A Comprehensive Analysis of The Jeffrey Epstein Case (#GotBitcoin)

Financier’s business relationships with investment banks sometimes turned sour, ending in lawsuits. A Comprehensive Analysis of The Jeffrey Epstein Case (#GotBitcoin)

Jeffrey Epstein worked closely with some of the world’s largest investment banks to build a fortune of more than $500 million. But he cut a course through Wall Street that was marked by disagreements, lawsuits and acrimony.

On the heels of his suicide, lawyers and others involved in the case expect the sex-trafficking investigation to expand into Mr. Epstein’s lengthy financial dealings.

Federal investigators have obtained Mr. Epstein’s financial records from at least one bank, and a close look at his finances may help answer murky questions unresolved after his death: How did he make his money? Who worked with him and when?

Related:

Catholic Church Used Bankruptcy For Sexual-Assault Cases

Boy Scouts Weighs Bankruptcy Due To Sex-Abuse Allegations

Boy Scouts of America Considers Bankruptcy Filing Amid Sex-Abuse Lawsuits

Former World Bank Chief Didn’t Act On Warnings Of Sexual Harassment

The Faithful Are Considering Abandoning The Church

US Customs Seized JP Morgan Chase Ship Carrying $1Billion Of Cocaine

Mr. Epstein left Bear Stearns Cos. in the early 1980s. He struck out on his own but used the firm for dozens of transactions, former Bear Stearns executives said.

For years, Mr. Epstein enjoyed a close bond with James Cayne, these people said. Mr. Cayne, who became the chief executive in 1993, sometimes called underlings to ask that they “take care of” Mr. Epstein, one former executive recalls. Mr. Cayne didn’t respond to requests for comment.

But he changed his tune after he started investing for Leslie Wexner, then an up-and-coming Ohio retail magnate whose company controlled Abercrombie & Fitch.

Mr. Epstein drove a hard bargain with Bear Stearns, becoming a difficult client, according to a former employee who worked on several of the transactions.

“He wanted the best deal in the entire world anyone has ever seen,” the former employee said, calling him “ferocious” and “a tiger” in his conduct.

Mr. Epstein’s relationship with Bear Stearns came apart as the firm did. He had put his own money into two Bear Stearns hedge funds and owned shares in the bank itself. He lost $57 million in the funds, and his firm still held 100,000 shares when Bear Stearns was sold for $2 a share to JPMorgan Chase & Co. in March 2008.

As the bank’s problems deepened in August 2007, Mr. Epstein sold more than 56,000 shares at a price of $101. He intended to sell more, he later said in a lawsuit filed in the Virgin Islands, but in a series of phone conversations, Mr. Cayne insisted that Mr. Epstein retain the rest of his shares, arguing that the firm’s problems were contained, Mr. Epstein’s complaint said.

Mr. Epstein also filed a complaint before the Financial Industry Regulatory Authority against former Bear Stearns Co-President Warren Spector.

A judge in the Virgin Islands ordered the transfer of Mr. Epstein’s lawsuit to the Southern District of New York for its inclusion in a class-action suit filed against the bank. The lawsuit was ultimately dismissed.

Mr. Epstein had a relationship with what became Citigroup Inc. that turned combative. In 1987, Mr. Epstein began dealing with the big bank on behalf of Mr. Wexner, according to people close to the matter and a lawsuit later filed by Mr. Epstein against the bank.

By 1993, Mr. Epstein was working closely with Dayle Davison, then a vice president in the firm’s private-banking division, according to the people and the lawsuit. She and her colleagues would visit Mr. Epstein’s Upper East Side residence, which doubled as his office, according to the lawsuit.

By 1999, Mr. Epstein himself was a client of Citigroup’s private bank. That year and in 2000, Ms. Davison helped Mr. Epstein receive two $10 million loans that he used to invest in a debt-related vehicle called a collateralized bond obligation as well as in an investment fund, both managed by outside parties, according to the lawsuit.

By 2002, the investments were in trouble. Mr. Epstein defaulted on both loans, even after Citigroup extended their repayment deadlines, the bank later claimed.

Mr. Epstein filed a lawsuit in District Court of the Virgin Islands claiming Citigroup had defrauded him and misrepresented information related to the investments, which he said had been made on the recommendation of Ms. Davison, who “aggressively solicited my participation.” Through a spokeswoman, Ms. Davison declined to comment.

Citigroup filed its own suit in the Southern District of New York for repayment of the loans. Both parties dropped their suits in 2005. Mr. Epstein’s relationship with Citigroup was severed in 2006, according to people close to the matter, around the time Mr. Wexner stopped working with Citigroup, the people say. A spokesman for Mr. Wexner declined to comment.

“Mr. Epstein was a client for a short period of time, before his abhorrent behavior came to light,” a Citigroup spokeswoman said.

From the 1990s through about 2013, Mr. Epstein had a relationship with JPMorgan, one that proved lucrative for the bank. The Wall Street Journal previously reported that JPMorgan gained a stream of private-banking clients and referrals from Mr. Epstein.

The bank ended the relationship in the midst of concern about its reputation, the Journal reported, years after a 2007 nonprosecution agreement with the government related to a Florida sexual-misconduct investigation into Mr. Epstein.

A spokesman for the bank declined to comment.

Soon, Deutsche Bank AG DB +0.91% was helping Mr. Epstein move millions of dollars in cash and securities through dozens of private-banking accounts, playing a key role in his financial dealings, the Journal also reported. The German bank severed its relationship with Mr. Epstein this year, the Journal reported.

Deutsche Bank has said it is “closely examining any business relationship with Jeffrey Epstein, and we are absolutely committed to cooperating with all relevant authorities.”

It wasn’t just banks with whom Mr. Epstein had fraught business relationships. Mr. Epstein sued a powerboat company about modifications, was sued by a New York law firm for unpaid bills and fought with an interior designer hired to work on his 70-acre property in the U.S. Virgin Islands. (Mr. Epstein dropped the powerboat suit, was ordered by a judge to pay the law firm and settled with the interior designer.)

“It was a nightmare,” said Juan Pablo Molyneux, the interior designer, who installed a bronze desk for Mr. Epstein, along with velvet, upholstered chairs, terrestrial globes with designs based on a John Ford movie and bronze cabinetry with shapes of marine fauna.

He described Mr. Epstein as an unpleasant client who was very insecure and would constantly change his mind.

“It was dreadful, exhausting and abusive,” Mr. Molyneux said.

8-11-2019

The Jeffrey Epstein Debacle

The results of the investigations need to be made public.

Attorney General William Barr says he’s appalled by the death of sexual offender Jeffrey Epstein in a jail cell Saturday, and he’s not alone. The death by apparent suicide of the politically connected financier couldn’t have been scripted better to undermine trust in law enforcement and the prison and legal systems.

Epstein’s accusers are rightly upset that they won’t get their day in court to prove their claims. Conspiracy theorists are also suggesting that perhaps Epstein was killed in jail so he wouldn’t expose the names of his famous friends who joined him in allegedly exploiting young women and girls for sex. He had pleaded not guilty.

But you don’t have to believe in conspiracy to question the competence of the Federal Bureau of Prisons and Epstein’s prosecutor, U.S. Attorney for the Southern District of New York Geoffrey Berman. Epstein had already been found close to death once from what was either a suicide attempt or an assault.

Epstein was removed for psychological evaluation, but media reports say he was sent back to his cell in late July. Prison officials had to know he was a suicide risk no matter what he told the psychologists, yet press reports say he wasn’t on suicide watch. Why not?

As Nebraska Sen. Ben Sasse said in a letter to Mr. Barr: “Every single person in the Justice Department—from your Main Justice headquarters staff all the way to the night-shift jailer—knew that this man was a suicide risk, and that his dark secrets couldn’t be allowed to die with him.”

Mr. Barr has asked the Justice Department inspector general and the FBI to investigate, and the results need to be made public for the sake of public confidence. This kind of fiasco is why so many Americans mistrust government.

7-26-2019

What We’ve Learned About Jeffrey Epstein’s Mysterious Ties to Les Wexner

One of the enduring mysteries of the Jeffrey Epstein case is how, exactly, a former high-school math teacher transformed himself into a financier worth hundreds of millions of dollars.

At the center of that conundrum is Les Wexner, the CEO of L Brands, which controls mall staples like Victoria’s Secret, Pink, and Bath & Body Works.

Wexner was Epstein’s central client for years; he granted Epstein an enormous amount of trust and authority. But the bond between the two men has always been shrouded in mystery.

“It’s a weird relationship,” one Wall Streeter who reportedly knew Epstein told New York for its profile of Epstein in 2002. “It’s just not typical for someone of such enormous wealth to all of a sudden give his money to some guy most people have never heard of.” That profile also described Wexner as Epstein’s “mentor.”

Two exposés published on Thursday, by the New York Times and the Wall Street Journal, offered more insight into the Epstein-Wexner connection, though they didn’t solve its central mystery. Here are the highlights of what the stories uncovered:

Suspicions About the Relationship Existed From the Beginning

The Times reports that Epstein and Wexner met in Ohio, where the 81-year-old Wexner is based, in the mid-to-late 1980s. They were introduced by insurance executive Robert Meister, a mutual friend.

Epstein, who was coming off a stint at Bear Stearns, pitched himself as a tax expert, and Wexner immediately began spending a lot of time with him — though it’s unclear if there was a formal financial arrangement between the two at the time.

Some associates of Wexner were baffled as to why the billionaire would become so enamored of someone who was such an unknown quantity.

“I tried to find out how did he get from a high school math teacher to a private investment adviser,” Robert Morosky, the former vice chairman of The Limited, said. “There was just nothing there.”

That did not appear to matter to Wexner, who gave Epstein an increasing share of authority over his finances, to the point that in 1991, he granted his adviser power of attorney, which “enabled Mr. Epstein to hire people, sign checks, buy and sell properties and borrow money — all on Mr. Wexner’s behalf.”

Epstein grew steadily richer over the next few years, but his association with Wexner ended in 2007. Wexner has said he was not aware of Epstein’s alleged criminal activities.

Wexner Prioritized Epstein Over Old Friends

The Times quotes Jim Duberstein, a onetime friend of Wexner’s who had known him for years, as saying that shortly after the Wexner-Epstein bond took hold, Wexner took Epstein’s side over his in a disagreement — then cut him out of his life completely, in what appeared to be a pattern.

“Les Wexner, until the time he quit talking to me, was probably the finest person I ever met in my life,” Duberstein said. He was the most charitable, the most generous, the most understanding. I have nothing but praise for him — until he just cut his umbilical cord.”

Epstein Used His Wexner Connection To Pose As A Victoria’s Secret Scout

Former Victoria’s Secret model Alicia Arden says that Epstein grabbed her and tried to undress her after introducing himself as a talent scout in 1997, a detail that had been previously reported with fewer details. Arden filed a police report, but says that it was not taken seriously.

Two senior executives had also told Wexner around the time of the alleged Arden assault that Epstein was telling people he was a Victoria’s Secret recruiter; it’s not clear if he took any action.

In 1996, Epstein allegedly sexually assaulted Maria Farmer, a woman who was working on an art project Epstein was supervising at Wexner’s Ohio mansion.

Epstein Made Very, Very Good Money From Wexner

The Journal estimates that Epstein’s years controlling Wexner’s finances — including matters like arranging his prenuptial agreement and helping to handle investments, netted him at least $200 million. The Journal puts his entire fortune at more than half a billion dollars.

Wexner Was Not Epstein’s Only Big Client

Though Wexner was the first big fish Epstein handled after he formed his own firm, he wouldn’t be the last; the Wall Street Journal reports that “the bulk of his wealth appears to have come from a small number of very wealthy clients.”

Building off his success with Wexner, Epstein began working with Elizabeth Ross Johnson, heiress to the Johnson & Johnson fortune.

Once again, Epstein’s life seemed to overlap with a client’s in unusual ways; “Mr. Epstein’s name appears briefly on property records for Ms. Johnson’s home in Vail and several land parcels in Dutchess County, N.Y., north of New York City,” the Journal reports.

Around 1997, Epstein also began working with Leon Black, CEO of the private-equity firm Apollo Management, providing tax strategy to the company’s high-earning clientele. The association appears to have ended about a decade later.

And Epstein made investments in the hedge fund Highbridge Capital, which almost tripled when he directed clients their way.

Updated: 9-9-2019

MIT Media Lab Director Joi Ito Steps Down Over Epstein Financing (#GotBitcoin?)

Joichi Ito, head of the Media Lab at the Massachusetts Institute of Technology (MIT), has resigned after it was revealed that he and other Media Lab staff had attempted to conceal financial contributions from convicted sex offender Jeffrey Epstein.

The New Yorker reported last Friday that Ito and MIT Media lab – which hosts a number of innovation programs including a Digital Currency Initiative – had accepted donations from Epstein even though the financier was on the university’s “disqualified” donors list and attempted to keep the source of the funds a secret.

Ito had disclosed last Wednesday that he had accepted $525,000 from Epstein for the lab, as well as $1.2 million for his investment funds.

However, the New Yorker published MIT emails sent by Ito that appear to illustrate how he had attempted to veil the donations from the university and the public.

After Epstein funded a researcher at the lab, Ito penned one message that said: “Make sure this gets accounted for as anonymous.”

Reportedly, the fact that the links to Epstein were widely known in the lab and he was known as Harry Potter villain Voldemort, “he must not be named,” among staff.

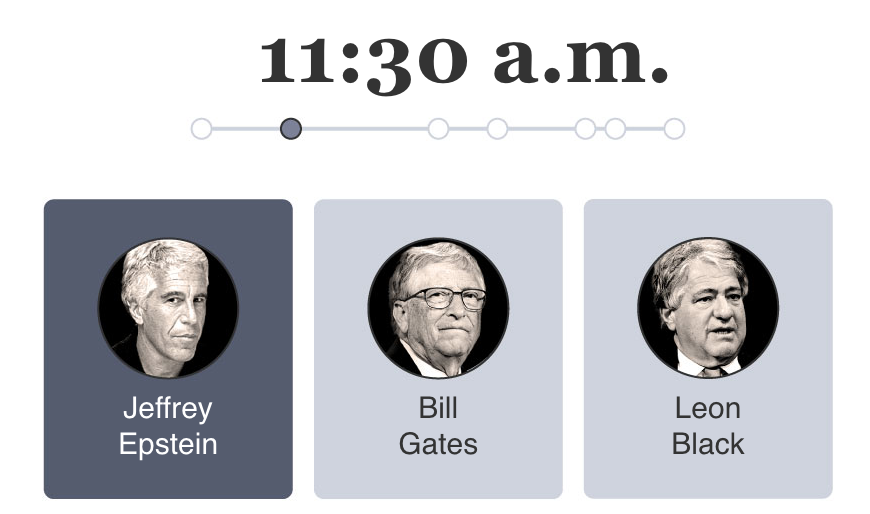

Epstein had also allegedly encouraged other notable figures to back the lab, including Bill Gates and investor Leon Black. When Gates made a $2 million contribution, Peter Cohen, the lab’s then Director of Development and Strategy reportedly said in an MIT email:

“This is a $2M gift from Bill Gates directed by Jeffrey Epstein For gift recording purposes, we will not be mentioning Jeffrey’s name as the impetus for this gift.”

A spokesperson for Gates denied that Epstein had a role in directing any funding by the Microsoft billionaire.

Ito resigned from his role at MIT a day after the New Yorker report. MIT President L. Rafael Reif said in a message to the MIT community:

“Because the accusations in the story are extremely serious, they demand an immediate, thorough and independent investigation. This morning, I asked MIT’s General Counsel to engage a prominent law firm to design and conduct this process.”

Ito is also reported by the New York Times as having stepped down from positions at the MacArthur Foundation, the John S. and James L. Knight Foundation and The New York Times Company, as well as a visiting professorship at Harvard.

It’s not yet clear if the scandal will affect the operations of lab’s various programs, including the Digital Currency Initiative.

Updated: 12-28-2022

How Corrupt Is YOUR Bank? #gotbitcoin

Virgin Islands Sues JPMorgan For Facilitating Epstein Abuse

* JPMorgan Managed Millions for Ghislaine Maxwell Despite Booting Epstein in 2013

* Case: USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).

* Suit Follows Similar Class Action Filed By Epstein Victims

* USVI Says Bank Turned ‘Blind Eye’ To Epstein’s Sex-Trafficking

The US Virgin Islands is suing JPMorgan Chase & Co. for “turning a blind eye” to former client Jeffrey Epstein’s sex-trafficking on his private island there.

USVI Attorney General Denise George said her suit filed Tuesday in Manhattan federal court was part of an “ongoing effort” to hold accountable those who facilitated Epstein’s activities. Epstein brought many of his victims to his villa on Little St. James, the private island he owned.

“Human trafficking was the principal business of the accounts Epstein maintained at JPMorgan,” the USVI complaint states.

JPMorgan declined to comment.

According to the suit, JPMorgan concealed “wire and cash transactions that raised suspicion of a criminal enterprise whose currency was the sexual servitude” of women and girls in the Virgin Islands. George also claims JPMorgan’s willingness to do business with Epstein unfairly enriched it at the expense of other banks.

Class Actions

The suit is seeking unspecified damages for violating sex-trafficking, bank-secrecy and consumer laws.

George’s suit makes similar claims to proposed class actions filed last month by Epstein victims against JPMorgan and Deutsche Bank AG. A JPMorgan spokesman declined to comment on that suit, while a Deutsche Bank spokeswoman said the case “lacks merit.”

Epstein was found dead in his jail cell in 2019, after being arrested and charged with sex-trafficking by Manhattan federal prosecutors. His former girlfriend, Ghislaine Maxwell, was convicted of similar charges last December.

During her trial, a JPMorgan banker testified that Epstein wired her $31 million, money prosecutors characterized as Maxwell’s payment for procuring young girls for the financier.

George said in her suit that her office conducted an investigation into Epstein’s activities and presented the findings to JPMorgan in September.

According to the complaint, the USVI probe found that the bank “pulled the levers through which recruiters and victims were paid” and was indispensable to the operation of Epstein’s trafficking enterprise.

Earlier this year, Epstein’s estate reached a $105 million settlement with the Virgin Islands after the US territory filed racketeering claims against it.

Epstein spent decades cultivating ties to US and British elites including several Wall Street figures. Ties to Epstein led to career downfalls for former Barclays Chief Executive Officer Jes Staley, who formerly headed JPMorgan’s private bank and Apollo Global Management co-founder Leon Black. Both have denied knowing about or participating in inappropriate conduct with Epstein.

The case is USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).

Updated: 4-3-2023

JPMorgan Bankers Joked About Epstein’s Reputation, USVI Says

* Executive Mary Erdoes Deposition Redacted In New Court Filing

* USVI Accuses JPMorgan Of Delaying Charges Against Epstein

JPMorgan Chase & Co. executives joked about Jeffrey Epstein’s “interest in young girls,” the US Virgin Islands said in a court filing in its lawsuit accusing the bank of aiding his sex-trafficking.

The US territory made the claim on Monday while asking a federal judge for permission to amend the lawsuit.

USVI claims that the bank allowed Epstein to avoid scrutiny and obstructed law enforcement from uncovering his crimes earlier while he was a client from 1998 to 2013.

In the filing, USVI referenced a recent deposition from JPMorgan’s Asset and Wealth Management chief executive Mary Erdoes but it was heavily redacted.

Lawyers for the territory claim “Epstein’s behavior was so widely known at JPMorgan that senior executives joked about Epstein’s interest in young girls.”

USVI then cites a 2008 email Erdoes received as an example, however the content of the email is blacked out. The territory also pointed to internal emails at JPMorgan about Epstein being under investigation or sued for sexual abuse and communication from a senior compliance official in 2010.

Young women and an alleged recruiter for Epstein’s trafficking venture were also paid from the late sex offender’s JPMorgan accounts, according to the court filing.

Epstein made cash withdrawals to further his sex trafficking while the bank allegedly failed to follow anti-money laundering requirements.

“JPMorgan knowingly did not follow these requirements because it knew that doing so would have prevented Epstein’s secret cash transactions that were necessary to his sex-trafficking operation from escaping knowledge of federal investigative and prosecuting agencies,” lawyers for USVI wrote.

Federal prosecutors charged Epstein with sex trafficking in 2019. He was found dead in his prison cell in Manhattan. Authorities ruled it a suicide.

US District Judge Jed Rakoff last month dismissed a majority of USVI’s claims against JPMorgan but allowed one claim to remain — that the bank knowingly benefited from Epstein’s behavior.

The US territory, which filed the suit against the bank late last year, is asking for permission to file an additional claim under the Trafficking Victims Protection Act.

A victim of Epstein, Jane Doe, was the first to file a lawsuit against JPMorgan in November, claiming it facilitated Eptein’s trafficking operation.

JPMorgan contends that it merely provided routine banking services to Epstein, while Doe argued that he was afforded special treatment because he brought in wealthy clients.

The banks have long claimed that they didn’t know about Epstein’s crimes. Former JPMorgan executive Jes Staley has emerged as a central figure in the lawsuits, with Doe claiming that he “personally observed” sex-trafficking victims.

Both USVI and Doe allege in their suits that any knowledge Staley had should be imputed to JPMorgan as his employer.

The cases are Jane Doe 1 v. JPMorgan Chase Bank, 22-cv-10019; Jane Doe 1 v. Deutsche Bank, 22-cv-10018, and USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).

Updated: 4-6-2023

JPMorgan Subpoenas Staley’s Former Hedge Fund in Epstein Dispute

* Bank Seeks Communications From When Staley Was At Bluemountain

* Staley Joined Fund In 2013 But Left To Become CEO At Barclays

JPMorgan Chase & Co. subpoenaed information from the hedge fund where Jes Staley was once managing partner as part of its lawsuit over his ties to Jeffrey Epstein, according to people familiar with the matter.

Lawyers for the bank recently sent a subpoena to Assured Investment Management, the people said. Assured is the successor to BlueMountain Capital, which Staley, 66, joined in 2013 after more than 30 years at JPMorgan, where he rose to become head of private banking.

According to one of the people, the subpoena requests any communications Staley had with Epstein during his time at BlueMountain. A spokeswoman for JPMorgan declined to comment. A spokeswoman for Assured didn’t respond to requests for comment. Staley’s lawyer also didn’t respond to requests for comment.

JPMorgan is facing two lawsuits claiming it benefited from Epstein’s sex-trafficking. The bank, which has denied knowing about Epstein’s conduct, in turn sued Staley in March.

It claims his contacts with Epstein, who was a bank client between 1997 and 2013. violated JPMorgan’s policies and argues that he should be responsible for any damages stemming from the two suits.

The bank is also attempting to claw back tens of millions of dollars in compensation it paid to Staley.

His time at BlueMountain, which was co-founded by Andrew Feldstein and Stephen Siderow, has not previously received much attention amid the revelations about his relationship with Epstein.

Staley was only at the fund a short time before he became chief executive officer at Barclays Plc in 2015. BlueMountain was acquired and rebranded by Assured Guaranty Ltd in 2019.

Staley stepped down as Barclays CEO in late 2021, after a Financial Conduct Authority inquiry raised questions about exactly how transparent Staley had been with the UK bank about his ties to Epstein.

Staley has long claimed his relationship with Epstein tapered off after he left JPMorgan and completely ceased when he joined Barclays.

In April 2015, while he was still at BlueMountain, Staley and his wife briefly visited Epstein’s private island, Little St James, in the US Virgin Islands, Bloomberg has previously reported.

The two suits against JPMorgan, one by an Epstein victim and the other by the USVI, both claim Staley knew about his client’s sex-trafficking and argue that his knowledge should be imputed to his then-employer.

A considerable amount of material about Staley’s relationship with Epstein has been disclosed in the litigation, including the contents of some of the 1,200 emails the two men exchanged over the years.

Federal prosecutors charged Epstein with sex trafficking in July 2019, but he was found dead in his jail cell a month later.

The cases are USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan) and Jane Doe 1 v. JPMorgan Chase Bank, 22-cv-10019, US District Court, Southern District of New York (Manhattan)

Updated: 4-12-2023

JPMorgan Internally Flagged Epstein’s Large Withdrawals Years Before His 2008 Conviction, Lawsuit Alleges

In 2006, court papers say, bank staffers noted financier was withdrawing $750,000 a year in cash.

JPMorgan Chase & Co. employees internally flagged Jeffrey Epstein’s large cash withdrawals two years before he was convicted of soliciting a minor for prostitution, according to new court papers filed Wednesday.

A JPMorgan risk-management team in 2006 noted that Epstein “routinely” made cash withdrawals of $40,000 to $80,000 several times a month, the U.S. Virgin Islands said in an amended lawsuit against the bank.

At the time, Epstein was pulling more than $750,000 a year in cash from the bank, according to the lawsuit.

Epstein was first charged with a sex crime in 2006. He pleaded guilty to solicitation of prostitution with a minor in 2008 and spent about 13 months in prison.

JPMorgan continued providing services to Epstein until 2013, when it says it closed his accounts. Epstein died in jail of an apparent suicide in 2019 while awaiting trial on federal sex-trafficking charges.

The U.S. Virgin Islands sued JPMorgan late last year in a Manhattan federal court, saying the bank facilitated Epstein’s alleged sex trafficking.

The suit alleges the financier used the bank to pay his victims with cash and wire transfers, transactions that should have been concerning to the bank.

Another lawsuit filed by an unnamed woman who accused Epstein of sexual abuse also accuses the bank of failing to monitor his transactions. The cases are running together in Manhattan federal court.

Banks are required to file suspicious-activity reports on sizable cash withdrawals and transactions that could indicate crimes such as money laundering. JPMorgan, the U.S. Virgin Islands says, had information that could have flagged Epstein’s alleged crimes to law enforcement sooner.

Lawyers have questioned several JPMorgan employees so far in this case, including Mary Erdoes, its head of asset and wealth management. Her deposition hasn’t been released publicly, but Wednesday’s court filing sheds light on its contents.

Ms. Erdoes said in a deposition that JPMorgan executives knew as far back as 2006 that Epstein was accused of paying cash to have underage girls and young women brought to his home, according to the filing.

The filing alleges that Epstein’s behavior was so widely known at the bank that his interest in girls was the subject of jokes. In 2008, the filing says, Ms. Erdoes received an email asking whether Epstein was at an event with pop star Miley Cyrus, a minor at the time.

Ms. Erdoes and a JPMorgan spokeswoman declined to comment. The bank previously has said Ms. Erdoes wouldn’t overrule the bank’s compliance officials to protect a customer and “has only one recollection of formally meeting with [Epstein], which was the day she fired him as a client.”

The bank has denied that it aided Epstein and has sought to shift the focus to former executive Jes Staley. In a lawsuit against Mr. Staley last month, JPMorgan said the former executive “affirmatively misrepresented the true facts of his and Epstein’s personal interactions.”

Mr. Staley has said he never knew about Epstein’s alleged crimes. His lawyer has declined to comment about the allegations in the JPMorgan lawsuit.

In 2010, JPMorgan compliance officials decided that Epstein “should go,” according to the Wednesday filing, and raised questions about Epstein’s behavior.

A senior compliance official in 2011 voiced concerns about extending Epstein a loan in relation to a modeling agency that had been accused of bringing underage girls into the U.S.

According to court papers, the official noted that Epstein was no longer managing retail billionaire Leslie Wexner’s money and questioned whether he had any clients at all.

“I would like to know if in fact he is managing anyone’s money at this point or is it all his money,” the official wrote.

The compliance officer also said that Epstein had sponsored accounts and credit cards for two 18-year-olds in 2004, one of whom was named regularly in media reports about Epstein’s “escapades,” according to the filing. That woman had received $450,000 from Epstein, the complaint said.

Epstein deposited hundreds of thousands of dollars into the accounts of one known victim and another unnamed “recruiter” after he pleaded guilty in 2008, the U.S. Virgin Islands claimed in its amended lawsuit.

The compliance department flagged other payments Epstein made to women, the suit says. One official referred to Epstein as a “Sugar Daddy!”

The bank, according to court papers, was told the cash was being used for fuel and landing fees for Epstein’s private planes. Yet withdrawals continued while Epstein was in prison, the filing said.

Updated: 4-21-2023

JPMorgan’s Ties To Jeffrey Epstein Were Deeper Than the Bank Has Acknowledged

The bank has said it shut the convicted sex offender’s accounts in 2013, but its bankers were still meeting with him years later, people familiar with the matter said.

JPMorgan Chase & Co. had ties to Jeffrey Epstein that ran deeper than the bank has acknowledged and extended years beyond when it decided to close the convicted sex offender’s accounts, according to people familiar with the matter.

Mary Erdoes, a top lieutenant to Chief Executive Jamie Dimon, made two trips to Epstein’s townhouse on Manhattan’s Upper East Side, in 2011 and 2013, when Epstein still was a client of the bank, said the people familiar with the matter.

She exchanged dozens of emails with him and discussed sharing with him fees related to a charitable fund the bank was considering launching, the people said.

John Duffy, who ran JPMorgan’s U.S. private bank for the ultrarich, went to Epstein’s townhouse for a meeting in April 2013, the people said.

One month later, the private bank renewed an authorization allowing Epstein to borrow money against his accounts despite repeated warnings from compliance staffers about his unusual banking practices.

Justin Nelson, one of Epstein’s bankers at JPMorgan, had about a half-dozen meetings at Epstein’s townhouse between 2014 and 2017, the people said. He also traveled to Epstein’s ranch in New Mexico in 2016, the people said.

JPMorgan has said it closed Epstein’s accounts in 2013. Ms. Erdoes has previously said through a JPMorgan spokesman that the only time she remembered meeting Epstein was the day she fired him as a client of JPMorgan’s private bank. Ms. Erdoes declined to comment for this article.

Epstein was convicted of soliciting a minor for prostitution in 2008 and forced to register as a sex offender. He was arrested in 2019, accused of orchestrating a scheme to traffic and sexually abuse girls.

The bank has denied knowing about Epstein’s crimes and has sued one of its former executives, Jes Staley, accusing him of misleading the bank about Epstein’s character and conduct. Mr. Staley’s lawyers have said the allegations against him are baseless.

The new details show that JPMorgan was treating Epstein like a star client after his first conviction and despite repeated warnings from its own employees. And after JPMorgan closed Epstein’s accounts, bankers kept meeting with him for years.

A JPMorgan spokesman said the level of interaction with Epstein wasn’t atypical for a client of a private bank. Any meeting held with Epstein after 2013, the spokesman said, was regarding other JPMorgan bank clients whom Epstein represented.

Mr. Nelson declined to comment, the spokesman said. Mr. Duffy, who no longer works at the bank, didn’t respond to requests for comment.

A pair of lawsuits filed against JPMorgan late last year in federal court in Manhattan have drawn fresh attention to the bank’s ties to Epstein, who died in 2019 in New York jail of what the city’s medical examiner said was a suicide.

At the time, he was awaiting trial on sex-trafficking charges. The lawsuits, brought by a woman who has accused Epstein of sexual abuse and by the U.S. Virgin Islands—home to Epstein’s private island getaway—alleged that the bank moved the money that was used to pay off his purported victims.

JPMorgan said it isn’t liable for Epstein’s crimes. Through a spokeswoman, lawyers for the Virgin Islands and the Epstein accuser said the public filings in the lawsuits speak for themselves.

In response to the two lawsuits, JPMorgan has handed over documents detailing interactions between Epstein and more than 20 employees and executives, past and present.

Many of them have given sworn testimony in depositions, and Mr. Dimon, the CEO, is expected to do the same next month.

Epstein became a JPMorgan client in about 1998, according to documents filed in connection with the lawsuits. Over the years, the bank would come to manage some 55 Epstein-related accounts containing hundreds of millions of dollars, the documents show.

Epstein formed a close bond with Mr. Staley, who ran the private bank that caters to the firm’s wealthiest clients. Epstein connected JPMorgan to Glenn Dubin, co-founder of Highbridge Capital Management, one of the fastest-growing hedge-fund firms of the 2000s.

JPMorgan bought a controlling stake in Highbridge in 2004 for more than $1 billion. Epstein earned a finder’s fee of about $15 million, The Wall Street Journal has reported.

The next year, the Palm Beach, Fla., police department launched an investigation after several teenage girls said Epstein paid them for massages and sexually assaulted them. He was indicted in 2006 for sex crimes.

That year, JPMorgan executives and compliance staffers began writing emails and memos sharing press reports about Epstein and discussing what to do with his accounts, classifying them as “high risk,” according to the Virgin Islands lawsuit.

JPMorgan executives were aware that Epstein had been accused of using cash to pay for girls to come to his house, Ms. Erdoes said in a previously reported deposition for the lawsuits.

A compliance team pointed out that Epstein routinely made large cash withdrawals, up to $80,000 at a time and more than $750,000 a year, according to the lawsuit.

Epstein pleaded guilty in 2008 in Florida state court to procuring and soliciting a minor for prostitution. He was sentenced to 18 months and required to register as a sex offender. He ultimately served about 13 months in a work-release program.

Epstein advised JPMorgan’s Mr. Staley in 2008 as he negotiated his compensation at the bank, according to the lawsuit. In 2009, Mr. Staley visited Epstein’s Palm Beach mansion and Little St. James, his private island, the Virgin Islands lawsuit said.

The Virgin Islands lawsuit said communication between the two men “suggest that Staley may have been involved in Epstein’s sex-trafficking operation.”

The suit alleges Epstein wired money to a woman around the time that Mr. Staley stayed at Epstein’s Palm Beach, Fla., mansion and then again to the same woman when Mr. Staley told Epstein he would be in London.

Mr. Staley has said he was in the dark about Epstein’s alleged crimes and regrets their long-running friendship.

In September 2009, Mr. Staley was promoted to a new job running JPMorgan’s sprawling corporate and investment bank. Ms. Erdoes took over running its asset and wealth-management unit.

Mr. Staley visited Little St. James that November. “Presently, I’m in the hot tub with a glass of white wine,” Mr. Staley emailed Epstein, according to the lawsuit.

“This is an amazing place. Truly amazing. Next time, we’re here together. I owe you much. And I deeply appreciate our friendship. I have few so profound.”

JPMorgan’s compliance department was pressuring the bank to drop Epstein. “See below new allegations of an investigation related to child trafficking—are you still comfortable with this client who is now a registered sex offender,” one compliance officer wrote in a 2010 email, according to a recent filing in the Virgin Islands suit.

JPMorgan stuck with Epstein and granted him the ability that year to borrow against his $50 million account.

In January 2011, the bank’s anti-money-laundering compliance director contacted general counsel Stephen Cutler to get him to re-approve the relationship, according to the recent filing. Mr. Cutler didn’t respond to a request for comment.

A review of the relationship fell to Mr. Staley. Epstein told him “there was no truth to the allegations, no evidence,” compliance officials reported in 2011, the Virgin Islands lawsuit said.

“We will continue to monitor the accounts and cash usage closely going forward.”

Mr. Staley traveled to Little St. James again in January 2011, the people said.

In March of that year, Mr. Cutler asked a member of his team to seek information about Epstein from prosecutors, but the U.S. attorney in Miami didn’t disclose whether it was conducting a criminal investigation, according to the people familiar with the matter.

The bank’s anti-money-laundering division recommended closing Epstein’s accounts, the Virgin Islands lawsuit said.

Top bank executives continued meeting with Epstein. Epstein had pitched to JPMorgan a multibillion-dollar donor-advised philanthropy fund, where he would help bring in wealthy clients that could put in a minimum $100 million, according to the people familiar with the matter.

For months, Ms. Erdoes, Mr. Staley and Epstein discussed working together on the fund. Epstein’s potential compensation was a sticking point, according to emails reviewed by the Journal.

“Everyone is marching together to create something very powerful and we will solve the comp issues,” Ms. Erdoes wrote to Epstein in October 2011.

The fund never got off the ground.

Ms. Erdoes visited Epstein’s Manhattan townhouse in 2011 and 2013, said the people familiar with the matter. The 2011 meeting was about settling a lawsuit Epstein had filed against Bear Stearns, which JPMorgan had acquired, over losses from the investment bank’s collapse, the JPMorgan spokesman said.

Ms. Erdoes played a role in negotiating that settlement with Epstein for JPMorgan, according to the emails reviewed by the Journal. The bank offered Epstein $9.2 million to resolve the lawsuit, the emails show.

Mr. Nelson, who is currently a managing director at JPMorgan working with hedge-fund founders and big investors, visited Epstein at his New York townhouse several times, accompanied by other JPMorgan executives and bankers, the people said.

None of those visits have previously been reported.

Mr. Staley left the bank in early 2013, and JPMorgan decided to close Epstein’s accounts a few months later. Mr. Staley later became the CEO of Barclays PLC, but left the British bank in late 2021 after U.K. regulators said he provided an incomplete accounting of his relationship with Epstein.

JPMorgan employees continued meeting with Epstein after his accounts were closed about other clients and to discuss introductions he could make to potential clients, according to people familiar with the meetings.

Epstein had ties to ultrarich JPMorgan clients such as Leon Black, the co-founder of private-equity firm Apollo Global Management. Over the years, Mr. Black paid Epstein a total of $148 million for trust- and estate-tax advice, an independent review found.

Mr. Nelson went to Epstein’s townhouse seven times between 2014 to 2017, and visited Epstein’s ranch south of Santa Fe in January 2016, according to the people familiar with the matter.

Managing director Paul Barrett scheduled at least five meetings with Epstein from 2014 to 2017 before he left JPMorgan, according to documents reviewed by the Journal.

Epstein’s 2019 death ended the criminal trial against him.

The lawsuits against JPMorgan are scheduled to go to trial in October.

Updated: 4-30-2023

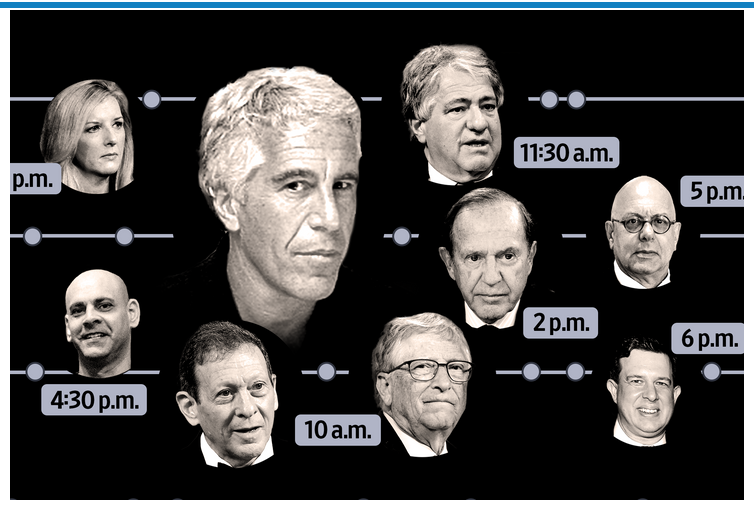

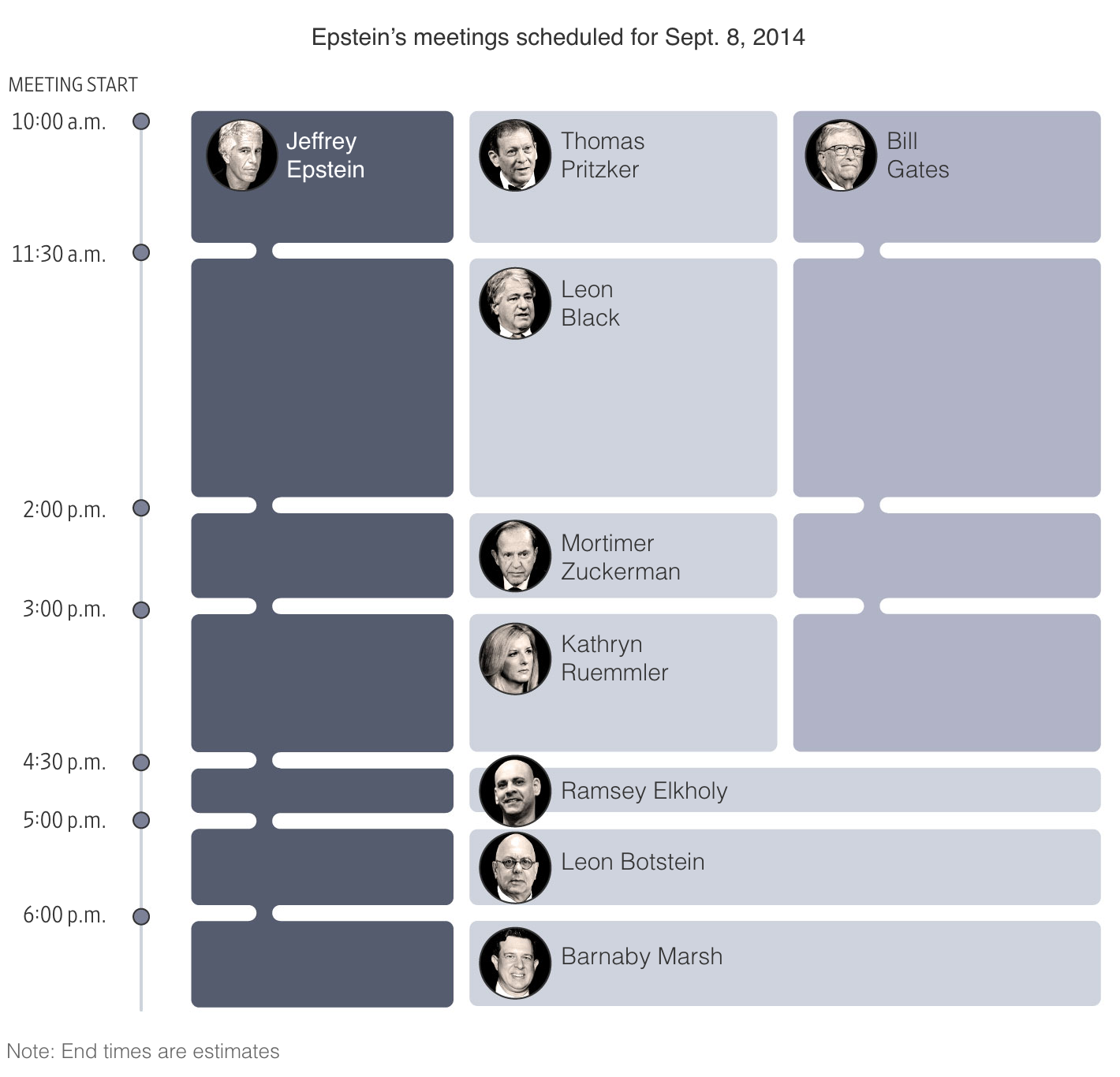

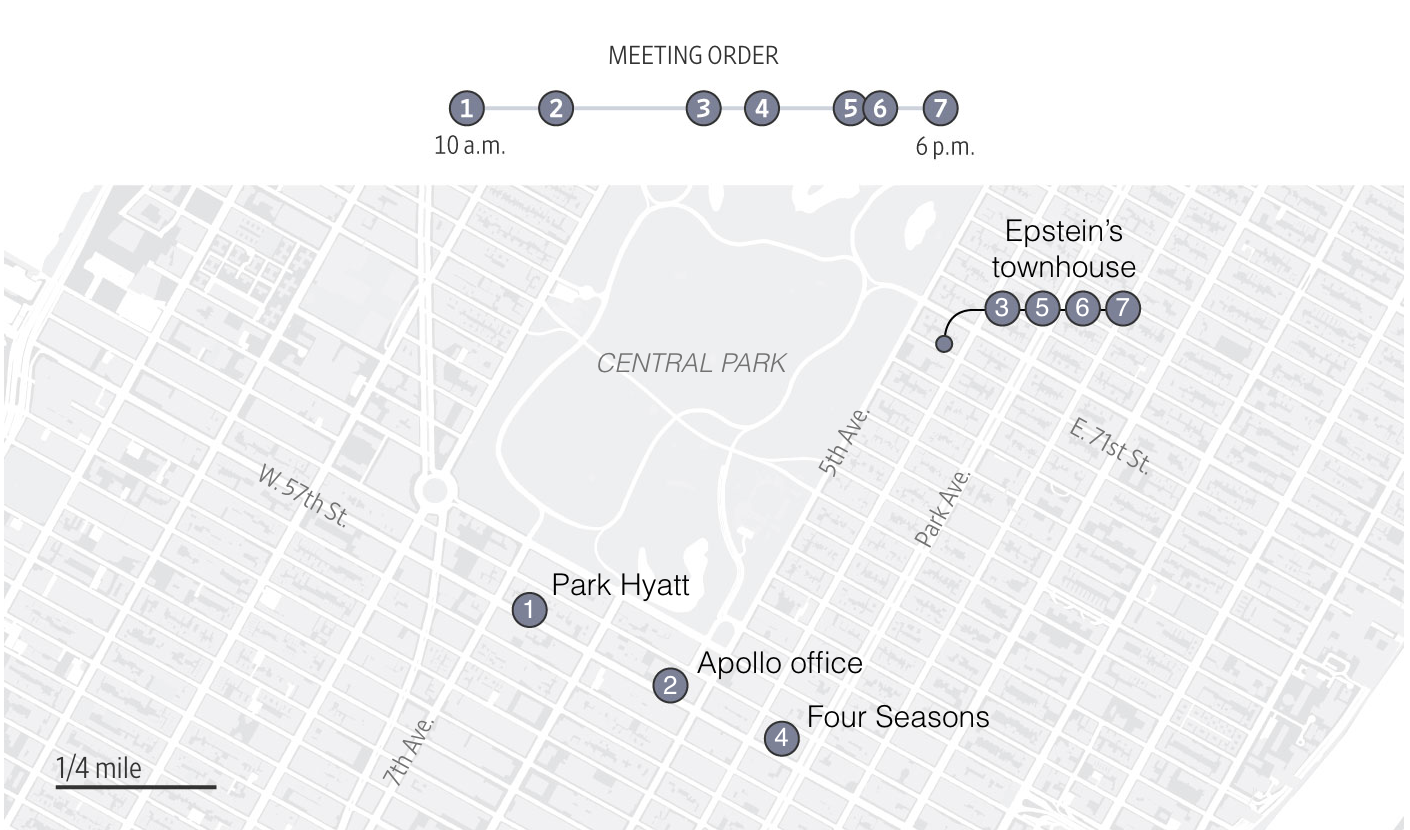

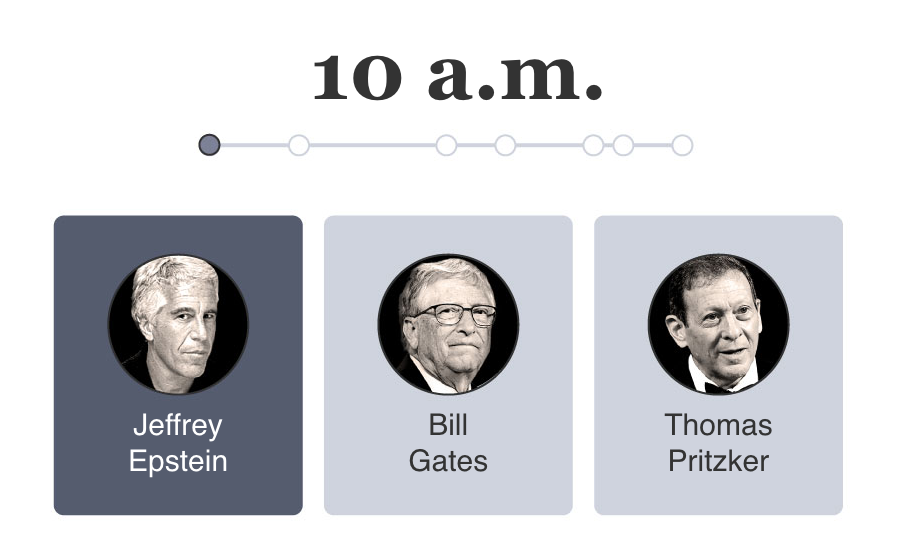

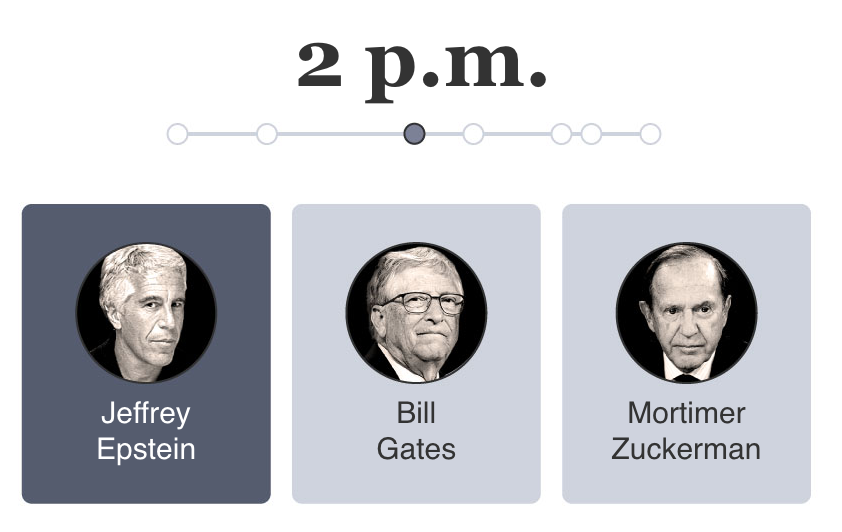

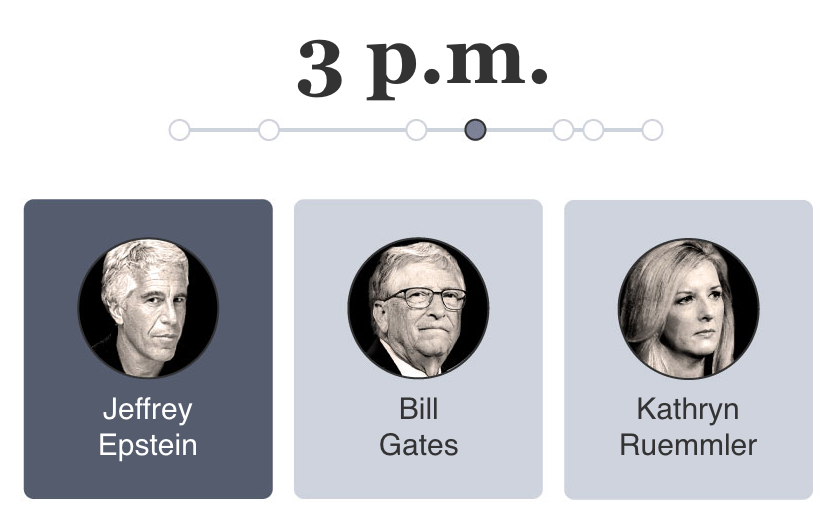

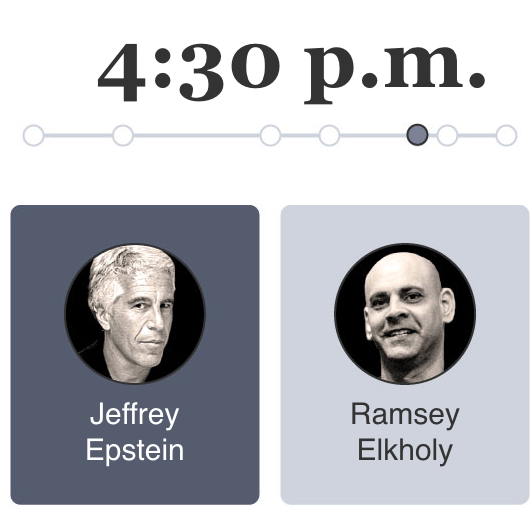

Epstein’s Private Calendar Reveals Prominent Names, Including CIA Chief, Goldman’s Top Lawyer

Schedules and emails detail meetings in the years after he was a convicted sex offender; visitors cite his wealth and connections.

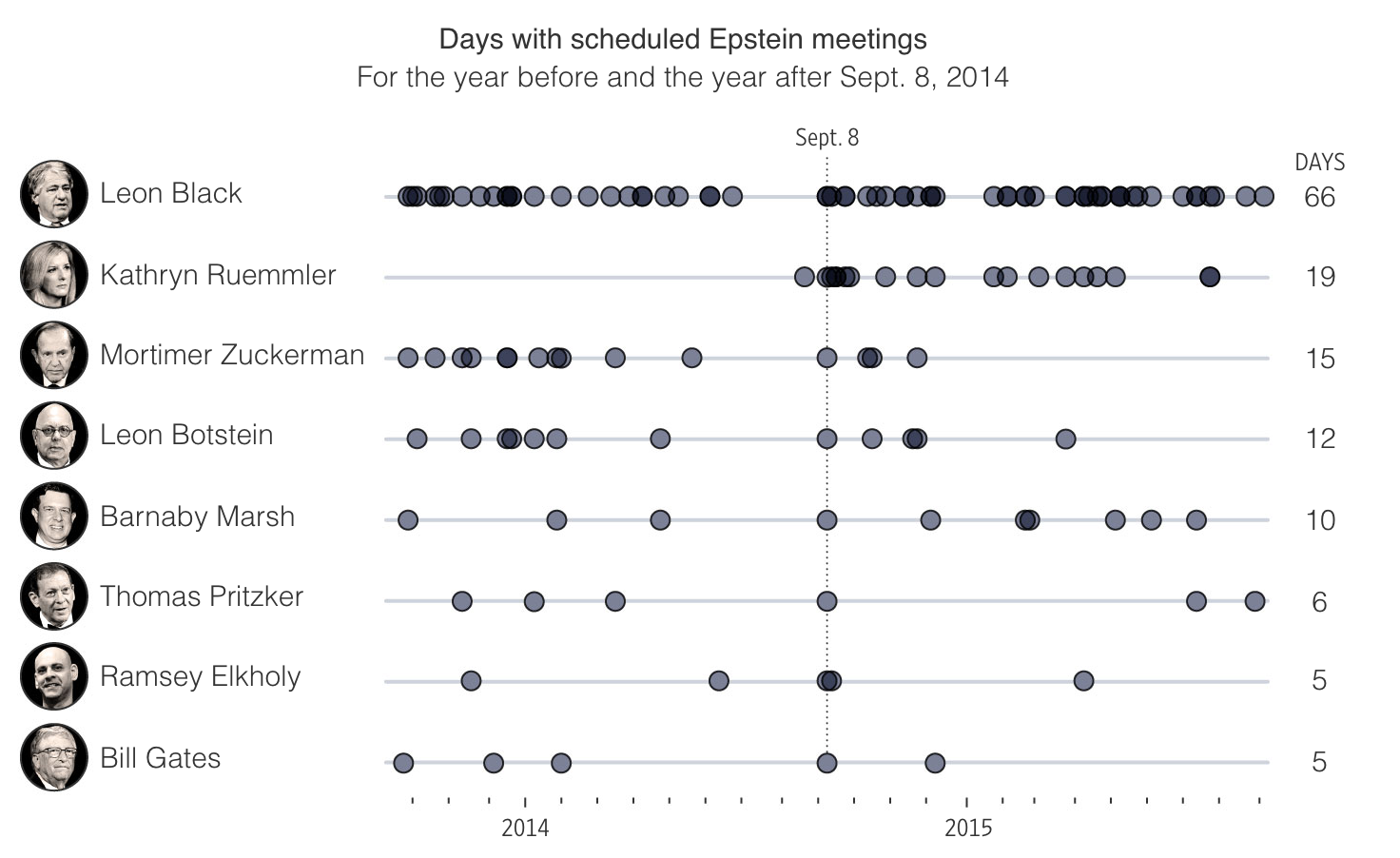

The nation’s spy chief, a longtime college president and top women in finance. The circle of people who associated with Jeffrey Epstein years after he was a convicted sex offender is wider than previously reported, according to a trove of documents that include his schedules.

William Burns, director of the Central Intelligence Agency since 2021, had three meetings scheduled with Epstein in 2014, when he was deputy secretary of state, the documents show. They first met in Washington and then Mr. Burns visited Epstein’s townhouse in Manhattan.

Kathryn Ruemmler, a White House counsel under President Barack Obama, had dozens of meetings with Epstein in the years after her White House service and before she became a top lawyer at Goldman Sachs Group Inc. in 2020.

He also planned for her to join a 2015 trip to Paris and a 2017 visit to Epstein’s private island in the Caribbean.

Leon Botstein, the president of Bard College, invited Epstein, who brought a group of young female guests, to the campus.

Noam Chomsky, a professor, author and political activist, was scheduled to fly with Epstein to have dinner at Epstein’s Manhattan townhouse in 2015.

None of their names appear in Epstein’s now-public “black book” of contacts or in the public flight logs of passengers who traveled on his private jet.

The documents show that Epstein arranged multiple meetings with each of them after he had served jail time in 2008 for a sex crime involving a teenage girl and was registered as a sex offender.

The documents, which include thousands of pages of emails and schedules from 2013 to 2017, haven’t been previously reported.

The documents don’t reveal the purpose of most of the meetings. The Wall Street Journal couldn’t verify whether every scheduled meeting took place.

Most of those people told the Journal they visited Epstein for reasons related to his wealth and connections. Several said they thought he had served his time and had rehabilitated himself.

Mr. Botstein said he was trying to get Epstein to donate to his school. Mr. Chomsky said he and Epstein discussed political and academic topics.

Mr. Burns met with Epstein about a decade ago as he was preparing to leave government service, said CIA spokeswoman Tammy Kupperman Thorp.

“The director did not know anything about him, other than that he was introduced as an expert in the financial services sector and offered general advice on transition to the private sector,” she said. “They had no relationship.”

Ms. Ruemmler had a professional relationship with Epstein in connection with her role at law firm Latham & Watkins LLP and didn’t travel with him, a Goldman Sachs spokesman said.

Epstein introduced her to potential legal clients, such as Microsoft Corp. co-founder Bill Gates, the spokesman said. “I regret ever knowing Jeffrey Epstein,” Ms. Ruemmler said.

A spokeswoman for Latham & Watkins said Epstein wasn’t a client of the firm.

In 2006, Epstein was publicly accused of sexually abusing girls in Florida who were as young as 14 years old.

The Federal Bureau of Investigation and police investigated, and Epstein reached a deal with prosecutors in 2008. He avoided federal charges and pleaded guilty to soliciting and procuring a minor for prostitution.

He registered as a sex offender and served about 13 months in a work-release program.

Epstein’s case generated waves of media coverage at the time, with publications in the U.S. and abroad reporting on accusations from underage girls and young women.

In 2006, several politicians returned donations from Epstein. Some associates moved to distance themselves from him.

His biggest known client, retail billionaire Leslie Wexner, later said he cut ties in 2007. His bank, JPMorgan Chase & Co., later said it closed his accounts in 2013, though some bankers continued to meet with him for years after.

In 2015, Virginia Giuffre publicly accused Epstein of sexually abusing and trafficking her when she was a teen and forcing her to have sex with influential people, including Prince Andrew. Prince Andrew has denied the allegations and last year settled a sex-abuse lawsuit by Ms. Giuffre.

Despite the negative press, Epstein’s days were filled from morning to night with meetings with prominent people, the documents show.

There were dinners at New York restaurants, meetings at luxury hotels and gatherings in the offices of prominent law firms. Many appointments were held at Epstein’s townhouse in Manhattan.

Prosecutors alleged in 2019 that the townhouse is where Epstein sexually abused female victims for years, many underage, and that he paid some of them to recruit their friends to engage in sexual activity.

After the Miami Herald reported that dozens of women said they were abused, prosecutors charged Epstein in 2019 with a sex trafficking conspiracy. He died that year in a New York jail while awaiting trial in what the city’s medical examiner said was a suicide.

Mr. Burns, 67 years old, a career diplomat and former ambassador to Russia, had meetings with Epstein in 2014 when Mr. Burns was deputy secretary of state.

A lunch was planned that August at the office of law firm Steptoe & Johnson in Washington. Epstein scheduled two evening appointments that September with Mr. Burns at his townhouse, the documents show.

After one of the scheduled meetings, Epstein planned for his driver to take Mr. Burns to the airport.

Mr. Burns recalls being introduced in Washington by a mutual friend, and meeting Epstein once briefly in New York, said Ms. Thorp. “The director does not recall any further contact, including receiving a ride to the airport,” she said.

The following month, October 2014, Mr. Burns stepped down from his role at the State Department to serve as president of the Carnegie Endowment for International Peace, a think tank.

He ran the Carnegie Endowment until he was nominated in early 2021 by President Biden to serve as CIA director.

The documents show that Epstein appeared to know some of his guests well. He asked for avocado sushi rolls to be on hand when meeting with Ms. Ruemmler, according to the documents.

He visited apartments she was considering buying. In October 2014, Epstein knew her travel plans and told an assistant to look into her flight. “See if there is a first class seat,” he wrote, “if so upgrade her.”

In 2014, Epstein called Ms. Ruemmler within weeks of her leaving the Obama White House. Epstein planned a lunch in August 2014 at his townhouse, followed by a series of meetings to introduce her to a wider circle of his acquaintances.

Ms. Ruemmler first met Epstein after he called her to ask if she would be interested in representing Mr. Gates and the Bill & Melinda Gates Foundation, the Goldman Sachs spokesman said.

A spokeswoman for Mr. Gates said Epstein never worked for Mr. Gates, misrepresented their relationship, and that Mr. Gates regrets ever meeting with him.

Epstein and his staff discussed whether Ms. Ruemmler, now 52, would be uncomfortable with the presence of young women who worked as assistants and staffers at the townhouse, the documents show.

Women emailed Epstein on two occasions to ask if they should avoid the home while Ms. Ruemmler was there. Epstein told one of the women he didn’t want her around, and another that it wasn’t a problem, the documents show.

Ms. Ruemmler didn’t see anything that would lead her to be concerned at the townhouse and didn’t express any concern, the Goldman spokesman said.

Several people who visited Epstein during this time period said they noticed young women at his townhouse. One of the visitors, Helen Fisher, an anthropologist who studies romantic love and attachment, had lunch with Epstein in January 2016 to discuss her work.

Dr. Fisher said that after the lunch, Epstein invited her to speak with his staff. “And then, in filed, I would say, six young women,” she said. “All of them good looking. All of them young.”

Dr. Fisher said Epstein never funded her work, they weren’t friends and they didn’t stay in touch. “I didn’t have anything to do with Jeffrey Epstein,” she said. “But I remembered it because of his spectacular house and because of the six young women.”

Over the next few years, Ms. Ruemmler, then a partner specializing in white-collar defense at Latham & Watkins, had more than three dozen appointments with Epstein, including for lunches and dinners.

“In the normal course, Epstein also invited her to meetings and social gatherings, introduced her to other business contacts and made referrals,” the Goldman spokesman said. “It was the same kinds of contacts and engagements she had with other contacts and clients.”

In 2015, she was scheduled to fly with Epstein to Paris and in 2017 he planned to stop in St. Lucia to take her to his island home in the U.S. Virgin Islands for the day, according to the documents.

Ms. Ruemmler never visited his island and “never accepted an invitation or an opportunity to fly with Jeffrey Epstein anywhere,” the Goldman spokesman said.

In addition to her current role as general counsel at Goldman Sachs, Ms. Ruemmler is co-chair of its reputational risk committee, which monitors business and client decisions for potential damage to the bank’s image.

Epstein also connected Ms. Ruemmler with Ariane de Rothschild, who is now chief executive of the Swiss private bank Edmond de Rothschild Group.

The bank hired Ms. Ruemmler’s law firm, Latham & Watkins, after the introduction to help with U.S. regulatory matters, according to the bank and the Goldman spokesman.

Mrs. de Rothschild, who married into the famous banking family, had more than a dozen meetings with Epstein. He sought her help with staffing and furnishings as well as discussed business deals with her, according to the documents.

In September 2013, Epstein asked Mrs. de Rothschild in an email for help finding a new assistant, “female…multilingual, organized.”

“I’ll ask around,” Mrs. de Rothschild emailed back.

She bought nearly $1 million worth of auction items on Epstein’s behalf in 2014 and 2015, the documents show.

Mrs. de Rothschild was named chairwoman of the bank in January 2015. That October, she and Epstein negotiated a $25 million contract for Epstein’s Southern Trust Co. to provide “risk analysis and the application and use of certain algorithms” for the bank, according to a proposal reviewed by the Journal.

In 2019, after Epstein was arrested, the bank said that Mrs. de Rothschild never met with Epstein and it had no business links with him.

The bank acknowledged to the Journal that its earlier statement wasn’t accurate. It said Mrs. de Rothschild met with Epstein as part of her normal duties at the bank between 2013 and 2019, and Epstein introduced the bank to U.S. finance leaders, recommended law firms and provided tax and risk consulting.

“In parallel to that, Epstein solicited her personally on a couple occasions for advice and services on estate management,” the bank said.

Mrs. de Rothschild had no knowledge of any legal proceedings against Epstein and “was similarly unaware of any questions regarding his personal conduct,” the bank said.

After later learning of his behavior, the bank said, “she feels for and supports the victims.”

One of Epstein’s scheduled meetings with Mrs. de Rothschild, in January 2014, included another of his regular guests: Joshua Cooper Ramo, then co-chief executive of Henry Kissinger’s corporate consulting firm.

Epstein scheduled more than a dozen meetings from 2013 to 2017 with Mr. Ramo, who at the time served on the boards of Starbucks Corp. and FedEx Corp., the documents show. Epstein had special snacks on hand because he believed Mr. Ramo was vegetarian, the documents indicate.

Many of Mr. Ramo’s appointments with Epstein were in the evenings, typically after 5 p.m., at the townhouse.

Mr. Ramo also was invited to a breakfast at the townhouse in September 2013 with former Israeli Prime Minister Ehud Barak, another regular guest, the documents show.

Mr. Ramo, who still sits on the board of FedEx and recently stepped down from the Starbucks board, didn’t respond to requests for comment. A spokeswoman for Mr. Kissinger said he wasn’t aware that Mr. Ramo was meeting with Epstein.

Mr. Barak also met Epstein in 2015 with Mr. Chomsky, now 94, a linguistics professor and political activist who has been critical of capitalism and U.S. foreign policy.

Mr. Chomsky said Epstein arranged the meeting with Mr. Barak for them to discuss “Israel’s policies with regard to Palestinian issues and the international arena.”

Mr. Barak said he often met with Epstein on trips to New York and was introduced to people such as Mr. Ramo and Mr. Chomsky to discuss geopolitics or other topics.

“He often brought other interesting persons, from art or culture, law or science, finance, diplomacy or philanthropy,” Mr. Barak said.

Epstein arranged several meetings in 2015 and 2016 with Mr. Chomsky, while he was a professor at the Massachusetts Institute of Technology.

When asked about his relationship with Epstein, Mr. Chomsky replied in an email: “First response is that it is none of your business. Or anyone’s. Second is that I knew him and we met occasionally.”

In March 2015, Epstein scheduled a gathering with Mr. Chomsky and Harvard University professor Martin Nowak and other academics, according to the documents. Mr. Chomsky said they had several meetings at Mr. Nowak’s research institute to discuss neuroscience and other topics.

Two months later, Epstein planned to fly with Mr. Chomsky and his wife to have dinner with them and movie director Woody Allen and his wife, Soon-Yi Previn, the documents show.

“If there was a flight, which I doubt, it would have been from Boston to New York, 30 minutes,” Mr. Chomsky said. “I’m unaware of the principle that requires that I inform you about an evening spent with a great artist.”

Epstein donated at least $850,000 to MIT between 2002 and 2017, and more than $9.1 million to Harvard from 1998 to 2008, the schools have said.

In 2021, Harvard said it was sanctioning Mr. Nowak for violating university policies in his dealings with Epstein, and was shutting a research center he ran that Epstein had funded.

MIT said it was inappropriate to accept Epstein’s gifts, and that it later donated $850,000 to nonprofits supporting survivors of sexual abuse.

In a 2020 interview with the “dunc tank” podcast, Mr. Chomsky said that people he considered worse than Epstein had donated to MIT. He didn’t mention any of his meetings with Epstein.

Mr. Chomsky told the Journal that at the time of his meetings “what was known about Jeffrey Epstein was that he had been convicted of a crime and had served his sentence. According to U.S. laws and norms, that yields a clean slate.”

MIT said lawyers investigating its ties to Epstein didn’t find that Mr. Chomsky met with Epstein on its campus or received funding from him. Harvard declined to comment beyond the report it published on its Epstein ties in 2020.

Mr. Nowak has said he regretted his role in fostering a connection between Epstein and Harvard. He didn’t respond to requests for comment.

Mr. Botstein, 76, president of Bard College since 1975, had about two dozen meetings scheduled with Epstein over about four years, which were mostly visits to the townhouse.

“I was an unsuccessful fundraiser and actually the object of a little bit of sadism on his part in dangling philanthropic support,” said Mr. Botstein. “That was my relationship with him.”

Mr. Botstein said he first visited Epstein’s townhouse in 2012 to thank him for unsolicited donations to Bard’s high schools, then he returned over several years in an attempt to get more donations.

In 2015, Epstein donated 66 laptops, the documents show.

“We looked him up, and he was a convicted felon for a sex crime,” he said. Bard has a large program providing education to prisoners, he said. “We believe in rehabilitation.”

Mr. Botstein, also the longtime music director for the American Symphony Orchestra, invited Epstein to an opera at Bard in 2013, then a concert at the college in 2016, the documents indicate.

Epstein planned each time to bring some of his young female assistants and arrive by helicopter.

Mr. Botstein said he was expecting Epstein to support classical music causes and that the school took precautions when he visited. “Because of his previous record, we had security ready,” he said. “He did not have any free access to anybody.”

At Epstein’s home, Mr. Botstein was led to a dining room where they discussed classical music and other causes, he said. “He presented himself as a billionaire, a really, really rich person,” he said.

“I found him odd and arrogant. And what I finally came to believe, which is why we stopped contact with him, is that he was simply stringing us along.”

Despite all his meetings, Mr. Botstein said, Epstein never made another donation to Bard. “It was a blessing in disguise,” he said, “that we never got any [more] money.”

Updated: 5-3-2023

Jeffrey Epstein Documents: Dinners With Lawrence Summers And Movie Screenings With Woody Allen

Schedules and emails show deeper relationships between the disgraced financier and a range of prominent people, including the former Treasury secretary and the filmmaker.

Lawrence Summers wanted $1 million to fund an online poetry project his wife was developing. The former Treasury secretary and onetime Harvard University president turned to Jeffrey Epstein.

“I need small scale philanthropy advice. My life will be better if i raise $1m for Lisa,” Mr. Summers said in an email to Epstein in April 2014, referring to his wife, Elisa New, a Harvard professor. “Mostly it will go to make it a pbs series and for teacher training. Ideas?”

Epstein replied that they could meet in Cambridge, Mass. Mr. Summers invited him to dinner, according to a trove of documents reviewed by The Wall Street Journal. Two days later they made plans to meet at The Fireplace, a cozy restaurant in nearby Brookline, one of several meetings the two men scheduled that year.

In 2016, a nonprofit linked to Epstein donated $110,000 to Ms. New’s nonprofit, which develops video content about poetry, according to tax records.

The documents reviewed by the Journal, which include thousands of pages of emails and schedules from 2013 to 2017, provide new details about the nature and frequency of Epstein’s contacts with an array of powerful people long after he was a registered sex offender. He had pleaded guilty in 2008 to soliciting and procuring a minor for prostitution.

Mr. Summers “deeply regrets being in contact with Epstein after his conviction,” and Ms. New’s nonprofit “regrets accepting funding from Epstein,” said a spokeswoman for the couple. Ms. New’s nonprofit later made a contribution “exceeding the amount received, to a group working against sex trafficking,” the spokeswoman said.

Many of the people or institutions named in the documents were previously known to have associated with Epstein. Some of the documents show that their disclosures about contacts with Epstein were incomplete.

Other documents provide new details about how often or where the people met with Epstein, and the kinds of favors Epstein did for them.

The documents don’t reveal the purpose of most of the meetings. The Journal couldn’t verify whether every scheduled meeting took place. Many of the people told the Journal they met with Epstein for reasons related to his wealth and connections.

Among the new details:

Mr. Summers continued to meet with Epstein and seek his help years after Harvard decided it would no longer accept his donations.

Reid Hoffman, a billionaire venture capitalist and LinkedIn co-founder, visited Epstein’s private island in the Caribbean and was scheduled to stay over at his Manhattan townhouse in 2014.

Woody Allen, the Oscar-winning movie director, attended dozens of dinners with his wife, Soon-Yi Previn, at Epstein’s mansion and invited Epstein to film screenings.

Ehud Barak, the former Israeli prime minister, visited Epstein dozens of times and accepted flights on Epstein’s private jet while visiting Epstein’s mansions in Florida and New York.

Leon Black, the billionaire co-founder of private-equity giant Apollo Global Management, scheduled more than 100 meetings with Epstein from 2013 to 2017.

Mr. Hoffman said he met with Epstein to raise funds for the Massachusetts Institute of Technology, and that he regrets interacting with Epstein after his conviction. Mr. Allen’s spokeswoman said the filmmaker went with his wife to group social events at Epstein’s townhouse.

Mr. Black declined to comment. He stepped down after an Apollo investigation found he paid Epstein for tax planning and estate advice.

Mr. Barak said he often visited Epstein when he traveled to New York. He said he met interesting people at Epstein’s townhouse where they would discuss politics and other topics.

“In retrospect, [Epstein] seems to be a terrible version of Dr. Jekyll and Mr. Hyde, but at the time seemed to be an intelligent person, socially well connected and of wide areas of interest, from science to geopolitics,” Mr. Barak said. He said that he never participated in any parties or activities with girls or women.

The documents show that the disgraced financier kept a busy schedule, filling his days with meetings with politicians, executives and celebrities, including at his New York townhouse and his residence in the U.S. Virgin Islands.

Prosecutors alleged in 2019 that Epstein had abused girls and had run a sex-trafficking ring. He died that year in jail awaiting trial in what the New York City medical examiner said was a suicide.

Barnaby Marsh, then an executive at the large charitable fund John Templeton Foundation, met with Epstein roughly two dozen times, often for breakfast at the townhouse, the documents show. He was previously known to have met with Epstein, but not to that extent.

Mr. Marsh, who advises wealthy people on philanthropy, said he went to Epstein’s townhouse for gatherings because it was full of billionaires and academics who had many of the same interests in charitable giving. Mr. Marsh said Epstein openly discussed his jail time.

“So many of these billionaires knew him,” Mr. Marsh said. “Nobody ever said ‘Watch out for him.’ ”

He said Epstein convened people, including Microsoft co-founder Bill Gates, to try to solve problems facing rich donors, such as how to make large gifts. Epstein told Mr. Marsh that Epstein was managing money for Mr. Gates, Mr. Marsh said.

“I had high hopes that he would follow the paths of others who used their ‘second chance’ to make a positive impact in the world,” Mr. Marsh said. “In the end, he disappointed me.”

Epstein misrepresented his relationship with Mr. Gates and didn’t manage money for him, said a spokeswoman for Mr. Gates.

Mr. Gates has said they met for philanthropic reasons.

“As Bill has said many times before, it was a mistake to have ever met with him and he deeply regrets it,” the spokeswoman said.

Glenn Dubin and Eva Andersson-Dubin

The documents reveal how Epstein’s friends sustained a relationship after his conviction in ways that were mutually beneficial. Epstein received help to repair his reputation, and his friends received favors.

Eva Andersson-Dubin, a longtime friend and the wife of hedge-fund billionaire Glenn Dubin, invited Epstein to charity events, to which he contributed.

In the summer of 2015, Epstein sent Dr. Andersson-Dubin a “funny story” about checking into a California hotel with a young woman.

“I went to park the car and the bellman said to Karnya ‘is that your father,’ ” Epstein, then 62, wrote in an email, referring to his female companion, then in her 20s.

Dr. Andersson-Dubin wrote back: “Glenn laughs so hard!!!!”

In 2019, when Epstein was charged with sex trafficking, the Dubins told the Journal through a spokesman that they were “horrified,” and that they had continued their friendship after his 2008 guilty plea because they believed he had rehabilitated himself.

Dr. Andersson-Dubin, a physician and former Miss Sweden, has said she dated Epstein in the 1980s. Epstein connected Mr. Dubin to JPMorgan Chase, which bought control of his hedge fund, Highbridge Capital Management, in 2004 for more than $1 billion. Epstein earned a fee for the transaction, the Journal has reported.

The documents also reveal Epstein offering help to one of the Dubins’ daughters, as he did for the children of other contacts.

In 2012, Epstein emailed the Dubins’ daughter that he would arrange modeling jobs for her with apparel brands. In 2014, he scheduled a meeting between her and a professor at Harvard, where she was a student, the documents show.

A spokeswoman for the Dubins said Epstein didn’t make introductions for modeling jobs for their daughter. The spokeswoman reaffirmed the Dubins’ 2019 statement, which also said: “Had they been aware of the vile and unspeakable conduct described in these new allegations, they would have cut off all ties long ago and certainly never allowed him to be in the presence of their children.”

Lawrence Summers

Epstein donated millions of dollars to Harvard during Mr. Summers’s tenure as the university’s president from 2001 to 2006. Harvard has said it decided to reject donations from Epstein after his 2008 guilty plea in Florida.

Mr. Summers, who remains a Harvard professor, had more than a dozen meetings scheduled with Epstein from 2013 through 2016, including several dinners, the documents show.

Mr. Summers didn’t solicit donations for Harvard from Epstein after his conviction and didn’t personally receive money from him, his spokeswoman said. “Their interactions primarily focused on global economic issues,” she said.

But he did solicit donations for Ms. New, his wife. In 2014, Ms. New, a professor of English, was hoping to expand to the general public her Harvard coursework about poetry. She established the nonprofit that received the Epstein donation and later created a public-television series, the spokeswoman said.

Mr. Marsh said Epstein asked him multiple times if the Templeton Foundation could donate to Ms. New’s poetry project. Templeton didn’t donate to the project, he said.

Harvard declined to comment beyond its 2020 report on its ties with Epstein, which found he donated $9.1 million before 2008 and had visited the campus dozens of times after his conviction.

Woody Allen

Epstein was known to have been friendly with Mr. Allen. The documents reveal new details about some of their activities and how often they met. They were scheduled to get together nearly every month in 2014 and 2015.

In November 2012, an assistant to Mr. Allen sent one of Epstein’s assistants a note: “Woody was wondering if Jeffrey would be interested in watching his new film either today or tomorrow?” Epstein said he was available.

Epstein and Mr. Allen also planned visits to the studio of artist Jeff Koons in 2013, and to Sotheby’s auction house in 2017, the documents show. Mr. Koons didn’t respond to requests for comment.

Epstein arranged for Mr. Allen to join dozens of dinners at Epstein’s townhouse. Mr. Allen went with his wife, Ms. Previn. Epstein’s staff sometimes ordered Mr. Allen flourless chocolate cakes and bottles of Beck’s beer, the documents show.

“Woody and Soon-Yi lived in the same neighborhood as Epstein and were frequently invited to dinner parties at his townhouse,” said a spokeswoman for the couple. “There were always other guests at those gatherings.”

“Woody never had a business meeting with Epstein and not once spent time with him without Soon-Yi also being present,” the spokeswoman said.

In October 2014, Epstein planned for Mr. Allen to give lessons on film editing at his townhouse to a group of guests watching Alfred Hitchcock’s “Psycho,” the documents show.

Terje Rød-Larsen

On the guest list for the 2014 film session with Mr. Allen, the documents show, was Terje Rød-Larsen, a Norwegian diplomat who helped negotiate the Oslo Accords in the 1990s.

The documents reveal Epstein also made plans for Mr. Rød-Larsen to visit his private island in 2012. The diplomat came so frequently to Epstein’s townhouse—dozens of times from 2013 to 2017—that the staff knew to have cucumbers on hand for his gin, the documents show.

Mr. Rød-Larsen resigned in 2020 as president of the International Peace Institute after Norwegian newspaper DN reported he visited the townhouse frequently, had received a $130,000 personal loan from Epstein, and had accepted about $650,000 in donations from Epstein foundations for the nonprofit.

The IPI said in 2020 that it was unaware of the donations and the loan, and that Mr. Rød-Larsen had apologized for his “failed judgment.”

Mr. Rød-Larsen didn’t respond to requests for comment. A spokeswoman for the IPI said it had no comment beyond its 2020 statement.

Ehud Barak

After Epstein was arrested in 2019, photos were published in newspapers showing Mr. Barak, the Israeli politician, entering Epstein’s townhouse in 2016.

The documents provide new details about his scheduled meetings. They show that between 2013 and 2017, Epstein planned at least three dozen meetings with Mr. Barak. They had appointments every month for 11 consecutive months starting in December 2015, the documents show.

Mr. Barak told the Journal he was introduced to Epstein in 2003 by Shimon Peres, another former prime minister of Israel, at a social event with U.S. dignitaries, and that he would regularly visit Epstein when he traveled to New York.

“Quite often, I came to the townhouse with my wife,” Mr. Barak said. Mr. Peres died in 2016.

Mr. Barak also took flights on Epstein’s private jet, the documents show. In January 2014, he met Epstein at his Palm Beach mansion and then they flew together to Tampa, where Epstein dropped him off and continued on to New York.

“I flew only twice on his airplane, together with my wife and Israeli security detail,” Mr. Barak said. He said he remembers the trip in Florida was to visit a U.S. military installation in Tampa.

“I never participated in any party or any other improper event around [Epstein], and never met him with girls or minors, or even adult women in improper context or behavior,” Mr. Barak said.

Reid Hoffman

Mr. Hoffman, the LinkedIn co-founder, has apologized for his interactions with Epstein, including inviting him in 2015 to a dinner in Palo Alto with Silicon Valley leaders. After Epstein was arrested in 2019, Mr. Hoffman said he had met with him to help raise funds for MIT at the request of the then director of MIT’s Media Lab, Joi Ito.

The documents reveal that Epstein had plans for Mr. Hoffman and Mr. Ito to visit his private island in March 2014 and in November 2014. On the second date, Epstein planned to travel with both men from Palm Beach to the island for a weekend and then fly together to Boston.

When the venture capitalist had a flight scheduled to land late at night in New York on Dec. 4, 2014, Epstein arranged for Mr. Hoffman to stay overnight in his townhouse, the documents show.

The following morning, Mr. Hoffman was scheduled to attend a “breakfast party” with Epstein, Mr. Gates and others, according to the documents.

Mr. Hoffman told the Journal he only once visited Epstein’s island residence, Little St. James, for an MIT fundraising trip with Mr. Ito. He said he regrets ever meeting with Epstein and his last interaction with Epstein was in 2015.

“It gnaws at me that, by lending my association, I helped his reputation, and thus delayed justice for his survivors,” Mr. Hoffman said in an email. He said he met with Epstein to discuss science projects at universities.

“While I relied on MIT’s endorsement, ultimately I made the mistake,” he said, “and I am sorry for my personal misjudgment.”

Mr. Ito said in an email: “Reid attended a few fundraising events at my request, including one trip to Little St. James, after I confirmed to Reid that Mr. Epstein had been an approved donor target for MIT in accordance with university rules and regulations.”

After Epstein’s arrest in 2019, Mr. Ito resigned from the MIT Media Lab and apologized for accepting funding from Epstein.

MIT said at the time that it was a mistake to accept Epstein’s gifts. The school later said it donated $850,000 to nonprofits supporting survivors of sexual abuse.

Updated: 5-3-2023

Epstein’s Islands Sell To Finance Buyer Planning Luxury Resort

Stephen Deckoff agreed to pay $60 million for Little St. James and Great St. James in the US Virgin Islands.

The pair of Caribbean islands that belonged to Jeffrey Epstein, the former financier accused of sex trafficking, have sold to a buyer who plans to build a luxury resort that can break free of the land’s sordid past.

Stephen Deckoff, through his SD Investments, is buying Great St. James and Little St. James in the US Virgin Islands, according to a statement Wednesday. The properties sold for a combined price of $60 million, according to Bespoke Real Estate, which had the listing with the Modlin Group.

Epstein was accused of trafficking young women and underage girls on the islands, which locals called “Pedophile Island” and “Orgy Island.” The sale comes with a big discount from a March 2022 listing price of $125 million.

The US Virgin Islands will receive half the proceeds from the sale of Little St. James – where Epstein lived – as part of a settlement his estate reached with the government last year. The islands were priced at $30 million each, according to a person familiar with the matter who asked not to be identified citing private details.

Epstein’s business dealings continue to come under scrutiny, including in a lawsuit filed by the government of the US Virgin Islands accusing JPMorgan Chase & Co. of benefiting from sex trafficking through its ties to the late money manager.

Deckoff, the founder and principal of Black Diamond Capital Management, intends to develop a 25-room luxury resort to boost tourism and create jobs, according to a statement. He is in the process of hiring architects and engineers to work on the project, which he expects to open in 2025.

Deckoff “has built a successful career crafting and executing plans to turn distressed situations into successful enterprises,” according to the statement Wednesday.

Forbes first reported Deckoff’s purchase.

Epstein bought the 72-acre (29-hectares) island of Little St. James, which had a main house and additional structures, in 1998 for $7.95 million. He paid $22.5 million in 2016 for Great St. James.

Updated: 5-4-2023

JPMorgan CEO Jamie Dimon To Be Deposed In Lawsuits Over Former Client Epstein

JPMorgan Chase CEO Jamie Dimon is scheduled to be deposed May 26 and 27 in two civil cases related to the bank’s former client Jeffrey Epstein, the powerful financier accused of child sex trafficking before his death, according to a source familiar with the cases.

A complaint filed last month in New York alleged that JPMorgan Chase executives were aware of numerous sex abuse and trafficking allegations against Epstein, and overlooked them, for several years before the financial institution cut ties with him.

The complaint was part of a lawsuit against the bank filed by the attorney general for the US Virgin Islands (USVI). It added an additional count alleging that JPMorgan obstructed federal law enforcement and prosecuting agencies that were pursuing Epstein.