Ultimate Resource On Government And Corporate Whistleblowers (#GotBitcoin)

One of the tipsters received $37 million, the third-largest award in the history of the agency’s whistleblower program. Ultimate Resource On Government And Corporate Whistleblowers (#GotBitcoin)

Two whistleblowers received a total of $50 million for providing information that helped the Securities and Exchange Commission pursue a case of corporate wrongdoing, the agency said Tuesday.

Related:

The Facebook Whistleblower, Frances Haugen, Says She Wants To Fix The Company, Not Harm It

The case is related to a December 2015 settlement with JPMorgan Chase & Co., according to law firm Labaton Sucharow LLP, which represented one of the whistleblowers. In the case, the New York-based bank agreed to pay $307 million to settle charges it failed to disclose conflicts of interest to its wealth management customers.

The agency granted $37 million to one whistleblower—the third-biggest individual whistleblower award granted by the SEC—and $13 million to the other.

The SEC didn’t disclose details of the case in a news release or provide identifying details about the whistleblowers.

One tipster received $50 million in March, and another received $39 million in September, according to the SEC.

Updated: 6-1-2020

Tips To SEC Surge As Working From Home Emboldens Whistleblowers

Over 4,000 reports of potential wrongdoing poured in from mid-March to mid-May. ‘These people have more time on their hands,’ a lawyer says.

A new side effect of remote working, layoffs and furloughs stemming from the coronavirus pandemic: more whistleblowers.

The U.S. Securities and Exchange Commission received about 4,000 tips, complaints and referrals of possible corporate wrongdoings from mid-March to mid-May, said Steven Peikin, co-director of the SEC’s enforcement division. That number is 35% higher than it was in the same period last year. The tips have led to hundreds of new investigations—“many Covid-19 related, but many in other traditional areas,” Mr. Peikin said in a recent speech.

Lawyers chalk up the increase to the fact that many would-be tipsters are working from the privacy of their home, out of view of snooping colleagues and managers and thus safer from being exposed as whistleblowers. Tipsters might also feel less concerned about retaliation if they are not interacting regularly with their managers, lawyers say; if they have been furloughed or laid off, they might feel even less so.

“These people have more time on their hands,” said Christopher Connors, a managing attorney at the Connors Law Group in Chicago, whose team has taken on at least seven new whistleblower clients since the end of February—a big increase for the firm. “They don’t have to go see their bosses, and they may feel a bit more emboldened to report,” he said.

When employees face pressure to meet goals during difficult financial times, the likelihood of wrongdoing can increase. Anticorruption organizations have warned that the current economic tumble could create an environment ripe for bribery.

In recent months, Mr. Connors’ clients have raised red flags on possible foreign corruption in health care, pharmaceuticals and technology to the SEC, the Justice Department and the Federal Bureau of Investigation.

Stuart Meissner, an attorney at Meissner Associates in New York, said some of the whistleblower cases brought to him are connected to the pandemic, such as small, public companies promoting home-testing kits that were allegedly fictional. Others presented more typical infractions such as money-laundering, insider trading, accounting gambits and bankruptcy fraud, unrelated to the pandemic, he said.

The economic spiral following coronavirus lockdowns is likely a factor in the rise in calls and reports he has received in recent weeks, he said.

“This caused companies to do things—whether they worry about survival or failures—that often lead to people doing wrong,” said Mr. Meissner, who said he has filed five complaints on behalf of clients to the SEC.

A record number of whistleblower awards from the SEC this year may also have incentivized more people to report wrongdoing, said Rebecca Katz, who leads the whistleblower litigation team at Motley Rice LLC in New York.

Under SEC rules, a whistleblower can get between 10% and 30% of the fines levied in SEC civil enforcement actions that result from their tip, assuming the fines total more than $1 million.

Over $64 million was paid to whistleblowers in the seven months of the fiscal year that began in October—more than the SEC has disbursed in any full year except 2018, according to an analysis of agency records. Most of that total was awarded just since March 23.

Publicity of those awards might have tempted tipsters to come forward, Ms. Katz said.

Updated: 9-1-2020

SEC Cancels Vote On Controversial Whistleblower Program Reforms

The U.S. Securities and Exchange Commission has twice canceled a vote on a proposal that could allow it to curtail the largest whistleblower awards.

The U.S. Securities and Exchange Commission has called off a second attempt to vote on long-pending amendments to its whistleblower award program—a sign the agency’s commissioners still haven’t reached a consensus on a final version of the rules.

The amendments, in the works for more than two years, would give the SEC the ability to curtail the largest whistleblower awards and process some award claims more quickly. A vote on the amendments scheduled for Wednesday morning was canceled Tuesday.

“In light of a combination of factors, including holiday schedules and other work demands, we will reschedule the meeting for a future date,” an SEC spokeswoman said. One of the SEC’s Democratic commissioners, Caroline Crenshaw, only began her tenure on Aug. 17.

The SEC previously called off another vote on the amendments that was scheduled for last October.

The regulator unveiled the proposed changes in 2018. Under the whistleblower program, tipsters who provide information that leads to a successful enforcement action against a company can be eligible for an award of between 10% and 30% of the overall monetary sanction.

Whistleblower advocates have supported changes that the SEC says would make it more efficient in processing claims, including one that would allow it to ban tipsters who provide false information or make repeated, frivolous claims.

But they have mounted a vocal opposition to several other amendments, including one that would allow the SEC to downsize awards for information that leads to fines of $100 million or more, simply because of their size. The amendment would disincentivize the highest-paid Wall Street insiders from providing information, whistleblower lawyers have said.

Whistleblower advocates have also criticized new guidance that could restrict the type of information whistleblowers can be rewarded for providing, and a new rule that disqualifies tipsters who don’t submit a special form before contacting the SEC.

Stephen Kohn, a whistleblower lawyer and a founder of the National Whistleblower Center, said the commission shouldn’t adopt changes that would undermine the program’s success. In an award announcement on Tuesday, the SEC’s whistleblower office said the agency had awarded approximately $510 million to 92 individuals since its first award in 2012.

“There’s an old saying, ‘If it ain’t broke, don’t fix it’,” Mr. Kohn said. “The success of the program should carry the day and I think those successes are weighing heavily on those that may want to weaken it.”

After the first vote was canceled last year, SEC Chairman Jay Clayton issued a statement defending the proposed amendments, including the discretion to limit large awards, which whistleblower advocates and others had referred to as a “cap.”

The proposed provision wasn’t a cap, Mr. Clayton said, adding that he had taken on board comments by the whistleblower bar about how the amendment had raised uncertainty over the SEC’s commitment to the program.

Updated: 9-24-2020

SEC Votes To Amend Whistleblower-Award Rules

Regulator says new rules would bring efficiency and transparency to how awards are given out.

The U.S. Securities and Exchange Commission has approved amendments to the rules governing monetary awards made to whistleblowers who voluntarily report potential wrongdoing.

Commissioners voted 3-2 Wednesday to approve the amendments, with Democratic members Allison Herren Lee and Caroline Crenshaw opposing.

The long-anticipated vote, which clarifies the regulator’s discretion in determining award amounts, could change how the SEC pays out some of its largest whistleblower awards, lawyers representing whistleblowers said.

The regulator said the new rules would add clarity to its decade-old whistleblower program and bring efficiency and transparency to the award determination process, according to a statement published Wednesday.

“These amendments would allow us to devote more time and resources to the processing of meritorious award claims,” Jane Norberg, chief of the SEC’s Office of the Whistleblower, said during a meeting for the vote on Wednesday.

The SEC’s whistleblower program was enacted in 2011 as part of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. Under the program, a whistleblower can receive an award totaling between 10% and 30% of the fines levied in SEC civil enforcement actions that result from their tip, assuming the fines total more than $1 million. The SEC has awarded about $523 million to 97 individuals since the program began.

The commission analyzes a range of factors in determining an award amount. Some factors—such as whether the whistleblower provided firsthand information and whether a tipster assisted in an investigation—can lead to bigger awards. The SEC also weighs discounting factors, such as whether tipsters themselves are culpable in the alleged violations.

The new rules would allow the SEC to streamline the award evaluation process, particularly for certain awards of $5 million or less. The adopted amendments provide a presumption of a statutory maximum award percentage at 30% for awards that are estimated to be $5 million or less, assuming that there were no negative factors.

The SEC, which has faced complaints that it was slow to issue awards, said the move would help the agency process whistleblower claims faster and issue awards more efficiently, considering that about 75% of the awards given out in the whistleblower program have been $5 million or less.

For awards estimated to be more than $5 million, the SEC would analyze more deeply positive and negative factors in determining a final award amount, the agency said. If there are no negative factors, a tipster can expect to receive an award that is in the top third of the range, according to the final rules published Wednesday.

After considering comments from the public, the SEC said it decided not to adopt a proposed amendment that sought the authority to reduce rewards in cases involving monetary penalties of at least $100 million.

The proposal argued that the whistleblower rules at the time “do not expressly permit the commission to consider whether a relatively small or exceedingly large potential payout is appropriate to advance the program’s goals of rewarding whistleblowers and incentivizing future whistleblowers.”

The proposal might have dissuaded some would-be tipsters from reporting major securities-law violations, attorneys representing whistleblowers said when the rules were proposed in 2018.

The rule that was approved, however, “is even more problematic than the proposal,” Ms. Lee, one of the commissioners who opposed the rule, said in the meeting Wednesday.

The new rule says the SEC already “has the authority to consider the dollar amount when applying the award criteria.”

The two commissioners who opposed the new rules questioned the pre-existence of this discretion. Ms. Lee said this would create different outcomes for tipsters in cases where the only difference is the size of the fine collected by the SEC.

“Importantly, the rule will not require the commission to tell whistleblowers if or when we have exercised this discretion, that there will be no transparency and no accountability,” Ms. Lee said during the meeting.

While acknowledging the efforts by the SEC to improve the speed in issuing payouts to tipsters, lawyers representing whistleblowers are concerned about how the SEC would exercise that discretion.

“I think this is particularly problematic,” Erika Kelton, a partner at Phillips & Cohen LLP, said, noting that the consideration of the size of the payouts wasn’t a factor that Congress adopted when it enacted the law in 2010. She said her clients and potential whistleblowers are concerned about the new rules. “The rules do not bring clarity to the awards process and actually bring more uncertainty.”

“The lack of transparency as to how they would apply that discretion is troubling and could dissuade whistleblowers from coming forward,” said Jason Zuckerman, principal of Zuckerman Law in Washington.

Updated: 9-28-2020

Whistleblower In Orthofix Bribery Case Awarded $1.8 Million

SEC grants award more than three years after Texas-based medical-device company agreed to settle bribery accusations.

The U.S. Securities and Exchange Commission awarded $1.8 million to a whistleblower whose tip helped the regulator conduct an investigation that led to bribery charges against Orthofix International NV.

The regulator, which announced the award Friday, didn’t name the company nor did it identify the tipster, but lawyers representing the whistleblower said the award was connected to a 2017 bribery settlement involving Orthofix, a Lewisville, Texas, medical-device company.

The tipster, a doctor in Brazil, provided information to the SEC about an alleged kickback scheme operated by an Orthofix subsidiary in that country, according to the lawyers, Christopher Connors of Connors Law Group LLC and Andy Rickman of Rickman Law Group LLP.

The company, now called Orthofix Medical Inc., “self-reported to the SEC about these matters and cooperated fully with the government during the course of the investigations,” a spokeswoman said.

Orthofix in 2017 agreed to admit wrongdoing and pay more than $14 million to settle accusations that it improperly booked revenue in some instances and made improper payments to doctors at government-owned hospitals in Brazil from 2011 to 2013, the SEC said at the time.

As part of the total, the company agreed to pay more than $6 million to settle allegations that it violated the Foreign Corrupt Practices Act, a U.S. antibribery law that prohibits the use of bribes to foreign officials to win or keep business. Orthofix also agreed to pay an $8.25 million penalty for allegedly failing to maintain an adequate system of internal accounting controls.

The tipster first reported the potential wrongdoing to Orthofix’s executives, general counsel and auditors before providing the tip to the SEC in 2014, according to the lawyers.

The SEC, which has faced complaints that it has been slow to issue awards, this week approved amendments to whistleblower-award rules that it said would make the process more efficient and transparent.

Under the program, whistleblowers are entitled to between 10% and 30% of monetary penalties when their tips result in a successful enforcement action and when the monetary penalties total more than $1 million.

The rules amended this week were also designed to raise percentages for certain awards of $5 million or less.

The SEC initially set the award percentage in the Orthofix case at 15%, according to the lawyers. But the regulator increased the percentage this week to 30% of the $6 million FCPA settlement payment, consistent with the updated rules, Messrs. Connors and Rickman said.

The award reflected factors the SEC considers in determining award amounts, with an eye toward rewarding whistleblowers with the highest possible amount based on the circumstances of their claims, the agency said.

The amended rules are technically not in effect yet. They will become effective 30 days after they are published in the Federal Register.

The SEC on Friday issued a separate award of $750,000 to a tipster that also reported securities violations abroad. The regulator didn’t identify the whistleblower or the case connected to the award.

The regulator has awarded about $525 million to 99 people since the program began in 2011 as part of the 2010 Dodd-Frank Act.

Updated: 10-23-2020

SEC Whistleblower Program Awards Tipster A Record $114 Million

The whistleblower, who was not identified, gave the SEC and another agency ‘substantial, ongoing assistance’ critical to bringing successful enforcement actions.

The U.S. Securities and Exchange Commission’s whistleblower program on Thursday awarded more than $114 million—a record amount—to a person whose information helped it and another agency bring successful enforcement actions against a company, the agency said.

In keeping with policy, the SEC didn’t identify the whistleblower, the company or the case the award is connected to.

The award is a combination of roughly $52 million from the SEC case and another $62 million from a related enforcement action brought by the other agency alleging similar misconduct to that in the SEC case, according to the SEC.

A whistleblower can receive an award of between 10% and 30% of the fines collected in SEC civil enforcement actions and related actions from other enforcement agencies resulting from their tip, assuming the SEC collects more than $1 million.

“After repeatedly reporting concerns internally, and despite personal and professional hardships, the whistleblower alerted the SEC and the other agency of the wrongdoing and provided substantial, ongoing assistance that proved critical to the success of the actions,” Jane Norberg, chief of the SEC’s Office of the Whistleblower, said in a statement Thursday.

The award set a record for the SEC’s whistleblower program, the agency said. The next largest was a nearly $50 million award to an individual in June. Two individuals also shared a nearly $50 million award in 2018.

“This may be the largest award to a whistleblower in any whistleblower program,” Erika Kelton, a partner at law firm Phillips & Cohen LLP who represents tipsters, said in an email.

The record award comes as the SEC adopted amendments to its whistleblower program rules last month. The SEC, as part of the vote last month, clarified that it would consider the dollar amount of the potential payout as a factor in deciding the award.

The SEC’s whistleblower program, enacted as part of the 2010 Dodd-Frank Act, has awarded about $676 million to 108 individuals since it began in 2011.

Updated: 12-08-2020

Defense Bill Proposes Anti-Money-Laundering Whistleblower Program

The proposed rules would offer an award to those who report possible violations of anti-money-laundering laws to the Treasury or the Justice Department that lead to successful enforcement.

A new whistleblower reward program incentivizing the reporting of potential violations of anti-money-laundering laws would be established as part of an annual defense-spending bill that is poised to clear Congress.

The program would offer awards to tipsters who voluntarily provide original information to the Treasury Department or the Justice Department on possible violations of the Bank Secrecy Act. Awards would be granted in cases where the tips lead to successful enforcement actions and the monetary sanctions exceed $1 million.

Congress is expected to vote as soon as this week on the National Defense Authorization Act for the 2021 fiscal year.

Under the proposed rules, a tipster or joint tipsters can receive up to 30% of the monetary penalties collected in an enforcement action brought by the Treasury or the attorney general and from related actions.

The amount would be determined by factors such as the significance of the information and the degree of assistance from the tipster, according to the defense bill. The rules would also provide tipsters protection against retaliation from employers, including demotion, suspension and industry blacklisting.

The program, if enacted, would be an expansion of current incentives, observers said. Existing regulations permit the Treasury, at its discretion, to pay a reward of either $150,000 or 25% of the fine or penalty, whichever is less. Proponents of a new whistleblower program have said the existing incentives aren’t strong enough and haven’t attracted much attention.

A spokesman for the Treasury Department declined to comment.

The whistleblower program is part of the bill’s provision to improve efforts in communications and oversight in combating money laundering and terrorism financing. The bill also includes beneficial-ownership rules requiring companies in the U.S. to register their true owners.

The proposed cash-for-tips program would be a critical tool to identify and combat money laundering, said Jason Zuckerman, a lawyer at Zuckerman Law who represents whistleblowers. He said the proposed program rules are similar to those governing the Securities and Exchange Commission’s whistleblower program, which was created by the Dodd-Frank Act.

The SEC whistleblower program has awarded at least $731 million to 123 individuals. Information provided by tipsters has helped the securities regulator recover more than $2.7 billion in total monetary sanctions from enforcement actions between 2011 and the end of September, according to the SEC Whistleblower Office’s annual report to Congress.

The proposed anti-money-laundering whistleblower program could close the enforcement gaps left by existing whistleblower programs at various agencies, including those of the SEC and Commodity Futures Trading Commission, which may have limited jurisdiction over potential money laundering violations.

“Often, people aware of money laundering might have learned about it in the course of interaction with organizations that are involved in financial crimes, and stepping forward to report it is a big deal,” Mr. Zuckerman said.

Updated: 12-10-2020

Whistleblowers Worry SEC’s Interpretation of ‘Independent Analysis’ Could Discourage Tipsters

New guidance from the regulator states that a tip must offer insight ‘beyond what would be reasonably apparent’ from publicly available information.

A new Securities and Exchange Commission rule interpretation threatens to weaken the incentive for external whistleblowers to come forward with details about potential corporate fraud, tipsters and lawyers who represent them said.

The clarification, which goes into effect Monday, states that a whistleblower’s tip has to offer insight “beyond what would be reasonably apparent” to the agency from publicly available information. That worries whistleblower lawyers and tipsters who have received awards.

They fear the clarification could make it harder for tipsters from outside of a company to be awarded in a fast-growing program where the odds of getting a payout are already long.

Anyone with original information of potential financial wrongdoing can submit a tip to the SEC. The cash-for-tips program has attracted tips from company insiders as well as outside experts who scrutinize corporate filings, such as forensic accountants and Wall Street analysts.

The original rules define independent analysis as examination or evaluation of information that may be public, done by a person or group that reveals information that isn’t generally known or available.

In its new guidance, the agency said it would consider whether a whistleblower’s conclusion derives from multiple sources, “including sources that are not readily identified and accessed by a member of the public without specialized knowledge, unusual effort, or substantial cost.” The sources must also collectively “raise a strong inference of a potential securities law violation that is not reasonably inferable” from any single source.

Whistleblowers and their attorneys are concerned that the interpretation could give the commission greater scope to reject payouts and raise the bar for potential awards so high that some tipsters might be discouraged from coming forward.

“It’s a sliding scale and it’s so subjective, and I think that’s what is worrisome to me,” said Harry Markopolos, a former derivatives portfolio manager who began alerting regulators to Bernard Madoff’s multibillion-dollar Ponzi scheme years before it was publicly exposed and an advocate for creating the SEC’s whistleblower program.

Mr. Markopolos said, however, he understood why the SEC would adopt stricter language, as third-party evaluation is highly specialized work.

“It’s a higher burden of proof and it should be,” he said. Mr. Markopolos, who since Mr. Madoff’s arrest has pursued cases of alleged corporate wrongdoing and submitted at least five tips based on independent analysis to the SEC, said he doesn’t think the clarification will affect his own efforts to win an award.

The SEC program has grown rapidly since it began in 2011. The program, created by the Dodd-Frank Act, has given out at least $728 million to 118 individuals. It set a new record in the fiscal year ended Sept. 30 with 6,911 tips, and has received an average of about 4,400 annually over its nine-year history, according to a Wall Street Journal analysis of SEC data.

The odds of winning an award for somebody submitting a tip to the program were less than one-third of 1%, according to law firm Labaton Sucharow LLP.

Nine whistleblower awards have been given to individuals for providing independent analysis that led to successful enforcement actions, according to the SEC data.

Jane Norberg, chief of the SEC’s whistleblower office, said the agency recognized the “incredibly valuable” independent analysis by outsiders that helped it bring enforcement actions against companies.

“Simply providing a publicly available document is not enough,” Ms. Norberg said. “It needs to be more. It needs to reveal insight into the securities law violation that isn’t evident from the face of that public document.”

An SEC spokeswoman said “requiring additional analysis to publicly available information in order to qualify for an award is how the commission has been approaching this issue for years.”

Two Democratic commissioners who dissented during the vote for the rule amendments in September called the clarification problematic. “I worry this guidance will inadvertently impact the perception of the type of information the commission considers valuable,” Commissioner Caroline Crenshaw said at the time.

Ms. Crenshaw argued that the focus for the SEC should instead be on the quality of the information and the analysis provided by the tipster. “The amount of data and information available to the commission is extensive,” she said at the time of the vote.

“Given that, we should not focus on whether the staff could have inferred the information from what was provided, but whether the staff actually did infer the information prior to getting the submission.”

For one of the cases that Mr. Markopolos submitted to the SEC—concerning what he suspected to be a Ponzi scheme—agency staff told him the case wasn’t robust enough to meet the requirements of an independent analysis. Mr. Markopolos hired an expert in the relevant area to address the problem.

“You have to go down a lot of paths and a lot of blind paths, without success, to come out with something fruitful for a third-party independent analysis that qualifies under this program,” Mr. Markopolos said. “It’s a lot of work. Cases aren’t done in hours or days. The cases are done in months and seasons.”

The SEC hasn’t disclosed its decisions regarding the tips that Mr. Markopolos has submitted to the SEC based on independent analysis, in keeping with its policy. He has received an award from the SEC and filed at least two applications for claims of awards, he said. The SEC spokeswoman declined to comment.

Edward Siedle, a former SEC attorney who won a $48 million SEC whistleblower award in 2017 for helping provide information leading to an enforcement action against JPMorgan Chase & Co. for failing to disclose conflicts of interest, said staffing and resource limitations at the SEC mean some outside experts are better equipped to do the kind of forensic analysis that is often required to uncover wrongdoing.

Mr. Siedle, who now runs his own law office representing whistleblowers and has submitted about 20 tips to the SEC based on independent analysis over the years, said he imagined the SEC was inundated with possibly frivolous claims. But limiting awards could discourage people from coming forward, he said.

“The program is so incredibly powerful, so incredibly profitable to the SEC, so incredibly beneficial to investors, that this is not an area where you need to be concerned about cutting back on the input you’re getting from the public,” Mr. Siedle said.

SEC Whistleblower Program Sets New Records In 2020

The office paid out around $175 million in awards to 39 tipsters in the fiscal year ended in September, and received a record number—around 6,900—of tips.

The U.S. Securities and Exchange Commission’s whistleblower program set annual records, awarding more money to more tipsters in fiscal 2020 than in any other year of the program’s history.

The volume follows efforts by the regulator to speed up payouts to whistleblowers after years of complaints that it was slow to dole out awards.

“We are sending the message to people that if you bring us high-quality tips, we’re going to dig into them, and pursue actions with vigor, and then we’re going to get you a whistleblower award promptly,” SEC Chairman Jay Clayton said in an interview last Thursday.

On Monday, Mr. Clayton announced that he plans to step down at the end of this year.

The SEC’s Office of the Whistleblower issued about $175 million to 39 individuals in the fiscal year ended Sept. 30, according to the office’s annual report to Congress, which was published Monday. The total dollar amount was 4% higher than the previous record—about $168 million in fiscal 2018—and almost three times the total issued in fiscal 2019, when $60 million was distributed to eight individuals.

In the most recent fiscal year, the whistleblower’s office also issued a record 315 preliminary determinations of award claims detailing whether a tipster’s claim should be approved or denied, which is 96% more than the previous record, set in 2014—when the majority of the preliminary orders were denials issued to one claimant, according to the report.

The SEC started to review its claim-evaluation process with the goal of making it more efficient about a year and a half ago, as the regulator proposed changes to whistleblower program rules, according to Mr. Clayton.

Amendments to the whistleblower program rules, approved in September and designed to make the award process more efficient, go into effect next month.

The regulator has added staff to the program and used resources from across the SEC enforcement division, said Stephanie Avakian, director of the division, which oversees the whistleblower program.

The office now has 13 attorneys, plus three more on temporary detail, and a support staff that includes an accountant, paralegals, analysts and law clerks, according to the report. That is up from eight attorneys, three paralegals and a support specialist in 2012.

“The program, like everything else, needs to adapt over time,” Ms. Avakian said. “It’s really paid massive dividends, and I expect those dividends to only increase as time goes by.”

The SEC also received a record number of about 6,900 whistleblower tips this year—the most for any year since the program began in 2011, according to the report.

Lawyers representing whistleblowers have chalked up the increase in part to the pandemic, pointing to the fact that many would-be tipsters are working from the privacy of their home, out of view of snooping colleagues and managers and thus safer from being exposed as whistleblowers.

“There’s probably been a fair amount of uptick in things to complain about in light of Covid,” said Ms. Avakian, the enforcement chief, noting that they can’t be certain what precisely contributed to the increase and there could be multiple reasons.

Under the program, which was enacted as part of the 2010 Dodd-Frank Act, a whistleblower can receive an award totaling between 10% and 30% of the fines levied in SEC civil enforcement actions that result from their tip, assuming the fines total more than $1 million.

By Monday, the SEC had awarded about $720 million to 113 individuals since the program began.

Updated: 4-19-2021

SEC Whistleblower Program Shows Value of Speaking Up, Departing Chief Says

Jane Norberg, who has served as chief of the whistleblower office since 2016, is leaving the agency on Friday.

The departing chief of the Securities and Exchange Commission’s whistleblower office, who helped lead the unit from its infancy, hopes the growth of the cash-for-tips program will help show the true value of whistleblowers.

Jane Norberg, who has served as chief of the whistleblower office since 2016, is leaving the agency after nine years. Her last day was Friday.

“One thing I hope the program has accomplished is that whistleblowing is becoming more accepted as the fabric of normalcy,” Ms. Norberg said in an interview this week, noting that about $1.1 billion has been or is scheduled to be returned to harmed investors based on whistleblower tips.

She said she thinks the program helped investors and companies see the value in creating an environment in which employees feel comfortable speaking up when they see potential wrongdoing.

Ms. Norberg’s departure from the unit, announced last week, came days before the death of Bernie Madoff, whose fraud—one of the biggest in U.S. history—helped lead the regulator to create the bounty program to encourage reports of financial wrongdoing and prevent lapses in oversight.

The SEC initially failed to discover Mr. Madoff’s multibillion-dollar Ponzi scheme, despite warnings from whistleblower Harry Markopolos. Mr. Madoff confessed to the scheme in 2008.

The regulator’s whistleblower program was enacted by the 2010 Dodd-Frank Act and has since received more than 40,000 tips, according to a Wall Street Journal analysis of the agency’s data. In the fiscal year ending Sept. 30, 2020, it received more than 6,900 tips, a single-year record.

Ms. Norberg said the tips have helped the SEC’s enforcement efforts—particularly those from company insiders who have access to detailed information on possible wrongdoing.

The program has issued a record amount of award dollars already this fiscal year, a surge that follows the agency’s adoption of controversial amendments to its whistleblower-award rules. The rules were intended to bring efficiency and transparency to the award determination process, the regulator has said. But some have criticized the amendments, saying they would disincentivize would-be tipsters.

In the first seven months of fiscal 2021, more than $250 million was awarded to whistleblowers, including a $50 million award to joint whistleblowers announced Thursday. The agency didn’t identify the whistleblower or the case the award is connected to, in keeping with its policy.

The agency has faced complaints in recent years that it has been slow to compensate tipsters for the risks they take to help spot fraud.

The SEC credited Ms. Norberg with streamlining the award determination process, and managing an expansion of the unit and growth in the number of awards issued to whistleblowers. The office now has 30 staff members that include attorneys, paralegals, an accountant and other support staff, the agency said. That is up from eight attorneys, three paralegals and a support specialist in 2012, according to the agency’s 2012 annual report to Congress.

“We’re seeing the fruits of the efficiencies now and things are working seamlessly,” she said in a statement sent after the interview. “I think you will keep seeing more and more awards being paid to deserving whistleblowers.”

Ms. Norberg, who previously worked as a lawyer in private practice and before that served as a special agent for the U.S. Secret Service, said she was always interested in returning to the government. “Public service has always been very important to me,” she said. “The SEC seemed to be a logical path for me based on my work in private practice.”

She declined to say what she will be doing after she leaves the regulator. She added that she thinks the program will continue to deliver on its mission after she is gone.

Emily Pasquinelli, the whistleblower office’s deputy chief who joined the office as an attorney in 2012, will take over as the unit’s acting chief, the SEC has said.

Lawyers who represent whistleblowers praised Ms. Norberg’s contribution to the program.

“She has a lot to be proud of, and she left her mark,” said Jordan Thomas, a former SEC assistant director who helped develop the agency’s whistleblower program and now represents tipsters.

Mr. Thomas, who chairs the whistleblower representation practice at law firm Labaton Sucharow LLP, filed a lawsuit in January against the securities regulator over the recent whistleblower-program rules changes.

“Jane Norberg’s efforts to protect SEC whistleblowers from employer retaliation and intimidation were extremely important and put the industry on notice that efforts to silence or chill whistleblowers would not be tolerated,” Erika Kelton, a partner at law firm Phillips & Cohen LLP who represents whistleblowers, said in a statement.

Updated: 5-11-2021

CFTC Whistleblower Program In Peril Over Potential $100 Million-Plus Payout

Agency in turmoil over proposed award to ex-Deutsche Bank executive who provided information in Libor investigation.

The Commodity Futures Trading Commission’s whistleblower program is in turmoil over a potential payout exceeding $100 million to a former Deutsche Bank AG executive—one so large it would deplete the agency’s whistleblower funds and has led it to seek congressional action.

The executive had provided information that helped CFTC and Justice Department investigations that led to roughly $2.5 billion in settlements with Deutsche Bank in 2015, including $800 million with the CFTC. They alleged that the bank manipulated the London interbank offered rate, or Libor, a benchmark interest rate used to set short-term loans for global banks.

A unit of the German bank pleaded guilty to U.S. criminal charges, and acknowledged that it failed to adequately police employees.

Some CFTC officials who have reviewed the case internally have recommended the whistleblower payout, calculated as a percentage of the agencies’ legal settlements. But the application is under investigation by others, according to people familiar with the matter. Agency leaders have contended there is no mechanism to pay the bank executive and other applicants and keep funding the whistleblower program.

The CFTC pays whistleblowers from money it collects in enforcement penalties. But the agency’s whistleblower fund can be replenished only when it falls below $100 million. Penalties collected otherwise typically go into the U.S. Treasury.

It would be difficult to quickly replenish the fund through new settlements after a large whistleblower award because many of the agency’s penalties are $5 million or less, according to a person familiar with the matter.

The payout flap is creating sharp tensions inside the agency, which regulates U.S. futures and derivatives markets, according to people familiar with the matter. It also led the CFTC to seek legislation that would expand its whistleblower fund cap; a bill sponsored by Iowa Sen. Chuck Grassley, the ranking Republican on the Judiciary Committee, has languished.

A CFTC spokeswoman in a statement said the whistleblower program “has been critically important” and that the agency is “working with Congress to ensure the continued success of the program.”

At issue is one of regulators’ front-line defenses against white-collar crime. The nation’s two largest financial cops, the CFTC and the Securities and Exchange Commission, launched whistleblower programs in the wake of the 2008 financial crisis and the Bernie Madoff Ponzi-scheme scandal, encouraging insiders and others to help the agencies uncover fraud.

The Dodd Frank Act, enacted in 2010, said whistleblowers could collect between 10% and 30% of penalties or settlements reached with the companies accused of financial misconduct. The $100 million CFTC cap didn’t anticipate that a single award could exceed that amount.

Besides paying awards, the money is used to fund the whistleblower office, which attracts and handles whistleblowers, who are the source of or are helping with about one-third of the agency’s active investigations.

Amid the uncertainty, most other whistleblower applications before the CFTC stalled for many months, the people familiar with the matter said. In April the agency issued its first two whistleblower awards since September, for $3 million and less than $250,000, respectively.

“We know there are cases right now in limbo because the payout could potentially deplete the funds,” said Jeb White, president of Taxpayers Against Fraud, an organization that represents whistleblower attorneys. “What we’re seeing is a hyper-concern” about whether whistleblowers will step forward, he said.

David Kovel, a lawyer for the ex-Deutsche Bank whistleblower, said his client “paid a very high price, personally and professionally” in helping the government’s investigation around 10 years ago. “It is critically important for him and others like him that the award system works,” Mr. Kovel said.

The CFTC’s fund cap hadn’t previously been a problem. Since its first whistleblower award in 2014, the payments have ranged from less than $250,000 to $30 million, according to the agency, awarding a total of around $123 million to 30 individuals.

The Deutsche Bank action changed the equation.

The former bank executive reached out to the CFTC in 2012. At the time, the CFTC and other U.S. agencies were investigating whether more than a dozen banks, including Deutsche Bank, had rigged the Libor market.

The whistleblower held midlevel positions in the bank’s risk management and global markets areas. He submitted a formal whistleblower complaint to the CFTC with specific allegations and documents showing the size and scope of Deutsche Bank’s risky bets.

The whistleblower provided the CFTC and Justice Department additional documents and extensive information during a series of meetings, including the details of trades and the names of people involved, according to correspondence with the CFTC.

In 2015, the CFTC announced its largest-ever fine, $800 million, settling civil charges against Deutsche Bank alleging false reporting and Libor manipulation. At the same time, Deutsche Bank agreed to pay $775 million in a criminal penalty to the U.S. Justice Department, and a total of more than $900 million in civil penalties to two other financial authorities.

A Deutsche Bank spokesman said the bank “disciplined or dismissed individuals involved” in the misconduct and strengthened its controls in reviewing and addressing the matter.

Two former Deutsche Bank traders were convicted in 2018 on charges related to Libor manipulation. In an argument in that case, the Justice Department said it had sought information from the whistleblower, among other sources, in its investigation, according to court filings.

The CFTC initially denied the whistleblower’s application, saying the agency relied solely on two 2008 Wall Street Journal articles and evidence turned over by the bank.

But after Mr. Kovel asked for reconsideration, agency staffers wrote a memo last summer stating that the whistleblower did deserve a substantial award, according to the people familiar with the matter.

The agency’s whistleblower office could end up furloughed if the fund is depleted. The Government Accountability Office in October said there is no other mechanism to fund the office.

Some CFTC officials have argued that the agency could find legal solutions, but the agency’s leadership says there is no other option but to furlough the whistleblower office staff if the large award is paid, according to the people familiar with the matter.

Late last year, the CFTC reached out to Sen. Grassley’s office saying the situation had become an emergency.

The Senate bill, introduced by two Republicans and two Democrats, would raise the cap to $150 million and temporarily create a separate account to pay for the whistleblower program. It hasn’t yet been taken up by the Agriculture Committee, which oversees the CFTC.

Sen. Grassley’s office said it is “working on a bipartisan fix to restructure the program and avoid catastrophe.” A spokesman for the majority Democrats on the Agriculture Committee said the committee was working with the CFTC on a potential solution.

Updated: 5-19-2021

Whistleblower Is Awarded $28 Million In Panasonic Avionics Case

SEC says sum is one of 10 largest awards paid out by its whistleblower program.

The U.S. Securities and Exchange Commission said it awarded more than $28 million to a whistleblower whose tip helped the regulator and the Justice Department launch investigations that led to bribery charges against a U.S. subsidiary of Japanese electronics company Panasonic Corp. and former executives.

The SEC said the sum is one of the 10 largest awards paid out by its whistleblower program, which was created by the 2010 Dodd-Frank Act.

The regulator, which announced the award Wednesday, didn’t name the company and didn’t identify the tipster, in keeping with its policy. But lawyers representing the whistleblower said the award was connected to 2018 bribery settlements involving Panasonic Avionics Corp., a Lake Forest, Calif.-based unit of Panasonic that makes entertainment and communication systems for aircraft.

The tipster, who isn’t a Panasonic employee, notified the SEC about alleged wrongdoing at the company in countries in Asia and Europe, prompting the regulator to open the investigation, according to the whistleblower’s lawyers, Christopher Connors of Connors Law Group LLC and Andy Rickman of Rickman Law Group LLP.

Under the SEC program, whistleblowers are entitled to between 10% and 30% of monetary penalties when their tips result in a successful enforcement action and when the penalties total more than $1 million.

The tipster in the Panasonic Avionics case received 10% of the monetary penalties collected from both the SEC and the Justice Department actions, according to documents viewed by The Wall Street Journal.

The award “shows the SEC’s continued commitment to rewarding [Foreign Corrupt Practices Act] whistleblowers under the program,” Messrs. Connors and Rickman said in a statement, noting that this was the third SEC whistleblower award related to FCPA violations their clients received in the past few years.

A spokesman for Panasonic Avionics declined to comment. Representatives for Panasonic didn’t respond to a request for comment.

The chief executive of Panasonic Avionics said in 2018 that the company was pleased to have resolved the matter and had taken steps to improve its compliance program and internal controls. Panasonic said it disclosed the U.S. investigations to investors in February 2017.

Panasonic Avionics in April 2018 agreed to pay the SEC more than $143 million to resolve accusations that it violated the Foreign Corrupt Practices Act and engaged in accounting fraud. The FCPA, a U.S. antibribery law, prohibits the use of bribes to foreign officials to win or keep business.

Later in 2018, the SEC accused the former chief executive and former chief financial officer of Panasonic Avionics of violating federal securities laws.

The Justice Department also announced in 2018 that Panasonic Avionics had entered into a deferred prosecution agreement and agreed to pay $137 million. U.S. prosecutors alleged that the company retained consultants for improper purposes and concealed payments to third-party sales agents, including in China and other Asian countries.

SEC staff said in the documents viewed by The Wall Street Journal that the tipster’s information prompted the agency and the Justice Department to begin investigating potential improprieties at the company.

But the settlements ultimately focused on misconduct in different regions than the one identified by the tipster and were based on information reported by the company and following investigative efforts by SEC and Justice Department staff, according to the documents.

The SEC said in 2018 that Panasonic Avionics had offered a consulting position to a government official at a state-owned airline to get help in obtaining and retaining business from the airline. Panasonic Avionics at the time was negotiating agreements with the airline that were valued at more than $700 million, the SEC alleged. The company hired the official and used a third-party vendor to conceal the payments, the SEC said.

Updated: 5-23-2021

Anti-Money-Laundering Whistleblower Program Struggles To Get Off Ground

With no minimum reward setting and program delays, lawyers are reluctant to represent potential tipsters.

A new U.S. program to reward those who report possible violations of anti-money-laundering laws has gotten off to a slow start, as some lawyers say the lack of a minimum reward and delays in establishing the systems for receiving and investigating tips have made them reluctant to take on whistleblowers as clients.

The cash-for-tips program, included in the annual defense-spending bill passed into law in January, aims to offer rewards to people who voluntarily provide original information to the Treasury Department or the Justice Department on possible violations of the Bank Secrecy Act when their tips lead to enforcement actions where monetary sanctions exceed $1 million.

The provision of the National Defense Authorization Act said tipsters can receive up to 30% of the monetary penalties collected in an enforcement action brought by the Treasury Department or attorney general and from related actions.

But the bill didn’t set a deadline for the implementation of the whistleblower regulatory framework, designate an agency to implement it or set a floor for rewards. That stands in contrast to the bounty programs at the Securities and Exchange Commission and the Commodity Futures Trading Commission, which offer a 10% minimum reward payment to successful whistleblowers.

Secretary of the Treasury Janet Yellen has delegated responsibility for the whistleblower program to the Financial Crimes Enforcement Network, an anti-money-laundering bureau of the U.S. Treasury Department, a Treasury official said in a statement. FinCEN has already received tips from several purported whistleblowers and is evaluating those tips, the official said.

“The kind of robust and well-funded office needed to implement the enhanced whistleblower provisions…has not been funded by Congress, so FinCEN has diverted existing enforcement, compliance, and policy division resources to start implementing the law,” the Treasury official said in the statement. The statement also noted that FinCEN is consulting with several agencies that have mature whistleblower programs, such as the SEC, CFTC and the Internal Revenue Service, to identify best practices.

“We understand that full, robust implementation of the whistleblower program and other measures will require significant resources, and our immediate focus is on obtaining the necessary resources to support implementation,” a spokeswoman for FinCEN said. “Once the available funding levels are known, FinCEN will continue its detailed hiring plan and execute against those plans.”

Representatives For The Justice Department Didn’t Respond To A Request For Comment

The new anti-money-laundering program offered further business opportunities to lawyers who have set up practices to guide corporate whistleblowers through government investigations, with a share of any reward windfall as their compensation.

Stuart Meissner, an attorney with his own practice that represents whistleblowers, said he has decided not to participate in the anti-money-laundering program after looking into the law. In December he started working to recruit clients by tracking down individuals who previously called him about possible money-laundering cases, with an expectation that the program could be more popular than the SEC’s. He said he still receives calls every day from people with information on possible money laundering.

But now he is turning down possible tipsters unless the case also falls under the SEC’s jurisdiction. He cited a lack of minimum reward of 10% of monetary sanctions as well as how those sanctions are defined as two factors for his decision, adding that so far there is no clarity on where to file the complaints and which office would handle them.

“These things take years; you don’t want to wait four to five years before finding out it’s all a waste of time,” Mr. Meissner of Meissner Associates said of whistleblowers. “That’s a bit too frustrating, knowing that you might not get an award when you help with the investigations.”

Rebecca Katz, who leads the whistleblower litigation team at law firm Motley Rice LLC, said she would still assess cases and information from whistleblowers, but added that opaque parameters, the fact that the government has more discretion in giving out rewards and a lack of a track record of results make the program difficult.

“It’s always good to have another program for whistleblowers, since they are risking a lot to come forward,” she said. “But this one is certainly not as well crafted as the SEC program.”

Sean McKessy, who helped set up the SEC whistleblower program as the first chief of the whistleblower office, said the lack of leadership in the government program is making some law firms hesitant to get involved.

“I saw my job as publicizing the program to whistleblowers,” Mr. McKessy said. “I just don’t think you can get a program off the ground if you don’t have a champion internally and externally.”

Updated: 6-3-2021

Senate Passes Bill To Fund CFTC Whistleblower Program

The bill was passed unanimously on Friday; a similar bill may be considered by the House of Representatives.

A newly passed Senate bill would temporarily create a separate account to pay for the operation of the Commodity Futures Trading Commission’s whistleblower program as the agency confronts a funding crisis over a large potential payout.

Currently, the CFTC’s Customer Protection Fund, which is funded by money the agency collects in enforcement penalties, is used to pay successful whistleblowers as well as for operating expenses and educational initiatives associated with the whistleblower office.

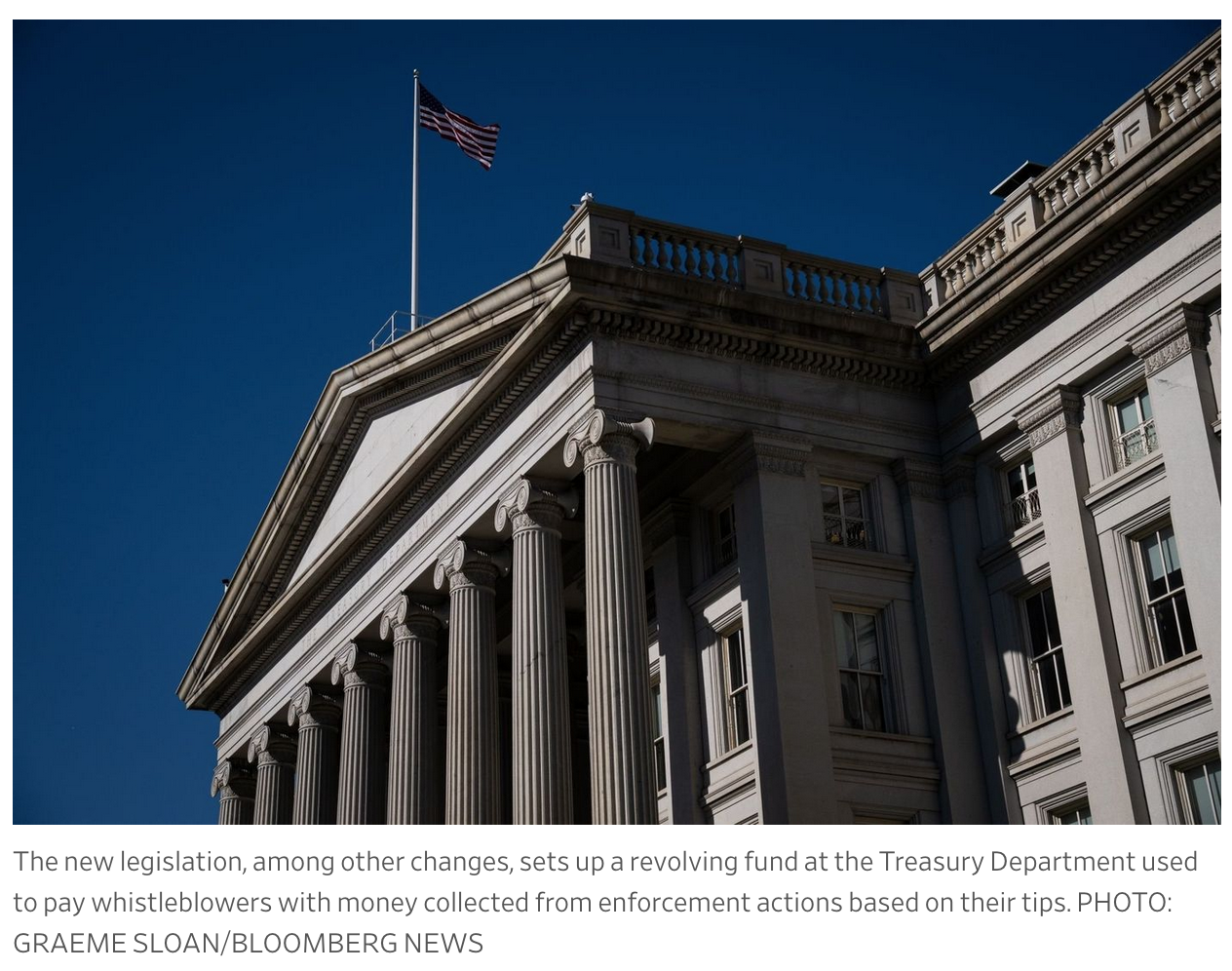

The bipartisan legislation proposes the establishment of a separate account at the U.S. Treasury Department until Oct. 1, 2022, to ensure that the CFTC’s whistleblower office will be able to continue operations even if the amount in the fund drops to a critical level.

The CFTC Fund Management Act was passed unanimously by the U.S. Senate on Friday. A similar bill may be considered by the U.S. House of Representatives.

“We continue to work with Congress to ensure the program’s success,” a CFTC spokeswoman said in an email.

The CFTC, which regulates the U.S. futures and derivatives markets, has been in turmoil in recent months over a potential whistleblower payout of more than $100 million to a former Deutsche Bank AG executive, The Wall Street Journal previously reported. CFTC leaders contended there was no mechanism to pay the bank executive and other applicants and keep funding the whistleblower program.

The Customer Protection Fund, created by the 2010 Dodd-Frank Act, can be replenished only when it falls below its cap of $100 million. Any fines collected after the account reaches the cap typically go into the U.S. Treasury. If the fund is depleted, the CFTC whistleblower office could end up furloughed.

The bill would allow the CFTC to transfer up to $10 million from the fund into a separate account and use the account to pay for operating and programming expenses when the balance in the protection fund is insufficient. After Oct. 1, 2022, the remaining money in this account would be returned to the fund.

Under the program rules, eligible tipsters are entitled to between 10% and 30% of monetary penalties collected. The CFTC has awarded roughly $123 million to whistleblowers, according to the agency website.

The increasing size of the whistleblower awards in recent years would risk depleting the fund before it could be replenished, according to a statement for the bill from the office of Sen. Chuck Grassley (R., Iowa), who wrote the bill. The bill would carry no cost to taxpayers, according to the statement.

“The CFTC whistleblower program has become far more successful than Congress imagined when we set it up back in 2010,” Sen. Grassley said in the statement. “We can’t allow this program to become a victim of its own success. Now that the Senate has passed this bill, the House must act quickly to preserve the program.”

Without congressional action, Sen. Grassley’s office said they have been told the whistleblower office staff could be furloughed as soon as mid-June, said Taylor Foy, the communications director for Sen. Grassley. “We’re trying to get it done as soon as we can,” Mr. Foy said.

Attorneys representing whistleblowers said the legislation is an important step to help keep the CFTC program operating.

“Without the legislation, we would lose the whistleblower office during a time of heightened fraud concerns,” said Jeb White, chief executive of Taxpayers Against Fraud, an organization that represents whistleblower attorneys.

“This program has worked really well and any action that would allow it to keep operating is a big win,” said Jason Zuckerman, a lawyer at Zuckerman Law who represents whistleblowers. He noted that without the legislation, tipsters might be deterred from making further disclosures to the CFTC.

Some attorneys worry the temporary fix might not be enough to address the problem long-term.

“What I fear about this is they are just kicking the can down the road and we’ll be encountering this again,” said Erika Kelton, a partner at law firm Phillips & Cohen LLP who represents whistleblowers.

Updated: 6-27-2021

Whistleblower Thought He Would Get A Big Payout. Instead He Got Nothing And Went Broke

Securities and Exchange Commission says it can’t reward watchdogs if recouped funds come through bankruptcy process.

John McPherson was almost certain he’d get rich from the Securities and Exchange Commission’s whistleblower program. Instead, he ended up bankrupt and embittered.

Despite what the SEC called his “extraordinary and continuing” assistance in helping the agency shut down an alleged $1.4 billion investment scam, Mr. McPherson was notified last year that his whistleblower award would likely be close to zero.

The reason? The target company, Life Partners Holdings Inc., had declared bankruptcy, and the SEC never collected financial penalties it was owed. Investors, however, were able to recoup more than $1 billion through the bankruptcy process.

Mr. McPherson’s experience illustrates a little-known facet of the SEC’s whistleblower program: The regulator won’t pay awards for financial recoveries in bankruptcy proceedings, even if the affected company entered bankruptcy as a result of the agency’s enforcement actions.

Some critics say that discourages people from reporting the most egregious frauds—Ponzi schemes and companies with major accounting chicanery—which often collapse or end up in bankruptcy court.

“It’s lunacy on the part of the SEC to interpret the rules that way,” says Harry Markopolos, a financial sleuth who has partnered on whistleblower cases with Mr. McPherson. Mr. Markopolos is famed for trying, but failing, to get the SEC to investigate Bernard Madoff’s huge Ponzi scheme.

The 2008 collapse of Mr. Madoff’s securities firm was a major reason Congress established the SEC’s whistleblower program in 2010. But under the SEC’s interpretation of the rules, Mr. Markopolos says, “I wouldn’t have been paid anything” for turning in Mr. Madoff, because the Madoff firm filed for bankruptcy as soon as its fraud finally came to light.

Mr. Markopolos says many major frauds, including WorldCom Inc. and Enron Corp., also ended up in bankruptcy.

The SEC declined to comment. The agency, in revising and clarifying rules for its whistleblower program last year, said that by statute it can only pay awards based on actions brought by it or other government entities, not from bankruptcies, which are private actions. That is true, it said, even if a bankruptcy in some way results from SEC enforcement action or the activities of a whistleblower.

Attorneys who represent whistleblowers say they have other clients who have blown the whistle on companies that ended up in bankruptcy and can’t collect on their awards, though it is unclear how often this happens.

“The problem with Ponzi schemes is that the money is gone,” says Sean McKessy, a former chief of the SEC’s whistleblower office who is now in private practice representing whistleblowers.

The SEC’s whistleblower program is intended to help the regulator police the markets by rewarding citizens who provide original information about a securities violation. Successful whistleblowers can get 10% to 30% of the amount the agency collects in fines or penalties.

To date, the SEC has paid more than $900 million in awards, including a record-setting $114 million sum last October.

Although most whistleblowers are former or current company insiders, others are analysts, short sellers or industry observers. Attorneys who practice in the area say the program is skewed to incentivize blowing the whistle on deep-pocketed public companies and Wall Street firms, who can afford to pay big fines.

Mr. McPherson, a former Ernst & Young LLP forensic accountant, was a partner in a small consulting firm working in the “life settlements” industry when he discovered what he believed was fraudulent conduct by Life Partners, a publicly traded company based in Waco, Texas. Life Partners was the subject of an article in The Wall Street Journal in December 2010.

The company sold more than 20,000 individual investors fractional shares in life settlements—the right to collect on a stranger’s life insurance policy when the insured person dies. Mr. McPherson suspected the company was overcharging clients by providing misleading estimates of how quickly the insured person was likely to die.

He contacted the SEC in mid-2010, becoming a key source for the agency as it pursued a case against Life Partners. In praising his help, the SEC later noted that Mr. McPherson had communicated with its staff on more than 100 occasions and provided “voluminous pages of documents.” By his own count, he spent about 3,000 hours helping the SEC over a five-year period.

Mr. McPherson says he initially wasn’t interested in getting rewarded for aiding the SEC, but did it to help out the investors. It wasn’t until years later that he realized he might be in line for a big payday.

Life Partners officials denied any wrongdoing, saying retail investors could still make money even if its life expectancies were off. Its chief executive, Brian Pardo, in a later self-published book, blamed much of the negative attention on competitors and short sellers. An attorney for Mr. Pardo said his client had nothing new to say on the topic.

The SEC in 2012 sued Life Partners, later telling Mr. McPherson some of its claims closely aligned with information he had provided. Despite a mixed jury verdict, the agency in 2014 won $47 million in financial penalties against the company and its top two executives.

Then came the events that cost Mr. McPherson his hoped-for whistleblower award.

The SEC asked the federal judge overseeing the case to appoint a receiver to take control of Life Partners. If that had happened, Mr. McPherson might have been in line for a whopping payout, based on the more than $1 billion later recovered by investors.

The SEC has said that “monies recovered by a receiver and returned to harmed investors” could count for whistleblower-award purposes.

On the eve of a January 2015 hearing at which the judge was going to consider appointing a receiver, Life Partners filed for bankruptcy protection, saying it was doing so “to avoid the appointment of a receiver which could have liquidated the company.”

The SEC quickly got the bankruptcy judge to appoint a trustee to take control of Life Partners. It was an almost identical outcome, but under the aegis of a bankruptcy court.

The trustee, who in a court filing accused Life Partners of a “wide-ranging scheme to defraud its investors,” eventually set up a mechanism to return more than $1 billion over years to the retail investors in Life Partners’ fractional policies.

Last September, a decade after the original tip, the SEC told Mr. McPherson his whistleblower application was successful. The SEC staff recommended he be awarded 23% of the amount collected in the Life Partners case. But the agency said in a letter that “to date there have been no collections” in the case—meaning he shouldn’t expect much, if anything.

“I was astonished,” says Mr. McPherson. “My reward for five years’ work on one of the most successful enforcement actions in the SEC’s history was zero.”

Part of the reason the SEC hadn’t collected anything was due to the regulator’s own actions. When Life Partners declared bankruptcy, the SEC had a legal claim over $38.7 million, which was the company’s portion of the disgorgement and penalties the agency had won in the 2014 court judgment. But the SEC voluntarily subordinated its claim, making sure Life Partners’ retail investors collected as much as possible.

Mr. McPherson applauds the idea of protecting retail investors but believes he shouldn’t be penalized for that decision. At minimum, he thinks he should get 23% of that money, or $8.9 million.

“This outcome is deeply troubling,” says Jordan Thomas, a former SEC attorney who helped establish the regulator’s whistleblower program, and now represents whistleblowers at Labaton Sucharow. “Discretionary decisions made by the commission resulted in him being denied a whistleblower award. That kind of scenario is inconsistent with the way the program was developed.”

More broadly, Mr. Thomas says cases where bankruptcies keep a whistleblower from getting paid are relatively infrequent and tend to involve “low-level fraud—not the Wall Street banks but the small-time bad guys.” But he thinks the loophole is big enough that the SEC should either change its rules or seek a legislative fix.

Early in the Life Partners saga, Mr. McPherson was so beguiled by the lure of whistleblower millions that he essentially quit his day job to become a full-time whistleblower, using his accounting and life-insurance knowledge to spot potential miscreants.

He has submitted whistleblower tips to the SEC on 11 companies, in several cases teaming up with Mr. Markopolos. In 2018, he took out a $1 million litigation-funding loan at very high interest rates, secured by the Life Partners whistleblower claims, to pay back taxes and continue to pursue his cases.

The SEC at one point verbally told Mr. McPherson’s lawyers that he might get a small payout of about $18,000 from the Life Partners matter. But so far, he has received nothing from a decade’s whistleblower work. A financial squeeze at one point left him unable to pay his daughter’s past-due tuition, he says, and he received an eviction notice from the local sheriff.

In January he declared personal bankruptcy.

Updated: 7-7-2021

Former Enron Executive: SEC Whistleblower Program Is A Game Changer

Sherron Watkins, who warned management about accounting practices in 2001, says being publicly known hurt her career prospects.

Sherron Watkins, the Enron Corp. executive who warned management about fraud, said not having confidentiality and protection for whistleblowers can have a cost.

Nearly 20 years after the energy company’s collapse, Ms. Watkins, 61 years old, said being labeled a whistleblower has been a challenge to her career ever since.

If current whistleblower protections had been in place at the time, she said she would have been able to report her concerns to the Securities and Exchange Commission while keeping her name confidential.

Her revelations come as more corporate insiders are blowing the whistle these days on possible wrongdoing through whistleblower programs that give out awards for helpful tips and provide confidentiality and anti-retaliation protections to those who come forward.

Following her report of Enron’s use of complicated off-balance-sheet vehicles to mask hundreds of millions of dollars in losses, Ms. Watkins was lauded and even chosen as one of Time’s Persons of the Year in 2002, alongside two other whistleblowers. She has since co-written a book and traveled around the world to speak about Enron.

Ms. Watkins, now living near Austin, Texas, still gives speeches about Enron and on the warning signs of bad organizational culture. Nonetheless, Ms. Watkins describes herself as “grossly underemployed,” adding that she has struggled to find another job in the corporate world or long-term stable employment, including opportunities to teach.

“Different things I’ve looked into, there was always just a door kind of slammed at some point,” Ms. Watkins said. These included consulting gigs with companies that provide directors and officers liability education for boards. She said she also interviewed to be an adjunct professor for executive sessions at Rice University’s business school, a job she didn’t get in the end.

A representative for Rice declined to comment on personnel matters.

Today’s whistleblower reward programs at the SEC and the Commodity Futures Trading Commission provide an option to report potential misdeeds confidentially, offering an easier path for those concerned about fraud at their companies, industry observers said.

“I think it reflected badly on our country and on corporate America,” Jordan Thomas, who chairs the whistleblower representation practice at law firm Labaton Sucharow LLP, said, speaking of the repercussions on the career of Ms. Watkins and other whistleblowers whose names became public.

He adds that what Ms. Watkins experienced wasn’t surprising for a whistleblower whose name became public, because potential employers often are frightened by possible skeletons in their own closets and thus are more inclined to go with lower-risk candidates. “I think the most significant change has been the ability to report anonymously, which is the best protection against blacklisting” and retaliation, he added.

Ms. Watkins first wrote her one-page fraud complaint anonymously and placed it in an employee dropbox in August 2001, but she decided to identify herself the next day and meet with Kenneth Lay, Enron’s chief executive at the time.

She didn’t report what she knew directly to the government in hopes Enron executives would report it themselves, but later she was interviewed by the SEC and the Justice Department for their investigations into Enron and testified at congressional hearings.

She said she felt shunned after her name became attached to the Enron collapse. “It’s a toxic label, where you won’t work in your chosen career ever again, and you lose friendships. People are hesitant to really join in a venture with you or move forward, just because there’s too much noise around that label ‘whistleblower,’” she said.

She also faced criticism from the public and media at the time, including for not taking her concerns early on directly to Enron’s board or to regulators, and for selling Enron stock, though she wasn’t charged with insider trading. Looking back, she acknowledged the criticism that she could have done things differently, but added “that criticism is far outweighed by the thank-yous that I received from rank and file employees” who thought justice would be served, she said.

Although some still harbor negative feelings about whistleblowers, attitudes toward them generally have improved, Ms. Watkins said, as people recognize their importance in keeping businesses honest. “I think it is becoming a very important check and balance to abuses of power,” she said.

She attributes this to the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, which established bounty programs such as the one at the SEC, enabling individuals to report possible violations of federal securities laws anonymously with the help of lawyers. The SEC whistleblower program offers eligible tipsters a portion of the penalties the agency collects as a reward and has been widely seen as a success.

The SEC whistleblower program has received more than 40,000 tips, based on a review of the data. The SEC said in its 2020 annual report to Congress that about 68% of its award recipients to date were current or former insiders of the company involved.

The incentives and protection provisions of Dodd-Frank changed the landscape “because it attracted legal advocacy and legal support towards the cause of the whistleblower,” Ms. Watkins said.

Had Dodd-Frank been in place while she was at Enron, Ms. Watkins said she would have reported anonymously through an attorney and believes the SEC would have investigated and fined Enron earlier before the minor frauds became major ones.

“I would have remained anonymous, stayed employed, Enron would still be alive,” she said. “So it’s a wonderful check and balance.”

In 2019, Ms. Watkins wrote a comment letter protesting two amendments the SEC proposed to its whistleblower program rules, which she said could discourage individuals from reporting tips and affect how they are rewarded, and met with several of the commissioners at the time. The final versions were better than what was first proposed, she said.

Much has changed for Ms. Watkins since she first raised her concerns at Enron. She said her daughter, who was too young to remember when the company imploded and is now a senior in college, doesn’t have a detailed understanding of what she did but is still proud of her actions.

“In a way, it’s been interesting. I certainly do not make the kind of living I could have had I stayed in corporate America the last 20 years,” she said. “But then again, my daughter probably felt like I was a stay-at-home mom able to go to all of her school events, sporting events and was always there. So that’s got a benefit that money can’t buy.”

Updated: 7-8-2021

President Biden Signs Bill To Fund CFTC Whistleblower Program

The measure would temporarily set up a new account at the Treasury Department to pay for the operations of the Commodity Futures Trading Commission’s whistleblower program.

President Biden has signed into law legislation that would temporarily set up a new account to pay for the operations of the Commodity Futures Trading Commission’s whistleblower program, paving the way for the U.S. derivatives markets regulator to resolve a funding crisis over a large potential payout.

The bill, an amended version of the CFTC Fund Management Act, was signed into law by the president on Tuesday, after Congress passed the bipartisan legislation last month.

The White House in a statement thanked Senators Chuck Grassley (R., Iowa), Maggie Hassan (D., N.H.), Joni Ernst (R., Iowa), Tammy Baldwin (D., Wis.) and Susan Collins (R., Maine) for their work on the new law.

“We thank Congress and President Biden for their continued support of the Commodity Futures Trading Commission and our whistleblower program, which year after year contributes to our successful enforcement efforts,” a spokeswoman for the CFTC said in an email Thursday. A spokesperson for the White House didn’t respond to a request for additional comment.

The CFTC has been in turmoil in recent months over a potential whistleblower payout of more than $100 million to a former Deutsche Bank AG executive, The Wall Street Journal previously reported. CFTC leaders contended there was no mechanism to pay the bank executive and other whistleblower applicants while maintaining funding for the program.

The CFTC Customer Protection Fund, created by the 2010 Dodd-Frank Act, is funded by money the agency collects in enforcement penalties and is used to pay eligible whistleblowers as well as for operating expenses and educational initiatives associated with the whistleblower office.

The fund can be only replenished when it falls below $100 million. Any fines collected after the account reaches its cap typically go into the U.S. Treasury. The $100 million CFTC cap set in 2010 didn’t anticipate a single award could exceed that amount. If the fund is depleted, staff from the CFTC whistleblower office could end up being furloughed.

Under the new law, the CFTC would be able to transfer up to $10 million from the fund into a separate account at the Treasury and use the account to pay for operating and programming expenses when the balance in the protection fund is insufficient. After Oct. 1, 2022, the remaining money in this account would be returned to the fund.

The CFTC will include relevant information related to the account in its reports to Congress, the bill said.

“Congress’s broad bipartisan support for this bill demonstrates just how important this program is,” Sen. Grassley, who wrote the bill, said in a statement.

Some observers are concerned that the measures provided in the bill didn’t go far enough to address the funding problem long-term.