Plunging Yields Expose Sorry State of US And European Banks (#GotBitcoin?)

After a broad selloff last week, European bank stocks have given up their gains for the year, with valuations of some major lenders at multiyear lows. Plunging Yields Expose Sorry State of US And European Banks (#GotBitcoin?)

The global downdraft in bond yields and rising trade tensions are falling squarely on the shoulders of European banks.

After a broad selloff last week, European bank stocks fell again on Monday, with the valuations of some at multiyear lows. The Euro Stoxx Banks index is down 1.7% in the year to date, compared with an 8% rise in the S&P 500 banks index of U.S. lenders. Shares in Deutsche Bank AG touched an all-time low Monday of €5.85.

It is a sharp reversal from a little over a month ago, when the European bank index had been up as much as 19% for the year.

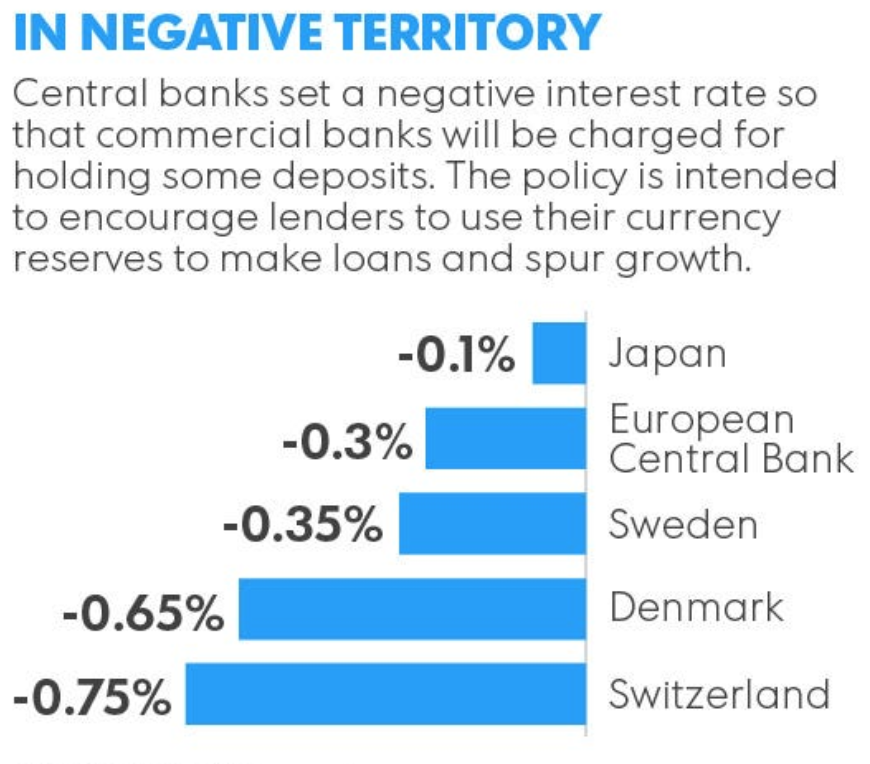

Driving shares lower: European banks have been buffeted by the recent plunge in Europe’s already low interest rates. German 10-year government bond yields hit a record low of negative 0.21% on Friday. Low rates crimp banks’ net-interest margins, the difference between what banks pay for funding and what they make from loans. The low yields are being driven by worries about the strength of the global economy, making safe assets more attractive.

Investors said they expect the pain for banks to continue until interest rates eventually rise. But many economists don’t expect the European Central Bank to move benchmark rates for years.

“I can’t see a reason to invest in European banks at the moment. They are being hit from all sides,” said Chris Garsten, a European equities fund manager at U.K.-based Waverton Investment Management.

Among the worst performers is French bank Société Générale SA, whose shares are down nearly 20% so far this year and trade for less than a third of their book value, the lowest since 2012 during the throes of Europe’s sovereign-debt crisis.

The ECB last week in its financial stability report slashed forecasts for banks’ return on equity, a key profit measure, indicating more trouble may lay ahead for lenders.

“Profitability continues to fall short of the returns required by investors for the majority of euro area banks,” it said.

President Trump’s announcement on Thursday of possible tariffs on Mexico hit the shares of Banco Bilbao Vizcaya Argentaria SA and Banco Santander SA, two of the region’s largest banks. Both rely on their Mexican operations to offset their slower-growing European businesses.

U.S. bank shares also fell in May because of concerns about the effect of dropping Treasury yields on their lending margins. But American banks have been supported by a relatively healthy economy and cleaner balance sheets.

In a sign of the differing fortunes between European and U.S. banks, the eurozone’s eight largest banks, including France’s BNP Paribas SA and Dutch bank ING Groep NV, have a smaller combined market value than JPMorgan Chase & Co., despite the Europeans having triple the assets.

Filippo Alloatti, a senior credit analyst at Hermes Investment Management, said European banks have little choice but to cut costs, but that “it’s a politically sensitive topic. Unions and politicians don’t want to see banks closing branches and reducing their footprint.”

In an April press conference, ECB President Mario Draghi lashed out at banks for having too many branches and employees, leaving little money to improve their digital businesses.

Deutsche Bank and Commerzbank AG ended merger talks in April, dimming hopes of a wave of consolidation among the region’s lenders. ING and Italy’s UniCredit SpA had also expressed interest in Commerzbank, but swooning market valuations are likely to make it harder for banks to raise capital for acquisitions.

Not all are deterred. Analysts at Keefe, Bruyette & Woods in a note said institutional investors’ interest in banks “is at new lows,” but rock-bottom valuations could mark a buying opportunity.

Updating: 10-25-2019

Lebanon Banks’ Shutdown Is ‘Most Potent Case’ For Crypto: Nassim Taleb

Bitcoin (BTC) proponents are encouraging Lebanese citizens to swap fiat for crypto after it emerged the country’s banks would stay closed.

Banks To Open “Once Normalcy Restored”

In an ongoing Twitter debate which began on Oct. 24, commentators vented anger on behalf of Lebanon’s population, which has been without banking services for more than a week.

Following civil unrest, banks everywhere closed their doors. Six working days later, a senior banking executive said the status quo would continue until conditions improved.

“Once normalcy is restored, we are very confident that we can resume servicing our customers in full capacity,” Salim Sfeir, head of local lender Bank of Beirut, told Reuters on Thursday.

Previously, long queues were seen at ATMs as worried consumers attempted to access their wealth. Around 65% of Lebanon is banked, figures say, leaving two-thirds of the country cut off from personal funds.

Taleb: shutdown “most potent case for crypto”

For well-known Lebanese statistician, former trader and author of “The Black Swan,” Nassim Nicholas Taleb, the government’s policy was enough to directly endorse cryptocurrencies such as Bitcoin.

“The most potent case for cryptocurrencies: banks are never there when you need them,” he summarized in a tweet. Taleb continued:

“And they are trying to bully the public so they avoid accountability and profit disbursements. Bankers are legal crooks.”

The anger is reminiscent of other recent episodes of economic chaos, during which states have withheld money for their own purposes. In addition to Hong Kong this year, an infamous example is India, which in 2016 began a series of botched currency reforms which left hundreds of millions of people holding worthless notes.

India’s taste for Bitcoin soon increased dramatically, before a hardline policy saw its exchange sector all but evaporated last year.

It is worth noting that unlike banks, the decentralized Bitcoin network operates 24/7 with 99.98% uptime since its inception, according to monitoring resource Bitcoin-uptime.

Updated: 1-26-2020

Europe’s Banking Regulator Paves the Way for Bank Mergers

Softer stance toward tie-ups comes as sector struggles to make money against backdrop of low rates.

Europe’s main banking regulator is trying to clear the path for mergers between the continent’s lenders as the belief grows that scale is the key to reviving the struggling sector, people familiar with the matter said.

The regulator—an arm of the European Central Bank that covers the largest eurozone banks—is making this softer stance toward potential tie-ups known privately, according to bankers, supervisors and analysts. Some of its officials have also publicly tackled the issue in recent speeches. It marks a departure for the regulator from its perceived stance of imposing prohibitively tough conditions on mergers.

The ECB showed an openness to work with two Spanish midsize banks, Liberbank SA and Unicaja Banco SA, during merger discussions last year, according to people familiar with the talks. The talks with the regulator revolved around whether any additional capital could be raised through the issuance of debt, rather than from shareholders, according to one of the people.

The regulator is also more open to giving some time for synergies from a merger to kick in—for example, accepting a smaller capital buffer during that period, according to one of the people familiar with the matter.

The loosening comes as the eurozone’s fragmented banking sector struggles to make money. Low interest rates—which are set up by the ECB’s own monetary-policy arm—continue to eat up banks’ margins on loans, hurting their profitability and making them largely unattractive for investors. Mergers have been long touted as a possible answer to the region’s banking woes. Part of the rationale for larger European lenders is they need scale to compete with U.S. rivals that have outperformed them on their own patch since the global financial crisis. European banks’ average return on equity is around 6%, almost half that of U.S. peers.

“Somewhere in the back of their minds, the ECB realizes that the negative rates environment is weighting on profitability of the banks, and they need to do something about it,” said Jérôme Legras, head of research at Axiom Alternative Investments.

To be sure, the ECB’s ability to foster deal making in Europe’s banking sector depends on the willingness of banks to join forces. Historically that has sometimes proved challenging because of disagreements between the companies over board makeup, executive leadership and shareholder structure of the proposed merged bank.

Some bankers are also skeptical about the extent to which the ECB is willing to be flexible and whether that will be enough to trigger mergers. An official at a large European lender said while it is true the ECB is looking to be helpful, “at the end of the day they are supervisors, and supervisors are by nature very risk-averse.”

But more openness toward mergers could prove a game changer for Europe’s banking system, and could trigger several midsize mergers, particularly in the oversize domestic markets, according to analysts. Germany has over 1,500 banks, followed by more than 500 in Italy, 400 in France and 200 in Spain. Big mergers between some of the region’s larger lenders have been discussed in recent years, most prominently talks between German lenders Deutsche Bank AG and Commerzbank AG , which broke down on the cost and complexity of pulling off a merger.

“I definitely think mergers will happen, likely from the second half of this year,” said Filippo Alloatti, an analyst at Hermes Investment Management, adding that high costs for digitalization in addition to the low-rate environment are putting too much pressure on banks and forcing the ECB to act.

Key to the regulator’s flexibility is willingness to ease capital requirements for a merged entity, something that has stalled consolidation among banks because few are willing to ask shareholders to put in more money.

In the past, the ECB has taken a tough stance on the matter. In 2016, two years after the banking supervision arm was created, it imposed tough conditions for the merger of two midsize Italian banks—Banco Popolare SC and Banca Popolare di Milano Scarl. The lenders were told to shrink their board size, make additional write-downs of bad loans and raise €1 billion in fresh capital.

The managers of both lenders branded the requests as excessive and opposed them for weeks. But in the end they capitulated. “Facing a position [of the ECB] which left no alternative, we decided to meet the regulator’s requirements,” Banco Popolare’s CEO Pier Francesco Saviotti said at the time.

Since then, sizable merger activity among banks has been muted, with many bankers citing hurdles imposed by the regulator.

More recently, though, the ECB has struck a milder tone.

“I would like to dispel the perception that the ECB requires higher levels of capital from merged entities,” Andrea Enria, the head of the ECB’s banking arm, said in November.

“Our objective is to support, rather than discourage, the effective restructuring of the merged entities and ensure that the resulting business model is sustainable,” he added.

In a speech the same month, Yves Mersch, another ECB senior official, signaled the regulator could revisit its assessment criteria for mergers, including on the treatment of bad-loan levels for the combined bank.

“As a supervisor, we step up our scrutiny of merged entities, at least at the start of their life, as we recognize the operational risk challenges posed by merging complex structures. That should not lead to double-counting, though,” he said.

Plunging Yields Expose Sorry, Plunging Yields Expose Sorry,Plunging Yields Expose Sorry,Plunging Yields Expose Sorry, Plunging Yields Expose Sorry,Plunging Yields Expose Sorry,Plunging Yields Expose Sorry, Plunging Yields Expose Sorry,Plunging Yields Expose Sorry

Related Articles:

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.