Slowing Mall Rent Growth Portends A Challenging 2019 (#GotBitcoin?)

Average rents in U.S. shopping malls gained less than 1% in the fourth quarter from a year earlier. Slowing Mall Rent Growth Portends A Challenging 2019

Rental growth rates at U.S. malls and open-air shopping centers eased in the final quarter of 2018 and could slow further this year amid a difficult retail climate and signs of slower economic growth.

The average rent for malls in the fourth quarter rose 0.2% to $43.35 a square foot, up from $43.25 in the third quarter, according to data from real-estate research firm Reis Inc. Mall rents grew by 0.8% in the fourth quarter from a year earlier, down from the 1.5% and 2.0% seen in 2017 and 2016, respectively.

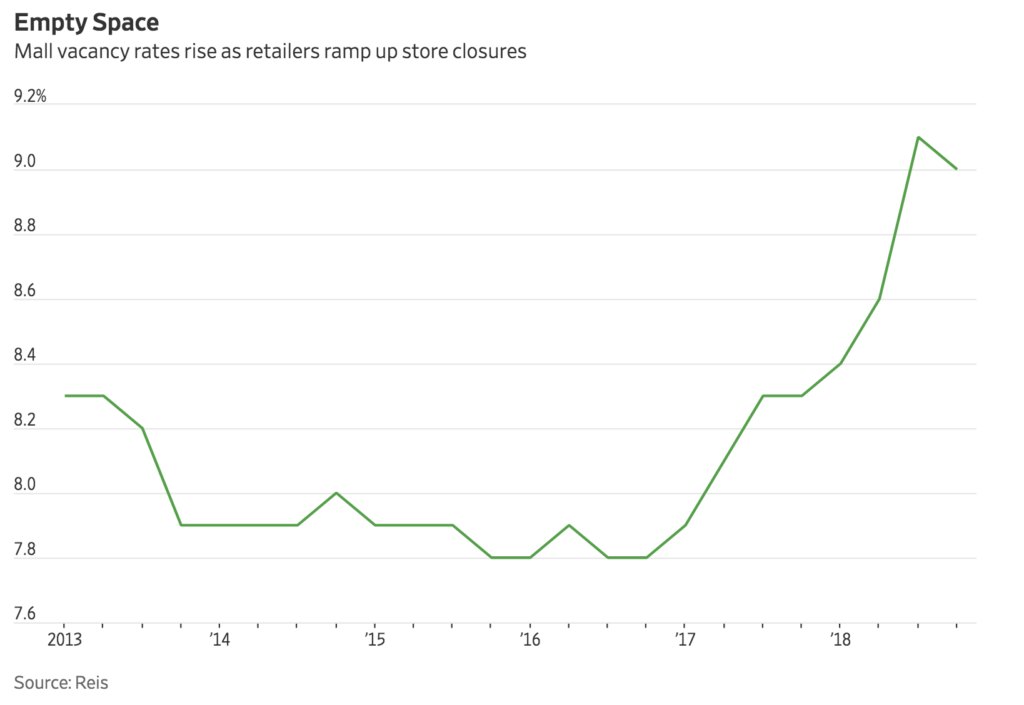

Landlords filled more empty spaces in their centers in the final months of 2018. The vacancy rate for malls fell to 9.0% in the fourth quarter from 9.1% in the third quarter, which was the highest vacancy rate since the third quarter of 2011 when it reached 9.4%, according to Reis.

While limited construction of new malls and open-air shopping centers has helped to temper the oversupply in the retail real-estate sector, landlords are bracing for additional store-closure announcements. Sears Holdings Corp., which filed for bankruptcy protection in October, just ahead of the new year that it will close another 80 stores by March.

“A number of stores are still expected to close in the coming months, and the industry continues to face a number of headwinds including gains in online shopping,” said Barbara Denham, senior economist with Reis.

The tepid retail real-estate market could see a further shakeout in the coming months if economic indicators continue to show that the U.S. economy is cooling. Manufacturing growth slowed sharply in December, while turbulence in stock markets during the final months of 2018 appears to be extending into the new year.

Brookfield’s Bet on Malls Looks Riskier Than Ever

Canadian investment giant defends contrarian strategy as things get worse for mall owners

Brookfield Asset Management Inc. BAM ’s big bet on malls last year, the firm’s latest wager on an out-of-favor asset, is looking riskier than ever as other investors increasingly sour on the sector.

In August 2018, the Canadian investment firm closed a deal to buy the two-thirds of real-estate investment trust GGP Inc. it didn’t already own. The transaction valued the 125-property portfolio, mostly comprised of malls, at around $15 billion.

The buyout was a gamble that investors preoccupied with the rise of Amazon.com Inc. and e-commerce had become overly negative about the fate of bricks-and-mortar retail—particularly the high-quality malls in GGP’s portfolio like Las Vegas’ Fashion Show. Brookfield officials believe that while there are probably too many malls in the country, many of the strongest ones will survive and thrive.

The move was also an assertion that Brookfield, with its expertise in new construction, could wring more value out of the properties by reconfiguring their stores and redeveloping the land around them.

But since the deal closed, things have gone from bad to worse for mall owners.

Major tenants Sears Holdings Corp. and Forever 21 Inc. have filed for bankruptcy protection and announced significant store closures. Shares of others including J.C. Penney Co. , Gap Inc. and Macy’s Inc. have collapsed following weak earnings reports.

A few months ago, Brookfield approached some institutions that had previously invested alongside the firm about buying stakes in other malls, according to people familiar with the matter. The investors declined to make new commitments, arguing it would be too expensive to improve the malls and citing further risk of store closures, among other concerns, the people said.

Adding to the bleak picture, stocks of mall-owners Simon Property Group Inc., Taubman Centers Inc. and Macerich Co. have fallen by double-digit percentages since the GGP deal closed, while the S&P 500 is up more than 10%.

Shares of Brookfield Property REIT Inc., a real-estate investment trust whose portfolio includes GGP as well as a substantial portion of nonretail assets, have fallen by about 13% since it was formed upon completion of the takeover.

Brookfield Property REIT is an investment vehicle created by Brookfield Property Partners LP, the firm’s separate publicly traded real-estate business.

Other cracks are starting to appear across the retail landscape. Outside appraisers last month valued the Saks Fifth Avenue flagship store in Manhattan at $1.6 billion as part of parent company Hudson’s Bay Co. ’s bid to go private. In 2014, the building was appraised at $3.7 billion. And UBS Group AG ’s Trumbull Property Fund—a roughly $20 billion real estate vehicle—has amassed a backlog of requests from investors wanting to pull about $5 billion in commitments since it wrote down the value of retail assets it owns, according to a person familiar with the matter.

Other big investors are bearish on retail real estate. Brookfield’s chief rival Blackstone Group Inc. has eschewed it, instead buying up big portfolios of warehouses used for e-commerce. Billionaire investor Carl Icahn placed a bet that mall owners will run into challenges servicing their debt,

“The sentiment is so negative on malls,” said Vince Tibone, lead retail analyst at real-estate research firm Green Street Advisors LLC. He said that investors can justify paying up for warehouses because the growth of e-commerce makes them a safer investment, but “if you buy a mall and you’re wrong, you’re probably going to get fired.”

Brookfield remains optimistic about a portfolio that ranges from Baltimore’s Mondawmin Mall to Portland, Ore.’s high-end Pioneer Place.

In an interview, Brian Kingston, chief executive of Brookfield Property Partners, expressed confidence that the bet will pay off despite recent weakness. “This is part of our strategy in that we’re contrarian investors,” he said. “This is what it always feels like.”

Brookfield hit it big in the past when it dared to tread where other investors wouldn’t. It bought the World Financial Center in lower Manhattan in the aftermath of the Sept. 11 terrorist attacks and redeveloped it, bringing businesses and commerce back to a neighborhood some thought couldn’t be revived—and earning the firm 15 times its initial investment.

The huge portfolio of real-estate and infrastructure assets Brookfield bought in Brazil when government corruption scandals and a deep recession kept other investors away has also proved to be a canny bet.

A big part of Brookfield’s strategy for making the GGP bet pay off involves squeezing more out of the properties it owns. It has $2.5 billion of projects under way to build new residential complexes, office space and hotels on the sites of nine of its malls and to remodel some of their existing retail space. For example, it is building new residential towers next to the Ala Moana Center mall in Honolulu and redeveloping large spaces once occupied by Nordstrom Inc. and Macy’s at San Francisco’s Stonestown Galleria.

The firm has also identified $2.6 billion of longer-term projects including more residential towers at Ala Moana and residential units next to Stonestown Galleria.

Brookfield aims to reap returns by selling the buildings it is constructing on land around malls to other investors. It is projecting it can create a combined $1.8 billion in incremental value through the current and long-term construction projects it has identified, and that doesn’t count the indirect benefits of driving more foot traffic to its malls.

The outcome of Brookfield’s bet very much remains to be seen. One closely watched indicator has raised some eyebrows in the industry. The value Brookfield assigned to its retail portfolio—almost entirely GGP—implies a cap rate of 5.2%, according to Green Street.

Brookfield’s cap rate is the same as what Green Street applies to malls rated A+, yet the researcher rates nearly half of Brookfield’s 113 malls B+ or lower. And while Green Street estimates a 10% drop in the value of malls this year, Brookfield’s balance-sheet valuation of its retail segment hasn’t materially changed over the period.

In a statement, Brookfield said it disagrees with Green Street’s ratings analysis given that its average tenant sales per square foot is a relatively high $787.

A major reason for the divergent views: While a number of lower-quality malls have been sold since Brookfield’s deal for GGP, very few higher-quality ones have changed hands, and transaction values are a major factor in valuations in the industry.

Slowing Mall Rent Growth,Slowing Mall Rent Growth,Slowing Mall Rent Growth,Slowing Mall Rent Growth,Slowing Mall Rent Growth,Slowing Mall Rent Growth,

Related Articles:

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your questions and comments are greatly appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.