals court on Friday sided with environmental and food-safety advocacy groups in finding that the EPA has to re-examine whether glyphosate poses a health risk. In a 3-0 decision, the 9th U.S. Circuit Court of Appeals said the EPA didn’t adequately consider whether glyphosate causes cancer. “EPA’s ‘no cancer’ risk conclusion did not stand up to scrutiny,” said Amy van Saun, an attorney with the Center for Food Safety. A Bayer spokeswoman said the company believed the EPA would continue to conclude, as it had for years, that glyphosate-based herbicides aren’t carcinogenic.

Bayer has fared better in jury trials, securing four consecutive verdicts in its favor in Roundup jury trials. Most recently, on Friday, Bayer won a verdict that Roundup didn’t cause an Oregon man’s cancer.

Since the EPA concluded that glyphosate isn’t a carcinogen and can be used safely, Bayer argues that federal law pre-empts state law on labeling requirements.

In May, U.S. Solicitor General Elizabeth Prelogar filed a brief urging the court not to take up Bayer’s petition, maintaining that EPA labeling requirements don’t prevent states from adding their own labeling requirements. Some Wall Street analysts said chances were low that the court would take up the case after the solicitor general weighed in.

Agricultural lobbying groups and some lawmakers in Washington have warned of broader consequences on the development of future crop-protection chemicals if the Bayer case isn’t heard.

Related Articles:

Ultimate Resource On Baby Formula Shortage

The Mystery Of The Wasting House-Cats

Bird Flu Outbreak Nears Worst Ever In U.S. With 37 Million Animals Dead

Handy Tech That Can Support Your Fitness Goals

What’s The Mysterious Liver Disease Hurting (And Killing) Children?

How To Naturally Increase Your White Blood Cell Count

Late-Night Eating And Melatonin May Impair Insulin Response (#GotBitcoin?)

The Complete Guide To The Science Of Circadian Rhythms (#GotBitcoin?)

Billionaire is Turning Heads With Novel Approach To Fighting Cancer (#GotBitcoin?)

Fighting Cancer By Releasing The Brakes On The Immune System (#GotBitcoin?)

Over-Diagnosis And Over-Treatment Of Cancer In America Reaches Crisis Levels (#GotBitcoin?)

Cancer Super-Survivors Use Their Own Bodies To Fight The Disease (#GotBitcoin?)

The Benefits of Grounding or Earthing For Improved Health

Electrical Hypersensitivity (EHS): The Truth!

Microbiome Live News

@metagenomics

Leave a Reply

You must be logged in to post a comment.