Ultimate Resource For The Number Of Bitcoin ATMs Around The World (#GotBitcoin)

The total number of bitcoin ATMs (BTMs) worldwide reached 5,000 for the first time, monitoring resource CoinATMRadar confirmed on June 24. Ultimate Resource For The Number Of Bitcoin ATMs Around The World (#GotBitcoin)

According to the latest statistics, there are now 5,006 standalone BTMs in around 90 countries, where cryptocurrency users can buy or sell bitcoin (BTC). Some machines offer both services simultaneously.

Related:

Bitcoin ATMs Go Live At 20 Circle K Convenience Stores (#GotBitcoin?)

Bitcoin ATM Firm Coinme To Sell Bitcoin At Coinstar Coin Counting Machines (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions of ATMs To Sell Bitcoin (#GotBitcoin?)

The First State-Licensed Bitcoin (BTC) ATMs Arrive In The US (#GotBitcoin?)

The data caps a protracted period of growth in the BTM sector, with the U.S. leading the trend as more and more locations and formats appear.

June has seen a total of 150 installations, around 6 per day. General Bytes recently overtook Genesis Coin as the manufacturer with the largest number of BTMs installed.

As Cointelegraph reported, in 2019, it is not just the ‘classic’ BTM model which is expanding, but other methods of procuring BTC. A deal earlier in the year involving coin counting kiosk operator Coinstar brought bitcoin functionality to over 2,200 U.S. locations.

The U.S. currently has more than half of the world’s BTMs at 3,229, with a new pilot scheme this month bringing the machines to Circle K convenience stores in Arizona and Nevada.

“We are thrilled to be partnering with a respected organization like Circle K,” Marc Grens, president and co-founder of cryptocurrency provider DigitalMint said in a press release issued June 20.

“This partnership opens the door for massive expansion of Bitcoin access to new markets around the globe.”

Increasing competition in the BTM market is likely to reduce the fees charged to users, which tend to be noticeably higher than online alternatives.

Other in-person options, such as buying vouchers, are also gaining popularity with users keen on avoiding burdensome identity requirements.

Updated: 11-17-2019

Bitcoin ATMs Worldwide Hit New Milestone, Surpassing 6,000

The number of Bitcoin (BTC) ATMs installed worldwide has now surpassed a new milestone surpassing 6,000.

Online resource CoinATMRadar shows that there are currently 6,004 machines installed worldwide, over 65% of which are in the United States.

The United States Dwarfs Other Countries In Bitcoin ATMs

Furthermore, 108 machines have been deployed this month and data also shows that the average daily number of Bitcoin ATMs installed is 11 — the fastest pace this year.

Over three-quarters of the machines installed worldwide are in North America, nearly 20% in Europe and only 2% in Asia. The U.S. is home to 3,924 ATMs, Canada has 653, while the next countries in the top-four are the United Kingdom and Austria with 272 and 189, respectively.

1,000 New Machines Deployed Since June

The total number worldwide increased by about 1,000 since June, showing that the industry is seeing significant growth. Bitcoin ATMs, sometimes referred to as BTMs, allow users to buy BTC, while over 35% of machines also have two-way capabilities enabling sell crypto for cash.

In mid-October, one such machine was installed by BTM firm Bitstop at the Miami International Airport. The company’s co-founder and chief strategy officer Doug Carillo claimed that explained that Bitcoin is useful for travelers:

“More and more people prefer to travel with Bitcoin instead of cash for convenience and security. Miami International Airport is a perfect place for our customers to conveniently exchange their dollars for Bitcoin and vice versa when traveling domestically or abroad.”

Still, not everyone seems happy about the growth in the popularity of Bitcoin ATMs, particularly in the United States.

As Cointelegraph reported yesterday, the U.S. Internal Revenue Service Criminal Investigation Chief John Fort said that the regulator is wary of the potential tax issues caused by Bitcoin ATMs and kiosks.

“They’re required to abide by the same Know-Your-Customer, Anti-Money Laundering regulations, and we believe some have varying levels of adherence to those regulations,” said Fort.

Updated: 11-27-2019

Bitcoin ATM Firm Partners With Largest Shopping Mall Operator In US

Miami-based Bitcoin (BTC) automatic teller machines (ATM) firm Bitstop has partnered with the largest shopping mall operator in the United States, Simon Malls, to install Bitcoin ATMs at several locations.

BitStop announced on Nov. 26 that the firm has already installed Bitcoin ATMs at five Simon Malls locations in California, Florida and Georgia. Bitstop co-founder and CEO Andrew Barnard said that the machines were installed ahead of the holiday season:

“With the strategic timing of this new installation of Bitcoin ATMs at Simon Mall locations, customers can conveniently buy Bitcoin while doing their Black Friday and Christmas holiday shopping.”

Bitsop, which claims to be licensed and regulated, plans to grow its teller machine network by over 500 locations by the end of 2020, according to Barnard.

The new partnership builds on the firm’s previous installation of a Bitcoin ATM at the Miami International Airport, which it announced in mid-October.

Global Bitcoin ATM Network Grows

As Cointelegraph reported earlier this month, the number of Bitcoin ATMs installed worldwide surpassed a new milestone. Data at the time showed that there were over 6,000 such machines worldwide, over 65% of which are in the United States.

Still, authorities are increasingly wary of such services. The United States Internal Revenue Service’s Criminal Investigation Chief John Fort, for instance, recently said that the regulator is looking into potential tax issues caused by Bitcoin ATMs and kiosks.

In addition to possible tax issues, Fort claimed that the operators of crypto kiosks should be obliged to follow the same Know Your Customer and Anti-Money Laundering rules as other cryptocurrency-related businesses.

Updated: 3-3-2020

There Are Now Over 7,000 Cryptocurrency ATMs Worldwide

The number of crypto ATMs across the globe has grown to over 7,000, with machines in 75 countries.

At press time, CoinATMRadar listed 7,014 cryptocurrency ATMs in existence. This number also includes machines hosting digital currencies other than Bitcoin (BTC), including assets such as Bitcoin Cash (BCH), Ether (ETH), Dash (DASH) and Litecoin (LTC).

Crypto ATMs Have Come A Long Way

The world saw its first Bitcoin ATM in 2013, when a company called Robocoin placed a machine in a Vancouver coffee shop. Allowing customers to trade Bitcoin for cash, and vice versa, the machine saw $10,000 in BTC transacted on its launch day.

At present, 42 different manufacturers are responsible for the 7,000 global crypto ATMs. Only two locations host Robocoin ATMs, CoinATMRadar data showed. Genesis Coin sits in the lead with machines in 2,348 locations.

Digital Asset ATMs Keep Coming

The world now sees 11.7 new crypto ATMs installed per day, according to CoinATMRadar’s data from the past seven days.

Last fall, Bitcoin ATM company Bitstop teamed up with massive United States-based mall operator Simon Malls, spurring the installation of five machines in five separate malls run by the operator.

Florida’s Miami International Airport also received a Bitcoin ATM from Bitstop in the latter half of 2019.

Crypto ATMs only recently surpassed the 6,000 landmark in November 2019, showing a growing public demand for cryptocurrency availability. This type of data shows digital asset adoption and presence continues waging forward, one step at a time.

Updated: 4-1-2020

Nigeria Becomes Eighth African Nation to Welcome Bitcoin ATMs

Africa’s largest country has welcomed its first Bitcoin ATM.

Blockstale BTM, the company that installed the ATM in the Dazey Lounge and Bar in Lagos state, plans to launch more than 30 more terminals across Nigeria.

“Despite all the legal uncertainties about cryptocurrencies in Nigeria, Nigerians happen to be the highest crypto traders in Africa,” Blockstale’s chief executive and founder, Daniel Adekunle, told local media on April 1.

Adekunle developed his Bitcoin ATMs in partnership with a tech firm based in Shenzhen, China.

Nigeria Welcomes Africa’s 15th Bitcoin ATM

Despite being home to the largest trade volume in Africa, Nigeria is the eighth country in the continent to host a Bitcoin ATM — with Blockstale’s comprising the 15th in Africa.

According to CoinATMRadar, South Africa is home to seven crypto ATMs, Ghana hosts two, and Botswana, Djibouti, Kenya, Uganda and Zimbabwe each have a single terminal.

With Nigeria comprising Africa’s largest economy and population, the country’s first Bitcoin ATM may be a signpost for broader adoption across the continent. Coinstale’s terminal is only the second Bitcoin ATM in West Africa.

Nigerian LocalBitcoins Volume Drops After KYC Overhaul

Recent weeks have seen roughly 220 Bitcoins, or $1.38 million worth, of peer-to-peer (P2P) trade between BTC and Nigerian Naira on LocalBitcoins.

However, Nigerian LocalBitcoins has dropped by roughly 50% since the P2P platform strengthened its KYC requirements during September 2019.

Nigerian ‘Bitcoin’ Searches Top Google Trends

Nigeria also consistently tops Google searches for ‘Bitcoin’ — driving nearly twice the traffic as the second-ranked country, Austria, according to Google Trends.

Three of the top five ranked nations for ‘Bitcoin’ searches are African — with South Africa and Ghana ranking third and fifth respectively.

Updated: 4-19-2020

Bitcoin ATMs Expand Despite Shelter-in-Place Rules

Tucked into corners of grocery stores, gas stations and transit hubs, crypto ATMs are part of the “critical infrastructure industry” still allowed to operate amid the coronavirus contagion event. And some are thriving.

With blockchain-based payments apps and entertainment platforms seeing a boost in users with people spending more time online, crypto and bitcoin ATMs, the physical manifestation of this network, seem an unlikely adjunct to this market growth.

Despite wide-reaching shelter-in-place rulings meant to keep people indoors, some bitcoin ATM operators are reporting an increase in transactions, while others are taking advantage of this intermission to expand their networks.

Perhaps people are scared and are prepping in the most immediate way: the nearest ATM. Bitcoin-related Google searches are skyrocketing, but for the many intimidated by the world of wallets, private keys and QR codes, bitcoin ATMs (sometimes called BTMs) provide a convenient onramp to these “safe haven” assets.

“Even during a global pandemic, and perhaps more so, Bitcoin and Bitcoin point-of-sale services meet our customers’ essential needs in participating in this next-generation of banking, remittance, and e-commerce,” Marc Grens, co-founder of DigitalMint, a Bitcoin ATM operator, said over email.

Approximately 95 percent of DigitalMint machines are located in or outside of essential businesses and still accessible to the public. While the firm has seen a “slight decline” in overall volumes, Grens said, “we’re still driving a consistent amount of new and existing customer traffic, even during the lockdown.”

Since March, DigitalMint has expanded its kiosk and teller services to a few dozen new locations in Boston, Los Angeles and Philadelphia. According to Coin ATM Radar, the total number of ATMs has increased 5.6 percent to 7,417 machines on April 1, up from 7,023 on March 1.

Similarly, LibertyX, which was granted a “BitLicense” to operate in New York last year, has finally begun to expand to locations in the state. “We’ve gone from zero to several hundred ATMs in a little over a month,” CEO & co-founder Chris Yim, said. Including expansions across the country, LibertyX has added approximately 1,000 new machines in the last two months.

LibertyX doesn’t own the actual physical machines, but licenses software to non-bank ATMs manufactured by Genmega and Hyosung, or operated by Payment Alliance International, which in turn are maintained by private owners across the country. At some point LibertyX’s software will be installed by default in new machines, but for now, ATM operators have to manually update their software to support crypto transactions.

“Timing-wise, it’s a little unfortunate,” Yim said. But, under quarantine, “I don’t think these operators have much else to do.”

Transaction volume across LibertyX’s 3,000 ATM network dropped approximately 20 percent in March. “We’re almost back to where we were pre-COVID.” Yim added: “April 15 was one of our highest volume ATM days, the day many taxpayers received their stimulus check.”

The company has also seen an increase in customer support tickets asking how the product works, suggesting an uptick in interest among new users.

Unlike LibertyX and DigitalMint, a recent market entrant is reporting a surge in transaction volume, despite the shrinking footprint of its ATM network. Coinsquare, which bought a controlling stake in crypto ATM startup Just Cash last summer, said about 350 of its 800 total ATMs are currently inaccessible.

“These numbers are staggering. Fewer machines, more overall transactions, and far more value per transaction.”

According to CEO Cole Diamond, the average transaction size in the past seven days is up 167 percent compared to the average transaction in 2019. While the average transaction size for the entire month is up 158 percent on last year’s average.

“These numbers are staggering. Fewer machines, more overall transactions, and far more value per transaction,” Diamond said.

“The average number, and average volume of transactions, is the highest it’s ever been.”

Coinsquare operates a similar business model to LibertyX, providing software to non-bank ATMs to enable crypto transactions. He expects to roll out to several thousand new operators in the coming months.

Still, aren’t these things germy?

Brick-and-mortar banks are modifying or curtailing in-person services, like all businesses trying to adhere to social distancing mandates. Some retail branches have cordoned off access to ATMs, while others are converting to “drive-through only.”

This is a level of control many Bitcoin ATM manufacturers are unable to exert. As providers of software, or companies that franchisee machines to private owners, it’s up to operators to determine how, if they choose to, sanitize these screens.

Grens, Yim and Diamond have reached out to machine operators to recommend best practices in disinfection. But there really isn’t much they can do.

“It’s not responsible for us to push people to go out and touch screens,” Yim said. His firm, like the others, has low variable costs, little overhead, and nearly pure profits when times are fat, and said there’s runway for the company to wait out the COVID-19 crisis.

“Although the country may be shut down, our lives and financial responsibilities cannot be put on hold,” Grens said. “Fortunately for our customers, Bitcoin never goes on hold, either.”

Updated: 6-3-2020

Bitcoin ATMs Face Tighter Regulations Over Money Laundering

The global regulatory landscape is tightening for crypto ATM operators.

Experts predict that Bitcoin ATMs (BATMs) will face stricter regulations worldwide, with countries including Canada and Germany already moving to tighten up anti-money laundering requirements.

A June 2 report from CipherTrace estimates that 74% of transactions made from U.S.-based Bitcoin ATMs were sent out of the country during 2019. The report also found that 88% of funds sent from U.S. crypto ATMs to virtual currency exchanges were transferred overseas. The figure has seen exponential growth over recent years, doubling annually since 2017.

In an interview with Law360, CipherTrace CTO John Jeffries predicted that BATMs will become “a greater point of regulatory focus,” emphasizing “the need for more uniform regulatory enforcement and compliance” concerning crypto ATMs moving forward.

Canada Tightens Bitcoin ATM Regulations

CipherTrace’s report was published two days after new regulations treating Canadian firms dealing with virtual currencies as Money Service Businesses (MSBs) took effect.

Francis Pouliot of Bitcoin Foundation Canada and local crypto exchange BullBitcoin tweeted that the new legislation will predominantly affect those firms that swap crypto for cash, citing Bitcoin ATM operators as the most heavily impacted. Bitcoin ATM operators are now required to report all transactions worth $10,000 CAD or more.

The amended Proceeds of Crime (Money Laundering) and Terrorist Financing Act was passed during June 2019 amid calls from the mayor of Vancouver to institute a city-wide ban on Bitcoin ATMs over money laundering concerns.

According to CoinATMradar, there are currently 778 crypto ATMs operating in Canada — which is almost 10% of the 7,958 terminals worldwide.

Global Regulators Target Crypto Kiosks

In July 2019, Spanish police also pointed to crypto ATMs as blind-spot in European anti-money laundering (AML) regulations after identifying a single local gang that had laundered roughly $10 million for Columbian drug traffickers using BATMs.

November last year saw the United States Internal Revenue Service (IRS) launch an investigation into illicit uses of cryptocurrencies, highlighting potential tax issues resulting from the use of Bitcoin ATMs and kiosks.

The German Financial Market Authority (BaFin) took action against unlicensed Bitcoin ATMs in March of this year. The crackdown followed the introduction of new anti-money laundering regulations targeting holes in Germany’s previously existing cryptocurrency regulations.

Updated: 10-27-2020

Bitcoin ATMs Are Booming In This Latin American Country

The country is relatively new to crypto adoption, but is building momentum quickly.

Colombia now has the largest number of Bitcoin (BTC) ATMs in Latin America. According to CoinATMRadar, Bogota, the nation’s capital, has 34 ATMs, followed by Medellin with 11, and Bucaramanga and Cali with 4 each. Other cities with one ATM at least include Armenia, Barranquilla, Cartagena, Cúcuta, La Hormiga, and Pereira.

Until recently, countries such as Venezuela and Argentina were more frequently discussed as crypto hotspots in terms of regional adoption due to factors like political and economic turmoil. Colombia has taken important steps towards regulating the nation’s crypto sphere, however, with its government approving a pilot program to test crypto transactions back in September. The pilot, which operates within a recently instituted regulatory sandbox, will run until December 31.

In September, the Colombian Ministry of Information Technology and Communications, or MinTIC, released a draft of a guide calling for the public sector to adopt blockchain technology, including crypto payments.

Figures released in August by Statista showed that cryptocurrency adoption had reached double digits in Brazil, Colombia, Argentina, Mexico, and Chile.

LibertyX Launches Bitcoin-To-Cash Sales At ATMs In United States

LibertyX wants to provide instant Bitcoin cashouts as the token hits new 2020 highs.

LibertyX, a major retail network of Bitcoin (BTC) ATMs in the United States, is expanding Bitcoin sales options at thousands of its ATMs.

According to an Oct. 26 announcement, LibertyX has enabled a Bitcoin cashout feature at 5,000 regular ATMs across the United States. As such, consumers can now sell Bitcoin for cash at any of the participating ATMs.

LibertyX CEO and co-founder Chris Yim said that previously, the firm’s software only supported Bitcoin purchases with debit cards. The latest addition allows holders to receive cash for selling their Bitcoin.

Yim noted that Bitcoin has reached new yearly highs. “With the run-up in the price of Bitcoin, consumers are looking for a way to sell Bitcoin without dealing with wire or bank transfer delays,” Yim said.

The Bitcoin sale feature is supported by a limited number of ATMs in the U.S. compared to Bitcoin purchases. Yim said:

“While it’s never been easier to buy Bitcoin, selling is another story. There are almost 15,000 bitcoin ATMs across the U.S., but fewer than 2,000 allow consumers to sell bitcoin for cash. Our ‘cash-out’ product deployed across 5,000 ATMs triples the number of Bitcoin ATMs where consumers can sell Bitcoin, furthering our mission of putting Bitcoin on every block.”

Bitcoin sales at ATMs come with their own fees. According to data from LibertyX’s helpdesk, the consumer fee at Bitcoin ATMs by LibertyX is 8%. Yim said that LibertyX’s BTC price is based on an index of exchanges, tracking closely to Coinbase’s consumer prices.

LibertyX came under the media spotlight in October 2020 shortly after reports claimed that the Tesla Fremont Gigafactory in Nevada had an operational Bitcoin ATM. LibertyX representatives told Cointelegraph that the company enabled BTC sales and purchases at three employee-accessible ATMs at Tesla in August 2020.

Updated: 11-8-2020

Crypto ATMs Continue To Boom Globally In 2020

New machines are now coming online at a rate of nearly 1 per hour.

In 2013 the world saw the debut of the first-ever Bitcoin ATM when a company called Robocoin placed a machine in a Vancouver coffee shop. Allowing customers to trade Bitcoin for cash, and vice versa, the machine saw $10,000 in BTC transacted on its first day.

Now that we are a month away from the end of 2020, the estimated number of crypto ATMs around the world that allow customers to buy and sell Bitcoin (BTC) and other altcoins for cash is about 11,665 ATMs, according to CoinATMRadar.

This reflects a remarkable rise in the number of crypto ATMs compared to last year. The number of crypto ATMs at the end of 2019 was estimated at 6372 machines; now, as we near bidding farewell to 2020, there has been a nearly 80% increase.

CoinATMRadar also shows that the number of crypto ATMs is constantly increasing by an average of 23 machines every day, or nearly one new ATM per hour.

The United States recorded the fastest spread in the world of crypto ATMs, and it acquired the largest share of crypto ATMs within its territory. The number of crypto ATMs located in the United States increased from 4,213 ATMs in 2019 to 9242 ATMs in 2020, an increase of more than 50%. The United States currently accounts for about 79.2% of the total number of crypto ATMs in the world.

There is also a growing diversity of the spread of crypto ATMs within the United States, with locations in small shops, shopping centers, transportation hubs, and even one in the Tesla Gigafactory.

Rounding out the top five is Canada, ranked second with 880 ATMs; the United Kingdom at third with 268 machines; Hong Kong in fourth with 62 machines; and finally Colombia, which recently showed great interest in establishing crypto ATMs with 59 machines.

As for Africa, South Africa occupied the leadership of the continent with 6 machines, but it should be careful, as Nigeria, the largest economy in the continent, has shown growing interest over the last year.

At the level of companies that manufacture crypto ATMs, Genesis Coin ranked first in the world, with the San Francisco-based company spreading 4000 crypto ATMs around the world, followed by General Bytes with 3442 ATMs.

The significant growth in the number of crypto ATMs in 2020 demonstrates the growing interest from both retail buyers and financial institutions, including financial behemoth Paypal.

Updated: 12-14-2020

Coinstar Expands Its Coinme Bitcoin ATM Fleet To 5,000

Supermarket kiosk company Coinstar has added Coinme bitcoin ATM functionality to 5,000 change-sorting machines across the U.S.

The service is now available in nearly 25% of Coinstar’s total kiosk fleet and in 40 U.S. states, according to figures provided by Neil Bergquist, chief executive of Coinme. Coinstar change-counting machines are located in supermarkets, gas stations and convenience stores around the country.

“There is a Coinstar kiosk located within five miles of 90% of the American population,” he told CoinDesk. “So the collective opportunity here is to be able to give the majority of the U.S. population access to digital currencies.”

Over the last year in particular Coinme has made in-roads in some of the farthest-flung U.S. locales. It was admitted to Hawaii’s digital currency sandbox in August along with 11 other cryptocurrency exchanges. Bergquist said Coinme is the only participant to offer cash-to-crypto services.

Also in the recent Coinme/Coinstar expansion: Georgia, Nevada, New Mexico, Ohio, Oregon, Maryland, West Virginia, Delaware and Rhode Island. Bergquist said locations have grown 65% since March.

The fast-growing kiosk network has allowed Coinme transaction volume to soar; bitcoin sales are up 650% year over year. Bergquist predicts yet higher numbers as more states give Coinme the go-ahead to launch operations.

Updated: 3-10-2021

The Number Of Bitcoin ATMs In The US Rose 177% Over The Past Year

Worldwide, close to 10,000 new Bitcoin ATMs have been installed since March 1, 2020.

Since March 1, 2020, the number of new Bitcoin ATMs installed worldwide is nearing 10,000. According to the latest data from Coin ATM Radar, the current number of machines stands at 16,835, a strong 57.5% increase, or 9,683 new machines, as compared with 7,152 last year.

Back in Nov. 2020, Cointelegraph had reported a striking year-on-year increase of 80%. As previously, the vast majority of machines continue to be located in the United States, where 81% (13,699 out of 16,835 machines globally) are installed.

Within the U.S., growth has been unparalleled, rising by 177% since March 1, 2020, or from 4,945 machines to 13,699 as of March 10, 2021. Canada, the country with the next-highest number of Bitcoin ATMs, clocks in at just 1,268, accounting for roughly 7.5% of machines worldwide.

Two of the top countries tracked by Coin ATM Radar, Austria and the United Kingdom, have seen a somewhat jagged trend in terms of Bitcoin ATM installations over the past couple of years: in the former, the number of machines peaked in May 2019, at 266, and has since fallen to 153 as of this week — a decrease of 42.5%.

In the U.K., the decline has been less stark, with a high point of 283 in Feb. 2020 as compared with 199 in the latest figures: just under a 30% decrease. Figures for Europe as a whole show a more or less steady, but modest, increase from a total of 1,233 machines back in March 2020 to 1,273 as of now.

Coin ATM Radar’s ticker tracking crypto ATM installation speed indicated that 34.6 new ATMs are being installed each day. A vast majority of these machines remain buy-only, at 77.6%, with 22.4% offering support for both buy and sell operations.

While the U.S., Canada and Europe account for the lion’s share of all crypto ATMs worldwide, Hong Kong (85 machines), the Russian Federation (53) and Colombia (46) stand out as the countries with the highest number of ATM locations beyond the North American and European contexts.

Updated: 3-25-2021

Crypto Exchange Coinsquare Ordered To Hand Thousands Of Customers’ Records To Canadian Tax Agency

Coinsquare estimates between 5 and 10 percent of customer records could be caught in the sweep.

Canada’s tax authority, the Canada Revenue Agency (CRA), has prevailed in a court battle for access to a trove of high-value customer data held by cryptocurrency exchange Coinsquare. And the CRA seems to be coming for more.

Under a federal judge’s March 19 order, Coinsquare must hand over detailed information on its Canadian customers, their crypto trading activity and identifying information to the Canada Revenue Agency (CRA).

Coinsquare told CoinDesk it will disclose information on an estimated 5% to 10% of its 400,000 customers to the CRA, which had originally sought to secure the lot. Court documents indicate only high-value accounts will be caught in the sweep.

The first of its kind ruling hands CRA a win just seven months after it began pursuing Coinsquare’s customer data in court. CRA argued it needed the data to check if taxpayers were meeting their crypto reporting burdens and the federal court agreed.

Today, CoinDesk also learned the tax authority is “currently in the process of serving” Coinsquare with a further request for customer information by means of an “Unnamed Persons Requirement” (UPR). According to a spokeswoman for the CRA, the agency needs Coinsquare’s customer information to verify compliance with Canada’s Income Tax Act (ITA) and Excise Tax Act (ETA).

Coinsquare will have 15 days to comply with the order once it is received.

Echoes of Coinbase vs. The IRS

Five years ago, the Internal Revenue Service, CRA’s U.S. counterpart, launched a similar effort against Coinbase, using a parallel argument for access. Though Coinbase at first lambasted the IRS’ “fishing expedition” it ultimately acceded to a judge’s order, handing over records on some 13,000 customers.

At the time, Coinbase called the outcome a “partial victory” because it said it had pared down the scope of the IRS’ demands to include only accounts trading more than C$20,000 (US$15,800).

Coinsquare echoed that sentiment on Tuesday as it touted the pared-down order secured through negotiations with CRA as a win.

Coinsquare’s final bargain will compel the crypto exchange to hand over at year’s end exhaustive data on accounts that held C$20,000 in crypto from 2014-2020 or cumulatively in their history, as well as the 16,500 largest accounts from each year.

“Coinsquare negotiated to protect its clients’ privacy, and limit any disclosure to only what was absolutely required by the CRA under Canadian tax law,” Coinsquare told CoinDesk.

“Instead of providing the CRA with all client data dating back to 2013 as was initially requested, Coinsquare and the CRA have agreed that information relating to 90%-95% of Coinsquare’s clients will not be disclosed.”

The CRA spokeswoman said the agency “reserves the right” to mount future taxpayer data collection efforts against Coinsquare and “other sources.” However, she said the pared-down court order “appears sufficient to verify compliance with the ITA and/or the ETA.”

Updated: 7-22-2021

Circle K Convenience Stores Will Host Thousands Of Crypto ATMs

Despite suspending service to some crypto ATMs during the early days of the pandemic, Bitcoin Depot has continued to expand.

The largest Bitcoin ATM operator in the world has said it will be expanding into Circle K locations in the United States and Canada.

Bitcoin Depot announced today that more than 700 of its Bitcoin ATM machines had already been installed at Circle K convenience stores in 30 U.S. states as part of the new partnership. The crypto ATM distributer said the expansion could provide underserved communities with financial access tools and attract more people to the crypto space.

“Over the last year, we have watched cryptocurrency gain mainstream adoption by wealth managers and investment firms, but what about the people that don’t have access to those services?” Bitcoin Depot’s director of product Alona Lubovnaya told Cointelegraph. “ATMs being located in Circle K’s provide an easy onramp for the underbanked and less affluent, not just someone with a wealth manager.”

The company claims to have more than 3,500 crypto ATMs in operation across the U.S. and Canada allowing customers to purchase more than 30 different types of cryptocurrencies including Bitcoin (BTC), Litecoin (LTC), and Ether (ETH). Alimentation Couche-Tard, the Canada-based operator of Circle K, reports that its brand operates roughly 7,150 stores in the U.S. and 2,111 in Canada.

Bitcoin Depot announced last year that it was suspending service to certain machines in areas at high risk during the ongoing pandemic. The company has since reported that it has restored service to all locations, despite the recent rise in COVID-19 cases and deaths in the United States.

The number of crypto ATMs across the globe allowing customers to exchange fiat for crypto has grown significantly in recent years. At the time of publication, data from CoinATMRadar shows there are roughly 24,000 crypto ATMs in 75 countries, from Kazakhstan to Australia. The majority — more than 20,000 — are in the United States.

“Our mission is to Bring Crypto to the Masses,” said Lubovnaya. “We will continue to do this with significant partner expansions going forward.”

Updated: 7-27-2021

Global Crypto ATM Installations Have Increased By 70% In 2021

2021 has seen the installation of over 10,000 new crypto ATMs worldwide, with the United States taking the lead.

Alongside cryptocurrency’s decade-long adoption drive, the momentum behind the installation of crypto ATMs continues across the globe. Based on Coin ATM Radar’s latest data, crypto ATM installations in 2021 have witnessed a spike of 71.73%, pulling up the numbers from 13,993 on Jan. 1 to 24,030 at the time of reporting.

Last year, the global count rose to 13,993 ATMs with a 119.56% growth after 7,620 new machines were installed. So far, 2021 has seen the installation of 10,037 ATMs. To keep things in perspective, data suggests that crypto ATMs are being installed at a speed of roughly 52.3 ATMs per day.

The United States currently leads this space, having installed nearly 48 ATMs per day, based on the data acquired in the last seven days. As reported by Cointelegraph back in March, the ATM count in the U.S. rose to 177% in just a year, standing at 16,835.

Crypto ATMs can be accessed across 75 sovereign nations and are powered by 42 producers. Coin ATM Radar’s data on the manufacturers also suggests that Genesis Coin dominates this space with 40.9% market share, while General Bytes owns around 24% of the market. The remaining 35% of the market is shared among other players, including BitAccess, Coinsource and Bitstop.

One of the largest holders of the Bitcoin (BTC) ATM network, Bitcoin Depot, recently announced a partnership with Circle K to install crypto ATMs across the U.S. and Canada. The partnership has since resulted in the installation of more than 700 Bitcoin ATMs.

Bitcoin Depot operates over 3,500 crypto ATMs allowing users in the U.S. and Canada to purchase over 30 types of cryptocurrencies, including Bitcoin, Ether (ETH) and Litecoin (LTC).

Updated: 8-6-2021

NCR Corporation Plans To Purchase Bitcoin ATM Company LibertyX

LibertyX currently services 20,000 retail stores in the U.S. with 9,500 crypto ATMs.

Enterprise technology provider NCR Corporation has announced an agreement to buy LibertyX, the company that launched one of the first retail Bitcoin ATMs.

In a Monday announcement, NCR said it expected to purchase LibertyX later this year depending on regulatory licensing consents and approvals. The firm said it planned to offer LibertyX’s capabilities as part of its solutions for banks, retailers and restaurants, implying NCR clients could see crypto withdrawals, purchasing and payment features after the deal is finalized.

“Our customers require a complete digital currency solution, including the ability to buy and sell cryptocurrency, conduct cross-border remittance and accept digital currency payments across digital and physical channels,” said NCR chief technology officer Tim Vanderham.

LibertyX has allowed users to make purchases with crypto at a variety of retailers in the United States using its mobile app or through its network of Bitcoin (BTC) ATMs. According to the firm, it currently services 20,000 retail stores in the United States with 9,500 crypto ATMs.

According to data from CoinATMRadar, there are more than 24,481 crypto ATMs in the world at the time of publication, with the market experiencing exponential growth in 2021. Bitcoin Depot, one of the largest holders of the Bitcoin ATM network, recently announced a partnership with convenience store Circle K, resulting in the installation of more than 700 Bitcoin ATMs in the U.S. and Canada.

Updated: 8-9-2021

NCR (Major ATM Manufacturer) To Buy LibertyX To Add Crypto-Currency Software To Digital Wallet, Mobile Apps:

The acquisition will make LibertyX capabilities available to banks, restaurants and retailers.

NCR Corporation (NYSE: NCR), one of the world’s largest makers of automated teller machines (ATMs), agreed to acquire cryptocurrency software provider and ATM-network firm LibertyX in an all-stock deal worth $73 million at market close Tuesday.

* NCR will pay 1.66 million shares for LibertyX, said CFO Tim Oliver on his Tuesday earnings call. The parties had not initially disclosed the terms.

* Atlanta-headquartered NCR said it plans to integrate LibertyX capabilities and make them available to banks, retailers and restaurants through its digital wallet and mobile applications.

* LibertyX’s digital-currency software runs on ATMs, kiosks and point-of-sale partners such as Cardtronics, which owns and manages ATMs in the U.S. at locations such as convenience stores, pharmacies and supermarkets.

* “Due to growing consumer demand, our customers require a complete digital currency solution, including the ability to buy and sell cryptocurrency, conduct cross-border remittance and accept digital currency payments across digital and physical channels,” NCR CTO Tim Vanderham said.

* As reported by CoinDesk last month, the number of crypto ATMs installed globally has increased by more than 70% this year to 24,030.

Updated: 8-26-2021

Bitcoin ATM Operators Set Up Association To Counter Money Laundering

“Many BTM operators feel that merely asking for a cell phone number is enough due diligence to absolve them of their mandated KYC requirements,” a Coinsource exec said.

Major Bitcoin (BTC) ATM operators in the United States are joining forces to fight illicit activity related to Bitcoin ATMs.

Bitcoin ATM operators DigitalMint and Coinsource have launched the Cryptocurrency Compliance Cooperative (CCC), a new association that aims to establish compliance standards for the Bitcoin ATM industry.

The new compliance effort has launched with support from major blockchain analytics firms, such as Chainalysis and Elliptic, among its 15 initial members. The CCC is now encouraging participation from cash-based crypto money services businesses, regulators, financial institutions, as well as non-state and law enforcement agencies.

The association specifically targets Bitcoin ATMs to ensure Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance, as this type of ATMs is often associated with a lack of KYC requirements. “Unfortunately, many BTM operators feel that merely asking for a cell phone number is enough due diligence to absolve them of their mandated KYC requirements,” Coinsource head of compliance Bo Oney said.

“Such lax provisions provide a safe haven for bad actors to abuse the machines for nefarious purposes. The CCC is seeking to bolster regulatory requirements for the benefit of all BTM users and operators. This will require input from the most knowledgeable in the industry, all with the goal of making the cash-to-crypto space as safe as possible for consumers,” he added.

Seth Sattler, director of compliance for DigitalMint and leading CCC contributor, said that illicit use cases related to the Bitcoin ATM industry are well documented by several law enforcement agencies, including fraud, elder abuse and drug and human trafficking.

“While a small number of Bitcoin ATM operators go above and beyond with KYC and AML protocols, others in the cash-to-crypto industry simply turn a blind eye and are complacent to these bad actors by simply applying the bare minimum customer protections, which in many cases allow for completely anonymous transactions,” Sattler noted.

Similar to a traditional ATM, a Bitcoin ATM, or a BTM, is a kiosk allowing users to purchase or sell Bitcoin and other cryptocurrencies by using cash or debit card. According to data by BTM tracking website How Many Bitcoin ATMs, there are currently more than 42,000 BTMs in the United States.

In February, the State of New Jersey Commission of Investigation discovered that 75% of the BTM operators in the state allowed certain transactions without requiring the customer to provide any information outside a cell phone number. Last year, an executive from blockchain analytics firm CipherTrace predicted that Bitcoin ATMs would face stricter regulations worldwide, with countries including Canada and Germany already moving to strengthen necessary AML regulations.

Updated: 8-27-2021

Honduras Gets Its First Bitcoin ATM

The “la bitcoinera” machine allows crypto enthusiasts to purchase BTC and ETH using the local fiat currency provided they are willing to scan their IDs and disclose certain personal information.

TGU Consulting Group, a Honduran company based in the capital of Tegucigalpa, has reportedly installed the country’s first Bitcoin ATM.

According to a Friday Reuters report, TGU chief executive Juan Mayen led the move to install the Bitcoin (BTC) ATM in one of the capital’s office buildings. The “la bitcoinera” machine allows crypto enthusiasts to purchase BTC and Ether (ETH) using the local fiat currency, lempira, provided they are willing to scan their IDs and disclose certain personal information.

Mayen said this was the first automated way to purchase Bitcoin in Honduras, but many software developers had been accepting crypto for payments. According to the TGU exec, many Hondurans have had to exchange cash for crypto in person, an action he described as “very inconvenient and dangerous” in the country — data from crowd-sourced platform Numbeo shows the level of crime in Honduras as “very high.”

Lawmakers in some Central America nations have been taking more pro-crypto positions as the market continues to grow. El Salvador is currently installing Bitcoin ATMs across the country in preparation for the cryptocurrency being accepted as legal tender starting on Sept. 7. At least one member of Panama’s congress has also proposed legislation for the country to adopt Bitcoin and other cryptocurrencies.

Data from Cointelegraph Markets Pro shows the price of BTC is $48,976 at the time of publication, having risen more than 3% in the last 24 hours. The ETH price is $3,272, having increased more than 4% over the same period.

Updated: 9-30-2021

Vulnerable: Kraken Reveals Many US Bitcoin ATMs Still Use Default Admin QR Codes

Kraken has urged BATMTwo ATM owners and operators to change the admin QR code for their ATMs to avoid potential attacks.

Kraken Security Labs has said that a “large number” of Bitcoin (BTC) ATMs are vulnerable to hacking, as the administrators never changed the default admin QR code.

In a Wednesday blog post, Kraken posted research from its Security Labs team, which found that there are “multiple hardware and software vulnerabilities” in the General Bytes BATMTwo ATM range.

“Multiple attack vectors were found through the default administrative QR code, the Android operating software, the ATM management system and even the hardware case of the machine,” the post read.

Kraken’s security team stated that if a hacker gets their hands on the administrative code, they can essentially “walk up to an ATM and compromise it,” while also highlighting issues with the BATMTwo’s lack of secure boot mechanisms, as well as “critical vulnerabilities” in the ATM’s management system. However, General Bytes has reportedly already alerted ATM owners to the vulnerabilities:

“Kraken Security Labs reported the vulnerabilities to General Bytes on April 20, 2021, they released patches to their backend system (CAS) and alerted their customers, but full fixes for some of the issues may still require hardware revisions.”

The team also found that it was able to gain full access to the Android operating system behind the BATMTwo ATM by simply attaching a USB keyboard to the machine and warned that “anyone” could “install applications, copy files or conduct other malicious activities.”

General Bytes is headquartered in the Czech Republic and, according to Coin ATM Radar, there are currently 6,391 General Bytes ATMs installed worldwide, which represents 22.7% of the global market. However, those figures also account for BATMThree machines that weren’t reported on by Kraken.

The majority of the BATM ATMs are located in the United States and Canada, with a combined figure tallying in at around 5,300, while Europe has around 824 ATMs installed.

Kraken is calling on BATMTwo owners and operators to change the default QR admin code, update the CAS server, and place the ATMs in visible locations for security cameras.

Bitcoin ATM Scams

While reports of hacked Bitcoin ATMs appear to be minimal, there is a history of crafty individuals building scams around crypto ATMs.

In March 2019, the Toronto Police issued a public statement calling on the community to locate four men suspected of carrying out a series of “double-spending” transactions that fetched $150,000 worth of funds over a 10-day window. Double-spending consists of canceling transactions before the ATM has had a chance to confirm but keeping the dispensed cash.

The Oakland Press reported on June 22 of this year that two women from Berkeley were scammed out of a combined $15,000 after fraudsters posed as public safety officers and federal employees. The scammers reportedly told the victims that they had outstanding warrants and tax violations and ordered them to pay fines via local Bitcoin ATMs in the area.

And Malwarebytes posted research in August that uncovered a trend of gas station Bitcoin ATM scams in which threat actors would post fake jobs listings to dupe applicants into money laundering.

Updated: 10-21-2021

Walmart Has Quietly Begun Hosting Bitcoin ATMs

The retail giant is offering bitcoin through 200 of its Coinstar kiosks in a tie-up with crypto ATM firm Coinme. We made sure it’s real.

Walmart, the world’s largest company by revenue, is letting customers buy bitcoin at dozens of its U.S. stores.

Shoppers can purchase the cryptocurrency at Coinstar machines inside the retailer’s cavernous big box stores. A CoinDesk editor verified that the service works, buying a small amount of BTC at a Pennsylvania Walmart on Oct. 12.

“Coinstar, in partnership with Coinme, has launched a pilot that allows its customers to use cash to purchase bitcoin,” Walmart communications director Molly Blakeman told CoinDesk via email. “There are 200 Coinstar kiosks located inside Walmart stores across the United States that are part of this pilot.”

Coinstar is best known for allowing consumers to exchange coins for paper bills or gift cards. The ability to buy bitcoin is enabled by Coinme, a crypto wallet and payment firm that specializes in bitcoin ATMs (BTMs).

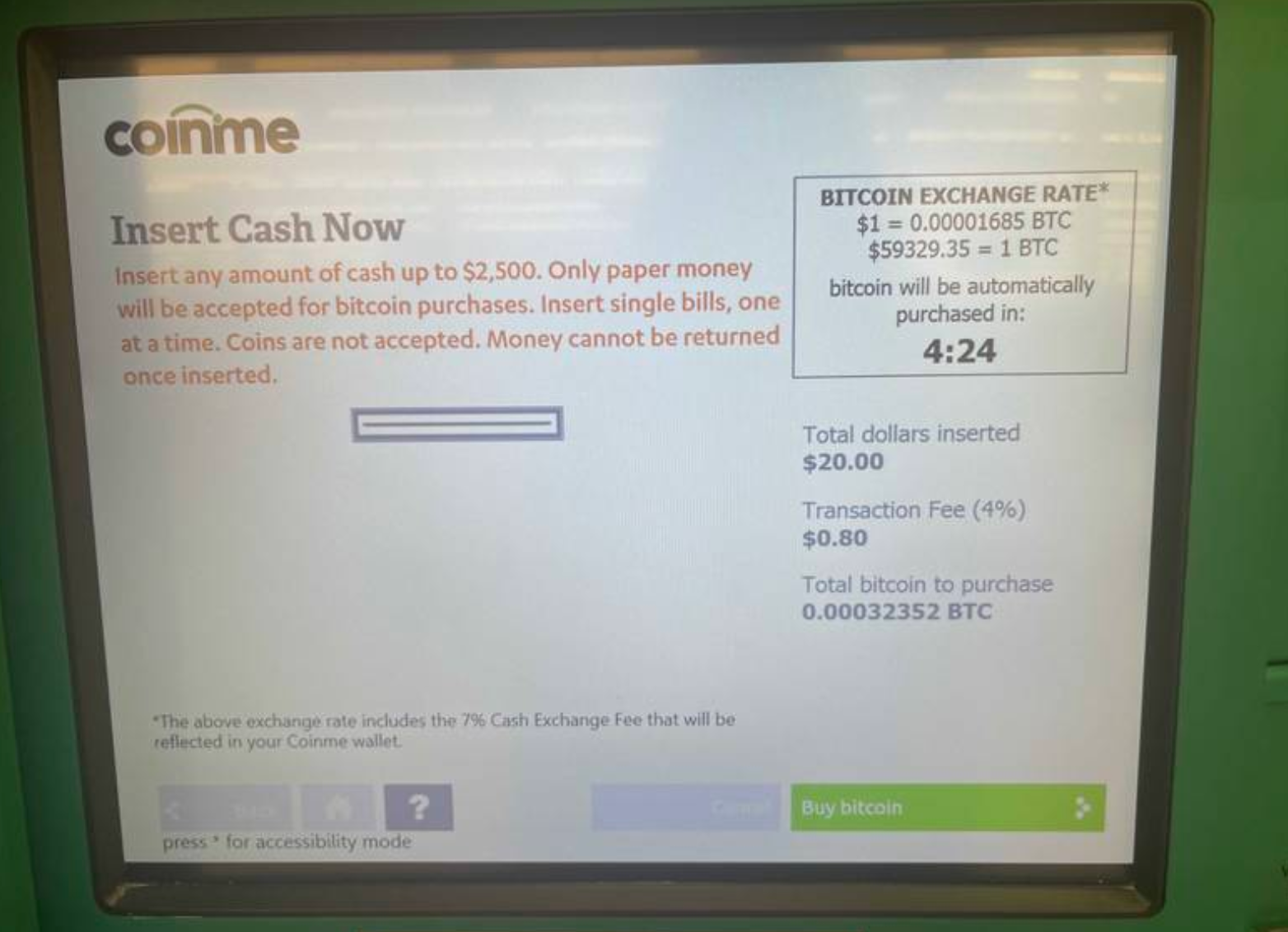

After inserting bills into the machine, a paper voucher is issued. The next stage involves setting up a Coinme account and passing a know-your-customer (KYC) check before the voucher can be redeemed. The machine charges a 4% fee for the bitcoin option, plus another 7% cash exchange fee, according to the Coinstar website and verified by CoinDesk.

CoinDesk tested the service out of an abundance of caution following a hoax last month, when a fake press release claimed that litecoin (LTC) would be accepted as payment at Walmart stores. This time, the bitcoin-Bentonville connection is real. A source with knowledge of the pilot said the Litecoin debacle had put Walmart, which is based in Bentonville, Ark., off from issuing a press release.

Bitcoin ATMs On The Rise

The cryptocurrency ATM industry is expanding at a rapid pace, partly fueled by the COVID pandemic. Coinstar announced plans in 2020 to double its fleet of 3,500 Coinme BTMs amid a spike in usage.

More recently, Coinstar, which started adding bitcoin-buying services with Coinme in early 2019, added 300 bitcoin-enabled machines at Winn-Dixie, Fresco y Más, Harveys and other grocery stores across Florida.

But Walmart, long seen as the crown jewel to bringing crypto financial services into the mainstream, is another step up – even if the 200-kiosk pilot is chump change for a company with 4,700 stores and a market cap of $409 billion.

The potential for crypto-enabled financial services for lower-income users is alluringly close given shared connections among Walmart, Coinme and MoneyGram, but the retailer didn’t elaborate further on its crypto plans.

Compliance concerns

While large-scale BTM rollouts could bode well for adoption, there are concerns about money laundering, said Seth Sattler, compliance director of BTM provider DigitalMint.

That’s because some crypto ATM operators turn a blind eye to the relatively high level of illicit activity the machines attract, he said. That includes money mules, human traffickers and assorted scammers.

Over the past 18 months, DigitalMint, which accounts for only 5% of total BTM transaction volume, has rejected and returned $5 million to fraud victims, said Sattler, who is also a leading contributor to the recently convened Cryptocurrency Compliance Cooperative.

“Large retailers need to make sure they know the vendor they’re getting into bed with and what that organization is doing to manage risk,” Sattler said in an interview.

Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,Ultimate Resource For The,

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.