Money-Laundering Is Completely Out-Of-Control In Traditional Finance/Banking Industry (#GotBitcoin?)

Police Raid Sweden’s Leading Bank as Russian Money Laundering Scandal Spreads.Money-Laundering Is Completely Out-Of-Control In Traditional Finance/Banking Industry (#GotBitcoin?)

The unfolding scandal comes six months after Danske Bank said its tiny Estonia branch had moved more than $230 billion from Russia and other former Soviet states.

Related:

Swedish police on Wednesday raided the headquarters of Swedbank AB, the latest Scandinavian banking giant to come under suspicion of laundering billions of dollars in illicit funds from Russia.

The unfolding scandal comes six months after Danske Bank said its tiny Estonia branch had moved more than $230 billion from Russia and other former Soviet states.

The raid is part of a probe into whether Swedbank informed 15 of its largest shareholders of a broadcast about money laundering allegations at its Estonian operations before it was aired last month, according to a spokesman for the Swedish prosecutors’ office.

In a new broadcast on Tuesday, the station provided more details on the transactions that went through Swedbank’s Estonian operations, based on a report by an outside investigator. The report, according to the broadcast, shows between €10 billion and €20 billion (between $11 billion and $22 billion) passed yearly through accounts of nonresident, high-risk customers at Swedbank Estonia between 2010 and 2016.

Swedbank confirmed its offices had been raided, adding that it will cooperate with the authorities, but declined to comment on the new allegations made by SVT on Wednesday.

Prosecutors are separately evaluating whether to open a probe directly into the suspected money laundering that was outlined in the SVT report.

Swedbank shares fell 7% Wednesday and are down by a fifth this year, making it the worst performing large bank in Europe.

Last year, Danske Bank, Denmark’s flagship lender, announced its Estonia branch had moved hundreds of billions of dollars from Russia and other former Soviet states over years before supervisors pressured it into dropping most of those clients. A large part of this was probably illicit, Danske Bank has said.

As with Danske, Swedbank’s problems appear to emanate from its operations in the tiny Baltic nation, where Swedbank is the largest lender. In February, Swedish and Estonian banking regulators began investigating the bank on money laundering concerns.

“We take such info very seriously and launch respective proceedings,” Kilvar Kessler, chairman of the management board of Estonia’s banking supervisor, the Finantsinspektsioon, said in a text message.

Analysts say there are likely to be more revelations about how Scandinavian banks became a crossroads for money leaving the former Soviet Union.

“You see new regulation and tightening up but I think it could be a latch on the stable door. This has been going on for at least a decade,” says. James Oates, the founder of Cicero Capital, a financial adviser in Tallinn, the Estonian capital.

Meanwhile:

Standard Chartered To Pay $1.1 Billion In Iran Sanctions Settlement

The bank took a $900 million provision earlier this year to help cover the settlement of the long-running probe.

Standard Chartered PLC on Tuesday agreed to pay $1.1 billion to settle allegations it violated sanctions on Iran and other countries, marking the end of a long-running probe by U.S. and U.K. regulators that had weighed on the bank’s share price.

The U.K.-based bank took a $900 million provision earlier this year to help cover the settlement. It is one of the largest settlements paid by a bank over alleged sanctions violations, although it is far smaller than the $8.9 billion French bank BNP Paribas paid in penalties in 2014.

Standard Chartered said it accepts full responsibility for the violations identified by authorities including the Justice Department and the U.K. Financial Conduct Authority, while also blaming some of the activities on two unnamed former employees. Existing corporate probation agreements with the Justice Department and the Manhattan district attorney’s office will be extended until April 2021, it said.

In a court filing, the Justice Department said Standard Chartered serviced customers with known Iranian connections through its Dubai branch between 2007 and 2011, resulting in around $240 million in transactions being processed through the U.S. The bank will now forfeit that amount and make settlement payments to the Justice Department, the FCA, the Manhattan DA, the Federal Reserve, the New York Department of Financial Services and the Treasury Office of Foreign Assets Control.

The Justice Department said a former employee in the Dubai branch pleaded guilty, and a former customer of the branch, an Iranian national, has been charged.

The FCA said it found “serious and sustained shortcomings” in the bank’s anti-money-laundering controls. In one instance, it said the bank opened an account for a consulate in the United Arab Emirates with 3 million U.A.E. dirham ($816,750) in a suitcase, without making adequate checks on the source of funds. OFAC said its settlement also resolves other apparent violations of sanctions relating to Cuba, Myanmar, Sudan, Syria and Zimbabwe.

The sanctions probe has hung over Standard Chartered since Chief Executive Bill Winters started in 2015 with the aim of cleaning up the bank’s culture and soured books of loans. On Tuesday, he said the bank will continue to root out any issues that threaten trust in the bank.

In the court filing in Washington, D.C. federal court, the Justice Department said two Standard Chartered employees conspired between 2007 and 2011 to skirt a formal ban by the bank on Iran-related business, and provided false information to bank compliance workers to disguise clients’ Iranian connections.

The bank had first disclosed the probe in 2014, and some analysts initially predicted fines as large as $2 billion. Its shares were up just under 1% after the announcement.

In 2012, Standard Chartered paid $667 million to settle U.S. authorities’ allegations of potential sanctions breaches between 2001 and 2007 that included transactions with Iranian companies.

In Tuesday’s court filing, the DOJ said it opened its probe after U.S. law enforcement learned through an unrelated investigation that Standard Chartered may have continued processing dollar transactions for companies and individuals with ties to Iran and other sanctioned countries after 2007.

Updated: 9-26-2019

ABN AMRO in Money-Laundering Scandal After Calling Bitcoin ‘Risky’

Having trumped up the risks of unregulated cryptocurrencies earlier this year, Dutch bank ABN Amro NV finds itself in the midst of a major money-laundering scandal.

On Sept. 26, Bloomberg reported on news of a criminal probe into the bank’s alleged failures to report suspicious transactions and to adequately vet its clients. ABN AMRO — which remains over 50% government-owned after a costly bailout — saw its shares slump by as much as 10.3% in Amsterdam trading.

This represents the highest plummet since June 2016, with the bank’s Additional Tier 1 bonds falling the most in six months, as Bloomberg notes.

Investigation Under Anti-Money Laundering And Terror Financing Laws

The Dutch prosecutor’s office further revealed that not only does ABN AMRO face scrutiny over its alleged compliance failures, but it is also being investigated under Dutch anti-money laundering and terror financing laws. Exact details of the investigation have not been disclosed.

Following a warning from the Netherlands’ central bank, ABN AMRO had announced this July that it needed to conduct better due diligence into all of its 5 million retail clients.

It has spent €220m to bolster its procedures in its consumer banking, credit card and small business lending operations — taking a €114 million provision for checks in Q2 in addition to €85 million in 2018. The bank had indicated it could face sanctions from authorities but noted that it couldn’t prepare for a possible fine as the amount could not be estimated at the time.

As the Financial Times has reported, ABN AMRO also tripled its staff numbers to over 1,400 in areas such as compliance, financial crime and anti-money laundering.

The situation imperils the Dutch government’s pledge to eventually sell off its 56% stake in the bank — and the uncertainty is redoubled by the announcement of CEO Kees van Dijkhuizen to leave when his term ends in April 2020.

Notably, ABN AMRO’s rival ING Group last year paid a record fine for “serious shortcomings” in working to prevent financial crime, facilitating money laundering through its accounts for years.

Banks Under Scrutiny

ABN AMRO’s crisis comes hot on the heels of a scandal involving Danske Bank’s unit in Estonia, whose former head was found dead earlier this week. He had been a witness — though not a suspect — in a major money-laundering probe into the unit.

Also this week, law enforcement officials raided Deutsche Bank AG this week in connection with the Danske Bank scandal.

This May, ABN AMRO’s senior press officer revealed that the bank would discontinue its plans to launch a custodial Bitcoin (BTC) wallet, having concluded that “cryptocurrencies because of their unregulated nature are at the moment too risky assets for our clients to invest in.”

Updated: 10-25-2019

Finra Fines BNP Parbas $15 Million Over Money-Laundering Controls

Says BNP lacked program that could detect suspicious activity in penny stocks, wire transfers.

The Financial Industry Regulatory Authority said Thursday it fined BNP Paribas SA $15 million for failing to develop an anti-money-laundering program that could detect suspicious penny stock and wire transfer activity.

The fine relates to activity from BNP Paribas Securities Corp. and BNP Paribas Prime Brokerage Inc.

Finra said that between February 2013 and March 2017, BNP lacked a written anti-money-laundering program that could reasonably be expected to detect questionable activity in its penny stock deposit and resale and wire transfers.

The self-regulatory organization claims BNP’s anti-money-laundering oversight was understaffed and until 2016, it didn’t include any surveillance that could target suspicious penny-stock activity.

Finra says that for a two-year period, BNP processed more than 70,000 wire transfers with a value of $233 billion, but only had one investigator to review alerts. Finra says BNP didn’t fully revise its program until March 2017, despite identifying many of the alleged problems with its program in 2014.

A BNP representative declined to comment.

BNP didn’t admit or deny the charges as part of its settlement but consented to the entry of Finra’s findings.

Updated: 11-20-2019

Bank Accused of Breaching Money Laundering Laws—23 Million Times

Westpac, Australia’s second-largest bank, failed to carry out due diligence on 12 customers with known child-exploitation risks, Austrac said.

Australia’s second-largest bank has been accused of the biggest breach of the country’s money laundering and terrorism financing laws in history, including failing to detect transfers that may have been used to facilitate child exploitation in Asia.

Westpac Banking Corp. allegedly breached money laundering laws more than 23 million times, including failing to report in a timely way about $7.5 billion in international transfers, Australia’s financial-intelligence agency said in a court filing Wednesday.

Each individual breach could attract a fine of up to $21 million Australian dollars (US$15.7 million).

Australia’s banks once held a reputation for being among the world’s safest and most profitable for investors, but a series of scandals in recent years has rocked the country’s top financial institutions. The country’s biggest lender, Commonwealth Bank of Australia, last year settled a case involving more than 53,800 money laundering contraventions for A$700 million plus legal costs, the largest corporate civil penalty ever paid in Australia. It could have faced penalties of more than A$1 trillion.

“We know we have to do better,” said Westpac Chief Executive Brian Hartzer, telling reporters that the bank agreed with the statement of claim filed by the Australian Transaction Reports and Analysis Centre, or Austrac.

The bank had self reported to the agency what it said was a failure to report a large number of international fund transfers, and Mr. Hartzer said Westpac should have identified and rectified the failings sooner. He added that he accepted there was a need for accountability within the bank, but declined to say whether he would step down.

The alleged infractions, which occurred between 2013 and 2019, were “the result of systemic failures in its control environment, indifference by senior management and inadequate oversight by the board,” Austrac said in court documents. “They have occurred because Westpac adopted an ad-hoc approach to money laundering and terrorism financing risk management and compliance.”

That led to a failure to properly assess and monitor the risks in moving money in and out of the country and to carry out appropriate due diligence on customers—who were known for child-exploitation risks—sending money to the Philippines and elsewhere in Southeast Asia.

The regulator is alleging Westpac failed to carry out due diligence on 12 of its customers to manage known child-exploitation risks. In one case, when a customer who had served jail time for child exploitation opened a number of Westpac accounts, only one was promptly identified as indicative of child exploitation. The customer continued to send frequent low-value payments to the Philippines through accounts that weren’t being monitored appropriately, Austrac said.

Australia’s Prime Minister Scott Morrison said he was “absolutely appalled” by the allegations, calling on the country’s banks to “lift their game.”

Westpac shares fell 3.3% to A$25.67 on Wednesday, underperforming the broader market and the other major banks. The lender this month reported its first decline in annual profit in four years, dented by a sharp rise in provisions for customer refunds and lawsuits.

Mr. Hartzer, who has been Westpac’s CEO since early 2015, said the bank had invested heavily to improve the management of financial crime risks, including enhancing automatic detection systems. He pledged to personally get to the bottom of the claims, including those that emerged in the financial agency’s investigation of links with child exploitation.

New Zealand’s central bank said Wednesday it was looking closely at the Australian financial-intelligence agency’s claims to see if they were relevant to Westpac’s subsidiary in New Zealand.

Recent scandals have rocked Australia’s big lenders, leading to a number of executive departures and a judicial probe last year that revealed a string of issues including inappropriate lending, collecting fees from dead customers for financial advice and lying to regulators.

Updated: 12-13-2019

Federal Reserve Lifts Anti-Money Laundering Orders Against JPMorgan, U.S. Bancorp

The regulatory orders stemmed from alleged deficiencies in the banks’ anti-money laundering controls.

The Federal Reserve on Thursday lifted consent orders against JPMorgan Chase & Co. and U.S. Bancorp stemming from what the central bank identified as weak anti-money laundering controls.

The Fed’s order against JPMorgan, issued in January 2013, directed the bank to strengthen its board oversight of anti-money laundering compliance and to improve its management of compliance-related risks.

JPMorgan had a similar order in place with the Office of the Comptroller of the Currency. That order was lifted in May.

A JPMorgan spokesman declined to comment.

The central bank also lifted an order issued last February against U.S. Bancorp. The order directed the Minneapolis-based bank to improve its customer due diligence procedures and strengthen its board oversight of anti-money laundering controls.

The order was issued alongside criminal charges filed by federal prosecutors against U.S. Bancorp alleging violations of the Bank Secrecy Act. The bank agreed to a two-year deferred prosecution agreement as part of a settlement with the U.S. Justice Department.

“We’re pleased with the Federal Reserve’s announcement today and with the current state of our anti-money laundering compliance program,” Cheryl Leamon, a U.S. Bancorp spokeswoman, said in a statement.

Updated: 1-10-2020

What The 5th Anti-Money Laundering Directive Means For Crypto Businesses

The European Union’s 5th Anti-Money Laundering Directive (5AMLD) came into effect today, January 10. The regulation was entered as law on July 9, 2018 in an effort to bring increased transparency to financial transactions for pushing back against money laundering and terrorist financing across Europe.

For the first time, 5AMLD is broadening its regulatory scope by including crypto service providers like virtual-fiat exchanges or custodian wallet providers. The idea is make it more plainly knowable who’s participating in crypto transactions. The rationale is that doing so pushes back against money laundering and terrorism financing.

According To An 5AMLD Fact Sheet, The Law Will:

increase transparency about who really owns legal entities in order to to prevent money laundering and terrorist financing via opaque structures give European financial regulators better access to information via centralized bank account registers

tackle terrorist financing risks linked to anonymous use of virtual currencies and prepaid instruments

improve the cooperation and exchange of information between anti-money laundering supervisors and with the European Central Bank broaden the criteria for assessing high-risk third countries and ensure a high level of safeguards for money moving to or from such countries.

The consequences for not obliging are fines, of course! Austria’s financial regulators, for example, will fine noncompliant crypto service providers a maximum of 200,000 euros. Crypto businesses can’t keep their doors open long if they have to pay 5AMLD noncompliance fines.

How 5AMLD Is Affecting Crypto Service Providers

European crypto companies are struggling to meet the new regulatory guidelines presented by 5AMLD. A number of businesses are shutting down due to the extensive know-your-customer (KYC) and anti-money laundering (AML) practices the new law calls for. The UK-based crypto wallet provider Bottle Pay announced its decision to cease operations at the end of last year. According to a company blog post published on Dec. 13, 2019:

“As we are a UK based custodial Bitcoin wallet provider, we will have to comply with the 5AMLD EU regulation coming into effect on January 10, 2020. The amount and type of extra personal information we would be required to collect from our users would alter the current user experience so radically, and so negatively, that we are not willing to force this onto our community.”

Bottle Pay shuts its doors after raising $2 million in seed funding this past September. The startup was launched just three months prior in June, offering users a tipping service that let small amounts of cryptocurrency be sent across social media networks and messenger apps

The takeaway is clear: the European Union is paying close attention to cryptocurrency and has established its first set of rules for how companies in this space must behave. Now it’s on those companies to gain compliance or risk being able to operate at all.

Updated: 3-5-2020

Former Risk Officer at U.S. Bank Fined for Weak Anti-Money Laundering Oversight

Michael LaFontaine ignored internal warnings about the bank’s transaction-monitoring software, according to the Financial Crimes Enforcement Network.

The Treasury Department’s financial crimes division fined a former risk officer at a regional bank in Minneapolis for failing to prevent corporate violations of anti-money laundering laws.

Michael LaFontaine, a former chief operational risk officer at U.S. Bank NA, was fined $450,000 on Wednesday for what the Financial Crimes Enforcement Network described as a failure to prevent violations of the Bank Secrecy Act.

U.S. Bank in February 2018 was fined $613 million for what federal prosecutors and regulators, including FinCEN, described as weak anti-money laundering controls. The bank’s parent company, U.S. Bancorp, also entered into a two-year deferred prosecution agreement with federal prosecutors at the time.

U.S. Bank noted the enforcement action is specific to Mr. LaFontaine and not against the bank.

“We are confident in the strength of the [anti-money laundering] program we have in place today,” Greg Vadala, a U.S. Bank spokesman, said in an emailed statement.

A spokesman for Mr. LaFontaine pointed to language in the enforcement action noting that Mr. LaFontaine took steps to improve the bank’s anti-money laundering program, including advocating and receiving funding for a system replacement. FinCEN in the enforcement action, however, described the steps as inadequate to address the program’s deficiencies.

“Mr. LaFontaine is proud of the work he did for U.S. Bank for more than a decade, spanning many important areas such as consumer compliance, privacy, vendor management, business continuity planning and operational risk management,” Blois Olson, the spokesman, said in an emailed statement.

According to FinCEN, U.S. Bank used transaction-monitoring software during and before Mr. LaFontaine’s tenure that placed a cap on the number of alerts it generated. The cap prevented the bank from filing suspicious activity reports, limiting the ability of law enforcement agencies to spot criminal activity, FinCEN said.

Mr. LaFontaine served as chief operational risk officer from October 2012 until June 2014, according to the enforcement action. In that role, he supervised the bank’s chief compliance officer and anti-money laundering staff, the enforcement action said.

Mr. LaFontaine was advised internally that the bank’s transaction-monitoring software was inadequate, and that the bank’s anti-money laundering staff was stretched too thin, according to FinCEN.

FinCEN Director Kenneth Blanco pointed to the internal warnings, saying in a press release that Mr. LaFontaine’s failure to take action prevented U.S. Bank from filing reports about suspicious and potentially criminal activity.

“FinCEN encourages technological innovations to help fight money laundering,” Mr. Blanco said, “but technology must be used properly.”

Updated: 1-18-2021

How Compliance Software Detects Fraud And Money Laundering Involving Crypto

As the crypto markets mature and institutional money flows into the space, technology to detect fraud and money laundering involving digital assets is more important than ever.

The crypto industry has boomed over the past 12 months. While 2019 began with a total market cap of $200 billion, the explosion in Bitcoin’s value resulted in this figure surging fivefold as 2020 began — and according to CoinMarketCap, the digital assets space was collectively worth $1 trillion at one point.

However, as the crypto sector continues to grow and flourish, so too does crypto-related crime. Virtual assets worth $3.8 billion were lost to fraud in 2019. This figure rose to almost $4.9 billion in 2020.

Fraud, money laundering and the financing of terrorism are not issues that are exclusive to the cryptocurrency sector — and every financial system on Earth has had to take action to ensure its infrastructure isn’t used for illicit purposes.

But now, regulators around the world are stepping up their efforts to clamp down on criminal activity — and this has the potential to affect operations for crypto service providers, many of whom are still behind the curve.

Mainstream media coverage of digital assets has increased dramatically in recent months, with countless column inches devoted to BTC’s current bull run. This increased exposure also results in newfound scrutiny, especially when exchanges fall victim to high-profile hacks. Thankfully, there are ways for crypto businesses to take action, to protect their operations, and to work in the interests of their consumers in the process.

Achieving Compliance

Amid the fractured landscape of regulatory developments for crypto, one of the most important sets of guidelines has come from the Financial Action Task Force, which has 39 members including the European Commission, Japan, the United Kingdom, and the United States.

The FATF recently unveiled a series of red flag indicators that suggest potentially suspicious activity is taking place — or possible attempts by entities to evade law enforcement. For example, the size and frequency of transactions could set off alarm bells for compliance officers, especially if such repeated payments are made that fall just underneath the threshold for reporting.

Other issues may arise where deposits are made using bank accounts that use a different name to the one registered with a crypto exchange, where mixers and tumblers are used to obfuscate the origins of BTC payments, or where potentially suspicious IP addresses are used.

At first, it might seem like a nightmare for virtual asset service providers to introduce safeguards that quickly detect when these red flag indicators emerge. In a competitive marketplace, some will be concerned about the costs associated with stopping high-risk transactions in their tracks — as well as the disruption that their operations could face if legitimate activity is mistaken for something more sinister.

But platforms do exist that can monitor new transactions in real time — instantaneously assigning a risk score to each and every transaction. This is by no means a straightforward task, as the high volume of transactions running through blockchains daily means that analysis needs to take place continuously and without interruption.

The speed with which bad actors can execute transactions also means that compliance systems need to be fast acting — identifying centers of suspicious activity, and creating meaningful connections to other wallets where potentially illegally acquired funds are distributed. Past data may also be used to anticipate future events, meaning that exchanges can receive a warning that potentially risky activity is about to happen — even if a transaction hasn’t been confirmed yet.

The benefits associated with this type of software aren’t hypothetical. In late September, KuCoin announced that close to $280 million was stolen from its exchange as a result of a security breach. Analytics tools enabled the company to track down and freeze these funds so they couldn’t be laundered further — and 84% of the assets taken were later recovered.

Taking Action

The technical nature of blockchain — along with the prevalence of crypto scams — has caused a significant image problem for Bitcoin in society. But despite missteps in the first decade of its existence, aspects of blockchain design champion transparency and security — meaning it can offer far greater levels of protection than older financial systems.

If $500,000 in banknotes are stolen from a bank vault, the funds could end up being far harder to track down than if the same amount was taken in BTC from an exchange that has safeguards in place.

Crystal Blockchain says its analytics platform enables compliance officers and anti-fraud departments to stop illicit activity in its tracks — and monitoring can either be performed manually or automatically as settings are configurable by the user.

This is achieved by understanding the provenance of funds being sent over the blockchain, their connections, their flow paths, and by alerting crypto service providers if these assets are stolen or fraudulent.

Addresses and bank cards can be linked to fraud, extortion, ransomware and darknet marketplaces. Businesses can also be alerted when entities are attempting to deposit to or withdraw funds from accounts and exchanges that have little or no due diligence procedures in place.

Institutional adoption of cryptocurrencies is happening at a staggering rate — and as we head into 2021 and beyond, Wall Street is ramping up efforts to ensure it has the infrastructure required for traders to gain exposure to digital assets.

But this comes with an expectation of a mature marketplace, meaning crypto service providers need to take the necessary actions to ensure they aren’t operating in the Wild West any more.

Marina Khaustova, the CEO of Crystal Blockchain, told Cointelegraph: “The crypto industry is relatively young, and as the technology develops it also brings with it unique compliance requirements.

We need to combine the best practices of the more mature financial industries with the knowledge amassed by crypto market experts to combat money laundering and the financing of terrorism. By assisting with fraud identification and suspicious activity monitoring on the blockchain, Crystal aims to improve safety and trust in the global financial markets.”

Updated: 1-19-2021

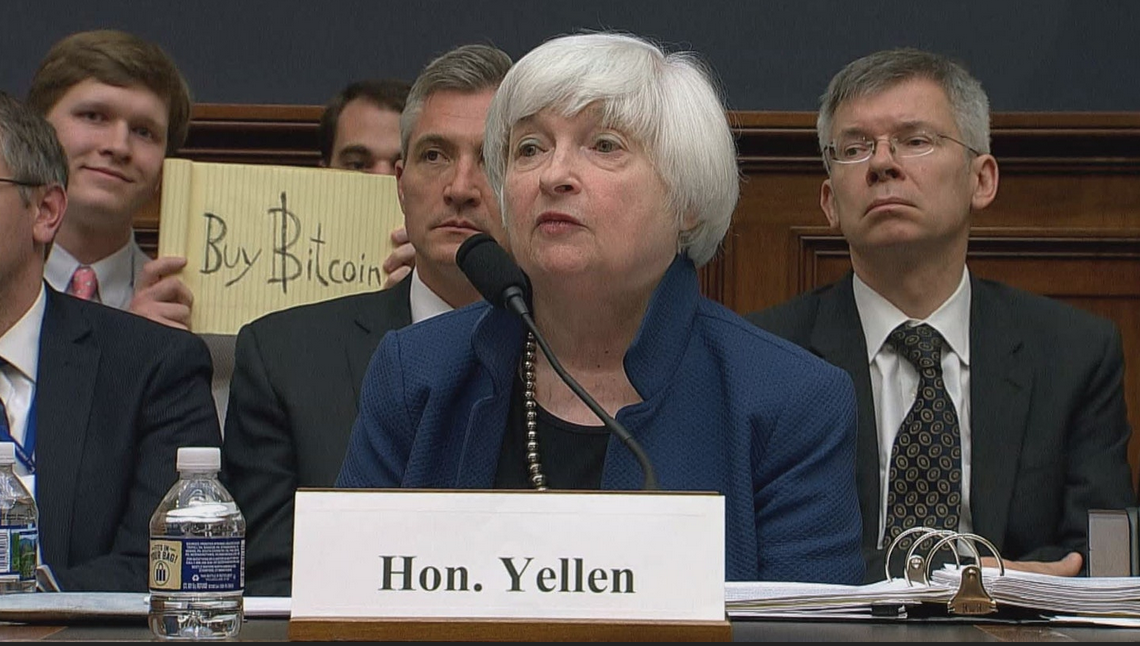

Janet Yellen, Treasury Secretary Nominee Calls Cryptocurrencies A ‘Particular Concern’ For AML

Janet Yellen claimed many cryptocurrencies are used “mainly for illicit financing.”

Janet Yellen, a former leader at the Federal Reserve and Joe Biden’s pick for Treasury Secretary, is still suspicious of crypto as a threat for illicit financing.

In a virtual hearing of the U.S. Senate Finance Committee held today, Yellen faced questions on combating the financing of terrorism, or CFT, from Democratic Senator Maggie Hassan from New Hampshire.

Hassan asked Yellen how she would respond as Treasury Secretary to “emerging financial technology” used to fund criminal organizations and terrorists. The Democratic senator called cryptocurrencies a “growing concern” and asked Biden’s pick how she would handle CFT.

“We need to make sure that our methods for dealing with these matters — with terrorist financing — change along with changing technology,” said Yellen. She added:

“Cryptocurrencies are a particular concern. I think many are used at least in a transaction sense mainly for illicit financing and I think we really need to examine ways in which we can curtail their use and make sure that anti-money laundering doesn’t occur through those channels.”

Yellen, the former chair of the Federal Reserve under U.S. President Barack Obama, has been rather quiet on her views surrounding the crypto space since calling Bitcoin “anything but useful” in October 2018. She left her position as Fed chair in early 2018 following the 2017 bull run which drove Bitcoin to a then all-time high.

If approved by the Senate, Yellen would be the first woman to serve as Treasury Secretary, replacing Steve Mnuchin.

Bitcoin And Altcoins Correct After Yellen’s ‘Illicit Financing’ Critique

Janet Yellen’s critical comments about cryptocurrencies put a damper on the wider market just as Ethereum price reached a new all-time high.

On Tuesday, Ether (ETH) underwent a bullish breakout which propelled the price to a new all-time high at $1,428.

While the move may have been technical, the fundamentals for Etheruem continue to improve as less than one month after launch there is now $3.8 billion worth of ETH locked on the Eth2 blockchain.

The rapid rise in price has clearly attracted the attention of pro traders but Cointelegraph analyst Marcel Pechman warns that Ether’s rise to a new high was also accompanied by a large increase in short positions.

Ether’s break to a new high had little effect on Bitcoin price and it appears that critical comments from former U.S. Federal Reserve chairwoman, Janet Yellen, had a negative impact on the wider market today.

Yellen, who has been nominated as President-Elect Biden’s Treasury Secretary, said that cryptocurrencies are being used “mainly for illicit financing.” She issued the comments during a hearing with the Sentate Finance Committee and also advocated for major fiscal stimulus by telling Congress to “act big” when it comes to aid for the ailing U.S. economy.

Institutions Are Still Bullish

Despite the negative view expressed by Yellen, positive developments for several blockchain projects helped drive select altcoin prices higher.

Enjin (ENJ) price rallied 71% after the project was legally authorized for trade by the Japanese Virtual Currency Exchange Association (JVCEA). Aside from Ether (ETH), the best performing top 20 coin over the past 24-hours was Bitcoin Cash (BCH), up 7.46% and trading at $546.

The overall cryptocurrency market cap now stands at $1.046 trillion and Bitcoin’s dominance rate is 65%.

Updated: 1-21-2021

Treasury Secretary Nominee (Janet Yellen) Says Crypto Has Potential To Improve The Financial System

Janet Yellen added that she planned to encourage the use of digital assets for “legitimate activities.”

U.S. President Joe Biden’s pick for Treasury Secretary Janet Yellen may see more benefits to cryptocurrency than her previous testimony indicated.

After a virtual hearing of the U.S. Senate Finance Committee held on Tuesday, Yellen hit the headlines for her answer to Democratic Senator Maggie Hassan’s question about how she would respond to “emerging financial technology” being used to fund criminal organizations and terrorists.

Yellen referred to cryptocurrencies as a “growing concern” in the U.S., said they were used “mainly for illicit financing” for the aforementioned groups, and that the U.S. government needed to examine ways to “curtail” the use of crypto as part of their anti-money laundering efforts.

However, her written statement published on the Senate Finance Committee website today suggests that Yellen’s views on crypto may not be as bearish as those remarks suggested. Though Yellen’s written statement reiterates the need to curtail the use of the crypto for “malign and illegal activities,” she also said that she planned to encourage the use of digital assets for “legitimate activities.”

Yellen Said:

“I think it important we consider the benefits of cryptocurrencies and other digital assets, and the potential they have to improve the efficiency of the financial system.”

The future Treasury Secretary also said she wanted the United States to be a “leader in the digital asset and financial technology areas.” She added that she would help develop a regulatory framework for cryptocurrency “and other fintech innovations” by working with the Federal Reserve Board.

Yellen served as the chair of the Federal Reserve under U.S. President Barack Obama, and has been quiet on her views surrounding the crypto space since calling Bitcoin “anything but useful” in October 2018. She left her position as Fed chair in early 2018 following the 2017 bull run which drove Bitcoin (BTC) to a then all-time high.

The Senate Finance Committee is expected to vote on Yellen’s nomination tomorrow, after which it will go to the Senate chamber where Democrats hold a majority. If approved, Yellen would be the first woman to serve as Treasury Secretary.

Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,Money-Laundering Is Completely Out-Of-Control,

Related Articles:

Probes Reveal Central, US-Based, International Banks All Have Sticky Fingers (#GotBitcoin?)

Trump Administration’s ‘Plunge Protection Team’ Convened Amid Wall Street Rout (#GotBitcoin?)

Major Banks Suspected Of Collusion In Bond-Rigging Probe (#GotBitcoin?)

Some Merrill Brokers Say Pay Plan Urges More Customer Debt (#GotBitcoin?)

Deutsche Bank Handled $150 Billion of Potentially Suspicious Flows Tied To Danske (#GotBitcoin?)

Wall Street Fines Rose in 2018, Boosted By Foreign Bribery Cases (#GotBitcoin?)

U.S. Market-Manipulation Cases Reach Record (#GotBitcoin?)

Poll: We Should Get Rid of The Federal Reserve And Central Banks Because:

Our Facebook Page

Leave a Reply

You must be logged in to post a comment.