Ultimate Resource On The 1MDB Scandal Involving Goldman Sachs, Celebrities, Politicians, Etc. (#GotBitcoin)

Armed with a seemingly bottomless supply of cash, an unassuming Malaysian named Jho Low staged the ultimate extravaganza. Ultimate Resource On The 1MDB Scandal Involving Goldman Sachs, Celebrities, Politicians, Etc. (#GotBitcoin)

Las Vegas, Nov. 3-4, 2012

Around 6 p.m. on a warm, cloudless November night, Pras Michél, a former member of the ‘90s hip-hop trio the Fugees, approached one of the Chairman Suites on the fifth floor of the Palazzo hotel. He knocked and the door opened, revealing a rotund man, dressed in a black tuxedo, who flashed a warm smile. The man, glowing slightly with perspiration, was known to his friends as Jho Low, and he spoke in the soft-voiced lilt common to Malaysians. “Here’s my boy,” Mr. Low said, embracing the rapper.

The Chairman Suites, at $25,000 per night, were the most opulent the Palazzo had to offer, with a pool terrace overlooking the Strip. But the host didn’t plan to spend much time in the room that night; Mr. Low had a much grander celebration in store for his 31st birthday.

The Chairman Suites, at $25,000 per night, were the most opulent the Palazzo had to offer, with a pool terrace overlooking the Strip. But the host didn’t plan to spend much time in the room that night; Mr. Low had a much grander celebration in store for his 31st birthday.

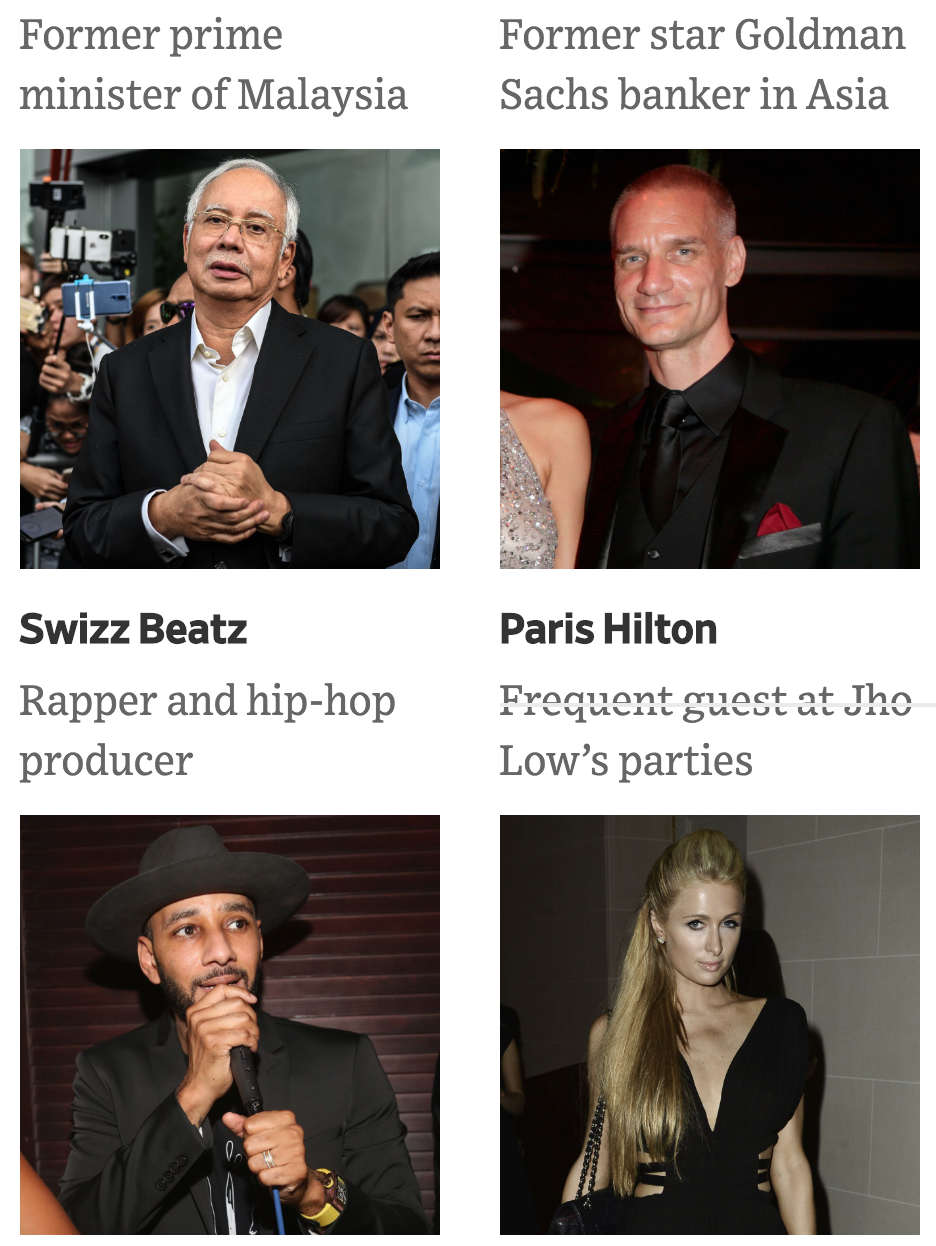

This was just the pre-party for his inner circle, who had jetted in from across the globe. Guzzling champagne, the guests, an eclectic mix of celebrities and hangers-on, buzzed around Mr. Low as more people arrived. Swizz Beatz, the hip-hop producer and husband of Alicia Keys, conversed animatedly with Mr. Low. At one point, Leonardo DiCaprio arrived alongside Benicio Del Toro to talk to Mr. Low about some film ideas.

What did the guests make of their host? To many at the gathering, Mr. Low cut a mysterious figure. Hailing from Malaysia, a small Southeast Asian country, Mr. Low had a round face that was still boyish, with glasses, red cheeks, and barely a hint of facial hair. His unremarkable appearance was matched by an awkwardness and lack of ease in conversation, which the beautiful women around Mr. Low took to be shyness. Polite and courteous, he never seemed fully in the moment, often cutting short a conversation to take a call on one of his half a dozen cellphones.

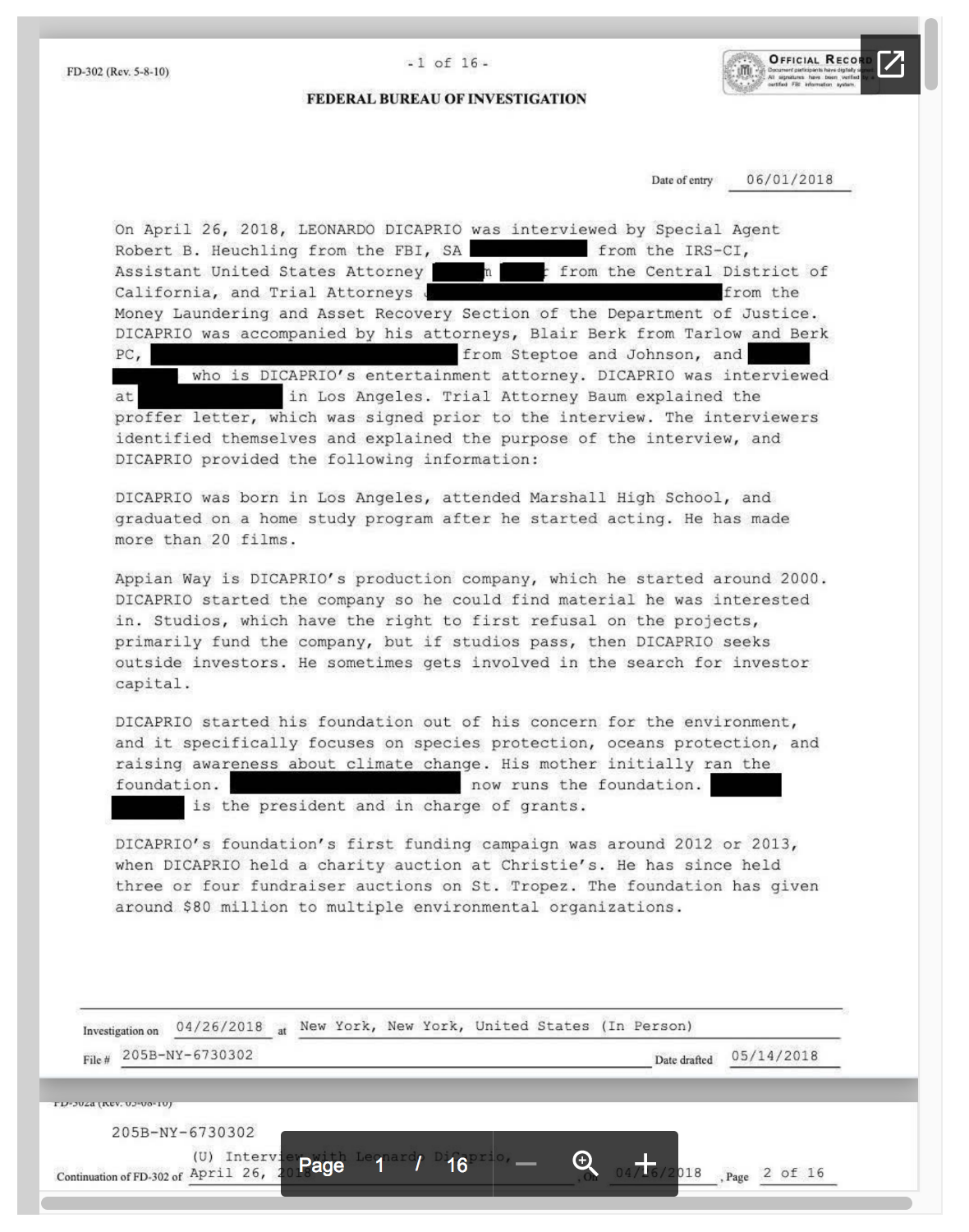

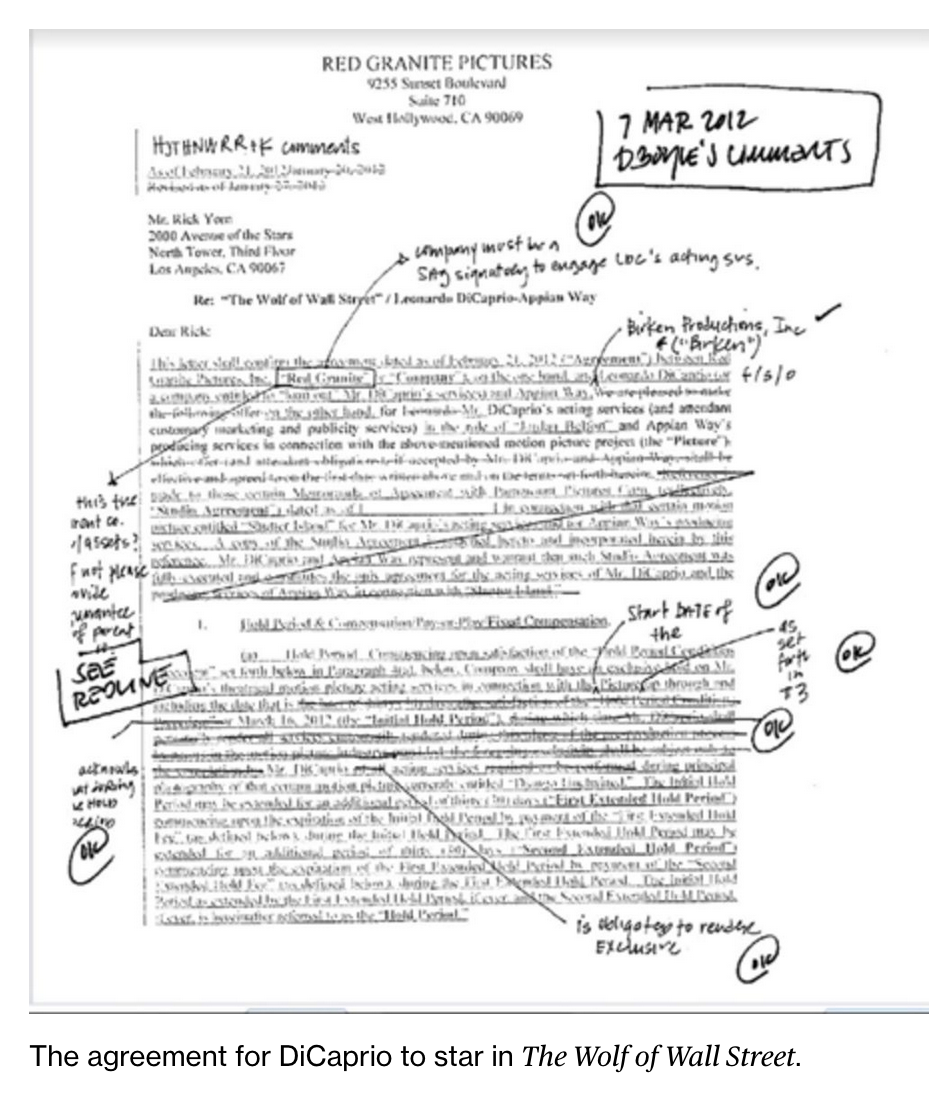

But despite Mr. Low’s unassuming appearance, word was that he was loaded—maybe a billionaire. Guests murmured to each other that he was the money behind Mr. DiCaprio’s latest movie, “The Wolf of Wall Street,” which was still filming. Mr. Low’s bashful manners belied a hard core of ambition the like of which the world rarely sees.

Look more closely, and Mr. Low wasn’t so much timid as quietly calculating, as if computing every human interaction, sizing up what he could provide for someone and what they, in turn, could do for him.

Despite his age, Mr. Low had a weird gravitas, allowing him to hold his own in a room of grizzled Wall Street bankers or pampered Hollywood types. For years, he had methodically cultivated the wealthiest and most powerful people on the planet. The bold strategy had placed him in their orbit and landed him a seat here in the Palazzo. Now, he was the one doling out favors.

The night at the Palazzo marked the apex of Mr. Low’s ascendancy. The guest list for his birthday included Hollywood stars, top bankers from Goldman Sachs , and powerful figures from the Middle East. In the aftermath of the U.S. financial crisis, they all wanted a piece of Mr. Low.

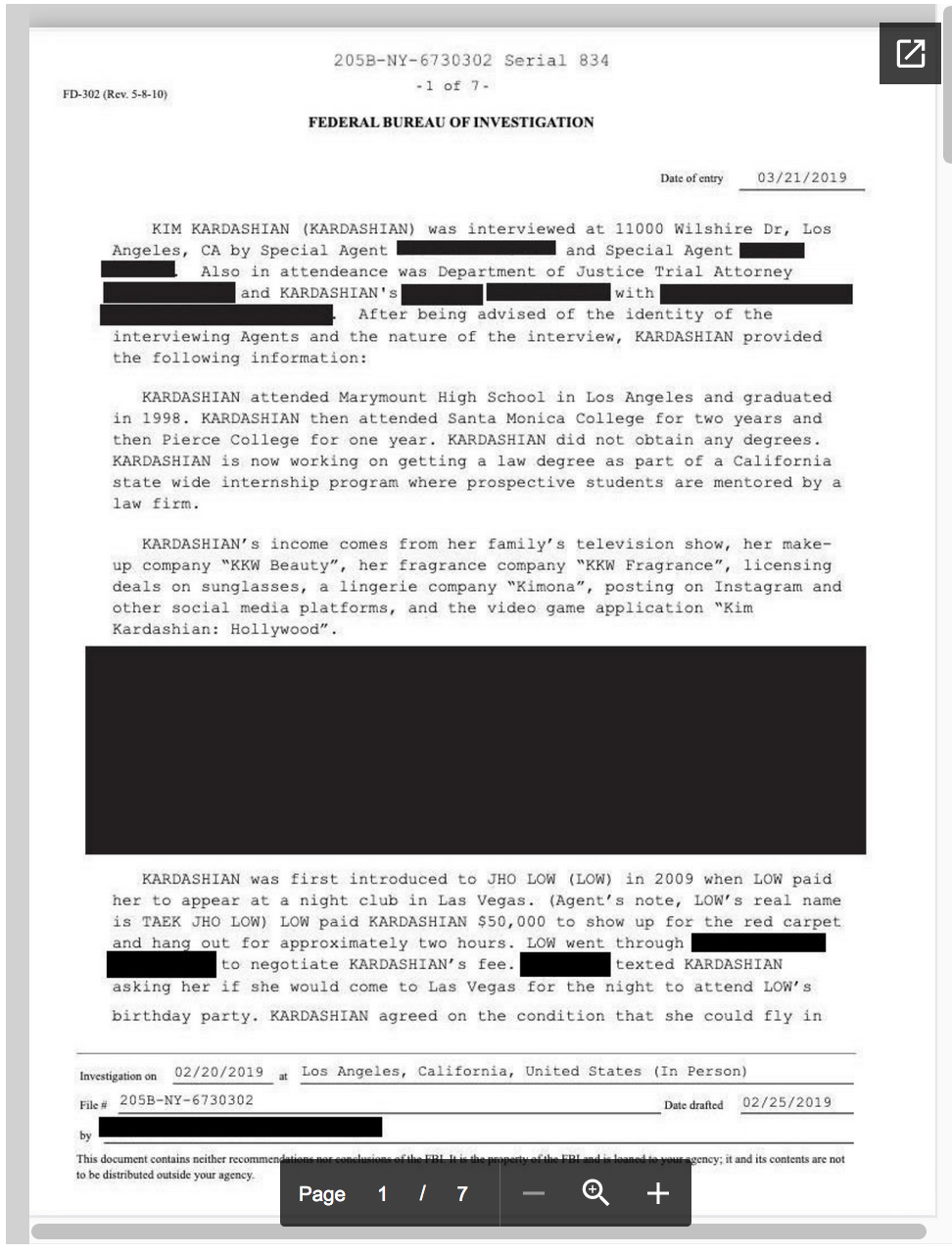

Pras Michél had lost his place in the limelight since the Fugees disbanded, but was hoping to reinvent himself as a private-equity investor, and Mr. Low held out the promise of funding. Some celebrities had received hundreds of thousands of dollars in appearance fees from Mr. Low just to turn up at his events, and they were keen to keep him happy.

But even those stars couldn’t really claim to know Mr. Low’s story. If you entered “Jho Low” into Google, very little came up. Some people said he was an Asian arms dealer. Others claimed he was close to the prime minister of Malaysia. Or maybe he inherited billions from his Chinese grandfather. Casino operators and nightclubs refer to their highest rollers as “whales,” and one thing was certain about Mr. Low: He was the most extravagant whale that Vegas, New York, and St. Tropez had seen in a long time—maybe ever.

A few hours later, just after 9 p.m., Mr. Low’s guests began the journey to the evening’s main event. As the limousines drove up the Strip, it was clear they weren’t heading to the desert, as some guests thought, instead pulling up at what looked like a giant aircraft hangar, specially constructed on a vacant parcel of land.

Among those present was Robin Leach, who for decades, as host of the TV show “Lifestyles of the Rich and Famous,” had chronicled the spending of rappers, Hollywood stars, and old-money dynasties. But that was the 1980s and 1990s, and nothing had prepared him for the intemperance of the night.

A gossip columnist for the Las Vegas Sun, Mr. Leach was among the few guests who had gleaned some details of what was coming. “Wicked whispers EXCLUSIVE: Britney Spears flying into Vegas tomorrow for secret concert, biggest big bucks private party ever thrown,” he tweeted.

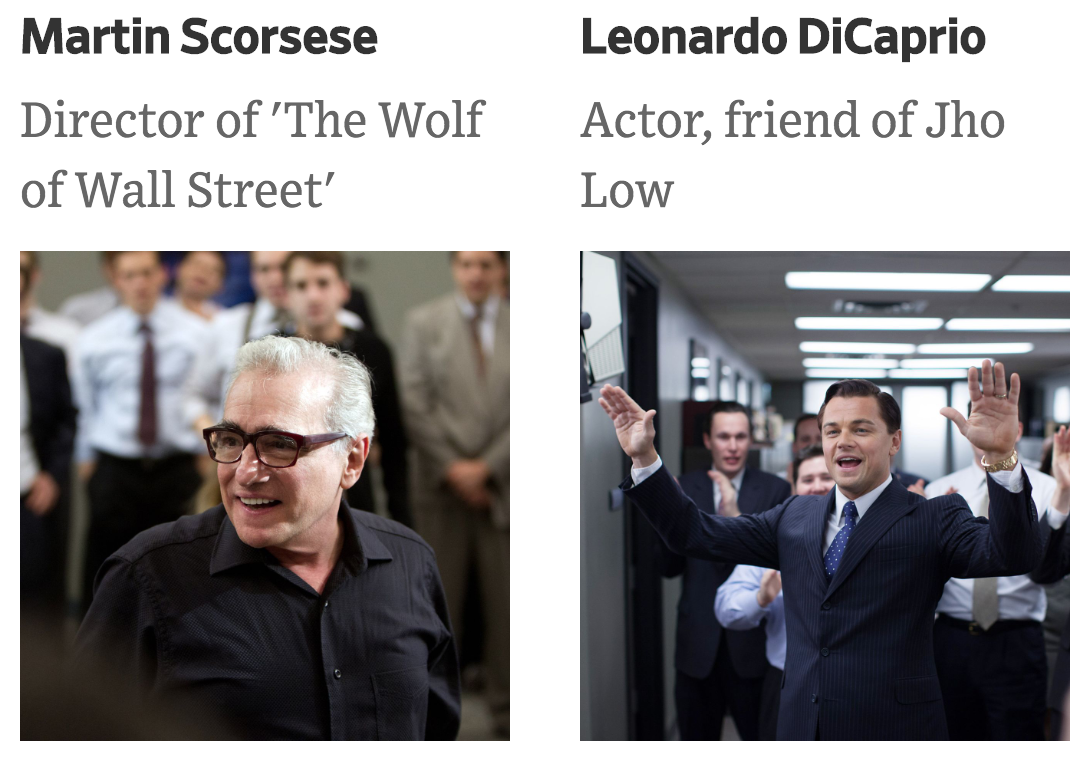

It must have cost millions, Mr. Leach estimated. Here were new lovers Kanye West and Kim Kardashian canoodling under a canopy; Paris Hilton and heartthrob River Viiperi whispering by a bar; actors Bradley Cooper and Zach Galifianakis, on a break from filming “The Hangover Part III,” laughed as they took in the scene. “We’re used to extravagant parties in Las Vegas, but this was the ultimate party,” Mr. Leach said. “I’ve never been to one like it.”

Mr. Low was careful not to overlook his less well-known friends and key business contacts. Among the guests were Tim Leissner, a German-born banker who was a star deal maker for Goldman Sachs in Asia. There were whispers among Wall Street bankers about the huge profits Goldman had been making in Malaysia, hundreds of millions of dollars arranging bonds for a state investment fund, but they hadn’t reached insular Hollywood.

The crowd was already lively when Jamie Foxx started off the show with a video projected on huge screens. It featured friends of Mr. Low from around the world, each dancing a bit of the hit song “Gangnam Style.” As the video ended, Psy, the South Korean singer who had shot to stardom that year for “Gangnam Style,” played the song live as the crowd erupted.

Over the following hour and a half, there were performances from Redfoo and the Party Rock Crew, Busta Rhymes, Q-Tip, Pharrell, and Swizz Beatz, with Ludacris and Chris Brown, who debuted the song “Everyday Birthday.”

During Q-Tip’s session, a drunk Mr. DiCaprio got on stage and rapped alongside him. Then, a giant faux wedding cake was wheeled on stage.

After a few moments, Britney Spears, wearing a skimpy, gold-colored outfit, burst out and, joined by dancers, serenaded Mr. Low with “Happy Birthday.” Each of the performers earned a fat check, with Ms. Spears reportedly taking a six-figure sum for her brief cameo.

Then the gifts. The nightlife impresarios who helped set up the party, Noah Tepperberg and Jason Strauss, stopped the music and took a microphone. Mr. Low had spent tens of millions of dollars in their clubs Marquee, TAO, and LAVO over the past few years, just as the financial crisis hit and Wall Street high rollers were feeling the pinch.

He was their No. 1 client, and they did everything to ensure other nightclub owners didn’t steal him away. As Messrs. Tepperberg and Strauss motioned to staff, a bright red Lamborghini was driven out into the middle of the marquee.

Someone gave not one but three high-end Ducati motorcycles. Finally, a ribbon-wrapped $2.5 million Bugatti Veyron was presented by Szen Low to his brother.

Just after 12:20 a.m., the sky lit up with fireworks. Partying went into the early hours, with performances by Usher, DJ Chuckie, and Kanye West. Surrounded by celebrities and friends, Mr. Low piled into a limousine and brought the party back to the Palazzo, where he gambled well into the bright light of Sunday afternoon.

This Was The World Built By Jho Low

“While you were sleeping, one Chinese billionaire was having the party of the year,” began an article on the website of local radio station KROQ two days later, mistaking Mr. Low’s nationality. It referred to him as “Jay Low.” It wasn’t the first time Mr. Low’s name seeped into the tabloids or was associated with extravagance—and it wasn’t the last—but the Vegas birthday party was a peak moment in his strange and eventful life.

Many of those who came across Mr. Low wrote him off as a big-talking scion of a rich Asian family. Few people asked questions about him, and those who bothered to do so discovered only fragments of the real person. But Mr. Low wasn’t the child of wealth, at least not the kind that would finance a celebrity-studded party.

His money came from a series of events that are so unlikely, they appear made up. Even today, the scale of what he achieved—the global heists he is suspected of having pulled off, allowing him to pay for that night’s party and much, much more—is hard to fathom.

Mr. Low might have hailed from Malaysia, but his was a 21st-century global scheme. His alleged co-conspirators came from the world’s wealthiest 0.1%, the richest of the rich, or people who aspired to enter its ranks: young Americans, Europeans and Asians who studied for M.B.A.s together, took jobs in finance, and partied in New York, Las Vegas, London, Cannes and Hong Kong.

The backdrop was the global financial crisis, which had sent the U.S. economy plummeting into recession, adding to the allure of a spendthrift Asian billionaire like Mr. Low.

Armed with more liquid cash than possibly any individual in history, Mr. Low infiltrated the very heart of U.S. power. He was enabled by his obscure origins and the fact that people had only a vague notion of Malaysia. If he claimed to be a Malaysian prince, then it was true. The heir to a billion-dollar fortune? Sure, it might be right, but nobody seemed to care.

Not Leonardo DiCaprio and Martin Scorsese, who were promised tens of millions of dollars to make films. Not Paris Hilton, Jamie Foxx and other stars who were paid handsomely to appear at events. Not Jason Strauss and Noah Tepperberg, whose nightclub empire was thriving.

Not the supermodels on whom Mr. Low lavished multimillion-dollar jewelry. Not the Wall Street bankers who made tens of millions of dollars in bonuses. And certainly not Mr. Low’s protector, Malaysian Prime Minister Najib Razak.

Mr. Low’s purported scheme involved the purchase of storied companies, friendships with the world’s most celebrated people, trysts with extraordinarily beautiful women, and even a visit to the White House—most of all, it involved an extraordinary and complex manipulation of global finance.

The FBI is still attempting to unravel exactly what occurred. Billions of dollars in Malaysian government money, raised with the help of Goldman Sachs, is believed to have disappeared into a Byzantine labyrinth of bank accounts, offshore companies, and other complex financial structures.

Tim Leissner, who left Goldman in 2016, is now in plea-deal talks with U.S. authorities. Goldman has said it had no way of knowing there might be fraud surrounding the Malaysian government funds.

As the scheme began to crash down around them, Malaysia’s prime minister turned his back on democracy in a failed attempt to cling to power. After a stunning election loss in May, he is now under arrest and facing charges including money laundering. He has denied wrongdoing.

Wanted for questioning by the FBI, Mr. Low is a fugitive moving between Hong Kong, Macau and mainland China as Malaysia seeks his arrest. Through a spokesman, he maintains his innocence.

“Billion Dollar Whale: The Man Who Fooled Wall Street, Hollywood and the World” is the result of three years of research, drawing on interviews with more than 100 people in more than a dozen countries. Every anecdote is based on the recollections of multiple sources and in some cases backed up by photographs, videos and other documentation.

The authors reviewed tens of thousands of documents, including public court records and confidential investigative and financial records, as well as hundreds of thousands of emails provided to authorities during the course of probing the case. They also relied on official allegations contained in the U.S. Justice Department’s civil asset-forfeiture cases, as well as court proceedings in Singapore and official reports by Swiss authorities.

Updated 10-4-2018

Rosmah Mansor, Wife of Former Malaysian Leader, Charged With Money Laundering Related to 1MDB Scandal

Malaysia’s former first lady, who faces charges of violating money-laundering laws and evading taxes, is free on bail.

Malaysian prosecutors charged the wife of former Prime Minister Najib Razak with 17 counts of violating money-laundering laws, including tax evasion, on Thursday in relation to one of the world’s biggest financial scandals.

The latest development follows a wave of criminal charges leveled against Mr. Najib by the government of Prime Minister Mahathir Mohamad, which has opened investigations into 1Malaysia Development Bhd., or 1MDB, a state investment fund established by Mr. Najib in 2009.

The former first lady, who is known for her lavish spending, is seen by investigators as a central force in the scandal.

Investigators and people close to her told journalists that she possessed extensive influence over decisions made by Mr. Najib when he was premier.

Rosmah Mansor, 66 years old, pleaded not guilty to all the charges, which included evading taxes of more than 7 million ringgit ($1.7 million). If convicted of money laundering, Ms. Rosmah could be imprisoned for up to 15 years and face fines of not less than five times the sum or value of the proceeds from the criminal activity.

Ms. Rosmah was detained in custody overnight by antigraft authorities before being presented at the court in Kuala Lumpur to face the charges. The judge has granted her bail on the condition that she surrenders her passport and not harass witnesses in the trial.

The former first lady left the court complex with Mr. Najib after paying a quarter of the 2 million ringgit ($483,200) bail on Thursday and has pledged to pay the remainder by Oct. 11. The judge set the next hearing date on Nov. 8.

Separately, Mr. Najib also appeared in court for procedural matters connected to some of the 32 charges that have been brought against him, including money laundering, abuse of power and criminal breach of trust. On Wednesday evening, he posted on his Facebook page urging prayers and hope.

“Malaysians will be very happy to see that Ms. Rosmah has been finally charged… and many want to see charges against the son,” said James Chin, a Malaysian analyst who heads the Asia Institute at the University of Tasmania.

In civil lawsuits, the U.S. Department of Justice says at least $4.5 billion was misappropriated from 1MDB, which, if true, would make it one of the largest-ever financial heists.

In addition to the U.S., Malaysia, Singapore and Switzerland have launched criminal investigations into 1MDB. The Swiss Attorney-General has said that around $7 billion originating from 1MDB and a former unit flowed through the global financial system between 2009 and 2015.

Mr. Najib tried to quash an investigation into the 1MDB scandal when it exploded in 2015 after reporting by journalist. But he was swept from office in May after Mr. Mahathir, his former mentor-turned-foe, campaigned on an anticorruption platform. Previously, Malaysia’s then-attorney general had cleared Mr. Najib in an earlier investigation into malfeasance at 1MDB.

“The big winner in all this will be Mr. Mahathir. To ordinary Malaysians, it looks like he has kept to his election promise that he will jail anyone who stole from 1MDB,” Mr. Chin, the analyst, said.

Since July, Mr. Najib, 65 years old, has pleaded not guilty to 32 charges related to the scandal, including criminal breach of trust, money laundering and abuse of power.

Some stem from a sum of more than $600 million that allegedly entered his personal bank accounts ahead of an election campaign in 2013 that his coalition narrowly won.

Mr. Najib has said the money didn’t come from 1MDB or public entities and described it as a “contingency fund” to aid his coalition in those elections. He and the state fund have repeatedly denied wrongdoing.

Mr. Najib is free on nearly $850,000 in bail and trials are due to begin in February. If convicted, the abuse of power counts are punishable by up to 20 years in prison, while the maximum penalty for money laundering is 15 years.

The Malaysian Anti-Corruption Commission has conducted several marathon rounds of questioning Ms. Rosmah in investigations related to 1MDB, including into SRC International Sdn Bhd., a former unit of 1MDB established in 2011 as a vehicle for overseas energy investments. SRC was placed under the Finance Ministry’s control in 2012.

Ms. Rosmah’s spending for years made her a lightning rod for anger over suspected corruption and Malaysians have singled her out for much of the blame for the scandal. Ms. Rosmah previously described criticism of her spending as politically motivated.

Ms. Rosmah has accumulated one of the world’s largest collections of pink diamonds, according to a Malaysian businessman who said he helped select some of the gems.

One diamond she acquired was valued at $27 million, according to the U.S. Justice Department. A man U.S. investigators believe played a critical role in the 1MDB affair—and who has also described helping procure diamonds for Ms. Rosmah—has estimated her collection’s value at $350 million.

Raids on Najib residences have unearthed $28 million in cash stuffed into suitcases and more than $266 million worth of handbags, luxury watches, jewelry and other goods, police said.

The Malaysian investigation has also focused on Mr. Najib’s stepson, Riza Aziz, who faced four days of questioning by antigraft officials in July.

A Justice Department lawsuit details how Mr. Riza, a onetime banker, allegedly received tens of millions of dollars from 1MDB, which U.S. officials say he used to buy property in London, Los Angeles and New York and to finance a Hollywood film company. Mr. Riza has denied any wrongdoing.

Updated 10-30-2018

Yacht Seized by Malaysia Goes Up for Auction

A $250 million superyacht seized by Malaysia in its probe of corruption linked to state fund 1MDB is now up for auction. The wife and sons of former Prime Minster Najib Razak were questioned again as the investigation continues. Mr. Najib, who denies wrongoing, walked out of a TV interview when asked about the scandal.

Updated 11-01-2018

Justice Department To Charge Former Goldman Bankers In Malaysia 1MDB Scandal

Charges will name former Goldman bankers Tim Leissner and Roger Ng, as well as Malaysian financier Jho Low.

The U.S. Justice Department is planning to announce Thursday morning multiple criminal charges related to a multibillion-dollar Malaysian sovereign-wealth fund scandal, including against two former Goldman Sachs bankers and Malaysian financier Jho Low, according to people familiar with the matter.

Tim Leissner, former partner for Goldman Sachs in Asia, is expected to plead guilty to conspiracy to launder money and conspiracy to violate the Foreign Corrupt Practices Act, the people familiar said. He will forfeit $43.7 million, they said.

Roger Ng, the other former Goldman banker, and Jho Low, the Malaysian financier who allegedly masterminded the fraud, will be indicted, the people familiar said. Mr. Ng was arrested in Malaysia, while Mr. Low is at large and was last seen in China.

U.S. prosecutors have previously filed civil asset forfeiture suits to seize assets allegedly purchased with funds stolen from the fund, called 1Malaysia Development Bhd, or 1MDB. These are the first criminal charges against individuals from the Justice Department in the case.

Calls to Mr. Leissner’s attorneys weren’t immediately returned. Mr. Ng couldn’t immediately be reached for comment.

U.S. Attorney General Jeff Sessions called the 1MDB scandal “kleptocracy at its worst” in a speech last December.

Updated 11-9-2018

Goldman Sachs’s Ex-CEO Lloyd Blankfein Met Malaysian at Center of 1MDB Scandal

Second of two meetings came after bank’s compliance department had raised concerns about dealings with financier Jho Low.

Former Goldman Sachs Chief Executive Lloyd Blankfein attended two meetings with a Malaysian financier at the center of one of the world’s largest financial scandals, including one after the Wall Street bank’s compliance department had raised multiple concerns about the financier’s background and said the bank shouldn’t do business with him.

The financier, Jho Low, was indicted this month by the U.S. Justice Department and charged with helping steal billions of dollars from 1Malaysia Development Bhd., an investment fund that he helped run from behind the scenes.

The Justice Department further alleges that two Goldman Sachs bankers participated in the schemes while hiding their collaboration with Mr. Low from Goldman’s management in New York.

The meetings, held in 2009 and 2013 for Mr. Blankfein to meet Najib Razak, Malaysia’s then prime minister, included discussions of 1MDB, according to people familiar with the meetings.

A Goldman spokesman said Mr. Blankfein met many people in his 12-year tenure atop the bank, and couldn’t have known Malaysia’s leader would bring Mr. Low to either meeting. Mr. Blankfein has no recollection of meeting Mr. Low, he said. There is no indication Mr. Blankfein was aware of the bank’s compliance concerns about Mr. Low at the time.

Asked last week at a public forum about the developing scandal, Mr. Blankfein laid the blame on rogue employees. “These are guys who evaded our safeguards and lie,” he said.

The Justice Department is continuing to investigate Goldman’s role in the 1MDB scandal, including which bankers were aware of Goldman’s interactions with Mr. Low and how the bank handled the matter once it learned of the alleged fraud.

The bank is also investigating, searching hundreds of thousands of pages of emails, calendars and travel records of employees involved in the deals.

Goldman helped 1MDB raise more than $6.5 billion through three bond issuances in 2012 and 2013, and in the process made around $600 million in profits. Over half of the sum raised was allegedly stolen by Mr. Low and others in a scheme Mr. Low masterminded, according to the Justice Department indictment. The bank has said it couldn’t have known what would happen to the money it helped raise.

Mr. Low, who Malaysia’s government believes is in China, has denied wrongdoing.

Tim Leissner, Goldman’s former chairman of Southeast Asia, pleaded guilty in August to conspiring to launder money and violate foreign anti-bribery laws for helping siphon billions of dollars from the bond deals, according to filings made public last week.

Former Goldman managing director Roger Ng was indicted on three counts of conspiring to violate foreign antibribery laws and launder money, the filings show.

When he pleaded guilty in U.S. District Court in Brooklyn, Mr. Leissner said he “conspired with other employees and agents of Goldman Sachs very much in line of its culture of Goldman Sachs to conceal facts from certain compliance and legal employees of Goldman Sachs,” according to a heavily redacted transcript of the hearing, released Friday.

“I and several other employees of Goldman Sachs at the time also concealed that we knew that Jho Low was promising and paying bribes and kickbacks to foreign officials to obtain and retain 1MDB business for Goldman Sachs,” Mr. Leissner said, adding that he and his co-workers knew some of the cash for the bribes came from the bonds Goldman sold for 1MDB.

An attorney for Mr. Leissner declined to comment on the indictment. Mr. Ng, who is under arrest in Malaysia, couldn’t be reached.

The indictment also named an “Italian national” at Goldman as a co-conspirator who allegedly helped keep Mr. Low’s involvement in 1MDB hidden from the bank’s management in New York. People familiar with the matter say the person is Andrea Vella, a Hong Kong-based partner who helped structure the 1MDB bonds and rose to be co-head of investment banking in Asia.

Goldman put Mr. Vella on leave after the indictment was unsealed last week. He had been stripped of his management responsibilities two weeks earlier in a management shakeup. Mr. Vella, who hasn’t been charged with any wrongdoing, didn’t respond to a request for comment.

In 2015, after news about 1MDB broke in international media, Goldman moved to reduce the size of its Singapore office, through which much of the 1MDB bond transaction business had been run.

One of the executives on a list of people to be laid off at the time, a Swiss national named Cyrus Shey who had worked closely with Mr. Vella on the 1MDB bonds, was unhappy about being fired, according to a person familiar with the matter.

Mr. Vella told colleagues at Goldman he was concerned Mr. Shey could go public with details about 1MDB at a time of scrutiny of the business, and he interceded to ensure Mr. Shey wasn’t immediately let go, according to the person.

Mr. Shey later got a $1.5 million private loan from Mr. Leissner, who was then Goldman’s chairman of Southeast Asia, the person said. Mr. Leissner left the bank in early 2016.

Mr. Shey didn’t respond to questions. His lawyer said Mr. Shey never planned to discuss 1MDB publicly; the lawyer didn’t respond to questions about the private loan from Mr. Leissner.

Mr. Leissner and his lawyer didn’t respond to requests for comments for this article.

The Justice Department indictment alleges that Messrs. Leissner and Ng sought to cover up their activities by repeatedly assuring Goldman executives Mr. Low wasn’t involved in their work with 1MDB, even as Mr. Low kept turning up at meetings.

The first meeting attended by Mr. Blankfein in November 2009, in New York’s Four Season’s hotel, was set up by Messrs. Leissner and Ng for Goldman to pursue deals with 1MDB, according to an affidavit, made public last week, from an FBI agent involved in the investigations.

Two months earlier, Mr. Leissner had attempted to get Mr. Low an account with Goldman’s private bank in Switzerland, but was turned down because of compliance concerns about the source of Mr. Low’s wealth, the affidavit says. Mr. Blankfein’s attendance alongside Mr. Low and then-Prime Minister Najib at the 2009 meeting was first reported by Bloomberg.

In the following years, as Goldman helped 1MDB raise money, the role of Mr. Low at the fund was a constant source of concern for the bank’s New York-based compliance executives and lawyers, the affidavit says. Two former Goldman executives based in Asia said Mr. Low’s role in the fund was widely talked about in the office.

Lawyers and members of Goldman committees that vet deals constantly asked Mr. Leissner by email and in meetings whether Mr. Low was involved. On multiple occasions, Mr. Leissner denied that Mr. Low played any role, according to the affidavit.

In March 2013, Goldman sold the last of three bonds for 1MDB. On March 10, just over a week ahead of the $3 billion bond issuance, a meeting of a New York-based committee that decides what deals and clients Goldman should back quizzed Mr. Leissner about Mr. Low’s role as an intermediary at 1MDB, the affidavit says.

After the deal, in late April, a member of the committee emailed Mr. Leissner with further concerns about Mr. Low’s role, the affidavit adds. Mr. Leissner denied Mr. Low had any involvement, according to the affidavit.

Just a few months later, in September 2013, Mr. Blankfein met Mr. Low for a second time. Mr. Leissner arranged for Mr. Najib, Malaysia’s then prime minister, to sit down with around 20 high-level Goldman clients at New York’s Mandarin Oriental hotel. Mr. Low attended with Mr. Najib, people familiar with the matter say.

In late 2014, Mr. Blankfein praised Messrs. Leissner and Vella for their efforts in arranging business with Malaysia.

“Look at what Tim and Andrea did in Malaysia,” he told a meeting in New York on how to build business in growth markets. “We have to do more of that.”

Updated 11-21-2018

Goldman Sachs Sued Over ‘Central Role’ in 1MDB Scandal

An Abu Dhabi sovereign-wealth fund says the bank enabled bribes.

An Abu Dhabi sovereign-wealth fund accused Goldman Sachs GS +1.68% Group Inc. in a lawsuit Wednesday of playing a “central role” in an international corruption scandal and enabling bribes to former top executives at the fund.

International Petroleum Investment Company, a one-time investment partner of scandal-struck 1Malaysia Development Bhd., or 1MDB, named Goldman in a lawsuit filed in a state court in New York. The suit, which also named several other individuals associated with 1MDB, didn’t specify the amount of damages IPIC was seeking.

“Goldman Sachs conspired with others to bribe IPIC’s and Aabar’s former executives,” the court filing said, referring to IPIC’s subsidiary Aabar Investments PJS.

“We are in the process of assessing the details of allegations and fully expect to contest the claim vigorously,” a Goldman spokesman said in a statement.

The filing comes on the heels of a Justice Department criminal case unsealed earlier in November against former Goldman executives, alleging they and others were involved in a conspiracy to defraud the Malaysian fund of billions of dollars.

The move is a sign that the 1MDB scandal, a reputational black eye for Goldman, could spill over into its banking business. IPIC and its successor, Mubadala Investment Co., are longtime investment-banking clients, having hired Goldman for years to advise on and raise money for deals.

Any moves by Abu Dhabi to shift business away from Goldman could influence other governments in the Middle East, especially Saudi Arabia, where it has a strong voice, according to people familiar with the bank’s regional business.

Sovereign-wealth funds are key for Goldman, which identified them as a source of new business. Last year, Goldman revamped its banker network to better cover these state-backed funds and in 2018 hired Dina Powell, an experienced foreign policy hand, from the White House to oversee its relationships with sovereigns.

Former Goldman Sachs partner Tim Leissner, who traveled to Abu Dhabi on multiple occasions to meet with IPIC executives during the 1MDB dealings, pleaded guilty to conspiracy to money laundering and violating antibribery laws in the Justice Department case unsealed earlier in November.

Former Goldman managing director Roger Ng was arrested in Malaysia on a warrant, where he is fighting extradition to the U.S. The Justice Department also indicted the Malaysian financier at the center of the scheme, Jho Low, who denies any wrongdoing and is believed to be living in China.

The criminal complaints allege that Mr. Leissner conspired with Mr. Low and IPIC executives to siphon away billions of dollars, sharing the proceeds.

Goldman, which earned $600 million in fees over two years for advising 1MDB on a series of bond sales, has maintained it acted appropriately and had no knowledge of wrongdoing by its former employees. IPIC guaranteed $3.5 billion of the bonds for 1MDB over roughly one year, a deal where Goldman earned nearly half its fees on its 1MDB-related work.

From 2012 to 2014, IPIC officials entered into a series of deals with 1MDB that purported to invest in Malaysian development projects, such as real estate and power stations. Prosecutors in the U.S. and Malaysia allege the deals were elaborate scams to siphon money away for the benefit of individuals involved.

IPIC said the New York filing was one of three actions it took Wednesday related to the 1MDB scandal to “protect its business interests against an international conspiracy.”

The company said it filed criminal complaints Wednesday in Abu Dhabi against former IPIC executive Khadem Al Qubaisi and the former CEO of Aabar Investments, Mohamed Badawy Al Husseiny. IPIC alleges the men laundered stolen funds and received bribes.

Justice Department cases alleged Mr. Al Qubaisi received nearly half a billion dollars of the stolen funds, using it to buy luxury homes in Los Angeles and New York. Mr. Husseiny allegedly received more than $60 million.

Mr. Al Qubaisi is Emirati, while Mr. Al Husseiny is an American citizen. Both men have been detained in Abu Dhabi for roughly two years.

Michael O’Kane, a lawyer for Mr. Al Qubaisi, said his client denies the allegations and had been “subject to arbitrary detention in the U.A.E. for 26 months in complete breach of his human rights and the rule of law.”

“His conditions are appalling, his health is failing and he has been cut off from all external communications,” Mr. O’Kane said in a statement. “It is extraordinary that he has now been charged when he has never been subject to a proper investigation in the U.A.E. into the 1MDB matter.”

In London, IPIC also initiated an arbitration proceeding to enforce a settlement agreement it reached with Malaysia in May 2017 over bonds that Goldman arranged and that are at the center of the embezzlement scandal.

The deal was negotiated under former Malaysian Prime Minister Najib Razak, who was voted out of office in May and is now accused of multiple crimes in Malaysia related to 1MDB and other dealings. He has denied the charges.

The new Malaysian government said in October it was filing an application in the U.K. to set aside the arbitration award.

“IPIC will take any and all legal action necessary, now and in the future, to protect its business interests against the financial exposure and damages it has suffered as a result of this international conspiracy,” said Michael Carlinsky, a lawyer at Quinn Emanuel Urquhart & Sullivan LLP, representing IPIC.

“We will also defend and protect the 2017 settlement concluded with and authorized by 1MDB and the government of Malaysia,” he added.

In the fallout from the 1MDB scandal, IPIC and Aabar merged their assets with another Abu Dhabi sovereign fund in 2017, creating the roughly $125 billion Mubadala Investment Co. IPIC and Aabar remain as legal entities in Abu Dhabi, registration records show.

Updated: 11-30-2018

1MDB Scandal Ensnares Former Justice Department Employee

Ex-staffer admits to helping funnel millions into the U.S. on behalf of Malaysian businessman Jho Low.

A former Justice Department employee pleaded guilty Friday to helping funnel tens of millions of dollars into the U.S. for the alleged mastermind of the multibillion-dollar fraud involving Malaysia’s sovereign-wealth fund.

Some of the $74 million allegedly brought into the U.S. on behalf of Jho Low, a Malaysian businessman, was used to pay a prominent Republican fundraiser, court documents show.

Mr. Low sought to use the funds to influence the Justice Department investigation into the fund, 1Malaysia Development Bhd, and other foreign lobbying activities, the documents said.

George Higginbotham, who worked at the Justice Department as a senior congressional affairs specialist until August, pleaded guilty Friday to conspiring to make false statements to banks about the source and purpose of the funds to move them into the U.S.

The Justice Department said Mr. Higginbotham played no role in the U.S. investigation, which led earlier this month to charges against two senior Goldman Sachs Group Inc. bankers along with Mr. Low.

In addition, the Justice Department has filed civil-forfeiture lawsuits seeking to recover more than $1.5 billion in illicit assets accused of being tied to the alleged fraud. Mr. Higginbotham “failed to influence any aspect of the Department’s investigation of 1MDB,” the agency said.

Mr. Higginbotham understood that Mr. Low would have difficulty moving money into the U.S. because of his public association with the 1MDB affair, so he agreed to help conceal from U.S. banks the origin and purpose of the funds, according to court documents.

A lawyer for Mr. Higginbotham couldn’t immediately be reached for comment. Mr. Low has denied wrongdoing.

1MDB was a state economic-development fund set up by former Malaysian Prime Minister Najib Razak in 2009. The U.S. Justice Department has said at least $4.5 billion was misappropriated from the fund and used to pay bribes to government officials, pad a slush fund controlled by the prime minister and purchase jewelry for his wife, among other embezzlements.

Mr. Najib has pleaded not guilty to charges in Malaysia related to the scandal and has denied wrongdoing. His wife has also pleaded not guilty to charges.

In March 2017, a friend of Mr. Low’s asked Mr. Higginbotham, 46 years old, to help identify “someone with political influence” who could “resolve” Mr. Low’s issues surrounding the Justice Department’s 1MDB case, according to the court documents. Mr. Low ultimately selected a fundraiser with “political connections at high levels of the United States government” to lobby on 1MDB issues, the documents said.

The fundraiser isn’t named but is identifiable as longtime Republican donor Elliott Broidy, whom journalists previously reported had been in negotiations to earn as much as a $75 million fee if the Justice Department quickly dropped its 1MDB investigation. The fee was described in a draft agreement journalists reported involved the law firm of Mr. Broidy’s wife.

The new court documents describe a draft retainer agreement—in which Mr. Low would pay a $75 million success fee if the 1MDB forfeiture proceedings were resolved within 180 days—that was negotiated with the law firm of the wife of the retained consultant.

Chris Clark, a lawyer for Mr. Broidy, said, “I have no comment on your speculation.” In the earlier journal article, he said neither Mr. Broidy nor his wife’s law firm had ever represented Malaysia or any of its officials “in any capacity.”

Mr. Broidy was a vice chairman for the Trump 2016 campaign’s joint fund with the Republican Party, helping it raise more than $108 million.

In his plea, Mr. Higginbotham also admitted to helping Mr. Low’s effort to have returned to China a foreign national who is identifiable as Guo Wengui, a wealthy Chinese businessman who has criticized the Chinese government from his home in New York. The Chinese government has aggressively sought to bring him back to China.

Updated: 12-17-2018

Malaysia Files Criminal Charges Against Goldman Sachs

Charges stem from alleged misappropriation of $2.7 billion from Malaysian fund 1MDB.

Malaysian authorities on Monday filed criminal charges against Goldman Sachs Group Inc. and a former partner of the bank in connection with the 1MDB financial scandal, the country’s attorney general said in a statement.

Goldman Sachs International and two Asian subsidiaries of the Wall Street bank were charged under securities laws for the omission of material information and publishing of untrue statements in offering documents in 2012 and 2013 for the sale of international bonds by state investment fund 1Malaysia Development Bhd., or 1MDB.

“We believe these charges are misdirected, will vigorously defend them and look forward to the opportunity to present our case. The firm continues to cooperate with all authorities investigating these matters,” Goldman said in a statement.

Malaysia’s attorney general also filed charges against Tim Leissner, a former Goldman partner, under securities laws. Mr. Leissner pleaded guilty in criminal charges made public by the U.S. Justice Department in November to misappropriating 1MDB money and bribing officials in Malaysia and Abu Dhabi. His sentencing is expected early next year.

Mr. Leissner wasn’t immediately available for comment.

Goldman arranged $6.5 billion in bonds for 1MDB in 2012 and 2013, of which $2.7 billion was allegedly stolen. The bank made $600 million in profits. The 1MDB fund is now the center of global investigations led by the U.S. Justice Department and including authorities in Malaysia, Singapore, Switzerland and Luxembourg.

“Malaysia considers the allegations in the charges against the accused to be grave violations of our securities laws, and to reflect their severity, prosecutors will seek criminal fines against the accused well in excess of the $2.7 billion misappropriated from the bonds proceeds and $600 million in fees received by Goldman Sachs, and custodial sentences against each of the individual accused: the maximum term of imprisonment being 10 years,” the attorney general’s statement said.

The attorney general also filed charges against Jho Low, the alleged mastermind of the 1MDB scheme, and Jasmine Loo, a former 1MDB counsel. Both already have been charged in absentia by Malaysian authorities with money laundering and other offenses.

The Justice Department also indicted Mr. Low with money-laundering and other charges. The whereabouts of Mr. Low and Ms. Loo are unclear, but Malaysian authorities believe Mr. Low is living in China.

Another former Goldman executive, Roger Ng, a Malaysian citizen, is in detention in Kuala Lumpur and is expected to be charged later this week. Attempts to reach Mr. Ng, who is fighting extradition to the U.S., weren’t successful.

Updated: 12-21-2018

Goldman CEO Defends Firm on 1MDB Accusations

David Solomon says culture of compliance is strong.

Goldman Sachs Group Inc. Chief Executive David Solomon on Friday made his most forceful defense yet of the firm, which is under fire for its dealings with a Malaysian sovereign-wealth fund at the center of an international bribery scandal.

In an message posted to Goldman’s internal website and seen by journalists, Mr. Solomon defended its culture and compliance measures, both of which have been criticized by U.S. prosecutors who last month criminally charged two former Goldman bankers in the widening probe of the 1Malaysia Development Bhd. fund, known as 1MDB. He has been relatively quiet on the matter since the U.S. Justice Department unsealed indictments Nov. 1.

“While we understand the anger and skepticism, we do not believe that the criticism directed at us accurately reflects who we were then or who we are now,” Mr. Solomon wrote. “Our culture and our processes around our due diligence and compliance was strong at the time, and is even stronger today.”

Goldman, through three bond sales, raised $6.5 billion for 1MDB, much of which prosecutors allege was stolen. One former Goldman banker has pleaded guilty and another is under arrest in Malaysia.

They are accused of conspiring with a Malaysian financier named Jho Low to loot 1MDB and pay bribes to foreign officials. Mr. Low, believed to be in China, previously has denied any wrongdoing.

Malaysia this week filed criminal charges against Goldman, and the bank said it would fight the allegations. U.S. prosecutors continue to investigate the bank’s role and are weighing whether to bring charges of their own.

The scandal has muddied the early going for Mr. Solomon, who took over as CEO just two months ago. Morale among many employees has tumbled alongside the stock, which is down 25% since Nov. 1 amid a broader market tumble.

In the internal note, Mr. Solomon said Goldman asked tough questions of 1MDB and investigated to ensure that there were no middlemen like Mr. Low on the deal.

He also defended the roughly $600 million Goldman made from the 1MDB bond offerings, which is nearly 10% of the total funds raised, far more than is typical. He said Goldman was paid to shoulder the risk that the bonds might not sell, and added that the bank was saddled with bonds from the third offering, in 2013, for almost a year.

Malaysia’s Finance Minister Wants Goldman’s $7.5 Billion, Not an Apology

Lim Guan Eng seeks full reimbursement and reparations for the money the 1MDB fund raised with the investment bank’s help.

Malaysia’s finance minister waved off an apology from Goldman Sachs Chief Executive David Solomon for the role of one its then-bankers in the scandal surrounding state investment fund 1Malaysia Development Bhd., saying it wasn’t enough.

Lim Guan Eng said Friday that the only apology that would matter is one that comes with full reimbursement and reparations for the $6.5 billion the 1MDB fund raised with the investment bank’s help. Prosecutors say much of the money was later siphoned off, with several hundred million dollars going to the personal accounts of then-leader Najib Razak.

The former prime minister has pleaded not guilty to multiple charges of money laundering and other offenses.

“Only when you pay reparation and compensation, then that will be sufficient,” Mr. Lim told reporters, saying an appropriate figure would be $7.5 billion.

He added that Malaysia would consider dropping charges it filed against Goldman Sachs if it was compensated for the full amount raised.

“As we have stated previously, Goldman Sachs was lied to by certain members of the former Malaysian government and 1MDB,” a spokesman for the investment bank said. “We intend to vigorously contest the charges brought against us.”

Goldman Sachs has been dragged into the scandal at 1MDB because of its role as underwriter and arranger for three bond sales that raised $6.5 billion for the fund.

Much of the total has gone missing, sparking a multinational investigation from Switzerland to the U.S. It also contributed to the defeat of Mr. Najib’s government in elections in May.

U.S. prosecutors charged two former Goldman bankers in November in relation to the theft of billions of dollars from 1MDB.

Tim Leissner, Goldman’s former chairman for Southeast Asia, pleaded guilty to conspiring to launder money and violating antibribery laws for his role in the affair. The other former Goldman banker, Roger Ng, was arrested in Malaysia in November at the request of U.S. authorities.

He is in custody facing extradition to the U.S. to face criminal charges relating to the scandal and couldn’t be reached for comment. His lawyer couldn’t immediately be reached for comment.

Malaysia also filed criminal charges against Goldman Sachs last month for its role in arranging the bond issues.

Mr. Solomon, the chief executive, apologized to the Malaysian people for Mr. Leissner’s involvement in the scandal during a conference call Wednesday to discuss the bank’s fourth-quarter results.

“At least he accepted that they have to bear and shoulder some responsibility,” Mr. Lim said. “But that apology is insufficient.”

Alleged 1MDB Conspirator Says He Is a Scapegoat For Emiratis

Former royal aide jailed in Abu Dhabi says U.A.E. authorities are pressing him to surrender his assets.

A former top aide to a powerful member of Abu Dhabi’s royal family alleged from prison that he is unfairly being blamed for the United Arab Emirates’ role in one of the world’s biggest financial scandals, and that Emirati authorities are trying to force him to turn over his assets.

Khadem Al Qubaisi was once one of the Middle East’s highflying businessmen. He helped negotiate the bailout of Barclays Bank in 2008 and a multibillion-dollar investment into Daimler AG on behalf of his boss, Sheikh Mansour Bin Zayed al Nahyan, the United Arab Emirates’ deputy prime minister and a member of the royal family.

Abu Dhabi authorities arrested Mr. Al Qubaisi in 2016 amid U.S. Justice Department accusations that he and several co-conspirators collectively stole billions of dollars from 1Malaysia Development Bhd., an investment fund ostensibly set up to help develop the Malaysian economy.

Mr. Al Qubaisi received $471 million of stolen funds into his private account in Luxembourg and used some of it to buy U.S. real estate, according to civil complaints by the Justice Department targeting his assets. Mr. Al Qubaisi hasn’t been charged with any crime in the U.A.E. or U.S.

In his first media interview since he was imprisoned in Abu Dhabi, Mr. Al Qubaisi said from a prison phone that he is being blamed as a “scapegoat” by Sheikh Mansour and Abu Dhabi authorities. Sheikh Mansour is also chairman of the Abu Dhabi Judicial Department, which oversees all criminal cases in the emirate.

Mr. Al Qubaisi said authorities are pressing him to turn over his assets to a private company owned by the sheikh.

The Abu Dhabi government declined to comment. Representatives for Sheikh Mansour and Das Holding, an Abu Dhabi company he controls, didn’t respond to multiple requests for comment.

An Abu Dhabi-based lawyer involved in Mr. Al Qubaisi’s case said Mr. Al Qubaisi “abused and exceeded his authorities” at Abu Dhabi sovereign funds “to achieve personal and illegal gains.”

“Now he is more concerned about keeping his illegal wealth than doing the right thing by admitting his guilt and returning the proceeds he obtained from his criminal activities,” the lawyer said.

Mr. Al Qubaisi said he had acted with the knowledge of more-senior U.A.E. officials when he steered a sovereign-wealth fund he managed, International Petroleum Investment Co., to become a key business partner of 1MDB, including guaranteeing $3.5 billion in 1MDB bonds.

That deal soured when billions of dollars went missing from 1MDB, setting off a multiyear legal battle between sovereign funds in the U.A.E. and Malaysia.

U.S. authorities say Mr. Al Qubaisi helped funnel 1MDB money to conspirators through companies set up to look like subsidiaries of IPIC, the U.A.E. fund.

Mr. Al Qubaisi didn’t address the specifics of the allegations against him in the interview.

“I did this deal but I did it on behalf of the government of Abu Dhabi,” he said. Now “they are putting everything on my back.”

Sheikh Mansour was chairman of IPIC at the time Mr. Al Qubaisi was agreeing to support 1MDB. After Mr. Al Qubaisi’s arrest, IPIC was folded into another U.A.E. fund, where Sheikh Mansour is a board member.

During two five-minute phone calls from Al Wathba prison in Abu Dhabi, Mr. Al Qubaisi said he hadn’t been interrogated by any law enforcement body about 1MDB deals.

Instead, U.A.E. officers periodically come and pressure him to sign over his assets, including land and villas in the U.A.E., to Das Holding, he said.

He said that earlier this month he was handcuffed to a window in a corridor and left for 24 hours.

“If I did something wrong for this Malaysia deal, ok, they can go and take my assets, no problem,” he said. “Why is a private company trying to take control of my assets?”

Two nephews who had power of attorney over some of his assets had been detained until they signed over $40 million in luxury cars and land to Das Holding, Mr. Al Qubaisi said. The nephews didn’t respond to requests for comment.

The Abu Dhabi lawyer involved in the case said Mr. Al Qubaisi’s description of his prison conditions and treatment were inaccurate.

Mr. Al Qubaisi said his plan was to “die here in this place or to get out.”

Soon after Mr. Al Qubaisi’s phone calls to journalists, an intermediary in Abu Dhabi who set up the calls was detained and questioned by Abu Dhabi security services, according to a person familiar with the situation.

Mr. Al Qubaisi is wanted for questioning in several other countries for allegedly pilfering money from 1MDB and committing other financial crimes, according to this person. Abu Dhabi authorities haven’t agreed to let him testify elsewhere.

The Justice Department is seeking to reclaim luxury homes in the U.S. that Mr. Al Qubaisi allegedly bought with funds stolen from 1MDB. The department declined to comment on the matter.

Luxembourg and Swiss authorities have frozen tens of millions of dollars in accounts controlled by Mr. Al Qubaisi and French authorities have seized real estate.

Financial documents reviewed after the interviews show an even bigger asset was largely financed with 1MDB money but hasn’t been targeted by authorities: a half billion-dollar yacht called the Topaz. Mr. Al Qubaisi directed companies he controlled to use approximately €116 million ($132 million) originating from 1MDB for debt payments on the yacht between 2012 and 2015, the documents show.

The Topaz—a 482-foot yacht with eight floors, a swimming pool, cinema and two helicopter pads—was used and controlled by Sheikh Mansour until at least 2015, according to people familiar with the matter.

Jho Low, the Malaysian financier who U.S. officials allege masterminded the 1MDB scandal, leased it on multiple occasions, including to attend the 2014 FIFA World Cup with Leonardo DiCaprio and other celebrities, according to people familiar with the matter. Mr. Low has denied wrongdoing.

The yacht’s current ownership couldn’t be determined. The remaining €271 million of an original €464.3 million loan to buy the boat was fully paid off last April, according to registry filings. The documents don’t specify who paid it.

1MDB Scandal Could Hit Pay For Goldman Execs, Including Lloyd Blankfein

New Chief Executive David Solomon, others also could have compensation withheld.

Goldman Sachs Group Inc. could withhold millions of dollars in pay from former chief Lloyd Blankfein because of the scandal around a corrupt Malaysian investment fund, the bank said Friday.

Goldman’s board of directors won’t—for now—pay out deferred bonuses that Mr. Blankfein and two other former top executives earned in prior years, and will instead await the outcome of an investigation into Goldman’s work for the Malaysian fund, known as 1MDB. The bank said it might also claw back some of the $23 million it paid new Chief Executive David Solomon in 2018.

By hitting executive pay—Wall Street’s most obvious tool to reward and punish—the moves are the clearest sign yet that Goldman sees potentially serious consequences in the 1MDB investigation. The bank faces a large fine and a reputational black eye it can ill afford as it courts retail customers and invests heavily in new businesses.

In recent months, Goldman has been laying out its case to regulators in an effort to avoid criminal charges, according to people familiar with the discussions.

Goldman raised $6.5 billion for 1MDB, of which prosecutors allege $2.7 billion was stolen by a Malaysian financier and two former Goldman bankers. One of those bankers, Tim Leissner, has pleaded guilty to stealing some $200 million and arranging bribes for government officials in Malaysia and Abu Dhabi. He hasn’t commented.

The federal indictments darkened Mr. Blankfein’s farewell tour and complicated the early tenure of Mr. Solomon, who took over Oct. 1 as chief executive.

Overall Mr. Blankfein earned $20.5 million in 2018, down from $24 million a year earlier, according to Friday’s filing. That figure isn’t affected by the potential clawback, which stems from a deferred cash grant he received in 2011 that was to be paid out this past January.

Goldman is temporarily withholding that award, which was originally granted at $7 million. The size of the ultimate payout was tied to Goldman’s performance over the past eight years. The value has roughly doubled, according to a review of filings.

The bank also said it was withholding similar bonuses owed to two unnamed former executives. They are, according to a person familiar with the matter, Michael Evans, who was a senior Goldman executive at the time of the 1MDB bond sales, and Michael Sherwood, a senior executive in London who retired in 2016.

Former executive Gary Cohn also got those bonuses, but was compensated in a lump sum when he joined the Trump administration in 2017.

Mr. Solomon wasn’t senior enough in 2011 to receive that particular bonus. But the bank said Friday it might later claw back some of his 2018 pay and that of other senior executives, a group likely to include President John Waldron and Chief Financial Officer Stephen Scherr.

Mr. Solomon was paid $23 million in 2018 for three months as CEO and nine months as chief operating officer. The biggest chunk, $15.4 million, is in stock units that pay out based on Goldman’s performance over the next few years.

Pay for Wall Street executives, which fell sharply after the financial crisis, has crept up as banks’ results have steadily improved. The highest-paid bank CEO is JPMorgan Chase & Co.’s James Dimon, who made $31 million last year, followed by Morgan Stanley’s James Gorman, who earned $29 million. Bank of America Corp. and Citigroup Inc. haven’t yet disclosed their CEOs’ compensation for 2018.

The Justice Department charged two former Goldman bankers in November. The next month, Malaysia lodged criminal charges against Goldman, and its attorney general said he would seek a fine well above the $2.7 billion allegedly stolen.

Updated: 5-6-2019

Ex-Goldman Banker Sent To U.S. To Face 1MDB Charges

Malaysian citizen Roger Ng to face U.S. charges in connection with one of the world’s largest financial scandals.

A former Goldman Sachs Group Inc. managing director is returning to the U.S. from Malaysia to contest U.S. criminal charges in connection with one of the world’s largest financial scandals, one of his attorneys said.

Malaysian citizen Roger Ng, 46, is accused of aiding his boss, Tim Leissner, Goldman’s former chairman for Southeast Asia. Mr. Leissner pleaded guilty last year in the U.S. to conspiring to launder money and violate foreign antibribery laws for helping to siphon off billions of dollars from Malaysian state investment fund 1Malaysia Development Bhd., or 1MDB. Mr. Leissner is awaiting sentencing.

Mr. Ng’s Malaysian lawyer, Tan Hock Chuan, said Monday that Mr. Ng had left the Southeast Asian country for New York over the weekend. Mr. Tan couldn’t confirm whether he had arrived. Mr. Ng’s American lawyer, Marc Agnifilo, said he expected a court date to be scheduled in Brooklyn for Monday.

Neither Mr. Ng nor his lawyers have commented on the charges.

In an indictment unsealed in the Eastern District Court of New York last November, Mr. Ng was accused—along with another Malaysian, the alleged 1MDB fraud architect Jho Low—of three counts of conspiring to violate foreign antibribery laws and launder money.

Mr. Low has maintained his innocence through a spokesman.

Mr. Ng was later arrested in Malaysia at the request of U.S. authorities and had been fighting extradition. In February, he volunteered to be sent to the U.S. Malaysian authorities declined as Mr. Ng was also facing charges related to 1MDB at home.

Malaysia subsequently agreed to surrender Mr. Ng to the U.S. temporarily, Malaysia’s Attorney General Tommy Thomas said in a statement Monday.

In December, Malaysian prosecutors charged Mr. Ng with four criminal charges of abetting Goldman in the sale of the guaranteed notes and bonds worth $1.57 billion belonging to 1MDB subsidiaries by omitting material information and publishing untrue statements. He has pleaded not guilty.

The financial scandals at 1MDB have sparked multinational investigations, including Switzerland and the U.S., with billions of dollars allegedly siphoned from the fund, created by then-Prime Minister Najib Razak to boost the economy. Public anger over the scandal led to Mr. Najib’s election defeat last year, and he and associates face charges in Malaysia including money-laundering and abuse of power.

Mr. Najib has been charged with 42 1MDB-related criminal counts and is facing his first of a series of trials at the Kuala Lumpur High Court.

Malaysian prosecutors have charged Mr. Leissner and Mr. Ng with abetting Goldman, which has been criminally charged in Malaysia. The two are accused of providing misleading statements in the offering prospectus for the bonds the bank helped sell for 1MDB. No trial date has been set.

Goldman has consistently denied wrongdoing. The bank said certain individuals from the former Malaysian government and 1MDB had lied to it about the proceeds from the bond sales.

A Goldman spokesman said Monday that the bank was “outraged’’ that any employee would undertake such actions as laid out in the U.S. charges.

Updated 6-22-2019

Alleged 1MDB Co-Conspirators Sentenced to Prison

As well as receiving jail sentences, the two men must jointly pay more than $300 million.

Two prominent figures in a global Malaysian sovereign-wealth fund scandal were convicted of financial crimes and sentenced to prison in Abu Dhabi, according to a statement from the emirate’s criminal court and people familiar with the matter.

Khadem al Qubaisi, a United Arab Emirates citizen who once headed Abu Dhabi’s International Petroleum Investment Company, was given a 15-year prison sentence and Mohammed Badawy al Husseiny, an American citizen who ran a subsidiary of IPIC, was sentenced to 10 years.

They jointly must pay about €300 million ($336 million), half to IPIC, referred to as the “victim company,” and half as a penalty, according to the criminal court.

The press release didn’t identify the men by name, but people familiar with the judicial actions confirmed the unnamed defendants were Messrs. Al Qubaisi and Mr. Al Husseiny.

Lawyers for both men and a representative of the Abu Dhabi Criminal Court declined to comment on the charges.

The Abu Dhabi court statement didn’t mention specific details of the charges, other than to say Mr. Al Qubaisi, referred to as the “first defendant,” was convicted of “exploiting his job and unlawfully appropriating 149 million euros after selling shares he owns for the company he heads, without disclosing his ownership of the shares, for 210 million euros.”

Further details of that transaction weren’t provided, but people familiar with the conviction said it wasn’t related to the Malaysian fund scandal.

The statement said the investigations were part of a broader investigation by the Abu Dhabi Public Funds Prosecution into allegations of corruption.

Mr. Al Husseiny, the “second defendant,” was convicted of “exploiting his position and facilitating the seizure of the company’s money by” Mr. Al Qubaisi, according to the statement and people familiar with the matter.

In an interview in January, Mr. Al Qubaisi told The Wall Street Journal from Al Wathba prison in Abu Dhabi that he was being unfairly blamed as the “scapegoat” for the U.A.E.’s role in the 1Malaysia Development Bhd. scandal, where the Justice Department says $4.5 billion was stolen and distributed among a group of alleged co-conspirators, including Messrs. Al Qubaisi and Al Husseiny.

“I did this deal but I did it on behalf of the government of Abu Dhabi,” he said, adding that he was being forced to turn over assets to Sheikh Mansour bin Zayed, former chairman of IPIC and senior member of the emirate’s royal family. Now “they are putting everything on my back,” he said at the time.

Sheikh Mansour didn’t respond to a request for comment at the time.

Mr. Al Qubaisi also claimed he had been handcuffed to a window in a corridor and left for 24 hours, saying his plan was to “die here in this place or get out.”

Updated: 10-30-2019

Accused Mastermind of 1MDB Reaches Civil Settlement With Justice Department

Jho Low agrees to forfeit more than $700 million in assets, but he remains a fugitive from U.S. criminal justice system.

Jho Low, the businessman-turned-fugitive accused of masterminding a multibillion-dollar fraud involving Malaysia’s sovereign-wealth fund, agreed to forfeit more than $700 million in assets U.S. authorities sought to seize, according to a settlement filed Wednesday.

Mr. Low will give up assets that include real estate, a luxury yacht and a private jet, according to the settlement, which doesn’t resolve the criminal cases against the Malaysian businessman or include any admission of wrongdoing by him.

Mr. Low remains a fugitive from the U.S. criminal justice system and is believed to be in China or under Chinese protection elsewhere in the world.

“This settlement agreement forces Low and his family to relinquish hundreds of millions of dollars in ill-gotten gains that were intended to be used for the benefit of the Malaysian people, and it sends a signal that the United States will not be a safe haven for the proceeds of corruption,” said Brian Benczkowski, head of the Justice Department’s criminal division.

In a statement, Mr. Low said “the agreement does not constitute an admission of guilt, liability or any form of wrongdoing by me or the asset owners. We believe all parties consider this resolution, which is subject to final court approval, to be a successful and satisfactory result.”

Mr. Low still faces criminal cases in New York and Washington that accuse him of conspiring to launder billions of dollars in proceeds from the fraud and bribing Malaysian government officials as well as committing U.S. campaign-finance violations.

The settlement resolves a set of civil-forfeiture suits the U.S. has filed to recover property valued at more than $1 billion, including van Gogh and Monet paintings and luxury real estate in New York and Los Angeles.

Prosecutors alleged that the assets were obtained using stolen funds that Mr. Low embezzled from 1Malaysia Development Bhd., or 1MDB, a Malaysian sovereign-wealth fund.

The Justice Department pursued the cases under a program that tries to recover the proceeds of international corruption. “The money would be returned for benefit of people harmed by the corruption,” said a department spokesman, who declined to comment on whether the funds would be provided to Malaysia.

The 1MDB scandal is believed to be one of the largest financial frauds in history, involving at least 10 countries around the world from Asia to the Middle East to North America.

It has resulted in the political downfall of former Malaysian Prime Minister Najib Razak, as well as criminal charges against top bankers at Goldman Sachs Group.

The Justice Department in November 2018 charged two former Goldman bankers, Timothy Leissner and Roger Ng. It is investigating Goldman itself, The Wall Street Journal has reported, with the likely outcome that the firm will pay a large fine.

Federal prosecutors will allow Mr. Low to keep $15 million of the funds to pay his legal team, according to the settlement. He has retained a number of prominent U.S. lawyers and law firms, including former New Jersey Gov. Chris Christie.

Those funds will be held in escrow for legal expenses, according to one person familiar with the matter.

“It is one of the largest civil forfeiture settlements in U.S. history and represents the voluntary return of each and every asset claimed by DOJ, thus resolving this litigation in its entirety without admission of wrongdoing or fault by any party,” Mr. Christie said in a statement.

Updated: 11-1-2019

Fugitive Businessman Jho Low To Forfeit Over $100 Million In Luxury Homes

That includes apartments in London and New York and a mansion in Los Angeles.

Fugitive businessman Jho Low, accused of orchestrating a multibillion-dollar fraud of a Malaysian sovereign wealth fund, has agreed to forfeit over $100 million worth of luxury real estate as part of a wide-ranging settlement with U.S. prosecutors.

That includes two posh London apartments, two New York City condos—one on the city’s famed Billionaire’s Row—and a contemporary mansion in Los Angeles, all of which U.S. prosecutors accused Mr. Low of buying with stolen money from a multibillion-dollar heist, known as the 1MDB scandal, the U.S. Department of Justice announced on Wednesday.

The collection of lavish properties are only a slice of some $700 million in assets, including a private jet, fine art and diamond jewelry, that Mr. Low has agreed to give up, according to court documents filed this week.

More: Former Superyacht of Fugitive Businessman Jho Low Hits the Market

Mr. Low, 37, has denied all charges against him. He said in a statement that the settlement did “not constitute an admission of guilt, liability or any form of wrongdoing by me.”

The three U.S. homes were already headed to the market as part of prior agreements between Mr. Low and federal prosecutors, Mansion Global has previously reported.

One of them, a lavish penthouse atop the Mandarin Oriental Residences by Central Park South, a stretch of Midtown Manhattan referred to as Billionaire’s Row for its superlatively expensive apartments, is already in contract, according to listing records on StreetEasy.

The four-bedroom penthouse went into contract earlier this month, asking $30 million—approximately $500,000 less than Mr. Low bought it for in 2011.

Agents for Mr. Low are expected to help the U.S. government manage and dispose of the assets, including his five homes, the Justice Department said.

But the intermediaries are likely to face an uphill task selling off the properties for figures close to what Mr. Low originally paid, as both New York City and London are in the midst of a downturn in their prime housing markets.

For example, Mr. Low’s other New York City property is located on the second floor of a historic pre-war building in Manhattan’s trendy SoHo neighborhood.

The apartment, which features 14-foot ceilings, decorative interior columns and built-in bookshelves, is asking $9.2 million—several million less than the $13.8 million Mr. Low purchased it for back in 2014, according to a listing for the property and court documents.

It’s not just a change in market conditions that presents a hurdle for those charged with unloading the properties, as some have fallen into disrepair.

For instance, the sprawling Los Angeles mansion, set on 1.2 acres off the city’s Sunset Strip, “will need full restoration,” according to a listing for the property with Ernie Carswell and Christopher Pickett, both of Douglas Elliman. The brokerage has declined to comment on the property.

The Los Angeles house, which prosecutors said Mr. Low purchased with embezzled funds, is on the market for $24 million—less than two-thirds of the $39 million the businessman paid in 2012, according to property records and court documents.

Meanwhile, the sale of Mr. Low’s London properties face a similarly daunting market, as higher transfer taxes in the U.K. paired with a rancorous political environment ahead of Brexit have combined to depress home values in the city’s center since 2014.

It’s not clear how much Mr. Low paid for the two London apartments, which include a 12,000-square-foot penthouse and a nearby flat, both in the city’s posh Mayfair neighborhood. Federal prosecutors claim he wired at least £35 million to a U.K. bank account for the purchase of the penthouse atop Stratton House in 2010, according to court documents.

But the developer of the building, Grafton Advisors, claims the lavish aerie set a record nine years ago at over £4,000 per square foot, according to Grafton’s website. That would mean a final sale price at the time of over £48 million. At the moment, there are no publicly listed apartments priced that high in London.

Mr. Low, who is reportedly in self-imposed exile in China, is accused of orchestrating the theft of $4.5 billion from the 1Malaysia Development Berhad, known as 1MDB. U.S. prosecutors maintain that he laundered the ill-gotten gains through banks around the world and used the funds to run a lavish lifestyle.

“Thanks to this settlement, one of the men allegedly at the center of this massive scheme will lose all access to hundreds of millions of dollars,” said U.S. Attorney Nicola T. Hanna of the Central District of California in a statement on Wednesday.

“This settlement agreement forces Low and his family to relinquish hundreds of millions of dollars in ill-gotten gains that were intended to be used for the benefit of the Malaysian people, and it sends a signal that the United States will not be a safe haven for the proceeds of corruption.”

Updated: 12-19-2019

Goldman Sachs in Talks to Admit Guilt, Pay $2 Billion Fine to Settle 1MDB Probe

Wall Street bank could install monitor as part of deal with Justice Department.

Goldman Sachs Group Inc. GS -0.22% is in talks with the U.S. government to pay a multibillion-dollar fine, admit guilt and agree to continuing oversight of its compliance procedures in order to resolve a criminal investigation into its role in a Malaysian corruption scandal.

Goldman and the Justice Department have largely agreed on a fine of just under $2 billion to settle allegations that the Wall Street firm ignored red flags while billions of dollars were looted from its client, a Malaysian government fund known as 1MDB, people familiar with the matter said.

The bank and U.S. officials have discussed a deal in which a Goldman subsidiary in Asia—not the parent company—would plead guilty to violating U.S. bribery laws, some of the people said. The discussions also involve Goldman installing an independent monitor to oversee and recommend changes to its compliance procedures, the people said.

Talks are continuing and the outlines of a deal, which could be reached early next year, may change.

The settlement wouldn’t resolve an investigation by authorities in Malaysia, which is seeking billions of dollars from Goldman. It couldn’t be determined whether other U.S. regulators would join the settlement or pursue their own.

“Resolution discussions are ongoing, and it is irresponsible to speculate on an outcome,” a Goldman spokeswoman said.

Last week, Goldman President John Waldron told CNBC: “We don’t control the outcome, obviously. We’re one party. We have a number of people to talk to … we’re working as hard as we can to try to get it resolved sensibly.”

Representatives of the Justice Department declined to comment.

Settling with the Justice Department would clear a matter that has weighed on Goldman’s stock price. But new, tighter oversight would keep the bank under the shadow of a scandal that its chief executive, David Solomon, is eager to move past.

Goldman raised $6.5 billion for 1MDB, the abbreviation for 1Malaysia Development Bhd., much of which U.S. authorities say was stolen by a Malaysian government adviser, Jho Low, and two Goldman bankers. Prosecutors say the bank ignored warning signs about Mr. Low and the fund in pursuit of fees that eventually reached about $600 million.

One of the bankers, Tim Leissner, pleaded guilty to stealing more than $200 million from 1MDB and this week agreed to a lifetime ban from the securities industry. Mr. Leissner is cooperating with investigators, The Wall Street Journal has previously reported, and is scheduled to be sentenced next year.

The other banker, a Malaysian national named Roger Ng, has pleaded not guilty in a New York court and also faces charges in Malaysia.

Mr. Low agreed in October to forfeit more than $700 million in assets to U.S. authorities but hasn’t admitted to wrongdoing and remains a fugitive from the U.S. criminal-justice system.

Goldman has said that Messrs. Leissner and Ng, who are no longer with the bank, were rogue actors who intentionally misled their bosses and siphoned money through personal accounts out of view of the bank.

A third executive, previously reported by the Journal to be a Hong Kong-based banker named Andrea Vella, is alleged by U.S. authorities to have known about the scheme. He hasn’t been charged and remains on administrative leave from Goldman. A lawyer for Mr. Vella couldn’t be reached for comment.

At $2 billion, a 1MDB-related fine would be one of the largest levied by the Justice Department against a bank since the mortgage settlements following the financial crisis. It is money Goldman can ill-afford as it struggles to boost revenue and is spending heavily on growth initiatives. The bank doesn’t disclose its legal reserves.

Bloomberg earlier reported the possibility of a settlement of around $2 billion.

The resolution of the 1MDB matter may also hit compensation for Goldman executives. The bank’s board reserved the right to claw back pay from Mr. Solomon and his predecessor, Lloyd Blankfein, as well as other top officials, pending the outcome of 1MDB investigations.

Independent monitors, often hired from law or consulting firms, are used to ensure that companies comply with settlement terms. They were widely required, for example, in the wake of the subprime-mortgage crisis to track banks’ progress in forgiving loans to struggling homeowners.

Monitors can be expensive— HSBC Holdings PLC hired thousands of staffers to clean up its money-laundering controls after a government settlement in 2012—and could make it harder for Goldman to make acquisitions or other moves that require approval from Washington.

Still unresolved is whether Goldman would receive credit offsetting any penalty paid to the Justice Department if the bank were to pay any fine to Malaysia, the people familiar with the matter said.

That country’s prime minister was swept into power on an anticorruption platform after the 1MDB scandal, for which his predecessor faces criminal charges. The former prime minister, Najib Razak, has pleaded not guilty.

Malaysia has filed criminal charges against Goldman itself, plus 17 current and former employees in its Asia offices. A Goldman spokeswoman at the time said the charges were “misdirected.”

Updated: 1-15-2020

Goldman Profit Falls As Bank Braces For 1MDB Fine

Bank sets aside more money toward expected settlement resolving its ties to Malaysian fund.

Eight years ago, Goldman Sachs Group Inc. GS +0.57% bankers sold bonds on behalf of a little-known Malaysian investment fund.

On Wednesday, the fallout from that deal wiped out about 13% of the bank’s 2019 profits and darkened otherwise strong results. Goldman socked away an extra $1.1 billion late last year to help pay for an expected settlement with regulators, who allege the bank overlooked signs of corruption at the Malaysian fund, known as 1MDB, in pursuit of fees.