Kiva Is Saving The World One Micro-Loan At A Time!

We envision a financially inclusive world where all people hold the power to improve their lives. Kiva Is Saving The World One Micro-Loan At A Time!

More than 1.7 billion people around the world are unbanked and can’t access the financial services they need. Kiva is an international nonprofit, founded in 2005 in San Francisco, with a mission to expand financial access to help underserved communities thrive.

Related:

Ultimate Resource For Charities And Organizations Accepting Bitcoin And Crypto-Currency Donations

Israel War Prompts Bitcoin Firms Including Fireblocks, MarketAcross To Start Aid Fund

Signal Encrypted Messenger Now Accepts Donations In Bitcoin

Unicef To Accept Donations In Bitcoin

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015

Melinda Gates Welcomes The Philanthropists Of The Future

By lending as little as $25 on Kiva, you can be part of the solution and make a real difference in someone’s life.

100% of every dollar you lend on Kiva goes to funding loans.

Hi Monty,

Thank you for joining Kiva, a powerful community creating opportunity for people around the globe.

On behalf of all of our borrowers, we would like to extend our personal thanks; your contribution is creating a world where all people have the power to pursue their dreams!

Here Are A Few Examples Of What Kiva Borrowers Have To Say About How Lenders Impact Their Lives:

“This loan helped me out so much. My clients expect their products on time, and this new sewing machine allows me to work so much faster.” – Judith, Colombia

“Before, I didn’t have a job, and it was difficult to pay my rent and feed myself. Then, I went to Kiva; they gave me money and I started a business. My life is different. My life is good.”

– Ann, Kenya

“People who never met me decided to fund so I could get a laptop loan. I’m very grateful for what they have done. They have changed my life.” -Jean Pierre, Rwanda

Visit Kiva and find more borrowers whose stories inspire you to lend a hand in making their dreams a reality.

What Makes Us Unique

It’s A Loan, Not A Donation

We believe lending alongside thousands of others is one of the most powerful and sustainable ways to create economic and social good. Lending on Kiva creates a partnership of mutual dignity and makes it easy to touch more lives with the same dollar. Fund a loan, get repaid, fund another.

You Choose Where To Make An Impact

Whether you lend to friends in your community, or people halfway around the world (and for many, it’s both), Kiva creates the opportunity to play a special part in someone else’s story. At Kiva, loans aren’t just about money—they’re a way to create connection and relationships.

Pushing The Boundaries Of A Loan

Kiva started as a pioneer in crowdfunding in 2005, and is constantly innovating to meet people’s diverse lending needs. Whether it’s reinventing microfinance with more flexible terms, supporting community-wide projects or lowering costs to borrowers, we are always testing and learning.

Lifting One, To Lift Many

When a Kiva loan enables someone to grow a business and create opportunity for themselves, it creates opportunities for others as well. That ripple effect can shape the future for a family or an entire community.

Join Our Community

We can’t wait to see the lives you’ll change through Kiva!

All The Best,

Kiva Team

Updated: 1-21-2022

A Mayor Makes The Case For Investing In Micro-Businesses

The smallest U.S. enterprises became more numerous during the pandemic. Oklahoma City Mayor David Holt says cities need to start paying attention.

An often-overlooked segment of the business community is getting some new attention from city leaders in the wake of the Covid-19 pandemic: micro-businesses.

Defined as organizations with 10 or fewer employees, there are now more than 20 million “micro-businesses” in the U.S., 3.4 million of which have been created since the onset of the pandemic, according to research compiled by GoDaddy Inc.

The number of operational U.S. micro-businesses increased significantly during the pandemic, as many people searched for new ways to engage with the economy. But cities have been slow to engage with and allocate resources toward micro-businesses, according to Oklahoma City Mayor David Holt. Either too small or too young to show up in government data, micro-businesses can sometimes be invisible to policymakers.

“The pandemic definitely elevated the concept of micro-businesses for mayors across the country,” said Holt at a panel discussion at the U.S. Conference of Mayors 90th Winter Meeting on Jan. 20. “Five years from now, this word, which may still seem new to a lot of us, is definitely going to be as much a part of the lexicon and policymaking as small businesses have been for the past half century.”

Micro-businesses typically need relatively small amounts of capital to get started. Through community outreach, Holt learned that a lot of micro-businesses, particularly those in Black and brown communities in Oklahoma City, were either unaware of or unable to receive small business loans through the Cares Act, the federal pandemic relief package passed in March 2020.

In May 2020, Oklahoma City started providing financial support for micro-businesses through the Oklahoma City Urban Renewal Authority. The program offers grants of up to $10,000 for businesses with five or fewer employees, including the owner.

Thus far, the city has issued over a dozen grants of $6,000 on average to micro-businesses around Oklahoma City, according to Holt. The city was one of several local governments to start grant programs targeted at micro-businesses.

In November, Oklahoma City also approved $15 million in funding for the creation of the Henrietta B. Foster Center for Northeast Small Business Development and Entrepreneurship to specifically provide support for minority small and disadvantaged businesses.

Research by GoDaddy, which was a sponsor of the panel discussion at the U.S. Conference of Mayors, has found that micro-businesses have three major needs: Access to capital, access to technical support and help with their marketing.

“Maybe there is room for another stratification that we as mayors and policymakers need to start thinking about,” said Holt. “There is clearly a huge difference between a business with three employees and one that has 75.”

Updated: 6-5-2022

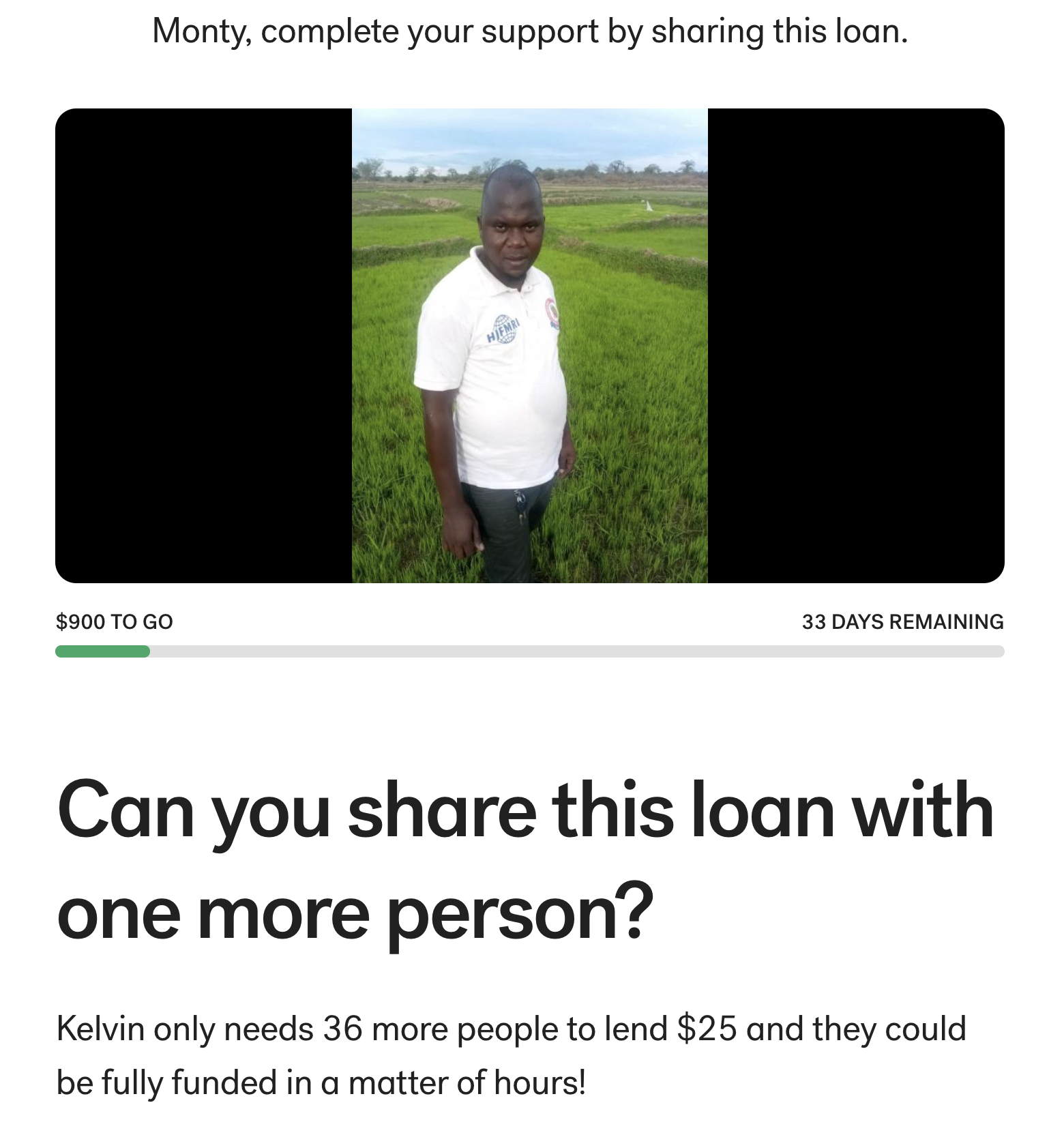

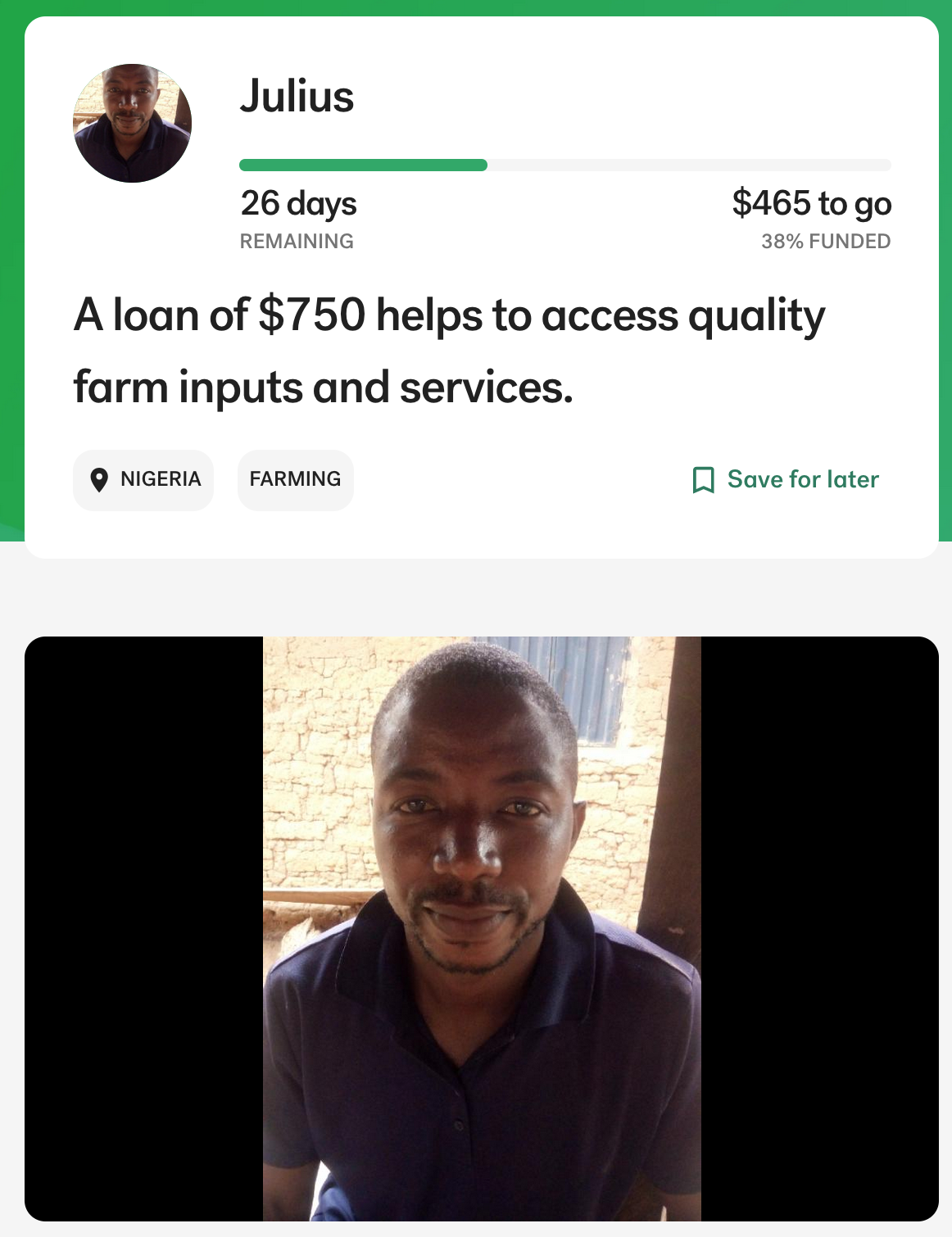

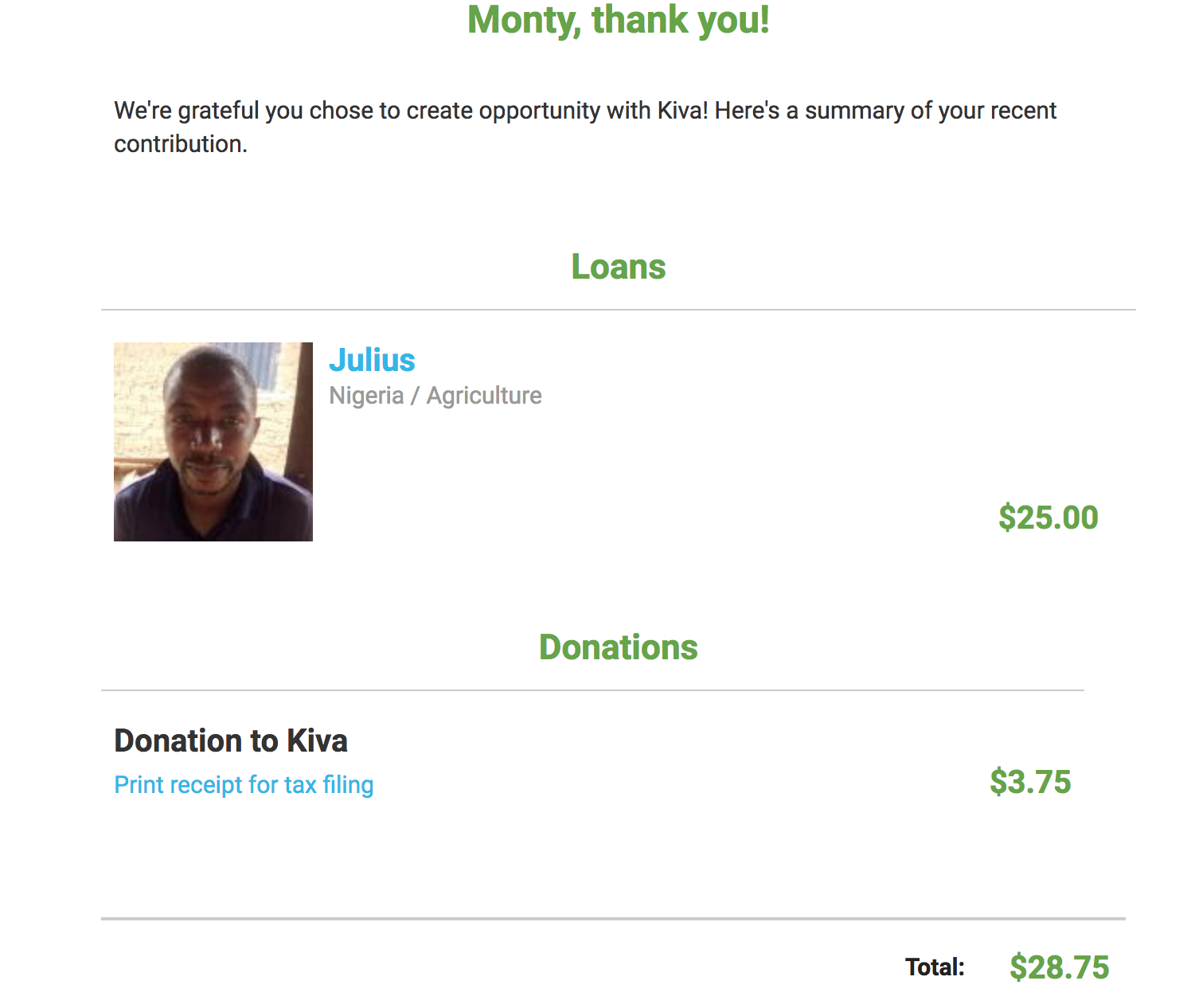

My Micro-Loan To Julius From Kenya Via Kiva

Julius’s Story

Julius, who appears in the photo, is a 32-year-old man who farms with his wife in a small village in Kaduna, Nigeria. Julius grew up in Katsina, Nigeria, and became interested in farming when he spent time with his grandfather during the holidays.

This motivated him to start farming as a career. He started his farm from scratch with no equipment and found Babban Gona shortly.

He has grown his farm by the training received by Babban Gona, carefully saving and re-investing his profit back into his farm.

He plants maize for commercial purposes and turns to Babban Gona for a loan to buy quality seeds, fertilizers and other essential inputs for his maize farming which will increase his yield and enhance his income.

Julius will use the profit he will gain from this harvest to add to his savings so he can expand his family and pay his children’s school fees. He hopes you will help by funding his loan.

This loan is special because it supports smallholder farmers and helps them increase yields.

More About This Loan

This loan is facilitated by our Field Partner, Babban Gona Farmers Organization.

Field Partners are local organizations working in communities to vet borrowers, provide services, and administer loans on the ground.

This loan is aimed at helping smallholder farmers. The farmers are divided into Trust Groups and deliver training and development services, inputs like seeds on credit and post-harvest marketing services.

This system increases farmers’ yields up to 4 times the national average.

In addition, Babban Gona markets its farmers’ produce to premium markets over the course of the year, ensuring that they receive the best price possible for their produce and have a steady flow of income year round.

Kiva loans are used to help Babban Gona expand its services to more rural areas in Northern Nigeria.

Babban Gona posts loans before the inputs are provided so there is a chance that farmers will change their input package after the loan is posted.

As a result, the loan amount may slightly change after you fund the loan, and any difference will be repaid to you when the first loan repayment is made.

By supporting this loan, you’re providing farmers with the opportunity to increase their yields.

Help Julius spread the word.

You can make change happen faster for Julius by getting the word out. Share their loan with others and have an even bigger impact.

Related Articles:

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.