Bitcoin Tops $9,000 As Crypto Rally Trounces Stocks, Bonds, Gold And Oil (#GotBitcoin)

Escalating U.S.-China trade tensions and Facebook’s plan to launch a digital coin help bitcoin soar. Bitcoin Tops $9,000 As Crypto Rally Trounces Stocks, Bonds, Gold And Oil (#GotBitcoin)

The price of bitcoin rose above $9,000, extending a rebound that has made cryptocurrencies far outperform traditional asset classes this year.

Related:

Buffett ‘Killed His Reputation’ by Being Stupid About BTC, Says Max Keiser

Bitcoin climbed to $9,381.82 over the weekend, a 13-month high, according to research site CoinDesk. While stocks, bonds, gold and oil are all up this year, bitcoin’s rally trounces them all.

Prices for bitcoin and rival digital currencies collapsed last year. Investors cite more institutional support for cryptocurrencies, escalating U.S.-China trade turmoil and Facebook Inc.’s planned digital coin as catalysts for the latest move higher.

Facebook has signed up more than a dozen companies including Visa Inc., Mastercard Inc., PayPal Holdings Inc. and Uber Technologies Inc. to back its cryptocurrency, The Wall Street Journal reported on Friday. The digital coin, called Libra, is set to launch next year.

Though bitcoin and the underlying blockchain technology are hardly used for payments, Facebook is betting that its giant social network with billions of users will gravitate toward its crypto-based payments system.

And investors say a company of Facebook’s stature using a cryptocurrency gives the industry wider appeal.

“When big, important companies get involved, crypto enters the zeitgeist in a different way,” said Rayne Steinberg, chief executive and co-founder at Arca, an asset-management firm that invests in digital currencies.

He said the U.S.-China trade tensions have been a positive catalyst for bitcoin. Bitcoin was formed about a decade ago as a decentralized, autonomous network which isn’t controlled by any individual, company or government.

That has made it particularly attractive to some investors who have grown disenchanted with the world’s two largest economies engaging in a bitter trade dispute.

“In this digital world where you have an unseizable, unmanipulatable, uninflatable asset that acts as a store of value, there is going to be a demand for that,” Mr. Steinberg said.

Additionally, bitcoin has separated itself from most other asset classes on a performance basis. The S&P 500 is up 15% this year, crude-oil futures have gained 16% and gold futures are up 4.8%. Bitcoin, meanwhile, is up 154%, although it is still well below its all-time high near $20,000.

Hacks, scammers and fraud remain key concerns. But there are bright spots. In a research report earlier this month, Anthony Pompliano, a founding partner at asset-management firm Morgan Creek Digital, said bitcoin was acting as a hedge against global instability, citing how bitcoin moved differently to most other asset classes.

SFOX, an institutional crypto prime dealer, found that there was “a near perfect negative correlation” between the S&P 500 and bitcoin in May after China announced plans to raise tariffs on $60 billion of U.S. goods.

“This is the core argument for why institutional investors should have exposure to the cryptocurrency,” Mr. Pompliano said.

Why Bitcoin Hasn’t Gone To Zero And Is Now Knocking On The Door Of $10,000

Bitcoin Is Back!

The world’s No. 1 cryptocurrency is on fire, with a price approaching $10,000, pushing the digital asset near its highest level in more than 14 months, according to MarketWatch data provided by CoinDesk.

A single bitcoin most recently, was trading at $9, 218.21, after putting in a December low at $3,194.96. Its current level is bitcoin’s loftiest level since March 29, 2018 when a bitcoin changed hands above $9,700.

Moreover, bitcoin trading on the CME Group’s futures exchange for June delivery was at $9,265, up 9.7% on the day, representing a 153% surge for bitcoin futures for the year to date.

This compares with a gain of 12% for the Dow Jones Industrial Average a 15% advance for the S&P 500 index and a more than 18.3% return for the Nasdaq Composite Index according to FactSet data.

Here Are A Few Theories About Why Bitcoin Has Been Zooming Higher Lately:

Institutions Not Individual Investors Are Bullish

Wall Street has taken a hard look at cryptocurrencies and the digital-ledger technology that underpins most assets, blockchain, and has decided to take a chance.

JPMorgan Chase & Co. led by one of bitcoin’s more outspoken critics, announced in February JPM Coin, designed as a way to handle digital settlements. A number of other banks, including UBS Group, have also announced efforts to use blockchain to assist in international settlements.

Michael Moro, CEO of Genesis Global Trading, an OTC digital currency trading firm, told MarketWatch via email:

“The first time Bitcoin crossed the $9,000 mark was in November 2017. That price movement was largely driven by international retail demand – South Korea, for example – in addition to hype around initial coin offerings.

This time around, however, we believe that institutional money is playing a much bigger role than it did in 2017, which is evidenced by CME’s record of futures volumes.”

Growing Interest

Trading of bitcoin has been climbing, as reflected in futures activity on CME Group. Over the past several weeks bitcoin futures trading activity, gauged by its moving average since inception of bitcoin trading is at a record.

Trading on the CME made its debut in late December, while another futures platform CBOE Futures Exchange, which kicked of bitcoin trading on Dec. 17, will see its June contract mark the end of its foray into bitcoin futures.

The social-media giant will unveil a new crypto-payment platform that could facilitate digital payments not just on Facebook’s site but anywhere on the internet. Participants reportedly include an array of heavyweight backers, like Mastercard Inc. PayPal Holdings Inc. UberTechnologies and Visa Inc.

Ripple Effect?

Shares of MoneyGram International Inc. soared late-Monday after Ripple Inc., a blockchain startup behind the XRP coin agreed to invest up to $50 million in the money-transfer company, marking another powerful event for cyptos.

Updated: 10-23-2023

Bitcoin Mining Stocks Rally As BTC Holds Above $30K Despite Looming Halving Concerns

The reward for mining new BTC will be cut in half soon, making it hard for less-efficient operators to survive.

The shares of bitcoin (BTC) miners are rallying on Monday after the largest cryptocurrency by market value continued to hold above $30,000 even as the mining industry is gearing up for upcoming halving that could cut mining rewards in half.

The shares of Bit Digital (BTBT), TeraWulf (WULF), Hut 8 (HUT) and CleanSpark (CLSK) rose more than 10%, outpacing their peers such as Marathon Digital (MARA), Riot Platforms (RIOT) and Hive Digital (HIVE) that rose between 5% and 9%.

The only mining stock that fell, though, was Bitdeer (BTDR), which was down about 10% at press time.

The moves in mining shares generally outpace other crypto-related stocks as mining digital assets is their primary source of revenue.

On Monday, other crypto-related stocks, such as Coinbase (COIN) and MicroStrategy (MSTR), were up less than 6%.

The mining stocks have outpaced bitcoin’s run this year, rebounding from their 2022 slump. The Valkyrie Bitcoin Miners ETF (WGMI), which tracks the performance of mining stocks, has doubled in price this year, while bitcoin has risen 87%.

Trouble could loom ahead, though. The bitcoin halving – also known as the halvening – is slated to take place next year. The event will cut in half the reward for successfully mining a bitcoin block.

This event takes place roughly every four years and is part of Bitcoin’s code to reduce inflationary pressure on the cryptocurrency.

Currently, rewards are 6.25 BTC per block or about $187,000 at the current spot price, and in April 2024 or so, they will be reduced to 3.125 BTC per block (approximately $93,000).

Halving is generally considered negative for the mining industry, and investors are keenly focused on the event’s impact on the miners, said B. Riley analyst Lucas Pipes. “We believe that the halving is, first and foremost, negative for the group.

However, low-cost producers should fare better than high-cost producers and well-capitalized companies should fare better than levered ones,” he wrote in a research note on Oct. 20.

Miners are gearing up by either buying more-efficient mining machines or diversifying into alternative sources of income that could help keep them afloat post-halving.

In fact, Bit Digital earlier announced that, like many of its peers, it is entering the artificial intelligence (AI) business, which will earn them enough cash flow to sustain their mining business, regardless of where the market is headed.

Updated: 10-31-2023

Will Weakness In ‘Magnificent 7’ Stocks Spread To Bitcoin Price?

Tech stocks face trillion-dollar losses as bond yields soar, but their $596 billion cash positions favor alternative hedges, including Bitcoin.

The mega-cap tech stocks, which saw a robust start in 2023, are now grappling with massive trillion-dollar losses, leaving their shareholders concerned. Wall Street’s unease over surging bond yields and higher interest rates has cast a shadow on these companies.

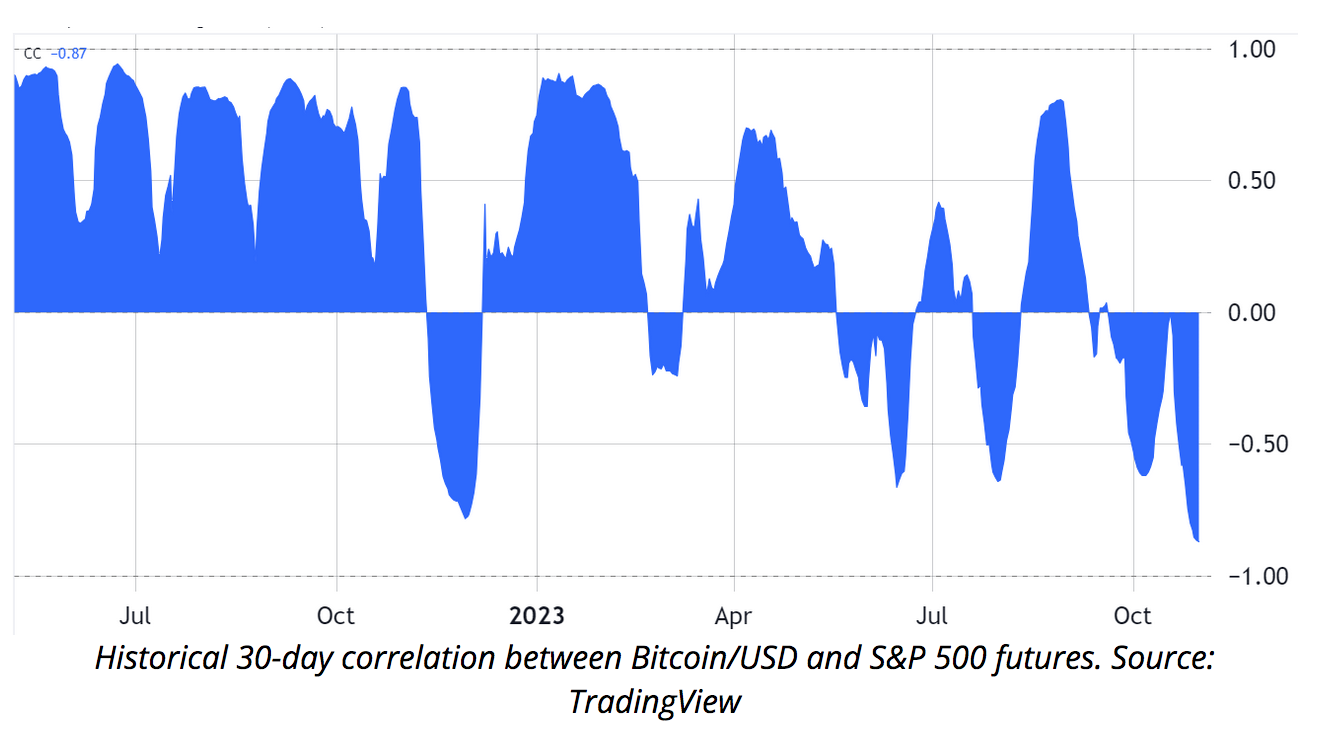

Traders are now pondering the potential impact on Bitcoin if the S&P 500 downtrend continues.

Consequently, investors must investigate the correlation between Bitcoin and the S&P 500 and consider whether cryptocurrencies can thrive in an environment of high interest rates.

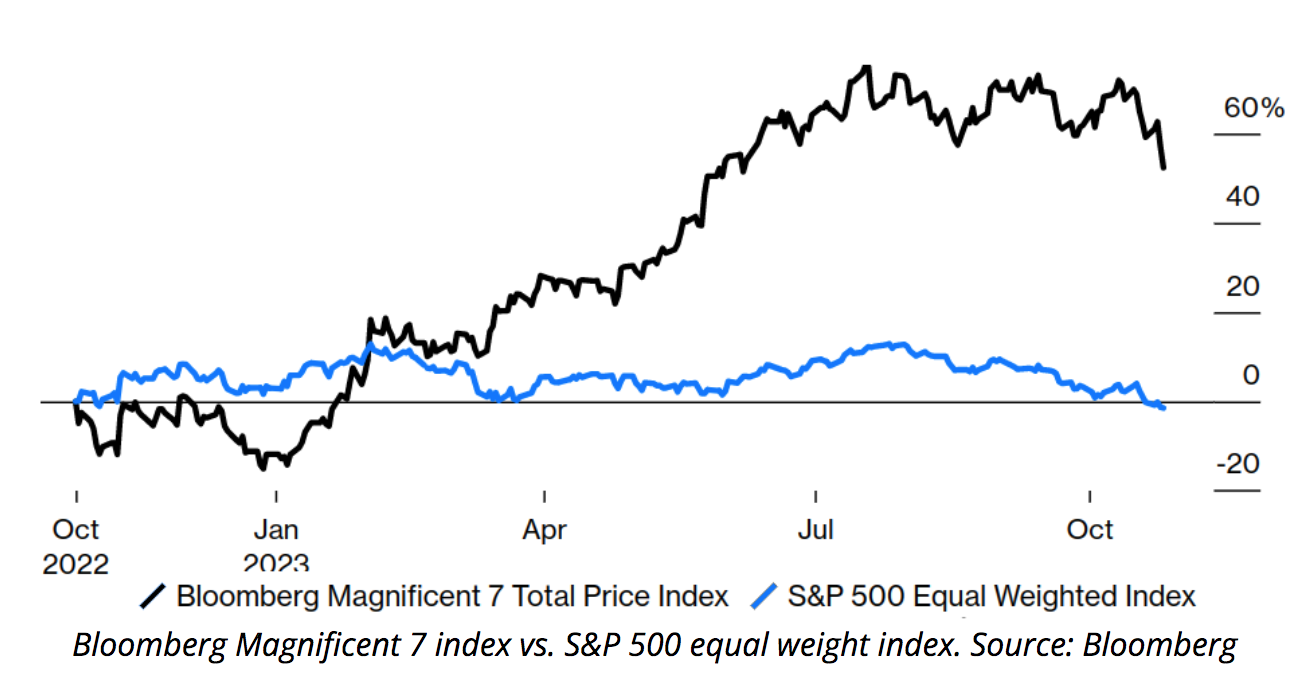

The seven-largest tech companies, including Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla, collectively constitute a staggering 29% of the S&P 500, marking the highest concentration ever recorded in this stock market index.

However, since the end of July, these tech giants have witnessed a substantial erosion in their market value, with a staggering $1.2 trillion loss.

Real Money’s James DePorre notes that “73% of stocks in the market are more than 20% below their highs,” which technically defines a bear market. This underscores growing worries in the broader economy apart from the top seven stocks.

In its endeavor to regain credibility in combating inflation, the United States Federal Reserve has indicated its intention to maintain higher interest rates for an extended period.

Crescat Capital warns that a significant decline in the S&P 500, coupled with a widening of corporate credit spreads, could elevate the likelihood of an economic downturn.

Higher Interest Rates Impact Stocks And Commodities

Crescat Capital has also raised concerns about the wave of corporate and sovereign debt maturing in 2024, which will necessitate refinancing at substantially higher interest rates.

They recommend exposure to commodities due to their historical resilience during inflationary periods, exacerbated by the challenge faced by commodity producers in investing in fixed assets.

Despite the vast difference in market capitalization, totaling $10.5 trillion for Apple, Microsoft, Google, Meta, Nvidia and Tesla, compared to cryptocurrencies (excluding stablecoins), which fall short by over nine times, there are some intriguing parallels.

First, both markets exhibit a scarcity quality that correlates with the monetary base. In essence, both react similarly to the actions of the Fed, where increased circulation benefits scarce assets, while a restrictive policy with high interest rates favors fixed-income investments.

Additionally, the trend toward digitalization has transformed the way people use apps and mobile services, particularly in financial services.

Given the limited adaptability of traditional providers, often due to regulatory constraints, it’s not surprising that the public is embracing cryptocurrencies, even in the form of stablecoins.

The growing demand for fully digital services is a secular trend that positively influences both the crypto and tech sectors.

Decoupling of The S&P 500 And Cryptocurrencies

The performance of the top seven S&P 500 stocks can decouple from cryptocurrencies regardless of the time frame. Currently, Bitcoin is trading approximately 50% below its all-time high, while Apple and Microsoft are down 13% and 7% from their peaks, respectively.

This discrepancy is partly due to investor concerns about a looming recession or a preference for companies with substantial reserves, whereas cryptocurrencies, excluding stablecoins, lack cash flow or earnings.

From an investment standpoint, stocks and cryptocurrencies inhabit different realms, but this contrast underscores how Bitcoin can grow independently of retail adoption and spot exchange-traded funds (ETFs), as evident by MicroStrategy’s $5.4 billion direct investment in the cryptocurrency.

The top seven tech companies hold a combined $596 billion in cash and equivalents, enough to purchase the entire circulating supply of Bitcoin, assuming 3.7 million coins are lost forever.

Furthermore, these companies are projected to generate $650 billion in earnings within the next five years. So, even if those companies continue to decline, their cash position could eventually shift to commodities including Bitcoin.

Meanwhile, the U.S. housing market, another pinnacle of savings for the economy, is facing problems of its own due to record-high mortgage rates.

Sales of previously owned homes in September dropped to the slowest pace since October 2010, according to the National Association of Realtors.

Ultimately, a downturn in the S&P 500, whether driven by mega-cap tech stocks or other factors, may not necessarily spell doom for cryptocurrencies.

Investors often seek diversification to mitigate risk, and Bitcoin’s low correlation with traditional markets, along with early signs of trouble in the real estate sector, offers an attractive condition for alternative hedges, as signaled by legendary investor Stanley Druckenmiller.

Bitcoin’s Heading To $150K And Quality Mining Stocks Offer A Good Way To Gain Exposure: Bernstein

Bernstein expects the largest cryptocurrency to hit that level during the 2024-2027 cycle, the report said.

Bitcoin (BTC) is en route to hit $150 and crypto miners are evolving into industrial-scale enterprises, with North America gaining market share over China, broker Bernstein said in a research report Monday as it initiated coverage of the sector in the U.S.

Bernstein says it prefers Riot Platforms (RIOT), outperform rated with a $15.60 price target, and CleanSpark (CLSK), also outperform rated with a $5.30 price target.

Updated: 11-2-2023

Bitcoin Mining Stocks Soar 10% As BTC Hovers Near 17-Month High At $35K

The bitcoin derivatives market shows signs of overheating, one observer noted.

Bitcoin mining stocks soared Thursday as bitcoin (BTC) itself traded around its 17-month high.

U.S.-listed mining companies such as Marathon Digital (MARA), Riot Platforms (RIOT) and CleanSpark (CLSK) rallied 10%-12% during the day amid a wider surge in equities. The Dow Jones Industrial Average notched its best day since June.

Crypto-related stocks were benefiting from thawing sentiment on Wall Street following a dismal October, as traders increasingly bet on the Federal Reserve is finished with its historic interest rate hiking cycle.

The S&P 500 and Nasdaq equity indexes advanced for the second consecutive day as investors continue to digest Fed Chair Jerome Powell’s slightly dovish remarks Wednesday and decision to leave rates unchanged for the second consecutive month amid signs of easing inflation and decreasing labor costs.

“If you’re a crypto trader who believes that a crypto and equity bull market is around the corner, I’d implore you to focus on bitcoin mining stocks to generate the most alpha,” Caleb Franzen, founder of Cube Analytics, said in an X/Twitter post.

If you’re a crypto trader who believes that a crypto + equity bull market is around the corner, I’d implore you to focus on #Bitcoin mining stocks to generate the most alpha.

YTD returns for miners vs. altcoins

🟠 $MARA +188%

🟢 $RIOT +231%

🔵 $CLSK +128%

🔴 $TOTAL.3 +27% pic.twitter.com/5gFz9B4Ipj— Caleb Franzen (@CalebFranzen) November 2, 2023

Coinbase (COIN) also closed the day with an 8.7% advance, but some of those gains were pared back after market close after the cryptocurrency exchange reported lower trading volumes in Q3. The company beat analyst expectations of revenues and earnings.

Cryptocurrencies Cool

BTC hovered around the $35,000 mark, just off its highest price level since May 2022.

Ether (ETH), the second largest crypto asset by market capitalization, lingered around $1,800, down nearly 2% over the past 24 hours.

The CoinDesk Market Index (CMI), which is a proxy for the broad crypto market, declined 1.3% over the same period.

Layer 1 network Cardano’s native token (ADA) and metaverse platform Decentraland’s (MANA) were notable outperformers advancing nearly 6%.

Chainlink (LINK), venture capital-backed blockchain Aptos’s token (APT) and liquid staking platform Lido’s governance token (LDO) tumbled 5%-7%.

Solana (SOL) cooled off after its spectacular rally, doubling its price in two-plus weeks. The token dipped to $40 from a 14-month high of $46.60 yesterday.

The Bitcoin (BTC) Price Rally’s Floor

Charles Edwards, founder of bitcoin-focused hedge fund Capriole Investments, warned about signs of over-exuberance in the bitcoin derivatives market.“All bitcoin derivatives markets are overheated at present,” Edwards said. “Stay safe out there.”

All Bitcoin derivatives markets are overheated at present. This captures Perps, Futures and Options. Stay safe out there… pic.twitter.com/V5JzWVsT62

— Charles Edwards (@caprioleio) November 2, 2023

Crypto trading firm QCP Capital said in a Thursday market update that BTC will likely stabilize around the current level barring a major catalyst, with $32,000 providing a price floor.

“It will take the spot ETF approval for us to start the new exponential leg higher,” analysts with the crypto asset trading firm QCP Capital said, referring to the possibility the U.S. Securities and Exchange Commission (SEC) approves a bitcoin-settled exchange-traded fund.

“At the same time, we expect only a major rug pull from SEC Chair Gensler will be able to take us back below $32,000 at this stage.”

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.