The NRA Says It’s in Deep Financial Trouble, May Be ‘Unable to Exist’ (#GotBitcoin)

The National Rifle Association warns that it is in grave financial jeopardy, according to a recent court filing obtained by Rolling Stone, and that it could soon “be unable to exist… or pursue its advocacy mission.” The NRA Says It’s in Deep Financial Trouble, May Be ‘Unable to Exist’ (#GotBitcoin)

(Read the NRA’s legal complaint at the bottom of this story.)

The reason, according to the NRA filing, is not its deep entanglement with alleged Russian agents like Maria Butina. Instead, the gun group has been suing New York Gov. Andrew Cuomo and the state’s financial regulators since May, claiming the NRA has been subject to a state-led “blacklisting campaign” that has inflicted “tens of millions of dollars in damages.”

In the new document — an amended complaint filed in U.S. District Court in late July — the NRA says it cannot access financial services essential to its operations and is facing “irrecoverable loss and irreparable harm.”

Specifically, the NRA warns that it has lost insurance coverage — endangering day-to-day operations. “Insurance coverage is necessary for the NRA to continue its existence,” the complaint reads. Without general liability coverage, it adds, the “NRA cannot maintain its physical premises, convene off-site meetings and events, operate educational programs … or hold rallies, conventions and assemblies.”

The complaint says the NRA’s video streaming service and magazines may soon shut down.

In addition to its insurance troubles, the NRA court filing also claims that “abuses” by Cuomo and the New York State Department of Financial Services “will imminently deprive the NRA of basic bank-depository services … and other financial services essential to the NRA’s corporate existence.

The lawsuit stems from actions taken by New York financial regulators to halt the sale of an illegal, NRA-branded insurance policy. The NRA actively marketed “Carry Guard,” a policy to reimburse members for legal costs incurred after firing a legal gun. In May, the state of New York found that Carry Guard “unlawfully provided liability insurance to gun owners for certain acts of intentional wrongdoing.” The NRA’s insurance partners agreed to stop selling the policies and pay a $7 million fine.

The NRA complaint alleges that New York was not content to block this single insurance product, but instead campaigned to sever the NRA’s ties to a wide range of financial service providers, from insurance companies to banks.

The NRA did not respond to a request for more detail about its financial distress, but its most recent financial disclosure also shows it overspent by nearly $46 million in 2016.

The lawsuit decries pressure from state regulators in the wake of the Parkland, Florida massacre — including a letter asking financial institutions to heed “the voices of the passionate, courageous, and articulate young people who have experienced this recent horror first hand” — and from the governor himself. In April, Cuomo tweeted: “I urge companies in New York State to revisit any ties they have to the NRA and consider their reputations, and responsibility to the public.”

In its complaint, the NRA paints these actions as a “malicious conspiracy to stifle the NRA’s speech and induce a boycott of the NRA.” Cuomo and state regulators, the NRA alleges, were intent on “suppressing the NRA’s pro-Second Amendment viewpoint” and had engaged in “unlawful conduct with the intent to obstruct, chill, deter, and retaliate against the NRA’s core political speech.”

The lawsuit seeks an immediate injunction to block state authorities from “interfering with, terminating, or diminishing any of the NRA’s contracts and/or business relationships with any organizations.” Without court intervention, the complaint reads, “the NRA will suffer irrecoverable loss and irreparable harm if it is unable to acquire insurance or other banking services due to Defendants’ actions.”

Cuomo also did not respond to a request for comment, but has previously waved off the NRA’s lawsuit as “a futile and desperate attempt to advance its dangerous agenda to sell more guns.”

NRA’s Carry Guard Insurance Violates New York Law; Broker Agrees to $7 Million Fine

New York financial regulators said on Wednesday that a controversial insurance program offered by the National Rifle Association violates state law, and they have levied a multi-million dollar fine on the company that administers it.

In a Wednesday announcement, the New York State Department of Financial Services said the NRA’s Carry Guard program “unlawfully provided liability insurance to gun owners for certain acts of intentional wrongdoing,” and that the group solicited coverage to New York residents without a license from the state. Lockton, the world’s largest privately held insurance brokerage, has agreed to pay the state $7 million for the violations, and will terminate Carry Guard policies held by New Yorkers.

Department of Financial Services Superintendent Maria T. Vullo described the conduct as “an egregious violation of public policy.”

The NRA launched Carry Guard to great fanfare in the weeks leading up to the group’s 2017 annual meeting in Atlanta. Carry Guard offers customers liability insurance in the event of a self-defense shooting, ranging up to $150,000 in criminal-defense reimbursement and $1 million in a civil-liability protection. Members also get a 24-hour advice hotline and immediate access to money for bail and the costs of cleaning up the scene.

Lockton administered Carry Guard’s marketing and distributing policies. The program was formerly underwritten, or designed and priced, by the insurance giant Chubb, which ceased its involvement earlier this year.

The NRA aggressively promoted Carry Guard to its members, giving the program a splashy debut at its annual meeting last April in Atlanta. The NRA gave Carry Guard a standalone website and advertised the product through email, YouTube, and social media. Some of the promotions featured the NRA personality Dana Loesch. Another came with this pitch to prospective clients: “You should never be forced to choose between defending your life…and putting yourself and your family in financial ruin.” The message concludes: “Sign up for NRA Carry Guard today!”

Carry Guard also includes a training program, designed to teach gun owners how to “effectively confront today’s evolving conflict environment.” As The Trace has reported, the program drew backlash from gun instructors, who argued that its emphasis on military tactics could encourage a dangerous mentality among civilians. “Civilians using military tactics will get you in trouble really fast with the law, if not dead,” read a blog post by Robert Boilard, an NRA-certified instructor from New Hampshire.

According to the Department of Financial Services, the NRA issued 680 Carry Guard policies to New York residents between April and November 2017.

New York regulators launched an official investigation into the NRA’s insurance practices in the state in the fall of 2017. No insurer can provide criminal defense coverage in New York for a person charged with a crime involving firearm. And while state law permits groups like the NRA to put their names on insurance products and endorse them, it prohibits direct insurance salesmanship by unlicensed parties.

The Department of Financial Services deemed Carry Guard’s liability insurance for criminal proceedings improper. It also determined that the NRA had actively “marketed and solicited” the program without a license to do so.

As Carry Guard’s administrator in New York, Lockton agreed to pay a $7 million settlement.

“It is our responsibility to ensure we are fully compliant,” said Dean Davison, a Lockton spokesperson. “We believe this settlement is the best way to resolve these issues.”

Following the February mass shooting at a high school in Parkland, Florida, Chubb disclosed that it had decided not to renew its contract to underwrite the program. Lockton also stated its intention to no longer act as broker and administrator for Carry Guard.

“It’s a major step back,” Peter Kochenburger, the executive director of the Insurance Law Center at the University of Connecticut Law School, told The Trace’s Mike Spies in February. “To keep this going, the NRA will have to find another insurance company to underwrite this. It’s hard to imagine another publicly traded company, or a company like State Farm, stepping in.”

Updated 11-4-2018

NRA Loses Midterm Muscle After Cash Crunch From Big Bet On Trump

After devoting record sums to help elect President Trump in 2016, the powerful lobbying organization had a sharp decline in working capital last year. The NRA borrowed against life insurance policies on top executives and took out a loan from its philanthropic arm. It also turned to a regional bank to refinance a long-standing credit line that it had almost exhausted from Wells Fargo & Co.

Even after borrowing the money, NRA spending by its lobbying arm in venues like television and radio has plunged this year 86 percent to $1.9 million from the last midterm elections. When this outlay is combined with spending by the NRA’s political action committee, which raises money separately, the $16.4 million total is less than half of what they deployed in 2014. The retreat comes as mass shootings in Las Vegas, Parkland, Florida, and Pittsburgh have made gun control a hot-button political issue in the Nov. 6 elections.

Andrew Arulanandam, the NRA’s spokesman, said changes in the group’s so-called unrestricted net assets, used for political activity and other purposes, are typical and not an indication of waning support.

“Like many organizations, unrestricted assets may fluctuate from year-to-year based upon the needs of the organization,” Arulanandam said in an emailed statement. He added that with 5.5 million members, the NRA is at “the highest levels of membership in our 150-year history.” He declined to provide additional details.

The NRA PAC has focused its independent political spending on a number of Senate races. It has paid out $1.1 million to oppose incumbent Democrat Joe Donnelly in Indiana and almost $667,000 against incumbent Democrat Claire McCaskill in Missouri. It deployed nearly $683,000 in support of McCaskill’s Republican opponent, Missouri Attorney General Josh Hawley.

Threat Recedes

The gun rights movement can be seen as a victim of its own success. Trump’s victory in 2016 pushed off the threat of gun control from Democrats and firearms sales stagnated as potential customers no longer saw the need to stock up on weapons. That hurt gunmakers. Shares of Sturm Ruger & Co. are down about 12 percent since the November 2016 election compared with a 29 percent gain in the S&P 500 Index.

Two years ago, the NRA’s finances began to weaken after the lobbying arm put $34.5 million behind the candidacy of Trump and other Republicans. The group ran a $41 million deficit in 2016 as increased political spending and membership acquisition costs drove total expenditures to $419 million, according to the NRA’s financial statements.

Last year, the deficit grew by $21 million as revenue from contributions and membership dues sank. The $35 million decline in dues — the NRA’s largest source of unrestricted revenue — was particularly significant.

“The worst thing that happens to the gun rights movement is when they are successful politically,” said former NRA lobbyist Richard Feldman, who’s president of the Independent Firearm Owners Association.

Assets Drop

By the end of 2017, the NRA had just $1.48 million of unrestricted assets, down from $65.6 million two years prior, according to the statements. The group warned of a potential funding shortage when it told members earlier this year that their annual dues would rise $5 in August, adding in the notice, “We simply can’t compete in the 2018 elections” without the increase.

Brian Mittendorf, an accounting professor at Ohio State University who studies the NRA’s financial statements, said the group does not appear to be facing an immediate fiscal crisis. But he said multiple years of declining net assets raise concerns: The organization will need to scale down its spending or find new sources of revenue.

The lobby last year turned to a form of credit it hadn’t used since 2011. It borrowed $3.5 million against whole life insurance policies it held as funding for a deferred compensation program for executives and employees, according to the statements.

The NRA also took the step of borrowing $5 million from its charitable foundation last November. While the foundation grants roughly $19 million a year to the NRA, that money can only be used for the same philanthropic activities that the charity supports.

Foundation Loan

The loan represents a way to “slip the bounds” of these charitable restrictions, said Marcus Owens, a partner at Loeb & Loeb and former director of the Internal Revenue Service division that oversees nonprofits. Under U.S. rules, the NRA has more leeway in how it spends its foundation loan as long as it bears interest at market rates and is repaid.

Wilson Phillips, who resigned in September as the NRA’s chief financial officer, described the foundation loan as “a very short-term deal” in an interview in January. NRA financial statements disclosed that its due date was extended from February until June. It remains outstanding, according to regulatory records.

The NRA pays an annual rate of 7 percent for the loan, making it relatively expensive compared with the floating rate of 2.16 percent for the Wells Fargo credit line last year, according to the statements. But the NRA had drawn $23 million on the credit line by the end of 2017, leaving little room for additional borrowings.

In September, the NRA refinanced its line of credit. While Wells Fargo had been renewing the $25 million line for roughly a decade, the NRA’s balance sheet appears to have weakened during the past several years. With the facility set to expire Sept. 30, the NRA switched to a new credit line with Access National Bank, securing it with 18 securities accounts at Morgan Stanley Smith Barney, according to a September filing.

Susan Budak, a consultant on nonprofit accounting who reviewed the NRA’s financial statements, said the group’s liquidity “has eroded. The biggest factor,” Budak added, “is they are pledging cash, investments and receivables as collateral for their borrowing.”

Access National provided the organization with a $3 million increase in the size of the credit line to $28 million, a person familiar with the situation said. Michael Clarke, Access’s chief executive officer, declined to comment on the NRA loan.

The NRA, which has managed through deficits before, won’t release new financial statements covering 2018 until next year.

The best outcome for NRA fundraising, said ex-lobbyist Feldman, would be success by Democrats election night.

“If the Democrats take the House, there will not just be gun control bills,” he said. “There will be hearings. It’s the kind of ink the NRA wants.”

Updated 12-2-2018

NRA Awarded Contracts To Firms With Ties To It’s Own Top Officials

The payments total millions of dollars over several years, some of which the gun-rights group revealed in recent filings.

New filings from the National Rifle Association reveal that the gun-rights group directed millions of dollars over several years to people with close ties to the group, including former top officials.

A separate review of the NRA’s vendor relationships found other business arrangements that similarly benefit insiders.

The NRA Foundation, an affiliated nonprofit, paid millions of dollars to a company controlled by a former NRA president, the filings indicate. The NRA also paid nearly $1 million over two years to a retired NRA official through one of its longtime vendors.

The separate review found that a consulting firm hired by the NRA in turn employed the wife of an NRA executive, and another of its outside consulting firms is controlled by the NRA Foundation’s executive director.

The NRA and its representatives said there is nothing improper about any of its relationships. Where potential conflicts of interest arise—such as when the organization’s insiders stand to financially benefit from its vendor contracts—the audit committee of its board generally reviews and approves such transactions, the NRA said.

William A. Brewer III, an outside lawyer for the NRA, said the group “strives to comply with all applicable regulations” and has “appropriate processes and safeguards in place” to manage potential conflicts of interest.

Some of these relationships weren’t reported in the NRA’s filings until recently. The NRA, one of the nation’s largest and most influential nonprofit organizations, said in its filings and to The Wall Street Journal the omissions were inadvertent.

NRA supporters say the gun-rights advocacy community is fairly small, and the NRA ends up doing business with people it knows and trusts.

Some governance experts said it isn’t unusual to see one or two conflicts of interest in a large nonprofit like the NRA. A broader pattern is less common and raises questions about how prudently the organization is being run, they said.

“If I were an NRA member paying my dues, I’d wonder why all this money was being paid into companies controlled by NRA insiders or benefiting them,” said Elizabeth J. Kingsley, a Washington lawyer specializing in nonprofit law.

In one previously unreported arrangement, an NRA fundraising consultant, McKenna & Associates, late last year hired as a new senior adviser the wife of NRA executive Josh Powell. McKenna had been paid $2.6 million by the NRA over the previous two years.

A few weeks after his wife’s hiring, Mr. Powell signed an extension of the firm’s contract with the NRA.

Mr. Powell, the NRA’s third-highest executive, said McKenna has worked for the NRA for about seven years. His wife was hired after she met McKenna’s owner socially at an NRA fundraiser, Mr. Powell said, and the owner hired her because of her consulting skills.

Mr. Powell said he disclosed the matter to other executives and the audit committee, which approved the contract extension with McKenna as in the best interest of the NRA. He said his wife is a McKenna contractor and “works on some NRA business and some other projects.”

Mr. Powell’s wife, Colleen Gallagher, didn’t return calls seeking comment. Toby Merchant, a lawyer for McKenna, said, “Colleen is not a project leader for the NRA account, nor was McKenna’s continued engagement with the NRA in any way contingent upon working with Colleen.”

Mr. Powell, the NRA’s executive director of general operations, said in an interview in September he is confident officials are “making prudent decisions with members’ money. I think about it every day.”

In a November tax filing, the NRA Foundation, which is controlled by the NRA board and sends most of its money to the NRA, disclosed for the first time a longstanding arrangement under which it buys millions of dollars in products from Crow Shooting Supply. That company is controlled by Pete Brownell, CEO of an Iowa gun retailer who was a longtime NRA director and NRA president from 2017 to early 2018.

The money—$3.1 million in 2017—went to buy ammunition and other supplies that the foundation donated to local shooting groups, a person familiar with the transaction said.

The NRA Foundation has been buying from Crow Shooting Supply since 2008, according to people familiar with the matter. The NRA, in a written statement, said the company provides goods and services at a discount, “in support of the Foundation’s educational programming.”

Mr. Brownell’s family company didn’t own Crow in the early years of its NRA contract, but purchased the supplier in 2011, when Mr. Brownell was on the NRA board and his father was CEO of the family company and president of the NRA Foundation.

IRS regulations around disclosures of “transactions with interested persons” are complex, but in general require disclosure of dealings with current or former officers, directors and their family members, or companies at least 35% controlled by them.

The NRA Foundation didn’t disclose the contract with the Brownells’ company until this year. The NRA said it made “additional disclosures” this year “to provide greater visibility” into the foundation’s activities.

The NRA also disclosed in its tax filing a complicated arrangement involving a longtime outside vendor and a former NRA official who retired about three years ago. The NRA paid the official nearly $1 million over two years after his retirement, the group disclosed. The money wasn’t paid directly by the NRA, but by the outside vendor, Lockton Affinity LLC, an insurance broker that arranged and managed NRA-branded insurance products.

The NRA said in the tax filing that it “inadvertently” failed to disclose the arrangement and a portion of the compensation in a prior year. In a statement to the Journal, the NRA said the former executive had been closely involved with Lockton while working at the NRA, and, after he retired, “the NRA wished to continue to utilize him in a consulting capacity.”

A spokeswoman for Lockton Affinity, which severed ties with the NRA earlier this year, declined to comment.

The NRA in 2017 saw a 21% decline in member dues and contributions, to $230 million, according to its financial filings. That is the lowest level since 2012. The NRA has run at a deficit for the past two years, its financial filings show.

In 2016, the NRA disclosed for the first time it was using an outside fundraising firm, HWS Consulting, and paid it $685,000 that year. The contract with HWS recently was extended to 2023, state filings show.

According to filings with state charities regulators, HWS Consulting is owned by H. Wayne Sheets, executive director of the NRA Foundation.

Like all nonprofits, the NRA Foundation is supposed to list all of its officers and their compensation in annual tax filings. Mr. Sheets was not listed in many recent foundation filings, even though he had been both an executive director and an officer since at least 2010.

After investigators contacted the NRA about the issue in September, the group said it “inadvertently omitted” Mr. Sheets from prior year filings. It included him, and his 2017 pay of $710,000 through HWS Consulting, in the NRA Foundation’s just-filed 2017 tax reports.

Mr. Sheets didn’t respond to calls seeking comment. Mr. Brewer, the NRA lawyer, said Mr. Sheets left the NRA as an employee in 2008 while continuing with the NRA Foundation and as a fundraiser through his own company. Mr. Brewer said the arrangement had been “properly vetted at the audit committee.”

Updated: 1-20-2021

National Rifle Association Files For Bankruptcy And Plans To Move To Texas

The National Rifle Association of America, the gun-rights group feared for its lobbying clout but now threatened with dissolution by the state of New York, filed Friday for Chapter 11 bankruptcy with plans to regroup in Texas.

Restructuring in federal court will help the NRA exit “a corrupt political and regulatory environment in New York,” according to a statement on its website. The NRA’s petition filed in Dallas listed assets and liabilities of as much as $500 million each.

The filing marked another dramatic twist in months of infighting and external legal pressure that have battered the New York-based NRA, one of the most powerful influencers in American politics. New York has been at the forefront of pursuing the NRA in court, with Attorney General Letitia James suing to dissolve the organization and accusing leader Wayne LaPierre and three others of fleecing it.

Chapter 11 bankruptcy allows entities to continue operating while working on a plan to repay creditors and pauses pending litigation. Besides James’s case, Washington D.C. Attorney General Karl Racine has filed a separate lawsuit against the NRA’s charitable arm, accusing it of misusing donor funds.

Whether the NRA’s maneuver will succeed in halting those cases isn’t certain. “Bankruptcy normally stays all litigation, but there is an exception for regulatory authorities like the New York attorney general,” said Eric Snyder, chairman of the bankruptcy practice at the law firm Wilk Auslander. “There will be a battle over whether the state’s regulatory power is an exception to the federal stay.”

Moving Out

The NRA struck a defiant tone Friday, asserting that it is in “its strongest financial condition in years” and is “not insolvent” on a question-and-answer web page about the bankruptcy filing.

“The plan can be summed up quite simply: We are DUMPING New York, and we are pursuing plans to reincorporate the NRA in Texas,” LaPierre, the group’s executive vice president, wrote in a letter on its website, citing “costly, distracting and unprincipled attacks” by politicians.

James retorted in her own statement, saying, “The NRA’s claimed financial status has finally met its moral status: bankrupt.” She said New York would “not allow the NRA to use this or any other tactic to evade accountability and my office’s oversight.”

The NRA has enjoyed enormous sway in Washington for its full-throated defense of the firearms industry and gun rights, beating back repeated attempts for stricter laws in the wake of mass shootings, especially since the 2012 Sandy Hook school massacre in Connecticut. But the internal rifts and James’s lawsuit dented the group’s image of invulnerability, and President Donald Trump’s impending departure is poised to remove one more NRA ally in Washington’s power structure.

For years, the NRA has received millions of dollars annually from the NRA Foundation, whose donors get a tax deduction — until the Covid-19 pandemic disrupted the group’s successful grassroots fund-raisers.

A report detailing alleged lavish spending under LaPierre, published in April 2019 by The Trace, led James to open a probe into the NRA’s nonprofit status. After former NRA President Oliver North complained about financial misconduct at the gun association, LaPierre pushed him out of his unpaid post. The NRA sued North in an attempt to bar him from seeking legal fees, and North countersued.

James filed suit in August, alleging the NRA for years diverted millions of dollars in charitable donations to enrich the organization’s top executives in violation of laws governing nonprofits. James also is demanding millions of dollars in restitution and penalties. The case immediately posed one of the biggest legal threats the NRA faced since its founding in New York in 1871.

No Letup

The NRA countersued James in federal court, accusing her of violating its First Amendment rights. The organization also accused her of weaponizing her regulatory and legal power under the guise of protecting state residents. James said Friday she will continue to pursue the NRA despite the case in Texas.

“We filed suit against the NRA because basically they were diverting funds from this charitable organization for their own personal use,” she said during a virtual town hall session on Friday hosted by Rep. Alexandria Ocasio-Cortez, the New York Democrat. “We will continue our effort because this organization has gone unchecked for years and it’s critically important that we continue to hold them accountable, even in bankruptcy court.”

The NRA’s turmoil began with a power struggle in 2019 between North and LaPierre, which included allegations of self dealing. A subsequent state probe found wrongdoing blamed for more than $64 million in losses in the last three years alone, James said when she filed her suit.

As part of litigation arising from the power struggle, the NRA claimed that North plotted with its former ad agency, Ackerman McQueen Inc., to smear LaPierre by leaking details of his spending. North and Ackerman denied the claims. The NRA has also accused James of trying to circumvent the organization’s legal rights by demanding information about its members as part of a “political witch hunt.”

The case is National Rifle Association of America, 21-30085-11, U.S. Bankruptcy Court for the Northern District of Texas (Dallas).

NRA Runs To Texas But Perhaps Cannot Hide With Bankruptcy

The National Rifle Association is about to find out what happens when its no-holds-barred embrace of the Second Amendment comes up against the U.S. Bankruptcy Code.

The group is seeking to sidestep New York’s regulators and the state’s fraud lawsuit by filing for bankruptcy in Dallas and moving to gun-friendly Texas, citing support for the right to bear arms. But the case filed last week may face a load of legal challenges at an initial court hearing Wednesday that could undermine the NRA’s plan or even add to its woes.

Opponents could ask that the case be thrown out entirely, since the NRA says it’s not really bankrupt. If the case does move forward, the customary disclosures could expose more of the NRA’s internal affairs to scrutiny from critics including Letitia James, New York’s attorney general. James has been suing to dissolve the organization and accusing leader Wayne LaPierre and three others of fleecing it. LaPierre has disputed New York’s allegations.

“I looked at this and I just laughed,” said Thomas J. Salerno, a Phoenix-based partner specializing in corporate bankruptcies with the law firm Stinson LLP. Texas may have a pro-gun reputation, but the bankruptcy judges there are federal appointees who will follow the law, not local politics, Salerno said. At best, the NRA can only slow the New York investigation, he said.

The NRA will be in court today before U.S. Bankruptcy Judge Harlin D. Hale in Dallas. While he’s unlikely to make any final rulings during the hearing, the judge could decide to reject the case, since the NRA has said it isn’t insolvent or bankrupt and told members the group is in “its strongest financial condition in years.”

Court papers show assets of about $203 million — mostly in cash, investments, receivables and its headquarters — against liabilities of $153 million. Revenue in 2020 was down 7% from a year earlier; the NRA said it cut expenses 23% and asked employees who remained on the job to take pay cuts.

Political Environment

In a statement announcing the filing, the NRA said it filed bankruptcy to escape “the toxic political environment of New York” and regroup in Texas, while allowing it to “streamline costs and expenses.”

“If you take what the NRA is saying at face value, it presents a strong argument for the case to be dismissed for a lack of good faith,” said Robert Lawless, a professor at the University of Illinois College of Law. “They’re going to have to come up with some financial reasons for doing this.”

The NRA gave a somewhat different explanation in court papers. “To be clear: the NRA is not seeking to escape regulatory oversight,” the group said. “However, it cannot allow its constitutional rights to be trampled or its existence destroyed by a political vendetta.” It said the Constitution guarantees people the right to free speech, to bear arms for self-defense “and seek a fresh start in bankruptcy court where appropriate. The NRA’s successful reorganization in Texas will affirm and advance all of these rights.”

Under the U.S. Bankruptcy Code, a company that reorganizes can leave behind legal liabilities tied to a civil lawsuit. That would require Hale to approve a reorganization plan that releases the newly reorganized NRA and its executives from the legal claims New York is making in its lawsuit. Such findings can be challenged by creditors and appealed to a higher court.

One possibility is that the judge could send the case to another state where the NRA has more substantive business ties. The organization filed for bankruptcy in Dallas — despite being headquartered in Virginia and incorporated in New York — citing a small Texas-based subsidiary that was created in November. It’s a common maneuver in Chapter 11 cases, but one that can still be challenged by creditors or the judge.

“The NRA’s filings have most of the hallmarks of a bad-faith filing and present almost textbook grounds for transfer of venue,” said Bruce Markell, a former judge and current bankruptcy professor at Northwestern Pritzker School of Law.

Still, dismissals of large corporate bankruptcies are exceedingly rare. And, unusual as it may seem, the NRA’s claim that it is “not insolvent” doesn’t invalidate its bankruptcy, according to Kevin Carey, a retired Delaware bankruptcy judge who is now a partner at Hogan Lovells. The bankruptcy code “is designed to help companies relieve financial distress” regardless of what caused it, he said.

Whether bankruptcy will help the NRA resolve pending lawsuits and investigations is a separate problem. Typically, a Chapter 11 filing halts most suits, but there’s an exception for regulatory and police powers. In a letter Wednesday, the New York attorney general said this exception applies to its lawsuit against the NRA, and urged the judge overseeing that case to let it proceed.

The NRA’s bankruptcy filing doesn’t seek to halt or transfer the New York case, William A. Brewer III, counsel to the NRA, said in an emailed statement. “Rather, it seeks to streamline and organize the NRA’s legal and financial affairs and, with approval of the court, to also allow the NRA to reincorporate in the state of Texas,” he said.

More Data

If the lawsuit does get put on hold by the so-called automatic stay, the New York case would simply become part of the bankruptcy — which may give New York new legal tools to extract information, Salerno said.

That’s because under Bankruptcy Rule 2004, creditors or other parties can often get access to more information than they would in another forum, Salerno said. In that sense, the NRA bankruptcy could turn out to be a self-inflicted wound, he said.

“Honestly, I just shook my head,” Salerno said. “It may be like the NRA pointing a gun to its own head and saying, ‘Stop me before I shoot again.”’

The case is National Rifle Association of America, 21-30085-11, U.S. Bankruptcy Court for the Northern District of Texas (Dallas).

(Michael R. Bloomberg, founder of Bloomberg News parent Bloomberg LP, is a donor to candidates and groups that support gun control, including Everytown for Gun Safety.)

The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,The NRA Says It’s,

Related Article:

NAAGA Offers Black Gun Owners An NRA Alternative

NRA CEO Wastes Members Money On Expensive And Personal Private Jet Use

Major Corruption And Scandal At The NRA (#GotBitcoin?)

After NRA Rebuke, Doctors Speak Louder On Gun Violence

The NRA Says It’s in Deep Financial Trouble, May Be ‘Unable to Exist’ (#GotBitcoin?)

NRA Loses Midterm Muscle After Cash Crunch From Big Bet On Trump (#GotBitcoin?)

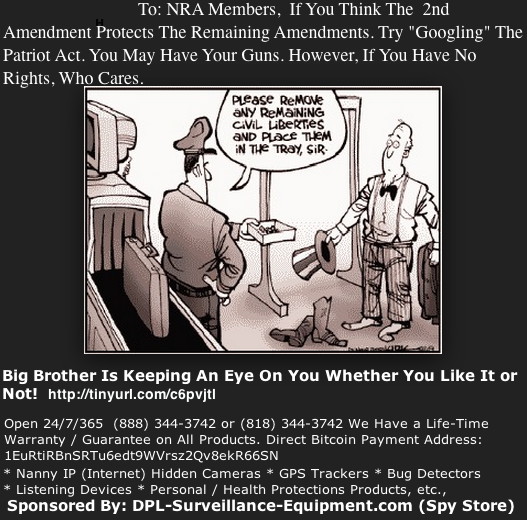

The NRA’s 2nd Amendment Rights vs The Patriot Act

More Schools Are Buying ‘Active-Shooter’ Insurance Policies (#GotBitcoin?)

[…] The NRA Says It’s in Deep Financial Trouble, May Be ‘Unable to Exist’ (#GotBitcoin?) […]