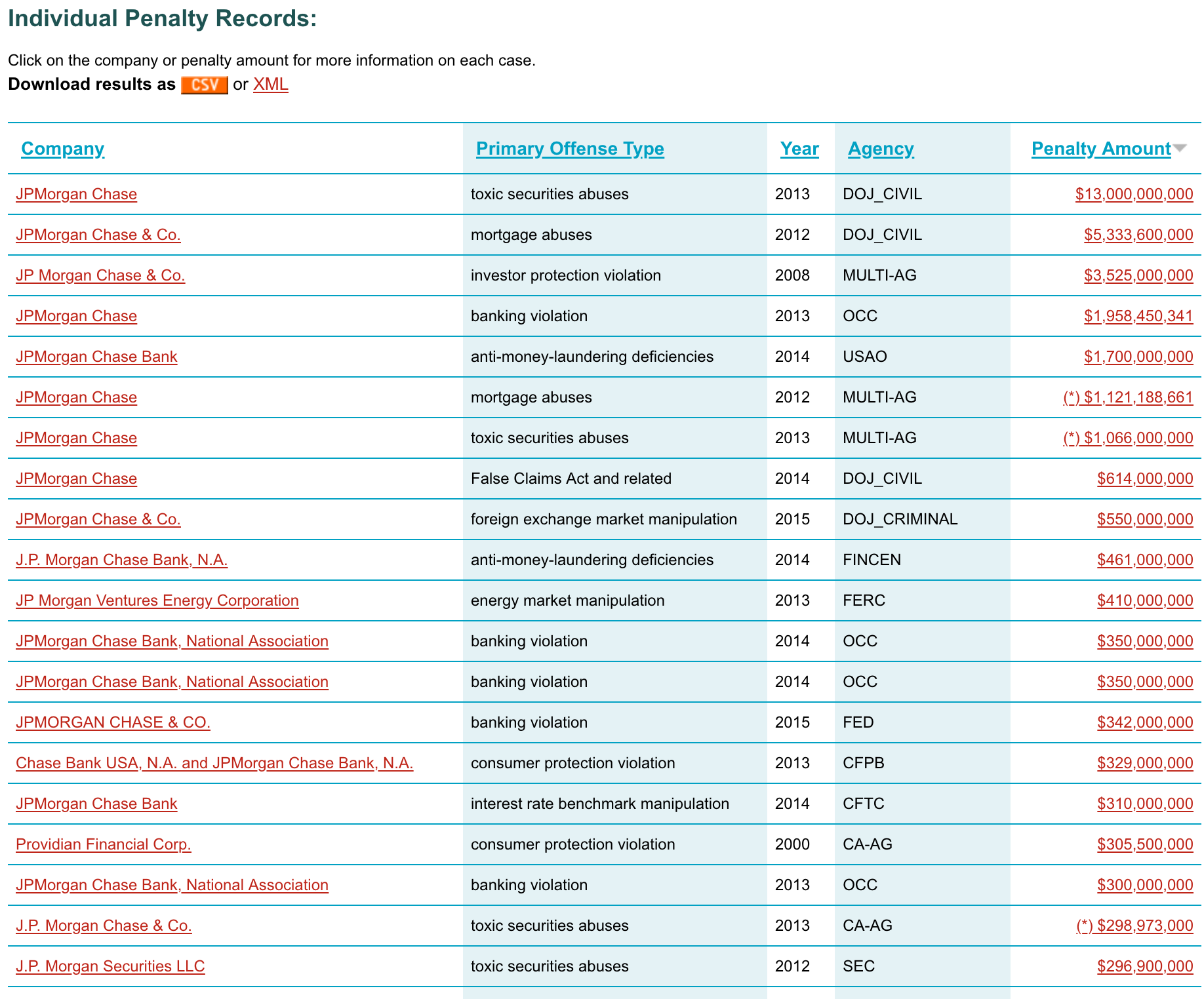

Violation Tracker For JP. Morgan Chase Amounts To Over $34 Billion Dollars (#GotBitcoin?)

Violation Tracker For JP. Morgan Chase. Violation Tracker For JP. Morgan Chase Amounts To Over $34 Billion Dollars (#GotBitcoin?)

Discover Which Corporations are the Biggest Regulatory Violators and Lawbreakers Throughout the United States

New: Cases from district attorneys and other local prosecutors in the country’s largest counties and cities (press release)

Violation Tracker is the first wide-ranging database on corporate misconduct. It covers banking, consumer protection, false claims, environmental, wage & hour, health, safety, employment discrimination, price-fixing, bribery and other cases resolved by more than 40 federal regulatory agencies and all parts of the Justice Department since 2000 — plus state AG and local DA cases and selected class action lawsuits. In all: 397,000 civil and criminal cases with total penalties of $604 billion. Other types of cases will come later. Violation Tracker is produced by the Corporate Research Project of Good Jobs First.

Agency Data Sources | User Guide | Update Log | Corporate Research Project analyses of Violation Tracker data

Send questions or comments to Philip Mattera of the Corporate Research Project of Good Jobs First.

The Violation Tracker site was built with the help of Rich Puchalsky of Grassroots Connection.

Here is an updated list of the highlights—or low-lights—of the bank’s settlements over the past couple of years.

Date: September 19, 2013

Amount: $309 Million

Behavior: The Consumer Financial Protection Bureau said that JPMorgan Chase and Chase Bank used unfair billing practices and charged credit card customers for credit monitoring services they never actually got. It was forced to pay refunds to a total of 2.1 million customers

Date: September 19, 2013

Amount: $920 Million

Behavior: Massive losses in 2012 from trades conducted by the so-called “London Whale” led to fines from both US and UK regulators. They include: $200 million to the Federal Reserve for risk-management failures, $300 million to the Comptroller of the Currency for unsafe derivatives trading activities, $200 million to the SEC, and $220 million to the UK Financial Conduct Authority.

Date: September 9, 2013

Amount: $300 Million*

Behavior: JPMorgan and insurer Assurant settled charges that it pushed customers into overpriced property insurance, which would reap kickbacks for JPMorgan in the form of commissions.

*The total amount was not all paid by JPMorgan.

Date: September 5, 2013

Amount: $18.3 Million

Behavior: When JPMorgan acquired Bear Stearns at the height of the financial crisis, it also acquired Bear, Stearns’s legal obligations and problems, including this lawsuit that charged Bear failed adequately to disclose interest rates on mortgage documents with adjustable interest rates. The company agreed to settle the charges for a small payment.

Date: July 30, 2013

Amount: $410 million

Behavior: From September 2010 to November 2012, JPMorgan allegedly engaged in market manipulation in the electricity markets in California and Michigan. It was forced to disgorge profits and pay a fine to the Federal Energy Regulatory Commission.

Date: June 6, 2013

Amount: $1.564 Billion

Behavior: In November of 2011, Jefferson County, Alabama declared bankruptcy in part because risky securities arrangements left it with billions of debt for financing sewer repair. JPMorgan Chase was the bank the county blamed in what was the biggest US municipal bankruptcy – until Detroit. In June, a court ruled that JPMorgan would lose $842 million of the $1.22 billion in sewer debt it held. What’s more, the bank also sacrificed $647 million in termination fees on derivatives that it had collected, and paid a $75 million to the SEC.

Date: March 2013

Amount: $100 million

Behavior: JPMorgan Chase agreed to return$546 million to former customers of MF Global Holdings, the investment firm run by former New Jersey governor Jon Corzine that collapsed in 2011. While it did not admit wrongdoing, JPMorgan had been threatened with a lawsuit if it didn’t return the cash that had been transferred from MF Global during the firm’s chaotic final days.

Date: January 2013

Amount: Unclear

Behavior: Ten banks, including JPMorgan Chase, agreed to an $8.5 billionsettlement with the Office of the Comptroller of the Currency and the Federal Reserve over “robo-signing” and other alleged abuses of the foreclosure process. The banks were to pay $3.3 billion to harmed borrowers and provide a combined of $5.2 billion in assistance in the form of principal reductions or mortgage modifications. JPMorgan Chase didn’t disclose its share of the settlement.

Date: November 2012

Amount: $296.9 million

Behavior: The Securities and Exchange Commission chargedJPMorgan with misleading investors about the quality of mortgages that underlay mortgage-backed securities it sold. The bank settled the charges without admitting or denying guilt.

Date: March 2012

Amount: $150 million

Behavior: After being sued by pension funds and investors for investing their funds in a risky structured investment vehicle that failed at the height of the global financial crisis in 2008, JPMorgan settled the suit without admitting wrongdoing.

Date: February 2012

Amount: $110 million

Behavior: Along with Bank of America and a few smaller lenders, JPMorgan settled consumer litigation that claimed the banks processed checks by size—rather than by chronological order—so they could charge unwarranted overdraft fees.

Date: February 2012

Amount: $5.29 Billion

Behavior: JPMorgan and four other major mortgage servicers agreed to pay a combined $25 billion to settle charges with state attorneys general, the Justice Department, and the Department of Housing and Urban Development relating to what Washington Attorney General Rob McKenna called years of “shoddy loan servicing, illegal robo-signing, and faulty foreclosure processing.” JPMorgan Chase’s share of the settlement came to $5.29 billion.

Date: August 2011

Amount: $88.3 Million

Behavior: Talk about shady dealings. The Treasury Department alleged the banking giant violated sanction orders by conducting transactions with people or entities tied to Iran, Sudan, Cuba, and Liberia. JPMorgan Chase settled the charges and violations by paying $88.3 million civil penalty.

Date: July 2011

Amount: $229 Million

Behavior: In response to a suit by federal and state authorities, JPMorgan settled allegations that it rigged the bidding process for reinvesting bond transactions that affected 31 state governments. The bank paid $229 million to settle the charges without admitting or denying the allegations.

Date: June 2011

Amount: $153.6 million

Behavior: The Securities and Exchange Commission sued JPMorgan for misleading buyers by allegedly failing to inform investors that a hedge fund assisted in picking and betting against securities in a collateralized debt obligation JPMorgan had sold in 2007. JPMorgan paid $153.6 million to settle the charges without admitting or denying the allegations.

Date: April 2011

Amount: $56 million

Behavior: JPMorgan was one of several banks called out in a class-action lawsuit for overcharging or wrongfully foreclosing on active-duty military personnel. The company apologized, paid out $27 million in cash, cut interest rates on home loans and returned houses that were wrongfully foreclosed upon.

Ownership Structure: Publicly Traded (Ticker Symbol JPM)

Headquartered In: New York

Major Industry: Financial Services

Specific Industry: Banking & Securities

Penalty Total Since 2000: $34,503,944,885

Number Of Records: 135

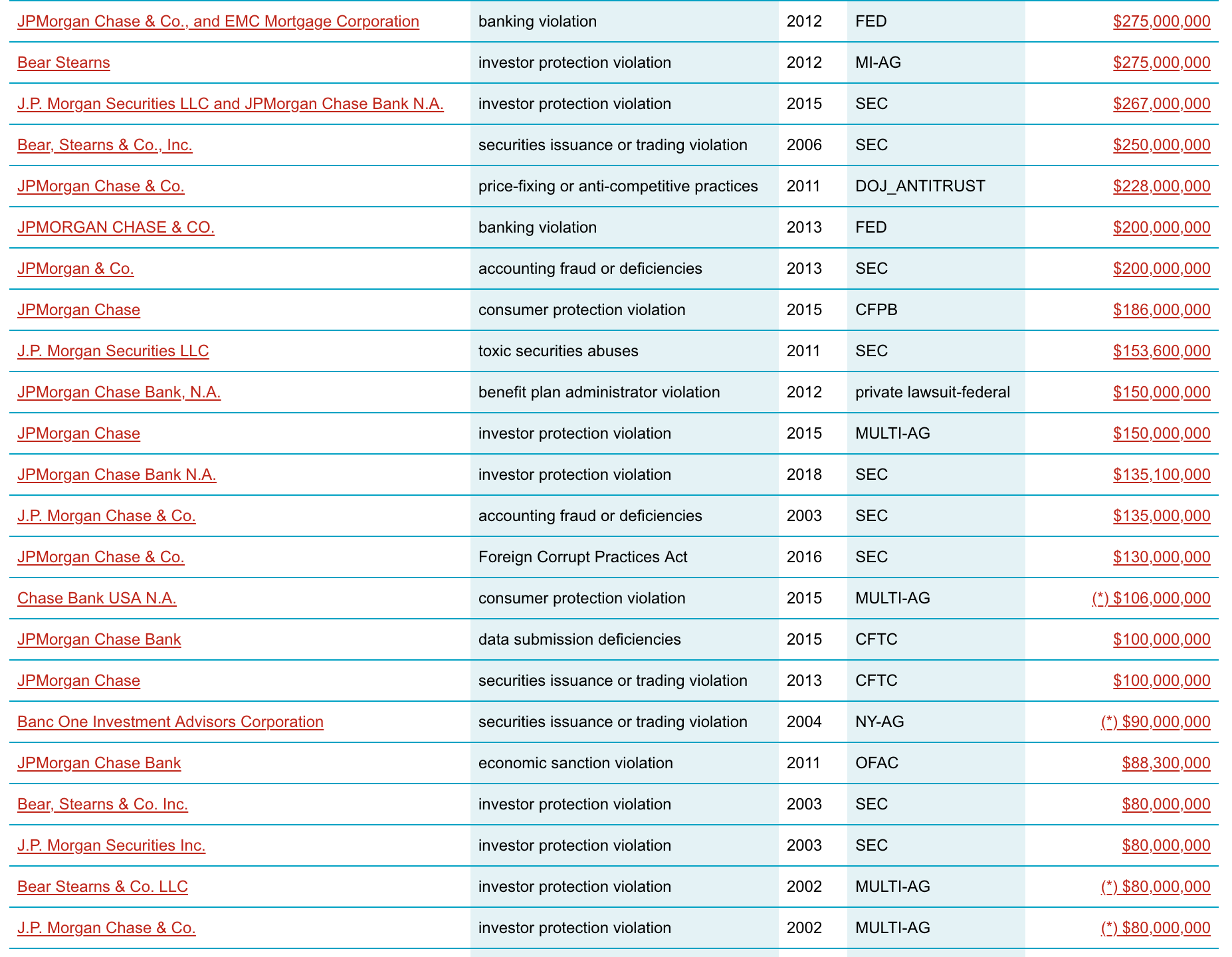

| Top 10 Primary Offense Types | Penalty Total | Number of Records |

|---|---|---|

| toxic securities abuses | $13,450,500,000 | 5 |

| mortgage abuses | $5,362,675,000 | 5 |

| investor protection violation | $4,548,103,031 | 19 |

| banking violation | $4,012,350,341 | 13 |

| anti-money-laundering deficiencies | $2,161,000,000 | 2 |

| consumer protection violation | $891,925,000 | 13 |

| False Claims Act and related | $614,000,000 | 1 |

| foreign exchange market manipulation | $550,000,000 | 1 |

| securities issuance or trading violation | $467,324,210 | 9 |

| energy market manipulation | $410,000,000 | 1 |

Violation Tracker For JP.,Violation Tracker For JP.,Violation Tracker For JP.,Violation Tracker For JP.,Violation Tracker For JP.

Related Articles:

U.S. Market-Manipulation Cases Reach Record (#GotBitcoin?)

Wall Street Fines Rose in 2018, Boosted By Foreign Bribery Cases (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Leave a Reply

You must be logged in to post a comment.