Ironically, Tech Titans Spend Ad Dollars On Traditional Advertising vs Digital Online Advertising (#GotBitcoin?)

Those firms’ recent splurging on TV advertising marks a somewhat ironic twist for companies that grew to become the three largest players in digital advertising, racing to persuade advertisers to shift their ad budgets online and away from TV. All three companies also built platforms that let people watch shows, sports and videos online, a trend that has helped undermine traditional TV.Ironically, Tech Titans Spend Ad Dollars On Traditional Advertising vs Digital Online Advertising

Now a Super Bowl mainstay, e-commerce giant spends more than McDonald’s on TV ads.

Amazon.com Inc. is becoming a fixture of Super Bowl advertising, a sign that the tech titans that championed the rise of online advertising and streaming video find TV’s mass-marketing appeal hard to resist.

The e-commerce giant will be in the big game for the fourth straight year and is expected to have two and half minutes of ad time, although timing could change, according to a person familiar with Amazon’s advertising plans.

Its 90-second big game spot, which was released Wednesday, features celebrities such as Harrison Ford, Forest Whitaker and astronauts Scott and Mark Kelly testing new products such as a dog collar and toothbrush, which are equipped with its Alexa voice assistant. But not all of them pan out.

The Super Bowl appearance is part of a larger TV advertising blitz by Amazon. Its national TV ad spending in the U.S. soared almost 60% last year to $679.1 million and has nearly doubled since 2015, according to estimates from Kantar Media, an ad-tracking firm owned by WPP PLC. Amazon was one of the top 15 national TV spenders last year, shelling out more than companies such as Toyota Motor Corp. and McDonald’s Corp.

Amazon is “jumping into mainstream advertising in a big way,” said Allen Adamson, co-founder of Metaforce, a marketing firm. “It’s a dramatic increase, which feels bigger, as the brand was virtually absent from traditional media advertising for most of its existence.”

Other tech heavyweights are also investing heavily in expanded TV advertising. The U.S. TV ad outlays of Alphabet Inc.’s Google increased almost 45% in 2018 to $522.5 million, while Facebook Inc. spent $272 million, far exceeding the $13.3 million it spent in 2017, Kantar estimates show.

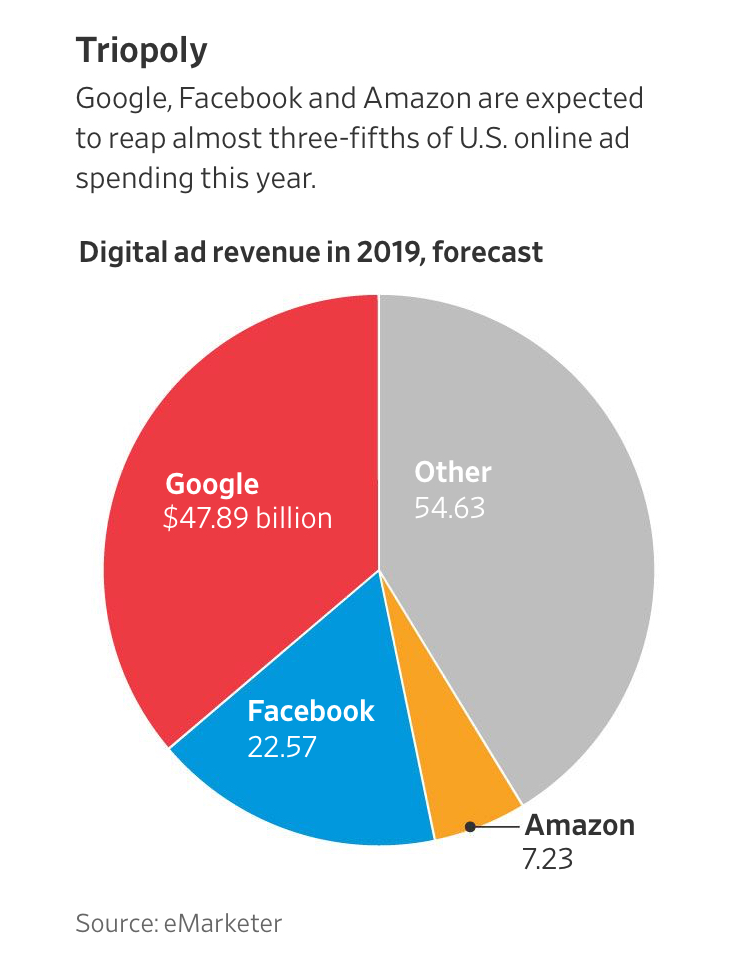

Digital ad spending in the U.S. eclipsed TV ad spending for the first time in 2016, according to eMarketer. The research firm expects brands to shell out $69.1 billion on TV spots this year and $132.3 billion on digital ads—59% of which will go to Google, Facebook and Amazon.

Amazon, which for years relied largely on digital ads in its marketing, is discovering what many online players eventually figure out: that TV’s appeal is tough to beat when it comes to brand building.

Digital companies are “selling direct to consumers more now, and that explains why they are increasing their direct-to-consumer ad spend,” said Jon Swallen, Kantar’s chief research officer. “They have to do mass marketing to grow, to cement their positions and to guard against those coming up from behind.”

That is true for Amazon as it battles with Google and others for dominance over the voice-assistant market, for example, branding experts said. Amazon has also used TV ads to plug products and services including its Prime membership program, Amazon Studios, its cloud business and Echo. Amazon didn’t respond to a request for comment.

The boost in TV spending has helped catapult Amazon into the big leagues in terms of overall U.S. ad spending. For 2018, Amazon shelled out $1.84 billion on ads, making it the fifth-largest advertiser in the country, behind Procter & Gamble Co. , AT&T Inc., Berkshire Hathaway Inc. and Comcast Corp. , according to Kantar. (The figure doesn’t include social-media ad spending.)

The Super Bowl is the priciest ad real-estate on television, with a 30-second slot this year selling for more than $5 million.

Last year, Amazon was one of the larger Super Bowl advertisers, spending big bucks to air a 90-second star-studded commercial that featured celebrities such as rapper Cardi B and actor Anthony Hopkins filling in after its voice assistant Alexa had lost her voice. Amazon Chief Executive Jeff Bezos made a cameo. The company also ran a 60-second commercial to promote its original series “Tom Clancy’s Jack Ryan.”

Google last year promoted its smart speaker Google Home with a sappy Super Bowl commercial that showed families asking Google Home for assistance with various tasks, from help with recipes to help with homework. Google will advertise during the Super Bowl, according to people familiar with the matter.

Facebook said it won’t be airing a spot in the big game. “We look at all available marketing channels to reach people where they are,” a spokeswoman for the company said.

The social-media giant spent heavily during the holidays, bombarding consumers with TV ads that promoted its video-chat device, Portal. The Menlo Park, Calif., company also blanketed the airwaves last year with apology ads, as it sought to repair its image following Russia’s meddling in the 2016 U.S. presidential election, in part by using Facebook, and the proliferation of fake news on its platform.

Related Article:

Ad Agency CEO Calls On Marketers To Take Collective Stand Against Facebook (#GotBitcoin?)

Facebook Bug Potentially Exposed Unshared Photos of Up 6.8 Million Users (#GotBitcoin?)

Advertisers Allege Facebook Failed to Disclose Key Metric Error For More Than A Year (#GotBitcoin?)

Facebook Finds Security Flaw Affecting Almost 50 Million Accounts (#GotBitcoin?)

Why You Should Back-up Your Facebook, Google And Twitter Data Regularly

Snapchat, Facebook & Twitter ’s Users Slide in Latest Setback For Social Media (#GotBitcoin?)

Your questions and comments are greatly appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.