Food Regulators To Share Oversight of Plant And Cell-Based Meats (#GotBitcoin)

Regulators’ decision raises prospects for cell meat coming to market. Food Regulators To Share Oversight of Plant And Cell-Based Meats (#GotBitcoin)

Two U.S. food regulators agreed to share oversight of meat grown from animal cells, moving the emerging technology closer to consumers’ dinner plates.

The U.S. Department of Agriculture and the Food and Drug Administration will jointly oversee cell-culture meat technology, senior officials said Friday. The decision settles a debate between agency officials over which department would regulate the technology, which has drawn investments from major meat companies and skepticism from cattle ranchers and hog farmers.

Related:

Lab-Grown Meat Raises Regulatory Questions

Poll: How Likely Are You To Eat Cell-Based Meat?

Fast-Growth Chickens Produce New Industry Woe: ‘Spaghetti Meat’

Airport X-Ray Machines Could Help Meat Industry Compete In Coming Years With Lab-Grown Meat

Cell-based meat is produced using poultry and livestock cells that have the ability to self-renew. Those cells are placed into bioreactor tanks, where they are fed nutrients and oxygen, helping muscle tissue to grow. In a matter of weeks, developers say, the tissue can be harvested as meat and formed into products ranging from beef meatballs to chicken strips.

Regulation of the technology had been in question, with both USDA and FDA officials asserting jurisdiction over it this year.

Startups like Memphis Meats Inc., Mosa Meat, Finless Foods Inc. and Aleph Farms are pursuing the technology, working to lower per-pound costs from tens of thousands of dollars to a range that interested consumers would consider.

In a statement, USDA Secretary Sonny Perdue and FDA Commissioner Scott Gottlieb said the FDA will oversee cell collection, cell banks and cell growth in meat production. When cells are harvested, the USDA will regulate production and labeling of meat and other products made from the cells. The agencies will share information as they fine-tune the regulatory process, they said.

“This regulatory framework will leverage both the FDA’s experience regulating cell-culture technology and living biosystems and the USDA’s expertise in regulating livestock and poultry products for human consumption,” the officials said in the statement.

They said new legislation to regulate the technology is unnecessary.

Uma Valeti, chief executive of Memphis Meats, said the move “provides a clear path to market for cell-based products.”

The regulators’ joint approach will help the U.S. stay at the forefront of the technology as companies in Israel, Japan and Singapore also pursue it, said Jessica Almy, policy director for the Good Food Institute, a Washington group promoting meat alternatives.

“We look forward to the day in the not-so-distant future when American families will be sitting down to a dinner of meat made directly from cells,” she said, “courtesy of this new industry that Commissioner Gottlieb and Secretary Perdue made possible.”

Livestock producer groups have called for the USDA to regulate the cell-cultured meat products, and maintain a level playing field with traditionally raised beef, pork and poultry. “This announcement that USDA would have primary jurisdiction over the most important facets of lab-produced fake meat is a step in the right direction, but there’s still a lot of work to do on this issue to ensure that real beef producers and consumers are protected and treated fairly,” said Colin Woodall, government affairs head for the National Cattlemen’s Beef Association.

Cell-cultured meat developers are part of a new wave of alternatives to traditional meat production, appealing to consumers’ concerns over the environmental impact of cattle feedlots and hog manure lagoons, the billions of tons of feed grains they consume each year, as well as treatment of livestock and poultry.

Startups also are promoting a new generation of plant-based products aiming to better mimic the texture and taste of meat. Beyond Meat Inc., which sells plant-based burger patties and chicken strips, on Friday filed for an initial public offering that would raise $100 million, and disclosed $32.6 million in 2017 sales.

Updated: 12-17-2021

Future Meat Raises $347 Million To Make Cell-Grown Meat In U.S.

Future Meat Technologies raised $347 million in a Series B round to build a U.S. production facility to make its cell-grown meat products.

The investment was co-led by ADM Ventures, part of agriculture giant Archer-Daniels-Midland Co., and an unnamed global tech investor, according to founder and Chief Executive Officer Yaakov Nahmias.

Tyson Foods Inc., the biggest U.S. meat company, also participated. Future Meat, based in Rehovot, Israel, declined to provide a valuation.

Money has been pouring into cultivated meat companies. Good Meat, a subsidiary of Eat Just, raised $267 million this year, while Upside Foods has taken in more than $200 million since 2020.

Future Meat makes chicken, beef and lamb products from cells harvested from animals that have already been slaughtered in accordance with kosher and halal guidelines, Nahmias said.

The company plans to build a 13,000-gallon production facility in the U.S. over the next year or so as it awaits U.S. regulatory approval. It’s scouting Boston and Minneapolis for locations, Nahmias said.

Updated: 1-4-2022

Can Lab-Grown Meat Really Be Halal or Kosher?

Food tech startups are racing to market the new proteins, but meeting religious dietary rules is a challenge.

After thousands of years of humans raising animals for food, the prospect of building a business around meat created in a laboratory instead of on farms or feedlots looks to be a huge technical challenge.

Yet for food tech entrepreneur Josh Tetrick, success depends not just on scientists familiar with the latest advances in bioengineering but also on sages devoted to the details of religious dietary laws.

Tetrick is chief executive officer of Eat Just Inc., a San Francisco startup backed by billionaires Marc Benioff, Peter Thiel, and Facebook co-founder Eduardo Saverin that’s developing meat that’s grown in bioreactors rather than raised on farms.

Unlike plant-based products from Beyond Meat Inc. and Impossible Foods Inc., cultured meat is grown from animal cells and is structurally identical to meat.

“From a genetic, from a nutritional profile, it is meat,” Tetrick says. “You just don’t have that slaughter component as a step in the whole process.”

But that lack of bloodshed creates all sorts of questions for religious Muslims and Jews who only eat such meats as beef, chicken, or lamb from animals slaughtered according to long-established rules. For instance, can meat be halal or kosher if it’s grown in a lab and doesn’t come from a killed animal?

Is it really even meat? These are no small questions given that billions of people globally subscribe to faiths or traditions that have strict guidelines about meat preparation.

Tetrick is betting that today’s technology can find favor with ancient traditions, ushering in a new way to satisfy the world’s ravenous appetite for protein. In 2020, Eat Just began selling lab-grown chicken nuggets in Singapore, and in December it received permission to introduce cultured chicken breast there.

The company, which raised $267 million in 2021, is now targeting Muslim consumers—in August it announced plans to build a facility in Qatar.

While Eat Just has consulted with religious experts, it hasn’t yet gotten a seal of approval for its new type of meat. “It’s a really important question, maybe even more important because of what we’re going to be doing in Qatar,” Tetrick says. “But we don’t have that stamp yet.”

Agribusiness giants aren’t waiting for such questions to be settled before entering the industry, which is still in its development stage and could be worth $25 billion by 2030, according to McKinsey & Co.

Brazil’s JBS SA, the world’s top supplier of animal protein through brands including Swift and Primo, agreed on Nov. 18 to acquire Spanish cultured meat company BioTech Foods for $100 million.

Archer-Daniels-Midland Co.’s investment arm, ADM Ventures, co-led a $347 million investment in Israeli startup Future Meat Technologies, the companies announced on Dec. 20. Cargill Inc. and Tyson Foods Inc., along with Bill Gates and Richard Branson, are investors in California-based lab-grown meat developer Upside Foods.

Cultured meat will be off-limits to observant followers of Islam—the world’s second-largest religion, with about 2 billion adherents—if Islamic authorities decide it’s not halal.

Indonesia’s largest Muslim organization, Nahdlatul Ulama, did just that in September, saying in a statement that cells taken from live animals and then grown in bioreactors fall “into the category of carcass which is legally unclean and forbidden to be consumed.”

The fatwa from Indonesia, the world’s most populous Muslim nation, could encourage authorities in other countries to issue similar decisions.

In Pakistan, the second-largest Muslim country, scholars led by Islamic law expert Muhammad Taqi Usmani last year ruled cultured meat permissible only if the original cells come from animals slaughtered according to the Sharia-compliant process. However, many startups rely on cell lines that originated in live animals.

The industry also faces a challenge with observant Jews, since rabbis have yet to reach agreement on whether meat can be kosher if it’s not from an animal killed by a ritual slaughterer.

Jewish authorities also worry about the use of fetal bovine serum (FBS), taken from the blood of fetuses killed during the slaughtering of pregnant cows, to feed the animal cells in the bioreactors.

FBS could render the meat unkosher because of a prohibition against consuming blood, says Joel Kenigsberg, a rabbi with London’s United Synagogue who studied Jewish law and science at Israel’s Bar-Ilan University and is advising companies on kashrut issues. “This technology is so novel, so new, trying to find precedent is the greatest challenge,” he says.

There’s not even agreement on whether Jews should consider products grown in a lab to be meat, which can’t be consumed with dairy products, or pareve, a neutral category that’s neither meat nor milk.

“What the companies call it doesn’t matter,” says Avrom Pollak, president of Star-K Kosher Certification Inc., a Baltimore-based organization that works with clients such as Nestlé SA and Walmart Inc. “There’s going to be some who say that it’s not really meat.”

Many companies are trying to move away from using FBS. Israel’s Aleph Farms, which cultivates slaughter-free beef, on Dec. 8 announced a partnership with Munich-based Wacker Biosolutions focused on nonanimal alternatives to feed the cells in bioreactors.

To address concerns about slaughter-free meat, Future Meat Technologies uses cell lines that originated with ritually killed cattle, chickens, and lambs, according to Yaakov Nahmias, its president.

Future Meat, which is seeking regulatory approval from the U.S. Food and Drug Administration, aims to have its chicken in restaurants by early 2023 and expects to have its religious issues resolved by then.

“We already have had several groups of rabbis visit. We are well on our way,” Nahmias says, adding that winning Islamic certification won’t be difficult. “It’s going to be both kosher and halal,” he says.

In Singapore, whose government has been the world’s speediest in approving commercialization of cultured meat, Muslim experts are nonetheless taking it slow.

“Novel foods such as these are new areas in Islamic jurisprudence and require appropriate religious research, analysis, and interpretations,” the Islamic Religious Council of Singapore (IRCS) said in an emailed statement. “It is a new development which IRCS is studying in detail.”

Updated: 1-5-2022

Beyond Meat Gives Up Early Gain After KFC Confirms Plant-Based Chicken

* Maker Of Alt-Meats Has Been Trading At Lowest Since April 2020

* Product On Sale Across U.S. On Jan. 10 Won’t Be Vegetarian

Beyond Meat Inc. erased earlier gains after Yum! Brands Inc. confirmed its KFC restaurants will start selling plant-based chicken on Jan. 10.

Beyond Fried Chicken will be offered for a limited time at KFC restaurants across the U.S., the companies said Wednesday in a statement. The product will be available as a combo meal or a la carte in six- or 12-piece orders. Prices start at $6.99, excluding taxes, and may vary by location.

The launch marks a new step in the partnership between the two brands. KFC in 2020 tested faux-chicken nuggets from Beyond Meat in about 70 locations in two states after the success of an initial trial.

At the time, the companies had said they were looking to offer a product that looked and tasted like real meat sliced from a chicken. In September, KFC’s U.S. head, Kevin Hochman, told Bloomberg News that the goal was to replicate a tenderloin or strip piece of chicken with whole muscle fibers.

Beyond Meat and KFC said Wednesday that the plant-based chicken isn’t prepared in a vegan or vegetarian manner. Plans for the launch were first reported Tuesday afternoon by CNBC.

Beyond shares fell 5.1% on Wednesday in New York. Yum shares fell 1.3% amid declines in the U.S. stock market.

Yum’s Taco Bell chain is also working with Beyond Meat to create a plant-based protein. Taco Bell canceled an earlier planned test of a faux carne asada from Beyond Meat, according to people with direct knowledge of the matter.

Plant-based foods are resonating with consumers amid mounting concern about the environment and the welfare of animals. The biggest restaurant chains, including McDonald’s Corp., Starbucks Corp. and Restaurant Brands International Inc.’s Burger King, have partnered with Beyond Meat and Impossible Foods Inc. to offer plant-based foods in recent years.

For El Segundo, California-based Beyond Meat, pressure is rising to produce new hit products follow a steady decline in the company’s share price. The company’s earnings and revenue projection in November disappointed Wall Street and sent the stock sharply lower.

Beyond Meat and the plant-based meat category as a whole are facing a more difficult outlook, according to a note from Peter Galbo, an analyst at Bank of America, who said that it appears plant-based meat will reach far fewer American households than initially projected.

Galbo said that consumers “develop more habitual routines when using plant-based dairy” as opposed to Beyond Meat’s products, which are consumed less frequently.

Following a series of departures from its leadership ranks, Beyond Meat recently announced the addition of two former executives from Tyson Foods Inc. to oversee operations and supply chain as the maker of plant-based meat ramps up production to support expansion in both retailers and restaurants.

Updated: 1-10-2022

Ready To Eat Some Lab-Grown Meat? The FDA Will Soon Decide

The science experiment could soon reach your supermarket.

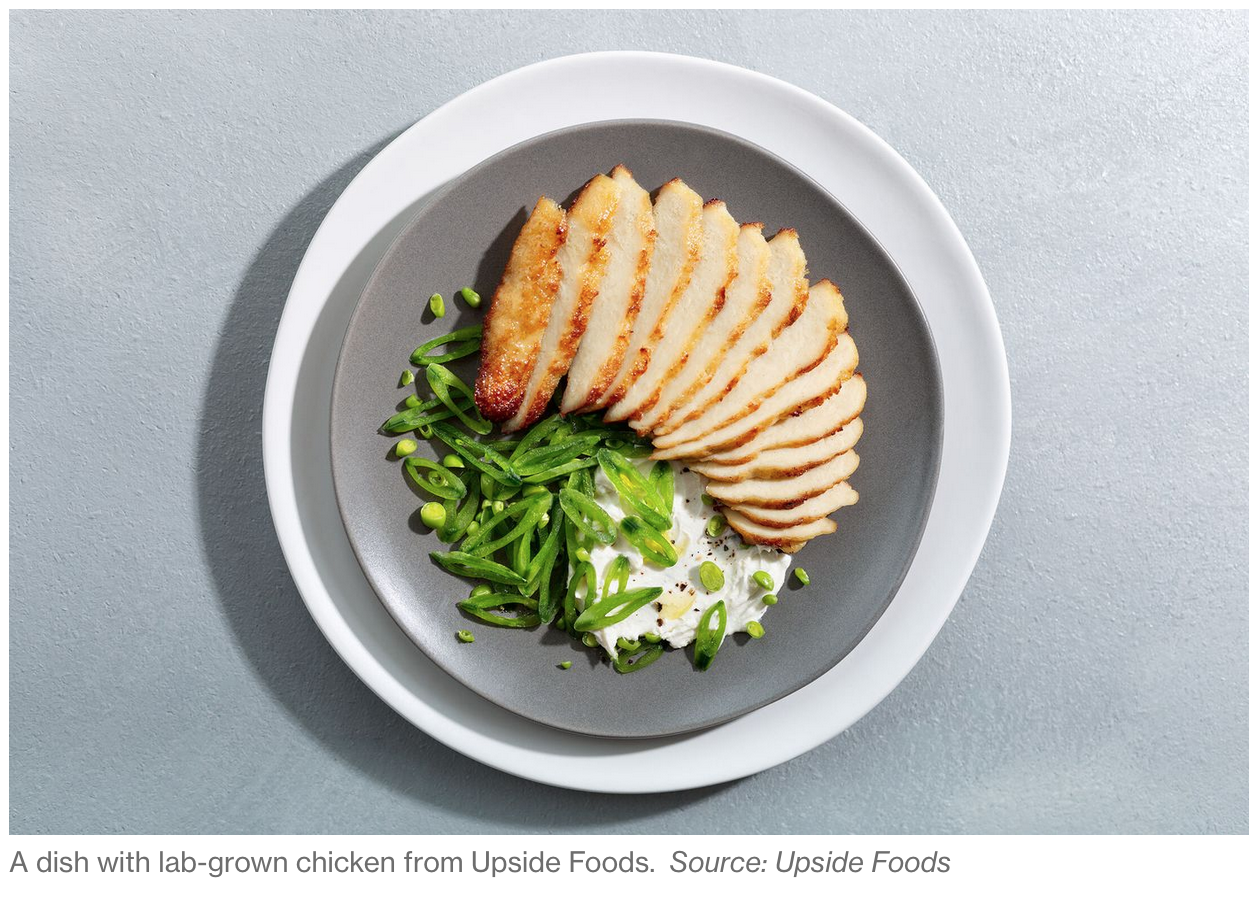

Near the end of last year, Upside Foods Inc. opened a meat processing plant like no other. Inside the $50 million facility, just outside Berkeley, Calif., workers cultivate small clumps of animal cells in large vats over two weeks, slowly growing them into chicken breasts and steaks.

No animal is slaughtered at any point in the process—the flesh is manufactured. At 53,000 square feet, the factory is the largest ever dedicated to so-called cultivated meat; the company hopes consumers will be able to buy the meat it makes sometime in 2022.

Unlike plant-based meat alternatives that have been on the market for years, cultivated meat is real meat. The techniques used to grow it are well developed; the problem for startups such as Upside is producing the meat in large quantities while achieving the smell, texture, and mouthfeel diners expect.

After seven years of work, Upside says it’s ready to pump out as much as 50,000 pounds of food from the California plant. “We want to be able to ship product from here nationally and then internationally,” says Uma Valeti, the chief executive officer and co-founder.

He says Upside can make just about any meat product, but it will focus first on things like chicken nuggets and chicken breasts and has already started production at the facility. When I tried an Upside chicken breast last year, it smelled and looked exactly like grilled chicken. It tasted like it, too, though the texture was a bit softer and less juicy.

My taste test required me to sign a waiver. Before the public gets the same chance to try it, Upside needs a green light from U.S. regulators. Both the Food and Drug Administration and the Department of Agriculture have spent three years figuring out how they’ll monitor the cultivated meat industry, visiting laboratories and examining every process companies use to make their products.

Although cultivated meat itself is considered safe, there are plenty of unanswered questions about how often the vats should be cleaned and how the meat should be transported and stored.

There’s also the question of what to name it. The agencies issued a public request for comment in November, asking interested parties to chime in on exactly what meat that’s been raised in a vat should be called.

Upside and others have pushed for “cultivated meat” instead of “synthetic meat,” “vat meat,” or other less appetizing alternatives.

Such deliberations are an encouraging sign for those hoping U.S. agencies will soon approve the products. Another potentially favorable development: The USDA recently spent $10 million to create the National Institute for Cellular Agriculture, which is meant to back research in the field and turn the U.S. into a leader in manufactured meat.

“There’s been this haggling over the regulatory framework, but these are signs that the agencies are really close,” says Chase Purdy, the author of Billion Dollar Burger: Inside Big Tech’s Race for the Future of Food.

It’s already possible to purchase some types of man-made meat. In December 2020, Singapore became the first nation to approve the sale of cultivated meat. Israel’s Aleph Farms says it will be ready with some vat-grown thin-cut steaks by yearend.

California companies such as BlueNalu Inc. and Wildtype hope to follow with seafood products, including sushi-grade fish. Meanwhile, San Francisco-based Eat Just Inc. is already selling chicken in Singapore.

According to Purdy, there’s been pushback from beef ranchers and their lobbyists about the arrival of cultured meat, though industrial processors have largely welcomed the technology.

Given the regulatory activity and the hundreds of millions of dollars already invested in American startups, the U.S. has a strong interest in becoming an early leader in the industry. “My view is that it might be a perfect storm that makes the U.S. the next country to greenlight cultured meat,” Purdy says.

Updated: 1-26-2022

Faux Lamb Aims For Piece Of Plant-Based Meat Boom

Black Sheep Foods targets upscale restaurants with its vegan “lamb.” The startup recently raised $5.25 million to expand.

At Souvla, a four-location Greek restaurant chain in San Francisco, the menu has a nearly singular focus on rotisserie meats. But in October, it added an asterisk to the popular lamb leg, alerting diners to a meatless option courtesy of local startup Black Sheep Foods.

“We have, over the years, gotten a tremendous amount of calls for vegetarian offerings,” said Charles Bililies, chief executive officer of Souvla.

The chain had experimented with faux beef, but ultimately nixed it because it didn’t work with a menu that doesn’t include cow. A lamb substitute, however, fit right in. Black Sheep’s product “captures [lamb’s] positive aromatics and flavor profiles,” Bililies said.

Black Sheep is betting there are more Souvlas out there. It recently raised $5.25 million in seed funding and is adding several notable Bay Area eateries to its customer list, including Rooh, an upscale Indian restaurant, and Ettan, a Cal-Indian eatery led by Srijith Gopinathan, the former chef at the two Michelin-starred Taj Campton Place.

Black Sheep co-founder Sunny Kumar declined to share the company’s valuation, but said he’s currently working on the next funding round with goal of raising as much as $30 million.

By starting with distribution to restaurants, the company is pursuing a similar strategy to Impossible Foods Inc., which won over fans at eateries and then expanded to grocery stores — a playbook that helped push its valuation to $7 billion last year, Bloomberg reported.

One hurdle for expansion is that lamb isn’t particularly popular in the U.S. Beef appeared on 91% of American restaurant menus in 2021, according to Datassential, while lamb showed up on only 17%.

“I’m not sure that there is a scalable market for lamb today, unless the product is so good that it overcomes other [plant-based] red meat in terms of consumer preference,” said JP Frossard, a consumer foods analyst at Rabobank.

However, the production of lamb on a per pound basis emits more greenhouse gases than beef, making it, in some ways, an obvious target to be replaced by consumers whose purchases are driven by environmental concerns.

In a category dominated by beef, pork and chicken, Black Sheep also offers some much needed variety.

The specificity of lamb gives the company a chance to be a “big fish in a small pond,” said Jennifer Bartashus, an analyst for Bloomberg Intelligence. “A startup having something unique that meets an underserved need is usually a winning formula.”

Kumar, a tech veteran who worked at cell-based seafood startup Finless Foods before starting Black Sheep in 2019, wants to be both: dominate in niche faux meats and compete with the bigger players.

“You could put us head-to-head with Impossible and Beyond Meat and, in terms of flavor, we’ll win,” he said. Black Sheep’s next product, duck nuggets, will beat the standard alt-chicken nugget, too, he said.

The company is also seeking regulatory approvals in the European Union and the U.K., where diaspora communities from the Middle East, India and North Africa heavily influence food culture and favor lamb.

For now, the company is working on scaling up in the U.S., Kumar said. That’s good news for Pujan Sarkar, chef de cuisine at Rooh, who is adding the product in San Francisco and is already talking to the company about having enough supply for his locations in New York, Chicago and Columbus, Ohio.

“I add my own spices and flavors to make it more Indian-ized,” he said, adding he had experimented with different cooking processes, like tandoor and high heat flash cooking. “There is a dimension of play with this product.”

Updated: 2-7-2022

Menus With Social Nudges, Tantalizing Words Can Spur Meatless Dining

Prompts encouraging small changes and mouth-watering descriptions of vegetables influence diners’ choices, according to new research.

Let’s talk about dinner and reducing greenhouse-gas emissions. But let’s do it carefully, because, as it turns out, picking words matters.

Since this is a climate newsletter, perhaps you are already bracing for a lecture about beef. And, yes, meat-eating is having an impact on the planet. Forests are being mowed down to make more space for grazing cattle.

Each year a single cow can belch up to 220 pounds of methane, a particularly potent greenhouse gas. The business sector is attempting to remedy the problem by creating credible alternatives, like Impossible Burgers, and even lab-grown meat.

But a new working paper from the World Resources Institute, a Washington-based nonprofit, suggests that in the short term there might be an easier way to modify behavior and reduce meat consumption: a simple prompt on a menu.

(The average American eats out several times a week, and in most years, the average family spends more than $3,000 a year on restaurant food, according to the U.S. Bureau of Labor Statistics.)

WRI asked 6,000 U.S.-based, meat-eating study participants to pick between entrees in a simulated online ordering scenario. Most participants received one of 10 prompts.

These nudged them to eat more plants or less meat, emphasizing various benefits such as improved health and a more sustainable planet. In a subsequent phase of the trial, the 10 prompts were winnowed down to five.

The most successful prompt resulted in twice as many plant-based menu orders as the unprompted control group’s: 25% as opposed to 12%. It read:

Each of us can make a positive difference to the planet. Swapping just one meat dish for a plant-based one saves greenhouse gas emissions that are equivalent to the energy used to charge your phone for two years. Your small change can make a big difference.

The suggestive power comes from two parts of the prompt, according to Edwina Hughes, head of the Cool Food Pledge at WRI, who will seek to put the findings into action. First, she said, “we know complying with social norms can be a powerful motivator.”

Social research has already demonstrated that well-timed, polite reminders of socially responsible behavior can meaningfully reduce everything from energy use to littering to towel use in hotels.

Part two, she said, was giving readers “a personal outcome they could relate to by making it an equivalent in their life. People do understand the idea of charging a phone.”

The next step will be to try the messages not just on human lab rats but on people putting money down and ordering actual dinner or lunch.

In the study, researchers also found that it helps to describe vegetables with evocative, appetite-provoking language usually reserved for meat, such as “slow roasted.” Menu readers responded to words that emphasize flavor in vegetarian options, like “caramelized” and “richly spiced.”

But Hughes says it’s important to tread lightly when categorizing meatless options. Meat eaters can be turned off when there is too much emphasis on terms like “vegetarian” or “vegan.” “Immediately, they think, ‘Oh, that’s not us, that’s not our tribe,’” she said.

So menu writers: Stick to caramelization.

Updated: 2-16-2022

Fake Meat Goes From The Main Event To Trying Out For The Ingredient Team

After growth flatlined in supermarkets last year, plant-based substitutes are appearing in new places. Ravioli, anybody?

For several years, faux meat has come to U.S. grocery stores mainly in the form of burgers and sausage links, often in the coveted refrigerated case right next to the real thing.

The arrival of patties from Beyond Meat Inc., Impossible Foods Inc., and a long list of competitors large and small at first translated into unceasing media attention and massive growth. But the continued hunger for fresh faux meat is proving to be unsustainable.

After surging 53% to $473 million in 2020, sales of plant-based meats in the meat departments of grocery stores increased only 1% in 2021, according to consumer products analytics firm IRI Worldwide.

Whether that was a result of people returning to eating at restaurants or the fading novelty of meat substitutes, the result is that makers of faux meats may have to accept a future where their plant-based products may not be the main attraction on as many consumers’ plates.

So manufacturers are looking beyond the meat case. Impossible’s beef substitute is now in Buitoni ravioli, while you’ll find Beyond Meat’s sausage on Banza pizza. There’s a frozen, microwaveable breakfast sandwich made with Field Roast’s faux sausage underneath plant-based eggs from Eat Just Inc. and Chao Creamery vegan cheese.

Nestlé SA’s fake-meat line, Sweet Earth, tops pizzas not only under its own brand but also as an ingredient for the company’s DiGiorno and California Pizza Kitchen lines.

“We see lots of opportunities for that kind of collaboration,” says Dennis Woodside, president of Impossible Foods, about the arrangement with Buitoni. His targets include sauces, prepared meals, and the “entire frozen aisle,” he says.

Impossible is still working to create innovative products through technological developments, like its continuing efforts to mimic a whole chicken breast, Woodside says. In the meantime, adding faux ground beef into pasta is easier.

“We’ve been pursuing growth by expanding ground products into every part of the supermarket,” he says. That’s in part because, as he says, “lots of people still haven’t heard of Impossible.”

The industry has discovered that even as Americans spend more time at home in the post-pandemic era, making a meal can still be a pain. For others, especially younger consumers gravitating toward the category, the idea of cooking from scratch with a new ingredient such as pea-based protein may be intimidating.

Instead, supplying ingredients for other brands’ ready-to-eat meals lets plant-based companies benefit from the trust of labels already familiar to shoppers.

Faux meat’s boom in 2020 was the result of a confluence of trends, says Jonna Parker, an IRI fresh food specialist. Increased grocery store distribution had already been planned before the pandemic, so makers were well-positioned for the hoarding that ensued at the start of Covid.

The shortages of traditional ground-meat products, she says, even led unlikely consumers to try plant-based products.

Last year’s minuscule growth wasn’t unexpected after 2020’s torrid pace, Parker says. But she adds that the slump was also attributable, in part, to lots of shoppers who’d made their first purchases but not a second or third:

Only half of consumers who bought a plant-based meat came back for more. That was partly because there were simply too many products, she says, and not all were good.

It’s time for plant-based meat makers to “diversify away from the kids’ menu,” says JP Frossard, a consumer-foods analyst at Rabobank. “There is a limit for the amount of burgers we eat.”

The frozen section, offering broad food variety and convenience, is one of the “pandemic winners,” he says, making it a prime target for plant-based companies.

Sales are exceeding expectations for the sandwich made with Field Roast “sausage,” Eat Just “egg,” and Chao “cheese,” says Dan Curtin, former president of Greenleaf Foods SPC, which owns the Field Roast and Chao brands.

And David Yeung, CEO of Hong Kong-based social venture Green Monday, says selling ready-to-eat foods, especially those made with recognizable partners, has paid off in Asia.

His vegan OmniPork label formed a partnership with well-known frozen food brand Amoy to sell a faux-pork dumpling in China and Hong Kong.

“It can trigger another demographic that may not be directly, consciously thinking about plant-based products to try,” Yeung says. “It definitely expands the appeal and reach of plant-based products. Both brands can enlarge their audience base.”

For Thrive Market Inc., an online seller of natural and organic products, its branded frozen meals made with Beyond Meat ingredients are “at the top of our category,” says Jeremiah McElwee, Thrive’s chief merchandising officer.

“They’re opening up a new audience of more and more flexitarians and omnivores who want to eat more plant-based.”

This shift toward ingredient status doesn’t necessarily mean a bright future for all the startups that have crowded into faux meats, says Michele Simon, an industry consultant and founder of the Plant Based Foods Association. “To me, it’s an indicator of the coming commodification of these products,” she says.

Large traditional meat companies now have plant-based divisions, and they’re likely to undercut the plant-based upstarts on price.

“At some point,” she says, “Tyson’s going to come along and say, ‘We can sell you a very similar sausage crumble for half the price.’ ”

Updated: 4-15-2022

Moonburger Wants To Bring Its Plant-Based Burger To The Masses

The tiny Upstate New York burger shack is keeping things simple and meat-free with some help from chef-y friends including author Alison Roman.

During the summer of 2020, Jeremy Robinson-Leon, 36, quit his job in New York City. The former president of Group Gordon, a communications firm, then decided to ride out the pandemic at a log cabin he bought in upstate New York in 2015 and concentrated on plotting his next move while hiking and brewing kombucha.

A trip to the grocery store, an Impossible Foods versus Beyond Meat burger cookoff and a subsequent text chain with food-loving friends about the results (Impossible prevailed) ultimately helped Robinson-Leon focus his mission in January 2021.

“I wanted to figure out if we could build a plant-based, fast-food concept for the mainstream,” he says.

In October 2021, Robinson-Leon opened Moonburger, a meatless, fast-food drive-through just off I-87 on the Western edge of exurban Kingston, New York.

Since its inception in 2011, privately held Impossible Foods has raised $2.1 billion with a recent $500 million round of fundraising closing last November. Their products are sold in nearly 40,000 restaurants around the world.

Beyond Meat has been traded publicly since May 2019 and continues to expand its relationship with restaurants, growing its footprint there by 35 percent in Q4 of 2021, according to a recent Wall Street Journal story.

Moonburger, which is drive-through only and doesn’t offer seating, isn’t the first business to serve plant-based burgers in a fast-food style.

Burger King sells an Impossible Whopper; White Castle makes an Impossible Slider; McDonald’s , in partnership with Beyond Meat, has introduced the McPlant. But Moonburger is aimed at meat eaters who want a great burger in any form and those who want to help the environment in a decidedly non-preachy way.

Robinson-Leon sets Moonburger apart from an ever-growing field of plant-based competitors by keeping his menu edit tight and his display copy free of terms he feels are polarizing—environmentalism, vegetarianism, veganism—that can play politically or turn off a carnivorous crowd.

Moonburger is built to appeal to the majority. “My belief in creating this,” says Robinson-Leon, “is to reach people who love meat.”

Other plant-based upstarts have taken a broad approach to their menus and have gained traction in doing so. Atlanta’s Slutty Vegan, soon to open its first Brooklyn location, sells 12 main menu items including the Hollywood Hooker, a vegan cheesesteak, and the Ménage à Trois, a plant-based patty with vegan bacon, vegan shrimp and vegan cheese.

National chain PLNT Burger and Los Angeles’s Honeybee Burger also serve sprawling menus.

“All the great burger places have stuck to a small, simple menu—doing one thing and doing it well,” says bestselling cookbook author and CNN+ host Alison Roman, one of Moonburger’s culinary advisors and a minority stakeholder. Moonburger’s menu sticks to the basics: a burger and a cheeseburger, fries and spicy fries with optional cheese sauce, and shakes.

Cheeseburgers are made with American cheese. “We use dairy,” Robinson-Leon says, but Moonburger also offers dairy-free cheese for those who would prefer it.

Robinson-Leon’s experience with messaging comes from his career at Group Gordon, a New York–based public relations and strategic communications firm founded by Michael Gordon.

Robinson-Leon started at Group Gordon at the entry level upon graduating from Vassar in 2007. He departed the firm in July 2020, as its president.

Robinson-Leon began looking for real estate for Moonburger’s pilot location, eyeing Kingston’s erstwhile Ice Cream Castle with its medieval facade and sprinkle-cone turret. He then tapped several friends with cooking, media and hospitality-operating backgrounds to serve as culinary advisors in return for a small piece of equity.

Anoop Pillarisetti brought expertise from managerial stints at Momofuku and Shake Shack, for whom Robinson-Leon also worked while employed at Group Gordon. Amiel Stanek lived in nearby Hudson, New York, and had been a cook and an editor at Bon Appétit.

One morning, Robinson-Leon and the third member of his culinary development team, Roman, were in his home kitchen working on a prototype Impossible smash burger during a snowstorm when they looked out the window and spotted, at close range, a large owl staring right at them.

Robinson-Leon quickly googled what’s significant about owl encounters and learned that they symbolize major life changes.

“That’s when I called up the real estate agent and put in the offer,” he says.

In 2021, Robinson-Leon closed on the 868-square-foot former ice cream shop for $245,000. He spent the better part of last year turning faux-regal kitsch into a ready-for-Instagram fast-food destination that would open in October.

Inspired by his former client, Shake Shack, which launched as a pop-up hot dog cart in New York City’s Madison Square Park in 2001 and is now a publicly traded company with $1.1 billion in annual sales and nearly 400 locations across the globe, Robinson-Leon built out his flagship to make an immediate visual impact.

Like Shake Shack’s urban kiosk, designed by James Wines, Moonburger’s architecture takes cues from the early American hamburger stands of the 1950s, celebrating the era’s newfound freedom of the open road.

Designed by Brooklyn’s Home Studios, Moonburger’s bifurcated exterior layers corrugated steel atop stained-pine siding.

Across the metal, an 18-foot-long, Maraschino cherry–colored rendering of the word Moonburger is spelled out in a custom font. The 25-by-20-foot facade attempts to signal not meatlessness, but imagination and possibility.

One recent afternoon in the Moonburger kitchen, Robinson-Leon, in Timberlands and a camouflage baseball cap, spells out what makes a Moonburger: a patty of Impossible’s ground beef facsimile hits the grill, slices of fresh Vidalia onion are dropped on top and smashed into the patty with a spatula. The flattened burger is flipped; its edges get lacey and crisp.

Then, that real cheese. French’s Crispy Fried Onions are toasted and used as burger toppings, as are sliced Vlasic pickles and leaves of lettuce. The standard bun is a Martin’s potato roll, but they also offer gluten- and dairy-free options.

Sir Kensington’s vegan mayo, Heinz ketchup, Maille dijon mustard and chopped sweet banana peppers comprise Moonburger’s secret sauce, which Roman says is mustard-forward because of her own distaste for ketchup and mayo.

The small stand will often have hundreds of guests come through its drive-through daily. “One thing that is inherent in PR is you are always communicating what someone else is doing,” he says. ”And I was really eager to do the doing.”

Updated: 4-21-2022

Lab-Grown Meat Producer Upside Foods Raises $400 Million

Abu Dhabi Growth Fund and Baillie Gifford are among Series C investors as cultivated-meat producers seek U.S. regulatory approval.

Upside Foods has privately raised $400 million from investors including the Abu Dhabi Growth Fund and Scottish fund manager Baillie Gifford, company officials said, a vote of confidence that Upside’s lab-grown meat can gain regulatory approval and be sold to U.S. consumers.

Formerly called Memphis Meats, Upside is one of several startups attempting to produce edible meat in a lab using animal cells cultivated in large brewery-like facilities. Upside hasn’t sold products to the public but expects to sell chicken after U.S. regulatory approval. The company also has made beef, pork and duck products.

So-called cultured meat is one of two fast-growing alternatives to meat produced by traditionally farmed animals, the other being plant-based products.

Proponents say lab-grown meat could reduce the need for animal antibiotics and help decarbonize the food industry by reducing land and water usage as well as emissions. It could also eventually cut the time it takes to produce meat products and simplify supply chains, they say.

Still, the products have so far only been approved to sell to consumers in Singapore and cost much more than meat produced by killing animals.

The Series C fundraising round is one of the largest ever in the nascent cultured-meat industry’s history and values Berkeley, Calif.-based Upside at more than $1 billion, the company said. The round was co-led by the government-owned Abu Dhabi Growth Fund and existing investor Temasek Holdings Ltd., a Singaporean government investment firm.

Tyson Foods Inc., Cargill Inc. and other existing investors including Microsoft Corp. co-founder Bill Gates and Japanese conglomerate SoftBank Group Corp. also participated. The company raised $161 million in a Series B financing in 2020.

Founded in 2015, Upside hopes its products will be approved by U.S. regulators for sales to consumers by the end of this year and plans to use the money to scale its commercial production facility, CEO Uma Valeti said.

“The field is moving from proving viability to going toward scalability,” he said. Upside Foods has been working with U.S. regulators for more than four years and would consider selling in other major countries if they approve cultivated meat products more quickly, he said.

Several other cultured-meat startups have raised large sums recently. Companies in the industry raked in more than $2.2 billion in private capital last year, more than triple the figure from the previous year, according to PitchBook.

Good Meat, a division of plant-based egg-alternative maker Eat Just Inc., raised $267 million last year and is selling its chicken products in Singapore. Cargill and other investors put more than $100 million into Israel-based lab-grown beef maker Aleph Farms last summer.

Another barrier for the startups is educating consumers, who currently have a number of plant-based meat alternatives to choose from. Executives in the cultured-meat industry say they will have an advantage because many consumers still prefer animal protein to plant-based options.

Mr. Valeti said some of the money raised will be used to bolster the company’s consumer-education programs so Upside is prepared if regulatory approval comes. In 2018, the Food and Drug Administration and the U.S. Department of Agriculture agreed to share oversight of meat grown from animal cells.

Updated: 4-28-2022

Leonardo DiCaprio Joins Lewis Hamilton’s Vegan Burger Empire

The new strategic investor in Neat Food Co. is helping fuel global expansion.

The plant-based food brand Neat Food Co. backed by Lewis Hamilton is expanding to open its first brick-and-mortar spot in the U.S. before the end of the year. On Thursday, April 28, the company announced the start of a $30 million Series B fundraise to fuel growth.

Neat is also adding another high-profile name to its list of supporters: Environmentally minded actor Leonardo DiCaprio has joined the group as a strategic investor.

“Disrupting our food system with sustainable alternatives is one of the key ways we can make a real difference in reducing global emissions,” DiCaprio said in a statement. “Neat Burger’s pioneering approach to alternative proteins is a great example of the type of solutions we need moving forward.”

Neat was launched in 2019 by the Formula 1 champion Hamilton and Tommaso Chiabra, an early investor in Beyond Meat. It currently has eight locations in London, but the plan is to have 12 locations in the U.S., a mix of storefronts and ghost kitchens, by the end of 2022.

The flagship will be a brick-and-mortar spot set to open in New York City this year: The company is scouting spaces in SoHo, Bryant Park, and Midtown Manhattan. In total, Neat expects to be operating 42 locations worldwide, including in the Middle East and Italy, by the end of the year.

The company’s most recent valuation is $100 million, based in part on a $7 million round led by Rajeev Misra, chief executive officer of SoftBank Investment Advisers.

“Our focus this year is on entering the New York market and establishing ourselves within the local community before expanding via our hybrid model of online and offline restaurants to other regions such as Miami, Austin, and L.A. next year,” said co-founder and Chairman Chiabra by email.

He said Neat is treating the United States as its primary market, targeting operations in 1,000 North American locations by 2030.

Last year, plant-based food retail sales grew three times faster than total food retail sales, hitting a record U.S. high of $7.4 billion. The global plant-based food market is expected to reach $162 billion in the next decade, according to a 2021 report by Bloomberg Intelligence.

In addition to its restaurant expansion, Neat plans to launch consumer packaged-good products (CPG) across the country in the next 12 months, including its plant-based chicken patty and hot dogs.

Neat initially used Beyond Meat for such options as the double-patty smash burger smothered with plant-based cheese, mustard, and house sauces, which goes for $12 at the recently opened Neat pop-up in UrbanSpace in Midtown Manhattan. The company has switched to a proprietary blend.

A recent taste test showed a burger that will not necessarily convert carnivores; it has the chewy texture of many a nondescript vegan patty, although the plant-based yellow cheese spilling over the sides is tantalizing, and so is a side of the fully loaded ‘nasty’ tater tots.

What is especially noteworthy is Neat’s chick’n burger ($12). Its faux poultry is surprisingly good, featuring a satisfying meaty bite dressed with vegan mayo within a well-griddled bun. It’s a good option for anyone still engaged in the fried chicken sandwich wars.

Updated: 5-6-2019

Beyond Meat Ceo Wants To Make Traditional Protein From Animals ‘Obsolete’

Beyond Meat shares jumped in Friday trading after soaring 163% on Thursday for the biggest U.S. IPO since 2000.

Beyond Meat Inc.’s Chief Executive Ethan Brown has a lofty goal for his plant-based meat product: he wants to replace traditional animal meat entirely.

“We want to make the existing product on the shelves obsolete,” Brown told MarketWatch after the company’s IPO.

Beyond Meat aims to “separate meat from animals” and position the newly-public business as a global protein company.

Beyond Meat shares priced at $25 on Wednesday and began trading Thursday on the Nasdaq at $46. Prices neared $73 at their intraday peak. Beyond Meat closed at $65.75 Wednesday.

Brown says there are four factors that are driving consumers to Beyond Meat: health, climate (such as worries about emissions), environment (such as sustainability) and animal welfare.

For those ages 40 and older, Brown says the health implications are the biggest reason consumers are making the transition. For millennials, who are driving increased vegetarian, vegan and plant-based dining, the environment is the biggest reason.

“It’s ubiquitous on social media,” Brown said. “It’s not foreign to them to get ‘meat’ from plants.”

Beyond Meat faces competition from companies like Boca Foods, Gardein and Morningstar Farms. And there are plant-based meal kits like Purple Carrot, which got a $4 million investment from Fresh Del Monte Produce Inc. in May.

Increased interest from diners is also driving more plant-based and vegetarian options to fast-food chains that are best-known for beef burgers. Burger King, part of the Restaurant Brands Inc. portfolio, just announced that it will be taking the meatless Impossible Whopper national later this year after successful pilot testing. And major food companies like Conagra Brands Inc. are adding choices for those with alternative dining preferences, including vegan and plant-based.

Meat producers Tyson Foods Inc. are also looking at different ways of creating protein, like “recycled” crisps and meat produced in a lab.

“With 60% of U.S. consumers telling NPD they want to get more protein in their diets, consumers are mixing both meat and plant-based proteins into their diets,” wrote NPD Group in a June 2018 report. At that time, 14% of U.S. consumers, or 43 million people, said they regularly used almond milk, tofu, and other plant-based alternatives.

Now that Beyond Meat is public, Brown said the company will focus on its Go Beyond campaign, which currently features basketball star Chris Paul as an ambassador.

“We sought to go public slightly earlier, but the government shutdown, markets and life just got in the way,” Brown said. “Now this is the right step for us.”

Beyond Meat shares are up 4.4% in Friday trading. The S&P 500 index SPX, +0.89% is up 1% in Friday trading, and has rallied 17.5% for the year to date.

Updated: 5-14-2022

A Former Steakhouse Chef Wants To Beat Beyond Meat At Plant-Based Food

A 12,000-year-old preservation technique lies at the center of his secret sauce.

The founder of a London steakhouse is an unlikely entrepreneur in plant-based foods. But Neil Rankin, co-founder of acclaimed BBQ restaurant Temper in London’s Soho, says the meat alternatives out there simply aren’t good enough.

His list of complaints begins with meatless protein maker Beyond Meat, which he says, is good at capturing the “texture and look” of meat, but ultimately the company makes food that’s so far unprofitable to make and sell. Quorn, the original meat substitute, is “clever and sustainable,” but “tasteless,” he says.

In 2020 the outspoken chef, now 45, thought he could do better and started plant-based food company Symplicity Foods.

His aim is to make plant-based food so delicious that even die-hard meat eaters will want to choose his burgers over beef.

With the help of fermentation, a unique recipe and the pandemic lockdown, he thinks he’s pulled it off. He says his food is “like a McDonalds health food. But better.”

The start of Rankin’s meat-to-plant conversion began with experiments in fermentation, a 12,000-year-old preservation technique, using vegetables in a glass jar at home, which he then pressed and minced into burger patties. Six months spent perfecting the recipe led to a pop-up plant-based burger spot in Brick Lane, which proved the concept.

Today Symplicity Foods’ home is a factory in Harlesden, West London, but the recipe today is the same as the one made in his kitchen. The “meat” is made from mushrooms grown in caves in the UK, Poland and France that are mixed with onions, beetroot and a barley miso, which are then cooked and fermented for 10 days.

Next it’s pressed, minced, mixed with spices, formed into sausages, burger patties or schnitzels, steamed, frozen and packed off to London restaurants. The leftover juice from the fermentation is turned into gravy or a flavor enhancer which can be sold on.

The pandemic and lockdown accelerated the idea last year. He teamed up with Mark Wogan, co-founder of Homeslice Pizza, who offered a shuttered restaurant for Rankin to develop the idea further and expand production.

Before long he’d signed up Bleecker Burger and Dishoom as customers, with make-at-home kits using his plant-based sausages getting rave reviews on Twitter. The next big customer is Soho House, which wanted a vegan schnitzel.

Rankin and his partners are bidding for contracts worth hundreds of millions of pounds, and he has huge airline food contracts in his sights.

But Is It Any Good?

We tried the Soho House schnitzel, Dishoom sausage naan and Bleecker burger, which Rankin fried up on an electric grill with a bit of oil and salt in a tasting room above the factory. The burger patty has the texture of a high quality fried beef burger, but with a salty, savory kick reminiscent of marmite, which mostly comes from the barley miso.

Most miso is made in Japan by fermenting soybeans, but Rankin has already found a supplier who will make it in the UK with barley, reducing the carbon impact of shipping.

Eventually, Rankin hopes to combine the cost- and carbon-saving benefits of using UK miso with food waste from supermarkets. “You can make miso with bread,” which UK supermarkets happen to have plenty of, often unsold and unsellable at the end of the day.

If he can pull it off, Rankin wants Symplicity Foods’ supply chain to be as clean as his factory’s worktops, where he can “look down the line and see that it’s sustainable from start to finish.

I want to know where my mushrooms come from, I want to know where my tomatoes come from.” Then, one day in the future, maybe customers won’t mind knowing how the sausage is made.

Updated: 5-28-2021

Beyond Meat Goes Public With A Bang: 5 Things To Know About The Plant-Based Meat Maker

Beyond Meat has a surprising number of competitors and plans to expand around the globe.

Beyond Meat Inc., the company created by vegan Ethan Brown in 2009, raised nearly a quarter of a billion dollars to grow its line of plant-based meats, with shares rocketing in their public debut.

The maker of the Beyond Burger, which is sold at Whole Foods and restaurant chain TGIF, among others, priced its initial public offering at $25 a share Wednesday evening, raising at least $240 million at a valuation slightly shy of $1.5 billion.

Beyond Meat priced the IPO at the top of a range that it had already increased during the process. The company said in a regulatory filing Tuesday that it planned to offer 9.5 million shares priced at $23 to $25 each, updating the original plan to offer 8.75 million shares priced at $19 to $21 each.

In the end, it sold 9.63 million shares, with underwriters holding the option to sell another 1.44 million shares in case of over-allotment. The stock began trading Thursday on the Nasdaq exchange under the ticker symbol “BYND.”

The first trade for the stock was $46 at $12:18 p.m. Eastern on Thursday, which was 84% above the IPO price. It extended gains to close its first day at $65.75, or 163% above its IPO price, making it the best performing first-day IPO in nearly two decades.

Goldman Sachs, JPMorgan and Credit Suisse are lead underwriters on the deal, with BofA Merrill Lynch, Jefferies and William Blair acting as co-managers. The company also makes plant-based pork and poultry products.

Proceeds of the deal will be used to expand current manufacturing facilities and open new ones, to finance research and development and to boost sales and marketing, along with the catchall “general corporate purposes,” according to the prospectus.

“As a young adult, I enjoyed a career in clean energy but continued to wrestle with a question born of these early days: do we need animals to produce meat?” asks Brown, who is chief executive as well as founder of Beyond Meat, in a letter included in the prospectus.

The letter explains how Brown set out to understand the history of human consumption of meat, acknowledging that it helped spur the increase in brain size that allowed our ancestors to become hunters, not scavengers, and led to the development of agriculture.

But the toll taken on human health, the environment, natural resources and animal welfare is a high one, he says, listing as examples of unintended consequences such illnesses as cancer, heart disease and diabetes.

“Livestock emerged as a major contributor of greenhouse gas emissions, with related burdens on land, energy, and water,” says the letter.

Brown argues that humans do not need to fully abandon meat, but to change the definition to one that considers composition and structure — amino acids, lipids, trace minerals, vitamins and water.

Those core elements are not exclusive to animals, but exist in the plant kingdom too, he says.

“The animal serves as a bioreactor, consuming vegetation and water and using their digestive and muscular system to organize these inputs into what has traditionally been called meat,” he writes

“At Beyond Meat, we take these constituent parts directly from plants, and together with water, organize them following the basic architecture of animal-based meat. We bypass the animal, agriculture’s greatest bottleneck.”

Beyond Meat’s strategy is to place its products in the meat case at its grocery partners with the aim of persuading meat lovers to try it out. The company does not try to market to vegans and vegetarians, who account for less than 5% of the U.S. population. The Beyond Burger is now available at about 11,000 of its 17,000 grocery-store customers in the U.S., says the prospectus.

It is also available at Canadian fast-food restaurant chain A&W.

Updated: 10-11-2021

How Air-Munching Microbes Could Grow The Fake Meat Of The Future

Startups are developing ways to produce meat substitutes from thin air.

Related:

Hey, Elon: We Made A $6 Billion Plan To End World Hunger

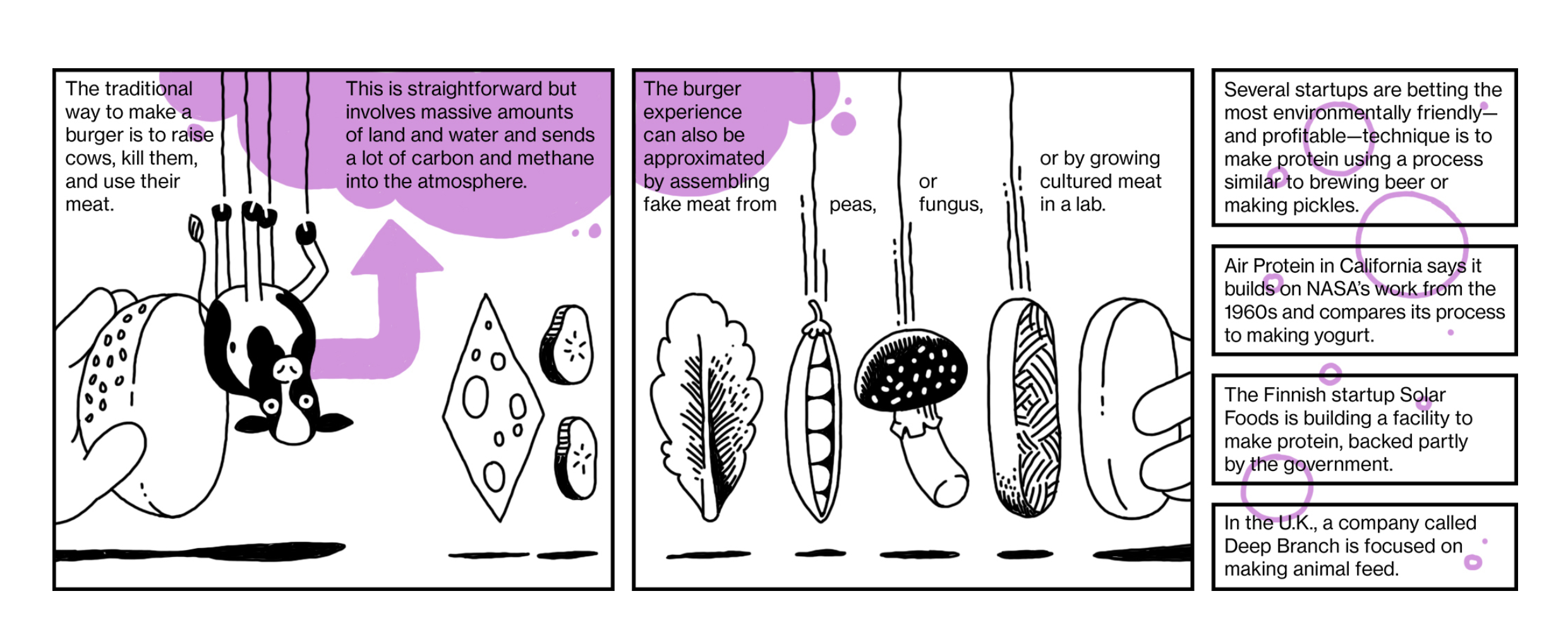

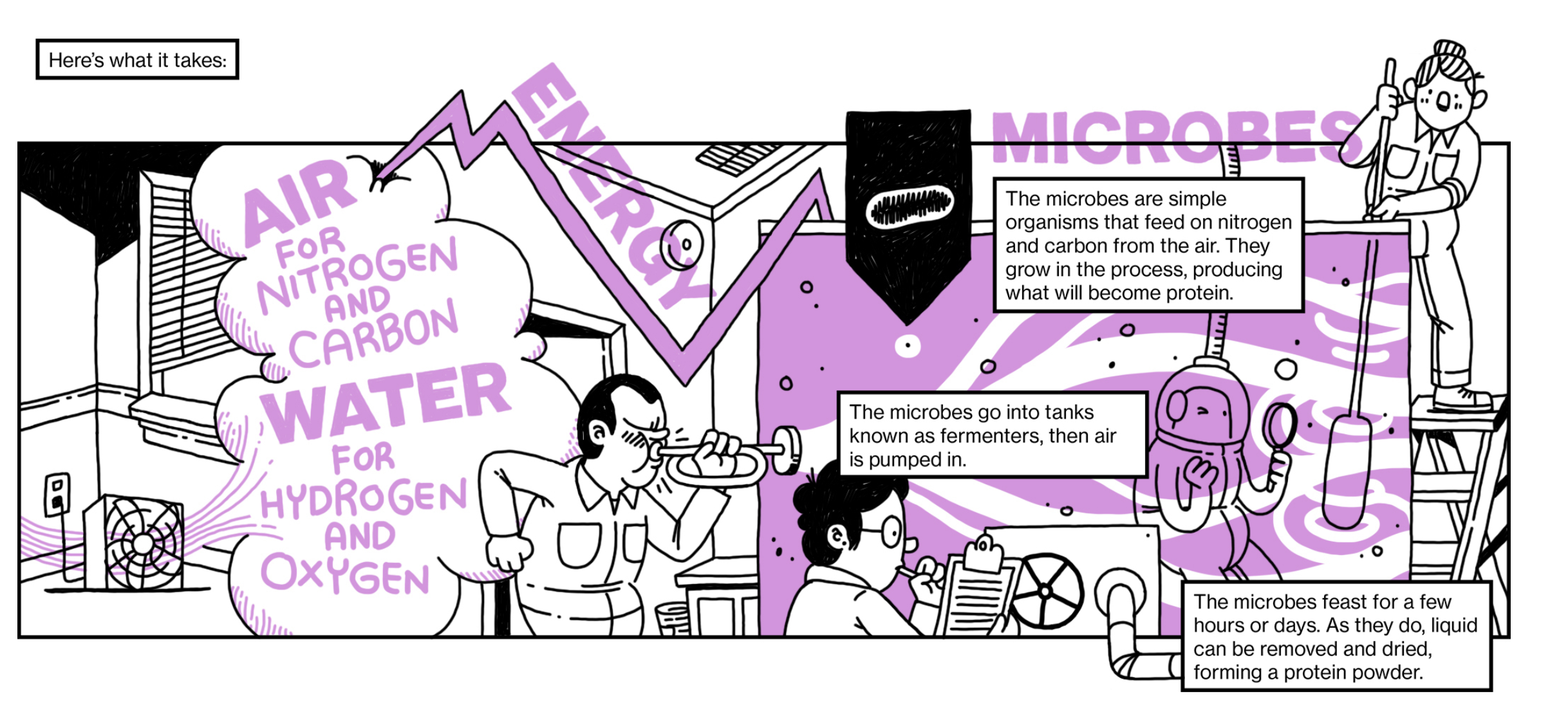

Conventional meat production takes a heavy environmental toll, which has inspired a search for alternative methods to satisfy a growing population’s need for protein while limiting land and water use and carbon emissions. Some of the more interesting experiments, from startups like Air Protein, Solar Foods, and Deep Branch, are based on fermentation. The companies working on this technology are still in early stages, but if they succeed, agriculture will look a lot different in the coming decades than it ever has before.

Updated: 11-4-2021

Faux-Meat Products Are Losing Their Sizzle For Canada’s Maple Leaf Foods

Faux meat seems have lost its sizzle for Maple Leaf Foods Inc.

The company is reviewing its strategy of expanding into plant-based foods after seeing cooling demand for such products, Canada’s largest food processor said Thursday in its quarterly earnings statement.

“We are seeing a marked slowdown in the plant-based protein category performance, which may suggest systemic change in the extremely high growth rates expected by the industry,” CEO Michael McCain said in the statement.

Maple Leaf said it doesn’t expect to meet sales growth targets for its plant-protein group for the second half after third-quarter sales in the division fell 6.6% from a year earlier. Meat sales, in comparison, jumped more than 13%. The company entered the faux-meat fray about four years ago, joining Tyson Foods Inc. and others in offering plant-based meat substitutes. Maple Leaf’s plant protein unit accounted for about 4% of sales this year.

In 2019, the Mississauga, Ontario-based processor articulated its goal of achieving C$3 billion ($2.4 billion) in sales in its plant-protein group by 2029 based on a market size of about C$25 billion.

“We have always been prepared to re-examine that investment thesis if circumstances change,” McCain said. “Given current category performance, such a review is underway, which will either affirm or adjust our strategies and investment thesis going forward.”

Maple Leaf’s review comes after Beyond Meat Inc. reduced its revenue guidance for the third quarter, citing a decline in retail orders. Major meat companies invested in plant-based protein as consumer demand rose amid concerns about the environmental impact of the livestock industry, animal welfare and maintaining a healthy diet.

Updated: 7-21-2022

The AI Platform Behind A Bezos-Backed Startup’s Vegan Burgers

Technology is helping Chilean plant-based food producer NotCo tweak its recipes to avert supply chain woes.

Not Company SpA has concocted some innovative recipes for its meat and dairy alternatives, with the assistance of an artificial intelligence platform named Giuseppe. Among the ingredients in NotMilk—NotCo’s plant-based milk—are pineapple juice, cabbage juice, and pea protein.

Its NotBurger contains beet juice powder, pea and rice proteins, bamboo fiber, and chia protein concentrate. But Giuseppe’s work is never done, and the war in Ukraine is disrupting supplies of a key component in both products: sunflower oil.

Food scientists at the startup in Santiago have asked Giuseppe to find a replacement that can mimic the neutral flavor and other prized traits of sunflower oil, an ingredient in more than one-third of all plant-based burgers, nuggets, sausages, and other meat alternatives, according to the Good Food Institute.

The stand-in could include a combination of different kinds of fats, but not unsustainable palm oil, says Matías Muchnick, the company’s 33-year-old co-founder and chief executive officer. “What NotCo is trying to do is offer a solution to the entire industry,” he says.

The AI platform, which has previously made recipe adaptations to enable NotCo to cope with a shortage of pea protein, gives the company an edge as the growing industry grapples with constraints. More than 800 factories will be needed globally to meet plant-based protein demand by 2030, with construction and operating costs to top $27 billion, according to GFI estimates.

“We need to be doing these things yesterday, being able to look through the supply chain and figure out what bottlenecks might be happening,” says Priera Panescu, a plant-based specialist at GFI. “This type of technology can help out with that a lot.”

Backed by investors including billionaire Jeff Bezos, restaurateur Danny Meyer, and world champion Formula One driver Lewis Hamilton, NotCo was valued at $1.5 billion after a funding round in July 2021. It has partnerships with Burger King, Shake Shack, and Starbucks, and it will soon introduce a joint venture with the Kraft Heinz Co. to develop plant-based, co-branded products.

Since it was founded in 2015, NotCo has expanded throughout much of Latin America, as well as Australia, Canada, and the US.

This year it’s planning to release products in Asia and Europe. In Chile, NotCo has captured a 5% share of the market for all burgers, according to the company.

NotCo’s goal is to create sustainable food products efficiently. “When you take the animal out of the equation and you replace it with plants, everything gets way more efficient, exponentially,” Muchnick says.

Giuseppe has a vast database that allows it to produce a formula to make a plant-based version of an animal product, considering things like texture, flavor, color, and nutritional profile, says Chief Technology Officer and co-founder Karim Pichara. “All those problems need help from AI because without it, it could take years to come up with that formula.”

Beyond Meat’s Pepperoni Problem Threatens Its Fast-Food Future

More than a year into a major partnership with the parent company of Pizza Hut, the alt-meat company is struggling to deliver new products.

In February 2021, Beyond Meat Inc. promised to bring fake meat to Pizza Hut, KFC and Taco Bell. More than a year and millions of dollars later, none of the restaurants has permanently added a faux-meat menu item in the US, leaving Beyond struggling to expand past its flagship burgers and sausages.

No product may be more emblematic of the El Segundo, California-based company’s current challenges than Beyond Pepperoni. Spicy, sliced pork is the most popular topping in the $46 billion US pizza business, and the alt-meat maker spent more than a year trying to nail a vegan version of it, but was plagued by production setbacks.

In the meantime, competitors like Hormel Foods Corp. and Maple Leaf Foods Inc. started offering their own vegan pepperonis at smaller chains.

The pepperoni problem is one of several issues in Beyond’s deal with Yum! Brands Inc., which has about 54,000 restaurants worldwide. KFC’s chicken-nugget rollout was delayed and then short on product. Taco Bell has yet to test Beyond’s “carne asada” in a single restaurant after the fast-food chain was dissatisfied with samples.

The partnership is Beyond’s most high-profile collaboration aside from a partnership with McDonald’s Corp. to sell a meat-free McPlant burger. Sales for the McDonald’s test have been “disappointing,” according to BTIG LLC analyst Peter Saleh.

This is a critical time for Beyond, which went public in 2019 to much fanfare and a soaring stock price. At the time, it was seen as a first mover in the fake-burger category, but it has since lagged behind its peers in the next frontier of meatless proteins — fake chicken.

Before a rally that started in early July, the 13-year-old company’s stock spent several weeks trading close to its $25 IPO price. It closed Wednesday at $37.17.

“I don’t really understand their strategy right now,” said Arun Sundaram, an analyst at CFRA. “They’re saying they have a vision where they’re introducing all kinds of plant-based meat products, but they don’t have the experience of scaling any individual product with the end goal of sustaining profits and cash flow.”

The most recent setbacks highlight a recurring issue, according to conversations with 19 current and former employees of Beyond Meat and a review of internal documents, photos and communications.

Beyond has a history of showing products to customers without a capital-efficient approach or the technical know-how to commercialize them, said the current and former employees, who asked not to be named discussing private company information.

Beyond Meat and Yum declined to make executives available for interviews.

“We work hand in hand with Yum! Brands to create best-in-class products to serve their customers and strongly refute any claims to the contrary. Beyond Meat’s global strategic partnership with Yum! Brands has resulted in the development of innovative plant-based proteins for KFC, Pizza Hut and Taco Bell, and we continue to work with them on exciting new opportunities,” a Beyond Meat spokesperson told Bloomberg.

“Yum! Brands values our global strategic partnership with Beyond Meat that’s focused on co-creating and offering innovative and delicious plant-based menu items,” Yum said in a statement.

First the chubs were made in Beyond’s Pennsylvania plant, then they were flown to its European manufacturing facility

Pepperoni Production

In August 2021, Beyond ran a small test of its pepperoni in fewer than 70 of Pizza Hut’s approximately 6,700 US locations. But in the months leading up to the test, the company kept hitting speed bumps, according to descriptions from eight of the current and former employees who spoke with Bloomberg.

Assembling the pepperoni involves multiple steps, first to form cylindrical, salami-like links known as chubs; these then have to be cooked and sliced. Beyond took an unconventional approach to this process for the August test: First the chubs were made in Beyond’s Pennsylvania plant, then they were flown to its European manufacturing facility for slicing, then brought back stateside for Pizza Huts.

Both before and after that test, according to seven of the current and former employees, there were ongoing disagreements over the order of cooking and slicing.

Flying a partially finished product from the US to Europe for completion and then back again is “unusual for a company of that stature,” said Sunil Pande, a veteran food executive who led fast-food and retail partnerships and growth strategies at Tyson Foods Inc., in the US and abroad.

Pande said that finding the necessary equipment domestically should have been possible. “Cost and complexity would tell you to do things in the US,” he said.

“Arriving at a best-in-class outcome for breakthrough novel products is an iterative process,” a Beyond spokesperson said in an email. The company explained its decision to fly the pepperoni from the US to Europe and back as “the more efficient solution to serve the needs of the small test.”

In July, just weeks before the Pizza Hut test, an explosion rattled a Kentucky Dippin’ Dots factory. The facility supplied the cryogenically frozen pellets of fat that are incorporated into the pepperoni to more closely mimic the pork product.

The incident temporarily paused production of the ingredient, the dessert maker’s chief executive officer, Scott Fischer, told Bloomberg.

Ten employees suffered non-life-threatening injuries. The explosion didn’t cause a “material disruption” to Beyond’s supply chain, Beyond’s spokesperson said, and Dippin’ Dots is still waiting for a final report on the cause.

In a November 2021 earnings call, Chief Executive Officer Ethan Brown told investors the company “overcame numerous technical challenges” to make the pepperoni and it was “excited” about its potential over the coming quarters.

But despite the initial enthusiasm from Yum and Beyond’s hefty investments, Pizza Hut balked at the high price of the pepperoni and has expressed doubts about Beyond’s ability to produce it at commercial scale, former employees with knowledge of the matter told Bloomberg.

By April 2022, Beyond still hadn’t finalized its commercial process for making pepperoni.

Complex Machinery

Developing and manufacturing novel plant-based meats relies on complex machinery. The process of assembling a standard pea-protein-based burger is completely different from the extrusion process that creates a fibrous piece of fake chicken, and different still from making fake cured meats.

The specialized machines can cost millions of dollars and are often built to order, sometimes keeping companies waiting more than a year, said Peter Golbitz, founder of food-company consultancy Agromeris.

Beyond wasted no time in purchasing at least four multimillion-dollar production lines from Metalquimia, a Spanish maker of industrial meat-production machinery, despite having no large orders in hand.

Making the whole-muscle texture required for the KFC Beyond Fried Chicken needed yet another kind of expensive machinery: high-moisture extruders, which can cost anywhere from $200,000 to $2 million, according to Golbitz.

Beyond’s fried chicken landed on KFC menus months after it was originally scheduled because of more production delays, according to descriptions from 11 people with knowledge of the matter.

In an echo of its pepperoni process, Beyond made “blanks” in a Missouri facility and then shipped them to its Pennsylvania plant for marinating, breading and frying, former employees explained to Bloomberg.

Beyond struggled in making the products according to Yum’s specifications and to produce enough of them, according to people familiar with the matter who weren’t authorized to speak for the company.

‘The Problem Was The Margins Were Really Poor On The Product’

Listeria has been found in Beyond’s production facilities, according to six people with knowledge of the matter who weren’t authorized to speak publicly; the presence of the bacteria interfered with production for KFC, three of these people said.

A spokesperson for Beyond said the US Food and Drug Administration “comprehensively inspected our facility during our most recent routine audit and concluded the inspection without any adverse findings,” and the FDA is unaware of any Beyond Meat products carrying Listeria, an agency spokesperson said.

While sales of Beyond at KFC were healthy, it wasn’t a big moneymaker. “In the first couple weeks it was out, it performed well,” said Saleh, the BTIG analyst.

Franchisees sensed that it lured new customers, but “the problem was the margins were really poor on the product,” Saleh said. He estimated the cost of goods on the Beyond nuggets was about 40%, compared with 30% to 32% for real chicken.

Despite falling short on product and profits, Beyond Fried Chicken brought in plenty of attention. Yum CEO David Gibbs said in a company earnings call in May that it “elevated the brand and boosted relevance, resulting in more media impressions than any other product launch in the brand’s history.”

In Canada, meanwhile, KFC tested a plant-based chicken made by Maple Leaf’s Greenleaf Foods unit in 2019 and created a permanent menu item less than a year later.

Distribution

Since the August 2021 test, Pizza Hut hasn’t put Beyond Pepperoni back on the menu. Beyond has tried to court other customers for its pepperoni product, but so far it hasn’t announced any.

Pizza Hut’s biggest competitor, Domino’s Pizza Inc., which doesn’t currently offer plant-based meat toppings, said it has considered some products but didn’t reveal from which companies.

“Products created for Pizza Hut are exclusive to Pizza Hut,” a Beyond spokesperson said, adding that the pepperoni product made for general foodservice customers recently won an award from the National Restaurant Association.

Beyond didn’t name any planned customers for its foodservice pepperoni product.

LeBron James-backed Blaze Pizza has tried several vegan pepperoni products, including Beyond’s, but didn’t move forward into official testing, citing problems with taste and texture.

Your Pie Pizza, a national chain with about 75 locations, also considered Beyond’s pepperoni but it wasn’t what the chain was looking for “in terms of taste or price point,” said Drew French, the chain’s founder.

Vegan pepperoni “still has a little ways to go when it comes to the meat-lover loving it,” said Jim Vowler, chief executive officer of Gourmet Provisions International Corp.

Even so, sales are taking off. Overall, vegan pepperoni units shipped to restaurants and retail foodservice outlets increased 174% in the year ended in April, according to data provided by the NPD Group’s SupplyTrack service. Greenleaf’s vegan pepperoni is in more than 700 restaurants in North America and over 10,000 US retailers.

Hormel, a top producer of pork pepperoni, is also selling a vegan version through more than 200 distributors across the country.

Missed Opportunities

In the February 2021 earnings call at the time of the announcement of the Yum partnership, CEO Brown was light on details, telling investors that “any activity is likely to skew toward the latter part of this year.”

Yet there were no major US offerings in 2021, and now, more than halfway through 2022, there has been nothing else aside from the KFC limited-time offer. Beyond shared no other plans for the partnership in its latest earnings call in May, other than a reference to “continuing to do trials.”

Beyond has enjoyed some success in the pizza business. Its “sausage” crumbles are basically indistinguishable from the real thing, Vowler said, and are on his company’s frozen vegan pizza. The crumbles were also added to menus at more than 450 Pizza Hut units in Canada after a successful test.

But that hasn’t assuaged investors, who have watched the stock price plummet more than 80% since its peak in July 2019. Leadership changes last year, including a new chief operating officer from Tyson, haven’t made a noticeable impact yet.

Wall Street analysts including Brian Holland from Cowen Inc. are wondering whether Brown is still suited for the top job.

“Startups reach inflection points,” he said. “Is the person with the vision still the right person to execute the day-to-day plan?”

Lisa Feria, managing partner and CEO of venture capital fund Stray Dog Capital, said she still has full confidence in Brown, though her fund exited with the IPO in 2019.

“The great majority of startups that we work with do go through a lot of growing pains as it relates to scaling their products,” she said.

Golbitz, the food-company consultant, is sympathetic to Beyond’s challenges. “It’s not that they don’t have the wherewithal to produce excellent products, it’s the speed they’re trying to do it and the volume that’s required,” he said.

Speed is what’s necessary, though, along with product improvements and lower prices. After surging in 2020, sales of plant-based meats at supermarkets largely flatlined in 2021.

Consumers are increasingly questioning claims about the healthfulness of the highly processed products. On the restaurant side, even as the industry rebounds, excitement around vegan options hasn’t returned to pre-Covid levels.

“The world is turning, and this has been deprioritized with consumers for value,” said Joseph Szala, managing director of Vigor, a restaurant consultancy. With inflation driving up food costs across the board, consumers are less likely to pay a premium for what is ultimately a substitution product. “If I had to guess, the energy, momentum and interest in this is dissipating,” Szala said.

Related Articles:

Could Organic Pesticides Be The Next Gold-Rush For Entrepreneurs? (#GotBitcoin?)

Consumer’s Appetite For Organic, Antibiotic / Hormone-Free Food Outstrips Supply (#GotBitcoin?)

Harvard Quietly Amasses California Vineyards—And The Water Underneath (#GotBitcoin?)

A Warming Climate Brings New Crops To Frigid Zones (#GotBitcoin?)

Cameras For Cows (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.