Workers Strike Demanding Better Pay And Benefits While Corporations Use Excess Cash To Buy-Back Company Stock (#GotBitcoin?)

The strengthening economy and tight labor market are giving workers more confidence to demand employer concessions through strikes. Workers Strike Demanding Better Pay And Benefits While Corporations Use Excess Cash To Buy-Back Company Stock

In recent weeks, unionized hotel housekeepers in Chicago, distillery workers in Kentucky and crane operators in Seattle have all walked off the job to pressure employers for better pay and benefits.

Some 31,000 teachers in Los Angeles are threatening to strike, and union members at ArcelorMittal SA and U.S. Steel Corp. have given the authority to strike if negotiations break down.

With the national unemployment rate at 3.9% in August, just above an 18-year low, and skilled workers in scarce supply, union officials say they have more leverage at the bargaining table and that workers are more comfortable with the risks associated with striking.

Labor disputes have caused workers, excluding teachers, to miss 633,000 days on the job this year through August, up from 440,000 in all of last year, according to the Labor Department. Including the wave of teacher strikes in the spring, there were more than 2 million days missed, the highest level since 2006.

“They see the economy is growing, but their share of it is not,” said Thomas A. Kochan, a professor of industrial relations at MIT’s Sloan School of Management. The economy has shifted the bargaining power toward labor. “We have not seen that take place in years.”

Strikes and other labor-related work stoppages had declined for decades, as the share of workers belonging to unions fell. The number of major strikes involving more than 1,000 workers has dropped in recent decades. Labor disputes, which tend to rise during good economic times and fall during recessions, reached a record low in 2009.

Public-sector unions suffered a blow in June when the Supreme Court ruled that government employees can’t be compelled to pay union fees, which has cut into the coffers of the politically powerful unions.

“Now is the time to make sure we’re delivering,” said Christian Sweeney, deputy organizing director at the AFL-CIO. “If you’re not going to do it when there’s 4% unemployment, when is it going to happen?”

Wages have been growing at a fairly modest pace relative to the historically low unemployment rate. Nonsupervisory, private-sector workers’ average hourly earnings rose 2.8% in August from a year earlier, the Labor Department said. While that matches the best annual gain since 2009, it is well below the 4% rate of wage growth recorded in late 2000, when unemployment was last similarly low. And stronger inflation in the past year has eroded the spending power of the raises workers did receive.

Wage increases for factory workers have been slower than average. Hourly earnings for nonsupervisory workers in metal manufacturing, which includes steel mills, rose 1.1% in August from a year earlier.

A statewide teachers’ strike in West Virginia that started in February resulted in a 5% pay increase for teachers and changes to the state public employees’ insurance program, as well as increases for other state employees, more than state officials had previously offered.

Teachers who walked out over the next several months in Oklahoma, Kentucky, Arizona, Colorado and North Carolina won some pay increases and pension plan changes but not as much as unions had sought in many cases.

Earlier this month, the union representing crane operators in the Seattle area ended a 17-day strike after reaching a tentative agreement with a 17.8% increase in pay and benefits over three years. The union had rejected a 15% increase before it went on strike.

“In an era of general prosperity, when companies are generating greater profits, unions see the need to share that and are more willing to take direct action to get it,” said Gary Chaison, a professor emeritus of industrial relations at Clark University.

In Chicago, roughly 5,000 housekeepers and other workers at 26 hotels went on strike on Sept. 7, demanding increased health-care coverage for newer employees, among other things. Unite Here Local 1 has argued that hotels are making record profits and should grant better benefits.

“It was a good time to go on strike,” said Tina Graham, a 60-year-old housekeeper who has worked at the Palmer House, a Hilton Worldwide Holdings Inc. property, for 11 years and now earns $19.75 an hour.

She said the union wants year-round health-care coverage for workers typically laid off in the winter before being called back in the spring. The union also wants to cut the number of rooms workers like Ms. Graham need to clean per shift to 14 from 16 currently.

A Hilton spokeswoman said the company is committed to negotiating in good faith and values its employees.

Michael D’Angelo, vice president of labor relations at Hyatt Hotels Corp. , said his company, also a target of the Chicago strike, was disappointed that Unite Here chose to walk out when negotiations are ongoing. Mr. D’Angelo said the company offers workers competitive wages and good benefits, including health care and retirement contributions.

“Hyatt has a long history of strong labor relations,” he said.

A Marriott International Inc. spokesman said the company reached a contract agreement with the union on Thursday, but declined to provide specifics. The union said the agreement covers 1,200 workers.

In Michigan, highway construction projects across the state are stalled because the Michigan Infrastructure & Transportation Association, which represents contractors, has locked out heavy-equipment operators.

Mike Nystrom, a spokesman for the contractors association, said the operating engineers’ union has turned down a 14.4% increase in total compensation. “They self-authored a contract and have put in it everything they’ve ever hoped for and wanted,” Mr. Nystrom said.

Dan McKernan, a spokesman for Local 324 of the International Union of Operating Engineers, which represents more than 1,000 affected heavy-equipment operators, said the union wants individual contractors to agree not to hire nonunion subcontractors. He said the tight labor market has strengthened the union’s hand.

“In a different economy, these contractors would have gone right out to get people to fill these positions,” Mr. McKernan said. “They just don’t have that ability right now.”

Officials with the United Steelworkers say steel giants ArcelorMittal and U.S. Steel are asking for concessions rather than sharing profits, which have been helped by tariffs on foreign metals.

Speaking of Trade Tariffs..

President Donald Trump’s waves of new tariffs on China now apply to over $250 billion of Chinese goods, roughly half the amount the country sells to the United States.

The latest round affects thousands of products bought by US consumers, including hundreds of millions of dollars of furniture and electronics imports. The US tariffs imposed earlier in the year mostly hit industrial goods.

Meanwhile,

Contracts for both companies expired Sept. 1. Both companies are asking workers to pay more for health care.

U.S. Steel said its offer contains significant wage increases and choice between quality benefits plans and that the two sides are continuing to work toward “a mutually agreeable conclusion.”

ArcelorMittal reported health-care costs per employee are up 78% since 2008, and the company said it is working to reach an agreement with the union.

In Lawrenceburg, Ky., 53 workers at a Four Roses bourbon distillery and bottling plant have been on strike since Sept. 7. Jeffrey Royalty, a distillery worker and president of United Food and Commercial Workers Local 10D, said the sticking point is proposed changes to paid sick-day plans for new hires.

“A claim that we are proposing a ‘two-tier’ sick leave policy that discriminates against new hires is not true,” the company said.

The union says the plan for new hires is inferior and is in fact a “two-tier” proposal. “I’m just a country gentleman, but I don’t need a dictionary to tell me that,” said Mr. Royalty.

Share Buybacks Help Lift Corporate Earnings

Tax cut-fueled repurchases are boosting per-share profits from Apple to Union Pacific and lifting the stock market to new heights.

Last December’s tax overhaul is boosting corporate profits in more ways than one.

The legislation lowered companies’ tax bills, improving their earnings. But the change has also helped them fund record stock buybacks—a move that makes their results appear even better, by boosting the per-share earnings they highlight for investors.

S&P 500 companies bought back a record $189 billion of their own shares in the first quarter, and a similar number—if not more—is expected for the second quarter, according to S&P Dow Jones Indices. By contrast, S&P 500 buybacks totaled no more than $137 billion in any of the six quarters before the tax overhaul.

Stock buybacks make profits appear better by boosting per-share earnings, a metric investors frequently use to justify a company’s stock price. Buybacks reduce a company’s share count, spreading the profits across fewer shares. As a result, companies can report a bigger percentage increase in per-share earnings than the profit results alone may show.

Among the more aggressive companies in buying back stock, Apple Inc. repurchased 112.8 million shares in the quarter that ended in June, contributing 5 cents to its earnings of $2.34 a share. Union Pacific Corp. repurchased about 4% of its shares in the second quarter, helping earnings per share climb substantially faster than net income. Thanks to buybacks, Southwest Airlines Co.’s quarterly per-share earnings rose even though its profit fell from a year earlier.

For the S&P 500, per-share earnings in the second quarter rose about 25% from a year ago—a full 2 percentage points faster than net income, according to data from Thomson Reuters. “It would be fair to assume it is all from buybacks,” said David Aurelio, senior research analyst at Thomson Reuters.

The higher per-share earnings have helped lead investors to pay more for stocks. The S&P 500 index is trading at record highs after gaining about 10% this year.

“Investors need to realize what they’re paying a premium for,” said Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

In all, dozens of large companies bought back 4% or more of their shares outstanding in the 12 months ended in June, according to data from S&P Dow Jones Indices. The resulting boosts to earnings might seem small in any given quarter, but they add up—Apple’s buybacks also added 8 cents a share in the March quarter, for instance. And companies also have started big new buyback programs, suggesting earnings-per-share increases will continue.

The buybacks aren’t necessarily done for the express purpose of increasing per-share earnings. Many companies say they want to return excess capital to shareholders. Others intend to offset new shares issued to employees as compensation.

The per-share earnings increases generated by stock buybacks are low quality, inflating results without underlying substance, said Gregory Milano, chief executive of Fortuna Advisors, a financial consulting firm that has examined buyback trends. “It has less value.”

Companies play down the buyback effect. They say their earnings are strong even without buybacks, and that while the buybacks add to per-share earnings, the effect is clear to investors and baked into the analyst earnings estimates that drive stock prices.

Apple pointed to its past statements that its earnings growth is accelerating and that tax overhaul “enables us to deploy our global cash more efficiently,” leading it to put forward plans to create 20,000 U.S. jobs and invest $350 billion in U.S. operations over the next five years.

Union Pacific’s buybacks contributed 9 cents to its second-quarter per-share earnings, helping that metric to climb 37%, while net income rose 29% from a year ago. The railroad’s finance chief, Robert Knight, said the buybacks “represent the return of excess cash to our shareholders and are consistent with guidance we provided to the financial-analyst community.”

Southwest Airlines’ second-quarter net income excluding items declined 2.1% from a year ago. On a per-share basis, however, it rose 2.4%, in part because the company has repurchased 28.3 million shares in the past year. Southwest said its per-share earnings growth “has been driven primarily by the strong financial performance of our robust network.”

As the economic cycle grinds on, Mr. Milano said, companies may find it harder to show earnings growth even as they face increased pressure from shareholders to do so–“and so buybacks start to look more attractive.”

The buyback effect adds to the earnings boost companies are already seeing because the U.S. cut its corporate tax rate to 21% from 35%. Union Pacific’s second-quarter effective rate, for example, declined to 22.1% from 37.5% a year ago, before the tax overhaul. At some companies, the tax cut has accounted for half or more of reported profits.

The benefits to per-share earnings from buybacks can help a company’s result compare more favorably to Wall Street forecasts.

In each of the past two quarters, big buybacks by Cisco Systems Inc. increased its adjusted per-share earnings by 2 cents. Each time, the networking giant’s total results surpassed analysts’ consensus expectations by a penny.

Cisco said its buybacks are incorporated into the earnings per share guidance it provides to analysts. “This is not a quality of earnings issue, and it is inaccurate to state that we would have otherwise ’missed’ EPS targets,” a company representative said.

Experts say when companies do guide analysts on their buyback plans, the effect on estimates is imprecise. For instance, buybacks earlier in a quarter make a bigger difference in per-share earnings, because such results are calculated using average shares outstanding. Companies, though, don’t typically forecast the timing of buybacks.

In the first quarter, just after the tax overhaul, a record 78% of S&P 500 companies reported earnings above analysts’ expectations, according to FactSet. The second quarter then beat that record, with 80%.

Updated: 12-27-2019

Rank-and-File Workers Get Bigger Raises

Short supply of labor, minimum-wage rises and increased poaching have helped lift wages for lower-income workers.

Wages for rank-and-file workers are rising at the quickest pace in more than a decade, even faster than for bosses, a sign that the labor market has tightened sufficiently to convey bigger increases to lower-paid employees.

Gains for those workers have accelerated much of this year, a time when the unemployment rate fell to a half-century low. A short supply of workers, increased poaching and minimum-wage increases have helped those nearer to the bottom of the pay scale.

Pay for the bottom 25% of wage earners rose 4.5% in November from a year earlier, according to the Federal Reserve Bank of Atlanta. Wages for the top 25% of earners rose 2.9%. Similarly, the Atlanta Fed found wages for low-skilled workers have accelerated since early 2018, and last month matched the pace of high-skill workers for the first time since 2010.

“A strong labor market makes the bargaining power of lower-paid workers more like the labor market higher-wage workers experience during good times and bad,” Nick Bunker, economist with job search site Indeed.com, said.

Labor Department data paint a similar picture. Average hourly earnings for production and nonsupervisory workers in the private sector were up 3.7% in November from a year earlier—stronger than the 3.1% advance for all employees—implying managers and other nonproduction workers saw a 1.6% wage increase in the past year. The department doesn’t produce separate management pay figures.

Nonsupervisory workers earned an average of $23.83 an hour in November according to the Labor Department; managers earned about twice that rate.

Mooyah Burgers, Fries & Shakes, a restaurant chain based in Plano, Texas, with 75 U.S. locations, is among the places that has lifted starting wages to fill positions.

“The effective labor pool is smaller than what it has been in the past,” said Tony Darden, Mooyah’s president. “As you look to bring on folks, ultimately higher wages are used to attract them.”

Mooyah is competing for workers with other restaurants, grocery stores, and service providers such as salons. He said the company increased wages 8% in 2019, with much of that flowing to entry-level workers. As a result managers, such as shift supervisors, are seeing less of a premium over their subordinates, Mr. Darden added.

Low-skilled workers are typically the easiest to replace, and thus struggle to command higher wages at most points in the economic cycle. When workers are in short supply, they can benefit more because there may be dozens of nearby opportunities offering slightly more money.

“There’s been more job hopping and firms are having a hard time finding employees,” said Michael Horrigan, president of the W.E. Upjohn Institute for Employment Research. He was previously associate commissioner with the Bureau of Labor Statistics.

While hourly pay for nonmanagers is growing, average hours worked a week have declined this year. Employers may offer higher wages to attract workers but keep hours in check to control labor costs, Mr. Horrigan said.

The labor market for skilled workers is always tighter, but it hasn’t improved as substantially in recent years. The unemployment rate for high school dropouts fell to 5.3% last month from 7.8% three years earlier. The rate for college grads is down to 2% from 2.4% in November 2016, and is slightly elevated relative to the late 1990s and early 2000s.

Higher-paid workers are more likely to have access to perks, including retirement contributions, vacation leave and subsidized child care—benefits in addition to pay that can keep workers from changing jobs. Many lower-paying jobs at retailers and restaurants don’t offer such perks, and workers may jump between those jobs for a few quarters an hour.

Managerial pay appeared to be held back by smaller production bonuses—such as continuing incentives to reach sales targets or deliver on output goals at a factory—said Bank of America economist Alex Lin. The wage figure excluded most benefits and one-time bonuses and stock options.

“Management pay is more sensitive to microcycles in the economy,” he said. “Other workers are more tied to the labor market, which has remained healthy.”

Share Your Thoughts

Have your wages changed in the last year? How so? Join the conversation below.

Another factor supporting the lowest-paid workers is a wave of minimum-wage increases. Twenty-nine states have increased minimum wages above the federal level, and 21 of those will lift the level again in 2020. For example, the minimum wage will increase 12.5% in Washington state, to $13.50 an hour.

“When I heard about that extra $1.50 an hour, I was excited,” said Brian Hoorn of Bellingham, Wash., who earns the minimum wage at Ross Dress for Less. The 28-year-old runs the cash register, aids in fitting rooms and arranges merchandise. He received several pay raises at retail jobs in recent years as the minimum wage rose.

Pay is also increasing for low-skilled work in states such as Georgia, where the minimum wage remains at the federal level of $7.25 an hour.

Eric Watson, owner of an Express Employment Professionals office in Atlanta, said he has advised clients to offer higher wages for warehouse and entry-level manufacturing jobs. The going rate for a warehouse worker in Atlanta is close to $15 an hour, up from $12 two years ago, he said. Some clients raised pay twice in the past year.

“They realize they’re losing their talent to their neighbors,” Mr. Watson said. “Another company will call and offer the worker 50 cents more an hour—and they’ll leave immediately.”

Updated: 3-9-2020

Stock-Buyback Plans Shrink (Once A Pillar Of Support For Stocks)

The new coronavirus may threaten companies’ buyback plans—though a down market could also create a buying opportunity

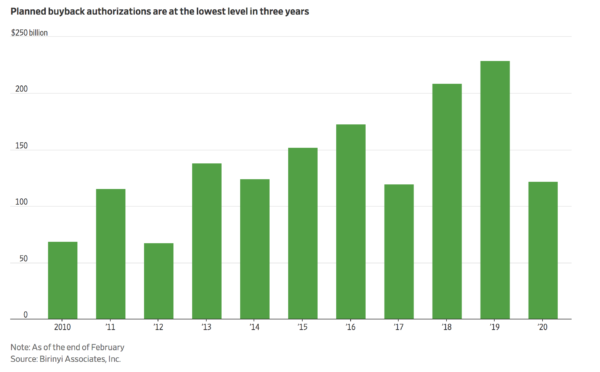

Planned buyback authorizations are at the lowest level in three years

U.S. corporations are signaling a reduced appetite for stock buybacks this year, undermining a pillar of support for stocks at a time of heightened volatility.

Companies authorized around $122 billion in future buybacks through February, according to data compiled by equity research firm Birinyi Associates, marking a nearly 50% drop from the same period a year ago and representing the slowest pace in three years. Meanwhile, S&P Dow Jones Indices projects that the total amount of buybacks in the final three months of 2019 was down 18% compared with a year earlier, totaling around $183 billion.

Companies repurchased around $730 billion of their own stock during 2019—one of the biggest sources of money flowing into the stock market. Analysts are still projecting around $800 billion in buybacks this year, according to S&P Dow Jones Indices, but that figure may be threatened by the uncertainty surrounding the new coronavirus’s effect on the global economy.

Stock buybacks reduce a company’s shares outstanding, which boosts its earnings per share, though not its overall profit. Companies enjoy the flexibility of buyback programs, which can be adjusted easily, whereas dividend payments—another common way for companies to return value to shareholders—are typically expected to be regular and, often, to rise over time.

After a 2018 corporate-tax change prompted two record-setting years for stock buybacks, investors are watching to see how companies are managing excess cash in a time of market volatility.

As the new coronavirus disrupts global supply chains and inspires concerns among consumers, companies are monitoring inventory and earnings pressure. Those forces may push them to be more protective of their cash in the near term, says Matt Miskin, co-chief investment officer of John Hancock Investments.

“It’s all about fortifying the balance sheet,” said Miskin. “The thought that the equity markets are going to be challenged hampers the buyback decision that corporate executives once came to more easily.”

A down market could also present a buying opportunity if a company’s stock has fallen along with broader indexes. The recent correction in equities provides an opportunity for companies to pick up more of their stock at lower prices.

Some companies are looking to do just that, cheering investors. AT&T shares jumped Tuesday after the company announced an additional $4 billion stock buyback program beginning in the second quarter. Hilton Worldwide Holding, which has bought $4.3 billion of its own stock since March 2017, authorized an additional $2 billion in buybacks on Tuesday after the market closed, rallying shares on Wednesday.

Many blue-chip names still have significant buyback runway from previous authorizations. Apple Inc. has $58 billion of stock still to purchase as of the end of last year, the largest amount outstanding, according to data from Birinyi. Union Pacific has $24 billion remaining, while Intel Corp has $23 billion.

So far this year, the biggest buyers of their own stocks are underperforming. The Invesco BuyBack Achievers ETF is down 16%, compared with an 8% drop in the S&P 500 during that same period. The SPDR S&P 500 Buyback ETF is down 15%.

“Usually the companies that do buybacks are mature companies, so they should not underperform on a correction,” said Vincent Deluard, director of global macro strategy at INTL FCStone. “If the market thinks a buyback is negative, why would you do it?”

Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,Workers Strike Demanding Better,

Related Articles:

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Go back

Leave a Reply

You must be logged in to post a comment.