Ultimate Resource On Bitcoin Whales (#GotBitcoin)

BTC Dump: Pure Whale Manipulation. BTC Dump: Pure Whale Manipulation, Makes $15 MILLION! (#GotBitcoin)

Following the recent decline in the Bitcoin price which has seen BTC go back below $8,000, questions have been asked about the manipulation of prices by whales. A recent whale move to Coinbase has led to speculations in the community.

The whale move in question occurred yesterday, with the whale moving 25,000 BTC ($213 million at the time of the first transfer) from an unknown wallet to Coinbase. The move coincided with a market dump that saw the price of Bitcoin drop dramatically.

Bitcoin saw a 9.21% decline in price over a 4 hour period, during the same time, the 25,000 BTC whale managed to dump their BTC on Coinbase.

What’s notable about the outgoing amounts is that they equal the 25,160 BTC incoming transaction. What is also worth noting is that the original transaction was valued at $213.36 million, and the outgoing transactions totalling the same amount of BTC, were estimated at roughly $200 million. Essentially the whale sold the top and immediately bought back the dump, netting a profit of $10 – $15 million in the process. There is also a $10 million USDT move shortly after the BTC outgoing whale moves, which could be the whale moving profits out of Coinbase.

The BTC Dump Today Was Completely Manufactured:

-

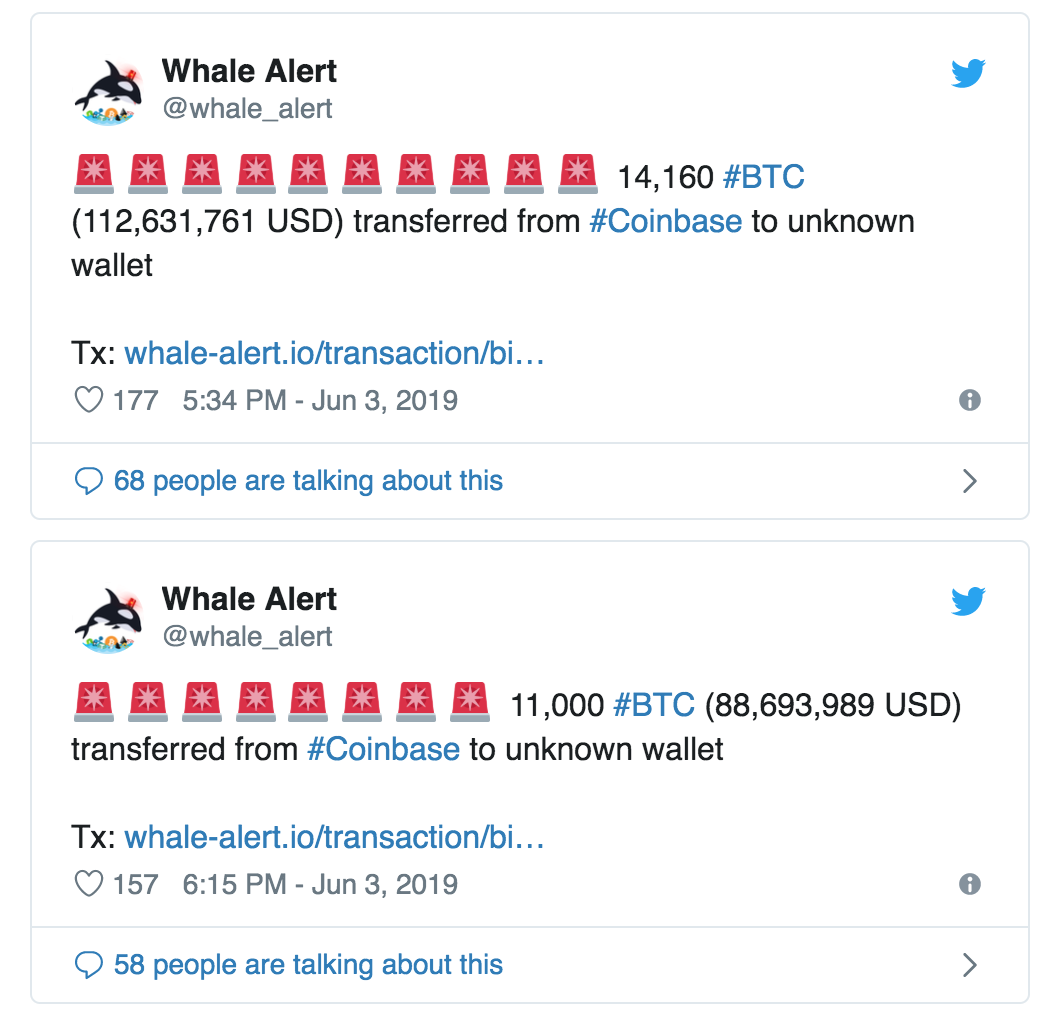

About 20-30 mins before the dump, a whale moved 25k BTC (worth $215M) to Coinbase: link

-

About an hour after the dump, a whale moved 14k BTC (worth $112M) from Coinbase to another wallet: link

-

40 mins after that, a whale moved 11k BTC (worth $88M) from Coinbase to another wallet: link

-

15 mins after that, a whale moved 10M USDT from one wallet to another: link

If you do a little math and follow the timeline, it’s not hard to see that someone dumped 25k BTC for $215M and bought it back shortly after for $200M. In doing so, they pocketed $15M and walked away with the same amount of BTC as they started with.

Fuckers.

Edit: For all those saying that no one was complaining when a whale entering the market drove the price us. No shit, all boats rise in that situation. In the one we’re talking about here, only one group of people benefit whereas the vast majority are negatively impacted. That’s the difference.

Updated: 4-30-2020

Bitcoin Whale Addresses Hit Highest Number Since August 2019

Large crypto investors, popularly known as “whales,” seem to be accumulating bitcoin amid the ongoing price rally.

The seven-day moving average of the number of addresses holding 10,000 bitcoins or more rose to 111 on Wednesday, the highest level since Aug. 2, 2019, according to blockchain intelligence firm Glassnode. That number has risen by more than 11% since early March.

“The increase in the number of BTC addresses with more than 10,000 BTC is likely the result of long-term holders coming back online to expand their holdings,” said Matthew Dibb, co-founder of Stack, a provider of cryptocurrency trackers and index funds.

Increased interest from long-term holders and large investors could be associated with the bullish narrative surrounding the macro factors and the upcoming reward halving.

“Some of these addresses may belong to high-net-worth individuals or groups, who are diversifying into bitcoin amid the ongoing coronavirus pandemic and ahead of the mining reward halving, due in the next two weeks,” said Wayne Chen, CEO of Interlapse Technologies and founder of Coincurve, a cryptocurrency purchasing, and spending platform.

Bitcoin’s supply is capped at 21 million and its monetary policy is pre-programmed to cut the pace of supply expansion by 50 percent every four years.

Hence, many advocates tout bitcoin as a safe haven asset and an inflation-hedge like gold. They claim the economic destruction caused by the coronavirus pandemic and the unprecedented money printing exercises undertaken by the global central banks and governments to bode well for bitcoin’s price.

“Amid the deteriorating economic outlook for the U.S. economy and the likelihood of an ever-increasing monetary supply, which weakens the U.S. dollar and stokes inflation fears, we believe bitcoin could easily test previous highs above $19,000 as investors look for safe havens away from traditional assets,” said, Simon Peters, analyst and crypto asset expert at global investment platform eToro.

Such bullish predictions have been doing the rounds for more than six weeks now and could have enticed large investors to add bitcoins to their portfolio.

Further, expectations that the mining reward halving, due on May 12, would put bitcoin on a long-term bullish trend could be the reason for the rise in the number of so-called “whale addresses.”

Bitcoin undergoes a process called mining reward halving every four years, which controls inflation by reducing mining rewards by 50%. Following the May 2020 halving, the reward per block mined will drop from 12.5 BTC to 6.25 BTC.

Many investors anticipate the cryptocurrency’s price would go up after halving, as the asset would become more scarce to satisfy the demand. Reinforcing this belief is the historical data, which shows bitcoin experienced solid bull runs in the year following previous halvings.

“At the first halving in November 2012, the price went from $11 to over $1100 a coin a year later. Then after the second halving in July 2016, bitcoin went from $600 to over $20,000 by the end of 2017,” said George McDonaugh, managing director and co-founder of publicly listed cryptocurrency and blockchain investment firm KR1 plc.

However, reward halving also means a 50% reduction in miners’ revenue. So, if the price fails to rally sharply post-halving, small and inefficient miners may shut down operations and offload their holdings to cover costs, leading to a price drop.

Bullish Narrative Reinforced

Bitcoin was trading near $8,900 at press time, a 130% gain from the low of $3,867 reached on March 13, according to CoinDesk’s Bitcoin Price Index.

Bitcoin is now reporting a bigger year-to-date gain compared to gold. While the cryptocurrency is up 21%, the yellow metal has seen a 12% increase.

The year-to-date performance may reinforce the narrative that bitcoin is a hedge against global economic malaise, fiscal and monetary indiscipline and could continue to draw demand from both small and large investors.

“The year-to-date performance indicates that investors’ awareness of the digital asset has increased and its role as a potential diversification vehicle for traditional portfolios has been underscored by its strong recovery from its recent lows, relative to more traditional markets. We expect this strength to persist as Bitcoin continues to take pole position in the race,” said Stack’s Dibb.

Not A Perfect Indicator

The rise in the number of unique addresses holding more than 10,000 bitcoins does not necessarily mean an influx of new whales into the market. After all, a single investor can hold multiple addresses.

Further, cryptocurrency exchanges tend to hold large balances. For instance, two of the top five addresses on the rich list (a table of the addresses holding the most bitcoins), published by bitinfocharts.com, belong to prominent exchanges Huobi and Bitfinex.

“Some of these addresses are owned by top exchanges which usually hold large reserves in their cold wallet. So this doesn’t necessarily signal a clear behavior for market activity,” said Coincurve’s Chen.

Updated: 12-28-2020

Whale Sightings Become Scarce, Removing Downward Pressure On Bitcoin: Analyst

A lack of whales with bitcoin (BTC) aplenty to sell may be clearing the way for the price of the leading cryptocurrency to rise further, according to CryptoQuant Chief Executive Ki Young Ju.

$BTC whales seem exhausted to sell. Fewer whales are depositing to exchanges.

I think this bull-run will continue as institutional investors keep buying and Exchange Whale Ratio keeps below 85%.

Chart ???? https://t.co/TLWRvP7pyZ pic.twitter.com/goUmowVv2e

— Ki Young Ju 주기영 (@ki_young_ju) December 28, 2020

* Fewer “whales” – bitcoin holders possessing large balances – are depositing bitcoin (BTC) onto exchanges the past few days, according to CryptoQuant, a crypto market data aggregator.

* CryptoQuant’s “Exchange Whale Ratio,” which is calculated by dividing top 10 bitcoin inflow transactions in an hour by total BTC exchange inflows, has dropped below 85%.

* From Dec. 8-22, the ratio stayed above 85% as whales were likely profit-taking during the bull run, which reached a price zenith of $28,352 Sunday according to CoinDesk 20 data.

* Some market exhaustion is expected, according to Young Ju, but he expects institutions to pick up some of the slack.

* “I think this bull run will continue as institutional investors keep buying and Exchange Whale Ratio keeps below 85%,” Young Ju noted on Twitter.

Bitcoin Whales Are Buying More Aggressively Since Christmas, Data Finds

High-net-worth investors, or whales, have been buying Bitcoin more aggressively since Christmas, on-chain data show.

Bitcoin (BTC) whales have been buying more since Christmas, on-chain data shows. This indicates that high-net-worth investors are continuing to eat up the supply of BTC.

It is nearly impossible to segregate institutional investors from individual investors through on-chain data. However, the trend shows that investors with large capital are increasingly entering into the Bitcoin market despite its rally.

Why Are Whales Continuing To Buy More Bitcoin?

According to the analysts at Santiment, around $647 million worth of Bitcoin likely transferred from small addresses to large addresses.

Addresses holding over 1,000 BTC or more are considered whales by many analysts, as 1,000 BTC is equivalent to over $27 million at the current price at $27,100. The analysts wrote:

“Over the last 48 hours since Christmas, #Bitcoin addresses with 1,000 or more $BTC now own 0.13% more of the supply that smaller addresses did previously. This is about 24,158 tokens, which translates to $647.7M at the time of this writing.”

Bitcoin has increased nearly threefold since mid-2020, and the upside for BTC is arguably limited in the near future.

Still, most on-chain data points show that fewer whales are selling across major exchanges. Ki Young Ju, CEO at CryptoQuant, said:

“BTC whales seem exhausted to sell. Fewer whales are depositing to exchanges. I think this bull-run will continue as institutional investors keep buying and Exchange Whale Ratio keeps below 85%.”

There are two main reasons why whales might be accumulating Bitcoin at the current price range.

First, in spite of Bitcoin’s overextended rally, whales might believe that the psychological barrier at $30,000 will break. If so, options data suggests $36,000 could be a likely target in the near term.

Second, there is no solid reason to anticipate a major correction coming, apart from the CME gap and the high futures market funding rate.

But if Bitcoin consolidates after each rally, as seen in the past two days, then the funding rate would likely normalize. When that happens, the derivatives market would be less overheated, raising the probability of a new rally.

A pseudonymous trader known as “Byzantine General” said that the market is currently giving conflicting signals. Both long and short contract holders are being aggressive, which makes both a long and short squeeze possible. He said:

“Such conflicting signals rn. Both longs & shorts are being overly aggressive lol. I should probably sit on my hands.”

The Likely Near-Term Scenario Is More Consolidation

Typically, the price of Bitcoin on Coinbase is higher than Binance and other Tether-reliant exchanges. However, in the past week, Bitcoin has been trading slightly lower on Coinbase, by around $20 to $30.

Although the gap is small, it shows that the U.S., which drove Bitcoin’s rally throughout December, might be seeing slowing buyer demand. But the Asian market and the derivatives market are seeing an increase in buyer demand.

Considering that the demand for Bitcoin in the U.S. spot market appears to be cooling down, Bitcoin could consolidate for longer with lower volatility.

Number Of People Holding Lots Of Bitcoin Surges In Rare ‘Whale-Spawning Season’Large investors continue to accumulate bitcoin, possibly putting upward pressure on the cryptocurrency’s price.The number of whale entities – clusters of crypto wallet addresses held by a single network participant holding at least 1,000 bitcoin – rose to a new record high of 1,994 on Wednesday. The previous peak of 1,969 reached in 2016 was surpassed on Dec. 18, according to data source Glassnode.The metric has increased by over 16% this year and 7.3% this quarter alone. Bitcoin’s price has rallied by over 300% in 2020 and 160% in the October-December period. At press time, the leading cryptocurrency is changing hands at over $28,800 per bitcoin, after reaching an all-time high of $29,280 on Wednesday, as per CoinDesk 20 data.“We have just entered a rare whale-spawning season, with ultra-high net worth and institutions recognizing the last call to build significant stores of bitcoin,” Jehan Chu, co-founder and managing partner at Hong Kong-based trading firm Kenetic Capital, told CoinDesk. “The final land grab has started, and by this time next year accumulating [over] 1,000 bitcoin will be nearly impossible for most people.”The steep rise in the whale entity population validates the popular narrative that increased participation by large investors has fueled bitcoin’s recent rally.According to Sumit Gupta, CEO and co-founder of CoinDCX, the data shows the cryptocurrency is going through a shift from being a speculative asset to a macro investment asset, and that switch is mainly being driven by the increasing acceptance from global institutions as well as investors from around the world.JPMorgan analysts say the recent bitcoin purchases by insurance firm MassMutual indicate growing mainstream adoption and could have a bearing on gold in the long run.Updated: 1-8-2021Bitcoin Price Volatility Spikes As BTC Whales Sell Each New HighData suggest Bitcoin’s price drops at each new all-time high are the result of “mega whales” selling into liquidity.Bitcoin price has re-established the $40,000 level as support but as bull push toward a new all-time high the possibility of another sharp sell-off looms.According to analysts at Material Indicators, a crypto analytics company, mega-whales sold off steeply when Bitcoin hit $40,000 on Jan. 7. This led to a quick 10% drop to the $36,000 area over the next few hours.The dip was quickly bought up, eventually pushing the price above $41,000 in the next 12 hours. However, BTC saw another large drop after setting another all-time high at $42,000, and at the time of writing the top-ranked digital asset is trading at $40,800. According to Material Indicators:“So, it looks like mega-whales started selling after that dump at around 2am UTC, and continued selling on the spikes. My guess is they expected more downside. They did not really participate in the rally back up to 42k, which would further support that point.”

In the most recent pullback from $42,000 to $40,000, Fred explained that smaller whales, who hold $100,000 to $1 million, began to take profit. He noted:

“However, now, they have started buying again. Presumably to break the 42k resistance. Only this time, it seems to be the normal whales ($100k – $1M class) who started taking profit.”

Considering that at times during the last week Bitcoin price has traded higher on Coinbase, it is clear that there is large buyer demand coming from the U.S.

This suggests that there is a battle between normal whales taking profit and new buyers in the U.S. market. The sharp rejections from each new all-time high also signals that whales may be aggressively taking profit as soon as Bitcoin hits a new record high

As such, it is important that the demand for Bitcoin from the U.S. is sustained in the near term. Otherwise, the high level of selling pressure from whales could cause BTC to see a correction in the foreseeable future.

Where could Bitcoin go from here?

Bitcoin currently has extremely strong technical momentum that continues to drive the price higher. For this reason, traders are reluctant to short it, but some have started to take profits.

In the short term, one concern for Bitcoin is the potential recovery of the U.S. dollar. A pseudonymous trader known as “Cantering Clark” pinpointed the rebound of the U.S. dollar and the decline of precious metals. He said:

“So the question is, with the $DXY finding a floor surprisingly, and metals responding by getting nuked, does $BTC hold well?”

The U.S. dollar index (DXY) is hovering at a support level on the monthly chart. Alternative stores of value, like Bitcoin and gold, are priced against the dollar. Hence, if the dollar begins to move upward, the risk of a BTC correction could intensify.

Updated: 1-20-2021

Bitcoin Whales Are Betting $40K Isn’t The Top As Data Hints Bull Run Is Only Beginning

Volatility is the latest indicator to call the start, not the end, of a bull market cycle as 1,000+ BTC wallet numbers spike to new highs.

Bitcoin (BTC) whales clearly expect massive price rises in future as the number of wallets containing over 1,000 BTC ($35 million) hits an all-time high.

Data from on-chain analytics resource Glassnode confirms that as of Jan. 20, there were in excess of 2,400 large-balance wallets.

Whale Wallets Hit Record Highs

In 2021 alone, 164 new 1,000+ BTC entities were created, together controlling around $6 billion. While these may not all denote whales increasing their positions, the numbers feed into an existing narrative of wealth transfer which has characterized Bitcoin’s latest bull run.

As Cointelegraph reported, the 1,000+ BTC wallet category was the only one to increase in recent times, with smaller wallet holder numbers conversely dropping.

While some appealed to hodlers not to sell out to whales, others argue that these newly-minted big players will aggressively protect the value of their investment.

“Large inflows to whale wallets were happening at $29,314. They will be protecting their btc… This should be strong support for bitcoin in the short term, and hopefully long term,” monitoring resource whalemap summarized on Twitter this week.

Bitcoin remains at a crossroads in terms of spot market price action, trading in a corridor between $30,000 and $40,000 throughout the week. At the same time, institutional giant Grayscale unveiled its largest-ever one-day BTC buy-in, which totalled over 16,000 BTC worth around $700 million.

“Strong Part” Of Bull Market Yet To Start

Looking ahead, however, and indicators continue to reveal extreme bullish upside potential for BTC/USD.

After Bitcoin’s thermocap pointed to the price being in the early stages of a bubble setup, volatility now suggests that the market is just getting going on its gains. A reference point, macro investor Dan Tapeiro suggests, seems to be early 2017 — the start of almost a year of uptrend.

“Phenomenal chart. Strong part of the #bitcoin upmove has not started yet. Chart suggests we are in Q117 equivalent time period,” he commented uploading a combined graphic of Bitcoin 90-day volatilty relative to S&P 500 260-day volatility.

“Volatility measurement spikes at end of moves… now still near the lows. Hard to think #btc could 5-8x from here in 2021. Best to just #HODL.”

Updated: 2-24-2021

Bitcoin Whale From 2010 Moves 100 BTC For First Time In 11 Years

Blockchain analysts have identified 100 BTC mined in June 2010 that were moved for the first time today.

A veteran miner has cracked open their 2010 stash of Bitcoin, with crypto analysts spotting 100 BTC being transferred from two wallets that had laid dormant for more than a decade.

Prior to today’s transaction, the addresses had not seen any activity since receiving a 50 BTC Coinbase reward each nearly 11 years ago, except for two incoming transactions worth just 0.00000547 BTC each that were sent to the wallets in the last six months.

The Feb. 25 transaction combined the two mining address outputs, indicating both addresses belong to the same owner. The two blocks were mined only a couple of hours apart on Jun. 10, 2010.

Bitcoin is currently trading for $49,800, giving the coins a combined value of nearly $5 million. With BTC trading for $0.08 when the coins were mined, the whale’s holdings have increased in value by 622,500 times.

Some old coins moved today (100 BTC from June 2010).

It’s very rare to see pre-GPU era bitcoins move, it only happened dozens of times in the past few years.

And no, it’s probably not Satoshi. pic.twitter.com/0jZXnmWUes

— Antoine Le Calvez (@khannib) February 24, 2021

About half of the coins were moved to a wallet belonging to German peer-to-peer exchange Bitcoin.de, which has been in operation since 2011. For now, the remaining coins are sitting in a newly created legacy address.

Forked altcoins such as Bitcoin Cash (BCH) and Bitcoin SV (BSV) have not yet been peeled from the BTC.

The coins, mined in blocks 60365 and 60385, are unlikely to belong to Satoshi Nakamoto, who is suggested to have mined at least 1.1 million BTC.

The movement of 2010 era coins is an uncommon occurrence, with researchers identifying just 18 transactions involving BTC with inputs from July 2010 or before in 2021 so far.

In May 2020, 50 Bitcoin moved from a 2009 mining address, triggering excited speculation the BTC may have belonged to Satoshi.

Updated: 3-9-2021

Bitcoin Whales ‘Bought The Dip’ As Orders For $100K Or More Hit All-Time Highs

There’s no shortage of demand for Bitcoin, even at $50,000, as big buyers dwarf smallholders in the latest stage of the bull run.

Bitcoin (BTC) whales and institutions alike have made the most of the recent BTC price “dip” by buying big, data suggests.

In an update on March 9, on-chain analytics service Material Indicators noted that buy orders of $100,000 and higher on Binance — the biggest cryptocurrency exchange by volume worldwide — are reaching all-time highs.

Big Bitcoin Buyers Don’t Hesitate

In stark contrast to orders worth less than $100,000, larger buys are more frequent than ever before in Bitcoin’s history.

Smaller allocations have plummeted in 2021, matching an existing narrative that institutions are scooping up liquidity on exchanges which surfaced during the recent bull run.

“The $100k – $1M class is now also about to make a new ATH,” Material Indicators commented on Twitter alongside a chart.

Material Indicators previously voiced concerns about this week’s price rise, arguing that whales could “sell into” the surge, producing a repeat of the run to $58,000 all-time highs and subsequent 25% correction.

While this has so far not come to pass, analysts also noted that macroeconomic factors were also having a different impact to that which was expected.

Whale orders declined after news that the United States’ $1.9 trillion stimulus package had passed the Senate, while China providing support to tech stocks had the opposite effect. As Cointelegraph reported, tech had led a dramatic change of fortunes on equities markets.

$54,500 Surge Followed Major Coinbase Buy

Later, meanwhile, another batch of nearly 12,000 BTC left professional trading platform Coinbase Pro as an example of major BTC allocations continuing at current prices.

“That happened just before the recent surge in price. Nice coincidence,” quant analyst Lex Moskovski commented on data from fellow on-chain analytics resource Glassnode.

BTC/USD hit two-week highs of $54,500 earlier on Tuesday.

Zooming out, the increasing institutional involvement around Bitcoin could fuel its entry as a standard for investors alongside traditional plays.

“We do think it will behave, actually, I would say more like the fixed income markets, believe it or not,” Cathie Wood, founder and CEO of ARK Investment Management, told CNBC this week.

Binance orderbooks show the next major BTC/USDT resistances for the bulls are around $58,000 — the all-time high — and $59,500.

Updated: 3-22-2021

Bitcoin Uptrend Not Over: Big Whales Aren’t Selling BTC, Data Shows

Big whales aren’t selling, but accumulating Bitcoin, as the price of BTC consolidates under $60,000.

The price of Bitcoin (BTC) is consolidating between the $55,000 to $59,000 range, establishing the mid-$50,000 region as a support area. This trend coincides with strengthening on-chain fundamentals, such as whale and address activity.

Since the Bitcoin rally began to accelerate in November 2020, the seven-day average active address has increased in tandem. A pseudonymous trader known as “Crypto Birb” pointed out:

“$BTC seven day average over daily active addresses in sideways while price action climbs. The upside trend is the strongest when backed by onchain trends.”

It shows that on-chain trends have been supplementing both short and long-term Bitcoin price cycles.

Big whales are not selling but accumulating Bitcoin

According to the data from Santiment, big Bitcoin whales have been mostly accumulating Bitcoin as over 35,000 BTC has left exchanges in the past 30 days. The latest outflows have also pushed down exchanges’ BTC reserves to the lowest levels since early March before BTC hit new all-time highs above $60,000.

The Santiment Team Wrote:

“As you’d expect, not all of #Bitcoin’s whales are behaving in unison. However, we’ve seen interesting trends these past couple months, such as 100-1,000 $BTC addresses adding 353k more $BTC since Feb. 1st, while 1k-10k addresses have shed 300k $BTC.”

The chart shows that 1,000 BTC to 10,000 BTC addresses have been selling, but analysts from Whalemap said that this range is a difficult range to analyze.

This range could include exchange addresses, which are not tagged by most on-chain data gathering platforms, so ideally, it would be more accurate to compare 100 BTC to 1,000 BTC, and then 10,000+ BTC holding addresses.

Whalemap Analysts Told Cointelegraph:

“In the 1k-10k band there are a lot of exchanges So this could be a part of it, as they are reducing the availability. Since these addresses could be exchanges, a better representation would be looking at 10k+ BTC and 100-1000 BTC.”

Additionally, researchers at Glassnode found that during bull markets, old coins move more frequently.

As long-time holders move to sell, it puts significant selling pressure on Bitcoin. However, in the current phase of the cycle, the frequency of old BTC moving is much lower than 50%, or where BTC topped out in previous cycles.

Glassnode Researchers Explained:

“In bull markets old coins tend to move more. This increases the relative supply of younger coins in the network. At previous $BTC tops, around 50% of the #Bitcoin supply was younger than 6 months. We are currently significantly below this level (36%).”

Bull Trend Intact As Long As $55,000 Support Is Defended

Considering that big whales have been accumulating Bitcoin as the cryptocurrency consolidates between $55,000 and $59,000, the bull trend remains intact despite the rising U.S. 10-year Treasury yields.

As Cointelegraph reported, when the 10-year Treasury yield begins rising, the risk-on markets typically take a hit, particularly in the near term.

In the past two weeks, as an example, U.S. tech stocks saw a steep pullback, which coincided with Bitcoin stagnating under $60,000.

However, given that on-chain data remains optimistic for Bitcoin, as long as the $55,000 support area remains defended, the bullish market structure would raise the probability of a larger rally.

Updated: 5-21-2021

Whales Scooped Up $5.5B In Bitcoin As BTC Price Dropped Below $36K

Derivatives data shows whales aggressively bought the dip as Bitcoin’s price dropped below $36,000, but that doesn’t mean BTC has bottomed yet.

The stream of negative regulatory news concerning Bitcoin (BTC) and cryptocurrencies has been nonstop over the past couple of weeks.

Today’s FUD — fear, uncertainty and doubt — news that failed to cite any actions and merely refreshes old information from China. A statement from the Chinese government revealed plans to “crack down on Bitcoin mining and trading behavior.”

While retail traders are easily scared by this type of news, whales and market makers know how to spot a buying opportunity, which was the case for today’s drop to $36,200.

China Banned Bitcoin Trading… In 2017

The Chinese Financial Stability and Development Committee minutes presented general guidelines on multiple issues, including reforming mid-sized financial institutions and cracking down on illegal securities activities. Therefore, it was neither a targeted attack on Bitcoin nor did it differ from the actions and discourse from previous years.

On May 18, trade associations under the People’s Bank of China warned financial institutions and other member organizations to not engage in crypto business transactions.

However, crypto trading in China has been banned since September 2017, and concerns regarding the carbon emissions of Bitcoin mining operations were expressed over three weeks ago by Chinese state media outlet PengPai.

Even market-making platforms have been targeted by Chinese authorities since 2018. Some crypto trading sites continued to operate illegally in the country, but most were identified and shut down by authorities in 2019.

Derivatives Indicators Signal Accumulation

Exchange-provided data highlights traders’ long-to-short net positioning. By analyzing every client’s position on the perpetual and futures contracts, one can obtain a clearer view of whether professional traders are leaning bullish or bearish.

Whales and market makers on OKEx reached a 1.08 long-to-short ratio in the early hours of May 21, favoring longs by 8%. It is worth noting that this level was the lowest in 30 days, indicating a lack of conviction. However, these pro traders entered bullish positions over the day as Bitcoin retraced below $37,000, favoring longs by 62%.

Volume Spikes Confirm The Theory

Trading volume is the best indicator to confirm whale activity, and those peaks need to coincide with price bottoms. Even though every trade has a buyer and a seller, extreme volatility can occur on low trading volumes, therefore not necessarily involving pro traders.

By looking at the above data, there should be no doubt that whales and market makers aggressively bought the $36,200 dip on May 21. Spot exchange volumes surpassed $5.6 billion in four hours, which is extreme even for a 12% price movement.

To put things in perspective, the daily average volume over the past month stands at $11 billion. Therefore, by combining this data with derivatives exchanges’ long-to-short ratio, one should assume that some heavy players were brave enough to buy today’s dip.

Although no one can precisely forecast whether $35,200 will hold over the weekend, one should expect those heavy hands to maintain their position for a very long time.

Updated: 5-23-2021

Bitcoin Whales Accumulate 122.5K BTC Amid Latest Market Mayhem

Some of Bitcoin’s most influential holders bought the dip during last week’s market meltdown.

Large Bitcoin (BTC) holders appear to be aggressively buying the dip amid the latest price correction, raising optimism that the coordinated selloff could be about to end.

Using data from Glassnode, Morgan Creek Digital’s Anthony Pompliano recently concluded that the so-called Bitcoin whales – entities who hold between 10,000 and 100,000 BTC – purchased 122,588 BTC during the height of the market crash on Wednesday. Much of the foot traffic to crypto exchanges came from the United States, as evidenced by Coinbase’s $3,000 BTC premium at one point.

Crypto hedge funds interviewed by Bloomberg have also reiterated that they were, in fact, dip buyers. MVPQ Capital and ByteTree Asset Management, both based in London, along with Singapore’s Three Arrows Capital, all bought the dip.

Kyle Davies, Co-Founder At Three Arrows Capital, Told Bloomberg:

“People that were borrowing money to invest, they were wiped from the system […] Every time we see massive liquidation is a chance to buy. I wouldn’t be surprised if Bitcoin and Ethereum retrace the entire drop in a week.”

As Cointelegrah recently reported, at least one prominent whale who sold BTC at a price of $58,000 has not only reaccumulated, but added to their holdings. The unknown entity sold 3,000 BTC on May 9 before buying back 3,521 BTC in three separate trades on May 15, 18 and 19.

The Bitcoin price languished below $32,000 on Sunday, as traders continued to test the limits of a new bearish range. The largest cryptocurrency by market cap briefly fell below $30,000 on Wednesday – a level that appeared highly unlikely to ever be penetrated again – before quickly shooting back up to $37,000. However, overhead resistance has limited BTC’s rally to no greater than $42,000.

Updated: 6-13-2021

Whither The Whales?

In the first Money Reimagined newsletter of 2021, we looked at how so-called “whale” bitcoin addresses with more than 1,000 BTC had grown significantly before and during the price rally that started in mid-2020 and accelerated into the end of the year.

We contrasted that with 2017, when whales started shedding positions mid-year while the price was not even a quarter of the $20,000 peak it would later hit in December, before it plummeted to levels below $8,000 in early February.

We saw in this a potential sign of sustainability for the 2020 rally because it indicated that the gains were driven by big, lasting bets by institutional investors.

So, now that we’ve had a big pullback, let’s look at how whales have been behaving.

Once again, the whales led the price decline. As the chart above shows, addresses with more than 1,000 BTC increased sharply during the first two months of the year while the price of bitcoin also soared. But then, around March, whale accounts dropped sharply, as if concluding that the small, retail investors now rushing into bitcoin were once again taking things too far.

Unlike the 2017 rally/bubble, the price response came only a couple of months after the whale drawback began, whereas there was a delay of six months in 2017. Then, the price increased four-fold during that gap period whereas this year, the increase was less than 50% – still huge, but less parabolic.

To me, this speaks to how important large, institutional accounts were in this most recent rally. They were the reason for it – the founding narrative being that “the suits” are coming – even if in the latter stages it was fueled by a small investor influx. When the institutions got cold feet – primarily because of environmental concerns – the market couldn’t sustain itself.

What now, then? Well, it’s probably too early to say, but there is a small uptick in whale addresses this past month. Just as importantly, as CoinDesk’s Omkar Godbole reported this week, even if whale addresses haven’t increased, existing addresses have been accumulating coins, adding a total of 80,000 BTC since the price crashed to $30,000 on May 19. For now, at least, the bigger players seem to see buying opportunities in these lower prices.

Updated: 6-17-2021

‘Millionaire’ Whales Gobble Up 90,000 Bitcoin Over The Past 25 Days

Whales appear to be accumulating in anticipation of higher prices, with “millionaire” wallets increasing their holdings by 90,000 BTC in just 25 days.

Bitcoin (BTC) whales are stocking up, with “millionaire” addresses accumulating around 90,000 Bitcoin worth $367 billion over the past 25 days.

The accumulation was identified by crypto market data aggregator Santiment, which identified that wallets holding between 100 and 10,000 BTC — described by the company as “millionaire tier” addresses — are now the largest segment of Bitcoin hodlers and currently account for 48.7% of Bitcoin’s supply.

The recent buying spree places the millionaire addresses at a seven-week high for the number of Bitcoin held, with the addresses representing more than 9.11 million BTC — down just a couple of percent from their mid-April high.

Miners also appear to be accumulating BTC, with on-chain analytics provider Glassnode identifying that weekly Bitcoin outflows from miner addresses slumped to a five-month low of roughly $1.7 million on Wednesday.

Looking at the opposite end of the scale from whales, Glassnode noted the share of supply represented by addresses holding less than 1 Bitcoin has doubled since December 2017 to compose roughly 5% of Bitcoin’s market capitalization.

The response of ‘the little guy’ to the evolution of #Bitcoin as an asset can be seen in the supply distribution.

Entities with

Live Chart: https://t.co/IujxVGegF9 pic.twitter.com/GU5a6emJBU— glassnode (@glassnode) June 16, 2021

While many whales and miners appear to be hodling their coins in expectation of higher prices, transaction monitor Whale Alert has identified two transfers of roughly 5,000 BTC, or $200 million each, destined for Coinbase since Monday, suggesting at least some large investors are looking to trade their Bitcoin.

Updated: 8-2-2021

Bitcoin Accumulation Accelerates Among ‘Whales’ And ‘Fish,’ While BTC Rallies To $40K

“This is just on-chain sentiment, though. The big question is, how does that correlate to the price action in general?”

Both small and rich Bitcoin (BTC) traders accumulated the benchmark cryptocurrency en masse during the period when its prices rose from below $30,000 to over $40,000, signaling their confidence in the asset’s long-term bullish setup.

The basis of the upside outlook came from Ecoinometrics, a crypto-focused newsletter service. It highlighted in its latest edition a flurry of on-chain data that tracked the flow of Bitcoin into wallets that belonged to the richest crypto traders, known as “whales,” and to entities that held the cryptocurrency in smaller quantities — the so-called “small fish.”

“After a couple of weeks of data showing that most address buckets are accumulating coins, Bitcoin is finally bouncing back from the $30k level,” wrote Nick, the author of the Ecoinometrics newsletters, as he highlighted a heat map that witnessed Bitcoin flowing into the small fish and whales’ wallets.

The color red points to a situation, in which every group — whales or fish — has accumulated Bitcoin in the past 30 days. Conversely, the color blue corresponds to situations wherein only the smaller fish have accumulated the digital asset in the same timeframe.

Bitcoin’s heat map has returned to red.

“We can do the same plot for the current cycle and we observe pretty much the same thing,” noted Nick while pointing to the July 2020–July 2021 graph as follows.

Moby Dicks Everywhere

Data from other sources matched the Ecoinometrics’ analogy.

For instance, crypto-focused data tracking service WhaleMap reported Thursday that the number of unspent transaction outputs currently belonging to Bitcoin whale wallets has spiked, thereby suggesting their intentions to wait for higher prices.

“The last whale bubble in our range,” tweeted WhaleMap.

“Get above $40,472 and the next resistance is only at around 47k. Whale bubbles for the win.”

Fundamental Backdrop

The fundamentals backing whales’ involvement in the current Bitcoin rally pointed to fears of persistently rising inflation despite United States Federal Reserve Chairman Jerome Powell’s attempts to sideline the issue in his recent press conference on Wednesday.

Powell admitted that inflation has surpassed the Fed’s projections for 2021 but blamed it on the unusual nature of the U.S.’ economic recovery. He noted that supply bottlenecks have created shortages that have led to “temporary” price increases.

The comments appeared as the Fed continues its expansionary policy of near-zero interest rates and $120 billion a month in bond purchases that, as the Wall Street Journal editorial noted, could have been stopped two months after its launch in March 2020.

The journal cited the National Bureau of Economic Research’s report of last week, which noted that the U.S. recession officially ended in April 2020.

“The FED has a real challenge ahead balancing its response to a global pandemic with low rates and seemingly rising inflation,” Jeffery Wang, head of Americas at Amber Group, told Cointelegraph, calling it “an extremely difficult situation” for central banks running their quantitative easing programs.

Wang added that the backdrop of cheap money and rising inflation creates a bullish narrative for flight-to-safety assets such as equities, real estate and Bitcoin. He said:

“From here, I think crypto and BTC will still be considered an asset that, while highly volatile can be a hedge against inflation and should do well in this environment.”

Pankaj Balani, CEO of the crypto derivatives platform Delta Exchange, meanwhile, anticipates Bitcoin to continue its bull run toward $50,000, citing options activity that he said remains heavily skewed to the upside at least until mid-August.

“There is call buying activity across maturities — weekly, bi-weekly and monthly,” Balani told Cointelegraph in an email statement.

“Fifty thousand (50K) strike for August expiry is highlighted here and has the highest OI. Once again there is not much OI between 45,000 and 50,000 strikes (for the Aug expiry) and we can see sharp moves here.”

Updated: 8-30-2021

Bitcoin Whales Join ‘Small Fish’ In Buying BTC As Price Holds Above $47K

Bitcoin addresses holding 1,000–10,000 BTC have resumed accumulating coins.

Rich crypto investors are turning their attention back to Bitcoin (BTC) as its price continues to eye a breakout move above $50,000.

Crypto-focused newsletter Ecoinometrics reported positive changes in Bitcoin holdings for addresses controlling 1,000–10,000 BTC. So, based on their rising account balances throughout August, Ecoinometrics spotted a renewed accumulation sentiment among “whales,” hinting that wealthy investors consider the current Bitcoin price levels as attractive to place bullish bets.

The sentiment appeared the same among small fish — Bitcoin investors who hold less than 1 BTC. Ecoinometrics reported that they have been accumulating Bitcoin since June and, during a period, have also absorbed the selling pressure coming from the whales’ side. Their buying sentiment coincided with a price rally to $50,000, a key psychological resistance level.

“Recently, there has been some on-chain divergence between small fish who are accumulating coins [and] whales who are offloading coins,” tweeted Ecoinometrics on Sunday.

“That’s not ideal [for supporting] Bitcoin’s price, but it looks like things are changing! Whales are ticking back up.”

Supportive Data

Blockchain analytics platform Glassnode also reported a spike in buying sentiment among small fish. In detail, the number of addresses holding at least 0.1 BTC reached a three-month high of 3,231,069 on Monday, further validating the accumulation data above.

Meanwhile, Glassnode’s unspent transaction output (UTXO) data alert presented the $45,000–$50,000 range, wherein whales capitulated the most recently, as a strong support area.

“Over 1.65M BTC now have an on-chain cost basis within the $45k to $50k range,” the platform tweeted Monday, adding:

“The $31k to $40k zone is also home to another 2.98M BTC, indicative of large accumulation demand.”

Bitcoin Holds Above The “Green Wave”

The whale and fish alert surfaces as the Bitcoin market awaits a clear breakout move above $50,000.

As it stands, the BTC/USD exchange rate has been consolidating under the said resistance level since Friday. In doing so, the pair have also found interim support above $47,000, which, more or less, has been coinciding with a 20-day exponential moving average floor (20-day EMA; the green wave in the chart below).

Historically, a break below the 20-day EMA prompts traders to move their downside target to the 50-day EMA (currently near $43,500). Popular market analyst Rekt Capital also presented an outlook that highlighted the levels around $43,500 as Bitcoin’s next support range.

The lack of weakness in this red area for #BTC has translated into downside$BTC is in no man’s land following its rejection from the red area

Next major support area is the orange region below$BTC #Crypto #Bitcoin https://t.co/wRWfkxc4iw pic.twitter.com/Qe4xvxNqUI

— Rekt Capital (@rektcapital) August 30, 2021

Small fish have accumulated Bitcoin relentlessly in the $40,000–$50,000 range, with no signs of trend reversals in the previous 30 days. On the other hand, whales underwent a capitulation period when Bitcoin entered the $45,000–$50,000 range.

Updated: 10-29-2021

Bitcoin Whales Fuel This Month’s Price Jump, Kraken Report Says

The biggest Bitcoin holders are accumulating more of the token and powering its rally, according to a report by the research arm of a crypto exchange.

Holders of 100 Bitcoin or more, so-called whales, and a supply shock drove the increased network activity, Pete Humiston, manager at Kraken Intelligence, wrote in a report.

The weekly average holdings of whales rose 0.25% since early October to reach a record $724.4 billion, according to the report. The number of such holders increased 1.6% to 16,156, the highest level since May.

“Larger market participants have grown increasingly more confident, preferring to accumulate further than to take profit,” the report said. “With the number of whales and whale holdings rising, it is clear that whales are a driving force in this latest run-up and remain optimistic.”

Bitcoin has more than quadrupled in the past year and reached a record near $67,000 on Oct. 20 amid optimism around the debut of Bitcoin futures-backed exchange-traded funds in the U.S., and waning concerns about issues like China’s crackdown on the digital-asset space.

However, crypto remains extremely volatile, and many experienced market players still regard it with a strong degree of caution.

In addition, market concentration is a concern to some. A recent report from the National Bureau of Economic Research said that the top 10,000 investors in Bitcoin hold more than one-third of the cryptocurrency in circulation.

Updated: 11-2-2021

Bitcoin Whale Holdings Reach 2021 High Amid Inflation Fears

The renewed buying amid rising inflation expectations across the globe suggests investment is the primary use case for bitcoin.

Bitcoin whales, or large investors with ample capital supply, appear to be buying again as fears of inflation lurching out of control strengthen the case for investing in store of value assets.

Large investors holding at least 1,000 BTC snapped up 142,000 coins last week, taking the cumulative tally to nearly 200,000 BTC – the highest in 2021, according to blockchain analytics firm Chainalysis’s market intel report published Tuesday.

The renewed buying amid rising inflation expectations across the globe suggests investment is the primary use case for bitcoin.

“Its a confirmation of the view that bitcoin is seen as digital gold, or perhaps institutions are just making a longer term trade on the bitcoin price,” Chainalysis said.

The U.S. 10-year breakeven rate, which represents how the market foresees long-term price pressures, recently rose to a decade high of 2.64%, according to the Federal Reserve Bank of St. Louis. Bitcoin rallied nearly 40% in October, hitting a record high of $66,975.

Analysts at JPMorgan have attributed the rally to the perception that bitcoin is an inflation hedge contrary. The perception stems from bitcoin’s mining reward halving. This programmed code reduces the pace of supply expansion by 50% every four years, putting the cryptocurrency’s monetary policy at odds with the Federal Reserve’s decades of money printing.

However, bitcoin needs to expand its footprint into crypto sub-sectors like Web 3 and decentralized finance to remain relevant relative to ether in the long run, according to Chainalysis.

“Bitcoin usage has not reached the sophistication of Ethereum or other layer 1 assets,” Chainalysis said. “A decentralized way of wrapping bitcoin is needed to unlock the use of bitcoin as high-quality capital in DeFi.”

“If bitcoin can be used as capital in Web 3.0 then it will have a future as both a scarce fungible asset and as a useful asset in the more innovative side of crypto,” Chainalysis added.

The uptick in whale holdings suggests the recent rally is backed by strong hands and is sustainable. Bitcoin’s bullish momentum lost steam in the first quarter as whale holdings started declining. The market crashed in May.

The cryptocurrency was last changing hands near $62,900, representing a 0.5% drop on the day, according to CoinDesk 20 data.

Updated: 11-5-2021

Bitcoin Whale Selling Jumps While BTC Price Holds $60K And Buyers Snap Up Supply

Demand is keeping up with increasing activity from whales this week, the latest data confirms.

Bitcoin (BTC) is still seeing a supply squeeze despite a significant uptick in whale selling on exchanges this week.

As confirmed by on-chain monitoring resource CryptoQuant on Nov. 5, whales have accounted for the vast majority of selling pressure in recent days.

Whale Coins Find A New Home

A familiar event but with curious timing — large-volume holders are “dumping” BTC on the market, but at or near April’s all-time highs.

Despite seemingly unanimous consensus among traders and analysts that the bull run is far from over, whales appear eager to divest themselves of their holdings.

“Most BTC exchange deposits are coming from whales,” Ki Young Ju, CEO of CryptoQuant, said as part of comments on Nov. 5.

“Top 10 TXs take almost 90% of the total volume in an hour.”

An accompanying chart of the exchange whale ratio — the top ten inflows to exchanges relative to overall inflows — showed a clear increase from the middle of October onwards.

Binance Again Bucks Decreasing Exchange Balance Trend

Nonetheless, a dichotomy exists — whales may be selling, but overall, the BTC balance across exchanges continues to decrease.

Appetite among buyers is rising to meet seller supply, and this accounts for the relative stability in BTC price action over the week, Ki argues.

“Bitcoin holds support above $60k in spite of whale dumping… Exchange reserve is decreasing, leading to less supply on exchanges,” he added.

Separate figures from data firm Coinglass shows Binance to be an exception to the trend on Nov. 5, its reserves up 2,141 BTC in the 24 hours to the time of writing. This, in itself, however, is not unusual, as Cointelegraph reported last month.

Updated: 11-8-2021

Bitcoin Price In Classic ‘Bull Pennant’ Breakout As BTC Whales Go On Buying Spree

The latest BTC price jump above $65,000 has all the signs of a classic bullish breakout.

Bitcoin (BTC) has the potential to rise toward $75,000 by the end of this year as it breaks out of a classic bullish pattern and picks additional upside cues from its richest investors’ recent accumulation spree.

Bitcoin Bull Pennant Breakout In Play

BTC rallied over by 6% in the past 24 hours to reach a three-week high just shy of $66,500. In doing so, the cryptocurrency broke out of a consolidation range consisting of two diverging trendlines, a setup reminiscent of a Bull Pennant.

Bull Pennants are bullish continuation patterns that appear when an instrument consolidates in a Triangle-like price range following a strong move higher (called Flagpole). It typically ends up breaking out of the range to the upside, eyeing a profit target at length equal to the Flagpole’s size.

Bitcoin ticks almost all the boxes when it comes to confirming a Bull Pennant breakout. As a result, its likelihood of continuing its upside boom has risen, with its profit target sitting as high as the height of its Flagpole, which is over $12,300, as shown in the chart below.

The bull setup puts the BTC price on the way towards $75,000, after adding the Flagpole height to the point of breakout around $63,300.

Whales Enter BTC Accumulation Spree

Bitcoin’s bullish setup received additional confirmation from an on-chain indicator by Santiment that tracks distribution/accumulation activities of the wallets with balances between 10,000 BTC and 100,000 BTC.

The metric highlighted that the so-called “Bitcoin whales” have been accelerating their buying spree.

Specifically, these entities accumulated 43,000 BTC (worth about $2.82 billion) in the last five days and about 92,000 BTC (over $6 billion) in the last 25 days, just as the price rallied to a record high near $67,000, corrected below $60,000, and surged back above $66,000.

The whale-led buying between the $60,000–67,000 area underscored their preparations for the times ahead, i.e., they anticipated Bitcoin to close beyond its previous record high.

In addition, on-chain analyst Willy Woo noted that Bitcoin continues to move off exchanges to cold storage in recent weeks. At the same time, the deposits of dollar-pegged stablecoin USD Coin (USDC) surged in the same period, underlining a classing buying pattern.

“Price was previously overheated, calling for a time of consolidation, since then we’ve seen significant buying from investors while [the] price has been sideways,” wrote Woo in a note to clients, adding:

“It’s been a healthy consolidation. Meanwhile, significant whale activity has been spotted which suggests BTC’s next move in price may come soon.”

Bitcoin is up by nearly 50% so in Q4, just 2% under its all-time high of $67,000.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Probes Reveal Central, US-Based, International Banks All Have Sticky Fingers (#GotBitcoin?)

Major Banks Suspected Of Collusion In Bond-Rigging Probe (#GotBitcoin?)

Some Merrill Brokers Say Pay Plan Urges More Customer Debt (#GotBitcoin?)

Deutsche Bank Handled $150 Billion of Potentially Suspicious Flows Tied To Danske (#GotBitcoin?)

Wall Street Fines Rose in 2018, Boosted By Foreign Bribery Cases (#GotBitcoin?)

U.S. Market-Manipulation Cases Reach Record (#GotBitcoin?)

Poll: We Should Get Rid of The Federal Reserve And Central Banks Because:

Leave a Reply

You must be logged in to post a comment.