Excessive Number Of Mall Closures And Continued Slump In U.S. Manufacturing Spell Trouble For Economy (#GotBitcoin?)

U.S. retailers have already closed 5,994 stores so far this year, compared with 5,864 closures for all of last year, according to Coresight Research. The net store closings, or the number of closings minus openings this year, stands at 3,353. Excessive Number Of Mall Closures And Continued Slump In U.S. Manufacturing Spell Trouble For Economy (#GotBitcoin?)

What Retail Recovery? Malls Under Pressure As Stores Close

Delayed openings, recent drop in retail sales signal malls aren’t ‘out of the woods.

Payless ShoeSource Inc., Gymboree Group Inc. and Charlotte Russe Holding Inc. are among the retailers to announce plans to close stores after earlier attempts at restructuring failed.

An unexpected rebound in brick and mortar stores last year suggested that malls might enjoy a bit of a comeback, too. Consumer spending was strong, and shopping centers benefited from the expansion of beauty chains like Sephora and Ulta. Macy’s and Nordstrom made new investments in their stores to create a more appealing experience for shoppers.

But retail sales have slipped more recently, falling 0.2% in February from a month earlier, after gaining 0.7% in January. Retail sales fell 1.2% in December.

“I don’t think malls are out of the woods yet,” said Ana Lai, an analyst at S&P Global Ratings, adding that the firm has a negative outlook on the overall U.S. retail sector as a significant number of retailers will continue to struggle.

The mortgage for Destiny USA, one of the largest malls in the country, was recently moved to a special servicer that deals with defaults or renegotiations of loan terms. The servicer said it expects the mall owner, Pyramid Management Group, to default when the mortgage is due in June.

Pyramid has two securitized mortgages on the 2.4 million-square-feet mall in Syracuse, N.Y., totaling $430 million, according to real-estate data provider Trepp Inc. Pyramid said it is now in discussions for an extension on its mortgage.

“Destiny USA has experienced tenant closures, just as other properties across the country have on the brick and mortar front,” said a Pyramid spokesman. “We have and will continue to fill those spaces with new and exciting uses as we work to ensure the health, vibrancy and longevity of the center.”

Other mall developers, facing a softening market, have pushed back openings. The owners of the American Dream retail and entertainment center in the Meadowlands in New Jersey said the mall will open in late summer. The developer, Triple Five Worldwide Group of Cos., previously said it would open in the spring.

The developer of Empire Outlets, an outdoor shopping and dining center on Staten Island, said the mall would open in May after an initially planned opening last fall.

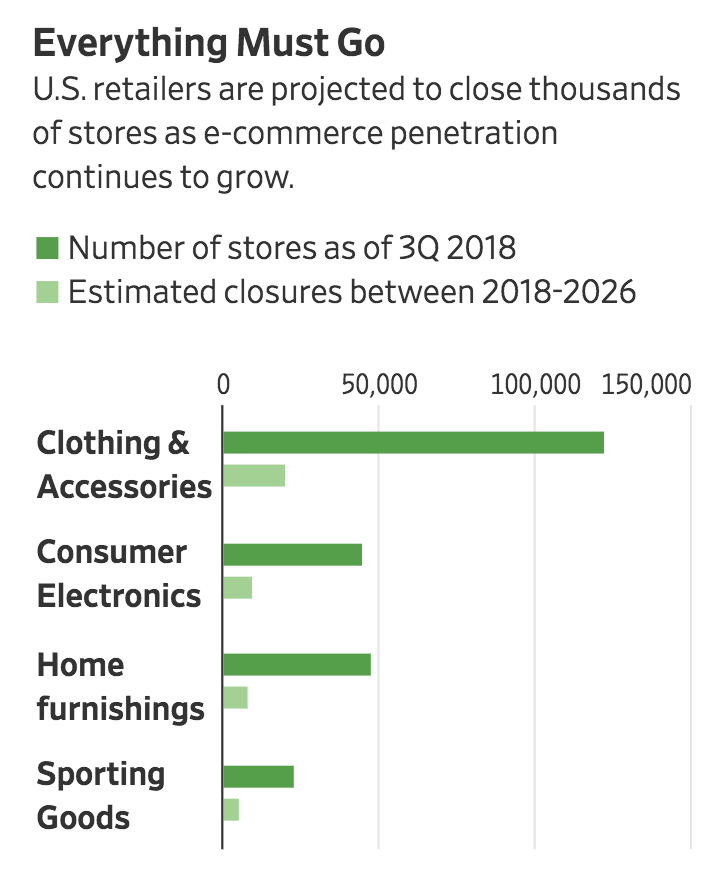

S&P also signaled more turbulence ahead. Analysts say about 12 of the approximately 136 retailers it rates would default this year, compared with three a year historically. UBS said that another 75,000 stores, or around a 10th of existing stores as of the third quarter of 2018, will have to close by 2026 if online retail penetration continues to rise from the current 16% to 25%.

Mall vacancy rates, meanwhile, inched up in the first quarter to 9.3% from 9% in the fourth quarter of 2018, according to real-estate research firm REIS Inc. This is the highest vacancy rate since the third quarter of 2011, when it reached 9.4%.

U.S. Manufacturing Squeezed by Global Slowdown, Trade Pressures

Continued weakness in output aligns with gloomy economic outlook world-wide

American manufacturing production failed to bounce back last month after slumping earlier in the year, showing the global slowdown is squeezing a key sector in the U.S. economy.

The manufacturing sector has sent mixed signals in recent weeks, but Federal Reserve data released Tuesday reinforces the view that manufacturing has hit a soft patch.

Manufacturing output was flat in March after falling in the first two months of 2019, according the Fed data. For the first quarter as a whole, manufacturing output declined at an annual rate of 1.1%, the first drop since output fell 1.6% in the third quarter of 2017.

More broadly, industrial production, a measure of output at factories, mines and utilities, fell 0.1% in March.

Declines among wood products as well as motor vehicles and parts, both of which fell by more than 2% on the month, dragged down manufacturing output. Production of textiles, coal products and chemicals all rose, helping offset losses in other categories.

While the U.S. manufacturing sector is clearly pulling back from a robust 2018, it remains to be seen how sharp and persistent the slowdown might be.

Manufacturers are still generally upbeat in their outlook, but the weakness in output underscores challenges posed by the global slowdown, said Chad Moutray, chief economist for the National Association of Manufacturers.

“The U.S. economy continues to plug along,” Mr. Moutray said. “The real risk to the outlook comes from abroad, when it comes to the slowing global economy both in Asia and in Europe.”

Figures from a series of purchasing managers’ indexes—which measure manufacturing conditions based on surveys of companies—indicate a broader economic slowdown in recent months, as trade tensions drag on businesses across global markets.

Based on such PMIs, the International Monetary Fund expects continued pullback this year and, in its world economic outlook report last week, attributed recent industrial-production slowdowns in many countries to global trade pressures.

JPMorgan’s global manufacturing PMI flashed further signs of slowing growth in March. Europe’s manufacturing sector appears particularly hard hit by trade pressures. The IHS Markit PMI index for the eurozone logged the biggest fall in output in nearly six years in March. Germany, which relies relatively more on exports to drive growth than other large economies, saw its PMI decline in March to near a seven-year low.

In the U.S., some manufacturers are feeling the crunch from tariffs.

Marshallberg, N.C.-based Budsin Electric Boats increased marketing spending in Europe last year to take advantage of new electric boat mandates. However, increased sales and a planned production expansion didn’t materialize after the European Union tariffs on boats from the U.S. made its products less competitive. Canada and Mexico instituted similar duties on U.S. boats in retaliation for tariffs the Trump administration placed on steel and aluminum. The company, which produces around 20 boats a year, had to cut back production plans when it lost two sales abroad after the tariffs were announced and buyers backed out.

“U.S. sales are pretty much steady, but the EU sales and Canada and Mexico are severely impacted,” said Tom Hesselink, Budsin’s owner. “It’s impossible to compete.”

Though manufacturing accounts for a small share of gross domestic product, the sector is highly sensitive to shifts in global demand, making it a bellwether for the broader U.S. economy.

Economists are watching the sector closely since it has sent diverging signals recently. Gauges of factory activity in the U.S. and China stabilized in March, but U.S. employment in the industry declined for the first time since mid-2017 last month and Tuesday’s Fed report indicated broad-based weakness.

Manufacturing capacity use, a measure of slack, decreased 0.1 percentage point to 76.4% in March. That is about 2 percentage points below its long-run average.

Sliding Freight Rates Send More Big Bulk Ships To Scrapyards

Brazil’s reduced mining output, shifting China demand have hit demand for transport on capesize vessels.

A sharp decline in dry cargo ship freight rates in the first quarter sent more giant ships to scrapyards in Southeast Asia in the first three months of the year.

But analysts expect a slow recovery in Chinese imports of commodities such as iron ore will likely boost demand and put the brakes on recycling later this year.

Ship-broker BTIG said in a report that 107,000 deadweight metric tons of ship steel were recycled in the first three months of this year, up 35% from 78,000 metric tons in the same period a year ago. Of 23 vessels scrapped, 16 were capesize vessels, the biggest cargo ships that move products such as iron, aluminum, coal and cement from mines in Australia and Latin America to China.

Shipowners generally step up scrapping when the cost of operating vessels or idling and maintaining them outweighs the price of scrap metal.

Vale S.A.’s mine-waste dam disaster in Brazil in January curbed iron ore production, idling a number of capes, brokers in London and Singapore said. The situation was exacerbated by a seasonal lull in Chinese industrial output during the long Lunar New Year holidays in February.

Capes now command daily freight rates of around $9,000, well below the average $25,000 needed to break even. The Baltic Dry index, which measures the cost of moving commodities across the seas, was at 726 points on Friday, down 27% in the past 12 months.

The ship-breaking industry has annual revenue up to $5 billion and 2018 was one of the busiest years ever, according to Anil Sharma, chief executive of U.S. and Dubai-based GMS, the biggest cash buyer of ships headed for scrap. Crude oil tankers and dry bulk vessels were the ship types that were mostly broken up. Brokers expect up to 20% less ship steel in terms of tonnage to be recycled this year.

China’s iron ore imports rose 3.5% in March, compared with a year earlier, after touching a 10-month-low in February, according to Chinese customs data on Friday, with steel mills replenishing inventories. Imports came in at 89 million metric tons, up from 83 million in February and 86 million in March 2018.

Brokers also expect a recovery in capesize freight rates as diminished iron ore transports from Vale’s damaged facilities in Brazil are replaced with longer sailings from Australia.

Neiman Marcus Pushes Refinancing, Highlighting Retail Sector’s Vulnerability

Retailer offered existing lenders deal that would leave those that don’t participate more exposed to losses if it files for bankruptcy.

Neiman Marcus Group Ltd. is poised to become the latest U.S. business to push lenders into supporting a refinancing, a trend that has raised concerns that some companies might be delaying a reckoning on unsustainable debt loads.

In the coming weeks, Neiman Marcus is on track to replace around $4 billion of debt set to mature over the next two years with new bonds and loans that would mature in 2023 and 2024.

The transaction isn’t a normal debt refinancing. Instead, Neiman Marcus, like many others in recent years, has offered its existing lenders a deal that would leave those that don’t participate more exposed to losses if the company files for bankruptcy down the road. Neiman Marcus declined to comment for this article.

In a presentation to lenders, Neiman Marcus said its debt exchange would give it more time to increase its annual adjusted earnings before interest, taxes, depreciation and amortization, or Ebitda, by around 50% to at least $700 million in the next five years. After several years of declining or stagnant earnings, the company has said it expects to start seeing meaningful improvement in fiscal 2020, according to the research firm CreditSights.

From 1987 until the financial crisis, so-called distressed-debt exchanges, which are considered defaults by credit rating firms, accounted for 15% of all corporate defaults in the U.S., according to Moody’s Investors Service. After the crisis, they have accounted for 42% of defaults, reaching as high as 48% in 2015 and never dropping below 40% since then.

Such transactions have clearly been good for some companies. When commodity prices dropped in 2015, some metals and mining companies were able to use distressed exchanges to weather the downturn. From 1987 through 2017, however, some 28% of companies that executed a distressed exchange have ended up filing for bankruptcy anyway, while another 13% have come back with a second debt swap, according to Moody’s.

“For some firms, it may just be delaying the inevitable, and delay is costly,” said Edward Morrison, a Columbia Law School professor who focuses on bankruptcy.

Analysts who have studied distressed-debt exchanges attribute their rise largely to an erosion of the terms in bonds and loans, known as covenants, that are supposed to protect investors from losses.

While lenders could previously push companies into bankruptcy if they failed to meet certain financial metrics, those requirements have been disappearing as a result of strong investor demand for the debt of riskier businesses. Businesses also have more leeway to strip collateral from lenders and issue new debt that would take precedence in a bankruptcy—actions that can help engineer a debt exchange.

In Neiman Marcus’s case, its owners Ares Management ARES 0.55% LLC and the Canada Pension Plan Investment Board, have used both those tools. First, they took ownership of one of Neiman’s most prized assets, the online business Mytheresa. Now, they are offering to give lenders some of the business back in the form of preferred shares in the unit—so long as they agree to extend their coming debt maturities. Typical of a distressed exchange, Neiman’s new debt offers investors additional collateral and, in a bankruptcy, would be paid before the existing debt.

Accumulated over two private-equity buyouts, debt is Neiman Marcus’s chief challenge, many observers say.

The luxury retailer, which caters to wealthy shoppers who are less sensitive to economic downturns, has continued to invest in its business, integrating its e-commerce and store operations and, last month, opening a flagship store in New York’s new Hudson Yards development. As of Jan. 26, the Neiman Marcus had what Moody’s described as adequate liquidity, including $41 million of cash and $627 million of unused borrowing capacity under a revolving loan.

But it also had $4.7 billion of debt—around 10 times adjusted Ebitda—and had burned through $40 million of cash over the previous 12 months thanks in part to its more than $300 million of interest expense, according to CreditSights. Its 8% unsecured notes due 2021 recently traded at 55 cents on the dollar, according to MarketAxess, showing holders believe there is a significant risk that they won’t be paid back at close to their par value.

Neiman Marcus, “from an operating basis, has performed reasonably well,” said Steve Dennis, a former senior executive at Neiman Marcus and current president of SageBerry Consulting LLC, a retail-strategy consulting firm.

Still, he said, the company, in a challenging retail environment, is unlikely to generate enough cash in the next few years to make its debt sustainable. Its current debt exchange, he added, is likely “just buying time to do a different transaction.”

Neiman Marcus Pushes Into Growing Market For ‘Preloved’ Handbags

Luxury players are starting to embrace a booming resale market; ‘shoppers just want bargains’.

The market for secondhand clothing and accessories is going mainstream.

Neiman Marcus Group Ltd is taking a minority stake in Fashionphile LLC, an online seller of preowned designer handbags and accessories, according to company executives.

The RealReal Inc., a larger competitor to Fashionphile, is preparing for an initial public offering, according to people familiar with the situation. And on Monday, a retail chain owned by H&M Group began allowing shoppers in Sweden to buy and sell previously owned goods.

“Resale is at the nexus of a lot of trends,” said Oliver Chen, a senior equity analyst at Cowen Inc. “You have a new generation who is interested in sustainability and recycling. But most of all, shoppers just want bargains.”

Mr. Chen says items in the secondary market sell for 30% to 90% less than the retail price of similar new items.

The U.S. luxury resale market totaled $6 billion in 2018, according to the consulting firm Bain & Co. But the overall U.S. recommerce market for clothing, accessories and footwear is far larger and growing fast. It is expected to reach $51 billion by 2023, up from $24 billion last year, according to GlobalData PLC, which prepared the research for a report published by online reseller ThredUP.

For Neiman Marcus, the investment in Fashionphile—the terms of which weren’t disclosed—is its second attempt at cracking what some call the “preloved” market. A partnership with The RealReal ended in 2016, a year after it launched. Chanel had expressed displeasure with the arrangement, according to people familiar with the situation. A Neiman Marcus executive previously told The Wall Street Journal that the partnership didn’t make sense at the time for the retailer or its customers.

“We are at a different point in time than we were three years ago,” said Neiman Marcus Chief Executive Geoffroy van Raemdonck. “The resale industry has grown faster and is now something our customers are much more engaged in.”

According to a survey conducted by Neiman Marcus, half its customers buy or sell preowned luxury goods.

Neiman Marcus plans to introduce Fashionphile “salons” to some of its stores, where customers can drop off handbags, jewelry and other accessories. Unlike some of its competitors that operate on a consignment model, Fashionphile pays sellers on the spot for their goods once they have been authenticated. To buy the secondhand goods, shoppers will have to visit Fashionphile’s website or one of its four boutiques.

Mr. van Raemdonck said the move is part of a strategy to increase Neiman Marcus’s reach. “We want customers to think of us for all the categories we sell, but also those we don’t currently offer,” he said. “Recommerce is one of those areas.”

The hope is that once they receive the cash, shoppers will spend it buying new items at Neiman Marcus. The retailer plans to test different types of incentives to encourage customers to do that, but Mr. van Raemdonck declined to elaborate.

One challenge for luxury resellers has been opposition from brands, who worry that the secondary market degrades their image. Chanel is suing The RealReal for allegedly selling counterfeit products. The RealReal denies the claims.

Mr. van Raemdonck said Neiman Marcus won’t sell any secondhand products in its stores. By allowing customers to drop off their preowned goods, it is simply providing a service they want, he said.

A previous lawsuit by Chanel against Fashionphile was settled when the reseller agreed to change some wording on its website to make it clear it isn’t affiliated with Chanel, according to Ben Hemminger, Fashionphile’s chief executive.

“Chanel will one day recognize that resale isn’t going away,” said Sarah Davis, Fashionphile’s president, who started the company in 1999 after selling her own luxury handbags on eBay Inc.

“I always wanted to own things that I couldn’t afford, but I realized that I could afford them if I bought them secondhand,” Ms. Davis said.

Mr. Hemminger said Fashionphile is on track to sell $200 million worth of goods this year, up 50% from a year ago. That is smaller than RealReal and other luxury resellers such as Vestiaire Collective, according to analyst estimates. Unlike those players, Fashionphile only sells handbags and accessories, not clothing.

Fashionphile says the average bag sells for $1,400. It has sold trendy items such as Chanel handbags designed in collaboration with the musician Pharrell Williams as well as Chanel Classic Flap bags.

“Fashionphile shares with us the mentality that they will only sell the best products,” Mr. van Raemdonck said. “Other players might be bigger, but they are truly luxury.”

Grocers Brace For Another Blow From Amazon

E-commerce giant already has pushed grocers to focus on delivery and pricing. Now it takes aim at stores’ profitable beauty aisle.

Amazon.com Inc. has challenged grocers by pushing them to lower prices and expand their delivery options. Now the company’s latest plans threaten to steal sales of some of the industry’s more profitable products.

The e-commerce giant plans to launch urban grocery stores that could offer a spectrum of goods that includes beauty products alongside food, The Wall Street Journal has reported. Beauty products represent a small portion of supermarket sales but tend to offer higher profits than more traditional items.

The move couldn’t come at a worse time for grocers, which have been focused on building up digital selling operations to compete with Amazon online.

Amazon has an aggressive timeline for the store openings, with the first on track to debut as soon as the end of this year, according to people familiar with the matter. The company aims to open dozens of locations in major cities, including Los Angeles, Chicago, and Washington, D.C., the Journal has reported.

Much could change about Amazon’s plan, but initial details about the size and layouts of the stores—smaller than most traditional supermarkets but bigger than many convenience stores—suggest they could pose a competitive threat to traditional supermarket chains like Kroger Co. KR 2.21% as well as mass merchants like Walmart Inc. and Target Corp., according to food industry analysts.

Amazon has pushed for leases that won’t restrict what it sells in its new chain, opening it to offer cosmetics and skin- and hair-care products as well as other retail items, according to people familiar with the matter.

Beauty items offer high margins for grocers, and Amazon has expanded its array of such products under various labels. Health and personal-care items are Amazon’s largest source of consumer-product sales online, with roughly $5 billion in sales last year, according to e-commerce data analysts Edge by Ascential.

The timing of Amazon’s store development comes during a difficult period for the roughly $1 trillion food and consumer-product retail sector, which already deals with low margins and extreme competition. Grocers have been struggling to keep shoppers coming to their stores, while Amazon’s quick, low-cost delivery has eaten into sales of shelf-stable goods and bulky items sold at supermarkets, market analysis shows.

“Amazon just keeps on pushing the finish line further ahead for the others,” said Phil Lempert, a grocery consultant.

An Amazon spokeswoman declined to comment and said the company doesn’t comment on rumors or speculation.

Grocery industry executives said it is too early to know how traditional supermarkets would alter their operations in light of Amazon’s latest grocery store push.

In the past two years, however, many have been forced to change some fundamental aspects of their operations, from staffing to the way they organize their stores, often to facilitate online ordering and compete with Amazon.

Walmart, Target and Kroger, for instance, have sped up investments in technology and online selling strategies, and in some case have sacrificed profits to offer delivery and digital pickup for a growing number of markets.

Some also have cut back at opening new stores. Walmart reiterated last month that it would open fewer than 10 stores in its current fiscal year, while looking to double the number of locations offering same-day grocery delivery and adding 1,000 grocery pickup places.

“Amazon forced them all into delivery…and then this,” Mr. Lempert said, referring to the company building stores.

A Target spokesman declined to comment. A Walmart spokesman pointed to its chief executive’s comments last month on the company’s efforts to compete online and in stores. “We’re meeting the changing needs of customers and delivering solutions that are increasing customer engagement,” CEO Doug McMillon said.

Kroger, the U.S.’s largest supermarket chain by stores and sales, has scaled back on new store plans. The company also is spending tens of millions of dollars to build a network of automated warehouses for online grocery services, while trying to expand in higher-margin mass merchandise with a clothing line.

A Kroger spokesman said the grocer has a winning strategy. “We are transforming from grocer to growth company,” he said Saturday.

Investors remain skittish about the industry as the low-margin businesses divert profits into digital-ordering technologies that have yet to contribute to their bottom line, while also offering low prices for shoppers.

Following the Journal’s report about Amazon’s store plans on Friday, Kroger’s shares dropped more than 4% and Walmart fell 1.1%. Walgreens Boots Alliance Inc., which recently struck a deal to put mini-Kroger stores in some locations, was down more than 6%. Amazon shares rose.

A Walgreens spokeswoman declined to comment on Amazon’s grocery push.

Amazon has a long-term initiative to build out a physical grocery presence, and at one point envisioned more than 2,000 brick-and mortar stores in different formats. It is a bet that shoppers still want to buy groceries, personal-care items and other consumer products at physical stores.

Though more shopping is expected to migrate online, less than 5% of the roughly $1 trillion in annual U.S. food and consumer product shopping is done over the internet now, market research shows.

With its new stores, Amazon could market itself as a food seller to a greater range of consumers than those currently buying sundries online. It also broadens its reach beyond the higher-income shoppers who tend to frequent Whole Foods Market, which it bought two years ago.

It isn’t clear whether the new stores would carry the Amazon name, but they are expected to be distinct from Whole Foods.

The latest foray into physical retail isn’t without risks. Those knowledgeable about the company’s plans say the stores could average 35,000 square feet—a size that industry consultants say could be tough to make appealing to consumers because it is too small for big shopping trips but larger than the typical quick convenience store run.

“The economics of a store that size are tough,” said Bryan Gildenberg, chief knowledge officer at Kantar Consulting, adding that Amazon will need to locate the stores in high-traffic areas to drive volume.

Updated: 6-4-2019

The Mall Meltdown Continues

Mall-based retailers reported dismal earnings last week, reminding investors of the sector’s fundamental problems.

Retailers’ earnings season has gone from bad to worse. The bleeding intensified last week, with shares of Abercrombie & Fitch plummeting 26% on Wednesday, the biggest percentage decline since the company went public. PVH Corp., owner of brands including Van Heusen, Tommy Hilfilger, and Calvin Klein, dropped 10% that day, too. On Thursday, women’s wear chain J.Jill was down a jaw-dropping 53% and on Friday, Gap Inc. slid 9%.

It is hard to miss what all of these retailers have in common: They are mall-based.

While retailers posted generally strong numbers in 2018, raising hopes of a retail renaissance, this year has seen a reversion to the pre-2018 trend: department stores and mall-based retailers giving up share to discount stores and e-commerce. The perceived renaissance now seems to have been largely a function of lean inventories, not an actual increase in demand. Now inventory is high again, and retailers are resorting to promotions.

Gap, for example, warned Friday that it may have to rely on promotional activity in coming months to move unsold merchandise off shelves. That will weigh on gross margins. The company, which posted its weakest quarterly sales in three years, has suffered not merely at its namesake brand, where comparable-store sales were down 10% for the quarter, but also at Old Navy, typically its best performer. Comparable-store sales there fell 1%. By comparison, in the same period last year they climbed 3%.

Gap Chief Executive Art Peck partially blamed the company’s poor performance on weather, calling the three-month period ended May 4 “one of the coldest, wettest quarters in memory.” Of course, weather is rarely a satisfying explanation, especially when a Gap rival like Zara is succeeding with a leaner supply chain and rapid merchandise turnover.

Many of these retailers are scrambling to restructure. In February, Gap announced plans to spin off its more successful Old Navy brand into its own public company. That sent shares up 20%, though the deal won’t be completed until 2020. This past week, Abercrombie & Fitch said it plans to shut several flagship stores world-wide.

Investors should expect more announcements of this sort and much more restructuring. Whether such plans will actually succeed remains to be seen. An independent Old Navy seemed like a good idea—until last week’s report included a sales decline. At some point, investors will have to contend with the fact that for some retailers, restructuring can only fix so much.

10-6-2019

Outlet Malls Bucked the Shift to Online. Until Now

A website is offering merchandise from outlet stores, which are starting to feel the same pressures as retailers at malls.

Outlet stores had long been immune to pressures weighing on traditional malls, including the shift to online shopping that has sapped customers from physical stores.

Shoppers often were willing to trek miles to outlet centers, located far away because brands didn’t want their reduced-priced goods to be too close to their full-priced stores. For that reason, outlet merchandise, typically last season’s goods sold at steep discounts, hasn’t been widely available online. Until now.

Simon Property Group Inc., one of the largest mall owners, in conjunction with Rue Gilt Groupe, which operates flash-sale websites, has launched shoppremiumoutlets.com, where brands from Vince to Under Armour offer their outlet goods for sale online. It is one of the first curated websites to feature merchandise from outlet stores.

Simon Chief Executive David Simon said he isn’t worried the website will siphon shoppers away from his company’s outlet malls, which include Woodbury Commons Premium Outlets, a sprawling complex in Central Valley, N.Y., with 250 stores ranging from Gucci to Nike that does more than $1.4 billion in annual sales.

“When you can’t make that trip to Woodbury, knowing you can get outlet pricing online makes sense,” he said. “We think the two will feed off each other to generate higher sales.”

Outlet stores were long a source of growth for retailers, which have been hard hit by the shift to online shopping and competition from startups. Shoppers flocked to these centers for bargains they couldn’t traditionally get at malls, but now outlets are showing the same signs of stress as traditional stores.

There are only about 400 U.S. outlet centers compared with more than 1,100 traditional malls, according to the International Council of Shopping Centers. That means outlet centers aren’t struggling against the oversupply that has plagued traditional malls, which have seen dozens of their retail tenants close stores or go out of business as more shoppers buy online.

But outlets are feeling the effects of retail bankruptcies and the shift to online shopping, too. Chains including Gymboree and Charlotte Russe have closed locations in outlet centers, and Forever 21, which filed for bankruptcy protection this week, plans to close around a dozen outlet stores.

Outlet centers are also facing stiffer competition from off-price chains such as T.J. Maxx and Nordstrom Rack, which are located closer to where most people live, as well as from regular stores that have cut prices to remain competitive.

“The proposition of driving (typically) much further distances to get to an outlet center seems that much less attractive,” Paul Lejuez, a Citi analyst, wrote in a recent research note.

Retailers including Ralph Lauren and Kate Spade have recently called out softness in their outlet stores, a sign, according to Mr. Lejuez, that they may have opened too many locations.

“We continue to clearly see challenges with brick-and-mortar traffic, both full price and outlet,” Ralph Lauren Corp. Chief Executive Patrice Louvet told analysts in July when he laid out plans to address the issue. Victor Luis, the former chief executive of Kate Spade parent Tapestry Inc., told analysts in August that a decline in foot traffic led to higher-than-expected promotions among outlet retailers.

Just as with traditional malls, not all outlet centers are created equal. The best ones, typically with higher-end retailers, continue to draw shoppers by the busload while others struggle.

Tanger Factory Outlet Centers Inc., which owns 39 outlet centers, posted a 0.3% decline in net operating income in the first half of the year because of the effect of retailer bankruptcies, lease modifications and store closures. The landlord posted 96% occupancy at the end of June, down from 97.7% at the end of 2016. Over the past year, shares of Tanger have fallen by 34%.

Simon Property, which operates 107 malls and 69 outlet centers among other properties, doesn’t disclose the difference in sales and rent metrics between its malls and outlet centers.

Outlet retailers are among the last to venture online, in part because some of these chains are high-end and don’t want consumers to be able to easily search the internet for discounts that could tarnish their brand. Shoppremiumoutlets.com is launching with just 24 brands, but Mr. Simon said he is in discussions with dozens more.

“We’re looking at where the market is going,” and increasingly that is online, said Michael Rubin, the chief executive of Kynetic, which owns Rue Gilt Groupe.

Updated: 9-29-2020

Brookfield Cuts Staff As It Tries To Steady Mall Portfolio

Real-estate company is slowing plans to redevelop malls for other uses.

Brookfield Property Partners ’ recent move to slash staff shows how the firm’s big bet on repurposing shopping malls is slamming into unanticipated challenges during the coronavirus pandemic.

The head of the real-estate giant’s retail group sent a memo last week informing staff that around 20% or around 300 employees would be laid off or offered early retirement.

The company is planning to sell some assets more quickly, the memo said. It is slowing plans to redevelop malls for other uses, and in some cases where weaker properties require additional capital, it may elect to hand over the malls to the lenders, Brookfield has said previously.

While many investors and property owners have been bearish on malls as shoppers look increasingly online, Brookfield had a plan it thought fit with evolving consumer habits. After acquiring mall operator General Growth Properties in a 2018 deal valued at $15 billion, Brookfield planned to wring more value out of the properties by scaling back or reconfiguring stores and redeveloping land nearby for other uses such as offices, residences or hotels.

But the coronavirus pandemic accelerated plans to trim its 122-retail property portfolio to a smaller group of higher quality malls, according to the staff memo. Brookfield’s management said it had to focus on health and safety with enhanced cleaning and upgraded air filters rather than on new construction. That made some prior capital investments and redevelopment less of a priority, the firm said.

“The number of malls we will have at some point in the future will be fewer than the number of malls we have today,” said Brian Kingston, chief executive officer of Brookfield Property Partners, at an investor day presentation Thursday. “That does not mean we are running out and trying to sell malls in a market like we see today.”

A Brookfield representative declined to provide further comment.

The pandemic has fueled more retail bankruptcies and impeded rent collection and the ability to lease space. That has made it tougher for mall companies to keep all their employees on payroll and compelled them to hold off on redevelopment projects. Mall giant Simon Property Group also furloughed staff in March, though the company declined to say how many.

Brookfield’s Chief Financial Officer Bryan Davis said at the investor presentation that the company has invested $13 billion in equity in its 122 retail properties. Value is concentrated in the top 25 properties, which have $10 billion in equity, he added, including malls in Honolulu and in Oak Brook, Ill.

In July, Brookfield pulled out of a redevelopment project in Burlington, Vt. after working for three years on assembling the site and getting approvals. It said that the long-term nature of the next phase of development didn’t fit with its funds mandate.

The Toronto-based company has also struggled at times to convince its property-ownership partners, such as pension funds and other asset management groups, to spend more money to redevelop the malls.

Even before the pandemic, institutional investors who have stakes in some of the so-called A malls have been getting cold feet about pouring tens of millions more in the properties, which they view as too risky as the prospect for rent growth dims. But this in turn could result in spaces sitting empty for longer and could lead to further erosion in values.

Since taking GGP private, Brookfield has tried to sell malls in St. Louis and Houston, but couldn’t get the price it wanted, say people familiar with the matter. On average, mall values have fallen 28% in the past 12 months, said commercial-real-estate analytics firm Green Street.

Brookfield said many people in the U.S. still want to shop in person and it has organized outdoor farmers markets, food trucks and drive-in movie screenings at the parking lots of its malls, as well as invested in virtual fitting rooms for customers who are apprehensive about trying new clothes. It has also said it would spend $5 billion to shore up retailers hit by the pandemic, including J.C. Penney Co.

Updated: 11-2-2020

Malls Dragged Into Bankruptcy By Carnage At Retail Tenants

America’s ailing malls suffered a pair of body blows over the weekend as two major landlords followed their ever-growing list of bankrupt tenants into Chapter 11 protection.

Pennsylvania Real Estate Investment Trust and CBL & Associates Properties Inc. sought protection from creditors Sunday, citing pandemic-induced pressures on their tenants and, in turn, themselves. Together the two REITs account for some 87 million square feet of real estate across the U.S., according to court papers.

The pandemic worsened an already dire situation for brick-and-mortar retailers, with a steady stream of chains falling victim as their customers shifted to online shopping. J.C. Penney Co., J. Crew Group and the owner of Ann Taylor are among the dozens of chains that have sought court protection since Covid-19 lockdowns throttled in-store shopping this year.

That’s an even bigger problem for the likes of PREIT and CBL, which own less productive malls than rivals such as Simon Property Group and Macerich Co., according Bloomberg Intelligence analyst Lindsay Dutch.

“There’s too much retail real estate in the U.S.,” said Dutch, a REIT equity analyst. “Retailers continue to reduce their store footprints, and while brick and mortar is here to stay, the focus is on high-quality locations.”

The Chapter 11 filing doesn’t necessarily mean the malls are closing. Instead, it gives their owners time to work out a plan to turn the business around and repay creditors.

CBL, based in Chattanooga, counts 107 properties in 26 states in its portfolio, including enclosed malls, outlets and open-air retail centers, according to a company statement. Philadelphia-based PREIT owns malls in Pennsylvania, New Jersey, Virginia, Maryland and Michigan, according to its website.

B Class

Many of their properties are known in the industry parlance as B-class malls, which bring in fewer sales per square foot than their better-placed peers. They may be located outside major metropolitan areas or upscale regions, making them vulnerable as middle-class customers struggle to make ends meet, and they were hit hard by the pullback of anchor stores like J.C. Penney and Sears.

Just in 2020, more than 30 of CBL’s retail tenants went bankrupt, according to court papers filed by CBL in Houston on Monday. The resulting closures cut deep into revenue, which was also hurt by rent deferrals and other types of concessions for tenants.

The recovery plan envisions giving a 90% ownership stake to holders of CBL’s senior unsecured notes, along with almost $50 million in cash. A 10% stake in the reorganized company would be awarded to current stockholders, which may ease some of the impact on founder and Chairman Charles B. Lebovitz, who ranked as the biggest share owner.

Fresh Cash

The mall owners drummed up support from creditors for restructuring plans prior to their bankruptcy filings, possibly shortening their trips through bankruptcy. PREIT’s plan would, pending court approval, push out debt maturities and bring in $150 million of additional capital.

CBL’s plan would slash debt by $1.5 billion and also extend certain maturities, but the process may not be smooth. The mall company said its bank lenders cut short negotiations, acting “under cover of darkness and asserting a variety of conjured up alleged Events of Default that occurred during the global pandemic.” CBL said it was suing to void those actions.

PREIT, too, faces opposition from a dissenting creditor. An investment firm — Strategic Value Partners LLC — bought up a small piece of PREIT debt in the run-up to its bankruptcy and is the “lone holdout” to its proposed restructuring, Chief Financial Officer Mario Ventresca Jr. said in documents filed Monday in Delaware.

The lender “will almost certainly seek to delay or derail” PREIT’s proposal, Ventresca said. The plan would let stockholders keep their shares, leave trade creditors unimpaired and hand new debt claims to holders of some unsecured PREIT debt, among other things.

Strategic Value Partners instead proposed handing all the equity to unsecured lenders, but that plan would probably lead to a legal fight with other lenders, undoing support PREIT worked to build with other creditors, Ventresca said.

Representatives for Strategic Value Partners declined to comment.

Updated: 11-10-2020

Malls File For Bankruptcy Or Shut Their Doors As Pandemic Pain Spreads

Glut of retailers struggling with lower sales will continue to haunt the mall industry even after Covid-19 eases.

Mall landlords are starting to seek bankruptcy protection or shutting down, the latest signs that the pandemic is deepening a crisis that began before Covid-19.

CBL & Associates Properties Inc. and Pennsylvania Real Estate Investment Trust, two midsized publicly listed mall owners, said last week they were filing for chapter 11 bankruptcy protection after their earlier debt-restructuring efforts failed. Both companies said they have secured support from a majority of their respective bondholders entering the bankruptcy process and hope to emerge from it as soon as possible.

While retailers like Neiman Marcus Group Inc., Brooks Brothers and J.C. Penney Co. have filed for bankruptcy in recent months, it’s rare for real estate investment trusts that own malls or shopping centers to do so. That is because REITs have more conservative debt levels than many retailers. They also have multiyear leases across a wide variety of tenants.

Still, analysts said the mall-owner bankruptcy filings weren’t a surprise.

“Retail has gone through a radical transformation in the last five years,” said Larry Young, a managing director at consultant AlixPartners’ turnaround and restructuring group. “You are getting a knock-on effect as lessees move out. A fundamental reset is what you should be thinking about.”

Mall closings are also picking up, too. Phoenix’s Metrocenter Mall shut down in July, just a few weeks after it was allowed to reopen. The 47-year-old mall had around 30 tenants, less than a fifth of what the property had at its peak decades ago. Cascade Mall in Burlington, Wash., and the Northgate Mall in Durham, N.C., also closed in recent months.

Shares of mall owners and other real estate companies rallied on Monday, after a Covid-19 vaccine developed by Pfizer Inc. and BioNTec SE proved 90% effective in trials. Simon Property Group Inc.’s stock price rose 28%, as investors bet that easing public health fears would bring more people out to the malls.

But analysts say even if the pandemic comes under control, the glut of department stores and other retail tenants struggling with lower sales will continue to haunt the mall industry. In the spring, government-mandated shutdowns and social distancing guidelines further hurt rent collection, which in turn, made it difficult for some owners to service their debt.

Many malls purchased with a mortgage within the past 10 years are now underwater, leading owners to return properties to their lenders at a record pace. But some lenders don’t want struggling properties on their balance sheet and have batted them back by extending their loans.

From January to October this year, 76 loans secured by retail properties totaling $1 billion were liquidated. That was about half the number of loans recorded in the same period in the previous year, according to credit ratings firm DBRS Morningstar.

“The quantity of distressed debt and distressed opportunity is at a historical high,” said Andy Weiner, president of RockStep Capital, a shopping center investment firm that owns 11 malls across the country.

The recent setbacks aren’t all bad news. Some analysts said the closure of outdated retail businesses and properties will result in a healthier business environment for both landlords and tenants.

Covid-19 has also compelled these businesses to become more versatile, including adjusting clauses that allowed tenants to reduce their rent if key tenants or a certain number of tenants leave the retail space. Many landlords offered rent abatements in exchange for fewer restrictions on how they can lease neighboring space.

“I’ve never seen more flexibility in these conversations,” said Dana Telsey, chief executive of Telsey Advisory Group in a recent online discussion.

Many owners are already dismantling the traditional makeup of a mall. Rather than having three or four department stores, they are preparing to live with one.

RockStep sees hope for the sector and is looking to buy some of these distressed malls, bring in more-modern tenants and offer more-affordable leases.

“We are reaching out and welcoming conversations with communities concerned about the viability of their malls,” Mr. Weiner said.

Updated: 1-19-2021

Developers Want Malls To Become Warehouses Or Offices. It Is A Slog.

Potential land mines await those seeking to raze and redevelop a space that spans dozens of football fields.

Many developers look at failing malls and envision modern office campuses, bustling warehouses or residential buildings. But some are finding that converting these shopping centers isn’t so easy.

Repurposing a mall is expensive. New owners typically need to shell out hundreds of millions of dollars on construction and labor, developers and brokers say.

Razing and redeveloping a space that spans dozens of football fields is filled with potential land mines. The new investor may own the mall but not the department stores or parcels in the parking lot, which means an owner needs their approval. Owners will also need to seek rezoning and entitlements permits that can take years, during which economic conditions can deteriorate.

Consequently, many recent conversion efforts have gone awry, forcing the owner to sell the property at a discount. In other cases, local government authorities have lost patience and bought the owners out.

Brookfield Property Partners LP has made converting all or part of malls one of its prime real-estate strategies. In 2018, the firm bought the two-thirds of mall operator GGP Inc. it didn’t already own, valuing GGP’s property portfolio at around $15 billion. The acquisition reflected Brookfield’s confidence in the mall-conversion strategy, but the real-estate investor has often struggled to make this approach work.

Brookfield last week handed over its North Point Mall in Alpharetta, Ga., to a lender, despite having secured rezoning approvals to add hundreds of residential units to the site in 2019. Yet with the two-story property losing tenants in recent years, its value has sunk below its loan balance of roughly $200 million—thereby making little economic sense for Brookfield to continue repaying the loan and investing in the mall’s redevelopment.

The property firm in July canceled plans for the redevelopment of a former Vermont mall after securing permits to tear down the property. Brookfield said at that time that the long-term nature of the development’s next phase didn’t fit with its funds mandate. Analysts said that office and retail tenants are turning more cautious about signing new leases, which made redevelopment projects like this less of a sure bet.

An investor’s ambitious plan to turn the struggling Gwinnett Place Mall outside Atlanta into a 20,000-seat cricket stadium didn’t work out, either. The 1.7 million-square-foot mall thrived in the 1980s and ’90s but later suffered from competition by neighboring malls and went into foreclosure in 2012.

Moonbeam Capital Investments LLC purchased the mall in 2013 for $13.5 million. The firm, which specializes in buying nonperforming loans backed by commercial properties, planned to build apartments and offices after demolishing a department store at the mall. But Moonbeam ran out of money and didn’t proceed, according to a person familiar with the matter.

In 2019, an investor proposed buying the site and turning it into a cricket stadium, hoping to appeal to the region’s large Indian population and its enthusiasm for the British sport. The investor, Philadelphia-based businessman Jignesh Pandya, hoped a stadium would be a part of a proposed U.S. cricket league. But the sale fell apart when the two sides couldn’t agree on terms, according to a person familiar with the matter.

In December, county officials agreed to purchase the mall from Moonbeam for $23 million rather than see this valuable site go unused by the community. It couldn’t be determined if Moonbeam, which didn’t respond to requests for comment, made money on the sale after including investment costs.

Not all conversions fail. Some dying malls have become warehouses, prized by logistics companies since they are located near major highways and have ample parking fields. In rare instances, tired shopping centers draw technology firms seeking a site for their headquarters or an office campus.

Local governments often step in to buy the mall to prevent further decay and make the site more palatable for future investors. While local authorities rarely pay top dollar for failing malls, some sellers have broken even or squeezed out a profit if they picked up the malls cheaply after the 2009 recession.

In Norfolk, Va., the Norfolk Economic Development Authority purchased Military Circle Mall and called for investors to submit plans for the site. The city said this month it has shortlisted four groups, including one with entertainment companies and the musician Pharrell Williams.

Updated: 2-8-2021

Malls Spent Billions On Theme Parks To Woo Shoppers. It Made Matters Worse

For big operators who thought entertainment was a solution to a declining business, the bills are coming due.

Destiny USA is New York’s largest shopping mall, a six-story structure by Onondaga Lake. Its feature attraction is WonderWorks, a 40,000-square-foot theme park where children can experience a simulated earthquake, learn about space travel wearing an astronaut suit or play laser tag.

They could, that is, until the state made the mall close many of the attractions in November for the second time last year to counter Covid-19. Only 18% of the space leased to entertainment tenants is open currently, said a spokesman for the mall’s owner, Pyramid Management Cos.

Adding theme-park-like attractions was a strategy that Pyramid viewed as crucial to drawing foot traffic and reversing the yearslong struggles of mall operators battling online shopping. Now, the strategy looks less like a lifeline and more like a millstone.

Even as new pandemic measures have allowed the mall’s stores to reopen, regulations have kept many of its entertainment attractions closed. Pyramid, which is privately held, borrowed heavily to expand and to build entertainment extravaganzas at Destiny USA and another mall, Palisades Center in West Nyack, N.Y., and the bills are coming due.

In April, the Pyramid entities that operate the two malls became delinquent on securitized debt called commercial mortgage-backed securities, or CMBS, according to real-estate-data provider Trepp LLC, eventually negotiating extensions and deferrals.

It’s a plight facing another privately held major mall owner that bet on on-site entertainment, Triple Five Group. It owns Mall of America in Minnesota and a New Jersey mall, American Dream, that have invested heavily in attractions from giant waterslides to an indoor ski slope.

Pyramid and Triple Five have gone much further than other mall owners in adding grand spectacles to their biggest U.S. properties, racking up debt they are now having trouble repaying. Last year, three of their four big U.S. malls defaulted on some CMBS debt, according to Trepp; the fourth mall is delinquent on some local-government bills.

Among all CMBS mall loans that ratings firm DBRS Morningstar tracks, about 14% of $50.6 billion were delinquent at the end of 2020, up from 2.7% at 2019’s end.

Entertainment typically draws foot traffic, but today it has become an unsustainable expense, said Nick Egelanian, president of retail-consulting firm SiteWorks. “This is one of the great dilemmas,” he said. “You think about all the things we’re experimenting with to take the place of the department store anchor, entertainment is the most expensive. Anything that requires mass gatherings isn’t a good idea during a pandemic.”

These burdens will become benefits again after the pandemic, Mr. Egelanian said, assuming vaccines are effective and something akin to normal life can resume.

Pyramid and Triple Five have more payments coming due this year without a clear idea of how long Covid-19 restrictions will affect revenue. A Triple Five spokesperson didn’t respond to requests for comment.

Pyramid Chief Executive Stephen J. Congel said he is confident Destiny USA will make it through. During the summer, he said, when Destiny USA reopened, traffic was as high as 80% of its year-ago numbers, as overworked parents and bored children streamed through its doors.

They will again, he said, after the vaccine becomes widely available. “That segment has been hit hard,” he said of the entertainment business. “But it will eventually return to be healthy.”

While many factors, such as retailer bankruptcies and competition from nearby properties can contribute to a mall’s default, analysts said, owners that borrowed to build entertainment attractions are more vulnerable in the pandemic. Still, they said, lenders are less inclined to foreclose on malls with large-scale entertainment venues because taking the keys back means taking on the complexities of running such a center or finding another buyer.

The pain goes further at Pyramid, which owns 14 malls: Entities that operate 11 of those malls, including the big two, missed repayments starting April on $1.2 billion of their $1.6 billion in CMBS debt, according to Trepp. Destiny USA defaulted on $430 million and Palisades Center on $418.5 million.

Pyramid negotiated extensions and deferrals with its lenders and resumed making payments in November, according to Trepp. Pyramid said its remaining three malls aren’t in default.

“These difficulties are very consistent with the entire mall industry,” a Pyramid spokesman said. “We expect to work out financial restructurings, as needed, as we have done so successfully in the past.”

Mall Malaise

Malls have been staples of suburban life since the 1950s, but big department stores and retailers started closing outlets as consumers shifted toward shopping online and at independent stores, and spending on experiences instead of goods. Of the roughly 1,500 U.S. properties that were once enclosed shopping malls, at least 500 no longer are, said Ellen Dunham-Jones, a Georgia Institute of Technology professor who studies the retrofitting of dying malls.

Mall operators began looking to experiential games and rides to woo foot traffic and help cure the mall malaise. Several hundred malls now feature a few attractions—minigolf, karting, bowling lanes, gaming arcades—that consumers can’t replicate at home.

For most malls, these attractions are a small piece of business: Entertainment tenants occupy about 2% of U.S. mall space, according to CoStar Group, a provider of commercial-real-estate data and analytics.

Pyramid and Triple Five have bet more. About 12.5% of Destiny USA’s square footage is entertainment attractions and about 12.2% of Palisades Center’s, said the Pyramid spokesman. Pyramid’s other 12 malls are in smaller markets and have entertainment square footage ranging from 3.8% to 18.1%, he said.

When American Dream opened in 2019, Triple Five said it would feature 55% entertainment. It said that year that Mall of America in Bloomington, Minn., which opened in 1992, has 25% entertainment, including roller coasters and a giant sea aquarium.

Mall of America’s roller-coaster rides closed in March, reopened in August, closed again on Nov 21 and reopened on Jan 11.

Triple Five missed multiple Mall of America mortgage payments on its $1.4 billion loan last year. After negotiations with its lenders, the loan was modified and it secured interest-only repayment terms until maturity and is deemed current since December, according to Trepp.

Triple Five’s American Dream, in East Rutherford, N.J., across the Hudson River from Manhattan, became one of the first U.S. malls to devote more space to entertainment, restaurants and theme-park rides than to traditional retail when the $5.7 billion project opened—the costliest U.S. mall ever, analysts said.

Attractions include a 1,000-foot-long indoor ski slope and it planned to open a giant indoor wave pool in March but closed that month under pandemic restrictions. The mall partially reopened in October; two-thirds of its stores are operating, its website says.

The water park, Nickelodeon theme park, minigolf and the ice skating rink are open. Other attractions have yet to open even for a day, because they are either still under renovation or are waiting for more people to get the vaccines. Other attractions that haven’t opened include the aquarium, Legoland and mirror maze.

Triple Five is on the hook for $2.7 billion in loans, including through municipal bonds, for the mall, according to municipal-market information provider Electronic Municipal Market Access. The Journal couldn’t determine whether Triple Five was delinquent on any payments on that debt; the firm didn’t take out any CMBS for American Dream.

American Dream is delinquent on payments of $1 million in 2019 and $2 million in 2020 in a payment-in-lieu-of-taxes deal with East Rutherford, said Anthony Bianchi, the borough’s chief financial officer. Triple Five, of Edmonton, Alberta, also operates a mall in Canada.

Pyramid’s Bet

Mr. Congel’s father co-founded Pyramid in 1968 as a Syracuse construction company. It built its first mall, in New York, in 1971 and by 1976 had completed 22. In 1990, it opened a mall on a former scrapyard, naming it Carousel Center for the merry-go-round that was the main feature. In 2012, Pyramid expanded it by 883,000 square feet to its current 2.4 million, renaming it Destiny USA.

To help fill the space and woo traffic, it added experiences typical of amusement parks: indoor go-kart operation, the WonderWorks theme park including a ropes course. Destiny USA’s foot traffic in 2012 rose by more than a third, and sales per square foot were 25% over the prior year, Pyramid said.

Destiny USA, which also added laser tag, a mirror maze, bowling and simulated rides, became a tourist attraction. Shoppers from Buffalo, N.Y., and Canada drove hours to experience it. “People were curious to see what it would be like,” said Frank Cerio, who grew up nearby and is chief operating officer of 5 Wits, which runs interactive and fantasy games at Destiny USA and other Pyramid malls.

Pyramid began offering day passes for access to entertainment sites at Destiny USA and developed a 209-room Embassy Suites hotel nearby. Girl Scouts held sleepovers at WonderWorks. Pyramid spent hundreds of millions bringing on more entertainment attractions to Destiny USA and other properties, Mr. Congel said.

The mall’s net operating income rose 16.7% from 2010 through the first quarter of 2014, according to a Standard & Poor’s report in 2014. But Destiny USA suffered declining net operating income every year after 2016, and Pyramid’s Palisades Center has also experienced declining income since 2017, according to Standard & Poor’s.

A Pyramid spokesman said: “While Pyramid has not been immune to the past decade’s fluctuation trends, which were exacerbated by the pandemic, we have confidence in the long-term outlook, based on our diversification strategy.”

Covid effect

When New York state implemented shutdowns in March, Destiny USA closed. Tenants struggled to pay rents and Pyramid became delinquent on the repayment of its mortgages for Destiny USA and Palisades Center starting April. Pyramid secured deferrals on debt service payments and delayed the maturity dates for the loans.

“We’re concerned about the survivability of the business here,” said Nicole Montgomery, general manager of WonderWorks at Destiny USA, referring to the theme park’s operations.

Destiny USA is now around 70% occupied, down from as high as 97% in 2013, said the spokesman. A J.C. Penney store shut in October, Lord & Taylor closed there in December as part of its bankruptcy and Best Buy said it is closing its Destiny USA store in March.

Macy’s and TJ Maxx stores are still there, men’s apparel maker Untuckit said it is in talks about opening there, and Women’s clothing retailer Anthropologie said it is opening a store this year.

Depending on each tenant’s sales and circumstances, Destiny USA said, the mall has agreed to consider granting rent reductions.

One afternoon in December, yellow tape cordoned off the mall’s arcades, shutters were down on a laser-tag area and a peek inside Dave & Buster’s sports bar and videogame rooms revealed mostly darkness. The arcades and Dave & Buster’s remain closed.

Adam Liu, a 22-year old Syracuse University student, stopped by Destiny USA but said he wasn’t taking chances with the ropes course, the only part of WonderWorks open that day. “Not today,” he said, “because of the pandemic.”

Updated: 6-14-2021

Mall Owner Washington Prime Files For Chapter 11 Bankruptcy

Washington Prime Group Inc., a real estate investment trust that operates enclosed malls and strip centers across the U.S., filed for bankruptcy after the Covid-19 pandemic drove away shoppers.

The Chapter 11 filing in Houston lets Washington Prime stay in business while it restructures its debts in a deal that it reached with certain creditors, according to the bankruptcy. The company, with assets estimated at $4 billion and debt of almost $3.5 billion, secured a bankruptcy loan of as much as $100 million to fund operations during court proceedings.

After extensive negotiations with creditors including the investment firm SVPGlobal, the company agreed to pursue a plan to reduce debt by swapping equity for some of its debt claims while simultaneously soliciting the market for better offers, according to court filings which cited the “dual path” plan.

Rent collections dried up and tenants filed for bankruptcy or went out of business as the pandemic spread around the nation in 2020. The Columbus, Ohio-based company, which has about 100 locations, began negotiating with its creditors last year and skipped a $23 million bond interest payment in February. Creditors had been extending a forbearance agreement amid the debt talks.

Still, Washington Prime’s share price surged in recent weeks as it was whipped into the frenzy of trading around meme stocks popular among retail investors and on Reddit message boards. The stock rose as high as $6.98 in June, from a price closer to $2 earlier this year. Trading was halted on Monday as investors digested news of the bankruptcy.

Washington Prime aims to deleverage its balance sheet by nearly $950 million, according to a company statement. The plan includes swapping unsecured notes for equity, a $190 million paydown of its revolving credit and term loan facilities and a $325 million equity rights offering.

The plan has support from creditors that hold about 73% of the principal outstanding of secured corporate debt and 67% of the unsecured notes. Bloomberg News previously reported that Washington Prime was weighing a bankruptcy filing as talks faltered.

The case is Washington Prime Group Inc., 21-31948, U.S. Bankruptcy Court for the Southern District of Texas (Houston).

Excessive Number Of Mall, Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall,Excessive Number Of Mall

Related Articles:

Trump Calls On Fed To Cut Interest Rates, Resume Bond-Buying To Stimulate Growth (#GotBitcoin?)

Fake News: A Perfectly Good Retail Sales Report (#GotBitcoin?)

Anticipating A Recession, Trump Points Fingers At Fed Chairman Powell (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Los Angeles And Other Cities Stash Money To Prepare For A Recession (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.