Tech Stocks Down $800 Billion While Asian Stocks Erase $5.6 Trillion In Market Value (#GotBitcoin?)

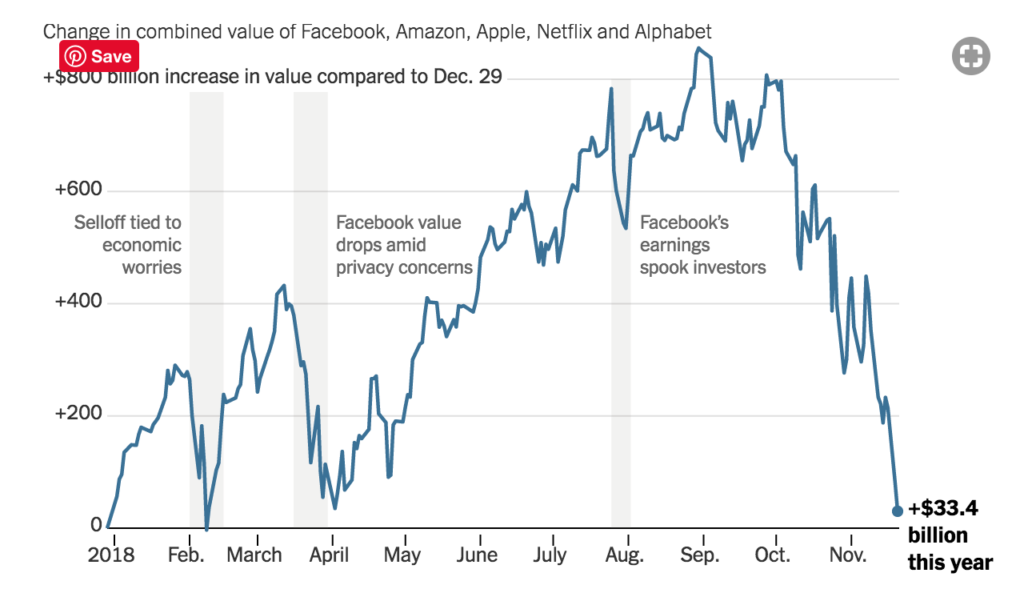

As investors have dumped shares of Facebook, Amazon, Apple, Netflix, and Google-parent Alphabet, $822 billion in value has been wiped off their combined market value since the end of August. Tech Stocks Down $800 Billion While Asian Stocks Erase $5.6 Trillion In Market Value

Wall Street’s Turn Against Big Tech Is Adding Up

Based on the losses from each company’s high point in recent months, more than $1 trillion in value has been erased. Facebook, Apple and Amazon have endured the greatest declines, all down $250 billion or more from their respective peaks.

That is a marked reversal for one of the most popular trades on Wall Street. Investors piled into shares of the largest tech companies, betting their revenue would continue to grow strongly as these behemoths upended industries from retail to communication to media.

By the end of August, the market value of Apple and Amazon had each surpassed $1 trillion, and Alphabet was flirting with $900 billion. The combined market value of the five had reached $3.6 trillion.

But worries about global economic growth as well as lackluster earnings and outlooks the past two quarters have shaken investors’ confidence. In particular, concerns have mounted about how many new iPhones Apple will manage to sell. Facebook has spent much of the year mired in scandal, raising the specter that the United States government will tighten regulation of big tech. All of that has investors questioning whether the values of these big tech companies have become too lofty.

Of course, Facebook, Amazon, Apple, Netflix, and Alphabet have faced steep sell-offs before, only to bounce back quickly. Just this year, the combined market value of those five companies has tumbled 7 percent or more during three separate periods. In each instance, the stocks resumed their march to fresh highs within weeks.

The question now, though, is whether this time will be different.

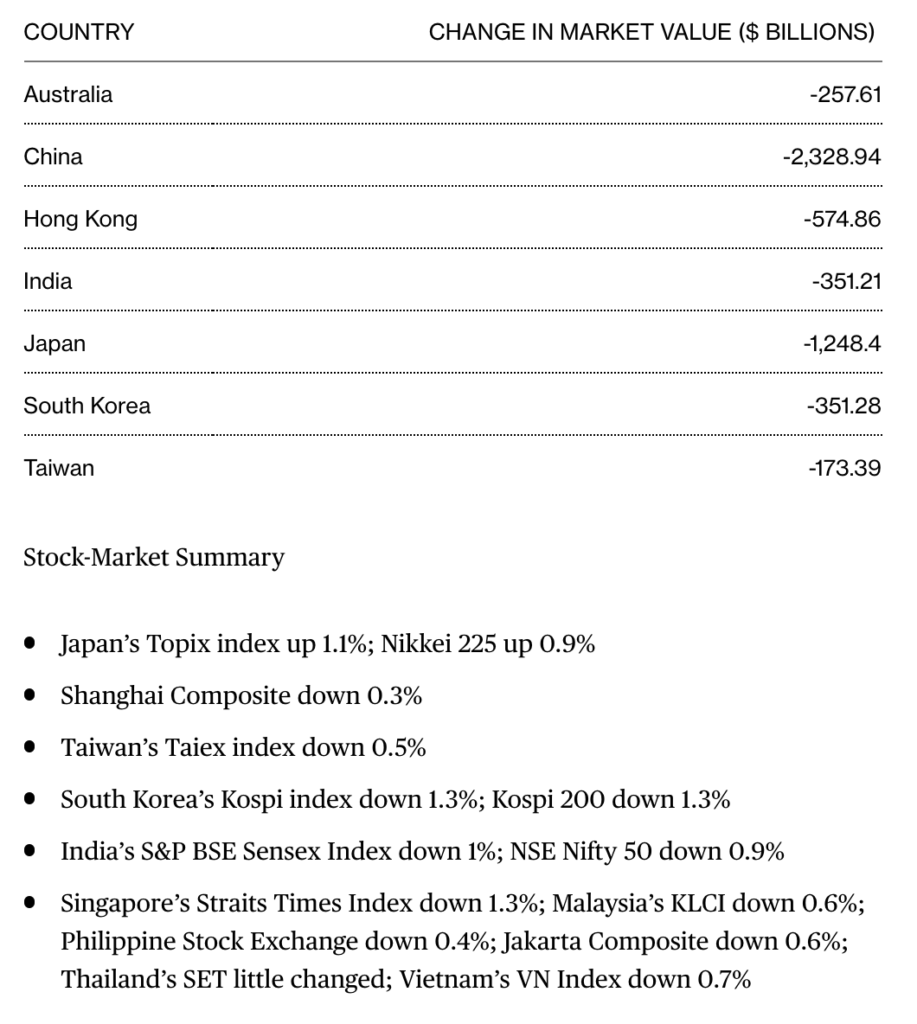

$5.6 Trillion Asia Stock Loss Has Traders on Edge of Their Seats

Here’s A Look At How Major Stock Markets Have Done This Year Across The Region, As Of Dec. 25

With three days of Asia equity trading left for the year and low volumes across the board, traders don’t seem to be taking any chances.

About $5.6 trillion of equity value has been obliterated in the region this year as the global carnage shows no let-up. And investors are bracing for volatile days ahead.

Today (12-26-2018) is a classic example of that:

The MSCI Asia Pacific Index, which climbed as much as 0.6 percent on Wednesday, swung between gains and losses and was 0.2 percent higher as of 4:20 p.m. in Hong Kong.

Japan’s Nikkei 225 Stock Average also had a choppy day but ultimately closed up 0.9 percent after entering a bear market on Christmas Day.

U.S. stock-index futures fluctuated between gains and losses, with the S&P 500 Index on the brink of entering a bear market when it reopens on Wednesday.

Hong Kong, Australia and New Zealand remain closed for a holiday.

There’s a chance that 10-year U.S. bull market comes to an end when markets reopen even after U.S. President Donald Trump gave his first expression of public support for Treasury Secretary Steven Mnuchin and Fed Chairman Jerome Powell since Bloomberg News last week reported that the president had discussed dismissing the Fed chief, who was recommended by Mnuchin.

“The direly weak sentiment continues to be the engine behind the declines for markets that have yet to find the panacea in the form of any positive impetus,” said Jingyi Pan, market strategist for IG Asia Pte. “The weight that is given to President Trump’s assurances is simply much lighter than the threats he is throwing.”

What’s next? “As far as the futures are suggesting, the market is indecisive right now,” Pan said. “One should not be surprised if most are still waiting out the storm this week.”

Related Articles:

US Treasury Secretary Steven Mnuchin Tries Calm Banks, Panicked Stock Markets, Trump Completely Silent (#GotBitcoin?)

Trump Policies Cause Chinese Stocks To Out-perform Those of US. (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Go back

Leave a Reply

You must be logged in to post a comment.