Ultimate Guide For Cryptocurrency Tax Resources (#GotBitcoin)

Tax specialists warn those who aren’t in compliance with rules to act quickly to avoid more woes. The Internal Revenue Service is on the war path against Americans who haven’t reported income from cryptocurrencies like bitcoin. The Ultimate Guide For Cryptocurrency Tax-Related Matters (#GotBitcoin)

Related:

Service Reduces IRS Phone Hold Time From Hours To Minutes

Taxpayer Money Finances IRS “Star Trek” Parody

IRS Failed To Collect $2.4 Billion In Taxes From Millionaires

IRS Workers Who Failed To Pay Taxes Got Bonuses (#GotBitcoin)

Cyber Hack Got Access To Over 700,000 IRS Accounts (#GotBitcoin)

IRS Fails To Prevent $1.6 Billion In Tax Identity Theft (#GotBitcoin)

Trump DOJ Declines To Charge Lois Lerner In IRS Scandal (#GotBitcoin)

IRS Uses Cellphone Location Data To Find Suspects

IRS Buying Spying Equipment: Covert Cameras In Coffee Trays, Plants (#GotBitcoin)

In late July, the IRS said it had started to send warning letters to more than 10,000 people who may not have complied with tax rules on virtual currencies. Agency officials have said criminal tax indictments involving cryptocurrencies are expected soon, and other enforcement letters are going out.

“I tell them, ‘It’s time to put your running shoes on.’ You must get to the IRS before they find you, especially if you got a letter,” says Bryan Skarlatos, a criminal tax lawyer with Kostelanetz & Fink in New York.

Dealing with the IRS disclosure maze is Mr. Skarlatos’s specialty: He guided nearly 2,000 U.S. taxpayers through it when they confessed secret offshore accounts between 2009 and 2018.

He performed triage for more, telling those with cases that wouldn’t land them in prison about simpler solutions.

The IRS’s crypto crackdown has similarities with its offshore-account campaign. Mr. Skarlatos has handled about a dozen high-dollar cryptocurrency cases.

Mr. Skarlatos says people in possible violation of IRS rules should first look for signs of tax fraud. It must involve intentional disobedience of the law. One clear sign is a large amount of unpaid tax, say above $15,000, he adds.

Other signs of fraud can be efforts to disguise cryptocurrency ownership, as by using an assumed name; using a “tumbler” service that mixes some cryptocurrency with others to obscure the original source; and lying to a prior tax preparer—because the IRS will ask.

If there was fraud, the crypto owner will need a lawyer to provide attorney-client privilege. The owner should probably apply to the IRS’s Voluntary Disclosure program, which often levies large civil penalties but protects against criminal prosecution.

If the wrongdoing wasn’t fraudulent, the crypto owner can often file what is called a qualified amended return, typically through an accountant. This will avoid some penalties but not interest.

There is an important exception for crypto owners who weren’t fraudulent but are already known to the IRS. This category includes people who were outed when a federal court required Coinbase, the leading cryptocurrency exchange, to turn over information on about 14,000 customers to the agency.

When the IRS contacts wrongdoers about an audit before they come forward, Mr. Skarlatos says, they often face larger penalties than wrongdoers who weren’t known to the IRS.

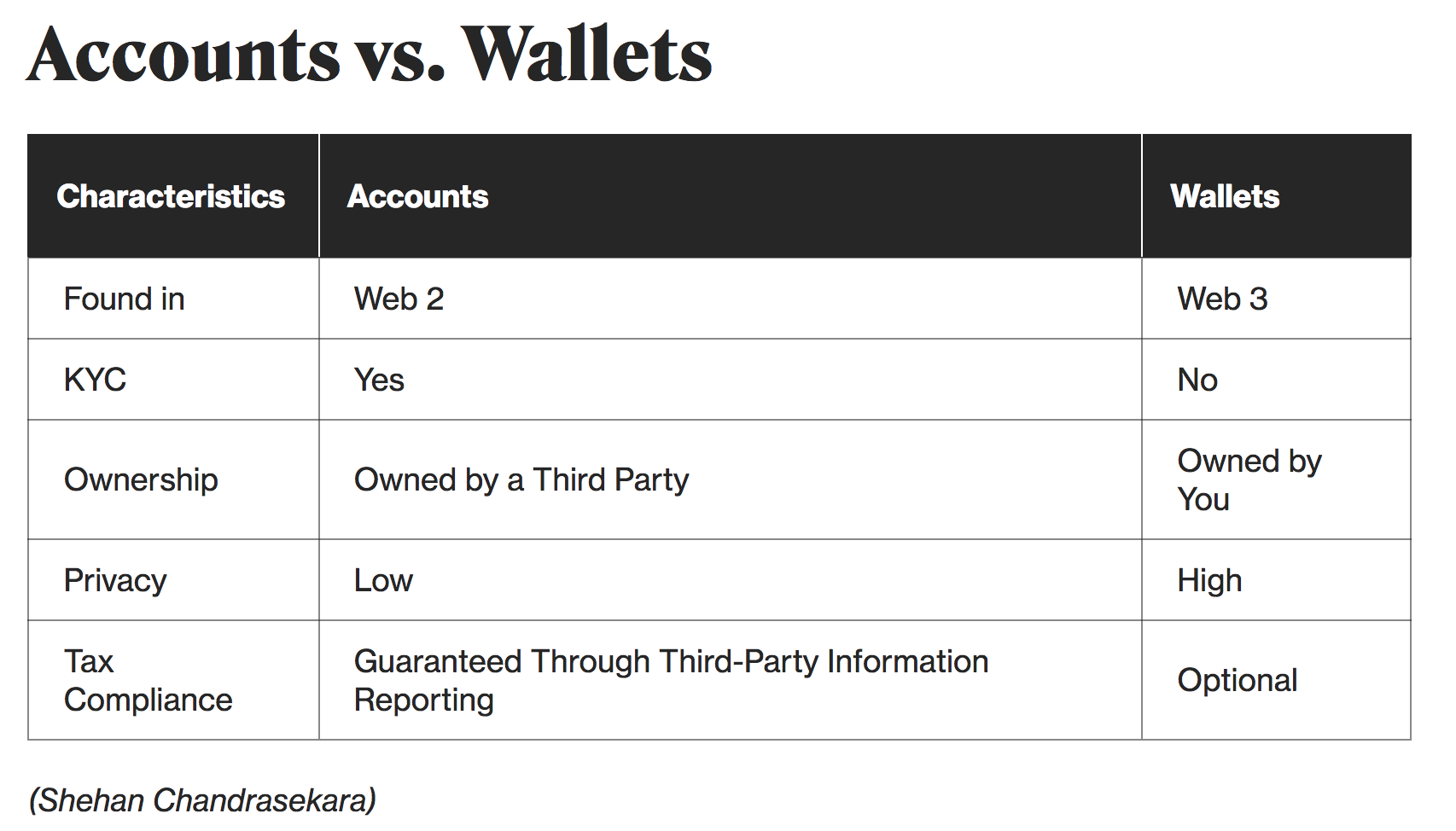

The IRS is focusing on cryptocurrencies because their use is expanding, and enthusiasts often praise the anonymity virtual currencies offer. Many trades aren’t reportable to the IRS by third parties—unlike sales of securities such as stock shares, which generally must be reported to the IRS by brokerage firms.

An IRS analysis found that for 2013, 2014, and 2015, when more than 80% of returns were electronically filed, fewer than 1,000 e-filed returns each year reported transactions appearing to use virtual currencies. Coinbase said at the end of 2013 that it had 650,000 accounts. Now it has more than 30 million.

Cryptocurrency advocates are upset by the IRS’s campaign. They say the agency hasn’t yet released long-promised guidance, including how to pinpoint some fair market values; which cost-allocation methods to use; or whether the agency favors a small exemption for personal use.

Recently, 60% of global bitcoin transactions were below $600, according to Coin Metrics, a cryptocurrency data provider.

Advocates also point out that tax reporting is onerous because the IRS classifies cryptocurrencies as property akin to stocks or a home. If someone uses bitcoin to buy a car or lunch, that is typically a taxable sale—as it would be if the person paid in shares of stock.

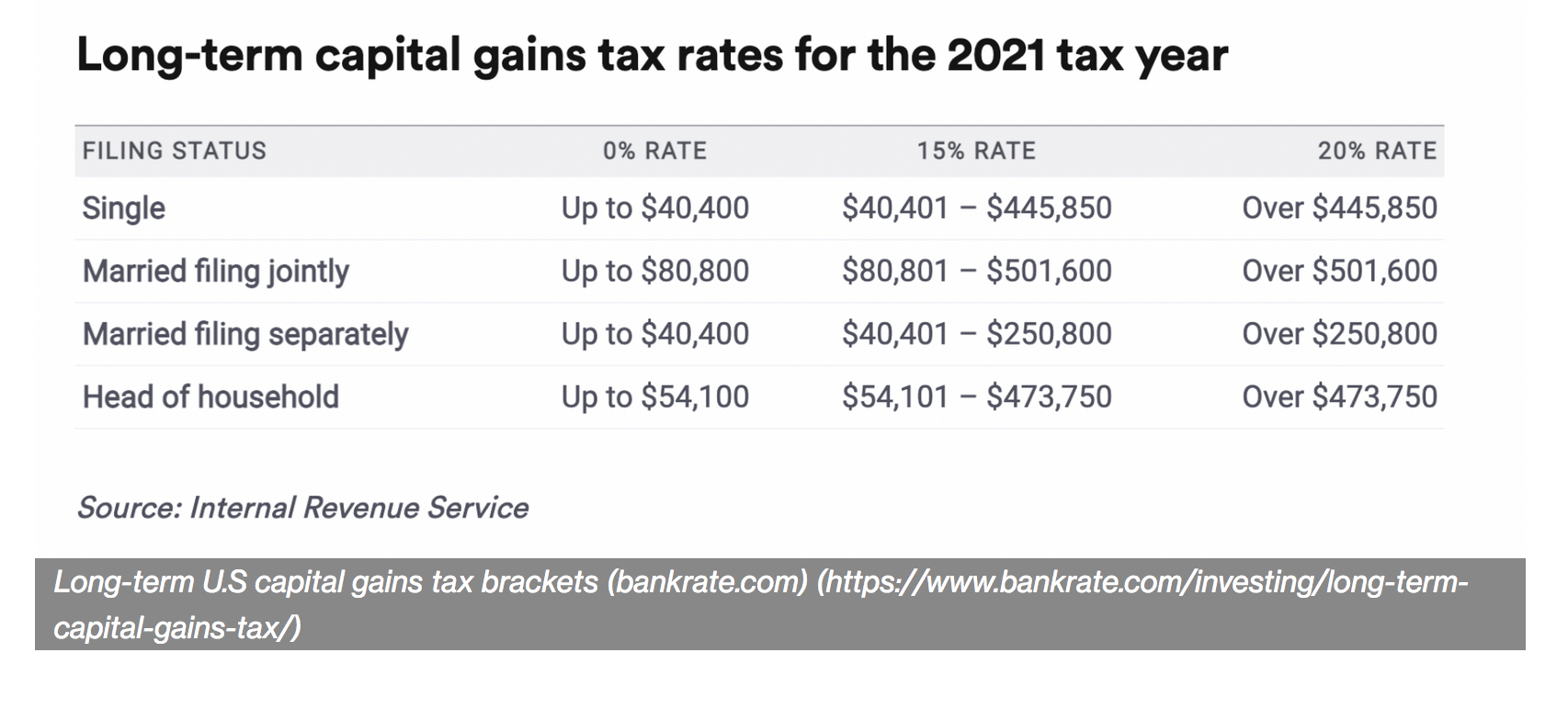

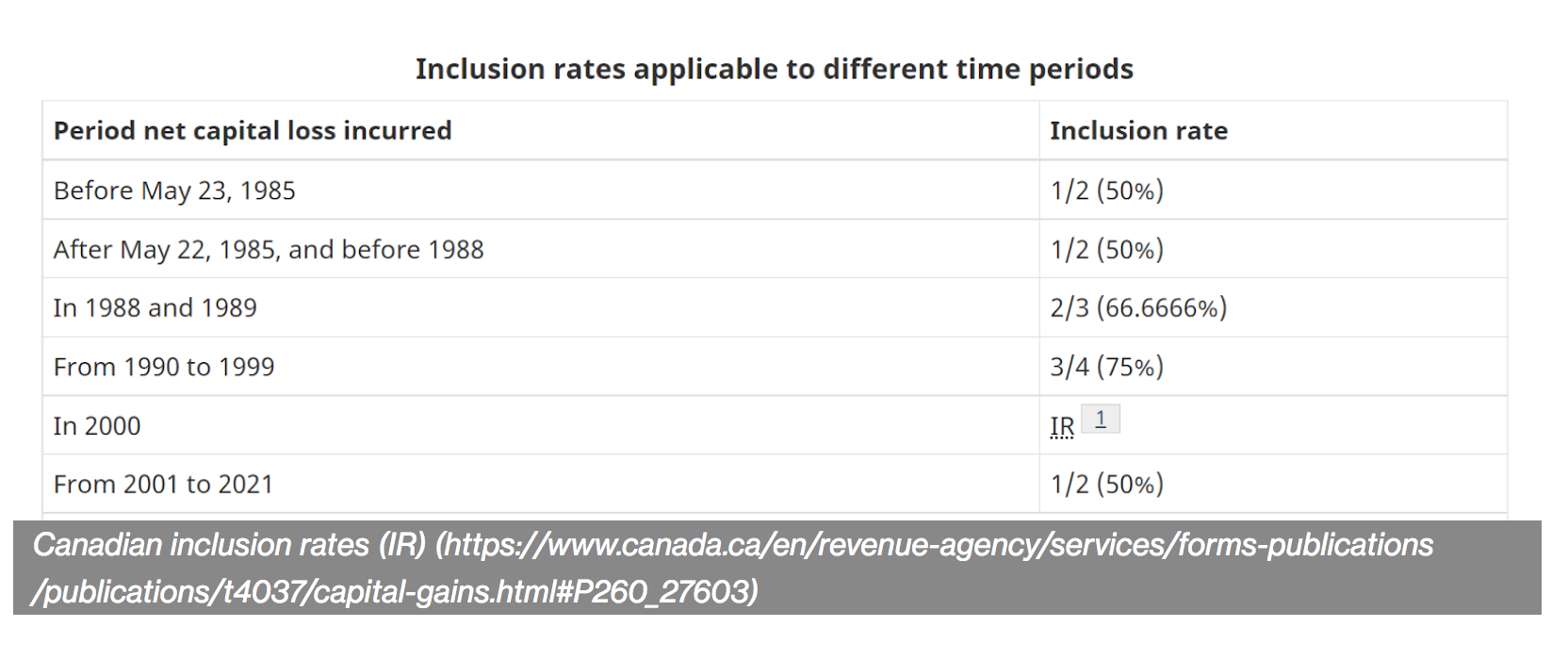

If the selling price of the bitcoin is higher than its purchase price, then the profit is typically taxable at capital-gains rates. If the selling price is lower, there may be a deductible capital loss. Frequent traders can have thousands of transactions to detail on IRS Form 8949, and cryptocurrencies’ volatility can yield both gains and losses within a short period.

The IRS will dismiss these arguments, says Jordan Bass, a certified public accountant in Los Angeles who says three-quarters of his tax-prep practice involves cryptocurrencies, a specialty he turned to after advising friends with bitcoin.

“The tax framework has been clear since 2014,” he says. “The IRS isn’t going to impose terrible penalties on good-faith efforts, but it will try to make an example of bad actors.”

Updated: 8-27-2019

IRS Sends New Round of Letters To Bitcoin And Crypto Holders

Last week, the United States Internal Revenue Service sent another round of letters to crypto traders called CP2000. These notices were sent to traders of some crypto exchanges due to inconsistencies found in their tax reports.

Using the information provided by third-party systems — such as crypto exchanges and payment systems — the IRS has been able to determine the amounts traders owe and included the amounts in dollars in the notices. Individuals who have received these notices are required to pay within 30 days, starting on the delivery date indicated in the letter.

If you think the exchange — on which you traded — provided your details to the bureau, you are probably right, but do not hold it against the exchanges. The regulation stipulates that all broker and barter exchange services are required by law to annually report trader activity on a 1099-B form, send it directly to the IRS and send a copy to the recipient.

In addition, transaction payment cards and third-party network transactions are also required to report on Form 1099-K, send it directly to the IRS and send a copy to the payee.

The IRS has not yet published specific guidelines for crypto exchanges. In fiat stocks, every broker must submit 1099-B to the IRS and send a copy to the trader. In crypto, the IRS still didn’t publish clarification whether exchanges should provide 1099-K or 1099-B.

Exchanges can benefit from the uncertain situation to provide 1099-K — like Coinbase Pro and Gemini — but some do not provide any forms, such as Kraken and Bittrex. Meanwhile, the exchange must provide the users with the 1099-K copy by the end of every January, so they will be available to use it in their capital gains report. The users, at the same time, don’t submit the IRS their copy of 1099-K, as they only use this form to calculate and report on their capital gains or loss report.

Similarly, earlier this month, the United Kingdom’s tax, payments and customs authority, Her Majesty’s Revenue and Customs, has reportedly requested that digital currency exchanges provide it with information about traders’ names and transactions, aiming to identify cases of tax evasion.

In the U.S., data gathered from these exchanges is collected by the IRS and compared to every trader’s 1099-K report. If the reports do not match the data provided by the exchanges, the IRS will send the CP2000 notice to traders. The notice includes the amount every trader is expected to pay within 30 calendar days.

What’s more, the notice generally includes interest accrued, which is calculated from the due date of the return to 30 days from the date on the notice. This Interest continues to mount until the amount is paid in full, or the IRS agrees to an alternate amount.

It means that interest began on the due date — on the day that you were supposed to report this for the first time. If you should, for example, have included this capital gains on your 2017 report, the interest will start on April 2018 — the last day you should have reported this gain. And it’s calculated until the reply date on the CP2000 notice.

Those Who Received The CP2000 Letter Have Two Options:

If The Amount Proposed Is Correct:

Complete the response form, sign it and mail it to the IRS along with the tax payment.

If the amount proposed is incorrect:

Complete the response form and return it to the IRS along with a signed statement outlining why you are in disagreement with the amount listed. It is important to include any supporting documentation to your claims.

It is highly recommended to provide a supporting calculation that is comprehensive and includes all wallet activities and transactions carried out on all exchanges in order to have a complete and accurate report as required by the IRS.

You do not need to file an amended return Form 1040X, but if you choose to do so, you should write “CP2000” on top of it.

It is important to understand that 1099-K reports for individuals trading crypto can be inaccurate in some cases, and does not include the cost basis, which is crucial for crypto trading calculations.

1099-K only asks for the gross amount of the activity. In crypto reports, you need to know how much it costs you (how much you paid when you bought it) and not only how much you got when you exchanged it.

You pay capital gains tax on the profit between the buy amount to the exchange (to fiat or another crypto) amount.

The price you pay for it is called “cost basis.” Without it you will not have an accurate report on crypto. 1099-K forms don’t ask this information, only 1099-b forms do.

Therefore, crypto activity must be fully calculated and compared to the previous tax filing before replying to the IRS notice.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Or Lokay Cohen is the vice president at Bittax, a crypto tax calculation platform. Or has 10 years’ experience with regulation and managing a leading tax consultant firm. She holds an LL.M. law degree, a B.A. in communications and an M.A. in management and public policy. In her work at Bittax, Or promotes the goal of bridging cryptocurrency to the taxation reality to enable tax reporting under a clear regulatory framework and specific identification methods.

Updated: 9-3-2019

IRS Expands Penalties: Which Tax Mistakes Are Better Not To Commit

Willful and non-willful tax flubs are different. Taxes are complex, and innocent tax mistakes can often be forgiven — maybe with no penalty. Even if there is a penalty, non-willful is vastly lower than willful. In a criminal tax case, this fundamental dichotomy can mean the difference between innocence or guilt, freedom or incarceration. But penalties in civil cases can be plenty bad — and most tax cases are civil — and to the United States Internal Revenue Service, bad intent may not be bad at all.

With crypto, the IRS has said it is digging hard, investigating both tax evasion and just poor compliance. But any interaction with the IRS can routinely involve some kind of penalty. Sometimes, the IRS uses the threat of penalties to encourage payments. But in other cases, the IRS pursues penalties with a vengeance.

A good example is offshore accounts, which have strong parallels to crypto tax-compliance issues. Both willful and non-willful failures to report offshore accounts can be penalized. Civil penalties for non-willful violations can be $10,000 per account per year. But if the IRS says you were willful, you can pay up to $100,000 or 50% of the amount in the account. This is for civil cases, imposed in the context of regular IRS audits, even through the mail.

If the IRS says you were willful and wants big penalties, you can pay them or push back through the IRS Appeals Division. IRS Appeals is the classic place where the IRS and taxpayers settle disputes. But sometimes, either the IRS or the taxpayer won’t budge. Some courts say willfulness is a resolution to disobey the law, but one that can be inferred by conduct. Watch out for conduct meant to conceal.

However, much less can now be willful. The IRS penalizes for willful blindness and recklessness. The IRS often refers to Section 6672 of the tax code, which involves payroll taxes. Every employer must withhold taxes and promptly send the money to the IRS. If you don’t, Section 6672 permits the government to collect it from officers, directors and even just check-signers — any “responsible” person who willfully fails to pay employment taxes.

Willful mean in this context is very favorable to the government. Taxpayers are readily found to be willful if they merely ought to have known there was a risk withholding taxes were not being paid, and if they were in a position to find out. The IRS usually wins these payroll tax cases, so willful in this context means pretty little.

Aren’t foreign bank accounts different? The IRS appears not to think so. In the case Bedrosian v. U.S., Arthur Bedrosian opened two Swiss bank accounts in the 1970s but did not tell his accountant until the 1990s. The accountant advised him to do nothing. He said it would be cleared up at Bedrosian’s death, when the assets in the accounts were repatriated as part of his estate. But in 2007, a new accountant listed one account and not the other.

Eventually, Bedrosian amended his tax returns to correctly report both accounts. The IRS said the violation was willful and slapped on a penalty of $975,789 — 50% of the maximum value of the account. The District Court for the Eastern District of Pennsylvania found Bedrosian’s actions “were at most negligent,” and that the omission of the large account was “unintentional oversight or a negligent act.” So, the government appealed to the 3rd U.S. Circuit Court of Appeals.

The 3rd Circuit reversed the lower court’s decision due to the IRS’ arguments about the much harsher willful standards from Section 6672 payroll tax cases.

The 3rd Circuit cited two Section 6672 cases and quoted the standard for reckless disregard from one. The Bedrosian case was remanded to the District Court to apply the new standard. The fear is that willfulness is beginning to look quite broad — just as the IRS likes.

The IRS can almost always show willfulness any time payroll taxes were not paid. The flimsy “in a position to find out” standard in the context of Section 6672 noncompliance is very broad. In short, is the government seeking a sort of carte blanche when it comes to proving willful FBAR penalties (i.e., when one fails to report a foreign bank account)?

The Justice Department’s reply in the Bedrosian case claims that the taxpayer, by signing and filing his or her return without reviewing it, “ought to have known” that there was a “grave risk” the form might not be accurate.

This argument suggests an attempt to use the signing of a return as inherent reckless disregard of the duty to report foreign accounts. The Justice Department has successfully argued in other cases that merely signing a return without the proper box checked is per-se willfulness — see United States v. Horowitz, et al., 123 AFTR 2d 2019-500 (DC MD); Kimble v. United States, 122 AFTR 2d 2018-7109 (Ct. Fed. Cl.).

The courts in both cases said taxpayers have constructive knowledge of the content of their tax returns and cannot claim ignorance. In Horowitz, the taxpayers are arguing on appeal that the Section 6672 standard is inappropriate because FBAR willfulness occurs in a much different context.

Uneasy Conclusions

It may be too soon to tell how all of this will shake out. Perhaps many taxpayers facing willful penalties may end up with understanding IRS agents who opt for non-willful penalties, at least if the taxpayer’s explanation and behavior seem reasonable. Taxpayers should be prepared to justify their mistake or misunderstanding in their particular circumstances if they hope to avoid the ever-expanding net of willfulness that seems to be brewing from the government.

There are growing concerns about whether IRS penalties are getting harsher and harsher. So far, the specific context for this drive seems to be in the offshore account arena. That is an easy one for the government.

These days, the IRS has mountains of information and documentation about offshore accounts nearly everywhere. That makes any infractions, however minor, perhaps even more risky than most other tax gaffes.

Still, if the IRS’ drive for penalties continues, one wonders if we might one day have strict liability for tax problems. In the meantime, when it comes to penalty notices and disputing penalty findings at any level, extra care is likely to be required.

The IRS Is Blindly Coming After Cryptocurrency Traders — Here’s Why

Over the past month, we have seen the IRS, the tax collecting agency of the United States, send out more than 10,000 warning and action letters to suspected cryptocurrency holders and traders who may have misreported digital assets on their tax returns. Letters like the 6174-A, 6173 and CP2000 have appeared in the mailboxes of cryptocurrency traders throughout the country, and the crypto tax software company that I run has seen an influx of frantic customers coming to us for tax help out of fear of penalties.

The problem here is that the IRS doesn’t have all of the necessary information. In fact, not only does it not have all the information, but the information that it does have on the cryptocurrency holders that it is sending letters to is extremely misleading.

This information, which was supplied to the IRS by cryptocurrency exchanges like Coinbase, is causing the agency to blindly and oftentimes inaccurately come after cryptocurrency traders.

Related: Internal Revenue Service Sends New Round of Letters to Crypto Holders

Allow me to break this down further.

How Is Cryptocurrency Taxed In The U.S.?

In many countries around the world — the U.S. included — cryptocurrencies like Bitcoin are treated as property from a tax perspective, rather than as a currency. Just like other forms of property — stocks, bonds, real-estate — you incur capital gains and capital losses that need to be reported on your tax return whenever you sell, trade or otherwise dispose of your cryptocurrency.

Pretty straightforward: If you make a bunch of money investing in Bitcoin (BTC), you have a capital gain and a tax liability that needs to be reported. If you lose a bunch of money, you have a capital loss, which will actually save you money on your tax bill — though it still needs to be reported.

It doesn’t come as a huge surprise that many enthusiasts have not been paying taxes on their cryptocurrency activity. Because of this, it actually makes a lot of sense why the IRS has started carrying out these enforcement campaigns. However, the agency is using information that is extremely misleading, and it is leading to problems. This misleading information starts with Form 1099-K.

Breaking Down Form 1099-K

Cryptocurrency exchanges like Coinbase, Gemini and others issue 1099-K’s to users who meet certain thresholds of transaction volume on their platforms. The IRS states on its website that the 1099-K is an information return used to report third-party network transactions to improve voluntary tax compliance.

In plain English, the 1099-K is used to report your gross transactions on a third-party network — in this case, a cryptocurrency exchange. This means that all of your transactions, buys, sells, transfers, etc. are summed up and reported on a 1099-K. If you meet certain thresholds — gross payments that exceed $20,000 and more than 200 such transactions — you and the IRS are both sent a copy of this 1099-K from the cryptocurrency exchange. The IRS is using these documents to monitor who is and isn’t paying taxes correctly.

These “gross transaction” reports can quickly get extremely large for high volume cryptocurrency traders. Remember, every transaction you made is being summed together on this form. I purchased $1,000 worth of Bitcoin, and then traded that Bitcoin in and out for Ether (ETH) five times, and my gross proceeds are now over $6,000 — even though I only ever “put in” $1,000 cash!

This is because all “buy” transactions are added together to report gross proceeds, and in this case, I technically had six different buy transactions and six different “sell” transactions — a Bitcoin trade into ETH is considered both a buy of ETH and a sell of BTC.

You can see how this number can become extremely large for a high volume trader. At CryptoTrader.Tax, we’ve seen 1099-K’s from customers in the millions of dollars range when the trader only ever had a few thousand dollars worth of crypto.

Why this is so problematic

1099-K’s are reporting gross transaction amounts and are being sent to the government. Yet, the numbers reported are completely irrelevant when it comes to tax reporting, as you are only actually taxed on your capital gains and losses.

Again as an example, say you purchased $10,000 worth of Bitcoin in April and then sold it two months later for $9,500. You have a $500 capital loss that would be deducted from your taxable income. However, reported on 1099-K, nothing is said of your net loss; the form only tells the government that you have $19,500 of gross cryptocurrency transactions.

Ultimately, 1099-K is not a form that should be used for tax reporting purposes, yet the IRS is relying on it for enforcement. Many people often mistake the 1099-K that they receive from cryptocurrency exchanges with the typical 1099-B that they might receive from their stock broker or other investment platform outside of crypto.

The 1099-B is the correct form that reports all necessary information required to calculate and accurately report capital gains and losses — including cost basis and fair market value of your investments. It’s very easy to determine your total capital gain and loss with this form, contrary to 1099-K.

The fact that the IRS is relying on 1099-K to issue action letters is problematic.

Unfortunately, cryptocurrency exchanges do not have the ability to give you an accurate Form 1099-B.Why cryptocurrency exchanges can’t provide tax reports like a stock brokerage does because cryptocurrency users are constantly transferring crypto into and out of their exchanges, the exchange itself has no way of knowing how, when, where or at what cost (cost basis) you originally acquired your cryptocurrencies. It only sees that they appear in your wallet on their platform.

The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and fair market value of your cryptocurrencies, both of which are mandatory components for tax reporting.

In other words, cryptocurrency exchanges do not have the ability to provide you with the necessary information to calculate your capital gains and losses. This also means that they also don’t have the ability to provide you with a 1099-B.

Coinbase Itself Explains To Its Users In Its Faqs That Their Generated Tax Reports Won’t Be Accurate If Any Of The Following Scenarios Took Place:

You Bought Or Sold Digital Assets On Another Exchange.

You Sent Or Received Digital Assets From A Non-Coinbase Wallet.

You Sent Or Received Digital Assets From Another Exchange, Including Coinbase Pro.

You Stored Digital Assets On An External Storage Device.

You Participated In An Initial Coin Offering.

You Previously Used A Method Other Than ”First In, First Out“ To Determine Your Gains/Losses On Digital Asset Investments

These Scenarios Affect Millions Of Users.

Only Reporting Part Of Your Crypto Addresses? The IRS Needs To Know

Just a few months ago in July 2019, the United States Internal Revenue Service (IRS) sent approximately 10,000 letters to cryptocurrency holders regarding their crypto holdings.

The letters detailed that recipients may not have reported their transactions properly, or failed to report income and pay taxes on their digital currency transactions.

The IRS asked the recipients to check their reports and submit delinquent returns or file amended returns according to specific requirements. According to the letters, the reports must be “true, correct and complete” in order to be approved by the IRS. But how can the IRS know the submitted reports meet their criteria?

It is a well-known fact that the IRS used Chainalysis back in 2015 to possibly assist them in their Coinbase case, in which Coinbase was ordered by a United States federal magistrate to report 14,355 users to the IRS.

What many people don’t know, however, is that the IRS continuously contracts Chainalysis to support their intelligence work on cryptocurrency investors. The last contract was signed on July 2019, with a completion date of August 2020.

Additionally, the IRS has enlisted the help of Elliptic, another company involved in blockchain analysis that supports regulatory compliance under several contracts, the last of them signed on September 2018, with a completion date of September 2019.

Chainalysis Adds More ERC-20 Tokens to Crypto Sleuthing Service

Blockchain investigations firm Chainalysis has added support for five more ERC-20 tokens, expanding the reach of its anti-money laundering tracking service.

New coins include Basic Attention Token (BAT), OmiseGO (OMG), Dai (DAI), Maker (MKR) and 0x (ZRX). Together, they represented about 0.4% of the overall crypto market cap, and 0.002% of the market’s 24-hour volume at press time, data from CoinMarketCap showed.

The additions bring Chainalysis’ compliance, regulatory and tracking software – a favorite among federal investigators – to a larger swath of ERC-20 tokens. ERC-20 is crypto shorthand for “Ethereum Request for Comment” – a common set of rules governing tokens issued on the ethereum blockchain.

Chainalysis “is a de-facto federal standard,” said Casey Bohn, a crypto-crimes specialist with the federally funded National White Collar Crime Center. “That’s what they seem to be using most” to analyze and track crypto transactions.

Jonathan Levin, Chainalysis’ co-founder and chief strategy officer, said the additions help regulators trace illicit tokens – especially ERC-20 tokens on the ethereum network, which he said has become a popular hotbed for hackers to exploit.

In early 2019, hackers cleared out an estimated $16 million in ether and ERC-20 tokens from the now-defunct Cryptopia exchange.

ERC-20 tokens continue to gain popularity, putting pressure on exchanges to list them and increasing the chance bad actors try to steal them. This, Levin said, made the addition of ERC-20 tokens a priority.

Levin Said:

“As of this month, there are more than 216,000 ERC-20 tokens found on the Ethereum network. With many end users flocking to get involved, cryptocurrency businesses want to quickly meet this demand.”

The eagle-eyed AML software is popular among crypto exchanges facing stringent global money-laundering safeguards. Last week, U.S. exchange Bittrex began using Chainalysis KYT software to monitor suspicious transactions, joining Binance.

Chainalysis will double its crypto coverage by the end of the year. It plans on adding XRP, ZCash and Doge, among others.

These Contracts Are A Signal That The IRS Has The Following Abilities:

Connecting one cryptocurrency address to another: The IRS can automatically find connected paths of crypto addresses and trace the flow of funding, source and destination of a specific transaction.

This technology enables the IRS to find the link between crypto addresses that have been reported to them with others that may not have been reported.

Identifying exchange activity: While crypto trading on exchanges is off-chain and cannot be found on the blockchain, every trader must use a crypto address on the blockchain in order to deposit or withdraw their cryptocurrencies.

The blockchain analysis systems have collected big data of exchanges addresses, which enable the IRS to link reported addresses to exchange activity.

Identifying estimated revenue and cash-outs and monitoring large volumes of activity.

Investigating criminal activity: Blockchain analysis companies provide support to the IRS in criminal and forensic cryptocurrency investigations.

Why Is It Difficult To Complete A Report As Per IRS Requirements?

Traders who have a lot of activity or trade on many exchanges and use many wallets sometimes have difficulties tracking all their past addresses.

Furthermore, crypto investors that use crypto as a means of payment make many transactions to third-parties, just like any other payment service. However, unlike credit cards, crypto payments do not specify who is the third-party, and those who did not keep records in real-time will struggle to reconstruct the data. With Bitcoin (BTC), this transaction will also contain a change address that needs to be associated with the payer to get an accurate and complete report.

What Can You Do To Make Sure Your Report Is Complete?

Collect all your data before you start your calculation. First of all, you need to understand that although tax filing is something that most people feel like they “just want to get it over and done with,” it is a process that should be done properly, so ensure you take the time to properly collect your data. Collect your addresses from all the wallets, all data from your crypto exchanges, and all of your activities during the required tax period.

Make sure nothing is missing. After you have successfully collected all your data, check for incomplete or incorrect information. There are some crypto tax platforms, such as Bittax or Blox, that track all your crypto addresses and combine them with exchange information.

In the event that information is missing, the system will alert the user and will continue to send alerts until the user has completed or corrected all required information in order to provide a complete report.

Disclose your missing information. Over time, it is possible that one of your crypto exchanges shut down, an address was rendered inaccessible due to hacking, or you misplaced your seed password and are unable to restore the information.

If you are unable to restore or gather the information required, disclose the reasons to the IRS with supporting documentation if you have any. It is important to consult with a professional before filling with the IRS. Make sure that your CPA or legal advisor understands crypto taxation.

In Conclusion

The information that the IRS is receiving from cryptocurrency exchanges does not reflect your capital gains and losses whatsoever. This is problematic because these capital gains and losses are what you actually pay taxes on, not gross transaction amounts.

So, if you received a warning letter from the IRS, don’t panic. As long as you have been properly filing your cryptocurrency gains and losses on your taxes, you should be fine. The absurdly high numbers that you are seeing on these letters are often times irrelevant.

Nonetheless, it is a good idea to consult a tax professional who is familiar with cryptocurrency for further help and clarification — especially if it’s an action letter.

Updated: 10-9-2019

US IRS Releases Guidance On Crypto Airdrops And Hard Forks

The United States’ federal tax service has issued guidelines for tax reporting regarding cryptocurrency airdrops and hard forks.

In an announcement on Oct. 9, the U.S. Internal Revenue Service (IRS) announced the issuance of Revenue Ruling 2019-24, which addresses common questions of taxpayers and practitioners regarding crypto hard forks and airdrops.

The guidance also answers questions regarding cryptocurrency transmissions for investors that hold cryptocurrencies as a capital asset. IRS Commissioner Chuck Rettig said:

“The new guidance will help taxpayers and tax professionals better understand how longstanding tax principles apply in this rapidly changing environment. We want to help taxpayers understand the reporting requirements as well as take steps to ensure fair enforcement of the tax laws for those who don’t follow the rules.”

Today’s new guidance adds to Notice 2014-21, which sets “general principles of tax law to determine that virtual currency is property for federal tax purposes.”

Or Lokay Cohen, the vice president of crypto tax calculation platform Bittax, told Cointelegraph that the guidance distinguishes hard forks from airdrops, and that not every hard fork should be treated as an airdrop.

Those who receive new currency in a hard fork need to report the assets to the IRS as gross income.

Cohen further stated that the recent guidance follows a Congressional request to the IRS that sought clarity on tax reporting for cryptocurrencies.

IRS Sends Letters To Cryptocurrency Investors

Earlier this year, the IRS sent thousands of letters to cryptocurrency investors to clarify crypto tax filing requirements. 10,000 crypto investors received post from the agency, asking some to amend their tax filings, while compelling others to pay back taxes and/or interest and penalties.

Capitalizing on the uncertainty surrounding crypto tax reporting, scammers subsequently attempted to con investors out of their digital assets by sending letters claiming to be from the IRS. Some letters claimed that an arrest warrant had been issued against the recipient due to their unpaid tax obligations and that failure to make a payment immediately could result in an arrest or other criminal action.

The IRS Will Now Ask If You Own Crypto in the Most Widely Used US Tax Form

The Internal Revenue Service (IRS) has updated the main form individual U.S. taxpayers use to report their income to include a question about cryptocurrencies.

Following the release earlier this week of the IRS’s long-awaited guidance for reporting crypto-related income, the IRS on Friday circulated a draft of the new Form 1040, Schedule 1, Additional Income and Adjustments to Income.

The draft was shared in an email to tax software companies, which the agency also shared with journalists.

The sheet, prefaced by a warning that it’s only a draft and not an actual document for filing taxes, asks at the top:

“At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

The main parts of the form, “Additional Income” and “Adjustments to Income,” both appear below this question.

“Taxpayers who file Schedule 1 to report income or adjustments to income that can’t be entered directly on Form 1040 should check the appropriate box to answer the virtual currency question.

Taxpayers do not need to file Schedule 1 if their answer to this question is NO and they do not have to file Schedule 1 for any other purpose,” the IRS said.

The IRS asked its software partners to send comments on the new form in the next 30 days.

The guidance released this week was the agency’s second-ever given on virtual currencies, following five years of silence on the matter.

The document provided answers to long-standing questions, addressing such issues as crypto received as a result of a hard fork, buying goods and services with virtual currencies, calculating the fair value of crypto holdings and other matters.

Updated: 10-14-2019

Crypto IRS Audits: Hire Professionals Or Do It Yourself?

Do it yourself or outsource it? Rightly or wrongly, most people seem to fear the IRS, and an IRS audit can be daunting, even if it is entirely by correspondence. Most considerations are arguably the same in many different kinds of tax audits.

However, crypto tax matters can be even more sensitive than many others. One reason is return filings and records.

Let’s face it, many crypto investors have not been exactly scrupulous about filing taxes on time, reporting consistently, and keeping good records. After all, doing all of that isn’t easy, although it has gotten easier over the last year or two.

Another reason is the IRS focus on crypto. The IRS has said that virtual currency is an ongoing focus area for IRS criminal investigations, following its announcement on a Virtual Currency Compliance campaign to address tax noncompliance related to the use of virtual currency through outreach and audits.

For some time now, the IRS has been hunting crypto user identities with software too. The IRS keeps stressing noncompliance related to virtual currency transactions through a variety of efforts, ranging from taxpayer education to audits to criminal investigations.

A Wake-up Call

Remember the IRS summons for John Doe to get Coinbase user accounts? More of those could be coming. More recently, the IRS sent thousands of letters to people with virtual currency transactions stating that they may have failed to report income or pay taxes properly.

The IRS says it identified these targets through various IRS compliance efforts. IRS Commissioner Chuck Rettig seems to think this should be a wake-up call, and a warning.

The most frightening part of the IRS is the Criminal Investigation Division, although its involvement in an audit is rare. Even so, it is important to have a sound understanding of how criminal tax issues arise, so you can be prepared.

Many people are surprised to learn that the vast majority of IRS criminal tax cases arise because of so-called “referrals” from the civil division of the IRS.

It happens from plain civil audits and civil IRS collection activity. One IRS Agent spots or hears something fishy and passes it on. It can start innocuously. During the course of an audit or a tax collection matter, a civil IRS auditor discovers something that seems odd and refers it to the Criminal Investigation Division.

You may not even know that you are being investigated. Of course, many investigations do not lead to prosecutions. However, if you are contacted by the IRS Criminal Investigation Division, whether as a target or as a witness, you should politely decline to be interviewed. Refer them to your lawyer.

Many people think that cryptocurrency could be the next big thing for the IRS, which has been training its criminal agents for Bitcoin and other virtual currencies — and that should tell you something.

If the IRS is suspicious, they can require you to produce records, even ones that may incriminate you. With offshore bank accounts, the IRS refined this technique by seeking a grand jury subpoena to produce your offshore bank records.

Many Americans have a knee-jerk reaction to this. “Just take the Fifth,” lawyers tend to say.

The Fifth Amendment says you cannot be forced to incriminate yourself. However, the IRS can make you produce these required records even if they will incriminate you.

You may be able to refuse to speak under the Constitution, but sometimes, you cannot refuse to produce certain records.

Getting Professional Help vs. DIY

To return to more normal tax audits and notices, if the IRS audits you or has begun sending you notices and so on, should you handle it yourself or get professional help? The answer can vary, but getting help is often the wiser path. If the IRS visits you in person, hire a lawyer.

No personal visit should be taken lightly. You have no legal obligation to talk to the IRS, whether it is the civil or the criminal part of the IRS contacting you. Politely tell them that your lawyer will contact them, and ask for their business card.

It is unlikely that the IRS will push you to talk after you say this. But even if they do, politely decline. Even if the IRS says you are just a witness and that it is someone else they are pursuing, you do not have to talk.

Besides, who is a witness and who is a target of an investigation can be quite fluid — it can and does change. Written notices and other materials are obviously considerably less threatening. However, even if the query or audit is all in writing, most people feel a chill when dealing with the IRS.

You might receive a letter from the IRS asking about some aspect of your tax return. You might want to handle it yourself — but be cautious and reflective if you do, especially in more serious matters.

The point at which you may need a representative is often early. In fact, some taxpayers spend large sums with tax professionals precisely because they initially tried to handle the case themselves. Sometimes, you can dig a hole that runs deeper than if you had handed the case to a professional from the start.

One reason to have a tax lawyer or accountant handle your audit is to get some distance. Even in a civil audit, talking to the IRS can be dangerous and can put you in a disadvantageous position. The IRS may ask you about things you don’t want to answer, but not answering is awkward if you are handling it yourself.

Having a representative means you will have time outside the IRS presence to prepare appropriate responses that put the issues in the best possible light.

Some taxpayers even represent themselves beyond an audit at the IRS Appeals Division or in the United States Tax Court, although many of those cases seem to be poorly handled. Even the once-famous lawyer, F. Lee Bailey, represented himself in the U.S. Tax Court in a $4 million dispute with the IRS.

Bailey won one issue but lost most of them, including claimed loss deductions for his yacht. Worse, the court approved significant negligence penalties against him that he probably could have avoided with tax counsel. Seeing to your own case clearly isn’t easy, but it usually pays to hire someone to handle it.

Updated: 10-31-2019

New IRS Guidance: How To Report Crypto Assets Accurately

The United States Internal Revenue Service (IRS) is continuing to focus its efforts in cryptocurrency. After sending a recent enforcement letter, the IRS has released two new pieces of guidance for taxpayers who engage in transactions involving digital currency.

The new guidance includes Revenue Ruling 2019–24 and FAQs, including guidance for using the specific identification method. Additionally, the IRS has published a new draft for form 1040 Schedule 1, including a broad declaration regarding crypto holdings or trade.

Here Is A Breakdown Of These Publications.

Revenue Ruling 2019–24: Airdrops And Hard Forks

So, what are airdrops and hard forks, and what do they mean for the tax obligations of crypto holders?

In short, an airdrop occurs when a company distributes its tokens to a user’s wallet, free of charge, in order to raise funds, and in certain other cases, such as after hard forks.

A hard fork is when nodes of the newest version of a blockchain creates a permanent separation from the previous version, creating a “fork” in which one path follows the new and upgraded blockchain, while the other follows the old path.

In Bitcoin (BTC), a hard fork is the result of changes in the blockchain rules, sharing a transaction history with Bitcoin up to a certain time and date. The most famous hard fork occurred in August 2017, when some Bitcoin developers and users decided to initiate a hard fork known as Bitcoin Cash (BCH).

The new IRS guidelines distinguish between hard forks and airdrops, stating that not every hard fork should be treated as an airdrop. Those who received new currencies in a hard fork are considered as having received them through airdrop and should report it to the IRS as gross income.

The new ruling also acknowledges the possibility that a taxpayer did not receive an airdrop, detailing that if a taxpayer receives new currency from an airdrop into a wallet managed by an exchange that does not support the airdropped currency, the taxpayer is off the hook.

But, if the exchange later ends up supporting that airdropped crypto, the taxpayer is considered to have received the new currency at that time and is therefore liable to taxation.

While the IRS has made significant steps in regulating crypto, the new guidance raises questions about the request to tax airdrops when the crypto holder receives them as gross income, unlike regular crypto which it’s taxable events occur only on selling or exchanging.

Frequently Asked Questions

Back in 2014, the IRS issued Notice 2014–21, which describes how existing general tax principles apply to transactions using digital currency.

This notice contained 16 Q&As, which have now been amended and added to the 2019 ruling, resulting in a whopping 43 questions and answers that cover the entirety of crypto taxation issues.

These Are The Main Issues You Should Know:

1. Understand What Fair Market Value Is:

Fair Market Value (FMV) is typically defined as the selling price for an item to which a buyer and seller can agree.

Cryptocurrency value is determined by the cryptocurrency exchange and recorded in U.S. dollars. However, when it comes to peer-to-peer (P2P) transactions or other transactions not facilitated by an exchange, the FMV is determined according to the date and time at which the transaction was recorded on the blockchain.

2. Determine The Cost Basis:

Cost basis is the original value of an asset for tax purposes. For digital currencies, the cost basis is the amount you spent to acquire the digital currency, including fees, brokerage commissions from exchanges, and other acquisition costs in U.S. dollars.

Your adjusted basis is your basis increased by certain expenditures and decreased by certain deductions or credits based on marital status, income, etc.

To calculate an accurate cost basis, you must first determine which units of currency were sold, exchanged, or disposed of and match the buying cost for every unit sold.

3. Choose The Calculation Method Carefully:

Here is the big news: For the first time, the IRS has clarified the preferable method of calculation for cryptocurrency, advising to use the “specific identification” method.

This means identifying the exact unspent output Bitcoin transaction (UTXO) you have sold out of all the Bitcoin you had in your wallets, and then calculating your tax liability based on the sale of the actual Bitcoin UTXO.

If you are not using it already, you should use the first in, first out (FIFO) method. This method does not take real-time user activity into consideration. Basically, to calculate in the FIFO method, you need to make a list of all purchases and another list of all sales.

Then, to do the matching, take the first item in the purchase list and calculate the tax results as if you sold it at the same price and on the same date as the first sale in the sales list. FIFO results can cause overtaxation, especially if you bought your first Bitcoins in the early years.

To get a complete and accurate report, taxpayers are encouraged to use the specific identification method.

This method is used to track individual units of virtual currency. It is applicable only when individual units can be clearly identified to provide a complete report of crypto-asset movements, including addresses, wallets, exchanges, etc.

Taxpayers can identify specific units by unique digital identifiers such as private and public keys and addresses, or with records showing the transaction information for all units of a specific digital currency (such as Bitcoin) held in a particular account, wallet or address.

Specific identification must exhibit the date and time each unit was acquired, the cost basis and FMV of each unit at the time of acquisition, as well as the date, time, FMV and sale value or price of each unit when it was sold, exchanged or disposed of.

4. Save All Your Documentation:

When compiling a report and filling out the appropriate documentation, taxpayers must report all income, gains and losses incurred by all taxable transactions, regardless of the amount.

IRS codes and requirements are to maintain thorough documentation on receipts, sales and exchanges in order to establish validity on their tax returns.

Updated: 11-1-2019

New IRS Tax Guidance Targets Crypto, and US Persons Who Use It

On Oct. 9, 2019, the United States Internal Revenue Service issued Revenue Ruling 2019-24 and a series of frequently asked questions, identifying rules governing U.S. taxation of digital currencies.

Taxation in the U.S. is unbelievably complex, but the new IRS guidance takes a step-by-step approach to address some of the most common issues facing holders of digital currency.

The basics are as follows: If you hold digital currency and you sell or exchange it, you are subject to U.S. tax. If you are granted digital currency in the form of salary or as a result of a hard fork, you have taxable income. If you receive digital currency as a result of a gift, there is no immediate tax.

U.S. taxation of digital currency is limited to U.S. persons. Who is a U.S. person? U.S. citizens, U.S. green card holders and individuals who spend more than 183 days in the country (measured using a formulaic three-year lookback). If that is you, a tax obligation may exist.

How do you measure your gain or loss from a sale or exchange of currency? It’s the difference between your digital currency cost basis and the fair market value of the property you received in exchange. How do you know what your cost basis is? The FAQs provide detailed guidance, but essentially, the IRS allows two methods for identifying your basis:

1) You Can Specifically Identify The Exact Currency Sold, Traced To The Ledger, And Use The Cost Of That Specific Currency To Determine Your Gain Or Loss.

2) Or You Can Use The “First In, First Out” Method, Meaning Your Basis Is Computed Based On The Cost Of The Oldest Currency Acquisition In Your Wallet, Moving Forward In Time As You Continue To Sell Currencies.

What about digital currency provided as compensation for services? That type of distribution is treated as ordinary income, not a capital gain, similar to cash paid in the form of salary and wages.

What about cryptocurrency forks? The Revenue Ruling holds that when a taxpayer does not receive units of a new cryptocurrency as a result of a hard fork, the taxpayer also does not have gross income. That is the good news.

However, when units of new cryptocurrency are distributed (either as a complete currency replacement or split with the new currency being issued but old currency still valid), the Revenue Ruling holds that the taxpayer has accession to wealth and therefore has ordinary income.

The amount included in gross income is equal to the fair market value of the new cryptocurrency measured as of the date that the distribution (usually via airdrop) is recorded on the distributed ledger.

While the IRS materials provide much-needed guidance, there are some concerns about unexpected hard forks.

Many times you find out about a hard fork after the fact. Nevertheless, the IRS takes the position that taxpayers must track and account for hard fork transactions. Thus, it places the burden on individuals to watch their wallet and trace activity throughout the year.

Also, there is no “de minimis” exclusion. Meaning, every transaction involving digital currency must be reported. What about a purchase of a cup of coffee with crypto cash? This payment gives rise to a taxable exchange. The value of the coffee you just bought less the basis in your currency you provided must be computed and reported to the IRS as a gain or loss.

Compliance Efforts

Letter Campaign

When did you have to start complying with these basis rules and coffee purchases? Forever. In July 2019, the IRS announced through a news release that it had begun sending “educational” letters to taxpayers with digital currency transactions that have either potentially failed to report income or did not accurately report their transactions.

By the end of August, over 10,000 taxpayers had received these letters. There are three letter versions: Letter 6173, Letter 6174 and Letter 6174‑A.

Letter 6173 informs the taxpayer that the IRS has “information that you have or had one or more accounts containing virtual currency and may not have met your U.S. tax filing and reporting requirements for transactions involving virtual currency.” This letter requires the taxpayer to provide a direct response by taking one of three possible actions:

1) File delinquent returns, reporting any digital currency transactions.

2) Amend Returns To Properly Report Any Digital Currency Transactions.

3) Provide A Statement That Explains Why The Taxpayer Believes It Is In Full Compliance, Signed Under Penalties Of Perjury.

Letters 6174 and 6174-A inform the taxpayer that the IRS has “information that you have or had one or more accounts containing virtual currency.” Though neither of the two letters requires a direct response from the taxpayer, Letter 6174-A expressly warns the taxpayer that the IRS may pursue further enforcement activity in the future.

The three versions of the letters show that the IRS is mining the information it has in its possession and forming views about which digital currency holders it believes are noncompliant, and to what degree.

Although the IRS stated in its announcement that “all three versions of the letters strive to help

taxpayers understand their tax and filing obligations and how to correct past errors,” Letter 6173 seems to presume that the taxpayer in question already understands the digital currency reporting requirements and has chosen not to comply with them. Letter 6174-A is a step down from Letter 6173, but it still assumes a higher level of knowledge on the part of the taxpayer than Letter 6174 does.

John Doe Summons

The letters followed the IRS’s issuance of a “John Doe” summons to Coinbase, one of the largest platforms for exchanging Bitcoin and other forms of digital currency.

Through the John Doe summons, the IRS sought information regarding all Coinbase customers who conducted transactions on the Coinbase platform between 2013 and 2015. Coinbase resisted the summons and sought to narrow its scope.

In late 2017, the U.S. District Court for the Northern District of California ordered Coinbase to produce the taxpayer identification number, name, birthdate, address, records of account activity, and all periodic statements of account or invoices.

Ultimately, Coinbase produced documents for approximately 13,000 customers.

While it is widely speculated that the IRS identified the initial group of more than 10,000 taxpayers to receive compliance letters using the data provided by the Coinbase subpoena, any taxpayer with dealings in digital currency should anticipate increased IRS scrutiny.

Revised Draft Form 1040

Following the issuance of the October Revenue Ruling and FAQs, the IRS also released a draft Form 1040, Schedule 1 — which, if adopted, will require taxpayers to answer whether at any time during the year the taxpayer sold, sent, exchanged or otherwise acquired any financial interest in digital currency.

The change in Form 1040 would place taxpayers in the position of having to think about their digital currency holdings and inquire whether there have been taxable events that need to be reported and taxed.

Methods of coming into compliance

In light of increased enforcement and compliance efforts on the part of the IRS, it is especially important for taxpayers who have held digital currency in the years preceding 2019 to seek advice from a competent tax professional to determine if there have been any taxable transactions associated with the acquisition or disposition of digital currencies.

If there was a reportable transaction left off an income tax return, the IRS could impose significant penalties and interest charges.

The IRS is also reviewing income tax returns to determine if the noncompliance was due to willful conduct. Such review can result in criminal referrals and prosecutions for filing false tax returns.

There is good news in the face of the potential enforcement of noncompliance. Most taxpayers can take advantage of the IRS’s voluntary disclosure policy, which mitigates penalties. And for those taxpayers who received letters directly from the IRS, options for taking affirmative action are outlined in the letter.

The bottom line is this: If you have held digital currency at any time, you should contact a qualified tax professional to assist you in evaluating your tax situation.

Updated: 11-14-2019

IRS: Like-Kind Tax Exemption Has Never Applied To Crypto Transactions

The like-kind exchange tax exemption is not applicable to cryptocurrency transactions, according to the United States Internal Revenue Service (IRS).

An official at the IRS Office said that U.S. taxpayers have never been authorized to postpone paying tax as part of the like-kind exchange principle even before the 2017 tax overhaul, Bloomberg Tax reports Nov. 13.

Suzanne Sinno, an attorney in the IRS Office of the Associate Chief Counsel, delivered her remarks on U.S. crypto taxation at the American Institute of CPAs conference this Wednesday in Washington. According to the report, Sinno worked on recent IRS cryptocurrency guidance that was issued in October.

Like-Kind Exchange Exemption Can Defer Tax Payments On The Gain Of A Sale

Under U.S. tax law, a like-kind exchange, also known as a 1031 exchange, is an asset transaction that does not generate a tax liability from the sale of an asset when it was sold to acquire a replacement asset.

While it was clear that taxpayers could not claim crypto-to-crypto sales as like-kind after 2018, the rules governing transactions previous to the 2017 overhaul were unclear.

Based on the new announcement by Sinno, U.S. taxpayers have never been authorized to apply the like-kind exchange principle to crypto-to-crypto trades in order to postpone paying tax on the gain of a sale.

Promotional airdrops are still tax-free, for now

The news comes after the IRS issued guidelines for tax reporting regarding cryptocurrency airdrops and hard forks on Oct. 9. The new rules say that those who receive new currency in a hard fork need to report the assets to the IRS as gross income.

While the IRS distinguishes hard forks from airdrops, the agency has reportedly not yet decided whether promotional airdrops should be treated as taxable.

Updated: 11-21-2019

IRS Vs. Bitcoin ATMs: Industry Says There Is Already Enough Regulation

Earlier this week, the number of Bitcoin (BTC) ATMs installed worldwide reached a new milestone, surpassing 6,000. Coincidentally, another major development just a day before occurred within the same area: The United States Internal Revenue Service said it was looking into potential tax issues caused by such ATMs and kiosks.

This development might allow the IRS to succeed in mitigating the use cryptocurrency for large-scale federal tax non-compliance, experts suggest. However, Bitcoin ATMs remain a low-transaction-size business which is already regulated enough to detect high-scale fraud.

Bitcoin ATMS, From A Single Kiosk To A Multimillion Dollar Industry In Six Years

The world’s first-ever Bitcoin ATM opened in October 2013 at Waves Coffee House in Vancouver’s downtown area, while the first machine in the United States went online in February 2014 in Albuquerque, New Mexico (although, it was removed 30 days later).

Since then, Bitcoin ATMs have grown into a multi-million-dollar industry, as the companies who operate the machines collect sizeable fees (reportedly around 8.93%).

For instance, Cottonwood, a firm that controlled 91 machines in New York as of December 2018, had a gross annual revenue ostensibly exceeding $35 million — about $385,000 in cash per machine — and just 13 employees, as per a Bloomberg investigation.

According to data from online resource CoinATMRadar, the U.S. currently has the most Bitcoin ATMs in the world. More specifically, there are 3924 machines installed across the country, accounting for over 65% of the world’s total Bitcoin ATMs.

Moreover, the industry continues to develop at a rapid pace: Over 130 machines have been deployed this month alone, while the average daily number of Bitcoin ATMs installed is fluctuating at around seven.

Regulation: “Totally Legal” But Still A Gray Area

As it tends to happen within most booming industries, sooner or later, regulators start to apply more scrutiny. On Nov. 15, the IRS Criminal Investigation Chief, John Fort, said that his agency is collaborating with law enforcement to investigate illicit uses of cryptocurrency through kiosks, stating:

“If you can walk in, put cash in and get bitcoin out, obviously we’re interested potentially in the person using the kiosk and what the source of the funds is, but also in the operators of the kiosks.”

Fort explained that such services are required to conform to Know Your Customer and Anti-Money Laundering rules: “They’re required to abide by the same know-your-customer, anti-money laundering regulations, and we believe some have varying levels of adherence to those regulations.”

The IRS executive added that although the regulators haven’t had any public cases filed, they “do have open cases in inventory” related to cryptocurrency tax issues.

So how exactly is the industry regulated in the U.S.? It seems to fall into a grey area of the law. Cal Evans, founder of compliance and strategy firm Gresham International, told Cointelegraph:

“Most Bitcoin ATM owners that are trying to follow the rules, as much as possible, are relying on Money Transmitter laws. We see this strategy deployed with the bigger firms such as Coinbase. These laws differ from state to state with the USA, with the most notable exception being the state of New York where parties are required to own one of the notorious ‘Bitcoin’ Licenses to conduct this business.”

Thus, there are two levels of regulation: federal and state. As CEO of CoinATMRadar Matthew Hayes told Cointelegraph, the former is “similar in all the states and quite straightforward,” and aims to prevent illicit activities such as money laundering and tax evasion. State-level regulation, however, differs:

“Some states have relaxed rules and allow quite easy access to start such a business. In other states, there might be high requirements to operate incl. large size surety bonds and costly licenses.”

Thus, unlike traditional ATM operators, Bitcoin ATM operators are typically treated as Money Services Businesses that have to operate under Money Transmitter Licenses, the requirements for which vary by state, as Zachary Kelman, managing partner at Kelman.law, summed up in a conversation with Cointelegraph.

However, there are some exceptions among more crypto-friendly states that differ from New York and Florida regulations:

“On the other end of the spectrum are states that are far more Bitcoin ATM-friendly — for example, the Pennsylvania Department of Banking and Securities has determined that cryptocurrency transactions are exempt from money transmitter rules, and the Wyoming legislature enacted a law exempting cryptocurrency businesses from MSB licensing requirements.”

Andrew Barnard, co-founder of Bitcoin ATM firm Bitstop, added that many states, including California, have still not made up their minds in regard to Bitcoin ATMs or do not require a Money Transmitter License as long as the crypto sold through the ATMs is a two-party transaction. He elaborated to Cointelegraph:

“States like Texas and others do not require a money transmitter license if you are selling your own Bitcoin to the person in front of the machine as opposed to just sending the Bitcoin directly from an exchange to the customer which would make it a three party transaction.”

Some other hindrances come with the lack of more clear-cut regulations, albeit less major. For instance, companies have difficulties with obtaining local city permits for Bitcoin ATMs, which is why they are usually installed in private establishments, Evans observed.

Indeed, as the Bloomberg investigation argued, most crypto kiosks in the U.S. tend to be located in corner shops, cigar bars and casinos.

Nevertheless, there are some noticeable exceptions: Earlier this month, Bitstop installed one of its machines at the Miami International Airport, one of the largest airline hubs in the country.

As for the regulations, it seems that industry players do have concrete guidance to follow despite the juridical uncertainty that experts highlight.

“FinCEN has been clear since 2013 about the KYC/BSA/AML requirements for cryptocurrency exchangers,” said Max Lopez, marketing director at Coin Cloud — a company that operates as a licensed Money Service Business and hosts over 350 cryptocurrency kiosks across the U.S.

“We only know the regulations we are following and can not speak for others in the cryptocurrency kiosk industry,” Lopez added, drawing a line between large businesses and smaller players. “It’s important to separate individual companies and not place them all under one umbrella as you have regional, hobbyist and ‘mom and pop’ operators with one machine.”

Barnard of Bitstop confirms that larger companies follow the same rules within the Bitcoin ATM industry. “The top legitimate operators in the space are registered with FinCEN on a federal level and maintain a AML/BSA compliance program which should be tested and updated regularly (once a year),” he told Cointelegraph, adding:

“It’s Not That Difficult To Be Registered On A Federal Level.”

What Does The IRS Development Mean For The Industry?

The IRS should have a “probable cause” or “reasonable belief” to delve into the Bitcoin ATM industry, according to Evans. As of now, “simply using the Bitcoin ATMs itself is in no way a crime,” the expert stressed, especially if the vendor is following MTLs and users are declaring their transactions to the IRS:

“Let’s paint a scenario, if you are a Bitcoin ATM user in the US (which is totally legal), and you declare those transactions on your tax return (as now required), the IRS could be in breach of constitutional rights by investigating the individual. Essentially, the IRS should not be able to tax activity it then deems as ‘illegal’ activity after the fact. Otherwise, where do we draw the line? Do we begin taxing drug dealers?”

Nevertheless, the IRS has been historically slow to act, which also suggests that the industry is far from being radically changed by the tax regulator, Evans adds. Kelman, however, envisions certain changes that might come with the IRS statement. He told Cointelegraph that some of their Bitcoin ATM operator clients had already engaged with the IRS:

“The IRS has been amenable to these clients and their businesses, asking for and accepting without issue the Bitcoin ATM users’ Know Your Customer (KYC) information, which is collected to the extent possible by Bitcoin ATM operators per compliance with MSB rules.”

Kelman explained that while his firm does not expect Bitcoin kiosk owners to close down in light of this development, they do expect changes to which the kiosk operators must respond, such as collecting KYC data from any user whose transactions require Currency Transaction Reports or Suspicious Activity Reports filings:

“The Financial Crimes Enforcement Network (FinCEN) already requires MSBs to file Currency Transaction Reports (CTRs) on all transactions in excess of $10,000 and Suspicious Activity Reports (SARs) for any and all suspicious transactions — or sequences of transactions — over $2,000.”

Kelman believes that the statement from the IRS will prompt users to conduct smaller transactions beneath the KYC limit. In his opinion, the IRS “will be able to greatly mitigate efforts to use cryptocurrency for large-scale federal tax non-compliance,” while small-scale tax cheats will likely stay under the radar.

Indeed, larger operators seem unfazed by the news. Both Coin Cloud and Bitstop representatives told Cointelegraph that while smaller Bitcoin ATM owners might not be forced to either become fully compliant or shut down, it remains business as usual for them.

Even if smaller players choose to play by the rules, they might still have to shut shop over time due to the costs associated with maintaining a thorough compliance program, Bitstop’s Barnard added. He also told Cointelegraph:

“Mr Fort is reasonable when he says there is most likely a high variance of compliance and adherence to regulations from operator to operator. This is true because there are different Bitcoin ATM hardware models that have different software stacks and perform compliance differently. Not all operators are created equal. There’s a lot of good guys, but our industry does have its own share of bad apples.”

As Evans of Gresham International told Cointelegraph, physical ATM machines harness a large amount of data about their users, such as card used, PIN number attempts, speed of PIN entry, date, time, transaction sizes, and pictures of their face. “The main concern the IRS has with the Bitcoin ATMs, is that some of these machines do not collect ANY data,” he said:

“If we compare this, for example, to online exchanges (those which allow US citizens and residents to use them), they are required to keep accurate data on the users, which the IRS and other law enforcement bodies can then use to track the movement of funds.”

Enough Is Being Done Already

Nevertheless, Bitcoin ATMs controlled by large operators claim that they collect a considerable amount of data about their clients as per current regulations concerning Anti-Money Laundering and the Bank Secrecy Act.

“As a registered MSB with FinCEN, Coin Cloud is required to keep customer KYC and transactional data for at least 5 years,” Lopez told Cointelegraph. “All cryptocurrency kiosk companies can be subpoenaed at any time for the records they keep.”

Barnard said that although KYC collection can vary depending on how much the customer wants to buy or sell.

“For lower amounts under $150, a phone number, name and address may be reasonable,” the Bitstop representative told Cointelegraph, adding that they limit all of their customers to purchase no more than $3,000 per person per day.

“Even then, less than 5% of our customer base will use that limit,” he continued. “The average purchase from our Bitstop Bitcoin ATMs is $180 per person. Bitcoin ATMs are a high-volume, low transaction amount business.”

Updated: 11-29-2019

IRS Not Infringing Privacy Requesting Crypto Exchange Data: US Judge

A California federal court has affirmed the validity of the United States Internal Revenue Service’s (IRS) request for data from crypto exchange Bitstamp in connection with an individual tax reporting case.

Per a Nov. 25 filing, the court has found that five of the six arguments presented against the IRS “lack merit,” but has conceded on one point that the tax agency’s summons was indeed overbroad, as the Petitioner contended.

The filing relates to court proceedings initiated by William Zietzke, who has argued that the IRS is overstepping its remit in conducting an audit of his tax returns.

Petitioner Alleges Privacy Infringement, ‘Bad Faith’ And Irrelevance

As the filing outlines, Zietke had initially informed the IRS of his own mistake in a tax return that had allegedly overestimated his long-term capital gains in 2016.

In seeking a refund from the IRS to correct his error, the agency set out to investigate Zietke’s case, requiring him to provide extensive data on his history of Bitcoin holdings and transactions.

Zietke is alleged to have failed to inform the IRS of his use of crypto exchange Bitstamp, prompting the agency to summon data from the exchange about his holdings, as well as public keys and blockchain addresses associated with his transactions.

As the court outlines, Zietzke has questioned the IRS’ actions on six grounds; firstly, that it issued the summons to Bitstamp “in bad faith”; secondly, that it seeks data that is irrelevant to its audit of the Petitioner’s reporting; thirdly, that it already possesses the information that it seeks from Bitstamp.

Zietzke’s three subsequent arguments claim that the IRS allegedly made administrative missteps and — more crucially — has violated his reasonable expectation of privacy in Bitstamp’s records.

He has also argued that the U.S. government cannot guarantee the security of any records it receives from the crypto exchange.

Court Concedes One Of Six Arguments Against The IRS

The California court has conceded only one of Zietke’s arguments, noting that he is “correct that the summons is overbroad because it seeks both relevant and irrelevant material.”

The Court States That The IRS’ Summons Would Require Bitstamp To Produce Data That Is Without Due Temporal Limitation:

“Relating to Petitioner’s Bitcoin sales prior to 2016—even though such sales could not impact the gain or loss Petitioner realized if he sold Bitcoins in 2016. In this way, the summons requests information that is irrelevant to the IRS’s stated purpose of auditing Petitioner’s 2016 amended return.”

The court has however refuted all other arguments, finding that the validity of the IRS’ summons fulfills legal precedents and supports the agency’s role in enforcing the tax consequences of crypto transactions.

As reported, Zietke has made a similar attempt previously to quash an IRS summons issued to Coinbase, which was strongly contested by the IRS.

Updated: 12-20-2019

US Lawmakers Ask IRS to Clarify Crypto Tax Rules Around Airdrops, Forks in New Letter

The U.S. taxman’s most recent crypto guidance is sowing confusion, according to a letter from eight congressmen published Friday.

According to a letter penned by Representatives Tom Emmer (R-Minn.), Bill Foster (D-Ill.), David Schweikert (r-Ariz.), Darren Soto (D-Fla.), Lance Gooden (R-Texas), French Hill (R-Ark.), Matt Gaetz (R-Fla.) and Warren Davidson (R-Ohio), the Internal Revenue Service’s (IRS) latest guidance clarifies some aspects of the tax treatment for cryptocurrencies, but leaves much to be desired.

Friday’s letter was first shared by industry think tank Coin Center.

The IRS published guidance around taxing cryptocurrency holdings in October, addressing cost basis and forks, two long-standing questions the crypto community has had.

However, the new guidance raised a number of new questions, particularly around airdrops and unwanted forks. There was also no de minimis exemption for small purchases, such as a cup of coffee.

Friday’s letter pointed to these unwanted forks and airdrops as one major area of concern, noting that the current guidance appears to suggest that individuals are liable for taxes on any cryptocurrencies they gain as a result of a hard fork or airdrop, regardless of whether or not they’re aware they received these cryptocurrencies.

“This creates potentially unwarranted tax liability and administrative burdens for users of these important new technologies and would create inequitable results,” the letter said. “We do not expect this is the intended effect of the guidance, and we urge the IRS to clarify the matter.”

The Letter Specifically Asks:

“Does the IRS intend to clarify its airdrop and fork hypotheticals to better match the actual nature of these events within the cryptocurrency ecosystem? When does the IRS anticipate issuing that clarification?”

“Does the IRS intend to clarify its standard for finding dominion and control over forked assets wherein some level of knowledge and actual affirmative steps taken are necessary to find that the taxpayer has dominion and control?”

“Does the IRS intend to apply the current guidance or any future guidance retroactively, or will the IRS issue proposed guidance that is subject to notice and comment?”

The letter also said the congressmen are “concerned that the form of the guidance appears to indicate that this is ‘established’ law.”

The congressmen wrote that they hope the IRS continues to treat crypto as a “new and developing” area, and hope that the questions listed are answered “as soon as possible.”

The IRS has been ramping up its efforts in taxing crypto transactions, writing letters to exchange users warning they may need to restate their earnings and adding a question about cryptocurrency in its Form 1040.

Friday’s letter is only the latest in a series sent by lawmakers to the IRS asking the agency to clarify how it is approaching the space.

Updated: 1-26-2020

Tax Agencies Step Up Efforts To Hone In On Crypto Tax Evasion

The year 2019, for a short while, raised expectations that stablecoins would bring about mass adoption of cryptocurrencies. 2020, however, seems to be dousing those hopes with ever-tightening regulation that is putting pressure on investors and companies alike.

The first complication came only 10 days into the year. In early January, the European Union’s landmark Fifth Anti-Money Laundering Directive, or 5AMLD, was signed into law.

The law is the latest evolution of the EU’s response to the Panama Papers scandal, in which a leak of over 11 million documents uncovered the opaque financial networks used by the world’s richest and most prominent individuals to divert wealth overseas.

The era-defining financial scandal shone a light on a controversial characteristic of international finance that would soon spell trouble for cryptocurrency investors and businesses the world over: anonymity.

Lawmakers are constantly striving to tighten the legal loopholes that allow the world’s richest companies and individuals to avoid paying their dues. Try as they might, there are still states, often small island nations in the Caribbean, that willingly provide less legally restrictive environments.