Five Innovative Ways Cities Are Improving Life For Seniors

As the 65 and over population grows, urban planners are looking for new approaches to serve the booming demographic. Five Innovative Ways Cities Are Improving Life For Seniors (#GotBitcoin?)

Cities are trying to make life better for their older residents.

Brenda, 67, A Resident Of The Roxbury Neighborhood Of Boston, Hosted MIT Student Pheobus, 27, For A Seven-Month Fellowship, Through Nesterly, A Platform For Intergenerational Home-Sharing.

In many ways, cities have little choice, since people over 65 are the fastest-growing age group in the U.S. By 2030, about 20% of the U.S. population will be over age 65, according to the Census Bureau, up from 15% in 2016. By 2035 older adults will outnumber children for the first time in U.S. history.

As a result, urban areas are searching for innovative ways to meet the needs of this booming demographic. Their efforts range from small changes (adjusting bus schedules and putting additional benches in parks) to big (passing zoning regulations to permit the building of garage apartments that can be rented out for extra income or used to accommodate caregivers.)

Officials of some 350 public bodies, ranging from states to towns, have committed to improving life for seniors in terms of housing, outdoor spaces, recreation, transportation, social participation and other needs, as part of the AARP Network of Age-Friendly States and Communities, supported in part by the World Health Organization,

What’s more, cities are starting to realize that the benefits of age-friendly planning don’t just accrue to the elderly. That’s because many things seniors want—flexible housing, neighborhood parks, even pavement, safe crosswalks and events in which generations can mingle—appeal to the stroller set, seniors and everyone in between.

“You end up creating places that serve kids, single parents and a wide range of demographic needs better,” says Danielle Arigoni, director of livable communities at AARP.

Now, Columbus, Ohio, another big college town,

Intergenerational Home Sharing

Almost 90% of seniors say they want to age in their own home, but maintaining the two- and four-bedroom homes that make up 80% of U.S. housing stock can be difficult for some. Take on a younger tenant or housemate, and aging in place suddenly gets easier.

In 2017, the city of Boston teamed up with Nesterly, a local startup, to pilot a service that matches graduate students in need of cheap housing with elderly homeowners who might want some companionship and help around the house. Users pay a one-time fee ranging from $95 to $195. Nesterly does background checks and provides an online payment system for which it charges 2.5% of monthly rent. Today, there are 251 Nesterly hosts renting rooms in the Boston area.

Now, Columbus, Ohio, another big college town, is giving Nesterly a try. Nesterly calculates that baby boomers in the Columbus area have more than 27,000 spare bedrooms they might be willing to rent to students. So, this summer the Central Ohio Area Agency on Aging, in partnership with Age Friendly Columbus and Franklin County, will roll out its own Nesterly platform.

The project will be marketed first to homeowners in four predominantly elderly neighborhoods. Nesterly says it will perform background checks on the homeowners and prospective renters, who will be able to communicate with each other through an app. If the plan works well, Ohio government officials say they will start extending it beyond Columbus this summer.

Housing For Grandparents And Granchildren

According to the Census Bureau, there are more than 2.6 million seniors raising grandchildren who live with them. Many of these grandparents are on fixed incomes and live in homes that aren’t suitable for children, or were forced to leave senior-housing developments that don’t permit resident children.

Washington, D.C. is one of a handful of cities to have built housing designed for such families. Its Plaza West affordable housing development, which was financed with tax-exempt bonds and low-income housing credits, includes 50 apartments designed for grandfamilies and an on-site Grandfamily Community Life Program operated by the nonprofit Mission First Housing Group in partnership with Golden Rule Plaza, Inc., a nonprofit affiliated with Bible Way Church, which owns the land the development sits on.

“We aren’t even a year old yet, and there is so much life around here,” says Jamari D. Clark, manager of the Grandfamily Community Life Program.

The building, home to 54 grandparents and their 80 grandchildren, features wide hallways and low counters for wheelchair accessibility. There is a playground for the children, and twice-a-week academic tutoring. Classes about computers and social media are available for the grandparents, too.

Plaza West is one of about a dozen such projects around the U.S. Others include the Grandparent Family Apartments in New York City; Pemberton Park in Kansas City; Grandfamilies Place in Phoenix and Las Abuelitas Family Housing in Tucson, Ariz.

“Children raised by grandparents rather than unrelated foster parents have more stability, are safer and have better mental-health and behavioral outcomes,” says Ana Beltran, a special adviser to Generations United, a nonprofit that advocates for the development of intergenerational communities. In addition to protecting their grandchildren, these grandparents and other relative caregivers are saving cities billion of dollars they would otherwise spend on foster care, she adds.

Pre-K In Retirement Homes

In Oklahoma and Kansas, dozens of 4- and 5-year-olds go to public school in classrooms inside nursing homes.

“If you want to change the lives of 100 80-year-olds, put 20 4-year-olds in the building,” says Jeff Jackson, community relations director at The Commons, in Enid, Okla. “I’ve seen uncooperative grandmas and grandpas get motivated when a four-year-old comes up to the window and waves.”

Each day, a few of the 22 students in the pre-K at The Commons spend 30 minutes with the nursing-home residents, doing art projects, singing, reading and playing games together. At recess, residents can watch the children on the playground through a long wall of windows, and from the physical-therapy room, patients can look right into the classroom.

The benefits to the children are social, emotional and academic, says Suzanne Lair, site principal at Jenks West Elementary, which runs a pre-K and kindergarten program inside the Grace Living Center in Jenks, Okla.

Students Attending The Pre-K At The Commons, A Nursing Home In Enid, Okla., Read, Sing And Play Games With Residents On A Regular Basis.

Program graduates need less reading support in elementary school, Ms. Lair says. “We really attribute that to their one-on-one daily reading with the grandmas and grandpas,” she says.

The children also become comfortable around people in wheelchairs, people with oxygen tanks and people with many of the other disabilities of old age.

There are currently five such programs in Oklahoma and one in nearby Coffeyville, Kan., says Chris Smith, director of early childhood at Enid Public Schools. The Enid and Jenks districts rent their classrooms for $1 a year from the nursing homes. Both programs are full.

A Park Designed For Seniors

When the City of Wichita, Kan., surveyed residents of its Tri-S neighborhood, which has a large share of grandparents caring for grandchildren, they said they wanted a park suitable for multiple generations.

In 2013, half-acre Grandparents Park opened, featuring pleasant landscaping, pickleball courts, benches, an exercise station for people over 50 and a playground for those closer to 5. AARP Kansas helped with a $22,000 grant. There was help also from the Central Plains Area Agency on Aging, the Older Adult Alliance and other groups.

Some cities see advantages in turning old tennis courts into pickleball courts. Pickleball is played with a hollow plastic ball and wooden or composite paddles on a badminton-sized court. Seniors like the game because it is competitive but less strenuous than tennis.

The City of Findlay, Ohio, replaced three underused, cracked tennis courts with an eight-court pickleball facility. The courts are now active with players, most of whom are between 60 and 75 years old. On “try-it-out nights,” regulars teach newcomers of all ages how to play.

The city spent $50,000 on the project, which also had a $23,525 grant from AARP.

Flexible Public Transportation

Roughly 8.4 million Americans age 65 and older don’t drive, according to AARP calculations based on the 2017 National Household Travel Survey. There will be more soon.

Denver is working on a new online trip planner that many local seniors may find more useful than the trip planners you find on most transit agency websites or Google Maps. In addition to showing train and bus schedules, Denver’s system aims to integrate such transportation options as private-car or public-van services that require requests for pickup. The goal is to make it easier for seniors to plan the so-called “first and last mile” of their travel.

The new planner requires transportation providers to adopt new data standards that are being developed and shared by the Vermont Agency of Transportation, says Denver Regional Transport senior manager of business development Jeff Becker.

Another way Denver is making travel easier for seniors is with its FlexRide service. FlexRide vans circulate in 21 areas of the city making both scheduled and on-demand stops. Call ahead or book online, and a FlexRide van will pick you up at your door and take you to a destination in its service area for the same price as a regular bus fare. Those with disabilities travel free.

Rural communities, by contrast, don’t have budgets for circulating vans. Vassalboro, Maine, population 4,347, used to offer weekly vans to the nearby towns of Waterville and Augusta, but they were rarely used.

This summer, Vassalboro will try a different solution: an online system for linking riders and volunteer drivers. The town will lease ride-coordination software from the nonprofit ITN America, whose systems currently enable a nationwide network of volunteer drivers to not only schedule rides but also to earn future rides by volunteer driving today or trading in a car.

The service offers flexibility and gives people another opportunity to volunteer in their community, says Town Select Board Member John Melrose. “There are retirees in town who will give their time to this,” he says.

Updated: 9-25-2021

Here Are More Tips on Aging in Place, and Why Design Pros Like Smart Lighting

A recent Barron’s Retirement article on how to tailor your home for aging in place drew a big response from readers. Many had questions about certain suggestions by architects and interior designers or about universal design ideas we didn’t mention.

Some readers had good tips on how they’ve added accessibility features to their homes. And a few were critical of certain aspects of the advice.

One reader found fault with our suggestion that people book an accessible hotel room to get a feel for how a universal design layout might work. “Please bear in mind that an able-bodied person who books an accessible hotel room denies availability of the room to those who truly need it,” the reader said.

This is a fair point. These types of hotel rooms can be in limited supply, so people interested in aging in place should ask to see what an accessible room looks like if there is one available when they check in.

Or they can investigate open houses at independent living facilities and ask to look at units that incorporate universal design elements, says John Gleichman, certified specifications writer with Sheehan Nagle Hartray Architects in Chicago.

Here Are Some More Tips For Preparing Your Home To Age In Place:

More simple ideas. Arrange furniture to give wide spaces, as people using crutches, a walker, or a wheelchair need more room to turn around and navigate, says Todd Wiltse, partner at WJW Architects, a firm focusing on senior living and memory care architecture.

When choosing furniture, consider seating with varied heights, and buy some chairs with arms, says Heidi Wang, partner at WJW Architects. Chair arms offer support when needing to stand up from seated positions.

Consider door openings. Traditional swinging doors require horizontal clearance to open and close and could be a hindrance for someone using a mobility device. One popular trend for interior doors is to replace swinging doors with sliding doors. If privacy isn’t an issue, a homeowner may be able to forgo doors.

Suggestions for stairways. Stairs often present a challenge for seniors, but there are ways to address the vertical space inside and outside a home. For the outside, a designer can use landscaping to make it appear as if ramps and mechanical lifts providing accessibility are integrated. “You can design a beautiful walkway with planters on each side and it looks like it was meant to be part of the home,” she says.

Interior stairs are trickier. To limit stair climbing, rearrange or redesign first-floor rooms to incorporate as much living space on one level. For homeowners tackling a larger redesign project, Wang suggests including a bedroom and bathroom on the first floor, and if space allows, a laundry unit equipped with front-loading washers and dryers, which are easier to load and unload.

One reader who redesigned his home for aging in place agreed with having these key living spaces on one floor, and offered a useful tip. “We installed a Murphy bed which allows for flexible use of the room. It not only serves as a place to recuperate after surgery, we (also) use it as a guest bedroom, exercise room, spa room for our hot tub and our wintering room for potted plants.”

Homeowners with greater means may want to consider adding an elevator, a burgeoning design trend. These can be a big undertaking, and the most cost-efficient way to install one or allow for one in the future is as part of larger renovation.

For homeowners thinking about aging in place, for instance, Gleichman at Sheehan Nagle says a renovation can include vertically stacked hall closets where each floor is framed with a knock-out floor panel system to accommodate a future elevator.

“Until you need that inevitable lift, you have ample storage,” he says. Gleichman says depending on the number of floors served and how sophisticated the system, installing an elevator can cost between $25,000 and $100,000.

Another reader added an elevator to the home he bought four years ago at a lower cost and without disrupting the interior space. “This is large enough for a wheelchair but we are using it for a dumbwaiter in the short term since we do not need wheelchairs. The elevator is totally outside…[and] is only $20,000 with no house modifications.”

Why smart lighting? Some readers questioned the need for smart lighting and other smart devices. One reader wondered if smart devices won’t become too complex if mental functioning slows, and another suggested that multiple smart devices might be too taxing on WiFi and a pain to reconfigure after major WiFi software updates.

Homeowners will need stronger WiFi to run multiple smart devices, and some devices may require help to set up or update when needed. However, universal design experts focused specifically on smart lighting because of its simplicity and greatest functionality.

Lisa Cini, senior living designer and author of “Boom,” a book about aging and technology, says smart lighting doesn’t require reworking every light switch in the house. “You can do one remote light switch where you want it,” she says.

Homeowners can try out smart lighting by buying a single smart plug, such as the WiFi-enabled iHome brand, which costs less than $30. These can be manually overridden if the user needs to physically turn on or off the light and unplugged if the homeowner decides it isn’t worth it.

Wang says she installed smart lighting in her home. By connecting lights to a smart speaker such as Amazon ‘s Alexa devices, she can turn on or off lights by voice, which is useful for those with severe arthritis or mobility issues. “If you have arthritis in your knees or feet, it can be a struggle to get into bed, and if you realize you’ve forgotten to turn off a light,” you can turn it off by voice, she says.

Updated: 9-26-2021

U.S. Slips In Retirement Index, And 682,400 Seniors Are Behind On Their Mortgage

The U.S. fell one spot to No. 17 among developed countries in Natixis Investment Managers’ 2021 Global Retirement Index, as Iceland topped the rankings for the third consecutive year. The ninth annual report provides a snapshot of the relative financial security of retirees in 44 countries.

Separately, a survey of 401(k) participants found that the pandemic has contributed to financial stress for younger workers more so than for older workers, and a federal report determined that almost 700,000 seniors were behind on their mortgage payments in July, raising concerns about a possible spike in homelessness among older Americans.

U.S. Slips One Spot in Retirement Rankings

In a survey of 750 individual U.S. investors, Natixis found that 41% believe they will “need a miracle” to retire comfortably and 34% think that retirement might never be an option. In addition, 49% avoid thinking about their retirement security because the challenge seems too daunting, and 59% believe they’ll have to work longer than they originally had planned, according to the report.

Survey respondents had median retirement savings of $350,000, compared with a median of $65,000 for all Americans, according to the report.

Economic consequences from the pandemic such as increased government debt, rising inflation, and low interest rates for investment vehicles are causing many Americans to feel that “their retirement dreams are slipping away,” according to the report.

“The pandemic has exacerbated financial inequality and accelerated long-term trends that are eroding the prospect of retirement security for many,” said Jim Roach, senior vice president of retirement strategies at Natixis, which says it has $1.4 trillion in assets under management.

To Rank Countries According To Retirement Security, The Gri Examines 18 Metrics Grouped Into Four Categories:

● Material well-being—The material means to live comfortably in retirement. The U.S. ranked 26th in this category.

● Finances in retirement—Access to quality financial services to help preserve savings value and maximize income (U.S. ranked 11th.)

● Access to quality healthcare services (U.S. ranked 17th.)

● Quality of life—A clean, safe environment in which to live (U.S. ranked 21st.)

After Iceland, the next six countries also retained their positions from 2020, with Switzerland ranked second, followed by Norway, Ireland, Netherlands, New Zealand, and Australia. Germany moved up two places to eighth.

Younger workers are significantly more likely than older workers to be so stressed out about their finances that they struggle to perform their job duties, according to a survey from Schwab Retirement Plan Services. The survey found that 44% of Generation Z workers said financial worries were hurting their job performance, compared with 38% of millennials, and 24% of all workers.

Catherine Golladay, head of Schwab Workplace Financial Services, said the “stressful environment” created by the pandemic has had an outsize impact on younger workers because they “are just starting their careers at a time of upheaval at home and in the workplace—from new health and safety challenges to the rapid expansion of virtual offices and dramatic swings in our economy and markets.”

In early April, Schwab polled 1,000 active participants in 401(k) plans at companies with at least 25 employees, plus an additional 100 plan participants from Generation Z. The survey defined Generation Z as workers ages 21 to 24, while millennials were 25-40, Generation X were 41-56, and baby boomers were 57-70.

Only 10% of boomers were experiencing financial stress that affected their job performance, compared with 20% of Gen X. Younger workers were more likely to predict that Covid-19 will delay their retirement, with 35% of millennials saying so, compared with 32% of Gen Z, 20% of Gen X, and 13% of boomers.

Gen Z savers are the most likely to say that they don’t know which investments to select within their 401(k) plans, with 51% saying that, compared with 32% of older participants.

The survey found that Gen Z and millennials were significantly more interested in having annuity options within their 401(k)s, the ability to purchase fractional shares of funds, and ESG investing options that take into account companies’ environmental, social and governance records.

Among Gen Z participants, 45% said they wish they could purchase annuities within their plan, compared with 52% of millennials, 39% of Gen X, and 26% of boomers. As for wanting more ESG options, it was 41% for Gen Z, 43% for millennials, 29% for Gen X, and 12% for boomers. Among Gen Z, 41% wanted the ability to purchase fractional shares, compared with 39% of millennials, 25% of Gen X, and 13% of boomers.

CFPB: Nearly 700,000 Seniors Behind On Their Mortgage

About 4.4% of seniors with a mortgage are behind on their payments, with non-white homeowners and those making less than $25,000 a year most likely to be in arrears, according to the U.S. Consumer Financial Protection Bureau.

In July, about 682,400 homeowners ages 65 and older were behind on their mortgage payments, and an additional 236,000 who were current had no confidence they would be able to make their next month’s payment, according to the CFPB.

The number of seniors missing payments appears to be trending downward, however, having briefly topped 1 million homeowners in the summer of 2020 and last February, according to the agency.

The CFPB’s report cites data from the Census Bureau’s Household Pulse Survey, an online poll evaluating the economic and social impacts of Covid-19 on U.S. households. About 19,400 seniors took the survey June 23 through July 5, including 5,800 homeowners.

Only 2.7% of white seniors with mortgage payments reported being behind in July, compared with 10% of non-whites. Similarly, 3.4% of seniors with mortgages who had incomes of $25,000 or more were behind, compared with 17.7% of those with lower incomes, according to the CFBP.

Of the seniors who were behind, 52.4% reported living in a household with three or more people, while 39.4% lived with one other person, and 8.2% lived alone. Children are present in 33% of these households, and 20.4% of these homeowners report that they sometimes or often lack enough food during the week.

About 36% percent of seniors missing mortgage payments said a job loss by a household member was a principal cause. In addition, 12.2% of seniors who were behind on their mortgage payments report that they’ll likely face foreclosure. That’s on top of the 188,700 seniors who are behind on rent payments and face eviction, the CFPB said.

Updated: 9-27-2021

Who Will Pay For The Elderly Is Now An Urgent Question

As the U.S. population skews older, long-term care will become a more urgent need for families. The pandemic showed the current system falls woefully short.

The next few years are going to determine how you’ll spend the most vulnerable years of your life, and who’s going to pay for it.

Pandemic excluded, the odds that you’ll live to an advanced old age have increased. But living longer doesn’t necessarily mean better quality of life. More than 40% of Americans over age 85 have Alzheimer’s disease and 70% of 65 year-olds are projected to need long-term care at some point.

The grim reality is that as people live longer, many will need long-term care. The pandemic exposed the poor quality of many care facilities, making it all the more clear that the status quo isn’t sustainable. All developed countries are grappling with aging populations that will force them to decide how best to manage and finance the care of their elderly. The U.S. Congress is debating the question now as it grapples with President Joe Biden’s spending plan.

Will it be the federal government assuming responsibility for universal care? State governments doling it out to the most needy? Or will families retain more control through wider access to private market insurance?

In the UK, Prime Minister Boris Johnson has proposed a major overhaul to the country’s social care system financed with a 1.25% tax increase on Britons. The tax increase is getting pushback, but at least it’s an honest acknowledgement of the costs involved and that everyone will need to pay.

In the U.S., long-term care — by which I mean non-medical care for individuals living with disabling conditions — isn’t covered by Medicare. It’s designed as a last resort for impoverished retirees provided through each state’s Medicaid program. Since long-term care is expensive and most people don’t have private long-term-care insurance, Medicaid shoulders more than 50% of the costs of caring for America’s disabled and elderly; private insurance covers just 11%.

To qualify for Medicaid, beneficiaries must prove they don’t have enough wealth to pay for care themselves. This creates an incentive for middle-class retirees to spend or give-away their assets so they don’t exceed state limits. According to one study between 1998 to 2008, almost 10% of retirees had to do this to gain Medicaid coverage.

Most of that care is through institutions such as nursing homes. Even if a family prefers home care, there are few options, and long wait lists for home health services.

Biden’s original Build Back Better plan offered a solution to this problem. It included $400 billion to expand access to home health workers through state Medicaid programs. The money would be well spent on long-term care, as that will help the most vulnerable and needy members of society who are falling through the cracks of Medicaid.

It’s certainly a better use of government money than other provisions in the budget that mostly benefit the upper middle class, like reinstating state and local tax deductions for income taxes, or endless subsidies for electric cars.

But the provision already is getting pared back as lawmakers balance competing interests in the reconciliation process.

Even if it passed in full, the extra money is only a stopgap solution. Expanding Medicaid programs isn’t entirely bad, but it also gives states an incentive to loosen the asset requirements for qualification, drawing more people into the program and raising reliance on Medicaid when the opposite should be happening.

It’s another step toward crowding out an already thin and expensive private insurance market that would otherwise be a viable option for many middle class Americans who’d prefer private insurance.

Its’ a vicious cycle. When fewer people buy long-term care insurance, those who do tend to be in need of the most expensive care, which makes the insurance even more expensive and excludes more buyers.

There is an argument to be made that long-term care should be provided by our government universally. But as the population ages, our taxes will need to cover more people with expensive needs, especially if more people get care at home. Unless we devote substantial resources (and forgo investment in other parts of the economy), there will still be waitlists and people shuttled into poor-quality institutions.

Before we go all in on government provided care, ask yourself if you want to spend your most vulnerable years at a government-run institution, or burdening your children as you languish on a waitlist.

The pandemic exposed the need for developed countries to address long-term care in an urgent timeframe. Even if the current budget provisions pass, it expands an entitlement that will only get more expensive. It doesn’t solve the root of the problem: an over reliance on Medicaid for long-term care.

If Medicaid is expanded, it should be accompanied by more stringent asset limits as part of larger reform. This would keep Medicaid for what it is was meant to be: help for the neediest.

For everyone else, long-term care insurance needs to become a viable option. There is an incentive to buy private insurance because it offers better care and gives families more choices. But most people don’t buy it because it’s so expensive. Premiums are high because of Medicaid.

But they also reflect that long-term care is inherently expensive for companies to insure because many people who buy insurance will need it. The market could be improved by pairing long-term care with life insurance or reverse mortgages and making all premiums tax deductible.

Long-term care will only become a bigger expense for many families. If the government tries to turn this incrementally into a universal benefit through Medicaid, it will be expensive and lead to worse options for the people who need care. Instead we must reform Medicaid, give it adequate funding and grow the private market.

Updated: 10-2-2021

1 In 5 Older Americans Say They Used Up Their Savings Or Lost Their Main Source Of Income Because Of The Pandemic

Alarming statistics of the harm that COVID-19 has wreaked on the health and finances of people over 65.

We’ve all known that COVID-19 has taken a cruel toll on the health of older Americans. Now, a new study from the Commonwealth Fund foundation finds that the coronavirus has been equally brutal financially.

In fact, the 2021 International Health Policy Survey of Older Adults shows Americans 65+ have been facing greater economic hardship and health care disruption than people their age in 10 other wealthy nations. In some cases, far greater.

The findings were released a day after the U.S. Census reported that median household income for Americans 65+ fell by 3.3% from 2019-20. It’s now roughly $46,400, said David Waddington, chief of social, economic and housing statistics at the Census. (The median household income dropped by 2.6% for those under 65).

Some 9% of Americans 65 and older are now living in poverty. Half of Medicare beneficiaries have incomes below $30,000, according to the National Council on Aging.

A Poor Showing For U.S. For ‘Retiree Well-Being’

Another new international survey, from Natixis Investment Managers, named the U.S. No. 17 in the world for “retiree well-being.” (Iceland was No. 1 for the third year running.) America’s rank is down a spot from last year. This survey’s respondents — individuals with at least $100,000 in investible assets — said COVID-19 has made retiring securely more difficult.

In addition, the Commonwealth Fund President Dr. David Blumenthal said during a call with the media, in the U.S., “Black and Hispanic older adults suffered disproportionately from the pandemic’s economic fallout.”

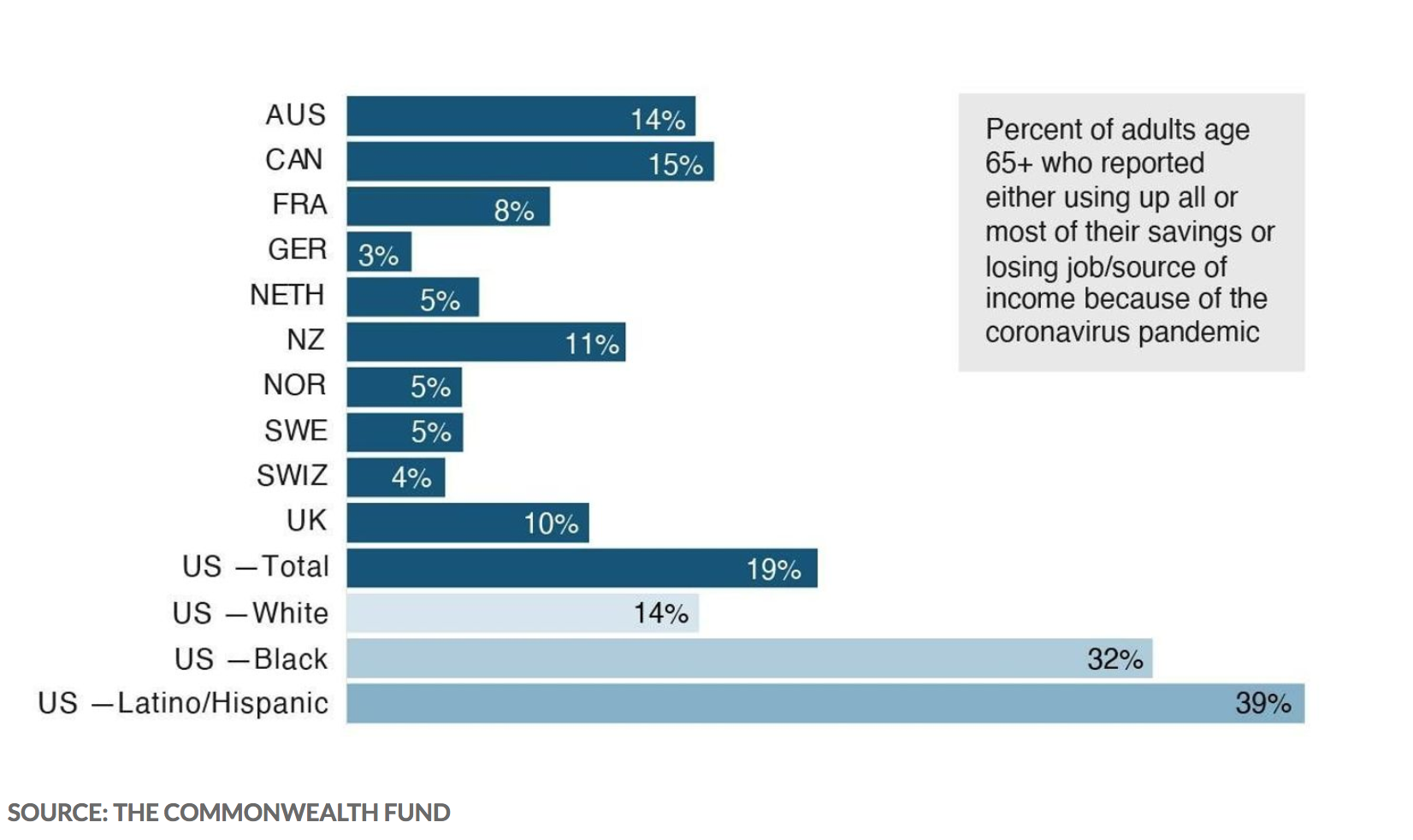

The Commonwealth Fund surveyed 18,477 adults 65+ from March to June 2021 in Australia, Canada, France, Germany, the Netherlands, New Zealand, Norway, Sweden, Switzerland, the United Kingdom and the U.S. Among its stark findings:

Nineteen percent of older Americans reported they used up their savings or lost their main source of income because of the pandemic. That’s four to six times the rate in Germany, Switzerland, the Netherlands and Sweden.

Nearly 4 in 10 older Hispanic adults and 1 in 3 older Black adults said they experienced economic difficulties related to the pandemic. By contrast, just 14% of older white adults said so.

Thirty-seven percent of older Americans with two or more chronic conditions reported pandemic-related disruptions in their health care. Compared with all the other countries in the survey, they were the most likely to have medical appointments canceled or postponed due to the pandemic. In Germany, for instance, just 11% of people 65+ reported such results.

The Commonwealth Fund says 68% of its U.S. respondents reported having two or more chronic conditions; 42% had three or more — significantly higher rates than in the other 10 countries and slightly lower than the percentages for Medicare beneficiaries in the U.S. overall.

Twenty-three percent of Americans 65+ who needed help with activities of daily living during the pandemic — like eating or getting dressed — didn’t receive such help because caregiving services were canceled or very limited. Only people 65 and older in Canada and the United Kingdom had things worse (31% and 30% respectively).

All of these findings are despite our nation spending the highest percentage of its gross domestic product overall on health care. And despite the vast majority of Americans 65+ having health insurance, either through traditional Medicare, private Medicare Advantage plans or Medicaid.

In fact, Sharon Stern, assistant division chief for employment statistics at the Census said on Tuesday, Sept. 14 that its new figures showed just 1% of Americans 65+ lack health insurance. The percentage who are uninsured is slightly higher than 0.9% in 2018.

Economic Challenges, Despite Health Insurance

Still, said Reginald D. Williams II, the Commonwealth Fund’s vice president for international health policy and practice innovations, “At the end of the day, despite having health insurance, older adults [in the U.S.] face higher economic challenges compared to those in other countries.”

Very few older Americans surveyed said they weren’t planning to get COVID-19 vaccinations. “The vaccination story overall was pretty positive,” said Williams.

Blumenthal noted that one of the advantages of comparing just Americans 65+ with those of a similar age in other countries is that Medicare is the closest the U.S. comes to having the kind of national health insurance the other nations have for all their residents.

He called Medicare a “critical lifeline” for Americans 65+, but also said it is a “flawed program” with significant gaps for vulnerable beneficiaries.

Because of those gaps, Blumenthal said, some on Medicare have sizable out-of-pocket health care expenses. “We could make Medicare more affordable by putting caps on out-of-pocket costs and by covering more health services, including dental, vision and hearing,” he noted.

Sadly, almost half of all Medicare beneficiaries didn’t see a dentist in the past year or don’t have dental coverage, the National Council on Aging reports.

Legislation that President Joe Biden has proposed and is under discussion by Congress would add dental, vision and hearing coverage to Medicare. The vision coverage would begin in October 2022, the hearing coverage in October 2023 and the dental coverage in January 2028, according to the National Council on Aging’s Howard Bedlin.

Proposals For Broadening Medicare coverage

“This is history in the making,” said National Council on Aging Chair-Elect Kathy Greenlee, the former Assistant Secretary for Aging under President Barack Obama, speaking about the potential for broadening Medicare during an online panel discussion Wednesday.

But whether any of those Medicare reforms will become law is far from certain. Already, medical and dental lobbying groups are fighting the proposed extra coverage, fearing lower reimbursements to physicians and dentists.

Some Republicans believe the added coverage would be too costly for the U.S. government. A 2019 proposal to add dental, vision and hearing to Medicare was estimated to cost $358 billion over 10 years, according to the Brookings Institution.

The Commonwealth Fund’s report concludes with this call to action: “The U.S. has the means to take steps to reduce this burden on older Americans and to ensure that their health needs are met.”

The foundation’s researchers say the U.S. can do more to help older adults meet their care needs by: improving access to telehealth services and integrating them fully with regular primary care; further improving the economic security of older Americans and addressing the racial and ethnic inequities the pandemic has exacerbated.”

Five Innovative Ways Cities,Five Innovative Ways Cities,Five Innovative Ways Cities,Five Innovative Ways Cities,Five Innovative Ways Cities,Five Innovative Ways Cities

Related Articles:

Even A Booming Job Market Can’t Fill Retirement Shortfall For Older Workers (#GotBitcoin?)

These 16 Money Wasters Will Ruin Your Retirement (#GotBitcoin?)

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing (#GotBitcoin?)

Three Steps To Take If You’re Behind In Retirement Savings (#GotBitcoin?)

A Retirement Wealth Gap Adds A New Indignity To Old Age (#GotBitcoin?)

401(k) or ATM? Automated Retirement Savings Prove Easy to Pluck Prematurely

Leave a Reply

You must be logged in to post a comment.