Americans’ Love Affair With The Automobile Headed For Divorce (#GotBitcoin)

If teenagers are any guide, Americans’ love affair with the automobile may no longer be something car makers can bank on. Americans’ Love Affair With The Automobile Headed For Divorce (#GotBitcoin)

In a challenge for Detroit, teens put off getting their licenses and buying cars.

The percentage of teens with a driver’s license has tumbled in the last few decades and more young people are delaying purchasing their first car—if buying one at all, say analysts, generational experts and car industry executives. About a quarter of 16-year-olds had a driver’s license in 2017, a sharp decline from nearly half in 1983, according to an analysis of licensing data by transportation researcher Michael Sivak.

Whereas a driver’s license once was a symbol of freedom, teenagers are reaching their driving age at a time when most have access to ride-hailing services such as Uber and Lyft to shuttle them around town. At the same time, social media and video chat let them hang out with friends without actually leaving the house.

When they reach their 20s, more are moving to big cities with mass transit, where owning a car is neither necessary nor practical. And of those who do buy a car, many more than in older generations opt for a used one, according to J.D. Power.

One reason for that is rising new-vehicle prices. Detroit has jettisoned many of their lower-priced compact and subcompact cars like the Ford Fiesta and Chevy Cruze that have traditionally been starter cars for young buyers. For the auto makers, the strategy makes sense: Sport-utility vehicles or trucks have steadily become more popular over the past decade, and also have much better profit margins.

Now, a new mind-set among many Generation Zers—roughly those born after 1997—is confounding parents and stumping auto makers at a time when new-vehicle sales in the U.S. are slowing.

“That freedom of getting your own wheels and a license—and that being the most important thing in life—is gone,” said Brent Wall, owner of All Star Driver Education in Michigan, a chain of drivers’-ed schools. He said the average age of students in his class is rising. “It used to be the day they turned 14 years and eight months, everybody was lining up at the door. Now I’m starting to see more 15- and 16-year-olds in class.” He frequently hears from parents that they’re the ones pushing their children to enroll.

David Metzler, of Culver City, Calif., is baffled that his 16-year-old daughter June sees no reason to get her license.

“I went out and got it immediately” upon turning 16, he said. “I wanted to get out of the house and go places. For her, getting a license is more like planning for the future.”

June Metzler says she is content with inviting friends over or hanging out with them after school. “Going out to eat is hard, but I can live with it,” she said.

Auto-industry executives say they are attuned to the shifting sentiment—even hearing it from their own children—and are adapting some of their marketing strategies. Japanese auto makers are keeping their lower-priced sedans as a way to attract young people to their brands. But Detroit is betting that even if young people wait longer to buy a car, they eventually will when finances improve and they start families. And then, they’ll buy an SUV or truck.

Some industry analysts aren’t so sure Detroit will be proven right in its bet on larger cars.

“It’s a gamble,” said Mark Wakefield, a global co-leader of automotive and industrial practice at consulting firm AlixPartners, saying that for the auto makers it’s no longer workable to offer a vehicle for every price point. “With urbanization and the cost of ownership going up, those two things combined with the fact that it’s a mature market certainly could put a damper on car sales,” he said.

“Gen Z buyers’ participation in the new-car space is declining year after year,” said Tyson Jominy, an analyst with research firm J.D. Power. “We expect to see them get their first job” and buy a car. “But we’re not seeing this.”

J.D. Power estimates that Gen Zers will purchase about 120,000 fewer new vehicles this year compared with millennials in 2004, when they were the new generation of drivers—or 488,198 vehicles versus 607,329 then.

Cost is increasingly a challenge. The average price paid for a new vehicle was $32,544 in 2018, up from $25,490 a decade ago, according to J.D. Power. The average monthly payment on a new-car loan reached $535 a month last year, or more than 10% of the median household income, a level most Americans can’t afford, said Cox Automotive.

Generation Zers grew up during the financial crisis and tend to be more budget-conscious, according to researchers who study generational trends. In addition, many face substantial student-loan payments, making them more cautious about big-ticket purchases. Total student-loan debt has soared to $1.5 trillion, surpassing Americans’ credit-card and car-loan bills.

The process for teenagers is also getting more expensive. State budget cuts have meant that many public schools no longer offer free driver’s training and a private course can cost upward of a thousand dollars, say driver’s-ed professionals.

On top of the shortage of small cars, auto makers are also packing more technology into vehicles, contributing to rising prices. The new extras also make cars more expensive to repair, helping to drive up car-insurance costs, another deterrent for many teens and 20-somethings.

Bob Carter, Toyota Motor Corp.’s North American sales chief, says that auto makers are aware young people face different financial pressures than previous generations. “We just got to be prepared that getting their license is going to happen later” than has been the norm.

To adapt, some car companies are expanding into new transportation ventures, such as car sharing and electric scooters, to better compete with the ride-hailing options offered by Silicon Valley. But to fund costly investments in new technology and ventures such as electric and self-driving vehicles, auto makers need to keep sales of traditional cars growing.

That may prove tricky if a different mind-set continues to take hold.

In 1983, the first year Mr. Sivak began analyzing the ages of drivers based on licensing data, the percentage of 16-year-olds with driver’s licenses was 46%. By 2008, it had fallen to less than a third and in 2014, it hit a low point of 24.5%. It was up slightly to 26% in 2017, which Mr. Sivak said was likely due to the economy improving.

Even among those in their early 20s, fewer are getting their licenses. About 80% of 20- to 24-year-olds were licensed drivers in 2017, compared with 92% in 1983, Mr. Sivak found.

“The topic comes up in cocktail conversations all the time,” said Stephanie Frazier, a parent of an 18-year-old in Hawaii who she says has no interest in getting a driver’s license. “When I was that age, I wanted wheels and freedom.”

Lizette Dominguez, a sophomore in Westfield, Ind., who turned 16 this month, says she hasn’t gotten around to getting a license yet. “I have after-school activities, homework and clubs.” The cost of driver’s education also deterred her. “It costs almost $400.”

Ms. Dominguez said she uses Uber or has one of her older friends give her a ride to the movies, a friend’s house or the mall.

To appeal to younger consumers, several auto makers. have recently debuted small, sporty crossovers priced under $25,000.

Hyundai Motor Co. , for example, rolled out a new Kona small utility last year that comes packed with technology—including a seven-inch touch screen—for a starting price of $19,000. The Korean auto maker revealed an even smaller crossover, called the Venue, at the New York Auto Show this month.

Volvo Cars two years ago launched a vehicle-subscription service to attract millennials and Gen Zers who don’t want to own a car outright. Subscribers pay about $700 a month to drive a Volvo model for a year and then can swap it out for a different one. Unlike a traditional leasing contract, there are no financing charges and insurance is included.

Meanwhile, appealing to Gen Zers was part of the motivation behind Ford Motor Co.’s purchase last year of electric-scooter startup Spin, says Sheryl Connelly, Ford’s manager for consumer trends. She said the auto maker is also looking to invest in other urban-mobility ventures such as electric bikes, as well as ride-hailing and car-sharing services.

The cost challenges have sent many young car buyers to the used-vehicle lot, and analysts say this trend is likely to continue even as they get older. About 60% of car shoppers in their early 20s bought preowned cars last year, up from 57% five years ago, according to J.D. Power.

Neika Daniel, a 17-year-old high-school student in Little River, Texas, said she is focused on price more than anything else. With help from her parents, she recently bought a used 2016 Volkswagen Beetle for $2,500, and while not fancy, it gets her around.

“It was a relief to avoid car payments and debt,” she said.

Updated: 4-1-2020

Coronavirus Outbreak Takes Toll On U.S. Auto Sales

Buyers began steering clear of showrooms in mid-March to avoid interactions with others and possible exposure to the virus.

A collapse of showroom traffic in March led to a big drop in U.S. sales for major car companies in the first quarter, illustrating how quickly the coronavirus outbreak has dented business for one of the nation’s largest industries.

Fiat Chrysler Automobiles NV reported a 10% drop in first-quarter U.S. sales, saying strong results in January and February were more than offset by the impact of the virus in March.

General Motors Co. said its U.S. sales were down 7% in the January-to-March period, citing similar reasons, while Nissan Motor Co. reported a 30% drop in the first quarter.

Hyundai Motor Co. ’s U.S. sales were off 11% for the first quarter and Toyota Motor Corp. reported a nearly 9% decline.

Ford Motor Co. will release its first-quarter sales results Thursday.

The weaker first-quarter results provide a window into what is ahead for the U.S. car business as the outbreak continues to shut down large parts of society. Analysts in recent weeks have rushed to cut their U.S. sales forecasts, and executives and dealers expected the sales declines to only deepen in April with a rebound not likely until the summer, at the earliest.

“Consumers obviously and understandably shifted their priorities,” said David Kershaw, Nissan’s U.S. sales chief. “The situation is very fluid right now and everybody’s trying to get their arms around where and how this is going to play out.”

Car companies already had been grappling with collapsing sales in Europe and China as the virus spread around the globe earlier this year. But new-car demand in the U.S. has held strong, all the way through the first half of March, analysts and dealers said.

The turning point came midmonth, when buyers began steering clear of showrooms to avoid interactions with others and possible exposure to the virus. U.S. car factories went dark soon after and many dealers have since temporarily closed their locations to comply with stay-at-home orders.

For March alone, analysts are expecting sales to have decreased by about a third compared to the same month last year. Toyota’s sales last month fell nearly 37%, while Hyundai’s dropped 43%.

“This is a sign of things to come,” said Jessica Caldwell, an analyst with car shopping website Edmunds.com. “April is going to be another tough month. It’s going to be hard for any company to move the needle.”

Some retailers are trying to stimulate business by promoting online sales and at-home delivery services, allowing buyers to purchase a car without having to leave their homes. That has helped some, analysts say, but the bigger challenge is customers are delaying purchases altogether.

Auto makers, rushing to salvage business, have also responded by reviving sales promotions used during the 2007-09 recession, such as no-interest loans, delayed first payments and protection plans that give buyers relief if they lose a job.

Fiat Chrysler on Wednesday said starting in April it will offer customers 0% financing for seven years and deferred payments for three months.

Those kinds of no-interest finance deals helped lift pickup truck sales for the Detroit car companies in March, said Tyson Jominy, a J.D. Power auto analyst. But it is unclear if such promotions helped business more broadly because many were rolled out late in the month.

One point of relief for the industry, dealers and analysts say, is that while demand craters, nearly all U.S. factories have also closed due to parts shortages orders and to curb the spread of the coronavirus. That will help auto makers avoid unwieldy stockpiles of unsold cars.

The U.S. auto industry entered the year with expectations that vehicle sales, while slowing from a peak of 17.6 million in 2016, would remain healthy. Now, some forecasters are predicting sales could dip as low as 13.5 million in 2020—a level not seen since 2010 when the industry was only starting to emerge from the financial crisis.

Dealers who remained open last month saw business nosedive as buyers canceled appointments and avoided showrooms.

George Waikem II, treasurer of Waikem Auto Family, a dealership chain in Ohio, said store traffic was off 60% last month compared with February and he doesn’t expect it to improve anytime soon.

Updated: 10-3-2022

As More Cars Hit Dealership Lots, Buyers Feel Pinch of Rising Interest Rates

Improved supply chain lifted dealer inventory and sales, but economic obstacles are weighing on customers.

More new cars and trucks are finally trickling into dealerships as supply-chain troubles ease and auto makers increase factory output. Now, rising interest rates and other economic pressures are starting to put a damper on the car-buying mood.

Several major auto makers reported U.S. sales declines in the third quarter as inventory levels remained pressured, despite some improvement in recent months.

General Motors Co. posted a 24% jump in third-quarter U.S. sales as its vehicle availability increased after it was disproportionately hit last year by supply-chain constraints resulting from Covid-related shutdowns in Asia.

The auto industry has grappled for nearly two years with choppy factory schedules and thin dealership stocks, stemming from semiconductor shortages and other supply problems. Those troubles are easing and vehicle availability is slowly improving, the car companies say.

Auto executives continue to express confidence they will be able to fill a big backlog in consumer demand as production normalizes. But a worsening economic picture and higher interest rates are raising questions about whether consumers will still keep snapping up cars and trucks at the same pace once stock levels improve.

“There’s a lot of negative consumer sentiment in the marketplace. So we’re obviously concerned about that,” Hyundai Motor America Chief Executive Randy Parker said Monday, citing rising rates and stock-market declines. Hyundai’s third-quarter sales rose 3%.

Still, Mr. Parker said it was too early to say whether demand is weakening significantly and said he is cautiously optimistic that it will hold up.

He said sales slowed last week partly because of Hurricane Ian’s impact on the Southeast, making it more difficult to gauge underlying consumer demand.

Auto makers pointed to continued low vehicle inventories as the reason for weaker third-quarter sales. Toyota Motor Corp. said sales fell 7% in the July-to-September period.

Stellantis NV’s dropped 6%, with the Jeep maker citing continued supply constraints, and Nissan Motor Co. reported a nearly 23% drop in U.S. sales for the third quarter.

Overall, industrywide sales in the U.S. for the third quarter were about 3.36 million, roughly flat over the prior-year period, according to Wards Intelligence. Ford Motor Co. F -6.89% is set to report U.S. sales results on Tuesday.

Electric-vehicle leader Tesla Inc. on Sunday said global vehicle deliveries in the third quarter rose about 42% to a record 343,830, but were hampered by vehicle-shipping capacity. The deliveries total fell short of Wall Street estimates.

EV startup Rivian Automotive Inc. also reported on Monday that it had produced 7,363 vehicles at its factory in Illinois and delivered 6,584 to customers during that same period.

The figure remains in line with Rivian’s target of producing 25,000 vehicles this year, the company said. Rivian’s stock was up more than 6% in after-hours trading Monday.

Rising interest rates are making it harder for U.S. buyers to afford record-high pricing on new vehicles, a byproduct of the scant inventory at dealership lots. Gone are the days of 0% financing on new vehicles, which car companies and dealers have long used as a staple promotion to sell cars.

The average interest rate on a new-car loan in the U.S. hit 5.7% in the third quarter, the highest in three years, according to research site Edmunds.com.

Americans also are financing more of the purchase price than ever, reflecting record-high car prices. The average amount financed per vehicle in the third quarter was $41,347, compared with $38,315 a year earlier, according Edmunds.com.

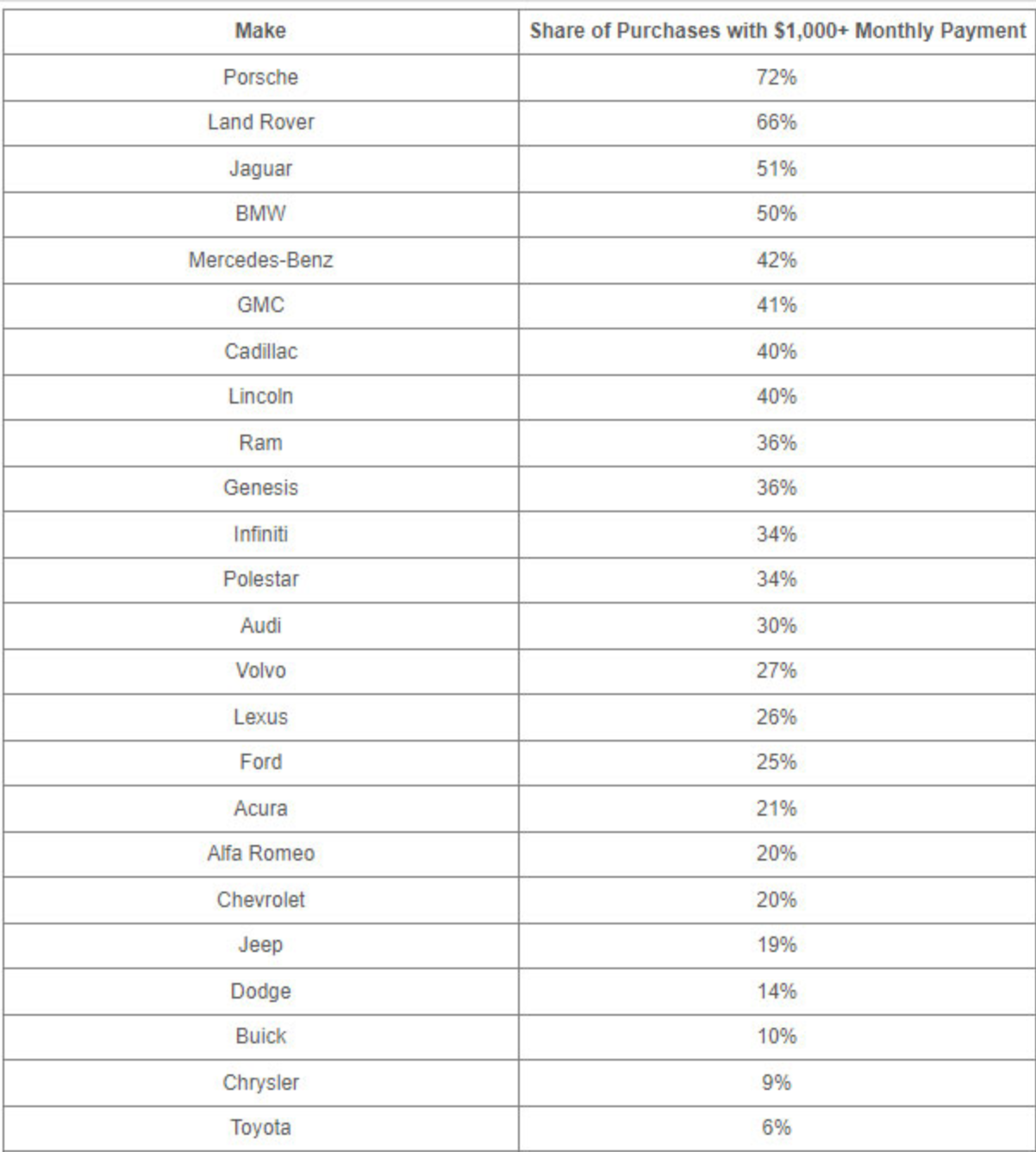

And 14% of auto-loan customers during that same period took on a monthly payment of $1,000 or more, up from 8% a year earlier, the firm found.

“It seems likely that much of the pent-up demand from limited supply is quickly disappearing as high interest rates eat away at vehicle buyers’ willingness and ability to purchase,” said Charlie Chesbrough, senior economist with research firm Cox Automotive.

The firm last week lowered its 2022 U.S. sales forecast to 13.7 million new vehicles, which would be down 9% from last year. In the five years leading up to the pandemic-plagued year of 2020, the industry sold more than 17 million vehicles annually.

So far, though, car companies and dealers say that most new vehicles that get shipped from the factory are quickly snapped up by buyers.

There were nearly 1.3 million vehicles on dealership lots or en route to stores in August, up 10% from July and 19% higher than a year earlier, according to research firm Wards Intelligence. That represented a 29-day supply, the highest in months but still roughly half historical norms.

“There is still really strong consumer demand, and huge replacement demand,” said Duncan Aldred, head of GM’s Buick and GMC brands, during an interview at the Detroit auto show last month. “I think that will probably overcome a lot of the economic headwinds.”

GM said Monday that semiconductor availability has improved and output has stabilized, allowing it to stock more cars and increase sales. The number of vehicles on dealership lots or en route to stores at the end of the third quarter rose 45% from a year earlier, GM said.

Auto executives have said the semiconductor shortage that has plagued output for nearly two years is gradually easing. Still, shortages continue, and the impact tends to be felt unevenly across regions and companies.

There are signs that rising interest rates are starting to strain car buyers, which could pressure pricing.

This past week, CarMax Inc. shares sank after the used-car retailer flagged that high prices, paired with high broader inflation and rising interest rates, have slowed demand.

The company’s profit fell 50% in its most recent quarter and its sales leveled off at 2% growth, both worse than analysts expected.

Will Higher Interest Rates Cool Demand For New Cars?

For much of the year, analysts believed that whatever automakers could build would sell amid a climate of heightened demand and tightened inventory levels.

They believed as inventory levels grew, the depressed sales pace of the first half of the year would pick up.

What they didn’t count on was a depressed economy. Now, flat sales for new cars are expected as automakers report third-quarter sales results.

Tight supplies remain an ongoing problem. Shortages of semiconductor chips and other components continue to hamper vehicle production and slow sales.

Higher interest rates also could cool demand. The average interest rate paid on a new vehicle purchase hit 5.7% in September, up from about 4% a year earlier, JD Power said.

“It seems likely that much of the pent-up demand from limited supply will dissipate quickly as high interest rates erode car buyers’ willingness and ability to buy,” said Charlie Chesbrough, senior economist at research firm Cox Automotive.

Cox Automotive has lowered its 2022 sales forecast to 13.7 million new vehicles, down 9% from 2021and far less than pre-pandemic levels when the industry sold over 17 million vehicles annually.

So far, car companies and dealers say consumers purchase new vehicles as soon as they land on the lot.

“There’s still really strong consumer demand and huge replacement demand,” Duncan Aldred, head of General Motors Co., told Aumag.

Record prices for new and used vehicles are keeping automaker and dealer profits high. The average price U.S. car buyers paid for new vehicles reached $45,971 in the third quarter, up 10% from a year earlier and the highest of any quarter on record, according to JD Power.

Updated: 10-6-2022

Europe’s Carmakers Scrap Growth Hopes, Ask Policy Makers For Aid

* ACEA Now Sees Passenger Vehicle Sales Slipping 1% This Year

* Industry Seeks Help On Supply Chains, Charging Infrastructure

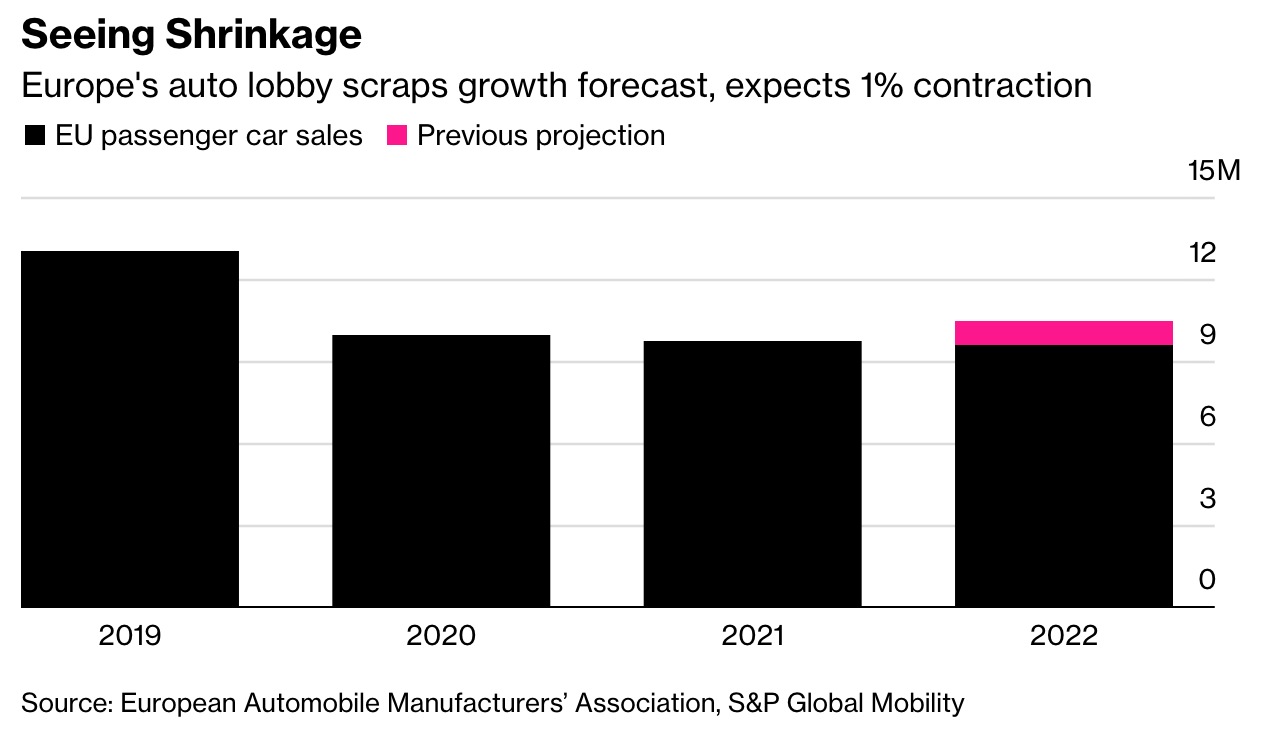

Europe’s automakers warned they’re likely headed for another year of shrinking sales and called for policy makers to step up their support of the industry struggling to recover from the pandemic.

Passenger car sales will probably drop 1% to 9.6 million this year, the European Automobile Manufacturers’ Association said Friday. While that outlook suggests there may be some recovery in the closing months — registrations were down almost 12% through August — the lobby group doesn’t expect enough of a bounce back to stick with its forecast toward the beginning of the year for a bit of growth.

Seeing Shrinkage

Europe’s Auto Lobby Scraps Growth Forecast, Expects 1% Contraction

A pile-up of setbacks — including Brexit, semiconductor shortages, the war in Ukraine and the resulting energy crisis — have contributed to the industry struggling to get back to pre-pandemic volumes, Oliver Zipse, the ACEA’s president and the chief executive officer of BMW AG, said in a statement.

Until recently, carmakers’ concerns were about constraints on production limiting vehicle supply. Now, runaway inflation and fears of recession are weighing on demand.

“To ensure a return to growth — with an even greater share of electric vehicle sales so climate targets can be met — we urgently need the right framework conditions to be put in place,” Zipse said. “These include greater resilience in Europe’s supply chains, an EU Critical Raw Materials Act that ensures strategic access to the raw materials needed for e-mobility, and an accelerated roll-out of charging infrastructure.”

European Commission President Ursula von der Leyen said during an address last month that the bloc’s ambition to become the first climate-neutral continent is at risk without secure access of raw materials including lithium and rare earths.

The act the ACEA is throwing its weight behind would streamline procedures and improve access to financing for strategic mining, refining, processing and recycling projects.

Updated: 10-7-2022

Soaring Prices And Interest Rates Send Many Monthly Car Payments To Over $1,000

If you’ve been shopping for a new car lately, you’ve likely had sticker shock.

While inflation and low inventories have already been conspiring to raise prices, rising interest rates are creating a one-two punch of pain.

According to a new study from Edmunds, the average annual percentage rate (APR) on new financed vehicles was 5.7% in the third quarter. Those are the highest rates since 2019 and it’s even worse when you consider the average amount financed hit an all-time record of $41,347.

As a result, buyers are facing large monthly payments which averaged over $700 per month in the third quarter. However, that’s cheap compared to the 14.3% of consumers who financed a new vehicle with a monthly payment of at least $1,000.

That rate is the highest Edmunds has on record and just 8.3% of monthly payments were $1,000 or more in the third quarter of 2021.

While traditional incentives have largely fallen by the wayside, a number of automakers have been offering low interest rates to entice consumers. People seem to be responding as Edmunds found a “small uptick in shorter loan terms in Q3.”

These offers might be the way to go as the company “calculated how much additional interest a consumer could expect to pay on a $40,000 car loan for 72 months at 5% APR versus 36 months at 1.9% APR.”

While the shorter term loan would increase the payment from $644 to $1,144 per month, consumers would save a whopping $5,200 in interest. That being said, not everyone can afford an extra $500 a month for their car payment.

Speaking of shoppers with smaller budgets, buying used has perils of its own. Edmunds found that the average APR for used cars in the third quarter was 9.0% and consumers were financing an average of $31,366. That results in a monthly payment of $565.

Getting back to new cars, 26% of EV buyers in the third quarter were paying a $1,000+ per month. That compares to 24% for plug-in hybrids, 14% for traditional ICE models, and 4% for hybrids.

The brands with the highest share of customers paying a $1,000+ per month were unsurprisingly premium automakers such as Porsche (72%), Land Rover (66%) and Jaguar (51%). However, GMC and Ram cracked the top ten list thanks to pricey pickups.

Edmunds’ executive director of insights, Jessica Caldwell, said “Despite worrisome macroeconomic conditions, Americans are spending more money than ever on new vehicle purchases.” She added, “Rising interest rates combined with higher prices has sent monthly payments soaring to new heights.”

Updated: 10-9-2022

Cathie Wood Warns Of ‘Serious Losses’ In Automobile Debt

* Investor Cites Manheim US Used Vehicle Index In A Tweet

* Bloomberg Data Show ABS Lose Less Than Global Bonds This Year

Cathie Wood flagged the risk of “serious losses” in the trillion-dollar auto debt market, after statistics showed US used vehicle prices decreased in September.

The Ark Investment Management LLC founder and chief executive officer cited a shift in consumer taste toward electric cars as leading to a drop in the price of gasoline-powered vehicles, according to a tweet that referenced data released by Manheim Auctions, the world’s largest reseller of used vehicles.

That organization’s US Used Vehicle Value Index posted a 3% drop in September from the month before.

Wood’s post follows a tweet last month warning about risks building for US auto debt. Vehicle loans were at an all-time high of nearly $1.4 trillion as on June 30, according to a quarterly data released by the Federal Reserve.

A Bloomberg index of asset-backed securities has lost 5.3% so far this year, less than the 20.2% slump in an index of global bonds.

Updated: 10-10-2022

Ford, GM and Other Carmakers Face 50% Profit Slump Next Year, UBS Analysts Say

* Industry Faces ‘Demand Destruction’ And Oversupply Of Vehicles

* RBC Says Estimates For The Group Need To Move Materially Lower

Shares of automakers Ford Motor Co. and General Motors Co. took a beating Monday as outlook for the industry darkened further with at least two Wall Street analysts predicting earnings will fall steeply next year.

Profits for US and European car companies are set to drop by half next year as weakening demand leads to an oversupply of vehicles, UBS Group AG analysts led by Patrick Hummel wrote in a note on Monday.

Meanwhile, RBC Capital Markets analyst Joseph Spak said 2023 estimates for the sector need to “move materially lower.”

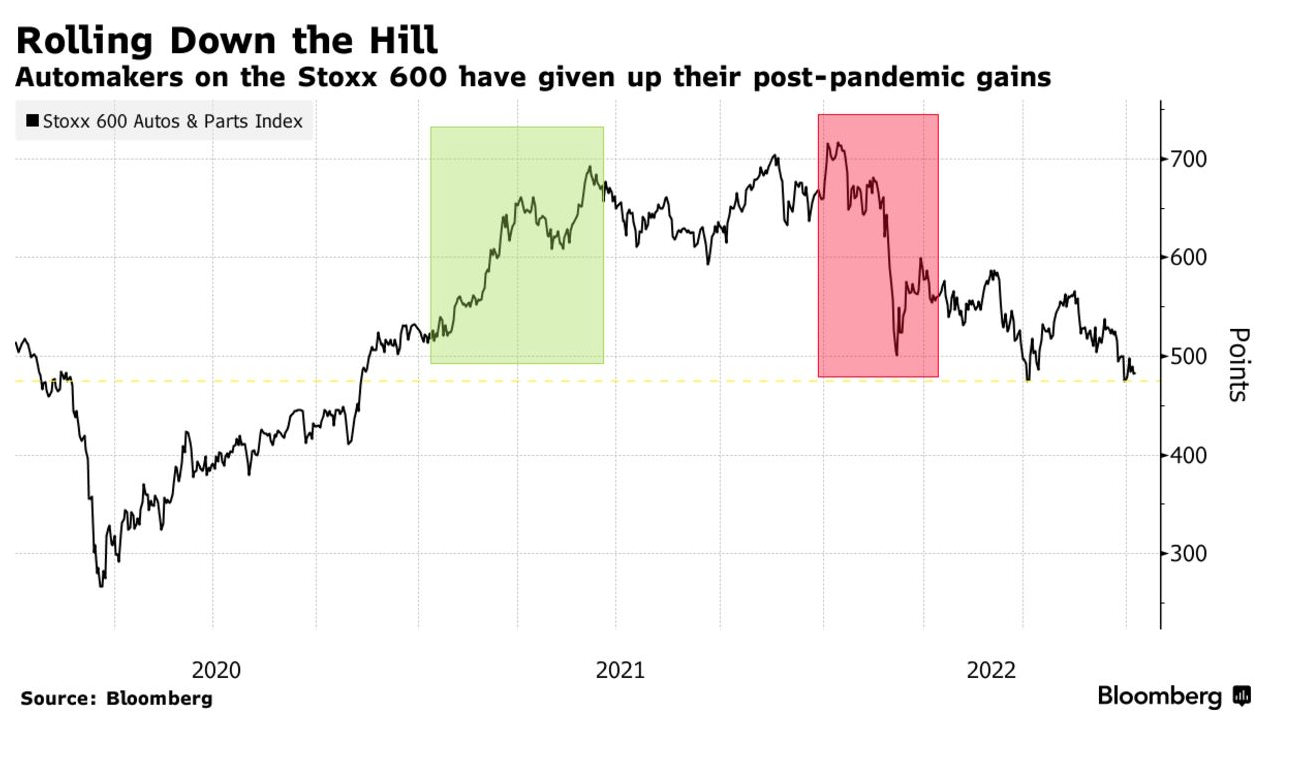

Ford shares sank 6.9% to close at $11.36, while GM shares dropped 3.9% to $32.29. The declines add to an already rough year for the two carmakers, whose shares have tumbled more than 45% so far, as investors concerned about the many challenges of the industry — including supply-chain shortages, rising costs and a cash-strapped consumer — exited the stocks.

“Demand destruction is no longer a vague risk, but has started to become a reality,” UBS analysts said. They downgraded their stock ratings on Volkswagen AG, General Motors Co. and Renault SA to neutral and cut Ford Motor Co. to sell.

A three-year run of “unprecedented” pricing and margins is about to end abruptly, with a glut of cars beginning to emerge as soon as three months from now, the analysts added.

For electric-vehicle maker Tesla Inc., whose third-quarter deliveries failed to match up to expectations, both UBS and RBC analysts struck a more benign note.

UBS sees the Elon Musk-led company continuing its “aggressive” growth through cutting prices and leveraging costs, while RBC’s Spak said it is very well-positioned mid-term as the low-cost EV provider.

Still, demand trends will be a key item to watch for Tesla as well, Spak added. Tesla shares closed Monday down less than 0.1% at $222.96.

Multiple threats confront the industry, with strained consumers seeking to downgrade and growing inventories that will leave automakers unable to pass on inflationary pressures, the UBS analysts said.

In September, Ford warned of how rising costs were affecting its earnings, prompting its stock to plunge. European auto stocks have surrendered their post-pandemic gains.

The nearer term outlook is more positive, with the third quarter expected to be another strong one for most manufacturers, the analysts wrote.

Some companies may show improved margins, with Mercedes-Benz Group AG among those that could increase their forecast. VW, BMW AG and Ford are likely to show a negative earnings trend.

However, the focus will be on commentaries for the rest of the year and 2023, analysts from both UBS and RBC said. Investors are likely to overlook good news as they focus on the headwinds lying ahead for the sector, UBS analysts added.

UBS favors automakers with luxury exposure, like Mercedes-Benz, due to the higher resilience of higher-income household spending, and parts suppliers with a dominant market position and pricing power, such as Autoliv Inc. and Valeo SA.

Updated: 1-20-2023

Ally Is Racing To Outrun Auto-Loan Losses

Though net charge-offs are projected to jump, Ally Financial also expects a boost from higher rates.

More borrowers are likely to hit the skids on their car loans this year. But that doesn’t necessarily mean the end of the road for auto lenders.

Ally Financial, one of the U.S.’s major auto finance providers, said on Friday in its fourth-quarter earnings report that it expects its net charge-off rate on retail auto loans to rise this year.

Ally anticipates an annualized net charge-off rate of 2.2% in retail auto lending in the fourth quarter of 2023, versus 1.7% in the fourth quarter of 2022. Its fourth-quarter average was just 1.6% in the couple of years before the pandemic.

This is yet another indicator that the long-awaited normalization of consumer credit risk is finally arriving this year. Likewise, consumer lender Discover Financial Services this week said it expects its net charge-off rate to jump from 1.8% in 2022 to a full-year average in the range of 3.5% to 3.9% in 2023.

But Ally also expects a boost from higher rates. Ally says its consumer auto loans originated in the fourth quarter are expected to yield about 9.6%—well above the roughly 7% level on loans originated in the same period in 2019.

Plus, Ally says that the transformation of its business toward deposit funding and away from wholesale funding is going to benefit the company’s ultimate net interest margin, which measures its earning yield net of funding costs.

Ally’s cost of funds was at 1.7% in 2022, the company said, down from roughly 2% in 2020 and 2.3% back in 2018. This despite the Federal Reserve’s tightening.

All in, Ally says it expects its net interest margin to hit around 3.5% in 2023. That would be a drop-off from above 3.8% in full-year 2022, but analysts were forecasting just around 3.4% for 2023, according to estimates compiled by Visible Alpha.

Ally then says the ratio could head toward 4% in 2024. That as much as anything likely explains the big reaction in the market, with Ally shares up roughly 19% on Friday.

Credit fears were also priced in already. For much of the past year, Ally has been trading at a steep discount to book value, dipping under 0.7 times late in 2022, according to FactSet.

Such discounts often reflect fears of loan losses in excess of what a lender anticipates. Ally said its economic outlook assumes a mild recession and the unemployment rate to approach 5% by the end of this year.

So the quarterly pace of retail auto net charge-offs rising to 2.2% in that scenario may actually be viewed as relatively good news, with the bank’s current loan-loss reserve levels in consumer auto finance sufficient to cover annual losses of 3.6%.

Certainly not all questions are answered yet. Whether a potential recession moves from “mild” to something worse is obviously one unknown, as is whether the Fed decides to start cutting rates, how fast deposit rates could jump or if consumers start to reject higher loan rates.

But for now, many consumer lenders are rallying so far in 2023, perhaps reflecting just how dire expectations were getting.

Discover is up more than 7%, card giant Capital One Financial is up more than 10% and buy now-pay later provider Affirm is up some 45%. As is often the case in markets, finally having a firm idea how bad things might get can itself be a form of relief.

Updated: 5-3-2023

Harley-Davidson Struggles With Repossessing Bikes From Owners Late With Payments

Motorcycle maker cites lack of repossession agents; repo companies say Harley doesn’t pay enough for difficult, dangerous work.

Repo men are at odds with Harley-Davidson.

The Milwaukee-based motorcycle maker said it can’t find enough agents to repossess bikes from buyers who fall behind on their payments, which Harley executives attributed to a shrinking number of professionals willing to take on the task.

Some repossession companies said Harley doesn’t pay enough for a job that is more complex and dangerous than reclaiming cars—and, like other lenders, doesn’t pay at all if a recovery agent fails to come back with the goods.

“They expect the work for free, and that’s what we’re trying to get away from,” said Vaughn Clemmons, who is president of Automobile Recovery Bureau in Houston and head of the American Recovery Association.

Harley said it values its relationship with the recovery industry.

“We recognize that in many cases, repossession within our sector is more complicated than within the auto sector,” the company said. “However, aligned with industry standards, we pay above and beyond including surcharges to recognize the complexity of the work undertaken.”

The lending arms of Harley and other companies, including auto makers, provide financing as a way to ease purchases of big-ticket items.

To protect against losses on those loans, companies for decades have turned to repossession agents, who tow away vehicles from buyers who haven’t made payments.

Harley last week said that its credit loss rate was 3.2% in the first quarter, up from its typical rate of about 2%. The company said the first quarter is usually the worst for such losses because some customers tend to make their payments during the spring and summer riding season only to become delinquent later in the year.

Harley Treasurer David Viney said Thursday during a conference call with analysts that while the delinquencies weren’t especially high, the declining residual values of motorcycles and “a weaker repossession industry” led to more severe losses in the quarter. Mr. Viney said many recovery agents left the industry during the Covid-19 pandemic.

People in the repossession business agree, saying their employee base shrank by as much as 40% over that period. They said work dried up as stimulus payments and enhanced unemployment benefits helped consumers stay current with their bills, and as some states imposed temporary moratoriums on repossessions.

Mr. Clemmons said the pandemic prompted some of his colleagues to put their tow trucks to less stressful and more profitable use, such as roadside assistance.

“Who wants to back up in a driveway at 3 a.m. and get shot at?” he said. “You can make the same money doing something else.”

Cox Automotive, which tracks auto industry data, said that car, truck and SUV recoveries, by far the biggest part of the repossession business, have declined over the past three years.

About 1.6% of the loan base was subject to repossession over that period. Over the 12 years before that, the average was 2.4%, according to the firm.

At National Powersport Auctions, which specializes in motorcycles, Chief Executive Jim Woodruff said he saw a two-decade low last year in the number of repossessed units hitting the auction floor. About a quarter of his auction volume comes from repossessions, he said.

The Consumer Financial Protection Bureau has estimated that agents are paid an average of $350 for an auto repossession, and recovery executives said that hasn’t changed in decades. Mr. Clemmons said that Harley has been paying extra fees, but that the amount still isn’t enough.

He said he spoke with Harley representatives last week and pressed for a “close fee,” which would cover a repo man’s costs even if he strikes out.

“It’s a conversation,” he said. “It’s a good thing that we’re conversing.”

Harley declined to comment on the fees. The company said during the conference call that it is making enhancements to its repossession strategy and expects the credit loss rate to drop.

Octane, a lender that works with motorcycle and snowmobile maker Polaris and other powersports manufacturers, said its repossessions have stabilized after a few lean months caused by the labor shortage. Chief Executive Jason Guss said he expected the recovery business as a whole to rebound as defaults climb.

Mr. Clemmons and other recovery professionals said they are becoming more selective about the work they accept, moving some clients to the bottom of the priority list or refusing them outright if the odds of success appear low.

His company no longer accepts jobs involving motorcycles, which he said are recovered less than 10% of the time. Motorcycles are harder to recover because riders typically keep them in the garage, meaning a repo man must leave his truck, knock on the debtor’s door and ask for the bike’s return.

Those situations don’t always go smoothly, said Jeremy Cross, owner of International Recovery Systems in suburban Philadelphia.

“Have you met some of the people who ride motorcycles?” he said. “They care more about their motorcycles than their work trucks or their family vans.”

Mr. Clemmons said one memorable case came when a Harley rider he had pursued for months finally agreed to give up his bike.

“We get to the guy’s house, and it was in 3,000 pieces,” Mr. Clemmons said. “It took us 2 ½ hours to get all those pieces cataloged and delivered back to the lot.”

Related Articles:

Wells Fargo, Ford, JPMorgan Chase, Verizon, Etc. To Lay-off 100,000+ Employees (#GotBitcoin?)

San Francisco’s Housing Market Braces For An IPO Millionaire Wave (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Home Prices Continue To Lose Momentum (#GotBitcoin?)

Freddie Mac Joins Rental-Home Boom (#GotBitcoin?)

Retreat of Smaller Lenders Adds to Pressure on Housing (#GotBitcoin?)

OK, Computer: How Much Is My House Worth? (#GotBitcoin?)

Borrowers Are Tapping Their Homes for Cash, Even As Rates Rise (#GotBitcoin?)

‘I Can Be the Bank’: Individual Investors Buy Busted Mortgages (#GotBitcoin?)

Why The Home May Be The Assisted-Living Facility of The Future (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.